UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

|

Investment Company Act file number |

811-22187 | |||||||

|

| ||||||||

|

PAX WORLD FUNDS TRUST II | ||||||||

|

(Exact name of registrant as specified in charter) | ||||||||

|

| ||||||||

|

30 Penhallow Street, Suite 400, Portsmouth, NH |

|

03801 | ||||||

|

(Address of principal executive offices) |

|

(Zip code) | ||||||

|

| ||||||||

|

Pax World Management LLC 30 Penhallow Street, Suite 400, Portsmouth, NH 03801 Attn.: Joseph Keefe | ||||||||

|

(Name and address of agent for service) | ||||||||

|

| ||||||||

|

Registrant’s telephone number, including area code: |

800-767-1729 |

| ||||||

|

| ||||||||

|

Date of fiscal year end: |

December 31 |

| ||||||

|

| ||||||||

|

Date of reporting period: |

12/31/12 |

| ||||||

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. §3507.

Item 1. Annual Report to Shareholders

December 31, 2012

ANNUAL REPORT

Pax MSCI North America

ESG Index ETF

(NASI)

Pax MSCI EAFE ESG

Index ETF

(EAPS)

Table of Contents

|

Letter to Shareholders |

2 |

||||||

|

Sustainability Update |

5 |

||||||

|

Commentary and Portfolio Highlights |

8 |

||||||

|

Pax MSCI North America ESG Index ETF |

8 |

||||||

|

Pax MSCI EAFE ESG Index ETF |

12 |

||||||

|

Shareholder Expense Examples |

17 |

||||||

|

Schedules of Investments |

19 |

||||||

|

Statements of Assets and Liabilities |

25 |

||||||

|

Statements of Operations |

26 |

||||||

|

Statements of Changes in Net Assets |

27 |

||||||

|

Financial Highlights |

28 |

||||||

|

Notes to Financial Statements |

30 |

||||||

|

Report of Independent Registered Public Accounting Firm |

40 |

||||||

For More Information

General Fund Information

888.729.3863

www.esgshares.com

Transfer Agent and

Custodian

State Street Bank and Trust Company

1 Lincoln Street

Boston, MA 02111

Investment Adviser

Pax World Management LLC

30 Penhallow Street, Suite 400

Portsmouth, NH 03801

Distributor

ALPS Distributors, Inc.

1290 Broadway, #1100

Denver, CO 80203

Letter to Shareholders

by Joseph Keefe, President & CEO

Dear fellow shareholders,

In the investment world, 2012 was a curious year. Markets remained somewhat volatile, the economy continued to stumble through an anemic recovery, businesses were reluctant to hire, money remained on the sidelines, and "uncertainty" seemed to be the recurring explanation for why things weren't getting any better. Uncertainty over Europe's fiscal situation, uncertainty about slowing growth in China, the U.S. election, the so-called "fiscal cliff," changes in tax policy... Every piece of good news, and there was some—lower household debt, improved consumer sentiment and spending, home prices recovering, banks starting to lend after repairing their balance sheets—was greeted with a big, "Yes, but... there's still so much uncertainty."

At year end, however, the S & P 500 Index1 was up 16.00%, the Russell 2000 Index2 of small-cap stocks was up 16.35%, the Lipper High Yield Bond Funds Index3 was up 15.40% and international developed markets as represented by the MSCI EAFE Index4 were up 17.32%. Markets performed quite well, in other words, even against a backdrop of caution and uncertainty.

As the year closed, Congress wisely chose to steer clear of the fiscal cliff and a self-inflicted recession. President Obama got some of the revenue he wanted and we will have to see what transpires in the next act of the seemingly endless drama over spending and taxes. My strong sense is that, should Congress and the President avoid budget sequestration, which would be as silly as it is destructive, and perhaps even come to terms on an earnest long-term deficit reduction and economic growth package, this would send the mother of all positive

1The S&P 500 Index is an unmanaged index of large capitalization common stocks.

2The Russell 2000 Index measures the performance of the small-cap segment of the U.S. equity universe. The Russell 2000 Index is a subset of the Russell 3000 Index representing approximately 10% of the total market capitalization of that index. It includes approximately 2000 of the smallest securities based on a combination of their market cap and current index membership.

3The Lipper High Yield Bond Funds Index tracks the results of the 30 largest mutual funds in the Lipper High Current Yield Bond Funds Average. The Lipper High Current Yield Bond Funds Average is a total return performance average of mutual funds tracked by Lipper, Inc. that aim at high (relative) current yield from fixed income securities, have no quality or maturity restrictions and tend to invest in lower grade debt issues. The Lipper High Current Yield Bond Funds Index is not what is typically considered an "index" because it tracks the performance of other mutual funds rather than changes in the value of a group of securities, a securities index or some other traditional economic indicator.

4The MSCI EAFE (Europe, Australasia, Far East) Index is a free float-adjusted market capitalization index that is designed to measure the equity market performance of developed markets, excluding the U.S. and Canada. The MSCI EAFE Index consisted of the following 22 developed market country indices: Australia, Austria, Belgium, Denmark, Finland, France, Germany, Greece, Hong Kong, Ireland, Israel, Italy, Japan, the Netherlands, New Zealand, Norway, Portugal, Singapore, Spain, Sweden, Switzerland, and the United Kingdom. Performance for the MSCI EAFE Index is shown "net", which includes dividend reinvestments after deduction of foreign withholding tax.

An investor cannot invest directly in an index.

2

signals to the market. Much of the uncertainty, much of the delayed hiring and pent-up demand, much of the cash on the sidelines, would suddenly dissipate. A full-fledged recovery could begin to take shape. In fact, one could argue that it is already underway—if only policy makers would not undermine it.

In the meantime, herein you will find information about how Pax World's two Exchange-Traded Funds ("ETFs")—the Pax MSCI North America ESG Index Fund (NASI) and the Pax MSCI EAFE ESG Fund (EAPS)—performed in 2012.

At Pax World, our view is that sustainable investors need to remain focused on the long term even as companies, markets and policy makers too often allow the short-term to dominate. The preoccupation with short-term profit at the expense of more meaningful long-term metrics is taking an increasing toll. In 2012, that toll arguably included Hurricane Sandy. In fact, the environmental fallout from our current economic paradigm is becoming acute. All of earth's natural systems—air, water, minerals, oil, forests and rainforests, soil, wetlands, fisheries, coral reefs, the oceans themselves—are in serious decline. Climate change (and the altered weather patterns associated with it) may be the most urgent crisis but it is really only a symptom. "The problem," as Australian ecologist Paul Gilding has written, "is the delusion that we can have infinite quantitative economic growth, that we can keep having more and more stuff, on a finite planet."5

Our ability to address climate change and other environmental and resource challenges has been hampered by our long-time underinvestment in infrastructure. My own view is that we need to be sounding the alarm about climate change, resource scarcity and the need for a massive public/private investment in clean energy, energy efficiency and other resource optimization technologies. The problem is not going away. A warming climate, rising global population, a growing middle class in developing nations, increased demand for resources, including food and water, rising commodity prices... The age of resource scarcity is upon us.

As a result of these trends, we see a rapidly accelerating global demand for efficiency solutions in the areas of energy (renewable energy and energy efficiency), water (water infrastructure and technologies, pollution control) and waste (waste management and technologies, environmental support services). And we see growing demand for sustainable investment solutions more generally. Sustainable investing offers investors strategies to manage the risks and take advantage of the opportunities associated with the transition to a low-carbon, resource-efficient global economy. It offers a way for investors to be part of the solution rather than part of the problem, and to align their investments with the urgent need for solutions to these critical issues.

2012 was a challenging year but something tells me 2013 will be too. That's OK. In fact, that's what we are here for: to help investors manage their way through these challenges times. The fundamental premise underlying sustainable investing is that business corporations and markets need to alter their focus from maximizing short-term profit to maximizing long-term value, and long-term value must expressly include the societal benefits associated with or

5Paul Gilding, the Great Disruption, Bloomsbury Press, 2011, p. 186.

3

derived from economic activity. The connections between economic output and ecological/societal health should not be incidental, let alone negative, but must be expressly and positively linked. At Pax World, we promise to stay committed to this approach, which in the long run we think best serves investors, society and the planet.

Peace,

Joseph F. Keefe

President and CEO

4

December 31, 2012

Sustainable Investing

Sustainability Update

Sustainability Update

The second half of 2012 put three of the issues at the heart of sustainable investing into the public spotlight: climate, board diversity and guns.

