UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_______________

FORM 10-K

_______________

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2016

Commission File Number 1-1136

_______________

BRISTOL-MYERS SQUIBB COMPANY

(Exact name of registrant as specified in its charter)

________________

Delaware | 22-0790350 | |

(State or other jurisdiction of incorporation or organization) | (IRS Employer Identification No.) | |

345 Park Avenue, New York, N.Y. 10154

(Address of principal executive offices)

Telephone: (212) 546-4000

Securities registered pursuant to Section 12(b) of the Act:

Title of each class | Name of each exchange on which registered | |

Common Stock, $0.10 Par Value | New York Stock Exchange | |

1.000% Notes due 2025 | New York Stock Exchange | |

1.750% Notes due 2035 | New York Stock Exchange | |

Securities registered pursuant to Section 12(g) of the Act:

Title of each class |

$2 Convertible Preferred Stock, $1 Par Value |

_________________

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes x No ¨

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of the registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See definitions of “large accelerated filer”, “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer x | Accelerated filer ¨ | Non-accelerated filer ¨ | Smaller reporting company ¨ | |||

Indicate by check mark if the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No x

The aggregate market value of the 1,669,074,782 shares of voting common equity held by non-affiliates of the registrant, computed by reference to the closing price as reported on the New York Stock Exchange, as of the last business day of the registrant’s most recently completed second fiscal quarter (June 30, 2016) was approximately $122,760,450,216. Bristol-Myers Squibb has no non-voting common equity. At February 1, 2017, there were 1,672,715,340 shares of common stock outstanding.

DOCUMENTS INCORPORATED BY REFERENCE: Portions of the Proxy Statement for the registrant’s Annual Meeting of Stockholders to be held May 2, 2017, to be filed within 120 days after the conclusion of the registrant's fiscal year ended December 31, 2016, are incorporated by reference into Part III of this Annual Report on Form 10-K.

BRISTOL-MYERS SQUIBB COMPANY

INDEX TO FORM 10-K

DECEMBER 31, 2016

* Indicates brand names of products which are trademarks not owned by BMS. Specific trademark ownership information is included in the Exhibit Index.

PART I

Item 1. | BUSINESS. |

General

Bristol-Myers Squibb Company was incorporated under the laws of the State of Delaware in August 1933 under the name Bristol-Myers Company, as successor to a New York business started in 1887. In 1989, Bristol-Myers Company changed its name to Bristol-Myers Squibb Company as a result of a merger. We are engaged in the discovery, development, licensing, manufacturing, marketing, distribution and sale of biopharmaceutical products on a global basis. Refer to the Summary of Abbreviated Terms at the end of this 2016 Form 10-K for terms used throughout the document.

We operate in one segment—BioPharmaceuticals. For additional information about business segments, refer to “Item 8. Financial Statements—Note 2. Business Segment Information.”

We compete with other worldwide research-based drug companies, smaller research companies and generic drug manufacturers. Our products are sold worldwide, primarily to wholesalers, retail pharmacies, hospitals, government entities and the medical profession. We manufacture products in the U.S., Puerto Rico and in five foreign countries. Most of our revenues come from products in the following therapeutic classes: oncology; cardiovascular; immunoscience; and virology, including HIV infection.

The percentage of revenues by significant region/country were as follows:

Year Ended December 31, | ||||||||||||

Dollars in Millions | 2016 | 2015 | 2014 | |||||||||

United States | 55 | % | 49 | % | 49 | % | ||||||

Europe | 22 | % | 21 | % | 23 | % | ||||||

Japan | 7 | % | 10 | % | 6 | % | ||||||

Other | 16 | % | 20 | % | 22 | % | ||||||

Total Revenues | $ | 19,427 | $ | 16,560 | $ | 15,879 | ||||||

Acquisitions and Divestitures

Acquisitions in the last five years include Cormorant and Padlock in 2016, Cardioxyl and Flexus in 2015, iPierian in 2014 and Amylin and Inhibitex in 2012 and we also entered into several license and other collaboration arrangements. Divestitures in the last five years include certain OTC products and investigational HIV medicines businesses in 2016, Erbitux* in North America and certain mature and other OTC product businesses in 2015 and our diabetes business in 2014. These transactions continue to allow us to focus our resources behind growth opportunities which drive the greatest long-term value.

Products, Intellectual Property and Product Exclusivity

Our pharmaceutical products include chemically-synthesized drugs, or small molecules, and products produced from biological processes, called “biologics.” Small molecule drugs are typically administered orally, e.g., in the form of a pill or tablet, although other drug delivery mechanisms are used as well. Biologics are typically administered to patients through injections or by intravenous infusion.

Below is a product summary including approved indications. For information about our alliance arrangements for the products below, refer to “—Alliances" below and "Item 8. Financial Statements—Note 3. Alliances.”

Empliciti | Empliciti, a biological product, is a humanized monoclonal antibody for the treatment of multiple myeloma. |

Opdivo | Opdivo, a biological product, is a fully human monoclonal antibody that binds to the PD-1 on T and NKT cells. Opdivo has received approvals for several indications including melanoma, head and neck, lung, kidney and blood cancer. The Opdivo+Yervoy regimen also is approved in multiple markets for the treatment of melanoma. There are several ongoing potentially registrational trials for Opdivo across other tumor types and other disease areas. |

Sprycel | Sprycel is a multi-targeted tyrosine kinase inhibitor approved for the first-line treatment of adults with Philadelphia chromosome-positive chronic myeloid leukemia in chronic phase and the treatment of adults with chronic, accelerated, or myeloid or lymphoid blast phase chronic myeloid leukemia with resistance or intolerance to prior therapy, including Gleevec* (imatinib mesylate). |

Yervoy | Yervoy, a biological product, is a monoclonal antibody for the treatment of patients with unresectable or metastatic melanoma. |

3

Eliquis | Eliquis is an oral Factor Xa inhibitor targeted at stroke prevention in atrial fibrillation and the prevention and treatment of VTE disorders. |

Orencia | Orencia, a biological product, is a fusion protein with novel immunosuppressive activity targeted initially at adult patients with moderately to severely active RA who have had an inadequate response to certain currently available treatments. |

Baraclude | Baraclude is a potent and selective inhibitor of the hepatitis B virus. |

Hepatitis C Franchise | Daklinza (daclatasvir (DCV)) is an oral small molecule NS5A replication complex inhibitor for the treatment of HCV and was approved for use with Gilead's sofosbuvir. |

Sunvepra (asunaprevir (ASV)) is an oral small molecule NS3 protease inhibitor for the treatment of HCV and is part of the dual regimen of DCV+ASV in Japan which is also currently in registration in China.

Beclabuvir (BCV) is an oral small molecule non-nucleoside NS5B inhibitor for the treatment of HCV and is part of the triple combination tablet, Ximency, (DCV+ASV+BCV) in Japan.

Reyataz Franchise | Reyataz is a protease inhibitor for the treatment of HIV. The Reyataz Franchise includes Reyataz and combination therapy Evotaz (atazanavir 300 mg and cobicistat 150 mg), a once-daily single tablet two drug regimen combining Reyataz and Gilead's Tybost* (cobicistat) for the treatment of HIV-1 infection in adults. |

Sustiva Franchise | Sustiva is a non-nucleoside reverse transcriptase inhibitor for the treatment of HIV. The Sustiva Franchise includes Sustiva, an antiretroviral drug used in the treatment of HIV, as well as bulk efavirenz which is included in the combination therapy Atripla* (efavirenz 600 mg/ emtricitabine 200 mg/ tenofovir disoproxil fumarate 300 mg), a once-daily single tablet three-drug regimen combining our Sustiva and Gilead’s Truvada* (emtricitabine and tenofovir disoproxil fumarate). |

We own or license a number of patents in the U.S. and foreign countries primarily covering our products. We have also developed many brand names and trademarks for our products. We consider the overall protection of our patents, trademarks, licenses and other intellectual property rights to be of material value and act to protect these rights from infringement.

