UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): April 6, 2012

EASTERN RESOURCES, INC.

(Exact name of registrant as specified in its charter)

| Delaware | 333-149850 | 45-0582098 |

| (State or Other Jurisdiction | (Commission File | (I.R.S. Employer |

| of Incorporation) | Number) | Identification Number) |

1610 Wynkoop Street, Suite 400

Denver, CO 80202

(Address of principal executive offices, including zip code)

(303) 893-2334

(Registrant’s telephone number, including area code)

Copy to:

Adam S. Gottbetter, Esq.

Gottbetter & Partners, LLP

488 Madison Avenue, 12th Floor

New York, NY 10022

Phone: (212) 400-6900

Facsimile: (212) 400-6901

166 East 34th Street, Suite 18K

New York, NY 10016

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

¨ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

¨ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

¨ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

¨ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Table of Contents

| Forward-Looking Statements | 3 | ||

| Explanatory Note | 5 | ||

| Item 1.01 | Entry into a Material Definitive Agreement | 5 | |

| Item 2.01 | Completion of Acquisition or Disposition of Assets | 6 | |

| The Merger and Related Transactions | 6 | ||

| Description of Business | 12 | ||

| Description of Properties | 37 | ||

| Risk Factors | 39 | ||

| Management’s Discussion and Analysis of Financial Condition and Plan of Operations | 55 | ||

| Security Ownership of Certain Beneficial Owners and Management | 67 | ||

| Directors, Executive Officers, Promoters and Control Persons | 69 | ||

| Executive Compensation | 75 | ||

| Summary Compensation Table | 75 | ||

| Certain Relationships and Related Transactions | 77 | ||

| Market Price of and Dividends on Common Equity and Related Stockholder Matters | 81 | ||

| Dividend Policy | 81 | ||

| Description of Securities | 84 | ||

| Legal Proceedings | 86 | ||

| Indemnification of Directors and Officers | 86 | ||

| Item 3.02 | Unregistered Sales of Equity Securities | 87 | |

| Item 5.01 | Changes in Control of Registrant | 88 | |

| Item 5.02 | Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers | 88 | |

| Item 9.01 | Financial Statements and Exhibits | 88 | |

| Glossary of Relevant Mining Terms | |||

| Signatures | |||

| 2 |

FORWARD-LOOKING STATEMENTS

This Current Report contains forward-looking statements, including, without limitation, in the sections captioned “Description of Business,” “Risk Factors,” and “Management’s Discussion and Analysis of Financial Condition and Plan of Operations,” and elsewhere. Any and all statements contained in this Report that are not statements of historical fact may be deemed forward-looking statements. Terms such as “may,” “might,” “would,” “should,” “could,” “project,” “estimate,” “pro-forma,” “predict,” “potential,” “strategy,” “anticipate,” “attempt,” “develop,” “plan,” “help,” “believe,” “continue,” “intend,” “expect,” “future,” and terms of similar import (including the negative of any of the foregoing) may be intended to identify forward-looking statements. However, not all forward-looking statements may contain one or more of these identifying terms. Forward-looking statements in this Report may include, without limitation, statements regarding (i) the plans and objectives of management for future operations, including plans or objectives relating to exploration programs, (ii) a projection of income (including income/loss), earnings (including earnings/loss) per share, capital expenditures, dividends, capital structure or other financial items, (iii) our future financial performance, including any such statement contained in a discussion and analysis of financial condition by management or in the results of operations included pursuant to the rules and regulations of the SEC, and (iv) the assumptions underlying or relating to any statement described in points (i), (ii) or (iii) above.

In addition to the specific statements referenced above and the factors identified under “Item 1A. Risk Factors” in this Current Report below, other uncertainties that could affect the accuracy of our forward-looking statements include:

| § | The effect of government regulations on our business; |

| § | Our ability to secure additional capital; |

| § | Unexpected changes in business and economic conditions, including the rate of inflation; |

| § | Changes in interest rates and currency exchange rates; |

| § | Timing and amount of production, if any; |

| § | Technological changes in the mining industry; |

| § | Our costs; |

| § | Changes in exploration and overhead costs; |

| § | Access and availability of materials, equipment, supplies, labor and supervision, power and water; |

| § | Results of current and future feasibility studies; |

| § | The level of demand for our products; |

| § | Changes in our business strategy, plans and goals; |

| § | Interpretation of drill hole results and the geology, grade and continuity of mineralization; |

| § | The uncertainty of mineralized material estimates and timing of development expenditures; |

| § | Commodity price fluctuations; |

| § | Operational and environmental risks associated with the mining industry; and |

| § | Lack of clear title to some of our mineral prospects. |

| 3 |

The forward-looking statements are not meant to predict or guarantee actual results, performance, events or circumstances and may not be realized because they are based upon our current projections, plans, objectives, beliefs, expectations, estimates and assumptions and are subject to a number of risks and uncertainties and other influences, many of which we have no control over. Actual results and the timing of certain events and circumstances may differ materially from those described by the forward-looking statements as a result of these risks and uncertainties. Factors that may influence or contribute to the inaccuracy of the forward-looking statements or cause actual results to differ materially from expected or desired results may include, without limitation, our inability to obtain adequate financing, insufficient cash flows and resulting illiquidity, our inability to expand our business, government regulations, lack of diversification, volatility in the price of gold, zinc, silver, lead and copper, increased competition, results of arbitration and litigation, stock volatility and illiquidity, and our failure to implement our business plans or strategies. A description of some of the risks and uncertainties that could cause our actual results to differ materially from those described by the forward-looking statements in this Report appears in the section captioned “Risk Factors” and elsewhere in this Report.

Readers are cautioned not to place undue reliance on forward-looking statements because of the risks and uncertainties related to them and to the risk factors. We disclaim any obligation to update the forward-looking statements contained in this Report to reflect any new information or future events or circumstances or otherwise.

Readers should read this Report in conjunction with the discussion under the caption “Risk Factors,” our financial statements and the related notes thereto in this Report, and other documents which we may file from time to time with the Securities and Exchange Commission (the “SEC”).

| 4 |

EXPLANATORY NOTE

We were incorporated as Eastern Resources, Inc., in Delaware on March 15, 2007. Prior to the Merger (as defined below), our business was to engage in the acquisition, production and distribution of independent films.

As used in this Current Report, unless otherwise stated or the context clearly indicates otherwise, the term “ESRI” refers to Eastern Resources, Inc., before giving effect to the Merger, the term “MTMI” refers to Montana Tunnels Mining, Inc., a Delaware corporation, the term “EGI” refers to Elkhorn Goldfields, Inc., a Montana corporation, and the terms “Company,” “we,” “us,” and “our” refer to Eastern Resources, Inc., and its wholly-owned subsidiaries, including MTMI and EGI, after giving effect to the Merger.

On April 6, 2012, (i) MTMI Acquisition Corp., a Delaware corporation formed on February 27, 2012 and a wholly-owned subsidiary of ESRI (“MTMI Acquisition Sub”), merged with and into MTMI, a wholly-owned subsidiary of Elkhorn Goldfields LLC, a Delaware limited liability company (“EGLLC”), with MTMI as the surviving corporation and (ii) EGI Acquisition Corp., a Montana corporation formed on February 27, 2012 and a wholly-owned subsidiary of ESRI (“EGI Acquisition Sub”), merged with and into EGI, a wholly-owned subsidiary of EGLLC, with EGI as the surviving corporation (collectively, the “Merger”). As a result of the Merger and the Split-Off (as defined below), ESRI discontinued its pre-Merger business and acquired the business of MTMI and EGI, and will continue the existing business operations of MTMI and EGI as a publicly-traded company under the name Eastern Resources, Inc.

This Current Report contains summaries of the material terms of various agreements executed in connection with the transactions described herein. The summaries of these agreements are subject to, and are qualified in their entirety by, reference to these agreements, all of which are incorporated herein by reference.

This Current Report is being filed in connection with a series of transactions consummated by the Company and certain related events and actions taken by the Company.

This Current Report responds to the following Items in Form 8-K:

| Item 1.01 | Entry into a Material Definitive Agreement |

| Item 2.01 | Completion of Acquisition or Disposition of Assets | |

| Item 3.02 | Unregistered Sales of Equity Securities |

| Item 5.01 | Changes in Control of Registrant |

| Item 5.02 | Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers |

| Item 9.01 | Financial Statements and Exhibits |

Item 1.01 Entry into a Material Definitive Agreement

On April 6, 2012, ESRI, MTMI Acquisition Sub, EGI Acquisition Sub, MTMI, EGI and EGLLC entered into an Agreement and Plan of Merger and Reorganization (the “Merger Agreement”), which closed on the same date. Pursuant to the terms of the Merger Agreement, (i) MTMI Acquisition Sub merged with and into MTMI with MTMI as the surviving corporation and (ii) EGI Acquisition Sub merged with and into EGI with EGI as the surviving corporation. MTMI and EGI became wholly-owned subsidiaries of ESRI. For a description of the Merger and the material agreements entered into in connection with the Merger, see the disclosures set forth in Item 2.01 to this Current Report, which disclosures are incorporated into this Item by reference.

| 5 |

Item 2.01 Completion of Acquisition or Disposition of Assets

THE MERGER AND RELATED TRANSACTIONS

Merger Agreement

On April 6, 2012, ESRI, MTMI Acquisition Sub, EGI Acquisition Sub, MTMI, EGI and EGLLC entered into the Merger Agreement, which closed on the same date, and pursuant to which (i) MTMI Acquisition Sub merged with and into MTMI with MTMI as the surviving corporation and (ii) EGI Acquisition Sub merged with and into EGI with EGI as the surviving corporation. MTMI and EGI became wholly-owned subsidiaries of ESRI.

Pursuant to the Merger, we ceased to engage in the acquisition, production and distribution of independent films and acquired the business of MTMI and EGI to engage in exploration and production activities in the precious metals mining industry, as a publicly-traded company under the name Eastern Resources, Inc. See “Split-Off” below.

