UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(RULE 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934

Filed by the Registrant þ

Filed by a Party other than the Registrant ¨

Check the appropriate box:

| ¨ | Preliminary Proxy Statement |

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| þ | Definitive Proxy Statement |

| ¨ | Definitive Additional Materials |

| ¨ | Soliciting Material Pursuant to Rule 14a-12 |

SCRIPPS NETWORKS INTERACTIVE, INC.

(Name of Registrant as Specified in Its Charter)

(Name of Person(s) Filing Proxy Statement, if Other Than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| þ | No fee required. |

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11 |

| (1) | Title of each class of securities to which transaction applies: |

| (2) | Aggregate number of securities to which transaction applies: |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| (4) | Proposed maximum aggregate value of transaction: |

| (5) | Total fee paid: |

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the form or schedule and the date of its filing. |

| (1) | Amount previously paid: |

| (2) | Form, Schedule or Registration Statement No.: |

| (3) | Filing Party: |

| (4) | Date Filed: |

SCRIPPS NETWORKS INTERACTIVE, INC.

9721 Sherrill Blvd.

Knoxville, TN 37932

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

TO BE HELD MAY 13, 2014

TO THE SHAREHOLDERS OF SCRIPPS NETWORKS INTERACTIVE, INC.

The Annual Meeting of the Shareholders of Scripps Networks Interactive, Inc. (the “Company”) will be held at the Company’s headquarters, 9721 Sherrill Blvd., Knoxville, Tennessee 37932, on Tuesday, May 13, 2014, at 4:00 p.m., local time, for the following purposes:

| 1. | to elect 12 directors; |

| 2. | to hold an advisory (non-binding) vote to approve named executive officer compensation (a “say-on-pay vote”); and |

| 3. | to transact such other business as may properly come before the meeting. |

The board of directors has set the close of business on March 20, 2014 as the record date for the determination of shareholders who are entitled to notice of and to vote at the meeting and any adjournment thereof.

If you plan to attend the meeting and need special assistance because of a disability, please contact the corporate secretary’s office.

We are furnishing our proxy materials to you under Securities and Exchange Commission rules that allow companies to deliver proxy materials to their shareholders on the Internet. On or about April 3, 2014, we began mailing a Notice of Internet Availability of Proxy Materials (“Notice”) and provided access to our proxy materials on the Internet. The proxy materials include the 2013 Annual Report to Shareholders and the Proxy Statement.

We encourage you to attend the Annual Meeting. However, it is important that your shares be represented whether or not you are personally able to attend. Even if you plan to attend the Annual Meeting, please vote as instructed in the Notice, via the Internet or the telephone as promptly as possible to ensure that your vote is recorded. Alternatively, you may follow the procedures outlined in the Notice to request a paper proxy card to submit your vote by mail. If you attend the meeting and your shares are registered in your name, you may withdraw your proxy at that time and vote your shares in person.

Your proxy is being solicited by the board of directors.

CYNTHIA L. GIBSON

Executive Vice President,

Chief Legal Officer and Corporate Secretary

April 3, 2014

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE ANNUAL MEETING OF SHAREHOLDERS TO BE HELD ON MAY 13, 2014.

The Proxy Statement and Annual Report to Shareholders are available without charge at http://www.proxyvote.com

SCRIPPS NETWORKS INTERACTIVE, INC.

9721 Sherrill Blvd.

Knoxville, TN 37932

PROXY STATEMENT

2014 ANNUAL MEETING

May 13, 2014

This Proxy Statement is being furnished in connection with the solicitation of proxies by the board of directors of Scripps Networks Interactive, Inc., an Ohio corporation (the “Company”), for use at the Company’s Annual Meeting of Shareholders (the “Annual Meeting”), which will be held on Tuesday, May 13, 2014, at the Company’s headquarters, 9721 Sherrill Blvd., Knoxville, Tennessee, at 4 p.m. local time.

The close of business on March 20, 2014, has been set as the record date for the determination of shareholders entitled to notice of and to vote at the meeting.

INTERNET AVAILABILITY OF PROXY MATERIALS

We are furnishing proxy materials to our shareholders primarily via the Internet under rules adopted by the U.S. Securities and Exchange Commission, instead of mailing printed copies of those materials to each shareholder. On April 3, 2014, we mailed to our shareholders a Notice of Internet Availability of Proxy Materials containing instructions on how to access our proxy materials, including our Proxy Statement and our Annual Report to Shareholders. The Notice of Internet Availability of Proxy Materials also instructs you on how to access your proxy card or to vote via the Internet or by telephone.

This process is designed to expedite the shareholders receipt of proxy materials, lower the cost of the Annual Meeting and help conserve natural resources. Shareholders who would prefer to continue to receive printed proxy materials should follow the instructions included in the Notice of Internet Availability of Proxy Materials.

VOTING PROCEDURES

On March 20, 2014, the Company had outstanding 109,622,647 Class A Common Shares, $.01 par value per share (“Class A Common Shares”), and 34,317,171 Common Voting Shares, $.01 par value per share (“Common Voting Shares”). Holders of Class A Common Shares are entitled to elect the greater of three or one-third of the directors of the Company but are not entitled to vote on any other matters except as required by Ohio law. Holders of Common Voting Shares are entitled to elect all remaining directors and to vote on all other matters requiring a vote of shareholders. Each Class A Common Share and Common Voting Share is entitled to one vote upon matters on which such class of shares is entitled to vote. Holders of Class A Common Shares and Common Voting Shares do not have cumulative voting.

A quorum of shareholders is necessary to hold a valid meeting. The presence, in person or by proxy, of the holders of a majority of the outstanding Class A Common Shares is necessary for the election of the four directors to be elected by the holders of the Class A Common Shares and the presence, in person or by proxy, of the holders of a majority of the outstanding Common Voting Shares is necessary for any other action to be taken at the meeting.

The presence of any shareholder at the meeting will not operate to revoke his or her proxy. A proxy may be revoked at any time, insofar as it has not been exercised, by giving written notice to the Company or in open meeting.

Abstentions will be treated as present at the meeting for purposes of establishing a quorum for the meeting and for purposes of the vote on the particular matter (other than the election of directors) and, therefore, will have the same effect as a vote against the matter.

Broker non-votes also will be treated as present at the meeting for purposes of establishing a quorum for the meeting, but will not be treated as shares present for purposes of the vote on the particular matter. Accordingly,

broker non-votes will have no effect on the matter unless the matter must be approved by a specified percentage of the outstanding shares or the outstanding shares of a particular class (in which event broker non-votes will have the same effect as a vote against the matter). A broker “non-vote” occurs when a broker or other nominee does not vote shares on a particular matter because the broker or nominee does not have discretionary voting power for the particular matter and has not received voting instructions from the beneficial owner of the shares.

If you are a shareholder of record (i.e., you directly hold your shares through an account with our transfer agent, Wells Fargo), you can vote using one of the methods described below. If you are a beneficial owner (i.e., you indirectly hold your shares through a nominee such as a bank or broker), you can vote using the methods provided by your nominee.

| VOTE BY INTERNET

http://www.proxyvote.com

Have your 12-Digit Control Number (printed in the box marked by the arrow on the notice or proxy card) and follow the instructions. |

VOTE BY PHONE

1-800-690-6903

Use any touch-tone telephone to transmit your voting instructions. |

TO REQUEST A PAPER OR E-MAIL COPY

If you want to receive a paper or email copy of these documents, you must request one. There is NO charge for requesting a copy. Please choose one of the following methods to make your request:

1) BY INTERNET: www.proxyvote.com 2) BY TELEPHONE: 1-800-579-1639 3) BY EMAIL*: sendmaterial@proxyvote.com * If requesting materials by email, please send a blank email with your 12-Digit Control Number in the subject line (your Control Number can be found in the box marked by the arrow on the notice or proxy card). Requests, instructions and other inquiries sent to this email address will NOT be forwarded to your investment advisor. Please make the request as instructed above on or before April 29, 2014 to facilitate timely delivery.

|

PROPOSAL 1

Election of Directors

A board of 12 directors is to be elected, four by the holders of Class A Common Shares voting separately as a class and eight by the holders of Common Voting Shares voting separately as a class. In the election, the nominees receiving the greatest number of votes will be elected.

