As filed with the Securities and Exchange Commission on June 20, 2013

Registration No. 333-188547

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

WASHINGTON D.C. 20549

Amendment No. 1

To

Form S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

TONIX PHARMACEUTICALS HOLDING CORP.

(Name of registrant in its charter)

| Nevada | 2834 | 26-1434750 | ||||

|

(State or other Jurisdiction of Incorporation or Organization) |

(Primary Standard Industrial Classification Code |

(I.R.S. Employer Identification No.) |

509 Madison Avenue, Suite 306

New York, New York 10022

(212) 980-9155

(Address and telephone number of principal executive offices and principal place of business)

Seth Lederman

Chief Executive Officer

Tonix Pharmaceuticals Holding Corp.

509 Madison Avenue, Suite 306

New York, New York 10022

(212) 980-9155

(Name, address and telephone number of agent for service)

Copies to:

|

Marc J. Ross, Esq. James M. Turner, Esq. Sichenzia Ross Friedman Ference LLP 61 Broadway, 32nd Flr. New York, New York 10006 (212) 930-9700 (212) 930-9725 (fax) |

John Hogoboom, Esq. Lowenstein Sandler LLP 1251 Avenue of the Americas New York, New York 10020 (212) 262-6700 (phone) (973) 597-2500 (facsimile) |

APPROXIMATE DATE OF PROPOSED SALE TO THE PUBLIC: As soon as practicable after the effective date of this registration statement.

If any securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, other than securities offered only in connection with dividend or interest reinvestment plans, check the following box: x

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a small reporting company. See definitions of “large accelerated filer,” “accelerated filed,” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer ¨ | Accelerated filer ¨ |

| Non-accelerated filer ¨ | Smaller reporting company x |

| (Do not check if a smaller reporting company) |

CALCULATION OF REGISTRATION FEE

| Title

of Each Class Of Securities To Be Registered | Proposed

Maximum Aggregate Offering Price (1) (2) | Amount

Of Registration Fee | ||||||

| Units, each unit consisting of: (3) | $ | 13,800,000 | $ | 1,882.32 | ||||

| (i) one share of Common Stock, par value $0.001 per share (4) | - | - | ||||||

| (ii) one Series A Warrant to purchase one share of Common Stock (4) | - | - | ||||||

| Common Stock issuable upon exercise of Series A Warrants included in Units | 13,800,000 | 1,882.32 | ||||||

| Underwriter Warrants (4) | - | - | ||||||

| Common Stock issuable upon exercise of Underwriter Warrants (5) | 552,000 | 75.29 | ||||||

| Total | $ | 28,152,000 | $ | 3,839.93 | (6) | |||

| (1) | Estimated solely for the purpose of calculating the registration fee pursuant to Rule 457(o) under the Securities Act of 1933, as amended (the “Securities Act of 1933”). |

| (2) | Pursuant to Rule 416 under the Securities Act, the securities being registered hereunder include such indeterminate number of additional shares of common stock as may be issued after the date hereof as a result of stock splits, stock dividends or similar transactions. |

| (3) | Includes units the underwriters have the option to purchase to cover over-allotments, if any. |

| (4) | No separate fee is required pursuant to Rule 457(g) under the Securities Act of 1933. |

| (5) | Estimated solely for the purpose of calculating the registration fee pursuant to Rule 457(g) under the Securities Act of 1933. |

| (6) | $3,339.07 previously paid. |

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the registration statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

The information in this prospectus is not complete and may be changed. We may not sell these securities under this prospectus until the registration statement of which it is a part and filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

PRELIMINARY PROSPECTUS

SUBJECT TO COMPLETION, DATED JUNE 20, 2013

1,920,000 Units

Each Unit Consisting of One Share of Common Stock

and

One Series A Warrant to Purchase One Share of Common Stock

We are offering 1,920,000 units (assuming an offering price of $6.25 per unit, the last reported sale price of our common stock on June 18, 2013), each of which consists of one share of our common stock, par value $0.001 per share, and one Series A Warrant to purchase one share of our common stock at an exercise price of [ * ] per share. The Series A Warrants will be immediately exercisable and will expire on the fifth anniversary of the issuance date. No units will be issued, however, and purchasers will receive only shares of common stock and Series A Warrants. The common stock and the Series A Warrants may be transferred separately immediately upon issuance.

We have applied to list our common stock on The NASDAQ Capital Market under the symbol “TNXP”. Our common stock is currently quoted on the OTCQB under the same symbol. On June 18, 2013, the last reported sale price of our common stock was $6.25 per share. We do not intend to list the Series A Warrants on any securities exchange or other trading market and we do not expect that a public trading market will develop for any of the Series A Warrants.

Investing in our common stock involves a high degree of risk. Before making any investment in our common stock, you should read and carefully consider the risks described in this prospectus under “Risk Factors ” beginning on page 7 of this prospectus.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

| Per Unit | Total | |||||||

| Public offering price | $ | $ | ||||||

| Underwriting discounts and commissions (1) | $ | $ | ||||||

| Proceeds to us, before expenses | $ | $ | ||||||

| (1) The underwriters will receive compensation in addition to the underwriting discount. See “Underwriting” beginning on page 89 of this prospectus for a description of compensation payable to the underwriters. |

We have granted the underwriters a 45-day option to purchase up to (i) 288,000 additional units, (ii) 288,000 additional shares of common stock and/or (iii) additional warrants to purchase up to 288,000 shares of common stock to cover over-allotments, if any. If the underwriters exercise the option in full, the total underwriting discounts and commissions payable by us will be $[ * ], and the total proceeds to us, before expenses, will be $[ * ].

In addition to the discounts and commissions listed above, we have agreed to issue to the underwriters or their designees underwriter warrants to purchase shares of common stock equal to 4% of the total number of shares included in the units. The registration statement of which this prospectus is a part also covers the underwriter warrants and the shares of common stock issuable upon the exercise thereof. We also have agreed to reimburse the underwriters for certain of their out-of-pocket expenses. See “Underwriting” for a description of these arrangements.

The underwriters expect to deliver the units against payment on or about [ * ], 2013.

Roth Capital Partners

National Securities Corporation

This prospectus is dated , 2013

TABLE OF CONTENTS

| Page | ||

| Special Note Regarding Forward-Looking Statements | 1 | |

| Prospectus Summary | 2 | |

| Risk Factors | 7 | |

| Use of Proceeds | 32 | |

| Market For Common Stock and Related Shareholder Matters | 33 | |

| Dilution | 34 | |

| Management’s Discussion and Analysis of Financial Condition and Results of Operations | 35 | |

| Business | 43 | |

| Description of Property | 69 | |

| Legal Proceedings | 69 | |

| Management | 70 | |

| Executive Compensation | 78 | |

| Certain Relationships and Related Transactions | 81 | |

| Security Ownership of Certain Beneficial Owners and Management | 82 | |

| Description of Capital Stock | 85 | |

| Description of Securities we are Offering | 87 | |

| Underwriting | 89 | |

| Notice to Investors | 91 | |

| Legal Matters | 93 | |

| Experts | 93 | |

| Additional Information | 93 | |

| Index to Financial Statements | 94 |

You should rely only on the information contained in this prospectus and any free writing prospectus prepared by us or on our behalf. We have not, and the underwriters have not, authorized anyone to provide you with different information. If anyone provides you with different or inconsistent information, you should not rely on it. We are not, and the underwriters are not, making an offer to sell these securities in any jurisdiction where the offer is not permitted. The information contained in this prospectus and any free writing prospectus that we have authorized for use in connection with this offering is accurate only as of the date of those respective documents, regardless of the time of delivery of this prospectus or any authorized free writing prospectus or the time of issuance or sale of any securities. Our business, financial condition, results of operations and prospects may have changed since those dates. You should read this prospectus and any free writing prospectus that we have authorized for use in connection with this offering in their entirety before making an investment decision. You should also read and consider the information in the documents to which we have referred you in the section of this prospectus entitled “Where You Can Find More Information.”