At the closing of the Merger, (i) each of the 100 shares of MTMI’s common stock issued and outstanding immediately prior to the closing of the Merger was converted into 45,000,000 shares of common stock, par value $0.001 per share (“Common Stock”), and 5,000,000 shares of Series A preferred stock, par value $0.001 per share (“Series A Preferred Stock” and, together with the Common Stock, the “Capital Stock”), of the Company and (ii) each of the 100 shares of EGI’s common stock issued and outstanding immediately prior to the closing of the Merger was converted into 45,000,000 shares of Common Stock and 5,000,000 shares of Series A Preferred Stock. As a result, an aggregate of 90,000,000 shares of our Common Stock 10,000,000 shares of our Series A Preferred Stock were issued to EGLLC, as the sole stockholder of each of MTMI and EGI. MTMI and EGI did not have any stock options or warrants to purchase shares of their capital stock outstanding at the time of the Merger.

The Merger Agreement contained customary representations and warranties and pre- and post-closing covenants of each party and customary closing conditions. Breaches of the representations and warranties will be subject to customary indemnification provisions, subject to specified aggregate limits of liability.

The Merger will be treated as a recapitalization of the Company for financial accounting purposes. MTMI and EGI will be considered the acquirers for accounting purposes, and the historical financial statements of ESRI before the Merger will be replaced with the historical combined financial statements of MTMI and EGI before the Merger in all future filings with the SEC.

The parties have taken all actions necessary to ensure that the Merger is treated as a tax-free exchange under Section 368(a) of the Internal Revenue Code of 1986, as amended.

The issuance of shares of Common Stock and Series A Preferred Stock to holders of MTMI’s and EGI’s capital stock in connection with the Merger was not registered under the Securities Act of 1933, as amended (the “Securities Act”), in reliance upon the exemption from registration provided by Section 4(2) of the Securities Act, which exempts transactions by an issuer not involving any public offering, and Regulation D promulgated by the SEC under that section. These securities may not be offered or sold in the United States absent registration or an applicable exemption from the registration requirement.

| 6 |

Merger Related Agreements

At the closing of the Merger, Dylan Hundley, a holder of 5,751,000 shares of our Common Stock prior to the Merger, surrendered to us for cancellation all of her shares. Ms. Hundley agreed to the surrender of her shares to enhance our ability to complete the Merger and the Split-Off (discussed below).

Also at the closing of the Merger, holders of approximately $270,000 of ESRI convertible promissory notes surrendered these notes to ESRI for cancellation. These note holders agreed to release ESRI from any obligations to them relating to the notes.

Tri-Party Agreement; Security Interest in MTMI and EGI Assets; and Pledge of Series A Preferred Stock

From time to time between 2006 and 2009, EGLLC and MFPI Partners, LLC, a Delaware limited liability company whose sole members are Michael Feinberg and Patrick Imeson (“MFPI”), raised approximately $6,000,000 and $13,000,000, respectively, through the sale of promissory notes to certain investors (the “Secured Lenders”). The notes issued by EGLLC included a $5,000,000 secured note issued in 2006 and a $1,000,000 secured bridge note issued in 2009 and subsequently repaid in April, 2011. The $5,000,000 secured note was revised in May of 2009 to include accrued interest. The revised note is in the principal amount of $5,800,000. The notes issued by MFPI included an $8,000,000 note issued in 2007 and a $5,000,000 note issued in 2008. The MFPI notes were revised in May of 2009 to include accrued interest. The revised notes are in the principal amounts of $9,700,000 and $6,100,000 respectively. During that time, EGLLC raised an additional $16,500,000 from the sale of unsecured bonds issued at a 40% discount to face value to certain investors, including MFPI, which invested $8,000,000 in the unsecured EGLLC bonds from the proceeds of the $13,000,000 it borrowed from the Secured Lenders.

EGLLC used $5,000,000 from the 2006 notes to purchase a loan and mortgage on property owned by an unrelated mining company and used $14,250,000 of the $16,500,000 in proceeds from the issuance of the unsecured bonds to complete a joint venture with Apollo Gold, Inc. that entitled EGLLC to 50% of the assets and distributions of Montana Tunnels Mine – See Description of Business for additional information. In October 2009, EGLLC paid $250,000 in cash and in February 2010 assigned that loan and mortgage on the property owned by the unrelated mining company to Apollo Gold, Inc. for 100% ownership in MTMI (owner of Montana Tunnels Mine) and, concurrently with the closing of that payment and assignment, EGLLC and Apollo dissolved their joint venture.

In May 2009, as a condition to the additional $1,000,000 bridge loan (that was subsequently repaid) from the Secured Lenders to EGLLC and as an inducement for the Secured Lenders to stand still regarding an event of default on the part of EGLLC, (i) the $5,000,000 secured notes issued by EGLLC, (ii) the $8,000,000 loan to MFPI to purchase the unsecured bonds, (iii) a $5,000,000 loan to MFPI whose proceeds were used to make an unrelated investment1 and (iv) a redemption right allowing the Secured Lenders to obligate MFPI to purchase from the Secured Lenders a $5,950,000 equity investment made in one of the investment funds that is an owner of EGLLC and is managed by Black Diamond have been included under a security agreement with the Secured Lenders.

| 1 | MFPI invested $5,000,000 in Global VR, Inc. a private company managed by Black Diamond Holdings, LLC, which is managed by Patrick Imeson and Eric Altman, principals of the Company |

| 7 |

Currently, the notes and rights secured by the Company’s assets include (i) approximately $21,600,000 in principal amount of notes, including the $5,800,000 issued by EGLLC in 2006, $9,700,000 issued by MFPI in 2007 and $6,100,000 issued by MFPI in 2008, plus accrued and unpaid interest thereon through May 2009, and (ii) the redemption rights on the Secured Lenders’ $5,950,000 equity investment in EGLLC. The approximate amount of principal, accrued but unpaid interest and redemption rights as of December 31, 2011 was approximately $46,350,000. The notes and rights have been secured by two first lien mortgages on all of the property and assets of EGI and MTMI. Under the terms of these mortgages, the administrative agent representing the Secured Lenders was required to consent to the transfer by EGLLC to ESRI of the capital stock of EGI and MTMI. Pursuant to the terms of a tri-party agreement by and among the Company, EGLLC and the administrative agent dated as of the Merger closing date, the administrative agent consented to this transfer and ESRI acknowledged and agreed to cause EGI and MTMI to perform and keep all the covenants and obligations set forth in the two mortgages.

Additionally, because certain of the secured notes were in default prior to the Merger closing date, the administrative agent required that EGLLC and MFPI enter into a loan reinstatement and modification agreement, effective as of the Merger closing date, pursuant to which EGLLC agreed to pledge, in accordance with the terms of a separate pledge agreement, to the Secured Lenders all of its interest in the Series A Preferred Stock. Under the tri-party agreement, the Company acknowledged and agreed to treat the administrative agent as the owner and holder of the Series A Preferred Stock upon notice from the administrative agent of a default by EGLLC under the pledge agreement.

Under the Merger Agreement, EGLLC has covenanted that, for so long as any of its payment obligations under the loan restatement and modification agreement remain outstanding, EGLLC will designate all proceeds derived from the Series A Preferred Stock, including from preferential dividends that may be paid on this stock, to repay principal and interest due on the secured loans.

Each of the tri-party agreement, loan reinstatement and modification agreement and pledge agreement has been filed as Exhibit 10.4, 10.3, and 10.5, respectively, to this Current Report and is incorporated herein by reference.

The EGI Bridge Financing

Prior to the closing of the Merger, EGI completed a number of closings of a bridge financing with Black Diamond Holdings LLC (“BDH”), our beneficial stockholder through holdings in EGLLC, and another investor. In this bridge financing, EGI sold an aggregate of $300,000 in principal amount of its 12% unsecured convertible bridge notes (the “Bridge Notes”) to BDH and $1,500,000 in principal amount of these Bridge Notes to the other investor. The Bridge Notes mature on August 29, 2012 and, prior to that date but after the closing of the Merger, may be converted, at the sole discretion of each of the note holders, including accrued but unpaid interest, into units of the Company’s securities (the “Units”) at a conversion price of $2.00 per Unit, each Unit consisting of: (i) one share of Common Stock, (ii) and a five year warrant to purchase one-half share of Common Stock, exercisable at a price of $3.00 per whole share, and (iii) a special warrant exercisable upon the closing of the Company’s planned private placement, provided the share price of the Common Stock offered in the private placement is less than $2.50 per share, so that the exercise of the special warrant will reduce the lender’s effective conversion price for the Common Stock at a 25% discount to the private placement offering price, such special warrant exercisable at a price of $0.01 per share

Split-Off

In conjunction with the Merger and concurrent with the closing of the Merger, ESRI split off (the “Split-Off”) its wholly owned subsidiary, Buzz Kill, Inc., a New York corporation (“Split Corp.”). Split Corp. had been formed to produce the feature length film entitled “BuzzKill” and to market the film to distributors in the United States and abroad. The Split-Off was accomplished through the exchange of 5,793,000 shares of our Common Stock held by certain ESRI shareholders (the “Split-Off Shareholders”) for all of the issued and outstanding shares of common stock of Split Corp. Thomas H. Hanna, Jr., our sole officer and director prior to the Merger, exchanged 5,755,000 shares of our Common Stock for Split Corp. shares as part of the Split-Off. We executed a Split-Off Agreement and General Release Agreement with Split Corp. and the Split-Off Shareholders, copies of which are attached to this Current Report and are incorporated herein by reference.

| 8 |

As an inducement to the Split-Off Shareholders to agree to the Split-Off, ESRI and Buzz Kill terminated and cancelled an investment agreement between them dated May 1, 2007. Pursuant to this agreement cancellation, ESRI relinquished its right to recoup its $800,000 investment in Buzz Kill and Buzz Kill no longer is required to share 50% of its net revenue from sales of the film BuzzKill with ESRI.

