AMENDED AND RESTATED

MINERAL PRODUCT RECEIVABLES PURCHASE AGREEMENT

This AMENDED AND RESTATED MINERAL PRODUCT RECEIVABLES PURCHASE AGREEMENT (the “Agreement”), dated as of the 18th day of October, 2012 (the “Effective Date”), by and among ELKHORN GOLDFIELDS, INC. (“EGI”), a Montana corporation, and a majority owned, indirect subsidiary of Elkhorn Goldfields, LLC (“EGLLC”) and by and among the Persons identified as a Purchaser on Schedule “A” attached hereto and who have executed a counterpart of this Agreement as a Purchaser, as updated from time to time, the “Purchaser(s)”.

RECITALS

WHEREAS, EGI is the owner of the Golden Dream Mine, a gold-copper underground mine, located at 2725-A Elkhorn Road, Boulder, Montana;

WHEREAS, EGI is in the process of arranging financing to construct and operate the Golden Dream Mine;

WHEREAS, EGI entered into that certain Mineral Product Receivables Purchase Agreement, dated April 15, 2011 (“Original Agreement”), with EGLLC and Black Diamond Holdings LLC (“BDH”) to purchase 33,360 aggregate ounces of Payable Au;

WHEREAS, pursuant to that certain binding Letter of Intent entered into by BDH and EGI on August 20, 2012, EGI, EGLLC and BDH hereby desire to amend and restate the Original Agreement as set forth herein;

WHEREAS, the Parties to this Agreement acknowledge, agree and confirm that BDH has made aggregate Capital Contributions totaling $10,000,000 pursuant to the Original Agreement to purchase 33,360 aggregate ounces of Payable Au and for other consideration provided herein;

WHEREAS, pursuant to this Agreement, the parties acknowledge that potential new PURCHASER(S) may contribute up to an additional $15,391,200 in aggregate Capital Contributions to purchase 46,640 aggregate ounces of Payable Au and for other consideration as provided herein;

WHEREAS, EGI desires to sell and the PURCHASERS desire to purchase the Payable Au and this Agreement constitutes such definitive purchase agreement;

WHEREAS, Capital Contributions to be made by new PURCHASERS to EGI under this Agreement shall be used to complete the construction of the Golden Dream Mine in accordance with the Mine Plan;

WHEREAS, EGI has agreed to grant a security interest to the PURCHASERS to secure its obligations under this Agreement by executing and delivering the Amended and Restated Security Agreement to the PURCHASERS;

WHEREAS, the Parties are therefore desirous of executing and delivering this Agreement, all on and subject to the terms and conditions contained herein;

NOW THEREFORE, in consideration of the premises recited above which form part of this Agreement, the mutual covenants and agreements herein contained, and for other good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged by each of the Parties, the Parties mutually agree as follows:

AGREEMENT

1. Definitions.

“Act of God or Force Majeure” has the meaning set forth in Section 27(a).

“Allowable Deductions” means any and all charges withheld from proceeds to cover refining, treatment, processing and other charges, penalties, adjustments, shipping expenses and/or expenses pertaining to and/or in respect of Au sales and deliveries and charged by an Offtaker (excluding any adjustments made by the Offtaker based on the Offtaker’s analysis of the assays of Au contained in the Minerals or Concentrate), charged or imposed in respect of delivery costs to the final customer of the respective Purchaser or charged to or burdening the net interest of EGI as and by way of royalty payments, as the case may be.

“Annual Report” means a written report, in relation to any calendar year, detailing: (i) the number of ounces of Au produced and recovered from the Golden Dream Mine and delivered to an Offtaker in the applicable calendar year; (ii) the names and addresses of each Offtaker to which the Au referred to in subsection (i) was delivered; (iii) the number of ounces of Payable Au which have resulted or which are estimated to result from the Au deliveries to Offtakers referred to in subsection (i); (iv) if necessary, a reconciliation between the number of ounces of Payable Au provisionally identified in an Annual Report for a preceding calendar year and the final number of ounces of Payable Au actually realized for the applicable calendar year; and (v) the Au price assumptions used by EGI and its affiliates for short term and long term planning purposes with respect to the Golden Dream Mine.

“Au” means gold.

“Business Day” means any day other than a Saturday or Sunday or a day that is a federal holiday in the United States of America.

“Capital Contribution” means each PURCHASERS cash payment aggregating a total of up to $25,391,200 million to EGI as set forth on Schedule “A”, as updated from time to time by the Parties.

“Closing” has the meaning set forth in Section 2.

“Closing Date” has the meaning set forth in Section 3(a).

“Commencement of Commercial Production” means such time as and when Payable Au totaling 1,000 ounces is produced from the Golden Dream Mine.

“Concentrate” means the product created by the beneficiation of Minerals derived from the Golden Dream Mine.

“Demanding Party” has the meaning set forth in Section 21(b).

“Dispute Notice” has the meaning set forth in Section 6(c)(i).

| 2 |

“Encumbrances” means any and all liens, charges, mortgages, encumbrances, pledges, security interests, royalties, proxies and third party rights or any other encumbrances of any nature whatsoever, whether registered or unregistered.

“Effective Date” means October 18, 2012.

“ESRI” means Eastern Resources, Inc., the parent company of EGLLC and EGI.

“Event of Default” has the meaning set forth in Section 12(a).

“Future Gold Streaming Agreement” means any Au purchase agreement entered into by EGI after the Effective Date of the Agreement that is subordinate in claims and rights to this Agreement and is undertaken to cure a violation of any Development and Operations Covenant. Such subordination shall mean no Au will be allocated to an FGSA until the PURCHASERS have received net proceeds from sales of Payable Au in an amount not less their Capital Contribution under this Agreement. After satisfaction of the immediately preceding condition, an FGSA will be pari-passu with this Agreement and will participate equally on a pro-rata basis. The terms and conditions of any FGSA are more fully described in the Oversight and Operations Committee Agreement, included herein as Exhibit “C”.

“Golden Dream Mine” - means the mineral claims owned or leased by EGI, as more fully described in Schedule “B”.

“In kind” means Refined Au, which may be payable by the applicable Offtaker to EGI or PURCHASER, as the case may be, on account of Payable Au pursuant to the provisions of the applicable Offtake Agreement.

“Inflation Accelerator” means an annual (compounded) inflation accelerator equal to 1.01.

“Losses” means any and all damages, claims, losses, liabilities, fines, injuries, costs, penalties and expenses (including reasonable legal fees).

“Lot” means the applicable quantity of Minerals delivered to and accepted by the Offtaker that is separately sampled and assayed so that EGI and the Offtaker can agree upon or verify the content of Au and other metals therein, all as set forth in the applicable Offtake Agreement.

“Majority Action” means a vote or action taken or a determination otherwise made at any time by each PURCHASER that has purchased more than 20,000 ounces of Payable Au as set forth on Schedule “A”.

“Material Adverse Change” means any one or more changes, events or occurrences which, in either case, either individually or in the aggregate are material and adverse to the relevant business operation or party hereto, other than any change, effect, event or occurrence: (i) relating to the global economy or securities markets in general; (ii) affecting the worldwide gold mining industry in general and which does not have a materially disproportionate effect on EGI on a consolidated basis, or (iii) resulting from changes in the price of gold in recognized markets; which general changes and market developments and amounts attributable thereto shall not be deemed to be relevant for the purpose of determining whether a "Material Adverse Change" has occurred or for purposes of any other determination of materiality for purposes of this Agreement.