Climate change has been there before, of course, but after two very bad hurricane years in 2004 and 2005, followed by gridlock on emissions at the federal policy level, the issue drifted into a news backwater for a few years. It came roaring back with Hurricane Sandy, followed by news that 2012 was the hottest year on record for the contiguous United States, and the ninth hottest on record globally (the only eight years with higher temperatures have all happened since 1987). Moreover, after four years of doing very little on climate change, President Obama has made action on climate change a political priority for his second term.

Whether climate change tops the news charts is often a matter of what else is happening at any given moment. But it has been a top priority for Pax World for many years, as it is one of the most profound challenges humanity faces, and will require the active commitment of the sustainable investment community to help solve it. For our part, Pax World has taken action on several fronts: offsetting our own greenhouse gas emissions through Native Energy, encouraging companies to understand their own emissions and take steps to reduce them, and joining others to support public policies needed to morph our economy from one dependent on fossil fuels to one based on clean, renewable energy. Some specific recent actions include:

• Pax World endorsed a letter to the U.S. Congress, organized by the Investor Network on Climate Risk (INCR), urging the extension of the production tax credit for wind energy. The tax credit was extended by Congress in its deal with the President to avoid the fiscal cliff.

• Pax World signed on to an investor letter sponsored by Ceres to the newly formed oil sands industry collaborative named Canada's Oil Sands Innovation Alliance (COSIA). Investors laid out clear and specific expectations for how the industry can improve its environmental and social performance.

• Pax World signed on to a letter, sponsored by the American Sustainable Business Council, to EPA Administrator Lisa Jackson in support of the adoption of the Greenhouse Gas New Source Performance Standard or the Carbon Pollution Standard for New Power Plants, which would establish a national carbon pollution standard for new power plants for the first time.

5

December 31, 2012

Sustainability Update, continued

While not much happened in U. S. policy circles with respect to board diversity, the global landscape has been more lively. Several European states (including France, the Netherlands, Italy and Belgium) enacted legislation in 2011 aimed at improving gender balance on corporate boards, following earlier actions in Norway. That prompted the European Commission to assess gender diversity on boards, and in November 2012 the Commission proposed to set an objective of 40% female representation on public company boards as a quota to be met in 2020. That action, plus efforts elsewhere in the world (e.g., Australia) to improve gender balance on boards, kept the spotlight on board diversity. Over the past year, Pax has filed several shareholder proposals urging companies to diversify their boards, and most recently we were successful in convincing Hospitality Properties Trust and Riverbed Technologies to modify their governance guidelines to specify that gender diversity would be a component of every director search. Pax World continues to file resolutions and conduct focused dialogues with companies in pursuit of gender balance on corporate boards. Pax World has also been deeply involved with the Thirty Percent Coalition, an organization comprising industry leaders, including senior business executives, national women's organizations, institutional investors with approximately $1.2 trillion in assets under management, corporate governance experts and board members. The goal of the Coalition is to assure that women hold 30% of board seats at public companies by the end of 2015. That coalition has, in the past few months, sent letters urging greater gender diversity on boards to all the companies in the S&P 500 that have no women on their boards, and we are in the process of sending letters to companies in the Russell 1000 index that have no women on their boards.

Guns also debuted on the investment landscape in 2012 with the terrible incident in Newtown, Connecticut. While shootings in schools or other public places have long ignited horror and outrage, the shockwave rarely reached into the investment world. This time, however, it did, and almost immediately after the incident, some of the nation's largest pension funds announced that they would divest or are considering divesting holdings in gun manufacturers. A lot of editorial debate has since been devoted to whether this would really affect the fortunes of gun manufacturers. We don't think that is the crux of the matter. Pax World chose, right from the start, not to invest in companies that manufacture weapons, and we remain committed to that choice—not because we think it will drive gun manufacturers' stock prices down to the point where they disappear, but because we would rather not profit from the manufacture of guns, and we would rather not be owners of companies that siphon millions of dollars, through political contributions and gun purchase programs, to the National Rifle Association.

6

December 31, 2012

Sustainability Update, continued

While fund managers, gun owners and activists of many stripes debate the wisdom of introducing this ultra-polarized political issue onto the landscape of fund management, the fact remains that the status quo is not neutral with respect to the place or type of guns in our society: those who own stocks of gun makers are profiting from the use of guns in our society, and the companies they own are deeply involved in the political landscape of gun ownership and control. Over the past seven years, corporations have contributed between $19.6 million and $52.6 million1 to the NRA's Ring of Freedom program, and the NRA has fiercely resisted public policy attempts to place any limits on the type of guns that may be sold or owned in the United States, including assault weapons.

We are under no illusion that investments are somehow socially neutral. They have consequences. At Pax World, the focus of all our advocacy, directly with companies and also through public policy, is to make our economy and society more sustainable, which we believe will be good for investors along with everyone else.

1Violence Policy Center, Blood Money: How the Gun Industry Bankrolls the NRA, April 2011.

7

Pax MSCI North America ESG Index ETF

December 31, 2012

Commentary

The Pax MSCI North America ESG Index ETF (NASI) employs a passive management approach, seeking to track the performance of the MSCI North America ESG Index, a broadly diversified, sector-neutral index of American and Canadian companies with superior ESG performance as rated by MSCI ESG Research.

For the one-year period ended December 31, 2012, the Fund's NAV return was 12.77%, tracking the MSCI North America ESG Index return of 13.41% and the MSCI North America Index return of 15.57%.

During the period the financial, health care and the consumer discretionary sectors made the most positive contributions to performance while utilities and the energy sectors contributed the least amount to performance. There were no sectors that had a negative contribution to performance during the period. From a country prospective, the United States (88.88% average weight of total investments for the period) made up the largest positive contribution to performance due to its significant weight in the ETF. During the period, Canada (10.25% average weight of total investments) also contributed positively to performance.

Companies that contributed positively to performance included Oracle Corp., a manufacturer of enterprise software systems which reported strong earnings on cloud computing demand; Gilead Sciences, Inc., a biopharmaceutical company received FDA approval for their HIV drug and had positive results in a late stage trial for their new Hepatitis C drug. Both companies posted strong returns during the period. Companies that detracted most from performance included Hewlett-Packard Co., a manufacturer of computer and printer systems; and Intel Corp., a manufacturer of computer components. Both companies declined during the period due to weak demand for personal computers.

The Fund described herein is indexed to an MSCI index. The Fund referred to herein is not sponsored, endorsed or promoted by MSCI or its affiliates, and MSCI and its affiliates bear no liability with respect to any such fund or any index on which such fund is based.

The MSCI North America ESG Index is designed to measure the performance of equity securities of issuers organized or operating in the United States and Canada that have high environmental, social and governance (ESG) ratings relative to their sector and industry group peers, as rated by MSCI ESG Research annually.

MSCI ESG Research evaluates companies' ESG characteristics and derives corresponding ESG scores and ratings. Companies are ranked by ESG score against their sector peers to determine their eligibility for the MSCI ESG indices. MSCI ESG Research identifies the highest-rated companies in each peer group to meet the float-adjusted market capitalization sector targets. The rating system is based on general and industry specific ESG criteria, assigning ratings on a 9-point scale from AAA (highest) to C (lowest). Constituents of the MSCI EAFE Index having an ESG rating of B or above are eligible for inclusion in the Index.

8

December 31, 2012

Commentary, continued

The MSCI North America ESG Index includes or utilizes data, ratings, analysis, reports, analytics or other information or materials from MSCI's ESG Research Group within Institutional Shareholder Services Inc., an indirect wholly-owned subsidiary of MSCI. The prospectus contains a more detailed description of the limited relationship MSCI has with Pax World Management LLC, ESG Shares and any related funds.

The MSCI North America Index is a free float-adjusted market capitalization weighted index that is designed to measure the equity market performance of North America.

Unlike the Fund, the MSCI North America ESG Index and the MSCI North America Index are not investments, are not professionally managed and do not reflect deductions for fees, expenses or taxes.