In the pharmaceutical industry, the majority of an innovative product’s commercial value is usually realized during the period in which the product has market exclusivity. A product’s market exclusivity is generally determined by two forms of intellectual property: patent rights held by the innovator company and any regulatory forms of exclusivity to which the innovative drug is entitled.

Patents are a key determinant of market exclusivity for most branded pharmaceuticals. Patents provide the innovator with the right to exclude others from practicing an invention related to the medicine. Patents may cover, among other things, the active ingredient(s), various uses of a drug product, pharmaceutical formulations, drug delivery mechanisms and processes for (or intermediates useful in) the manufacture of products. Protection for individual products extends for varying periods in accordance with the expiration dates of patents in the various countries. The protection afforded, which may also vary from country to country, depends upon the type of patent, its scope of coverage and the availability of meaningful legal remedies in the country.

Market exclusivity is also sometimes influenced by regulatory intellectual property rights. Many developed countries provide certain non-patent incentives for the development of medicines. For example, in the U.S., the EU, Japan, and certain other countries, regulatory intellectual property rights are offered as incentives for research on medicines for rare diseases, or orphan drugs, and on medicines useful in treating pediatric patients. These incentives can extend the market exclusivity period on a product beyond the patent term.

The U.S., EU and Japan also each provide for a minimum period of time after the approval of a new drug during which the regulatory agency may not rely upon the innovator’s data to approve a competitor’s generic copy, or data protection. In some regions such as China, however, it is questionable whether such data protection laws are enforceable. In certain markets where patent protection and other forms of market exclusivity may have expired, data protection can be of particular importance. However, most regulatory forms of exclusivity do not prevent a competitor from gaining regulatory approval prior to the expiration of regulatory data exclusivity on the basis of the competitor’s own safety and efficacy data on its drug, even when that drug is identical to that marketed by the innovator.

Specific aspects of the law governing market exclusivity and data protection for pharmaceuticals vary from country to country. The following summarizes key exclusivity rules in markets representing significant sales:

United States

In the U.S., most of our key products are protected by patents with varying terms depending on the type of patent and the filing date. A significant portion of a product’s patent life, however, is lost during the time it takes an innovative company to develop and obtain regulatory approval of a new drug. As compensation at least in part for the lost patent term, the innovator may, depending on a number of factors, extend the expiration date of one patent up to a maximum term of five years, provided that the extension cannot cause the patent to be in effect for more than 14 years from the date of drug approval.

4

A company seeking to market an innovative pharmaceutical in the U.S. must submit a complete set of safety and efficacy data to the FDA. If the innovative pharmaceutical is a chemical, the company files an NDA. If the medicine is a biological product, a BLA is filed. The type of application filed affects regulatory exclusivity rights.

Chemical products

A competitor seeking to launch a generic substitute of a chemical innovative drug in the U.S. must file an aNDA with the FDA. In the aNDA, the generic manufacturer needs to demonstrate only “bioequivalence” between the generic substitute and the approved NDA drug. The aNDA relies upon the safety and efficacy data previously filed by the innovator in its NDA.

An innovator company is required to list certain of its patents covering the medicine with the FDA in what is commonly known as the Orange Book. Absent a successful patent challenge, the FDA cannot approve an aNDA until after the innovator’s listed patents expire. However, after the innovator has marketed its product for four years, a generic manufacturer may file an aNDA and allege that one or more of the patents listed in the Orange Book under an innovator’s NDA is either invalid or not infringed. This allegation is commonly known as a Paragraph IV certification. The innovator then must decide whether to file a patent infringement suit against the generic manufacturer. From time to time, aNDAs, including Paragraph IV certifications, are filed with respect to certain of our products. We evaluate these aNDAs on a case-by-case basis and, where warranted, file suit against the generic manufacturer to protect our patent rights.

In addition to benefiting from patent protection, certain innovative pharmaceutical products can receive periods of regulatory exclusivity. An NDA that is designated as an orphan drug can receive seven years of exclusivity for the orphan indication. During this time period, neither NDAs nor aNDAs for the same drug product can be approved for the same orphan use. A company may also earn six months of additional exclusivity for a drug where specific clinical trials are conducted at the written request of the FDA to study the use of the medicine to treat pediatric patients, and submission to the FDA is made prior to the loss of basic exclusivity.

Medicines approved under an NDA can also receive several types of regulatory data protection. An innovative chemical pharmaceutical is entitled to five years of regulatory data protection in the U.S., during which competitors cannot file with the FDA for approval of generic substitutes. If an innovator’s patent is challenged, as described above, a generic manufacturer may file its aNDA after the fourth year of the five-year data protection period. A pharmaceutical drug product that contains an active ingredient that has been previously approved in an NDA, but is approved in a new formulation, but not for the drug itself, or for a new indication on the basis of new clinical trials, receives three years of data protection for that formulation or indication.

Biologic products

The U.S. healthcare legislation enacted in 2010 created an approval pathway for biosimilar versions of innovative biological products that did not previously exist. Prior to that time, innovative biologics had essentially unlimited regulatory exclusivity. Under the new regulatory mechanism, the FDA can approve products that are similar to (but not generic copies of) innovative biologics on the basis of less extensive data than is required by a full BLA. After an innovator has marketed its product for four years, any manufacturer may file an application for approval of a “biosimilar” version of the innovator product. However, although an application for approval of a biosimilar may be filed four years after approval of the innovator product, qualified innovative biological products will receive 12 years of regulatory exclusivity, meaning that the FDA may not approve a biosimilar version until 12 years after the innovative biological product was first approved by the FDA. The law also provides a mechanism for innovators to enforce the patents that protect innovative biological products and for biosimilar applicants to challenge the patents. Such patent litigation may begin as early as four years after the innovative biological product is first approved by the FDA.

In the U.S., the increased likelihood of generic and biosimilar challenges to innovators’ intellectual property has increased the risk of loss of innovators’ market exclusivity. First, generic companies have increasingly sought to challenge innovators’ basic patents covering major pharmaceutical products. Second, statutory and regulatory provisions in the U.S. limit the ability of an innovator company to prevent generic and biosimilar drugs from being approved and launched while patent litigation is ongoing. As a result of all of these developments, it is not possible to predict the length of market exclusivity for a particular product with certainty based solely on the expiration of the relevant patent(s) or the current forms of regulatory exclusivity.

European Union

Patents on pharmaceutical products are generally enforceable in the EU and, as in the U.S., may be extended to compensate for the patent term lost during the regulatory review process. Such extensions are granted on a country-by-country basis.

5

The primary route we use to obtain marketing authorization of pharmaceutical products in the EU is through the “centralized procedure.” This procedure is compulsory for certain pharmaceutical products, in particular those using biotechnological processes, and is also available for certain new chemical compounds and products. A company seeking to market an innovative pharmaceutical product through the centralized procedure must file a complete set of safety data and efficacy data as part of an MAA with the EMA. After the EMA evaluates the MAA, it provides a recommendation to the EC and the EC then approves or denies the MAA. It is also possible for new chemical products to obtain marketing authorization in the EU through a “mutual recognition procedure,” in which an application is made to a single member state, and if the member state approves the pharmaceutical product under a national procedure, then the applicant may submit that approval to the mutual recognition procedure of some or all other member states.

After obtaining marketing authorization approval, a company must obtain pricing and reimbursement for the pharmaceutical product, which is typically subject to member state law. In certain EU countries, this process can take place simultaneously while the product is marketed but in other EU countries, this process must be completed before the company can market the new product. The pricing and reimbursement procedure can take months and sometimes years to complete.

Throughout the EU, all products for which marketing authorizations have been filed after October/November 2005 are subject to an “8+2+1” regime. Eight years after the innovator has received its first community authorization for a medicinal product, a generic company may file a marketing authorization application for that product with the health authorities. If the marketing authorization application is approved, the generic company may not commercialize the product until after either 10 or 11 years have elapsed from the initial marketing authorization granted to the innovator. The possible extension to 11 years is available if the innovator, during the first eight years of the marketing authorization, obtains an additional indication that is of significant clinical benefit in comparison with existing treatments. For products that were filed prior to October/November 2005, there is a 10-year period of data protection under the centralized procedures and a period of either six or 10 years under the mutual recognition procedure (depending on the member state).