“Mine Plan” EGI has projected that a probable underground mineral reserve of 1.17 million tons of gold (approximately 258,000 ounces) and 8.3 million pounds of copper is commercially exploitable from the Golden Dream Mine and has designed a “Mine Plan” aligned with this probable mineral reserve estimate relating to the construction required for the Golden Dream Mine.

| 3 |

“Minerals” means any and all economic, marketable Au metal bearing material, in whatever form or state, that are mined, extracted, removed, produced or otherwise recovered from the Golden Dream Mine, including any such material derived from any processing or reprocessing of any tailings originally derived from the Golden Dream Mine.

“Monthly Report” means a written report, in relation to a calendar month, detailing: (i) the number of ounces of Au produced and recovered from the Golden Dream Mine and delivered to an Offtaker in the applicable calendar month; (ii) the names and addresses of each Offtaker to which the Au referred to in clause (i) above was delivered; (iii) the number of ounces of Payable Au which have resulted or which are estimated to result from the Au referred to in clause (i) above; (iv) a reconciliation between any provisional number of ounces of Payable Au specified in a Monthly Report pursuant to clause (iii) above for a preceding calendar month and the final number of ounces of Payable Au for the applicable calendar month; and (v) the Au prices assumed by EGI and its affiliates for short term and long term planning purposes with respect to the Golden Dream Mine.

“Offtaker” means the counterparty to an Offtake Agreement.

“Offtake Agreement” means any refining, smelter, Concentrate purchase, Minerals purchase or processing agreement entered into by EGI with respect to Minerals.

“Offtake Payments” means cash or “in kind” payments in respect of Payable Au to be made by the Offtaker under the Offtake Agreements.

“OOC” means the Oversight and Operations Committee.

“Oversight and Operations Committee” means the supervisory committee established by the Oversight and Operations Agreement.

“Oversight and Operations Committee Agreement” means an agreement between the PURCHASERS and EGI as set forth in Exhibit “C”.

“Parties” means the Parties to this Agreement and “Party” means any one of the Parties.

“Payable Au” means, subject to any Payable Au Adjustments: (i) fifty percent (50%) of the Au mined, extracted, removed, produced or otherwise recovered from the Golden Dream Mine, less the number of ounces of Au deducted on account of the processing of such Au into Refined Au, for which net number of ounces EGI receives payment or Refined Au from an Offtaker pursuant to and in accordance with any Offtake Agreement for the first 160,000 aggregate ounces of Payable Au sold by EGI to the PURCHASERS (on a pro-rata basis consistent with Schedule “A”) hereunder; and (ii) fifteen percent (15%) of the Au mined, extracted, removed, produced or otherwise recovered from the Golden Dream Mine, less the number of ounces of Au deducted on account of the processing of such Au into Refined Au, for which net number of ounces EGI, as the case may be, receives payment or Refined Au from an Offtaker pursuant to and in accordance with any Offtake Agreement with respect to each ounce of Payable Au sold by the EGI to the PURCHASERS (on a pro-rata basis consistent with Schedule “A”) hereunder in excess of 250,000 aggregate ounces of Refined Au from the Golden Dream Mine.

“Payable Au Adjustments” means if any or all or the remaining Capital Contributions are not paid by any potential new PURCHASER(S), for the 46,640 aggregate ounces of Payable Au that may be purchased by such potential new PURCHASER(S) shall be proportionally reduced to correspond with the reduction of the $15,391,200 not paid to EGI as a Capital Contribution on a pro-rata basis.

| 4 |

“Payment Invoice” has the meaning set forth in Section 10(e).

“Person” means and includes individuals, corporations, bodies corporate, limited or general partnerships, joint stock companies, limited liability corporations, joint ventures, associations, companies, trusts, banks, trust companies, governments or any other type of organization, whether or not a legal entity.

“Port of Loading” means the port of loading the Minerals or Concentrate, as shall be specified in the applicable Offtake Agreement.

“Purchase Price” means, subject to any Purchase Price Adjustments: (i) with respect to the first 80,000 aggregate ounces of Payable Au sold by EGI to the PURCHASERS hereunder, the lesser of $500 per ounce or the latest Comex spot gold price, subject to the Inflation Accelerator; and (ii) with respect to each ounce of Payable Au sold by EGI to the PURCHASERS hereunder in excess of 250,000 aggregate ounces, the lesser of $600 per ounce or the latest Comex spot gold price, subject to the Inflation Accelerator. For the avoidance of doubt, the Purchase Price includes any and all Capital Contributions.

“PURCHASER Audit” has the meaning set forth in Section 6(e).

“PURCHASER Default Fee” has the meaning set forth in Section 12(d).

“Reference Price” means the market price used to determine the price for Refined Au in connection with a sale of Minerals under an Offtake Agreement. For greater certainty, “Reference Price” does not include Refining Adjustments.

“Refining Adjustments” means any refining charges, treatment charges, penalties, insurance charges, transportation charges, settlement charges, financing charges or price participation charges, or other similar charges or Deductions, regardless of whether such charges or Deductions are expressed as a specific metal deduction, separate and apart from the recovery rate pursuant to the terms of the applicable Offtake Agreement.

“Refined Au” means marketable metal bearing material in the form of Au that is refined to standards meeting or exceeding commercial standards for the sale of refined Au.

“Responding Party” has the meaning set forth in Section 21(b).

“Security Holder” means Gordon Synder, acting as Agent to the senior secured lenders of EGI.

“Term” has the meaning set forth in Section 4(a).

“Termination Notice” has the meaning set forth in Section 4(b).

“Transfer” when used as a verb, means to sell, grant, assign, encumber, pledge or otherwise dispose of or commit to dispose of, directly or indirectly, including through mergers, consolidations or asset purchases. When used as a noun, “Transfer” means a sale, grant, assignment, pledge or disposal or the commitment to do any of the foregoing, directly or indirectly, including through mergers, consolidation or asset purchase.

| 5 |

“Use of Proceeds” means the specified application of Capital Contributions included herein as Exhibit “D”.

2. Agreement of Purchase and Sale.

Subject to the terms and conditions of this Agreement and on a pro-rata basis consistent with each PURCHASER’S Capital Contribution, from and after the Effective Date the transactions contemplated herein (the “Closing”), EGI shall sell to the PURCHASERS and the PURCHASERS shall purchase from EGI for resale on terms and conditions contained in PURCHASER approved purchase contracts with Offtakers, the Payable Au, free and clear of any and all liens or Encumbrances other than the rights of Offtakers to receive product conforming to specifications, in consideration of those payments set forth in Section 3. EGI’s obligation under this Agreement shall be to sell and deliver the Payable Au in a manner consistent with the terms of this Agreement.

3. Purchase and Payment.

(a) In consideration of the delivery and sale of the Payable Au, each PURCHASER shall have paid its respective Capital Contributions to EGI upon its execution of this Agreement as set forth in Schedule “A”, in cash by wire transfer. Subject to Section 8 and Section 9, the date on which a PURCHASER executes Schedule “A” and makes its Capital Contribution shall be referred to herein as the “Closing Date”.

(b) During the Term, a PURCHASER shall receive net proceeds pursuant to the formula set forth in Section 10(d) upon EGI receiving an Offtake Payment. During the Term and upon a PURCHASER’S election thereto, the PURCHASERS shall make ongoing payments to EGI in cash or by wire transfer for each ounce of Payable Au sold and delivered by EGI to the PURCHASERS, on a pro-rata basis, under this Agreement pursuant to the provisions of Section 10, at a price per ounce of Payable Au equal to the Purchase Price.

(c) Commencing on the second year anniversary of the Effective Date, the Purchase Price shall be increased by multiplying the then applicable Purchase Price by the Inflation Accelerator.

In the event of any dispute between the Parties with respect to Section 3(b), either Party shall have the right to elect to have the matter settled in accordance with the dispute resolution procedures set forth in Section 21.

