Table of Contents

Filed Pursuant to Rule No. 424(b)(5)

Registration No.: 333-264453, 333-264453-01,

333-264453-02, 333-264453-04

Prospectus Supplement

(To Prospectus dated April 22, 2022)

€1,500,000,000

WarnerMedia Holdings, Inc.

4.302% Senior Notes due 2030

4.693% Senior Notes due 2033

Unconditionally Guaranteed by

Warner Bros. Discovery, Inc.

We are offering €650,000,000 aggregate principal amount of 4.302% Senior Notes due 2030 (the “2030 notes”) and €850,000,000 aggregate principal amount of 4.693% Senior Notes due 2033 (the “2033 notes” and together with the 2030 notes, the “senior notes”). The 2030 notes will bear interest at the rate of 4.302% per year. The 2030 notes will mature on January 17, 2030. The 2033 notes will bear interest at the rate of 4.693% per year. The 2033 notes will mature on May 17, 2033. Interest on the 2030 notes will be payable annually on January 17 of each year, beginning on January 17, 2025. Interest on the 2033 notes will be payable annually on May 17 of each year, beginning on May 17, 2025.

We may redeem either series of senior notes in whole or in part at any time prior to their maturity at the redemption prices described in this prospectus supplement. In addition, either series of senior notes may be redeemed in whole but not in part, at any time at our option, in the event of certain developments affecting U.S. taxation. If a Change of Control Triggering Event (as defined herein) occurs, we must offer to repurchase the senior notes at a redemption price equal to 101% of the principal amount of the senior notes, plus accrued and unpaid interest, if any, to, but excluding, the date of repurchase.

The senior notes will be unsecured and will rank equally with all our other unsecured senior indebtedness. The senior notes will be fully and unconditionally guaranteed on an unsecured and unsubordinated basis by Warner Bros. Discovery, Inc. (“WBD”), our parent company, and each wholly owned domestic subsidiary of WBD that is a borrower or that guarantees the payment of any debt under the Senior Credit Facility (as defined herein) or any Material Debt (as defined herein). The senior notes will rank senior in right of payment to all of the Issuer’s future subordinated debt and rank equally in right of payment with the Issuer’s existing and future senior debt, including debt under the Issuer’s existing senior notes and the Senior Credit Facility. The senior notes will be effectively subordinated to any of the Issuer’s existing and future secured debt, to the extent of the value of the assets securing such debt, and the senior notes will be structurally subordinated to all of the existing and future liabilities (including trade payables) of each of WBD’s subsidiaries that do not guarantee the senior notes.

The note guarantees will rank senior in right of payment to all of the guarantors’ future subordinated debt and rank equally in right of payment with all of the guarantors’ existing and future senior debt, including debt under existing senior notes and the Senior Credit Facility. The note guarantees will be effectively subordinated to any of the guarantors’ existing and future secured debt, to the extent of the value of the assets securing such debt, and the note guarantees will be structurally subordinated to all of the existing and future liabilities (including trade payables) of each of WBD’s subsidiaries that do not guarantee the senior notes. The senior notes will be issued only in denominations of €100,000 and integral multiples of €1,000 in excess thereof.

Concurrently with this offering, the Issuer, Warner Media, LLC (“WML”) and Discovery Communications, LLC (“DCL” and, collectively with the Issuer and WML, the “Offerors”), each a wholly-owned subsidiary of WBD, are conducting a cash tender offer (the “Tender Offer”) for an aggregate purchase price of up to $2,500,000,000 (excluding accrued and unpaid interest), for the Tender Offer Notes (as defined below under “Summary—Recent Developments—Concurrent Tender Offer”). As described under “Use of Proceeds,” the Issuer intends to use the net proceeds of this offering, together with cash on hand and other available sources of liquidity, as necessary, to pay the purchase price for, and accrued and unpaid interest on, the Tender Offer Notes in the Tender Offer. This offering is not conditioned on the completion of the Tender Offer.

Investing in the senior notes involves risks. See “Risk Factors” beginning on page S-9 of this prospectus supplement and the risks discussed in the documents we file with the U.S. Securities and Exchange Commission and that are incorporated by reference herein.

Neither the U.S. Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus supplement or the accompanying prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

| Price to public(1) |

Underwriting discounts |

Proceeds, before expenses |

||||||||||

| Per 2030 note |

100.000 | % | 0.350 | % | 99.650 | % | ||||||

| 2030 notes total |

€ | 650,000,000 | € | 2,275,000 | € | 647,725,000 | ||||||

| Per 2033 note |

100.000 | % | 0.500 | % | 99.500 | % | ||||||

| 2033 notes total |

€ | 850,000,000 | € | 4,250,000 | € | 845,750,000 | ||||||

| Total |

€ | 1,500,000,000 | € | 6,525,000 | € | 1,493,475,000 | ||||||

| (1) | Plus accrued interest, if any, from the date of original issuance. |

Each series of senior notes is a new issue of securities with no established trading market. We intend to apply to list the senior notes of each series on the Nasdaq Bond Exchange (“Nasdaq”). We expect trading in the senior notes on Nasdaq to begin less than 30 days after the original issue date. The listing applications will be subject to approval by Nasdaq and no assurance can be given that these applications will be granted. If such listings are obtained, we will have no obligation to maintain such listings, and we may delist each series of senior notes at any time. Settlement of the senior notes of each series is not conditional on obtaining the applicable listing.

The underwriters expect to deliver the senior notes in book-entry form through Euroclear Bank S.A./N.V., as operator of the Euroclear System (“Euroclear”) and Clearstream Banking S.A. (“Clearstream”) (together, Euroclear and Clearstream are referred to herein as the “ICSDs”), on or about May 17, 2024. Upon issuance, each series of the senior notes will be represented by a global note in registered form (each a “Global Note”), which is expected to be deposited with a common depository (“Common Depository”) for Euroclear and Clearstream and registered in the name of a nominee of the Common Depository.

Joint Bookrunners

| Barclays |

Deutsche Bank |

Goldman Sachs & Co. LLC | ||

| Commerzbank | Santander |

Co-Managers

| ING |

SMBC Nikko |

May 14, 2024

Table of Contents

We have not, and the underwriters have not, authorized anyone to provide any information other than that contained or incorporated by reference in this prospectus supplement, the accompanying prospectus or any free writing prospectus prepared by or on behalf of us or to which we have referred you. We take no responsibility for, and can provide no assurance as to the reliability of, any other information that others may give you. We are not, and the underwriters are not, making an offer to sell these securities in any jurisdiction where the offer or sale is not permitted. You should assume that the information appearing in this prospectus supplement, the accompanying prospectus or any free writing prospectus is accurate only as of their respective dates. Our business, financial condition, results of operations and prospects may have changed since those dates.

Table of Contents

Prospectus Supplement

| S-i | ||||

| Where You Can Find More Information and Incorporation by Reference |

S-ii | |||

| S-iii | ||||

| S-v | ||||

| Notice to Prospective Investors in the European Economic Area |

S-vi | |||

| S-vii | ||||

| S-1 | ||||

| S-4 | ||||

| S-9 | ||||

| S-16 | ||||

| S-17 | ||||

| S-19 | ||||

| S-38 | ||||

| S-46 | ||||

| S-51 | ||||

| S-51 | ||||

Prospectus

| i | ||||

| ii | ||||

| iii | ||||

| iv | ||||

| 1 | ||||

| 3 | ||||

| 4 | ||||

| 6 | ||||

| 7 | ||||

| 9 | ||||

| 22 | ||||

| 26 | ||||

| 31 | ||||

| 34 | ||||

| 35 | ||||

| 36 | ||||

| 37 | ||||

| 39 | ||||

| 43 | ||||

| 43 |

Table of Contents

ABOUT THIS PROSPECTUS SUPPLEMENT

This prospectus supplement relates to a prospectus that is part of a registration statement on Form S-3 that we filed with the U.S. Securities and Exchange Commission, or SEC, utilizing a “shelf” registration process. Under this shelf registration process, we may sell debt securities described in the accompanying prospectus in one or more offerings. The accompanying prospectus provides you with a general description of the debt securities we may offer. This prospectus supplement contains specific information about the terms of this offering. This prospectus supplement may add, update or change information contained in the accompanying prospectus. To the extent that information in this prospectus supplement is inconsistent with information in the accompanying prospectus, the information in this prospectus supplement replaces the information in the accompanying prospectus and you should rely on the information in this prospectus supplement. Generally, when we refer to the prospectus, we are referring to both parts of this document combined.