9

Pax MSCI North America ESG Index ETF

December 31, 2012

Portfolio Highlights (Unaudited)

Total Return—Historical Growth of $10,000—Since Inception

Returns—Period ended December 31, 2012

|

Total Return |

|||||||||||

|

One year |

Since Inception1 |

||||||||||

|

NAV Return2 |

12.77 |

% |

8.72 |

% |

|||||||

|

Market Value Return2 |

12.37 |

% |

8.70 |

% |

|||||||

|

MSCI North America ESG Index3 |

13.41 |

% |

9.39 |

% |

|||||||

|

MSCI North America Index4 |

15.57 |

% |

11.50 |

% |

|||||||

Total annual operating expenses for Pax MSCI North America ESG Index ETF are 0.50%

All total return figures assume reinvestment of dividends and capital gains at net asset value; actual returns may differ. Performance data quoted represents past performance. Past performance does not guarantee future results. Investment return and principal value of an investment will fluctuate so that an investor's shares, when sold or redeemed, may be worth more or less than the original cost. Current performance data may be higher or lower than actual data quoted. Total returns for periods of less than one year have not been annualized. For more recent month-end performance data, please visit www.esgshares.com or call us at 888-729-3863.

An index is a statistical measure of a specified financial market or sector. An index does not actually hold a portfolio of securities, incur expenses or pay any transaction costs. Therefore, index returns do not reflect deductions for fees or expenses and are not available for direct investment. In comparison, the Fund's performance is negatively impacted by these deductions. Fund returns do not reflect brokerage commissions on transactions in Fund shares or taxes that a shareholder would pay on Fund distributions.

1The Fund's inception date is May 18, 2010.

2The NAV return is based on the closing NAV (net asset value per share) of the Fund and the Market Value return is based on the market price per share of the Fund. The market prices used for Market Value returns are based on the midpoint of the bid/ask spread at 4 p.m. ET and do not represent the returns an investor would receive if shares were traded at other times.

10

Pax MSCI North America ESG Index ETF

December 31, 2012

Portfolio Highlights (Unaudited), continued

3The MSCI North America ESG Index is designed to measure the performance of equity securities of issuers organized or operating in North America that have high environmental, social and governance (ESG) ratings from MSCI, selected initially and adjusted annually by MSCI.

4The MSCI North America Index is a free float-adjusted market capitalization weighted index that is designed to measure the equity market performance of North America.

|

Asset Allocation |

Percent of Net Assets |

||||||

|

Common Stocks |

99.8 |

% |

|||||

|

Money Market Fund |

0.7 |

% |

|||||

|

Other Assets & Liabilities |

(0.5 |

)% |

|||||

|

Total Net Assets |

100.0 |

% |

|||||

Top Ten Holdings

|

Company |

Percent of Net Assets |

||||||

|

IBM |

3.1 |

% |

|||||

|

Johnson & Johnson |

2.9 |

% |

|||||

|

Procter & Gamble Co. |

2.8 |

% |

|||||

|

Google, Inc. (Class A) |

2.8 |

% |

|||||

|

Oracle Corp. |

2.0 |

% |

|||||

|

Merck & Co., Inc. |

1.9 |

% |

|||||

|

PepsiCo, Inc. |

1.6 |

% |

|||||

|

QUALCOMM, Inc. |

1.6 |

% |

|||||

|

Cisco Systems, Inc. |

1.6 |

% |

|||||

|

Intel Corp. |

1.5 |

% |

|||||

|

Total |

21.8 |

% |

|||||

Ten largest holdings do not include money market securities, certificates of deposit, commercial paper or cash and equivalents, if applicable. Holdings are subject to change.

Sector Diversification

|

Sector |

Percent of Net Assets |

||||||

|

Information Technology |

19.0 |

% |

|||||

|

Financials |

18.3 |

% |

|||||

|

Health Care |

12.1 |

% |

|||||

|

Consumer Discretionary |

11.9 |

% |

|||||

|

Industrials |

10.5 |

% |

|||||

|

Consumer Staples |

10.1 |

% |

|||||

|

Energy |

8.7 |

% |

|||||

|

Materials |

5.0 |

% |

|||||

|

Utilities |

2.5 |

% |

|||||

|

Telecommunication Services |

1.7 |

% |

|||||

|

Cash and cash equivalents plus other assets less liabilities |

0.2 |

% |

|||||

|

Total |

100.0 |

% |

|||||

Geographical Diversification

|

Country |

Percent of Net Assets |

||||||

|

United States |

89.5 |

% |

|||||

|

Canada |

10.3 |

% |

|||||

|

Other Countries |

0.7 |

% |

|||||

|

Other Assets & Liabilities |

(0.5 |

)% |

|||||

|

Total |

100.0 |

% |

|||||

11

Pax MSCI EAFE ESG Index ETF

December 31, 2012

Commentary

The Pax MSCI EAFE ESG Index ETF (EAPS) employs a passive management approach, seeking to track the performance of the MSCI EAFE ESG Index, which consists of companies operating in developed market countries around the world, excluding the U.S. and Canada, that have superior ESG performance as rated by MSCI ESG Research.

For the one-year period ended December 31, 2012, the Fund's NAV return was 16.98%, almost matching the MSCI EAFE ESG Index return of 17.03%, while slightly underperforming the MSCI EAFE index return of 17.32%.

During the period, regional exposure to Europe, which is the largest regional weighting (41.17% average weight of total investments for the period) in the ETF, was the greatest positive contributor to performance. The European sovereign debt crisis1 abated during the period and drove many of the European stock indices higher for the year. UK (23.98% average weight of total investments for the period) also made a meaningful positive contribution during the period. Greece (0.16% average weight of total investments for the period) was the only country that had a negative contribution to performance.

Companies that contributed positively to performance included HSBC Holdings PLC, a London based international banking and financial services company; and Mitsui Fudosan Co. Ltd, a Tokyo, Japan based real estate service and development company. The European sovereign debt crisis stabilized during the period driving shares higher for many of the large-cap European banks. A continued recovery from the tsunami and nuclear disaster helped support higher prices for many Japanese real estate companies. Companies that detracted from performance included Shikoku Electric Power, a Japan based electric utility company; and BG Group PLC, a U.K. based energy company. Plant shutdowns, regulatory scrutiny and new safety standards weighed heavily on the shares Japanese electric utilities. Project delays and a poor outlook for growth depressed shares of BG Group during the latter part of the year.

1Sovereign debt are bonds issued by a national government in a foreign currency, in order to finance the issuing country's growth. Sovereign debt is generally a riskier investment when it comes from a developing country, and a safer investment when it comes from a developed country. The stability of the issuing government is an important factor to consider, when assessing the risk of investing in sovereign debt, and sovereign credit ratings help investors weigh this risk.

The Fund described herein is indexed to an MSCI index. The Fund referred to herein is not sponsored, endorsed or promoted by MSCI or its affiliates, and MSCI and its affiliates bear no liability with respect to any such fund or any index on which such fund is based.

The MSCI EAFE ESG Index is a free float-adjusted market capitalization weighted index designed to measure the performance of equity securities of issuers organized or operating in developed market countries around the world excluding the U.S. and Canada that have high environmental, social and governance (ESG) ratings relative to their sector and industry group peers, as rated by MSCI ESG Research annually. The Index targets

12

December 31, 2012

Commentary, continued

sector weights that reflect the relative sector weights of the MSCI Europe & Middle East Index and the MSCI Pacific Index. MSCI ESG Research evaluates companies' ESG characteristics and derives corresponding ESG scores and ratings. Companies are ranked by ESG score against their sector peers to determine their eligibility for the MSCI ESG indices. MSCI ESG Research identifies the highest-rated companies in each peer group to meet the float-adjusted market capitalization sector targets. The rating system is based on general and industry-specific ESG criteria, assigning ratings on a 9-point scale from AAA (highest) to C (lowest). Constituents of the MSCI EAFE Index having an ESG rating of B or above are eligible for inclusion in the Index.

The MSCI EAFE ESG Index includes or utilizes data, ratings, analysis, reports, analytics or other information or materials from MSCI's ESG Research Group within Institutional Shareholder Services Inc., an indirect wholly-owned subsidiary of MSCI. The prospectus contains a more detailed description of the limited relationship MSCI has with Pax World Management LLC, ESG Shares and any related funds.

The MSCI EAFE (Europe, Australasia, Far East) Index is a free float-adjusted market capitalization index that is designed to measure the equity market performance of developed markets, excluding the U.S. and Canada. The MSCI EAFE Index consisted of the following 22 developed market country indices: Australia, Austria, Belgium, Denmark, Finland, France, Germany, Greece, Hong Kong, Ireland, Israel, Italy, Japan, the Netherlands, New Zealand, Norway, Portugal, Singapore, Spain, Sweden, Switzerland, and the United Kingdom.

The MSCI Europe & Middle East Index is a free float-adjusted market capitalization weighted index that is designed to measure the equity market performance of the developed markets in Europe and the Middle East. The MSCI Europe & Middle East Index consisted of the following 17 developed market country indices: Austria, Belgium, Denmark, Finland, France, Germany, Greece, Ireland, Israel, Italy, the Netherlands, Norway, Portugal, Spain, Sweden, Switzerland, and the United Kingdom.