4. Term.

(a) The Term of this Agreement shall commence on the Effective Date and subject to Section 12, shall continue for the life of the Golden Dream Mine after the Effective Date (the “Term”).

(b) The PURCHASERS, subject to unanimous consent, may terminate the Term by providing to EGI, prior to the end of such Term, written notice of its intention to terminate the Term (“Termination Notice”).

5. Positive Covenants of EGI.

EGI covenants and agrees to, and in favor of the PURCHASERS as follows and acknowledges and agrees that the PURCHASERS are relying on such covenants in executing and delivering this Agreement:

| 6 |

(a) EGI shall only use the Capital Contributions to fund capital expenditures which are required to meet development, construction, completion and commissioning costs requirements of the Golden Dream Mine and for reasonable general and administrative fees and costs (including attorney’s fees) associated therewith, all in a manner consistent with the Mine Plan and Use of Proceeds.

(b) EGI shall limit spending on other properties to minimum levels as agreed upon between EGI and the PURCHASERS as described in the Mine Plan, until the Commencement of Commercial Production at the Golden Dream Mine in accordance with the Mine Plan.

(c) EGI shall notify the PURCHASERS, on a timely basis (and in any event within one (1) Business Day after ascertainment by EGI) of any material departure from the Mine Plan, including cost overruns (if any), as well as any negative material impact on Au to be produced from the Golden Dream Mine, either in amount or timing, together with the plans to rectify the situation, except as otherwise stipulated in the Oversight and Operations Committee Agreement.

(d) Until the Commencement of Commercial Production at the Golden Dream Mine, the Monthly Reports shall include information as to budgets and permitting status as well as monthly and annual operating reports and proposed budgets, which shall include Au production from the Golden Dream Mine.

(e) So long as the “New Purchaser” (as defined in the Oversight and Operations Committee Agreement) has purchased 20,000 ounces of Payable Au as provided for herein, EGI shall establish and maintain the OOC in accordance with the Oversight and Operations Committee Agreement.

6. Monthly Reports and Annual Reports.

(a) During the Term, after the first calendar month during which Au is mined, extracted, removed, produced or otherwise recovered from the Golden Dream Mine, being after the Commencement of Commercial Production, EGI shall deliver to each of the PURCHASERS a Monthly Report on or before the tenth (10) Business Day after the last day of each calendar month.

(b) During the Term, EGI shall deliver to each of the PURCHASERS, an Annual Report, on or before forty-five (45) days after the last day of each calendar year.

(c) Each PURCHASER shall have the right to dispute an Annual Report in accordance with the provisions of this Section 6. If a PURCHASER disputes an Annual Report: (i) such PURCHASER shall notify EGI in writing within ninety (90) days from the date of delivery of the applicable Annual Report that it disputes the accuracy of that Annual Report (or any part thereof) (the “Dispute Notice”); (ii) such PURCHASER and EGI shall have thirty (30) days from the date the Dispute Notice is delivered by the PURCHASER to resolve the dispute. If the PURCHASER and EGI have not resolved the dispute within the thirty (30) day period, the PURCHASER shall have the right to require EGI to cause the firm of certified public accountants engaged by EGI to audit or review the Annual Report to examine or re-examine the records relied upon with respect to the actual number of ounces of Payable Au and to determine the extent of any variance between such actual amount and the number of ounces of Payable Au as set out in the Annual Report. If the amount so determined varies by five percent (5%) or less from the number of ounces of Payable Au set out in the Annual Report, then the cost of the Auditor’s review and determination shall be for the account of the PURCHASER; (iv) if the Auditor’s review and determination concludes that the number of ounces of Payable Au varies by more than five percent (5%) from the number of ounces of Payable Au set out in the Annual Report, then the cost of the Auditor’s Report shall be for the account of EGI; and (v) if either the PURCHASER or EGI disputes the Auditor’s Report and such dispute is not resolved between the Parties within ten (10) days after the date of delivery of the Auditor’s Report, then such dispute shall be resolved by the dispute mechanism procedures set forth in Section 21.

| 7 |

(d) If a PURCHASER has made an overpayment to EGI in accordance with the provisions of Section 3(b), as determined in accordance with this Section 6, EGI shall forthwith refund to the PURCHASER(S), without setoff or deduction, the amount of any such overpayment and until paid, such refund shall bear interest at a rate of Prime plus two percent (2%) per annum. If the PURCHASER(S) have underpaid EGI in accordance with the provisions of Section 3(b), as determined in accordance with this Section 6, the PURCHASERS shall forthwith pay to EGI, without setoff, deduction or defalcation, the amount of any such underpayment and until paid, shall bear interest at a rate of Prime plus two percent (2%) per annum.

(e) If EGI does not deliver a Monthly Report or an Annual Report as required pursuant to this section, after the time specified therefore and after two (2) weeks of making a written request therefore, each PURCHASER shall have the right to perform or to cause its representatives or agents to perform an audit of EGI's books and records relevant to the production and delivery of Payable Au produced during the calendar month or calendar year in question (the "PURCHASER Audit"). EGI shall grant the PURCHASERS or its representatives or agents access to all such books and records on a timely basis. In order to exercise this right, PURCHASER must provide not less than seven (7) days’ written notice to EGI of its intention to conduct the PURCHASER Audit. If within seven (7) days of receipt of such notice, EGI delivers the applicable Monthly Report or Annual Report, as the case may be, then the PURCHASERS shall have no right to perform the PURCHASER Audit. If EGI delivers the applicable Monthly Report or Annual Report, as the case may be, before the delivery of the PURCHASER Audit, the applicable Monthly Report or Annual Report, as the case may be, shall be taken as final and conclusive, subject to the rights of the PURCHASERS as set forth in Section 6(c). Otherwise, absent any manifest or gross error in the auditor's report, the PURCHASER Audit shall be final and conclusive and EGI shall not have the right to dispute its findings.

7. INTENTIONALLY REMOVED.

8. Closing Conditions for the Benefit of the PURCHASERS.

The PURCHASERS shall not be obligated to complete the transactions contemplated in this Agreement unless, at or before the applicable Closing Date, each of the conditions listed below has been satisfied, it being understood that the said conditions are included for the exclusive benefit of the PURCHASERS. EGI shall take all such actions, steps and proceedings as are reasonably within their respective control as may be necessary to ensure that the conditions listed below are fulfilled at or before the Closing Date.

(a) The representations and warranties of EGI contained in Section 23 shall be true and correct, in all material respects, at the Closing Date.

(b) Each of EGI and the PURCHASERS shall have received any and all required consents or approvals, including without limitation, third Person consents and all governmental or regulatory consents in any applicable jurisdiction.

(c) The PURCHASERS shall have received all such other assurances, consents, agreements, documents and instruments as may be reasonably required by the PURCHASERS to complete the transactions contemplated by this Agreement, all of which shall be in form and substance satisfactory to the PURCHASERS, acting reasonably.

| 8 |

(d) EGI shall have executed, to and in favor of the PURCHASERS, the Security Agreement in substantially the form attached as Exhibit “A” (the “Security Agreement”), as security for the performance of its obligations to the PURCHASERS under this Agreement, the executed Security Agreement, which Security Agreement shall have been registered, filed or recorded in all offices, and all actions shall have been taken, that may be prudent or necessary to preserve, protect or perfect the security interest of Elkhorn Streaming under the Security Agreement.

(e) EGI and certain Purchasers shall have executed the Oversight and Operations Committee Agreement in substantially the form set forth in Exhibit “C” so long as the “New Purchaser” (as defined in the Oversight and Operations Committee Agreement) has purchased 20,000 ounces of Payable Au as provided for herein.