Except as the context otherwise requires, or as otherwise specified or used in this prospectus supplement, the terms “we,” “our,” “us,” “the Issuer” and “WMH” refer to WarnerMedia Holdings, Inc. together with its subsidiaries (unless the context requires otherwise); the terms “WBD” and “the Parent Guarantor” refer to Warner Bros. Discovery, Inc., together with its subsidiaries (unless the context requires otherwise); the term “DCL” refers to Discovery Communications, LLC; and the term “Scripps” refers to Scripps Networks Interactive, Inc. References in this prospectus supplement to “U.S. dollars,” “U.S. $” or “$” are to the currency of the United States of America and references to “€” and “euro” are to the lawful currency of the member states of the European Union that adopted the single currency in accordance with establishing the European Economic Community, as amended.

The distribution of this prospectus supplement and the accompanying prospectus and the offering and sale of the senior notes in certain jurisdictions may be restricted by law. Persons who come into possession of this prospectus supplement and the accompanying prospectus should inform themselves about and observe any such restrictions. This prospectus supplement and the accompanying prospectus do not constitute, and may not be used in connection with, an offer or solicitation by anyone in any jurisdiction in which such offer or solicitation is not authorized or in which the person making such offer or solicitation is not qualified to do so or to any person to whom it is unlawful to make such offer or solicitation.

You should not consider any information in this prospectus supplement or the accompanying prospectus to be investment, legal or tax advice. You should consult your own counsel, accountant and other advisors for legal, tax, business, financial and related advice regarding the purchase of the senior notes. We are not making any representation to you regarding the legality of an investment in the senior notes by you under applicable investment or similar laws.

You should read and consider all information contained or incorporated by reference in this prospectus supplement and the accompanying prospectus before making your investment decision.

CURRENCY CONVERSION

The euro and U.S. dollar equivalents reflected in this prospectus supplement are based on a euro/U.S. dollar exchange rate of €1.00=$1.0773, the noon buying rate in New York City on May 10, 2024 for cable transfers payable in euro, as announced by the U.S. Federal Reserve Board.

S-i

Table of Contents

WHERE YOU CAN FIND MORE INFORMATION AND INCORPORATION BY REFERENCE

WBD files annual, quarterly and current reports, proxy statements and other information with the SEC. Its SEC filings are available to the public over the Internet at the SEC’s website at http://www.sec.gov. Copies of certain information filed by WBD with the SEC are also available on its website at http://ir.wbd.com. The website is not a part of this prospectus supplement or the accompanying prospectus.

The SEC allows WBD to incorporate by reference much of the information WBD files with the SEC, which means that WBD can disclose important information to you by referring you to those publicly available documents.

WBD incorporates by reference in this prospectus supplement and the accompanying prospectus the documents listed below, and any future filings made with the SEC under Sections 13(a), 13(c), 14, and 15(d) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), other than any portions of the respective filings that were furnished, under applicable SEC rules, rather than filed, until the completion of the offering of the senior notes:

| • | Annual Report on Form 10-K for the fiscal year ended December 31, 2023, filed on February 23, 2024 (the “2023 WBD Annual Report”); |

| • | Quarterly Report on Form 10-Q for the quarter ended March 31, 2024, filed on May 9, 2024 (the “Q1 2024 WBD 10-Q”); |

| • | The sections of WBD’s Definitive Proxy Statement on Schedule 14A for the 2024 annual meeting of shareholders, filed with the SEC on April 19, 2024, incorporated by reference in the 2023 WBD Annual Report; and |

| • | Current Reports on Form 8-K, filed on January 31, 2024, April 1, 2024 and May 9, 2024 (Item 8.01 only). |

The consolidated financial statements of WBD included in the 2023 WBD Annual Report, the Q1 2024 WBD 10-Q and other SEC filings, which are incorporated into this prospectus supplement and the accompanying prospectus, have been prepared on a consolidated basis and include certain financial information related to the Issuer, DCL and Scripps. The Issuer, DCL and Scripps do not produce their own separately audited standalone or consolidated financial statements.

You may request a copy of these filings, at no cost, by writing or telephoning WBD at the following address or telephone number:

Warner Bros. Discovery, Inc.

230 Park Avenue South

New York, New York 10003

(212) 548-5555

Attn: Investor Relations

Exhibits to the filings will not be sent, however, unless those exhibits have specifically been incorporated by reference into such document. Any statement contained in this prospectus supplement or the accompanying prospectus or in any document incorporated by reference in this prospectus supplement will automatically update and, where applicable, supersede any earlier information contained or incorporated by reference in this prospectus supplement and the accompanying prospectus.

S-ii

Table of Contents

Certain statements in this prospectus supplement, the accompanying prospectus and any documents incorporated by reference herein or therein may constitute forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995, including statements regarding WBD’s business, marketing and operating strategies, integration of acquired businesses, new product and service offerings, financial prospects and anticipated sources and uses of capital. Words such as “anticipate,” “assume,” “believe,” “continue,” “estimate,” “expect,” “forecast,” “future,” “intend,” “plan,” “potential,” “predict,” “project,” “strategy,” “target” and similar terms, and future or conditional tense verbs like “could,” “may,” “might,” “should,” “will” and “would,” among other terms of similar substance used in connection with any discussion of future operating or financial performance identify forward-looking statements. Where, in any forward-looking statement, we express an expectation or belief as to future results or events, such expectation or belief is expressed in good faith and believed to have a reasonable basis, but there can be no assurance that the expectation or belief will result or be accomplished. The following is a list of some, but not all, of the factors that could cause actual results or events to differ materially from those anticipated:

| • | more intense competitive pressure from existing or new competitors in the industries in which WBD operates; |

| • | reduced spending on domestic and foreign television advertising, due to macroeconomic, industry or consumer behavior trends or unexpected reductions in WBD’s number of subscribers; |

| • | uncertainties associated with product and service development and market acceptance, including the development and provision of programming for new television and telecommunications technologies, and the success of WBD’s streaming services; |

| • | market demand for foreign first-run and existing content libraries; |

| • | negative publicity or damage to WBD’s brands, reputation or talent; |

| • | realizing direct-to-consumer subscriber goals; |

| • | industry trends, including the timing of, and spending on, sports programming, feature film, television and television commercial production; |

| • | the possibility or duration of an industry-wide strike, such as the strikes of the Writers Guild of America and Screen Actors Guild-American Federation of Television and Radio Artists in 2023, player lock-outs or other job action affecting a major entertainment industry union, athletes or others involved in the development and production of WBD’s sports programming, television programming, feature films and interactive entertainment (e.g., games) who are covered by collective bargaining agreements; |

| • | disagreements with WBD’s distributors or other business partners; |

| • | continued consolidation of distribution customers and production studios; |

| • | potential unknown liabilities, adverse consequences or unforeseen increased expenses associated with the WarnerMedia Business or WBD’s efforts to integrate the WarnerMedia Business; |

| • | adverse outcomes of legal proceedings or disputes related to WBD’s acquisition of the WarnerMedia Business; |

| • | changes in, or failure or inability to comply with, laws and government regulations, including, without limitation, regulations of the Federal Communications Commission and similar authorities internationally and data privacy regulations, and adverse outcomes from regulatory or legal proceedings; |

| • | inherent uncertainties involved in the estimates and assumptions used in the preparation of financial forecasts; |

S-iii

Table of Contents

| • | WBD’s level of debt, including the significant indebtedness incurred in connection with the acquisition of the WarnerMedia Business, and WBD’s future compliance with debt covenants; |

| • | threatened or actual cyber-attacks and cybersecurity breaches; |

| • | theft of WBD’s content and unauthorized duplication, distribution and exhibition of such content; and |

| • | general economic and business conditions, fluctuations in foreign currency exchange rates, global events such as pandemics, and political unrest in the international markets in which WBD operates. |

Forward-looking statements are subject to various risks and uncertainties which change over time, are based on management’s expectations and assumptions at the time the statements are made and are not guarantees of future results.

