ANNUAL INFORMATION FORM

of

B2GOLD CORP.

March 23, 2018

TABLE OF CONTENTS

- 2 -

B2GOLD CORP.

ANNUAL INFORMATION FORM

INTRODUCTORY NOTES

Date of Information

In this Annual Information Form (“Annual Information Form”), B2Gold Corp., together with its subsidiaries, as the context requires, is referred to as “we”, “our”, “us”, the “Company” or “B2Gold”. All information contained in this Annual Information Form is as at December 31, 2017, unless otherwise stated, being the date of our most recently completed financial year, and the use of the present tense and of the words “is”, “are”, “current”, “currently”, “presently”, “now” and similar expressions in this Annual Information Form is to be construed as referring to information given as of that date.

Readers are also encouraged to review the Company’s annual financial statements and the management’s discussion & analysis of the Company for the year ended December 31, 2017.

Cautionary Note Regarding Forward-Looking Information

This Annual Information Form includes certain “forward-looking information” within the meaning of applicable Canadian securities legislation and “forward-looking statements” within the meaning of applicable U.S. securities legislation (collectively “forward-looking statements”), including, but not limited to, projections of future financial and operational performance; statements with respect to future events or future performance; production estimates; anticipated operating and production costs and revenue; estimates of capital expenditures; future demand for and prices of commodities and currencies; estimated mine life of our mines; estimated closure and reclamation costs and statements regarding anticipated exploration, development, construction, production, permitting and other activities on the Company’s properties, including: expected grades and sources of ore to be processed in 2018 and expected gold production in 2018 on a consolidated basis and by each property; the projections included in existing technical reports, economic assessments and feasibility studies; anticipated or potential new technical reports and studies, including the potential findings and conclusions thereof; planned exploration and exploration budgets and the results thereof; budgeted costs for 2018 and estimated operating and capital costs for the life of mine of each of the material properties; the expected ratification by the Mali National Assembly of the Fekola Shareholders Agreement and the Share Purchase Agreement in connection with the final ownership of Fekola S.A.; planned relocation efforts of the village of Fadougou and timing of completion thereof; negotiations with the Malian government as to the terms of an escrow account in regards to reclamation and closure of the Fekola Mine; additional drilling extending the Fekola deposit to the north and indicating the potential for large, Fekola-style mineralized zones; completion of follow-up surface trenching and drilling in 2018 at the Masbate Gold Project; the expectation that mining activities at Masbate Gold Project will end in 2023 while stockpile processing will last until 2031; the projected economic life of the Masbate Gold Project mine fleet being sufficient to achieve completion of mining activities in 2023; the potential rescission of Memorandum #1 in respect of a moratorium placed on new mining projects in the Philippines, the continued issuance of permits at existing operations notwithstanding executive order #79 and new DENR policy direction allowing the issuance of the permits necessary to conduct planned satellite pit operations; the potential consolidation of Filminera and VMC’s MPSAs and exploration permits in connection with expansion areas of the Masbate Gold Project; the timing of MICC’s review of the audit by the DENR in relation to the Masbate Gold Project and the final outcome thereof; in respect of the Ondundu Joint Venture, the focus of exploration on identifying new drill targets outside the main zone and on the Razorback zone; exploration directed towards near-mine brownfields targets and prospective regional targets; ore production from the Wolfshag Pit in 2019 and the expected higher grade open-pit mill feed in the future; successful negotiations for a collective agreement at the Otjikoto Mine; timing of completion of a study to evaluate the potential to expand the El Limon throughput; the new drill information and metallurgical data supporting a resource estimate that will help inform studies as to optimum grind size, capital costs and project economics to re-process historic tailings; planned production being sourced from underground operations at Santa Pancha and the Mercedes Pit; commencement of production from the Jabali Antenna Pit at La Libertad Mine in the third quarter of 2018; successful completion of settlement activities and receipt of the remaining mining permits; planned mining and processing into 2020 at La Libertad Mine; the timing of mine construction at the Kiaka Project; the planned drilling in Burkina Faso to further test the down-plunge potential of the mineralized zone and other new zones of mineralization identified in close proximity to the main Toega zone; discussions with AngloGold regarding AngloGold’s planned feasibility study for the Gramalote Project and the potential involvement by the Company thereof; the potential imposition of additional taxes or increase of current tax rates; the potential enactment of new legislation in respect of our foreign operations and their potential impact on the Company; the likelihood of certain terms and conditions being attached to new and renewed mineral licences in Namibia; the adequacy of capital for continued operations, including access to funding under the debt and equity funding facilities described herein and having sufficient liquidity to repay the Notes in full; estimates regarding the outcome of tax audits; the potential to develop and produce from currently non-producing properties and the delivery of ounces under the Prepaid Sales transactions. Estimates of mineral resources and reserves are also forward-looking statements because they constitute projections, based on certain estimates and assumptions, regarding the amount of minerals that may be encountered in the future and/or the anticipated economics of production, should mining occur. All statements in this Annual Information Form that address events or developments that we expect to occur in the future are forward-looking statements. Forward-looking statements are statements that are not historical facts and are generally, although not always, identified by words such as “expect”, “plan”, “anticipate”, “project”, “target”, “potential”, “schedule”, “forecast”, “budget”, “estimate”, “intend” or “believe” and similar expressions or their negative connotations, or that events or conditions “will”, “would”, “may”, “could”, “should” or “might” occur. All such forward-looking statements are based on the opinions and estimates of management as of the date such statements are made.

- 2 -

Forward-looking statements are necessarily based on estimates and assumptions that are inherently subject to known and unknown risks, uncertainties and other factors, many of which are beyond our ability to control, that may cause our actual results, level of activity, performance or achievements to be materially different from those expressed or implied by such forward-looking information. Such factors include, without limitation, assumptions and factors related to the Company's ability to carry on current and future operations, including development and exploration activities; the timing, extent, duration and economic viability of such operations, including any mineral resources or reserves identified thereby; the accuracy and reliability of estimates, projections, forecasts, studies and assessments; the Company’s ability to meet or achieve estimates, projections and forecasts; the availability and cost of inputs; the price and market for outputs, including gold; the timely receipt of necessary approvals or permits; the ability to meet current and future obligations; the ability to obtain timely financing on reasonable terms when required; the current and future social, economic and political conditions; other assumptions and factors generally associated with the mining industry; and the risks, uncertainties and other factors referred to in this Annual Information Form under the heading “Risk Factors” and elsewhere herein.

Forward-looking statements are not a guarantee of future performance, and actual results and future events could materially differ from those anticipated in such statements. All of the forward-looking statements contained in this Annual Information Form are qualified by these cautionary statements.

Although we have attempted to identify important factors that could cause actual results to differ materially from those contained in the forward-looking statements, there may be other factors that cause actual results to differ materially from those which are anticipated, estimated, or intended. There can be no assurance that such information will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. You should not place undue reliance on forward-looking statements. Our forward-looking statements reflect current expectations regarding future events and operating performance and speak only as of the date hereof, and we expressly disclaim any intention or obligation to update or revise any forward-looking statements, whether as a result of new information, events or otherwise, except as may be required by applicable securities laws.

Currency and Exchange Rate Information

Our financial statements are reported in U.S. dollars. A reference in this Annual Information Form to:

| • | “C$” is to the lawful currency of Canada; | |

| • | “N$” is to the lawful currency of Namibia; | |

| • | “Rand” is the lawful currency of South Africa; | |

| • | “Córdobas” is to the lawful currency of Nicaragua; | |

| • | “PHP” is to the lawful currency of the Philippines; | |

| • | “CFA franc” is to the lawful currency of Mali and Burkina Faso; |

- 3 -

| • | “Euro” is to the lawful currency of the European Union; and | |

| • | “$” or “US$” is to the lawful currency of the United States. |

The following table sets forth, for each period indicated, the high and low exchange rates for Canadian dollars expressed in U.S. dollars, the average of such exchange rates during such period, and the exchange rate at the end of such period. These rates are based on the Bank of Canada rate of exchange.

| Fiscal Year Ended December 31, | ||||||||||

| 2015 | 2016 | 2017 | ||||||||

| Rate at the end of period | US$0.7225 | US$0.7448 | US$0.7971 | |||||||

| Average rate during period | US$0.7820 | US$0.7548 | US$0.7708 | |||||||

| Highest rate during period | US$0.8527 | US$0.7972 | US$0.8245 | |||||||

| Lowest rate during period | US$0.7148 | US$0.6854 | US$0.7276 | |||||||

On March 22, 2018, the daily average rate of exchange for one Canadian dollar in United States dollars as reported by the Bank of Canada was C$1.00 = US$0.7747.

