UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

x QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the quarterly period ended January 31, 2021

q TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

Commission File Number: 000-53848

RISE GOLD CORP.

(Exact name of registrant as specified in its charter)

Nevada |

| 30-0692325 |

(State or other jurisdiction of incorporation) |

| (IRS Employer Identification Number) |

| ||

650-669 Howe Street Vancouver, British Columbia, Canada V6C 0B4 | ||

(Address of principal executive offices) (Zip Code) | ||

(604) 260-4577 | ||

(Registrant’s telephone number, including area code) | ||

N/A | ||

(Former name, former address and former fiscal year, if changed since last report) | ||

Securities registered pursuant to Section 12(b) of the Act:

Title of each class |

| Trading Symbol(s) |

| Name of exchange on which registered |

None |

| None |

| None |

|

|

|

|

|

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. [X] Yes [ ] No

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). x Yes q No

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer q | Accelerated filer q |

Non-accelerated filer q | Smaller reporting company x |

Emerging growth company x |

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. q

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). q Yes x No

As of March 15, 2021, the registrant had 26,770,298 shares of common stock issued and outstanding.

PART I - FINANCIAL INFORMATION

ITEM 1. FINANCIAL STATEMENTS.

The condensed consolidated interim financial statements of Rise Gold Corp. (“we”, “us”, “our”, the “Company”, or the “registrant”), a Nevada corporation, included herein were prepared, without audit, pursuant to rules and regulations of the Securities and Exchange Commission. Because certain information and notes normally included in financial statements prepared in accordance with accounting principles generally accepted in the United States of America were condensed or omitted pursuant to such rules and regulations, the condensed consolidated interim financial statements should be read in conjunction with the financial statements and notes thereto included in the audited financial statements of the Company in the Company's Form 10-K for the fiscal year ended July 31, 2020.

1

RISE GOLD CORP.

(AN EXPLORATION STAGE COMPANY)

CONDENSED CONSOLIDATED INTERIM FINANCIAL STATEMENTS

PERIOD ENDED JANUARY 31, 2021

INDEX TO CONSOLIDATED FINANCIAL STATEMENTS: | Page |

|

|

Consolidated Interim Balance Sheet | F-1 |

Consolidated Interim Statement of Loss and Comprehensive Loss | F-2 |

Consolidated Interim Statement of Cash Flows | F-3 |

Consolidated Interim Statement of Stockholders’ Equity | F-4 |

Notes to Unaudited Consolidated Interim Financial Statements | F-5 |

2

RISE GOLD CORP.

(An Exploration Stage Company)

CONDENSED CONSOLIDATED INTERIM BALANCE SHEET

(Expressed in United States Dollars)

(Unaudited)

Nature and continuance of operations (Note 1)

Nature and continuance of operations (Note 1)

Contingency (Note 6)

The accompanying notes are an integral part of these condensed consolidated interim financial statements.

F-1

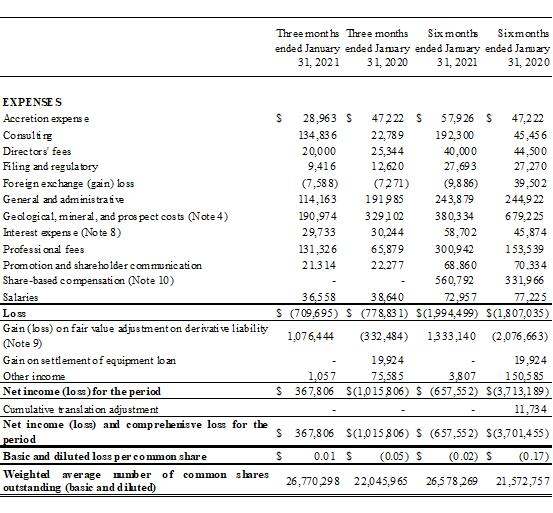

RISE GOLD CORP.

(An Exploration Stage Company)

CONDENSED CONSOLIDATED INTERIM STATEMENT OF LOSS AND COMPREHENSIVE LOSS

(Expressed in United States Dollars)

(Unaudited)

The accompanying notes are an integral part of these condensed consolidated interim financial statements.

F-2

RISE GOLD CORP.

(An Exploration Stage Company)

CONDENSED CONSOLIDATED INTERIM STATEMENT OF CASH FLOWS

(Expressed in United States Dollars)

(Unaudited)

Supplemental cash flow information (Note 11)

Supplemental cash flow information (Note 11)

The accompanying notes are an integral part of these condensed consolidated interim financial statements.

F-3

RISE GOLD CORP.

(An Exploration Stage Company)

CONDENSED CONSOLIDATED INTERIM STATEMENT OF STOCKHOLDERS’ EQUITY

(Expressed in United States Dollars)

(Unaudited)

The accompanying notes are an integral part of these condensed consolidated interim financial statements.

F-4

RISE GOLD CORP.

(An Exploration Stage Company)

NOTES TO THE CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

FOR THE SIX-MONTH PERIOD ENDED JANUARY 31, 2021

(Expressed in United States Dollars)

(Unaudited)

1.NATURE AND CONTINUANCE OF OPERATIONS

Rise Gold Corp. (the “Company”) was originally incorporated as Atlantic Resources Inc. in the State of Nevada on February 9, 2007 and is in the exploration stage. On April 11, 2012, the Company merged its wholly-owned subsidiary, Patriot Minefinders Inc., a Nevada corporation, in and to the Company to effect a name change to Patriot Minefinders Inc. On January 14, 2015, the Company completed a name change to Rise Resources Inc. in the same manner. On April 7, 2017, the Company changed its name to Rise Gold Corp. These mergers were carried out solely for the purpose of effecting these changes of names.

On January 29, 2016, the Company completed an initial public offering in Canada and began trading on the Canadian Securities Exchange (“CSE”) under trading symbol “RISE.CN” on February 1, 2016.

On September 18, 2020, the Company increased its authorized capital from 40,000,000 shares to 400,000,000 shares.

The Company is in the early stages of exploration and, as is common with any exploration company, it raises financing for its acquisition activities. The accompanying condensed consolidated interim financial statements have been prepared on the going concern basis, which presumes that the Company will continue operations for the foreseeable future and will be able to realize assets and discharge liabilities in the normal course of business. The Company has incurred a loss of $657,552 for the six-month period ended January 31, 2021 and has accumulated a deficit of $18,598,151. The ability of the Company to continue as a going concern is dependent on the Company’s ability to maintain continued support from its shareholders and creditors and to raise additional capital and implement its business plan. There is no assurance that the Company will be able to obtain adequate financing in the future or that such financing will be on terms advantageous to the Company. However, management believes that the Company has sufficient working capital to meet its projected minimum financial obligations for the next fiscal year. The consolidated financial statements do not include any adjustments that might be necessary if the Company is unable to continue as a going concern.

