American Realty Capital Properties Activity Update January 3, 2014

2 Information set forth herein (including information included or incorporated by reference herein) contains “forward - looking statements” (as defined in Section 21 E of the Securities Exchange Act of 1934 , as amended), which reflect American Realty Capital Properties, Inc . ’s (“ARCP”), American Realty Capital Trust IV, Inc . ’s (“ARCT IV”) and Cole Real Estate Investments, Inc . ’s (“Cole”) expectations regarding future events . The forward - looking statements involve a number of risks, uncertainties and other factors that could cause actual results to differ materially from those contained in the forward - looking statements . Such forward - looking statements include, but are not limited to, whether and when the transactions contemplated by the Cole merger agreement will be consummated, the ability to incorporate ARCT IV’s portfolio into ARCP’s portfolio, the combined company’s plans, market and other expectations, objectives, intentions, as well as any expectations or projections with respect to the combined company, including regarding future dividends and market valuations, and estimates of growth, including funds from operations and adjusted funds from operations and other statements that are not historical facts . The following additional factors, among others, could cause actual results to differ from those set forth in the forward - looking statements : ( 1 ) the occurrence of any event, change or other circumstances that could give rise to the termination of the Cole merger agreement ; ( 2 ) the inability to incorporate the ARCT IV assets into the ARCP portfolio ; ( 3 ) the inability to obtain regulatory approvals for the Cole merger transaction and the approval by ARCP’s stockholders of the issuance of ARCP common stock in connection with the Cole merger and the approval by Cole’s stockholders of the Cole merger ; ( 4 ) risks related to disruption of management’s attention from the ongoing business operations due to the proposed Cole merger and closing of the ARCT IV merger ; ( 5 ) the effect of the announcement of the proposed Cole merger on ARCP’s or Cole’s relationships with their respective customers, tenants, lenders, operating results and businesses generally ; ( 6 ) the outcome of any legal proceedings relating to any of the mergers or the merger agreements ; ( 7 ) risks to consummation of the Cole merger, including the risk that the Cole merger will not be consummated within the expected time period or at all ; and ( 8 ) ARCP’s inability to timely achieve the benefits associated with becoming a self - managed real estate company . Additional factors that may affect future results are contained in ARCP’s, ARCT IV’s and Cole’s filings with the U . S . Securities and Exchange Commission (“SEC”), which are available at the SEC’s website at www . sec . gov . ARCP, ARCT IV and Cole disclaim any obligation to update and revise statements contained in these materials based on new information or otherwise . Forward - Looking Statements

3 Investment Highlights • Largest net lease REIT and 14 th largest publicly traded REIT in the U.S. • Dynamic investment strategy focused on long - term and vintage leases providing stable income and organic growth potential • High credit quality portfolio with 47% of revenues derived from investment grade tenants and 100% of top ten tenants are rated • Diversification across asset type, geography, industry and tenants with no tenant representing more than 3.5% of rent • Attractive Private Capital Management business drives fee income and absorbs G&A • Meaningful common stock dividend growth, as a result of the expected annual dividend rate increase to $1.00 following the expected close of the Cole merger • Strong, flexible balance sheet and diverse access to capital • Experienced management team with extensive industry knowledge and proven track record Note: All data includes ARCT IV merger, which closed on January 3, 2014, as well as the remaining acquisitions of the properties co nst ituting the Inland and Fortress portfolios and other pipeline properties and the proposed Cole merger.