Production Results, Technical Information and Cautionary Note for United States Readers

Actual and projected production results presented in this Annual Information Form reflect total production at the mines the Company operates on a 100% basis. As described in this Annual Information Form, we hold less than a 100% interest in certain of our mines.

The disclosure included in this Annual Information Form uses Mineral Reserve and Mineral Resource classification terms that comply with reporting standards in Canada and the Mineral Reserve and Mineral Resource estimates are made in accordance with the Canadian Institute of Mining, Metallurgy and Petroleum (“CIM”) Council – Definitions adopted by CIM Council on May 10, 2014 (the “CIM Standards”), which were adopted by the Canadian Securities Administrators’ (“CSA”) National Instrument 43-101 Standards of Disclosure for Mineral Projects (“NI 43-101”). NI 43-101 is a rule developed by the CSA that establishes standards for all public disclosure an issuer makes of scientific and technical information concerning mineral projects. The following definitions are reproduced from the CIM Standards:

A Modifying Factor or Modifying Factors are considerations used to convert Mineral Resources to Mineral Reserves. These include, but are not restricted to, mining, processing, metallurgical, infrastructure, economic, marketing, legal, environmental, social and governmental factors.

A Mineral Resource is a concentration or occurrence of solid material of economic interest in or on the Earth’s crust in such form, grade or quality and quantity that there are reasonable prospects for eventual economic extraction. The location, quantity, grade or quality, continuity and other geological characteristics of a Mineral Resource are known, estimated or interpreted from specific geological evidence and knowledge, including sampling. Mineral Resources are sub-divided, in order of increasing geological confidence, into Inferred, Indicated and Measured categories.

An Inferred Mineral Resource is that part of a Mineral Resource for which quantity and grade or quality are estimated on the basis of limited geological evidence and sampling. Geological evidence is sufficient to imply but not verify geological and grade or quality continuity. An Inferred Mineral Resource has a lower level of confidence than that applying to an Indicated Mineral Resource and must not be converted to a Mineral Reserve. It is reasonably expected that the majority of Inferred Mineral Resources could be upgraded to Indicated Mineral Resources with continued exploration.

An Indicated Mineral Resource is that part of a Mineral Resource for which quantity, grade or quality, densities, shape and physical characteristics are estimated with sufficient confidence to allow the application of Modifying Factors in sufficient detail to support mine planning and evaluation of the economic viability of the deposit. Geological evidence is derived from adequately detailed and reliable exploration, sampling and testing and is sufficient to assume geological and grade or quality continuity between points of observation. An Indicated Mineral Resource has a lower level of confidence than that applying to a Measured Mineral Resource and may only be converted to a Probable Mineral Reserve.

- 4 -

A Measured Mineral Resource is that part of a Mineral Resource for which quantity, grade or quality, densities, shape, and physical characteristics are estimated with confidence sufficient to allow the application of Modifying Factors to support detailed mine planning and final evaluation of the economic viability of the deposit. Geological evidence is derived from detailed and reliable exploration, sampling and testing and is sufficient to confirm geological and grade or quality continuity between points of observation. A Measured Mineral Resource has a higher level of confidence than that applying to either an Indicated Mineral Resource or an Inferred Mineral Resource. It may be converted to a Proven Mineral Reserve or to a Probable Mineral Reserve.

A Mineral Reserve is the economically mineable part of a Measured and/or Indicated Mineral Resource. It includes diluting materials and allowances for losses, which may occur when the material is mined or extracted and is defined by studies at pre-feasibility or feasibility level as appropriate that include application of Modifying Factors. Such studies demonstrate that, at the time of reporting, extraction could reasonably be justified. The reference point at which Mineral Reserves are defined, usually the point where the ore is delivered to the processing plant, must be stated. It is important that, in all situations where the reference point is different, such as for a saleable product, a clarifying statement is included to ensure that the reader is fully informed as to what is being reported. The public disclosure of a Mineral Reserve must be demonstrated by a pre-feasibility study or feasibility study.

A Probable Mineral Reserve is the economically mineable part of an Indicated, and in some circumstances, a Measured Mineral Resource. The confidence in the Modifying Factors applying to a Probable Mineral Reserve is lower than that applying to a Proven Mineral Reserve.

A Proven Mineral Reserve is the economically mineable part of a Measured Mineral Resource. A Proven Mineral Reserve implies a high degree of confidence in the Modifying Factors.

Unless otherwise indicated, all of our Mineral Reserves and Mineral Resources included in this Annual Information Form have been prepared in accordance with NI 43-101. Canadian standards for public disclosure of scientific and technical information concerning mineral projects differ significantly from the requirements of U.S. securities laws. In particular, and without limiting the generality of the foregoing, the terms “Mineral Reserve”, “Proven Mineral Reserve” and “Probable Mineral Reserve” are Canadian mining terms as defined in accordance with NI 43-101 and CIM Standards. These definitions differ from the definitions in the United States Securities and Exchange Commission’s (the “SEC”) Industry Guide 7 (“Guide 7”) under the U.S. Securities Act of 1933, as amended, and therefore may not qualify as reserves under SEC standards. Under Guide 7 standards, a “final” or “bankable” feasibility study is required to report reserves, the three-year historical average price is used in any reserve or cash flow analysis to designate reserves and the primary environmental analysis or report must be filed with the appropriate governmental authority. Under Guide 7 standards, mineralization may not be classified as a “reserve” unless the determination has been made that the mineralization could be economically and legally produced or extracted at the time the reserve determination is made.

In addition, the terms “Mineral Resource”, “Measured Mineral Resource”, “Indicated Mineral Resource” and “Inferred Mineral Resource” are defined in and required to be disclosed by NI 43-101; however, these terms are not defined terms under Guide 7 and are normally not permitted to be used in reports and registration statements filed with the SEC. Accordingly, resource information contained herein may not be comparable to similar information disclosed by U.S. companies. Investors are cautioned not to assume that any part or all of mineral deposits in these categories will ever be converted into reserves or that they can be mined economically or legally. “Inferred Mineral Resources” have a great amount of uncertainty as to their existence, and great uncertainty as to their economic and legal feasibility. Historical results or feasibility models presented herein are not guarantees or expectations of future performance. It cannot be assumed that all, or any part, of an Inferred Mineral Resource will ever be upgraded to a higher category. Investors are cautioned not to assume that all or any part of an Inferred Mineral Resource exists or that it can be economically or legally mined. Further, while NI 43-101 permits companies to disclose economic projections contained in pre-feasibility studies and preliminary economic assessments, which are not based on “reserves”, U.S. companies are not normally permitted to disclose economic projections for a mineral property in their SEC filings prior to the establishment of “reserves”. Disclosure of “contained ounces” in a resource is permitted disclosure under Canadian reporting standards; however, the SEC normally only permits issuers to report mineralization that does not constitute “reserves” by SEC standards as in-place tonnage and grade without reference to unit measures.

- 5 -

Accordingly, information contained in this Annual Information Form contain descriptions of our mineral deposits that may not be comparable to similar information made public by U.S. companies subject to the reporting and disclosure requirements under the United States federal securities laws and the rules and regulations thereunder.

The term “Qualified Person” as used in this Annual Information Form means a Qualified Person as that term is defined in NI 43-101.

Except where otherwise disclosed:

-

Peter D. Montano, P.E., the Project Director of B2Gold, a qualified person under NI 43-101, has approved the scientific and technical information related to operations matters contained in this Annual Information Form.

-

Tom Garagan, Senior Vice President of Exploration of B2Gold, a qualified person under NI 43-101, has approved the scientific and technical information regarding exploration matters contained in this Annual Information Form.

-

John Rajala, Vice President of Metallurgy of B2Gold, a qualified person under NI 43-101, has approved El Limon development information contained in this Annual Information Form.

- 6 -

CORPORATE STRUCTURE

Name, Address and Incorporation

We were incorporated under the Business Corporations Act (British Columbia) (the “BCBCA”) on November 30, 2006. Our head office is located at Suite 3100, Three Bentall Centre, 595 Burrard Street, Vancouver, British Columbia, V7X 1J1 and our registered office is located at 1600-925 West Georgia Street, Vancouver, British Columbia, V6C 3L2.

