UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

Report of Foreign Issuer

Pursuant To Rule 13a-16 Or 15d-16 of the

Securities Exchange Act of 1934

For the month of February 2021

Commission File Number: 333-251238

COSAN S.A.

(Exact name of registrant as specified in its charter)

N/A

(Translation of registrant’s name into English)

Av. Brigadeiro Faria Lima, 4100, – 16th floor

São Paulo, SP 04538-132 Brazil

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40‑F:

| Form 20-F | ☒ | Form 40-F | ☐ |

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1):

| Yes | ☐ | No | ☒ |

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7):

| Yes | ☐ | No | ☒ |

| # |

|

São Paulo Corporate Towers Av. Presidente Juscelino Kubitschek, 1.909 Vila Nova Conceição 04543-011 - São Paulo – SP - Brazil

Phone: +55 11 2573-3000 ey.com.br |

Independent auditor’s report on individual and consolidated financial statements

The Shareholders, Board of Directors and Officers

Cosan S.A.

São Paulo – SP

We have audited the individual and consolidated financial statements of Cosan S.A. (the “Company”), identified as Individual and Consolidated, respectively, which comprise the statement of financial position as of December 31, 2020, and the statements of profit or loss, of comprehensive income, of changes in equity and of cash flows for the year then ended, and notes to the financial statements, including a summary of significant accounting policies.

In our opinion, the financial statements referred to above present fairly, in all material respects, the individual and consolidated financial position of the Company as of December 31, 2020, its individual and consolidated financial performance and its respective individual and consolidated cash flows for the year then ended, in accordance with accounting practices adopted in Brazil and the International Financial Reporting Standards (IFRS), issued by the International Accounting Standards Board (IASB).

Basis for opinion

We conducted our audit in accordance with Brazilian and International Standards on Auditing. Our responsibilities under those standards are further described in the Auditor’s responsibilities for the audit of the individual and consolidated financial statements section of our report. We are independent of the Company and its subsidiaries in accordance with the relevant ethical principles set forth in the Code of Professional Ethics for Accountants, the professional standards issued by Brazil’s National Association of State Boards of Accountancy (CFC) and we have fulfilled our other ethical responsibilities in accordance with these requirements. We believe that the audit evidence we have obtained is sufficient and appropriate to provide a basis for our opinion.

|

São Paulo Corporate Towers Av. Presidente Juscelino Kubitschek, 1.909 Vila Nova Conceição 04543-011 - São Paulo – SP - Brazil

Phone: +55 11 2573-3000 ey.com.br |

Key audit matters

Key audit matters are those matters that, in our professional judgment, were of most significance in our audit of the financial statements of the current period. These matters were addressed in the context of our audit of the individual and consolidated financial statements as a whole, and in forming our opinion thereon, and we do not provide an individual opinion on these matters. For each matter below, our description of how our audit addressed the matter, including any commentary on the findings or outcome of our procedures, is provided in that context.

We have fulfilled the responsibilities described in the Auditor’s responsibilities for the audit of the individual and consolidated financial statements section of our report, including in relation to these matters. Accordingly, our audit included the performance of procedures designed to respond to our assessment of the risks of material misstatement of the financial statements. The results of our audit procedures, including the procedures performed to address the matters below, provide the basis for our audit opinion on the accompanying financial statements.

Recognition of unbilled revenue

As mentioned in Notes 5.3 and 18 to the financial statements, given the difference between the dates of the monthly cycle measurement and the accounting closing date, the Company estimates the gas distributed, but not yet billed, observing the reference period of gas delivery. Such revenue is calculated by estimating the amount of gas delivered to customer segments multiplied by the regulated tariffs applicable to these segments. As of December 31, 2020, the unbilled revenue and related accounts receivable was R$667,793 thousand.

|

São Paulo Corporate Towers Av. Presidente Juscelino Kubitschek, 1.909 Vila Nova Conceição 04543-011 - São Paulo – SP - Brazil

Phone: +55 11 2573-3000 ey.com.br |

Monitoring this matter was considered significant for our audit given the materiality of amounts involved in relation to accounts receivable balance and the potential risks of misstatement to profit or loss for the period, in addition to uncertainties inherent in determining the estimate of amounts recorded, given the use of information by customer segment with different prices, and the degree of judgment exercised by management in determining the assumptions for the calculation. A change in any of these assumptions could have a significant impact on the Company’s individual and consolidated financial statements.

How our audit has addressed this matter:

Our audit procedures included, among others, (i) the understanding of internal control environment related to the allocation of gas volumes and price by segment according to regulated tariffs (ii) evaluation of the design of internal controls implemented by the Company to ensure adequate revenue recognition; iii) involvement of senior audit professionals in planning the audit approach, review and supervision. In addition, i) we substantively tested, on a sample basis, the data used in the calculation of unbilled revenue by segment; ii) we recalculated unbilled revenue by segment, including the assessment of the key assumptions used; iii) we prepared an independent estimate based on historical data and compared it with the estimate of volume by segment calculated by the Company; iv) we compared, on a sample basis, the tariffs by segment used in the calculation with the tariffs determined by the regulatory agency; v) we compared the assumption of average consumption estimated by the Company with the actual average consumption of the subsequent cycle in January, 2021; vi) we have performed analytical procedures to develop an independent expectation based on the historical figures of the balances under analysis; and vii) we have reconciled the balance of unbilled revenue to the accounting records. We also analyzed the arithmetic calculation. Lastly, we assessed the adequacy of the disclosures in Notes 5.3 and 18 to the financial statements at December 31, 2020.

Based on the result of our audit procedures on unbilled revenue amounts, in the statement of profit or loss, and the respective accounts receivable balance, in assets, which is consistent with management’s evaluation, we consider that the criteria and assumptions adopted by management, as well as the respective disclosures in the Notes 5.3 and 18, are acceptable, in the context of the financial statements taken as a whole.

|

São Paulo Corporate Towers Av. Presidente Juscelino Kubitschek, 1.909 Vila Nova Conceição 04543-011 - São Paulo – SP - Brazil

Phone: +55 11 2573-3000 ey.com.br |

Concession infrastructure

As disclosed in Note 10 to the financial statements, at December 31, 2020, the Company recorded contract assets and concession intangible assets, in the amounts of R$686,690 thousand and R$8,425,082 thousand, respectively, which represent, substantially, the concession infrastructure.

The amount of the investments applied on infrastructure serving the concession is an essential part of the methodology applied by the granting authority to define the tariff to be charged by the Company to final consumers, under the terms of the Concession Contract. The definition of which expenses are eligible and should be capitalized as cost of infrastructure and the definition of the useful life are subject to judgment by management. In the year ended December 31, 2020, the Company recognized R$885,631 thousand of additions to the infrastructure assets.

Due to the specific elements inherent in the capitalization process and the subsequent measurement of expenditures in infrastructure, in addition to the significance of the amounts involved, we consider this to be a significant matter for our audit.