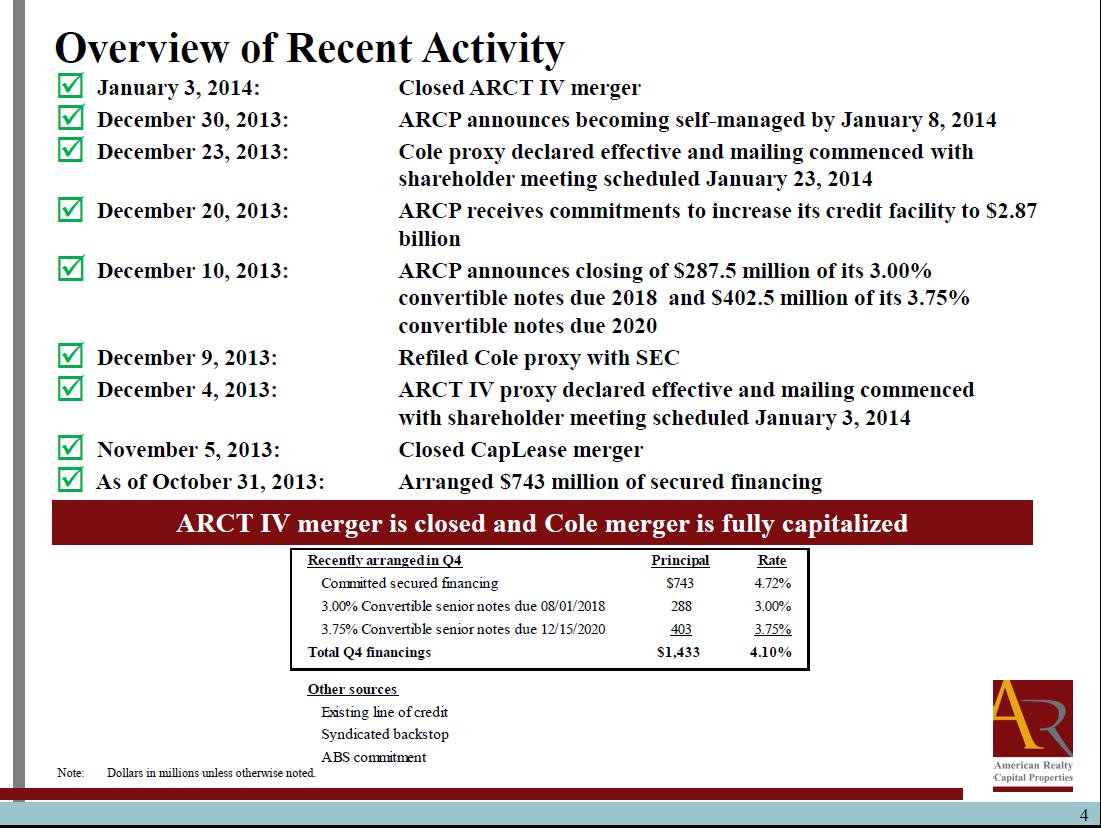

January 3, 2014: Closed ARCT IV merger December 30, 2013: ARCP announces it will become self - managed by January 8, 2014 December 23, 2013: Cole proxy declared effective and mailing commenced with shareholder meeting scheduled January 23, 2014 December 20, 2013: ARCP receives commitments to increase its credit facility to $2.87 billion December 10, 2013: ARCP announces closing of $287.5 million of its 3.00% convertible notes due 2018 and $402.5 million of its 3.75% convertible notes due 2020 December 9, 2013: Refiled Cole proxy with SEC December 4, 2013: ARCT IV proxy declared effective and mailing commenced with shareholder meeting scheduled January 3, 2014 November 5, 2013: Closed CapLease merger As of October 31, 2013: Arranged $743 million of secured financing 4 Overview of Recent Activity ARCT IV merger is closed and Cole merger is fully capitalized Note: Dollars in millions unless otherwise noted. January 3, 2014: Closed ARCT IV merger December 30, 2013: ARCP announces becoming self - managed by January 8, 2014 December 23, 2013: Cole proxy declared effective and mailing commenced with shareholder meeting scheduled January 23, 2014 December 20, 2013: ARCP receives commitments to increase its credit facility to $2.87 billion December 10, 2013: ARCP announces closing of $287.5 million of its 3.00% convertible notes due 2018 and $402.5 million of its 3.75% convertible notes due 2020 December 9, 2013: Refiled Cole proxy with SEC December 4, 2013: ARCT IV proxy declared effective and mailing commenced with shareholder meeting scheduled January 3, 2014 November 5, 2013: Closed CapLease merger As of October 31, 2013: Arranged $743 million of secured financing Recently arranged in Q4 Principal Rate Committed secured financing $743 4.72% 3.00% Convertible senior notes due 08/01/2018 288 3.00% 3.75% Convertible senior notes due 12/15/2020 403 3.75% Total Q4 financings $1,433 4.10% Other sources Existing line of credit Syndicated backstop ABS commitment