- 7 -

Intercorporate Relationships

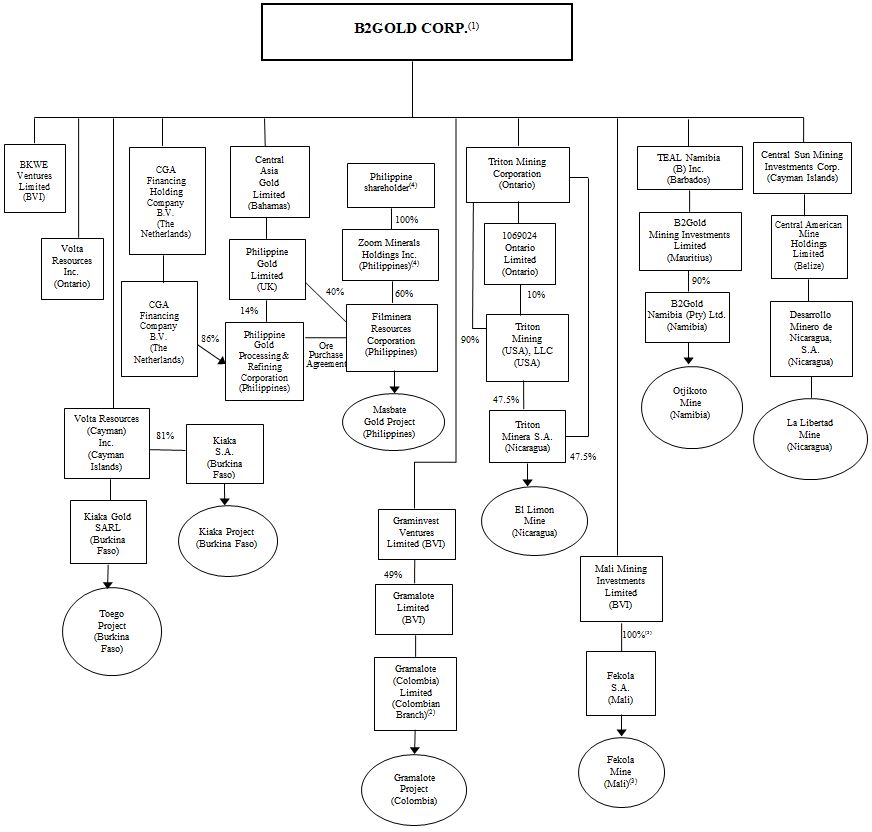

A significant portion of our business is carried on through our subsidiaries. A chart showing the names of our material subsidiaries and certain subsidiaries holding an interest in mineral projects the Company considers significant that are described in this Annual Information Form and their respective jurisdiction of incorporation is set out below:

Notes:

| (1) |

All ownership of subsidiaries is 100% unless indicated. Certain subsidiaries are indirectly owned by us through wholly-owned subsidiaries not reflected above. |

| (2) |

Colombian branches are not separate legal entities. |

| (3) |

As described in “Material Properties – Fekola Mine – Property Description, Location and Access”, it is anticipated that the State of Mali will have a 20% ownership interest in Fekola S.A., the owner of the Fekola Mine. |

| (4) |

Not a subsidiary of B2Gold. |

- 8 -

GENERAL DEVELOPMENT OF THE BUSINESS

We are a Vancouver-based gold producer with five operating mines (one mine in Mali, one mine in Namibia, one mine in the Philippines and two mines in Nicaragua). In addition, we have a portfolio of other evaluation and exploration projects in several countries including Mali, Colombia, Burkina Faso, Finland, Namibia and Nicaragua. Our material mineral properties consist of the following three mines:

|

• |

Fekola mine (anticipated 80% ownership), an open pit gold mine located approximately 40 kilometres (“km”) south of the city of Kéniéba, Mali (“Fekola Mine”). As described in “Material Properties – Fekola Mine” below, it is anticipated that the State of Mali will have a 20% ownership interest; | |

| • | Otjikoto mine (90% ownership), an open pit, and potential underground, gold mine located approximately 300 km north of Windhoek, the capital of Namibia (“Otjikoto Mine”); and | |

|

• |

Masbate gold project (ownership as described in “Material Properties – Masbate Gold Project” below), an open pit gold mine, located near the northern tip of the island of Masbate, 360 km south-east of Manila, the capital of the Philippines (“Masbate Gold Project”). |

Our other significant assets consist of the following mines and two projects:

| • | El Limon mine (95% ownership), an underground gold mine located in northwestern Nicaragua, approximately 100 km northwest of Managua, the capital of Nicaragua (“El Limon Mine”); | |

| • | La Libertad mine (100% ownership), an open pit gold mine located 110 km due east of Managua, and 32 km northeast of Juigalpa, Nicaragua (“La Libertad Mine”); | |

| • | Burkina Faso regional projects consisting of the Kiaka and Toega projects (81% ownership), gold projects located 140 km southeast of Ouagadougou, the capital of Burkina Faso (“Kiaka–Toega Project”); and | |

| • | Gramalote Project (49% ownership), a gold project located 230 km northwest of Bogota, the capital of Colombia (“Gramalote Project”). |

Three Year History

Over the three most recently completed financial years, the significant events described below contributed to the development of our business.

2015 Developments

On February 28, 2015, the Otjikoto Mine achieved commercial production, ahead of schedule.

On May 20, 2015 (as subsequently amended on June 10, 2015, March 11, 2016, May 10, 2016 and July 7, 2017), we entered into a $350 million revolving credit facility with a syndicate of international banks, which replaced the previous $150 million secured credit facility with a syndicate led by Macquarie Bank Limited dated April 12, 2013. The syndicate includes HSBC Bank USA, National Association, which acts as administrative agent and lender, HSBC Securities (USA) Inc., which acts as sole lead arranger and sole bookrunner, and The Bank of Nova Scotia, Société Générale and ING Bank N.V, (together, and with CIBC (defined below), the “Credit Facility Bank Syndicate”). On March 14, 2017, the Company received a binding letter of commitment from the Canadian Imperial Bank of Commerce (“CIBC”) to participate in the revolving credit facility and join the Credit Facility Bank Syndicate.

2016 Developments

On January 11, 2016, we filed a final short form base shelf prospectus (the “Base Shelf Prospectus”) in each of the provinces of Canada and a corresponding amended shelf registration statement in the United States allowing us to offer up to $300,000,000 of debt securities, warrants, subscription receipts, units or common shares of the Company (the “Common Shares”), or any combination thereof, from time to time during a 25-month period, which expired in February 2018.

- 9 -

On March 14, 2016, we received approvals for prepaid sales financing arrangements of up to $120 million from our Credit Facility Bank Syndicate (the “Prepaid Sales”). The Prepaid Sales, in the form of metal sales forward contracts, allow us to deliver pre-determined volumes of gold on agreed future delivery dates in exchange for an upfront cash pre-payment (“Prepaid Amount”). The Prepaid Sales arrangements have a term of 33 months commencing March 2016, and settlement will be in the form of physical deliveries of unallocated gold from any of our mines in 24 equal monthly installments during 2017 and 2018. Initial Prepaid Sales contracts have been entered into for the delivery of 49,475 ounces of gold in 2017 and 53,791 in 2018, for total cash Prepaid Amount proceeds of $120 million.

On June 8, 2016, the Otjikoto equipment loan facility, entered into on December 4, 2013 (and as amended from time to time) between B2Gold Namibia Minerals (Proprietary) Limited, as borrower, Caterpillar Financial SARL, as arranger, Caterpillar Financial Services Corporation, as original lender, and the Company and B2Gold Namibia (Proprietary) Limited, as guarantors (the “Otjikoto Equipment Facility”), was amended to extend the term over which loans may be advanced under the facility to December 31, 2016 and an additional $4.5 million was made available for drawdown. As at December 31, 2017, we had drawn down the full amount currently available under the Otjikoto Equipment Facility.

On August 11, 2016, we entered into an equity distribution agreement (the “ATM Agreement”) with two placement agents for the sale of Common Shares having up to an aggregate gross offering price of $100 million through “at the market” distributions. The offering of Common Shares under the ATM Agreement (the “ATM Offering”) was made pursuant to a prospectus supplement (the “Supplement”) filed in all of the provinces of Canada and incorporated by reference into the Base Shelf Prospectus. During the year ended December 31, 2016, we issued 14.8 million Common Shares at an average price of $3.17 per Common Share for gross proceeds of $47.1 million (net proceeds of $44.2 million after deducting costs associated with the issuance). During the year ended December 31, 2017, no Common Shares were issued under the ATM Agreement. In the second quarter of 2017, we terminated the ATM Agreement.