Each proxy for Class A Common Shares executed and returned by a holder of such shares will be voted for the election of the four directors hereinafter shown as nominees for such class of shares, unless otherwise indicated on such proxy. Each proxy for Common Voting Shares executed and returned by a holder of such shares will be voted for the election of the eight directors hereinafter shown as nominees for such class of shares, unless otherwise indicated on such proxy. Although the board of directors does not contemplate that any of the nominees hereinafter named will be unavailable for election, in the event that any such nominee is unable to serve, the proxies will be voted for the remaining nominees and for such other person(s), if any, as the board of directors may propose.

2

REPORT ON THE NOMINEES FOR ELECTION TO THE BOARD OF DIRECTORS

The following table sets forth certain information as to each of the nominees for election to the board of directors.

| Name |

Age | Director Since |

Principal Occupation or Occupation/Business Experience for Past Five Years | |||

| Nominees for Election by Holders of Class A Common Shares | ||||||

| Jarl Mohn(1) |

62 | 2008 | Trustee of the Mohn Family Trust since September 1991, Interim CEO at MobiTV (converged media platform) from May 2007 to October 2007; President and Chief Executive Officer of Liberty Digital, Inc. (a media company) from January 1999 to March 2002; President and CEO of E! Entertainment Television (a network with programming dedicated to the world of entertainment) from January 1990 to December 1998. | |||

| Mr. Mohn brings more than forty years experience in the media industry through his prior positions as Chief Executive Officer of several major media companies. Additionally, he has 25 years experience in the cable TV industry. He is known for his vast and extensive industry knowledge, innovative thinking and expertise as well as a thorough understanding of the challenges and opportunities faced by the Company. Additionally, he served as a director of The E. W. Scripps Company, which provided him with institutional knowledge of the Company. | ||||||

| Nicholas B. Paumgarten(2) |

67 | 2008 | Chairman, Corsair Capital LLC (an investment firm) since March 2006; Managing Director of J.P. Morgan Chase and Chairman of J.P. Morgan Corsair II Capital Partners L.P. (an investment banking firm and an investment fund) from February 1992 to March 2006. | |||

| Mr. Paumgarten has extensive financial industry experience and brings both financial services and corporate governance perspective to the Company as the current Chairman of Corsair Capital, a former Managing Director of J.P. Morgan Chase, and the former Chairman of J.P. Morgan Corsair II Capital Partners L.P. His prior service as a director of The E. W. Scripps Company provided him with institutional knowledge and expertise in the media industry. | ||||||

3

| Name |

Age | Director Since |

Principal Occupation or Occupation/Business Experience for Past Five Years | |||

| Jeffrey Sagansky(3) |

61 | 2008 | President of Silver Eagle Acquisition Corp. since July 2013; Chairman of Hemisphere Media Capital (a private film and TV finance company) since 2011; Former President of Global

Eagle Acquisition Corp. (a special purpose acquisition company) from 2011 to February 2013; former Chairman of RHI Entertainment, LLC (a producer and distributor of long-form television content) from February 2009 to December 2010; Former Chairman of Elm Tree Partners, LLC (a capital project fund and financing company) from January 2007 to December 2010. | |||

| Mr. Sagansky brings more than thirty-five years of experience managing television operations and investing in television distribution and production companies, which enables him to provide critical insights into the media industry and how best to position the Company for success. He also holds an MBA from Harvard Business School. From his long-term experience in the media industry, he brings expertise and industry knowledge to the board. Also, as a former director of The E. W. Scripps Company, he brings historical knowledge of the Company and its strengths, challenges and opportunities. | ||||||

| Ronald W. Tysoe(4) |

60 | 2008 | Senior Advisor of Perella Weinberg Partners LP (a global, independent advisory and asset management firm) from October 2006 to September 2007; Vice Chairman of Federated Department Stores, Inc. (now Macy’s Inc., a retail organization operating stores and Internet websites) from April 1990 to October 2006. | |||

| Mr. Tysoe brings significant experience in accounting and finance, including serving on a number of audit committees of public companies and as a former Chief Financial Officer of a large public company. Mr. Tysoe is an audit committee financial expert as defined in the SEC rules adopted under the Sarbanes-Oxley Act. Additionally, he served as a director of The E. W. Scripps Company, which provided him with institutional knowledge and insight into the challenges and opportunities of the Company. |

4

| Name |

Age | Director Since |

Principal Occupation or Occupation/Business Experience for Past Five Years | |||

| Nominees for Election by Holders of Common Voting Shares | ||||||

| Gina L. Bianchini |

41 | 2012 | Founder and CEO of Mighty Software, Inc. (provider of social software solutions) since September 2010. CEO of Ning, Inc. (platform for creating social websites) from 2004 to March 2010. Co-Founder and President of Harmonic Communications (an advertising tracking, measurement, and optimization software company) from March 2000 to July 2003. | |||

| Ms. Bianchini’s expertise, vision and creativity in the rapidly evolving world of social networking make her uniquely qualified to serve the Company. Her valuable insight and guidance will benefit the Company as it develops new interactive businesses and explores opportunities to create and deliver our brand of lifestyle content on innovative digital platforms. | ||||||

| Michael R. Costa |

56 | 2009 | Former Head of Mergers and Acquisitions and Vice Chairman of Investment Banking, Cowen and Company (a diversified financial services firm) from 2010–2011. Former Managing Director, Global Markets and Investment Banking/Mergers and Acquisitions of Merrill Lynch & Co. (provider of wealth management, securities trading and sales, corporate finance and investment banking services) from 1989 through 2008. | |||

| Mr. Costa brings more than twenty years of finance/investment banking experience to the board of directors. He also holds a law degree. His prior work experience includes serving as a financial advisor to numerous corporations/boards of directors in the media and communications industries in connection with mergers, acquisitions and corporate restructurings. | ||||||

| David A. Galloway(5) |

70 | 2008 | President and Chief Executive Officer of Torstar Corporation (a media company listed on the Toronto Stock Exchange) from 1988 until his retirement in May 2002. | |||

| Mr. Galloway brings over twenty years of media industry experience to the Company. His previous role as Chief Executive Officer provides him with knowledge, experience and insight into various budget issues as well as oversight, governance and management of large organizations. He holds an MBA from Harvard Business School and has extensive business experience and leadership skills. Additionally, he served on the board of directors of The E. W. Scripps Company, which provided him with institutional knowledge and insight into the challenges and opportunities of the Company. | ||||||

5

| Name |

Age | Director Since |

Principal Occupation or Occupation/Business Experience for Past Five Years | |||

| Kenneth W. Lowe |

64 | 2008 | Chairman, President and Chief Executive Officer of the Company since July 2008. President and Chief Executive Officer of The E. W. Scripps Company (a media company) from October 2000 to June 2008. President and Chief Operating Officer from January 2000 to September 2000 of The E. W. Scripps Company. | |||

| From his service as the current Chairman, President and Chief Executive Officer of the Company and his prior service as President and Chief Executive Officer and Chief Operating Officer of The E. W. Scripps Company, Mr. Lowe brings deep institutional knowledge and perspective regarding the Company’s strengths, challenges and opportunities. He possesses extensive public company and media industry experience. | ||||||

| Richelle P. Parham |

46 | 2012 | Chief Marketing Officer of eBay Marketplaces, North America (Ecommerce company) since 2010. Head of Global Marketing Innovation and Head of Global Marketing Services for Visa, Inc. (credit card company) from 2008 to 2010. Senior Vice President and General Manager of Digitas (an integrated advertising agency) from 1994 to 2007. | |||

| Ms. Parham has more than 20 years of global marketing experience. Her experience developing strategies that deliver strong return on marketing investments becomes increasingly important as we create lifestyle content services for consumers on emerging interactive media platforms. | ||||||

| Mary McCabe Peirce(6)(7) |

65 | 2008 | Mrs. Peirce brings institutional knowledge to the Company through her service as a trustee of The Edward W. Scripps Trust and as a director of The E. W. Scripps Company. As a result of her service, she has a thorough understanding of the Company’s history and vision. | |||

| Nackey E. Scagliotti(7) |

68 | 2008 | Former Chairman of The E. W. Scripps Company from 2009 to 2013; Former Chairman of the Board of Directors from May 1999 to December 2008 and Assistant Publisher from 1996 to May 1999 of The Union Leader Corporation (New Hampshire publisher of daily, Sunday and weekly newspapers). Former President (1999 to 2003) and Publisher (1999 to 2000) of Neighborhood Publications, Inc. (New Hampshire publisher of weekly newspapers). | |||