The MSCI Pacific Index is a free float-adjusted market capitalization weighted index that is designed to measure the equity market performance of the developed markets in the Pacific region. The MSCI Pacific Index consisted of the following 5 developed market country indices: Australia, Hong Kong, Japan, New Zealand, and Singapore.

Unlike the Fund, the MSCI EAFE ESG Index, the MSCI EAFE Index, the MSCI Europe & Middle East Index and the MSCI Pacific Index are not investments, are not professionally managed and do not reflect deductions for fees, expenses or taxes.

13

Pax MSCI EAFE ESG Index ETF

December 31, 2012

Portfolio Highlights (Unaudited)

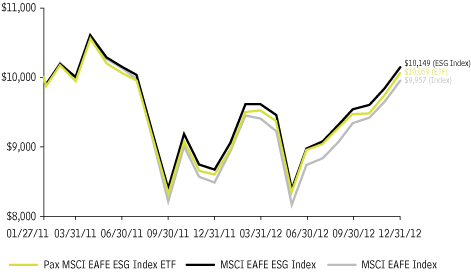

Total Return—Historical Growth of $10,000—Since Inception

Returns—Period ended December 31, 2012

|

Total Return |

|||||||||||

|

One year |

Since Inception1 |

||||||||||

|

NAV Return2 |

16.98 |

% |

0.31 |

% |

|||||||

|

Market Value Return2 |

19.71 |

% |

1.54 |

% |

|||||||

|

MSCI EAFE ESG Index3 |

17.03 |

% |

0.77 |

% |

|||||||

|

MSCI EAFE Index4 |

17.32 |

% |

-0.22 |

% |

|||||||

Total annual operating expenses for Pax MSCI EAFE ESG Index ETF are 0.55%

All total return figures assume reinvestment of dividends and capital gains at net asset value; actual returns may differ. Performance data quoted represents past performance. Past performance does not guarantee future results. Investment return and principal value of an investment will fluctuate so that an investor's shares, when sold or redeemed, may be worth more or less than the original cost. Current performance data may be higher or lower than actual data quoted. Total returns for periods of less than one year have not been annualized. For more recent month-end performance data, please visit www.esgshares.com or call us at 888-729-3863.

An index is a statistical measure of a specified financial market or sector. An index does not actually hold a portfolio of securities, incur expenses or pay any transaction costs. Therefore, index returns do not reflect deductions for fees or expenses and are not available for direct investment. In comparison, the Fund's performance is negatively impacted by these deductions. Fund returns do not reflect brokerage commissions on transactions in Fund shares or taxes that a shareholder would pay on Fund distributions.

1The Fund's inception date is January 27, 2011.

2The NAV return is based on the closing NAV (net asset value per share) of the Fund and the Market Value return is based on the market price per share of the Fund. The market prices used for Market Value returns are based on the midpoint of the bid/ask spread at 4 p.m. ET and do not represent the returns an investor would receive if shares were traded at other times.

14

Pax MSCI EAFE ESG Index ETF

December 31, 2012

Portfolio Highlights (Unaudited), continued

3MSCI EAFE ESG Index is a free float-adjusted market capitalization weighted index designed to measure the performance of equity securities of issuers organized or operating in Europe and the Asia Pacific region that have high environmental, social and governance (ESG) ratings from MSCI, selected initially and adjusted annually by MSCI.

4The MSCI EAFE (Europe, Australasia, Far East) Index is a free float-adjusted market capitalization index that is designed to measure the equity market performance of developed markets, excluding the U.S. and Canada. The MSCI EAFE Index consisted of the following 22 developed market country indices: Australia, Austria, Belgium, Denmark, Finland, France, Germany, Greece, Hong Kong, Ireland, Israel, Italy, Japan, the Netherlands, New Zealand, Norway, Portugal, Singapore, Spain, Sweden, Switzerland, and the United Kingdom.

|

Asset Allocation |

Percent of Net Assets |

||||||

|

Common Stocks |

99.5 |

% |

|||||

|

Preferred Stock |

0.3 |

% |

|||||

|

Money Market Fund |

2.7 |

% |

|||||

|

Rights |

0.0 |

%* |

|||||

|

Other Assets & Liabilities |

(2.5 |

)% |

|||||

|

Total Net Assets |

100.0 |

% |

|||||

*Less than 0.05%.

Top Ten Holdings

|

Company |

Percent of Net Assets |

||||||

|

HSBC Holdings PLC |

3.9 |

% |

|||||

|

Vodafone Group PLC |

3.0 |

% |

|||||

|

Roche Holding AG |

2.8 |

% |

|||||

|

Novartis AG |

2.6 |

% |

|||||

|

GlaxoSmithKline PLC |

2.5 |

% |

|||||

|

Commonwealth Bank of Australia |

2.3 |

% |

|||||

|

BASF SE |

2.0 |

% |

|||||

|

Westpac Banking Corp. |

2.0 |

% |

|||||

|

Novo Nordisk A/S (Class B) |

1.6 |

% |

|||||

|

Colruyt SA |

1.6 |

% |

|||||

|

Total |

24.3 |

% |

|||||

Ten largest holdings do not include money market securities, certificates of deposit, commercial paper or cash and equivalents, if applicable. Holdings are subject to change.

Sector Diversification

|

Sector |

Percent of Net Assets |

||||||

|

Financials |

26.7 |

% |

|||||

|

Consumer Discretionary |

13.1 |

% |

|||||

|

Health Care |

11.8 |

% |

|||||

|

Industrials |

11.7 |

% |

|||||

|

Consumer Staples |

11.7 |

% |

|||||

|

Materials |

7.4 |

% |

|||||

|

Energy |

5.6 |

% |

|||||

|

Telecommunication Services |

5.2 |

% |

|||||

|

Information Technology |

3.9 |

% |

|||||

|

Utilities |

2.7 |

% |

|||||

|

Cash and cash equivalents plus other assets less liabilities |

0.2 |

% |

|||||

|

Total |

100.0 |

% |

|||||

15

Pax MSCI EAFE ESG Index ETF

December 31, 2012

Portfolio Highlights (Unaudited), continued

Geographical Diversification

|

Country |

Percent of Net Assets |

||||||

|

Japan |

22.9 |

% |

|||||

|

United Kingdom |

22.5 |

% |

|||||

|

Australia |

10.0 |

% |

|||||

|

Switzerland |

9.2 |

% |

|||||

|

France |

8.0 |

% |

|||||

|

Germany |

5.5 |

% |

|||||

|

Spain |

5.4 |

% |

|||||

|

Sweden |

4.6 |

% |

|||||

|

Netherlands |

2.7 |

% |

|||||

|

Belgium |

2.0 |

% |

|||||

|

Denmark |

2.0 |

% |

|||||

|

Italy |

1.3 |

% |

|||||

|

Finland |

0.8 |

% |

|||||

|

New Zealand |

0.7 |

% |

|||||

|

Hong Kong |

0.7 |

% |

|||||

|

Luxembourg |

0.5 |

% |

|||||

|

Norway |

0.5 |

% |

|||||

|

Austria |

0.4 |

% |

|||||

|

Israel |

0.1 |

% |

|||||

|

Ireland |

0.0 |

%* |

|||||

|

Short Term Investment |

2.7 |

% |

|||||

|

Other Assets & Liabilities |

(2.5 |

)% |

|||||

|

Total |

100.0 |

% |

|||||

*Less than 0.05%.

16

December 31, 2012

Shareholder Expense Examples (Unaudited)

Examples As a shareholder of the Funds, you incur two types of costs: (1) transaction costs, including brokerage commissions on purchases and sales of your fund shares and (2) ongoing costs, including management fees and other Fund expenses. The examples below are intended to help you understand your ongoing costs (in dollars) of investing in the Funds and compare these costs with the ongoing costs of investing in other funds. For more information, see the prospectus or talk to your financial adviser.

The examples are based on an investment of $1,000 invested at the beginning of the period and held for the entire period beginning on July 1, 2012 and ending on December 31, 2012.

Actual Expenses The first line in the table provides information about actual account values and actual expenses. You may use the information in this table, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number under the heading entitled "Expenses Paid During Period" to estimate the expenses you paid on your account during this period.

Hypothetical Examples for Comparison Purposes The second line in the table provides information about hypothetical account values and hypothetical expenses based on each Fund's actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund's actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Funds and other funds. To do so, compare these 5% hypothetical examples with the 5% hypothetical examples that appear in the shareholder reports of other funds.