How our audit has addressed this matter:

Our audit procedures involved, among others, i) overall understanding of the internal control environment on the accounting for investments in infrastructure, including their eligibility as a qualifying assets for capitalization; ii) evaluation of the nature of these investments with the applied infrastructure; iii) testing in a sample basis of the materials and services allocated as well as workforce; iv) evaluation of the accounting classifications between the contract asset and the concession right intangible asset, observing the properly periods of construction; v) the policies established by the Company for such accounting and its applicability to current accounting standards; vi) the capitalization of interest, when applicable; vii) use of substantive analytical procedures over additions and amortization; and, viii) testing of the amortization of the concession right intangible asset.

|

São Paulo Corporate Towers Av. Presidente Juscelino Kubitschek, 1.909 Vila Nova Conceição 04543-011 - São Paulo – SP - Brazil

Phone: +55 11 2573-3000 ey.com.br |

Based on the result of audit procedures performed, which is consistent with management’s assessment, we consider the criteria and policies for capitalization and amortization of these concession infrastructure assets prepared by management to be acceptable, as well as the respective disclosures in Note 10, in the context of the financial statements taken as a whole.

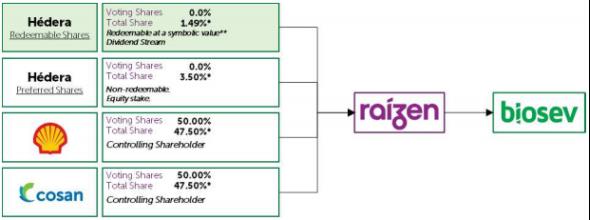

Investments in joint ventures

As disclosed in Note 9 to the financial statements, on December 31, 2020, the Company holds join control of Raízen Combustíveis S.A and Raízen Energia S.A (“Components”), in the amount of R$7,988,208 thousand, classified as investments in joint ventures, which represents approximately 22% of the total consolidated assets. In addition, the Company recorded an amount of R$583,001 thousand interest in earnings of joint ventures, in the statement of profit and loss for the year ended December 31, 2020, which represents approximately 50% of the profit before taxes of the Company for the same period.

Monitoring this matter was considered significant for our audit given the materiality of amounts involved in relation to both the total consolidated assets and profit and loss for the year ended December 31, 2020, considering the choice of accounting policies, the use of accounting estimates and judgments applied, in respect to a group audit where the primary team performs the review and supervision of its components.

How our audit has addressed this matter:

Our audit procedures included, among others (i) the understanding of the internal controls environment related to the supervision by the Company of its investments in joint ventures, including the accounting policies choice and financial information reporting; (ii) the evaluation of the design of the internal controls in place to ensure the accurate recognition of such components results in the Company's financial statements; iii) involvement of senior audit professionals in the risk assessment process, including the definition of scope and strategy, nature, time and extent of audit procedures, review and supervision of audit results of the component. Additionally, i) involvement of an experienced audit team in the sector, particularly, in which the component companies operate; ii) assessment of the risks that such components represent to the level of the Company's financial statements, application of group audit procedures including audit instructions to the component team and supervision by the primary team; iii) use of a single audit methodology, formal review and communication protocol between the teams; iv) evaluation of the standardization of accounting policies between companies, including equivalent fiscal year; v) review of the deliverables and audit work papers prepared by the component team relevant to the Company's financial statements; and, v) review of the accounting records to reflect the results of the component in the Company’s financial statements.

|

São Paulo Corporate Towers Av. Presidente Juscelino Kubitschek, 1.909 Vila Nova Conceição 04543-011 - São Paulo – SP - Brazil

Phone: +55 11 2573-3000 ey.com.br |

Based on the result of audit procedures performed, which is consistent with management’s assessment, we consider the amounts recorded and disclosures prepared by management as acceptable, as well as the respective disclosures in Note 9, in the context of the financial statements taken as a whole.

Other matters

Statements of value added

The individual and consolidated statements of value added (SVA) for the year ended December 31, 2020, prepared under the responsibility of Company management, and presented as supplementary information for purposes of IFRS, were submitted to audit procedures conducted together with the audit of the Company’s financial statements. To form our opinion, we evaluated if these statements are reconciled to the financial statements and accounting records, as applicable, and if their form and content comply with the criteria defined by NBC TG 09 – Demonstração do Valor Adicionado (Statement of Value Added). In our opinion, these statements of value added were prepared fairly, in all material respects, in accordance with the criteria defined in the abovementioned accounting pronouncement and are consistent in relation to the overall individual and consolidated financial statements.

Audit of the corresponding amounts

The audit of the individual and consolidated financial statements as of and for the year ended December 31, 2019, presented for comparison purposes, were conducted under the responsibility of another auditor, which issued audit report without modification, dated February 14, 2020.

|

São Paulo Corporate Towers Av. Presidente Juscelino Kubitschek, 1.909 Vila Nova Conceição 04543-011 - São Paulo – SP - Brazil

Phone: +55 11 2573-3000 ey.com.br |

Responsibilities of management and those charged with governance for the individual and consolidated financial statements

Management is responsible for the preparation and fair presentation of the individual and consolidated financial statements in accordance with accounting practices adopted in Brazil and with the International Financial Reporting Standards (IFRS) issued by the International Accounting Standards Board (IASB), and for such internal control as management determines is necessary to enable the preparation of financial statements that are free of material misstatement, whether due to fraud or error.

In preparing the individual and consolidated financial statements, management is responsible for assessing the Company’s ability to continue as a going concern, disclosing, as applicable, matters related to going concern and using the going concern basis of accounting unless management either intends to liquidate the Company or to cease operations, or has no realistic alternative but to do so.

Those charged with governance are responsible for overseeing the Company’s and its subsidiaries’ financial reporting process.

|

São Paulo Corporate Towers Av. Presidente Juscelino Kubitschek, 1.909 Vila Nova Conceição 04543-011 - São Paulo – SP - Brazil

Phone: +55 11 2573-3000 ey.com.br |

Auditor’s responsibilities for the audit of individual and consolidated financial statements

Our objectives are to obtain reasonable assurance about whether the individual and consolidated financial statements as a whole are free of material misstatement, whether due to fraud or error, and to issue an auditor’s report that includes our opinion. Reasonable assurance is a high level of assurance, but is not a guarantee that an audit conducted in accordance with Brazilian and International Standards on Auditing will always detect a material misstatement when it exists. Misstatements can arise from fraud or error and are considered material if, individually or in the aggregate, they could reasonably be expected to influence the economic decisions of users taken on the basis of these financial statements.

As part of an audit in accordance with Brazilian and International Standards on Auditing, we exercise professional judgment and maintain professional skepticism throughout the audit. We also:

- Identified and assessed the risks of material misstatement of the individual and consolidated financial statements, whether due to fraud or error, designed and performed audit procedures responsive to those risks, and obtained audit evidence that is sufficient and appropriate to provide a basis for our opinion. The risk of not detecting a material misstatement resulting from fraud is higher than for one resulting from error, as fraud may involve collusion, forgery, intentional omissions, misrepresentations, or the override of internal control.

- Obtained an understanding of internal control relevant to the audit in order to design audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the Company’s and its subsidiaries’ internal control.