6

| Name |

Age | Director Since |

Principal Occupation or Occupation/Business Experience for Past Five Years | |||

| Mrs. Scagliotti brings institutional knowledge to the Company through her service as a trustee of The Edward W. Scripps Trust and as former Chairman of The E. W. Scripps Company. | ||||||

| Wesley W. Scripps(7) |

31 | Founder and owner of Forlio Designs LLC (a web design firm) since 2008. | ||||

| Mr. Scripps’ experience in owning and operating a web design firm provides real-time, valuable insight and guidance to the Company as it develops new interactive businesses and promotes its brands on various platforms. |

| (1) | Mr. Mohn is a director of comScore (an internet and media measurement company), Fan TV (a video discovery device), Rubicon Project (a private web real time ad trading company) and Playdek (a mobile game developer). He was previously a director of CNET, XM Satellite Radio Holdings, Inc. and Ntro. |

| (2) | Mr. Paumgarten is a director of Sparta Insurance (an insurance company) and Kyobo Life Insurance Co., Ltd. (a Korean private company). He was previously a director of Compucredit and Post Properties, Inc. |

| (3) | Mr. Sagansky is a managing partner in Hemisphere Media Capital (a private film and TV finance company), a director of Global Eagle Entertainment, Inc. (an airline supplier of entertainment to the worldwide airline business) and a director of Starz (a pay cable operator). He was previously a director of RHI Entertainment and American Media. |

| (4) | Mr. Tysoe is a director of Canadian Imperial Bank of Commerce, Cintas Corporation (a company providing specialized services, including uniform programs and other products, to businesses), J. C. Penney Company, Inc. (an apparel and home furnishing retailer) and Taubman Centers, Inc. (a real estate company that owns and operates regional shopping centers). He was previously a director of NRDC Acquisition Corporation, Ohio Casualty Corporation and Pzena Investment Management, Inc. |

| (5) | Mr. Galloway is a director of Toromont Industries (a Caterpillar machinery dealer). He was previously chair of Bank of Montreal and a director of Shell Canada, Cognos Inc. and Abitibi Consolidated. He was chair of Hospital for Sick Children in Toronto from 2002-2005 and on the board for thirteen years. |

| (6) | Mrs. Peirce is a director of The E. W. Scripps Company (a media company with interests in television stations, newspapers and local news and information Web sites). |

| (7) | Mrs. Peirce and Mrs. Scagliotti are first cousins. Mr. Scripps is a nephew to Mrs. Peirce and Mrs. Scagliotti. |

7

REPORT ON THE SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS

The following table sets forth certain information with respect to persons known to management to be the beneficial owners, as of January 31, 2014, unless indicated otherwise in the footnotes below, of more than 5 percent of the Company’s outstanding Class A Common Shares or Common Voting Shares. Unless otherwise indicated, the persons named in the table have sole voting and investment power with respect to all shares shown therein as being beneficially owned by them.

| Total Shares to be Beneficially Owned |

Percentage of Total(1) | |||||||||||||||

| Name and Address of Beneficial Owner |

Class A Common Shares |

Common Voting Shares |

Class A Common Shares |

Common Voting Shares |

||||||||||||

| GREATER THAN FIVE PERCENT SHAREHOLDERS |

||||||||||||||||

| Signatories to Scripps Family Agreement(2) |

— | 31,533,112 | — | 91.9 | % | |||||||||||

| c/o Bruce W. Sanford, Esq. Baker & Hostetler LP Washington Square, Suite 1100 1050 Connecticut Avenue, NW Washington, DC 20036-5304 |

||||||||||||||||

| Miramar Fiduciary Corporation(3) |

9,419,121 | — | 8.4 | % | — | |||||||||||

| 100 West Liberty Street, 10th Floor Reno, Nevada 89501 |

||||||||||||||||

| The Vanguard Group(4) |

5,987,506 | — | 5.3 | % | — | |||||||||||

| 100 Vanguard Blvd. Malvern, Pennsylvania 19355 |

||||||||||||||||

| (1) | Percentage of class is based on 111,972,476 Class A Common Shares and 34,317,171 Common Voting Shares outstanding as of January 31, 2014. Subject to the Scripps Family Agreement, each Common Voting Share is convertible at no cost and at any time into one Class A Common Share. |

| (2) | Certain descendants of Robert P. Scripps, descendants of John P. Scripps, certain trusts of which descendants of John P. Scripps or Robert P. Scripps are trustees or beneficiaries and an estate of a descendent of Robert P. Scripps are signatories to the Scripps Family Agreement, which governs the transfer and voting of all Common Voting Shares held by such signatories. The information in the table and this footnote is based on Amendment No. 2 to a Schedule 13D filed with the SEC on September 20, 2013 by the signatories to the Scripps Family Agreement. The signatories to the Scripps Family Agreement report shared voting power with each other with respect to the Common Voting Shares shown in the table because such shares will be voted as instructed by a vote conducted in accordance with the procedures set forth in the Scripps Family Agreement. The shares shown in the table do not include 1,604,000 Common Voting Shares held by two signatories to the Scripps Family Agreement as co-guardians for a minor which are not subject to the Scripps Family Agreement or 801,999 Common Voting Shares which may be deemed to be beneficially owned by another signatory to the Scripps Family Agreement as advisor to minors trusts, which also are not subject to the Scripps Family Agreement. |

The signatories to the Scripps Family Agreement also report that they individually beneficially own, in the aggregate, an additional 23,200,423 Class A Common Shares (20.8% of the outstanding Class A Common Shares), including an additional 29,192 Class A Common Shares, 51,683 Class A Common Shares, 34,272 Class A Common Shares and 34,272 Class A Common Shares, respectively, that Mary McCabe Peirce and Nackey Scagliotti (each of whom is a director of the Company), Edward W. Scripps, Jr. and Paul K. Scripps have the right to acquire within 60 days pursuant to outstanding stock options and restricted share units. Also includes 1,638,108 Class A Common Shares which may be deemed to be beneficially owned by two signatories to the Scripps Family Agreement in their capacity as co-guardians for a minor and 819,054 Class A Common Shares which may be deemed to be beneficially owned by another signatory to the Scripps Family Agreement in her capacity as an advisor to minors trusts. None of the Class A Common Shares are subject to the Scripps Family Agreement.

8

If the Scripps Family Agreement is not considered, none of the signatories of the Scripps Family Agreement currently beneficially owns more than 5% of the Company’s outstanding Class A Common Shares or Common Voting Shares, other than: (i) Mary McCabe Peirce and Elizabeth A. Logan, each of whom beneficially owns 2,406,000 Common Voting Shares (7 percent of the outstanding Common Voting Shares), including 1,604,000 Common Voting Shares as to which they may be deemed to share beneficial ownership as co-guardians on behalf of a minor (which are not subject to the Scripps Family Agreement), and (ii) Virginia S. Vasquez and Rebecca Scripps Brickner, each of whom beneficially owns 2,406,000 Common Voting Shares (7 percent of the outstanding Common Voting Shares), including shares held by the Estate of Robert P. Scripps, Jr., of which they are co-executors (all of which are subject to the Scripps Family Agreement).