On September 7, 2016, we entered into a Euro 71.4 million term equipment facility (the “Fekola Equipment Facility”) with Caterpillar Financial SARL, as mandated lead arranger, and Caterpillar Financial Services Corporation, as original lender. The aggregate principal amount of up to Euro 71.4 million is available to our majority-owned subsidiary, Fekola S.A. to finance or refinance the mining fleet and other mining equipment at our Fekola Mine in Mali. The Fekola Equipment Facility is available for a period that commenced on February 13, 2017 (the “Financial Close Date”) and ends on the earlier of the day when the Fekola Equipment Facility is fully drawn and 30 months from the Financial Close Date. The Fekola Equipment Facility may be drawn in installments of not less than Euro 5 million, and each such installment shall be treated as a separate equipment loan. The Company is required to maintain a deposit in a debt service reserve account (“DSRA”) equal at all times to the total of the principal, interest and other payments that become payable over the next six month period. Each equipment loan is repayable in 20 equal quarterly installments. The final repayment date shall be five years from the first disbursement under each equipment loan. The interest rate on each loan is a rate per annum equal to EURIBOR plus a margin of 5.10% . A commitment fee of 1.15% per annum on the undrawn balance of each tranche for the first 24 months after December 7, 2016 and 0.5% thereafter is also due, each payable quarterly. In each case, from October 1, 2017, 0.4167% per annum on the undrawn balance of each tranche is also due. We and our subsidiary, Mali Mining Investments Limited, have guaranteed the Fekola Equipment Facility and security will be given over equipment which has been financed by the Fekola Equipment Facility, related warranty and insurance and over the DSRA. As at December 31, 2017, we had drawn Euro 49.4 million ($54.4 million equivalent) with Euro 22.0 million ($26.4 million equivalent) undrawn.

On September 27, 2016, the Philippine Department of Environment and Natural Resources (“DENR”) announced the preliminary results of mining audits carried out by the DENR in respect of all metallic mines in the Philippines. As reported by us on February 2, 2017, the DENR announced further results of its mining audit and the Masbate Gold Project was not among the mines announced to be suspended or closed. We believe that we continue to be in compliance with Philippine’s laws and regulations. The Philippine Mining Industry Coordinating Council (the “MICC”), the oversight committee for DENR plans to commence its review of mines in the Philippines in March 2018.

- 10 -

In December 2016, pursuant to applicable mining law, we formed a new 100% owned subsidiary company, Fekola S.A., which now holds our interest in the Fekola Mine. Under Mali law, we will contribute a 10% free carried interest in Fekola S.A. to the State of Mali. The State of Mali also has the option to purchase an additional 10% of Fekola S.A. which it has confirmed its intent to exercise. We have signed a mining convention in the form required under the 2012 Mining Code (Mali) (the “2012 Mining Code”) that relates to, among other things, the ownership, permitting, reclamation bond requirements, development, operation and taxation applicable to the Fekola Mine with the State of Mali (the “Fekola Convention”). In August 2017, we finalized certain additional agreements with the State of Mali including a shareholder’s agreement (the “Fekola Shareholders Agreement”), the share purchase agreement pursuant to which the State of Mali exercised the aforementioned additional 10% ownership interest in Fekola S.A. (the “Share Purchase Agreement”) and an amendment to the Fekola Convention to address and clarify certain issues under the 2012 Mining Code. The Fekola Convention, as amended, will govern the procedural and economic parameters pursuant to which we will operate the Fekola Mine. The Fekola Shareholders Agreement and the Share Purchase Agreement for the purchase of the additional 10% of Fekola S.A. have been finalized and signed by the relevant Malian government ministers and the Malian Council of Ministers, subject to ratification by the Mali National Assembly, which is now expected at their next scheduled sitting in April 2018. Upon such ratification, we will transfer ownership of 20% of Fekola S.A. to the State of Mali. The first non-participating10% of the State of Mali's ownership will entitle it to an annual priority dividend equivalent to 10% of calendar net income of Fekola S.A. The second fully participating 10% of the State of Mali's interest will entitle it to ordinary dividends payable on the same basis as any ordinary dividends declared and payable to us for our 80% interest.

2017 Developments

On February 13, 2017, the Financial Close Date was established under the Fekola Equipment Facility and the first drawdown in the amount of Euro 24.7 million was advanced on February 17, 2017.

In the first half of 2017, we entered into further Prepaid Sales transactions with the Credit Facility Banking Syndicate totalling $30 million for delivery of 25,282 ounces of gold for delivery between January 31 and May 20, 2019.

On May 30, 2017, an amendment to the Otjikoto Equipment Facility was entered into to allow B2Gold Namibia Minerals (Proprietary) Limited to re-borrow up to $6.48 million of the amount previously repaid, which was fully drawn as at December 31, 2017.

On June 1, 2017, our affiliate Filminera Resource Corporation and subsidiary Philippine Gold Processing & Refining Corp. entered into aggregate $17.8 million equipment facilities with Caterpillar Financial Services Philippines, Inc. (together, the “Masbate Equipment Facility”). The principal amount is available to finance or refinance the mining fleet and other mining equipment at the Masbate Gold Project in the Philippines. The Masbate Equipment Facility is available for a period that ends on the earlier of the day when the Masbate Equipment Facility is fully drawn and December 31, 2018. The Masbate Equipment Facility may be drawn in installments of not less than $0.5 million, and each such installment shall be treated as a separate equipment loan. Each equipment loan is repayable in 20 equal quarterly installments. The final repayment date shall be five years from the first disbursement under each equipment loan. The interest rate on each loan is a rate per annum equal to LIBOR plus a margin of 3.85% . A commitment fee of 1.15% per annum on the undrawn balance of each tranche is also due, each payable quarterly. We have guaranteed the Masbate Equipment Facility and security is given over the equipment of the borrower which has been financed by the Masbate Equipment Facility. As at December 31, 2017, $8.7 million had been drawn.

- 11 -

On July 7, 2017, we entered into an amended and restated revolving credit facility (the “Credit Facility”) with the Credit Facility Bank Syndicate to upsize our revolving credit facility to an aggregate amount of $500 million, representing a $75 million increase from the principal amount of $425 million under our previously amended revolving credit facility. The Credit Facility also allows for an accordion feature whereby upon receipt of additional binding commitments, the Credit Facility may be increased to $600 million any time prior to the maturity date. The Credit Facility bears interest on a sliding scale of between LIBOR plus 2.25% to 3.25% based on our consolidated net leverage ratio. Commitment fees for the undrawn portion of the Credit Facility will also be on a similar sliding scale basis of between 0.5% and 0.925% . The term of the Credit Facility is four years, maturing on July 7, 2021. From December 29, 2017 onwards, for such time as the indebtedness outstanding under our existing convertible Notes (defined below) is greater than $100 million, the sliding scale interest will temporarily increase to a sliding scale range of between LIBOR plus 2.5% to 4%. The increase in the sliding scale rate will cease upon the reduction of outstanding indebtedness under the Notes to $100 million or less. In addition, a fee equal to 0.25% of the total Credit Facility shall be payable on December 29, 2017 and every 90 days thereafter until the outstanding indebtedness under the Notes is $100 million or less.

On September 25, 2017, we announced that we completed the construction of the Fekola mill and commenced ore processing at the Fekola Mine, more than three months ahead of schedule and on budget. We also completed a new life-of-mine (“LoM”) plan for the Fekola deposit that projects higher mill throughput and annual gold production, and lower projected operating costs per ounce and all-in sustaining costs per ounce of gold than the original (4 million tonnes per annum) plan in the optimized Fekola feasibility study. The new LoM plan was completed based on the expanded 5 million tonnes per annum mill throughput and takes into account an early start-up, increased processing throughput and improved open-pit design and scheduling.

On October 7, 2017, the first gold pour at the Fekola Mine occurred, approximately three months ahead of schedule.

On October 23, 2017, Ms. Robin Weisman was appointed to the board of directors of the Company (the “Board”).

On November 30, 2017, the Fekola mine achieved commercial production, one month ahead of the revised schedule and four months ahead of the schedule announced in the optimized Fekola feasibility study.

In 2017, the MICC voted to rescind the existing Department Administrative Order which bans new open-pit mines in the Philippines (which does not apply to current Masbate operations). They have indicated that the order may be lifted provided that mining laws, rules and regulations are strictly enforced.

In 2017, a detailed capital cost estimate of $25.5 million was completed by Lycopodium, working with the Company's engineering team, for the expansion of the Masbate processing plant to 8 million tonnes per year and the expansion has been approved by the Company.

DESCRIPTION OF THE BUSINESS

General

We are a Vancouver-based gold producer with a strategic focus on acquiring and developing interests in mineral properties with demonstrated potential for hosting economic mineral deposits, with gold deposits as the primary focus. We conduct gold mining operations and exploration and drilling campaigns to define and develop Mineral Resources and Mineral Reserves on our properties with an intention of developing, constructing and operating mines on such properties.

Our corporate objective is to continue growing as a profitable and responsible gold producer through ongoing exploration of our existing projects and accretive acquisitions, irrespective of the gold price.

- 12 -

Principal Product

Our principal product is gold, with gold production forming all of our revenues. There is a global market into which we can sell our gold and, as a result, we are not dependent on a particular purchaser with respect to the sale of the gold that we produce.