| i |

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

This prospectus contains “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, or Securities Act, and Section 21E of the Securities Exchange Act of 1934, or Exchange Act. Forward-looking statements reflect the current view about future events. When used in this prospectus, the words “anticipate,” “believe,” “estimate,” “expect,” “future,” “intend,” “plan,” or the negative of these terms and similar expressions, as they relate to us or our management, identify forward-looking statements. Such statements, include, but are not limited to, statements contained in this prospectus relating to our business strategy, our future operating results and liquidity and capital resources outlook. Forward-looking statements are based on our current expectations and assumptions regarding our business, the economy and other future conditions. Because forward–looking statements relate to the future, they are subject to inherent uncertainties, risks and changes in circumstances that are difficult to predict. Our actual results may differ materially from those contemplated by the forward-looking statements. They are neither statements of historical fact nor guarantees of assurance of future performance. We caution you therefore against relying on any of these forward-looking statements. Important factors that could cause actual results to differ materially from those in the forward-looking statements include, without limitation, a continued decline in general economic conditions nationally and internationally; decreased demand for our products and services; market acceptance of our products and services; our ability to protect our intellectual property rights; the impact of any infringement actions or other litigation brought against us; competition from other providers and products; our ability to develop and commercialize new and improved products and services; our ability to raise capital to fund continuing operations; changes in government regulation; our ability to complete customer transactions and capital raising transactions; and other factors (including the risks contained in the section of this prospectus entitled “Risk Factors”) relating to our industry, our operations and results of operations and any businesses that may be acquired by us. Should one or more of these risks or uncertainties materialize, or should the underlying assumptions prove incorrect, actual results may differ significantly from those anticipated, believed, estimated, expected, intended or planned.

Factors or events that could cause our actual results to differ may emerge from time to time, and it is not possible for us to predict all of them. We cannot guarantee future results, levels of activity, performance or achievements. Except as required by applicable law, including the securities laws of the United States, we do not intend to update any of the forward-looking statements to conform these statements to actual results.

| 1 |

PROSPECTUS SUMMARY

This summary highlights information contained throughout this prospectus and is qualified in its entirety to the more detailed information and financial statements included elsewhere in this prospectus. This summary does not contain all of the information that should be considered before investing in our common stock. Investors should read the entire prospectus carefully, including the more detailed information regarding our business, the risks of purchasing our common stock discussed in this prospectus under “Risk Factors” beginning on page 7 of this prospectus and our financial statements and the accompanying notes beginning on page F-1 of this prospectus.

Unless otherwise indicated or unless the context requires otherwise, this prospectus includes the accounts of Tonix Pharmaceuticals Holding Corp., a Nevada corporation (“Tonix”), and together with its wholly-owned subsidiaries, as follows, collectively referred to as “we”, “us” or the “Company”: Tonix Pharmaceuticals, Inc., a Delaware corporation (“Tonix Sub”), Krele LLC, a Delaware limited liability company (“Krele”) and Tonix Pharmaceuticals (Canada), Inc., a corporation incorporated under the laws of the province of New Brunswick, Canada (“Tonix Canada”). Tonix Sub is a wholly-owned subsidiary of Tonix, and Krele and Tonix Canada are wholly-owned subsidiaries of Tonix Sub.

Business Overview

We are a specialty pharmaceutical company focused on developing novel pharmaceutical products for challenging disorders of the central nervous system, or CNS. Our drug development programs are directed toward CNS conditions that manifest with pain that originates in the brain, or central pain. Central pain results from abnormal sensory processing in the CNS, rather than from dysfunction in peripheral tissues where pain is perceived. Our lead development program is for the management of fibromyalgia, or FM, a central pain syndrome. We also have a development program for the management of post-traumatic stress disorder, or PTSD, in which central pain is a component. Central pain is associated with disturbed sleep, and an improvement in pain or sleep quality can benefit the other symptom. We are developing proprietary products for FM and PTSD that are based on cyclobenzaprine, or CBP, a pharmaceutical agent approved for use in another indication. A very low dose, or VLD, of CBP has been demonstrated to decrease pain and improve sleep quality in subjects with FM. Our products feature new dose, formulation, and delivery characteristics tailored to their chronic therapeutic uses in FM and PTSD, and are intended to be administered sublingually at bedtime. We expect to begin a Phase 2b clinical trial for FM in the third quarter of 2013, which, if successful, will serve as the first of two pivotal studies required for marketing approval in the U.S.

We are currently devoting the majority of our efforts to the development of our lead product candidate, TNX-102 sublingual tablet, or TNX-102 SL. TNX-102 SL is a novel dose and formulation of CBP, the active pharmaceutical ingredient of two widely prescribed muscle relaxant products, Flexeril® and Amrix®. We believe that TNX-102 SL is an optimized CBP product for the treatment of FM and PTSD, and is distinct from current CBP products in three ways: (1) it is being developed at a dose level significantly below the lowest marketed doses of current CBP products; (2) it is placed under the tongue, to disintegrate, dissolve and provide sublingual absorption, whereas current CBP products are swallowed and provide absorption in the small intestine; and (3) it is being developed for chronic use, whereas current CBP products are marketed for two to three weeks of use.

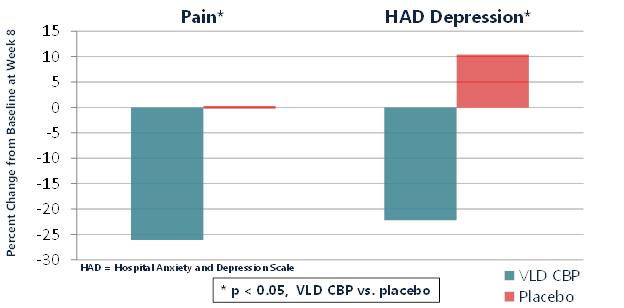

Our therapeutic strategy is supported by results from a double-blind, randomized placebo-controlled study of VLD CBP taken between dinner and bedtime in 36 subjects with FM, which demonstrated a significant decrease in pain and other symptoms after eight weeks of treatment. This study also demonstrated that VLD CBP led to a significant improvement in objective measures of sleep quality. Our Phase 1 studies demonstrated TNX-102 SL to have a pharmacokinetic profile distinct from that of oral CBP products, which we believe supports chronic bedtime administration for the treatment of FM and PTSD.