Furthermore, the novel coronavirus outbreak (“COVID-19”) was declared a pandemic by the World Health Organization in 2020. The situation is dynamic and the ultimate duration and magnitude of the impact on the economy and the Company’s business are not known at this time. These impacts could include an impact on the Company’s ability to obtain debt and equity financing to fund ongoing exploration activities as well as its ability to explore and conduct business. These consolidated financial statements do not give effect to adjustments that would be necessary to the carrying values and classification of assets and liabilities should the Company be unable to continue as a going concern.

At January 31, 2021, the Company had working capital of $2,215,282 (July 31, 2020 - $3,267,744).

2.BASIS OF PREPARATION

Generally Accepted Accounting Principles

The accompanying unaudited condensed consolidated interim financial statements have been prepared in conformity with generally accepted accounting principles of the United States of America (“US GAAP”) and the rules and regulations of the Securities and Exchange Commission (“SEC”) for financial information with the instructions to Form 10-Q and Regulation S-K. Results are not necessarily indicative of results which may be achieved in the future. The unaudited condensed consolidated interim financial statements should be read in conjunction with the Company’s Annual Report on Form 10-K, which contains the audited financial statements and notes thereto, together with Management’s Discussion and Analysis, for the year ended July 31, 2020. Certain information and footnote disclosures normally included in the financial statements prepared in accordance with US GAAP have been condensed or omitted pursuant to such SEC rules and regulations. The operating results for the six months ended January 31, 2021 are not necessarily indicative of the results that may be expected for the year ended July 31, 2021.

F-5

RISE GOLD CORP.

(An Exploration Stage Company)

NOTES TO THE CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

FOR THE SIX-MONTH PERIOD ENDED JANUARY 31, 2021

(Expressed in United States Dollars)

(Unaudited)

2.BASIS OF PREPARATION (continued)

Basis of Consolidation

These condensed consolidated interim financial statements include the accounts of the Company and its wholly-owned subsidiary, Rise Grass Valley Inc. All significant intercompany accounts and transactions have been eliminated on consolidation.

Subsidiaries

Subsidiaries are all entities over which the Company has exposure to variable returns from its involvement and has the ability to use power over the investee to affect its returns. The existence and effect of potential voting rights that are currently exercisable or convertible are considered when assessing whether the Company controls another entity. Subsidiaries are fully consolidated from the date on which control is transferred to the Company until the date on which control ceases.

The accounts of subsidiaries are prepared for the same reporting period as the parent company, using consistent accounting policies. Intercompany transactions, balances and unrealized gains or losses on transactions are eliminated upon consolidation.

Functional and reporting currency

The Company changed its functional currency from Canadian dollars to United States dollars as at August 1, 2019. The change in functional currency from Canadian dollars to United States dollars is accounted for prospectively from August 1, 2019. Management determined that the Company’s functional currency had changed based on the assessment related to significant changes of the Company’s economic facts and circumstances. These significant changes included the fact that the Company’s equity and debt financings as well as the majority of the Company’s expenses are now primarily denominated in US dollars. Moreover, the Company’s place of business and management are now located in the United States.

In addition, beginning August 1, 2019, the Company also changed its reporting currency from Canadian dollars to United States dollars to provide greater clarity to users of the financial statements. The change in reporting currency was applied retrospectively effective beginning August 1, 2019. Financial statements for all periods presented have been recast into United States dollars.

All monetary assets and liabilities denominated in foreign currencies are translated into United States dollars using exchange rates in effect as of the date of the balance sheet date. The United States dollar translated amounts of nonmonetary assets and liabilities as of August 1, 2019 became the historical accounting basis for those assets and liabilities as of August 1, 2019. Revenue and expense transactions are translated at the approximate exchange rate in effect at the time of the transaction. All resulting exchange differences were recognized within currency translation adjustment, a separate component of shareholders’ equity.

In applying the change in reporting currency, the Company applied the current rate method for presenting the comparative period presented. Under this method, all assets and liabilities of the Company’s operations were translated from their Canadian dollar functional currency into United States dollars using the exchange rates in effect on the balance sheet date, and shareholders’ equity were translated at the historical rates. Opening shareholders’ equity at August 1, 2017 has been translated at the historic rate on that date and any other movements in shareholders’ equity during the period from August 1, 2017 to July 31 2019 were translated using the appropriate historical rates at the date of the respective transaction. All other revenues, expenses and cash flows were translated at the average rates during the reporting periods presented. The resulting translation adjustments are reported under comprehensive income as a separate component of shareholders’ equity.

F-6

RISE GOLD CORP.

(An Exploration Stage Company)

NOTES TO THE CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

FOR THE SIX-MONTH PERIOD ENDED JANUARY 31, 2021

(Expressed in United States Dollars)

(Unaudited)

2.BASIS OF PREPARATION (continued)

Derivatives

Derivatives are initially recognized at the fair value on the date the derivative contract is entered into and transaction costs are expensed. The Company’s derivatives are subsequently re-measured at their fair value at each balance sheet date with changes in fair value recognized in profit or loss. As the exercise price of the Company’s warrants are in Canadian Dollars, and the functional currency of the Company is the United States Dollar, these warrants are considered a derivative as a variable amount of cash in the Company’s functional currency will be received upon exercise.

Use of Estimates

The preparation of these financial statements in conformity with US GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenue and expenses during the reporting period. Significant areas requiring the use of estimates include the carrying value and recoverability of mineral properties and the recognition of deferred tax assets based on the change in unrecognized deductible temporary tax differences. Actual results could differ from those estimates and would impact future results of operations and cash flows.

3.PREPAID EXPENSES

F-7

RISE GOLD CORP.

(An Exploration Stage Company)

NOTES TO THE CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

FOR THE SIX-MONTH PERIOD ENDED JANUARY 31, 2021

(Expressed in United States Dollars)

(Unaudited)

4.MINERAL PROPERTY INTERESTS

The Company’s mineral properties balance consists of:

|

|

| Idaho-Maryland, California |

|

|

|

|

July 31, 2020 and January 31, 2021 |

|

| $ 4,149,053 |

Title to mineral properties

Title to mineral properties involves certain inherent risks due to the difficulties of determining the validity of certain mineral titles as well as the potential for problems arising from the frequently ambiguous conveying history characteristic of many mineral properties. As at January 31, 2021, the Company holds title to the Idaho-Maryland Gold Mine Property.

