Document

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One) |

| |

ý | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 28, 2018

OR

|

| |

¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Commission File Number: 001-36040

Fox Factory Holding Corp.

(Exact name of registrant as specified in its charter)

|

| |

Delaware | 26-1647258 |

(State or Other Jurisdiction of Incorporation or Organization) | (I.R.S. Employer Identification No.) |

| |

6634 Hwy 53 Braselton, GA | 30517 |

(Address of Principal Executive Offices) | (Zip Code) |

(831) 274-6500

(Registrant’s Telephone Number, Including Area Code)

|

| | |

Securities registered pursuant to Section 12(b) of the Act: |

| | |

Title of Each Class | | Name of each exchange on which registered |

| | |

Common Stock, par value $0.001 per share | | The NASDAQ Stock Market LLC (NASDAQ Global Select Market) |

Securities registered pursuant to Section 12(g) of the Act:

None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ý No ¨

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No ý

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ý No ¨

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ý No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of "large accelerated filer," "accelerated filer," "smaller reporting company" and "emerging growth company" in Rule 12b-2 of the Exchange Act.

|

| | | |

Large accelerated filer | ý | Accelerated filer | ¨ |

Non-accelerated filer | ¨ | Smaller reporting company | ¨ |

Emerging growth company | ¨

| | |

If any emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No ý

Based upon the closing price of the registrant's common stock on the NASDAQ Global Select Market on June 29, 2018 (the last business day of the registrant’s most recently completed second fiscal quarter), the approximate aggregate market value of the common stock held by non-affiliates of the registrant was approximately $1,240,176,000. As of February 24, 2019, there were 37,990,546 shares of the registrant’s common stock outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the registrant’s Definitive Proxy Statement for the 2019 Annual Meeting of Stockholders to be filed with the Securities and Exchange Commission pursuant to Regulation 14A not later than 120 days after the end of the fiscal year covered by this Annual Report on Form 10-K are incorporated by reference in Part III, Items 10-14 of this Annual Report on Form 10-K.

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

This Annual Report on Form 10-K includes forward-looking statements, which are subject to the “safe harbor” created by Section 27A of the Securities Act of 1933, as amended (the "Securities Act"), and Section 21E of the Securities Exchange Act of 1934, as amended (the "Exchange Act"). We may make forward-looking statements in our U.S. Securities and Exchange Commission ("SEC") filings, press releases, news articles, earnings presentations and when we are speaking on behalf of the Company. Forward-looking statements generally relate to future events or our future financial or operating performance which involve substantial risks and uncertainties. In some cases, you can identify forward-looking statements because they contain words such as “may,” “might,” “will,” “would,” “should,” “expect,” “plan,” “anticipate,” “could,” “intend,” “target,” “project,” “contemplate,” “believe,” “estimate,” “predict,” “likely,” “potential” or “continue” or the negative of these words or other similar terms or expressions that concern our expectations, strategy, plans or intentions. Forward-looking statements contained in this Annual Report on Form 10-K are subject to numerous risks and uncertainties, including but not limited to risks related to:

| |

• | our ability to develop new and innovative products in our current end-markets; |

| |

• | our ability to leverage our technologies and brand to expand into new categories and end-markets; |

| |

• | our ability to increase our aftermarket penetration; |

| |

• | our ability to accelerate international growth; |

| |

• | our exposure to exchange rate fluctuations; |

| |

• | the loss of key customers; |

| |

• | our ability to improve operating and supply chain efficiencies; |

| |

• | our ability to enforce our intellectual property rights; |

| |

• | our future financial performance, including our sales, cost of sales, gross profit or gross margins, operating expenses, ability to generate positive cash flow and ability to maintain our profitability; |

| |

• | our ability to maintain our premium brand image and high-performance products; |

| |

• | our ability to maintain relationships with the professional athletes and race teams we sponsor; |

| |

• | our ability to selectively add additional dealers and distributors in certain geographic markets; |

| |

• | the growth of the markets in which we compete, our expectations regarding consumer preferences and our ability to respond to changes in consumer preferences; |

| |

• | changes in demand for performance-defining products; |

| |

• | the loss of key personnel, management and skilled engineers; |

| |

• | our ability to successfully identify, evaluate and manage potential or completed acquisitions and to benefit from such acquisitions; |

| |

• | the outcome of pending litigation; |

| |

• | future disruptions in the operations of our manufacturing facilities; |

| |

• | our ability to adapt our business model to mitigate the impact of certain changes in tax laws including those enacted in the US in December 2017; |

| |

• | changes in the relative proportion of profit earned in the numerous jurisdictions in which we do business and in tax legislation, case law and other authoritative guidance in those jurisdictions; |

| |

• | products recalls and product liability claims; and |

| |

• | future economic or market conditions. |

You should not rely upon forward-looking statements as predictions of future events. We have based the forward-looking statements contained in this Annual Report on Form 10-K primarily on our current expectations and projections about future events and trends that we believe may affect our business, financial condition, results of operations, and prospects and the outcomes of any of the events described in any forward-looking statements are subject to risks, uncertainties, and other factors. In addition to the risks, uncertainties and other factors discussed above and elsewhere in this Annual Report on Form 10-K, the risks, uncertainties and other factors expressed or implied discussed in Item 1A, "Risk Factors" of this Annual Report on Form 10-K could cause or contribute to actual results differing materially from those set forth in any forward-looking statement. Moreover, we operate in a very competitive and challenging environment. New risks and uncertainties emerge from time to time, and it is not possible for us to predict all risks and uncertainties that could have an impact on the forward-looking statements contained in this Annual Report on Form 10-K. We cannot assure you that the results, events, and circumstances reflected in the forward-looking statements will be achieved or occur. Actual results, events, or circumstances could differ materially from those contemplated by, set forth in, or underlying any forward-looking statements.

For all of these forward-looking statements we claim the protection of the safe harbor for forward-looking statements in Section 27A of the Securities Act and Section 21E of the Exchange Act.

The forward-looking statements made in this Annual Report on Form 10-K relate only to events as of the date on which the statements are made. We undertake no obligation to update any forward-looking statements made in this Annual Report on Form 10-K to reflect events or circumstances after the date of this Annual Report on Form 10-K or to reflect new information or the occurrence of unanticipated events, except as required by law. We may not actually achieve the plans, intentions, or expectations disclosed in our forward-looking statements and you should not place undue reliance on our forward-looking statements. Our forward-looking statements do not reflect the potential impact of any future acquisitions, mergers, dispositions, joint ventures or investments we may make.

Fox Factory Holding Corp.