FM is a chronic syndrome characterized by widespread musculoskeletal pain accompanied by fatigue, sleep, memory and mood issues. According to the National Institutes of Health, there are approximately five million people suffering from FM in the U.S. The peak incidence of FM occurs at 20-50 years of age, and 80-90% of diagnosed patients are female. FM may have a substantial negative impact on social and occupational function, including disrupted relationships with family and friends, social isolation, reduced activities of daily living and leisure activities, avoidance of physical activity, and loss of career or inability to advance in careers or education.

| 2 |

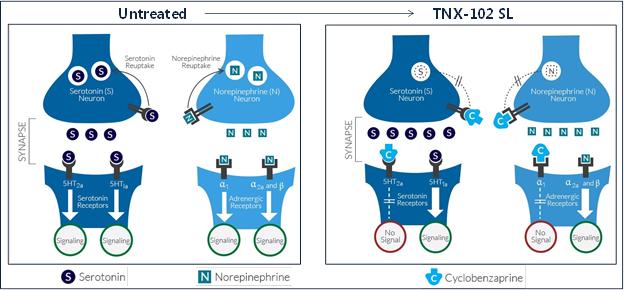

Although the disordered brain processes that underlie FM are yet to be fully understood, the mechanisms of drugs that treat central pain are believed to target certain aspects of nerve signaling. Three drugs, Lyrica® (pregabalin), Cymbalta® (duloxetine), and Savella® (milnacipran), are approved by the Food and Drug Administration, or FDA, for the management of FM and are believed to act upon molecular pathways involved in central pain. Lyrica is believed to affect nerve signaling by blocking calcium channels on nerve cells, and is considered a nerve membrane stabilizer. Cymbalta and Savella are believed to directly inhibit the reuptake of serotonin and norepinephrine by nerves, and are referred to as Serotonin and Norepinephrine Reuptake Inhibitors, or SNRIs. CBP, the active ingredient of TNX-102 SL, is a selective antagonist of serotonin and norepinephrine receptors as well as an inhibitor of serotonin and norepinephrine reuptake, and we refer to it as a Serotonin and Norepinephrine receptor Antagonist and Reuptake Inhibitor, or SNARI.

As many products used for the treatment of FM are approved and marketed for other conditions, sales of these products related specifically to FM can only be estimated. Based on information obtained from publicly available sources, we believe U.S. sales of prescription drugs specifically for the treatment of FM totaled approximately $1.5 billion in 2012, and we believe this segment had grown at a compounded annual growth rate of approximately 14% in 2007-12. Based on information obtained from publicly available sources, we believe 2012 sales of Cymbalta, Lyrica, and Savella in FM were approximately $600 million, $475 million, and $100 million, respectively.

Despite the availability and use of a variety of pharmacologic and non-pharmacologic interventions, FM remains a significant unmet medical need. Many patients fail to adequately respond to the approved medications, or discontinue therapy due to poor tolerability. Prescription pain and sleep medications are frequently taken ‘off-label’ for symptomatic relief, despite the lack of evidence that such medications provide a meaningful or durable therapeutic effect. An important goal of FM treatment is to reduce the dependence on opiate analgesic as well as on benzodiazepine and non-benzodiazepine sedative-hypnotic medications by FM patients. Since CBP has no recognized addictive potential, we believe that TNX-102 SL, if approved, could reduce the exposure of FM patients to medications that have not been shown to be effective in treating FM and are associated with significant safety risks.

We are currently developing TNX-102 SL for the treatment of FM under an Investigational New Drug application, or IND, filed in the US, and under three Clinical Trial Applications, or CTAs, filed in Canada. For this program, we held an End-of-Phase 2/Pre-Phase 3 meeting with the FDA in February 2013. We are also developing TNX-102 SL for the treatment of PTSD, for which we held a pre-IND meeting in October 2012. We expect that any applications we submit for FDA approval of TNX-102 SL will be submitted under Section 505(b)(2) of the Federal Food, Drug, and Cosmetic Act, or FDCA, which we believe will allow for a shorter timeline of clinical and non-clinical development as compared to that needed to fulfill the requirements of Section 505(b)(1), under which new chemical entities, or NCEs, are generally developed to meet the FDA’s requirements for new drug approvals.

TNX-102 SL is a small, rapidly disintegrating tablet containing CBP for sublingual administration at bedtime. We designed TNX-102 SL to enable the efficient delivery of CBP to the systemic circulation via sublingual transmucosal absorption and to avoid first-pass liver metabolism. We also designed TNX-102 SL to provide CBP at doses lower than those currently available. We have conducted several clinical and non-clinical pharmacokinetic studies of TNX-102 sublingual formulations, which we believe support the development of TNX-102 SL as a novel therapeutic product for FM and PTSD, and which demonstrate a number of potentially advantageous characteristics as compared to current CBP-containing products, none of which are approved for these indications. For example, our Phase 1 comparative study showed that TNX-102 SL results in faster systemic absorption and significantly higher plasma levels of CBP in the first hour following administration relative to oral CBP tablets. TNX-102 SL was generally well-tolerated, with no serious adverse events reported in this study. Some subjects experienced transient numbness on the tongue after TNX-102 SL administration, and other side-effects reported were similar to those associated with current CBP products.

At our End-of-Phase 2/Pre-Phase 3 meeting with the FDA in February 2013, we discussed the design of the clinical program, including the acceptability of the pivotal study design and the proposed registration plan, to support the approval of TNX-102 SL for the management of FM. We believe that positive results from two adequate, well-controlled safety and efficacy studies and the completion of long-term open-label safety exposure studies per FDA and International Conference on Harmonization, or ICH, requirements for chronic use would support the approval of TNX-102 SL for the management of FM. Under the IND, we plan to initiate a potential pivotal trial (Phase 2b) in FM in the third quarter of 2013. We have entered into a non-binding letter of intent to engage Premier Research International, LLC, a contract research organization, or CRO, to provide clinical and data management services for this Phase 2b trial.

| 3 |

We are also advancing TNX-102 SL for the management of PTSD. We held a pre-IND meeting with the FDA in October 2012, and we plan to file an IND to initiate a proof-of-concept study in the third quarter of 2013. We plan to begin this trial of TNX-102 SL in the fourth quarter of 2013. Based on our pre-IND discussion with the FDA, the clinical data necessary to support the PTSD New Drug Application, or NDA, approval will be comprised of positive results from two adequate, well-controlled efficacy and safety studies and safety exposure data. We expect to be able to rely, at least in part, on safety exposure data generated by our clinical development of TNX-102 SL in FM for the purpose of the NDA requirements for PTSD.

We have a pipeline of other product candidates, including TNX-201 and TNX-301. TNX-201 is based on isometheptene mucate and is under development as a treatment for certain types of headaches. TNX-201 is a pure isomer of isometheptene mucate, which has been approved and marketed only as a mixture of two isomers. TNX-301 is a fixed dose combination of two FDA-approved drugs, disulfiram and selegiline, and is under development as a treatment for alcohol abuse and dependence. Due to our size and being in the development stage, we do not currently devote a significant amount of time or resources towards our other pipeline candidates. We may perform non-clinical development work on TNX-201 and possibly on TNX-301, but we do not expect to start clinical trials of either of these candidates until 2014 at the earliest. For competitive reasons, we do not disclose the identities of the active ingredients or targeted indications in our pipeline until a U.S. patent has been allowed or issued.