At the closing of the Merger, holders of approximately $233,755 of Split Corp. promissory notes agreed to release ESRI from any obligations ESRI might have had with respect to these notes having been the parent company of Split Corp. prior to the Split-Off.

2012 Equity Incentive Plan

Before the Merger, our Board of Directors (sometimes referred to herein as the “Board”) adopted, and our stockholders approved, the Company’s 2012 Equity Incentive Plan (the “2012 Plan”), which provides for the issuance of incentive awards of up to 10,000,000 shares of Common Stock to officers, directors, employees and consultants of the Company and its affiliates. No awards have been granted under the 2012 Plan. See “Market Price of and Dividends on Common Equity and Related Stockholder Matters—Securities Authorized for Issuance under Equity Compensation Plans” below for more information about the 2012 Plan.

Departure and Appointment of Directors and Officers

Our Board consists of five members. On the Closing Date, Thomas H. Hanna, Jr., the sole director of the Company before the Merger, resigned his position as a director of the Company, and Patrick Imeson, Robert Trenaman, Michael Feinberg and Kenneth Hamlet were appointed to the Company’s Board. Pursuant to the terms of the Merger Agreement, the stockholders of ESRI before the Merger have the right to designate one person as a director to fill the vacancy on the Board prior to the next annual meeting of stockholders of the Company.

Also on the Closing Date, Mr. Hanna, the sole officer of the Company before the Merger, resigned his position as an officer of the Company, and Patrick Imeson was appointed as our Chairman and Chief Executive Officer, Robert Trenaman was appointed as our President and Chief Operating Officer, Eric Altman was appointed as our Chief Financial Officer, Treasurer and Vice President–Finance, and Timothy G. Smith was appointed as a Vice President–General Manager–Montana Tunnels Mine. See “Management – Directors and Executive Officers.”

Lock-up Agreements and Other Restrictions

In connection with the Merger, holders (the “Pubco Holders”) of the free trading shares of ESRI immediately prior to the Merger (the “Public Float Shares”) entered into lock-up agreements with ESRI whereby the Pubco Holders agreed that forty percent (40%) of their Public Float Shares may not be sold for a period of twelve (12) months following the Merger closing date.

Further, for a period of twelve (12) months after the Merger closing, the Public Holders have agreed to be subject to restrictions on engaging in certain transactions, including effecting or agreeing to effect short sales, whether or not against the box, establishing any “put equivalent position” with respect to the Public Float Shares, borrowing or pre-borrowing any shares of Common Stock, or granting other rights (including put or call options) with respect to the Public Float Shares or with respect to any security that includes, relates to or derives any significant part of its value from the Public Float Shares, or otherwise seeking to hedge their position in the Public Float Shares.

| 9 |

In addition, all officers, directors, stockholders holding ten percent (10%) or more of the Common Stock of ESRI after giving effect to the Merger and the Split-Off, and certain key employees (the “Restricted Holders”) have agreed that, for a period of twelve (12) months after the Merger closing date, the Restricted Holders will be subject to restrictions on engaging in certain transactions, including effecting or agreeing to effect short sales, whether or not against the box, establishing any “put equivalent position” with respect to shares of our Common Stock, borrowing or pre-borrowing any shares of Common Stock, or granting other rights (including put or call options) with respect to our Common Stock or with respect to any security that includes, relates to or derives any significant part of its value from our Common Stock, or otherwise seeking to hedge their position in the Common Stock.

Pro Forma Ownership

Immediately after giving effect to (i) the closing of the Merger and (ii) the cancellation of 5,793,000 shares of Common Stock in the Split-Off and an additional 5,751,000 shares of our Common Stock surrendered for cancellation by Dylan Hundley, there were 109,085,000 issued and outstanding shares of Capital Stock, as follows:

| · | EGLLC, as the sole stockholder of each of MTMI and EGI, held an aggregate of 90,000,000 shares of Common Stock and 10,000,000 shares of Series A Preferred Stock; and |

| · | The stockholders of the Company prior to the Merger held an aggregate of 9,085,000 shares of Common Stock. |

In addition,

| · | The 2012 Plan authorized issuance of up to 10,000,000 shares of Common Stock as incentive awards to officers, directors, employees and consultants; awards totaling 5,445,000 shares of Common Stock have been granted under the 2012 Plan; and |

| · | The Bridge Notes, may be converted, at the sole discretion of each of the note holders, including accrued but unpaid interest, into Units of the Company’s securities at a conversion price of $2.00 per Unit, each Unit consisting of: (i) one share of Common Stock, (ii) a warrant to purchase one-half share of Common Stock, exercisable at a price of $3.00 per whole share, and (iii) a special warrant exercisable upon the closing of the Company’s planned private placement, provided the share price of the Common Stock offered in the private placement is less than $2.50 per share, so that the exercise of the special warrant will reduce the lender’s effective conversion price for the Common Stock at a 25% discount to the private placement offering price, such special warrant exercisable at a price of $0.01 per share |

No other securities convertible into or exercisable or exchangeable for Common Stock (including options or warrants) are outstanding.

Our common stock is quoted on the OTC Bulletin Board under the symbol “ESRI”.

| 10 |

Accounting Treatment; Change of Control

The Merger is being accounted for as a “reverse merger,” and MTMI and EGI are deemed to be the acquirers in the reverse merger. Consequently, the assets and liabilities and the historical operations that will be reflected in the financial statements prior to the Merger will be those of MTMI and EGI and will be recorded at the historical cost basis of MTMI and EGI, and the consolidated financial statements after completion of the Merger will include the assets and liabilities of MTMI and EGI, historical operations of MTMI and EGI and operations of the Company and its subsidiaries from the closing date of the Merger. As a result of the issuance of the shares of Common Stock and Series A Preferred Stock pursuant to the Merger, a change in control of the Company occurred as of the date of consummation of the Merger. Except as described in this Current Report, no arrangements or understandings exist among present or former controlling stockholders with respect to the election of members of our Board of Directors and, to our knowledge, no other arrangements exist that might result in a change of control of the Company.

We continue to be a “smaller reporting company,” as defined under the Securities Exchange Act of 1934, as amended (the “Exchange Act”), following the Merger.

| 11 |

DESCRIPTION OF BUSINESS

Immediately following the Merger and the Split-Off, the business of MTMI and EGI, to engage in the exploration and production activities in the precious and base metal industry, became the business of the Company.

GENERAL BACKGROUND

Montana Tunnels Mining, Inc., a Delaware corporation (“MTMI”), was formed in 1998 to own and operate the Montana Tunnels gold-zinc-silver-lead open pit mining operation (the “Montana Tunnels Mine”). The Montana Tunnels Mine has been in operation since 1987. Elkhorn Goldfields, Inc., a Montana corporation (“EGI”), was formed in 1998 and owns the Elkhorn Project, which includes the Golden Dream mine – a planned gold-copper underground mining operation (“Golden Dream Mine”). Prior to the Merger, MTMI and EGI were wholly-owned subsidiaries of Elkhorn Goldfields, LLC, a Delaware limited liability company (“EGLLC”). EGLLC is a mining holding company and is owned by the private equity investment funds that are managed by Black Diamond Financial Group LLC, a Delaware limited liability company (“Black Diamond”).

Corporate History

Pegasus Gold Inc., a Province of British Columbia corporation (“Pegasus”), had operations in Montana, Nevada and Australia. Pegasus commenced operations at the Montana Tunnels Mine in 1987. In January 1998, due to struggling mine operations external to the Montana Tunnels Mine, Pegasus was unable to service approximately $238 million in debt and filed for bankruptcy under Chapter 11 of the United States Bankruptcy Code. Under the reorganization plan, Pegasus incorporated a holding company named Apollo Gold Inc., a Delaware corporation, and Apollo Gold Inc. became the owner/operator of the Montana Tunnels Mine.

During the second quarter of 2002, Apollo Gold Inc. was acquired by a Toronto Stock Exchange listed company – Nevoro Gold Inc. – which, upon closing of the acquisition, changed its name to Apollo Gold Corporation (“Apollo”) and traded publicly on the Toronto Stock Exchange as such.

On July 28, 2006, EGLLC earned a 50% interest in the Montana Tunnels Mine and related assets by providing $14,250,000 to establish a joint venture with Apollo to remediate the “L” Pit and put the Montana Tunnels Mine back into production. Montana Tunnels Mine is an open pit mine. Each pit expansion shell is named in alphanumeric order. The “L” Pit was the south and west wall layback. Before that was the “K” Pit which was the east wall layback.

In July 2006, EGLLC established, and owned 100% of, Elkhorn Tunnels, LLC to facilitate the joint venture with Apollo. The “L” pit was mined out in November 2008. In June 2009, Apollo advised EGLLC that it intended to market its position in the joint venture. EGLLC optioned to purchase Apollo’s interest which it exercised in the fall of 2009 and paid $250,000 as the first installment on the purchase. In February 2010, EGLLC and Apollo renegotiated the form of payment and the terms of the purchase of Apollo’s 50% interest in MTMI was modified to include the $250,000 cash already paid plus an assignment to Apollo of EGLLC’s interest in a certain loan and mortgage on a property owned by an unrelated mining company. Elkhorn Tunnels, LLC was dissolved following EGLLC’s completion of its acquisition of the remaining interest in MTMI.

