U. S. SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 10-Q

| þ |

QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES

EXCHANGE ACT OF 1934 |

For the quarterly period ended September

30, 2015

| ¨ |

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF

THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from

__________ to __________. |

Commission File Number 001-36860

LION BIOTECHNOLOGIES, INC.

(Exact name of small business issuer as

specified in its charter)

| Nevada |

75-3254381 |

| (State or other jurisdiction of |

(I.R.S. employer |

| incorporation or organization) |

identification number) |

| 112 W. 34th Street,

17th floor, New York, NY 10120 |

| (Address of principal executive offices and

zip code) |

(212)946-4856 |

(Registrant’s telephone number,

including area code) |

Indicate by check mark whether the registrant

(1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding

12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such

filing requirements for the past 90 days.

Yes x

No ¨

Indicate by check mark whether the registrant

has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted

and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant

was required to submit and post such files). Yes x No

¨

Indicate by check mark whether the

registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See

the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting

company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer ¨ |

Accelerated filer x |

| Non-accelerated filer ¨

(Do not check if a smaller reporting company) |

Smaller reporting company ¨ |

Indicate by check mark whether the registrant

is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No þ

At October 31, 2015, the issuer had 47,833,934 shares of

common stock, par value $0.000041666 per share, outstanding.

LION BIOTECHNOLOGIES, INC.

FORM 10-Q

For the Quarter Ended September 30,

2015

Table of Contents

PART I. FINANCIAL INFORMATION

| Item 1. |

Condensed Financial Statements |

LION

BIOTECHNOLOGIES, INC.

Condensed Balance

Sheets

(in thousands,

except share information)

| | |

September 30, | | |

December 31, | |

| | |

2015 | | |

2014 | |

| ASSETS | |

| (unaudited) | | |

| | |

| | |

| | | |

| | |

| Current Assets | |

| | | |

| | |

| Cash and cash equivalents | |

$ | 10,210 | | |

$ | 44,910 | |

| Money market funds | |

| 20,562 | | |

| - | |

| Short-term investments available for sale | |

| 79,374 | | |

| - | |

| Prepaid and other current

assets | |

| 245 | | |

| 67 | |

| Total Current Assets | |

| 110,391 | | |

| 44,977 | |

| | |

| | | |

| | |

| Property and equipment, net

of accumulated depreciation of $794 and $103, respectively | |

| 1,833 | | |

| 1,532 | |

| Total Assets | |

$ | 112,224 | | |

$ | 46,509 | |

| | |

| | | |

| | |

| LIABILITIES AND STOCKHOLDERS’

EQUITY | |

| | | |

| | |

| | |

| | | |

| | |

| Current Liabilities | |

| | | |

| | |

| Accounts payable | |

$ | 1,161 | | |

$ | 1,249 | |

| Accrued expenses | |

| 1,608 | | |

| 328 | |

| Accrued payable to officers

and former directors | |

| 86 | | |

| 86 | |

| Total Current Liabilities | |

| 2,855 | | |

| 1,663 | |

| | |

| | | |

| | |

| Commitments and contingencies | |

| | | |

| | |

| | |

| | | |

| | |

| Stockholders’ Equity | |

| | | |

| | |

Preferred stock, $0.001

par value; 50,000,000 shares

authorized,

3,694 shares and 5,694 shares issued

and

outstanding, respectively | |

| - | | |

| - | |

Common stock, $0.000041666

par value; 150,000,000

shares authorized,

47,807,398 and 33,750,188

shares

issued and outstanding, respectively | |

| 2 | | |

| 2 | |

| Common stock to be issued, 245,153 shares | |

| 245 | | |

| 245 | |

| Accumulated other comprehensive income | |

| 38 | | |

| - | |

| Additional paid-in capital | |

| 204,929 | | |

| 121,161 | |

| Accumulated deficit | |

| (95,845 | ) | |

| (76,562 | ) |

| Total Stockholders’

Equity | |

| 109,369 | | |

| 44,846 | |

| | |

| | | |

| | |

| Total Liabilities

and Stockholders’ Equity | |

$ | 112,224 | | |

$ | 46,509 | |

| | |

| | | |

| | |

The accompanying

notes are an integral part of these condensed financial statements.

LION

BIOTECHNOLOGIES, INC.

Condensed

Statements of Operations

(in

thousands, except per share information)

(Unaudited)

| | |

For the Three Months Ended

September 30, | | |

For the Nine Months Ended

September 30, | |

| | |

2015 | | |

2014 | | |

2015 | | |

2014 | |

| Revenues | |

$ | - | | |

$ | - | | |

$ | - | | |

$ | - | |

| Costs and expenses | |

| | | |

| | | |

| | | |

| | |

| Operating expenses (includes $1,452, $658,

$3,726, and $1,905, respectively in share-based compensation costs) | |

| 2,660 | | |

| 2,449 | | |

| 7,259 | | |

| 6,155 | |

| Research and development (includes

$895, $282, $2,050, and $817, respectively in share-based compensation costs) | |

| 4,983 | | |

| 354 | | |

| 12,147 | | |

| 1,018 | |

| Total costs and expenses | |

| 7,643 | | |

| 2,803 | | |

| 19,406 | | |

| 7,173 | |

| | |

| | | |

| | | |

| | | |

| | |

| Loss from operations | |

| (7,643 | ) | |

| (2,803 | ) | |

| (19,406 | ) | |

| (7,173 | ) |

| Interest income | |

| 8 | | |

| 5 | | |

| 123 | | |

| 5 | |

| Net Loss | |

$ | (7,635 | ) | |

$ | (2,798 | ) | |

$ | (19,283 | ) | |

$ | (7,168 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Net Loss Per

Share, Basic and Diluted | |

$ | (0.16 | ) | |

$ | (0.11 | ) | |

$ | (0.44 | ) | |

$ | (0.30 | ) |

| | |

| | | |

| | | |

| | | |

| | |

Weighted-Average

Common Shares

Outstanding, Basic and Diluted | |

| 47,271,593 | | |

| 26,632,908 | | |

| 43,398,650 | | |

| 24,107,787 | |

The accompanying notes are an integral

part of these condensed financial statements.

LION

BIOTECHNOLOGIES, INC.

Condensed

Statements of Comprehensive Loss

(in

thousands)

(Unaudited)

| | |

For the Three Months Ended

September 30, | | |

For the Nine Months Ended

September 30, | |

| | |

2015 | | |

2014 | | |

2015 | | |

2014 | |

| Net Loss | |

$ | (7,635 | ) | |

$ | (2,798 | ) | |

$ | (19,283 | ) | |

$ | (7,168 | ) |

| Other comprehensive income: | |

| | | |

| | | |

| | | |

| | |

| Unrealized gain on short-term investments | |

| 38 | | |

| - | | |

| 38 | | |

| - | |

| | |

| | | |

| | | |

| | | |

| | |

| Comprehensive

Loss | |

$ | (7,597 | ) | |

$ | (2,798 | ) | |

$ | (19,245 | ) | |

$ | (7,168 | ) |

The accompanying

notes are an integral part of these condensed financial statements.

LION BIOTECHNOLOGIES, INC.