The signatories to the Scripps Family Agreement filing the Amendment No. 2 to Schedule 13D were Virginia S. Vasquez, Rebecca Scripps Brickner, Estate of Robert P. Scripps, Jr., Edward W. Scripps, Jr., Corina S. Granado, Jimmy R. Scripps, Mary Ann S. Sanchez, Margaret E. Scripps (Klenzing), William H. Scripps, Marilyn J. Scripps (Wade), Adam R. Scripps, William A. Scripps, Gerald J. Scripps, Charles E. Scripps, Jr., Eli W. Scripps, Jonathan L. Scripps, Peter M. Scripps, Barbara Victoria Scripps Evans, Molly E. McCabe, John P. Scripps Trust FBO Peter M. Scripps U/A dated 2/10/77, John P. Scripps Trust FBO Paul K. Scripps U/A dated 2/10/77, John P. Scripps Trust Exempt Trust U/A dated 2/10/77, John P. Scripps Trust FBO Barbara Scripps Evans U/A dated 2/10/77, John Peter Scripps 1983 Trust, The Marital Trust of the La Dow Family Trust, Anne M. La Dow Trust U/A dated 10/27/2011, The La Dow Family Trust U/A dated 6/29/2004, John P. Scripps Trust FBO John Peter Scripps U/A dated 12/28/84, John P. Scripps Trust FBO Ellen McRae Scripps U/A dated 12/28/84, John P. Scripps Trust FBO Douglas A. Evans U/A dated 12/24/84, Douglas A. Evans 1983 Trust, Ellen McRae Scripps 1983 Trust, Victoria S. Evans Trust U/A dated 5/19/2004, Peter M. Scripps Trust U/A Dated 11/13/2002, Paul K. Scripps Family Revocable Trust U/A dated 2/7/1994, Thomas S. Evans Irrevocable Trust U/A dated 11/13/2012, Thomas S. Evans, Douglas A. Evans, Julia Scripps Heidt, Paul K. Scripps, Charles Kyne McCabe, Peter R. La Dow, J. Sebastian Scripps, Anne M. La Dow, Wendy E. Scripps, Nackey E. Scagliotti, Cynthia J. Scripps, Edith L. Tomasko, Mary Peirce, Elizabeth A. Logan, Eva Scripps Attal, John P. Scripps, Eaton M. Scripps, Megan Scripps Tagliaferri, Ellen McRae Scripps, Careen Cardin and Cody Dubuc. Since Amendment No. 2 to Schedule 13D was filed with the SEC, to the knowledge of the Company, the following transferees of Common Voting Shares from signatories to the Scripps Family Agreement also have become parties to the Scripps Family Agreement: Kathy Scripps, Sam D.F. Scripps, Welland H. Scripps, William A. Scripps, Jr., Wesley W. Scripps, John Peter Scripps 2013 Revocable Trust dated December 20, 2013 and R. Michael Scagliotti.

| (3) | This information is based on a Schedule 13G filed with the SEC by Miramar Fiduciary Corporation on September 20, 2013. According to the filing, Miramar Fiduciary Corporation has sole voting and dispositive power with respect to these Class A Common Shares, which are held by several grantor retained annuity trusts of which it serves as independent trustee. |

| (4) | This information is based on a Schedule 13G filed with the SEC by The Vanguard Group on February 11, 2014. According to the filing, The Vanguard Group holds sole voting power with respect to 170,875 Class A Common Shares, sole dispositive power with respect to 5,826,831 Class A Common Shares and shared dispositive power with respect to 160,675 Class A Common Shares. |

The Scripps Family Agreement

General. The Edward W. Scripps Trust (the “Trust”), the former controlling shareholder of the Company, ended on October 18, 2012 upon the death of Robert P. Scripps, a grandson of the founder. He was the last of Edward W. Scripps’ grandchildren upon whom the duration of the Trust was based.

Certain beneficiaries of the Trust and certain members of the John P. Scripps family and trusts for their benefit, are signatories to the Scripps Family Agreement that governs the transfer and voting of Common Voting Shares. On January 28, 2013, the Company filed with the SEC a Report on Form 8-K reporting a change in control of the Company as a result of an order issued by the Court of Common Pleas, Probate Division, Butler County, Ohio directing that the trustees of the Trust vote the Common Voting Shares held by the Trust prior to distribution as instructed by a vote conducted in accordance with the Scripps Family Agreement.

9

On March 14, 2013, the Trust distributed to the beneficiaries of the Trust, other than three beneficiaries who are minors, 31,943,106 Class A Common Shares and 31,277,999 Voting Common Shares held by the Trust pursuant to the terms of the Trust for no consideration. The remaining 819,091 Class A Common Shares and 801,999 Voting Common Shares held by the Trust (other than 37 Class A Common Shares that were sold in the market so that no fractional shares were distributed) were distributed on September 20, 2013 to trusts established for the purpose of holding the shares on behalf of the three minor beneficiaries of the Trust. One of the signatories to the Scripps Family Agreement was appointed as a trust advisor with respect to the transfer and voting of such shares.

As of March 14, 2013, the provisions of the Scripps Family Agreement fully govern the transfer and voting of the Common Voting Shares held by the signatories to the Scripps Family Agreement. The three minors’ trusts are not parties to the Scripps Family Agreement, and they may or may not become a party in the future. The signatory to the Scripps Family Agreement who was appointed as trust advisor with respect to the shares to be held by the minors’ trusts may be deemed to have beneficial ownership of those shares, but unless the minor’s trust becomes a party, it will not be bound by the Scripps Family Agreement with respect to those shares.

Voting Provisions of the Scripps Family Agreement. Section 9 of the Scripps Family Agreement provides that the Company will call a meeting of the signatories to the agreement prior to each annual or special meeting of the shareholders of the Company. At each of these meetings, the Company will discuss with the signatories to the agreement, each matter, including election of directors, that the Company will submit to the holders of Common Shares at the annual meeting or special meeting with respect to which the meeting under the agreement has been called. Each signatory to the agreement is entitled, either in person or by proxy, to cast one vote for each Common Voting Share owned of record or beneficially by the signatory on each matter brought for a vote at the meeting. Each signatory to the agreement is bound by the decision reached by majority vote with respect to each such matter, and at the related annual or special meeting of the shareholders of the Company each signatory to the agreement is required to vote the signatory’s Common Voting Shares in accordance with the decisions reached at the meeting of the signatories.

The signatories to the Scripps Family Agreement have informed the Company that at a March 12, 2014 meeting of the signatories held pursuant to the Scripps Family Agreement, the signatories approved election of the eight director nominees to be voted on by the holders of Common Voting Shares and approved Proposal 2. Accordingly, based on such approval, the signatories have informed the Company that they will vote the Common Voting Shares held of record by them in favor of such nominees and for Proposal 2 at the annual meeting of shareholders.

Transfer Restrictions of the Scripps Family Agreement. No signatory to the Scripps Family Agreement is permitted to dispose of any Common Voting Shares (except as otherwise summarized below) without first giving other signatories and the Company the opportunity to purchase the shares. Signatories are not able to convert Common Voting Shares into Class A Common Shares except for a limited period of time after giving other signatories and the Company the opportunity to purchase and except in certain other limited circumstances.

Signatories are permitted to transfer Common Voting Shares to their lineal descendants or trusts for the benefit of such descendants, or to any trust for the benefit of the spouse of such descendant or any other person or entity. Descendants to whom the shares are sold or transferred outright, and trustees of trusts into which such shares are transferred, must become parties to the Scripps Family Agreement or the shares will be deemed to be offered for sale pursuant to the Scripps Family Agreement. Signatories also are permitted to transfer Common Voting Shares by testamentary transfer to their spouses provided the shares are converted to Class A Common Shares and to pledge the shares as collateral security provided that the pledgee agrees to be bound by the terms of the Scripps Family Agreement. If title to any such shares subject to any trust is transferred to anyone other than a descendant of Robert P. Scripps or John P. Scripps, or if a person who is a descendant of Robert P. Scripps or John P. Scripps acquires outright any such shares held in trust but is not or does not become a party to the Scripps Family Agreement, such shares shall be deemed to be offered for sale pursuant to the Scripps Family Agreement. Any valid transfer of Common Voting Shares made by signatories to the agreement without compliance with the agreement will result in automatic conversion of such shares to Class A Common Shares.

10

Duration of the Scripps Family Agreement. The provisions restricting transfer of Common Voting Shares under the Scripps Family Agreement will continue until 21 years after the death of the last survivor of the descendants of Robert P. Scripps and John P. Scripps alive when the Trust terminated. The provisions of the Scripps Family Agreement governing the voting of Common Voting Shares will be effective for a 10-year period after termination of the Trust and may be renewed for additional 10-year periods.

