UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 20-F

(Mark One)

| ¨ | REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) OR 12(g) OF THE SECURITIES EXCHANGE ACT OF 1934 |

OR

| þ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

OR

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

OR

| ¨ | SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Date of event requiring this shell company report ________________

For the fiscal year ended: December 31, 2012

Commission file number: 000-53233

Wowjoint Holdings Limited

(Exact name of Registrant as specified in its charter)

N/A

(Translation of Registrant’s name into English)

Cayman Islands

(Jurisdiction of incorporation or organization)

1108 A Block Tiancheng Mansion, #2 Xinfeng Rd.

Deshengmenwai St, Xicheng District. Beijing 100088

(Address of principal executive offices)

Securities registered or to be registered pursuant to Section 12(b) of the Act:

Securities registered or to be registered pursuant to Section 12(g) of the Act: None

| Name of exchange on which each class is to be | ||

| Title of each class | registered | |

| Ordinary Shares | OTCQB | |

| Warrants | OTCQB | |

| Units | OTCQB |

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act:

None

(Title of Class)

Indicate the number of outstanding shares of each of the Issuer’s classes of capital or ordinary shares as of the close of the period covered by the annual report: 8,406,968 ordinary shares.

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨ No þ

If this report is an annual or transition report, indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934. Yes ¨ No þ

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes þ No ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer. See definition of “accelerated filer and large accelerated filer” in Rule 12b-2 of the Exchange Act. (Check one):

Large accelerated filer ¨ Accelerated filer ¨ Non-accelerated filer þ

Indicate by check mark which basis of accounting the registrant has used to prepare the financial statements included in this filing:

| US GAAP þ |

International Financial Reporting Standards as issued by the International Accounting Standards Board ¨ |

Other ¨ |

If “Other” has been checked in response to the previous question indicate by check mark which financial statement item the registrant has elected to follow.

Item 17 ¨ Item 18 ¨

If this is an annual report, indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No þ

(APPLICABLE ONLY TO ISSUERS INVOLVED IN BANKRUPTCY PROCEEDINGS DURING THE PAST FIVE YEARS)

Indicate by check mark whether the registrant has filed all documents and reports required to be filed by Sections 12, 13 or 15(d) of the Securities Exchange Act of 1934 subsequent to the distribution of securities under a plan confirmed by a court. Yes ¨ No ¨

WOWJOINT HOLDINGS LIMITED

| TABLE OF CONTENTS | ||

| INTRODUCTION | ||

| PART I | ||

| Item 1. | Identity of Directors, Senior Management and Advisers | 5 |

| Item 2. | Offer Statistics and Expected Timetable | 5 |

| Item 3. | Key Information | 5 |

| Item 4. | Information on the Company | 27 |

Item 4A. |

Unresolved Staff Comments |

45 |

| Item 5. | Operating and Financial Review and Prospects | 45 |

| Item 6. | Directors, Senior Management and Employees | 60 |

| Item 7. | Major Shareholders and Related Party Transactions | 64 |

| Item 8. | Financial Information | 65 |

| Item 9. | The Offer and Listing | 65 |

| Item 10. | Additional Information | 66 |

| Item 11. | Quantitative and Qualitative Disclosures About Market Risk | 70 |

| Item 12. | Description of Securities Other than Equity Securities | 70 |

| PART II | ||

| Item 13. | Defaults, Dividend Arrearages and Delinquencies | 70 |

| Item 14. | Material Modifications to the Rights of Security Holders and Use of Proceeds | 70 |

| Item 15. | Controls and Procedures | 71 |

Item 15T. |

Controls and Procedures |

72 |

| Item 16A. | Audit Committee Financial Expert | 72 |

| Item 16B. | Code of Ethics | 72 |

| Item 16C. | Principal Accountant Fees and Services | 72 |

| Item 16D. | Exemption from the Listing Standards for Audit Committees | 72 |

| Item 16E. | Purchases of Equity Securities by the Issuer and Affiliated Purchasers | 73 |

| Item 16F. | Change in Registrant’s Certifying Accountant | 73 |

| Item 16G. | Corporate Governance | 73 |

| Item 16H. | Mine Safety Disclosure | 73 |

| PART III | ||

| Item 17. | Financial Statements | 73 |

| Item 18. | Financial Statements | 73 |

| Item 19. | Exhibits | 73 |

| 3 |

INTRODUCTION

Unless otherwise indicated and except where the context otherwise requires,

| · | references to “Wowjoint,” “we,” “us” or “the Company” refer to Wowjoint Holdings Limited (together with its subsidiaries and affiliated entities, except where the context indicates otherwise); |

| · | references to “CFAC” or “China Fundamental” refer to China Fundamental Acquisition Corporation, our former name; |

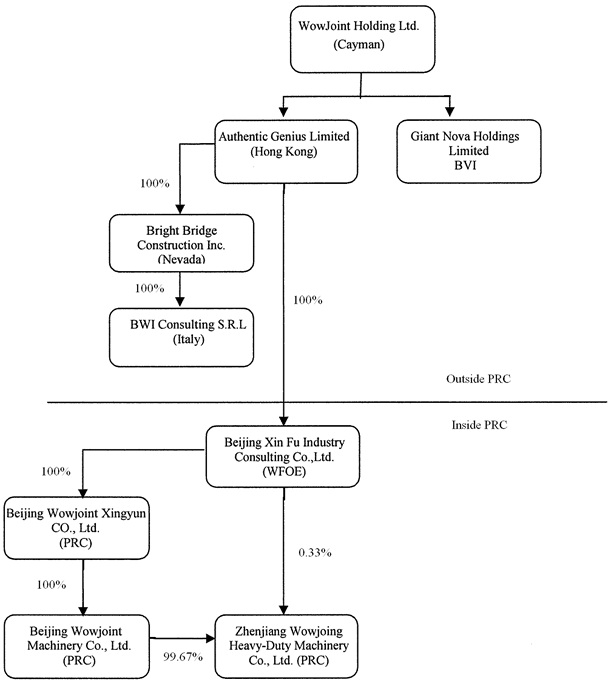

| · | except where otherwise indicated, references to “Beijing Wowjoint” refer collectively to Authentic Genius Limited (“AGL”); its consolidated subsidiaries, Beijing Xin Fu Industry Consulting Co., Ltd. (“BXFI”), Bright Bridge Construction Inc. (“Bright Bridge”) and BWI Consulting s.r.l. (“BWI”); its former variable interest entity ("VIE") and now wholly owned subsidiary, Beijing Wowjoint Machinery Co., Ltd. (“BWMC”); Giant Nova Holdings Limited; and, for periods subsequent to May 10, 2010, Beijing Wowjoint Xingyun Co. Ltd. (“BWXC”); |

| · | references to the “acquisition” or the “business combination” refer to the purchase by China Fundamental of all of the outstanding shares of Beijing Wowjoint on February 22, 2010; |

| · | references to the financial statements of Beijing Wowjoint, either audited or unaudited, refer collectively to those of AGL and its consolidated subsidiaries, BXFI, Bright Bridge and BWI; its former VIE and now wholly owned subsidiary, Beijing Wowjoint Machinery Co., Ltd.; Giant Nova Holdings Limited; and, for periods subsequent to May 10, 2011, Beijing Wowjoint Xingyun Co., Ltd. (“BWXC”); |

| · | references to “our original shareholders” refer collectively to Chun Yi Hao, Hope Ni, Q.Y. Ma and Tan Xiao Wei, each of whom purchased China Fundamental shares and warrants prior to its initial public offering; |

| · | references to “PRC” or “China” refer to the People’s Republic of China; |

| · | references to “dollars” or “$” refer to the legal currency of the United States; and |

| · | references to “public shareholders” refer to the holders of shares purchased in China Fundamental’s initial public offering. |

FORWARD-LOOKING STATEMENTS

This Annual Report on Form 20-F contains forward-looking statements as defined in Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the Securities Exchange Act of 1934 (the “Exchange Act”). Such forward-looking statements involve risks and uncertainties. All statements other than statements of historical facts are forward-looking statements, and such statements include information about our possible or assumed future results of operations or our performance. Words such as “expects,” “intends,” “plans,” “believes,” “anticipates,” “estimates,” and variations of such words and similar expressions are intended to identify the forward-looking statements.

