UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

|

(Mark One)

|

|

þ

|

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

|

For the fiscal year ended September 30, 2015

|

|

OR

|

|

¨

|

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

|

For the transition period from ____________ to ____________

|

Commission file number: 0-53570

ActiveCare, Inc.

(Exact name of registrant as specified in its charter)

|

Delaware

|

87-0578125

|

|

(State or other jurisdiction of incorporation or organization)

|

(I.R.S. Employer Identification No.)

|

1365 West Business Park Drive, Suite 100, Orem, Utah 84058

(Address of principal executive offices, Zip Code)

(877) 219-6050

(Registrant's telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act: None

Securities registered pursuant to Section 12(g) of the Act: Common Stock, $0.00001 par value

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐ No ☑

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act. Yes ☐ No ☑

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☑ No ☐

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ☑ No ☐

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definitions of "large accelerated filer," "accelerated filer" and "smaller reporting company" in Rule 12b-2 of the Exchange Act.

|

Large accelerated filer ☐

|

|

Accelerated filer ☐

|

|

Non-accelerated filer ☐

|

|

Smaller reporting company ☑

|

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ☐ No ☑

The aggregate market value of the voting and non-voting common stock held by non-affiliates of the registrant as of March 31, 2015 was approximately $6 million, based on the average bid and asked price ($0.25 per share) and a total of 23,315,602 shares issued and outstanding to non-affiliates on that date.

There were 79,486,873 shares of the registrant's common stock outstanding as of January 11, 2016.

Documents Incorporated by Reference

None.

ACTIVECARE, INC.

FORM 10-K

For the Fiscal Year Ended September 30, 2015

|

|

|

Page

|

| |

|

|

|

|

Part I

|

|

| |

|

|

|

Item 1

|

Business

|

1

|

| |

|

|

|

Item 1A

|

Risk Factors

|

9

|

| |

|

|

|

Item 2

|

Properties

|

14

|

| |

|

|

|

Item 3

|

Legal Proceedings

|

14

|

| |

|

|

|

Item 4

|

Mine Safety Disclosures (omitted)

|

|

| |

|

|

|

|

|

|

| |

|

|

|

Item 5

|

Market for Registrant's Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities

|

15

|

| |

|

|

|

Item 6

|

Selected Financial Data (omitted)

|

|

| |

|

|

|

Item 7

|

Management's Discussion and Analysis of Financial Condition and Results of Operations

|

17

|

| |

|

|

|

Item 7A

|

Quantitative and Qualitative Disclosures About Market Risk (omitted)

|

|

| |

|

|

|

Item 8

|

Financial Statements and Supplementary Data

|

24

|

| |

|

|

|

Item 9

|

Changes in and Disagreements with Accountants on Accounting and Financial Disclosure

|

24

|

| |

|

|

|

Item 9A

|

Controls and Procedures

|

24

|

| |

|

|

|

Item 9B

|

Other Information

|

25

|

|

|

|

|

| |

|

|

|

Item 10

|

Directors, Executive Officers and Corporate Governance

|

26

|

| |

|

|

|

Item 11

|

Executive Compensation

|

28

|

| |

|

|

|

Item 12

|

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters

|

33

|

| |

|

|

|

Item 13

|

Certain Relationships and Related Transactions, and Director Independence

|

34

|

| |

|

|

|

Item 14

|

Principal Accounting Fees and Services

|

37

|

| |

|

|

|

|

|

|

| |

|

|

|

Item 15

|

Exhibits, Financial Statement Schedules

|

38

|

| |

|

|

|

Signatures

|

39

|

Disclosure Regarding Forward-Looking Statements

This Annual Report on Form 10-K contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934, as amended, relating to our operations, results of operations, and other matters that are based on our current expectations, estimates, assumptions, and projections. Words such as "may," "will," "should," "likely," "anticipates," "expects," "intends," "plans," "projects," "believes," "estimates," and similar expressions are used to identify these forward-looking statements. These statements are not guarantees of future performance and involve risks, uncertainties, and assumptions that are difficult to predict. Forward-looking statements are based upon assumptions as to future events that might not prove to be accurate. Actual outcomes and results could differ materially from what is expressed or forecast in these forward-looking statements. Risks, uncertainties, and other factors that might cause such differences, some of which could be material, include, but are not limited to, the factors discussed under Item 1A of this report entitled "Risk Factors."

Item 1. Business

Background

ActiveCare, Inc. ("we," "us," "our," the "Company" or "ActiveCare") was formed March 5, 1998 as a wholly owned subsidiary of Track Group [OTCQX: TRCK], a Utah corporation, formerly known as Track Group, Inc. ("Track Group"). We were spun off from Track Group in February 2009. Effective July 15, 2009, we changed our name to ActiveCare, Inc., and our state of incorporation to Delaware. Our fiscal year ends on September 30.

In this Annual Report on Form 10-K, unless indicated otherwise, references to "dollars" and "$" are to United States dollars.

We own or have rights to trademarks, service marks or trade names that we use in connection with the operation of our business, including, without limitation, "CareCenter," "4G," "ActiveOne," "ActiveOne+," "ActiveHome," "ActiveCare" and the stylized "ActiveCare" logo. Solely for convenience, some of the trademarks, service marks and trade names referred to in this report are listed without the ©, ® and ™ symbols, but we will assert, to the fullest extent under applicable law, our rights to our copyrights, trademarks, service marks, trade names and domain names. The trademarks, service marks and trade names of other companies appearing in this report are, to our knowledge, the property of their respective owners.

General

Our focus is on markets addressing chronic conditions and disease states. Remote patient monitoring ("RPM") is a technology to enable monitoring of patient vital signs and physical functions outside of conventional clinical settings (e.g., in the home, work or travel). Physiological data such as blood sugar levels, blood pressure, pulse rate, and blood oxygen levels are collected by sensors on medical peripheral devices. Examples of these devices include glucometers, blood pressure cuffs, weight scales, and pulse oximeters. The data is stored for future assessment or transmitted to healthcare providers or third parties via wireless telecommunication devices. Disease states targeted by RPM technology providers typically include diabetes, congestive heart failure, sleep apnea, activity monitoring, and diet management. Since the launch of our Chronic Illness Monitoring segment in 2012, its primary focus has been on those patients diagnosed with diabetes. We believe that we can improve the lives of the chronically ill through the use of technology, while reducing the cost of care. Central to these efforts is our "CareCenter." This service is designed to monitor and track patients' health conditions and chronic illnesses on a real time basis. As part of these efforts we have staffed this CareCenter with trained specialists to assist the chronically ill in managing their daily lives; 24 hours per day, seven days per week. In order for the CareCenter to service our customers, we have developed and continue to develop products and technologies designed to improve the health of the chronically ill.