FORM 10-K

Table of Contents

|

| | |

| | Page |

| | |

PART I. | | |

Item 1 | Business | |

Item 1A | Risk Factors | |

Item 1B | Unresolved Staff Comments | |

Item 2 | Properties | |

Item 3 | Legal Proceedings | |

Item 4 | Mine Safety Disclosures | |

| | |

PART II. | | |

Item 5 | Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities | |

Item 6 | Selected Financial Data | |

Item 7 | Management’s Discussion and Analysis of Financial Condition and Results of Operations | |

Item 7A | Quantitative and Qualitative Disclosures About Market Risk | |

Item 8 | Financial Statements and Supplementary Data | |

Item 9 | Changes in and Disagreements with Accountants on Accounting and Financial Disclosure | |

Item 9A | Controls and Procedures | |

Item 9B | Other Information | |

| | |

PART III. | | |

Item 10 | Directors, Executive Officers and Corporate Governance | |

Item 11 | Executive Compensation | |

Item 12 | Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters | |

Item 13 | Certain Relationships and Related Transactions, and Director Independence | |

Item 14 | Principal Accounting Fees and Services | |

| | |

PART IV. | | |

Item 15 | Exhibits, Financial Statement Schedules | |

| | |

Signatures | |

| |

Financial Statements | |

| Management’s Report on Internal Control Over Financial Reporting | |

| Reports of Independent Registered Public Accounting Firm | |

| Consolidated Balance Sheets as of December 28, 2018 and December 29, 2017 | |

| Consolidated Statements of Income for the years ended December 28, 2018, December 29, 2017 and December 30, 2016 | |

| Consolidated Statements of Comprehensive Income for the years ended December 28, 2018, December 29, 2017 and December 30, 2016 | |

| Consolidated Statements of Stockholders' Equity for the years ended December 28, 2018, December 29, 2017 and December 30, 2016 | |

| Consolidated Statements of Cash Flows for the years ended December 28, 2018, December 29, 2017 and December 30, 2016 | |

| Notes to Consolidated Financial Statements | |

PART I

ITEM 1. BUSINESS

Our company, Fox Factory Holding Corp., designs, engineers, manufactures and markets performance-defining products and systems for customers worldwide. Fox Factory Holding Corp. is the holding company of Fox Factory, Inc. As used herein, "Fox Factory," "FOX," the "Company," "we," "our," and similar terms refer to Fox Factory Holding Corp. and its subsidiaries, unless the context indicates otherwise. Our premium brand, performance-defining products and systems are used primarily on bicycles ("bikes"), side-by-side vehicles ("Side-by-Sides"), on-road vehicles with and without off-road capabilities, off-road vehicles and trucks, all-terrain vehicles, or ATVs, snowmobiles, specialty vehicles and applications, motorcycles and commercial trucks. Some of our products are specifically designed and marketed to some of the leading cycling and powered vehicle original equipment manufacturers ("OEMs"), while others are distributed to consumers through a global network of dealers and distributors.

Fox Factory, Inc., our operating subsidiary, was incorporated in California in 1978. Fox Factory Holding Corp. was incorporated in Delaware on December 28, 2007. In October 2018, we announced the relocation of our corporate headquarters from Scotts Valley, California to Braselton, Georgia, which was effective on December 31, 2018.

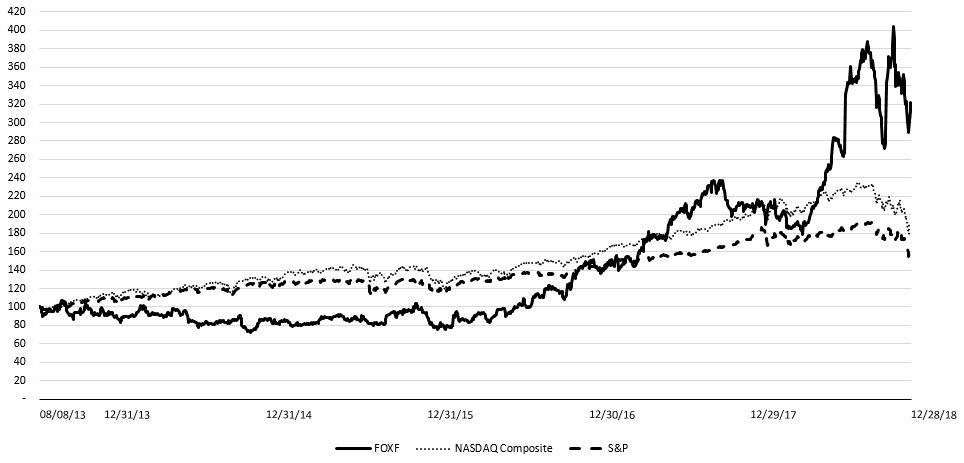

In August 2013, we completed an initial public offering ("IPO") of our common stock. Our common stock is traded on the NASDAQ Global Select Market (the "NASDAQ") under the symbol "FOXF."

Description of our business

We are a designer, manufacturer and marketer of performance-defining products and systems used primarily on bikes, Side-by-Sides, on-road vehicles with and without off-road capabilities, off-road vehicles and trucks, ATVs, snowmobiles, specialty vehicles and applications, motorcycles, and commercial trucks. We believe our products offer innovative design, performance, durability and reliability. Our brand is associated with high-performance and technologically advanced products, by which we generally mean products that provide users with improved control and comfort while riding over rough terrain in varied environments, or providing improved control and responsiveness for on-road only vehicles. We believe that the performance of our products has been demonstrated by, and our brand benefits from, the success of professional athletes who use our products in elite competitive events, such as the Union Cycliste Internationale Mountain Bike World Cup and the X Games. We believe the exposure our products receive when used by successful professional athletes positively influences the purchasing habits of enthusiasts and other consumers seeking high-performance products. We believe that our strategic focus on the performance and racing segments in our markets influences many aspiring and enthusiast consumers who we believe seek to emulate the performance of professional and other elite athletes. We believe our products are generally sold at premium prices, which to us means manufacturer suggested retail sale prices that are generally in the upper quartile of their respective product categories.

We design our products for, and market our products to, some of the world’s leading cycling and automotive OEMs and to consumers through the aftermarket channel. Many of our OEM customers, including Giant, Santa Cruz Bicycles, Specialized, Scott, Trek, Yeti Cycles and YT in bikes and BRP, Ford, Honda, Jeep, Polaris, Toyota, Triumph, and Yamaha in powered vehicles, are among the market leaders in their respective product categories, and help shape, as well as respond to, consumer trends in their respective categories. We believe that OEMs often prominently display and incorporate our products to improve the marketability and consumer demand for their performance models, which reinforces our brand image. In addition, consumers select our products in the aftermarket channel where we market through a global network of dealers and distributors.

Industry

We participate in large global markets for bikes and powered vehicles used by recreational and professional users. Today, our products for bicycles are primarily for mountain bikes, road bikes, and e-bikes. Our products for powered vehicles are used primarily on Side-by-Sides, on-road vehicles with and without off-road capabilities, off-road vehicles and trucks, ATVs, snowmobiles, specialty vehicles and applications, motorcycles, and commercial trucks.

We focus on premium-priced products within each of these categories, which we consider to be the high-end segment because of their higher retail sale prices, where we believe consumers prefer well-designed, performance-oriented equipment. We believe that performance-defining products, which include suspension systems, as well as wheels, cranks, and other components, are critical to the performance of the bikes and powered vehicles in the product categories in which we focus and that technical features, component performance, product design, durability, reliability, and brand recognition strongly influence consumer purchasing decisions.

We believe the high-end segments in which we participate are well positioned for growth due to several factors, including:

| |

• | increasing consumer appetite for performance-defining products; |

| |

• | increasing average retail sales prices, which we believe are driven by differentiated and feature-rich products with advanced technologies; |

| |

• | continuing product cycle innovation, which we have observed often motivates consumers to upgrade and purchase new products for enhanced performance; and |

| |

• | increased sales opportunities for high-end bikes and powered vehicles in international markets. |

As vehicles in our end-markets evolve and grow more capable, performance-defining products and systems have become, and we believe will continue to become, increasingly more important for improved performance and control. Additionally, we believe there are opportunities to continue to leverage our technical know-how of suspension products to provide solutions beyond our current applications and end-markets.