The risk factors and cautionary language referred to in this Annual Report provide examples of risks, uncertainties and events that may cause actual results to differ materially from the expectations described by the Company in its forward-looking statements, including among other things:

| · | the diversion of management time on acquisition and integration related issues; |

| · | difficulties in integrating the merged businesses and management teams; |

| · | changes in Chinese government’s anticipated infrastructure construction plans; |

| · | changes in demand for non-standard special construction machinery and equipment used in bridge, road and railway construction; |

| · | changes in demand for customized heavy duty special construction machinery and equipment used in constructions of bridges, roads and railways; |

| · | the impact of inflation generally, as well as the rising costs of materials, such as steel; |

| 4 |

| · | loss of key customers; |

| · | changes in our operating expenses, partially attributable to fluctuating prices of raw materials such as steel; |

| · | changes in RMB exchange rate against major currencies that may negatively impact on the purchase of import materials or the export of finished products; |

| · | legislation or regulatory environments, requirements or changes adversely affecting the construction machinery and equipment businesses in which we are engaged; |

| · | statements about industry trends in construction machinery and equipment, including infrastructure development and economic growth factors affecting supply and demand; |

| · | economic conditions in China generally and in particular in the construction machinery and equipment markets in which we operate; and |

| · | geo-political events and regulatory changes. |

You are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date of this report.

Although we believe that the expectations reflected in such forward-looking statements are reasonable, there can be no assurance that such expectations will prove to be correct. These statements involve known and unknown risks and are based upon a number of assumptions and estimates, which are inherently subject to significant uncertainties and contingencies, many of which are beyond our control. Actual results may differ materially from those expressed or implied by such forward-looking statements.

We undertake no obligation to publicly update or revise any forward-looking statements contained in this Annual Report, or the documents to which it refers you, to reflect any change in our expectations with respect to such statements or any change in events, conditions or circumstances upon which any statement is based.

PART I

ITEM 1. IDENTITY OF DIRECTORS, SENIOR MANAGEMENT AND ADVISERS

Not Applicable.

ITEM 2. OFFER STATISTICS AND EXPECTED TIMETABLE

Not Applicable.

ITEM 3. KEY INFORMATION

A. Selected Financial Data

The following selected consolidated quarterly financial and operating data is unaudited. The summary statement of cash flow data is derived from our audited consolidated financial statements as of and for the years ended December 31,2012, December 31,2011, December 31,2010, August 31,2009, August 31,2008 and the four month period ended December 31,2009 and 2008. The consolidated financial statements were prepared and presented in accordance with U.S. generally accepted accounting principles, or GAAP. The summary statement of cash flow data for the four month period ended December 31,2008 is unaudited.

Our results of operations in any past period may not necessarily be indicative of the results that may be expected for any future period. See “Risk Factors” included elsewhere in this Annual Report. The summary consolidated financial information for those periods and as of those dates should be read in conjunction with those consolidated financial statements and the accompanying notes, if available, and “Operating and Financial Review and Prospects” included elsewhere in this Annual Report.

| 5 |

Summary of statement of operation data:

(unaudited)

(US$ in thousands except per share and operating data)

| Year ended December 31, | Four months ended December 31, | Year ended August 31, | ||||||||||||||||||||||||||

| 2012 | 2011 | 2010 | 2009 | 2008 | 2009 | 2008 | ||||||||||||||||||||||

| Revenue | 10,098 | 24,398 | 24,062 | 1,696 | 17,208 | 44,622 | 36,233 | |||||||||||||||||||||

| Gross profit | 2,938 | 6,763 | 5,977 | (4,469 | ) | 4,918 | 13,323 | 6,055 | ||||||||||||||||||||

| Operating income | (4,308 | ) | 2,058 | 637 | (6,222 | ) | 4,210 | 10,897 | 4,359 | |||||||||||||||||||

| Net income | (3,858 | ) | 1,188 | 424 | (5,336 | ) | 3,819 | 9,784 | 3,939 | |||||||||||||||||||

| Basic net income per share(1) | (0.46 | ) | 0.15 | 0.06 | n/a | n/a | n/a | n/a | ||||||||||||||||||||

| Diluted net income per share(1) | (0.46 | ) | 0.15 | 0.06 | n/a | n/a | n/a | n/a | ||||||||||||||||||||

Summary of statement of operation data:

(US$ in thousands except per share and operating data)

| 2012Q4 | 2012Q3 | 2012Q2 | 2012Q1 | |||||||||||||

| Revenue | 6,040 | 1,510 | 1,358 | 1,190 | ||||||||||||

| Gross profit | 1,635 | 446 | 445 | 412 | ||||||||||||

| Operating income | (1,584 | ) | (837 | ) | (843 | ) | (1,044 | ) | ||||||||

| Net income | (1,770 | ) | (823 | ) | (873 | ) | (392 | ) | ||||||||

| Basic net income per share(1) | (0.20 | ) | (0.10 | ) | (0.11 | ) | (0.05 | ) | ||||||||

| Diluted net income per share(1) | (0.20 | ) | (0.10 | ) | (0.11 | ) | (0.05 | ) | ||||||||

| 2011Q4 | 2011Q3 | 2011Q2 | 2011Q1 | 2010Q4 | 2010Q3 | 2010Q2 | 2010Q1 | |||||||||||||||||||||||||

| Revenue | 4,011 | 5,355 | 8,416 | 6,616 | 11,028 | 8,740 | 2,562 | 1,732 | ||||||||||||||||||||||||

| Gross profit | 1,591 | 1,329 | 2,436 | 1,407 | 3,170 | 1,928 | 596 | 282 | ||||||||||||||||||||||||

| Operating income | (100 | ) | 297 | 1,516 | 345 | 1,538 | 424 | (818 | ) | (507 | ) | |||||||||||||||||||||

| Net income | (376 | ) | 250 | 1,024 | 290 | 1,312 | 299 | (762 | ) | (425 | ) | |||||||||||||||||||||

| Basic net income per share(1) | (0.05 | ) | 0.03 | 0.13 | 0.04 | 0.17 | 0.04 | (0.10 | ) | (0.07 | ) | |||||||||||||||||||||

| Diluted net income per share(1) | (0.05 | ) | 0.03 | 0.13 | 0.04 | 0.17 | 0.04 | (0.10 | ) | (0.07 | ) | |||||||||||||||||||||

| (1) | Earnings per share information is not presented for the periods prior to January 1, 2010, as its inclusion would not be meaningful as Wowjoint was a privately held company during those periods. |

| 6 |

Summary of statement of cash flow data:

(US$ in thousands)

| Year ended December 31, | Four months ended December 31, | Year ended August 31, | ||||||||||||||||||||||||||

| 2012 | 2011 | 2010 | 2009 | 2008 | 2009 | 2008 | ||||||||||||||||||||||

| Net cash provided by/(used in) operating activities | 4,720 | 9,597 | (3,898 | ) | (1,224 | ) | (522 | ) | 763 | 1,905 | ||||||||||||||||||

| Net cash provided by/(used in) investing activities | (6,167 | ) | (12,004 | ) | 5,132 | (50 | ) | (238 | ) | (347 | ) | (2,138 | ) | |||||||||||||||

| Net cash provided by/(used in) financing activities | (1,486 | ) | 3,973 | 24 | 19 | 260 | (5 | ) | 537 | |||||||||||||||||||