As of January 31, 2021, based on management’s review of the carrying value of mineral rights, management determined that there is no evidence that the cost of these acquired mineral rights will not be fully recovered and accordingly, the Company determined that no adjustment to the carrying value of mineral rights was required. As of the date of these consolidated financial statements, the Company has not established any proven or probable reserves on its mineral properties and has incurred only acquisition and exploration costs.

Idaho-Maryland Gold Mine Property, California

On August 30, 2016, the Company entered into an option agreement with three parties to purchase a 100% interest in and to the Idaho-Maryland Gold Mine property located near Grass Valley, California, United States; pursuant to the option agreement, in order to exercise the option, the Company was required to pay $2,000,000 by November 30, 2016. Upon execution of the option agreement, the Company paid the vendors a non-refundable cash deposit in the amount of $25,000, which was credited against the purchase price of $2,000,000 upon exercise of the option. On November 30, 2016, the Company negotiated an extension of the closing date of the option agreement to December 26, 2016, in return for a cash payment of $25,000, which was also credited against the purchase price of $2,000,000 upon exercise of the option. On December 28, 2016, the Company negotiated a further no-cost extension of the closing date of the option agreement to April 30, 2017. On January 25, 2017, the Company exercised the option by paying the net amount owing of $1,950,000 and acquired a 100% interest in the Idaho-Maryland Gold Mine property.

In connection with the option agreement, the Company agreed to pay a cash commission of $140,000 equal to 7 per cent of the purchase price of $2,000,000; the commission was settled on January 25, 2017 through the issuance of 92,000 units valued at C$2.00 per unit. Each unit consists of one share of common stock and one transferable share purchase warrant exercisable into one share of common stock at a price of C$4.00 for a period of two years from the date of issuance. On January 24, 2019, these warrants expired unexercised. The Company also incurred additional transaction costs of $109,053, which have been included in the carrying value of the Idaho-Maryland Gold Mine.

F-8

RISE GOLD CORP.

(An Exploration Stage Company)

NOTES TO THE CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

FOR THE SIX-MONTH PERIOD ENDED JANUARY 31, 2021

(Expressed in United States Dollars)

(Unaudited)

4.MINERAL PROPERTY INTERESTS (continued)

Idaho-Maryland Gold Mine Property, California (continued)

On January 6, 2017, the Company entered into an option agreement with Sierra Pacific Industries Inc. (“Sierra”) to purchase a 100% interest in and to certain surface rights totalling approximately 82 acres located near Grass Valley, California, United States, contiguous to the Idaho-Maryland Gold Mine property acquired by the Company on January 25, 2017. Pursuant to the option agreement, in order to exercise the option, the Company was required to pay $1,900,000 by March 31, 2017. Upon execution of the option agreement, the Company paid the vendors a non-refundable cash deposit in the amount of $100,000, which was credited against the purchase price of $1,900,000 upon exercise of the option. On April 3, 2017, the Company negotiated an extension of the closing date of the option agreement to June 30, 2017, in return for a cash payment of $200,000, at which time a payment of $1,600,000 was due in order to exercise the option. On June 7, 2017, the Company negotiated an extension of the closing date of the option agreement to September 30, 2017, in return for a cash payment of $300,000, at which time a payment of $1,300,000 was due in order to exercise the option.

On May 14, 2018, the Company completed the purchase of the surface rights totalling approximately 82 acres by making the final payment of $1,300,000.

As at January 31, 2021, the Company has incurred cumulative exploration expenditures of $6,767,736 on the Idaho-Maryland Gold Mine property as follows:

|

Six months ended January 31, 2021 |

Year ended July 31, 2020

|

|

|

|

Idaho-Maryland Gold Mine expenditures: |

|

|

Opening balance | $ 6,387,402 | $ 4,750,611 |

|

|

|

Consulting | 247,021 | 1,472,374 |

Depreciation | 12,612 | 22,986 |

Engineering | 7,355 | 32,543 |

Exploration | 61,398 | (117,792) |

Logistics | 4,264 | 32,157 |

Rent | 47,502 | 71,363 |

Supplies | - | 11,007 |

Sampling | 182 | 112,153 |

Total expenditures for the period | 380,334 | 1,636,791 |

|

|

|

Closing balance | $ 6,767,736 | $ 6,387,402 |

F-9

RISE GOLD CORP.

(An Exploration Stage Company)

NOTES TO THE CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

FOR THE SIX-MONTH PERIOD ENDED JANUARY 31, 2021

(Expressed in United States Dollars)

(Unaudited)

5.EQUIPMENT

6.CONTINGENCY

During the year ended July 31, 2014, the Company entered into a binding letter of intent (“LOI”) with Wundr Software Inc. (“Wundr”). Under the terms of the LOI, the Company would acquire 100% of the issued and outstanding common shares of Wundr. Due to unforeseen circumstances, the Company did not complete the transactions contemplated in the LOI, which the Company announced had expired on January 10, 2014.

On September 17, 2014, the Company learned that it was the subject, along with a number of additional defendants, of a notice of civil claim (the “Claim”) filed in the Supreme Court of British Columbia by Wundr, under which Wundr is seeking general damages from the Company as well as damages for conspiracy to cause economic harm. None of the allegations contained in the Claim have been proven in court. Management has determined that the probability of the Claim resulting in an unfavourable outcome and financial loss to the Company is unlikely.

7.RELATED PARTY TRANSACTIONS

Key management personnel consist of the Chief Executive Officer, Chief Financial Officer, and the directors of the Company. The remuneration of the key management personnel is as follows:

a)Salaries of $67,500 (2020 - $67,500) to the CEO of the Company.

b)Directors fees of $40,000 (2020 - $44,500) to directors of the Company.

c)During the period ended January 31, 2021, the Company paid $68,992 (2020 - $68,187) in professional and consulting fees to a company controlled by a director of the Company.

d)Share-based compensation of $560,792 (2020 - $326,393) for options granted during the six-month period ended January 31, 2021.

e)As at January 31, 2021 and July 31, 2020, $20,000 and $79,479 were owed to related parties, respectively.

F-10

RISE GOLD CORP.