Condensed Statements of Stockholders’

Equity

For the Nine Months Ended September

30, 2015

(in thousands, except share information)

(Unaudited)

| | |

| | |

| | |

| | |

| | |

Common | | |

| | |

| | |

| | |

| |

| | |

| | |

| | |

| | |

| | |

Stock | | |

Additional | | |

| | |

| | |

Total | |

| | |

Preferred

Stock | | |

Common

Stock | | |

to be | | |

Paid-In | | |

Comprehensive | | |

Accumulated | | |

Stockholders’ | |

| | |

Shares | | |

Amount | | |

Shares | | |

Amount | | |

Issued | | |

Capital | | |

Income | | |

Deficit | | |

Equity | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| |

| Balance - January 1, 2015 | |

| 5,694 | | |

$ | - | | |

| 33,750,188 | | |

$ | 2 | | |

$ | 245 | | |

$ | 121,161 | | |

$ | - | | |

$ | (76,562 | ) | |

$ | 44,846 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Fair

value of vested stock options | |

| | | |

| | | |

| | | |

| | | |

| | | |

| 4,223 | | |

| | | |

| | | |

| 4,223 | |

| Common

stock issued upon exercise of warrants | |

| | | |

| | | |

| 3,847,210 | | |

| - | | |

| | | |

| 9,618 | | |

| | | |

| | | |

| 9,618 | |

| Common

stock issued upon exercise of options | |

| | | |

| | | |

| 10,000 | | |

| - | | |

| | | |

| 66 | | |

| | | |

| | | |

| 66 | |

| Common

stock issued upon conversion of preferred shares | |

| (2,000 | ) | |

| | | |

| 1,000,000 | | |

| - | | |

| | | |

| | | |

| | | |

| | | |

| - | |

| Common

stock sold in public offering, net of offering costs | |

| | | |

| | | |

| 9,200,000 | | |

| - | | |

| | | |

| 68,308 | | |

| | | |

| | | |

| 68,308 | |

| Vesting

of restricted shares issued for services | |

| | | |

| | | |

| | | |

| | | |

| | | |

| 1,553 | | |

| | | |

| | | |

| 1,553 | |

| Unrealized

gain on short-term investments | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| 38 | | |

| | | |

| 38 | |

| Net

loss | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| (19,283 | ) | |

| (19,283 | ) |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Balance - September

30, 2015 | |

| 3,694 | | |

$ | - | | |

| 47,807,398 | | |

$ | 2 | | |

$ | 245 | | |

$ | 204,929 | | |

$ | 38 | | |

$ | (95,845 | ) | |

$ | 109,369 | |

The accompanying notes are an integral

part of these condensed financial statements.

LION

BIOTECHNOLOGIES, INC.

Condensed

Statements of Cash Flows

(In thousands)

(Unaudited)

| | |

For the Nine Months Ended | |

| | |

September 30, | |

| | |

2015 | | |

2014 | |

| | |

| | |

| |

| Cash Flows From Operating Activities | |

| | | |

| | |

| Net loss | |

| (19,283 | ) | |

$ | (7,168 | ) |

| Adjustments to reconcile net loss to net cash used in operating

activities: | |

| | | |

| | |

| Depreciation | |

| 691 | | |

| 23 | |

| Fair value of vested stock options | |

| 4,223 | | |

| 1,896 | |

| Vesting of restricted shares

issued for services | |

| 1,553 | | |

| 825 | |

| Changes in assets and liabilities: | |

| | | |

| | |

| Prepaid and other

current assets | |

| (179 | ) | |

| 118 | |

| Accounts

payable and accrued expenses | |

| 1,193 | | |

| (1,012 | ) |

| | |

| | | |

| | |

| Net cash used in operating

activities | |

| (11,802 | ) | |

| (5,318 | ) |

| | |

| | | |

| | |

| Cash Flows From Investing Activities | |

| | | |

| | |

| Increase in money market funds | |

| (20,562 | ) | |

| - | |

| Purchase of short-term investments | |

| (95,236 | ) | |

| - | |

| Maturities of short-term investments | |

| 15,900 | | |

| - | |

| Purchases of property and

equipment | |

| (992 | ) | |

| (167 | ) |

| Net cash used

in investing activities | |

| (100,890 | ) | |

| (167 | ) |

| | |

| | | |

| | |

| Cash Flows From Financing Activities | |

| | | |

| | |

| Proceeds from the issuance of common stock

upon exercise of warrants | |

| 9,618 | | |

| 3,002 | |

| Proceeds from the issuance of common stock

upon exercise of options | |

| 66 | | |

| | |

| Proceeds from the issuance

of common stock, net | |

| 68,308 | | |

| - | |

| | |

| | | |

| | |

| Net cash provided by

financing activities | |

| 77,992 | | |

| 3,002 | |

| | |

| | | |

| | |

| Net Decrease In Cash And Cash Equivalents | |

| (34,700 | ) | |

| (2,483 | ) |

| Cash and Cash Equivalents,

Beginning of Period | |

| 44,910 | | |

| 19,673 | |

| Cash and Cash

Equivalents, End of Period | |

| 10,210 | | |

$ | 17,190 | |

| | |

| | | |

| | |

| Supplement non-cash

financing activities | |

| | | |

| | |

|

Unrealized gain on short-term investments | |

| 38 | | |

$ | - | |

The accompanying notes are an integral

part of these condensed financial statements.

LION BIOTECHNOLOGIES, INC.

NOTES TO CONDENSED FINANCIAL STATEMENTS

For the Nine Months Ended September

30, 2015 and 2014 (Unaudited)

NOTE 1. GENERAL ORGANIZATION AND BUSINESS

Lion Biotechnologies, Inc. (the “Company,”

“we,” “us” or “our”) is a clinical-stage biopharmaceutical company focused on the development

and commercialization of novel cancer immunotherapy products designed to harness the power of a patient’s own immune system

to eradicate cancer cells. Our lead program is an adoptive cell therapy utilizing tumor-infiltrating lymphocytes (TIL), which

are T cells derived from patients’ tumors, for the treatment of metastatic melanoma. The TIL are then activated and expanded

ex vivo and then infused back into the patient to fight their tumor cells. The Company was originally incorporated under the laws

of the state of Nevada on September 17, 2007. Until March 2010, we were an inactive company known as Freight Management Corp.

On March 15, 2010, we changed our name to Genesis Biopharma, Inc., and in 2011 we commenced our current business.

Basis of Presentation of Unaudited

Condensed Financial Information

The unaudited

condensed financial statements of the Company for the nine months ended September 30, 2015 and 2014 have been prepared in accordance

with accounting principles generally accepted in the United States of America for interim financial information and pursuant to

the requirements for reporting on Form 10-Q and Regulation S-K. Accordingly, they do not include all the information and footnotes

required by accounting principles generally accepted in the United States of America for complete financial statements. However,

such information reflects all adjustments (consisting solely of normal recurring adjustments), which are, in the opinion of management,

necessary for the fair presentation of the financial position and the results of operations. Results shown for interim periods

are not necessarily indicative of the results to be obtained for a full fiscal year. The balance sheet information as of December

31, 2014 was derived from the audited financial statements included in the Company’s financial statements as of and for the year

ended December 31, 2014 included in the Company’s Annual Report on Form 10-K filed with the Securities and Exchange Commission

(the “SEC”) on March 16, 2015. These financial statements should be read in conjunction with that report.

Liquidity

We are currently engaged in the development

of therapeutics to fight cancer, we do not have any commercial products and have not yet generated any revenues from our biopharmaceutical

business. We currently do not anticipate that we will generate any revenues during 2015 from the sale or licensing of any products.

In addition, we have not generated any revenues from our prior business plans.

We have not had any revenues and are still

in the development stage. As shown in the accompanying condensed financial statements, we have incurred a net loss of $19.3 million

for the nine months ended September 30, 2015 and used $11.8 million of cash in our operating activities during the nine months

ended September 30, 2015. As of September 30, 2015, we had $110.1 million of cash, money market funds, and short term investments

on hand, stockholders’ equity of $109.4 million and had working capital of $107.5 million.

During 2015, we expect to further ramp

up our operations, which will increase the amount of cash we will use in our operations. Our budget for 2015 includes increased

spending on research and development activities, higher payroll expenses as we increase our professional staff, the costs associated

with operating our new Tampa, Florida, research facility, as well as ongoing payments under the Cooperative Research and Development

Agreement (CRADA) we have entered into with the National Cancer Institute (NCI). Based on the funds we had available on September

30, 2015, we believe that we have sufficient capital to fund our anticipated operating expenses for at least 24 months.

On March 3, 2015, the Company sold 9,200,000

shares of its common stock in an underwritten public offering at $8.00 per share for net proceeds of $68.3 million, after deducting

expenses of the offering. On December 22, 2014, the Company sold 6,000,000 shares of its common stock in an underwritten public

offering at $5.75 per share for net proceeds of $32.2 million after deducting expenses of the offering. On November 5, 2013, we

completed a $23.3 million private placement of our securities to various institutional and individual accredited investors. Despite

the amount of funds that we have raised, the estimated cost of completing the development of our TIL-based therapy, and of obtaining

all required regulatory approvals to market those product candidates, may be substantially greater than the amount of funds we

have available. Therefore, while we believe that our existing cash balances will be sufficient to fund our currently planned level

of operations for at least 24 months, we will have to obtain additional funds in the future to complete our development plans.