Summary of balance sheet data:

(US$ in thousands)

| As of December 31, | Year ended August 31, | |||||||||||||||||||

| 2012 | 2011 | 2010 | 2009 | 2008 | ||||||||||||||||

| Cash and cash equivalents | 1,714 | 4,627 | 2,168 | 1,895 | 1,438 | |||||||||||||||

| Working capital(1) | (1,515 | ) | 7,982 | 16,033 | 14,978 | 5,532 | ||||||||||||||

| Total assets | 41,347 | 52,249 | 37,591 | 29,920 | 33,688 | |||||||||||||||

| Total shareholders’ equity | 18,690 | 22,527 | 20,387 | 17,943 | 8,151 | |||||||||||||||

Summary of balance sheet data:

US$ in thousands)

| 2012Q4 | 2012Q3 | 2012Q2 | 2012Q1 | |||||||||||||

| Cash and cash equivalents | 1,714 | 723 | 2,271 | 1,484 | ||||||||||||

| Working capital(1) | (1,515 | ) | 4,894 | 6,049 | 6,607 | |||||||||||

| Total assets | 41,347 | 46,141 | 48,054 | 46,247 | ||||||||||||

| Total shareholders’ equity | 18,690 | 20,823 | 21,624 | 21,919 | ||||||||||||

| 7 |

| 2011Q4 | 2011Q3 | 2011Q2 | 2011Q1 | 2010Q4 | 2010Q3 | 2010Q2 | 2010Q1 | |||||||||||||||||||||||||

| Cash and cash equivalents | 4,627 | 3,762 | 4,324 | 3,009 | 2,168 | 2,026 | 7,242 | 7,554 | ||||||||||||||||||||||||

| Working capital(1) | 7,982 | 10,113 | 15,100 | 15,682 | 16,033 | 15,216 | 15,110 | 15,985 | ||||||||||||||||||||||||

| Total assets | 52,249 | 57,040 | 44,715 | 46,390 | 37,591 | 31,310 | 31,811 | 31,352 | ||||||||||||||||||||||||

| Total shareholders’ equity | 22,527 | 22,817 | 22,157 | 20,746 | 20,387 | 18,816 | 18,281 | 18,951 | ||||||||||||||||||||||||

| (1) | Working capital is calculated as current assets minus current liabilities. |

The following table sets forth information concerning exchange rates between the RMB and the U.S. dollar for the periods indicated. These rates are provided solely for your convenience and are not necessarily the exchange rates that were used in this Annual Report or will use in the preparation of our periodic reports or any other information to be provided to you.

| Spot Exchange Rate | ||||

| Period | Average (1) | |||

| (RMB per US$1.00) | ||||

| 2008 | 6.9477 | |||

| 2009 | ||||

| January | 6.8360 | |||

| February | 6.8363 | |||

| March | 6.8360 | |||

| April | 6.8306 | |||

| May | 6.8235 | |||

| June | 6.8334 | |||

| July | 6.8317 | |||

| August | 6.8323 | |||

| September | 6.8277 | |||

| October | 6.8267 | |||

| November | 6.8271 | |||

| December | 6.8275 | |||

| 2010 | ||||

| January | 6.8260 | |||

| February | 6.8274 | |||

| March | 6.8262 | |||

| April | 6.8256 | |||

| May | 6.8275 | |||

| June | 6.8127 | |||

| July | 6.7762 | |||

| August | 6.7873 | |||

| September | 6.7361 | |||

| October | 6.6675 | |||

| November | 6.6538 | |||

| December | 6.6497 | |||

| 2011 | ||||

| January | 6.5964 |

| 8 |

| February | 6.5761 | |||

| March | 6.5645 | |||

| April | 6.5267 | |||

| May | 6.4948 | |||

| June | 6.4776 | |||

| July | 6.4575 | |||

| August | 6.4036 | |||

| September | 6.3884 | |||

| October | 6.3710 | |||

| November | 6.3564 | |||

| December | 6.3482 | |||

| 2012 | ||||

| January | 6.3107 | |||

| February | 6.2997 | |||

| March | 6.3125 | |||

| April | 6.3043 | |||

| May | 6.3242 | |||

| June | 6.3632 | |||

| July | 6.3717 | |||

| August | 6.3593 | |||

| September | 6.3200 | |||

| October | 6.2627 | |||

| November | 6.2338 | |||

| December | 6.2328 | |||

| 2013 | ||||

| January | 6.2215 | |||

| February | 6.2323 | |||

| March | 6.2154 | |||

| April | 6.1861 | |||

| May | 6.1416 | |||

| June till June 5, 2013 | 6.1291 |

Source: Federal Reserve Statistical Release

| (1) | Annual averages are calculated from month-end rates. Monthly averages are calculated using the average of the daily rates during the relevant period. |

| 9 |

B. Capitalization and Indebtedness

Not applicable

C. Reasons for the Offer and Use of Proceeds

Not applicable

D. Risk Factors

Risks Associated with Our Business and Industry

We cannot assure you that we will be able to refinance any indebtedness incurred under our rolling credit facilities or obtain additional debt financing.

We rely on lines of credit provide by several banks in China. As of June 10, 2013, approximately US$3 million (RMB19 million) was outstanding under our revolving lines of credit. As the lines are uncommitted working lines of credit, we cannot assure you that we will be able to continue rolling over these lines of credit or to do so at an interest rate or on terms that are acceptable to us or at all. Our ability to obtain bank financing or to access the capital markets for future offerings may be limited by our financial condition at the time of any such financing or offering, including our actual or perceived credit quality, as well as by adverse market conditions resulting from, among other things, general economic conditions in China. In addition, future disruptions in the financial markets, such as have been recently experienced, could affect our ability to extend our existing loans or to obtain new or additional debt financing or on favorable terms (or at all), which may have other adverse effects on us. The incurrence of debt under our credit facilities could adversely affect our business by increasing our vulnerability to general adverse economic and industry conditions and requiring us to dedicate a substantial portion of our cash flow from operations to payments on our indebtedness, thereby reducing the availability of our cash flow for other purposes. See “Operating and Financial Review and Prospects – Liquidity and Capital Resources.”

Actual overall risks or costs of our contracts may exceed our initial evaluation and lead to cost overruns, resulting in a reduction in revenues, lower profitability or even losses on such contracts.

We base a number of contracts in part on cost estimates that are subject to a number of assumptions, including assumptions about future economic conditions, cost and availability of raw materials and labor. However, these assumptions may prove to be inaccurate. In addition, we may not be able to reduce our costs through our cost management scheme. Any deficiencies in internal cost control or unreasonable price increases in raw materials could result in cost overruns.

We currently generate, and expect to continue to generate, a substantial portion of our revenues from fixed-price contracts. For the year ended August 31, 2008, and in the period since then through June 10, 2013, a substantial majority (i.e. more than 90%) of our revenues were derived from fixed-price contracts. The terms of these contracts require us to complete the delivery of equipment and machinery for a fixed price and therefore expose us to cost overruns. Cost overruns, whether due to inefficiency, inaccurate estimates or other factors, result in lower profit or a loss on a contract. As a result, we will only realize profits on these contracts if we successfully estimate our costs and avoid cost overruns. Other variations and risks inherent in the performance of fixed price contracts, such as delays caused by technical issues, any inability to obtain the requisite permits and approvals, may cause our actual overall risks and costs to differ from our original estimates despite any buffer we may have built into our bids for increases in labor and material costs. While there have only been two occasions involving small projects where our costs have equaled or exceeded our revenues from the project, as a project based company, we anticipate, from time to time, encountering cost overruns or delays on our current and future contracts. If such cost overruns or delays occur, we could experience an increase in costs exceeding our budget or be subject to penalties with a consequent reduction in, or elimination of, the profits on our contracts.