- Evaluated the appropriateness of accounting policies used and the reasonableness of accounting estimates and related disclosures made by management.

|

São Paulo Corporate Towers Av. Presidente Juscelino Kubitschek, 1.909 Vila Nova Conceição 04543-011 - São Paulo – SP - Brazil

Phone: +55 11 2573-3000 ey.com.br |

- Concluded on the appropriateness of management’s use of the going concern basis of accounting and, based on the audit evidence obtained, whether a material uncertainty exists related to events or conditions that may cast substantial doubt as to the Company’s and its subsidiary’s ability to continue as a going concern. If we conclude that a material uncertainty exists, we are required to draw attention in our auditor’s report to the related disclosures in the individual and consolidated financial statements or, if such disclosures are inadequate, to modify our opinion. Our conclusions are based on the audit evidence obtained up to the date of our auditor’s report. However, future events or conditions may cause the Company and its subsidiaries to cease to continue as a going concern.

- Evaluated the overall presentation, structure and content of the financial statements, including the disclosures, and whether the individual and consolidated financial statements represent the underlying transactions and events in a manner that achieves fair presentation.

- Obtained sufficient appropriate audit evidence regarding the financial information of the entities or business activities within the Group to express an opinion on the individual and consolidated financial statements. We are responsible for the direction, supervision and performance of the group audit. We remain solely responsible for our audit opinion.

We communicate with those charged with governance regarding, among other matters, the scope and timing of the planned audit procedures and significant audit findings, including deficiencies in internal control that we may have identified during our audit.

We also provided those charged with governance with a statement that we have complied with relevant ethical requirements, including applicable independence requirements, and to communicate with them all relationships and other matters that may reasonably be thought to bear on our independence, and where applicable, related safeguards.

|

São Paulo Corporate Towers Av. Presidente Juscelino Kubitschek, 1.909 Vila Nova Conceição 04543-011 - São Paulo – SP - Brazil

Phone: +55 11 2573-3000 ey.com.br |

From the matters communicated with those charged with governance, we determined those matters that were of most significance in the audit of the financial statements of the current period and are therefore the key audit matters. We describe these matters in our auditor’s report unless law or regulation precludes public disclosure about the matter or when, in extremely rare circumstances, we determine that a matter should not be communicated in our report because the adverse consequences of doing so would reasonably be expected to outweigh the public interest benefits of such communication.

São Paulo, February 11, 2021.

ERNST & YOUNG

Auditores Independentes S.S.

CRC-2SP034519/O-6

Marcos Alexandre S. Pupo

Accountant CRC-1SP221749/O-0

In thousands of Brazilian Reais - R$)

|

|

|

|

|

Parent Company |

|

Consolidated |

||||

|

|

|

Note |

|

December 31, 2020 |

|

December 31, 2019 |

|

December 31, 2020 |

|

December 31, 2019 |

|

Assets |

|

|

|

|

|

|

|

|

|

|

|

Cash and cash equivalents |

|

5.1 |

|

1,149,267 |

|

3,490,707 |

|

4,614,053 |

|

6,076,644 |

|

Marketable securities |

|

5.2 |

|

788,965 |

|

910,064 |

|

2,271,570 |

|

1,363,048 |

|

Trade receivables |

|

5.3 |

|

— |

|

— |

|

1,585,708 |

|

1,400,498 |

|

Derivative financial instruments |

|

5.9 |

|

— |

|

— |

|

156,208 |

|

144,422 |

|

Inventories |

|

7 |

|

— |

|

— |

|

685,900 |

|

538,797 |

|

Receivables from related parties |

|

5.5 |

|

286,993 |

|

354,285 |

|

71,783 |

|

93,590 |

|

Income tax receivable |

|

|

|

141,018 |

|

47,151 |

|

178,501 |

|

73,356 |

|

Other current tax receivable |

|

6 |

|

35,507 |

|

33,307 |

|

434,480 |

|

602,927 |

|

Dividends receivable |

|

|

|

160,694 |

|

22,684 |

|

77,561 |

|

22,684 |

|

Sectorial financial assets |

|

12 |

|

— |

|

— |

|

241,749 |

|

— |

|

Other financial assets |

|

5.4 |

|

779,695 |

|

708,783 |

|

848,821 |

|

773,629 |

|

Other current assets |

|

|

|

101,673 |

|

137,952 |

|

270,065 |

|

247,096 |

|

Total current assets |

|

|

|

3,443,812 |

|

5,704,933 |

|

11,436,399 |

|

11,336,691 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Trade receivables |

|

5.3 |

|

— |

|

— |

|

19,131 |

|

14,613 |

|

Deferred tax assets |

|

14 |

|

54,032 |

|

— |

|

629,591 |

|

432,920 |

|

Receivables from related parties |

|

5.5 |

|

473,349 |

|

423,707 |

|

199,983 |

|

78,320 |

|

Income taxes receivable |

|

|

|

— |

|

— |

|

836 |

|

— |

|

Other non-current tax receivable |

|

6 |

|

37,533 |

|

41,516 |

|

167,224 |

|

63,181 |

|

Judicial deposits |

|

15 |

|

380,727 |

|

349,416 |

|

544,226 |

|

527,230 |

|

Other financial assets |

|

5.4 |

|

— |

|

— |

|

— |

|

69,791 |

|

Derivative financial instruments |

|

5.9 |

|

2,457,604 |

|

1,359,821 |

|

2,971,210 |

|

1,755,957 |

|

Contract asset |

|

10.3 |

|

— |

|

— |

|

695,938 |

|

600,541 |

|

Other non-current assets |

|

|

|

165,310 |

|

158,981 |

|

227,857 |

|

214,118 |

|

Investments in associates |

|

8.1 |

|

11,026,580 |

|

10,299,665 |

|

333,705 |

|

325,695 |

|

Investments in joint ventures |

|

9 |

|

2,314,537 |

|

2,395,437 |

|

7,988,208 |

|

7,548,960 |

|

Property, plant and equipment |

|

10.1 |

|

61,459 |

|

57,316 |

|

416,996 |

|

380,037 |

|

Intangible assets and goodwill |

|

10.2 |

|

2,191 |

|

3,299 |

|

10,045,296 |

|

9,465,681 |

|

Right-of-use assets |

|

|

|

24,809 |

|

18,685 |

|

84,224 |

|

51,405 |

|

Total non-current assets |

|

|

|

16,998,131 |

|

15,107,843 |

|

24,324,425 |

|

21,528,449 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Total assets |

|

|

|

20,441,943 |

|

20,812,776 |

|

35,760,824 |

|

32,865,140 |

The accompanying notes are an integral part of these financial statements.