There are obvious problems associated with aging and patients diagnosed with chronic conditions. According to a 2004 presentation to the American Telemedicine Association, approximately one in every four Americans suffers from a chronic illness, which typically becomes more severe and prominent with age. The demographics of chronic illnesses include over 29 million people with diabetes (according to the Centers for Disease Control and Prevention's 2015 National Diabetes Statistics Report) and close to 14 million with coronary heart disease (according to reports published by the American Heart Association), as well as over 10 million with osteoporosis (according to a study by the University of Maryland Medical Center). All of these reports and studies, as well as those cited elsewhere in this report, are on file with the Company.

According to a 2010 analysis from the Centers for Disease Control and Prevention ("CDC"), as many as one in three U.S. adults could have diabetes by 2050 if current trends continue. Diabetes currently affects approximately 9% of the overall U.S. population or 29 million people. According to a 2012 diabetes fact sheet the annual cost of treating an individual diagnosed with diabetes, and the comorbidities associated with the disease, can range from $12,000 to $16,000 per year. This combination costs the U.S. health system up to $245 billion annually. A major driver of the diabetic related claims is the lack of adherence to regular blood glucose monitoring. It is estimated by the National Center for Biotechnology Information that less than 30% of diabetics monitor their blood glucose levels on a regular basis.

With U.S. healthcare costs increasing annually, we believe that cost containment is a primary issue facing the industry. These escalating costs will only intensify as the baby-boom generation ages. As of 2000, 35 million Americans were 65 years of age or older, and this number is projected to increase to 55 million by the year 2020, according to a study by the U.S. Department of Health and Human Services. By that year, one in six Americans will be over the age of 65 and by the middle of the century, the number of elderly could reach more than 86 million people, more than double the present number. According to an article published in the National Review Online and the sources cited therein, approximately 80% of healthcare costs occur in the last two years of life. This combined with an aging population supports the assertion that the nation is in dire need of viable cost-saving options for health care.

We believe the ability to monitor chronic illness in your own home will mitigate health care costs for the chronically ill and the elderly. Through the technologies we are developing, we believe we can both enhance lives of and provide peace of mind with the knowledge that their vital signs are being monitored. At the same time we believe we can save millions of dollars in the health care sector as we identify problems and issues before they become crises.

We believe that through the technologies we have already developed and are continuing to develop, we can enhance the lives not only of the growing diabetic segment of today's population, but also the lives of other segments of the population, such as those with other chronic illnesses. The CareCenter is staffed around the clock with advisors that receive calls originating from our clients who utilize our products. We can immediately communicate with them and emergency personnel in times of need and communicate their location and an abbreviated medical history.

Our Product and Service Strategy

During the fiscal year 2015, our product/service strategy fell into two distinctly different categories; chronic illness monitoring and care services ("CareServices") or personal emergency response systems ("PERS"). In December 2014, we sold substantially all of our customer contracts and equipment leased to customers associated with our CareServices segment. The sale of our CareServices contracts allows us to focus solely on our Chronic Illness Monitoring segment.

Chronic Illness Monitoring

Chronic illness monitoring involves the use of biometric monitoring devices in combination with proprietary data and algorithms to assess the wellbeing of an individual under care. Individual care profiles are created through the aggregation of personal health and medical claims information from multiple data sources. Real-time biometric readings for blood glucose levels, blood pressure, heart rate, weight, tidal volume and other vital readings can be captured over time and added to the existing personal information. This unique data set may now be used for proactive care protocols, care provider alerts to elevated readings, and behavioral intervention prior to crisis events.

Technology to facilitate data-driven chronic illness monitoring consists of three components: (1) biometric monitoring products and supplies, (2) medical and claims data aggregation, and (3) algorithms for the analysis of the data. Biometric monitoring products and supplies are provided by numerous medical hardware providers and deliver a wide range of features and functionality. ActiveCare is agnostic to any specific device requirement, and has as a core competency the ability to integrate and capture data from any 510(k) or HL7 compliant monitoring device (see "Regulatory Matters" on page 8 of this report). Strategic relationships have been created with technology and market leaders, and evaluation of new and emerging technology partners is ongoing. Medical and claims data is aggregated from multiple source providers using a proprietary application programmatic interface and data storage architecture. This data is analyzed to identify individual care needs of those entering the program. Monitoring alerts, predictive informatics and individual care plans are created and managed using the ActiveCare technology platform. Care for chronic conditions may now be performed in real-time, and outcomes may be measured on both a medical and claims cost basis.

During the fiscal year ended September 30, 2015, we spent approximately $107,000 on research and development for chronic illness monitoring related to ongoing improvements to methods and systems for the capture and analysis of data, as well as scalable architectures to migrate to production applications and deployments that were developed during fiscal years 2013 and 2012. We will continue to identify claims and medical data sets as well as analytical and informatics technologies that advance our ability to provide unique services. Core competency will continue to evolve in the methods and technologies for data analytics and predictive informatics.

Care Services

We have developed products that incorporate GPS, cellular capability, and fall detection, all of which are connected to our 24-hour CareCenter with the push of a button. The transmitter can be worn on a neck pendant or belt clip, or carried in a purse, and sends a cellular signal to our CareCenter. When the wearer of the device pushes the button, the staff at the CareCenter evaluate the situation and decide whether to call emergency services or a designated friend or family member.

CareCenter

The central point of our product offerings is our CareCenter. Our CareCenter is staffed 24x7 with CareCenter specialists who are 911-certified and trained. In addition, we have nurses on duty and on call that are available to assist with medical issues or questions. Our CareCenter specialists and CareCenter provide monitoring related to chronic illness test results, contact testers who have not tested when scheduled, and onboard new users to our services. We focus on our outreach initiatives in respect of engagement programs, which assist end users with the importance of monitoring their health.

In contrast to a typical monitoring center, our CareCenter is equipped to respond to real-time alerts and data to better assist users of our services. In addition, the CareCenter's software will identify the caller, access the individual's medical information, and assist with emergency dispatch. We believe the CareCenter is a cornerstone of our business and will support current technology as well as evolve to support the integration of future technologies.

Recent Developments

We have financed operations primarily through the sale of equity securities, long-term debt and short-term debt. Until revenues are sufficient to meet our needs, we will attempt to secure financing through equity or debt securities. We continue to incur negative cash flows from operating activities and net losses. We had negative working capital and negative total equity as of September 30, 2015 and September 30, 2014 and are in default with respect to certain debt. We determined that our goodwill of $825,894 was impaired during the fourth quarter of 2015 and it was expensed. These factors, among others, raise substantial doubt about our ability to continue as a going concern. The financial statements included in this Form 10-K do not include any adjustments that might result from the outcome of this uncertainty.

In order for us to eliminate substantial doubt about our ability to continue as a going concern, we must achieve profitability, generate positive cash flows from operating activities and obtain the necessary debt or equity funding to meet our projected capital investment requirements. Our management's plans with respect to this uncertainty consist of raising additional capital by issuing debt or equity securities and increasing the sales of our products and services. There can be no assurance that we will be able to raise sufficient additional capital or that revenues will increase rapidly enough to offset operating losses. If we are unable to increase revenues or obtain additional financing, we will be unable to continue the development of our products and services and may have to cease operations.