These risks have the potential to impact the recoverability of the assets recorded on WBD’s balance sheets, including goodwill or other intangibles. Management’s expectations and assumptions, and the continued validity of any forward-looking statements we make, cannot be foreseen with certainty and are subject to change due to a broad range of factors affecting the U.S. and global economies and regulatory environments, factors specific to WBD and other factors discussed under the heading “Risk Factors” in this prospectus supplement and the documents incorporated by reference in this prospectus supplement, including the risks and uncertainties discussed in the 2023 WBD Annual Report and the Q1 2024 WBD 10-Q.

Actual outcomes and results may differ materially from what is expressed in our forward-looking statements and from our historical financial results due to the factors discussed in this section and elsewhere in this prospectus supplement or disclosed in WBD’s other SEC filings incorporated by reference in this prospectus supplement. These forward-looking statements and such risks, uncertainties and other factors speak only as of the date of this prospectus supplement and we expressly disclaim any obligation or undertaking to disseminate any updates or revisions to any forward-looking statement contained herein, to reflect any change in our expectations with regard thereto, or any other change in events, conditions or circumstances on which any such statement is based.

S-iv

Table of Contents

IN CONNECTION WITH THE ISSUE OF THE SENIOR NOTES, DEUTSCHE BANK AG, LONDON BRANCH (IN THIS CAPACITY, THE “STABILIZING MANAGER”) (OR ANY PERSON ACTING ON BEHALF OF THE STABILIZING MANAGER) MAY OVER-ALLOT THE SENIOR NOTES OR EFFECT TRANSACTIONS WITH A VIEW TO SUPPORTING THE MARKET PRICE OF THE SENIOR NOTES AT A LEVEL HIGHER THAN THAT WHICH MIGHT OTHERWISE PREVAIL. HOWEVER, STABILIZATION MAY NOT NECESSARILY OCCUR. ANY STABILIZATION ACTION MAY BEGIN ON OR AFTER THE DATE ON WHICH ADEQUATE PUBLIC DISCLOSURE OF THE FINAL TERMS OF THE OFFER OF THE SENIOR NOTES IS MADE, AND, IF BEGUN, MAY CEASE AT ANY TIME, BUT IT MUST END NO LATER THAN THE EARLIER OF 30 DAYS AFTER THE ISSUE OF THE SENIOR NOTES AND 60 DAYS AFTER THE DATE OF THE ALLOTMENT OF THE SENIOR NOTES. ANY STABILIZATION ACTION OR OVER-ALLOTMENT MUST BE CARRIED OUT BY THE STABILIZING MANAGER (OR ANY PERSON ACTING ON BEHALF OF THE STABILIZING MANAGER) IN ACCORDANCE WITH APPLICABLE LAWS AND RULES.

S-v

Table of Contents

NOTICE TO PROSPECTIVE INVESTORS IN THE EUROPEAN ECONOMIC AREA

Prohibition of sales to EEA retail investors-The senior notes are not intended to be offered, sold or otherwise made available to and should not be offered, sold or otherwise made available to any retail investor in the European Economic Area (the “EEA”). For these purposes, a retail investor means a person who is one (or more) of: (i) a retail client as defined in point (11) of Article 4(1) of Directive 2014/65/EU, as amended (“MiFID II”); (ii) a customer within the meaning of Directive (EU) 2016/97 (as amended, the “Insurance Distribution Directive”), where that customer would not qualify as a professional client as defined in point (10) of Article 4(1) of MiFID II; or (iii) not a qualified investor as defined in Article 2 of Regulation (EU) 2017/1129 (as amended, the “EU Prospectus Regulation”). Consequently, no key information document required by Regulation (EU) No 1286/2014, as amended (the “PRIIPs Regulation”) for offering or selling the senior notes or otherwise making them available to retail investors in the EEA has been prepared and therefore offering or selling the senior notes or otherwise making them available to any retail investor in the EEA may be unlawful under the PRIIPs Regulation. This prospectus supplement has been prepared on the basis that any offer of senior notes in any member state of the EEA will be made pursuant to an exemption under the EU Prospectus Regulation from the requirement to publish a prospectus for offers of notes. This prospectus supplement is not a prospectus for the purposes of the EU Prospectus Regulation.

MiFID II product governance / professional investors and ECPs only target market-Solely for the purposes of each manufacturer’s product approval process, the target market assessment in respect of the senior notes has led to the conclusion that: (i) the target market for the senior notes is eligible counterparties and professional clients only, each as defined in MiFID II; and (ii) all channels for distribution of the senior notes to eligible counterparties and professional clients are appropriate. Any person subsequently offering, selling or recommending the senior notes (an “EU distributor”) should take into consideration the manufacturers’ target market assessment; however, an EU distributor subject to MiFID II is responsible for undertaking its own target market assessment in respect of the senior notes (by either adopting or refining the manufacturers’ target market assessment) and determining appropriate distribution channels.

S-vi

Table of Contents

NOTICE TO PROSPECTIVE INVESTORS IN THE UNITED KINGDOM

Prohibition of sales to UK retail investors-The senior notes are not intended to be offered, sold or otherwise made available to and should not be offered, sold or otherwise made available to any retail investor in the UK. For these purposes, a retail investor means a person who is one (or more) of: (i) a retail client, as defined in point (8) of Article 2 of Regulation (EU) No 2017/565 as it forms part of domestic law of the UK by virtue of the European Union (Withdrawal) Act 2018 (the “EUWA”); (ii) a customer within the meaning of the provisions of the UK’s Financial Services and Markets Act 2000 (as amended, the “FSMA”) and any rules or regulations made under the FSMA to implement the Insurance Distribution Directive, where that customer would not qualify as a professional client, as defined in point (8) of Article 2(1) of Regulation (EU) No 600/2014 as it forms part of domestic law of the UK by virtue of the EUWA; or (iii) not a qualified investor as defined in Article 2 of the EU Prospectus Regulation as it forms part of domestic law by virtue of the EUWA (the “UK Prospectus Regulation”).

Consequently, no key information document required by the PRIIPs Regulation as it forms part of domestic law in the UK by virtue of the EUWA (the “UK PRIIPs Regulation”) for offering or selling the senior notes or otherwise making them available to retail investors in the UK has been prepared and therefore offering or selling the senior notes or otherwise making them available to any retail investor in the UK may be unlawful under the UK PRIIPs Regulation. This prospectus supplement has been prepared on the basis that any offer of senior notes in the UK will be made pursuant to an exemption under the UK Prospectus Regulation from the requirement to publish a prospectus for offers of notes. This prospectus supplement is not a prospectus for the purposes of the UK Prospectus Regulation.

UK MiFIR product governance / professional investors and ECPs only target market-Solely for the purposes of each manufacturer’s product approval process, the target market assessment in respect of the senior notes has led to the conclusion that: (i) the target market for the senior notes is only eligible counterparties, as defined in the FCA Handbook Conduct of Business Sourcebook, and professional clients, as defined in Regulation (EU) No 600/2014 as it forms part of domestic law of the UK by virtue of the EUWA; and (ii) all channels for distribution of the senior notes to eligible counterparties and professional clients are appropriate. Any person subsequently offering, selling or recommending the senior notes (a “UK distributor”) should take into consideration the manufacturer’s target market assessment; however, a UK distributor subject to the FCA Handbook Product Intervention and Product Governance Sourcebook is responsible for undertaking its own target market assessment in respect of the senior notes (by either adopting or refining the manufacturer’s target market assessment) and determining appropriate distribution channels.

In the UK, this prospectus supplement is being distributed only to, and is directed only at, persons who are “qualified investors” (as defined in the UK Prospectus Regulation) who are (i) persons having professional experience in matters relating to investments falling within Article 19(5) of the Financial Services and Markets Act 2000 (Financial Promotion) Order 2005 (as amended, the “Order”), or (ii) high net worth entities falling within Article 49(2)(a) to (d) of the Order, or (iii) persons to whom it would otherwise be lawful to distribute it (all such persons together being referred to as “relevant persons”). In the UK, the senior notes are only available to, and any invitation, offer or agreement to subscribe, purchase or otherwise acquire such senior notes will be engaged in only with, relevant persons. This prospectus supplement and its contents are confidential and should not be distributed, published or reproduced (in whole or in part) or disclosed by any recipients to any other person in the UK. Any person in the UK that is not a relevant person should not act or rely on this prospectus supplement or its contents. The senior notes are not being offered to the public in the UK.