Special Skills and Knowledge

Various aspects of our business require specialized skills and knowledge. Such skills and knowledge include the areas of permitting, engineering, geology, metallurgy, logistical planning, implementation of exploration programs, mine construction and development, mine operation, as well as legal compliance, finance and accounting. We have an active recruitment program, have highly qualified management personnel on staff, and believe that persons having the necessary skills are generally available. We have found that we can locate and retain competent employees and consultants in such fields as well as a retention rate of highly skilled employees and we anticipate that we will not have significant difficulty in recruiting other personnel as needed. Training programs are in place for workers who are recruited locally.

Competitive Conditions

The gold exploration and mining business is a competitive business. We compete with numerous other companies and individuals in the search for and the acquisition of quality gold properties, mineral claims, permits, concessions and other mineral interests, as well as recruiting and retaining qualified employees. Our ability to acquire gold properties in the future will depend not only on our ability to develop our present properties, but also on our ability to select and acquire suitable producing properties or prospects for development or mineral exploration.

Cycles

The mineral exploration and development business is subject to mineral price cycles. The marketability of minerals is also affected by worldwide economic cycles.

Employees

Our business is administered principally from our head office in Vancouver, British Columbia, Canada. We also have offices in Managua, Nicaragua; Manila, Philippines; Windhoek, Namibia; Ouagadougou, Burkina Faso; Bamako, Mali; Accra, Ghana; Dakar, Senegal; and Medellin, Colombia. As at the date hereof, we, including our subsidiaries, employ a total of 3,109 permanent employees and 2,283 fixed-term employees for a total of 5,392 employees.

- 13 -

Production at our mining operations is dependent upon the efforts of our employees and our relations with our unionized and non-unionized employees. Some of our employees are represented by labour unions under various collective labour agreements. The collective bargaining agreement covering the workers at the El Limon Mine is effective until August 1, 2018. The collective bargaining agreement covering the workers at La Libertad Mine is effective until December 31, 2019, having signed a renewal in January 2018. The collective bargaining agreement covering the workers at the Otjikoto Mine is negotiated annually, and remains in place until current negotiations are complete.

Fekola currently is not unionized. However, the entire mining industry in Mali is governed by a single union and it is anticipated that the Fekola Mine will ultimately have a union in place. Currently, all labour discussions are managed through employee representatives that are elected during site-wide elections. Labour relations are currently very good at Fekola.

Foreign Operations

Our principal operations and assets are located in Mali, Namibia, the Philippines, Nicaragua, Burkina Faso, Colombia and Finland. Our operations are exposed to various levels of political, economic and other risks and uncertainties. These risks and uncertainties vary from country to country and include, but are not limited to government regulations (or changes to such regulations) with respect to restrictions on production, export controls, income taxes, expropriation of property, repatriation of profits, environmental legislation, land use, water use, local ownership requirements and land claims of local people, regional and national instability and mine safety. The effect of these factors cannot be accurately predicted. See “Risk Factors”.

Environmental Protection

Our activities are subject to extensive laws and regulations governing the protection of the environment, natural resources and human health. These laws address, among other things, emissions into the air, discharges into water, management of waste, management of hazardous substances, protection of natural resources, antiquities and endangered species and reclamation of lands disturbed by mining operations. We are required to obtain governmental permits and, in some instances, provide bonding requirements under federal, state, or provincial air, water quality, and mine reclamation rules and permits. Violations of environmental, health and safety laws are subject to civil sanctions and, in some cases, criminal sanctions, including the suspension or revocation of permits. The failure to comply with environmental laws and regulations or liabilities related to hazardous substance contamination could result in project development delays, material financial impacts or other material impacts to our projects and activities, fines, penalties, lawsuits by the government or private parties, or material capital expenditures.

Additionally, environmental laws in some of the countries in which we operate require that we periodically perform audits and environmental impact studies at our mines. These studies could reveal environmental impacts that would require us to make significant capital outlays or cause material changes or delays in our intended activities.

Our current closure and reclamation cost estimate at La Libertad Mine, El Limon Mine, the Masbate Gold Project, the Otjikoto Mine and the Fekola Mine is approximately US$101.8 million on an undiscounted basis. These estimates are generally based on conceptual level engineering and will be updated periodically to reflect changes in site conditions and the LoM plans.

Environmental, Occupational Health and Safety, and Regulatory

We have adopted environmental and biodiversity policies designed to ensure environmental risks are adequately addressed while committing to environmental protection for all our activities. We have also adopted occupational health and safety policies designed to ensure the protection and promotion of the safety, human health, and welfare of our employees. We have also implemented Health, Safety & Environmental (“HSE”) Management System Standards and Occupational Health and Safety, Environmental and Biodiversity Performance Standards at the corporate level to provide minimum requirements for the development and implementation of both corporate and site HSE management systems. Our HSE Management System and Performance Standards are based on international standards including compliance with in-country regulations, relevant International Organization for Standardization (“ISO”) and Occupational Health, Safety and Security (“OHSAS”) standards, and reliance on the International Finance Corporation (“IFC”) Performance Standards and international best practices in cases where national regulatory systems are not sufficiently stringent. These management systems enable us to mitigate and manage the potential risks and impacts of our operations.

- 14 -

We implement the HSE management systems and manage HSE performance with dedicated HSE personnel at both the corporate and site levels. In addition, we have in place a Health, Safety, Environment and Social Committee of the Board to assist the Board in overseeing our health, safety, environmental and corporate social responsibility policies and programs, and our health, safety, environmental and corporate social responsibility performance.

The following is a brief summary of HSE management systems in place across our different projects:

|

• |

Fekola Mine: With the transition in 2017 from construction to mine operations, the Fekola Mine has begun the formal development of its HSE management system according to the local and national regulatory requirements, as well as the requirements of the corporate HSE Management System and Performance Standards. The HSE management system and performance will be audited by independent experts, with initial baseline audits scheduled for February (HSE Management System Standards) and August (HSE Performance Standards) 2018. | |

|

• |

Masbate Gold Project: Masbate Gold Project has developed and implemented an HSE management system based on our HSE Management System and Performance Standards. The HSE management system and performance includes annual internal auditing of the Masbate Gold Project by independent experts. In addition, the Masbate Gold Project maintains ISO 14001 certification and evaluates its management of cyanide in relation to the International Cyanide Management Code. | |

|

• |

Otjikoto Mine: B2Gold Namibia (Proprietary) Limited (“B2Gold Namibia”) continues to develop and implement a full HSE management system that covers all corporate HSE management systems and performance standards requirements on health, safety, environment, and biodiversity. Otjikoto Mine undergoes annual audits by independent experts. | |

|

• |

El Limon Mine: El Limon Mine continues to develop its HSE management system based on our HSE Management System and Performance Standards led by senior management, the HSE departments, and HSE Management System Coordinators. The HSE management system and performance includes annual auditing of the El Limon Mine by independent experts. | |

|

• |

La Libertad Mine: La Libertad Mine continues to develop its HSE management system based on our HSE Management System and Performance Standards through its internal management system implementation committee. La Libertad Mine undergoes annual audits by independent experts. | |

|

• |

Regional Exploration Projects: Regional exploration projects adhere to the same HSE policies as the rest of our projects, and apply specific standards, procedures, and processes as are relevant and applicable to the specific site. | |

|

• |

Reclamation and Care and Maintenance Sites: Reclamation and care and maintenance sites adhere to the same HSE policies as the rest of our projects, and apply specific standards, procedures, and processes as are relevant and applicable to the site. |

In addition, we work with occupational health, safety, and environmental regulatory agencies to ensure that the performance of our operations is at a level that is acceptable to the regulatory authorities. We encourage open dialogue and have prepared procedures for responding to concerns of all entities with respect to HSE issues.

- 15 -

SUMMARY OF MINERAL RESERVE AND MINERAL RESOURCE ESTIMATES

Mineral Reserves are reported from pit designs and underground stope designs based on Measured and Indicated Mineral Resources. Mineral Resources are reported inclusive of those Mineral Resources that have been converted to Mineral Reserves.

Economic parameters such as mining costs, processing costs, metallurgic recoveries and geotechnical considerations have been applied to determine economic viability of the Mineral Reserves based on a gold price of US$1,250 per ounce (“/oz”). Mineral Reserves contained in stockpiles that meet the project-specific Mineral Reserve cutoff grades are also included for the Fekola, Masbate and Otjikoto Mines.

Mineral Resources amenable to open pit mining are constrained with conceptual pit shells defined by economic parameters and using a gold price of US$1,400/oz. Mineral Resources amenable to underground mining methods are reported above cutoff grades defined by site operating costs and using a gold price of US$1,400/oz. Gold grades are expressed in grams per tonne of gold (“g/t Au”).

Except where stated otherwise, Mineral Reserve and Resource estimates for B2Gold’s operating mines are reported from B2Gold’s Mineral Resource models that have been updated to account for mining depletion, using topographic surfaces as of December 31, 2017 and are reported on an attributable basis (details in Notes).