Beneficial Ownership by Executive Officers and Directors

The following table sets forth certain information with respect to the beneficial ownership of Class A Common Shares and Common Voting Shares by the Company’s executive officers and directors as of January 31, 2014.*

| Name of Beneficial Owner: |

Class A Common Shares(1) |

Exercisable Options(2) |

Vested Restricted Stock Units(3) |

Total Class A Common Shares(4) |

Common Voting Shares(1) |

Percentage of Total(1) |

||||||||||||||||||||||

| Class A Common Shares |

Common Voting Shares |

|||||||||||||||||||||||||||

| Gina L. Bianchini |

1,500 | 8,933 | 1,138 | 11,571 | 0 | * | * | |||||||||||||||||||||

| John H. Burlingame |

10,383 | 45,881 | 1,138 | 57,402 | 0 | * | * | |||||||||||||||||||||

| Michael R. Costa |

4,825 | 33,029 | 1,138 | 38,992 | 0 | * | * | |||||||||||||||||||||

| David A. Galloway |

2,000 | 33,029 | 1,138 | 36,167 | 0 | * | * | |||||||||||||||||||||

| Cynthia L. Gibson |

12,511 | 25,563 | 3,083 | 41,157 | 0 | * | * | |||||||||||||||||||||

| Mark S. Hale |

4,815 | 76,924 | 7,039 | 88,778 | 0 | * | * | |||||||||||||||||||||

| Burton F. Jablin |

807 | 12,775 | 1,940 | 15,522 | 0 | * | * | |||||||||||||||||||||

| Kenneth W. Lowe |

187,401 | 841,235 | 39,008 | 1,067,644 | 0 | * | * | |||||||||||||||||||||

| Jarl Mohn(5) |

20,162 | 33,029 | 1,138 | 54,329 | 0 | * | * | |||||||||||||||||||||

| Joseph G. NeCastro |

28,490 | 167,486 | 39,308 | 235,284 | 0 | * | * | |||||||||||||||||||||

| Richelle P. Parham |

1,500 | 8,933 | 1,138 | 11,571 | 0 | * | * | |||||||||||||||||||||

| Nicholas B. Paumgarten(6) |

19,531 | 61,298 | 1,138 | 81,967 | 0 | * | * | |||||||||||||||||||||

| Mary M. Peirce(7) |

2,053,713 | 33,029 | 1,138 | 2,087,880 | 33,137,112 | 1.86 | % | 96.6 | % | |||||||||||||||||||

| Jeffrey Sagansky |

13,580 | 8,933 | 1,138 | 23,651 | 0 | * | * | |||||||||||||||||||||

| Nackey E. Scagliotti(7) |

835,845 | 50,165 | 1,138 | 887,148 | 31,533,112 | * | 91.9 | % | ||||||||||||||||||||

| Dennis W. Shuler |

0 | 0 | 0 | 0 | 0 | * | * | |||||||||||||||||||||

| Ronald W. Tysoe |

1,500 | 18,458 | 1,138 | 21,096 | 0 | * | * | |||||||||||||||||||||

| All directors & executive |

3,213,492 | 1,518,729 | 109,500 | 4,841,721 | 33,137,112 | 2.87 | % | 96.6 | % | |||||||||||||||||||

| officers as a group (22 persons) |

||||||||||||||||||||||||||||

| * | Shares owned represent less than 1% of the outstanding shares of such class of stock. |

| (1) | The shares listed for each of the officers and directors represent his or her direct or indirect beneficial ownership of Class A Common Shares and Common Voting Shares. |

| (2) | The shares listed for each of the executive officers and directors include Class A Common Shares underlying exercisable options at January 31, 2014 and options that will be exercisable within 60 days after January 31, 2014 and options that will vest upon retirement. |

| (3) | The shares listed for each of the executive officers and directors includes Class A Common Shares underlying restricted stock units at January 31, 2014 and restricted stock units that will be vested within 60 days of January 31, 2014 and restricted stock units that will vest upon retirement. |

| (4) | The shares listed do not include the balances held in any of the directors’ phantom share accounts that are the result of an election to defer compensation under the 2008 Deferred Compensation Plan for Directors. None of the shares listed for any officer or director is pledged as security for any obligation, such as pursuant to a loan arrangement or agreement or pursuant to any margin account agreement. |

11

| (5) | The shares for Mr. Mohn include 100 shares held in an S corporation that is 100 percent controlled by The Mohn Family Trust. |

| (6) | The shares listed for Mr. Paumgarten include 1,700 shares owned by his wife. Mr. Paumgarten disclaims beneficial ownership of such shares. |

| (7) | The shares listed for Mrs. Peirce include 1,638,108 Class A Shares and 1,604,000 Common Voting Shares held as co-guardian on behalf of a minor trust beneficiary. Mrs. Peirce and Mrs. Scagliotti are signatories to the Scripps Family Agreement. See “The Scripps Family Agreement” and footnote (2) to the preceding table. |

REPORT ON THE BOARD OF DIRECTORS AND ITS COMMITTEES

2013 Board Meetings

During 2013, the board of directors held four regularly scheduled meetings and eight special meetings. All directors attended at least 75 percent of the meetings of the board and of the committees on which they served during the year ended December 31, 2013.

Executive Sessions of Directors

Executive sessions of non-management directors are held regularly. A lead director selected by the board of directors or another non-management director selected by the board of directors at the time of the meeting presides at each of these meetings. Nicholas B. Paumgarten currently is serving as the lead director.

Committee Charters

The charters of the audit, compensation and nominating and governance committees are available for review on the Company’s website at www.scrippsnetworksinteractive.com by first clicking on “Investors,” and then “Corporate Governance,” and then on each committee’s name. Copies are available in print to any shareholder who requests a copy by contacting the corporate secretary at 9721 Sherrill Blvd., Knoxville, Tennessee 37932.

Committees of the Board of Directors

Executive Committee. Kenneth W. Lowe, Chair, Nicholas B. Paumgarten and Nackey E. Scagliotti are the members of the executive committee. The board of directors may delegate authority to the executive committee to exercise certain powers of the board of directors in the management of the business and affairs of the Company between board of directors meetings.

Audit Committee. Ronald W. Tysoe, Chair, Michael R. Costa, Richelle P. Parham and Jeffrey Sagansky are the members of the audit committee. The purpose of the committee is to assist the board of directors in fulfilling its oversight responsibility relating to: (1) the integrity of the Company’s financial statements and financial reporting process and the Company’s systems of internal accounting and financial controls; (2) the performance of the internal audit services function; (3) the annual independent audit of the Company’s financial statements, the engagement of the independent auditors and the evaluation of the independent auditors’ qualifications, independence, performance and fees; (4) the compliance by the Company with legal and regulatory requirements, including the Company’s disclosure controls and procedures; (5) the evaluation of enterprise risk issues; and (6) the fulfillment of all other responsibilities as outlined in its charter. The internal and independent auditors have unrestricted access to the audit committee. The committee meets privately with each of the independent auditors, the internal auditors and management. During 2013, the audit committee held ten meetings. Each member of the audit committee is financially literate, under applicable Securities and Exchange Commission (“SEC”) and New York Stock Exchange (“NYSE”) standards. In addition, Mr. Tysoe is an “audit committee financial expert,” as defined under SEC regulations. No member of the committee may receive any compensation, consulting, advisory or other fee from the Company, other than the board of directors compensation described elsewhere in this proxy statement, as determined in accordance with applicable SEC and NYSE rules.

The Company does not limit the number of other audit committees on which the members serve; however, in each case, the board of directors evaluates and determines whether commitments to serve on other audit

12

committees impairs such member’s effective service to the Company. Mr. Tysoe currently serves on the audit committees of three public companies, in addition to service on the audit committee of the Company. The Company’s board of directors reviewed this service commitment and determined that such simultaneous service does not impair his ability to effectively serve on the Company’s audit committee.

Compensation Committee. David A. Galloway, Chair, Gina L. Bianchini, John H. Burlingame, Jarl Mohn and Nackey E. Scagliotti are the members of the compensation committee. The committee is appointed by the board of directors to discharge the board of director’s responsibilities relating to compensation of the Company’s officers. The committee reviews and approves the Company’s goals and objectives relevant to compensation of senior management and evaluates the performance of senior management in light of those goals and objectives. With respect to the senior managers, the committee establishes base compensation levels, the terms of incentive compensation plans and equity-based plans and post-service arrangements. The committee approves all awards under the Company’s Long-Term Incentive Plan and approves awards under the Company’s Executive Annual Incentive Plan. The committee reviews all of the components of the chief executive officer’s compensation, including goals and objectives, and makes recommendations to the board of directors.