S-vii

Table of Contents

This summary highlights selected information contained elsewhere in this prospectus supplement or the documents incorporated by reference in this prospectus supplement. Because this is only a summary, it does not contain all of the information that you should consider in making your investment decision. You should read the following summary together with the entire prospectus supplement, including the more detailed information regarding our company and the senior notes elsewhere in this prospectus supplement or the documents incorporated by reference in this prospectus supplement. You should also carefully consider, among other things, the matters discussed in the sections entitled “Risk Factors” in this prospectus supplement and the documents incorporated by reference in this prospectus supplement, as well as the consolidated financial statements and the related notes included elsewhere in this prospectus supplement, before deciding to invest in the senior notes.

Warner Bros. Discovery, Inc.

On April 8, 2022, Discovery, Inc. (“Discovery”) completed the acquisition of the business, operations and activities that constituted the WarnerMedia segment of AT&T Inc., subject to certain exceptions (the “WarnerMedia Business”), and changed its name from “Discovery, Inc.” to “Warner Bros. Discovery, Inc.”

WBD is a leading global media and entertainment company that creates and distributes the world’s most differentiated and complete portfolio of branded content across television, film, streaming and gaming. Available in more than 220 countries and territories and 50 languages, WBD inspires, informs and entertains audiences worldwide through its iconic brands and products including: Discovery Channel, Max, discovery+, CNN, DC, TNT Sports, Eurosport, HBO, HGTV, Food Network, OWN, Investigation Discovery, TLC, Magnolia Network, TNT, TBS, truTV, Travel Channel, MotorTrend, Animal Planet, Science Channel, Warner Bros. Motion Picture Group, Warner Bros. Television Group, Warner Bros. Pictures Animation, Warner Bros. Games, New Line Cinema, Cartoon Network, Adult Swim, Turner Classic Movies, Discovery en Español, Hogar de HGTV and others.

WBD is home to powerful creative engines and one of the largest collections of owned content in the world. WBD has one of the strongest hands in the industry in terms of the completeness and quality of assets and intellectual property across sports, news, lifestyle, and entertainment in virtually every region of the globe and in most languages. Additionally, WBD serves audiences and consumers around the world with content that informs, entertains, and, when at its best, inspires.

WBD represents the full entertainment eco-system, and the ability to serve consumers across the entire spectrum of offerings from domestic and international networks, premium pay-TV, streaming, production and release of feature films and original series, related consumer products and themed experience licensing, and interactive gaming.

WarnerMedia Holdings, Inc.

WMH is a direct, wholly owned subsidiary of WBD. WMH, which was originally named Magallanes, Inc., was organized specifically for the purpose of effecting the WarnerMedia Transactions. The WarnerMedia Business is conducted through WMH and its subsidiaries.

Discovery Communications, LLC

DCL is an indirect, wholly owned subsidiary of WBD. DCL includes WBD’s Discovery Channel and TLC networks in the U.S. DCL is a Delaware limited liability company.

S-1

Table of Contents

Scripps Networks Interactive, Inc.

Scripps is a direct, wholly owned subsidiary of WBD. Certain of WBD’s operations, including Food Network and HGTV, are conducted through Scripps. Scripps is an Ohio corporation.

The common stock of WBD trades on the Nasdaq Global Select Market under the symbol “WBD”. The principal executive offices of WBD, the Issuer, DCL and Scripps are located at 230 Park Avenue South, New York, NY, 10003, and their telephone number is (212) 548-5555.

Recent Developments

Concurrent Tender Offer

Concurrently with this offering, the Issuer, WML and DCL, each a wholly-owned subsidiary of WBD, are conducting the Tender Offer for an aggregate purchase price of up to $2,500,000,000 (excluding accrued and unpaid interest) (the “Aggregate Tender Cap”), for the following series of notes (collectively, the “Tender Offer Notes”): 3.900% Senior Notes due 2024 issued by Scripps; 3.900% Senior Notes due 2024 issued by DCL; 4.000% Senior Notes due 2055 issued by DCL; 4.650% Senior Notes due 2050 issued by DCL; 4.950% Senior Notes due 2042 issued by DCL; 4.875% Senior Notes due 2043 issued by DCL; 5.200% Senior Notes due 2047 issued by DCL; 5.300% Senior Notes due 2049 issued by DCL; 4.650% Senior Notes due 2044 issued by WML; 4.850% Senior Notes due 2045 issued by WML; 4.900% Senior Notes due 2042 issued by WML; 5.350% Senior Notes due 2043 issued by WML; and 5.050% Senior Notes due 2042 issued by WMH.

The tender offers are being made upon, and are subject to, the terms and conditions set forth in the Offer to Purchase dated May 9, 2024 (the “Offer to Purchase”). The Tender Offer will expire at 5:00 p.m., New York City time, on June 7, 2024 (such date and time, as it may be extended with respect to a Tender Offer, the applicable “Expiration Date”), unless extended or terminated by us.

The consideration paid in the Tender Offer for each series of Tender Offer Notes that are validly tendered and accepted for purchase will be determined in the manner described in the Offer to Purchase by reference to a fixed spread over the yield to maturity of the applicable U.S. Treasury Security (the “Reference Yield”). The Reference Yield is expected to be calculated at 9:00 a.m., New York City time, on May 23, 2024, unless extended (the “Price Determination Time”).

This prospectus supplement is not an offer to purchase any of the Tender Offer Notes. Any such offer is made exclusively pursuant to the terms of, and subject to the conditions set forth in, the Offer to Purchase.

We intend to pay the purchase price for, and accrued and unpaid interest on, the Tender Offer Notes with the net proceeds from this offering together with cash on hand and other available sources of liquidity, as necessary. The completion of the Tender Offer will be conditioned on, among other things, our having completed, on or prior to the settlement date for the Tender Offer, one or more debt financing transactions, including the senior notes offered hereby, on terms acceptable to the Issuer, WML and DCL and providing net proceeds in an amount, that, together with cash on hand and other available sources of liquidity is sufficient in the discretion of the Issuer, WML and DCL to (1) fund the purchase of validly tendered Tender Offer Notes accepted for purchase in the Tender Offer and (2) pay all fees and expenses associated with the foregoing. This offering is not conditioned on the completion of the Tender Offer. See “Use of Proceeds” and “Capitalization.”

We are permitted, subject to applicable law, to amend, extend, terminate or withdraw the Tender Offer, including to increase, decrease or eliminate the Aggregate Tender Cap. There can be no assurance that we will consummate the Tender Offer. There can be no assurance as to the principal amount of any series of Tender Offer Notes that will be tendered or accepted for purchase pursuant to the Tender Offer and, as a result, the aggregate principal

S-2

Table of Contents

amount of Tender Offer Notes tendered and accepted for purchase, and the cash consideration paid pursuant to the Tender Offer, may differ from the assumed amounts presented herein.

One or more of the underwriters or their respective affiliates may own Tender Offer Notes and may participate in the Tender Offer. As a result, one or more of the underwriters or their respective affiliates may receive a portion of the net proceeds from this offering. See “Underwriting.”