Statements of financial position

(In thousands of Brazilian Reais - R$)

|

|

|

|

|

Parent Company |

|

Consolidated |

||||

|

|

|

Note |

|

December 31, 2020 |

|

December 31, 2019 |

|

December 31, 2020 |

|

December 31, 2019 |

|

Liabilities |

|

|

|

|

|

|

|

|

|

|

|

Loans, borrowings and debentures |

|

5.6 |

|

— |

|

1,161,406 |

|

2,352,057 |

|

2,373,199 |

|

Leases |

|

|

|

11,108 |

|

2,038 |

|

20,466 |

|

7,583 |

|

Derivative financial instruments |

|

5.9 |

|

7,291 |

|

— |

|

293,656 |

|

— |

|

Trade payables |

|

5.7 |

|

4,066 |

|

5,175 |

|

1,875,192 |

|

1,676,725 |

|

Employee benefits payables |

|

|

|

25,168 |

|

34,140 |

|

195,881 |

|

164,115 |

|

Income tax payables |

|

|

|

2,571 |

|

1,191 |

|

374,339 |

|

416,090 |

|

Other taxes payable |

|

13 |

|

125,368 |

|

143,091 |

|

367,076 |

|

351,895 |

|

Dividends payable |

|

16 |

|

216,929 |

|

588,752 |

|

285,177 |

|

590,204 |

|

Payables to related parties |

|

5.5 |

|

278,740 |

|

430,531 |

|

150,484 |

|

260,236 |

|

Sectorial financial liabilities |

|

12 |

|

— |

|

— |

|

91,912 |

|

— |

|

Other financial liabilities |

|

|

|

— |

|

— |

|

149,293 |

|

132,927 |

|

Other current liabilities |

|

|

|

103,501 |

|

70,909 |

|

259,580 |

|

193,102 |

|

Total current liabilities |

|

|

|

774,742 |

|

2,437,233 |

|

6,415,113 |

|

6,166,076 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Loans, borrowings and debentures |

|

5.6 |

|

— |

|

566,054 |

|

13,075,170 |

|

10,983,851 |

|

Leases |

|

|

|

17,037 |

|

17,592 |

|

59,297 |

|

50,320 |

|

Preferred shareholders payable in subsidiaries |

|

5.8 |

|

387,044 |

|

611,537 |

|

387,044 |

|

611,537 |

|

Derivative financial instruments |

|

5.9 |

|

124,171 |

|

47,985 |

|

124,171 |

|

49,785 |

|

Other taxes payable |

|

13 |

|

141,233 |

|

141,349 |

|

146,895 |

|

147,490 |

|

Provision for legal proceedings |

|

15 |

|

308,819 |

|

301,378 |

|

887,794 |

|

873,228 |

|

Provision for uncovered liability of associates |

|

8 |

|

458,852 |

|

152,827 |

|

— |

|

— |

|

Payables to related parties |

|

5.5 |

|

7,096,139 |

|

5,549,607 |

|

— |

|

— |

|

Post-employment benefits |

|

23 |

|

177 |

|

184 |

|

728,677 |

|

704,919 |

|

Deferred tax liabilities |

|

14 |

|

— |

|

158,954 |

|

1,271,208 |

|

1,558,742 |

|

Sectorial financial liabilities |

|

12 |

|

— |

|

— |

|

473,999 |

|

— |

|

Other non-current liabilities |

|

|

|

286,064 |

|

274,342 |

|

685,642 |

|

657,976 |

|

Total non-current liabilities |

|

|

|

8,819,536 |

|

7,821,809 |

|

17,839,897 |

|

15,637,848 |

|

Total liabilities |

|

|

|

9,594,278 |

|

10,259,042 |

|

24,255,010 |

|

21,803,924 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Shareholders' equity |

|

16 |

|

|

|

|

|

|

|

|

|

Share capital |

|

|

|

5,727,478 |

|

5,045,214 |

|

5,727,478 |

|

5,045,214 |

|

Treasury shares |

|

|

|

(583,941) |

|

(112,785) |

|

(583,941) |

|

(112,785) |

|

Additional paid-in capital |

|

|

|

(939,347) |

|

(958,001) |

|

(939,347) |

|

(958,001) |

|

Accumulated other comprehensive loss |

|

|

|

(252,610) |

|

(349,501) |

|

(252,610) |

|

(349,501) |

|

Retained earnings |

|

|

|

6,896,085 |

|

6,928,807 |

|

6,896,085 |

|

6,928,807 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Equity attributable to: |

|

|

|

|

|

|

|

|

|

|

|

Owners of the Company |

|

|

|

10,847,665 |

|

10,553,734 |

|

10,847,665 |

|

10,553,734 |

|

Non-controlling interests |

|

8.3 |

|

— |

|

— |

|

658,149 |

|

507,482 |

|

Total shareholders' equity |

|

|

|

10,847,665 |

|

10,553,734 |

|

11,505,814 |

|

11,061,216 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Total shareholders' equity and liabilities |

|

|

|

20,441,943 |

|

20,812,776 |

|

35,760,824 |

|

32,865,140 |

|

|

|

|

|

|

|

|

|

|

|

|

The accompanying notes are an integral part of these financial statements.

(In thousands of Brazilian Reais - R$, except earnings per share)