Our competitive strengths

Broad offering of performance-defining products across multiple consumer markets

Our performance-defining products enhance vehicle performance across multiple consumer markets. Through the use of adjustable suspension, position sensitive damping, multiple air spring technologies, lightweight and rigid materials, and other technologies and methods, our products improve the performance and control of the vehicles used by our consumers. We believe our reputation for performance-defining products is reinforced by the successful finishes in world class competitive events by athletes incorporating our products in their vehicles.

Premium brand with strong consumer loyalty

We believe that we have developed a reputation for performance-defining products and that we own and license established trademarks, such as FOX®, FOX RACING SHOX®, and RACE FACE® which are perceived as premium brands. As such, our performance-defining products are generally sold at premium prices. We take great effort to maintain our brands in the eyes of consumers. For instance, our FOX® logo is prominently displayed on our FOX® branded products used on bikes and powered vehicles sold by our OEM customers, which helps further reinforce our brand image. We believe that our brands have achieved strong loyalty from our consumers. To support our brands, we introduce new products that we believe feature innovative technologies designed to improve vehicle performance and enhance our brand loyalty with consumers.

Track record of innovation and new product introductions

Innovation, including new product development, is a key component of our growth strategy. Due to our experience in suspension engineering and design in multiple markets and with a variety of vehicles, solutions we develop for use in one market can ultimately be deployed across multiple markets. For example, we believe that our success in the high-end ATV category led to the widespread adoption of our suspension technology in the Side-by-Side market. Our innovative product development and speed to market are supported by:

| |

• | our racing culture, including on-site technical race support of professional athletes, which provides us with unique real-time insights as to the evolving performance-defining product needs of those participating in challenging world-class events and is an integral part of our R&D efforts; |

| |

• | ongoing research and development through a team of full-time engineers and numerous other technicians and employees who spend at least part of their time testing and using our products and helping develop engineering-based solutions to enhance our product offerings; |

| |

• | feedback from professional athletes, race teams, enthusiasts and other consumers who use our products; |

| |

• | strategic and collaborative relationships with OEM customers, which furthers our ability to extend technologies and applications across end-markets; and |

| |

• | our integrated manufacturing facilities and performance testing center, which allow us to quickly move from concept to product. |

Over the past several years, we have developed multiple new products, such as:

| |

• | Live Valve, our proprietary semi-active, electronic suspension that processes data from multiple vehicle sensors to adjust the suspension virtually instantaneously to the demands of changing terrain. This technology is currently in use on Side-by-Sides, off-road capable, on-road trucks, and mountain bikes; |

| |

• | 32, 34 and 36 Factory Series FLOAT FIT4, which reduces overall fork weight, provides external adjustability with our fourth-generation FOX Isolated Technology (FIT) closed-cartridge damper, and includes the self-adjusting negative chamber air spring for quieter operation and ease of adjustment; |

| |

• | The GRIP2 fork damper, which is our next-evolution sealed cartridge FIT system, our highest performing gravity-focused damper. GRIP2 shares its roots with the original GRIP architecture, but has been enhanced with all-new technology: four-way adjustability, VVC high-speed rebound circuit, high-performance mid-valve, and overall friction-reducing treatments; |

| |

• | X2 technology used in our Factory Series FLOAT and DH rear shocks, which allows the rider to independently tune high- and low-speed compression and high- and low-speed rebound; |

| |

• | DPX2 rear shock technology that combines the character of our DPS damping and X2 damping circuits to provide a lightweight trail-tuned adjustable shock; |

| |

• | Rhythm series fork products developed to address a lower price point offering without compromising proven FOX performance; |

| |

• | PODIUM Internal Bypass, introduced into the Side-by-Side market, which through its internal bypass technology, allows the vehicle to be plush on small bumps and deliver excellent chassis control while providing progressive bottoming resistance with each increment of travel used; |

| |

• | X2 technology used in our 2.5 PODIUM shocks for side-by-sides that feature high- and low-speed rebound adjustment, high- and low-speed compression adjustment, and a dual-rate spring for the rear shocks to allow drivers to tune for many different terrain types and driving styles; |

| |

• | Race Face Vault Hub, a new 120-point high-engagement mountain bike hubset featuring tool-free end caps that simplify conversion among all major axle standards and is approved for e-bike applications; |

| |

• | Race Face Next R31 Carbon Wheels featuring a single spoke length throughout and an offset rim design for improved spoke balance and strength; and |

| |

• | Easton EC90 SL Crankset with Cinch Power Meter spindle, a versatile road bike crankset that allows quick conversion between 1x and 2x road and gravel chainring configurations. The Cinch Power Meter spindle, through a one-time connection to a smart phone, automatically works with ride-recording and power-measurement applications. |

Strategic brand for OEMs, dealers and distributors

Through our strategic relationships, we are often sought out by our OEM customers and work closely with them to develop and design new products and product enhancements. We believe our collaborative approach and product development processes strengthen our relationships with our OEM customers. We believe consumers value our branded products when selecting performance bikes and powered vehicles, and as a result, OEMs purchase and incorporate our products in their bikes and powered vehicles in order to increase the sales of their premium-priced products. In addition, we believe the inclusion of our products on high-end bikes and powered vehicles reinforces our premium brand image which helps to drive our sales in the aftermarket channel where dealers and distributors sell our products to consumers.

Experienced management team

We have an experienced senior management team led by Larry L. Enterline, our Chief Executive Officer. Many members of our management team and many of our employees are avid users of our products, which further extends their knowledge of, and expertise in, our products and end-markets. We are able to attract and retain highly trained and specialized employees who enhance our Company culture and serve as strong brand advocates.

Our strategy

Our goal is to expand our leadership position as a designer, manufacturer and marketer of performance-defining products designed to enhance ride dynamics and performance. We intend to focus on the following key strategies in pursuit of this goal:

Continue to develop new and innovative products in current end-markets

We intend to continue to develop and introduce new and innovative products in our current end-markets to improve ride dynamics and performance for our consumers. For example, our patented position-sensitive damping systems provide terrain optimized ride characteristics across many of our product lines. We believe that performance and control are important to our consumer base, and that our frequent introduction of products with innovative and improved technologies increases both OEM and aftermarket demand as consumers seek out products for their vehicles that can deliver these characteristics. We also believe evolving market trends, such as changing bike wheel and tire sizes and increasing adoption rates of off-road capable, on-road trucks should increase demand for vehicles in our end-markets, which, in turn, should increase demand for our suspension products.

Leverage technology and brand to expand into new categories and end-markets

We believe we have developed a reputation as a leader in performance-defining products and that our reputation combined with our ability to improve vehicle performance by incorporating performance suspension products and other components results in us frequently being approached by OEM product development teams, athletes and others looking to improve the performance of their vehicles, including in end-markets in which we have not previously offered products. We believe our performance-defining technologies have applications in end-markets in which we do not currently participate in a meaningful way, and we intend to selectively develop products for and forge relationships with customers in additional markets. These markets may include military, recreational vehicles (RVs), and "performance street" cars.