Some of our contracts contain price adjustment clauses, which allow us to recoup additional costs incurred as a result of unexpected increases in raw material costs. However, we are typically required to bear a portion of the increased costs. From time to time, we may be required to perform extra or “change order” work under our contracts despite the absence of prior agreements with our customers on the scope or price of the work to be performed. Even though our contracts generally contain adjustment clauses for customers to pay for the extra work, we may be required to fund the cost of such work until the change order is approved and funded by the customer. We account for the costs of contract performance pending approval and funding of a change order by a customer by temporarily recording such costs as deferred cost and then adjusting to cost of sales in the period when revisions to a sale contract are determined. In addition, the performance of the extra work may cause delays in our other contract commitments and may have a negative impact on our ability to meet specified deadlines.

| 10 |

We rely on third parties to complete part of our equipment manufacturing, which may be adversely affected by the sub-standard performance or non-performance of such third parties.

We typically engage third-party subcontractors to perform a portion of the work under our contracts, in order to minimize the need to employ a large workforce that includes skilled labor and semi-skilled labor, as well as to maximize our-cost efficiency and flexibility. However, we may not be able to monitor the performance of these subcontractors as efficiently as our own in-house staff. In addition, our inability to engage qualified subcontractors could affect our ability to maintain the quality of our products. Subcontracting exposes us to risks associated with non-performance, delayed performance, or sub-standard performance by subcontractors. We may also suffer losses or a lesser profit margin if the amounts we pay our subcontractors exceed our original estimates. As a result, we may experience deterioration in quality or delays with respect to the delivery of our equipment, incur additional costs due to the delays or higher costs in sourcing the services, or be subject to liability under the relevant contracts for our subcontractors’ performances. Such events could impact upon our profitability, financial performance and reputation, and result in litigation or damage claims.

Delays in collecting accounts receivable, progress payments or the release of retention money by our customers, or delays in the continued growth of our leasing business, may affect our liquidity.

Like other companies in the construction and construction equipment industry in China, we typically receive progress payments from our customers with reference to the value of work completed at specified milestones, as well as receive final payments upon the delivery of complete equipment. We receive installment payments in the process of equipment manufacturing, and usually a significant percentage of contract value would be billed upon the delivery of the equipment to our customers.

Usually we are either requested by our customers to secure a letter of credit issued by a licensed commercial bank or a portion of the contract value, normally 5% to 10%, is withheld by the customer as retention money to be paid or released after the warranty period (generally one year after the completion of the respective equipment and products).

In the past few years, we have experienced some delay in collection of account receivables from state-owned companies, which are majority of our current customers. In the event that we encounter delays or defaults in the payment of accounts receivable or progress payments by our customers, we may be required to invest working capital to maintain our day-to-day operations. There is no assurance that amounts due pursuant to accounts receivable, progress payments or retention money will be remitted by our customers on a timely basis or that those delays or defaults in payment will not affect our financial condition and results of operations.

From 2010, we began leasing equipment to several of our customers. As lease payments are received periodically over time, rather than in upfront payments, growth in our leasing business could also affect our liquidity in the future.

We depend upon customers concentrated in the infrastructure construction industry. A reduction in government spending in infrastructure development could adversely affect our performance.

From a macro-economic perspective, a major risk we face is the relatively large reliance on the PRC government's investment in transportation and infrastructure sectors. The PRC government's judgment of the national economic conditions and expectations regarding economic development trends together with the utilization status of existing infrastructures and the expected needs for future expansion may result in changes in public budget for infrastructure development. This is especially true with respect to investments in transport infrastructure such as railways and highways, and in the outsourcing volume of infrastructure construction projects by government bodies, changes in which may have an adverse impact on our business volume.

The majority of our sales are generated from customers involved in the construction of railways and highways. In particular, China Railway Construction Corporation (“CRCC”), China Railway Group Limited (“CRG”), China Communications Company Limited (“CCC”), SinoHydro Corporation (“SinoHydro”), Eden Technology s.r.l. (”Eden”) and BBE Solutions Sdn Bhd (“BBE”) have accounted for a sizeable portion of our total revenues in recent years. For example, in the fiscal year ended August 31, 2008, CRCC, CCC and CRG accounted for 35% (Bureau 16, 20%; Bureau 12, 15%), 26% and 13% of our total sales, respectively; in the fiscal year ended August 31, 2009, CCC and CRG accounted for 46% and 16% of our total sales, respectively; in the four months from August 31, 2009 to December 31, 2009, SinoHydro Corporation ("SinoHydro"), a Chinese state-owned hydropower engineering and construction company, accounted for 98% of our total sales; and in the year ended December 31, 2010, CRCC, CCC and CRG accounted for 37% (Bureau 16, 34%; Bureau 12, 3%), 20% and 19% of our total sales, respectively. In the year ended December 31, 2011, CRCC and Eden accounted for 65% and 21% of our total sales, respectively. In the year ended December 31, 2012, BBE, CRG (Bureau 25) and CCC (Bureau 1) accounted for 24%, 21% and 14% of our total sales, respectively.

| 11 |

Shifts in customer relationship from period to period reflect our results in bidding for new infrastructure contracts, as well as an increase in international sales, which accounted for approximately 26% of total sales in 2012, 26% of total sales in 2011 and 11.6% of total sales in 2010, respectively.

Although we have relatively few major customers, we deal with many different bureaus and subsidiaries within these large PRC state-owned enterprises and often have a number individual sales and service contracts with major customers. For example, CRG has approximately 10 separate bureaus, each with a number of different subsidiaries, while CRCC has 15 bureaus, each with multiple subsidiaries at any point in time, including China Railway 16th Bureau Group Ltd. (No.4 Engineering Company Ltd., No. 5 Engineering Company Ltd.; and No. 1 Engineering Company Ltd.), China Railway 3rd Bureau Group Co., Ltd (Bridge and Tunnel Engineering Company of the Third Engineering Group Co., Ltd. of China Railway; China Railway No.3 Construction and Installation Engineering Co., Ltd; No.2 Engineering Company Ltd.; No.5 Engineering Company Ltd.; and No.6 Engineering Company Ltd.), China Railway 12th Bureau Group Co., Ltd (No.1 Engineering Company Ltd.; No.3 Engineering Company Ltd.; and No.4 Engineering Company Ltd.), and China Railway 1st Bureau Group Co., Ltd. All of these contracts have been entered into in the ordinary course of business, were individually negotiated and are for equipment custom tailored for a specific project. Any reduction or delay in the capital spending by these companies or in the PRC’s infrastructure development could cause a significant decline in our sales and profitability.

Our revenues depend on gaining new customers and we do not have long-term purchase commitments from our customers.

Our revenues result from individual equipment sales, which produce a limited amount of ongoing revenues from equipment maintenance and other services. In order to maintain and expand our business, we must be able to replenish new orders in our pipeline on a continuous basis. Our potential customers could choose products of our competitors instead. Should they do so, we could suffer a decline in revenues and profitability.

We expect to rely increasingly on our proprietary products and if we become involved in an intellectual property dispute, we may be forced to spend a significant amount of time and financial resources to resolve such intellectual property dispute, diverting time and resources away from our business and operations.