(An Exploration Stage Company)

NOTES TO THE CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

FOR THE SIX-MONTH PERIOD ENDED JANUARY 31, 2021

(Expressed in United States Dollars)

(Unaudited)

8.LOAN PAYABLE

On September 3, 2019, the Company completed a debt financing with Eridanus Capital LLC (the “Lender”) for $1,000,000 (the “Loan”). The Loan has a term of 4 years and an annual interest rate of 10% for the first two years increasing to 20% in year 3 and to 25% in year 4. Interest will accrue and be paid along with the principal upon the maturity date. The Lender received 1,150,000 bonus share purchase warrants as additional consideration for advancing the Loan. The fair value of these warrants was calculated to be $444,942 which was netted against the loan payable balance along with $15,000 paid to the lender for a total of $459,942 in issuance costs. Each warrant entitles the holder to acquire one share of common stock at an exercise price of $0.80 (C$1.00) for a period of three years from the date of issuance. The Loan may be repaid prior to the maturity date, in whole or in part, provided that all accrued interest is paid. In addition, if total interest payments are less than $200,000, the difference will be paid to the Lender as prepayment compensation. The Loan is secured against the assets of the Company and its subsidiary and will be used for permitting, engineering and working capital at the Company’s Idaho Maryland Gold Project.

F-11

RISE GOLD CORP.

(An Exploration Stage Company)

NOTES TO THE CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

FOR THE SIX-MONTH PERIOD ENDED JANUARY 31, 2021

(Expressed in United States Dollars)

(Unaudited)

9.DERIVATIVE LIABILITY

The exercise price of the Company’s share purchase warrants is fixed in Canadian dollars and the functional currency of the Company is the USD. These warrants are considered to be a derivative as a variable amount of cash in the Company’s functional currency will be received on exercise of the warrants. Accordingly, the share purchase warrants issued as part of past financings, are classified and accounted for as a derivative liability.

The following table shows a continuity of the Company’s derivative liability:

For the six-month period ended January 31, 2021, the Company recorded a total gain on fair value of derivative liability of $1,333,140 during the period (January 31, 2020 – loss of $2,076,663).

The following weighted average assumptions were used for the Black-Scholes pricing model valuation of warrants as at January 31, 2021 and July 31, 2020:

|

January 31, 2021 |

July 31, 2020 |

|

|

|

Risk-free interest rate | 1.52% | 1.52% |

Expected life of warrants | 0.08 to 1.64 years | 0.46 to 2.05 years |

Expected annualized volatility | 84.6% to 116.0% | 92.6% to 117.0% |

Dividend | Nil | Nil |

Forfeiture rate | 0% | 0% |

F-12

RISE GOLD CORP.

(An Exploration Stage Company)

NOTES TO THE CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

FOR THE SIX-MONTH PERIOD ENDED JANUARY 31, 2021

(Expressed in United States Dollars)

(Unaudited)

10.CAPITAL STOCK AND ADDITIONAL PAID-IN-CAPITAL

Private Placements

On July 3, 2019, the Company completed the first tranche of a non-brokered private placement. The Company raised a total of $552,000 (C$725,769) through the sale of 1,036,813 units at a price of $0.50 (C$0.70) per unit where each unit consists of one share of common stock and one-half of one share purchase warrant. Each whole warrant entitles the holder to acquire one additional share at an exercise price of $0.80 (C$1.00) until July 3, 2022.

On August 19, 2019, the Company completed the second tranche of a non-brokered private placement for a total of $2,412,281 (C$3,207,850) through the sale of 4,582,644 units at a price of $0.53 (C$0.70) per unit where each unit consists of one share of common stock and one-half of one share purchase warrant. Each whole warrant is exercisable into one share of common stock at a price of $0.80 (C$1.00) until August 19, 2022. The Company has paid finders’ fees and associated legal fees of $8,710, and issued a total of 11,196 finder’s warrants valued at $4,990 (Note 11), entitling the holder to acquire one share at a price of $0.80 (C$1.00) until August 19, 2022.

On July 31, 2020, the Company completed a non-brokered private placement for a total of $3,272,875 through the issuance of 4,363,833 units at a price of $0.75 per Unit (C$1.02 per Unit), with each Unit comprising of one share of common stock (a “Share”) and one-half of one share purchase warrant. Each whole warrant entitles the holder to acquire one Share at an exercise price of $1.00 until July 31, 2022. The Company paid a total of $40,414 in finders fees and issued a total of 43,435 finders warrants with a fair value of $15,500, where each finder’s warrant entitles the holder to acquire one Share at a price of $1.00 until July 31, 2022. The following weighted average assumptions were used for the Black-Scholes pricing model valuation of these warrants: Risk-free interest rate – 1.52%; expected volatility – 115.42%; share price of C$0.86 and strike price – C$1.02; expected life of warrants – 2 years.

To accommodate the lack of authorized capital to facilitate the closing of the private placement, the Company’s President and CEO surrendered 1,097,298 stock options priced between C$0.70 and C$2.40 per share.

On September 23, 2020, the Company completed a non-brokered private placement for a total of $250,000 through the issuance of 333,333 units at a price of $0.75 per Unit (C$1.02 per Unit), with each Unit comprising one share of common stock and one-half of one common share purchase warrant. Each whole warrant entitles the holder to acquire one Share at an exercise price of $1.00 (C$1.36) until September 21, 2022. The Company has paid associated legal fees of $1,802 in connection with this financing.

F-13

RISE GOLD CORP.

(An Exploration Stage Company)

NOTES TO THE CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

FOR THE SIX-MONTH PERIOD ENDED JANUARY 31, 2021

(Expressed in United States Dollars)

(Unaudited)

10.CAPITAL STOCK AND ADDITIONAL PAID-IN-CAPITAL (continued)

Stock Options

During the year ended July 31, 2020, the Company granted a total of 826,284 stock options with a fair value of $357,271 to employees, officers, directors, and consultants of the Company, exercisable at a weighted average price of C$0.68 per share for a period of five years.

On September 22, 2020, the Company granted a total of 1,338,500 stock options to the Company’s President and CEO, Benjamin Mossman. The stock options are exercisable at a price of $0.90 (C$1.20) per share until September 22, 2025. The company recorded share-based compensation of $560,792 in connection with this grant.

The following incentive stock options were outstanding and exercisable as at January 31, 2021:

| Number of Options |

| Weighted Average Exercise Price (C$) |

|

Expiry Date |

|

|

|

|

|

|

| 110,000 | $ | 1.50 |

| March 22, 2021 |

| 75,000 |

| 0.50 |

| March 17, 2023 |

| 350,000 |

| 1.20 |

| April 19, 2023 |

| 180,000 |

| 1.00 |

| November 30, 2023 |

| 290,000 |

| 0.70 |

| August 21, 2024 |

| 1,338,500 |

| 1.20 |

| September 22, 2025 |

| 2,343,500 | $ | 1.11 |

|

|

As at January 31, 2021, the aggregate intrinsic value of the Company’s stock options is $14,250 (July 31, 2020 – $73,400).