In August 2010, we formed Krele to commercialize products that are generic versions of predicate NDA products. We anticipate that when our branded products lose patent protection, Krele may market authorized generic versions of them. Krele also may develop or acquire generic products approved under FDA abbreviated new drug applications, or ANDAs, and we may market branded versions (branded generics) of such products. Krele has been issued a state license in New York.

Corporate Structure

We were incorporated on November 16, 2007 under the laws of the State of Nevada as Tamandare Explorations Inc. From inception through October 2011, we were involved in the acquisition, exploration and development of natural resource properties in the State of Nevada. On October 7, 2011, we executed and consummated a share exchange agreement by and among Tonix Sub and the stockholders of 100% of the equity securities of Tonix Sub, including, the holders of 5,207,500 shares of common stock, 1,500,000 shares of Series A Preferred Stock and 2,275,527 shares of Series B Preferred Stock (the “Tonix Shareholders”), on the one hand, and us and David Moss, our then sole officer and director and majority shareholder, on the other hand (the “Share Exchange Agreement” and the transaction, the “Share Exchange”).

In the Share Exchange, the Tonix Shareholders exchanged their shares of Tonix Sub for newly issued shares of our common stock. As a result, upon completion of the Share Exchange, Tonix Sub became our wholly-owned subsidiary.

Upon completion of the Share Exchange, the Tonix Shareholders received an aggregate of 1,133,334 shares of our common stock. Mr. Moss returned 75,000 shares of common stock to us, which were retired, and our existing shareholders retained 200,000 shares of common stock. The 1,133,334 shares issued to the Tonix Shareholders constituted approximately 85% of our 1,333,334 issued and outstanding shares of common stock immediately after the consummation of the Share Exchange.

As a result of the Share Exchange, we acquired 100% of the capital stock of Tonix Sub and consequently, control of the business and operations of Tonix Sub and Krele. From and after the consummation of the Share Exchange, our primary operations consist of the business and operations of Tonix Sub and Krele.

On October 11, 2011, we changed our name to Tonix Pharmaceuticals Holding Corp. to reflect our new business.

| 4 |

On April 23, 2013, we formed Tonix Canada as a wholly-owned subsidiary of Tonix Sub. Tonix Canada is intended to perform research and development efforts in Canada. As a Canadian entity, we expect Tonix Canada will be entitled to receive certain reimbursable tax credits for research expenditures in Canada.

Corporate Background

In 1996, Seth Lederman, MD, and Donald Landry, MD, PhD, formed L & L Technologies, LLC, or L&L, to develop medications for central nervous system, or CNS, conditions. Dr. Lederman is our Chairman and Chief Executive Officer and Dr. Landry is a Director. L&L was a founder of Janus Pharmaceuticals, Inc., which later became Vela Pharmaceuticals, Inc., or Vela, which developed various therapeutics, including a VLD version of CBP under an agreement with L&L. Vela decided to focus its resources on other programs and transferred the rights to VLD CBP and certain other technologies to L&L in March 2006.

Tonix Sub formed in June 2007 as Krele Pharmaceuticals, Inc. by L&L and Plumbline LLC, or Plumbline. Dr. Lederman is Managing Partner of Plumbline. Plumbline possessed rights to certain technology for the treatment of alcohol dependence and abuse. In connection with founding Tonix Sub, L&L and Plumbline entered into an intellectual property transfer and assignment agreement with Tonix Sub for the purpose of assigning patents and transferring intellectual property and know-how in exchange for shares of common stock of Tonix Sub. As a result of economic conditions related to the financial crisis of 2007 and 2008, Tonix Sub was not successful in raising money to fund its programs until 2009. As a result, Tonix Sub was unable to advance the development programs and had little activity except for prosecuting and maintaining patents and maintaining contracts.

In 2009, Tonix Sub contracted with the Toronto Psychiatric Research Foundation to analyze the sleep data from a Phase 2a trial of bedtime VLD CBP in FM (the “Moldofsky Study”). The Moldofsky Study was conducted in Canada by the Toronto Psychiatric Research Foundation, and Tonix Sub obtained the data from this study from L&L. In addition, in 2009, Tonix Sub contracted with Caliper Life Sciences Inc., or Caliper, to analyze the interactions of CBP with certain receptors. In June 2010, Tonix Sub entered into consulting agreements with L&L and Lederman & Co., LLC, or Lederman & Co, and also acquired certain rights to develop isometheptene mucate as a treatment for certain types of headaches from Lederman & Co, which we are developing as TNX-201. Dr. Lederman is the managing partner of Lederman & Co. Between June 2010 and October 2011, Tonix Sub was active in recruiting new officers and directors and initiating preclinical and clinical development of novel CBP formulations.

Lederman & Co predominantly provides us with clinical development expertise. L&L predominantly provided us with scientific development expertise until the termination of the consulting agreement in June 2012. Relative to traditional pharmaceutical development companies, we can be considered a virtual company, since we contract with third-party vendors to provide many functions that are core to traditional pharmaceutical companies. For example, we have contracted with PharmaNet Canada, Inc., or PharmaNet Canada, to develop methods for analyzing CBP in the blood and to conduct human clinical studies to evaluate the performance of our formulation technology. Lederman & Co is responsible for overseeing the scientific and technical aspects of PharmaNet’s contract work product.

In July 2010, Tonix Sub changed its name to Tonix Pharmaceuticals, Inc. In August 2010, Tonix Sub formed Krele.

| 5 |

The Offering

| Securities we are offering: | 1,920,000 units (assuming an offering price of $6.25 per unit, the last reported sale price of our common stock on June 18, 2013), each consisting of one share of our common stock and one Series A Warrant to purchase one share of our common stock at an exercise price of $[ * ] per share. The Series A Warrants will be immediately exercisable and will expire on the fifth anniversary of the issuance date. | |

| Public offering price: | $[ * ] per unit. | |

| Common stock outstanding before this offering: | 2,197,490 shares. | |

| Common stock included in the units: | 1,920,000 shares or 3,840,000 shares if the warrants sold in this offering are exercised in full. | |

| Common stock to be outstanding after this offering: | 4,117,490 shares or 6,037,490 shares if the warrants sold in this offering are exercised in full. | |

| Use of proceeds: | We currently intend to use the net proceeds of this offering for the clinical development of TNX-102 SL, including a Phase 2b clinical trial for the treatment of FM, and for general corporate purposes, including working capital and operational purposes, including pre-clinical development. For a more complete description of our intended use of proceeds from this offering, see “Use of Proceeds.” | |

| Market Symbol and Listing: | Our common stock is currently quoted on the OTCQB under the symbol “TNXP”. We have applied to have our common stock listed on The NASDAQ Capital Market under the same symbol. There is no established trading market for the Series A Warrants and we do not expect a market to develop. In addition, we do not intend to apply for listing of the Series A Warrants on any national securities exchange or other trading market. | |

| Risk Factors: | Investing in our securities involves substantial risks. You should carefully review and consider the “Risk Factors” section of this prospectus for a discussion of factors to consider before deciding to invest in our securities. |

The number of shares of our common stock outstanding prior to and to be outstanding immediately after this offering, as set forth in the table above, is based on 2,197,490 shares outstanding as of June 18, 2013 and excludes:

| • | 1,232,400 shares of common stock issuable upon the exercise of warrants outstanding at June 18, 2013 with a weighted average exercise price of $14.52 per share; |

| • | 376,500 shares of common stock issuable upon the exercise of options outstanding at June 18, 2013 with a weighted average exercise price of $18.09 per share; |

| • | 173,500 shares of common stock reserved for future grants, awards and issuance under our equity compensation plan as of June 18, 2013; |

| • | shares of common stock issuable upon the exercise of the Series A Warrants offered hereby; |

| • | shares of common stock issuable upon the exercise of the underwriter warrants; and |

| • | shares of common stock issuable upon the exercise of the underwriters’ over-allotment option. |

Except as otherwise indicated, all information in this prospectus reflects the 1-for-20 reverse stock split of our outstanding common stock that was effected on May 1, 2013.

| 6 |

RISK FACTORS

This investment has a high degree of risk. Before you invest you should carefully consider the risks and uncertainties described below and the other information in this prospectus. If any of the following risks actually occur, our business, operating results and financial condition could be harmed and the value of our stock could go down. This means you could lose all or a part of your investment.