We intend to seek this additional funding through various financing sources, including possible sales of our securities, and in

the longer term through strategic alliances with other pharmaceutical or biopharmaceutical companies.

LION BIOTECHNOLOGIES, INC.

NOTES TO CONDENSED FINANCIAL STATEMENTS

For the Nine Months Ended September

30, 2015 and 2014 (Unaudited)

NOTE 2. SUMMARY OF SIGNIFICANT ACCOUNTING PRACTICES

Cash and Cash Equivalents

The Company considers highly liquid investments

with an original maturity of 90 days or less when purchased to be cash equivalents. The carrying amounts reported in the Balance

Sheets for cash and cash equivalents are valued at cost, which approximates their fair value.

Short-term Investments

The Company’s short-term investments

represent available for sale securities and are recorded at fair value and unrealized gains and losses are recorded within accumulated

other comprehensive income (loss). The estimated fair value of the available for sale securities is determined based on quoted

market prices or rates for similar instruments. In addition, the cost of debt securities in this category is adjusted for amortization

of premium and accretion of discount to maturity. The Company evaluates securities with unrealized losses to determine whether

such losses, if any, are other than temporary.

Property and Equipment

Property and equipment are recorded at cost and depreciated

using the straight-line method over their estimated useful lives of two to five years. Maintenance and repairs of depreciable

assets are charged against earnings as incurred. When properties are retired or otherwise disposed of, the cost and accumulated

depreciation are removed from the accounts and gains or losses are credited or charged to earnings. Leasehold improvements are

amortized over the lesser of their estimated useful life or lease term, whichever is shorter.

Net Income (Loss) Per Share

Basic net income (loss) per share is computed

by dividing net income (loss) by the weighted average number of common shares outstanding for the period, excluding unvested shares

of restricted common stock. Shares of restricted stock subject to vesting are included in basic weighted average common shares

outstanding from the time they vest. Diluted earnings per share is computed by dividing the net income applicable to common stock

holders by the weighted average number of common shares outstanding plus the number of additional common shares that would have

been outstanding if all dilutive potential common shares had been issued, using the treasury stock method. Potential common shares

are excluded from the computation when their effect is antidilutive. When calculating diluted net income per share, shares of

restricted stock subject to vesting are included in diluted weighted average common shares outstanding as of their grant date.

At September 30, 2015 and 2014, basic

and diluted net loss per share are the same, as the effect of potentially dilutive securities was antidilutive. At September 30,

2015, potentially dilutive securities include options to acquire 2,704,195 shares of common stock, warrants to acquire 7,237,216

shares of common stock, preferred stock that can be converted into 1,847,000 shares of common stock, and 494,001 shares of non-vested

restricted stock. At September 30, 2014, potentially dilutive securities include options to acquire 1,098,750 shares of common

stock, warrants to acquire 11,172,426 shares of common stock, and preferred stock that can be converted into 2,847,000 shares

of common stock.

Fair Value Measurements

Under FASB ASC 820, Fair Value Measurements

and Disclosures, fair value is defined as the price at which an asset could be exchanged or a liability transferred in a transaction

between knowledgeable, willing parties in the principal or most advantageous market for the asset or liability. Where available,

fair value is based on observable market prices or parameters or derived from such prices or parameters. Where observable prices

or parameters are not available, valuation models are applied.

LION BIOTECHNOLOGIES, INC.

NOTES TO CONDENSED FINANCIAL STATEMENTS

For the Nine Months Ended September

30, 2015 and 2014 (Unaudited)

Assets and liabilities recorded at fair

value in our financial statements are categorized based upon the level of judgment associated with the inputs used to measure

their fair value. Hierarchical levels directly related to the amount of subjectivity associated with the inputs to fair valuation

of these assets and liabilities, are as follows:

Level 1—Inputs are unadjusted,

quoted prices in active markets for identical assets at the reporting date. Active markets are those in which transactions for

the asset or liability occur in sufficient frequency and volume to provide pricing information on an ongoing basis.

The fair valued assets we hold

that are generally included under this Level 1 are money market securities where fair value is based on publicly quoted prices.

Level 2—Are inputs, other

than quoted prices included in Level 1, that are either directly or indirectly observable for the asset or liability through correlation

with market data at the reporting date and for the duration of the instrument’s anticipated life.

The fair valued assets we hold

that are generally assessed under Level 2 are corporate bonds and commercial paper. We utilize third party pricing services in

developing fair value measurements where fair value is based on valuation methodologies such as models using observable market

inputs, including benchmark yields, reported trades, broker/dealer quotes, bids, offers and other reference data. We use quotes

from external pricing service providers and other on-line quotation systems to verify the fair value of investments provided by

our third party pricing service providers. We review independent auditor’s reports from our third party pricing service

providers particularly regarding the controls over pricing and valuation of financial instruments and ensure that our internal

controls address certain control deficiencies, if any, and complementary user entity controls are in place.

Level 3—Unobservable inputs

that are supported by little or no market activity and that are significant to the fair value of the assets or liabilities and

which reflect management’s best estimate of what market participants would use in pricing the asset or liability at the

reporting date. Consideration is given to the risk inherent in the valuation technique and the risk inherent in the inputs to

the model.

We do not have fair valued

assets classified under Level 3.

Fair Value on a Recurring Basis

Financial assets measured at fair value on a recurring basis

are categorized in the tables below based upon the lowest level of significant input to the valuations (in thousands):

| |

Assets at Fair Value as of September 30, 2015 | |

| | |

Level 1 | | |

Level 2 | | |

Level 3 | | |

Total | |

| Money market funds | |

$ | 20,562 | | |

$ | - | | |

$ | - | | |

$ | 20,562 | |

| | |

| | | |

| | | |

| | | |

| | |

| Corporate debt

securities | |

| - | | |

| 79,374 | | |

| - | | |

| 79,374 | |

| Total | |

$ | 20,562 | | |

$ | 79,374 | | |

$ | | | |

$ | 99,936 | |

LION BIOTECHNOLOGIES, INC.

NOTES TO CONDENSED FINANCIAL STATEMENTS

For the Nine Months Ended September

30, 2015 and 2014 (Unaudited)

(Amounts in thousands, except share

information)

Use of Estimates

The preparation of financial statements

in conformity with accounting principles generally accepted in the United States of America requires management to make estimates

and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities

at the date of the financial statements and the reported amounts of revenue and expenses during the reporting period. Actual results

could differ from those estimates. Significant estimates include accounting for potential liabilities and the assumptions made

in valuing stock instruments issued for services.

Stock-Based Compensation

The Company periodically grants stock

options and warrants to employees and non-employees in non-capital raising transactions as compensation for services rendered.

The Company accounts for stock option grants to employees based on the authoritative guidance provided by the Financial Accounting

Standards Board where the value of the award is measured on the date of grant and recognized over the vesting period. The Company

accounts for stock option grants to non-employees in accordance with the authoritative guidance of the Financial Accounting Standards

Board where the value of the stock compensation is determined based upon the measurement date at either a) the date at which a

performance commitment is reached, or b) at the date at which the necessary performance to earn the equity instruments is complete.

Non-employee stock-based compensation charges generally are amortized over the vesting period on a straight-line basis. In certain

circumstances where there are no future performance requirements by the non-employee, option grants are immediately vested and

the total stock-based compensation charge is recorded in the period of the measurement date.

The Company issues restricted shares of

its common stock for share-based compensation programs. The Company measures the compensation cost with respect to restricted

shares to employees based upon the estimated fair value of the equity instruments at the date of the grant, and is recognized

as expense over the period which an employee is required to provide services in exchange for the award.