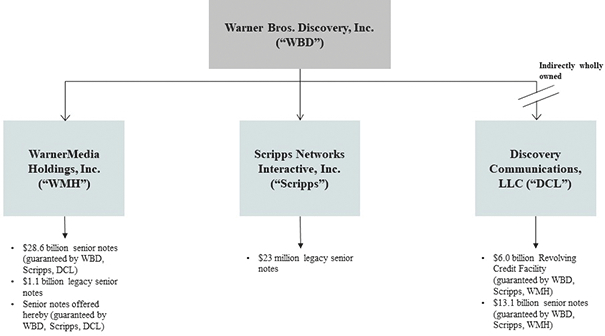

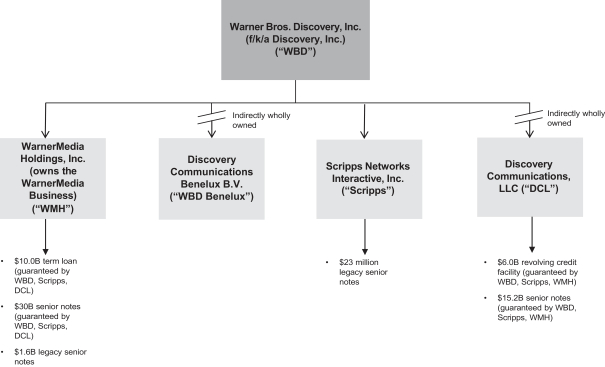

Organizational structure

Set forth below is a diagram that graphically illustrates, in simplified form, the corporate debt and guarantee structure of WBD as of March 31, 2024. The diagram is in general terms and does not include intermediate subsidiaries.

Risk factors

An investment in the senior notes involves risk. Before investing in the senior notes, you should carefully consider the risks described in “Risk Factors” in this prospectus supplement, as well as other information included or incorporated by reference into this prospectus supplement and the accompanying prospectus, including the risk factors set forth in “Item 1A. Risk Factors” in the 2023 WBD Annual Report and the Q1 2024 WBD 10-Q before making an investment decision.

S-3

Table of Contents

The following is a brief summary of certain terms of this offering. For a more complete description of the terms of the senior notes, see “Description of Senior Notes” in this prospectus supplement and “Description of Debt Securities” in the accompanying prospectus.

| Issuer |

WarnerMedia Holdings, Inc. |

| Parent Guarantor |

Warner Bros. Discovery, Inc. |

| Subsidiary Guarantors |

Each wholly owned domestic subsidiary of WBD that is a borrower or that guarantees the payment of any debt under the Senior Credit Facility or any Material Debt. As of the date of issuance of the senior notes, the subsidiary guarantors will be DCL and Scripps. Under certain circumstances, subsidiary guarantors may be released from their note guarantees without the consent of the holders of the senior notes of the applicable series. See “Description of Senior Notes—Guarantees.” |

| DCL and Scripps conduct a substantial amount of their operations, and WBD and the Issuer conduct substantially all of their respective operations, through subsidiaries. |

| Securities Offered |

€650,000,000 in aggregate principal amount of 4.302% Senior Notes due 2030. |

| €850,000,000 in aggregate principal amount of 4.693% Senior Notes due 2033. |

| Stated Maturity Date |

The 2030 notes will mature on January 17, 2030. The 2033 notes will mature on May 17, 2033. |

| Interest Rate |

The 2030 notes will bear interest at the rate of 4.302% per year, accruing from May 17, 2024. |

| The 2033 notes will bear interest at the rate of 4.693% per year, accruing from May 17, 2024. |

| Interest Payment Dates |

Interest on the 2030 notes will be paid annually on January 17 of each year to the holders of record on the business day immediately preceding the applicable interest payment date. The first interest payment on the 2030 notes will be made on January 17, 2025 to holders of record on January 16, 2025. Interest on the 2033 notes will be paid annually on May 17 of each year to the holders of record on the business day immediately preceding the applicable interest payment date. The first interest payment on the 2033 notes will be made on May 17, 2025 to holders of record on May 16, 2025. |

| Currency of Payments |

All payments of interest and principal, including payments made upon any redemption of the senior notes will be payable in euro. If, on or after the date of this prospectus supplement, the euro is unavailable to the Issuer due to the imposition of exchange controls or other circumstances beyond the Issuer’s control or if the euro is no longer used by the then member states of the European Economic and Monetary Union that have adopted the euro as their currency or for |

S-4

Table of Contents

| the settlement of transactions by public institutions of or within the international banking community, then all payments in respect of the senior notes will be made in U.S. dollars until the euro is again available to the Issuer or so used. In such circumstances, the amount payable on any date in euro will be converted into U.S. dollars on the basis of the most recently available market exchange rate for euro. |

| Ranking of the Senior Notes |

The senior notes and the note guarantees will be senior unsecured obligations of the Issuer and the guarantors, respectively, and will: |

| • | rank senior in right of payment to all of the Issuer’s and the guarantors’ future subordinated indebtedness; |

| • | rank equally in right of payment with all of the Issuer’s and the guarantors’ existing and future senior indebtedness, including the Issuer’s existing senior notes and indebtedness under the Senior Credit Facility; |

| • | be effectively subordinated to any of the Issuer’s and the guarantors’ existing and future secured indebtedness, to the extent of the value of the assets securing such indebtedness; and |

| • | be structurally subordinated to all of the existing and future liabilities (including trade payables) of each of WBD’s subsidiaries (other than the Issuer) that do not guarantee the senior notes. |

| As of March 31, 2024: |

| • | WBD had $42.8 billion of total indebtedness, none of which was secured indebtedness; and |

| • | DCL and certain other subsidiaries of WBD had commitments available to be borrowed under its Revolving Credit Facility (as defined herein) of $6.0 billion. |

| For the three-month period ended March 31, 2024, WBD’s subsidiaries other than the Issuer, DCL and Scripps represented 95% of WBD’s consolidated revenues. As of March 31, 2024, WBD’s subsidiaries other than the Issuer, DCL and Scripps represented approximately 95% of WBD’s consolidated total assets and had approximately $31.0 billion of total liabilities, including trade payables but excluding intercompany liabilities. |

| Payment of Additional Amounts |

The Issuer will, subject to certain exceptions and limitations set forth in this prospectus supplement, pay as additional interest such additional amounts as are necessary in order that the net payment of the principal and interest on the senior notes to a holder who is not a United States person (as defined herein), after withholding or deduction for any present or future tax, assessment or other governmental charge imposed by the United States or a taxing authority in the United States, will not be less than the amount provided in such holder’s senior notes to be then due and payable. See “Description of Senior Notes—Payment of additional amounts.” |

S-5

Table of Contents

| Optional Redemption |

2030 notes: Prior to December 17, 2029 (one month prior to maturity), the Issuer may redeem the 2030 notes, in whole or in part, at any time and from time to time, at the applicable make-whole premium redemption price described under “Description of Senior Notes—Optional redemption.” On and after December 17, 2029 (one month prior to maturity), the Issuer may redeem the 2030 notes, in whole or in part, at any time and from time to time, at a redemption price equal to 100% of the aggregate principal amount of the 2030 notes being redeemed, plus any accrued and unpaid interest on the 2030 notes being redeemed to, but excluding, the redemption date. See “Description of Senior Notes—Optional redemption.” |

2033 notes: Prior to February 17, 2033 (three months prior to maturity), the Issuer may redeem the 2033 notes, in whole or in part, at any time and from time to time, at the applicable make-whole premium redemption price described under “Description of Senior Notes—Optional redemption.” On and after February 17, 2033 (three months prior to maturity), the Issuer may redeem the 2033 notes, in whole or in part, at any time and from time to time, at a redemption price equal to 100% of the aggregate principal amount of the 2033 notes being redeemed, plus any accrued and unpaid interest on the 2033 notes being redeemed to, but excluding, the redemption date. See “Description of Senior Notes—Optional redemption.”

