Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934 (Amendment No. )

Filed by the Registrant þ

Filed by a Party other than the Registrant ¨

Check the appropriate box:

| ¨ | Preliminary Proxy Statement |

| ¨ | Confidential, for Use of the SEC Only (as permitted by Rule 14a-6(e)(2)) |

| þ | Definitive Proxy Statement |

| ¨ | Definitive Additional Materials |

| ¨ | Soliciting Material Pursuant to §240.14a-12 |

LORILLARD, INC.

(Name of Registrant as Specified In Its Charter)

N/A

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| þ | No fee required. |

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11. |

| (1) | Title of each class of securities to which transaction applies: |

| (2) | Aggregate number of securities to which transaction applies: |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined): |

| (4) | Proposed maximum aggregate value of transaction: |

| (5) | Total fee paid: |

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| (1) | Amount Previously Paid: |

| (2) | Form, Schedule or Registration Statement No.: |

| (3) | Filing Party: |

| (4) | Date Filed: |

Table of Contents

Notice of 2014 Annual Meeting

of Shareholders and Proxy Statement

Greensboro, North Carolina

May 15, 2014

Table of Contents

April 4, 2014

Dear Fellow Shareholder:

You are cordially invited to attend the Annual Meeting of Shareholders for 2014 (the “Annual Meeting”) of Lorillard, Inc. (the “Company”), which will be held at the O.Henry Hotel, 624 Green Valley Road, Greensboro, North Carolina 27408, on May 15, 2014 at 10:00 a.m., eastern daylight time.

At the Annual Meeting, shareholders will be asked to elect the seven director nominees named in the attached proxy statement to hold office for one-year terms until the Annual Meeting of Shareholders for 2015 and until their respective successors are duly elected and qualified, to hold a non-binding, advisory vote to approve the Company’s executive compensation, to approve the 2008 Incentive Compensation Plan as amended and restated, to ratify the selection of Deloitte & Touche LLP as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2014, to consider two shareholder proposals, if properly presented at the Annual Meeting, and to transact such other business as may properly come before the meeting. The accompanying Notice of Annual Meeting and Proxy Statement describe in more detail the business to be conducted at the Annual Meeting and provide other information concerning the Company of which you should be aware when you vote your shares. Also enclosed is a copy of the Company’s Annual Report on Form 10-K for the year ended December 31, 2013.

Admission to the Annual Meeting will be by ticket only. If you are a registered shareholder planning to attend the meeting, please check the appropriate box on the proxy card and retain the bottom portion of the card as your admission ticket. If your shares are held through an intermediary, such as a bank or broker, please follow the instructions under the “About the Annual Meeting of Shareholders” section of the Proxy Statement to obtain a ticket.

Your participation in the Company’s Annual Meeting is important, regardless of the number of shares you own. In order to ensure that your shares are represented at the Annual Meeting, whether you plan to attend or not, please vote in accordance with the enclosed instructions. As a shareholder of record, you can vote your shares by telephone, electronically via the Internet or by submitting the enclosed proxy card. If you vote using the proxy card, you must sign, date and mail the proxy card in the enclosed envelope. If you decide to attend the Annual Meeting and wish to modify your vote, you may revoke your proxy and vote in person at the meeting.

The Board of Directors appreciates your time and attention in reviewing the accompanying Proxy Statement. Thank you for your interest in Lorillard, Inc. We look forward to seeing you at the meeting.

Sincerely,

Murray S. Kessler

Chairman, President and CEO

Table of Contents

LORILLARD, INC.