In December 2014, we sold substantially all of our customer contracts and equipment leased to customers associated with our CareServices segment. Additional equipment that we held in stock was sold to the buyer pursuant to a written invoice. The purchase price included a cash payment of $412,280 for the customer contracts and $66,458 for the equipment held in stock. The sale of the CareServices segment allows us to focus our resources solely on Chronic Illness Monitoring.

Our Growth Strategy

Our plan is to continue to focus on addressing the diabetic population and to execute our existing business plan serving this chronic illness market during fiscal year 2016. We market our products through insurance companies, disease management companies, third-party administrators ("TPAs"), and self-insured companies. We plan to invest in research and development and patent filings, as we broaden the services we offer. We will continue to look for ways to provide solutions for other chronic illness and disease states markets.

Our strategy is to develop relationships with these various customers. TPAs administer the claims, payments, co-pays, and medical coding for self-insured companies. They effectively act as the medical benefits administrators for their customers, most of which are not large enough to justify a fully operational in-house department. Disease management companies are hired by insurance companies and self-insured companies to actively engage with members and employees with the goal that more interaction will reduce significant health care claims. Our strategy is achieved by providing specific information related to the benefits to be realized by all parties, which, in most cases is substantial to the self-insured companies and the insurance companies. The key to monetary savings is the CareCenter, which operates 24x7 and is integral to chronic illness monitoring. The CareCenter is the real-time recipient of all test results which are delivered using cellular glucometers. This information is gathered, sorted and reported. This information, which the customers have generally never before seen, is then delivered to the customers. The ultimate objective is to increase the percentage of diabetics who are regularly testing, which has been proven to be a major factor in reducing the cost of claims based on statistical history. Once the customers recognize the benefits to be realized from this information for one or more patients, it is a natural progression to add the rest of the customer's members or clients to the ActiveCare solution.

Our ultimate objective is to become a chronic illness monitor for all of our customer's members, measuring not only blood sugar for diabetics, but also blood pressure, weight, and blood oxygen levels.

Research and Development Program

During fiscal year 2015, we spent approximately $107,000, compared to $215,000 in fiscal year 2014, on research and development related to chronic illness monitoring. The research and development program focused on ongoing improvements to methods and systems for the capture and analysis of data, as well as scalable architectures to migrate to production applications and deployments during fiscal year 2015 that were developed during fiscal years 2013 and 2012.

Competition

Over the past decade, technology device manufacturers have rushed to provide peripheral devices to capture data related to chronic health conditions rather than provide any assessment or intelligence regarding the data being captured. In most cases the data captured remains static on the peripheral device or data capture system, providing little to no perspective on the current and recent condition of the patient. In cases in which the data are utilized, the application of that data is typically limited to the "point of care" or physician's office. The ActiveCare solution is a complex combination of components that provide an overall care system. The analysis of the competitive landscape will focus on six primary market segments representing the primary components of our system, noting the implications for us resulting from the strengths of the leaders in each segment.

Legacy Consumer Oriented Monitoring and Communications Device Providers

Overview – While not a primary threat to our business model, several leading providers of health care technologies have targeted the patient monitoring market and made significant investments in pursuing the segment. The primary business focus of these companies is high-end diagnostics equipment, point of care technologies, and health information technologies. While the investments in telehealth technologies have totaled significant dollars they represent a very small component of these competitors' overall business in the health care segment. The approach to entering the market has typically been to acquire an existing technology and attempt to distribute that technology through existing distribution channels in complementary offerings. Examples of providers in this segment include:

|

·

|

Philips – Telestation

|

| |

|

|

·

|

Bosch - HealthStation

|

| |

|

|

·

|

Honeywell – Genesis

|

Strengths – The strengths of this segment are the competitors' overall position in the health care market, existing distribution channels and availability of capital to fund and pursue future opportunities.

Weaknesses – The value proposition of the providers in this segment has been focused on providing a consumer-based platform for "telemedicine," or providing care to a patient not at the same location as the provider of care. Solutions have been an extension of the videophone concept, and in some cases have included connectivity to blood pressure and blood oxygen measuring peripherals. The weaknesses in the execution of this approach include:

|

·

|

The market / product strategy has been as a tertiary complement to the core business, lacking focus on execution.

|

| |

|

|

·

|

The business model has been hardware based, focusing on the product as a "part" of the primary hardware business.

|

| |

|

|

·

|

Solutions have been limited to facilitating the moment of care, and do not capture or make data available for later assessment.

|

| |

|

|

·

|

Products have been based on legacy technologies, lacking ease of use and rich functionality.

|

| |

|

|

·

|

Revenue models have been based on sources outside of the primary economics of health care; federal and state funded grants, patient payer, and as a bundled component of a sponsoring product line or business.

|

Summary – We do not directly compete with the offerings in this segment. The possible threat is based on the competitors' reassessment of strategy in this market and the ability to fund and customize products. If they follow past patterns, we believe that we would be a prime candidate for partner relationship or acquisition by one of these competitors to gain an immediate presence in a more viable business model.

Current Consumer Peripheral Monitoring Device Providers

Overview – Competitors in this segment have specialized in the delivery of low cost diagnostic peripherals for measuring blood pressure, weight, pulse rate, blood sugar and activity. Examples include:

|

·

|

A and D Medical

|

| |

|

|

·

|

Telcare

|

Strengths – These competitors have refined the product requirements to meet the needs of the market. Products are easy to use and accurately capture vitals and metrics. In the past five years significant effort has been made to lower the cost of products as they compete more on cost rather than functionality or other benefits.

Weaknesses – These products continue to evolve as commodity offerings, differentiating on price rather than any other feature. Solutions have been targeted on facilitating the moment of care, and lack complementing strategies to make data for later assessment.

Summary – Currently this segment provides us with some key partnerships. They facilitate the means of capturing patient data with an easy to use, low cost offering. While some devices have been innovative, the strategies continue to focus primarily on the manufacture and sale of hardware components.

Next Generation Monitoring Device Providers

Overview – The past five years have seen a proliferation of consumer-oriented devices to monitor individuals' physical activity, sleep patterns and pulse rate. The strategy of those in this segment has also been focused on integration with smartphones and other consumer devices. Examples include:

|

·

|

Activity monitoring

|

| |

o

|

MisFit

|

| |

o

|

Striiv

|

| |

o

|

Lark

|

| |

|

|

|

·

|

Consumer vital signs monitoring

|

| |

o

|

iHealth

|

| |

o

|

Digifit

|

| |

|

|

|

·

|

Sleep and diet monitoring

|

| |

o

|

FitBit

|

Strengths – The rapid evolution of product and strategy has been fueled by the culture and investors that innovated the technology segment. Companies such as Apple, Google, Frog Design and Stanford Research Institute (SRI) are directly or indirectly funding and leading efforts of innovation. Designs are state-of-the-art and are focused on attracting use by consumers in daily activity. The segment has a strong first adopter appeal.