Our business is based on a number of proprietary products, which are protected by patents filed in the PRC. We expect our future growth will rely on these proprietary products to meet customers’ demands. For example, given the expansion of China’s rail system into mountainous and heavily forested areas, we expect that sales of our integrated launching gantry, which is designed and well suited for such terrain, to represent an increasing portion of our overall sales in the next several years. However, if third parties should infringe on any of our patents on our integrated launching gantry or other products, as has happened on several occasions, we may need to devote significant time and financial resources in legal actions brought through the China court system to attempt to halt the infringement. For example, a lawsuit that we filed in connection with infringements of our patents ended in our favor in 2009, whereby the Beijing court awarded us RMB 1.0 million, and a second lawsuit was also settled in Beijing court in 2010 for similar amount. Under the terms of that settlement we agreed to grant the infringing party the use of our patent in return for it entering into a multi-year contract with us. Conversely, in the event of an infringement claim by third parties against us, we may be required to spend a significant amount of time and financial resources to defend against such claim. However we may not always be successful in lawsuits that we initiate or in defending ourselves against claims made against us by others. Moreover, any litigation could result in substantial costs and the diversion of our management resources and could materially and adversely affect our business and operating results.

The slow down of general economy in China in 2010, 2011 and 2012, and the reduction in government spending in railway sector due to the railway accident in 2011 could adversely affect our results of operations.

China initiated a policy of fiscal constraint in the latter part of 2009 to deliberately cool the country’s economy, including infrastructure investment, which resulted in the suspension of spending on a number of major infrastructure projects, including several in which we were involved. As a result, Chinese economic growth had slowed down noticeably in the past few years, as the Chinese GDP growth was 10.4%, 9.3%, 7.8% in 2010, 2011 and 2012, respectively. In particular, 2012 recorded the slowest growth rate since 1999.

| 12 |

China faced a highly complicated external environment in 2012, as the economies of the EU countries and the United States remained sluggish, the global financial market experienced turbulence and protectionism was on the rise. There were also a number of domestic negative factors affecting GDP growth, including mid- and long-term upward price pressures in raw materials and labor, funding shortages for small businesses, as well as structural changes intended to enhance energy-saving, emission reduction and other environmental protection measures already in implementation or to be implemented. However, China's urbanization process, development of its market economy and industrialization should continue to provide impetus for its mid- and long-term growth.

Some economists predicated that the international economic situation will remain challenging in 2013, while in China the driving force for mid- and long-term economic growth has not changed in 2013 while constraints in resources, environment and labor supply continued to increase. The government has shifted its top priority from taming inflation to stabilizing growth. It has moderately eased its grip over lending, approved massive construction projects, and stepped up tax reductions to buoy the economy in recent months.

Many of our customers are state-owned enterprises which depend substantially on government funding of railway construction and other infrastructure projects. The high-speed railway accident in July 23, 2011 together with the PRC government’s adopted measures designed to keep railway construction from overheating have resulted in substantial slow-down on construction of high-speed rail lines across the country, which have not recovered to pre-accident level yet.

As our business is closely tied to the global infrastructure investments, and in particular such investments in China, our business was directly impacted by these trends. The currently implemented 12th Five Year Plan (2011-2015) includes a significant allocation of government dollars (RMB 2.8 trillion, i.e. approximately US$456 billion) for large infrastructure projects which we anticipate will drive demand for our products and services through the next few years. As the global economic climate continues to improve, the Chinese government may halt, decrease or delay railway construction and maintenance as part of their macroeconomic policy.

Any decrease or delay in government funding of railway construction and maintenance, other infrastructure projects and overall government spending could cause the number of contracts up for bid to fall, traditional upfront payments of 20% - 40% to be lowered and payment terms to be stretched, adversely affecting our results of operations.

Our business could be adversely affected by claims by third parties for possible infringement of their intellectual property rights.

We may face claims from time to time that our products infringe upon the intellectual property rights of third parties, including our competitors. If any legal proceedings against us for infringement of intellectual property rights are successful, we may be ordered to be responsible for the losses incurred by the claiming parties due to our infringement of their intellectual property rights. Further, if we are unable to obtain a license for the usage of such intellectual property rights on acceptable terms, or at all, or unable to design around such intellectual property rights, we may be prohibited from manufacturing or selling products which are dependent on the usage of such intellectual property rights. In such cases, we may experience a material adverse effect on our business and reputation, and these types of proceedings and their consequences could divert management’s attention from our business, all of which could have a material adverse effect on our business and results of operations.

We rely upon receiving an adequate supply of raw materials at acceptable prices and quality in a timely manner.

The success of our operations depends on our ability to obtain sufficient quantities of raw materials and supplies at acceptable prices and quality in a timely manner. We have historically relied on a few suppliers and should we subsequently lose any of these suppliers, we will be forced to seek other suppliers. Such suppliers may be difficult to replace. We are exposed to the market risk of fluctuations in certain commodity prices for raw materials and supplies, such as steel and electronic parts utilized in our products. The price and availability of such raw materials and supplies may vary significantly from year to year due to factors such as China’s import restrictions, consumer demand, producer capacity, market conditions and costs of materials. We do not have long-term contracts with our suppliers or guarantees of supply. Should the prices of raw materials rise, we may experience lower than expected profit margins on our existing contracts.

| 13 |

We may be exposed to potential product liability claims that may affect our profitability and damage our reputation.

A majority of our products are large-scale heavy-duty machines that require skilled labor to operate. Failures in the design, quality control, installation and assembly, and operation of these machines, as well as accidents, geological catastrophes and other construction field hazards, may result in injuries to personnel, loss of lives and damage to property despite repeated testing by us before and after delivery of these machines to our customers. Existing PRC laws and regulations do not require us to maintain third party liability insurance to cover product liability claims and we currently do not carry product liability insurance. In the event a product liability claim is brought against us, the lawsuit may, regardless of merit or eventual outcome, result in damages to our reputation, result in loss of contracts, inhibit our ability to win future contracts, and lead to substantial costs in litigation, product recalls and loss of revenue.

China’s financial markets are not as sophisticated as markets in developed countries and regions such as the United States, European Union, Hong Kong, Taiwan and Singapore. The choice and selection of insurance policies to cover the potential liability of our products may not be widely available, which may result in our inability to obtain adequate insurance coverage against product liability risks.

Our success depends on stringent quality controls and timely delivery of our products, and any related failure could adversely impact our financial performance and result in damages to our reputation.

We design, manufacture and install our products based on the specific requirements of each customer. Our ability in obtaining future orders depends upon our ability to maintain and uphold the performance, reliability and quality standards required by our customers. We may experience delays in the collection of accounts receivables, additional expenses resulting from warranty and maintenance services, and reduced, cancelled or discontinued orders. Additionally, performance, reliability or quality claims by our customers, with or without merit, could result in costly and time-consuming litigation, which would consume the time and attention of management and may result in significant monetary damages.

The majority of our current products are custom-made for specific projects, which provides no guarantee of future success.

We are a solution provider of customized heavy-duty large-scale equipment for infrastructure construction projects. Each of our products is relatively unique to the construction projects in which it is designed to operate. Although most designs provide flexibility and capacity to be modified, we are usually engaged by our customer on a per project basis. Thus, a majority of our sales do not result in repetitive purchases of the same piece of equipment, which may limit the extent to which our sales and profitability are sustainable in the future.

Our plans to enter the international construction machinery and equipment market may not be successful.

Although we have conducted most of our business within China, we have been exploring business opportunities in selected markets outside China and strategically expanding our global footprint. Expansion into new markets outside China exposes us to substantial risks, such as risks related to currency fluctuations, regulatory problems, punitive tariffs, trade embargoes, differences in general business environments, higher competition, costly legal and regulatory requirements, adverse tax consequences, insufficient experience dealing with local payment and business practices, and protectionism. In addition, the additional demands on our management from such expansion may detract from efforts in the domestic Chinese market, causing our operating results in China to be adversely affected.

Our plans to enter into vertical markets may not be successful.

In 2012, we made certain progress entering new vertical markets by providing marine hoists to yacht manufacturer and wind tower hoist to wind turbine tower manufacturer and building certain inspection equipment of the overhead concrete beams of the elevated pave way of China's high-speed railway. However, these markets are new to us and there is no assurance that we will be successful in these markets.