714 Green Valley Road

Greensboro, North Carolina 27408

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS FOR 2014

To Be Held on May 15, 2014

To Our Shareholders:

The Annual Meeting of Shareholders of Lorillard, Inc. (the “Company”) for 2013 will be held at the O.Henry Hotel, 624 Green Valley Road, Greensboro, North Carolina 27408, on May 15, 2014 at 10:00 a.m., eastern daylight time (the “Annual Meeting”), to consider and vote upon the following matters:

| 1. | To elect seven director nominees named in the attached proxy statement to hold office for one-year terms until the Annual Meeting of Shareholders for 2015, and until their respective successors are duly elected and qualified; |

| 2. | An advisory vote to approve the Company’s executive compensation; |

| 3. | To approve the 2008 Incentive Compensation Plan as amended and restated; |

| 4. | To ratify the selection of Deloitte & Touche LLP as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2014; |

| 5. | To consider a shareholder proposal on disclosure of lobbying policies and practices, if properly presented at the Annual Meeting; |

| 6. | To consider a shareholder proposal on additional disclosure of the health risks of smoking, if properly presented at the Annual Meeting; and |

| 7. | To transact such other business as may properly come before the Annual Meeting or any adjournment or postponement thereof. |

The Board of Directors has fixed the close of business on March 24, 2014 as the record date for the Annual Meeting. Only shareholders of record as of the record date are entitled to notice of, and to vote at, the Annual Meeting and any adjournment or postponement thereof.

By Order of the Board of Directors

Ronald S. Milstein

Executive Vice President, Legal and External Affairs,

General Counsel and Secretary

April 4, 2014

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE ANNUAL MEETING OF SHAREHOLDERS FOR 2014 TO BE HELD ON MAY 15, 2014. THE PROXY STATEMENT FOR THE ANNUAL MEETING AND THE COMPANY’S ANNUAL REPORT ON FORM 10-K FOR THE YEAR ENDED DECEMBER 31, 2013, BOTH OF WHICH ARE PROVIDED HEREWITH, ARE ALSO AVAILABLE AT http://investors.lorillard.com/phoenix.zhtml?c=134955&p=irol-proxy.

PLEASE VOTE YOUR SHARES IN ACCORDANCE WITH THE INSTRUCTIONS PROVIDED IN THE PROXY STATEMENT. IF VOTING USING THE ENCLOSED PROXY CARD, PLEASE MARK, SIGN, DATE AND PROMPTLY RETURN THE PROXY IN THE ADDRESSED REPLY ENVELOPE WHICH IS FURNISHED FOR YOUR CONVENIENCE. THE ENVELOPE NEEDS NO POSTAGE IF MAILED WITHIN THE UNITED STATES.

Table of Contents

2014 Proxy Summary

This proxy summary highlights information contained elsewhere in the Proxy Statement and does not contain all information that you should consider. Please read the entire Proxy Statement carefully before voting.

| Annual Meeting of Shareholders |

| • Time and Date |

10:00 a.m. EDT on Thursday, May 15, 2014 | |

| • Place |

O.Henry Hotel, 624 Green Valley Road, Greensboro, North Carolina 27408 | |

| • Record Date |

March 24, 2014 | |

| • Voting |

Shareholders as of the record date are entitled to vote at the Annual Meeting. Each share of Common Stock is entitled to one vote for each director nominee and each proposal to be voted upon. There is no cumulative voting. | |

| • Admission |

An admission ticket is required for attendance at the Annual Meeting. Please see page 1 for instructions. | |

| Voting Matters |

| Proposal |

Description |

Board’s Voting |

Page |

|||||

| 1 | Election of seven director nominees to hold office until the Annual Meeting of Shareholders for 2015, and until their respective successors are duly elected and qualified | FOR (each Nominee) |

9 | |||||

| 2 | Non-binding, advisory vote to approve the Company’s executive compensation | FOR | 21 | |||||

| 3 | Approval of the 2008 Incentive Compensation Plan as amended and restated | FOR | 52 | |||||

| 4 | Ratification of the selection of Deloitte & Touche LLP as the Company’s independent registered public accounting firm | FOR | 61 | |||||

| 5 | Shareholder proposal on disclosure of lobbying policies and practices | AGAINST | 65 | |||||

| 6 | Shareholder proposal on additional disclosure of the health risks of smoking | AGAINST | 68 | |||||

| Casting Your Vote |

| How to Vote |

Registered Holders and Lorillard Plan Participants |

Beneficial Holders Bank or Nominee | ||||

|

Mobile Device |

Scan the applicable QR Code to vote using |

|

| |||

|

Internet |

Visit the applicable voting website: |

www.investorvote.com/LO |

www.proxyvote.com | |||

|

Telephone |

Within the United States, its territories and Canada using a touch tone phone, dial: |