Stock option transactions are summarized as follows:

Share-Based Payments

The Company has a stock option plan under which it is authorized to grant options to executive officers and directors, employees and consultants enabling them to acquire up to 10% of the issued and outstanding common stock of the Company. Under the plan the exercise price of each option equals the market price of the Company’s stock, less any applicable discount, as calculated on the date of grant. The options can be granted for a maximum term of 5 years with vesting determined by the board of directors.

F-14

RISE GOLD CORP.

(An Exploration Stage Company)

NOTES TO THE CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

FOR THE SIX-MONTH PERIOD ENDED JANUARY 31, 2021

(Expressed in United States Dollars)

(Unaudited)

10.CAPITAL STOCK AND ADDITIONAL PAID-IN-CAPITAL (continued)

The following weighted average assumptions were used for the Black-Scholes pricing model valuation of stock options issued during the period ended January 31, 2021 and year ended July 31, 2020:

|

January 31, 2021 |

July 31, 2020 |

|

|

|

Risk-free interest rate | 1.52% | 1.52% |

Expected life of options | 5 years | 3-5 years |

Expected annualized volatility | 119.09% | 117.21% - 123.27% |

Dividend | Nil | Nil |

Forfeiture rate | 0% | 0% |

Warrants

The following warrants were outstanding at January 31, 2021:

| Number of Warrants |

| Exercise Price (C$) |

|

Expiry Date |

|

|

|

|

|

|

| 3,516,100 |

| $ 1.50 |

| April 18, 2021 |

| 288,125 |

| 1.20 |

| August 31, 2021 |

| 200,313 |

| 1.20 |

| September 17, 2021 |

| 933,686 |

| 1.30 |

| March 1, 2021 |

| 518,407 |

| 1.00 |

| July 3, 2022 |

| 2,302,517 |

| 1.00 |

| August 19, 2022 |

| 1,150,000 |

| 1.00 |

| September 3, 2022 |

| 2,225,352 |

| 1.36 |

| July 31, 2022 |

| 166,666 |

| 1.36 |

| September 21, 2022 |

| 11,301,166 |

| $ 1.27 |

|

|

|

|

|

|

|

|

During the period ended January 31, 2021, a total of 1,337,500 warrants with an exercise price of C$1.30 expired unexercised.

Warrant transactions are summarized as follows:

F-15

RISE GOLD CORP.

(An Exploration Stage Company)

NOTES TO THE CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

FOR THE SIX-MONTH PERIOD ENDED JANUARY 31, 2021

(Expressed in United States Dollars)

(Unaudited)

11.SUPPLEMENTAL DISCLOSURE WITH RESPECT TO CASH FLOWS

During the six-month periods ended January 31, 2021 and 2020, the Company had the following non-cash financing and investing activities:

For the period ended January 31, 2021:

a)The Company accrued $58,702 of interest expense as part of the outstanding balance of loan payable.

For the period ended January 31, 2020:

b)Company accrued $42,441 of interest expense as part of the outstanding balance of loan payable.

c)The Company issued a total of 11,196 finder’s warrants entitling the holder to acquire one share at a price of

$1.00 until August 19, 2022 with a fair value of $4,990. The following weighted average assumptions were used for the Black-Scholes pricing model valuation of these warrants: Risk-free interest rate – 1.52%; expected volatility – 123.27%; share price and strike price - C$1.00; expected life of warrants – 3 years.

12.SEGMENTED INFORMATION

A reporting segment is defined as a component of the Company that:

-Engages in business activities from which it may earn revenues and incur expenses;

-Operating results are reviewed regularly by the entity’s chief operating decision maker; and

-Discrete financial information is available.

The Company has determined that it operates its business in one geographical segment located in California, United States, where all of its equipment and mineral property interests are located.

F-16

ITEM 2.MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS.

SPECIAL NOTE OF CAUTION REGARDING FORWARD-LOOKING STATEMENTS

CERTAIN STATEMENTS IN THIS REPORT, INCLUDING STATEMENTS IN THE FOLLOWING DISCUSSION, ARE WHAT ARE KNOWN AS "FORWARD LOOKING STATEMENTS", WHICH ARE BASICALLY STATEMENTS ABOUT THE FUTURE. FOR THAT REASON, THESE STATEMENTS INVOLVE RISK AND UNCERTAINTY SINCE NO ONE CAN ACCURATELY PREDICT THE FUTURE. WORDS SUCH AS "PLANS", "INTENDS", "WILL", "HOPES", "SEEKS", "ANTICIPATES", "EXPECTS" AND THE LIKE OFTEN IDENTIFY SUCH FORWARD LOOKING STATEMENTS, BUT ARE NOT THE ONLY INDICATION THAT A STATEMENT IS A FORWARD LOOKING STATEMENT. SUCH FORWARD LOOKING STATEMENTS INCLUDE STATEMENTS CONCERNING OUR PLANS AND OBJECTIVES WITH RESPECT TO PRESENT AND FUTURE OPERATIONS, AND STATEMENTS WHICH EXPRESS OR IMPLY THAT SUCH PRESENT AND FUTURE OPERATIONS WILL OR MAY PRODUCE REVENUES, INCOME OR PROFITS. NUMEROUS FACTORS AND FUTURE EVENTS COULD CAUSE US TO CHANGE SUCH PLANS AND OBJECTIVES OR FAIL TO SUCCESSFULLY IMPLEMENT SUCH PLANS OR ACHIEVE SUCH OBJECTIVES, OR CAUSE SUCH PRESENT AND FUTURE OPERATIONS TO FAIL TO PRODUCE REVENUES, INCOME OR PROFITS. THEREFORE, THE FOLLOWING DISCUSSION SHOULD BE CONSIDERED IN LIGHT OF THE DISCUSSION OF RISKS AND OTHER FACTORS CONTAINED IN THIS QUARTERLY REPORT ON FORM 10-Q AND IN OUR OTHER FILINGS WITH THE SECURITIES AND EXCHANGE COMMISSION. NO STATEMENTS CONTAINED IN THE FOLLOWING DISCUSSION SHOULD BE CONSTRUED AS A GUARANTEE OR ASSURANCE OF FUTURE PERFORMANCE OR FUTURE RESULTS.

Description of Business

Our Company was incorporated on February 9, 2007 as Atlantic Resources Inc. in the state of Nevada pursuant to the Nevada Revised Statutes. On April 11, 2012, we changed our name to Patriot Minefinders Inc. On January 14, 2015, we changed our name to Rise Resources Inc. On April 7, 2017, we changed our name to Rise Gold Corp.