We may not be able to retain, recruit and train adequate management and engineering personnel, and our inability to attract and retain qualified personnel may limit our development.

Our success is dependent to a large extent on our ability to retain the services of our executive management personnel who have contributed to our growth and expansion. The industry experience of our executive officers, directors and other members of our senior management is essential to our continuing success. Accordingly, the loss of their services, particularly those of Mr. Yabin Liu and Mr. Fude Zhang, may be difficult to replace and could have an adverse affect on our operations and future business prospects.

| 14 |

In addition, our continued operations are dependent upon our ability to identify and recruit adequate engineering personnel in China. We require trained graduates of varying levels of experience and a flexible work force of semi-skilled operators. Given the current rate of economic growth in China, competition for qualified personnel will be substantial. Wage rates that we must offer our employees to retain qualified personnel may not enable us to remain competitive.

Limitations on the ability of our operating subsidiary to make payments to us could have a material adverse effect on our ability to conduct our business and fund our operations.

We are a holding company and conduct substantially all of our business through our principal operating subsidiary, Beijing Wowjoint Machinery Co. Ltd. and affiliated entities. The payment of dividends by entities organized in China is subject to limitations. In particular, regulations in China currently permit payment of dividends only out of accumulated profits as determined in accordance with PRC accounting standards and regulations. Beijing Wowjoint Machinery Co. Ltd. (“BWMC”) is also required to set aside at least 10% of its after-tax profit based on PRC accounting standards each year to its general reserves until the accumulative amount of such reserves reaches 50% of its registered capital. These reserves are not distributable as cash dividends. In addition, it is required to allocate a portion of its after-tax profit to its staff welfare and bonus fund at the discretion of its board of directors. Moreover, if Beijing Wowjoint Machinery Co. Ltd. incurs debt on its own behalf in the future, the instruments governing the debt may restrict its ability to pay dividends or make other distributions to us. Any limitation on the ability of our PRC subsidiaries to distribute dividends and make other distributions to us could materially and adversely limit our ability to make investments or acquisitions that could be beneficial to our businesses, pay dividends or otherwise fund and conduct our business.

Wowjoint currently enjoys certain preferential tax treatment in China; there can be no assurance that this will continue.

Pursuant to the PRC Income Tax Laws, prior to January 1, 2008, Chinese companies were subject to Enterprise Income Taxes (“EIT”) at a statutory rate of 33%, which consisted of 30% national income tax and 3% local income tax. Beginning January 1, 2008, the new EIT law replaced the existing laws for Domestic Enterprises (“DES”) and Foreign Invested Enterprises (“FIEs”). The new standard EIT rate of 25% replaced the 33% rate currently applicable to both DES and FIEs, except for High Tech companies who pay a reduced rate of 15%. Companies established before March 16, 2007 will continue to enjoy tax holiday treatment approved by local government until the tax holiday term is completed, whichever is determined by local government.

We currently qualify as a High Technology company, a classification which is available to companies that consistently invest in the research and development of new technology or products or own proprietary intellectual property rights in key areas supported by the PRC government, and meet certain minimum revenue and employment requirements. As a result, we are entitled to preferential tax treatment and enjoy the benefit of a reduced income tax rate at 15%. We have received a 50% tax exemption (Tax Exemption Certificate) from the tax authorities in the PRC for corporate enterprise income tax for the years ended August 31, 2007, 2008 and 2009. The approved income tax rate for the company was 7.5%. The reduced income tax rate was applicable until December 31, 2009. Our current income tax rate has been 15% since 2009

Our business and financial performance may be adversely affected if the PRC government reduces or postpones public spending on infrastructure construction.

Our largest customers are business entities such as project and construction companies established and directed by the central and local governments of the PRC. The future growth of the infrastructure construction industry in China depends primarily upon the continued need for major infrastructure projects. The nature, extent and timing of those projects will, however, be determined by the interplay of a variety of factors, including the PRC government’s spending on infrastructure in China, as well as the general conditions and prospects for China’s economy. Since the majority of funding for infrastructure construction projects in China comes from governmental budgets, implementation of the projects relies, to a significant degree, on the PRC government’s public policies and spending. Changes in public policies or government budgets may therefore impact our business operations and financial performance.

The PRC government’s spending on infrastructure has historically been, and will continue to be, cyclical in nature and vulnerable to China’s economic growth and direction. The PRC government has, in recent years, implemented various policies in an effort to control the growth rate of certain industries and to limit inflation, which has affected the level of public spending on infrastructure construction projects. A significant decrease or delay in public spending on infrastructure construction in China could reduce the number of available construction projects, which in turn could reduce the demand for heavy duty construction equipment, and thus reduce the market demand for our core business.

| 15 |

If we cannot compete successfully for market share against other non-standard construction equipment and machinery companies, we may not achieve sufficient revenues and our business could suffer.

The market for our products and services is characterized by intense competition and rapid technological advances. Our products and services compete with a multitude of products and services developed, manufactured and marketed by others. We will also compete with new market entrants in the future. Existing or future competing products may be of higher quality, contain more sophisticated technology, provide greater utility or other benefits, or may offer comparable performance at a lower cost. We must therefore continue to develop innovative new solutions and products for our customers to remain competitive. If our products fail to capture and maintain market share, we may not achieve sufficient product revenues, and our business could suffer.

We are subject to increasing environmental regulation

Our facilities, operations and products are subject to increasingly stringent environmental laws and regulations, including laws and regulations governing air emissions, discharges to water and the generation, handling, storage, transportation, treatment and disposal of waste materials. While we believe we are in compliance in all material respects with these environmental laws and regulations, there can be no assurance that we will not be adversely affected by costs, liabilities or claims with respect to existing or subsequently acquired operations resulting from present laws and regulations or those that may be adopted or imposed in the future.

Risks Associated with Conducting Business in China

Our results of operations, financial position and prospects are subject to a certain degree to the economic, political and legal developments of the PRC.

Political and economic policies of the PRC government could affect Wowjoint's business and results of operations.

The Chinese economy differs from the economies of most developed countries in a number of respects, including:

| § | its structure; |

| § | level of government involvement; |

| § | level of development; |

| § | growth rate; |

| § | level of capital reinvestment; |

| § | control of capital reinvestment; |

| § | control of foreign exchange; and |

| § | allocation of resources. |

Prior to the PRC government’s adoption of reform and the “Open Door” policies in 1978, China was a planned economy. Since then, the PRC government has implemented a number of measures to encourage growth and to guide the allocation of resources, thus resulting in significant economic and social development in the past 30 years. China has since transitioned into a more market-oriented economy.

Although the PRC government still owns a significant portion of the productive assets in China, economic reform policies since the late 1970s have encouraged the development of autonomous and privately owned businesses, the utilization of market forces and the establishment of good corporate governance measures in China. We cannot predict whether changes resulting from these reforms in China’s political, economic and social conditions and policies, or in relevant laws and regulations, will have any adverse effects on our current or future business, operational results or financial condition.

| 16 |

In addition, our ability to continue to sustain and expand our business is dependent on a number of factors, including general economic and capital market conditions and credit availability from banks or other lenders. Recently, the PRC government has articulated a need to control the rate of economic growth and has been reported to be tightening its monetary policies, including increasing interest rates on bank loans and deposits and tightening the money supply to control growth in lending. We cannot give any assurance that further measures to control growth in lending will not be implemented in a manner that may adversely affect its future growth and profitability. Furthermore, we cannot assure that the historical economic and market conditions affecting our business will continue, or that we will be able to sustain its growth.

Uncertainties with respect to the PRC legal system could limit the legal protections available to Wowjoint and its shareholders.