The fair value of the Company’s common

stock option grants is estimated using a Black-Scholes option pricing model, which uses certain assumptions related to risk-free

interest rates, expected volatility, expected life of the common stock options, and future dividends. Compensation expense is

recorded based upon the value derived from the Black-Scholes option pricing model, and based on actual experience. The assumptions

used in the Black-Scholes option pricing model could materially affect compensation expense recorded in future periods.

Total stock-based

compensation expense related to all of our stock-based awards was as follows (in thousands):

| | |

For the Three Months Ended

September 30, | | |

For the Nine Months Ended

September 30, | |

| | |

2015 | | |

2014 | | |

2015 | | |

2014 | |

| | |

| | |

| | |

| | |

| |

| Operating expenses | |

$ | 1,492 | | |

$ | 658 | | |

$ | 3,726 | | |

$ | 1,905 | |

| Research

and development | |

| 895 | | |

| 282 | | |

| 2,050 | | |

| 817 | |

| Total stock-based

compensation expense | |

$ | 2,387 | | |

$ | 940 | | |

$ | 5,776 | | |

$ | 2,722 | |

LION BIOTECHNOLOGIES, INC.

NOTES TO CONDENSED FINANCIAL STATEMENTS

For the Nine Months Ended September

30, 2015 and 2014 (Unaudited)

(Amounts in thousands, except share

information)

Research and Development

Research and development costs consist

primarily of fees paid to consultants and outside service providers, patent fees and costs, and other expenses relating to the

acquisition, design, development and testing of the Company’s treatments and product candidates. Research and development costs

are expensed as incurred, unless the achievement of milestones, the completion of contracted work, or other information indicates

that a different expensing schedule is more appropriate. The Company reviews the status of its research and development contracts

on a quarterly basis.

Concentrations

Financial instruments, which potentially

subject the Company to concentrations of credit risk, consist principally of cash and short-term investments.

The Company maintains cash balances at

one bank. As of September 30, 2015, the Company’s cash balances were in excess of insured limits maintained at this bank.

Management believes that the financial institution that hold the Company’s cash are financially sound and, accordingly,

minimal credit risk exists.

At September 30, 2015, the Company’s

short-term investments were invested in short-term fixed income debt securities of domestic and foreign high credit issuers and

in money market funds. The Company’s investment policy limits investments to certain types of instruments such as certificates

of deposit, money market instruments, obligations issued by the U.S. government and U.S. government agencies as well as corporate

debt securities, and places restrictions on maturities and concentration by type and issuer. At September 30, 2015, approximately

56% of the Company’s short-term investments were invested in notes of five companies, 25% were invested in notes of various

domestic issuers, and 19% were invested in notes of a foreign issuers. The average maturity of these notes was 66 days (See Note

3).

Recent Accounting Pronouncements

In May 2014, the Financial Accounting

Standards Board (FASB) issued Accounting Standards Update (ASU) No. 2014-09, Revenue from Contracts with Customers. ASU 2014-09

is a comprehensive revenue recognition standard that will supersede nearly all existing revenue recognition guidance under current

U.S. GAAP and replace it with a principle based approach for determining revenue recognition. ASU 2014-09 will require that companies

recognize revenue based on the value of transferred goods or services as they occur in the contract. The ASU also will require

additional disclosure about the nature, amount, timing and uncertainty of revenue and cash flows arising from customer contracts,

including significant judgments and changes in judgments and assets recognized from costs incurred to obtain or fulfill a contract.

ASU 2014-09 is effective for interim and annual periods beginning after December 15, 2017. Early adoption is permitted in annual

reporting periods beginning after December 15, 2016, and the interim periods within that year, and either full retrospective adoption

or modified retrospective adoption is permitted. The Company is in the process of evaluating the impact of ASU 2014-09 on the

Company’s financial statements and disclosures.

In June 2014, the FASB issued Accounting

Standards Update No. 2014-12, Compensation – Stock Compensation (Topic 718). The pronouncement was issued to clarify the

accounting for share-based payments when the terms of an award provide that a performance target could be achieved after the requisite

service period. The pronouncement is effective for reporting periods beginning after December 15, 2015. The adoption of ASU 2014-12

is not expected to have a significant impact on the Company’s consolidated financial position or results of operations.

Other recent accounting pronouncements

issued by the FASB, including its Emerging Issues Task Force, the American Institute of Certified Public Accountants, and the

Securities and Exchange Commission did not or are not believed by management to have a material impact on the Company’s present

or future consolidated financial statements.

LION BIOTECHNOLOGIES, INC.

NOTES TO CONDENSED FINANCIAL STATEMENTS

For the Nine Months Ended September

30, 2015 and 2014 (Unaudited)

(Amounts in thousands, except share

information)

Reclassifications

In presenting the Company’s statement

of operations for the three and nine month periods ended September 30, 2014, the Company has reclassified $0.8 million and $0.3

million, respectively, of stock-based compensation that was previously reflected as operating expenses to research and development

expenses. The reclassification relates to stock-based compensation attributable to individuals working in the Company’s

research and development activities, and had no impact on total costs and expenses, or on net loss.

NOTE 3. CASH, MONEY MARKET FUNDS, AND SHORT-TERM INVESTMENTS

Cash, money market funds, and short-term investments consist

of the following (in thousands):

| | |

September

30,

2015 | | |

December

31, 2014 | |

| | |

| | |

| |

| Checking and savings accounts

(reported as cash and cash equivalents) | |

$ | 10,210 | | |

$ | 45 | |

| Money market funds | |

| 20,562 | | |

| - | |

| Corporate debt

securities (reported as short-term investments) | |

| 79,374 | | |

| - | |

| | |

$ | 110,146 | | |

$ | 45 | |

Money market funds and short-term investments include the following

securities with gross unrealized gains and losses (in thousands):

| | |

| | |

Gross | | |

Gross | | |

| |

| | |

| | |

Unrealized | | |

Unrealized | | |

| |

| September 30, 2015 | |

Cost | | |

Gains | | |

Gains | | |

Fair

Value | |

| Money market funds | |

$ | 20,562 | | |

$ | - | | |

$ | - | | |

$ | 20,562 | |

| Corporate debt

securities | |

| 79,336 | | |

| 38 | | |

| - | | |

| 79,374 | |

| | |

| | | |

| | | |

| | | |

| | |

| Total | |

$ | 99,897 | | |

$ | 38 | | |

$ | - | | |

$ | 99,936 | |

As of September 30, 2015, the contractual maturities of our

money market funds and short-term investments were (in thousands):

| | |

Within One | |

| | |

Year | |

| Money market funds | |

$ | 20,562 | |

| Corporate debt

securities | |

| 79,374 | |

| | |

$ | 99,936 | |

At September 30, 2015,the Company’s

short-term investments were invested in short-term fixed income debt securities and notes of domestic and foreign high credit

issuers and in money market funds. The Company’s investment policy limits investments to certain types of instruments such

as certificates of deposit, money market instruments, obligations issued by the U.S. government and U.S. government agencies as

well as corporate debt securities, and places restrictions on maturities and concentration by type and issuer. At September 30,

2015, the Company’s short-term investments totaled $80 million, of which 56% were invested in notes of five companies, 25%

were invested in notes of other domestic issuers, and 19% were invested in notes of foreign issuers. The average maturity of these

notes was 66 days. At September 30, 2015 the Company’s money-market funds totaled $20.6 million and were invested in a single

fund, the Dreyfus Cash Management Money Market Fund, a no-load money market fund.

LION BIOTECHNOLOGIES, INC.

NOTES TO CONDENSED FINANCIAL STATEMENTS

For the Nine Months Ended September

30, 2015 and 2014 (Unaudited)

(Amounts in thousands, except share

information)

NOTE 4. PROPERTY AND EQUIPMENT

Property and equipment are comprised of

the following as of (in thousands):

| | |

September 30, 2015 | | |

December 31, 2014 | |

| Laboratory equipment | |

$ | 1,563 | | |

$ | 688 | |

| Leasehold improvements | |

| 853 | | |

| 762 | |

| Computer, software, and office equipment | |

| 211 | | |

| 185 | |

| | |

| 2,627 | | |

| 1,635 | |

| Accumulated depreciation | |

| (794 | ) | |

| (103 | ) |

| | |

$ | 1,833 | | |

$ | 1,532 | |

Depreciation expense for the three and

nine months ended September 30, 2015 and 2014 was $266, $691, $5, and $23, respectively.