In contrast to the U.S., patents in the EU are not listed with regulatory authorities. Generic versions of pharmaceutical products can be approved after data protection expires, regardless of whether the innovator holds patents covering its drug. Thus, it is possible that an innovator may be seeking to enforce its patents against a generic competitor that is already marketing its product. Also, the European patent system has an opposition procedure in which generic manufacturers may challenge the validity of patents covering innovator products within nine months of grant.

In general, EU law treats chemically-synthesized drugs and biologically-derived drugs the same with respect to intellectual property and data protection. In addition to the relevant legislation and annexes related to biologic medicinal products, the EMA has issued guidelines that outline the additional information to be provided for biosimilar products, also known as generic biologics, in order to review an application for marketing approval.

Japan

In Japan, medicines of new chemical entities are generally afforded eight years of data exclusivity for approved indications and dosage. Patents on pharmaceutical products are enforceable. Generic copies can receive regulatory approval after data exclusivity and patent expirations. As in the U.S., patents in Japan may be extended to compensate for the patent term lost during the regulatory review process.

In general, Japanese law treats chemically-synthesized and biologically-derived drugs the same with respect to intellectual property and market exclusivity.

Rest of the World

In countries outside of the U.S., the EU and Japan, there is a wide variety of legal systems with respect to intellectual property and market exclusivity of pharmaceuticals. Most other developed countries utilize systems similar to either the U.S. or the EU. Among developing countries, some have adopted patent laws and/or regulatory exclusivity laws, while others have not. Some developing countries have formally adopted laws in order to comply with WTO commitments, but have not taken steps to implement these laws in a meaningful way. Enforcement of WTO actions is a long process between governments, and there is no assurance of the outcome. Thus, in assessing the likely future market exclusivity of our innovative drugs in developing countries, we take into account not only formal legal rights but political and other factors as well.

In the U.S., the EU and some other countries, when these patent rights and other forms of exclusivity expire and generic versions of a medicine are approved and marketed, there are often substantial and rapid declines in the sales of the original innovative product. For further discussion of patent rights and regulatory forms of exclusivity, refer to “—Intellectual Property and Product Exclusivity” below. For further discussion of the impact of generic competition on our business, refer to “—Generic Competition” below.

6

The following chart shows our key products together with the year in which the earliest basic exclusivity loss (patent rights or data exclusivity) occurred or is currently estimated to occur in the U.S., the EU and Japan. We also sell our pharmaceutical products in other countries; however, data is not provided on a country-by-country basis because individual country revenues are not significant outside the U.S., the EU and Japan. In many instances, the basic exclusivity loss date listed below is the expiration date of the patent that claims the active ingredient of the drug or the method of using the drug for the approved indication, if there is only one approved indication. In some instances, the basic exclusivity loss date listed in the chart is the expiration date of the data exclusivity period. In situations where there is only data exclusivity without patent protection, a competitor could seek regulatory approval by submitting its own clinical trial data to obtain marketing approval prior to the expiration of data exclusivity.

We estimate the market exclusivity period for each of our products for the purpose of business planning only. The length of market exclusivity for any of our products is impossible to predict with certainty because of the complex interaction between patent and regulatory forms of exclusivity and the inherent uncertainties regarding patent litigation. There can be no assurance that a particular product will enjoy market exclusivity for the full period of time that appears in the estimate or that the exclusivity will be limited to the estimate.

Total Revenues by Product | Past or Currently Estimated Year of Basic Exclusivity Loss | ||||||||||||||||||||

Dollars in Millions | 2016 | 2015 | 2014 | U.S. | EU(a) | Japan | |||||||||||||||

Oncology | |||||||||||||||||||||

Empliciti (elotuzumab)(b) | $ | 150 | $ | 3 | $ | — | 2026 | 2026 | 2024 | ||||||||||||

Opdivo (nivolumab) | 3,774 | 942 | 6 | 2027 | (c) | 2026 | (c) | 2031 | (c) | ||||||||||||

Sprycel (dasatinib) | 1,824 | 1,620 | 1,493 | 2020 | (d) | ^^ | 2021 | ||||||||||||||

Yervoy (ipilimumab) | 1,053 | 1,126 | 1,308 | 2025 | (e) | 2025 | (f) | 2025 | (g) | ||||||||||||

Cardiovascular | |||||||||||||||||||||

Eliquis (apixaban) | 3,343 | 1,860 | 774 | 2023 | (h) | 2022 | (i) | 2026 | (i) | ||||||||||||

Immunoscience | |||||||||||||||||||||

Orencia (abatacept) | 2,265 | 1,885 | 1,652 | 2019 | (j) | 2017 | (k) | 2018 | (l) | ||||||||||||

Virology | |||||||||||||||||||||

Baraclude (entecavir) | 1,192 | 1,312 | 1,441 | 2014 | 2011-2016 | (m) | 2016 | ||||||||||||||

Hepatitis C Franchise(n) | 1,578 | 1,603 | 256 | 2028 | 2027 | 2028 | (o) | ||||||||||||||

Reyataz (atazanavir sulfate) Franchise | 912 | 1,139 | 1,362 | 2017 | 2017-2019 | (p) | 2019 | ||||||||||||||

Sustiva (efavirenz) Franchise | 1,065 | 1,252 | 1,444 | 2017 | (q) | 2013 | (r) | ++ | |||||||||||||

Note: The currently estimated earliest year of basic exclusivity loss includes any statutory extensions of exclusivity that have been granted. In some instances, we may be able to obtain an additional six months exclusivity for a product based on the pediatric extension. In certain other instances, there may be later-expiring patents that cover particular forms or compositions of the drug, as well as methods of manufacturing or methods of using the drug. Such patents may sometimes result in a favorable market position for our products, but product exclusivity cannot be predicted or assured. Under the U.S. healthcare law enacted in 2010, qualifying biologic products will receive 12 years of data exclusivity before a biosimilar can enter the market, as described in more detail in “—Intellectual Property and Product Exclusivity” below.

++ We do not currently market the product in the country or region indicated.

^^ | In May 2013, Apotex Inc., Actavis Group PTC ehf, Generics [UK] Limited (Mylan) and an unnamed company filed oppositions in the EPO seeking revocation of European Patent No. 1169038 (the '038 patent) covering dasatinib, the active ingredient in Sprycel. The ‘038 patent is scheduled to expire in April 2020 (excluding potential term extensions). On January 20, 2016, the Opposition Division of the EPO revoked the ‘038 patent. In May 2016, the Company appealed the EPO’s decision to the EPO Board of Appeal and in February 2017, the EPO Board of Appeal upheld the Opposition’s decision, and the ‘038 patent has been revoked. We may experience a decline in European revenues in the second half of 2017 due to the unfavorable the EPO Board of Appeal's decision. The EPO Board of Appeal’s decision does not affect the validity of our other Sprycel patents, including different patents that cover the monohydrate form of dasatinib and the use of dasatinib to treat chronic myelogenous leukemia (CML). Additionally, in February 2017, the EPO Board of Appeal reversed and remanded an invalidity decision on European Patent No. 1610780 and its claim to the use of dasatinib to treat CML, which the EPO’s Opposition Division had revoked in October 2012. We intend to pursue legal options to defend our intellectual property rights from any future infringement. Refer to “Note 18. Legal Proceedings and Contingencies” for more information. |

(a) | References to the EU throughout this Form 10-K include all member states of the EU during the year ended December 31, 2016. Basic patent applications have not been filed in all current member states for all of the listed products. In some instances, the date of basic exclusivity loss will be different in various EU member states. For those EU countries where the basic patent was not obtained, there may be data protection available. |