Our operating subsidiaries and associated companies are generally subject to laws and regulations applicable to foreign investments in China and, in particular, laws applicable to foreign-invested enterprises. The PRC legal system is based on written statutes, and prior court decisions may be cited for reference but have limited precedential value. Since 1979, a series of new PRC laws and regulations have significantly enhanced the protections afforded to various forms of foreign investments in China. However, since the PRC legal system continues to rapidly evolve, the interpretations of many laws, regulations and rules are not always uniform and the enforcement of these laws, regulations and rules involve uncertainties that may limit legal protections available to our shareholders and us. In addition, any litigation in China may be protracted and result in substantial costs and the diversion of resources and management attention.

Fluctuations in China's economy may slow the growth of Wowjoint and reduce its profitability.

China has been one of the world’s fastest growing economies as measured by GDP in recent years. It has also been one of the driving forces for the heightened demand in the world’s construction equipment industry. However, China may not be able to sustain such a growth rate. In addition, a slowdown in the economies of the United States, the European Union and certain Asian nations, with which China has important trade relationships, may adversely affect the economic growth of China, which may in turn lead to a decrease in demand for China’s construction equipment and correspondingly, demand for our services. We cannot assure that its financial condition and operational results, as well as its future prospects, will not be adversely affected by an economic downturn in China.

Changes in the laws, regulations and policies adopted by the PRC government, including in relation to the environment, labor and taxation, may adversely affect our business, growth strategies, operating results and financial condition.

The political, economic and social conditions in the PRC differ from those in more developed countries in many respects, including structure, government involvement, level of development, growth rate, control of foreign exchange, capital reinvestment, allocation of resources, rate of inflation and trade balance position. For the past three decades, the PRC government has implemented economic reform and measures emphasizing the utilization of market forces in the development of the PRC economy. Although we believe these economic reforms and measures will have a positive effect on the PRC’s overall and long-term development, the resulting changes may also have any adverse effect on our current or future business, financial condition or results of operations. Despite these economic reforms and measures, the PRC government continues to play a significant role in regulating industrial development, the allocation of natural resources, production, pricing and management of currency, and there can be no assurance that the PRC government will continue to pursue a policy of economic reform or that the current direction of reform will continue.

Our ability to successfully expand our business operations in the PRC depends on a number of factors, including macroeconomic and other market conditions and credit availability from lending institutions. Stricter lending policies in the PRC may affect our ability to obtain external financing, which may reduce our ability to implement our expansion strategies. We cannot assure you that the PRC government will not implement any additional measures to tighten lending standards or that, if any such measure is implemented, it will not adversely affect our future results of operations or profitability.

Demand for our products and our business, financial condition and results of operations may be adversely affected by the following factors:

| · | political instability or changes in social conditions in the PRC; |

| · | changes in laws, regulations and administrative directives; |

| · | measures which may be introduced to control inflation or deflation; |

| 17 |

| · | changes in the rate or method of taxation; and |

| · | reduction in tariff protection and other import and export restrictions. |

These factors are affected by a number of variables that are beyond our control.

Changes in PRC tax laws may result in Wowjoint being subject to a higher income tax rate.

Under the new PRC Enterprise Income Tax Law that became effective on January 1, 2008 (the “New EIT Law”), enterprises organized under the laws of jurisdictions outside the PRC with their de facto management bodies located within the PRC may be considered PRC resident enterprises and therefore subject to PRC enterprise income tax at the rate of 25% on their worldwide income. The New EIT Law, however, does not define the term “de facto management bodies”. If, among other things, a portion of our management continues to be located in the PRC, the Company may be considered a PRC resident enterprise by PRC tax administration and therefore subject to PRC enterprise income tax at the rate of 25% on our worldwide income, which may have a material adverse effect on our financial results. In addition, although the New EIT Law provides that “dividend income between qualified resident enterprises” is exempted income, it is still unclear as to what is considered a “qualified resident enterprise” under the New EIT Law.

Almost all of Wowjoint's assets are located in China and substantially all of its revenue are derived from its operations in China. Accordingly, Wowjoint’s results of operations and prospects are subject, to a significant extent, to the economic, political and legal developments in China.

The PRC’s economic, political and social conditions, as well as government policies, could affect our business. The PRC economy differs from the economies of most developed countries in many respects.

Since 1978, China has been one of the world’s fastest-growing economies in terms of gross domestic product (GDP) growth. There can be no assurance, however, that such growth will be sustained in the future. If in the future China’s economy experiences a downturn or grows at a slower rate than expected, there may be less demand for spending in certain industries. The PRC’s economic growth has been uneven, both geographically and among various sectors of the economy. The PRC government has implemented various measures to encourage sustainable economic growth and guide the allocation of resources. The PRC government has also begun to use macroeconomic tools to decelerate the rate of Chinese economic growth. Some of these measures benefit the overall PRC economy, but may also have a negative effect on our business.

The PRC economy has been transitioning from a planned economy to a more market-oriented economy. Although in recent years the PRC government has implemented measures emphasizing the use of market forces for economic reform, the reduction of state ownership of productive assets and the establishment of sound corporate governance in business enterprises, a substantial portion of productive assets in China is still owned by the PRC government. In addition, the PRC government continues to play a significant role in regulating industry development by imposing industrial policies. It also exercises significant control over PRC economic growth through the allocation of resources, and by controlling payment of foreign currency-denominated obligations, setting monetary policy and providing preferential treatment to particular industries or companies. We cannot assure that China’s economic, political or legal systems will not develop in a way that becomes detrimental to our business prospects, financial conditions and results of operations.

If the PRC government finds that Wowjoint’s organizational structure does not comply with PRC governmental restrictions on foreign investment, or if these regulations or the interpretation of existing regulations change in the future, it could be subject to significant penalties or be forced to relinquish its interests in those operations.

If Wowjoint or any of its potential future subsidiaries or affiliated entities are found to be in violation of any existing or future PRC laws or regulations, the relevant PRC regulatory authorities might have the discretion to:

| § | revoke the business and operating licenses of possible future PRC subsidiaries or affiliates; |

| § | confiscate relevant income and impose fines and other penalties; |

| § | discontinue or restrict possible future PRC subsidiaries’ or affiliates’ operations; |

| 18 |

| § | require Wowjoint or possible future PRC subsidiaries or affiliates to restructure the relevant ownership structure or operations; |

| § | restrict or prohibit remittance of any profits or dividends abroad by our PRC subsidiaries or affiliates; |

| § | impose conditions or requirements with which Wowjoint or possible future PRC subsidiaries or affiliates may be not be able to comply. |

The imposition if any of these penalties could have a material adverse effect on our ability to conduct business.

In addition, the relevant PRC regulatory authorities may impose further penalties. Any of these consequences could have a material adverse effect on our operations.

In many cases, existing regulations with regard to investments from foreign investors and domestic private capital investors lack detailed explanations and operational procedures, and are subject to interpretations that may change over time. We thus cannot be certain how the regulations will be applied to its business, either currently or in the future. Moreover, new regulations may be adopted or the interpretation of existing regulations may change, any of which could result in similar penalties and have a material adverse effect upon our ability to conduct our business.

Because Chinese law governs most of Wowjoint's current material agreements, it may not be able to enforce its rights within the PRC or elsewhere, which could result in a significant loss of business, business opportunities or capital.

We cannot assure you that we will be able to enforce any of our material agreements or that remedies will be available outside of the PRC. The Chinese legal system is similar to a civil law system based on written statutes. Unlike common law systems, it is a system in which decided legal cases have little precedential value. Although legislation in China over the past 25 years has significantly improved the protection afforded to various forms of foreign investment and contractual arrangements in China, these laws, regulations and legal requirements are relatively new. Due to the limited volume of published judicial decisions, their non-binding nature, the short history since their enactments, the discrete understanding of the judges or government agencies of the same legal provision, the inconsistent professional abilities of the judicators, and the inclination to protect local interests, interpretation and enforcement of PRC laws and regulations involve uncertainties which could limit the legal protection available to Wowjoint and foreign investors. The inability to enforce or obtain a remedy under any of our future agreements could result in a significant loss of business, business opportunities or capital and could have a material adverse impact on our business prospects, financial condition, and results of operations. In addition, the PRC legal system is based in part on government policies and internal rules (some of which are not published on a timely basis or at all) that may have a retroactive effect. As a result, we may not be aware of its violation of these policies and rules until sometime after the violation. In addition, any litigation in China, regardless of outcome, may be protracted and result in substantial costs and diversion of resources and management attention.