With respect to any funded employee benefit plans, the committee appoints and monitors named fiduciaries. On an annual basis, the committee reviews the operation of the Company’s compensation program to evaluate its coordination and execution and reviews any management perquisites. The committee reviews succession planning relating to positions held by senior officers and makes recommendations with respect thereto to the board of directors. The committee has the authority to engage outside consultants to assist in determining appropriate compensation levels for the chief executive officer, other senior managers and directors. The committee is also responsible for producing an annual report for inclusion in the Company’s proxy statement and for reviewing and approving the Compensation Discussion and Analysis and related compensation disclosure included in the Company’s proxy statement. During 2013, the compensation committee held four meetings.

Nominating and Governance Committee. Jeffrey Sagansky, Chair, Nicholas B. Paumgarten, Mary McCabe Peirce and Ronald W. Tysoe are the members of the nominating and governance committee. The purpose of the committee is: (1) to assist the board of directors by identifying individuals qualified to become board members and to recommend director nominees to the board of directors; (2) to recommend to the board the Corporate Governance Guidelines applicable to the Company; (3) to lead the board of directors in its annual review of the board of directors’ performance; (4) to recommend to the board of directors nominees for each committee of the board of directors; and (5) to review and make recommendations with respect to director compensation to the board of directors. During 2013, the nominating and governance committee held four meetings.

Pricing Committee. Ronald W. Tysoe, Jarl Mohn and Michael R. Costa are the members of a special pricing committee appointed by the board of directors to review affiliate agreements. The pricing committee met one time in 2013.

Digital Advisory Committee. Gina L. Bianchini, Chair, Jarl Mohn and Richelle P. Parham are the members of the digital advisory committee appointed by the board of directors in November 2012 to further the Company’s on-going commitment to create viable, profitable and growing interactive content strategies and businesses. The digital advisory committee met three times in 2013.

CORPORATE GOVERNANCE

The board of directors is committed to good corporate governance, good business practices and transparency in financial reporting. The nominating and governance committee annually reviews the Company’s corporate governance principles, a copy of which is available on the Company’s website by clicking on “Investors,” then “Corporate Governance,” and “Governance Highlights.” Copies are available in print to any shareholder who requests a copy by contacting the corporate secretary at 9721 Sherrill Blvd., Knoxville, Tennessee 37932.

Code of Ethics

The Company demonstrates its commitment to operate at the highest ethical standards by enforcing the principles in its Code of Ethics which is applicable to all employees. The Company’s corporate ethics program

13

director is responsible for implementation and oversight of the ethics program. Additionally, the Company has in place a Code of Business Conduct and Ethics for the Chief Executive Officer and the Senior Financial and Accounting Officers. It is the responsibility of the audit committee and the chief financial officer to make sure that this policy is operative and has effective reporting and enforcement mechanisms. The Code of Business Conduct and Ethics for the Chief Executive Officer and Senior Financial Officers is available for review on the Company’s website and to any shareholder who requests a printed copy. Amendments to the policies and waivers of provisions applicable to executive officers or directors may only be made by the board of directors or an authorized committee of the board of directors. Any such amendment or waiver will be promptly disclosed on the Company’s website within four business days.

The Company believes it has an obligation to provide employees with the guidance and support needed to ensure that the best, most ethical choices are made at work. To support this commitment, the Company established a means for employees to submit confidential and anonymous reports of suspected or actual violations of the Company’s Code of Ethics relating, among other things, to: accounting and auditing matters; antitrust activity; confidentiality and misappropriation; conflicts of interest, discrimination or harassment; diverting of product or business activity; embezzlement; falsification of contracts, reports or records; gifts or entertainment; improper supplier or contractor activity; securities violations; sexual harassment; substance abuse; theft; or unsafe working conditions. To submit a report, an employee may call a toll-free number that is answered by a trained professional of EthicsPoint, an independent firm. This number (888-258-3507) is operational 24 hours a day, seven days a week. Employees may also raise questions online through the Internet (www.ethicspoint.com).

Charitable Contributions

The Company has not made any charitable contributions, where the amount has exceeded $1 million or 2 percent of such charity’s consolidated gross revenues, to any charitable organization of which a director is an executive officer.

Board Leadership Structure

Kenneth W. Lowe serves as both the chairman of the Company’s board of directors and as its president and chief executive officer. The board of directors has also appointed a lead director, Nicholas B. Paumgarten, who presides at all meetings of the board of directors at which the chairman is not present, including executive sessions of the independent directors. The lead director also serves as a liaison between the chairman, president and chief executive officer and the independent directors, which includes sharing with the chairman, president and chief executive officer such observations, comments or concerns as he and the other independent directors deem appropriate, reviews with the chairman, president and chief executive officer matters to be presented to the board of directors, including meeting agendas, and has the authority to call meetings of the independent directors. The Company’s enterprise risk issues are reviewed by the audit committee, which reports on such issues to the board of directors based on periodic reports from management. The chairman, president and chief executive officer’s performance is reviewed annually by the compensation committee, which reports such determinations to the board of directors. The Company deems this leadership structure appropriate as it promotes efficiency in communications between the chairman, president and chief executive officer and the board of directors while monitoring effective independent board oversight over the chief executive officer.

Communications with the Board of Directors

Shareholders and other interested parties wishing to communicate with the independent directors as a group or with any individual director (including the lead director) may do so by addressing a letter to the independent directors or to the individual director and sending it to them in care of the corporate secretary at 9721 Sherrill Blvd., Knoxville, Tennessee 37932. For those who wish to send such communications via e-mail, they can do so to cynthia.gibson@scrippsnetworks.com. A majority of the independent directors have instructed the corporate secretary to review all communications so received, and to forward directly to the independent directors or the individual director all such communications, except for communications unrelated to the function of the board of directors. Any communications not forwarded will be retained for one year, and any independent director may request the corporate secretary to forward to the independent director any such communication. The corporate

14

secretary will not share direct communications to the independent directors or an individual director with any other member of management unless instructed to do so by the lead director or the independent director to whom the communication was addressed.

Director Attendance at Annual Meetings of Shareholders

The Company does not have a policy with regard to attendance by the directors at the Annual Meeting of Shareholders. Directors are strongly encouraged to attend the Annual Meeting of Shareholders. At last year’s Annual Meeting, all directors were present.

Director Education

New directors attend a training session that introduces them to the Company’s operations and to the members of management. Thereafter, directors are informed on a regular basis of various director educational programs offered by governance and director organizations. The Company pays for the continuing education of its directors. The director orientation policy is reviewed by the nominating and governance committee annually.

Director Independence — Audit Committee

The board of directors of the Company has determined that none of the current members of the audit committee has any relationship with the Company that could interfere with his or her exercise of independence from management and the Company. Each of the members satisfies the definitions of independence set forth in the rules promulgated under the Sarbanes-Oxley Act and in the listing standards of the NYSE.

Director Independence — Controlled Company Status

The NYSE requires listed companies to have a majority of independent directors on their board of directors and to ensure that their compensation committee and governance committee are composed solely of independent directors as well. A company that qualifies as a “controlled company” does not have to comply with these requirements so long as it discloses to shareholders that the company qualifies as a “controlled company” and is relying on this exemption in not having a majority of independent directors on the board or solely independent directors on either of the aforementioned committees. A “controlled company” is a listed company of which more than 50 percent of the voting power is held by an individual, a group, or another company. Signatories to the Scripps Family Agreement hold a majority of the Company’s outstanding Common Voting Shares and as such the Company qualifies as a “controlled company” and may rely on the NYSE exemption. The Company is not relying at present on that exemption.

Director Independence

The Company has determined that all of the directors, other than Kenneth W. Lowe, have no material relationship with the Company and are independent under the criteria set forth in applicable rules of the SEC, the NYSE Corporate Governance Standards and the Company’s Corporate Governance Principles. Additionally, all of the members of the audit committee, nominating and governance committee and the compensation committee are independent under such standards.