NOTE 5. STOCKHOLDERS’ EQUITY

Public offering

On March 3, 2015, the Company completed

an underwritten public offering of 9,200,000 shares of its common stock at a price of $8.00 per share of common stock. The net

proceeds to the Company from the offering were $68.3 million, after deducting underwriting discounts and commissions and offering

expenses. The offering was made pursuant to the Company’s existing shelf registration statement on Form S-3, including a

base prospectus, which was filed with the SEC on November 20, 2014 and declared effective on December 10, 2014, a preliminary

prospectus supplement thereunder, and a registration statement on Form S-3 filed with the SEC on February 26, 2015.

Issuance of common stock upon conversion of preferred

stock

During the nine months ended September

30, 2015, the Company issued 1,000,000 shares of common stock upon the conversion of 2,000 shares of Series A Convertible Preferred

Stock. The number of conversion shares issued was determined on a formula basis of 500 common shares for each Series A Convertible

Preferred Stock held consistent with the contract.

Common stock with vesting terms

During 2014, the Company granted 797,500

shares of its restricted common stock to nine of its employees in accordance with the terms of their employment agreements. The

797,500 shares vest over a period of three years. As these shares were granted to employees, the Company calculated the aggregate

fair value of the 797,500 shares based on the trading prices of the Company’s stock at their grant dates and determined

it to be $5.3 million, of which $1.3 million was expensed in 2014. The allocable portion of the fair value of the stock that vested

during the nine months ended September 30, 2015 amounted to $1.5 million and was recognized as expense in the accompanying statements

of operations. As of September 30, 2015, the amount of unvested compensation related to the unvested outstanding shares of restricted

common stock was $2.5 million, which will be recorded as expense in future periods as the shares vest.

LION BIOTECHNOLOGIES, INC.

NOTES TO CONDENSED FINANCIAL STATEMENTS

For the Nine Months Ended September

30, 2015 and 2014 (Unaudited)

(Amounts in thousands, except share

information)

When calculating basic net income (loss)

per share, these shares are included in basic weighted average common shares outstanding from the time they vest. When calculating

diluted net income (loss) per share, these shares are included in diluted weighted average common shares outstanding from the

time they are granted, unless they are antidilutive. Shares of restricted stock granted above are subject to forfeiture to the

Company or other restrictions that will lapse in accordance with a vesting schedule determined by our Board.

The following table summarizes restricted common stock activity:

| | |

Number of Shares | | |

Weighted Average Grant

Date Fair

Value | |

| Non-vested shares, January 1, 2015 | |

| 757,500 | | |

$ | 6.84 | |

| Granted | |

| | | |

| | |

| Vested | |

| (233,499 | ) | |

| 4.37 | |

| Forfeited | |

| (30,000 | ) | |

| 8.24 | |

| Non-vested shares, September 30, 2015 | |

| 494,001 | | |

$ | 6.56 | |

NOTE 6. STOCK OPTIONS AND WARRANTS

Stock Options

A summary of the status of stock options

at September 30, 2015, and the changes during the nine months then ended, is presented in the following table:

| | |

| | |

| | |

Weighted | | |

| |

| | |

| | |

Weighted | | |

Average | | |

Aggregate | |

| | |

Shares | | |

Average | | |

Remaining | | |

Intrinsic | |

| | |

Under | | |

Exercise | | |

Contractual | | |

Value | |

| | |

Option | | |

Price | | |

Life | | |

(in

thousands) | |

| Outstanding at January 1, 2015 | |

| 1,857,877 | | |

$ | 7.31 | | |

| 8.2 | | |

$ | 2,875 | |

| Granted | |

| 943,750 | | |

| 9.18 | | |

| 9.8 | | |

| | |

| Exercised | |

| (10,000 | ) | |

| | | |

| | | |

| | |

| Expired/Forfeited | |

| (87,432 | ) | |

| 5.92 | | |

| 7.29 | | |

| - | |

| Outstanding at September 30, 2015 | |

| 2,704,195 | | |

$ | 8.05 | | |

| 8.16 | | |

$ | 64 | |

| Exercisable at September 30, 2015 | |

| 883,449 | | |

$ | 8.63 | | |

| 6.67 | | |

$ | 98 | |

During the nine months ended September

30, 2015, the Company granted options to purchase 943,750 shares of common stock to new employees and directors of the Company.

The stock options generally vest between one and three years. The fair value of these options was determined to be $8.3 million

using the Black-Scholes option pricing model based on the following assumptions: (i) volatility rate of 211%, (ii) discount rate

of 1.57%, (iii) zero expected dividend yield, and (iv) expected life of 6 years.

LION BIOTECHNOLOGIES, INC.

NOTES TO CONDENSED FINANCIAL STATEMENTS

For the Nine Months Ended September

30, 2015 and 2014 (Unaudited)

(Amounts in thousands, except share

information)

During the nine months ended September

30, 2015 and 2014, the Company recorded compensation costs of $4.1 million and $1.9 million, respectively, relating to the vesting

of stock options. As of September 30, 2015, the aggregate value of unvested options was $10.3 million, which will continue to

be amortized as compensation cost as the options vest over terms ranging from nine months to three years, as applicable.

On September 19, 2014, The Company’s

Board of Directors adopted the Lion Biotechnologies, Inc. 2014 Equity Incentive Plan (the “2014 Plan”). The 2014 Plan

was approved by our stockholders at the annual meeting of stockholders held in November 2014. The 2014 Plan as approved by the

stockholders authorized the issuance up to an aggregate of 2,350,000 shares of common stock. On April 10, 2015 the Board amended

the 2014 Plan, subject to stockholder approval, to increase the total number of shares that can be issued under the 2014 Plan

by 1,650,000 from 2,350,000 shares to 4,000,000 shares. The increase in shares available for issuance under the 2014 Plan was

approved by stockholders on June 12, 2015.

Warrants

A summary of the status of stock warrants

at September 30, 2015, and the changes during the nine months then ended, is presented in the following table:

| | |

| | |

| | |

Weighted | | |

| |

| | |

| | |

Weighted | | |

Average | | |

Aggregate | |

| | |

Shares | | |

Average | | |

Remaining | | |

Intrinsic | |

| | |

Under | | |

Exercise | | |

Contractual | | |

Value | |

| | |

Warrants | | |

Price | | |

Life | | |

(in

thousands) | |

| Outstanding at December 31, 2014 | |

| 11,084,426 | | |

$ | 2.51 | | |

| 3.85 years | | |

$ | 59,518 | |

| Issued | |

| - | | |

| | | |

| | | |

| | |

| Exercised | |

| (3,847,210 | ) | |

$ | 2.50 | | |

| | | |

| | |

| Expired | |

| - | | |

| | | |

| | | |

| | |

| Outstanding and exercisable at September 30, 2015 | |

| 7,237,216 | | |

$ | 2.51 | | |

| 3.3 years | | |

$ | 23,593 | |

During the

nine months ended September 30, 2015, the Company received $9.6 million in cash from the exercise of

3,847,210 warrants for the purchase of an equal number of shares of its common stock.

NOTE 7. LICENSE AND COMMITMENTS

National Institutes of Health and the National Cancer

Institute

Cooperative Research and Development Agreement

Effective August 5, 2011, the Company

signed a Cooperative Research and Development Agreement (CRADA) with the National Institutes of Health and the National Cancer

Institute (NCI). Under the terms of the five-year cooperative research and development agreement, the Company will work with Dr.

Steven A. Rosenberg, M.D., Ph.D., chief of NCI’s Surgery Branch, to develop adoptive cell immunotherapies that are designed

to destroy metastatic melanoma cells using a patient’s tumor infiltrating lymphocytes.

LION BIOTECHNOLOGIES, INC.