|

|

|

|

Parent Company |

|

Consolidated |

||||

|

|

Note |

|

December 31, 2020 |

|

December 31, 2019 |

|

December 31, 2020 |

|

December 31, 2019 |

|

Net sales |

18 |

|

— |

|

— |

|

13,508,787 |

|

13,560,445 |

|

Cost of sales |

19 |

|

— |

|

— |

|

(9,816,078) |

|

(9,588,006) |

|

Gross profit |

|

|

— |

|

— |

|

3,692,709 |

|

3,972,439 |

|

|

|

|

|

|

|

|

|

|

|

|

Selling expenses |

19 |

|

— |

|

— |

|

(927,346) |

|

(1,115,813) |

|

General and administrative expenses |

19 |

|

(181,418) |

|

(190,852) |

|

(1,006,625) |

|

(796,322) |

|

Other expenses, net |

20 |

|

(11,454) |

|

428,891 |

|

71,774 |

|

428,790 |

|

Operating expenses |

|

|

(192,872) |

|

238,039 |

|

(1,862,197) |

|

(1,483,345) |

|

|

|

|

|

|

|

|

|

|

|

|

Profit before equity in earnings of investees, finance results and taxes |

|

|

(192,872) |

|

238,039 |

|

1,830,512 |

|

2,489,094 |

|

|

|

|

|

|

|

|

|

|

|

|

Interest in earnings of associates |

8.1 |

|

1,347,408 |

|

2,327,698 |

|

15,714 |

|

(20,644) |

|

Interest in earnings of joint ventures |

|

|

(80,900) |

|

(119,503) |

|

583,001 |

|

1,131,406 |

|

Equity in earnings of investees |

|

|

1,266,508 |

|

2,208,195 |

|

598,715 |

|

1,110,762 |

|

|

|

|

|

|

|

|

|

|

|

|

Finance expense |

|

|

(719,523) |

|

(490,891) |

|

(1,679,752) |

|

(1,301,443) |

|

Finance income |

|

|

188,005 |

|

386,367 |

|

227,925 |

|

742,648 |

|

Foreign exchange, net |

|

|

(1,399,682) |

|

(186,616) |

|

(1,612,525) |

|

(311,492) |

|

Net effect of derivatives |

|

|

1,532,029 |

|

393,307 |

|

1,801,790 |

|

471,507 |

|

Finance results, net |

21 |

|

(399,171) |

|

102,167 |

|

(1,262,562) |

|

(398,780) |

|

|

|

|

|

|

|

|

|

|

|

|

Profit before taxes |

|

|

674,465 |

|

2,548,401 |

|

1,166,665 |

|

3,201,076 |

|

|

|

|

|

|

|

|

|

|

|

|

Income taxes |

14 |

|

|

|

|

|

|

|

|

|

Current |

|

|

(39) |

|

(41,473) |

|

(695,832) |

|

(835,708) |

|

Deferred |

|

|

177,432 |

|

(92,544) |

|

437,981 |

|

106,886 |

|

|

|

|

177,393 |

|

(134,017) |

|

(257,851) |

|

(728,822) |

|

|

|

|

|

|

|

|

|

|

|

|

Profit from continuing operations |

|

|

851,858 |

|

2,414,384 |

|

908,814 |

|

2,472,254 |

|

Profit from discontinued operation, net of tax |

|

|

— |

|

11,021 |

|

— |

|

11,021 |

|

|

|

|

|

|

|

|

|

|

|

|

Profit for the year |

|

|

851,858 |

|

2,425,405 |

|

908,814 |

|

2,483,275 |

|

|

|

|

|

|

|

|

|

|

|

|

Profit attributable to: |

|

|

|

|

|

|

|

|

|

|

Owners of the Company |

|

|

851,858 |

|

2,425,405 |

|

851,858 |

|

2,425,405 |

|

Non-controlling interests |

|

|

— |

|

— |

|

56,956 |

|

57,870 |

|

|

|

|

851,858 |

|

2,425,405 |

|

908,814 |

|

2,483,275 |

|

|

|

|

|

|

|

|

|

|

|

|

Earnings per share |

17 |

|

|

|

|

|

|

|

|

|

Basic earnings per share |

|

|

|

|

|

|

R$2.2093 |

|

R$6.1534 |

|

Diluted earnings per share |

|

|

|

|

|

|

R$2.1887 |

|

R$6.1320 |

| Earnings per share from continuing operations | 17 | ||||||||

| Basic earnings per share | R$2.2093 | R$6.1255 | |||||||

| Diluted earnings per share | R$2.1887 | R$6.1041 | |||||||

The accompanying notes are an integral part of these financial statements.

(In thousands of Brazilian Reais - R$, except earnings per share)

|

|

|

Parent Company |

|

Consolidated |

||||

|

|

|

December 31, 2020 |

|

December 31, 2019 |

|

December 31, 2020 |

|

December 31, 2019 |

|

Profit for the year |

|

851,858 |

|

2,425,405 |

|

908,814 |

|

2,483,275 |

|

Other comprehensive income |

|

|

|

|

|

|

|

|

|

Items that may not be reclassified to profit or loss |

|

|

|

|

|

|

|

|

|

Actuarial loss on defined benefit plan |

|

(1,192) |

|

(80,640) |

|

(56,642) |

|

(116,710) |

|

Taxes over actuarial loss on defined benefit plan |

|

405 |

|

— |

|

19,258 |

|

35,509 |

|

|

|

(787) |

|

(80,640) |

|

(37,384) |

|

(81,201) |

|

|

|

|

|

|

|

|

|

|

|

Items that are or may subsequently be reclassified to profit or loss: |

|

|

|

|

|

|

|

|

|

Foreign currency translation effect |

|

624,257 |

|

83,723 |

|

732,715 |

|

85,105 |

|

Gain on cash flow hedge |

|

(526,856) |

|

(256,782) |

|

(526,628) |

|

(256,782) |

|

Changes in fair value of financial assets |

|

277 |

|

192 |

|

277 |

|

192 |

|

|

|

97,678 |

|

(172,867) |

|

206,364 |

|

(171,485) |

|

|

|

|

|

|

|

|

|

|

|

Total other comprehensive (loss) income, net of tax |

|

96,891 |

|

(253,507) |

|

168,980 |

|

(252,686) |

|

|

|

|

|

|

|

|

|

|

|

Comprehensive income |

|

948,749 |

|

2,160,877 |

|

1,077,794 |

|

2,219,568 |

|

Comprehensive income (loss) - Discontinued operation |

|

— |

|

11,021 |

|

— |

|

11,021 |

|

Total comprehensive income for the year |

|

948,749 |

|

2,171,898 |

|

1,077,794 |

|

2,230,589 |

|

|

|

|

|

|

|

|

|

|

|

Total comprehensive income attributable to: |

|

|

|

|

|

|

|

|

|

Owners of the Company |

|

948,749 |

|

2,171,898 |

|

948,749 |

|

2,171,898 |

|

Non-controlling interests |

|

— |

|

— |

|

129,045 |

|

58,691 |

|

|

|

948,749 |

|

2,171,898 |

|

1,077,794 |

|

2,230,589 |

The accompanying notes are an integral part of these financial statements.

(In thousands of Brazilian Reais - R$)

|

|

|

|

|

|

|

Capital reserve |

|

|

|

Profit reserve |

|

|

|

|

|

|

|

|

||||||||

|

|

|

Share capital |

|

Treasury share |

|

Corporate transactions - Law 6404 |

|

Capital transactions |

|

Accumulated other comprehensive loss |

|

Legal |

|

Statutory reserve |

|

Profits to be realized |

|

Retained earnings |

|

Accumulated profits |

|

Total |

|

Non-controlling interest |

|

Total equity |

|

At January 1, 2019 |

|

4,418,476 |

|

(627,913) |

|

367,979 |

|

23,195 |

|

(95,994) |

|

82,616 |

|

4,560,371 |

|

171,021 |

|

1,028,964 |

|

— |

|

9,928,715 |

|

994,418 |

|

10,923,133 |

|

Net income for the year |

|

— |

|

— |

|

— |

|

— |

|

— |

|

— |

|

— |

|

— |

|

— |

|

2,425,405 |

|

2,425,405 |

|

57,870 |

|

2,483,275 |

|

Other comprehensive income: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Loss on cash flow hedge |

|

— |

|

— |

|

— |

|

— |

|

(256,782) |

|

— |

|

— |

|

— |

|

— |

|

— |

|

(256,782) |

|

— |

|

(256,782) |

|

Foreign currency translation effects |

|

— |

|

— |

|

— |

|

— |

|

83,723 |

|

— |

|

— |

|

— |

|

— |

|

— |

|

83,723 |

|

1,382 |

|

85,105 |

|

Actuarial loss on defined benefit plan |

|

— |

|

— |

|

— |

|

— |

|

(80,640) |

|

— |

|

— |

|

— |

|

— |

|

— |

|

(80,640) |

|

(561) |

|

(81,201) |

|

Change in fair value of financial assets net of tax |

|

— |

|

— |

|

— |

|

— |

|

192 |

|

— |

|

— |

|

— |

|

— |

|

— |

|

192 |

|

— |

|

192 |

|

Total comprehensive income for the year |

|

— |

|

— |

|

— |

|

— |

|

(253,507) |

|

— |

|

— |

|

— |

|

— |

|

2,425,405 |

|

2,171,898 |

|

58,691 |

|

2,230,589 |

|

Contributions by and distributions to owners of the Company: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Capital increase |