We are a mineral exploration company and our primary asset is a major past producing high-grade I-M Mine Property near Grass Valley, California, United States, which we own outright. In the past, we have held several other potential mineral properties in British Columbia, Canada, which have been written off based on the strength of the I-M Mine Project.

As of January 31, 2021, based on management’s review of the carrying value of mineral rights, management determined that there is no evidence that the cost of these acquired mineral rights will not be fully recovered and accordingly, the Company determined that no adjustment to the carrying value of mineral rights was required. As of the date of these consolidated financial statements, the Company has not established any proven or probable reserves on its mineral properties and has incurred only acquisition and exploration costs.

On January 14, 2015, we completed a merger with our wholly owned subsidiary, Rise Resources Inc., and formally assumed the subsidiary’s name by filing Articles of Merger with the Nevada Secretary of State. The subsidiary was incorporated entirely for the purpose of effecting the name change and the merger did not affect our Articles of Incorporation or corporate structure in any other way.

On January 22, 2015, we completed a 1 for 80 reverse split of our common stock and effected a corresponding decrease in our authorized capital by filing a Certificate of Change with the Nevada Secretary of State (the “Reverse Split”). As a result of the Reverse Split, our authorized capital decreased from 168,000,000 shares to 2,100,000 and our issued and outstanding common stock decreased from 6,340,000 shares to 79,252, with each fractional share being rounded up to the nearest whole share.

Both the name change and Reverse Split became effective in the market at the open of business on February 9, 2015.

On April 9, 2015, we increased our authorized capital from 2,100,000 to 40,000,000 shares of common stock.

On March 29, 2017, we completed another merger with our wholly owned subsidiary, Rise Gold Corp., and formally assumed the subsidiary’s name by filing Articles of Merger with the Nevada Secretary of State. The subsidiary was incorporated

3

entirely for the purpose of effecting the name change and the merger did not affect our Articles of Incorporation or corporate structure in any other way.

We currently have one wholly owned subsidiary, Rise Grass Valley, Inc., which holds certain of our interests and assets located in the United States, and in particular, our interest in the I-M Mine Property. Rise Grass Valley, Inc. was incorporated in the state of Nevada pursuant to the Nevada Revised Statutes.

Our common stock is currently listed in Canada on the Canadian Securities Exchange (the “CSE”) under the symbol “RISE.CN”. We are a reporting issuer in British Columbia, Alberta, and Ontario in Canada. Our common stock is also currently traded in the United States on the OTCQX Market under the symbol “RYES”. We are an SEC reporting company by virtue of our class of common stock being registered under Section 12(g) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”).

Business Development

Developments in our Company’s business during the July 31, 2020 fiscal year and the six-month period ended January 31, 2021 include the following:

On July 3, 2019, the Company completed the first tranche of a non-brokered private placement. The Company raised a total of $552,000 (C$725,769) through the sale of 1,036,813 units at a price of $0.50 (C$0.70) per unit where each unit consists of one share of common stock and one-half of one share purchase warrant. Each whole warrant entitles the holder to acquire one additional share at an exercise price of $0.80 (C$1.00) until July 3, 2022.

On August 19, 2019, the Company completed the second tranche of a non-brokered private placement for a total of $2,412,281 (C$3,207,850) through the sale of 4,582,644 units at a price of $0.50 (C$0.70) per unit where each unit consists of one share of common stock and one-half of one share purchase warrant. Each whole warrant is exercisable into one share of common stock at a price of $0.80 (C$1.00) until August 19, 2022. The Company has paid finders’ fees and associated legal fees of $8,710 and issued a total of 11,196 finder’s warrants entitling the holder to acquire one share at a price of $0.80 (C$1.00) until August 19, 2022.

On September 3, 2019, the Company completed a debt financing with Eridanus Capital LLC (the “Lender”) for $1,000,000 (the “Loan”). The Loan has a term of 4 years and an annual interest rate of 10% for the first two years increasing to 20% in year 3 and to 25% in year 4. Interest will accrue and be paid along with the principal upon the maturity date. The Lender received 1,150,000 bonus share purchase warrants as additional consideration for advancing the Loan. The fair value of these warrants was calculated to be $444,942 which was netted against the loan payable balance along with $15,000 paid to the lender for a total of $459,942 in other issuance costs. Each warrant entitles the holder to acquire one share of common stock at an exercise price of $0.80 (C$1.00) for a period of three years from the date of issuance. The Loan may be repaid prior to the maturity date, in whole or in part, provided that all accrued interest is paid. In addition, if total interest payments are less than $200,000, the difference will be paid to the Lender as prepayment compensation. The Loan is secured against the assets of the Company and its subsidiary and will be used for permitting, engineering and working capital at the Company’s Idaho Maryland Gold Project.

On November 21, 2019, the Company submitted an application for a Use Permit to Nevada County to allow the re-opening of the Idaho-Maryland Gold Mine. The Use Permit application proposes underground mining to recommence at an average throughput of 1,000 tons per day. On March 17, 2020, the Company provided an update to the application where all technical reports for the Draft Environmental Impact Report have been completed and the timeline for approval is expected to range from 12 to 18 months.

On December 16, 2019, the Company completed a 1 for 10 reverse split of the Company’s authorized and issued shares of common stock with a par value of $0.001 per share. All references to the Company’s shares issued and outstanding have been adjusted to reflect this change.

On July 31, 2020, the Company completed a non-brokered private placement for a total of $3,272,875 through the issuance of 4,363,833 units (each a “Unit”) at a price of $0.75 per Unit (C$1.02 per Unit), with each Unit comprising one share of common stock (a “Share”) and one-half of one share purchase warrant. Each whole warrant entitles the holder to acquire one Share at an exercise price of $1.00 until July 31, 2022. The Company paid a total of $32,576 in finders fees and issued a total

4

of 43,435 finders warrants, where each finder’s warrant entitles the holder to acquire one Share at a price of $1.00 until July 31, 2022. To accommodate the lack of authorized capital to facilitate the closing of the private placement, the Company’s President and CEO surrendered 1,097,298 stock options priced between C$0.70 and C$2.40 per share.

On September 18, 2020, the Company announced an increase of the Company’s authorized capital from 40,000,000 shares of common stock with a par value of $0.001 per share to 400,000,000 shares of common stock with a par value of $0.001 per share.

On September 22, 2020, the Company completed a non-brokered private placement for a total of $250,000 through the issuance of 333,333 units at a price of $0.75 per Unit (C$1.02 per Unit), with each Unit comprising of one share of common stock and one-half of one share purchase warrant. Each whole warrant entitles the holder to acquire one Share at an exercise price of $1.00 until September 21, 2022.