NOTES TO CONDENSED FINANCIAL STATEMENTS

For the Nine Months Ended September

30, 2015 and 2014 (Unaudited)

(Amounts in thousands, except share

information)

On January 22, 2015, the Company executed

an amendment (the “Amendment”) to the CRADA to include four new indications. As amended, in addition to metastatic

melanoma, the CRADA now also includes the development of TIL therapy for the treatment of patients with bladder, lung, triple-negative

breast, and HPV-associated cancers. Under the Amendment, the NCI also has agreed to provide the Company with samples of all tumors

covered by the Amendment for performing studies related to improving TIL selection and/or TIL scale-out production and process

development. Although the CRADA has a five year term, either party to the CRADA has the right to terminate the CRADA upon 60 days’

notice to the other party.

National Institutes

of Health

Development and Manufacture TIL

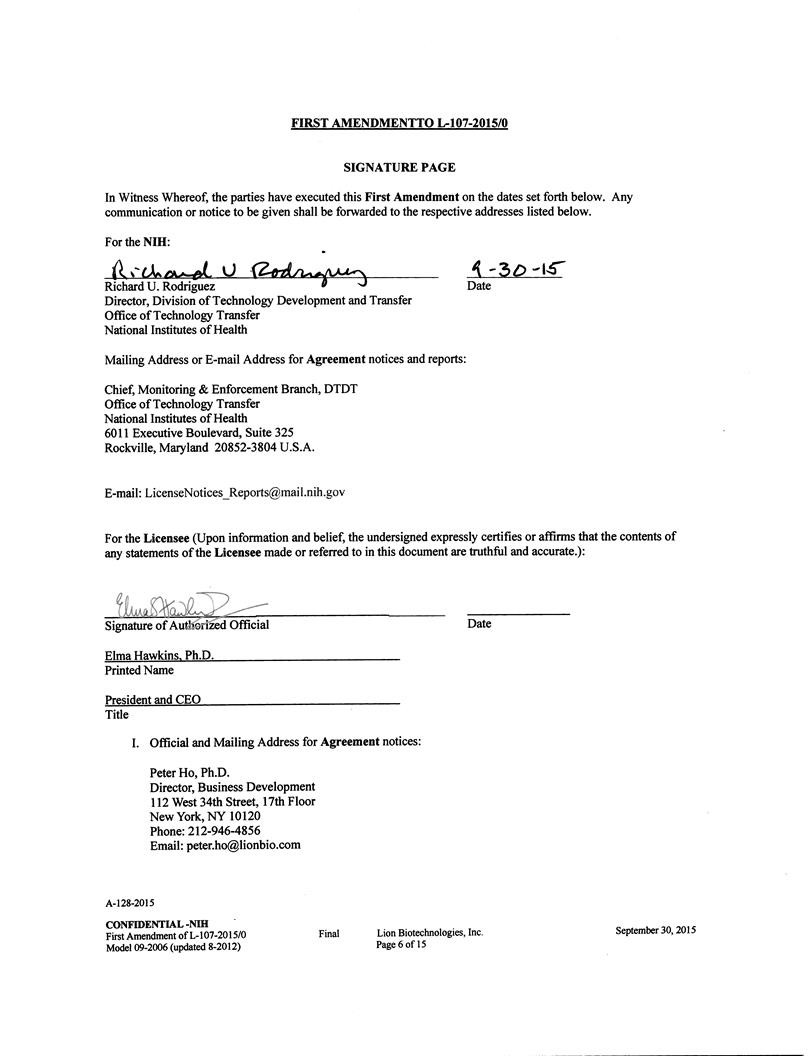

Effective October 5, 2011, the Company

entered into a Patent License Agreement with the National Institutes of Health, an agency of the United States Public Health Service

within the Department of Health and Human Services (“NIH”), which License Agreement was subsequently amended on February

9, 2015 and October 2, 2015. Pursuant to the License Agreement as amended, NIH granted to the Company an exclusive worldwide right

and license to develop and manufacture certain proprietary autologous tumor infiltrating lymphocyte adoptive cell therapy products

for the treatment of metastatic melanoma, ovarian cancer, breast cancer, and colorectal cancer. The License Agreement requires

the Company to pay royalties based on a percentage of net sales (which percentage is in the mid-single digits and subject to certain

annual minimum royalty payments), a percentage of revenues from sublicensing arrangements, and lump sum benchmark royalty payments

on the achievement of certain clinical and regulatory milestones for each of the various indications and other direct costs incurred

by NIH pursuant to the agreement.

NIH - Exclusive Patent License Agreement

On February 10, 2015, the Company entered

into an exclusive Patent License Agreement with the NIH under which the Company received an exclusive, world-wide license to the

NIH’s rights in and to two patent-pending technologies related to methods for improving tumor-infiltrating lymphocytes for

adoptive cell therapy. The licensed technologies relate to the more potent and efficient production of TIL from melanoma tumors

by selecting for T-cell populations that express various inhibitory receptors. Unless terminated sooner, the license shall remain

in effect until the last licensed patent right expires.

In consideration for the exclusive rights

granted under the exclusive Patent License Agreement, the Company agreed to pay the NIH a non-refundable upfront licensing fee

which was recognized as research and development expense during the nine months ended September 30, 2015. The Company also agreed

to pay customary royalties based on a percentage of net sales (which percentage is in the mid-single digits), a percentage of

revenues from sublicensing arrangements, and lump sum benchmark payments upon the successful completion of the Company’s

first Phase 2 clinical study, the successful completion of the Company’s first Phase 3 clinical study, the receipt of the

first FDA approval or foreign equivalent for a licensed product or process resulting from the licensed technologies, the first

commercial sale of a licensed product or process in the United States, and the first commercial sale of a licensed product or

process in any foreign country.

H. Lee Moffitt Cancer Center

Research Collaboration Agreement

In September, 2014, we entered into a

research collaboration agreement with the H. Lee Moffitt Cancer Center and Research Institute, Inc. to jointly engage in transitional

research and development of adoptive tumor-infiltrating lymphocyte cell therapy with improved anti-tumor properties and process.

Exclusive License Agreement

On July 21, 2014, the Company entered

into an Exclusive License Agreement (the “Moffitt License Agreement”), effective as of June 28, 2014, with the H.

Lee Moffitt Cancer Center and Research Institute, Inc. (“Moffitt”) under which the Company received an exclusive,

world-wide license to Moffitt’s rights in and to two patent-pending technologies related to methods for improving tumor-infiltrating

lymphocytes for adoptive cell therapy. Unless earlier terminated, the term of the license extends until the earlier of the expiration

of the last patent related to the licensed technology or 20 years after the effective date of the license agreement.

LION BIOTECHNOLOGIES, INC.

NOTES TO CONDENSED FINANCIAL STATEMENTS

For the Nine Months Ended September

30, 2015 and 2014 (Unaudited)

(Amounts in thousands, except share

information)

Pursuant to the Moffitt License Agreement,

the Company paid an upfront licensing fee which was recognized as research and development expense during 2014. A patent issuance

fee will also be payable under the Moffitt License Agreement, upon the issuance of the first U.S. patent covering the subject

technology. In addition, the Company agreed to pay milestone license fees upon completion of specified milestones, customary royalties

based on a specified percentage of net sales (which percentage is in the low single digits) and sublicensing payments, as applicable,

and annual minimum royalties beginning with the first sale of products based on the licensed technologies, which minimum royalties

will be credited against the percentage royalty payments otherwise payable in that year. The Company will also be responsible

for all costs associated with the preparation, filing, maintenance and prosecution of the patent applications and patents covered

by the Moffitt License Agreement related to the treatment of any cancers in the United States, Europe and Japan and in other countries

selected that the Company and Moffitt agreed to.

During the nine months ended September

30, 2015 and 2014, the Company recognized $2.5 million and $0.9 million respectively, of expenses related to its license agreements.

The amounts were recorded as part of research and development expenses in the statement of operations. Additionally, during the

nine months ended September 30, 2015, there were no net sales subject to certain annual minimum royalty payments or sales that

would require us to pay a percentage of revenues from sublicensing arrangements. In addition, there were no benchmarks or milestones

achieved that would require payment under the lump sum benchmark royalty payments on the achievement of certain clinical regulatory

milestones for each of the various indications.