RISKS RELATED TO OUR BUSINESS

We have a history of operating losses and expect to incur losses for the foreseeable future. We may never generate revenues or, if we are able to generate revenues, achieve profitability.

We are focused on product development, and we have not generated any revenues to date. We have incurred losses in each year of our operations, and we expect to continue to incur operating losses for the foreseeable future. These operating losses have adversely affected and are likely to continue to adversely affect our working capital, total assets and shareholders’ equity.

The Company and its prospects should be examined in light of the risks and difficulties frequently encountered by new and early stage companies in new and rapidly evolving markets. These risks include, among other things, the speed at which we can scale up operations, our complete dependence upon development of products that currently have no market acceptance, our ability to establish and expand our brand name, our ability to expand our operations to meet the commercial demand of our clients, our development of and reliance on strategic and customer relationships and our ability to minimize fraud and other security risks.

The process of developing our products requires significant clinical, development and laboratory testing and clinical trials. In addition, commercialization of our product candidates will require that we obtain necessary regulatory approvals and establish sales, marketing and manufacturing capabilities, either through internal hiring or through contractual relationships with others. We expect to incur substantial losses for the foreseeable future as a result of anticipated increases in our research and development costs, including costs associated with conducting preclinical testing and clinical trials, and regulatory compliance activities.

Our ability to generate revenues and achieve profitability will depend on numerous factors, including success in:

| · | developing and testing product candidates; |

| · | receiving regulatory approvals; |

| · | commercializing our products; and |

| · | establishing a favorable competitive position. |

Many of these factors will depend on circumstances beyond our control. We cannot assure you that we will ever have a product approved by the FDA, that we will bring any product to market or, if we are successful in doing so, that we will ever become profitable.

We expect to incur substantial additional operating expenses over the next several years as our research, development, pre-clinical testing, and clinical trial activities increase. The amount of future losses and when, if ever, we will achieve profitability are uncertain. We have no products that have generated any commercial revenue, do not expect to generate revenues from the commercial sale of products in the near future, and might never generate revenues from the sale of products. Our ability to generate revenue and achieve profitability will depend on, among other things, successful completion of the development of our product candidates; obtaining necessary regulatory approvals from the FDA; establishing manufacturing, sales, and marketing arrangements with third parties; and raising sufficient funds to finance our activities. We might not succeed at any of these undertakings. If we are unsuccessful at some or all of these undertakings, our business, prospects, and results of operations may be materially adversely affected.

| 7 |

We have a limited operating history and we expect a number of factors to cause our operating results to fluctuate on a quarterly and annual basis, which may make it difficult to predict our future performance.

We are a development stage biopharmaceutical company with a limited operating history. Our operations to date have been primarily limited to developing our technology and undertaking preclinical studies and clinical trials of our lead product candidate, TNX-102 SL. We have not yet obtained regulatory approvals for TNX-102 SL or any of our other product candidates. Consequently, any predictions made about our future success or viability may not be as accurate as they could be if we had a longer operating history or commercialized products. Our financial condition has varied significantly in the past and will continue to fluctuate from quarter-to-quarter or year-to-year due to a variety of factors, many of which are beyond our control. Factors relating to our business that may contribute to these fluctuations include other factors described elsewhere in this prospectus and also include:

| · | our ability to obtain additional funding to develop our product candidates; |

| · | delays in the commencement, enrollment and timing of clinical trials; |

| · | the success of our clinical trials through all phases of clinical development, including our TNX-102 SL trial; |

| · | any delays in regulatory review and approval of product candidates in clinical development; |

| · | our ability to obtain and maintain regulatory approval for TNX-102 SL or any of our other product candidates in the United States and foreign jurisdictions; |

| · | potential side effects of our product candidates that could delay or prevent commercialization, limit the indications for any approved drug, require the establishment of risk evaluation and mitigation strategies, or cause an approved drug to be taken off the market; |

| · | our dependence on third-party contract manufacturing organizations, or CMOs, to supply or manufacture our products; |

| · | our dependence on CROs to conduct our clinical trials; |

| · | our ability to establish or maintain collaborations, licensing or other arrangements; |

| · | market acceptance of our product candidates; |

| · | our ability to establish and maintain an effective sales and marketing infrastructure, either through the creation of a commercial infrastructure or through strategic collaborations; |

| · | competition from existing products or new products that may emerge; |

| · | the ability of patients or healthcare providers to obtain coverage of or sufficient reimbursement for our products; |

| · | our ability to leverage our proprietary technology platform to discover and develop additional product candidates; |

| · | our ability and our licensors’ abilities to successfully obtain, maintain, defend and enforce intellectual property rights important to our business; |

| · | our ability to attract and retain key personnel to manage our business effectively; |

| · | our ability to build our finance infrastructure and improve our accounting systems and controls; |

| · | potential product liability claims; |

| · | potential liabilities associated with hazardous materials; and |

| · | our ability to obtain and maintain adequate insurance policies. |

Accordingly, the results of any quarterly or annual periods should not be relied upon as indications of future operating performance.

We received a report from our independent registered public accounting firm with an explanatory paragraph for the year ended December 31, 2012 with respect to our ability to continue as a going concern. The existence of such a report may adversely affect our stock price and our ability to raise capital. There is no assurance that we will not receive a similar report for our year ended December 31, 2013.

In their report dated March 8, 2013, our independent registered public accounting firm expressed substantial doubt about our ability to continue as a going concern as we have incurred losses since inception of development stage, have a negative cash flow from operations, and require additional financing to fund future operations. Our ability to continue as a going concern is subject to our ability to obtain necessary funding from outside sources, including obtaining additional funding from the sale of our securities, obtaining loans and grants from various financial institutions where possible. Our continued net operating losses increase the difficulty in meeting such goals and there can be no assurances that such methods will prove successful.

| 8 |

We have no approved products on the market and therefore do not expect to generate any revenues from product sales in the foreseeable future, if at all.

To date, we have no approved product on the market and have generated no product revenues. We have funded our operations primarily from sales of our securities. We have not received, and do not expect to receive for at least the next several years, if at all, any revenues from the commercialization of our product candidates. To obtain revenues from sales of our product candidates, we must succeed, either alone or with third parties, in developing, obtaining regulatory approval for, manufacturing and marketing drugs with commercial potential. We may never succeed in these activities, and we may not generate sufficient revenues to continue our business operations or achieve profitability.