|

626,738 |

|

— |

|

(367,242) |

|

— |

|

— |

|

(82,616) |

|

— |

|

— |

|

(176,880) |

|

— |

|

— |

|

(11,939) |

|

(11,939) |

|

Cancellation of treasury shares |

|

— |

|

524,791 |

|

— |

|

— |

|

— |

|

— |

|

— |

|

— |

|

(524,791) |

|

— |

|

— |

|

— |

|

— |

|

Share options exercised - Subsidiaries |

|

— |

|

9,690 |

|

— |

|

(24,010) |

|

— |

|

— |

|

— |

|

— |

|

— |

|

— |

|

(14,320) |

|

— |

|

(14,320) |

|

Share options exercised in cash - Subsidiaries |

|

— |

|

— |

|

— |

|

(45,777) |

|

— |

|

— |

|

— |

|

— |

|

— |

|

— |

|

(45,777) |

|

— |

|

(45,777) |

|

Prescribed Dividends |

|

— |

|

— |

|

— |

|

— |

|

— |

|

— |

|

— |

|

— |

|

20,751 |

|

— |

|

20,751 |

|

— |

|

20,751 |

|

Proposed dividends |

|

— |

|

— |

|

— |

|

— |

|

— |

|

— |

|

— |

|

— |

|

— |

|

(576,034) |

|

(576,034) |

|

(16,969) |

|

(593,003) |

|

Constitution of legal reserve |

|

— |

|

— |

|

— |

|

— |

|

— |

|

121,270 |

|

— |

|

— |

|

— |

|

(121,270) |

|

— |

|

— |

|

— |

|

Constitution of statutory reserve |

|

— |

|

— |

|

— |

|

— |

|

— |

|

— |

|

1,728,101 |

|

— |

|

— |

|

(1,728,101) |

|

— |

|

— |

|

— |

|

Treasury shares acquired (note 16) |

|

— |

|

(19,353) |

|

— |

|

— |

|

— |

|

— |

|

— |

|

— |

|

— |

|

— |

|

(19,353) |

|

— |

|

(19,353) |

|

Share-based payment transactions |

|

— |

|

— |

|

— |

|

33,888 |

|

— |

|

— |

|

— |

|

— |

|

— |

|

— |

|

33,888 |

|

— |

|

33,888 |

|

Total contributions by and distributions to owners of the Company |

|

626,738 |

|

515,128 |

|

(367,242) |

|

(35,899) |

|

— |

|

38,654 |

|

1,728,101 |

|

— |

|

(680,920) |

|

(2,425,405) |

|

(600,845) |

|

(28,908) |

|

(629,753) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Transactions with owners of the Company |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Change of shareholding interest in subsidiary - Comgás |

|

— |

|

— |

|

— |

|

(1,093,117) |

|

— |

|

— |

|

— |

|

— |

|

— |

|

— |

|

(1,093,117) |

|

(972,988) |

|

(2,066,105) |

|

Change of shareholding interest in subsidiary - Moove |

|

— |

|

— |

|

— |

|

141,568 |

|

— |

|

— |

|

— |

|

— |

|

— |

|

— |

|

141,568 |

|

451,267 |

|

592,835 |

|

Change of shareholding interest in subsidiary - Payly |

|

— |

|

— |

|

— |

|

5,515 |

|

— |

|

— |

|

— |

|

— |

|

— |

|

— |

|

5,515 |

|

5,002 |

|

10,517 |

|

Total transactions with shareholders |

|

— |

|

— |

|

— |

|

(946,034) |

|

— |

|

— |

|

— |

|

— |

|

— |

|

— |

|

(946,034) |

|

(516,719) |

|

(1,462,753) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

At December 31, 2019 |

|

5,045,214 |

|

(112,785) |

|

737 |

|

(958,738) |

|

(349,501) |

|

121,270 |

|

6,288,472 |

|

171,021 |

|

348,044 |

|

— |

|

10,553,734 |

|

507,482 |

|

11,061,216 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

The accompanying notes are an integral part of these financial statements.

Statement of changes in equity

(In thousands of Brazilian Reais - R$)

|

|

|

|

|

|

|

Capital reserve |

|

|

|

Profit reserve |

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||||

|

|

|

Share capital |

|

Treasury share |

|

Corporate transactions - Law 6404 |

|

Capital transactions |

|

Accumulated other comprehensive loss |

|

Legal |

|

Statutory reserve |

|

Profits to be realized |

|

Retained earnings |

|

Accumulated profits |

|

Total |

|

Non-controlling interest |

|

Total equity |

|||||||||||||||||||||||||||

|

At January 1, 2020 |

|

5,045,214 |

|

(112,785) |

|

737 |

|

(958,738) |

|

(349,501) |

|

121,270 |

|

6,288,472 |

|

171,021 |

|

348,044 |

|

— |

|

10,553,734 |

|

507,482 |

|

11,061,216 |

|||||||||||||||||||||||||||

|

Net income for the year |

|

— |

|

— |

|

— |

|

— |

|

— |

|

— |

|

— |

|

— |

|

— |

|

851,858 |

|

851,858 |

|

56,956 |

|

908,814 |

|||||||||||||||||||||||||||

|

Other comprehensive income: (note 16) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||

|

Loss on cash flow hedge |

|

— |

|

— |

|

— |

|

— |

|

(526,856) |

|

— |

|

— |

|

— |

|

— |

|

— |

|

(526,856) |

|

228 |

|

(526,628) |

|||||||||||||||||||||||||||

|

Foreign currency translation effects |

|

— |

|

— |

|

— |

|

— |

|

624,257 |

|

— |

|

— |

|

— |

|

— |

|

— |

|

624,257 |

|

108,458 |

|

732,715 |

|||||||||||||||||||||||||||

|

Actuarial loss on defined benefit plan |

|

— |

|

— |

|

— |

|

— |

|

(787) |

|

— |

|

— |

|

— |

|

— |

|

— |

|

(787) |

|

(36,597) |

|

(37,384) |

|||||||||||||||||||||||||||

|

Change in fair value of financial assets net of tax |

|

— |

|

— |

|

— |

|

— |

|

277 |

|

— |

|

— |

|

— |

|

— |

|

— |

|

277 |

|

— |

|

277 |

|||||||||||||||||||||||||||

|

Total comprehensive income for the year |

|

— |

|

— |

|

— |

|

— |

|

96,891 |

|

— |

|

— |

|

— |

|

— |

|

851,858 |

|

948,749 |

|

129,045 |

|

1,077,794 |

|||||||||||||||||||||||||||

|

Contributions by and distributions to owners of the Company: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||