Future guaranteed commitments under all

of the Company’s agreements amount to (in thousands):

| Year | |

Amount | |

| 2015 | |

$ | 3,104 | |

| 2016 | |

| 2,874 | |

| Total | |

$ | 5,978 | |

NOTE 8. LEGAL PROCEEDINGS

On August 18, 2015,

MBA Holdings, LLC filed a breach of contract lawsuit against the Company in the Superior Court of California, County of Los Angeles

(MBA Holdings, LLC v. Lion Biotechnologies, Inc., Case BC 591513). The complaint alleges that the Company and MBA Holdings, LLC

were parties to (i) a June 15, 2012 “Finder’s Fee Agreement”, (ii) a Confidentiality, Non-Disclosure and Non-Circumvention

Agreement, dated June 13, 2012, and (iii) a Consulting Agreement, dated July 9, 2012, and that the Company breached these agreements

by failing to compensate MBA Holdings for introducing Roth Capital Partners, LLC and Highline Research Advisors LLC to the Company

in connection with the $23.3 million equity funding the Company completed in November 2013. MBA Holdings also alleges that the

Company failed to register certain shares underlying a common stock purchase warrant that the Company issued to MBA Holdings.

MBA Holdings has asked for damages in the amount of $7,746,000. The Company has not yet been served in the foregoing lawsuit.

The Company believes

that there is no merit to the claims made by MBA Holdings in the complaint. On September 9, 2015 the Company provided MBA Holdings

with evidence that the Company dealt with a certain investment banker on a financing transaction at least six months before MBA

Holdings purportedly introduced the Company to the banker, and that a certain research analyst group were known to the Company

prior to the purported introduction. Accordingly, the Company has demanded that MBA Holdings dismiss the lawsuit. To date, MBA

Holdings has not served the complaint on the Company, dismissed the lawsuit, or responded to the Company’s last communications.

Accordingly, on October 26, 2015 the Company renewed its demand on MBA and its counsel to dismiss the suit or face exposure to

damages for malicious prosecution, voluntarily entered an appearance in the case, and initiated discovery proceedings for the

purpose of pursuing an early resolution of the case in the Company’s favor. The Company intends to vigorously defend itself

in this matter and will seek a prevailing-party award of its attorney’s fees and other litigation costs pursuant to contractual

provisions in the agreements appended to MBA’s complaint.

There are no other pending legal proceedings

to which the Company is a party or of which its property is the subject other than as previously reported.

| Item 2. |

Management’s Discussion and Analysis

of Financial Condition and Results of Operations. |

In this section,

“we,” “our,” “ours” and “us” refer to Lion Biotechnologies, Inc.

This management’s

discussion and analysis of financial condition as of September 30, 2015 and results of operations for the three- and nine month

periods ended September 30, 2015 and 2014, respectively, should be read in conjunction with management’s discussion and

analysis of financial condition and results of operations included in our Annual Report on Form 10-K for the year ended December 31,

2014 which was filed with the SEC on March 16, 2015.

Forward-Looking Statements

The discussion

below includes forward-looking statements based upon current expectations that involve risks and uncertainties, such as our plans,

objectives, expectations and intentions. Actual results and the timing of events could differ materially from those anticipated

in these forward-looking statements as a result of a number of factors. We use words such as “anticipate,” “estimate,”

“plan,” “project,” “continuing,” “ongoing,” “expect,” “believe,”

“intend,” “may,” “will,” “should,” “could,” and similar expressions

to identify forward-looking statements. All forward-looking statements included in this Quarterly Report are based on information

available to us on the date hereof and, except as required by law, we assume no obligation to update any such forward-looking

statements. For a discussion of some of the factors that may cause actual results to differ materially from those suggested by

the forward-looking statements, please read carefully the information in the “Risk Factors” section in our Form 10-K

for the year ended December 31, 2014. The identification in this Quarterly Report of factors that may affect future performance

and the accuracy of forward-looking statements is meant to be illustrative and by no means exhaustive. All forward-looking statements

should be evaluated with the understanding of their inherent uncertainty.

Background on the Company and Recent Events Affecting our

Financial Condition and Operations

We are a clinical-stage

biopharmaceutical company focused on the development and commercialization of novel cancer immunotherapy products designed to

harness the power of a patient’s own immune system to eradicate cancer cells. Our lead program is an adoptive cell therapy

utilizing tumor-infiltrating lymphocytes (TIL), which are T cells derived from patients’ tumors, for the treatment of metastatic

melanoma. TIL therapy is being developed in collaboration with the National Cancer Institute (NCI). A patient’s immune system,

particularly their TIL, plays an important role in identifying and killing cancer cells. TIL consist of a heterogeneous population

of T cells that can recognize a wide variety of cancer-specific mutations and can overcome tumor escape mechanisms. TIL therapy

involves growing a patient’s TIL in special culture conditions outside the patient’s body, or ex vivo, and then infusing

the T cells back into the patient in combination with interleukin-2 (IL-2). By taking TIL away from the immune-suppressive tumor

microenvironment in the patient, the T cells can rapidly proliferate. Billions of TIL, when infused back into the patient, are

more able to search out and eradicate the tumor.

During the third quarter

of 2015, we initiated a Phase 2 clinical trial of our lead product candidate, LN-144, for the treatment of refractory metastatic

melanoma. The single-arm study is expected to enroll approximately 20 evaluable patients with metastatic melanoma whose disease

has progressed following treatment with at least one systemic therapy. The purpose of the study is to evaluate the safety, efficacy

and feasibility of autologous TIL infusion (LN-144). The trial’s primary endpoints include safety, and feasibility of LN-144

production using our central manufacturing process. Secondary outcome measures include an additional feasibility measure of number

of patients successfully infused with LN-144 and best overall response rate.

In 2011, we acquired

from the National Institutes of Health (NIH) a non-exclusive, worldwide right and license to certain NIH patents and patent applications

to develop and manufacture autologous TIL for the treatment of metastatic melanoma, ovarian, breast, and colorectal cancers. Under

a Cooperative Research and Development Agreement (CRADA) with the U.S. Department of Health and Human Services, as represented

by the NCI, we support the in vitro development of improved methods for the generation and selection of TIL, the development of

large-scale production of TIL, and clinical trials using these improved methods of generating TIL. On January 22, 2015, we executed

an amendment to the CRADA to include four new indications. On February 9, 2015, the NIH granted us an exclusive, worldwide license

to treat metastatic melanoma with TIL therapy, and on October 2, 2015, the NIH license agreement was amended to include the exclusive

rights to treat breast, lung, bladder and HPV-associated cancers with TIL therapy. The amendment also removed our non-exclusive

rights to treat colorectal and ovarian cancers with TIL therapy. In addition to our CRADA, we also conduct research and development

on TIL technology at our research facility in Tampa, Florida.

Recent Developments

On March 3, 2015 we

closed an underwritten public offering of 9,200,000 shares of our common stock, including shares sold pursuant to the exercise

in full of the underwriters’ option to purchase additional shares, at a price of $8.00 per share. The net proceeds to us from

that public offering were approximately $68.3 million.

In July 2015, we leased

temporary office space in New York, New York, until we locate a new office in New York to serve as our headquarters. The amount

of rent we have to pay for our temporary offices is not material and may vary if we change or increase the number of offices we

rent. Our Woodland Hills, California, offices were closed at end of August 2015.

Results of Operations

Revenues

As a development stage

company that is currently engaged in the development of novel cancer immunotherapy products, we have not yet generated any revenues

from our biopharmaceutical business or otherwise since our formation. We currently do not anticipate that we will generate any

revenues during 2015 from the sale or licensing of any products. Our ability to generate revenues in the future will depend on

our ability to complete the development of our product candidates and to obtain regulatory approval for them.

Operating Expenses

Operating

expenses include compensation-related costs for our employees engaged in general and administrative activities (other than

employees engaged in research and development), legal fees, audit and tax fees, consultants and professional services, and

general corporate expenses. For the three months ended September 30, 2015, our operating expenses increased by $0.2 million,

or 9%, and for the nine months ended September 30, 2015, our operating expenses increased by $1.1 million, or 18%, when

compared to the same periods in 2014. The increase in our operating expenses during the three- and nine-month periods ended

September 30, 2015 is due to the expansion of our company and an increase in our overall business activities, including

increases in employment related expenses, insurance costs and investor relations expenses. Since September 30, 2014, we have

increased the number of our officers and employees by 12 persons. In addition, in the three and nine month

periods ended September 30, 2015, we incurred $1.5 million, and $3.7 million, respectively, of non-cash stock-based

compensation costs, compared to $0.7 million and $1.9 million, respectively, for such costs in the same periods in 2014.