EGI is the operator of the Golden Dream Mine located at 2725-A Elkhorn Road, Boulder, Montana. The mine is located near the historic town of Elkhorn which dates back to the 1870s. The Golden Dream Mine is located about 15 air miles south east of the Montana Tunnels Mine and the over-the-road distance between the mines is approximately 30 miles. EGI was purchased by Calim Private Equity, LLC from Elkhorn Gold Mining Corporation, a Canadian corporation, in October 2000. Calim Private Equity, LLC, a private equity company, later created EGLLC and assigned its 100% interest in EGI to EGLLC.

| 12 |

montana tunnels mine

MTMI is an integrated mining company which is seeking to recommence mining and milling operations at the Montana Tunnels Mine. Currently, MTMI’s operations are limited to care and maintenance functions. MTMI’s staff engineers, in association with outside independent mining consultants, have designed a mine plan around the “M” Pit deposit of the Montana Tunnels Mine incorporating a proven and probable mineral reserve of 37.8 million tons (a ton is equal to 2,000 pounds) of ore containing 488,000 ounces of gold, 8.2 million ounces of silver, 358 million pounds of zinc and 124 million pounds of lead (the “M” Pit Mine Plan”), as documented in the Montana Tunnels Technical Report dated November 2010 (the “Nov. 2010 MTTR”). Table 21.3 M-Pit Production Schedule below:

| M-Pit Totals | ||||

| TONS MOVED | ||||

| Ore | 20,166,779 | |||

| Lowgrade Ore | 17,562,688 | |||

| Waste - Rock | 136,143,834 | |||

| Waste - Alluvium | - | |||

| Rehandle/Other/Topsoil | 6,304,696 | |||

| Total Tons Moved | 180,177,997 | |||

| TONS MILLED | 37,820,640 | |||

| Grade: Au (oz/ton) | 0.0129 | |||

| Ag (oz/ton) | 0.218 | |||

| Pb (%) | 0.164 | |||

| Zn (%) | 0.473 | |||

| PRODUCTION (GROSS) | ||||

| Gold (oz) | 487,886 | |||

| Silver (oz) | 8,244,900 | |||

| Lead (lbs) | 124,051,699 | |||

| Zinc (lbs) | 357,783,254 | |||

| PRODUCTION PAYABLE SOLD | ||||

| Gold (oz) | 346,681 | |||

| Silver (oz) | 4,651,964 | |||

| Lead (lbs) | 87,971,673 | |||

| Zinc (lbs) | 238,955,526 | |||

Source: Montana Tunnels Technical Report – Table 21.3 (page 113)

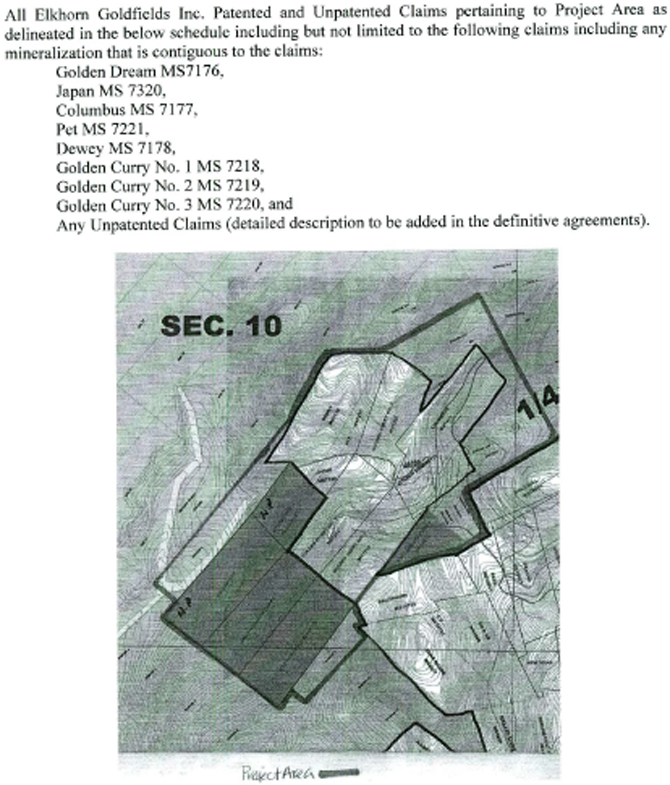

During 2011, gold prices peaked at $1,895 per ounce on the London Metal Exchange (“LME”) and silver prices reached levels not seen since 1980, exceeding $30 per ounce on the LME. As such, management believes that now is the ideal time to recommence development and production at the Montana Tunnels Mine.

| 13 |

A common misconception is that the current gold prices and predictions are in record territory; however, in 1980 gold traded at an average of $1,849 and peaked at $2,337 in 2011 dollars. The chart below reflects this inflation adjusted pricing.

The Montana Tunnels Mine lies within Jefferson County, Montana – approximately 5 miles west of Jefferson City. Access to the mine site is from U.S. Highway #15 at the Jefferson City exit approximately 19 miles south of Helena, Montana. From Jefferson City the mine is located 3.5 miles along Spring Creek road.

| 14 |

Aerial view of the existing open pit Mine at the Montana Tunnels Operation.

History of the Montana Tunnels Mine

To a large extent, mining activity developed and settled much of Montana during the 1860s and 1870s, including the historic “Wickes-Corbin” silver district in which the current Montana Tunnels Mine is centrally located. The Wickes-Corbin district thrived from the 1860s into the early 1890s, at which time the U.S. Government repealed the Sherman Silver Purchase Act (1893) sending silver prices plummeting and spelling the eventual demise of many silver producing mining camps, including the Wickes-Corbin camp.

In the early 1980s, with the price of silver trading at $50 per ounce on the LME, many historic silver camps were re-examined employing modern exploration techniques. It was during this period that the Montana Tunnels deposit – a named derived from the boring of two exploratory tunnels driven into the deposit in the early 1900s – was discovered. By 1986 Pegasus had commenced development of the Montana Tunnels Mine and construction of a 15,000 ton per day milling facility.

| 15 |

View of the Montana Tunnels Milling Facility, Crushing Facility and Administrative offices.

The open pit mine is located to the top and left of this photograph.

Since the commencement of production at Montana Tunnels Mine in early 1987, the mine has produced, under its previous owners, 99.6 million tons of ore containing 1.7 million ounces of gold, 30.9 million ounces of silver, 551,400 tons of zinc and 202,800 tons of lead, as reported through public filings of the parent companies. Using average prices as of January 2012, the cumulative value of the metals mined from the Montana Tunnels Mine since 1987 would total in excess of $4 billion. All metals mined at the Montana Tunnels Mine were sold prior to 2010.

| 16 |

The table below sets forth the Montana Tunnels Mine production history from 1987 to 2009.

Montana Tunnels Technical Report - November 2010

Table 1.1 Montana Tunnels Production History (Page 2)

| Mill Tons | Au | Oz Au | Ag | Oz A | Pb | Tons Pb | Zn | Tons Zn | ||||||||||||||||||||||||||||||

| Year | 000's | oz Au/t | 000's | oz Ag/t | 000's | % | 000's | % | 000's | |||||||||||||||||||||||||||||

| 1987 | 2,018 | 0.0198 | 39.9 | 0.485 | 979.7 | 0.377 | 7.6 | 0.923 | 18.6 | |||||||||||||||||||||||||||||

| 1988 | 3,982 | 0.0228 | 90.7 | 0.430 | 1,711.4 | 0.281 | 11.2 | 0.788 | 31.4 | |||||||||||||||||||||||||||||

| 1989 | 4,047 | 0.0204 | 82.5 | 0.488 | 1,974.5 | 0.250 | 10.1 | 0.674 | 27.3 | |||||||||||||||||||||||||||||

| 1990 | 4,149 | 0.0184 | 76.2 | 0.451 | 1,872.8 | 0.222 | 9.2 | 0.627 | 26.0 | |||||||||||||||||||||||||||||

| 1991 | 4,271 | 0.0185 | 78.9 | 0.428 | 1,829.7 | 0.233 | 10.0 | 0.638 | 27.2 | |||||||||||||||||||||||||||||

| 1992 | 4,573 | 0.0199 | 91.2 | 0.441 | 2,014.9 | 0.217 | 9.9 | 0.609 | 27.9 | |||||||||||||||||||||||||||||

| 1993 | 5,045 | 0.0173 | 87.5 | 0.440 | 2,218.5 | 0.195 | 9.8 | 0.523 | 26.4 | |||||||||||||||||||||||||||||

| 1994 | 5,411 | 0.0185 | 100.3 | 0.323 | 1,746.5 | 0.240 | 13.0 | 0.555 | 30.0 | |||||||||||||||||||||||||||||

| 1995 | 5,474 | 0.0202 | 110.8 | 0.314 | 1,716.4 | 0.200 | 11.0 | 0.582 | 31.8 | |||||||||||||||||||||||||||||

| 1996 | 5,467 | 0.0167 | 91.4 | 0.274 | 1,497.9 | 0.186 | 10.2 | 0.509 | 27.8 | |||||||||||||||||||||||||||||

| 1997 | 5,145 | 0.0194 | 100.0 | 0.242 | 1,245.3 | 0.224 | 11.5 | 0.576 | 29.6 | |||||||||||||||||||||||||||||

| 1998 | 4,833 | 0.0188 | 91.0 | 0.207 | 998.8 | 0.189 | 9.1 | 0.686 | 33.2 | |||||||||||||||||||||||||||||

| 1999 | 5,078 | 0.0174 | 88.2 | 0.225 | 1,142.7 | 0.203 | 10.3 | 0.614 | 31.2 | |||||||||||||||||||||||||||||

| 2000 | 5,384 | 0.0145 | 77.9 | 0.375 | 2,020.5 | 0.177 | 9.5 | 0.481 | 25.9 | |||||||||||||||||||||||||||||

| 2001 | 5,424 | 0.0168 | 91.0 | 0.281 | 1,525.2 | 0.182 | 9.9 | 0.552 | 29.9 | |||||||||||||||||||||||||||||

| 2002 | 2,881 | 0.0156 | 45.0 | 0.238 | 684.9 | 0.167 | 4.8 | 0.470 | 13.5 | |||||||||||||||||||||||||||||

| 2003 | 4,695 | 0.0157 | 73.5 | 0.202 | 947.4 | 0.193 | 9.1 | 0.440 | 20.6 | |||||||||||||||||||||||||||||

| 2004 | 5,394 | 0.0096 | 51.7 | 0.318 | 1,713.0 | 0.138 | 7.4 | 0.374 | 20.2 | |||||||||||||||||||||||||||||

| 2005 | 4,955 | 0.0130 | 64.3 | 0.190 | 939.8 | 0.155 | 7.7 | 0.337 | 16.7 | |||||||||||||||||||||||||||||

| 2006 | 1,427 | 0.0077 | 11.0 | 0.169 | 240.4 | 0.097 | 1.4 | 0.201 | 2.9 | |||||||||||||||||||||||||||||

| 2007 | 3,971 | 0.0123 | 49.0 | 0.221 | 876.4 | 0.197 | 7.8 | 0.466 | 18.5 | |||||||||||||||||||||||||||||

| 2008 | 4,510 | 0.0144 | 64.9 | 0.175 | 788.0 | 0.221 | 10.0 | 0.629 | 28.4 | |||||||||||||||||||||||||||||

| 2009 | 1,430 | 0.0100 | 14.3 | 0.176 | 251.0 | 0.160 | 2.3 | 0.442 | 6.3 | |||||||||||||||||||||||||||||

| Totals | 99,563 | 0.0164 | 1,671.4 | 0.30 | 30,935.6 | 0.20 | 202.8 | 0.54 | 551.4 | |||||||||||||||||||||||||||||