(f) EGI shall provide an officer’s certificate in a form and substance reasonably satisfactory to the PURCHASERS that (i) confirms the representations and warranties of EGI contained in Section 23 are true and correct, in all material respects, at the Closing Date and (ii) the Mine Plan is true and correct, in all material respects, as of the Effective Date.

If any condition contained in this Section 8 has not been fulfilled at or before the Closing Date or if any such condition is or becomes impossible to satisfy, other than as a result of the failure of EGI to act in good faith, using reasonable commercial efforts to procure the satisfaction of any such unfulfilled condition, then if the PURCHASERS are unwilling to waive the fulfillment of any such condition, this Agreement shall be terminated and each of the Parties shall be released from all of their obligations hereunder save and except as provided in Sections 20, 21 and 28.

9. Closing Conditions for the Benefit of EGI.

EGI shall not be obligated to complete the transaction contemplated in this Agreement unless, at or before the Closing Date, each of the conditions listed below has been satisfied, it being understood that the said conditions are included for the exclusive benefit of EGI. The PURCHASERS shall take all such actions, steps and proceedings as are reasonably within its control as may be necessary to ensure that the conditions listed below are fulfilled at or before the Closing Date.

(a) The representations and warranties of the PURCHASERS contained in Section 22 shall be true and correct, in all material respects, at the Closing Date.

(b) Each of EGI and the PURCHASERS shall have received any and all required consents or approvals, including without limitation, third Person consents and all governmental or regulatory consents in any applicable jurisdiction.

(c) EGI shall have received all such other assurances, consents, agreements, documents and instruments as may be reasonably required by EGI to complete the transactions contemplated by this Agreement, all of which shall be in form and substance satisfactory to EGI, acting reasonably.

(d) The PURCHASERS shall make their respective Capital Contributions as set forth in Schedule “A” as updated from time to time as provided in Section 3.

If any condition contained in this Section 9 has not been fulfilled at or before the Closing Date or if any such condition is or becomes impossible to satisfy, other than as a result of the failure of the PURCHASERS to act in good faith, using reasonable commercial efforts to procure the satisfaction of any such unfulfilled condition, then if EGI is unwilling to waive the fulfillment of any such condition, this Agreement shall be terminated and each of the Parties shall be released from all of their obligations hereunder save and except as provided in Sections 20, 21 and 28.

| 9 |

10. Delivery of Minerals, Payments and Invoicing.

(a) During the Term, EGI shall be a party to the Offtake Agreements and EGI shall be responsible for delivering all Minerals or Concentrate to each Offtaker, in such quantity, quality, description and amounts and at such times and places as required under and in accordance with each Offtake Agreement. EGI shall promptly deliver to the PURCHASERS once available and/or prepared, copies of all documents, certificates and instruments pertaining to each Lot, including without limitation, all invoices, credit notes, bills of lading, certificates indicating EGI’s provisional shipped moisture content and provisional shipped assays and any and all documentation prepared or produced by the Offtaker in respect of the Au, including without limitation, all analyses and assays.

(b) All Deductions relating to the delivery of each Lot shall be borne by EGI.

(c) All deliveries of Minerals or Concentrate, in accordance with Section 10(a), shall be made subject to withholding or deduction from the gross amount received as payment from the Offtaker for, or on account of any present or future production severance, taxes, duties, assessments, sales and excise taxes, tariffs or governmental charges of whatsoever nature imposed or levied on such delivery by or on behalf of any governmental authority having power and jurisdiction to tax and for which EGI is required by law to withhold, collect, deduct and remit to such governmental authority.

(d) EGI shall issue to each PURCHASER a Statement of Account (the “EGI Statement”) within ten (10) Business Days of the month following the month in which the Lot or Lots were received by the Offtaker. The EGI Statement shall describe the quantity of Payable Au ounces, the price received per ounce of Au and allowable Deductions. The EGI Statement shall also include the net amount payable to the PURCHASERS (on a pro-rata basis consistent with Schedule “A”) as calculated as:

For the first 160,000 ounces of Payable Au sold from the Golden Dream Mine:

Net amount due to the PURCHASERS = Payable Au ounces sold multiplied by fifty percent (50%) multiplied by the price per ounce of Au received less the Purchase Price per ounce of Au less Allowable Deductions.

In equation form the calculation is:

Net amount due the PURCHASERS = (Payable Au ounces sold x 50% x (price per ounce Au received - the Purchase Price)) - Allowable Deductions.

For Payable Au ounces sold from the Golden Dream Mine exceeding 250,000 Au ounces:

Net amount due to the PURCHASERS = Payable Au ounces sold multiplied by fifteen (15%) multiplied by the price per ounce of Au received less the Purchase Price per ounce of Au less Allowable Deductions.

In equation form the calculation is:

Net amount due the PURCHASERS = ((Payable Au ounces sold x 15% x (price per ounce Au received - the Purchase Price)) - Allowable Deductions.

(e) EGI shall pay by wire or Automated Clearing House the net amount due as determined in Section 10(d) to each PURCHASER within three (3) Business Days of EGI receiving an Offtake Payment (“Payment Invoice”).

| 10 |

11. Title, Risk of Loss and Insurance.

(a) EGI shall retain title to all Au contained in each Lot of Minerals or Concentrate until title is passed to an Offtaker in accordance with the terms of the applicable Offtake Agreement, including without limitation, on the making of provisional payments and/or advance payments by the Offtaker to EGI.

(b) Risk of loss or damage to all Au contained in each Lot of Minerals or Concentrate shall at all times remain with EGI until risk of loss or damage with respect to such Lot of Minerals or Concentrate passes to the applicable Offtaker or to a transporter in accordance with the terms of the Offtake Agreement to which such Offtaker is a party.

(c) Insurance in respect of each Lot of Minerals or Concentrate shall be procured and maintained by EGI at its cost against risk of loss, theft or product damage up until the time that risk of loss or damage passes to the applicable Offtaker or transporter in accordance with the terms of the applicable Offtake Agreement. EGI shall acquire and maintain adequate insurance for and in respect of each Lot of Minerals or Concentrate in accordance with the terms of the Offtake Agreements (and normal industry standards and practice) during the Term and shall deliver proof of such insurance to the PURCHASERS (including insurance obtained by each Offtaker) as well as at the Commencement of Commercial Production and thereafter upon the written request of a PURCHASER. Insurance in respect of each Lot of Minerals or Concentrate shall be covered by and shall be the responsibility of the applicable Offtaker at the time that risk of loss or damage passes to such Offtaker.