If the PRC imposes restrictions to reduce inflation, future economic growth in the PRC could be severely curtailed, which could lead to a significant decrease in Wowjoint’s profitability.

While the economy of the PRC has experienced rapid growth, this growth has been uneven among various sectors of the economy and in different geographical areas of the country. Rapid economic growth can lead to growth in the supply of money and rising inflation. In order to control inflation, in the past the PRC has imposed controls on bank credit, limits on loans for fixed assets and restrictions on state bank lending. If similar restrictions are imposed, it may lead to a slowing of economic growth and decrease interest in the services or products we may ultimately offer, leading to a decline in our profitability.

As a result of merger and acquisition regulations which became effective on September 8, 2006 relating to acquisitions of assets and equity interests of Chinese companies by foreign persons, it is expected that acquisitions will take longer and be subject to economic scrutiny by the PRC government authorities such that Wowjoint may not be able to complete a transaction, negotiate a transaction that is acceptable to its shareholders, or sufficiently protect shareholder’s interests in a transaction.

On August 8, 2006, six PRC regulatory agencies, namely, the Ministry of Commerce (“MOFCOM”), the State Assets Supervision and Administration Commission (“SASAC”), the State Administration for Taxation, the State Administration for Industry and Commerce (“SAIC”), the China Securities Regulatory Committee (“CSRC”), and the PRC State Administration of Foreign Exchange (“SAFE”), jointly adopted the Regulations on Mergers and Acquisitions of Domestic Enterprises by Foreign Investors, which became effective on September 8, 2006 (the “M&A Rules”). These comprehensive rules govern the approval process by which a Chinese company may participate in an acquisition of its assets or its equity interests and by which a Chinese company may obtain public trading of its securities on a securities exchange outside the PRC.

| 19 |

Although prior to September 8, 2006 there was a complex series of regulations administered by a combination of provincial and centralized agencies for approval of acquisitions of Chinese enterprises by foreign investors, the M&A Rules have largely centralized and expanded the approval process to MOFCOM, SAIC, SAFE or its branch offices, SASAC, and the CSRC. The M&A Rules established, among other things, additional procedures and requirements that could make merger and acquisition activities by foreign investors more time-consuming and complex, including the requirement in some instances that the MOFCOM be notified in advance when a foreign investor acquires equity or assets of a PRC domestic enterprise. Complying with the requirements of the M&A Rules to complete such transactions could be time-consuming and involves significant uncertainty, and any required approval processes, including obtaining approval from the MOFCOM, may delay or inhibit our ability to complete such transactions, which could affect our ability to expand its business or maintain its market share.

Depending on the structure of the transaction, these regulations will require the Chinese parties to make a series of applications and supplemental applications to the aforementioned agencies, some of which must be made within strict time limits and require approvals from one or more of the aforementioned agencies. The application process has been supplemented to require the presentation of economic data concerning a transaction, the economic and substantive analysis of the target business and the acquirer and the terms of the transaction by MOFCOM and the other governing agencies, as well as an evaluation of compliance with legal requirements. The application process for approval now includes submissions of an appraisal report, an evaluation report and the acquisition agreement, depending on the structure of the transaction. An employee settlement plan for the target company shall also be included in the application.

The M&A Rules also prohibit a transaction at an acquisition price obviously lower than the appraised value of the Chinese business or assets. The regulations require that in certain transaction structures, the consideration must be paid within strict time periods, generally not in excess of a year. In the agreement reached by the foreign acquirer, target, creditors and other parties, there must be no harm to third parties and the public interest in the allocation of assets and liabilities being assumed or acquired.

It is expected that compliance with the regulations will be more time consuming than in the past, will be more costly for the Chinese parties and will permit the government to conduct a much more extensive evaluation and exercise much greater control over the terms of the transaction. Therefore, acquisitions in China may not be able to be completed because the terms of the transaction may not satisfy aspects of the approval process or, even if approved, because they are not consummated within the time permitted.

Ambiguities in the M&A Rules may make it difficult for Wowjoint to properly comply with all applicable rules and may affect Wowjoint's ability to consummate an acquisition.

Although the M&A Rules set forth many requirements that have to be followed, there are many ambiguities with respect to the meaning of many provisions of the M&A Rules. Moreover, the ambiguities give regulators wide latitude in the enforcement of regulations and approval of transactions. Therefore, we cannot predict the extent to which the M&A Rules will apply to any acquisition transition in connection with Wowjoint, and therefore, there may be uncertainty in whether or not the transaction that has or will be completed by us will violate the M&A Rules.

Exchange controls that exist in the PRC may limit Wowjoint's ability to utilize its cash flow.

We are subject to the PRC’s rules and regulations on currency conversion. In the PRC, the SAFE regulates the conversion of the Renminbi into foreign currencies. Under PRC regulations, Renminbi may be converted into foreign currency for payments relating to “current account transactions,” which include among other things dividend payments and payments for the import of goods and services, by complying with certain procedural requirements. our PRC subsidiaries may also retain foreign exchange in their respective current bank accounts, subject to a cap set by SAFE or its local counterpart, for use in payment of international current account transactions.

However, conversion of Renminbi into foreign currencies, and vice versa, for payments relating to “capital account transactions,” which principally includes investments and loans, generally requires the approval of SAFE and other relevant PRC governmental authorities. Restrictions on the convertibility of the Renminbi for capital account transactions could affect the ability of our PRC subsidiaries to make investments overseas or to obtain foreign exchange through debt or equity financing, including by means of loans or capital contributions from the parent entity.

| 20 |

Any existing and future restrictions on currency exchange may affect the ability of our PRC subsidiaries or affiliated entities to obtain foreign currencies, limit our ability to utilize revenues generated in Renminbi to fund our business activities outside China that are denominated in foreign currencies, or otherwise materially and adversely affect our business.

A failure by Wowjoint’s shareholders or beneficial owners who are PRC citizens or residents to comply with certain PRC foreign exchange regulations could restrict Wowjoint’s ability to distribute profits, restrict Wowjoint’s overseas and cross-border investment activities or subject the combined company to liability under PRC laws, which could adversely affect Wowjoint’s business and financial condition.

In October 2005, SAFE issued the Notice on Relevant Issues Concerning Foreign Exchange Administration for PRC Residents Engaging in Financing and Round-trip Investments via Overseas Special Purpose Vehicles, or SAFE Circular 75. SAFE Circular 75 states that PRC citizens or residents must register with SAFE or its local branch in connection with their establishment or control of an offshore entity established for the purpose of overseas equity financing involving a round-trip investment whereby the offshore entity acquires or controls onshore assets or equity interests held by the PRC citizens or residents. In addition, such PRC citizens or residents must update their SAFE registrations when the offshore SPV undergoes material events relating to increases or decreases in investment amount, transfers or exchanges of shares, mergers or divisions, long-term equity or debt investments, external guarantees, or other material events that do not involve round-trip investments. To further clarify the implementation of SAFE Circular 75, SAFE issued SAFE Circular 106 on May 29, 2007. Under SAFE Circular 106, PRC subsidiaries of an offshore company governed by SAFE Circular 75 are required to coordinate and supervise the filing of SAFE registrations in a timely manner by the offshore holding company’s shareholders who are PRC residents.