Weaknesses – To date, the business models of the products in the segment have been an evolution of the products produced by traditional monitoring device companies, with one notable exception; products are not yet qualified for clinical data capture and are relegated to providing consumers with the most basic of physical monitoring data. Providers in this segment have noted intentions to become more robust, capturing clinical data type and securing federal 510(k) medical device certification in future products. It has also been forecasted by technology thought leaders that the segment strategy will fail unless it adds complementing user value and revenue opportunities.

Summary – Competitors in this segment are expected to become strategic partners for our business model as they evolve their ability to capture and transmit clinical data. We expect to expand into strategic market segments complementing the strengths of these technologies, offering data analytics, and personal fitness planning and wellness management services.

Health / Insurance Data Service Providers

Overview – Health data informatics has become a strategic focus of health care providers and payer organizations over the past 30 years. Aggregation, analytics, informatics and predictive modeling have enabled service providers to differentiate and better manage the process of health care. Traditionally providers specialized in offering information or services based on a vertical focus of EHR patient data, geographic and regional health care information, or insurance claims processing data. Examples include:

|

·

|

CareFX – recently acquired by Harris Healthcare

|

| |

|

|

·

|

Medicity –acquired by Aetna

|

| |

|

|

·

|

Certify Data Systems

|

| |

|

|

·

|

Benefit Informatics

|

Strengths – Data aggregation and utilization are core competencies of the companies in this segment. Product and service offerings have been successfully marketed to insurance companies and health plan providers.

Weaknesses – Sources of the data driving the product strategy of these competitors is becoming increasingly available, forcing an evolution of the business model in two directions; to become a provider of advanced services (rather than data), or to be acquired by large insurance and care groups to mine that specific groups' data. While significant federal and state funding has driven the efforts to create regional health information organizations, projects have become graveyards for careers and future funding. The fallout of this effort has had a significant impact on the viability of several major data services providers.

Summary – This segment presents us with direct competition and business opportunities. Forced to rapidly evolve their strategies, competitors are recognizing the value of real-time and "prior to care event" data. Increasing efforts are being made to facilitate data at the point of care and make that data available to the entire care and reimbursement cycle. Having the ability to capture and assess the data upstream of current offerings strategically differentiates our business, giving visibility to health risks in advance of change of condition and cost. Partnering with leaders in this segment should enable us to further gain expertise in this field as well as complement our data repository. Having data of past care from these partners in combination with data of current patient conditions allows for extremely valuable predictive modeling and services.

Dependence on Major Customers and Vendor

During fiscal year 2015, we had three customers that accounted for 69% of total revenue. During fiscal year 2014, we had two customers that accounted for 67% of total revenue. Although we are able to integrate and capture data from multiple devices, during fiscal years 2015 and 2014 we purchased substantially all of our products and supplies from one vendor. See Note 2 to the consolidated financial statements and Management's Discussion and Analysis of Financial Condition and Results of Operations.

Intellectual Property

Trademarks. We have registered certain of our trademarks with the United States Patent and Trademark Office, including ActiveCare®, ActiveOne®, and ActiveOne+®. We also use certain trademarks, trade names, and logos that have not been registered. We claim common law rights to these unregistered trademarks, trade names and logos. We also own domain names, including www.activecare.com, for our primary trademarks and we claim ownership of certain unregistered copyrights of our website content. We rely as well on a variety of property rights that we license from third parties as described below.

Patents. We own the exclusive, irrevocable, perpetual, worldwide, transferable, sublicensable license of all rights conferred by the patents, patent applications, and provisional patent applications listed in the table below.

|

Patent or

|

Country

|

Issue/Filing Date

|

Title of Patent

|

|

Application No.

|

|

|

|

|

|

|

11/486,989

|

United States

|

Pending 7/14/2006

|

Remote Tracking Device and System and Method for Two-Way Voice Communication Between Device and a Monitoring Center

|

|

11/486,991

|

United States

|

Pending 7/14/2006

|

Remote Tracking System and Device with Variable Sampling

|

|

11/830,398

|

United States

|

Pending 7/30/2007

|

Methods for Establishing Emergency Communications Between a Communications Device and a Response Center

|

|

12/614,242

|

United States

|

7/23/2015

|

Systems and Devices for Emergency Tracking and Health Monitoring

|

|

61/827,454

|

United States

|

Pending 5/24/2014

|

System and Method for Identifying, Tracking and Treating Chronic Illness Using Real-time Biometric Data

|

|

6,044,257

|

United States

|

3/28/2000

|

Panic Button Phone

|

|

6,636,732

|

United States

|

10/21/2003

|

Emergency Phone with Single Button Activation

|

|

6,226,510

|

United States

|

5/1/2001

|

Emergency Phone for Automatically Summoning Multiple Emergency Response Services

|

|

7,092,695

|

United States

|

8/15/2006

|

Emergency Phone with Alternate Number Calling Capability

|

|

7,251,471

|

United States

|

7/31/2007

|

Emergency Phone with Single Button Activation

|

|

Exclusive License

|

|

|

|

1/629,722

|

United States

|

Pending 12/15/2015

|

Nanosensors

|

|

1/501,466

|

United States

|

Pending 8/9/2006

|

Nanoscale Sensors

|

|

CT/US2007/006545

|

International

|

Pending 3/15/2007

|

Nonobioelectronics

|

|

CT/US2007/013700

|

International

|

Pending 7/11/2007

|

Nanosensors and Related Technologies

|

|

CT/US2007/024126

|

International

|

Pending 11/19/2007

|

High-Sensitivity Nanoscale Wire Sensors

|

|

Non-Exclusive License

|

|

|

|

10/588.833

|

United States

|

Pending 08/09/06

|

Nanostructures Containing Metal-Semiconductor Compounds

|

|

PCT/US2007/008540

|

International

|

Pending 04/06/07

|

Nanoscale Wires Methods and Devices

|

|

PCT/US2007/024222

|

International

|

Pending 11/20/06

|

Millimeter-Long Nanowires

|

|

PCT/US2007/021602

|

International

|

Pending 10/10/07

|

Liquid Films Containing Nanostructured Materials

|

|

6612985

|

International

|

9/2/2003

|

Method and System for Monitoring and Treating a Patient

|

Trade Secrets. We own certain intellectual property, including trade secrets, which we seek to protect, in part, through confidentiality agreements with employees and other parties, although some employees who are involved in research and development activities have not entered into these agreements. Even where these agreements exist, there can be no assurance that these agreements will not be breached, that we would have adequate remedies for any breach, or that our trade secrets will not otherwise become known to or independently developed by competitors.

Regulatory Matters

The testing, manufacture, distribution, advertising and marketing of medical devices in the United States is subject to extensive regulation by federal, state and local governmental authorities, including the Food & Drug Administration ("FDA"). Certain of our products may be subject to and required to receive regulatory clearances or approvals, as the case may be, before we may market them. Under United States law, a medical device is an article, which, among other things, is intended for use in the diagnosis of disease or other conditions, or in the cure, mitigation, treatment or prevention of disease, in man or other animals (see Food, Drug & Cosmetic Act (the "Act") § 201(h)).