On September 22, 2020, the Company granted a total of 1,338,500 stock options to the President and CEO of the Company. The stock options are exercisable at a price of $0.90 (C$1.20) per share with an expiry date of September 22, 2025.

Plan of Operations

As at January 31, 2021, the Company had a cash balance of $2,112,768, compared to a cash balance of $3,378,826 as of July 31, 2020.

Our plan of operations for the next 12 months is to continue the Use Permit process in Nevada County California, to re-open the Idaho-Maryland gold mine at the I-M Mine Property.

The Company submitted the application for a Use Permit to Nevada County on November 21st 2019. On April 28th, 2020, with a vote of 5-0, the Nevada County (“County”) Board of Supervisors approved the contract for Raney Planning & Management Inc. (“Raney”) to prepare the Environmental Impact Report (“EIR”) and conduct contract planning services on behalf of the County for the proposed Idaho-Maryland Mine Project. Raney began work immediately to review the technical studies submitted by Rise with the Use Permit application and is currently preparing the Draft Environmental Impact Report (“Draft EIR”). A general outline of remaining milestones in the process to approval of the permit is outlined as follows;

1) County planning staff and Raney prepare a Draft EIR which includes holding a public scoping meeting and public comments on which issues should be covered by the EIR;

2) Draft EIR is published for public comment;

3) Raney publishes a Final EIR which includes responses to public comments on the Draft EIR; and

4) County decision makers review the Final EIR, certify the environmental document and consider approval of the Use Permit and Reclamation Plan at a public hearing.

The Company’s estimate of the remaining timeline to approval is approximately May 2021. Ancillary construction and operational permits would follow as needed.

Project Design

The Use Permit application proposes underground mining to recommence at an average throughput of 1,000 tons per day. The existing Brunswick Shaft, which extends to ~3400 feet depth below surface, would be used as the primary rock conveyance from the I-M Mine Property. A second service shaft would be constructed by raising from underground to provide for the conveyance of personnel, materials, and equipment. Gold processing would be done by gravity and flotation to produce gravity and flotation gold concentrates. Processing equipment and operations would be fully enclosed in attractive modern buildings and numerous mature trees located on the perimeter of the Brunswick site would be retained to provide visual shielding of aboveground project facilities and operations.

The Company would produce barren rock from underground tunnelling and sand tailings as part of the project which would be used for creation of approximately 58 acres of level and useable industrial zoned land for future economic development in Nevada County.

5

A water treatment plant and pond, using conventional processes, would ensure that groundwater pumped from the mine is treated to regulatory standards before being discharged to the local waterways.

Detailed studies by professionals in the fields of civil and electrical engineering, biology, hydrology, cultural resources, traffic, air quality, human health, vibration, and sound have guided the design of the project.

Approximately 300 employees would be required if the mine reaches full production.

Government Regulations

We plan to engage in mineral exploration and development activities and will accordingly be exposed to environmental risks associated with mineral exploration activity. We are the operator of the I-M Mine Property.

Our exploration and development activities will be subject to extensive federal, state and local laws, regulations and permits governing protection of the environment. Among other things, its operations must comply with the provisions of the Federal Mine Safety and Health Act of 1977 as administered by the United States Department of Labor.

Our plan is to conduct our operations in a way that safeguards public health and the environment. We believe that our operations comply with applicable environmental laws and regulations in all material respects.

The costs associated with implementing and complying with environmental requirements can be substantial and possible future legislation and regulations could cause us to incur additional operating expenses, capital expenditures, restrictions and delays in developing or conducting operations on its properties, including the I-M Mine Property, the extent of which cannot be predicted with any certainty.

6

Results of Operations

For the Periods Ended January 31, 2021 and 2020

The Company’s operating results for the periods ended January 31, 2021 and 2020 are summarized as follows:

Liquidity and Capital Resources

Working Capital

|

| At January 31, 2021 |

| At July 31, 2020 |

| At July 31, 2019 |

Current Assets | $ | 2,506,964 | $ | 3,762,515 | $ | 416,569 |

Current Liabilities | $ | 291,682 | $ | 494,771 | $ | 923,152 |

Working Capital | $ | 2,215,282 | $ | 3,267,744 | $ | (506,583) |

7

Cash Flows

|

| For the six-month period ended January 31, 2021 |

| For the six-month period ended January 31, 2020 |

Net Cash used in Operating Activities | $ | (1,514,256) | $ | (1,603,191) |

Net Cash used in Investing Activities | $ | - | $ | - |

Net Cash provided by Financing Activities | $ | 248,198 | $ | 3,015,604 |

Net Increase (decrease) in Cash During the Period | $ | (1,266,058) | $ | 1,412,413 |

As of January 31, 2021, the Company had $2,112,768 in cash, $2,506,964 in current assets, $7,244,765 in total assets, $291,682 in current liabilities and $1,743,752 in non-current liabilities, a working capital of $2,215,282 and an accumulated deficit of $18,598,151.

During the six-month period ended January 31, 2021, the Company used $1,514,256 (2020 - $1,603,191) in net cash on operating activities. The difference in net cash used in operating activities during the two periods was largely due to the lower net loss for the most recent period as a result of the revaluation adjustment of the derivative liability.

The Company had no investing activities during the six-month periods ending January 31, 2021 (January 31, 2020 - $Nil).

The Company received net cash of $248,198 (2020 - $3,015,604) from financing activities during the six-month period ended January 31, 2021.

The Company expects to operate at a loss for at least the next 12 months. It has no agreements for additional financing and cannot provide any assurance that additional funding will be available to finance its operations on acceptable terms in order to enable it to carry out its business plan. There are no assurances that the Company will be able to complete further sales of its common stock or any other form of additional financing. If the Company is unable to achieve the financing necessary to continue its plan of operations, then it will not be able to carry out any exploration work on the Idaho-Maryland Property or the other properties in which it owns an interest and its business may fail.

On March 11, 2020, the novel coronavirus outbreak (“COVID-19”) was declared a pandemic by the World Health Organization. Governmental authorities around the world have implemented measures to reduce the spread of COVID-19. These measures have adversely affected workforces, customers, supply chains, consumer sentiment, economies, and financial markets, and, along with decreased consumer spending, have led to an economic downturn across many global economies.

The extent to which COVID-19 ultimately impacts our business, financial condition and results of operations will depend on future developments, which are highly uncertain and unpredictable, including new information which may emerge concerning the severity and duration of the COVID-19 pandemic and the effectiveness of actions taken to contain the COVID-19 pandemic or treat its impact. The COVID-19 pandemic is evolving and new information emerges regularly, and as a result, the ultimate duration and magnitude of the impact on the economy and our business are not known at this time. These conditions may affect our ability to obtain debt and equity financing to fund ongoing exploration activities, as well as conduct business more efficiently.