(d) In the event of a partial or total loss of a shipment of Minerals or Concentrate before or after title to Au has passed from EGI to the Offtaker and prior to receipt of payment in cash or “in kind” for the Payable Au, each PURCHASER, on a pro-rata basis consistent with Schedule “A”, shall be entitled to receive from: (i) EGI for the Payable Au contained in the shipment of Minerals or Concentrate: (1) final payment (for total loss) in accordance with Bill of Lading weight, along with moisture and assays determined from samples taken at the time of loading or immediately prior to loading, with the cargo being deemed to have arrived thirty (30) days after the Bill of Lading date; and (2) final payment (for partial loss), with net dry weight based on Bill of Lading weight adjusted for moisture on the safely delivered Minerals or Concentrate and assays determined from samples taken from the safely delivered Minerals or Concentrate; in each case as if the Payable Au had been sold and delivered pursuant to this Agreement on the date of loss; and (ii) from the Offtaker, the insurance proceeds for the Payable Au contained in the shipment of Minerals or Concentrate, with respect to the payment for partial or total loss of the Minerals or Concentrate as provided in the applicable Offtake Agreement, as if the Payable Au had been sold and delivered pursuant to this Agreement on the date of loss. If EGI shall receive any such payment from the Offtaker in error, EGI shall forthwith deliver the same to the PURCHASERS, on a pro-rata basis consistent with Schedule “A”, (and in any event within one (1) Business Day thereafter) without deduction or set-off. EGI covenants to enforce any and all title rights as are contained in the Offtake Agreements if there shall be loss or damage to the Minerals or Concentrate after title has passed from EGI to the PURCHASERS to the Offtaker.

| 11 |

12. Early Termination.

(a) The Parties (EGI acting as one Party for the purposes of this section) may terminate this Agreement at any time by mutual written consent. In addition, each Party shall have the right to terminate this Agreement effective upon ten (10) days’ prior written notice to the other Party, if any of the following shall occur (each, an “Event of Default”): (i) the other Party defaults in any material respect in the performance of any of its covenants or obligations contained in this Agreement and such default is not remedied to the reasonable satisfaction of the non-defaulting Party within thirty (30) days after written notice to the other Party (provided that no notice of a default given under Section 12 shall be deemed to establish the existence of a default unless it has in fact occurred), or if such default is not capable of rectification within thirty (30) days, the other Party has not promptly commenced to rectify the default within such thirty (30) day period, and thereafter proceeds diligently to rectify same; or (ii) the other Party makes an assignment for the benefit of creditors or is the voluntary or involuntary subject of any proceedings under any bankruptcy or insolvency law which proceedings remain undischarged for a period of sixty (60) days, or if a receiver or receiver/manager is appointed for all or any substantial part of its property and business and such receiver or receiver/manager remains undischarged for a period of sixty (60) days, or if the corporate existence of the other Party is terminated by voluntary or involuntary dissolution or winding-up (other than by way of amalgamation or reorganization). Notwithstanding the foregoing, in the case of any Event of Default applicable to all PURCHASERS, the remedies of the PURCHASERS shall be exercised by the PURCHASERS acting pursuant to Majority Action. In connection therewith, the PURCHASERS may, among other things, appoint by Majority Action one or more among themselves to act on behalf of all with respect to an Event of Default and the exercise and defense of the rights of the PURCHASERS.

(b) Notwithstanding any other provision of this Agreement, EGI shall have no right to terminate this Agreement.

(c) Notwithstanding the termination of this Agreement in accordance with the terms hereof, the Parties agree to fulfill and perform all of their respective covenants and obligations that arise prior to the date of termination.

(d) If an Event of Default as set forth in Section 12(a) occurs and is continuing: (i) if the non-defaulting Party is the PURCHASERS, the PURCHASERS shall have the right, upon written notice to EGI, at its option, to demand repayment of the Capital Contribution (the “EGI Default Fee”), without interest, at the time of the occurrence of the applicable Event of Default; and (ii) if the non-defaulting Party is EGI, EGI shall have the right, upon written notice to the PURCHASERS, at their option, to retain the Purchase Price received to such date (the “PURCHASER Default Fee”).

Upon demand from the PURCHASERS, which demand shall include a calculation of the EGI Default Fee, EGI shall promptly pay the EGI Default Fee in cash by wire transfer, in immediately available funds, to a bank account designated by each respective PURCHASER.

(e) The Parties hereby acknowledge that: (i) each Party will be damaged by an Event of Default; (ii) it would be impracticable or extremely difficult to fix the actual damages resulting from the Event of Default; (iii) any sums payable or retainable pursuant to the EGI Default Fee or the PURCHASER Default Fee, as the case may be, are in the nature of liquidated damages, not a penalty and are fair and reasonable; and (iv) any payment made or retained pursuant to the EGI Default Fee or the PURCHASER Default Fee, as the case may be, with respect to an Event of Default Represents fair compensation for the Losses that may reasonably be anticipated from such Event of Default in full and final satisfaction of all amounts owed in respect of such Event of Default.

| 12 |

13. Offtake Agreements.

(a) EGI shall notify the PURCHASERS in writing when it commences negotiations to enter into an Offtake Agreement or Offtake Agreements, from time to time. EGI shall negotiate the Offtake Agreements in accordance with the terms of Section 10. For greater certainty and without limitation, the Offtake Agreements shall clarify that title to the Minerals or Concentrate shall pass to such Offtaker upon the making of advance and/or provisional payments by such Offtaker. EGI shall provide the PURCHASERS with the proposed terms and conditions of any Offtake Agreement and/or subsequent amendments to the material terms and conditions of any Offtake Agreement prior to concluding a binding agreement or amendment. Each Offtake Agreement shall be on arm’s length commercial terms, consistent with normal industry standards and practice. EGI shall not enter into any Offtake Agreement nor amend or modify any Offtake Agreement if, by Majority Action, the PURCHASERS have notified EGI after receipt of the proposed terms and conditions of any such Offtake Agreement pertaining to the sale and purchase of Au or any amendment thereto that in the PURCHASERS reasonable opinion, the subject agreement or amendment would disadvantage the PURCHASERS in material respects, including without limitation, by reason of an increase in the number of ounces of Au deducted on account of Au content. In the event of EGI’s receipt of such notice from the PURCHASERS, EGI shall confer with the PURCHASER to determine acceptable terms and conditions for the Offtake Agreement and/or Offtake Agreement amendment prior to the execution and delivery thereof.

(b) EGI hereby agrees to indemnify and hold the PURCHASERS and its managers, directors, officers and employees harmless from and against any and all Losses incurred or suffered by any of them arising out of or in connection with or related to any breach or default of the obligation to secure, by Majority Action, the PURCHASERS approval of terms of an Offtake Agreement. The foregoing indemnity shall not apply to any reduced amount received as a result of any terms of a PURCHASER-approved Offtake Agreement related to adjustments for quality or otherwise. This Section 13(b) shall survive the termination of this Agreement

14. INTENTIONALLY REMOVED.

15. Books; Records; Inspections.

EGI shall keep true, complete and accurate books and records of all of its operations and activities with respect to the Golden Dream Mine, including the mining of Minerals there from and the mining and transportation of Minerals including Au, prepared in accordance with GAAP, consistently applied. Subject to the Confidentiality provisions of this Agreement and in addition to the provisions of Section 6(e), each PURCHASER and its authorized representatives shall be entitled to perform audits or other reviews and examinations of the books and records of EGI relevant to the delivery of Minerals including Au pursuant to this Agreement four (4) times per calendar year to confirm compliance by EGI with the terms of this Agreement. The PURCHASER shall diligently complete any audit or other examination permitted hereunder. For greater certainty and without limitation, each PURCHASER shall have access to all documents provided by the Offtaker to EGI or by EGI to an Offtaker, as contemplated under the Offtake Agreements or which otherwise relate to the Minerals vis-a-vis the Offtaker and that are, in any manner, relevant to the calculation of Payable Au or the delivery and credit in respect thereof, in each instance. The expenses of any audit or other examination permitted in this section shall be paid by the PURCHASER, unless the results of such audit or other examination permitted in this section, disclose a discrepancy in calculations made by EGI of equal to or greater than five percent, in which event the reasonable costs of such audit or other examination shall be paid by EGI.