Nominations for Directors

The nominating and governance committee will review any candidate recommended by a shareholder of the Company in light of the committee’s criteria for selection of new directors. If a shareholder wishes to recommend a candidate, he or she should send the recommendation, with a description of the candidate’s qualifications, to: Chair, Nominating and Governance Committee, c/o Ms. Cynthia L. Gibson, Scripps Networks Interactive, Inc., 9721 Sherrill Blvd., Knoxville, TN 37932.

In the past, the committee has hired an independent consultant to assist with the identification and evaluation of director nominees and may do so in the future.

15

Nomination for Directors — Qualification Standards

When selecting new director nominees, the nominating and governance committee considers requirements of applicable law and listing standards, as well as the director qualification standards highlighted in the Company’s corporate governance principles. The committee seeks diversity on the board of directors in terms of skills and experience and other factors. The committee is responsible for reviewing with the board of directors the experience, qualifications, attributes and skills of nominees as well as the diversity and composition of the board of directors as a whole. A person considered for nomination to the board of directors must be a person of high integrity. Other factors considered are independence, age, skills, and experience in the context of the needs of the board of directors. The nominating and governance committee makes recommendations to the board of directors regarding the selection of director nominees. The committee is required to review annually the effectiveness of the Company’s corporate governance principles, including the provisions regarding director qualifications (including diversity) that are part of the corporate governance principles.

Compensation Discussion and Analysis

The purpose of the Compensation Discussion and Analysis (“CD&A”) section is to provide material information about the compensation objectives and policies for our named executive officers (“NEOs”) and to put in perspective the quantitative and narrative disclosures that follow the CD&A. Our named executive officers for Fiscal 2013 were:

| • | Kenneth W. Lowe, Chairman, President & Chief Executive Officer; |

| • | Joseph G. NeCastro, Chief Financial & Administrative Officer; |

| • | Burton F. Jablin, President, Scripps Networks; |

| • | Mark S. Hale, Executive Vice President, Operations & Chief Technology Officer; |

| • | Cynthia L. Gibson, Executive Vice President, Chief Legal Officer and Corporate Secretary; and |

| • | John F. Lansing, Former President, Scripps Networks. |

The CD&A also describes the following:

| • | A summary of our business results and the alignment between executive pay and Company performance; |

| • | Our decision making process on compensation design and pay levels including our compensation governance approach; |

| • | Our compensation philosophy and objectives; and |

| • | A detailed description of the elements of the Company’s executive compensation program. |

Fiscal 2013 Business Review

Scripps Networks Interactive is one of the leading developers of lifestyle-oriented content for television and the Internet.

The Company’s media portfolio includes popular lifestyle television and Internet brands Food Network, HGTV, Travel Channel, DIY Network, Cooking Channel and Great American Country. The Company produces new, original lifestyle programming and has identified the development of Travel Channel as its leading growth opportunity. The Company acquired Travel Channel in late 2009.

The Company also has identified international expansion as a strategic priority. Its international businesses accounted for about 3 percent of total consolidated revenues in 2013 and approximately half of consolidated equity in earnings of affiliates. We currently broadcast 14 channels reaching approximately 150 million subscribers under the Food Network, HGTV, Travel Channel, Asian Food Channel, DIY Network and Fine Living brands.

16

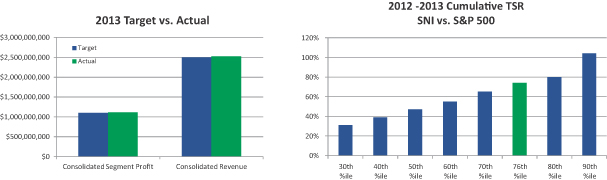

In 2013, the Company’s consolidated operating revenue was $2.5 billion, up 9.7 percent from the prior year. Advertising revenue was $1.7 billion, up 9.8 percent from the prior year. Affiliate fee revenue was $758 million, up 10 percent from the prior year.

Improved advertising revenue reflects the highly desirable audience that the Company’s lifestyle television networks aggregate. It also reflects the success of the Company’s strategy to create relevant programming focused on the valuable home, food and travel consumer categories.

Full-year revenues by network were as follows:

| • | Food Network, $858 million, up 3.3 percent. |

| • | HGTV, $879 million, up 12 percent. |

| • | Travel Channel, $316 million, up 13 percent. |

| • | DIY Network, $139 million, up 14 percent. |

| • | Cooking Channel, $111 million, up 25 percent. |

| • | Great American Country, $27.7 million, up 13 percent. |

Revenue from the Company’s digital businesses, which include its network-branded websites, was $109 million, down 2.6 percent.

Total segment profit for the Company in 2013 increased to $1.1 billion, up 6 percent from the prior year.

Segment profit excludes interest, income taxes, depreciation and amortization, divested operating units, restructuring activities, investment results and certain other items that are included in net income determined in accordance with accounting principles generally accepted in the United States of America (GAAP). The Company’s chief operating decision maker uses segment profit to evaluate the operating performance of business segments and make decisions about the allocation of resources to business segments. Items excluded from segment profit generally result from decisions made in prior periods or from decisions made by corporate executives rather than the managers of the business segments. A reconciliation of segment profit to operating income determined in accordance with GAAP is provided for on page F-7 of the Company’s 2013 Annual Report on Form 10-K.

For the full-year, equity earnings of affiliates were $79.6 million, up 31 percent. Equity earnings in affiliates include the Company’s business partnerships in the United Kingdom and Canada as well as the Food Network and HGTV magazines in the U.S.

Consolidated income from continuing operations attributable to Scripps Networks Interactive was $505 million, or $3.40 per diluted share, compared with $681 million, or $4.44 per diluted share in 2012.

Key Fiscal 2013 Compensation Decisions

Key decisions made in 2013 are recapped below, and discussed in greater detail in the remainder of the CD&A.

| • | Base salary: Three of the six NEOs received base salary increases effective January 1, 2013, ranging from 3.0 percent to 8.2 percent based on individual contributions to overall corporate results and salary level relative to market. |

| • | Annual incentive: Our financial goals, segment profit and revenue, were achieved at 104.8 percent and 103.8 percent of target respectively, resulting in a payout of 104.5 percent of target overall. These achievements represent 6.0 percent growth in segment profit and 9.7 percent growth in revenues over 2012. |

| • | Long-term incentives: |

| • | Performance: For the 2012 Performance-Based Restricted Share Unit (“PBRSU”) grant, the Company’s Total Shareholder Return (“TSR”) was at the 86th percentile as compared to the S&P 500 for the two-year period ending December 31, 2013. However, the Company’s share price experienced a short term |

17

| increase at the end of the measurement period as a result of a media report indicating that the Company was the potential target of an acquisition. In order to more accurately reflect the Company’s overall TSR performance for the entire period, upon the recommendation of management, the Compensation Committee adjusted the payout from 189 percent to 165 percent. |

| • | Plan design: For the 2013 PBRSU grant, we use the S&P 500 companies for relative TSR comparison purposes. |

| • | Employment arrangements: |

| • | We amended Mr. NeCastro’s contract to provide for an additional equity grant in consideration for his waiver of certain severance benefits available to him. |

| • | We entered into a separation agreement with Mr. Lansing in connection with his departure from the Company. |

| • | We entered into a new employment contract with Mr. Jablin who was appointed President, Scripps Networks, effective September 1, 2013. |

| • | Clawback Policy: In February 2014, we adopted a clawback policy under which the independent members of the board of directors may require executive officers to repay or forfeit certain performance-based compensation where the payment, granting or vesting of the compensation is based on restated financial results. |

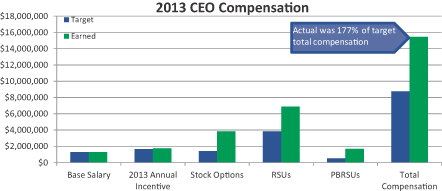

Business Results’ Impact on Compensation

We establish target compensation at the beginning of the performance period. An executive’s actual pay will be above or below the target level based on individual, organizational and stock performance. A substantial portion of each named NEO’s compensation is in the form of equity so that as the stock price rises or falls, so does the NEO’s actual compensation.

We employ a variety of quantitative criteria to assess the performance of our executives. Our objectives include achieving the segment profit and revenue targets and exceeding the median total shareholder return of our peers. The charts below illustrate the relationship between performance and our CEO’s compensation.