We have taken action to minimize the risks of the COVID-19 virus for our employees, contractors and other people participating in our operations, programs, and activities. Although there have been no known or suspected cases of the virus reported at any of our workplaces, either in Canada or the United States, the health and safety of our work force remains a priority. We are closely monitoring the rapid developments of the outbreak and continually assessing the potential impact on our business. We continue to follow government health protocols including our continued “work from home” protocol for personnel whose attendance at the office or work sites is not critical.

8

Off Balance Sheet Arrangements

The Company has no off-balance sheet arrangements that have or are reasonably likely to have a current or future effect on its financial condition, changes in financial condition, revenues or expenses, results of operations, liquidity, capital expenditures or capital resources that are material to investors.

ITEM 3.QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK.

Not applicable.

ITEM 4.CONTROLS AND PROCEDURES.

9

Evaluation of Disclosure Controls and Procedures

The Securities and Exchange Commission (the “SEC”) defines the term “disclosure controls and procedures” to mean controls and other procedures of an issuer that are designed to ensure that information required to be disclosed in the reports that it files or submits under the Securities Exchange Act of 1934, as amended (the “Exchange Act”), is recorded, processed, summarized and reported, within the time periods specified in the SEC’s rules and forms. Disclosure controls and procedures include, without limitation, controls and procedures designed to ensure that information required to be disclosed by an issuer in the reports that it files or submits under the Exchange Act is accumulated and communicated to the issuer’s management, including its principal executive and principal financial officers, or persons performing similar functions, as appropriate to allow timely decisions regarding required disclosure.

As of the end of the period covered by this Report, management of the Company carried out an evaluation, with the participation of its Chief Executive Officer and Chief Financial Officer, of the effectiveness of the design and operation of the Company’s disclosure controls and procedures. Based on this evaluation, management concluded that the Company’s disclosure controls and procedures were not effective as of January 31, 2021 because a material weakness in internal control over financial reporting existed as of that date as a result of a lack of segregation of incompatible duties due to insufficient personnel.

A material weakness is a deficiency or a combination of control deficiencies in internal control over financial reporting such that there is a reasonable possibility that a material misstatement of annual or interim financial statements will not be prevented or detected on a timely basis.

Until the Company is able to have the proper staff in place, it likely will not be able to remediate this material weakness.

Changes in Internal Control over Financial Reporting

There were no changes in the Company’s internal control over financial reporting during the period ended January 31, 2021 that have materially affected, or are reasonably likely to materially affect, its internal control over financial reporting.

PART II - OTHER INFORMATION

ITEM 1. LEGAL PROCEEDINGS.

On September 17, 2014, the Company learned that it was the subject, along with a number of additional defendants, of a notice of civil claim (the “Claim”) filed in the Supreme Court of British Columbia by Wundr Software Inc. (“Wundr”), an eBook software developer. Wundr and the Company were formerly parties to a binding letter of intent that was announced on November 12, 2013 (the “Wundr LOI”), pursuant to which the Company proposed to acquire 100% of the outstanding shares of Wundr. On January 10, 2014, the Company reported that the Wundr LOI had expired.

Among other things, the Claim alleges that the Company committed the tort of intentional interference with economic or contractual relations by virtue of its role in an alleged scheme to establish a competing business to Wundr, and that the Company, through its agents, breached the terms of the Wundr LOI by appropriating certain confidential information and intellectual property of Wundr for the purpose of establishing a competing business. The Claim also alleges that the Company is vicariously liable for the actions of its agents.

Wundr is seeking general damages from the Company as well as damages for conspiracy to cause economic harm. None of the allegations contained in the Claim have been proven in court, the Company believes that they are without merit, and it therefore intends to vigorously defend its position against Wundr.

Other than as described above, the Company is not aware of any material pending legal proceedings to which it is a party or of which its property is the subject. The Company also knows of no proceedings to which any of its directors, officers or affiliates, or any registered or beneficial holders of more than 5% of any class of the Company’s securities, or any associate of any such director, officer, affiliate or security holder are an adverse party or have a material interest adverse to the Company.

10

ITEM 1A.RISK FACTORS.

Not required.

ITEM 2.UNREGISTERED SALES OF EQUITY SECURITIES AND USE OF PROCEEDS.

The Company has previously provided disclosure in Form 8-K reports regarding all of its unregistered sales of securities made during the quarter covered by this report.

ITEM 3.DEFAULTS UPON SENIOR SECURITIES.

None.

ITEM 4.MINE SAFETY DISCLOSURES

Not applicable.

ITEM 5. OTHER INFORMATION.

None.

ITEM 6.EXHIBITS.

The following exhibits are filed herewith:

3.1Articles of Incorporation, as amended to date (1)

3.2Bylaws (2)

31.1Certification of the Chief Executive Officer pursuant to Rule 13a-14(a) or 15d-14(a) under the Securities Exchange Act of 1934, as amended, as adopted pursuant to Section 302 of the Sarbanes-Oxley Act of 2002

31.2Certification of the Chief Financial Officer pursuant to Rule 13a-14(a) or 15d-14(a) under the Securities Exchange Act of 1934, as amended, as adopted pursuant to Section 302 of the Sarbanes-Oxley Act of 2002

32.1Certification of the Chief Executive Officer pursuant to 18 U.S.C. Section 1350, as adopted pursuant to Section 906 of the Sarbanes-Oxley Act of 2002

32.2Certification of the Chief Financial Officer pursuant to 18 U.S.C. Section 1350, as adopted pursuant to Section 906 of the Sarbanes-Oxley Act of 2002

101.INSXBRL Instance File

101.SCHXBRL Taxonomy Schema Linkbase Document

101.CALXBRL Taxonomy Extension Calculation Linkbase Document.

101.DEFXBRL Taxonomy Extension Definition Linkbase Document

101.LABXBRL Taxonomy Extension Label Linkbase Document

101.PREXBRL Taxonomy Extension Presentation Linkbase Document

__________________

(1)Included as an exhibit to our registration statement on Form S-1 filed on September 5, 2017 and incorporated herein by reference.

11

(2)Included as an exhibit to our registration statement on Form S-1 filed on February 19, 2008 and incorporated herein by reference.

12

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

By: | /s/ Benjamin Mossman |

| Benjamin Mossman, Chief Executive Officer

|

Date: | March 15, 2021 |

13