| Redemption for Tax Reasons |

If, as a result of any change in, or amendment to, the laws (or any regulations or rulings promulgated under the laws) of the United States (or any taxing authority in the United States), or any change in, or amendments to, an official position regarding the application or interpretation of such laws, regulations or rulings, which change or amendment is announced or becomes effective on or after the date of this prospectus supplement, the Issuer becomes or, based upon a written opinion of independent counsel selected by the Issuer, there is a substantial probability that the Issuer will become, obligated to pay additional amounts as described above with respect to the senior notes of a series, then the Issuer may at any time at its option redeem, in whole, but not in part, the senior notes of such series on not less than 10 nor more than 60 days prior notice, at a redemption price equal to 100% of their principal amount, together with accrued and unpaid interest on those senior notes to, but not including, the date fixed for redemption. See “Description of Senior Notes—Redemption for tax reasons.” |

| Change of Control Offer to Repurchase |

If a Change of Control Triggering Event (as defined herein) occurs, the Issuer must offer to repurchase the senior notes at a redemption price equal to 101% of the principal amount of the senior notes, plus accrued and unpaid interest, if any, to, but excluding, the date of repurchase. See “Description of Senior Notes—Change of control offer to repurchase.” |

| Sinking Fund |

None. |

S-6

Table of Contents

| Covenants |

The Issuer will issue each series of the senior notes as a separate series of debt securities. Each series of senior notes will be issued under an indenture with U.S. Bank Trust Company, National Association, as trustee (the “base indenture”), as supplemented by a supplemental indenture to be entered into by the Issuer, the Parent Guarantor, DCL, Scripps and the trustee concurrently with the delivery of the senior notes (together with the base indenture, the “indenture”). The indenture will, among other things, limit the Issuer’s and its subsidiaries’ ability to: |

| • | incur liens securing debt; and |

| • | enter into sale and leaseback transactions. |

| In addition, the indenture will limit the Issuer’s and WBD’s ability to consolidate or merge with or into another company, or sell all or substantially all of the assets of the Issuer or WBD, as applicable. |

| Each of the covenants summarized above will be subject to a number of important exceptions and qualifications. For more details, see “Description of Senior Notes—Certain covenants.” |

| Listing |

Each series of senior notes is a new issue of securities with no established trading markets. We intend to apply to list the senior notes of each series on Nasdaq. We expect trading in the senior notes on Nasdaq to begin less than 30 days after the original issue date. The listing applications will be subject to approval by Nasdaq and no assurance can be given that these applications will be granted. If such listings are obtained, we will have no obligation to maintain such listings, and we may delist each series of senior notes at any time. Settlement of the senior notes of each series is not conditional on obtaining the applicable listing. |

| The underwriters have advised us that they intend to make a market in the senior notes after this offering is completed, but they are not obligated to do so and may discontinue any market-making activity at any time without notice to, or the consent of, noteholders. Accordingly, there can be no assurance as to the development or liquidity of any markets for the senior notes. |

| Form and Denomination |

The senior notes will be issued in denominations of €100,000 in principal amount and integral multiples of €1,000 in excess thereof. The senior notes will be represented on issue by one or more Global Notes, without coupons, and will be delivered to the Common Depository. The senior notes will be issued in the form of one or more permanent Global Notes in registered form. Each Global Note will be deposited with, or on behalf of, the Common Depository for Clearstream and Euroclear and issued to and registered in the name of a nominee of the Common Depository. Except as set forth below, the Global Notes may be transferred, in whole and not in part, only to the ICSDs or another nominee of the ICSDs. Investors may hold their beneficial interests in the applicable Global Note directly through an ICSD if they have an account with an ICSD or indirectly through |

S-7

Table of Contents

| organizations that have accounts with the ICSDs. See “Description of Senior Notes—Book-entry, delivery and form”, in this prospectus supplement. |

| Use of Proceeds |

The Issuer expects the net proceeds from this offering of senior notes to be approximately €1.49 billion after deducting the underwriting discounts and estimated expenses related to the offering. The Issuer intends to use the net proceeds of this offering together with cash on hand and other available sources of liquidity, as necessary, to pay the purchase price for, and accrued and unpaid interest on, the Tender Offer Notes in the Tender Offer and to pay fees and expenses in connection with the Tender Offer. We intend to use remaining proceeds, if any, for general corporate purposes, including repayment and refinancing of other debt. See “Use of Proceeds.” |

| Trustee, Registrar and Transfer Agent |

U.S. Bank Trust Company, National Association. |

| Paying Agent |

Elavon Financial Services DAC, UK Branch. |

| Material U.S. Federal Income Tax Considerations |

You should consult your tax advisors concerning the U.S. federal income tax consequences of owning the senior notes in light of your own specific situation, as well as consequences arising under the laws of any other taxing jurisdiction. See “Material U.S. Federal Income Tax Considerations.” |

| Governing Law |

The indenture, the senior notes and the guarantees will be governed by, and construed in accordance with, the laws of the State of New York. |

| Further Issues |

The Issuer may from time to time, without notice to, or the consent of, the holders of the senior notes, create and issue additional senior notes of the same series as either series of senior notes offered hereby, ranking equally and ratably with the senior notes of such series offered hereby in all respects, so that such additional senior notes will be consolidated and form a single series with the senior notes of such series and will have the same terms as to status, redemption or otherwise as the senior notes of such series (other than the date of issuance and, under certain circumstances, the first interest payment date and the date from which interest thereon will begin to accrue), provided that if such additional senior notes are not fungible with the original senior notes of such series for U.S. federal income tax purposes, such additional senior notes will have separate ISIN and Common Code numbers. |

| Risk Factors |

Investing in the senior notes involves substantial risk. Please read “Risk Factors” in this prospectus supplement and in the 2023 WBD Annual Report and the Q1 2024 WBD 10-Q incorporated by reference in this prospectus supplement for a discussion of certain factors you should consider in evaluating an investment in the senior notes. |

S-8

Table of Contents

An investment in the senior notes involves risks. You should carefully consider the following risks, as well as the other information contained or incorporated by reference in this prospectus supplement and the accompanying prospectus. In particular, you should carefully consider the risks and uncertainties included in “Item 1A. Risk Factors” of the 2023 WBD Annual Report and the Q1 2024 WBD 10-Q, which are incorporated by reference in this prospectus supplement, and under the caption “Forward-Looking Statements.” If any of those risks or the following risks actually occurs, the Issuer’s and WBD’s businesses, and your investment in the senior notes, could be negatively affected. These risks and uncertainties are not the only ones they face. Additional risks and uncertainties not presently known to the Issuer or WBD, or that they currently deem immaterial, may also materially and adversely affect their business operations, results of operations, financial condition or prospects. If any of these risks materialized, our ability to pay interest on the senior notes when due or to repay the senior notes at maturity could be adversely affected, and the trading prices of the senior notes could decline substantially.

WBD has a significant amount of debt and may incur significant amounts of additional debt, which could adversely affect WBD’s financial health and its ability to react to changes in its business.

As of March 31, 2024, WBD had approximately $42.8 billion of consolidated debt, of which approximately $3.4 billion was then current. WBD’s substantial level of indebtedness increases the possibility that it may be unable to generate cash sufficient to pay when due the principal of, interest on, or other amounts associated with its indebtedness. In addition, DCL and certain other subsidiaries of WBD had the ability to draw down all of the $6.0 billion Revolving Credit Facility in the ordinary course, which would have the effect of increasing its indebtedness. WBD is also permitted, subject to certain restrictions under its existing indebtedness, to obtain additional long-term debt and working capital lines of credit to meet future financing needs. This would have the effect of increasing WBD’s total leverage.

WBD’s substantial leverage could have significant negative consequences on its financial condition and results of operations, including:

| • | impairing its ability to meet one or more of the financial ratio covenants contained in its debt agreements or to generate cash sufficient to pay interest or principal, which could result in an acceleration of some or all of its outstanding debt in the event that an uncured default occurs; |

| • | increasing WBD’s vulnerability to general adverse economic and market conditions; |

| • | limiting WBD’s ability to obtain additional debt or equity financing; |

| • | requiring the dedication of a substantial portion of WBD’s cash flow from operations to service its debt, thereby reducing the amount of cash flow available for other purposes; |

| • | requiring WBD to sell debt or equity securities or to sell some of its core assets, possibly on unfavorable terms, to meet payment obligations; |

| • | limiting WBD’s flexibility in planning for, or reacting to, changes in its business and the markets in which it competes; and |

| • | placing WBD at a possible competitive disadvantage with less leveraged competitors and competitors that may have better access to capital resources. |

S-9

Table of Contents

DCL and Scripps conduct a substantial amount of their operations, and WBD and the Issuer conduct substantially all of their respective operations, through subsidiaries. WBD, the Issuer, DCL and Scripps may be limited in their ability to access funds from their subsidiaries to service their debt, including the senior notes and note guarantees. In addition, the senior notes will not be guaranteed, except in certain circumstances, by any subsidiaries of WBD other than DCL and Scripps and each other wholly owned domestic subsidiary of WBD that in the future becomes a borrower or that guarantees the payment of any debt under the Senior Credit Facility or any Material Debt.