Devices are subject to varying levels of regulatory control, the most comprehensive of which requires that a clinical evaluation be conducted before a device receives clearance or approval for commercial distribution. The FDA classifies medical devices into one of three classes. Class I devices are relatively simple and can be manufactured and distributed with general controls. Class II devices are somewhat more complex and require greater scrutiny. Class III devices are new and frequently help sustain life. Examples of the varying levels of regulatory control are described in the following paragraphs.

In the United States, a company generally can obtain permission to distribute a new device in two ways – through a Section 510(k) premarket notification application ("510(k) submission"), or through a Section 515 premarket approval ("PMA") application. The 510(k) submission applies to any device that is substantially equivalent to a "Predicate Device" (a device first marketed prior to May 28, 1976 or a device marketed after that date which was substantially equivalent to a pre-May 28, 1976 device). These devices are either Class I or Class II devices. Under the 510(k) submission process, the FDA will issue an order finding substantial equivalence to a Predicate Device and permitting commercial distribution of that device for its intended use. A 510(k) submission must provide information supporting its claim of substantial equivalence to the Predicate Device. The FDA permits certain low risk medical devices to be marketed without requiring the manufacturer to submit a premarket notification. In other instances, the FDA may not only require that a premarket notification be submitted, but also that such notification be accompanied by clinical data. If clinical data from human experiences are required to support the 510(k) submission, these data must be gathered in compliance with Integral Device Exemption ("IDE") regulations for clinical trials performed in the United States. The FDA review process for premarket notifications submitted pursuant to section 510(k) should take about 90 days on average, but it can take substantially longer if the FDA has concerns. Furthermore, there is no guarantee that the FDA will "clear" the device for marketing, in which case the device cannot be distributed in the United States. There is no guarantee that the FDA will deem the device subject to the 510(k) process, as opposed to the more time-consuming, resource intensive and problematic process described below.

We do not manufacture our own devices. We have contracted with a third party to manufacture the device for us. Manufacturers of medical devices are required to register with the FDA before they begin to manufacture devices for commercial distribution. As a result, any entity that manufactures products on our behalf will be subject to periodic inspection by the FDA for compliance with the FDA's Quality System Regulation ("QSR") requirements and other regulations. These regulations require us and our manufacturers to manufacture products and maintain documents in a prescribed manner with respect to design, manufacturing, testing and control activities. Further, we are required to comply with various FDA and other agency requirements for labeling and promotion. The Medical Device Reporting regulations require that we provide information to the FDA whenever there is evidence to reasonably suggest that a device may have caused or contributed to a death or serious injury or, if a malfunction were to occur, could cause or contribute to a death or serious injury. In addition, the FDA prohibits us from promoting a medical device for unapproved indications.

In the United States, Health Insurance Portability and Accountability Act ("HIPAA") regulations require national standards for some types of electronic health information transactions and the data elements used in those transactions, security standards to ensure the integrity and confidentiality of health information and standards to protect the privacy of individually identifiable health information. Covered entities under HIPAA, which include health care organizations such as our clients, our employer clinic business model and our claims processing, transmission and submission services, are required to comply with the privacy standards, the transaction regulations and the security regulations. As a business associate of our clients who are covered entities, we are generally required by contract to comply with the HIPAA regulations as they pertain to handling of covered client data. However, the extension of these HIPAA obligations to business associates by law has created additional liability risks related to the privacy and security of individually identifiable health information.

Employees

As of September 30, 2015, we had thirty four full-time and three part-time employees in the U.S. None of these employees are represented by a labor union or subject to a collective bargaining agreement. We have never experienced a work stoppage and our management believes that our relations with employees are good.

Additional Available Information

We maintain executive offices and principal facilities at 1365 West Business Park Drive, Suite 100, Orem, Utah, 84058. Our telephone number is (877) 219-6050. We maintain a website at www.activecare.com. The information on our website should not be considered part of this report. We make available, free of charge at our corporate website, copies of our annual reports filed under the Exchange Act with the United States Securities and Exchange Commission ("SEC") on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K, proxy statements, and all amendments to these reports, as soon as reasonably practicable after such material is electronically filed with or furnished to the SEC pursuant to Section 13(a) or 15(d) of the Exchange Act. We also provide copies of our Forms 8-K, 10-K, 10-Q, proxy and annual report at no charge to investors upon request.

All reports filed with the SEC are available free of charge through the SEC website at www.sec.gov. In addition, the public may read and copy materials we have filed with the SEC at the SEC's public reference room located at 450 Fifth St., N.W., Washington, D.C. 20549.

Item 1A. Risk Factors

We have identified the following important factors that could cause actual results to differ materially from those projected in any forward looking statements we may make from time to time. We operate in a continually changing business environment in which new risk factors emerge from time to time. We can neither predict these new risk factors, nor can we assess the impact, if any, of these new risk factors on our business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those projected in any forward-looking statement. If any of these risks, or combination of risks, actually occur, our business, financial condition and results of operations could be seriously and materially harmed, and the trading price of our common stock could decline.

Investors should also be aware that while we do, from time to time, communicate with securities analysts, it is against our policy to disclose to them any material non-public information or other confidential commercial information. Accordingly, stockholders should not assume that we agree with any statement or report issued by any analyst, regardless of the content of the statement or report. Furthermore, we do not confirm financial forecasts or projections issued by others. Thus, to the extent that reports issued by securities analysts contain any projections, forecasts, or opinions, such reports are not the responsibility of ActiveCare.

Because of our history of accumulated deficits, recurring losses and negative cash flows from operating activities, we must improve profitability and may be required to obtain additional funding if we are to continue as a "going concern."

We incurred negative cash flows from operating activities and recurring net losses in fiscal years 2015 and 2014. We had negative working capital at the end of each of those years. As of September 30, 2015 and 2014, our accumulated deficit was $91,840,158 and $78,327,447, respectively. These factors, among others, raise substantial doubt about our ability to continue as a going concern. The financial statements included with this report do not include any adjustments that might result from the outcome of this uncertainty. In order for us to remove substantial doubt about our ability to continue as a going concern, we must achieve profitability, generate positive cash flows from operating activities and obtain necessary debt or equity funding. If we are unable to increase revenues or obtain additional financing, we will be unable to continue the development of our products and services and we may have to cease operations.

Our financial statements have been prepared on the assumption that we will continue as a going concern. Our independent registered public accounting firm has issued its report dated January 13, 2016, which includes an explanatory paragraph stating that our recurring losses, negative cash flows from operating activities, negative working capital, negative total equity and certain debt that is in default, and other conditions, raise substantial doubt about our ability to continue as a going concern. It has been necessary to rely upon debt and the sale of our equity securities to sustain operations. Our management anticipates that we will require additional capital over the next 12 months to fund ongoing operations. There can be no guarantee that we will be able to obtain such funds, or obtain them on satisfactory terms, and that such funds would be sufficient. If such additional funding is not obtained, we may be required to scale back or discontinue operations.

Our profitability depends upon achieving success in our future operations through implementing our business plan, increasing sales, and expanding our customer base, for which there can be no assurance given.