(b) | Empliciti: We have a commercialization agreement with AbbVie for Empliciti. For more information about our arrangement with AbbVie, refer to “—Alliances” below and “Item 8. Financial Statements—Note 3. Alliances.” AbbVie owns a composition of matter patent covering elotuzumab that expires in 2026 in the U.S. (excluding potential patent term extension) and 2024 in the EU and Japan (excluding potential patent term extensions). Exclusivity period in Europe and Japan is based on regulatory data protection. |

(c) | Opdivo: We jointly own a patent with Ono covering nivolumab as a composition of matter that expires in 2027 in the U.S. (excluding potential patent term extensions) and 2026 in the EU (excluding potential patent term extensions). The composition of matter patent covering nivolumab in Japan expires in 2031 including the granted patent term extension. |

(d) | Sprycel: A patent term extension has been granted in the U.S. extending the term on the basic composition of matter patent covering dasatinib until June 2020. In 2013, the Company entered into a settlement agreement with Apotex regarding a patent infringement suit covering the monohydrate form of dasatinib whereby Apotex can launch its generic dasatinib monohydrate aNDA product in September 2024, or earlier in certain circumstances. |

(e) | Yervoy U.S.: Exclusivity period is based on the composition of matter patent that expires in 2025 including the granted patent term extensions. Data exclusivity expires in the U.S. in 2023. We own a patent covering ipilimumab as a composition of matter that currently expires in 2022 in the U.S. (excluding potential patent term extension). |

(f) | Yervoy EU: Exclusivity period is based on regulatory data protection. Data exclusivity expires in the EU in 2021. We own a patent covering ipilimumab as a composition of matter that currently expires in 2020 in the EU (excluding potential patent term extensions). The patent term extension has been granted in many European countries and in those countries, the composition of matter patent expires in 2025. |

(g) | Yervoy Japan: Exclusivity period is based on the composition of matter patent that expires in 2025, including the granted patent term extension. |

7

(h) | Eliquis U.S.: The composition of matter patent covering apixaban in the U.S. expires in February 2023 and a request for a patent term restoration extension until 2026 is pending (does not include a potential six month pediatric exclusivity extension, which if granted would provide protection until 2027). |

(i) | Eliquis EU and Japan: The composition of matter patent covering apixaban in the EU expires in 2022. We have applied for supplementary protection certificates.The supplementary protection certificates in most European countries have been granted and expire in 2026. Data exclusivity in the EU expires in 2021. The composition of matter patent covering apixaban in Japan expires in 2026 including the granted patent term extension. |

(j) | Orencia U.S.: We have a series of patents covering abatacept and its method of use. In the U.S., a patent term extension has been granted for one of the composition of matter patents, extending the term of the U.S. patent to 2019. Data exclusivity expires in the U.S. in December 2017 and the method of use patent expires in 2021. |

(k) | Orencia EU: In the EU, the composition of matter patent covering abatacept expired in 2012. In the majority of the EU countries, we have applied for supplementary protection certificates and also pediatric extension of the supplementary protection certificates for protection until December 2017. The supplemental protection certificates in most European countries have been granted. Data exclusivity expires in the EU in May 2017 and the method of use patent expires in 2021. |

(l) | Orencia Japan: Exclusivity period is based on regulatory data protection, which expires in 2018. |

(m) | Baraclude EU: The composition of matter patent expired in the EU between 2011 and 2016. |

(n) | Exclusivity period relates to the Daklinza brand. |

(o) | The composition of matter covering daclatasvir in Japan expires in 2028 including granted patent term extension. |

(p) | Reyataz EU: Data exclusivity in the EU expired in 2014 and market exclusivity is projected to expire between 2017 and 2019. |

(q) | Sustiva U.S.: Exclusivity period relates to the Sustiva brand and does not include exclusivity related to any combination therapy. The composition of matter patent for efavirenz in the U.S. expired in 2013 and the method of use patent for the treatment of HIV infection expired in September 2014. Pediatric exclusivity has been granted, which provides an additional six month period of exclusivity added to the term of the patents listed in the Orange Book. In October 2014, the Company announced that it has successfully resolved all outstanding U.S. patent litigation relating to efavirenz and that loss of exclusivity in the U.S. for efavirenz is not expected to occur until December 2017. The joint venture agreement with Gilead to commercialize Atripla* may be terminated upon the launch of a generic version of Sustiva. |

(r) | Sustiva EU: Exclusivity period relates to the Sustiva brand and does not include exclusivity related to any combination therapy. Market exclusivity for Sustiva expired in November 2013 in countries in the EU. Data exclusivity for Sustiva expired in the EU in 2009. |

Research and Development

R&D is critical to our long-term competitiveness. We have major R&D sites throughout the world. As part of our operating model evolution the geographic footprint will significantly transform to foster speed and innovation in the future. The transformation involves the closing of several existing R&D sites accompanied by increased investment in the expansion of others, specifically in the U.S. We supplement our internal drug discovery and development programs with alliances and collaborative agreements which help us bring new molecular agents, capabilities and platforms into our pipeline. Management continues to emphasize leadership, innovation, productivity and quality as strategies for success in our R&D activities.