DCL and Scripps conduct a substantial amount of their operations, and WBD and the Issuer conduct substantially all of their respective operations, through subsidiaries. Accordingly, they depend on their subsidiaries’ earnings and advances or loans made by the subsidiaries to them (and potentially dividends or distributions by the subsidiaries to them) to provide funds necessary to meet their obligations, including the payments of principal, premium, if any, and interest on the senior notes. If WBD, the Issuer, DCL and Scripps are unable to access the cash flows of their respective subsidiaries, they would be unable to meet their debt obligations.

The subsidiaries of WBD are separate and distinct legal entities and, except to the extent that they guarantee the senior notes, have no obligation, contingent or otherwise, to pay any amounts due on the senior notes or to make funds available to the Issuer to do so. In addition, the ability of the subsidiaries of WBD to pay dividends or otherwise transfer assets to WBD is subject to various restrictions under applicable law and limitations under contractual obligations. In the event of a bankruptcy, liquidation or reorganization of any of WBD’s subsidiaries, holders of their indebtedness and their trade creditors will generally be entitled to payment of their claims from the assets of those subsidiaries before any assets are made available for distribution to WBD. In addition, the indenture governing the senior notes will allow WBD to create new subsidiaries and invest in their subsidiaries, none of whose assets you will have any claim against, except to the extent that they guarantee the senior notes. The senior notes will be guaranteed on a senior unsecured basis by WBD and each wholly owned domestic subsidiary of WBD that is a borrower or that guarantees the payment of any debt under the Senior Credit Facility or any Material Debt. There can be no assurance that any other future domestic subsidiary of WBD will guarantee indebtedness of DCL or the Issuer under the Senior Credit Facility and, as a result, be required to guarantee the senior notes. In the event that a future domestic subsidiary does guarantee the senior notes as a result of its guaranteeing indebtedness of DCL or the Issuer under the Senior Credit Facility, there also can be no assurance that such guarantee of the Senior Credit Facility and, as a result, such guarantee of the senior notes, will remain in place. There can be no assurance that DCL and Scripps will continue to guarantee the Senior Credit Facility, and thus continue to be required to guarantee the senior notes.

The senior notes will be effectively subordinated to the Issuer’s and the guarantors’ future secured indebtedness to the extent of the value of the property securing that indebtedness.

The senior notes will not be secured by any of the Issuer’s or the guarantors’ assets. As a result, the senior notes and the note guarantees will be effectively subordinated to the Issuer’s and the guarantors’ future secured indebtedness with respect to the assets that secure that indebtedness. The effect of this subordination is that upon a default in payment on, or the acceleration of, any of the Issuer’s secured indebtedness, or in the event of bankruptcy, insolvency, liquidation, dissolution or reorganization of the Issuer or the guarantors, the proceeds from the sale of assets securing any secured indebtedness will be available to pay obligations on the senior notes only after all such secured debt has been paid in full. As a result, the holders of the senior notes may receive less, ratably, than the holders of secured debt in the event of the Issuer’s or the guarantors’ bankruptcy, insolvency, liquidation, dissolution or reorganization.

The senior notes will be structurally subordinated to all obligations of WBD’s existing and future subsidiaries (other than the Issuer) that are not and do not become guarantors of the senior notes.

The senior notes will be guaranteed on a senior unsecured basis by WBD and each wholly owned domestic subsidiary of WBD that is a borrower or that guarantees the payment of any debt under the Senior Credit

S-10

Table of Contents

Facility or any Material Debt. As of the date of issuance of the senior notes, DCL and Scripps will guarantee the senior notes. Except for such subsidiary guarantors of the senior notes, WBD’s subsidiaries, including all of its non-domestic subsidiaries, will have no obligation, contingent or otherwise, to pay amounts due under the senior notes or to make any funds available to pay those amounts, whether by dividend, distribution, loan or other payment. The senior notes and note guarantees will be structurally subordinated to all indebtedness and other obligations of any non-guarantor subsidiary such that in the event of insolvency, liquidation, reorganization, dissolution or other winding up of any subsidiary that is not a guarantor, all of that subsidiary’s creditors (including trade creditors) would be entitled to payment in full out of that subsidiary’s assets before WBD or the Issuer would be entitled to any payment.

DCL and Scripps conduct a substantial amount of their operations, and WBD and the Issuer conduct substantially all of their respective operations, through subsidiaries. For the three-month period ended March 31, 2024, WBD’s subsidiaries other than the Issuer, DCL and Scripps represented 95% of WBD’s consolidated revenues. As of March 31, 2024, WBD’s subsidiaries other than the Issuer, DCL and Scripps represented approximately 95% of WBD’s consolidated total assets and had approximately $31.0 billion of total liabilities, including trade payables but excluding intercompany liabilities.

In addition, WBD’s subsidiaries that provide, or will provide, note guarantees will be automatically released from those note guarantees upon the occurrence of certain events. See “Description of Senior Notes—Guarantees—Guarantee by Subsidiaries of the Parent Guarantor.”

If any note guarantee is released with respect to a series of senior notes, no holder of the senior notes of such series will have a claim as a creditor against that subsidiary, and the indebtedness and other liabilities, including trade payables and preferred stock, if any, whether secured or unsecured, of that subsidiary will be effectively senior to the claim of any holders of the senior notes of such series.

Variable rate indebtedness subjects the Issuer and WBD to interest rate risk, which could cause their respective debt service obligations to increase significantly.

Borrowings under the Senior Credit Facility and certain other indebtedness of the Issuer and WBD are at variable rates of interest and expose the Issuer and WBD to interest rate risk. As interest rates increase, the Issuer’s and WBD’s debt service obligations on their respective variable rate indebtedness increase even though the amount borrowed remains the same, and their respective net income and cash flows, including cash available for servicing their respective indebtedness, will correspondingly decrease.

The indenture governing the senior notes will not restrict the ability of the Issuer, WBD or any of their respective subsidiaries to incur additional unsecured debt, pay dividends or make other distributions to holders of its equity securities or repurchase their respective securities or to take other actions that could negatively impact their ability to pay their obligations under the senior notes or the note guarantees, respectively.

None of the Issuer, WBD or any of their respective subsidiaries will be restricted under the terms of the indenture governing the senior notes from incurring additional unsecured debt, paying dividends or making other distributions to holders of its equity securities or repurchasing its respective securities. In addition, WBD will not be restricted under the terms of the indenture governing the senior notes from incurring secured indebtedness or entering into sale and leaseback transactions, and the limited covenants applicable to the senior notes will not require the Issuer, WBD or any of their respective subsidiaries to achieve or maintain any minimum financial results relating to their respective financial position or results of operations. The ability to recapitalize, incur additional debt and take a number of other actions that are not limited by the terms of the indenture governing the senior notes could have the effect of diminishing the Issuer’s and the guarantors’ ability to make payments on the senior notes or the note guarantees, respectively, when due.

S-11

Table of Contents

The Issuer may not be able to repurchase all of the senior notes upon a change of control triggering event, which would result in a default under the senior notes.

Upon the occurrence of a Change of Control Triggering Event (as defined herein), unless the Issuer has exercised its right to redeem a series of senior notes, each holder of senior notes will have the right to require the Issuer to repurchase all or any part of such holder’s senior notes at a price equal to 101% of their principal amount, plus accrued and unpaid interest, if any, to, but excluding, the date of repurchase. If a Change of Control Triggering Event occurs, there can be no assurance that the Issuer would have sufficient financial resources available to satisfy its obligations to repurchase the senior notes. In addition, the ability of the Issuer to repurchase the senior notes for cash may be limited by law, or by the terms of other agreements relating to its indebtedness outstanding at that time. Any failure by the Issuer to repurchase the senior notes as required under the indenture governing the senior notes would result in a default under the indenture, which could have material adverse consequences for the Issuer and for holders of the senior notes.

Holders of the senior notes may not be able to determine when a change of control giving rise to their right to have the senior notes repurchased has occurred following a sale of “substantially all” of WBD’s assets.