Probable Mineral Reserves Statement

| Mine | Tonnes

(t) |

Gold

Grade (g/t Au) |

Contained

Gold Ounces (oz) |

Contained

Gold Kilograms (kg) |

| Fekola | 38,660,000 | 2.35 | 2,917,000 | 90,700 |

| Masbate | 88,520,000 | 0.85 | 2,420,000 | 75,300 |

| Otjikoto | 19,530,000 | 1.57 | 985,000 | 30,600 |

| La Libertad | 1,490,000 | 1.71 | 82,000 | 2,500 |

| El Limon | 820,000 | 4.20 | 110,000 | 3,400 |

| Total Probable Mineral Reserves (includes stockpiles) | 6,514,000 | 202,600 | ||

Notes:

| 1. |

Mineral Reserves have been classified using the CIM Standards. All tonnage, grade and contained metal content estimates have been rounded; rounding may result in apparent summation differences between tonnes, grade, and contained metal content. | |

| 2. |

Fekola Mine: Mineral Reserves are reported on an 80% attributable basis; B2Gold expects that the State of Mali will hold a 20% interest in the Fekola Mine. For further details of B2Gold’s interest in the Fekola Mine, see the heading “Material Properties – Fekola Mine – Property Description, Location and Access”. The Mineral Reserves have an effective date of December 31, 2017. The Qualified Person for the reserve estimate is Peter D. Montano, P.E., who is B2Gold’s Project Director. Mineral Reserves are based on a conventional open pit mining method, gold price of US$1,250/oz, metallurgical recovery of 93%, and average operating cost estimates of US$2.65/t mined (mining), US$15.81/t processed (processing) and US$3.13/t processed (general and administrative). Reserve model dilution and ore loss was applied through whole block averaging such that at a 0.8 g/t Au cutoff there is a 2.8% increase in tonnes, a 3.1% reduction in grade and 0.5% reduction in ounces when compared to the Mineral Resource model. An additional 5% dilution and 2% ore loss was applied during pit optimization and scheduling. Mineral Reserves are reported above a cutoff grade of 0.8 g/t Au. | |

| 3. |

Masbate Gold Project: Mineral Reserves are reported on a 100% attributable basis. Pursuant to the ore sales and purchase agreement between Filminera Resources Corporation (“Filminera”) and Philippine Gold Processing & Refining Corporation (“PGPRC”), B2Gold’s wholly-owned subsidiary, PGPRC has the right to purchase all ore from the Masbate Gold Project. The Mineral Reserves have an effective date of December 31, 2017. The Qualified Person for the reserve estimate is Kevin Pemberton, P.E., who is B2Gold’s Chief Mine Planning Engineer. Mineral Reserves are based on a conventional open pit mining method, gold price of US$1,250/oz, modeled metallurgical recovery (resulting in average LoM metallurgical recoveries by pit that range from 65% to 82%), and operating cost estimates of US$1.50/t-$1.60/t mined (mining), a variable ore differential cost by pit (average cost is US$0.17), US$8.45/t processed (processing) and US$2.50–3.83/t processed (general and administrative). Dilution and ore loss were applied through block averaging such that at a cutoff of 0.49 g/t Au, there is a 7% increase in tonnes, a 6% reduction in grade and no change in ounces when compared to the Mineral Resource model. Mineral Reserves are reported at cutoffs that range from 0.44– 0.52g/t Au. | |

| 4. |

Otjikoto Mine: Mineral Reserves for Otjikoto and Wolfshag are reported on a 90% attributable basis; the remaining 10% interest is held by EVI Mining (Proprietary) Ltd., a Namibian empowerment company (“EVI”). The Mineral Reserves have an effective date of December 31, 2017. The Qualified Person for the reserve estimate is Peter Montano, P.E., who is B2Gold’s Project Director. Mineral Reserves that will be mined by open pit methods assume a gold price of US$1,250/oz, metallurgical recovery of 98%, and operating cost estimates of US$1.79/t mined (mining), US$12.27/t processed (processing) and US$3.67/t processed (general and administrative). Dilution and ore loss was applied through block averaging such that at a cutoff of 0.45 g/t Au, there is a 1% decrease in tonnes, a 4% reduction in grade and 5% reduction in ounces when compared to the Mineral Resource model. Mineral Reserves are reported at a cutoff of 0.45 g/t Au. |

- 16 -

| 5. |

La Libertad Mine: Mineral Reserves are reported on a 100% attributable basis, and have an effective date of December 31, 2017. The Qualified Person for the estimate is Kevin Pemberton, P.E., who is B2Gold’s Chief Mine Planning Engineer. Mineral Reserves are based on a conventional open pit mining method, gold price of US$1,250/oz, metallurgical recoveries that range from 90% to 94%, and operating cost estimates of US$2.55/t mined (mining), US$13.93/t processed (processing) and US$4.31/t processed (general and administrative). Dilution and ore loss was applied to the Jabali material through block averaging such that at a cutoff of 0.73 g/t Au, there is a 10% increase in tonnes, a 27% reduction in grade and 20% reduction in ounces when compared to the Mineral Resource model. No dilution is applied to spent-ore. Mineral Reserves are reported at cutoffs that range from 0.62–0.73 g/t Au. | |

| 6. |

El Limon Mine: Mineral Reserves are reported on a 95% attributable basis; the remaining 5% interest is held by Inversiones Mineras S.A. (“IMISA”). The Mineral Reserves have an effective date of December 31, 2017. The Qualified Person for the estimate is Kevin Pemberton, P.E., who is B2Gold’s Chief Mine Planning Engineer. Mineral Reserves are based on underground long-hole stoping mining methods, gold price of US$1,250/oz, metallurgical recovery of 93.5%, and operating cost estimates of US$67.12– 82.39/t of ore mined (mining), US$24.61/t processed (processing) and US$11.57/t processed (general and administrative). Dilution of 24-37% is applied to most zones in addition to 90% mine recovery for all zones. Mineral Reserves are reported at cutoffs that range from 3.03–3.23 g/t Au. | |

| 7. |

Stockpiles: Mineral Reserves in stockpiled material are reported in the totals for the Masbate, Otjikoto and Fekola mines, and were prepared by mine site personnel at each operation. Ore stockpile balances are derived from mining truck movements to individual stockpiles or detailed surveys, with grade estimated from routine grade control methods. Stockpile cutoffs vary by deposit, from 0.4– 0.7 g/t Au. |

Measured and Indicated Mineral Resource Statement

| Country | Mine or

Project |

Tonnes

(t) |

Gold Grade

(g/t Au) |

Contained

Gold Ounces (oz) |

Contained

Gold Kilograms (kg) |

| Measured | |||||

| Burkina Faso | Kiaka | 27,310,000 | 1.09 | 953,000 | 29,600 |

| Total Measured Mineral Resources | 953,000 | 29,600 | |||

| Indicated | |||||

| Mali | Fekola | 59,170,000 | 2.08 | 3,948,000 | 122,800 |

| Philippines | Masbate | 120,430,000 | 0.88 | 3,411,000 | 106,100 |

| Namibia | Otjikoto | 35,390,000 | 1.33 | 1,513,000 | 47,100 |

| Nicaragua | La Libertad | 2,660,000 | 2.44 | 209,000 | 6,500 |

| El Limon | 2,310,000 | 5.05 | 375,000 | 11,700 | |

| Burkina Faso | Kiaka | 96,830,000 | 0.96 | 2,986,000 | 92,900 |

| Colombia | Gramalote | 79,660,000 | 0.75 | 1,926,000 | 59,900 |

| Total Indicated Mineral Resources (includes stockpiles) | 14,368,000 | 446,900 | |||

| Measured and Indicated | |||||

| Mali | Fekola | 59,170,000 | 2.08 | 3,948,000 | 122,800 |

| Philippines | Masbate | 120,430,000 | 0.88 | 3,411,000 | 106,100 |

| Namibia | Otjikoto | 35,390,000 | 1.33 | 1,513,000 | 47,100 |

| Nicaragua | La Libertad | 2,660,000 | 2.44 | 209,000 | 6,500 |

| El Limon | 2,310,000 | 5.05 | 375,000 | 11,700 | |

| Burkina Faso | Kiaka | 124,140,000 | 0.99 | 3,938,000 | 122,500 |

| Colombia | Gramalote | 79,660,000 | 0.75 | 1,926,000 | 59,900 |

| Total Measured and Indicated Mineral Resources 15,321,000 (includes stockpiles) | 15,321,000 | 476,500 | |||