Profitability depends upon many factors, including the success of our sales program, our ability to identify and obtain the rights to additional products to add to our existing product line, expansion of our customer base, maintenance or reduction of expense levels and the success of our business activities. We anticipate that we will generate operating income in the next 12 months. Our ability to achieve profitable operations will depend on our success in developing and maintaining valuable product and monitoring solutions, sales strategies, and strategic partnerships. There can be no assurance that we will be able to develop and maintain adequate resources to fund these goals. If adequate funds are not available, we may be required to materially curtail or cease operations.

Our products are not based entirely on technology that is proprietary to us, which means that we do not have a technological advantage over our competitors, and that we must rely on the owners of the proprietary technology that is the basis for our products to protect that technology. We have no control over such protection.

Our products utilize technology based in part on patents that have been licensed to us for use within our markets. Our success in adding to our existing product line will depend on our ability to acquire or otherwise license competitive technologies and products and to operate without infringing the proprietary rights of others, both in the United States and internationally. No assurance can be given that any licenses required from third parties will be made available on terms acceptable to us, or at all. If we do not obtain such licenses, we could encounter delays in product introductions while we attempt to adopt alternate sources. We could also find that the manufacture or sale of products requiring such licenses is not possible. Litigation may be necessary to defend against claims of infringement, to protect trade secrets or know‑how owned by us, or to determine the scope and validity of the proprietary rights of others. Such litigation could have an adverse and material impact on us and on our operations.

Our products are subject to the risks and uncertainties associated with the protection of intellectual property and related proprietary rights. We believe that our success depends in part on our ability to obtain and enforce patents, maintain trade secrets and operate without infringing on the proprietary rights of others in the United States and in other countries.

We own or have license rights under several patents; we have also applied for several additional patents and those applications are awaiting action by the United States Patent Office. There is no assurance those patents will issue or that when they do issue they will include all of the claims currently included in the applications. Even if they do issue, those new patents and our existing patents must be protected against possible infringement. The enforcement of patent rights can be uncertain and involve complex legal and factual questions. The scope and enforceability of patent claims are not systematically predictable with absolute accuracy. The strength of our own patent rights depends, in part, upon the breadth and scope of protection provided by the patent and the validity of our patents, if any.

We also rely on trade secrets laws to protect portions of our technology for which patent protection has not yet been pursued or is not believed to be appropriate or obtainable.

These laws may protect us against the unlawful or unpermitted disclosure of any information of a confidential and proprietary nature, including but not limited to our know-how, trade secrets, methods of operation, names and information relating to vendors or suppliers and customer names and addresses. We intend to protect this unpatentable and unpatented proprietary technology and processes, in addition to other confidential and proprietary information in part, by entering into confidentiality agreements with employees, collaborative partners, consultants and certain contractors. There can be no assurance that these agreements will not be breached, that we will have adequate remedies for any breach, or that our trade secrets and other confidential and proprietary information will not otherwise become known or be independently discovered or reverse-engineered by competitors.

Recent changes in insurance and health care laws have created uncertainty in the health care industry.

The Patient Protection and Affordable Care Act as amended by the Health Care and Education Reconciliation Act, each enacted in March 2010, generally known as the Health Care Reform Law, significantly expanded health insurance coverage to uninsured Americans and changed the way health care is financed by both governmental and private payers. We expect expansion of access to health insurance to increase the demand for our products and services, but other provisions of the Health Care Reform Law could affect us adversely. Additionally, further federal and state proposals for health care reform are likely. We cannot predict what further reform proposals, if any, will be adopted, when they may be adopted, or what impact they may have on us.

The collection, retention and disclosure of personal information and patient health information is regulated by law and subjects us and our business associates to potential liability for unauthorized disclosure and other use of such information.

State, federal and foreign laws, such as the federal Health Insurance Portability and Accountability Act of 1996 (HIPAA), regulate the confidentiality of sensitive personal information and the circumstances under which such information may be released. These measures may govern the disclosure and use of personal and patient medical record information and may require users of such information to implement specified security measures, and to notify individuals in the event of privacy and security breaches. Evolving laws and regulations in this area could restrict the ability of our customers to obtain, use or disseminate patient information, or could require us to incur significant additional costs to re-design our products in a timely manner to reflect these legal requirements, either of which could have an adverse impact on our results of operations. Other health information standards, such as regulations under HIPAA, establish standards regarding electronic health data transmissions and transaction code set rules for specified electronic transactions, for example, transactions involving claims submissions to third-party payers. These also continue to evolve and are often unclear and difficult to apply. In addition, under the federal Health Information Technology for Economic and Clinical Health Act (HITECH Act), which was passed in 2009, some of our business that was previously only indirectly subject to federal HIPAA privacy and security rules became directly subject to such rules because we may serve as "business associates" to persons or entities that are subject to these rules. On January 17, 2013, the Office for Civil Rights of the Department of Health and Human Services released a final rule implementing the HITECH Act and making certain other changes to HIPAA privacy and security requirements. Compliance with the rule was required by September 23, 2013, and increased the requirements applicable to some of our business. Failure to maintain the confidentiality of sensitive personal information in accordance with the applicable regulatory requirements, or to abide by electronic health data transmission standards, could expose us to breach of contract claims, fines and penalties, costs for remediation and harm to our reputation.

Our industry is fragmented, and we experience intense competition from a variety of sources, many of which are better financed and better managed than we are.

We face, and will continue to face, competition in the Chronic Illness Monitoring market. Many, if not most, of our competitors and potential competitors are much larger and consequently have greater access to capital. Moreover, many of our competitors have far greater name recognition and experience in the Chronic Illness Monitoring industry. There can be no assurance that competition from other companies will not render our products noncompetitive.

We are highly dependent on our executive officers and certain of our sales, technical and operations employees.

We depend heavily on our executive officers and certain sales, technical, and operations employees. The loss of services of any of these individuals could impede the achievement of our objectives. There can be no assurance that we will be able to attract and retain qualified executives, sales, or technical personnel on acceptable terms.

We rely on third parties to manufacture our product line.

We do not own or operate manufacturing facilities for the manufacture of our Chronic Illness Monitoring products. Consequently, we are dependent on these contract manufacturers for the production of our products and will depend on third-party manufacturing resources to manufacture products we may add to our product line in the future. During fiscal years 2015 and 2014, we purchased substantially all of our products and supplies from one vendor. Although there are other vendors who manufacture similar products and supplies, our systems would need to be modified to accommodate those products and supplies. A change in suppliers could cause a delay in providing products and services to customers and a possible loss of sales. In the event we are unable to obtain or retain third-party manufacturing, we will not be able to continue operations as they relate to the sale of products.

From time to time, we may be subject to expensive claims relating to product liability law; our ability to insure against this risk is limited.