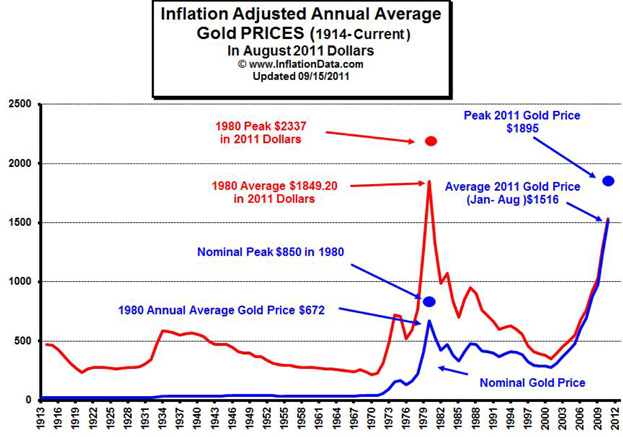

Products and mining industry trends

The deposit type currently being exploited at the Montana Tunnels Mine is precious and base metal mineralization (gold, silver, zinc and lead) occurring as disseminated and veined sulfides internal to a volcanic diatreme. Through the mining and treatment of the Montana Tunnels deposit, the mine will produce (i) gold, (ii) silver, (iii) zinc and (iv) lead. Minor amounts of other metals are also contained within the deposit but not of marketable quantities.

| 17 |

Cross section cartoon depicting the Montana Tunnels deposit showing current Pit development.

| I. | Gold |

Under the “M” Pit Mine Plan, over the 9 years that MTMI is planning to mine and treat ore at the Montana Tunnels Mine (the “Life of Mine”), we expect that 37.8 million tons of ore containing 488,000 ounces of gold will be mined and processed at the Montana Tunnels Mine, as documented in the Nov 2010 MTTR. Table 21.3 M-Pit Production Schedule. Considering associated dilution and deletion, mill recovery losses and smelter losses and deductions which are all within industry standards, we estimate that the Montana Tunnels Mine will produce 347,000 recoverable ounces of gold over the Life of Mine of the “M” Pit.

The Gold Market

The market for gold is large, liquid and global. Gold continues to see demand in the jewelry, industrial and health science industries; however, gold’s main demand comes in the form of safe haven investment. From economic, political and social uncertainty to a hedge against inflation, gold is, and has long been, considered by many a commodity of refuge from concerns with fiat currencies and their corresponding economies.

The World Gold Council (“WGC”), a leading international gold industry research organization, published on its website that total gold demand for the fourth quarter of 2011 rose 21% to 1,017 metric tonnes (a metric tonne is equal to 2,204.6 pounds) year-on-year. Of this increase, investment demand posted the largest segment increase, more than offsetting the decline in gold jewelry demand.

| 18 |

Gold prices over the past five years (courtesy Kitco).

| II. | Silver |

Over the planned Life of Mine for “M” Pit, we expect to mine and process 37.8 million tons of ore containing 8.24 million ounces of silver at Montana Tunnels Mine, as documented in the Nov. 2010 MTTR. (Source: Table 21.3 M-Pit Production Schedule). Taking Montana Tunnels Mine historical mine deletion, mill recoveries and industry-standard smelter payment terms into consideration, we estimate recovering 4.65 million recoverable ounces of silver (losses from reserve ounces to payable ounces are within industry standards).

The Silver Market

Unlike the gold market, demand within the silver market has been predominantly for fabrication – mainly industrial application, photography and jewelry – with investment making up only a small portion of total yearly demand.

Silver prices over the past five years (courtesy Kitco).

| 19 |

| III. | Zinc |

Over the planned Life of Mine for “M” Pit, we project total payable zinc production to be in excess of 239 million pounds, as documented in the Nov. 2010 MTTR. (Source: Table 21.3 M-Pit Production Schedule). At planned production rates, Montana Tunnels Mine should produce approximately 0.2% of the current annual global demand for zinc.

The Zinc Market

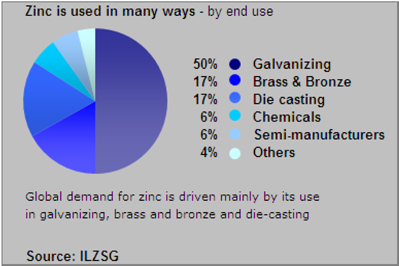

Zinc is fourth in terms of tonnage on the list of metals produced globally on an annual basis. Zinc is mainly used as coating to protect iron and steel from corrosion, as alloying metal to make bronze and brass, as zinc-based die casting alloy and as rolled zinc.

Pie chart depicting the various uses of Zinc.

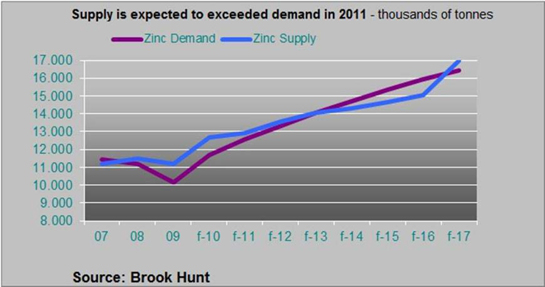

As documented by the International Lead and Zinc Study Group, global zinc supply has been in a surplus situation since late 2007. This supply surplus is forecast to continue through 2012. It is currently projected that a supply shortfall will occur during 2013 and continues until 2017. As a result, due to the lengthy time to restart mine production, a zinc supply shortfall may likely exist for some years after Montana Tunnels Mine is anticipating a restart of its operations.

| 20 |

Global Zinc supply and demand for years 2005 through 2010 (actual) and years 2011 through 2017 (forecast).

As of January 26, 2012, zinc prices are trading at around U.S. $1.00 per pound on the LME which is slightly above zinc’s 5-year average price as depicted in the chart below:

Zinc prices over the past five years (courtesy Kitco)

| IV. | Lead |

Over the planned Life of Mine for “M” Pit, we project total recoverable lead production to be approximately 88 million pounds, as documented in the Nov. 2010 MTTR. Table 21.3 M-Pit Production Schedule.

| 21 |

The Lead Market

As with the other metals that the Montana Tunnels Mine will produce, the market for lead is global in nature and active in terms of participants. This ensures that the metals produced from the Montana Tunnels Mine will be competitively priced.

Lead has been mined and used in daily life for at least 5,000 years, mainly for corrosion-resistant items such as roofs, pipes and windows. Lead’s use increased through the 1900s in items such as batteries and as an additive in gasoline until the mid-1980s when environmental regulations significantly reduced the use of lead in non-battery products. Per various public research publications, by the early 2000s the total demand for lead for use in battery-related items represented 88% of lead production. Other uses include ammunition, casting metals and oxides in glass and ceramics.

As of January 26, 2012, lead prices are trading at around U.S. $1.00 per pound on the LME which is slightly above lead’s 5-year average price as depicted in the chart below:

Lead prices over the past five years (courtesy Kitco)

In total, we project that the Montana Tunnels Mine “M” Pit deposit will produce 347,000 ounces of gold, 4.65 million ounces of silver, 239 million pounds of zinc and 88 million pounds of lead over the planned Life of Mine, as documented in the Nov. 2010 MTTR.

OPERATIONS SUMMARY

Mission. MTMI is an integrated mining company focused on the exploration, development and mineral extraction of the Montana Tunnels Mine. MTMI has produced gold, silver, zinc and lead from the Montana Tunnels Mine starting in 1987. We believe that extracting the remaining deposit will be more than ample to provide sufficient mineral resources to establish a mine plan to continue profitable mining and milling operations on the current target at Montana Tunnels Mine for approximately 9 years.

The Operations. The Montana Tunnels Mine is a fully integrated open-pit mine and concentrating facility. The goal in any successful metal mining operation is to take a lower concentration of metals per ton of rock – raw ore – and upgrade the valuable metal content per ton – while minimizing the loss of that metal content – thereby improving, or “concentrating” the value per ton.

| 22 |

This process is generally done in three steps – (1) mining, (2) beneficiation (concentration) and (3) smelting.