Please note that the expenses shown in the tables are meant to highlight your ongoing costs only and do not reflect any transactional costs. Therefore, the second line of the table under each Fund is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning

17

December 31, 2012

Shareholder Expense Examples (Unaudited), continued

different funds. In addition, if these transactional costs were included, your costs would have been higher.

|

Beginning Account Value (7/1/12) |

Ending Account Value (12/31/12) |

Annualized Expense Ratio |

Expenses Paid During Period1 |

||||||||||||||||

|

Pax MSCI North America ESG Index ETF |

|||||||||||||||||||

|

Based on Actual Fund Return |

$ |

1,000 |

$ |

1,070.50 |

0.50 |

% |

$ |

2.60 |

|||||||||||

|

Based on Hypothetical 5% Return |

1,000 |

1,022.59 |

0.50 |

% |

2.54 |

||||||||||||||

|

Pax MSCI EAFE ESG Index ETF |

|||||||||||||||||||

|

Based on Actual Fund Return |

$ |

1,000 |

$ |

1,123.70 |

0.55 |

% |

$ |

2.94 |

|||||||||||

|

Based on Hypothetical 5% Return |

1,000 |

1,022.34 |

0.55 |

% |

2.80 |

||||||||||||||

1 Expenses are equal to the Fund's annualized expense ratio, multiplied by the average account value over the period, multiplied by 184/366 (to reflect the period beginning on July 1, 2012 and ending on December 31, 2012).