Opportunistically expand our business platform through acquisitions

Over the past several years, we have completed acquisitions which we believe enhance our business and strategically expand our product offerings. In 2014, we acquired the business of Sport Truck, a full-service distributor of aftermarket suspension solutions. Sport Truck designs, markets, and distributes lift kit solutions primarily through its brands, BDS Suspension and Zone Offroad Products. In 2014, we also acquired the businesses of Race Face/Easton. Known for its unique carbon technology, Race Face/Easton designs, manufactures, and distributes performance bike wheels and other performance cycling components including cranks, bars, stems, and seat posts, globally to OEMs and the aftermarket. In 2015, we continued to expand our opportunities through the acquisition of certain assets of Marzocchi’s bike product lines. In November 2017, through our subsidiary FF U.S. Holding Corp. d/b/a ("Tuscany") we acquired the majority interest in the business of Flagship, Inc., a designer, manufacturer and distributor of premium aftermarket powered vehicle performance packages and personal-use specialty vehicles based on OEM vehicle chassis. The Company believes that this acquisition will accelerate the growth of its off-road and on-road truck products.

We also believe that our passionate customer base has a desire for other types of performance products beyond those that attach to a vehicle or bike. We believe there is opportunity to expand our total available market by broadening our acquisition focus to include a more diverse range of performance products that add to or increase our customers' enjoyment of their activities of choice.

Our business development group is responsible for identifying and assessing inorganic and organic potential growth opportunities of our ride dynamics platform and other specialty sports technology platforms. Specifically, our business development group: (i) identifies and assesses potential acquisition opportunities; (ii) aids the business in analyzing growth alternatives; and (iii) manages critical projects and programs as determined by senior management.

Increase our aftermarket penetration

We currently have a broad aftermarket distribution network of thousands of retail dealers and distributors worldwide. We intend to further penetrate the aftermarket channel by selectively adding dealers and distributors in certain geographic markets, increasing our internal sales force and strategically expanding aftermarket-specific products and services to existing vehicle platforms.

Accelerate international growth

While a significant percentage of our current sales are to OEMs and dealers and distributors located outside the United States, we believe international expansion represents a significant opportunity for us and we have, and intend to continue to, selectively increase infrastructure investments and focus on identified geographic regions. We believe that rising consumer discretionary income in a number of developing markets and increasing consumer preferences for premium, performance bikes and powered vehicles should contribute to increasing demand for our products. In addition, we believe increasing international viewership of racing and extreme sports and other outdoor events, such as the X Games, is contributing to the growth of international participation in activities in which our products are used. We intend to leverage the recognition of our brands to capitalize on these trends by globally increasing our sales to both OEMs and dealers and distributors, particularly in markets where we perceive significant opportunities.

Improve operating and supply chain efficiencies

During 2017, we completed the process of moving all bike suspension component manufacturing to our facility in Taichung, Taiwan. In connection with this move, we are using, and expect to continue to use, suppliers that are located closer to our Taichung, Taiwan facility for a number of materials and components. This transition has shortened production lead times to our bike OEM customers, improved supply chain efficiencies, and reduced manufacturing costs. With the transition of all of our bike suspension component manufacturing to Taichung, Taiwan, we have converted the Watsonville manufacturing facility to exclusively manufacture powered vehicle suspension products. We are currently pursuing a number of initiatives to improve efficiencies and achieve cost savings across our North American manufacturing locations including expanding our Powered Vehicles Group manufacturing operations in Hall County, Georgia and relocating our Specialty Sports Group’s U.S. aftermarket bike products distribution, sales, service operations to Reno, Nevada.

Seasonality

Certain portions of our business are seasonal; we believe this seasonality is due to the delivery of new products. Generally, our quarterly sales have been the lowest in the first quarter and highest in the third quarter of the year. For example, our sales in our first and third quarters of 2018 represented 21% and 28% of our total sales for the year, respectively.

Competition

The markets for performance-defining products, including suspension components, wheels, and cranks, are highly competitive. We compete with other companies that produce products for sale to OEMs, dealers and distributors, as well as with OEMs which produce their own line of products for their own use. Some of our competitors may have greater financial, research and development or marketing resources than we do. Competition in the high-end segment of the performance-defining market revolves around technical features, performance, product design, innovation, reliability and durability, brand, time to market, customer service and reliable order execution. While the pricing of competing products is always a factor, we believe the performance of our products helps justify our premium pricing. Within our markets, we compete with several large companies and numerous small companies that provide branded and unbranded products across many of our product lines. These competitors can be divided into the following categories:

Powered Vehicles

Within the market for powered vehicle suspension components, we compete with several companies in different submarkets. In the snowmobile market we compete with KYB (Kayaba Industry Co., Ltd.), Öhlins Racing AB (a wholly-owned subsidiary of Tenneco), Walker Evans Racing, Works Performance Products, Inc., and Penske Racing Shocks / Custom Axis, Inc. In the ATV and Side-by-Side markets, outside of vertically-integrated OEMs, we compete with ZF Sachs (ZF Friedrichshafen AG), Polaris, and Walker Evans Racing for OEM business and Elka Suspension Inc., Öhlins Racing AB, Works Performance Products, and Penske Racing Shocks / Custom Axis, Inc. for aftermarket business.

Within the market for off-road and specialty vehicle suspension components, we compete with ThyssenKrupp Bilstein Suspension GmbH (commonly known as Bilstein), and King Shock Technology, Inc. (commonly known as King Shocks), Icon Vehicle Dynamics, Sway-A-Way, Pro Comp USA Suspension, and Rancho (Tenneco). In the market for suspension systems, or lift kits, we compete with TransAmerican Wholesale/Pro Comp USA, Rough Country Suspension Systems, TeraFlex, ReadyLIFT Suspension, Tuff Country EZ-Ride Suspension, and Rusty’s Off-Road. In the market for up-fitted vehicles, we compete with SCA Performance, Rocky Ridge Trucks, and DSI Custom Vehicles.

Specialty Sports

Within the market for bike suspension components, we compete with several companies that manufacture front and rear suspension products, including RockShox (a subsidiary of SRAM Corp.), X-Fusion Shox (a wholly owned subsidiary of A-Pro), Manitou (a subsidiary of HB Performance Systems), SR Suntour, DT Swiss (a subsidiary of Vereinigte Drahtwerke AG), Cane Creek Cycling, DVO Suspension, Bos-Mountain Bike Suspensions, and Öhlins Racing AB. In the market for other bike components, we compete with SRAM, Truvativ and Zipp (all subsidiaries of SRAM Corp.), DT Swiss (a subsidiary of Vereinigte Drahtwerke AG), Mavic (a subsidiary of Amer Sports Corp.), and Shimano.

Our products

We design and manufacture performance-defining products, of which a significant portion is suspension products. These suspension products dissipate the energy and force generated by bikes and powered vehicles while they are in motion. Suspension products allow wheels or skis (in the case of snowmobiles) to move up and down to absorb bumps and shocks while maintaining contact with the ground for better control. Our products use adjustable suspension, position-sensitive damping, electronically controllable damping, multiple air spring technologies, low weight and structural rigidity, all of which improve user control for greater performance.

We use high-grade materials in our products and have developed a number of sophisticated assembly processes to maintain quality across all product lines. Our suspension products are assembled according to precise specifications throughout the assembly process to create consistently high-performance levels and customer satisfaction.