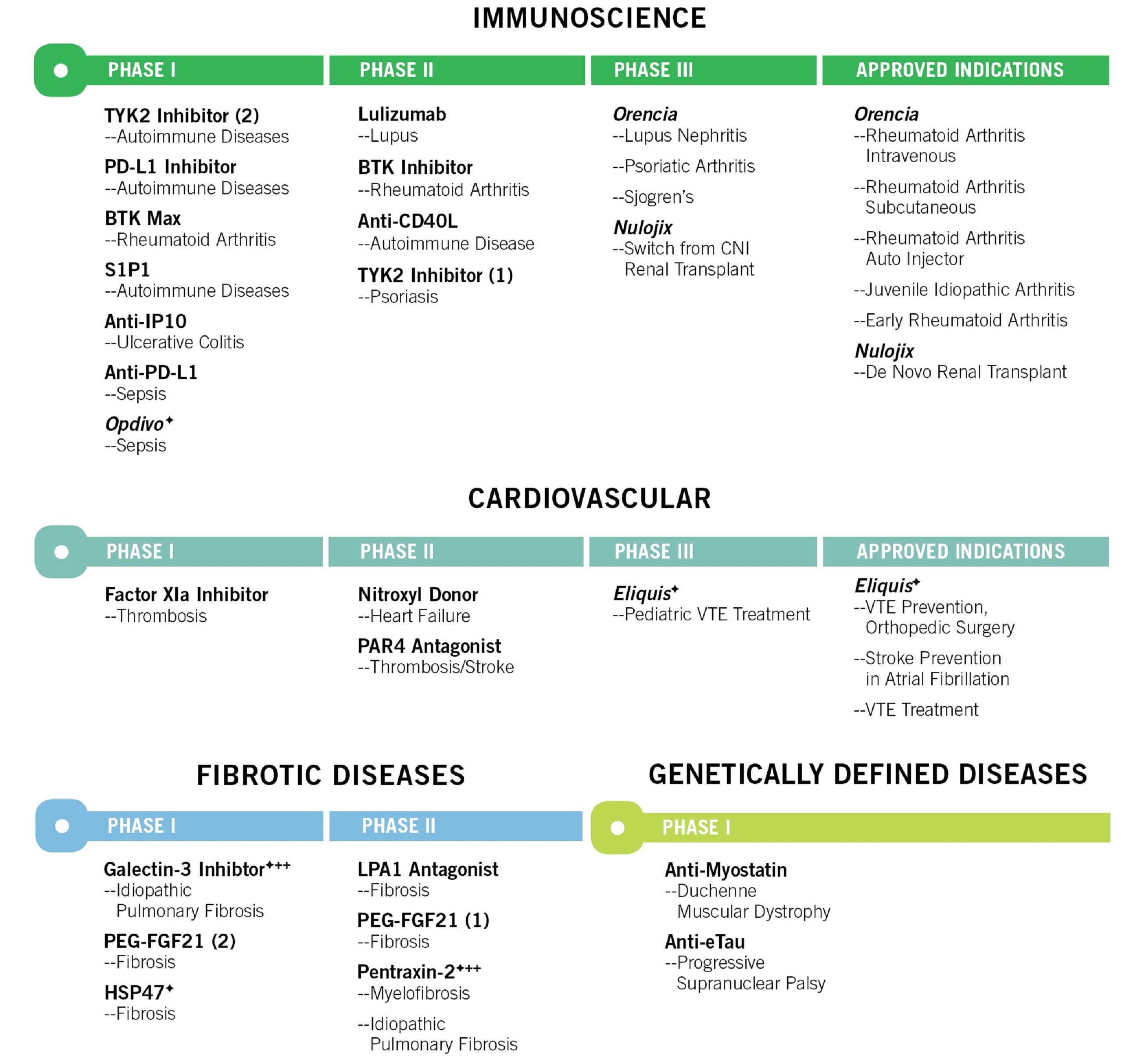

We concentrate our R&D efforts in the following disease areas with significant unmet medical needs: oncology, including IO, immunoscience, cardiovascular, fibrotic disease and GDD. We also continue to analyze and may selectively pursue promising leads in other areas. In addition to discovering and developing new molecular entities, we look for ways to expand the value of existing products through new indications and formulations that can provide additional benefits to patients.

In order for a new drug to reach the market, industry practice and government regulations in the U.S., the EU and most foreign countries provide for the determination of a drug’s effectiveness and safety through preclinical tests and controlled clinical evaluation. The clinical development of a potential new drug includes Phase I, Phase II and Phase III clinical trials that have been designed specifically to support a new drug application for a particular indication, assuming the trials are successful.

Phase I clinical trials involve a small number of healthy volunteers or patients suffering from the indicated disease to test for safety and proper dosing. Phase II clinical trials involve a larger patient population to investigate side effects, efficacy, and optimal dosage of the drug candidate. Phase III clinical trials are conducted to confirm Phase II results in a significantly larger patient population over a longer term and to provide reliable and conclusive data regarding the safety and efficacy of a drug candidate. Although regulatory approval is typically based on the results of Phase III clinical trials, there are times when approval can be granted based on data from earlier trials.

We consider our R&D programs in Phase III to be our significant R&D programs. These programs include both investigational compounds in Phase III development for initial indications and marketed products that are in Phase III development for additional indications or formulations.

Drug development is time consuming, expensive and risky. The R&D process typically takes about fourteen years, with approximately two and a half years often spent in Phase III, or late-stage, development. On average, only about one in 10,000 chemical compounds discovered by pharmaceutical industry researchers proves to be both medically effective and safe enough to become an approved medicine. Drug candidates can fail at any stage of the process, and even late-stage product candidates sometimes fail to receive regulatory approval. According to the KMR Group, based on industry success rates from 2011-2015, approximately 90% of the compounds that enter Phase I development fail to achieve regulatory approval. The failure rate for compounds that enter Phase II development is approximately 77% and for compounds that enter Phase III development, it is approximately 29%.

Total R&D expenses include the costs of discovery research, preclinical development, early- and late-stage clinical development and drug formulation, as well as post-commercialization and medical support of marketed products, proportionate allocations of enterprise-wide costs and licensing and acquiring assets. R&D expenses were $4.9 billion in 2016, $5.9 billion in 2015 and $4.5 billion in 2014 including license and asset acquisition charges of approximately $440 million, $1.7 billion and $280 million in 2016, 2015 and 2014,

8

respectively. At the end of 2016, we employed approximately 8,400 people in R&D and related support activities, including a substantial number of physicians, scientists holding graduate or postgraduate degrees and higher-skilled technical personnel.

We manage our R&D programs on a portfolio basis, investing resources in each stage of R&D from early discovery through late-stage development. We continually evaluate our portfolio of R&D assets to ensure that there is an appropriate balance of early-stage and late-stage programs to support the future growth of the Company. Spending on our late-stage development programs represented approximately 30-45% of our annual R&D expenses in the last three years. No individual investigational compound or marketed product represented 10% or more of our R&D expenses in any of the last three years, except Opdivo in both 2016 and 2015.

Listed below are our investigational compounds that we have in clinical trials as well as the approved and potential indications for our marketed products in the related therapeutic area as of January 1, 2017. Whether any of the listed compounds ultimately becomes a marketed product depends on the results of clinical studies, the competitive landscape of the potential product’s market, reimbursement decisions by payers and the manufacturing processes necessary to produce the potential product on a commercial scale, among other factors. There can be no assurance that we will seek regulatory approval of any of these compounds or that, if such approval is sought, it will be obtained. There is also no assurance that a compound which gets approved will be commercially successful. At this stage of development, we cannot determine all intellectual property issues or all the patent protection that may, or may not, be available for these investigational compounds.

9

As of January 10, 2017, the following potential registrational trial readouts for Opdivo are anticipated through 2018:

Tumor | Trial Details | Tumor | Trial Details | |||

Non-Small Cell Lung Cancer | CM-227 - Opdivo + Yervoy (1L) | Hepatocellular Carcinoma | CM-459 - Opdivo (1L) | |||

CM-078 - Opdivo (2L / Asia) | ||||||

Glioblastoma | CM-143 - Opdivo (2L) | |||||

Small Cell Lung Cancer | CM-331 - Opdivo (2L) | CM-548 - Opdivo + Standard of Care (1L) | ||||

CM-451 - Opdivo + Yervoy (1L) | ||||||

Head & Neck | CM-651 - Opdivo + Yervoy (1L) | |||||

Melanoma | CM-511 - Opdivo + Yervoy (1L) | Non-Hodgkin Lymphoma | CM-140 - Opdivo (2L) | |||

CM-238 - Opdivo (Adjuvant) | ||||||

Myeloma | CM-602 - Opdivo + Empliciti + Standard of Care (1L) | |||||

Renal Cell Carcinoma | CM-214 - Opdivo + Yervoy (1L) | Key: | Phase II | |||

Phase III | ||||||

10

Alliances

We enter into alliances with third parties that transfer rights to develop, manufacture, market and/or sell pharmaceutical products that are owned by other parties. These alliances include licensing arrangements, co-development and co-marketing agreements, co-promotion arrangements and joint ventures. When such alliances involve sharing research and development costs, the risk of incurring all research and development expenses for compounds that do not lead to revenue-generating products is reduced. However, profitability on alliance products is generally lower because profits from alliance products are shared with our alliance partners. We actively pursue such arrangements and view alliances as an important complement to our own discovery, development and commercialization activities.

Each of our alliances with third parties who own the rights to manufacture, market and/or sell pharmaceutical products contain customary early termination provisions typically found in agreements of this kind and are generally based on the material breach of the agreement by a party, or bankruptcy (voluntary or involuntary) of a party or product safety concerns. The amount of notice required for early termination generally ranges from immediately upon notice to 180 days after receipt of notice. Termination immediately upon notice is generally available where the other party files a voluntary bankruptcy petition or if a material safety issue arises with a product such that the medical risk/benefit is incompatible with the welfare of patients to continue to develop or commercialize the product. Termination with a notice period is generally available where an involuntary bankruptcy petition has been filed (and has not been dismissed) or a material breach by a party has occurred (and not been cured). Most of our alliance agreements also permit us to terminate without cause, which is typically exercisable with substantial advance written notice and is sometimes exercisable only after a specified period of time has elapsed after the alliance agreement is signed. Our alliances typically do not otherwise contain provisions that provide the other party the right to terminate the alliance.

In general, we do not retain any rights to a product brought to an alliance by another party or to the other party’s intellectual property after an alliance terminates. The loss of rights to one or more products that are marketed and sold by us pursuant to an alliance could be material to our results of operations and cash flows could be material to our financial condition and liquidity. As is customary in the pharmaceutical industry, the terms of our alliances generally are co-extensive with the exclusivity period and may vary on a country-by-country basis.

Our most significant alliances for both currently marketed products and investigational compounds are described below. Refer to “Item 8. Financial Statements—Note 3. Alliances” for additional information on these alliance agreements as well as other alliance agreements.