The use of any of our existing or potential products in clinical settings may expose us to liability claims. These claims could be made directly by persons who assert that inaccuracies or deficiencies in their test results were caused by defects in our products. Alternatively, we could be exposed to liability indirectly by being named as a third-party defendant in actions brought against companies or persons who have purchased our products. We have obtained limited product liability insurance coverage and we intend to expand our insurance coverage on an as needed basis as sales revenue increases. However, insurance coverage is becoming increasingly expensive, and no assurance can be given that we will be able to maintain insurance coverage at a reasonable cost or in sufficient amounts to protect us against losses due to liability. There can also be no assurance that we will be able to obtain commercially reasonable product liability insurance for any products added to our product line in the future. A successful product liability claim or series of claims brought against us could have a material adverse effect on our business, financial condition and results of operations.

Ineffective internal controls could impact our business and operating results.

Our internal control over financial reporting may not prevent or detect misstatements because of its inherent limitations, including the possibility of human error, the circumvention or overriding of controls, or fraud. Even effective internal controls can provide only reasonable assurance with respect to the preparation and fair presentation of financial statements. If we fail to maintain the adequacy of our internal controls, including any failure to implement required new or improved controls, or if we experience difficulties in their implementation, our business and operating results may be harmed and we could fail to meet our financial reporting obligations.

Risks Related to Ownership of Our Common Stock

Concentration of ownership among our existing executive officers, directors and principal stockholders may prevent new investors from influencing significant corporate decisions.

Our executive officers, directors and principal stockholders own, in the aggregate, approximately 39% of our outstanding common stock. In addition, certain of our officers and our directors have been granted warrants to purchase common stock and own convertible Series D and Series E preferred stock. The exercise of such warrants and conversion of preferred stock might also result in substantial dilution to our existing stockholders. As a result of the ownership of the shares currently held, their ownership and potential exercise of these options and preferred stock, these stockholders may be able to exercise significant control over matters requiring stockholder approval, including the election of directors, amendment of our certificate of incorporation and approval of significant corporate transactions and will have significant control over our management and policies. The interests of these stockholders may not be consistent with the interests of all other stockholders.

This control or the potential for such control may have the effect of deterring hostile takeovers, delaying or preventing changes in control or changes in management, or limiting the ability of our other stockholders to approve transactions that they may deem to be in our best interests.

Penny stock regulations may impose certain restrictions on marketability of our securities.

The SEC has adopted regulations which generally define a "penny stock" to be any equity security that has a market price (as defined) of less than $5.00 per share or an exercise price of less than $5.00 per share, subject to certain exceptions. As a result, our common stock is subject to rules that impose additional sales practice requirements on broker-dealers who sell such securities to persons other than established customers and accredited investors (generally those with assets in excess of $1,000,000 or annual income exceeding $200,000, or $300,000 together with their spouse). For transactions covered by these rules, the broker-dealer must make a special suitability determination for the purchase of such securities and have received the purchaser's written consent to the transaction prior to the purchase. Additionally, for any transaction involving a penny stock, unless exempt, the rules require the delivery, prior to the transaction, of a risk disclosure document mandated by the SEC relating to the penny stock market. The broker-dealer must also disclose the commission payable to both the broker-dealer and the registered representative, current quotations for the securities and, if the broker-dealer is the sole market maker, the broker-dealer must disclose this fact and the broker-dealer's presumed control over the market. Finally, monthly statements must be sent disclosing recent price information for the penny stock held in the account and information on the limited market in penny stocks. Consequently, the "penny stock" rules may restrict the ability of broker-dealers to sell our securities and may affect the ability of investors to sell our securities in the secondary market and the price at which such purchasers can sell any such securities.

Investors should be aware that, according to the SEC, the market for penny stocks has suffered in recent years from patterns of fraud and abuse. Such patterns include:

|

•

|

Control of the market for the security by one or a few broker-dealers that are often related to the promoter or issuer;

|

| |

|

|

•

|

Manipulation of prices through prearranged matching of purchases and sales and false and misleading press releases;

|

| |

|

|

•

|

"Boiler room" practices involving high pressure sales tactics and unrealistic price projections by inexperienced sales persons;

|

| |

|

|

•

|

Excessive and undisclosed bid-ask differentials and markups by selling broker-dealers; and

|

| |

|

|

•

|

The wholesale dumping of the same securities by promoters and broker-dealers after prices have been manipulated to a desired level, along with the inevitable collapse of those prices with consequent investor losses.

|

Our management is aware of the abuses that have occurred historically in the penny stock market.

Our stock price may be volatile or may decline regardless of our operating performance, and you may not be able to resell your shares at or above the price you paid for them.

The market price of our common stock may fluctuate significantly in response to a number of factors, most of which we cannot control, including:

|

•

|

Market conditions or trends in our industry or the economy as a whole and, in particular, in the retail sales environment;

|

| |

|

|

•

|

Timing of promotional events;

|

| |

|

|

•

|

Changes in key personnel;

|

| |

|

|

•

|

Entry into new markets;

|

| |

|

|

•

|

Announcements by us or our competitors of new product offerings or significant acquisitions;

|

| |

|

|

•

|

Actions by competitors;

|

| |

|

|

•

|

The level of expenses associated with new product development and marketing;

|

| |

|

|

•

|

Changes in operating performance and stock market valuations of competitors;

|

| |

|

|

•

|

The public's response to press releases or other public announcements by us or third parties, including our filings with the SEC;

|

| |

|

|

•

|

The financial projections we may provide to the public, any changes in these projections or our failure to meet these projections;

|

| |

|

|

•

|

Changes in financial estimates by any securities analysts who follow our common stock, our failure to meet these estimates or failure of those analysts to initiate or maintain coverage of our common stock;

|

| |

|

|

•

|

The development and sustainability of an active trading market for our common stock;

|

| |

|

|

•

|

Future sales of our common stock by our officers, directors and significant stockholders;

|

| |

|

|

•

|

Other events or factors, including those resulting from war, acts of terrorism, natural disasters or responses to these events; and

|

| |

|

|

•

|

Changes in accounting principles.

|

In addition, the stock markets have recently experienced extreme price and volume fluctuations that have affected and continue to affect the market prices of equity securities of many retail companies. In the past, stockholders in some companies have instituted securities class action litigation following periods of market volatility. If we were involved in securities litigation, we could incur substantial costs and our resources, and the attention of management could be diverted from our business.

Anti-takeover provisions in our charter documents and Delaware law might discourage or delay acquisition attempts.

Our certificate of incorporation and bylaws contain provisions that may make the acquisition of our Company more difficult without the approval of our Board of Directors. These provisions:

|

·

|

Authorize the issuance of undesignated preferred stock, the terms of which may be established and the shares of which may be issued without stockholder approval, and which may include super voting, special approval, dividend, or other rights or preferences superior to the rights of the holders of common stock; and

|

| |

|

|

·

|

Establish advance notice requirements for nominations for elections to our Board of Directors or for proposing matters that can be acted upon by stockholders at stockholder meetings.

|

These anti-takeover provisions and other provisions under Delaware law could discourage, delay, or prevent a transaction involving a change in control of our Company, even if doing so would benefit our stockholders. These provisions could also discourage proxy contests and make it more difficult for you and other stockholders to elect directors of your choosing and to cause us to take other corporate actions you desire.