16. Conduct of Mining Operations, etc.

(a) Subject to Section 16(e), all decisions concerning methods, the extent, times, procedures and techniques of any: (i) exploration, development and mining related to the Golden Dream Mine, including spending on capital expenditures; (ii) leaching, milling, processing or extraction or refining treatment; and (iii) materials to be introduced on or to the Golden Dream Mine shall be made by EGI in its sole and absolute discretion, subject to the provisions of Sections 5 and 16(i) and as otherwise stipulated in the Oversight and Operations Committee Agreement attached as Exhibit “C”. For greater certainty and without limitation, the foregoing shall in no way be in derogation of the rights of EGI, acting as a commercially and economically prudent mine operator, to curtail, suspend or terminate mining operations in respect of some or all of the Golden Dream Mine, subject to the provisions of Section 16(i).

| 13 |

(b) The PURCHASERS have no contractual rights relating to the development or operation of any of EGI’s operations, including without limitation, the Golden Dream Mine or any of its properties and the PURCHASERS shall not be required to contribute to any capital or exploration expenditures in respect of mining operations over and above the Capital Contributions. Except as provided in this Agreement, the PURCHASERS have no right, title or interest in and to the Golden Dream Mine.

(c) Save and except as provided in Sections 3(d) and 3(f), the PURCHASERS are not entitled to any form or type of compensation or payment from EGI if EGI does not meet forecasted mineral production targets with respect to the Golden Dream Mine in a specified period, if EGI discontinues or ceases operations from the Golden Dream Mine.

(d) This Agreement shall in no way be construed as containing any guarantee as to the delivery of any amount of Payable Au from the Golden Dream Mine on an annual basis or over the life of the Golden Dream Mine, subject to the provisions of Section 3(f).

(e) EGI shall perform or cause to be performed all mining operations and activities in respect of the Golden Dream Mine in a commercially prudent manner and in accordance with good mining, processing, engineering and environmental practices. For greater certainty and without limitation, both short term and long term Mine Planning and operations shall be carried out with prices for Au that are consistent with industry practices (i.e. near spot prices for short term planning and operations and long-term expected prices for long-term planning).

(f) At reasonable times and with EGI’s prior consent (which shall not be unreasonably withheld or delayed), at the sole risk and expense of the PURCHASER, such PURCHASER shall have a right of access by its representatives to the Golden Dream Mine and any mill, smelter, concentrator or other processing facility owned or operated by EGI and/or its respective affiliates and that is to process Minerals including Au for the purpose of enabling the PURCHASER to monitor compliance by EGI with the terms of this Agreement and to prepare technical reports on the Golden Dream Mine.

(g) EGI will cooperate with and will allow each PURCHASER access to technical information pertaining to the Golden Dream Mine to permit the PURCHASER to prepare technical reports on the Golden Dream Mine or to comply with the PURCHASERS disclosure obligations under applicable U.S. securities laws and/or stock exchange rules and policies, provided that: (i) to the extent permitted by law, each PURCHASER will use the same report writer as EGI to prepare all technical reports that the PURCHASER is required to prepare and to use the same reports as EGI (readdressed to the PURCHASER); and (ii) if the PURCHASER is unable to use the same report writer as EGI to prepare a required technical report, it will choose a Person to write the technical report that is acceptable to EGI, acting reasonably, and the PURCHASER will not finalize the technical report until EGI has been provided with a reasonable opportunity to comment on the contents of the technical report and the PURCHASER will act in good faith and will use its best efforts to incorporate EGI’s comments into the technical report to the extent EGI’s comments are made to conform the technical report with EGI’s existing disclosure. EGI will promptly deliver to the PURCHASERS any updated mineral reserve and mineral resource estimates produced that pertain to the Golden Dream Mine.

(h) EGI shall ensure that all Au produced from the Golden Dream Mine is processed in a prompt and timely manner. If EGI wishes to commingle the Minerals produced from the Golden Dream Mine with other Minerals, the same shall be subject to the prior written approval of a Majority Action by the PURCHASERS, acting reasonably, provided that the PURCHASERS are satisfied that it shall not be disadvantaged as a result of such commingling and further provided that a method is agreed upon by the PURCHASERS as one Party and EGI as a second Party to determine the quantum of Au produced from the Golden Dream Mine.

| 14 |

(i) EGI shall at all times during the Term, do and cause to be done all things necessary to maintain their respective corporate existence. EGI shall at all times during the Term, as the case may be, do all things necessary to maintain the Golden Dream Mine in good standing including paying all taxes owing in respect thereof. EGI, shall not abandon any of the claims or leases forming a part of the Golden Dream Mine or allow or permit any of the claims or leases forming a part of the Golden Dream Mine to lapse unless EGI provides evidence satisfactory to the PURCHASERS, acting reasonably, that it is not economical to mine Minerals from the claims or leases forming a part of the Golden Dream Mine that EGI proposes to abandon or let lapse.

17. INTENTIONALLY REMOVED.

18. Restricted Transfer Rights of EGI.

During the Term, EGI may not Transfer, in whole or in part: (a) the Golden Dream Mine; or (b) its rights and obligations under this Agreement; in each case, unless the following conditions are satisfied and upon such conditions being satisfied, in respect of such Transfer, EGI shall be released from its obligations under this section: (i) EGI shall provide the PURCHASERS with at least ten (10) Business Days prior written notice of its intent to Transfer; (ii) any purchaser, transferee or assignee shall have, in the opinion of a Majority Action by the PURCHASERS, acting reasonably, the financial, operational and technical capability to observe and perform the covenants, agreements and obligations of EGI under this Agreement; (iii) any purchaser, transferee or assignee agrees in writing in favor of the PURCHASERS to be bound by the terms of this Agreement, including without limitation, this section; and (iv) any transferee that is a mortgagee, chargeholder or encumbrancer agrees in writing in favor of the PURCHASERS to be bound by and subject to the terms of this Agreement in the event it takes possession of or forecloses on all or part of the Golden Dream Mine or any of the mining operations carried on by EGI on or in respect of the Golden Dream Mine and undertakes to obtain an agreement in writing in favor of the PURCHASERS from any subsequent purchaser or transferee of such mortgagee, chargeholder or encumbrancer that such subsequent mortgagee, chargeholder or encumbrancer will be bound by the terms of this Agreement including without limitation, this section.

19. Transfer Rights of the PURCHASERS.

(a) During the Term and until the payment of a PURCHASER’S Capital Contribution as provided for in Schedule “A”, a PURCHASER may not Transfer, in whole or in part, its rights and obligations under this Agreement, unless the following conditions are satisfied and upon such conditions being satisfied in respect of such Transfer, such PURCHASER shall be released from its obligations under this section: (i) the PURCHASER provides EGI with at least ten (10) Business Days prior written notice of its intent to Transfer its rights and obligations under this Agreement; (ii) any purchaser, transferee or assignee shall have the financial, operational and technical capability to observe and perform the covenants, agreements and obligations of the PURCHASER under this Agreement; (iii) any purchaser, transferee or assignee agrees in writing in favor of EGI to be bound by the terms of this Agreement, including without limitation, this section; (iv) any such transfer may not be made unless it is registered under the the Securities Act of 1933, as amended, or an exemption from such registration is available and established to the satisfaction of EGI and (v) any mortgagee, chargeholder or encumbrancer agrees in writing in favor of EGI to be bound by and subject to the terms of this Agreement, including without limitation, this section.

| 15 |

(b) During the Term and after the payment of a PURCHASER’S Capital Contribution as provided for in Schedule “A”, a PURCHASER shall have the right to Transfer, in whole or in part, its rights and obligations under this Agreement, upon the provision of ten (10) Business Days prior written notice to EGI and any such transfer may not be made unless it is registered under the Securities Act of 1933, as amended, or an exemption from such registration is available and established to the satisfaction of EGI, whereupon such PURCHASER shall be released from its obligations under this Agreement.