We are largely dependent on the success of our lead product candidate, TNX-102 SL, and we cannot be certain that this product candidate will receive regulatory approval or be successfully commercialized.

We currently have no products for sale, and we cannot guarantee that we will ever have any drug products approved for sale. We and our product candidates are subject to extensive regulation by the FDA and comparable regulatory authorities in other countries governing, among other things, research, testing, clinical trials, manufacturing, labeling, promotion, selling, adverse event reporting and recordkeeping. We are not permitted to market any of our product candidates in the United States until we receive approval of an NDA for a product candidate from the FDA or the equivalent approval from a foreign regulatory authority. Obtaining FDA approval is a lengthy, expensive and uncertain process. We currently have one lead product candidate, TNX-102 SL for the treatment of FM, and the success of our business currently depends on its successful development, approval and commercialization. Any projected sales or future revenue predictions are predicated upon FDA approval and market acceptance of TNX-102 SL. If projected sales do not materialize for any reason, it would have a material adverse effect on our business and our ability to continue operations.

TNX-102 SL has not completed the clinical development process; therefore, we have not yet submitted an NDA or foreign equivalent or received marketing approval for this product candidate anywhere in the world. The clinical development program for TNX-102 SL may not lead to commercial products for a number of reasons, including if we fail to obtain necessary approvals from the FDA or foreign regulatory authorities because our clinical trials fail to demonstrate to their satisfaction that this product candidate is safe and effective or the clinical program may be put on hold due to unexpected safety issues with marketed CBP products. We may also fail to obtain the necessary approvals if we have inadequate financial or other resources to advance our product candidates through the clinical trial process. Any failure or delay in completing clinical trials or obtaining regulatory approval for TNX-102 SL in a timely manner would have a material adverse impact on our business and our stock price.

We may use our financial and human resources to pursue a particular research program or product candidate and fail to capitalize on programs or product candidates that may be more profitable or for which there is a greater likelihood of success.

Because we have limited financial and human resources, we are currently focusing on the regulatory approval of TNX-102 SL. As a result, we may forego or delay pursuit of opportunities with other product candidates or for other indications that later prove to have greater commercial potential. Our resource allocation decisions may cause us to fail to capitalize on viable commercial products or profitable market opportunities. Our spending on existing and future product candidates for specific indications may not yield any commercially viable products. If we do not accurately evaluate the commercial potential or target market for a particular product candidate, we may relinquish valuable rights to that product candidate through strategic alliance, licensing or other royalty arrangements in cases in which it would have been more advantageous for us to retain sole development and commercialization rights to such product candidate, or we may allocate internal resources to a product candidate in a therapeutic area in which it would have been more advantageous to enter into a partnering arrangement.

| 9 |

We need additional capital. If additional capital is not available or is available at unattractive terms, we may be forced to delay, reduce the scope of or eliminate our research and development programs, reduce our commercialization efforts or curtail our operations.

In order to develop and bring our product candidates to market, we must commit substantial resources to costly and time-consuming research, preclinical and clinical trials and marketing activities. We anticipate that our existing cash and cash equivalents will enable us to maintain our current operations for at least the next six months, and we anticipate that we will require additional capital to complete the planned pivotal trial of TNX-102 SL in FM. We anticipate using our cash and cash equivalents to fund further research and development with respect to our lead product candidates. We may, however, need to raise additional funding sooner if our business or operations change in a manner that consumes available resources more rapidly than we anticipate. Our requirements for additional capital will depend on many factors, including:

| · | successful commercialization of our product candidates; |

| · | the time and costs involved in obtaining regulatory approval for our product candidates; |

| · | costs associated with protecting our intellectual property rights; |

| · | development of marketing and sales capabilities; |

| · | payments received under future collaborative agreements, if any; and |

| · | market acceptance of our products. |

To the extent we raise additional capital through the sale of equity securities, the issuance of those securities could result in dilution to our shareholders. In addition, if we obtain debt financing, a substantial portion of our operating cash flow may be dedicated to the payment of principal and interest on such indebtedness, thus limiting funds available for our business activities. If adequate funds are not available, we may be required to delay, reduce the scope of or eliminate our research and development programs, reduce our commercialization efforts or curtail our operations. In addition, we may be required to obtain funds through arrangements with collaborative partners or others that may require us to relinquish rights to technologies, product candidates or products that we would otherwise seek to develop or commercialize ourselves or license rights to technologies, product candidates or products on terms that are less favorable to us than might otherwise be available.

We will require substantial additional funds to support our research and development activities, and the anticipated costs of preclinical studies and clinical trials, regulatory approvals and eventual commercialization. Such additional sources of financing may not be available on favorable terms, if at all. If we do not succeed in raising additional funds on acceptable terms, we may be unable to initiate clinical trials or obtain approval of any product candidates from the FDA and other regulatory authorities. In addition, we could be forced to discontinue product development, forego sales and marketing efforts and forego attractive business opportunities. Any additional sources of financing will likely involve the issuance of our equity securities, which will have a dilutive effect on our shareholders.

There is no assurance that we will be successful in raising the additional funds needed to fund our business plan. If we are not able to raise sufficient capital in the near future, our continued operations will be in jeopardy and we may be forced to cease operations and sell or otherwise transfer all or substantially all of our remaining assets.

We face intense competition in the markets targeted by our lead product candidates. Many of our competitors have substantially greater resources than we do, and we expect that all of our product candidates under development will face intense competition from existing or future drugs.

We expect that all of our product candidates under development, if approved, will face intense competition from existing and future drugs marketed by large companies. These competitors may successfully market products that compete with our products, successfully identify drug candidates or develop products earlier than we do, or develop products that are more effective, have fewer side effects or cost less than our products.

| 10 |

Additionally, if a competitor receives FDA approval before we do for a drug that is similar to one of our product candidates, FDA approval for our product candidate may be precluded or delayed due to periods of non-patent exclusivity and/or the listing with the FDA by the competitor of patents covering its newly-approved drug product. Periods of non-patent exclusivity for new versions of existing drugs such as our current product candidates can extend up to three and one-half years. See “Business—Government Regulation.”

These competitive factors could require us to conduct substantial new research and development activities to establish new product targets, which would be costly and time consuming. These activities would adversely affect our ability to commercialize products and achieve revenue and profits.

Competition and technological change may make our product candidates and technologies less attractive or obsolete.

We compete with established pharmaceutical and biotechnology companies that are pursuing other forms of treatment for the same indications we are pursuing and that have greater financial and other resources. Other companies may succeed in developing products earlier than us, obtaining FDA approval for products more rapidly, or developing products that are more effective than our product candidates. Research and development by others may render our technology or product candidates obsolete or noncompetitive, or result in treatments or cures superior to any therapy we develop. We face competition from companies that internally develop competing technology or acquire competing technology from universities and other research institutions. As these companies develop their technologies, they may develop competitive positions that may prevent, make futile, or limit our product commercialization efforts, which would result in a decrease in the revenue we would be able to derive from the sale of any products.