- 17 -

Inferred Mineral Resource Statement

| Country | Mine or Project | Tonnes

(t) |

Gold

Grade (g/t Au) |

Contained

Gold Ounces (oz) |

Contained

Gold Kilograms (kg) |

| Mali | Fekola | 4,190,000 | 1.69 | 227,000 | 7,100 |

| Anaconda | 18,350,000 | 1.11 | 652,000 | 20,300 | |

| Philippines | Masbate | 7,200,000 | 0.84 | 193,000 | 6,000 |

| Namibia | Otjikoto | 4,600,000 | 1.70 | 251,000 | 7,800 |

| Nicaragua | La Libertad | 3,170,000 | 4.42 | 451,000 | 14,000 |

| El Limon | 5,920,000 | 4.85 | 923,000 | 28,700 | |

| Burkina Faso | Kiaka | 27,330,000 | 0.93 | 815,000 | 25,300 |

| Toega | 14,200,000 | 2.01 | 916,000 | 28,500 | |

| Colombia | Gramalote | 61,330,000 | 0.52 | 1,025,000 | 31,900 |

| Total Inferred Mineral Resources | 5,455,000 | 169,700 | |||

Notes:

| 1. |

Mineral Resources have been classified using the CIM Standards. Mineral Resources are reported inclusive of those Mineral Resources that have been modified to Mineral Reserves. Mineral Resources that are not Mineral Reserves do not have demonstrated economic viability. All tonnage, grade and contained metal content estimates have been rounded; rounding may result in apparent summation differences between tonnes, grade, and contained metal content. | |

| 2. |

Fekola Mine: Mineral Resources are reported on an 80% attributable basis; B2Gold expects that the State of Mali will hold a 20% interest in the Fekola Mine. For further details of B2Gold’s interest in the Fekola Mine, see the heading “Material Properties – Fekola Mine – Property Description, Location and Access”. The Mineral Resources have an effective date of December 31, 2017. The Qualified Person for the resource estimate is Tom Garagan, P.Geo., who is B2Gold’s Senior Vice President, Exploration. The Qualified Person for the stockpile estimate is Peter Montano, P.E., who is B2Gold’s Project Director. Mineral Resource estimates assume an open pit mining method, gold price of US$1,400/oz, metallurgical recovery of 93%, and average operating cost estimates of US$2.65/t mined (mining), US$15.81/t processed (processing) and US$3.13/t processed (general and administrative). Mineral Resources are reported at a cutoff of 0.6g/t Au. | |

| 3. |

Anaconda: Mineral Resources are reported on an 85% attributable basis; under the Mali Mining Code (2012), the State of Mali has the right to a 10% free carried interest and has an option to acquire an additional 10% participating interest, and 5% is held by a third party. The Mineral Resources have an effective date of March 22, 2017 and are considered current as of December 31, 2017. The Qualified Person for the resource estimate is Tom Garagan, P.Geo., who is B2Gold’s Senior Vice President, Exploration. The Qualified Person for the stockpile estimate is Peter Montano, P.E., who is B2Gold’s Project Director. Mineral Resource estimates assume an open pit mining method, gold price of US$1,400/oz, metallurgical recovery of 95%, and average operating cost estimates of US$1.75/t mined (mining), US$8.10/t processed (processing) and US$2.75/t processed (general and administrative). Mineral Resources are reported at a cutoff of 0.35g/t Au. | |

| 4. |

Masbate Gold Project: Mineral Resources are reported on a 100% attributable basis. Pursuant to the ore sales and purchase agreement between Filminera and PGPRC, B2Gold’s wholly-owned subsidiary, PGPRC has the right to purchase all ore from the Masbate Gold Project. The Mineral Resources have an effective date of December 31, 2017. The Qualified Person for the resource estimate is Tom Garagan, P.Geo., who is B2Gold’s Senior Vice President, Exploration. Mineral Resource estimates assume an open pit mining method, gold price of US$1,400/oz, modeled metallurgical recovery (resulting in average LoM metallurgical recoveries by pit that range from 65% to 82%), and operating cost estimates of US$1.50-$1.60/t mined (mining), a variable ore differential cost by pit (average cost is US$0.17), US$8.45/t processed (processing) and US$2.50–3.83/t processed (general and administrative). Mineral Resources are reported at an average cutoff of 0.43 g/t Au. | |

| 5. |

Otjikoto Mine: Mineral Resources are reported on a 90% attributable basis; the remaining 10% interest is held by EVI. The Mineral Resources have an effective date of December 31, 2017. The Qualified Person for the resource estimate is Tom Garagan, P.Geo., who is B2Gold’s Senior Vice President, Exploration. The Qualified Person for the stockpile estimate is Peter Montano, P.E., who is B2Gold’s Project Director. Mineral Resource estimates that are amenable to open pit mining methods assume a gold price of US$1,400/oz, metallurgical recovery of 98%, and operating cost estimates of US$1.79/t mined (mining), US$12.27/t processed (processing) and US$3.67/t processed (general and administrative). Mineral Resources that are amenable to open pit mining are reported at a cutoff of 0.40 g/t Au. Mineral Resources that are amenable to underground mining are reported at cutoff of 2.60 g/t Au. | |

| 6. |

La Libertad Mine: Mineral Resources are reported on a 100% attributable basis, and have an effective date of December 31, 2017. The Qualified Person for the estimate is Brian Scott, P.Geo., who is B2Gold’s Vice President, Geology and Technical Services. The Mineral Resource estimates amenable to open pit mining assume a gold price of US$1,400/oz, metallurgical recoveries that range from 90% to 94%, and operating cost estimates of US$2.55/t mined (mining), US$13.93/t processed (processing) and US$4.31/t processed (general and administrative). Mineral Resources amenable to open pit mining are reported at cutoffs that range from 0.55– 0.65 g/t Au. Mineral Resources amenable to underground mining are reported at cutoffs that range from 2.0–2.1 g/t Au. | |

| 7. |

El Limon Mine: Mineral Resources are reported on a 95% attributable basis; the remaining 5% interest is held by IMISA. Mineral Resources for El Limon Central have an effective date of January 31, 2018. All other Mineral Resources have an effective date of December 31, 2017. The Qualified Person for El Limon Central estimates is Tom Garagan, P.Geo., B2Gold’s Senior Vice President, Exploration. The Qualified Person for the other estimates is Brian Scott, P.Geo., B2Gold’s Vice President, Geology and Technical Services. Mineral Resource estimates assume a gold price of US$1,400/oz, metallurgical recovery of 93.5%, and operating cost estimates of US$67.12–82.39/t of ore mined from underground (mining), US$2.22/t of ore mined from open pit (mining), US$24.61/t processed (processing) and US$11.57/t processed (general and administrative). Mineral Resources amenable to underground mining are reported at cutoffs that range from 2.8 –2.9 g/t Au. Mineral Resources amenable to open pit mining are reported at cutoffs that range from 1.1 - 1.2 g/t Au. |

- 18 -

| 8. |

Kiaka Project: Mineral Resources are reported on an 81% attributable basis; the remaining interest is held by GAMS-Mining F&I Ltd (9%) a Cypriot company, and the Government of Burkina Faso (10%) (including the 10% interest that will be transferred to the Burkina Faso government if the project advances). The Mineral Resource estimate has an effective date of January 8, 2013. The Qualified Person for the estimate is Ben Parsons, MSc, MAusIMM (CP), Principal Consultant for SRK Consulting. Mineral Resources assume an open pit mining method, gold price of US$1,400/oz, metallurgical recovery of 89.8%, and operating cost estimates of US$1.58/t mined (mining), US$11.89/t processed (processing, and general and administrative). Mineral Resources are reported at a cutoff of 0.4 g/t Au. | |

| 9. |

Toega Project: Mineral Resources are reported on an 81% attributable basis; the remaining interest is held by GAMS-Mining F&I Ltd (9%) a Cypriot company, and the Government of Burkina Faso (10%) (including the 10% interest that will be transferred to the Burkina Faso government if the project advances). The Mineral Resource estimate has an effective date of January 8, 2018. The Qualified Person for the estimate is Tom Garagan, P.Geo., who is B2Gold’s Senior Vice President, Exploration. Mineral Resources assume an open pit mining method, gold price of US$1,400/oz, metallurgical recovery of 86.2%, and operating cost estimates of US$2.50/t mined (mining), US$10.00/t processed (processing) and US$2.10/t processed (general and administrative). Mineral Resources are reported at a cutoff of 0.6 g/t Au. | |

| 10. |

Gramalote Project: Mineral Resources are reported on a 49% attributable basis; the remaining 51% interest is held by AngloGold Ashanti Limited. Mineral Resources have an effective date of August 31, 2016. The Qualified Person for the estimate is Vaughan Chamberlain, FAusIMM, Senior Vice President, Geology and Metallurgy for AngloGold. Mineral Resources assume an open pit mining method, gold price of US$1,400, metallurgical recovery of 84% for oxide and 95% for sulphide, and operating cost estimates of US$2.30/t mined (mining), US$3.32 for oxide and US$5.71/t for sulphide processed (processing) and US$1.37/t processed (general and administrative). Mineral Resources are reported at cutoffs of 0.13 g/t Au for oxide and 0.17g/t Au for sulphide. | |

| 11. |

Stockpiles: Mineral Resources in stockpiled material are reported in the totals for the Masbate, Otjikoto, and Fekola mines, and were prepared by mine site personnel at each operation. Ore stockpile balances are derived from mining truck movements to individual stockpiles or detailed surveys, with grade estimated from routine grade control methods. Stockpile cut-offs vary by deposit, from 0.25–0.7 g/t Au. |