18

Pax MSCI North America ESG Index ETF

December 31, 2012

Schedule of Investments

|

Security Description |

Shares |

Value |

|||||||||

|

COMMON STOCKS: 99.8% |

|||||||||||

|

Consumer Discretionary: 11.9% |

|||||||||||

|

Advance Auto Parts, Inc. |

129 |

$ |

9,333 |

||||||||

|

Autoliv, Inc. |

171 |

11,524 |

|||||||||

|

AutoZone, Inc. (a) |

62 |

21,975 |

|||||||||

|

Bed Bath & Beyond, Inc. (a) |

426 |

23,818 |

|||||||||

|

Best Buy Co., Inc. |

526 |

6,233 |

|||||||||

|

BorgWarner, Inc. (a) |

206 |

14,754 |

|||||||||

|

Cablevision Systems Corp. (Class A) |

351 |

5,244 |

|||||||||

|

Canadian Tire Corp., Ltd. (Class A) |

138 |

9,616 |

|||||||||

|

CarMax, Inc. (a) |

403 |

15,129 |

|||||||||

|

Chipotle Mexican Grill, Inc. (a) |

55 |

16,360 |

|||||||||

|

Darden Restaurants, Inc. |

228 |

10,276 |

|||||||||

|

Discovery Communications, Inc. (Series A) (a) |

254 |

16,124 |

|||||||||

|

Discovery Communications, Inc. (Series C) (a) |

170 |

9,945 |

|||||||||

|

Ford Motor Co. |

6,392 |

82,776 |

|||||||||

|

GameStop Corp. (Class A) |

241 |

6,047 |

|||||||||

|

Genuine Parts Co. |

276 |

17,548 |

|||||||||

|

Gildan Activewear, Inc. |

205 |

7,480 |

|||||||||

|

Harley-Davidson, Inc. |

409 |

19,976 |

|||||||||

|

Hasbro, Inc. |

205 |

7,360 |

|||||||||

|

J.C. Penney Co., Inc. |

288 |

5,676 |

|||||||||

|

Johnson Controls, Inc. |

1,208 |

37,086 |

|||||||||

|

Kohl's Corp. |

400 |

17,192 |

|||||||||

|

Liberty Global, Inc. (Series A) (a) |

245 |

15,433 |

|||||||||

|

Liberty Global, Inc. (Series C) (a) |

200 |

11,750 |

|||||||||

|

Liberty Media Corp. – Interactive (Class A) (a) |

925 |

18,204 |

|||||||||

|

Liberty Media Corp. – Liberty Capital (Class A) (a) |

188 |

21,810 |

|||||||||

|

LKQ Corp. (a) |

537 |

11,331 |

|||||||||

|

Lowe's Cos., Inc. |

2,110 |

74,947 |

|||||||||

|

Macy's, Inc. |

734 |

28,641 |

|||||||||

|

Marriott International, Inc. (Class A) |

473 |

17,629 |

|||||||||

|

Mattel, Inc. |

602 |

22,045 |

|||||||||

|

McDonald's Corp. |

1,811 |

159,748 |

|||||||||

|

Mohawk Industries, Inc. (a) |

103 |

9,318 |

|||||||||

|

Netflix, Inc. (a) |

93 |

8,629 |

|||||||||

|

Newell Rubbermaid, Inc. |

512 |

11,402 |

|||||||||

|

NIKE, Inc. (Class B) |

1,306 |

67,390 |

|||||||||

|

Nordstrom, Inc. |

295 |

15,782 |

|||||||||

|

O'Reilly Automotive, Inc. (a) |

213 |

19,046 |

|||||||||

|

PetSmart, Inc. |

196 |

13,395 |

|||||||||

|

Ross Stores, Inc. |

405 |

21,931 |

|||||||||

|

Royal Caribbean Cruises, Ltd. |

251 |

8,534 |

|||||||||

|

Scripps Networks Interactive, Inc. (Class A) |

163 |

9,441 |

|||||||||

|

Staples, Inc. |

1,231 |

14,033 |

|||||||||

|

Starbucks Corp. |

1,362 |

73,030 |

|||||||||

|

Starwood Hotels & Resorts Worldwide, Inc. |

347 |

19,904 |

|||||||||

|

Target Corp. |

1,117 |

66,093 |

|||||||||

|

The Gap, Inc. |

563 |

17,476 |

|||||||||

|

The TJX Cos., Inc. |

1,321 |

56,076 |

|||||||||

|

Thomson Reuters Corp. |

680 |

19,655 |

|||||||||

|

Tiffany & Co. |

224 |

12,844 |

|||||||||

|

Security Description |

Shares |

Value |

|||||||||

|

COMMON STOCKS, continued |

|||||||||||

|

Consumer Discretionary, continued |

|||||||||||

|

Tim Hortons, Inc. |

281 |

$ |

13,780 |

||||||||

|

Time Warner Cable, Inc. |

550 |

53,454 |

|||||||||

|

Time Warner, Inc. |

1,704 |

81,502 |

|||||||||

|

Under Armour, Inc. (Class A) (a) |

142 |

6,891 |

|||||||||

|

V.F. Corp. |

157 |

23,702 |

|||||||||

|

Virgin Media, Inc. |

470 |

17,272 |

|||||||||

|

Whirlpool Corp. |

136 |

13,838 |

|||||||||

|

1,427,428 |

|||||||||||

|

Consumer Staples: 10.1% |

|||||||||||

|

Avon Products, Inc. |

765 |

10,985 |

|||||||||

|

Bunge, Ltd. |

253 |

18,391 |

|||||||||

|

Campbell Soup Co. |

338 |

11,793 |

|||||||||

|

Coca-Cola Enterprises, Inc. |

536 |

17,007 |

|||||||||

|

Colgate-Palmolive Co. |

857 |

89,591 |

|||||||||

|

ConAgra Foods, Inc. |

733 |

21,624 |

|||||||||

|

Dr. Pepper Snapple Group, Inc. |

375 |

16,568 |

|||||||||

|

Empire Co., Inc. (Class A) |

53 |

3,138 |

|||||||||

|

Energizer Holdings, Inc. |

117 |

9,358 |

|||||||||

|

General Mills, Inc. |

1,163 |

46,997 |

|||||||||

|

Green Mountain Coffee Roasters, Inc. (a) |

234 |

9,678 |

|||||||||

|

H.J. Heinz Co. |

567 |

32,705 |

|||||||||

|

Herbalife, Ltd. |

206 |

6,786 |

|||||||||

|

Hormel Foods Corp. |

257 |

8,021 |

|||||||||

|

Kellogg Co. |

444 |

24,797 |

|||||||||

|

Kimberly-Clark Corp. |

698 |

58,932 |

|||||||||

|

Loblaw Cos., Ltd. |

200 |

8,422 |

|||||||||

|

McCormick & Co., Inc. |

214 |

13,595 |

|||||||||

|

Mead Johnson Nutrition Co. |

361 |

23,786 |

|||||||||

|

Metro, Inc. (Class A) |

177 |

11,258 |

|||||||||

|

Mondelez International, Inc. (Class A) |

3,018 |

76,868 |

|||||||||

|

PepsiCo, Inc. |

2,794 |

191,193 |

|||||||||

|

Procter & Gamble Co. |

4,950 |

336,055 |

|||||||||

|

Safeway, Inc. |

430 |

7,779 |

|||||||||

|

Saputo, Inc. |

229 |

11,571 |

|||||||||

|

Sysco Corp. |

1,037 |

32,831 |

|||||||||

|

The Clorox Co. |

219 |

16,035 |

|||||||||

|

The Estee Lauder Cos., Inc. (Class A) |

419 |

25,081 |

|||||||||

|

The J.M. Smucker Co. |

200 |

17,248 |

|||||||||

|

The Kroger Co. |

929 |

24,173 |

|||||||||

|

Whole Foods Market, Inc. |

308 |

28,130 |

|||||||||

|

1,210,396 |

|||||||||||

|

Energy: 8.7% |

|||||||||||

|

Apache Corp. |

700 |

54,950 |

|||||||||

|

ARC Resources, Ltd. |

527 |

12,935 |

|||||||||

|

Cameron International Corp. (a) |

437 |

24,673 |

|||||||||

|

Cenovus Energy, Inc. |

1,353 |

45,236 |

|||||||||

|

Cimarex Energy Co. |

152 |

8,775 |

|||||||||

|

Concho Resources, Inc. (a) |

174 |

14,017 |

|||||||||

|

Continental Resources, Inc. (a) |

80 |

5,879 |

|||||||||

|

Core Laboratories NV |

85 |

9,291 |

|||||||||

|

Crescent Point Energy Corp. |

580 |

21,914 |

|||||||||

|

Denbury Resources, Inc. (a) |

692 |

11,210 |

|||||||||

|

Devon Energy Corp. |

681 |

35,439 |

|||||||||

SEE ACCOMPANYING NOTES TO FINANCIAL STATEMENTS.