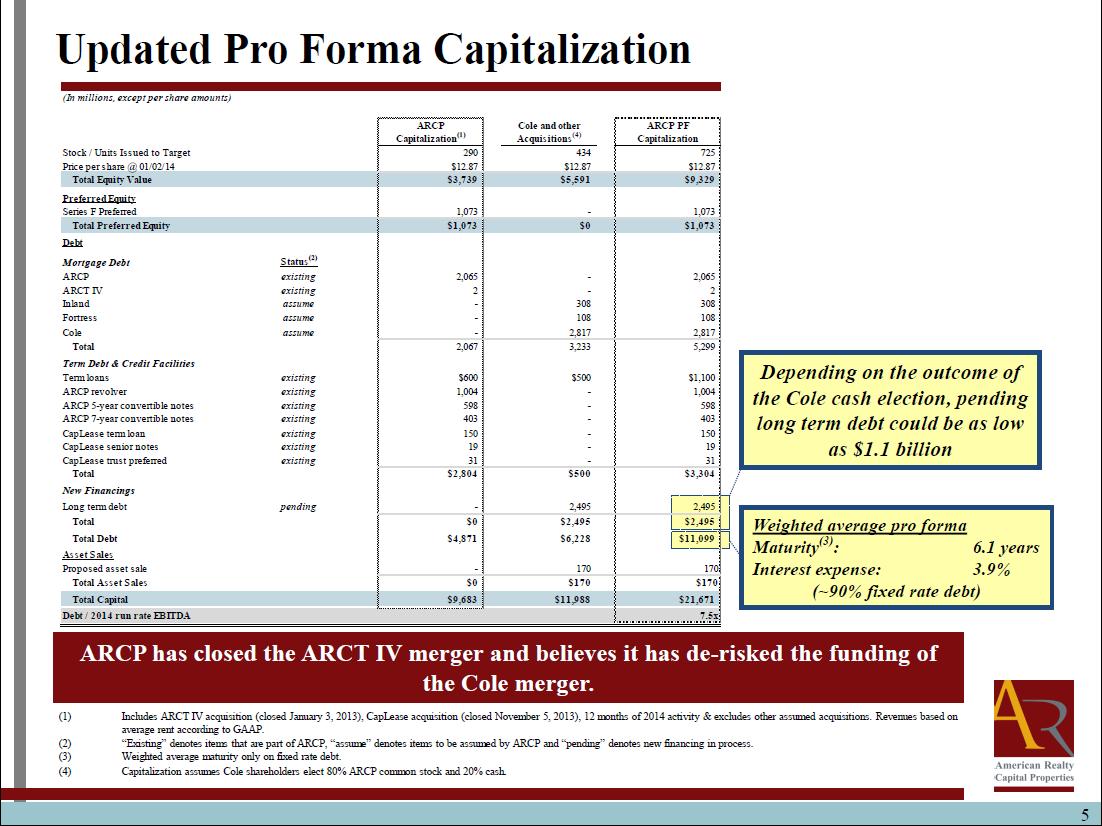

5 Updated Pro Forma Capitalization ARCP has closed the ARCT IV merger and believes it has de - risked the funding of the Cole merger. Depending on the outcome of the Cole cash election, pending long term debt could be as low as $1.1 billion Weighted average pro forma Maturity (3) : 6.1 years Interest expense: 3.9% (~90% fixed rate debt) (1) Includes ARCT IV acquisition (closed January 3, 2013), CapLease acquisition (closed November 5, 2013), 12 months of 2014 acti vit y & excludes other assumed acquisitions. Revenues based on average rent according to GAAP. (2) “Existing” denotes items that are part of ARCP, “assume” denotes items to be assumed by ARCP and “pending” denotes new financing in process. (3) Weighted average maturity only on fixed rate debt. (4) Capitalization assumes Cole shareholders elect 80% ARCP common stock and 20% cash. (In millions, except per share amounts) ARCP Cole and other ARCP PF Capitalization (1) Acquisitions (4) Capitalization Stock / Units Issued to Target 290 434 725 Price per share @ 01/02/14 $12.87 $12.87 $12.87 Total Equity Value $3,739 $5,591 $9,329 Preferred Equity Series F Preferred 1,073 - 1,073 Total Preferred Equity $1,073 $0 $1,073 Debt Mortgage Debt Status (2) ARCP existing 2,065 - 2,065 ARCT IV existing 2 - 2 Inland assume - 308 308 Fortress assume - 108 108 Cole assume - 2,817 2,817 Total 2,067 3,233 5,299 Term Debt & Credit Facilities Term loans existing $600 $500 $1,100 ARCP revolver existing 1,004 - 1,004 ARCP 5-year convertible notes existing 598 - 598 ARCP 7-year convertible notes existing 403 - 403 CapLease term loan existing 150 - 150 CapLease senior notes existing 19 - 19 CapLease trust preferred existing 31 - 31 Total $2,804 $500 $3,304 New Financings Long term debt pending - 2,495 2,495 Total $0 $2,495 $2,495 Total Debt $4,871 $6,228 $11,099 Asset Sales (90% fixed rate debt) Proposed asset sale - 170 170 Total Asset Sales $0 $170 $170 Total Capital $9,683 $11,988 $21,671 Debt / 2014 run rate EBITDA 7.5x