1. Mining Operations at Montana Tunnels Mine. There are four distinct stages to production mining at the Montana Tunnels Mine – (i) drilling, (ii) blasting, (iii) loading and (iv) hauling.

| (i) | Drilling – Following directions provided by the engineering, geological and technical staff, workers drill 6.75-inch diameter holes to depths of usually 20 feet on what are called “benches” using rotary percussion drills as depicted below. Samples from the drill piles are taken for analysis at the onsite assay lab to determine the ore value component of the rock to ensure, once the rock is blasted, that ore is being taken to the concentrator and waste is taken to the waste areas. |

| (ii) | Blasting – Once drilling is completed on a “bench”, the drilled out holes are filled with ANFO explosive (ammonium nitrate/fuel oil mixture) and, following a detonation pattern, are blasted. |

| (iii) | Loading – The blasted rock material is loaded by 21 yard shovels or by 13 yard front-end loaders into waiting haul trucks. |

| 23 |

| (iv) | Hauling – A fleet of haul trucks capable of hauling between 85 to 150 tons of ore or waste material per load work in unison with the loaders to quickly remove the blasted rock to the crushing facility, in the case of ore or, in the case of waste, to the waste rock dump for eventual reclamation. Once the blasted material is removed, the next cycle of drilling commences again. |

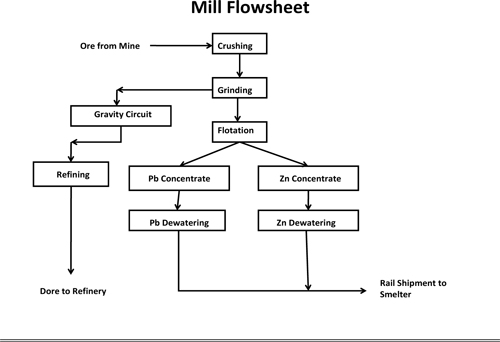

2. Beneficiation Operations at Montana Tunnels. Beneficiation is the act of crushing and separating ore into valuable substances by any of a variety of techniques so that metal can be recovered at a profit. Montana Tunnels Mine beneficiation plant is rated at 15,000 tons per day and consists of three distinct stages – (i) crushing, (ii) grinding and (iii) flotation & filtration.

| (i) | Crushing – Ore grade material from the mine is delivered to the crushing circuit where primary and secondary “jaw crushers”, used in series, crush the rock to between 5” and 7” in size. At times, ore from the open-pit is too large to enter the mouth of the jaw crusher and pneumatic rock breakers are employed to reduce the size to enable the rock to enter the jaw crusher. The crushed rock is stored on the “coarse ore stockpile” awaiting entry into the grinding circuit. |

| 24 |

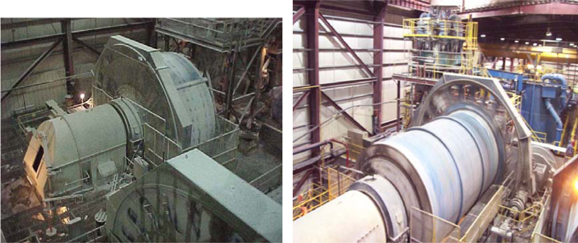

Ore leaving the crushing circuit going to the coarse ore stockpile

| (ii) | Grinding – From the coarse ore stockpile apron feeders draw the ore onto conveyor belts and deliver the coarse ore to a semi-autogenous grinding mill where it is mixed with water and 5” steel balls and ground to create coarse slurry. This slurry discharges from the semi-autogenous mill and, dependent upon size, is either sent to a cone crusher if oversized, or sent to the ball mill for further size reduction. The oversized material, once treated by the cone crusher, re-enters the semi-autogenous mill for additional grinding before being directed to the ball mill for additional size reduction. |

The ground ore material/slurry from the ball mill is pumped to the gravity circuit where gravity cyclones (funnel-shaped devices that separate particles entering the funnel by density), Knelson concentrators (machines that utilize the principles of a centrifuge to enhance gravitational force experienced by feed particles to effect separation based on particle density), sluices (troughs with riffles in the bottom that provide a lodging place for heavy or dense material such as gold) and separating tables work to separate the coarse gold-silver particles from the slurry. This gold-silver concentrated product is smelted onsite to produce doré bullion bars or flats.

Material passes from the gravity circuit to hyrocyclones where it is once again separated. The oversized material from this separation reports back to the ball mill for further grinding while the fine slurry or pulp material is pumped to the lead flotation circuit to commence the flotation and filtration process.

| 25 |

Montana Tunnels Semi-Autogenous Mill (left) and Ball Mill (right).

| (iii) | Flotation and filtration – The flotation circuit is made up of a series of large tanks, or cells, with each cell containing an agitator and air blower. There is a set of cells for concentrating the lead minerals and an independent set of cells for concentrating the zinc minerals. |

The process for concentrating the minerals occurs as the mineralized pulp enters the first in this series of tanks. At this point two reagents – a frothing reagent and a collecting reagent – are added to the pulp. These reagents create the conditions within the tanks to compel the lead and lead-associated minerals to attach to “bubbles” created by the frothing reagent mixed with air from the air blower. These mineral-ladened bubbles are collected through this series of cells, cleaned, thickened and filtered using a drum filter to make a final lead concentrate. Historically, the Montana Tunnels Mine lead concentrates contain 50% to 55% lead, 2.0 to 3.5 ounces per ton gold and 20 to 50 ounces per ton silver. Moisture content is between 8% and 10%.

After the pulp exits the final lead cell, reagents are again introduced to the pulp which activates the zinc minerals to attach to bubbles. As with the lead circuit, these zinc-ladened bubbles are collected, cleaned, thickened and filtered – this time using a pressure filter – to make a final zinc concentrate. The Montana Tunnels Mine final zinc concentrate traditionally have contained 52% to 56% zinc, 0.1 to 0.3 ounces per ton gold, 5 to 20 ounces per ton silver with a moisture content of between 8% and 10%.

Finally, with this pulp denuded of minerals it is pumped to a designed and approved area for storing the treated waste fraction of an ore or the “Tailings Impoundment Area” for eventual reclamation.

| 26 |

Schematic of Montana Tunnels beneficiation operations

3. Smelting and Refining of the Montana Tunnels Mine Products. We project that for the Life of Mine of the “M” Pit deposit, annual production of lead concentrate will be 16,000 tons and annual production of zinc concentrate will be approximately 46,000 tons, based upon historical production and the Nov. 2010 MTTR. Smelting of these concentrates has traditionally been carried out at a smelter facility in Trail, British Columbia, Canada which is owned by mining conglomerate Teck Corp. While we anticipate competitively shopping for alternative smelter facilities, we have identified Teck Corp. as the best situated smelting facility for the Montana Tunnels Mine.

From the Montana Tunnels Mine, lead and zinc concentrates are loaded separately into over-the-road haul trucks and delivered to railheads near Helena, Montana. From there, the concentrate products are delivered to Teck Corp.’s lead and zinc smelter approximately 400 miles via rail from Helena, Montana where they are smelted and refined into saleable lead and zinc products. Teck Corp. charges MTMI a smelting charge per metric tonne which is within industry standards.

A third product produced from the Montana Tunnels Mine is gold doré flats (a mold of semi-pure alloy consisting of gold and silver created at the mine site). Historically, between 8% to 12% of the gold recovered at Montana Tunnels reports to the gravity circuit and is smelted onsite into doré flats. In the past, these doré flats have been refined into gold bars by Johnson Matthey Inc.’s refining facility in Salt Lake City, Utah.

Montana Tunnels Mine “M” Pit Expansion

In December 2008, Montana Tunnels Mine was placed into a care and maintenance operational mode at the completion of the “L” Pit permit. The newly permitted “M” Pit is an expansion of the existing “L” Pit to enable the Company to continue to mine an additional 37.8 million tons of ore as an extension to the same ore body that has been previously mined since the inception of the Montana Tunnels Mine operation. The expansion plan will “layback” or expand the perimeter of the current pit making it wider, and making an additional 7.0 years of ore available to be mined from the bottom of the expanded pit.

| 27 |

We have completed ore-delineation drilling beneath the current pit elevation and have identified proven and probable reserves of the “M” Pit expansion as detailed in the table below:

| Proven and Probable Reserves Montana Tunnels Technical Report Montana Tunnels Mining, Inc. | ||||||||||||||||||||||||

| Grade | ||||||||||||||||||||||||

| Pit Design | Classification | Tons | Gold | Silver | Lead | Zinc | ||||||||||||||||||

| M – Pit | Proven | 27,673,000 | 0.0129 | 0.212 | 0.164 | % | 0.487 | % | ||||||||||||||||

| M – Pit | Probable | 10,105,000 | 0.0129 | 0.211 | 0.160 | % | 0.434 | % | ||||||||||||||||

| Total 2P Reserves | 37,778,000 | 0.0129 | 0.212 | 0.163 | % | 0.474 | % | |||||||||||||||||

Gold and Silver grades in ounces per ton, Lead and Zinc grades as percentage mineral content.

In 2004, MTMI commenced the process of permitting the “M” Pit expansion by filing a major amendment to the Montana Tunnels Operating Permit #00113 to expand the open pit and process ores from the “M” Pit mine design. An updated Environmental Impact Statement was completed and Records of Decisions to mine and process the “M” Pit were finally received in November 2008, subject to the addition of approximately $16 million to the current $18 million of reclamation bonds pledged by MTMI with the Montana Department of Environmental Quality (“MDEQ”). The reclamation bond can be in the form of cash, surety bond, letter of credit, company-owned land or a combination of any of these subject to the approval of the MDEQ.

The “M” Pit Mine Plan calls for an 18 to 24 month period of pit expansion development in which 53 million tons of waste rock will be removed to access the ore below the waste rock. The “M” Pit Mine Plan is contingent on the Company obtaining the capital required to begin the expansion development. The Company will seek to obtain funding from debt and the capital markets. If the Company is unable to secure acceptable terms from these markets the expansion development will begin only when the cash flow from the Golden Dream Mine (discussed below) can support the capital needs of the Plan.

Although we expect that some fringe ores will be encountered during the pit expansion, this ore will be stockpiled during the pit expansion phase. Only after primary ores are being mined from the pit on a continuous and sufficient basis to maintain continuous operation of the concentrator, will ore processing through the concentrator begin. It is planned that this will occur approximately 18 to 20 months after commencement of “M” Pit expansion development. Cash flow is expected to begin the month after the concentration mill is restarted.