Powered Vehicles

In our powered vehicle product categories, we offer premium products under the FOX, BDS Suspension, Zone Offroad, JKS Manufacturing, RT Pro UTV, 4x4 Posi-Lok, and Tuscany brands for Side-by-Sides, on-road vehicles with and without off-road capabilities, off-road vehicles and trucks, ATVs, snowmobiles, specialty vehicles and applications, motorcycles, and commercial trucks. In each of the years ended December 28, 2018, December 29, 2017 and December 30, 2016, approximately 54%, 48% and 44%, respectively, of our sales were attributable to sales of powered vehicles related products.

Products for these vehicles are designed for use on roads, for trail riding, in racing, and to help provide performance and comfort. Our products have also been used on limited quantities of off-road military vehicles and other small-scale select military applications. Our aftermarket truck suspension component products in the powered vehicles category range from two-inch aluminum bolt-on shocks to our patented position sensitive internal bypass shocks. We also offer lift kits and components with our shock products and aftermarket accessory packages for use in trucks. In addition, we up-fit trucks to be off-road capable, on-road vehicles with components and products such as lift kits, shock products, superchargers, interior accessories, wheel, tires, lighting, and body enhancements.

Specialty Sports

As a result of our acquisitions in recent years, our bike product offerings have expanded and are used on a wide range of performance mountain bikes and road bikes under the FOX, Race Face, Easton Cycling and Marzocchi brands. Given this wide range of bike products and brands, as well as the potential to expand our offerings to include other types of performance-defining products, we have changed the name of the group from Bike Division to Specialty Sports Group. In each of the years ended December 28, 2018, December 29, 2017 and December 30, 2016, approximately 46%, 52% and 56%, respectively, of our sales were attributable to sales of bike-related products. Primarily for the mountain bike market, we offer mid-end and high-end front fork and rear suspension products designed for cross-country, trail, all-mountain, free-ride and downhill riding. Our mountain bike suspension products are sold in four series and under the Marzocchi brand: (i) our Marzocchi BOMBER series, designed for a rider who values ease of use over adjustability (ii) our FOX Rhythm series, designed to provide FOX performance at the entry price point of the high-end mountain bikes segment (iii) our FOX Performance series, designed for demanding enthusiasts; (iv) our FOX Performance Elite series, designed for experienced and expert riders; and (v) our FOX Factory series, designed for maximum performance at a professional level.

We also offer mountain and road bike wheels and other performance-defining cycling components under the Race Face and Easton Cycling brands including cranks, chainrings, pedals, bars, stems, and seat posts.

Research and development

Research and development is at the core of our product innovation and market leadership strategy. We have a growing team of engineers and technicians focused on designing innovative products and developing engineering-based solutions to enhance our product offerings. In addition, a large number of our other employees, many of whom use our products in their recreational activities, contribute to our research and development and product innovation initiatives. Their involvement in the development of new products ranges from participating in initial brainstorming sessions to test riding products in development. Product development also includes collaborating with OEM customers across end-markets, field testing by professional athletes and sponsored race teams and working with enthusiasts and other users of our products. This feedback helps us to develop innovative products which meet our demanding standards as well as the evolving needs of professional and recreational end users and to quickly commercialize these products.

Our research and development activities are supported by state-of-the-art engineering software design tools, integrated manufacturing facilities and a performance testing center equipped to enhance product safety, durability and performance. Our testing center collects data and tests products prior to and after commercial introduction. Suspension products undergo a variety of rigorous performance and accelerated life tests before they are introduced into the market. Research and development expense totaled approximately $25.8 million, $20.2 million and $18.5 million in fiscal years 2018, 2017 and 2016, respectively.

Intellectual property

Intellectual property is an important aspect of our business. We rely upon a combination of patents, trademarks, trade names, licensing arrangements, trade secrets, know-how and proprietary technology and we secure and protect our intellectual property rights.

Our intellectual property counsel diligently protects our new technologies with patents and trademarks and defends against patent infringement allegations. We patent our proprietary technologies related to vehicle suspension and other products in the U.S. and various foreign patent offices. Our principal intellectual property also includes our registered trademarks in the U.S. and a number of international jurisdictions, including the marks FOX®, FOX RACING SHOX® and REDEFINE YOUR LIMITS®. Although our intellectual property is important to our business operations and constitutes a valuable asset in the aggregate, we do not believe that any single patent, trademark or trade secret is critical to the success of our business as a whole. We cannot be certain that our patent applications will be issued or that any issued patents will provide us with any competitive advantages or will not be challenged by third parties.

In addition to the foregoing protections, we generally control access to and use of our proprietary and other confidential information using internal and external controls, including contractual protections with employees, OEMs, distributors and others.

Customers

Our OEM customers include market leaders in their respective categories, and they help define, as well as respond to, consumer trends in their respective industries. These OEM customers include our products on a number of their performance models. We believe OEMs often use our products to improve the marketability and demand of their own products, which, in turn, strengthens our brand image. In addition, consumers select our performance-defining products in the aftermarket channel, where we market through a global network of dealers and distributors. We currently sell to more than 200 OEMs and distribute our products to more than 5,000 retail dealers and distributors worldwide. In 2018, 60% of our sales resulted from sales to OEM customers and 40% resulted from sales to dealers and distributors for resale in the aftermarket channel. No material portion of our business is subject to renegotiation of profits or termination of contracts or subcontracts at the election of the U.S. government.

Sales attributable to our 10 largest OEM customers, which can vary from year-to-year, collectively accounted for approximately 43%, 42% and 42% of our sales in 2018, 2017 and 2016.

Although we refer to the branded bike OEMs that use our products throughout this document as "our customers," "our OEM customers" or "our bike OEM customers," branded bike OEMs often use contract manufacturers to manufacture and assemble their bikes. As a result, even though we typically negotiate price and volume requirements directly with our bike OEM customers, it is the contract manufacturer that may place the purchase order and therefore assumes the payment responsibilities.

Our North American sales totaled $388.7 million, $280.9 million and $221.3 million, or 63%, 59% and 55% of our total sales in 2018, 2017 and 2016, respectively. Sales outside of North America totaled $230.5 million, $194.8 million and $181.8 million or 37%, 41% and 45% of our total sales in 2018, 2017 and 2016, respectively. Sales attributable to countries outside the United States are based on shipment location. Our international sales, however, do not necessarily reflect the location of the end users of our products, as many of our products are incorporated into bikes and powered vehicles that are assembled at international locations and then shipped back to the United States. Additional information about our product revenues and certain geographical information is available in Note 2 - Revenues, of the Notes to Consolidated Financial Statements in this Annual Report on Form 10-K. Powered Vehicles

We sell our powered vehicle-suspension products to OEMs, including Arctic Cat, BRP, Ford, Honda, Jeep, Polaris, Toyota, Triumph and Yamaha. We also are continually nurturing and developing relationships with our existing and new OEMs, as the powered vehicles market continues to grow. After incorporating our products on their powered vehicles, OEMs typically sell their powered vehicles to independent dealers, which then sell directly to consumers.

In the aftermarket, we typically sell to dealers and distributors, both domestically and internationally. Our dealers sell directly to consumers. When we sell to our distributors, they sell to independent dealers, which then sell directly to consumers.