Pfizer

The Company and Pfizer are parties to a worldwide co-development and co-commercialization agreement for Eliquis. Pfizer funds between 50% and 60% of all development costs depending on the study. The companies share commercialization expenses and profits and losses equally on a global basis except in certain countries where Pfizer commercializes Eliquis and pays BMS compensation based on a percentage of net sales.

Gilead

We have joint ventures with Gilead to develop and commercialize Atripla* in the U.S., Canada and in Europe. The Company and Gilead share responsibility for certain activities related to the commercialization of Atripla* in the U.S., Canada, throughout the EU and certain other European countries. Gilead recognizes 100% of Atripla* revenues in the U.S., Canada and most countries in Europe. Alliance revenue recognized for Atripla* include only the bulk efavirenz component of Atripla* which is calculated differently in the EU and the U.S. following the loss of exclusivity of Sustiva in the EU in 2013. Alliance revenue is deferred and the related alliance receivable is not recognized until Atripla* is sold to third-party customers.

In the U.S., the agreement may be terminated by Gilead upon the launch of a generic version of Sustiva or by BMS upon the launch of a generic version of Truvada* or its individual components. The loss of exclusivity in the U.S. for Sustiva is expected in December 2017.

Otsuka

BMS and Otsuka have an alliance for Sprycel in the U.S., Japan and the EU (the Oncology Territory). In February 2015, the co-promotion agreement with Otsuka was terminated in Japan. A fee is paid to Otsuka based on the combined annual net sales of Sprycel and Ixempra* in the Oncology Territory. We also maintain a commercialization agreement with Otsuka to co-develop and co-promote Abilify* in a limited number of countries outside of the U.S.

Ono

BMS is the principal in the end customer product sales and has the exclusive right to develop, manufacture and commercialize Opdivo in all territories worldwide except Japan, South Korea and Taiwan. Ono is entitled to receive royalties following regulatory approvals in all territories excluding the three countries listed above. Royalty rates on net sales are 4% in North America and 15% in all other applicable territories, subject to customary adjustments.

11

The alliance arrangement also includes collaboration activities in Japan, South Korea and Taiwan pertaining to Opdivo, Yervoy and several BMS investigational compounds. Both parties have the right and obligation to jointly develop and commercialize the compounds. BMS is responsible for supply of the products. Profits, losses and development costs are shared equally for all combination therapies involving compounds of both parties. Otherwise, sharing is 80% and 20% for activities involving only one of the party’s compounds.

BMS and Ono also have an alliance to co-develop and co-commercialize Orencia in Japan. BMS is responsible for the order fulfillment and distribution of the intravenous formulation and Ono is responsible for the subcutaneous formulation. Both formulations are jointly promoted by both parties with assigned customer accounts and BMS is responsible for the product supply. A co-promotion fee of 60% is paid to the other party when a sale is made to that other party’s assigned customer.

AbbVie

BMS and AbbVie have an alliance for Empliciti. Under the terms of the alliance, BMS was granted exclusive global rights to co-develop and commercialize Empliciti from PDL BioPharma, Inc. (now part of AbbVie). Both parties are co-developing the product and AbbVie funds 20% of global development costs. BMS is solely responsible for supply, distribution and sales and marketing activities within the alliance and is the principal in the end customer product sales. AbbVie shares 30% of all profits and losses in the U.S. and is paid tiered royalties on net sales of Empliciti outside of the U.S. In addition, AbbVie is entitled to receive milestone payments from BMS if certain regulatory events and sales thresholds are achieved.

Other Licensing Arrangements

In addition to the alliances described above, we have other in-licensing and out-licensing arrangements. With respect to in-licenses, we have agreements with Novartis for Reyataz and with Merck for efavirenz, among others. We also own certain compounds out-licensed to third parties for development and commercialization, including those obtained from our acquisitions. We are entitled to receive milestone payments as these compounds move through the regulatory process and royalties based on net product sales, if and when the products are commercialized.

Marketing, Distribution and Customers

We promote the appropriate use of our products directly to healthcare professionals and providers such as doctors, nurse practitioners, physician assistants, pharmacists, technologists, hospitals, PBMs and MCOs. We also provide information about the appropriate use of our products to consumers in the U.S. through direct-to-consumer print, radio, television and digital advertising and promotion. In addition, we sponsor general advertising to educate the public about our innovative medical research and corporate mission. For a discussion of the regulation of promotion and marketing of pharmaceuticals, refer to “—Government Regulation” below.

Through our field sales and medical organizations, we explain the risks and benefits of the approved uses of our products to medical professionals. We work to gain access for our products on formularies and reimbursement plans (lists of recommended or approved medicines and other products), including Medicare Part D plans, by providing information about the clinical profiles of our products. Our marketing and sales of prescription pharmaceuticals is limited to the approved uses of the particular product, but we continue to develop scientific data and other information about potential additional uses of our products and provide such information in response to unsolicited inquiries from doctors, other medical professionals and MCOs.

Our operations include several marketing and sales organizations. Each product marketing organization is supported by a sales force, which may be responsible for selling one or more products. We also have marketing organizations that focus on certain classes of customers such as managed care entities or certain types of marketing tools, such as digital or consumer communications. Our sales forces focus on communicating information about new products or new uses, as well as established products, and promotion to physicians is increasingly targeted at physician specialists who treat the patients in need of our medicines.

Our products are sold principally to wholesalers, and to a lesser extent, directly to distributors, retailers, hospitals, clinics, government agencies and pharmacies. Refer to “Item 8. Financial Statements—Note 2. Business Segment Information” for gross revenues to the three largest pharmaceutical wholesalers in the U.S. as a percentage of our global gross revenues.

Our U.S. business has IMAs with substantially all of our direct wholesaler and distributor customers that allow us to monitor U.S. wholesaler inventory levels and requires those wholesalers and distributors to maintain inventory levels that are no more than one month of their demand. The IMAs, including those with our three largest wholesalers, expire in December 2017 subject to certain termination provisions.

Our non-U.S. businesses have significantly more direct customers. Information on available direct customer product level inventory and corresponding out-movement information and the reliability of third-party demand information varies widely. We limit our direct customer sales channel inventory reporting to where we can reliably gather and report inventory levels from our customers.

12

In a number of countries outside of the U.S., we contract with distributors to support certain products. The services provided by these distributors vary by market, but may include distribution and logistics; regulatory and pharmacovigilance; and/or sales, advertising or promotion. Sales in these distributor-based countries represented approximately 1% of the Company’s total revenues in 2016.

Competition

The markets in which we compete are generally broad based and highly competitive. We compete with other worldwide research-based drug companies, many smaller research companies with more limited therapeutic focus and generic drug manufacturers. Important competitive factors include product efficacy, safety and ease of use, price and demonstrated cost-effectiveness, marketing effectiveness, product labeling, customer service and R&D of new products and processes. Sales of our products can be impacted by new studies that indicate a competitor’s product is safer or more effective for treating a disease or particular form of disease than one of our products. Our revenues also can be impacted by additional labeling requirements relating to safety or convenience that may be imposed on products by the FDA or by similar regulatory agencies in different countries. If competitors introduce new products and processes with therapeutic or cost advantages, our products can be subject to progressive price reductions or decreased volume of sales, or both.

Generic Competition

One of the biggest competitive challenges that we face is from generic pharmaceutical manufacturers. In the U.S. and the EU, the regulatory approval process exempts generics from costly and time-consuming clinical trials to demonstrate their safety and efficacy, allowing generic manufacturers to rely on the safety and efficacy of the innovator product. As a result, generic pharmaceutical manufacturers typically invest far less in R&D than research-based pharmaceutical companies and therefore can price their products significantly lower than branded products. Accordingly, when a branded product loses its market exclusivity, it normally faces intense price competition from generic forms of the product. Upon the expiration or loss of market exclusivity on a product, we can lose the major portion of revenues of that product in a very short period of time.