19

Pax MSCI North America ESG Index ETF

December 31, 2012

Schedule of Investments, continued

|

Security Description |

Shares |

Value |

|||||||||

|

COMMON STOCKS, continued |

|||||||||||

|

Energy, continued |

|||||||||||

|

Enbridge, Inc. |

1,346 |

$ |

58,155 |

||||||||

|

Energen Corp. |

128 |

5,772 |

|||||||||

|

Enerplus Corp. |

354 |

4,586 |

|||||||||

|

EOG Resources, Inc. |

484 |

58,462 |

|||||||||

|

EQT Corp. |

265 |

15,630 |

|||||||||

|

FMC Technologies, Inc. (a) |

425 |

18,203 |

|||||||||

|

Hess Corp. |

544 |

28,810 |

|||||||||

|

Kinder Morgan Management, LLC (a) |

180 |

13,583 |

|||||||||

|

Marathon Oil Corp. |

1,250 |

38,325 |

|||||||||

|

Marathon Petroleum Corp. |

610 |

38,430 |

|||||||||

|

National-Oilwell Varco, Inc. |

766 |

52,356 |

|||||||||

|

Newfield Exploration Co. (a) |

240 |

6,427 |

|||||||||

|

Nexen, Inc. |

940 |

25,084 |

|||||||||

|

Noble Corp. |

447 |

15,565 |

|||||||||

|

Noble Energy, Inc. |

315 |

32,048 |

|||||||||

|

Oceaneering International, Inc. |

192 |

10,328 |

|||||||||

|

Pacific Rubiales Energy Corp. |

518 |

12,023 |

|||||||||

|

Penn West Petroleum, Ltd. |

873 |

9,469 |

|||||||||

|

Phillips 66 |

1,066 |

56,605 |

|||||||||

|

Pioneer Natural Resources Co. |

207 |

22,064 |

|||||||||

|

Plains Exploration & Production Co. (a) |

227 |

10,655 |

|||||||||

|

QEP Resources, Inc. |

315 |

9,535 |

|||||||||

|

Range Resources Corp. |

287 |

18,032 |

|||||||||

|

Southwestern Energy Co. (a) |

620 |

20,714 |

|||||||||

|

Spectra Energy Corp. |

1,157 |

31,679 |

|||||||||

|

Suncor Energy, Inc. |

2,785 |

91,491 |

|||||||||

|

Superior Energy Services, Inc. (a) |

279 |

5,781 |

|||||||||

|

Talisman Energy, Inc. |

1,830 |

20,676 |

|||||||||

|

The Williams Cos., Inc. |

1,121 |

36,702 |

|||||||||

|

Ultra Petroleum Corp. (a) |

270 |

4,895 |

|||||||||

|

Weatherford International, Ltd. (a) |

1,346 |

15,062 |

|||||||||

|

Whiting Petroleum Corp. (a) |

208 |

9,021 |

|||||||||

|

1,040,487 |

|||||||||||

|

Financials: 18.3% |

|||||||||||

|

ACE, Ltd. |

608 |

48,518 |

|||||||||

|

AFLAC, Inc. |

829 |

44,036 |

|||||||||

|

American Express Co. |

1,832 |

105,303 |

|||||||||

|

American Tower Corp. (b) |

709 |

54,784 |

|||||||||

|

Ameriprise Financial, Inc. |

378 |

23,674 |

|||||||||

|

Annaly Capital Management, Inc. (b) |

1,723 |

24,191 |

|||||||||

|

Arch Capital Group, Ltd. (a) |

238 |

10,477 |

|||||||||

|

Assurant, Inc. |

155 |

5,379 |

|||||||||

|

Axis Capital Holdings, Ltd. |

209 |

7,240 |

|||||||||

|

Bank of Nova Scotia |

2,058 |

118,763 |

|||||||||

|

BB&T Corp. |

1,238 |

36,038 |

|||||||||

|

Berkshire Hathaway, Inc. (Class B) (a) |

1,645 |

147,556 |

|||||||||

|

BlackRock, Inc. |

235 |

48,577 |

|||||||||

|

Boston Properties, Inc. (b) |

269 |

28,463 |

|||||||||

|

Capital One Financial Corp. |

1,044 |

60,479 |

|||||||||

|

CBRE Group, Inc. (Class A) (a) |

553 |

11,005 |

|||||||||

|

Chubb Corp. |

481 |

36,229 |

|||||||||

|

Cincinnati Financial Corp. |

273 |

10,691 |

|||||||||

|

CME Group, Inc. |

561 |

28,448 |

|||||||||

|

Comerica, Inc. |

350 |

10,619 |

|||||||||

|

Security Description |

Shares |

Value |

|||||||||

|

COMMON STOCKS, continued |

|||||||||||

|

Financials, continued |

|||||||||||

|

Discover Financial Services |

924 |

$ |

35,620 |

||||||||

|

Duke Realty Corp. (b) |

462 |

6,408 |

|||||||||

|

Eaton Vance Corp. |

204 |

6,497 |

|||||||||

|

Federal Realty Investment Trust (b) |

112 |

11,650 |

|||||||||

|

Franklin Resources, Inc. |

268 |

33,688 |

|||||||||

|

HCP, Inc. (b) |

813 |

36,731 |

|||||||||

|

Health Care REIT, Inc. (b) |

458 |

28,071 |

|||||||||

|

Host Hotels & Resorts, Inc. (b) |

1,259 |

19,729 |

|||||||||

|

Hudson City Bancorp, Inc. |

843 |

6,854 |

|||||||||

|

Intercontinental Exchange, Inc. (a) |

128 |

15,848 |

|||||||||

|

Invesco, Ltd. |

792 |

20,663 |

|||||||||

|

KeyCorp |

1,693 |

14,255 |

|||||||||

|

Legg Mason, Inc. |

223 |

5,736 |

|||||||||

|

Liberty Property Trust (b) |

206 |

7,369 |

|||||||||

|

M&T Bank Corp. |

201 |

19,792 |

|||||||||

|

Marsh & McLennan Cos., Inc. |

965 |

33,264 |

|||||||||

|

New York Community Bancorp, Inc. |

777 |

10,179 |

|||||||||

|

Northern Trust Corp. |

384 |

19,261 |

|||||||||

|

NYSE Euronext |

458 |

14,445 |

|||||||||

|

PartnerRe, Ltd. |

115 |

9,256 |

|||||||||

|

People's United Financial, Inc. |

637 |

7,701 |

|||||||||

|

PNC Financial Services Group, Inc. |

950 |

55,394 |

|||||||||

|

Principal Financial Group, Inc. |

534 |

15,230 |

|||||||||

|

ProLogis, Inc. (b) |

816 |

29,776 |

|||||||||

|

Prudential Financial, Inc. |

830 |

44,264 |

|||||||||

|

Regency Centers Corp. (b) |

160 |

7,539 |

|||||||||

|

Regions Financial Corp. |

2,508 |

17,857 |

|||||||||

|

RenaissanceRe Holdings, Ltd. |

91 |

7,395 |

|||||||||

|

Royal Bank of Canada |

2,592 |

155,879 |

|||||||||

|

Simon Property Group, Inc. (b) |

543 |

85,843 |

|||||||||

|

State Street Corp. |

865 |

40,664 |

|||||||||

|

T. Rowe Price Group, Inc. |

450 |

29,309 |

|||||||||

|

The Bank of New York Mellon Corp. |

2,137 |

54,921 |

|||||||||

|

The Charles Schwab Corp. |

1,919 |

27,557 |

|||||||||

|

The Macerich Co. (b) |

234 |

13,642 |

|||||||||

|

The NASDAQ OMX Group, Inc. |

229 |

5,727 |

|||||||||

|

The Progressive Corp. |

1,030 |

21,733 |

|||||||||

|

The Toronto-Dominion Bank |

1,640 |

137,943 |

|||||||||

|

The Travelers Cos., Inc. |

696 |

49,987 |

|||||||||

|

U.S. Bancorp |

3,388 |

108,213 |

|||||||||

|

Ventas, Inc. (b) |

513 |

33,201 |

|||||||||

|

Vornado Realty Trust (b) |

295 |

23,624 |

|||||||||

|

2,189,185 |

|||||||||||

|

Health Care: 12.1% |

|||||||||||

|

Abbott Laboratories |

2,820 |

184,710 |

|||||||||

|

Aetna, Inc. |

600 |

27,780 |

|||||||||

|

Agilent Technologies, Inc. |

618 |

25,301 |

|||||||||

|

Baxter International, Inc. |

982 |

65,460 |

|||||||||

|

Becton, Dickinson & Co. |

358 |

27,992 |

|||||||||

|

Biogen Idec, Inc. (a) |

403 |

59,108 |

|||||||||

|

Bristol-Myers Squibb Co. |

3,014 |

98,226 |

|||||||||

|

CIGNA Corp. |

508 |

27,158 |

|||||||||

|

DENTSPLY International, Inc. |

252 |

9,982 |

|||||||||

|

Edwards Lifesciences Corp. (a) |

204 |

18,395 |

|||||||||

|

Gilead Sciences, Inc. (a) |

1,360 |

99,892 |

|||||||||

|

Henry Schein, Inc. (a) |

159 |

12,793 |

|||||||||

SEE ACCOMPANYING NOTES TO FINANCIAL STATEMENTS.