Specialty Sports

We sell our bike suspension and components products to a broad network of domestic and international bike OEMs, including Canyon, Giant, Santa Cruz Bicycles, Scott, Specialized, Trek, Yeti Cycles and YT. We have long-standing relationships with many of the top bike OEMs. After incorporating our products on their bikes, OEMs typically sell their bikes to independent dealers, which then sell directly to consumers.

In the aftermarket, we typically sell to U.S. dealers and through distributors internationally. Our dealers sell directly to aftermarket consumers. Our overseas distributors sell to independent dealers, which then sell directly to consumers.

Sales and marketing

We employ specialized and dedicated sales professionals. Each sales professional is fully responsible for servicing either OEM or aftermarket customers within our product categories, which ensures that our customers are in contact with capable and knowledgeable sales professionals to address their specific needs. We strongly believe that providing a high level of service to our end customers is essential to maintaining our reputational excellence in the marketplace. Our sales professionals receive training on the brands' latest products and technologies and attend trade shows and events to increase their market knowledge.

Our marketing strategy focuses on strengthening and promoting our brands in the marketplace. We strategically focus our marketing efforts on enthusiasts seeking high-end, performance-defining products and systems through promotions at destination riding locations and individual and team sponsorships. We believe the performance of our products has been demonstrated by, and our brands benefit from, the success of professional athletes who use our products in elite competitive events such as the Union Cycliste Internationale Mountain Bike World Cup and the X Games. We also believe these successes positively influence the purchasing habits of enthusiasts and other consumers seeking performance-defining products.

We believe that our strategic focus on the performance and racing segments in our markets, including our sponsorships of a number of professional athletes and race teams, influences many aspiring and enthusiast consumers and enables our products to be sold at premium price points. In order to continue to enhance our brand image, we will need to maintain our position in the suspension products industry and to continue to provide high-quality products and services.

We have also been able to develop long-term strategic relationships with leading OEMs. Our reputation for performance-defining products plays a critical role in our aftermarket sales to consumers.

In addition to our website and traditional marketing channels, such as print advertising and tradeshows, we maintain an active social media presence, including an Instagram feed, Facebook page, YouTube channel, Vimeo channel and Twitter feed to increase brand awareness, foster loyalty and build a community of users. As strategies and marketing plans are developed for our products, our internal marketing and communications group works to ensure brand cohesion and consistency.

Manufacturing and backlog

We manufacture and complete final assembly on most of our products. By controlling the manufacturing process of our products, we can maintain our strict quality standards, customize our machines and processes for the specific requirements of our products, and quickly respond to feedback we receive on our products in development and otherwise. Furthermore, manufacturing our own products enables us to adjust our labor and production inputs to meet seasonal demands and the customized requirements of some of our customers.

During 2018, we moved our corporate headquarters from Scotts Valley, California to our offices in Braselton, Georgia. We also purchased a 23-acre site in Hall County, Georgia to diversify our manufacturing platform and provide additional long-term capacity to support growth in our Powered Vehicles Group. The first phase of the Hall County, Georgia project is expected to be completed in early 2020 and will be used for manufacturing, warehousing, distribution and office space. Our Scotts Valley, California location will remain an essential shared services facility housing certain corporate functions.

In addition, we are also in the process of relocating our aftermarket bike products distribution, sales and service operations from Watsonville and Scotts Valley, California to Reno, Nevada to better serve our customers.

We had approximately $72.9 million and $45.6 million in firm backlog orders at December 28, 2018 and December 29, 2017, respectively. The increase in 2018 backlog, as compared to 2017, was due to normal growth in the business and changes in the seasonality of order placement.

Suppliers and raw materials

The primary raw materials used in the production of our products are aluminum, magnesium, carbon and steel. We generally use multiple suppliers for our raw materials and believe that our raw materials are in adequate supply and available from many suppliers at competitive prices. Prices for our raw materials fluctuate from time to time, but historically, price fluctuations have not had a material impact on our business.

We work closely with our supply base, and depend upon certain suppliers to provide raw inputs, such as forgings, castings and molded polymers that have been optimized for weight, structural integrity, wear and cost. In certain circumstances, we depend upon a limited number of suppliers for such raw inputs. We typically have no firm contractual sourcing agreements with our suppliers other than purchase orders.

Miyaki is the exclusive producer of the Kashima coating for our suspension component tubes. As part of our agreement with Miyaki, or the Kashima Agreement, we have been granted the exclusive right to use the trademark "KASHIMACOAT" on products comprising the aluminum finished parts for suspension components (e.g., tubes) and on related sales and marketing material worldwide, subject to a minimum model year order and certain other exclusions. The Kashima Agreement does not contain minimum purchase obligations.

Employees

As of December 28, 2018, we had approximately 2,240 full-time employees in the United States, Canada, Europe and Taiwan. We also use part-time employees at our manufacturing facilities to help us meet seasonal demands. None of our employees are subject to collective bargaining agreements.

Practices related to working capital items

Government regulation

Environmental

Our manufacturing operations, facilities and properties in the United States, Canada and Taiwan are subject to evolving foreign, international, federal, state and local environmental and occupational health and safety laws and regulations, including those governing air emissions, wastewater discharge and the storage and handling of chemicals and hazardous substances. If we fail to comply with such laws and regulations, we could be subject to significant fines, penalties, costs, liabilities or restrictions on operations, which could negatively affect our financial condition.

We believe that our operations are in compliance, in all material respects, with applicable environmental and occupational health and safety laws and regulations, and our compliance with such laws and regulations has not had, nor is it expected to have, a material impact on our earnings or competitive position. However, new requirements, more stringent application of existing requirements or the discovery of previously unknown environmental conditions could result in material environmental related expenditures in the future.

Employment

We are subject to numerous foreign, federal, state and local government laws and regulations governing our relationships with our employees, including those relating to minimum wage, overtime, working conditions, hiring and firing, non-discrimination, work permits and employee benefits. We believe that our operations are conducted in compliance, in all material respects, with such laws and regulations. We have never experienced a material work stoppage or disruption to our business relating to employee matters. We believe that our relationship with our employees is good.

Consumer safety

We are subject to the jurisdiction of the United States Consumer Product Safety Commission, or the CPSC, and other federal, state and foreign regulatory bodies including the National Highway Traffic Safety Administration, which enforces the Federal Motor Vehicle Safety Standards. Under CPSC regulations, a manufacturer of consumer goods is obligated to notify the CPSC, if, among other things, the manufacturer becomes aware that one of its products has a defect that could create a substantial risk of injury. If the manufacturer has not already undertaken to do so, the CPSC may require a manufacturer to recall a product, which may involve product repair, replacement or refund. During the past three years, we initiated two voluntary product recalls. For additional information, see Item 1A."Risk Factors" below. Government contracts

No material portion of our business is subject to renegotiation of profits or termination of contracts or subcontracts at the election of the U.S. government.

Financial information about segments and geographic Areas

We operate in one reportable segment: manufacturing, sale and service of performance-defining products. Additional information about our product segment and certain geographic information is available in Note 2 - Revenues of the "Notes to Consolidated Financial Statements" in this Annual Report on Form 10-K. Corporate and available information

Our principal executive offices are located at 6634 Hwy 53, Braselton, GA 30517, and our telephone number is (831) 274-6500. Our website address is www.ridefox.com.