The rate of revenues decline of a product after the expiration of exclusivity varies by country. In general, the decline in the U.S. market is more rapid than in most other developed countries, though we have observed rapid declines in a number of EU countries as well. Also, the declines in developed countries tend to be more rapid than in developing countries. The rate of revenues decline after the expiration of exclusivity has also historically been influenced by product characteristics. For example, drugs that are used in a large patient population (e.g., those prescribed by key primary care physicians) tend to experience more rapid declines than drugs in specialized areas of medicine (e.g., oncology). Drugs that are more complex to manufacture (e.g., sterile injectable products) usually experience a slower decline than those that are simpler to manufacture.

In certain countries outside the U.S., patent protection is weak or nonexistent and we must compete with generic versions shortly after we launch our innovative products. In addition, generic pharmaceutical companies may introduce a generic product before exclusivity has expired, and before the resolution of any related patent litigation. For more information about market exclusivity, refer to “—Intellectual Property and Product Exclusivity” above.

We believe our long-term competitive position depends upon our success in discovering and developing innovative, cost-effective products that serve unmet medical needs, together with our ability to manufacture products efficiently and to market them effectively in a highly competitive environment.

Pricing, Price Constraints and Market Access

Our medicines are priced based on a number of factors, including the value of scientific innovation for patients and society in the context of overall health care spend, economic factors impacting health care systems’ ability to provide appropriate and sustainable access and the necessity to sustain our investment in innovation platforms to address serious unmet medical needs. Central to price is the clinical value that this innovation brings to the market, the current landscape of alternative treatment options, the goal of ensuring appropriate patient access to this innovation and sustaining investment in creative platforms. We continue to explore new pricing approaches to ensure that patients have access to our medicines. Enhancing patient access to medicines is a priority for us. We are focused on offering creative tiered pricing, voluntary licensing, reimbursement support and patient assistance programs to optimize access while protecting innovation; advocating for sustainable healthcare policies and infrastructure, leveraging advocacy/payer’s input and utilizing partnerships as appropriate; and improving access to care and supportive services for vulnerable patients through partnerships and demonstration projects.

The growth of MCOs in the U.S. is also a major factor in the healthcare marketplace. Over half of the U.S. population now participates in some version of managed care. MCOs can include medical insurance companies, medical plan administrators, health-maintenance organizations, Medicare Part D prescription drug plans, alliances of hospitals and physicians and other physician organizations. Those organizations have been consolidating into fewer, larger entities, thus enhancing their purchasing strength and importance to us.

13

To successfully compete for business with MCOs, we must often demonstrate that our products offer not only medical benefits but also cost advantages as compared with other forms of care. Most new products that we introduce compete with other products already on the market or products that are later developed by competitors. As noted above, generic drugs are exempt from costly and time-consuming clinical trials to demonstrate their safety and efficacy and, as such, often have lower costs than brand-name drugs. MCOs that focus primarily on the immediate cost of drugs often favor generics for this reason. Many governments also encourage the use of generics as alternatives to brand-name drugs in their healthcare programs. Laws in the U.S. generally allow, and in many cases require, pharmacists to substitute generic drugs that have been rated under government procedures to be essentially equivalent to a brand-name drug. The substitution must be made unless the prescribing physician expressly forbids it.

Exclusion of a product from a formulary can lead to its sharply reduced usage in the MCO patient population. Consequently, pharmaceutical companies compete aggressively to have their products included. Where possible, companies compete for inclusion based upon unique features of their products, such as greater efficacy, better patient ease of use or fewer side effects. A lower overall cost of therapy is also an important factor. Products that demonstrate fewer therapeutic advantages must compete for inclusion based primarily on price. We have been generally, although not universally, successful in having our major products included on MCO formularies.

In many markets outside the U.S., we operate in an environment of government-mandated, cost-containment programs. In these markets, a significant portion of funding for healthcare services and the determination of pricing and reimbursement for pharmaceutical products is subject to government control. As a result, our products may face restricted access by both public and private payers and may be subject to assessments of comparative value and effectiveness against competitive products. Several governments have placed restrictions on physician prescription levels and patient reimbursements, emphasized greater use of generic drugs and/or enacted across-the-board price cuts as methods of cost control. In most EU countries, for example, the government regulates pricing of a new product at launch often through direct price controls, international price comparisons, controlling profits and/or reference pricing. In other markets, such as Germany, the government does not set pricing restrictions at launch, but pricing freedom is subsequently limited. Companies may also face significant delays in market access for new products, mainly in France, Spain, Italy and Belgium, and more than a year can elapse before new medicines become available on some national markets. Additionally, member states of the EU have regularly imposed new or additional cost containment measures for pharmaceuticals such as volume discounts, cost caps, cost sharing for increases in excess of prior year costs for individual products or aggregated market level spending, outcome-based pricing schemes and free products for a portion of the expected therapy period. In recent years, Italy, for example, has imposed mandatory price decreases. The existence of price differentials within the EU due to the different national pricing and reimbursement laws leads to significant parallel trade flows.

Government Regulation

The pharmaceutical industry is subject to extensive global regulation by regional, country, state and local agencies. The Federal Food, Drug, and Cosmetic Act, other Federal statutes and regulations, various state statutes and regulations, and laws and regulations of foreign governments govern to varying degrees the testing, approval, production, labeling, distribution, post-market surveillance, advertising, dissemination of information and promotion of our products. The lengthy process of laboratory and clinical testing, data analysis, manufacturing, development and regulatory review necessary for required governmental approvals is extremely costly and can significantly delay product introductions in a given market. Promotion, marketing, manufacturing and distribution of pharmaceutical products are extensively regulated in all major world markets. In addition, our operations are subject to complex Federal, state, local, and foreign environmental and occupational safety laws and regulations. We anticipate that the laws and regulations affecting the manufacture and sale of current products and the introduction of new products will continue to require substantial scientific and technical effort, time and expense as well as significant capital investments.

Of particular importance is the FDA in the U.S. It has jurisdiction over virtually all of our activities and imposes requirements covering the testing, safety, effectiveness, manufacturing, labeling, marketing, advertising and post-marketing surveillance of our products. In many cases, the FDA requirements have increased the amount of time and money necessary to develop new products and bring them to market in the U.S.

The FDA mandates that drugs be manufactured, packaged and labeled in conformity with cGMP established by the FDA. In complying with cGMP regulations, manufacturers must continue to expend time, money and effort in production, recordkeeping and quality control to ensure that products meet applicable specifications and other requirements to ensure product safety and efficacy. The FDA periodically inspects our drug manufacturing facilities to ensure compliance with applicable cGMP requirements. Failure to comply with the statutory and regulatory requirements subjects us to possible legal or regulatory action, such as suspension of manufacturing, seizure of product or voluntary recall of a product. Adverse experiences with the use of products must be reported to the FDA and could result in the imposition of market restrictions through labeling changes or product removal. Product approvals may be withdrawn if compliance with regulatory requirements is not maintained or if problems concerning safety or efficacy occur following approval.

14

The Federal government has extensive enforcement powers over the activities of pharmaceutical manufacturers, including authority to withdraw or delay product approvals, commence actions to seize and prohibit the sale of unapproved or non-complying products, to halt manufacturing operations that are not in compliance with cGMPs, and to impose or seek injunctions, voluntary recalls, civil, monetary and criminal penalties. Such a restriction or prohibition on sales or withdrawal of approval of products marketed by us could materially adversely affect our business, financial condition and results of operations and cash flows.

Marketing authorization for our products is subject to revocation by the applicable governmental agencies. In addition, modifications or enhancements of approved products or changes in manufacturing locations are in many circumstances subject to additional FDA approvals, which may or may not be received and which may be subject to a lengthy application process.

The distribution of pharmaceutical products is subject to the PDMA as part of the Federal Food, Drug, and Cosmetic Act, which regulates such activities at both the Federal and state level. Under the PDMA and its implementing regulations, states are permitted to require registration of manufacturers and distributors who provide pharmaceuticals even if such manufacturers or distributors have no place of business within the state. States are also permitted to adopt regulations limiting the distribution of product samples to licensed practitioners. The PDMA also imposes extensive licensing, personnel recordkeeping, packaging, quantity, labeling, product handling and facility storage and security requirements intended to prevent the sale of pharmaceutical product samples or other product diversions.