Currently, MTMI has eight staff individuals working at the mine site conducting care and maintenance of the mine. This team also supports operations at the Golden Dream Mine (see discussion below). These individuals occupy the key positions in management, engineering, environmental, human resources and accounting. Upon financing, MTMI will quickly increase the number of full-time hourly employees to approximately 160 and 190 individuals. Being within commuting distance from Montana’s capital city – Helena – and the major mining communities of Butte and Whitehall should allow for a quick filling of these hourly positions. In August 2006, when MTMI re-commenced operations, it took approximately 4 weeks to hire 125 qualified mine equipment operators and mechanics. In August 2006, the unemployment rate in Montana was 3.3%. As of December 2011, unemployment in Montana was approximately 6.6%, according to the United States Department of Labor, Bureau of Labor Statistics.

The existing Montana Tunnels Mine mining equipment has been in use since the early-to-mid 1990s and, as such, now is prone to maintenance costs and associated downtime. We plan to use the existing mining fleet at Montana Tunnels Mine augmented with new equipment as it becomes available. The existing and new planned equipment are listed in the tables below:

| 28 |

| Existing Equipment Description | Size | Quantity | |||

| Caterpillar 5230 Hydraulic Front Shovel | 21 cubic yard | 2 | |||

| Caterpillar 992 Loader | 13.5 cubic yard | 3 | |||

| Caterpillar 785 Truck | 150 ton | 12 | |||

| Caterpillar 777 Truck | 85 ton | 2 | |||

| Caterpillar D9N Bulldozer | 370 Horsepower | 2 | |||

| Ingersoll-Rand DN45E Drill | 6.75 inch hole | 3 | |||

| Caterpillar 16-G Motor Grader | 16 foot blade | 2 | |||

| Caterpillar 950 F11 Loader | 1 | ||||

| Caterpillar 325B Excavator | 1 | ||||

Existing Montana Tunnels Mining Equipment

| New Equipment Description | Size | Quantity | ||

| Shovel – Terex, Komatsu, Caterpillar | 20 cubic yard | 2 | ||

| Caterpillar 993K Loader | 15 cubic yard | 1 | ||

| Caterpillar 785D Truck | 150 ton | 9 | ||

| Caterpillar D10T Bulldozer | 1 | |||

| Caterpillar D9T Bulldozer | 1 | |||

| Caterpillar D25KS Drill | 2 | |||

| Caterpillar 16-M Motor Grader | 10.1 foot blade base | 2 | ||

| Light Plant | 4 | |||

| Lube Truck | 2 | |||

| Stemming Truck | 1 | |||

| Caterpillar 777D/Water Truck | 1 |

New Equipment planned for Montana Tunnels Mine “M” Pit expansion

As described above under the beneficiation section, the existing Montana Tunnels Mine concentrating and processing facility equipment consists of a number of components used in the crushing, grinding, flotation and filtration of gold, zinc, silver, lead and copper ores. In April 2009, the MTMI concentrator was turned off in a systematic way over a period of three weeks to ensure that recommencement of the facility would be seamless. All components of the MTMI concentrating facility are intact and the only piece of equipment contemplated to be replaced is the zinc pressure filter. Replacement of this component will be carried out in conjunction with the restart of the MTMI concentrating facility.

The Montana Tunnels Mine operation has been through several phases of exploration, development and production since the mid-1980s. Through this quarter century of operational experience, our management team has acquired the skills and knowledge to accurately plan and project development and operations timelines and costs.

The operational and cost components with the greatest influence relate to: (i) grade of the ore; (ii) mill recoveries; (iii) development and mining costs; and (iv) smelting and outside treatment costs. The grade of Montana Tunnels Mine “M” Pit has been delineated to standards employing defined requirements as set by the mining industry.

| 29 |

Historical – 1988 through 2009 – Montana Tunnels Mine mill recoveries for each of the payable metals are compiled in the table below (mill recovery is a calculation showing the percentage of recovered metals by analyzing the grade of pre-processed rock (heads) and comparing that with the grade of the same post-processed rock (tails)):

| Metal | Gold | Silver | Lead | Zinc | ||||||||||||

| Mill Recovery | 79.9 | % | 73.7 | % | 86.0 | % | 84.7 | % | ||||||||

Montana Tunnels Mine Historical Mill Recoveries (1988 through 2009)

MTMI’s engineering and management staff have projected development and operating costs combining a mix of the planned new equipment and existing equipment applying each particular piece of equipment’s operating specifications.

Over the 20-plus years of operations at Montana Tunnels Mine, various smelting and outside treatment options have been explored and utilized. Because of its relative proximity and its smelter payment terms, the most appropriate smelter for Montana Tunnels’ zinc and lead concentrates, found to date, is Teck Corp.’s Trail, B.C. Smelter. World benchmark smelter treatment charges are established annually between miners and smelters for both zinc and lead concentrates.

A gold doré flat ready for shipment to

Johnson Matthey Inc. (2006)

The ELKHORN project and the Golden Dream Mine

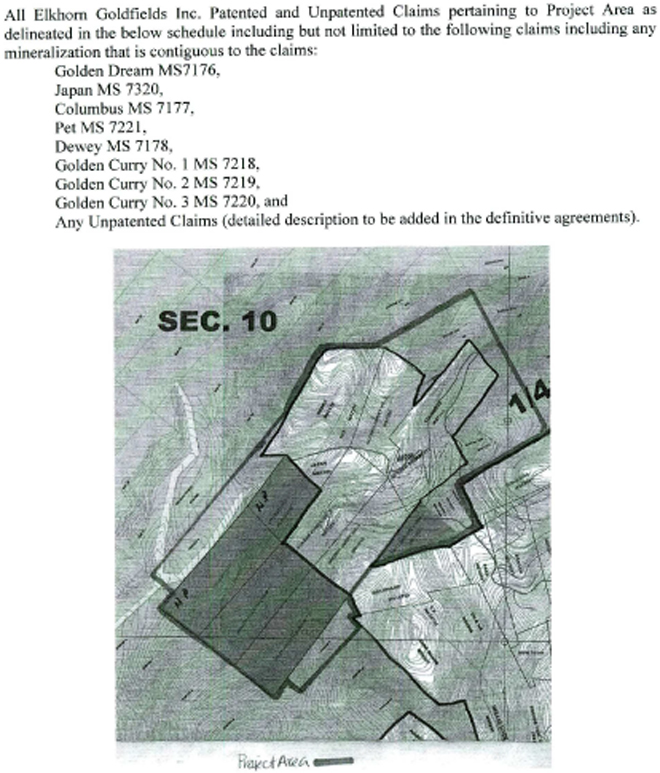

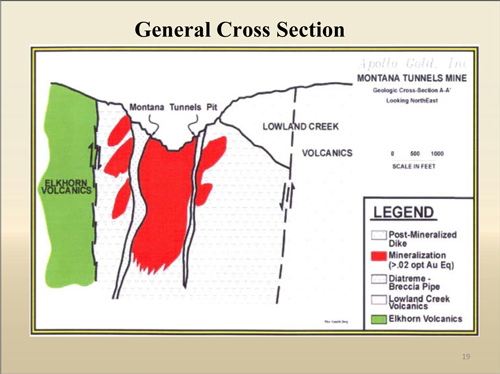

The Golden Dream Mine lies within the boundaries of EGI’s Elkhorn Project approximately 35 road miles to the south-east of the Montana Tunnels Mine. The Elkhorn Project consists of a collection of patented and unpatented mineral claims totaling approximately 4,500 acres.

| 30 |

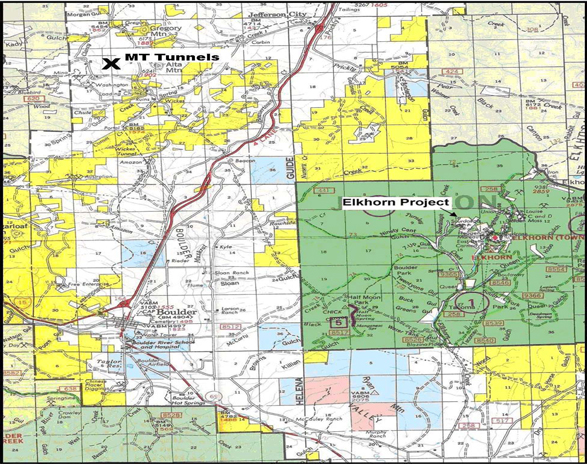

The Elkhorn Project and Golden Dream Mine are located approximately 35 road miles from Montana Tunnels.

Similar to the area in which the Montana Tunnels Mine is located, the area in which the Golden Dream Mine is located was extensively explored and settled during the 1870s through the 1890s. The present ghost town of Elkhorn, which lays just outside the Elkhorn Project property boundaries, once boosted a population in excess of 2,000 people in the 1880s. The major operating mine during this period was the Elkhorn Mine, a silver-lead mine, but several smaller silver, gold and copper mines were also being worked in the area. By 1894, the town’s population had diminished to 600 people and mining activity – due in large part to the collapse in silver prices – steadily declined through the 1890s.

During the early 1980s reconnaissance exploration started on the Elkhorn Project. Over the next decade extensive core drilling, analysis, planning and design work was carried out by Gold Fields Corp. (NYSE: GFI) and Santa Fe Pacific Gold Corp (“Santa Fe”) on the Elkhorn Project. In 1997 Newmont Corp (NYSE: NEM) acquired Santa Fe thereby creating the opportunity for EGI to acquire the Elkhorn Project.

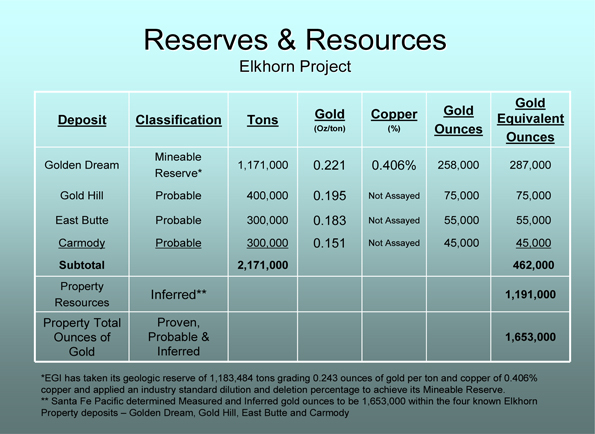

At the time EGI acquired the Elkhorn Project from Newmont in 1998, exploration work performed by Santa Fe Pacific Gold Corporation had identified a geologic resource containing 1.653 million ounces of gold located within four deposits – Carmody, Gold Hill, East Butte and Golden Dream .