We file reports with the SEC, including Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K and any other filings required by the SEC. We make available through the Investor Relations section of our website, free of charge, our Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K, and all amendments to those reports filed or furnished pursuant to Section 13(a) or 15(d) of the Exchange Act, as soon as reasonably practicable after we electronically file such material with, or furnish it to, the SEC. The information on our website is not incorporated by reference into this Annual Report on Form 10-K or in any other report or document we file with the SEC.

The public may read and copy any materials we file with the SEC at the SEC's Public Reference Room at 100 F Street, NE, Washington, DC 20549. The public may obtain information on the operation of the Public Reference Room by calling the SEC at 1-800-SEC-0330. The SEC maintains an Internet site (http://www.sec.gov) that contains reports, proxy and information statements, and other information regarding issuers that file electronically with the SEC.

ITEM 1A. RISK FACTORS

Our business, financial condition, operating results and prospects could be materially and adversely affected by various risks and uncertainties that are described herein. In addition to the risks and uncertainties discussed elsewhere in this Annual Report on Form 10-K, you should carefully consider the risks and uncertainties described below. If any of these risks actually occur, our business, financial condition, operating results and prospects could be materially and adversely affected. In that event, the trading price of our common stock could decline.

Risks related to our business

If we are unable to continue to enhance existing products and develop, manufacture and market new products that respond to consumer needs and preferences and achieve market acceptance, we may experience a decrease in demand for our products, and our business and financial results could suffer.

Our growth strategy involves the continuous development of innovative performance-defining products. We may not be able to compete as effectively with our competitors, and ultimately satisfy the needs and preferences of our customers and the end users of our products, unless we can continue to enhance existing products and develop new, innovative products in the global markets in which we compete. In addition, we must continuously compete not only for end users who purchase our products through the dealers and distributors who are our customers, but also for the OEMs, which incorporate our products into their bikes and powered vehicles. These OEMs regularly evaluate our products against those of our competitors to determine if they are allowing the OEMs to achieve higher sales and market share on a cost-effective basis. Should one or more of our OEM customers determine that they could achieve overall better financial results by incorporating a competitor’s new or existing product, they would likely do so, which could harm our business, financial condition or results of operations.

Product development requires significant financial, technological and other resources. While we expended approximately $25.8 million, $20.2 million and $18.5 million for our research and development efforts in 2018, 2017 and 2016, respectively, there can be no assurance that this level of investment in research and development will be sufficient in the future to maintain our competitive advantage in product innovation, which could cause our business, financial condition or results of operations to suffer.

Product improvements and new product introductions require significant planning, design, development and testing at the technological, product and manufacturing process levels, and we may experience unanticipated delays in our introduction of product improvements or new products. Our competitors’ new products may beat our products to market, be more effective and/or less expensive than our products, obtain better market acceptance or render our products obsolete. Any new products that we develop may not receive market acceptance or otherwise generate any meaningful sales or profits for us relative to our expectations. In addition, one of our competitors could develop an unforeseen and entirely new product or technology that renders our products less desirable or obsolete, which could negatively affect our business, financial condition or results of operations.

We face intense competition in all product lines, including from some competitors that may have greater financial and marketing resources. Failure to compete effectively against competitors would negatively impact our business and operating results.

The industries in which we operate are highly competitive. We compete with a number of other manufacturers that produce and sell performance-defining products to OEMs and aftermarket dealers and distributors, including OEMs that produce their own lines of products for their own use. Our continued success depends on our ability to continue to compete effectively against our competitors, some of which have significantly greater financial, marketing and other resources than we have. Also, several of our competitors offer broader product lines to OEMs, which they may sell in connection with suspension products as part of a package offering. In the future, our competitors may be able to maintain and grow brand strength and market share more effectively or quickly than we do by anticipating the course of market developments more accurately than we do, developing products that are superior to our products, creating manufacturing or distribution capabilities that are superior to ours, producing similar products at a lower cost than we can or adapting more quickly than we do to new technologies or evolving regulatory, industry or customer requirements, among other possibilities. In addition, we may encounter increased competition if our current competitors broaden their product offerings by beginning to produce additional types of performance-defining products or through competitor consolidations. We could also face competition from well-capitalized entrants into these product markets, as well as aggressive pricing tactics by other manufacturers trying to gain market share. As a result, our products may not be able to compete successfully with our competitors’ products, which could negatively affect our business, financial condition or results of operations.

Our business is sensitive to economic conditions that impact consumer spending. Our performance-defining products, and the bike and powered vehicles into which they are incorporated, are discretionary purchases and may be adversely impacted by changes in the economy.

Our business depends substantially on global economic and market conditions. In particular, we believe that currently a significant majority of the end users of our products live in the United States and countries in Europe. These areas are either in the process of recovering from recession or, in some cases, are still struggling with recession, disruption in banking and/or financial systems, economic weakness and uncertainty. In addition, our products are recreational in nature and are generally discretionary purchases by consumers. Consumers are usually more willing to make discretionary purchases during periods of favorable general economic conditions and high consumer confidence. Discretionary spending may also be affected by many other factors, including interest rates, the availability of consumer credit, taxes and consumer confidence in future economic conditions. During periods of unfavorable economic conditions, or periods when other negative market factors exist, consumer discretionary spending is typically reduced, which in turn could reduce our product sales and have a negative effect on our business, financial condition or results of operations.

There could also be a number of secondary effects resulting from an economic downturn, such as insolvency of our suppliers resulting in product delays, an inability of our OEM and distributor and dealer customers to obtain credit to finance purchases of our products, customers delaying payment to us for the purchase of our products due to financial hardship or an increase in bad debt expense. Any of these effects could negatively affect our business, financial condition or results of operations.

If we are unable to maintain our premium brand image, our business may suffer.

Our products are selected by both OEMs and dealers and distributors in part because of the premium brand reputation we hold with them and our end users. Therefore, our success depends on our ability to maintain and build the image of our brands. We have focused on building our brands through producing products or acquiring businesses that produce products that we believe are innovative, high in performance and highly reliable. In addition, our brands benefit from our strong relationships with our OEM customers and dealers and distributors and through marketing programs aimed at bike and powered vehicle enthusiasts in various media and other channels. For example, we sponsor a number of professional athletes and professional race teams. In order to continue to enhance our brand image, we will need to maintain our position in the performance-defining products industry and continue to provide high-quality products and services. Also, we will need to continue to invest in sponsorships, marketing and public relations.

There can be no assurance, however, that we will be able to maintain or enhance the strength of our brands in the future. Our brands could be adversely impacted by, among other things:

| |

• | failure to develop new products that are innovative, performance-oriented, and reliable; |

| |

• | internal product quality control issues; |

| |

• | product quality issues on the bikes and powered vehicles on which our products are installed; |

| |

• | high profile component failures (such as a component failure during a race on a mountain bike ridden by an athlete that we sponsor); |

| |

• | negative publicity regarding our sponsored athletes; |

| |

• | high profile injury or death to one of our sponsored athletes; |

| |

• | inconsistent uses of our brand and our other intellectual property assets, as well as failure to protect our intellectual property; and |

| |

• | changes in consumer trends and perceptions. |

Any adverse impact on our brand could in turn negatively affect our business, financial condition or results of operations.

A significant portion of our sales are highly dependent on the demand for high-end bikes and a material decline in the demand for these bikes or their suspension components could have a material adverse effect on our business or results of operations.