One of the circumstances under which a change of control may occur is upon the sale or disposition of “all or substantially all” of WBD’s assets. There is no precise established definition of the phrase “substantially all” under applicable law and the interpretation of that phrase will likely depend upon particular facts and circumstances. Accordingly, the ability of a holder of the senior notes to require the Issuer to repurchase its senior notes as a result of a sale of less than all of WBD’s, to another person may be uncertain.

An active trading market for the senior notes may not develop.

Each series of senior notes is a new issue of securities with no established trading market. We intend to apply to list the senior notes of each series on Nasdaq. We expect trading in the senior notes on Nasdaq to begin less than 30 days after the original issue date. The listing applications will be subject to approval by Nasdaq and no assurance can be given that these applications will be granted. If such listings are obtained, we will have no obligation to maintain such listings, and we may delist each series of senior notes at any time. If we do not obtain or maintain such listings, we do not intend to list them on any other securities exchange. Settlement of the senior notes of each series is not conditional on obtaining the applicable listing. Failure of the senior notes of each series to be admitted to listing on, or the delisting of the senior notes of each series from, Nasdaq may have a material adverse effect on a holder’s ability to sell the senior notes of such series. The Issuer has been informed by the underwriters that they intend to make a market in the senior notes after the offering is completed. However, the underwriters are not obligated to do so and may discontinue their market-making activities at any time without notice. In addition, the liquidity of the trading markets in the senior notes, and the market prices quoted for the senior notes, may be adversely affected by changes in the overall market for fixed income securities and by changes in WBD’s financial performance or prospects or in the prospects for companies in its industry generally. In addition, such market-making activity will be subject to limits imposed by the Securities Act of 1933, as amended (the “Securities Act”), and the Exchange Act. As a result, there can be no assurance that an active trading market will develop for the senior notes. If no active trading markets for the senior notes develop, you may not be able to resell your senior notes at their fair market value or at all.

Changes in the Issuer’s and WBD’s credit ratings or the debt markets could adversely affect the trading prices of the senior notes.

The trading prices for the senior notes will depend on many factors, including:

| • | the Issuer’s and WBD’s credit ratings with major credit rating agencies; |

| • | the prevailing interest rates being paid by other companies similar to the Issuer and WBD; |

| • | the financial condition, financial performance and future prospects of the Issuer or WBD; and |

| • | the overall condition of the financial markets. |

S-12

Table of Contents

The condition of the financial markets and prevailing interest rates have fluctuated significantly in the past and are likely to fluctuate in the future. Such fluctuations could have an adverse effect on the trading prices of the senior notes.

In addition, credit rating agencies continually review their ratings for the companies that they follow, including the Issuer and WBD. A negative change in the rating of the Issuer or WBD could have an adverse effect on the trading prices of the senior notes.

Holders of the senior notes will receive payments solely in euro.

All payments of interest on, and the principal of, the senior notes and any redemption price for the senior notes will be made in euro. The Issuer, WBD, the underwriters, the trustee and the paying agent with respect to the senior notes will not be obligated to convert, or to assist any registered owner or beneficial owner of senior notes in converting, payments of interest, principal, any redemption price or any additional amount in euro made with respect to the senior notes into U.S. dollars or any other currency.

Holders of the senior notes may be subject to the effects of foreign currency exchange rate fluctuations, as well as possible exchange controls, relating to the euro.

The initial investors in the senior notes will be required to pay for the senior notes in euro. None of the Issuer, WBD nor the underwriters will be obligated to assist the initial investors in obtaining euro or in converting other currencies into euro to facilitate the payment of the purchase price for the senior notes.

An investment in any security denominated in, and all payments with respect to which are to be made in, a currency other than the currency of the country in which an investor in the senior notes resides or the currency in which an investor conducts its business or activities (the “investor’s home currency”), entails significant risks not associated with a similar investment in a security denominated in the investor’s home currency. In the case of the senior notes offered hereby, these risks may include the possibility of:

| • | significant changes in rates of exchange between the euro and the investor’s home currency; and |

| • | the imposition or modification of foreign exchange controls with respect to the euro or the investor’s home currency. |

The Issuer has no control over a number of factors affecting the senior notes offered hereby and foreign exchange rates, including economic, financial and political events that are important in determining the existence, magnitude and longevity of these risks and their effects. Changes in foreign currency exchange rates between two currencies result from the interaction over time of many factors directly or indirectly affecting economic and political conditions in the countries issuing such currencies, and economic and political developments globally and in other relevant countries. Foreign currency exchange rates may be affected by, among other factors, existing and expected rates of inflation, existing and expected interest rate levels, the balance of payments between countries, and the extent of governmental surpluses or deficits in various countries. All of these factors are, in turn, sensitive to the monetary, fiscal and trade policies pursued by the governments of various countries important to international trade and finance. Moreover, the recent global economic volatility and the actions taken or to be taken by various national governments in response to the volatility could significantly affect the exchange rates between the euro and the investor’s home currency.

The exchange rates of an investor’s home currency for euro and the fluctuations in those exchange rates that have occurred in the past are not necessarily indicative of the exchange rates or the fluctuations therein that may occur in the future. Depreciation of the euro against the investor’s home currency would result in a decrease in the investor’s home currency equivalent yield on a senior note, in the investor’s home currency equivalent of the principal payable at the maturity of that senior note and generally in the investor’s home currency equivalent market value of that senior note. Appreciation of the euro in relation to the investor’s home currency would have the opposite effects.

S-13

Table of Contents

The European Union or one or more of its member states may, in the future, impose exchange controls and modify any exchange controls imposed, which controls could affect exchange rates, as well as the availability of euro at the time of payment of principal of, interest on, or any redemption payment or additional amounts with respect to, the senior notes.

This description of foreign exchange risks does not describe all the risks of an investment in securities, including, in particular, the senior notes, that are denominated or payable in a currency other than an investor’s home currency. You should consult your own financial and legal advisors as to the risks involved in an investment in the senior notes.

The senior notes permit us to make payments in U.S. dollars if we are unable to obtain euro.

If the euro is unavailable to us due to the imposition of exchange controls or other circumstances beyond our control or if the euro is no longer being used by the then member states of the European Economic and Monetary Union that have adopted the euro as their currency or for the settlement of transactions by public institutions of or within the international banking community, then all payments in respect of the senior notes will be made in U.S. dollars until the euro is again available to us or so used. The amount payable on any date in euro will be converted into U.S. dollars at the most recently available market exchange rate for euro. Any payment in respect of the senior notes so made in U.S. dollars will not constitute an event of default under the senior notes or the indenture governing the senior notes.

In a lawsuit for payment on the senior notes, an investor may bear currency exchange risk.

The indenture is, and the senior notes will be, governed by New York law. Under New York law, a New York state court rendering a judgment on the senior notes would be required to render the judgment in euro. However, the judgment would be converted into U.S. dollars at the exchange rate prevailing on the date of entry of the judgment. Consequently, in a lawsuit for payment on the senior notes, investors would bear currency exchange risk until a New York state court judgment is entered, which could be a long time from the date the judgment is rendered. A Federal court sitting in New York with diversity jurisdiction over a dispute arising in connection with the senior notes would apply the foregoing New York law. In courts outside of New York, investors may not be able to obtain a judgment in a currency other than U.S. dollars. For example, a judgment for money in an action based on the senior notes in many other U.S. federal or state courts ordinarily would be enforced in the United States only in U.S. dollars. The date used to determine the rate of conversion of euro into U.S. dollars will depend upon various factors, including which court renders the judgment and when the judgment is rendered.

Trading in the clearing system is subject to minimum denomination requirements.

The terms of the senior notes provide that notes will be issued with a minimum denomination of €100,000 and multiples of €1,000 in excess thereof. It is possible that the clearing systems may process trades that could result in amounts being held in denominations smaller than the minimum denominations. If definitive notes are required to be issued in relation to such senior notes in accordance with the provisions of the relevant global notes, a holder who does not have the minimum denomination or a multiple of €1,000 in excess thereof in its account with the relevant clearing system at the relevant time may not receive all of its entitlement in the form of definitive notes unless and until such time as its holding satisfies the minimum denomination requirement.

Each Global Note will be held by or on behalf of Euroclear and Clearstream and, therefore, investors will have to rely on their procedures for transfer, payment and communication with us.