There can be no assurance that any of our product candidates will be accepted by the marketplace as readily as these or other competing treatments. Furthermore, if our competitors' products are approved before ours, it could be more difficult for us to obtain approval from the FDA. Even if our products are successfully developed and approved for use by all governing regulatory bodies, there can be no assurance that physicians and patients will accept our product(s) as a treatment of choice.

Furthermore, the pharmaceutical research industry is diverse, complex, and rapidly changing. By its nature, the business risks associated therewith are numerous and significant. The effects of competition, intellectual property disputes, market acceptance, and FDA regulations preclude us from forecasting revenues or income with certainty or even confidence.

If we fail to protect our intellectual property rights, our ability to pursue the development of our technologies and products would be negatively affected.

Our success will depend in part on our ability to obtain patents and maintain adequate protection of our technologies and products. If we do not adequately protect our intellectual property, competitors may be able to use our technologies to produce and market drugs in direct competition with us and erode our competitive advantage. Some foreign countries lack rules and methods for defending intellectual property rights and do not protect proprietary rights to the same extent as the United States. Many companies have had difficulty protecting their proprietary rights in these foreign countries. We may not be able to prevent misappropriation of our proprietary rights.

We have received, and are currently seeking, patent protection for numerous compounds and methods of treating diseases. However, the patent process is subject to numerous risks and uncertainties, and there can be no assurance that we will be successful in protecting our products by obtaining and defending patents. These risks and uncertainties include the following: patents that may be issued or licensed may be challenged, invalidated, or circumvented, or otherwise may not provide any competitive advantage; our competitors, many of which have substantially greater resources than us and many of which have made significant investments in competing technologies, may seek, or may already have obtained, patents that will limit, interfere with, or eliminate our ability to make, use, and sell our potential products either in the United States or in international markets; there may be significant pressure on the United States government and other international governmental bodies to limit the scope of patent protection both inside and outside the United States for treatments that prove successful as a matter of public policy regarding worldwide health concerns; countries other than the United States may have less restrictive patent laws than those upheld by United States courts, allowing foreign competitors the ability to exploit these laws to create, develop, and market competing products.

| 11 |

Moreover, any patents issued to us may not provide us with meaningful protection, or others may challenge, circumvent or narrow our patents. Third parties may also independently develop products similar to our products, duplicate our unpatented products or design around any patents on products we develop. Additionally, extensive time is required for development, testing and regulatory review of a potential product. While extensions of patent term due to regulatory delays may be available, it is possible that, before any of our product candidates can be commercialized, any related patent, even with an extension, may expire or remain in force for only a short period following commercialization, thereby reducing any advantages of the patent.

In addition, the United States Patent and Trademark Office (the “PTO”) and patent offices in other jurisdictions have often required that patent applications concerning pharmaceutical and/or biotechnology-related inventions be limited or narrowed substantially to cover only the specific innovations exemplified in the patent application, thereby limiting the scope of protection against competitive challenges. Thus, even if we or our licensors are able to obtain patents, the patents may be substantially narrower than anticipated.

Our success depends on our patents, patent applications that may be licensed exclusively to us and other patents to which we may obtain assignment or licenses. We may not be aware, however, of all patents, published applications or published literature that may affect our business either by blocking our ability to commercialize our product candidates, by preventing the patentability of our product candidates to us or our licensors, or by covering the same or similar technologies that may invalidate our patents, limit the scope of our future patent claims or adversely affect our ability to market our product candidates.

In addition to patents, we rely on a combination of trade secrets, confidentiality, nondisclosure and other contractual provisions, and security measures to protect our confidential and proprietary information. These measures may not adequately protect our trade secrets or other proprietary information. If they do not adequately protect our rights, third parties could use our technology, and we could lose any competitive advantage we may have. In addition, others may independently develop similar proprietary information or techniques or otherwise gain access to our trade secrets, which could impair any competitive advantage we may have.

Patent protection and other intellectual property protection is crucial to the success of our business and prospects, and there is a substantial risk that such protections will prove inadequate.

We may be involved in lawsuits to protect or enforce our patents, which could be expensive and time consuming.

The pharmaceutical industry has been characterized by extensive litigation regarding patents and other intellectual property rights, and companies have employed intellectual property litigation to gain a competitive advantage. We may become subject to infringement claims or litigation arising out of patents and pending applications of our competitors, or additional interference proceedings declared by the PTO to determine the priority of inventions. The defense and prosecution of intellectual property suits, PTO proceedings, and related legal and administrative proceedings are costly and time-consuming to pursue, and their outcome is uncertain. Litigation may be necessary to enforce our issued patents, to protect our trade secrets and know-how, or to determine the enforceability, scope, and validity of the proprietary rights of others. An adverse determination in litigation or interference proceedings to which we may become a party could subject us to significant liabilities, require us to obtain licenses from third parties, or restrict or prevent us from selling our products in certain markets. Although patent and intellectual property disputes might be settled through licensing or similar arrangements, the costs associated with such arrangements may be substantial and could include our paying large fixed payments and ongoing royalties. Furthermore, the necessary licenses may not be available on satisfactory terms or at all.

Competitors may infringe our patents, and we may file infringement claims to counter infringement or unauthorized use. This can be expensive, particularly for a company of our size, and time-consuming. In addition, in an infringement proceeding, a court may decide that a patent of ours is not valid or is unenforceable, or may refuse to stop the other party from using the technology at issue on the grounds that our patents do not cover its technology. An adverse determination of any litigation or defense proceedings could put one or more of our patents at risk of being invalidated or interpreted narrowly.

| 12 |

Also, a third party may assert that our patents are invalid and/or unenforceable. There are no unresolved communications, allegations, complaints or threats of litigation related to the possibility that our patents are invalid or unenforceable. Any litigation or claims against us, whether or not merited, may result in substantial costs, place a significant strain on our financial resources, divert the attention of management and harm our reputation. An adverse decision in litigation could result in inadequate protection for our product candidates and/or reduce the value of any license agreements we have with third parties.

Interference proceedings brought before the U.S. Patent and Trademark Office may be necessary to determine priority of invention with respect to our patents or patent applications. During an interference proceeding, it may be determined that we do not have priority of invention for one or more aspects in our patents or patent applications and could result in the invalidation in part or whole of a patent or could put a patent application at risk of not issuing. Even if successful, an interference proceeding may result in substantial costs and distraction to our management.

Furthermore, because of the substantial amount of discovery required in connection with intellectual property litigation or interference proceedings, there is a risk that some of our confidential information could be compromised by disclosure. In addition, there could be public announcements of the results of hearings, motions or other interim proceedings or developments. If investors perceive these results to be negative, the price of our common stock could be adversely affected.

If we infringe the rights of third parties we could be prevented from selling products, forced to pay damages, and defend against litigation.

If our products, methods, processes and other technologies infringe the proprietary rights of other parties, we could incur substantial costs and we may have to: obtain licenses, which may not be available on commercially reasonable terms, if at all; abandon an infringing product candidate; redesign our products or processes to avoid infringement; stop using the subject matter claimed in the patents held by others; pay damages; and/or defend litigation or administrative proceedings which may be costly whether we win or lose, and which could result in a substantial diversion of our financial and management resources.

If preclinical testing or clinical trials for our product candidates are unsuccessful or delayed, we will be unable to meet our anticipated development and commercialization timelines.