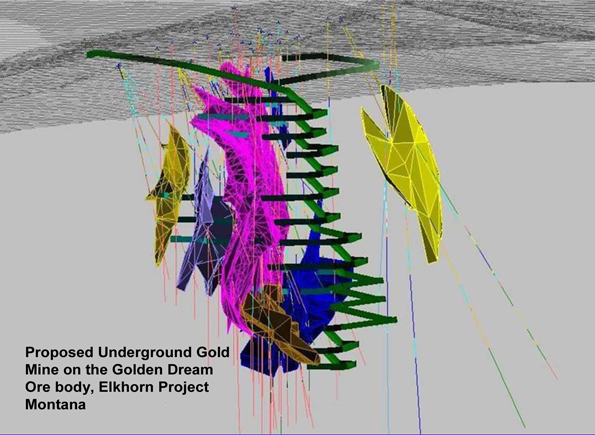

During EGI’s ownership of the Elkhorn Project it has focused its ore delineation drilling, analysis, design, planning and permitting on the Golden Dream deposit. EGI staff engineers have outlined in an internal feasibility study of the Golden Dream deposit a probable underground mineral reserve of 1.17 million tons containing 258,000 ounces of gold and 8.3 million pounds of copper and designed a Mine Plan around this mineral reserve as depicted below in computer-generated Mine Plan model.

| 31 |

Computerized schematic of the Golden Dream Mine showing planned tunnels and actual drill holes and ore blocks.

Unlike the Montana Tunnels Mine, the Golden Dream Mine is an underground mine with tunnels being approximately 14 feet high and 14 feet wide. The solid green bands in the above computer model represent the tunnels accessing the initial ore and the various other ore levels. It will be through these tunnels that the mined ore will be transported to the surface and then transported by haul trucks to the Montana Tunnels Mill Facility for processing (once the Montana Tunnels Mill Facility is up and running). Prior to the restart of the Montana Tunnels Mine Facility the ore may be shipped to other regional mills for processing.

Production mining will be undertaken using two different methods – cut-and-fill and sub-level stopping. The cut-and-fill method will be utilized on the upper levels of the Golden Dream Mine which are more oxidized or weathered.

Although the cut-and-fill method of mining is more expensive on a per ton basis, it is used in mining situations where waste rock, or country rock, around the ore to be mined is weaker and subject to falling in and diluting the ore. In the cut-and-fill mining method, ore is mined or “cut” along strike by driving a tunnel to remove the ore. This “cut” is then backfilled with cemented “fill” and another cut in the ore is driven alongside or above the cemented fill. The cemented backfill provides additional support to the country rock. Utilizing this mining method in the oxidized portions of the Golden Dream Mine should reduce dilution to the ore and provide a stable pillar that will not collapse or subside as the deeper sub-level areas are opened and mined.

As the mine reaches a depth below the first 150 feet of ore, the country rock turns from an oxidized, or weathered, material to a more solid, competent rock. At this point production mining will move from the cut-and-fill method to a sub-level stopping method. In the sub-level mining method, two drifts are driven, one at the top and one at the bottom of a block of ore 45 to 60 feet thick. Holes can then be drilled between the two levels and loaded with explosives and the ore blasted out. The mined out areas remaining from this procedure would be backfilled with loose rock or cemented backfill, if needed, for ground support.

| 32 |

The broken ore from either method of mining will be loaded into underground haul trucks and transported to the surface where it will be transferred into 30 ton covered over-the-road haul trucks and transported to the Montana Tunnels Mill Facility for processing (once the Montana Tunnels Mill Facility is up and running). Prior to the restart of the Montana Tunnels Mine Facility the ore may be shipped to other regional mills for processing.

Whereas in an open-pit operation the general goal is to move material for the lowest cost per ton – a bulk mining exercise – the general goal in an underground operation is to move fewer tons of material with the highest grade – an ore control exercise. Using the geologic model determined by core drilling analysis, staff engineers and geologists completed a production model and associated financial pro-forma employing capital and operating costs, mill recoveries and outside smelting and refining charges.

The current Golden Dream Mine Plan extends only to a depth of approximately 850 feet below surface. Drill intercepts by the prior owners of the Elkhorn Project have intersected ore grade mineralization on the Golden Dream deposit to depths of 1,400 feet below surface. EGI has also completed drilling and analysis laterally along the Golden Dream Mine deposit mineralized structure with positive results. Although the drill density in these locations is insufficient to define them as mineral reserves, there is a strong likelihood that additional mineable reserves will be identified upon commencement of mining operations at the Golden Dream Mine.

In addition to the mineralization in and around the Golden Dream Mine deposit, EGI and the property’s predecessors have completed drilling on the other mineralized deposits on the Elkhorn Project, namely Gold Hill, East Butte and Carmody. The current Elkhorn Project reserves and resources, as reported in the Santa Fe prefeasibility and EGI feasibility studies, including all deposits are outlined in the table below:

| 33 |

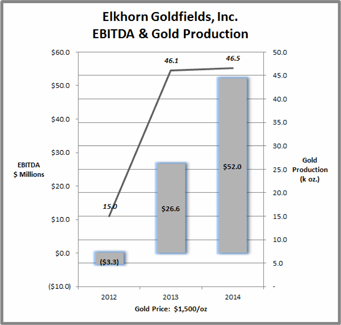

Golden Dream Project Underground Development

During the third quarter of 2011, EGI commenced development of the Golden Dream deposit. As of April 6, 2012, EGI has developed approximately 650 feet of 14’ X 14’ main underground access tunnel and 350 feet of 12’ X 12’ underground ore access tunnel to reach a specific level of the ore body. We are currently completing underground and surface water treatment and disposal infrastructure pursuant to our Operating Permit and, upon completion of this work we will commence development of the next stage at the decline into the lower level ore zones.

Golden Dream Main Access Decline (September 2011)

Company’s Two-Boom Jumbo working in 6500 level ore access ramp at Golden Dream Deposit (November 2011)

| 34 |

Trench being completed for Golden Dream water disposal (January 2012).

Golden Dream Main Access Decline and Mine shop buildings in background

Compliance with Government and Environmental Regulation

The Company’s mining, processing operations and exploration activities are subject to various laws and regulations governing the protection of the environment (federal regulator is the Bureau of Land Management (“BLM”) and state regulator is the Montana Department of Environmental Quality (“MDEQ”), exploration (BLM and MDEQ), mine safety, development and production (federal regulator is the Mine Safety and Health Administration (“MSHA”), exports, taxes, labor standards, occupational health (MSHA), waste disposal (BLM and MDEQ), toxic substances, water rights (federal regulator is the Department of Natural Resources and Conservation (“DNRC”), explosives (federal regulator is the Bureau of Alcohol, Tobacco, Firearms and Explosives (“ATF”) and other matters. New laws and regulations, amendments to existing laws and regulations or more stringent implementation of existing laws and regulations could have a material adverse impact on the Company, increase costs, cause a reduction in levels of, or suspension of, production and/or delay or prevent the development of new mining properties.

The Company believes it is currently in compliance in all material respects with all applicable environmental laws and regulations. Such compliance requires significant expenditures and increases mine development and operating costs. Mining is subject to potential risks and liabilities associated with pollution of the environment and the disposal of waste products occurring as a result of mineral exploration and production. Environmental liability may result from mining activities conducted by others prior to the Company’s ownership of a property. To the extent the Company is subject to uninsured environmental liabilities, the payment of such liabilities would reduce the Company’s otherwise available earnings and could have a material adverse effect on the Company. Should the Company be unable to fully fund the cost of remedying an environmental problem, it might be required to suspend operations or enter into interim compliance measures pending completion of the required remedy, which could have a material adverse effect on the Company. In addition, the Company does not have coverage for certain environmental losses and other risks as such coverage cannot be purchased at a commercially reasonable cost.

| 35 |

Licenses and Permits

The Company’s operations require licenses and permits from various governmental authorities. The Company believes it holds all material licenses and permits required under applicable laws and regulations and believes it is presently complying in all material respects with the terms of such licenses and permits. However, such licenses and permits are subject to change in various circumstances. There can be no guarantee that the Company will be able to obtain or maintain all necessary licenses and permits that may be required to explore and develop its properties, commence construction or operation of mining facilities and properties under exploration or development or to maintain continued operations that economically justify the cost.

Mine Safety and Health Administration Regulations

We consider health, safety and environmental stewardship to be a core value for the Company.

Pursuant to Section 1503(a) of the recently enacted Dodd-Frank Wall Street Reform and Consumer Protection Act, issuers that are operators, or that have a subsidiary that is an operator, of a coal or other mine in the United States are required to disclose in their periodic reports filed with the SEC information regarding specified health and safety violations, orders and citations, related assessments and legal actions, and mining-related fatalities. During the fiscal year ended December 31, 2011, the Company reported no lost time accidents. During this same fiscal year the Company incurred nine MSHA citations, seven of which have been cleared. The remaining two citations are being contested. All of the citations are covered by Section 104 (a) of the Mine Safety Act.

Competition

Because the life of a mine is limited by its mineral reserves, the Company is continually seeking to replace and expand its reserves through the exploration of existing properties as well as through acquisitions of interests in new properties or of interests in companies which own such properties. The Company encounters competition from other mining companies in connection with the acquisition of properties and with the engaging and maintaining of qualified industry experienced personnel. This competition may increase the cost of acquiring suitable properties and retaining qualified industry experienced personnel.

Employees

As of December 31, 2011, we had 18 full-time employees and two part-time employees, including our executive officers. We believe the relationship we have with our employees is good. In 2012 we anticipate the need to hire additional technical, mining and administrative personnel. Although demand for quality staff is high in the mining industry, we believe we will be able to fill these positions in a timely manner.