MATERIAL PROPERTIES

Fekola Mine

Certain portions of the following information are derived from and based on the technical report entitled “NI 43-101 Technical Report Feasibility Study on the Fekola Gold Project in Mali” that has an effective date of June 30, 2015, and was prepared by Tom Garagan, P.Geo, William Lytle, P.E, Peter Montano, P.E., Ken Jones, P.E., Sandra Hunter, MAusIMM(CP), and David J. T. Morgan, MIEAust CPEng (the “Fekola Feasibility Study”) and is based on the assumptions, qualifications and procedures set out therein. For a more detailed overview of the Fekola Mine, please refer to the Fekola Feasibility Study, which is available on SEDAR at www.sedar.com. Information that postdates the Fekola Feasibility Study is provided by the Company.

Property Description, Location, and Access

The Fekola Mine is situated in southwestern Mali, on the border between Mali and Senegal. The Fekola deposit is located about 210 kilometres (“km”) south of Kayes and approximately 40 km south of the city of Kéniéba, in the Kayes Region. From Bamako, the Malian capital, it is about a 480 km drive along the Millennium Highway to Kéniéba, then 40 km from the Millennium Highway to the mine site. The mine can also be accessed by road from Dakar in Senegal. The mine is serviced by a purpose-built gravel airstrip.

Permit number 0070/PM-RM (the “Médinandi Exploitation License”), which has an area of 75 square kilometers (“km2”) was granted on February 13, 2014, and is valid to February 2044, a 30-year term. The Médinandi Exploitation License was initially held in the name of Songhoi. B2Gold initially acquired a 90% interest in Songhoi through the acquisition of Papillon in October 2014 and purchased the remaining 10% non-controlling interest in Songhoi held by Mani SARL (“Mani”) through a subsequent transaction in January 2015. B2Gold holds an additional two exploration licences in the Fekola area and four in the southern part of Mali.

- 19 -

Fekola S.A., the new Malian exploitation company, was incorporated on March 17, 2016 and merged with Songhoi in December 2016 to become the holder of the Médinandi Exploitation Licence. The Company will contribute a 10% free carried interest in Fekola S.A. to the State of Mali as required under the 2012 Mining Code. Under the 2012 Mining Code, the State of Mali also has the option to purchase an additional 10% participating interest in Fekola S.A., which it has confirmed its intent to exercise. As a result, it is expected that the State of Mali will hold a 20% interest in Fekola S.A. B2Gold signed the Fekola Convention in the form required under the 2012 Mining Code that relates to, among other things, the ownership, permitting, reclamation bond requirements, development, operation and taxation applicable to the Fekola Mine with the State of Mali. In August 2017, B2Gold finalized certain additional agreements with the State of Mali including the Fekola Shareholders Agreement, Share Purchase Agreement and an amendment to the Fekola Convention to address and clarify certain issues under the 2012 Mining Code. The Fekola Convention, as amended, will govern the procedural and economic parameters pursuant to which B2Gold will operate the Fekola Mine. The Fekola Shareholders Agreement and the Share Purchase Agreement for the purchase of the additional 10% of Fekola S.A. have been finalized and signed by the relevant Malian government ministers and the Malian Council of Ministers, subject to ratification by the Mali National Assembly, which is now expected at their next scheduled sitting in April 2018. Upon such ratification, B2Gold will transfer ownership of 20% of Fekola S.A. to the State of Mali. The first non-participating10% of the State of Mali's ownership will entitle it to an annual priority dividend equivalent to 10% of calendar net income of Fekola S.A. The second fully participating 10% of the State of Mali's interest will entitle it to ordinary dividends payable on the same basis as any ordinary dividends declared and payable to B2Gold for 80% interest.

The State of Mali owns all surface rights in the Fekola Mine area, and no surface rights have been registered to a private entity. There are a number of small villages in the Exploitation License area, but there are currently no known inhabitants in a “no-go” zone, which is the area required for mining operations, infrastructure, and a 500 metre (“m”) buffer zone around the active blasting area. Farmers and other inhabitants have previously been relocated and compensation has been paid and there are no expected future payments or liabilities associated with the completed relocation effort. The Company is also relocating the village of Fadougou, located adjacent to the main Fekola pit. While the relocation of the village was not a requirement in the construction permit, after extensive stakeholder engagement with the local population, the Company decided to proceed with it because of the near proximity of the village to the mine site. Relocation will be completed in accordance with a Resettlement Action Plan (“RAP”) that was completed by an independent consultant in consultation with all stakeholders. The RAP has been approved by the appropriate Malian authorities and the Company is currently building the new village. It is anticipated that the relocation process will take two years to complete.

A 1.65% royalty is payable to Zoumana Traore SARL.

The financial model in the Fekola Feasibility Study was prepared on a pre-tax basis. The 2012 Mining Code introduced an ad valorem tax applicable to all substances, the taxable basis of which is the square-mine value of extracted substances, exported or not, minus intermediary fees and expenses. The tax rate is based on specified mining groups. Gold and other precious metals are levied at a 3% royalty rate.

Value-added tax (“VAT”) is payable in Mali; however, the 2012 Mining Code has a provision that exploitation license holders have a three-year VAT exemption period. Corporate income tax in Mali is 30%. For exploitation license holders, there is a 15-year period from the start of production where the corporate income tax is reduced to 25%.

- 20 -

A new tax has been introduced applying to holders of an exploitation license that produce, in one year, more than 10% of the expected quantity fixed in the annual production program approved by its shareholders’ general assembly. This new tax consists of standard taxes and rights applying to operations and results relating to overproduction.

A special tax on certain products (Impôt Spécial sur Certains Produits or “ISCP”), calculated on the basis of turnover exclusive of VAT, also applies and is based on the specified mining group assignment. Under the Fekola Convention, the applicable ISCP rate is 3%. Fekola S.A. is also subject to a stamp duty of 0.6% of its revenue.

To the extent known, there are no other significant factors or risks that might affect access or title to, or the right or ability to perform work on, the property, including permitting and environmental liabilities to which the project is subject that are not discussed in this Annual Information Form.

History

A number of companies have completed exploration activities in the general Fekola area, including Société Nationale de Recherches et d’Exploitation des Ressources Minières de Mali, Bureau de Recherches Géologiques et Minières, the Guefest Company, Western African Gold and Exploration S.A., Randgold Resources Ltd., Central African Gold plc (“Central African”) and Papillon.

The work programs included geological reconnaissance, interpretation of Landsat and aeromagnetic data, regional geological and regolith mapping, ground induced polarization (“IP”) geophysical surveys, airborne magnetic and electromagnetic (“EM”) surveys, soil, rock, and termite geochemical sampling, trenching, auger, rotary air blast (“RAB”), air core, reverse circulation (“RC”) and core drilling, Mineral Resource and Mineral Reserve estimates and updates to those estimates, environmental studies to support environmental permit applications, geotechnical and hydrological surveys and water sampling, topographic surveys, metallurgical sampling, upgrading of access roads and the accommodation camp, and mining and technical studies. There are no historical estimates that are relevant to the current Mineral Resources and Mineral Reserves.

Using assumptions and allowances in the 2004 Australasian JORC Code, Papillon completed a scoping-level study in 2012, and a pre-feasibility study in 2013; both studies indicated positive project economics using the assumptions in the studies. B2Gold completed the Fekola Feasibility Study in 2015, and subsequently commenced mine development activities on the Fekola deposit. B2Gold discovered the Anaconda zone in 2014 and announced an initial Mineral Resource estimate for the zone in 2017.

Fekola Mine construction was successfully completed in late September 2017, and the mine achieved commercial production on November 30, 2017, one month ahead of the revised schedule and four months ahead of the original schedule.

There are known zones of artisanal mining activity within the Fekola Mine area.

Geological Setting, Mineralization, and Deposit Types

The Fekola deposit and Anaconda zone are hosted in Birimian Supergroup rocks within the eastern portion of the Paleo-Proterozoic Kédougou–Kéniéba inlier, which covers eastern Senegal and western Mali. They are considered to be examples of orogenic-style gold deposits.