20

Pax MSCI North America ESG Index ETF

December 31, 2012

Schedule of Investments, continued

|

Security Description |

Shares |

Value |

|||||||||

|

COMMON STOCKS, continued |

|||||||||||

|

Health Care, continued |

|||||||||||

|

Humana, Inc. |

290 |

$ |

19,903 |

||||||||

|

Johnson & Johnson |

4,957 |

347,486 |

|||||||||

|

Life Technologies Corp. (a) |

317 |

15,558 |

|||||||||

|

Medtronic, Inc. |

1,840 |

75,477 |

|||||||||

|

Merck & Co., Inc. |

5,467 |

223,819 |

|||||||||

|

Patterson Cos., Inc. |

158 |

5,408 |

|||||||||

|

ResMed, Inc. |

255 |

10,600 |

|||||||||

|

Valeant Pharmaceuticals International, Inc. (a) |

522 |

31,109 |

|||||||||

|

Vertex Pharmaceuticals, Inc. (a) |

373 |

15,644 |

|||||||||

|

Waters Corp. (a) |

158 |

13,765 |

|||||||||

|

WellPoint, Inc. |

593 |

36,125 |

|||||||||

|

1,451,691 |

|||||||||||

|

Industrials: 10.5% |

|||||||||||

|

3M Co. |

1,184 |

109,934 |

|||||||||

|

AMETEK, Inc. |

427 |

16,042 |

|||||||||

|

Avery Dennison Corp. |

187 |

6,530 |

|||||||||

|

C.H. Robinson Worldwide, Inc. |

289 |

18,271 |

|||||||||

|

Canadian National Railway Co. |

784 |

71,125 |

|||||||||

|

CSX Corp. |

1,864 |

36,777 |

|||||||||

|

Cummins, Inc. |

324 |

35,105 |

|||||||||

|

Danaher Corp. |

1,058 |

59,142 |

|||||||||

|

Deere & Co. |

668 |

57,729 |

|||||||||

|

Dover Corp. |

326 |

21,421 |

|||||||||

|

Eaton Corp. PLC |

783 |

42,439 |

|||||||||

|

Emerson Electric Co. |

1,306 |

69,166 |

|||||||||

|

Equifax, Inc. |

212 |

11,473 |

|||||||||

|

Expeditors International Washington, Inc. |

376 |

14,871 |

|||||||||

|

Fastenal Co. |

499 |

23,298 |

|||||||||

|

IHS, Inc. (Class A) (a) |

100 |

9,600 |

|||||||||

|

Illinois Tool Works, Inc. |

757 |

46,033 |

|||||||||

|

Ingersoll-Rand PLC |

528 |

25,323 |

|||||||||

|

Iron Mountain, Inc. |

256 |

7,949 |

|||||||||

|

J.B. Hunt Transport Services, Inc. |

166 |

9,912 |

|||||||||

|

Joy Global, Inc. |

189 |

12,054 |

|||||||||

|

Manpower, Inc. |

142 |

6,026 |

|||||||||

|

Masco Corp. |

639 |

10,646 |

|||||||||

|

Norfolk Southern Corp. |

574 |

35,496 |

|||||||||

|

PACCAR, Inc. |

602 |

27,216 |

|||||||||

|

Pall Corp. |

205 |

12,353 |

|||||||||

|

Parker Hannifin Corp. |

268 |

22,796 |

|||||||||

|

Pentair, Ltd. |

370 |

18,186 |

|||||||||

|

Pitney Bowes, Inc. |

354 |

3,767 |

|||||||||

|

Precision Castparts Corp. |

261 |

49,439 |

|||||||||

|

Quanta Services, Inc. (a) |

368 |

10,043 |

|||||||||

|

Robert Half International, Inc. |

239 |

7,605 |

|||||||||

|

Rockwell Automation, Inc. |

253 |

21,249 |

|||||||||

|

Rockwell Collins, Inc. |

250 |

14,543 |

|||||||||

|

Roper Industries, Inc. |

171 |

19,063 |

|||||||||

|

Southwest Airlines Co. |

342 |

3,502 |

|||||||||

|

The Dun & Bradstreet Corp. |

85 |

6,685 |

|||||||||

|

Tyco International, Ltd. |

818 |

23,926 |

|||||||||

|

Union Pacific Corp. |

850 |

106,862 |

|||||||||

|

United Parcel Service, Inc. (Class B) |

1,300 |

95,849 |

|||||||||

|

Security Description |

Shares |

Value |

|||||||||

|

COMMON STOCKS, continued |

|||||||||||

|

Industrials, continued |

|||||||||||

|

W.W. Grainger, Inc. |

105 |

$ |

21,249 |

||||||||

|

Waste Management, Inc. |

778 |

26,250 |

|||||||||

|

Xylem, Inc. |

328 |

8,889 |

|||||||||

|

1,255,834 |

|||||||||||

|

Information Technology: 19.0% |

|||||||||||

|

Accenture PLC (Class A) |

1,140 |

75,810 |

|||||||||

|

Adobe Systems, Inc. (a) |

877 |

33,045 |

|||||||||

|

Analog Devices, Inc. |

528 |

22,208 |

|||||||||

|

Applied Materials, Inc. |

2,222 |

25,420 |

|||||||||

|

Autodesk, Inc. (a) |

401 |

14,175 |

|||||||||

|

CA, Inc. |

601 |

13,210 |

|||||||||

|

CGI Group, Inc. (Class A) (a) |

365 |

8,409 |

|||||||||

|

Cisco Systems, Inc. |

9,625 |

189,131 |

|||||||||

|

Citrix Systems, Inc. (a) |

330 |

21,697 |

|||||||||

|

Cognizant Technology Solutions Corp. (Class A) (a) |

539 |

39,913 |

|||||||||

|

Corning, Inc. |

2,701 |

34,087 |

|||||||||

|

Dell, Inc. |

2,702 |

27,371 |

|||||||||

|

EMC Corp. (a) |

3,762 |

95,179 |

|||||||||

|

Flextronics International, Ltd. (a) |

1,217 |

7,558 |

|||||||||

|

Google, Inc. (Class A) (a) |

467 |

331,276 |

|||||||||

|

Hewlett-Packard Co. |

3,552 |

50,616 |

|||||||||

|

IBM |

1,949 |

373,331 |

|||||||||

|

Intel Corp. |

8,986 |

185,381 |

|||||||||

|

Intuit, Inc. |

497 |

29,571 |

|||||||||

|

Lam Research Corp. (a) |

328 |

11,851 |

|||||||||

|

Microchip Technology, Inc. |

340 |

11,081 |

|||||||||

|

Motorola Solutions, Inc. |

463 |

25,780 |

|||||||||

|

Nuance Communications, Inc. (a) |

437 |

9,754 |

|||||||||

|

NVIDIA Corp. |

1,085 |

13,335 |

|||||||||

|

Open Text Corp. (a) |

102 |

5,699 |

|||||||||

|

Oracle Corp. |

7,006 |

233,440 |

|||||||||

|

QUALCOMM, Inc. |

3,058 |

189,657 |

|||||||||

|

Salesforce.com, Inc. (a) |

235 |

39,503 |

|||||||||

|

Symantec Corp. (a) |

1,261 |

23,719 |

|||||||||

|

Teradata Corp. (a) |

297 |

18,381 |

|||||||||

|

Texas Instruments, Inc. |

2,056 |

63,613 |

|||||||||

|

Xerox Corp. |

2,368 |

16,150 |

|||||||||

|

Yahoo!, Inc. (a) |

2,048 |

40,755 |

|||||||||

|

2,280,106 |

|||||||||||

|

Materials: 5.0% |

|||||||||||

|

Agnico-Eagle Mines, Ltd. |

306 |

16,021 |

|||||||||

|

Agrium, Inc. |

280 |

27,879 |

|||||||||

|

Air Products & Chemicals, Inc. |

373 |

31,339 |

|||||||||

|

Alcoa, Inc. |

1,892 |

16,423 |

|||||||||

|

Allegheny Technologies, Inc. |

180 |

5,465 |

|||||||||

|

Ball Corp. |

263 |

11,769 |

|||||||||

|

Celanese Corp. (Series A) |

279 |

12,424 |

|||||||||

|

Cliffs Natural Resources, Inc. |

252 |

9,717 |

|||||||||

|

Eastman Chemical Co. |

272 |

18,510 |

|||||||||

|

Ecolab, Inc. |

516 |

37,100 |

|||||||||

|

Franco-Nevada Corp. |

259 |

14,769 |

|||||||||

|

International Flavors & Fragrances, Inc. |

143 |

9,515 |

|||||||||

|

International Paper Co. |

737 |

29,362 |

|||||||||

SEE ACCOMPANYING NOTES TO FINANCIAL STATEMENTS.

21

Pax MSCI North America ESG Index ETF

December 31, 2012

Schedule of Investments, continued

|

Security Description |

Shares |

Value |

|||||||||

|

COMMON STOCKS, continued |

|||||||||||

|

Materials, continued |

|||||||||||

|

Kinross Gold Corp. |

2,022 |

$ |

19,617 |

||||||||

|

LyondellBasell Industries NV (Class A) |

560 |

31,970 |

|||||||||

|

MeadWestvaco Corp. |

303 |

9,657 |

|||||||||

|

Nucor Corp. |

563 |

24,310 |

|||||||||

|

Osisko Mining Corp. (a) |

685 |

5,504 |

|||||||||

|

Owens-Illinois, Inc. (a) |

277 |

5,892 |

|||||||||

|

Potash Corp. of Saskatchewan, Inc. |

1,536 |

62,446 |

|||||||||

|

Praxair, Inc. |

537 |

58,775 |

|||||||||

|

Rock-Tenn Co. (Class A) |

125 |

8,739 |

|||||||||

|

Sealed Air Corp. |

324 |

5,673 |

|||||||||

|

Sigma-Aldrich Corp. |

214 |

15,746 |

|||||||||

|

Silver Wheaton Corp. |

627 |

22,581 |

|||||||||

|

Teck Resources, Ltd. (Class B) |

1,023 |

37,141 |

|||||||||

|

The Sherwin-Williams Co. |

157 |

24,150 |

|||||||||

|

Yamana Gold, Inc. |

1,325 |

22,769 |

|||||||||

|

595,263 |

|||||||||||

|

Telecommunication Services: 1.7% |

|||||||||||

|

BCE, Inc. |

464 |

19,866 |

|||||||||

|

CenturyLink, Inc. |

1,116 |

43,658 |

|||||||||

|

Crown Castle International Corp. (a) |

525 |

37,884 |

|||||||||

|

Frontier Communications Corp. |

1,768 |

7,567 |

|||||||||

|

Level 3 Communications, Inc. (a) |

260 |

6,009 |

|||||||||

|

Rogers Communications, Inc. (Class B) |

687 |

31,159 |

|||||||||

|

SBA Communications Corp. (Class A) (a) |

218 |

15,482 |

|||||||||

|

Sprint Nextel Corp. (a) |

5,323 |

30,181 |

|||||||||

|

Windstream Corp. |

1,040 |

8,611 |

|||||||||

|

200,417 |

|||||||||||

|

Utilities: 2.5% |

|||||||||||

|

American Water Works Co., Inc. |

312 |

11,585 |

|||||||||

|

Calpine Corp. (a) |

555 |

10,062 |

|||||||||

|

Canadian Utilities, Ltd. (Class A) |

101 |

7,297 |

|||||||||

|

CenterPoint Energy, Inc. |

719 |

13,841 |

|||||||||

|

Consolidated Edison, Inc. |

520 |

28,881 |

|||||||||

|

Integrys Energy Group, Inc. |

138 |

7,206 |

|||||||||

|

MDU Resources Group, Inc. |

318 |

6,754 |

|||||||||

|

NextEra Energy, Inc. |

712 |

49,263 |

|||||||||

|

NiSource, Inc. |

501 |

12,470 |

|||||||||

|

Northeast Utilities |

556 |

21,729 |

|||||||||

|

Oneok, Inc. |

348 |

14,877 |

|||||||||

|

Pepco Holdings, Inc. |

404 |

7,922 |

|||||||||

|

PG&E Corp. |

734 |

29,492 |

|||||||||

|

Pinnacle West Capital Corp. |

193 |

9,839 |

|||||||||

|

Sempra Energy |

404 |

28,660 |

|||||||||

|

TransAlta Corp. |

455 |

6,909 |

|||||||||

|

Wisconsin Energy Corp. |

408 |

15,035 |

|||||||||

|

Xcel Energy, Inc. |

864 |

23,078 |

|||||||||

|

304,900 |

|||||||||||

|

TOTAL COMMON STOCKS |

|||||||||||

|

(Cost $11,012,025) |

11,955,707 |

||||||||||

|

Security Description |

Shares |

Value |

|||||||||

|

SHORT TERM INVESTMENT: 0.7% |

|||||||||||

|

MONEY MARKET FUND: 0.7% |

|||||||||||

|

SSgA Prime Money Market Fund |

|||||||||||

|

(Cost $82,665) |

82,665 |

$ |

82,665 |

||||||||

|

TOTAL INVESTMENTS: 100.5% |

|||||||||||

|

(Cost $11,094,690) |

12,038,372 |

||||||||||

|

OTHER ASSETS & LIABILITIES: (0.5)% |

(53,937 |

) |

|||||||||

|

Net Assets: 100.0% |

$ |

11,984,435 |

|||||||||

(a) Non-income producing security.

(b) REIT Real Estate Investment Trust

SEE ACCOMPANYING NOTES TO FINANCIAL STATEMENTS.

22

Pax MSCI EAFE ESG Index ETF

December 31, 2012

Schedule of Investments

|

Security Description |

Shares |

Value |

|||||||||

|

COMMON STOCKS: 99.5% |

|||||||||||

|

Australia: 10.0% |

|||||||||||

|

Australia & New Zealand Banking Group, Ltd. |

7,631 |

$ |

198,459 |

||||||||

|

Commonwealth Bank of Australia |

4,663 |

301,021 |

|||||||||

|

Fortescue Metals Group, Ltd. |

3,439 |

16,602 |

|||||||||

|

GPT Group (a) |