|

Capital increase (note 16) |

|

682,264 |

|

— |

|

— |

|

— |

|

— |

|

(121,270) |

|

(560,994) |

|

— |

|

— |

|

— |

|

— |

|

6,666 |

|

6,666 |

|||||||||||||||||||||||||||

|

Dividends - non-controlling interests |

|

— |

|

— |

|

— |

|

(533) |

|

— |

|

— |

|

— |

|

— |

|

— |

|

— |

|

(533) |

|

533 |

|

— |

|||||||||||||||||||||||||||

|

Share options exercised |

|

— |

|

13,886 |

|

— |

|

(13,886) |

|

— |

|

— |

|

— |

|

— |

|

— |

|

— |

|

— |

|

— |

|

— |

|||||||||||||||||||||||||||

|

Share options exercised - cash |

|

— |

|

— |

|

— |

|

(22,758) |

|

— |

|

— |

|

— |

|

— |

|

— |

|

— |

|

(22,758) |

|

(46) |

|

(22,804) |

|||||||||||||||||||||||||||

|

Proposed and paid dividends |

|

— |

|

— |

|

— |

|

— |

|

— |

|

— |

|

— |

|

— |

|

— |

|

(202,316) |

|

(202,316) |

|

(16,054) |

|

(218,370) |

|||||||||||||||||||||||||||

|

Constitution of legal reserve (note 16) |

|

— |

|

— |

|

— |

|

— |

|

— |

|

42,593 |

|

— |

|

— |

|

— |

|

(42,593) |

|

— |

|

— |

|

— |

|||||||||||||||||||||||||||

|

Constitution of statutory reserve (note 16) |

|

— |

|

— |

|

— |

|

— |

|

— |

|

— |

|

606,949 |

|

— |

|

— |

|

(606,949) |

|

— |

|

— |

|

— |

|||||||||||||||||||||||||||

|

Treasury shares acquired (note 16) |

|

— |

|

(485,042) |

|

— |

|

— |

|

— |

|

— |

|

— |

|

— |

|

— |

|

— |

|

(485,042) |

|

— |

|

(485,042) |

|||||||||||||||||||||||||||

|

Share-based payment transactions |

|

— |

|

— |

|

— |

|

11,262 |

|

— |

|

— |

|

— |

|

— |

|

— |

|

— |

|

11,262 |

|

92 |

|

11,354 |

|||||||||||||||||||||||||||

|

Total contributions by and distributions to owners of the Company |

|

682,264 |

|

(471,156) |

|

— |

|

(25,915) |

|

— |

|

(78,677) |

|

45,955 |

|

— |

|

— |

|

(851,858) |

|

(699,387) |

|

(8,809) |

|

(708,196) |

|||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||

|

Transactions with owners of the Company |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||

|

Change of shareholding interest in subsidiary (note 8.1 and 8.3) |

|

— |

|

— |

|

— |

|

44,569 |

|

— |

|

— |

|

— |

|

— |

|

— |

|

— |

|

44,569 |

|

30,431 |

|

75,000 |

|||||||||||||||||||||||||||

|

Total transactions with shareholders |

|

— |

|

— |

|

— |

|

44,569 |

|

— |

|

— |

|

— |

|

— |

|

— |

|

— |

|

44,569 |

|

30,431 |

|

75,000 |

|||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||

|

At December 31, 2020 |

|

5,727,478 |

|

(583,941) |

|

737 |

|

(940,084) |

|

(252,610) |

|

42,593 |

|

6,334,427 |

|

171,021 |

|

348,044 |

|

— |

|

10,847,665 |

|

658,149 |

|

11,505,814 |

|||||||||||||||||||||||||||

The accompanying notes are an integral part of these financial statements.

(In thousands of Brazilian Reais - R$)