We rely and expect to continue to rely on third parties, including CROs and outside consultants, to conduct, supervise or monitor some or all aspects of preclinical testing or clinical trials involving our product candidates. We have less control over the timing and other aspects of these preclinical testing or clinical trials than if we performed the monitoring and supervision entirely on our own. Third parties may not perform their responsibilities for our preclinical testing or clinical trials on our anticipated schedule or, for clinical trials, consistent with a clinical trial protocol. Delays in preclinical and clinical testing could significantly increase our product development costs and delay product commercialization. In addition, many of the factors that may cause, or lead to, a delay in the clinical trials may also ultimately lead to denial of regulatory approval of a product candidate.

The commencement of clinical trials can be delayed for a variety of reasons, including delays in:

| · | demonstrating sufficient safety and efficacy to obtain regulatory approval to commence a clinical trial; |

| · | reaching agreement on acceptable terms with prospective contract research organizations and trial sites; |

| · | manufacturing sufficient quantities of a product candidate; and |

| · | obtaining institutional review board approval to conduct a clinical trial at a prospective site. |

| 13 |

Once a clinical trial has begun, it may be delayed, suspended or terminated by us or the FDA or other regulatory authorities due to a number of factors, including:

| · | ongoing discussions with the FDA or other regulatory authorities regarding the scope or design of our clinical trials; |

| · | failure to conduct clinical trials in accordance with regulatory requirements; |

| · | lower than anticipated recruitment or retention rate of patients in clinical trials; |

| · | inspection of the clinical trial operations or trial sites by the FDA or other regulatory authorities resulting in the imposition of a clinical hold; |

| · | lack of adequate funding to continue clinical trials; |

| · | negative results of clinical trials; or |

| · | side-effects of CBP. |

If clinical trials are unsuccessful, and we are not able to obtain regulatory approvals for our product candidates under development, we will not be able to commercialize these products, and therefore may not be able to generate sufficient revenues to support our business.

We rely on third parties to conduct, supervise and monitor our clinical trials, and if those third parties perform in an unsatisfactory manner, it may harm our business.

We rely on CROs and clinical trial sites to ensure the proper and timely conduct of our clinical trials. While we have agreements governing their activities, we will have limited influence over their actual performance. We will control only certain aspects of our CROs’ activities. Nevertheless, we will be responsible for ensuring that our clinical trials are conducted in accordance with the applicable protocol, legal, regulatory and scientific standards and our reliance on the CROs does not relieve us of our regulatory responsibilities.

We and our CROs are required to comply with the FDA’s current good clinical practices requirements, or cGCP, for conducting, recording and reporting the results of clinical trials to assure that data and reported results are credible and accurate and that the rights, integrity and confidentiality of clinical trial participants are protected. The FDA enforces these cGCPs through periodic inspections of trial sponsors, principal investigators and clinical trial sites. If we or our CROs fail to comply with applicable cGCPs, the clinical data generated in our clinical trials may be deemed unreliable and the FDA may require us to perform additional clinical trials before approving any marketing applications. Upon inspection, the FDA may determine that our clinical trials did not comply with cGCPs. In addition, our clinical trials, including our Phase 2b trial of TNX-102 SL in FM, will require a sufficiently large number of test subjects to evaluate the safety and effectiveness of a product candidate. Accordingly, if our CROs fail to comply with these regulations or fail to recruit a sufficient number of patients, our clinical trials may be delayed or we may be required to repeat such clinical trials, which would delay the regulatory approval process.

Our CROs are not our employees, and we are not able to control whether or not they devote sufficient time and resources to our clinical trials. These CROs may also have relationships with other commercial entities, including our competitors, for whom they may also be conducting clinical trials, or other drug development activities which could harm our competitive position. If our CROs do not successfully carry out their contractual duties or obligations, fail to meet expected deadlines, or if the quality or accuracy of the clinical data they obtain is compromised due to the failure to adhere to our clinical protocols or regulatory requirements, or for any other reasons, our clinical trials may be extended, delayed or terminated, and we may not be able to obtain regulatory approval for, or successfully commercialize our product candidates. As a result, our financial results and the commercial prospects for such product candidates would be harmed, our costs could increase, and our ability to generate revenues could be delayed.

We also rely on other third parties to store and distribute drug products for our clinical trials. Any performance failure on the part of our distributors could delay clinical development or marketing approval of our product candidates or commercialization of our products, if approved, producing additional losses and depriving us of potential product revenue.

| 14 |

We have never conducted a Phase 3 clinical trial or submitted an NDA before, and may be unable to do so for TNX-102 SL and other product candidates we are developing.

If our Phase 2b study of TNX-102 SL is successful, then we expect to conduct a Phase 3 confirmatory study in support of product registration. The conduct of Phase 3 clinical trials and the submission of a successful NDA is a complicated process. Although members of our management team have extensive industry experience, including in the development, clinical testing and commercialization of drug candidates, our company has never conducted a Phase 3 clinical trial before, has limited experience in preparing, submitting and prosecuting regulatory filings, and has not submitted an NDA before. Consequently, we may be unable to successfully and efficiently execute and complete these planned clinical trials in a way that leads to NDA submission and approval of TNX-102 SL and other product candidates we are developing. We may require more time and incur greater costs than our competitors and may not succeed in obtaining regulatory approvals of product candidates that we develop. Failure to commence or complete, or delays in, our planned clinical trials would prevent or delay commercialization of TNX-102 SL and other product candidates we are developing.

Our product candidates may cause serious adverse events or undesirable side effects which may delay or prevent marketing approval, or, if approval is received, require them to be taken off the market, require them to include safety warnings or otherwise limit their sales.

Serious adverse events or undesirable side effects from TNX-102 SL or any of our other product candidates could arise either during clinical development or, if approved, after the approved product has been marketed. The results of future clinical trials, including TNX-102 SL, may show that our product candidates cause serious adverse events or undesirable side effects, which could interrupt, delay or halt clinical trials, resulting in delay of, or failure to obtain, marketing approval from the FDA and other regulatory authorities.

If TNX-102 SL or any of our other product candidates cause serious adverse events or undesirable side effects:

| · | regulatory authorities may impose a clinical hold which could result in substantial delays and adversely impact our ability to continue development of the product; |

| · | regulatory authorities may require the addition of labeling statements, specific warnings, a contraindication or field alerts to physicians and pharmacies; |

| · | we may be required to change the way the product is administered, conduct additional clinical trials or change the labeling of the product; |

| · | we may be required to implement a risk minimization action plan, which could result in substantial cost increases and have a negative impact on our ability to commercialize the product; |

| · | we may be required to limit the patients who can receive the product; |

| · | we may be subject to limitations on how we promote the product; |

| · | sales of the product may decrease significantly; |

| · | regulatory authorities may require us to take our approved product off the market; |

| · | we may be subject to litigation or product liability claims; and |

| · | our reputation may suffer. |

Any of these events could prevent us from achieving or maintaining market acceptance of the affected product or could substantially increase commercialization costs and expenses, which in turn could delay or prevent us from generating significant revenues from the sale of our products.

| 15 |

If we are unable to file for approval under Section 505(b)(2) of the FDCA or if we are required to generate additional data related to safety and efficacy in order to obtain approval under Section 505(b)(2), we may be unable to meet our anticipated development and commercialization timelines.