During 2018, approximately 46% of our sales were generated from the sale of bike products. Part of our success has been attributable to the growth in the high-end bike industry, including increases in average retail sales prices, as better-performing product designs and technologies have been incorporated into these products. If the popularity of high-end or premium-priced bikes does not increase or declines, the number of bike enthusiasts seeking such bikes or premium priced suspension products, wheels, cranks and other specialty components for their bikes does not increase or declines, or the average price point of these bikes declines, we may fail to achieve future growth or our sales could decrease, and our business, financial condition or results of operations could be negatively affected. In addition, if current bike enthusiasts stop purchasing our products due to changes in preferences, we may fail to achieve future growth or our sales could be decreased, and our business, financial condition or results of operations could be negatively affected.

Our growth in the powered vehicle category is dependent upon our continued ability to expand our product sales into powered vehicles that require performance-defining products and the continued expansion of the market for these powered vehicles.

Our growth in the powered vehicle category is in part attributable to the expansion of the market for powered vehicles that require performance-defining products. Such market growth includes the creation of new classes of vehicles that need our products, such as Side-by-Sides, and our ability to create products for these vehicles. In the event these markets stopped expanding or contracted, or we are unsuccessful in creating new products for these markets or other competitors successfully enter into these markets, we may fail to achieve future growth or our sales could decrease, and our business, financial condition or results of operations could be negatively affected.

Changes in our customer, channel and product mix could place more rigorous demands on our infrastructure and cause our profitability percentages to fluctuate.

From time to time, we may experience changes in our customer, channel and product mix from changes in demands from existing customers due to shifts in their products and markets. Additionally, the Company may pursue new customers and markets. Such changes in customers, channel and product mix could place more rigorous demands on our infrastructure and supply chain and could result in changes to our profitability and profitability percentages. If customers begin to require more lower-margin products from us and fewer higher-margin products, or place demands on our performance that increase our costs, our business, results of operations and financial condition may suffer.

A disruption in the operations of our facilities, or delays in our planned expansion of certain facilities, could have a negative effect on our business, financial condition or results of operations.

During 2017, we completed the process of moving all of the manufacturing of our bike suspension component products to our facility in Taichung, Taiwan. In connection with this move, we are utilizing, and expect to continue to use, suppliers who are located closer to our facility in Taichung, Taiwan for a number of materials and components. With the transition of all of our bike suspension component manufacturing to Taichung, Taiwan, we have converted the Watsonville manufacturing facility to be a powered vehicle suspension products manufacturing location exclusively. Additionally, in 2018 we announced the planned construction of our new campus in Hall County, Georgia to further diversify our manufacturing platform and provide additional long-term capacity to support growth in our Powered Vehicles Group. In the future, we may move additional manufacturing operations as we re-balance existing facilities or expand to new manufacturing locations. As a result, we have incurred, and expect to continue to incur, costs associated with some duplication of facilities, equipment and personnel, the amount of which could vary materially from our projections. Significant construction delays or other unforeseen difficulties in our current and future expansion projects, whatever the cause, could have a material adverse effect on our business, customer relationships, financial condition, operating results, cash flow, and liquidity.

Equipment failures, delays in deliveries or catastrophic loss at any of our facilities could lead to production or service disruptions, curtailments or shutdowns. In the event of a stoppage in production or a slowdown in production due to high employee turnover or a labor dispute at any of our facilities, even if only temporary, or if we experience delays as a result of events that are beyond our control, delivery times to our customers could be severely affected. If there was a manufacturing disruption in any of our manufacturing facilities, we might be unable to meet product delivery requirements and our business, financial condition or results of operations could be negatively affected, even if the disruption was covered in whole or in part by our business interruption insurance. Any significant delay in deliveries to our customers could lead to increased returns or cancellations, expose us to damage claims from our customers or damage our brand and, in turn, negatively affect our business, financial condition or results of operations.

Work stoppages or other disruptions at seaports could adversely affect our operating results.

A significant portion of our goods move through ports on the Western Coast of the United States. We have a global supply chain and we import products from our third-party vendors as well as our Fox Taiwan facility into the United States largely through ports on the West Coast. Freight arriving at West Coast ports must be offloaded from ships by longshoremen, none of whom are our employees. We do not control the activities of these employees or seaports and we could suffer supply chain disruptions due to any disputes, capacity shortages, slowdowns or shutdowns which may occur, as was experienced in February 2015, in relation to certain West Coast ports. While the West Coast ports labor dispute ended with a five-year agreement, it lasted longer than we forecasted, and any similar labor dispute in the future could potentially have a negative effect on both our financial condition and results of operations.

Our business depends substantially on our ability to attract and retain experienced and qualified talent, including our senior management team.

We are dependent upon the contributions, talent and leadership of our senior management team, particularly our Chief Executive Officer, Larry L. Enterline. We do not have a "key person" life insurance policy on Mr. Enterline or any other key employees. We believe that the top nine members of our senior management team are key to establishing our focus and executing our corporate strategies as they have extensive knowledge of our systems and processes. Given our senior management team’s knowledge of our industry and the limited number of direct competitors in the industry, we believe that it could be difficult to find replacements should any of the members of our senior management team leave. We could also be adversely affected if we fail to attract and retain talent throughout our organization. For instance, we rely on skilled and well-trained engineers for the design and production of our products, as well as in our research and development functions. Competition for such individuals is intense, particularly in California where several of our facilities are located. Our inability to attract or retain qualified employees in our design, production or research and development functions or elsewhere in our Company could result in diminished quality of our products and delinquent production schedules or impede our ability to develop new products.

Our failure to adequately address any of these issues could have a material adverse effect on our business, operating results and financial condition.

We may not be able to sustain our past growth or successfully implement our growth strategy, which may have a negative effect on our business, financial condition or results of operations.

We grew our sales from approximately $475.6 million in 2017 to approximately $619.2 million in 2018. This growth rate may be unsustainable. Our future growth will depend upon various factors, including the strength of the image of our brands, our ability to continue to produce innovative performance-defining products, consumer acceptance of our products, competitive conditions in the marketplace, our ability to make strategic acquisitions, the growth in emerging markets for products requiring high-end suspension products and, in general, the continued growth of the high-end bike and powered vehicle markets into which we sell our products. Our beliefs regarding the future growth of markets for high-end suspension products are based largely on qualitative judgments and limited sources and may not be reliable. If we are unable to sustain our past growth or successfully implement our growth strategy, our business, financial condition or results of operations could be negatively affected.

The professional athletes and race teams who use our products are an important aspect of the image of our brands. The loss of the support of professional athletes for our products or the inability to attract new professional athletes may harm our business.

If our products are not used by current or future professional athletes and race teams, our brands could lose value and our sales could decline. While our sponsorship agreements typically restrict our sponsored athletes and race teams from promoting, endorsing or using competitors’ products that compete directly within our product categories during the term of the sponsorship agreements, we do not typically have long-term contracts with any of the athletes or race teams whom we sponsor.

If we are unable to maintain our current relationships with these professional athletes and race teams, if these professional athletes and race teams are no longer popular, if our sponsored athletes and race teams fail to have success or if we are unable to continue to attract the endorsement of new professional athletes and race teams in the future, the value of our brands and our sales could decline.

We depend on our relationships with dealers and distributors and their ability to sell and service our products. Any disruption in these relationships could harm our sales.