6 Supplemental Debt Disclosure ARCP arranged $1.433 billion of new fixed rate financings in Q4. Source: Company filings, updated for actual closing values . (1) Interest rate reset after 5 years. (2) Represents weighted average rate. Recent Activity ($ in millions, unless otherwise noted) # of Applicable Spread to Debt Type Security Amount loans Tenor Repayment Reference reference Rate 70 Properties $620 1 ~10 years Interest Only Applicable 5, 7 or 10 year “swap yield” 2.07% 4.97% 19 Properties $73 3 10 years 5-year IO; 30-year amort in 5-year N/A N/A 5-year IO: 3.25% Extension: 3.25% Min 1 Month LIBOR 1.85% BOKF Prime 0.00% Committed secured financing subtotal $743 7 9.7 years 4.72% Unsecured $403 N/A 7 years Interest Only N/A N/A 3.75% Unsecured $288 N/A 5 years Interest Only N/A N/A 3.00% Total / weighted average $1,433 7 8.0 years 4.10% 3.75%Interest Only Convertible senior notes Convertible senior notes 70 Properties 19 Properties Walgreen / FedEx Ground Properties Walgreen / FedEx Ground Properties $49 3 6 years (1) ( 2 )

7 This communication does not constitute an offer to sell or the solicitation of an offer to buy any securities or a solicitation of any vote or approval . In connection with the proposed Cole merger, ARCP and Cole prepared and filed with the SEC a definitive joint proxy statement/prospectus on December 23 , 2013 , and other additional documents with respect to ARCP’s proposed acquisition of Cole . The definitive joint proxy statement/prospectus contains important information about the proposed transaction and related matters . INVESTORS ARE URGED TO READ THE JOINT PROXY STATEMENT/PROSPECTUS (INCLUDING ALL AMENDMENTS AND SUPPLEMENTS THERETO) AND OTHER RELEVANT DOCUMENTS FILED OR TO BE FILED BY ARCP OR COLE WITH THE SEC CAREFULLY BECAUSE THEY CONTAIN OR WILL CONTAIN IMPORTANT INFORMATION ABOUT ARCP, COLE AND THE PROPOSED COLE MERGER . Investors and stockholders of ARCP and Cole may obtain free copies of the registration statement, the joint proxy statement/prospectus and other relevant documents filed or to be filed by ARCP and Cole with the SEC through the website maintained by the SEC at www . sec . gov . Copies of the documents filed by ARCP with the SEC are also available free of charge on ARCP’s website at www . arcpreit . com and copies of the documents filed by Cole with the SEC are available free of charge on Cole’s website at www . ColeREIT . com . ARCP, Cole, AR Capital, LLC and their respective directors and executive officers may be deemed to be participants in the solicitation of proxies from ARCP’s and Cole’s stockholders in respect of the proposed Cole merger . Information regarding ARCP’s directors and executive officers can be found in ARCP’s definitive proxy statement filed with the SEC on April 30 , 2013 . Information regarding Cole’s directors and executive officers can be found in Cole’s definitive proxy statement filed with the SEC on April 11 , 2013 . Additional information regarding the interests of such potential participants were included in the joint proxy statement/prospectus and other relevant documents filed with the SEC in connection with the proposed Cole merger . These documents are available free of charge on the SEC’s website and from ARCP or Cole, as applicable, using the sources indicated above . Additional Information about the Cole Merger and Where to Find It