1-800-652-8683 | Refer to voter instruction form. | |||

|

|

Sign and mail your completed proxy card or voter instruction form to the address provided. | |||||

|

In Person |

For instructions on attending the Annual Meeting in person, see page 1 of the proxy statement. | |||||

For voting via mobile device, the internet or telephone, you will need to have the control number printed on your proxy card or voter instruction form. If you have any difficulties voting, please refer to your proxy card or voter instruction form for additional information.

Table of Contents

| Accessing Proxy Materials Online |

You may access electronic copies of Lorillard’s proxy materials for the Annual Meeting of Shareholders for 2014 by scanning the following QR codes:

|

|

| |

| 2014 Proxy Statement |

2013 Annual Report |

The 2014 Proxy Statement and 2013 Annual Report are available via our website at www.lorillard.com under “Investor Relations — 2014 Annual Meeting of Shareholders.”

| Corporate Governance Highlights |

The following table summarizes certain corporate governance and compensation policies, practices and facts.

| Size of Board |

9 | |

| Average Age of Directors |

63 | |

| Number (%) of Independent Directors |

8 (89%) | |

| Annual Election of Directors |

Yes* | |

| Majority Voting of Directors |

Yes | |

| Separate Chairman and CEO |

No | |

| Lead Independent Director |

Yes | |

| Aggregate Number of Board and Committee Meetings in 2013 |

28 | |

| Executive Sessions of Independent Directors |

Yes | |

| Committees Comprised Solely of Independent Directors |

Yes | |

| Committees Authorized to Engage Independent Advisors |

Yes | |

| Shareholder Rights Plan (“Poison Pill”) |

No | |

| Employment Agreements with Named Executive Officers |

No | |

| Change in Control Tax Gross Ups |

No‡ | |

| Clawback Policy |

Yes | |

| Stock Ownership Guidelines |

Yes | |

| No Hedging Policy |

Yes | |

| Political Contributions and Lobbying Expenditures Policy and Board Oversight |

Yes |

| * | The Company amended its Certificate of Incorporation to provide for the annual election of directors and began electing directors for one-year terms at its Annual Meeting of Shareholders for 2013. Seven of nine directors have been nominated for election to one-year terms at the Annual Meeting of Shareholders for 2014; and all directors will be elected annually at the Annual Meeting of Shareholders for 2015 and thereafter. |

| ‡ | In 2013, the Company terminated and replaced existing severance agreements to eliminate the change in control tax gross up provision, effective January 1, 2014. The Company ceased entering into severance agreements with tax gross up provisions in 2010. |

Table of Contents

| Proposal No. 1 — Election of Seven Director Nominees (see page 9) |

| Name |

Age | Director Since |

Independent | Committee Membership | ||||||||||||||||

| Audit | Compensation | Nominating | ||||||||||||||||||

| Dianne Neal Blixt |

54 | 2011 | Yes | X | Chair | |||||||||||||||

| Andrew H. Card, Jr. |

66 | 2011 | Yes | X | ||||||||||||||||

| Virgis W. Colbert* |

74 | 2008 | Yes | X | X | |||||||||||||||

| David E.R. Dangoor |

64 | 2008 | Yes | X | X | |||||||||||||||

| Murray S. Kessler |

54 | 2010 | No | |||||||||||||||||

| Jerry W. Levin |

69 | 2014 | Yes | |||||||||||||||||

| Richard W. Roedel |

64 | 2008 | Yes | Chair | X | |||||||||||||||

| * | Mr. Colbert serves as the Lead Independent Director. |

Each of our incumbent directors, including the director nominees, attended at least 75% of Board and committee meetings on which he or she served during 2013. If elected, each of the director nominees will serve until the Annual Meeting of Shareholders for 2015, and until their respective successors are duly elected and qualified. The Board recommends a vote FOR each director nominee.