18

| * | Stock options and Restricted Share Units (“RSUs”) represent value of awards granted in 2010, 2011 and 2012 that vested in 2013 and PBRSU awards granted in 2012. All equity awards are valued at SNI share price on December 31, 2013. |

Compensation Process Overview

Below we highlight certain executive compensation practices that we consider instrumental in driving Company performance while mitigating risk, as well as practices that we avoid because we do not believe they would serve the interests of our shareholders.

| What We Do |

| Benchmark pay based on the size-adjusted median of companies with which we compete for business and for talent |

| Maintain a pay mix that is heavily performance-based |

| Fully disclose the financial performance drivers used in our incentives, in numeric terms |

| Use different performance metrics in the annual incentive and long-term incentive plan, to avoid heavy reliance on one definition of success |

| Maintain stock ownership guidelines for executives |

| Require double trigger vesting for cash severance payments |

| Retain an independent compensation consultant engaged by, and reporting directly to, the Compensation Committee |

| Initiate a clawback policy to permit repayment or forfeitures of compensation based on restated financial results |

| Retain an independent compensation consultant engaged by, and reporting directly to, the Compensation Committee |

| What We Don’t Do |

| Backdate stock options or reprice without shareholder approval |

| Pay dividends on unearned PBRSU awards |

| Permit hedging transactions or short sales by executives or directors |

| Permit pledging or holding Company stock in a margin account by executives or directors |

| Extend excise tax gross-up provisions to new executives |

19

Role of the Compensation Committee

The compensation committee is responsible for reviewing and approving the Company’s executive compensation policies, plan designs and the compensation of our senior officers, including our NEOs. The committee considers various factors in making compensation determinations, including the officer’s responsibilities and performance, the effectiveness of our programs in supporting the Company’s short-term and long-term strategic objectives, and the Company’s overall financial performance. Additionally, the compensation committee coordinates the full board of directors’ annual review of the CEO’s performance and considers the board of directors’ assessment in its compensation decisions related to the CEO.

To this end, the committee conducts an annual review of executive officer pay levels, reviews market data provided by the independent consultant, approves changes to program designs, including post-termination arrangements, based on an assessment of competitive market practice and emerging trends. Additionally, the committee recommends succession plans to the board of directors, and evaluates the risks associated with the Company’s executive compensation programs.

Role of the Compensation Consultant

In 2013 the compensation committee engaged Meridian Compensation Partners, LLC (“Meridian”) to provide executive compensation consulting services. Meridian’s services to the compensation committee and the nominating and governance committee have included updates on best practices and market trends in executive and director compensation, recommendations regarding executive and director compensation and an independent review of compensation proposals by the Company’s senior management. Meridian attended compensation committee meetings at the committee’s request and was available to provide guidance to the compensation committee questions and issues as they arose. Meridian provides no other services to the Company other than independent compensation advisory services. The compensation committee determined that Meridian is independent after consideration of the SEC independence factors.

Role of Executive Officers in Compensation Decisions

At the request of the compensation committee, the CEO presents individual pay recommendations for each of the NEOs, other than himself. In forming his recommendations, he is advised by information provided by human resource management (executive vice president, chief human resources officer and senior vice president, compensation and benefits) and the independent compensation consultant, assessments of individual contributions, achievement of performance objectives and other qualitative factors. The compensation committee considers these recommendations in approving the pay levels of each NEO. The CEO does not make recommendations concerning his own compensation.

The CEO and other members of human resources regularly attend compensation committee meetings at the committee’s request. Human resources management typically presents recommendations for change to program design and individual pay levels for executive officers, taking into consideration individual performance of each incumbent, appropriate benchmarking information and issues that may arise from an accounting, legal or tax perspective.

Compensation Program Overview

The Company’s executive compensation program is designed to meet the following three objectives that align with and support our strategic business goals:

| • | Attract and retain executives who lead the Company’s efforts to build long-term value for shareholders. |

| • | Reward achievement of annual operating performance goals and sustained increases in shareholder value. |

| • | Emphasize the variable performance-based components of the compensation program more heavily than the fixed components. |

The key elements of the Company’s executive compensation program are base salary, annual incentives, long-term incentives consisting of stock options, time-based restricted share units and performance-based

20

restricted share units, and retirement benefits. The compensation program also includes certain perquisites, but these perquisites are not a significant element of compensation. Each element of compensation is designed to fulfill the objectives discussed above.

| Program |

Form |

Fixed or Variable |

Objectives | |||

| Base salary |

Cash | Fixed | • Serves as attraction and retention incentive • Rewards individual performance | |||

| Annual incentive |

Cash | Variable | • Rewards annual operating results • Emphasizes variable performance-based compensation | |||

| Long-term incentive, which includes: |

• Emphasizes variable performance-based compensation | |||||

| Stock options |

Equity | Variable | • Serves as attraction and retention incentive • Rewards for increasing stock price and enhancing long-term value • Aligns interests with shareholders | |||

| RSUs |

Equity | Fixed | • Serves as attraction and retention incentive • Rewards for maintaining and increasing stock price and enhancing long-term value • Aligns interests with shareholders | |||

| PBRSUs |

Equity | Variable | • Rewards for total shareholder returns • Serves as attraction and retention incentive • Rewards for maintaining and increasing stock price and enhancing long-term value • Aligns interests with shareholders | |||

| Retirement benefits |

Cash | Fixed | • Serves as attraction and retention incentive | |||

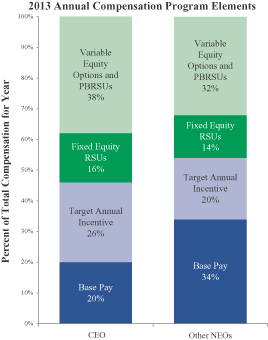

Pay Mix

The committee has not established a specific formula for the allocation of “fixed” and “variable” or “at risk” compensation components and instead retains the discretion to modify the allocation from year to year. In general, a larger percentage of Mr. Lowe’s compensation is variable or “at risk” than that of the other NEOs. The committee believes this approach directly aligns the CEO with shareholder interests and is reflective of his greater responsibilities.

As illustrated, for the 2013 annual program elements, approximately 66 percent of the total direct compensation opportunity (i.e., the sum of base salary, annual incentives, variable equity at target and fixed equity) for the Company’s NEOs employed on the last day of 2013 (other than the CEO) was weighted — assuming payout at target levels — toward variable and equity components. The total direct compensation opportunity for the CEO was approximately 80 percent weighted toward variable and equity components.

A significant portion of the compensation program for the NEOs is “variable” or “at risk.” This means that it is contingent upon achieving specific results that are essential to the Company’s long-term success and growth in shareholder value. As described above, the variable components of the 2013 compensation program include annual incentives, stock options, and performance-based restricted share units.

21

To assist in reviewing the levels of compensation in 2013, the compensation committee’s independent consultant, Meridian, collected and analyzed comprehensive market data, including base salary, target short-term incentives and long-term incentive opportunities for each of the NEOs from the following published and proprietary sources:

Primary data source: Proxy data from a peer group of 11 publicly-traded companies in the media industry, including:

| AMC Networks |

Lions Gate Entertainment Corp. | Twenty-First Century Fox, Inc. | ||

| CBS Corp. |

Sirius XM Radio, Inc. | Viacom, Inc. | ||

| Discovery Communications, Inc. |

Starz | Walt Disney Co. | ||

| Liberty Global, Inc. |

Time Warner, Inc. |

The companies in this peer group represent those companies with which we compete for business and for talent. In 2013, Starz and Twenty-First Century Fox, Inc. were added to the peer group as replacement for their former parent companies, Liberty Media Corp. and News Corp. The business of these two spin-offs was more comparable to the Company than the remaining entities post-spin. All pay opportunities were compared with the size-adjusted median of the market using regression analysis based on revenues to reflect pay of similarly-situated executives in comparable positions.

Secondary data source: To obtain a broader understanding of market pay levels and practices, the compensation committee also reviewed survey data from the following sources:

| • | The Cable and Telecommunications Human Resources Association (CTHRA) Cable Programmers/Broadcast Networks Compensation Survey; and |

| • | Towers Watson Executive Compensation Database: General Industry and Media Surveys. |