|

|

|

|

Parent Company |

|

Consolidated |

||||

|

|

Note |

|

December 31, 2020 |

|

December 31, 2019 |

|

December 31, 2020 |

|

December 31, 2019 |

|

Cash flows from operating activities |

|

|

|

|

|

|

|

|

|

|

Profit before taxes |

|

|

674,465 |

|

2,548,401 |

|

1,166,665 |

|

3,201,076 |

|

|

|

|

|

|

|

|

|

|

|

|

Adjustments for: |

|

|

|

|

|

|

|

|

|

|

Depreciation and amortization |

|

|

11,411 |

|

12,107 |

|

623,084 |

|

570,301 |

|

Interest in earnings of associates |

8.1 |

|

(1,347,408) |

|

(2,327,698) |

|

(15,714) |

|

20,644 |

|

Interest in earnings of joint ventures |

9 |

|

80,900 |

|

119,503 |

|

(583,001) |

|

(1,131,406) |

|

Loss (gain) on disposals assets |

|

|

96 |

|

(3,821) |

|

11,961 |

|

40,499 |

|

Share-based payment |

|

|

5,303 |

|

41,549 |

|

13,543 |

|

44,152 |

|

Legal proceedings provision (reversal) |

|

|

(62,756) |

|

29,461 |

|

(59,309) |

|

29,747 |

|

Indexation charges, interest and exchange, net |

|

|

417,396 |

|

(93,473) |

|

1,330,283 |

|

508,391 |

|

Sectorial financial assets and liabilities |

12 |

|

— |

|

— |

|

337,620 |

|

— |

|

Provisions for employee benefits |

|

|

23,876 |

|

19,182 |

|

113,470 |

|

107,694 |

|

Allowance for doubtful accounts |

|

|

— |

|

— |

|

31,196 |

|

17,466 |

|

Contractual obligations for sales of credit rights |

20 |

|

68,311 |

|

(410,000) |

|

68,311 |

|

(410,000) |

|

Indemnity |

20 |

|

— |

|

(50,284) |

|

— |

|

(50,284) |

|

Recovering tax credits |

20 |

|

(29,823) |

|

(101,179) |

|

(29,823) |

|

(124,952) |

|

Other |

|

|

8,307 |

|

18,615 |

|

200,156 |

|

22,937 |

|

|

|

|

(149,922) |

|

(197,637) |

|

3,208,442 |

|

2,846,265 |

|

Changes in: |

|

|

|

|

|

|

|

|

|

|

Trade receivables |

|

|

— |

|

— |

|

54,108 |

|

(280,112) |

|

Inventories |

|

|

— |

|

— |

|

(113,066) |

|

(104,065) |

|

Other current tax, net |

|

|

(26,554) |

|

(11,080) |

|

80,870 |

|

172,630 |

|

Income tax |

|

|

(75,830) |

|

31,767 |

|

(793,117) |

|

(266,862) |

|

Related parties, net |

|

|

(194,822) |

|

(30,284) |

|

(89,750) |

|

32,503 |

|

Trade payables |

|

|

(3,128) |

|

(29) |

|

50,860 |

|

371,227 |

|

Employee benefits |

|

|

(18,076) |

|

(14,460) |

|

(77,225) |

|

(88,294) |

|

Provision for legal proceedings |

|

|

(16,607) |

|

(23,004) |

|

(55,461) |

|

(41,871) |

|

Other financial liabilities |

|

|

— |

|

— |

|

(30,840) |

|

(24,283) |

|

Judicial deposits |

|

|

(279) |

|

(8,381) |

|

24,624 |

|

(8,081) |

|

Discontinued operation |

|

|

— |

|

(7,253) |

|

— |

|

(17,615) |

|

Contractual obligations for sales of credit rights |

|

|

(31,857) |

|

410,000 |

|

(31,857) |

|

410,000 |

|

Post-employment benefits |

|

|

— |

|

— |

|

(37,444) |

|

(39,387) |

|

Other assets and liabilities, net |

|

|

27,669 |

|

(27,000) |

|

(47,329) |

|

(154,056) |

|

|

|

|

(339,484) |

|

320,276 |

|

(1,065,627) |

|

(38,266) |

|

|

|

|

|

|

|

|

|

|

|

|

Net cash (used in) generated by operating activities |

|

|

(489,406) |

|

122,639 |

|

2,142,815 |

|

2,807,999 |

|

|

|

|

|

|

|

|

|

|

|

|

Cash flows from investing activities |

|

|

|

|

|

|

|

|

|

|

Capital contribution in associates |

8.1 |

|

(11,142) |

|

(49,638) |

|

(1,142) |

|

(30,188) |

|

Capital reduction of associates |

|

|

— |

|

1,487,105 |

|

— |

|

— |

|

Acquisition of subsidiary, net of cash acquired in consolidated |

8.2 |

|

— |

|

— |

|

(94,631) |

|

(9,837) |

|

Sale (purchase) of marketable securities |

|

|

142,392 |

|

(766,082) |

|

(862,098) |

|

61,182 |

|

Restricted cash |

|

|

— |

|

— |

|

— |

|

17 |

|

Dividends received from associates |

|

|

821,108 |

|

2,749,742 |

|

9,265 |

|

10,651 |

|

Dividends received from joint ventures |

|

|

1,417 |

|

74,078 |

|

1,852 |

|

1,462,625 |

|

Other financial assets |

|

|

(290,000) |

|

— |

|

(289,989) |

|

442 |

|

Acquisition of property, plant and equipment, intangible assets and contract assets |

|

|

(10,630) |

|

(4,797) |

|

(1,052,502) |

|

(819,748) |

|

Other |

|

|

— |

|

— |

|

(194) |

|

— |

|

Net cash from sale of discontinued operations |

|

|

— |

|

— |

|

— |

|

432 |

|

Acquisition of associates shares |

|

|

— |

|

— |

|

(51,299) |

|

— |

|

Cash received on sale of fixed assets, and intangible assets |

|

|

— |

|

10,550 |

|

— |

|

10,578 |

|

|

|

|

|

|

|

|

|

|

|

|

Net cash generated by (used in) investing activities |

|

|

653,145 |

|

3,500,958 |

|

(2,340,738) |

|

686,154 |

|

Cash flows from financing activities |

|

|

|

|

|

|

|

|

|

|

Loans, borrowings and debentures raised |

5.6 |

|

— |

|

1,692,647 |

|

2,443,732 |

|

4,137,789 |

|

Repayment of principal on loans, borrowings and debentures |

5.6 |

|

(1,700,000) |

|

— |

|

(2,739,416) |

|

(1,211,991) |

Statement of cash flows

(In thousands of Brazilian Reais - R$)

|

Payment of interest on loans, borrowings and debentures |

5.6 |

|

(35,203) |

|

(54,787) |

|

(796,040) |

|

(630,793) |

|

Payment of derivative financial instruments |

|

|

(54,651) |

|

(93,659) |

|

(56,811) |

|

(80,905) |

|

Receipt of derivative financial instruments |

|

|

572,374 |

|

131,424 |

|

765,759 |

|

249,498 |

|

Payment of principal on leases |

|

|

(1,466) |

|

(1,544) |

|

(23,699) |

|

(6,295) |

|

Payment of interest on leases |

|

|

(1,523) |

|

(1,416) |

|

(5,023) |

|

(2,916) |

|

Equity contribution from non-controlling interest |

8.3 |

|

— |

|

— |

|

6,666 |

|

— |

|

Equity contribution from shareholders interest |

8.3 |

|

— |

|

— |

|

75,000 |

|

453,082 |

|

Related parties |

8.2 |

|

(205,828) |

|

(232,495) |

|

— |

|

— |

|

Payments to redeem entity's shares |

|

|

(485,042) |

|

— |

|

(485,042) |

|

— |

|

Non-controlling interest subscription |

|

|

— |

|

1,192 |

|

— |

|

1,192 |

|

Acquisition of non-controlling interests |

|

|

— |

|

(2,067,296) |

|

— |

|

(2,067,296) |

|

Dividends paid |

|

|

(574,140) |

|

(389,256) |

|

(590,769) |

|

(409,339) |

|

Dividends paid - Preferential shares |

|

|

— |

|

— |

|

(174,227) |

|

(535,832) |

|

Receipts of consideration assets |

8.1 |

|

— |

|

— |

|

65,478 |

|

— |

|

Discontinued operation |

|

|

— |

|

— |

|

— |

|

1,542 |

|

Share options exercised |

|

|

(20,281) |

|

(45,777) |

|

(22,804) |

|

(45,961) |

|

|

|

|

|

|

|

|

|

|

|

|

Net cash used in financing activities |

|

|

(2,505,760) |

|

(1,060,967) |

|

(1,537,196) |

|

(148,225) |

|

|

|

|

|

|

|

|

|

|

|

|

(Decrease) increase in cash and cash equivalents |

|

|

(2,342,021) |

|

2,562,630 |

|

(1,735,119) |

|

3,345,928 |

|

|

|

|

|

|

|

|

|

|

|

|

Cash and cash equivalents at beginning of the year |

|

|

3,490,707 |

|

928,077 |

|

6,076,644 |

|

2,696,947 |

|

Effect of exchange rate fluctuations on cash held |

|

|

581 |

|

— |

|

272,528 |

|

33,769 |

|

Cash and cash equivalents at end of the year |

|

|

1,149,267 |

|

3,490,707 |

|

4,614,053 |

|

6,076,644 |

|

|

|

|

|

|

|

|

|

|

|

|

Additional information |

|

|

|

|

|

|

|

|

|

|

Income tax paid |

|

|

4,597 |

|

7,864 |

|

580,367 |

|

245,738 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

The accompanying notes are an integral part of these financial statements.

Non-cash transaction

- Recognition of interest on equity on Raízen Combustíveis S.A. investment in the amount of R$ 62,380

- Acquisition of assets for construction of the distribution network with payment in installments in the amount of R$ 7,804 (R$123,011 in December 31, 2019).

- Capital contribution in the subsidiary Payly Soluções de Payments S.A. (“Payly”) in the amount of R$10,000, through the capitalization of reimbursable expenses.

- Contribution of Comgás assets and liabilities, as detailed in note 8.2.

Disclosure of interest and dividends

The Company discloses the dividends and interest on shareholders' equity received as cash flow from investing activities, with the purpose of avoiding distortions in its cash flows from operation activities.

Interest received or paid is classified as cash flow in financing activities, as it is considered to be part of the costs of obtaining financial resources.

(In thousands of Brazilian Reais - R$, except earnings per share)

|

|

|

Parent Company |

Consolidated |

|||||

|

|

|

December 31, 2020 |

|

December 31, 2019 |

|

December 31, 2020 |

|

December 31, 2019 |

|

Revenues |

|

|

|

|

|

|

|

|

|

Sales and services rendered net of returns |

|

— |

|

— |

|

17,503,638 |

|

16,790,944 |

|

Other revenues |

|

(68,545) |

|

370,978 |

|

(24,006) |

|

16,256 |

|

Allowance for expected credit losses |

|

— |

|

— |

|

(31,196) |

|

(17,466) |

|

|

|

(68,545) |

|