(c) Notwithstanding the foregoing, at all times throughout the Term, as the case may be, the PURCHASERS shall have the right to assign its rights and obligations under this Agreement, to a wholly-owned subsidiary of such PURCHASER (so long as such company remains a wholly-owned subsidiary of the PURCHASER throughout the Term or the Extended Term, as the case may be, subject to the provisions of Section 19(b)), on the provision of thirty (30) Business Days’ prior written notice to EGI and on the delivery to EGI of an unlimited guarantee with respect to the compliance by such subsidiary of all of the obligations of the PURCHASER under this Agreement, which such subsidiary shall assume. The guarantee shall be in form and substance satisfactory to the PURCHASER and EGI.

20. Confidentiality.

(a) Subject to Section 20(b), neither the PURCHASERS nor EGI, shall, without the express written consent of the other Party (which consent shall not be unreasonably withheld or delayed), disclose any non-public information in respect of the terms of this Agreement or otherwise received under or in conjunction with this Agreement, other than to its respective employees, agents, bankers and/or consultants for purposes related to the administration of this Agreement and/or requisite regulatory authorities in connection with the procurement of consents and approvals contemplated hereunder and neither Party shall issue any press releases concerning the terms of this Agreement without the consent of the other Party after the other Party has first reviewed the terms of such press release. Each Party agrees to reveal such information only to its respective employees, agents, bankers and/or consultants who need to know who are informed of the confidential nature of the information and who agree to be bound by the terms of this Section 20. In addition, neither Party shall use any such information for its own use or benefit except for the purpose of enforcing its rights under this Agreement.

(b) Notwithstanding the foregoing, each Party may disclose information obtained under this Agreement if required to do so for compliance with applicable laws, rules, regulations or orders of any governmental authority or stock exchange having jurisdiction over such Party or to allow a current or potential bona fide provider of finance to conduct due diligence provided that the other Party shall be given the right to review and object to the data or information to be disclosed prior to any public release subject to any reasonable changes proposed by such other Party.

21. Dispute Resolution.

(a) In the event of any dispute or difference arising out of or relating to this Agreement or the breach thereof, the Parties shall use their best efforts to settle such disputes in good faith negotiations. Keeping in mind their mutual interests, in order to reach a just and equitable resolution of the dispute satisfactory to all Parties, either party may make a written request to the other by sending a notice thereof for a meeting of representatives to resolve the dispute. If within five (5) business days after a meeting of such representatives, the parties have not succeeded in negotiating a resolution of the dispute, the Parties may mutually agree to submit the dispute to mediation on terms to be agreed to by both parties. The Parties will use reasonable efforts to set such mediation within fifteen business (15) days after the failure to reach a resolution by the representatives. Any disputes left unresolved after consultation/mediation shall be resolved by litigation as provided for in Section 28(c).

| 16 |

22. Representations and Warranties of each PURCHASER.

Each PURCHASER, acknowledging that EGI and EGLLC are entering into this Agreement in reliance thereon, hereby represents and warrants to EGI and EGLLC as follows:

(a) It is a limited liability company or corporation, as the case may be, duly and validly existing under the laws of its governing jurisdiction and is up to date in respect of all filings required by law or by any governmental authority.

(b) It has the requisite corporate power and capacity to enter into this Agreement and to perform its obligations hereunder. PURCHASER has received all requisite approvals with respect to the execution and delivery of this Agreement.

(c) This Agreement has been duly and validly executed and delivered by the PURCHASER and constitutes a legal, valid and binding obligation of PURCHASER enforceable against PURCHASER in accordance with its terms.

(d) It has not made an assignment for the benefit of creditors nor is it the voluntary or involuntary subject of any proceedings under any bankruptcy or insolvency law, no receiver or receiver/manager has been appointed for all or any substantial part of its properties or business and its corporate existence has not been terminated by voluntary or involuntary dissolution or winding up (other than by way of amalgamation or reorganization) and it is not now aware of any circumstance which, with notice or the passage of time, or both, would give rise to any of the foregoing.

(d) It is able to accommodate the economic risks associated with this Agreement and each PURCHASER has such knowledge and experience in financial and business matters that the PURCHASER is capable, either on his, her its own or together with his or her advisors and representatives, of evaluating the merits and risks of this Agreement. The PURCHASER has no need for liquidity in his, her or its investment. Each PURCHASER represents in writing that he, she or it is an “accredited investor” as defined by Rule 501 of Regulation D under the Securities Act attached hereto as Exhibit “B”.

23. Representations and Warranties of EGI.

EGI acknowledging that each PURCHASER is entering into this Agreement in reliance thereon, hereby represents and warrants to the PURCHASERS as follows:

(a) EGI is a Montana corporation duly and validly existing under the laws of its governing jurisdiction and EGI is up to date in respect of all filings required by law or by any governmental authority.

(b) EGI is a majority-owned, indirect subsidiary of Elkhorn Goldfields, LLC, a Delaware limited liability company.

(c) EGI has the requisite corporate power and capacity to enter into this Agreement and to perform its obligations hereunder. EGI has received all requisite board approvals with respect to the execution and delivery of this Agreement.

(d) This Agreement has been duly and validly executed and delivered by EGI and constitutes a legal, valid and binding obligation of EGI enforceable against EGI in accordance with its terms.

| 17 |

(d) EGI has not made an assignment for the benefit of creditors, subject to the Security Holder, nor is the voluntary or involuntary subject of any proceedings under any bankruptcy or insolvency law; no receiver or receiver/manager has been appointed for all or any substantial part of its respective properties or business and its respective corporate existence has not been terminated by voluntary or involuntary dissolution or winding up (other than by way of amalgamation or reorganization) and, to the knowledge of EGI, any circumstance which, with notice or the passage of time, or both, would give rise to any of the foregoing.

(e) EGI is not obligated, by virtue of a prepayment arrangement, a “take or pay” arrangement or any other arrangement to deliver Au mined from the Golden Dream Mine at some future time without then or thereafter receiving full payment therefore. No Person has any agreement, option, right of first refusal or right, title or interest or right capable of becoming an agreement, option, right of first refusal or right, title or interest, in or to the ownership, use or control of the Golden Dream Mine or any of the Au therein, thereon or thereunder or derived therefrom, subject to the Security Holder.

(f) EGI has all necessary corporate power to own the surface rights forming a part of the Golden Dream Mine and EGI is in material compliance with all material applicable laws and licenses, registrations, permits, consents and qualifications to which the surface rights forming a part of the Golden Dream Mine and the exploitation concessions appertaining thereto are subject.

(g) EGI has sufficient right, title or interest in and to the Golden Dream Mine in order for EGI to perform its obligations and enter into and complete the transactions contemplated in this Agreement, subject to the terms and conditions contained in this Agreement.

(h) EGI has and will deliver to each PURCHASER with each shipment of Minerals including Au, the entire legal and beneficial ownership of the removed Minerals free and clear of any and all Encumbrances, except as created by the Purchaser-approved Offtaking Agreement or subject to the Security Holder.

(i) EGI has provided to the PURCHASERS all information in its respective control or possession with respect to the Golden Dream Mine, as well as corporate matters pertaining to EGI, as requested by the PURCHASERS.

24. The PURCHASERS Security Interest in Payable Au.

The PURCHASERS Security Interest in Payable Au shall be as set forth in the Security Agreement attached hereto as Exhibit “A”.

25. Indemnity of the PURCHASERS.

Each Purchaser shall indemnify and save EGI, without duplication, and their respective directors, officers, employees and agents harmless from and against any and all actual Losses suffered or incurred by them that arise out of or relate to any failure of such Purchaser to timely and fully perform or cause to be performed all of the covenants and obligations to be observed or performed by such Purchaser pursuant to this Agreement. Notwithstanding the foregoing, each PURCHASER’S indemnification obligations provided herein shall be limited to such PURCHASERS Capital Contribution.