If securities or industry analysts do not publish research, or publish inaccurate or unfavorable research, about our business, our stock price and trading volume could decline.

Any future trading market for our common stock will depend in part on the research and reports that securities or industry analysts publish about us or our business. We do not currently have and may never obtain research coverage by securities and industry analysts. If no securities or industry analysts commence coverage of us, the trading price for our common stock would be negatively impacted. If we obtain securities or industry analyst coverage and if one or more of the analysts who covers us downgrades our common stock or publishes inaccurate or unfavorable research about our business, our stock price would likely decline. If one or more of these analysts ceases coverage of us or fails to publish reports on us regularly, demand for our common stock could decrease, which could cause our stock price and trading volume to decline.

We do not expect to pay any cash dividends on our common stock for the foreseeable future.

The continued operation and expansion of our business will require substantial funding. Accordingly, we do not anticipate that we will pay any cash dividends on shares of our common stock for the foreseeable future. Any determination to pay dividends on the common stock in the future will be at the discretion of our Board of Directors and will depend upon results of operations, financial condition, contractual restrictions, including our senior secured credit facility and other indebtedness we may incur, restrictions imposed by applicable law and other factors our Board of Directors deems relevant. No dividends may be paid on the common stock unless and until all accrued and unpaid dividends are paid on the preferred stock. Accordingly, if you purchase or own shares of our common stock, realization of a gain on your investment will depend on the appreciation of the price of our common stock, which may never occur. Investors seeking cash dividends in the foreseeable future should not purchase our common stock.

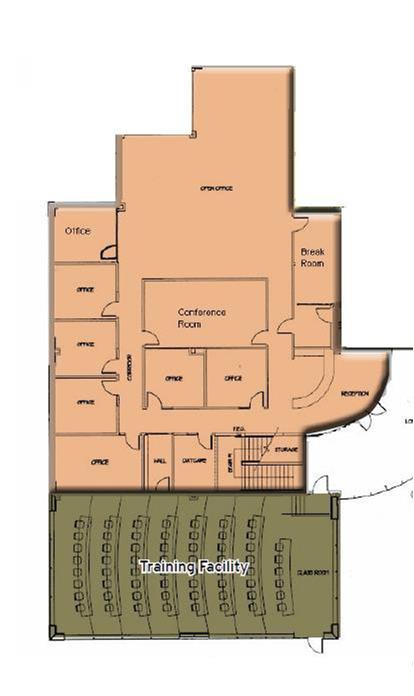

We sublease office facilities of approximately 6,900 square feet located at 1365 West Business Park Drive, Suite 100, Orem, Utah, 84058. This lease expires in July 2018 and the monthly rent is approximately $10,300 subject to annual adjustments.

Management believes the facilities described above are adequate to accommodate presently expected growth and needs of our operations.

Item 3. Legal Proceedings

On May 28, 2015, Fouzi, Al-Fouzan, an investor in the Company, filed a lawsuit against the Company, James Dalton, our Executive Chairman, ADP Management, an entity controlled by David Derrick, our former Executive Chairman, and 4G Biometrics, a wholly owned subsidiary of the Company in the District Court of Utah-Central Division (Case No. 2:15-CV-00373-BCW). The lawsuit alleges a breach of contract and seeks damages of $1,000,000 exclusive of interest and costs. The Company has engaged legal counsel regarding the matter. As the lawsuit is in its early stages, it is not possible to predict the outcome of the matter. The Company intends to vigorously dispute the litigation and believes it has meritorious defenses to the claims.

On November 4, 2015 the Company received a demand for payment of $275,000 from a former employee of the Company and former principle of 4G Biometrics who was terminated for cause in regards to his employment agreement. On December 4, 2015, the Company filed a complaint in the Third Judicial District Court in Salt Lake County, State of Utah (Case No. 150908531) against Kenith Lewis, a former employee, Randall K. Gardner, a former employee, and Darrell Meador, our President of Sales, the former owners of 4G Biometrics, seeking damages in excess of $300,000 related to alleged misrepresentations made to induce ActiveCare to acquire 4G Biometrics. As the lawsuit is in its early stages, it is not possible to predict the outcome of the matter.

Item 5. Market for Registrant's Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities

Market Information

Our common stock has traded on the OTCQB under the symbol "ACAR." The following table sets forth the range of high and low market prices of our common stock as reported for the periods indicated. The information is available online at http://finance.yahoo.com.

|

Fiscal Year Ended

|

|

High

|

|

|

Low

|

|

|

September 30, 2014

|

|

|

|

|

|

|

|

First Quarter

|

|

$

|

1.45

|

|

|

$

|

0.80

|

|

|

Second Quarter

|

|

$

|

1.00

|

|

|

$

|

0.60

|

|

|

Third Quarter

|

|

$

|

0.75

|

|

|

$

|

0.35

|

|

|

Fourth Quarter

|

|

$

|

0.61

|

|

|

$

|

0.22

|

|

| |

|

|

|

|

|

|

|

|

|

Fiscal Year Ended

|

|

High

|

|

|

Low

|

|

|

September 30, 2015

|

|

|

|

|

|

|

|

|

|

First Quarter

|

|

$

|

0.44

|

|

|

$

|

0.12

|

|

|

Second Quarter

|

|

$

|

0.43

|

|

|

$

|

0.05

|

|

|

Third Quarter

|

|

$

|

0.35

|

|

|

$

|

0.20

|

|

|

Fourth Quarter

|

|

$

|

0.28

|

|

|

$

|

0.11

|

|

| |

|

|

|

|

|

|

|

|

|

Fiscal Year Ended

|

|

High

|

|

|

Low

|

|

|

September 30, 2016

|

|

|

|

|

|

|

|

|

|

First Quarter

|

|

$

|

0.13

|

|

|

$

|

0.03

|

|

Holders

As of January 7, 2016, there were approximately 1,700 holders of record of our common stock and 79,486,837 shares of common stock outstanding. We have granted options and warrants for the purchase of 10,830,884 shares of common stock. We have issued and outstanding 70,070 shares of Series E preferred stock, 45,000 shares of Series D preferred stock, and 5,361 shares of Series F preferred stock. There are two holders of Series D preferred stock, 11 holders of Series E preferred stock and eight holders of Series F preferred stock. These shares of preferred stock are convertible into a total of 16,768,158 shares of common stock subject to the terms and conditions of their respective Designation of Rights and Preferences.

Dividends

Since incorporation, we have not declared any cash dividends on our common stock. We do not anticipate declaring cash dividends on our common stock for the foreseeable future. Our Series D preferred stock carries an 8% annual dividend rate. Our Series E preferred stock carries a 3.322% monthly dividend rate. Our Series F preferred stock carries an 8% annual dividend rate until April 30, 2015, 16% from May 1, 2015 until July 31, 2015, 20% from August 1, 2015 until October 31, 2015, and 25% thereafter.

Dilution