Share based compensation includes stock and options granted to our executive officers, our employees, our directors, and our

consultants and advisors. As a result of our increased operations and the additional employees, our operating expenses in the

future are expected to continue to increase.

Research and Development.

Research and development

expenses consist of expenses incurred in performing research and development activities, including compensation and benefits for

research and development employees and consultants, rent at our research and development facility in Tampa, Florida, cost of laboratory

supplies, manufacturing expenses, and fees paid to third parties, including the NCI and our third party contractor that will process

and manufacture LN-144 for our clinical trials in patients. Research and development expenses also included amounts paid (i) to

the National Institutes of Health under terms of our two license agreements, and (ii) to the NCI under the CRADA. During the three-

and nine-month periods ended September 30, 2015, our research and development costs increased by $4.4 million and $10.9 million

respectively, when compared to the same periods in 2014. The increases are mainly attributable to the expansion of our CRADA in

2015, the general expansion of our research and development efforts, and the establishment of our Tampa, Florida, research facility

in the fourth quarter of 2014. None of these expenses were incurred in the first nine months of 2014. Research and development

expenses in the first three quarters of 2015 and 2014 include payments made under license agreements. In addition, in the three

and nine month periods ended September 30, 2015, we incurred $0.9 million and $2.1 million, respectively, of non-cash stock-based

compensation costs, compared to $0.3 million and $0.8 million, respectively, in the same periods in 2014. We anticipate that our

research and development costs will continue to increase in the future as we increase our research and development activities

and accelerate the development of our technologies and product candidates.

Research and development

activities are central to our business model. Product candidates in later stages of clinical development generally have higher

development costs than those in earlier stages of clinical development, primarily due to the increased size and duration of later-stage

clinical trials. We expect our research and development expenses to increase over the next several years as we continue to conduct

our clinical trial for our lead product candidate, LN-144, and as we increase our research and development efforts on other cancer

indications. We also expect to incur increased research and development expenses as we selectively identify and develop additional

product candidates and in other licensed cancer indications. However, it is difficult to determine with certainty the duration

and completion costs of our current or future preclinical programs and clinical trials of our product candidates.

The duration, costs

and timing of our clinical trials and development of our product candidates will depend on a number of factors that include, but

are not limited to, the number of patients that enroll in the trial, per patient trial costs, number of sites included in the

trial, discontinuation rates of patients, duration of patient follow-up, efficacy and safety profile of the product candidate,

and the length of time required to enroll eligible patients. Additionally, the probability of success for our product candidate

will depend on a number of factors, including competition, manufacturing capability and commercial viability.

Net Loss

We had a net loss

of $7.6 million and $19.3 million, for the three and nine month periods ended September 30, 2015, respectively, compared to $2.8

million and $7.2 million, for the three and nine month periods ended September 30, 2014, respectively. The increase in our net

loss during 2015 is due to an increase in operating expenses, as described above, along with the expansion of our research and

development activities. We anticipate that we will continue to incur net losses in the future as we continue to invest in our

research and development, and we do not expect to generate any revenues in the near term.

Liquidity and Capital Resources

On March 3, 2015,

we closed an underwritten public offering. The net proceeds to us from the public offering were $68.3 million, after deducting

underwriting discounts and commissions and estimated offering expenses payable by us. In addition, during the nine months ended

September 30, 2015, holders of our common stock purchase warrants exercised warrants to purchase a total of 3,847,210 shares for

an aggregate purchase price of $9.6 million. As a result, as of September 30, 2015, we had $110.1 million in cash and cash equivalents.

Cash in excess of immediate requirements is invested in accordance with our investment policy, primarily with a view to liquidity

and capital preservation.

During the remainder

of 2015, we expect to further ramp up our operations and our research and development efforts, which will increase the amount

of cash we will use in our operations. Our budget for the remainder of 2015 includes increased spending on research and development

activities (including costs associated with a Phase 2 multi-center clinical trial to treat about 20 patients with refractory metastatic

melanoma that we initiated in the third quarter of 2015), higher payroll expenses as we increase our professional staff, increased

expenses for operating a new research and development facility in Tampa, Florida, as well as ongoing payments under the CRADA.

Based on the funds we had available on September 30, 2015, we believe that we have sufficient capital to fund our anticipated

operating expenses for at least 24 months.

As of September 30,

2015, we had no long-term debt obligations or other similar long-term liabilities other than various obligations under our CRADA

and our license agreements. We have no financial guarantees, debt or lease agreements or other arrangements that could trigger

a requirement for an early payment or that could change the value of our assets. We do not have any bank credit lines.

Cash Flow

Net Cash Used

in Operating Activities

Net cash used in operating

activities was $11.8 million for the nine months ended September 30, 2015, compared with $5.3 million for the nine months ended

September 30, 2014. The increase in cash used in operating activities of approximately $5.5 million resulted from the increase

in our net loss, partially offset by increases in non-cash stock compensation expense and depreciation.

Net Cash Flow

from Investing Activities

Net cash used in investing

activities was $100.9 million for the nine months ended September 30, 2015, compared with $0.2 million for the nine months ended

September 30, 2014. The increase was primarily due to the short-term investment purchases of the cash proceeds received in our

March 2015 public offering and, to a lesser extent, to purchases of laboratory equipment and furniture for our Tampa, Florida,

laboratory. The Tampa facility did not exist during the 2014 period.

Net Cash Flow

from Financing Activities

Net cash provided

by financing activities was $78.0 million for the nine months ended September 30, 2015, compared with $3.0 million for the nine

months ended September 30, 2014. The increase was due to net proceeds of $68.3 million received from the March 3, 2015 public

offering of our common stock, and $9.6 million received from common stock warrant exercises. We received $3.0 million of net proceeds

from common stock warrant exercises in the nine months ended September 30, 2014.

Off-Balance Sheet Arrangements

We have not entered

into any off-balance sheet financing arrangements.

Critical Accounting Policies and Estimates

In our Annual Report

on Form 10-K for the year ended December 31, 2014, we disclosed our critical accounting policies and estimates upon which our

financial statements are derived. There have been no changes to these policies since December 31, 2014 that are not included in

Note 2 of the accompanying condensed consolidated financial statements for the nine months ended September 30, 2015. Readers are

encouraged to read our Annual Report on Form 10-K in conjunction with this report.

Inflation

Inflation and changing

prices have had no effect on our continuing operations over our two most recent fiscal years.

| Item 3. |

Quantitative and Qualitative Disclosures

About Market Risk |

The primary objective

of our investment activities is to preserve capital. We do not utilize hedging contracts or similar instruments.

We are exposed to

certain market risks relating primarily to interest rate risk on our cash and cash equivalents and risks relating to the financial

viability of the institutions which hold our capital and through which we have invested our funds. To minimize this risk, we maintain

our portfolio of cash equivalents and short-term investments in a variety of securities, including corporate bonds, commercial

paper, money market funds and other government and non-government debt securities with maturities of less than one year. Due to

the short-term maturities of our cash equivalents, a change in interest rates would not have a material effect on the fair market

value of our cash equivalents.

| Item 4. |

Controls and Procedures |

Evaluation of Disclosure Controls and Procedures

As of the end of the

period covered by this quarterly report on Form 10-Q, our principal executive officer and our principal accounting officer (the

“Certifying Officers”), evaluated the effectiveness of our disclosure controls and procedures. Disclosure controls

and procedures are controls and procedures designed to reasonably assure that information required to be disclosed in our reports

filed under the Securities Exchange Act of 1934 (the “Exchange Act”), such as this quarterly report on Form 10-Q,

is recorded, processed, summarized and reported within the time periods specified in the SEC rules and forms. Disclosure controls