26. Indemnity of EGI.

EGI shall indemnify and save each PURCHASER and its managers, officers, employees and agents harmless from and against any and all actual Losses suffered or incurred by them, that arise out of or relate to any failure of EGI to timely and fully perform or cause to be performed all of the covenants and obligations to be observed or performed by EGI pursuant to this Agreement.

| 18 |

27. Force Majeure.

(a) Neither of the Parties will be liable for a breach of its obligations under this Agreement because of an event out of its control, such as acts of god or Force Majeure (each of which is referred to as an “Act of God or Force Majeure”), including without limitation, fire, storm, flood, explosion, war, disturbance, strike, legal or illegal stoppages, difficulty accessing the Golden Dream Mine because the surface owners refuse or third Persons that claim rights to the surface area or any other situation for which the Person that has the right to the benefit of this section is not responsible for the impossibility of continuing as agreed in this Agreement. For greater certainty and without limitation, an event of Force Majeure under the Offtake Agreements, shall to the extent applicable, constitute an Act of God or Force Majeure under this Agreement.

(b) All provisions of this Agreement will be extended for a period equal to the delay caused by an event derived from an Act of God or Force Majeure under the terms of Subsection 27(a), save and except that the Term shall only be extended if the period of the delay caused by an event derived from an Act of God or Force Majeure extends beyond a six (6) month period.

(c) The Party in the position described in Section 27(a) will take all measures necessary to eliminate the negative effects of any event caused by an Act of God or Force Majeure, and if possible, shall comply with its obligations appropriately. Notwithstanding the above, nothing herein implies that the Party must resolve a labor dispute hurriedly or that the Party is forced to challenge the validity of any rule, law, regulation or order from any government authority in order to comply with its obligations within the term established.

28. General Provisions.

(a) Each Party shall execute all such further instruments and documents and shall take all such further actions as may be necessary to effectuate the transactions contemplated in this Agreement, in each case at the cost and expense of the Party requesting such further instrument, document or action, unless expressly indicated otherwise.

(b) Nothing herein shall be construed to create, expressly or by implication, a joint venture, mining partnership, commercial partnership or other partnership relationship between EGI as one Party and the PURCHASERS as a second party.

(c) This Agreement shall be governed by, and construed in accordance with, the Laws of the State of Delaware without regard to the principles of conflicts of law thereof or any previous agreements to the contrary.

(d) Time is of the essence of this Agreement.

(e) INTENTIONALLY REMOVED.

(f) If any provision of this Agreement is wholly or partially invalid, this Agreement shall be interpreted as if the invalid provision had not been a part hereof so that the invalidity shall not affect the validity of the remainder of this Agreement which shall be construed as if this Agreement had been executed without the invalid portion.

| 19 |

(g) Any notice or other communication required or permitted to be given hereunder shall be in writing and shall be delivered by hand or transmitted by facsimile transmission addressed to:

If to EGI, to:

Elkhorn Goldfields, Inc.

1610 Wynkoop Street, Suite 400

Denver, CO

Attention: Robert Trenaman

Facsimile: (604) 689-4960

with a required copy to:

Messner & Reeves LLC

1430 Wynkoop Street, Suite 300

Denver, Colorado 80202

Attention: Mr. Steven Levine

Facsimile: (303) 623-0552

If to the PURCHASER, to the address and fax number set forth next to each respect PURCHASER’S signature on Schedule “A”:

Any notice given in accordance with this section, if transmitted by facsimile transmission, shall be deemed to have been received on the next Business Day following transmission or, if delivered by hand, shall be deemed to have been received when delivered.

(h) The Schedules that are attached to this Agreement are incorporated into this Agreement by reference and are deemed to form part hereof.

(i) This Agreement may not be changed, amended or modified in any manner, except pursuant to an instrument in writing signed on behalf of each of the Parties. The failure by any Party to enforce at any time any of the provisions of this Agreement shall in no way be construed to be a waiver of any such provision unless such waiver is acknowledged in writing, nor shall such failure affect the validity of this Agreement or any part thereof or the right of a Party to enforce each and every provision. No waiver or breach of this Agreement shall be held to be a waiver of any other or subsequent breach.

(j) Following the execution and delivery of this Agreement, if there shall occur any change in tax laws or other circumstances, each of the PURCHASERS and EGI will co-operate reasonably with the other Party in implementing any proposed adjustments to the structure of this Agreement to facilitate tax planning or other matters, provided that such adjustments have no material adverse impact on the non-proposing Party.

(k) This Agreement may be executed in one or more counterparts and by the Parties in separate counterparts, each of which when executed shall be deemed to be an original, but all of which when taken together shall constitute one and the same agreement. Delivery of an executed counterpart of a signature page to this Agreement by facsimile shall be effective as delivery of a manually executed counterpart of this Agreement.

| 20 |

(l) This Agreement shall inure to the benefit of and shall be binding on and shall be enforceable by the Parties and their respective, successors and permitted assigns.

(m) INTENTIONALLY REMOVED.

(n) This Agreement constitutes the entire agreement between the Parties pertaining to the subject matter hereof and supersedes all prior agreements, negotiations, discussions and understandings, written or oral, among the Parties.

*****Signature Page Follows*****

| 21 |

IN WITNESS WHEREOF, the Parties hereto have executed this Agreement as of the date and year first above written.

| ELKHORN GOLDFIELDS, LLC | ||

| By: | Patrick Imeson | |

| Title: | Manager | |

| ELKHORN GOLDFIELDS, INC. | ||

| By: | Robert Trenaman | |

| Title: | President | |

SCHEDULE “A”

PURCHASERS

|

Purchaser (Name and Address) |

|

Signature |

|

Aggregate Capital |

|

Ounces Acquired | |||

|

BLACK DIAMOND HOLDINGS LLC 1610 Wynkoop Street, Suite 400 Denver, CO 80202 Attention: Patrick W.M. Imeson |

BLACK DIAMOND HOLDINGS LLC

BLACK DIAMOND FINANCIAL GROUP, LLC, its manager |

$ | 10,000,000 | 33,360 | |||||

| By: Patrick W. M. Imeson | |||||||||

| Title: Manager | |||||||||

| {Insert name of new PURCHASER}, a {insert state of formation} {insert type of entity} | $ | [ ] | [ ] ounces | ||||||

| TOTAL OUNCES: | |||||||||

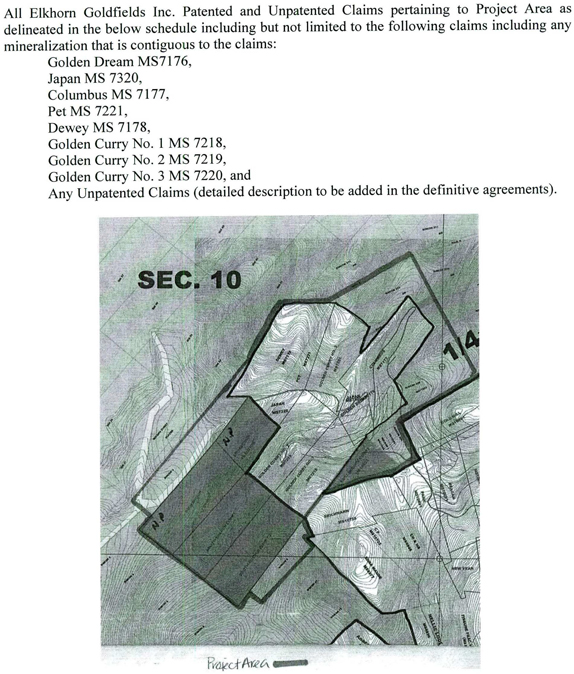

SCHEDULE “B”

Description of Golden Dream Mine

| 2 |