The FDA Amendments Act of 2007 imposed additional obligations on pharmaceutical companies and delegated more enforcement authority to the FDA in the area of drug safety. Key elements of this legislation give the FDA authority to (1) require that companies conduct post-marketing safety studies of drugs, (2) impose certain drug labeling changes relating to safety, (3) mandate risk mitigation measures such as the education of healthcare providers and the restricted distribution of medicines, (4) require companies to publicly disclose data from clinical trials and (5) pre-review television advertisements.

The marketing practices of all U.S. pharmaceutical manufacturers are subject to Federal and state healthcare laws that are used to protect the integrity of government healthcare programs. The OIG oversees compliance with applicable Federal laws, in connection with the payment for products by government funded programs (primarily Medicaid and Medicare). These laws include the Federal anti-kickback statute, which criminalizes the offering of something of value to induce the recommendation, order or purchase of products or services reimbursed under a government healthcare program. The OIG has issued a series of Guidances to segments of the healthcare industry, including the 2003 Compliance Program Guidance for Pharmaceutical Manufacturers, which includes a recommendation that pharmaceutical manufacturers, at a minimum, adhere to the PhRMA Code, a voluntary industry code of marketing practices. We subscribe to the PhRMA Code, and have implemented a compliance program to address the requirements set forth in the guidance and our compliance with the healthcare laws. Failure to comply with these healthcare laws could subject us to administrative and legal proceedings, including actions by Federal and state government agencies. Such actions could result in the imposition of civil and criminal sanctions, which may include fines, penalties and injunctive remedies, the impact of which could materially adversely affect our business, financial condition and results of operations and cash flows.

We are also subject to the jurisdiction of various other Federal and state regulatory and enforcement departments and agencies, such as the Federal Trade Commission, the Department of Justice and the Department of Health and Human Services in the U.S. We are also licensed by the U.S. Drug Enforcement Agency to procure and produce controlled substances. We are, therefore, subject to possible administrative and legal proceedings and actions by these organizations. Such actions may result in the imposition of civil and criminal sanctions, which may include fines, penalties and injunctive or administrative remedies.

The U.S. healthcare industry is subject to various government-imposed regulations authorizing prices or price controls that have and will continue to have an impact on our total revenues. We participate in state government Medicaid programs, as well as certain other qualifying Federal and state government programs whereby discounts and rebates are provided to participating state and local government entities. We also participate in government programs that specify discounts to certain government entities, the most significant of which are the U.S. Department of Defense and the U.S. Department of Veterans Affairs. These entities receive minimum discounts based off a defined “non-federal average manufacturer price” for purchases. As a result of the Patient Protection and Affordable Care Act (HR 3590) and the reconciliation bill containing a package of changes to the healthcare bill, we have experienced and will continue to experience additional financial costs and certain other changes to our business. For example, minimum rebates on our Medicaid drug sales have increased from 15.1 percent to 23.1 percent and Medicaid rebates have also been extended to drugs used in risk-based Medicaid managed care plans. In addition, we extend discounts to certain critical access hospitals, cancer hospitals and other covered entities as required by the expansion of the 340B Drug Pricing Program under the Public Health Service Act.

We are required to provide a 50 percent discount on our brand-name drugs to patients who fall within the Medicare Part D coverage gap, also referred to as the “donut hole” and pay an annual non-tax-deductible fee to the federal government based on an allocation of our market share of branded drug sales to certain government programs including Medicare, Medicaid, Department of Veterans Affairs, Department of Defense and TRICARE.

15

Our activities outside the U.S. are also subject to regulatory requirements governing the testing, approval, safety, effectiveness, manufacturing, labeling and marketing of our products. These regulatory requirements vary from country to country. Whether or not FDA approval or approval of the EC has been obtained for a product, approval of the product by comparable regulatory authorities of countries outside of the U.S. or the EU, as the case may be, must be obtained prior to marketing the product in those countries. The approval process may be more or less rigorous from country to country, and the time required for approval may be longer or shorter than that required in the U.S. Approval in one country does not assure that a product will be approved in another country.

For further discussion of these rebates and programs, refer to “Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations—Total Revenues” and “—Critical Accounting Policies.”

Sources and Availability of Raw Materials

In general, we purchase our raw materials and supplies required for the production of our products in the open market. For some products, we purchase our raw materials and supplies from one source (the only source available to us) or a single source (the only approved source among many available to us), thereby requiring us to obtain such raw materials and supplies from that particular source. We attempt, if possible, to mitigate our raw material supply risks, through inventory management and alternative sourcing strategies. For further discussion of sourcing, refer to “—Manufacturing and Quality Assurance” below and discussions of particular products.

Manufacturing and Quality Assurance

We operate and manage our manufacturing network in a manner that permits us to improve efficiency while maintaining flexibility to reallocate manufacturing capacity. Pharmaceutical production processes are complex, highly regulated and vary widely from product to product. Given that shifting or adding manufacturing capacity can be a lengthy process requiring significant capital and other expenditures as well as regulatory approvals, we maintain and operate our flexible manufacturing network, consisting of internal and external resources that minimize unnecessary product transfers and inefficient uses of manufacturing capacity. For further discussion of the regulatory impact on our manufacturing, refer to “—Government Regulation and Price Constraints” above.

Our pharmaceutical manufacturing facilities are located in the U.S., Puerto Rico, France, Italy, Ireland, Japan and China and require significant ongoing capital investment for both maintenance and compliance with increasing regulatory requirements. In addition, as our product line changes over the next several years, we expect to continue modification of our existing manufacturing network to meet complex processing standards that may be required for newly introduced products, including biologics. Biologics manufacturing involves more complex processes than those of traditional pharmaceutical operations. The FDA approved our large scale multi-product bulk biologics manufacturing facility in Devens, Massachusetts in May 2012 and we continue to make capital investments in this facility. We are building a new large-scale biologics manufacturing facility in Cruiserath, Ireland.

We rely on third parties to manufacture or supply us with all or a portion of the active ingredients necessary for us to manufacture various products, such as Opdivo, Sprycel, Yervoy, Eliquis, Orencia, Baraclude, Reyataz and the Sustiva Franchise. To maintain a stable supply of these products, we take a variety of actions including inventory management and maintenance of additional quantities of materials, when possible, designed to provide for a reasonable level of these ingredients to be held by the third-party supplier, us or both, so that our manufacturing operations are not interrupted. As an additional protection, in some cases, we take steps to maintain an approved back-up source where available. For example, we rely on the capacity of our Devens, Massachusetts facility and the capacity available at our third-party contract manufacturers to manufacture Orencia.

In connection with divestitures, licensing arrangements or distribution agreements of certain of our products, or in certain other circumstances, we have entered into agreements under which we have agreed to supply such products to third parties. In addition to liabilities that could arise from our failure to supply such products under the agreements, these arrangements could require us to invest in facilities for the production of non-strategic products, result in additional regulatory filings and obligations or cause an interruption in the manufacturing of our own products.

Our success depends in great measure upon customer confidence in the quality of our products and in the integrity of the data that support their safety and effectiveness. Product quality arises from a total commitment to quality in all parts of our operations, including research and development, purchasing, facilities planning, manufacturing, and distribution. We maintain quality-assurance procedures relating to the quality and integrity of technical information and production processes.

Control of production processes involves detailed specifications for ingredients, equipment and facilities, manufacturing methods, processes, packaging materials and labeling. We perform tests at various stages of production processes and on the final product to ensure that the product meets regulatory requirements and our standards. These tests may involve chemical and physical chemical analyses, microbiological testing or a combination of these along with other analyses. Quality control is provided by business unit/site quality assurance groups that monitor existing manufacturing procedures and systems used by us, our subsidiaries and third-party suppliers.

16

Environmental Regulation