Other Incumbent Directors (not up for election at the Annual Meeting):

| Name |

Age | Director Since |

Independent | Committee Membership | ||||||||||||||||||

| Audit | Compensation | Nominating | ||||||||||||||||||||

| Robert C. Almon |

62 | 2008 | Yes | X | X | |||||||||||||||||

| Kit D. Dietz |

57 | 2008 | Yes | X | Chair |

The terms for the two incumbent directors not up for election at the Annual Meeting will expire at the Annual Meeting of Shareholders for 2015, at which time they will be up for annual election for one-year terms pursuant to the Company’s Amended and Restated Certificate of Incorporation.

| Proposal No. 2 — Advisory Vote to Approve the Company’s Executive Compensation (see page 21) |

We are asking shareholders to approve on an advisory basis the compensation for our Named Executive Officers. The Company has adopted an executive compensation program that reflects the Company’s philosophy that executive compensation should be structured so as to provide pay for performance and align each executive’s interests with the interests of our shareholders. The Board recommends a vote FOR this proposal.

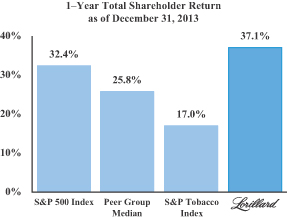

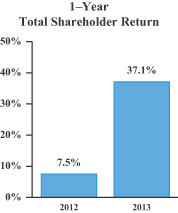

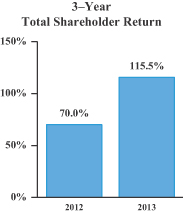

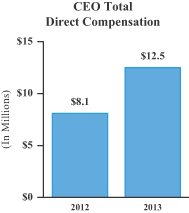

|

Key Performance Highlights for 2013 | ||

|

| |

Table of Contents

|

| |

|

• Annual net sales reached a record $6.950 billion, a 4.9% increase compared to 2012.

• Adjusted operating income(1) for 2013 reached $2.030 billion, a 7.8% increase compared to 2012.

• Adjusted earnings per diluted share(1) for 2013 reached a record $3.12, a 10.6% increase compared to 2012.

• The 11th consecutive year of market share gains resulted in Lorillard domestic retail market share of cigarettes reaching a record 14.9%, a 0.5 share point increase over 2012.

• Total Newport domestic retail market share of cigarettes in 2013 reached a record 12.6%, a 0.6 share point increase over 2012.

• blu eCigs established itself as the U.S. electronic cigarette category leader with a 47% market share in 2013.

• The acquisition of the U.K.-based SKYCIG electronic cigarette business was completed in October 2013.

• $1.6 billion was returned to shareholders in 2013 in the form of share repurchases and dividends.

• Pursuant to our pay for performance philosophy, the incentive compensation payouts awarded by the Compensation Committee to the Named Executive Officers reflect the Company’s performance relative to the targets established at the beginning of 2013. On average, payouts for the 2013 annual incentive plan and 2013 long-term incentive plan for the Named Executive Officers were at 178% and 169% of target based on exceeding the established Company performance targets and individual executive officer performance goals. (1) See Appendix C, “Reconciliation of Reported (GAAP) to Adjusted (Non-GAAP) Results,” for a reconciliation of adjusted operating income and adjusted earnings per diluted share to the reported results for 2012 and 2013.

| ||

Table of Contents

| Proposal No. 3 — Approval of 2008 Incentive Compensation Plan as Amended and Restated (see page 52) |

In 2014, our Board of Directors approved the 2008 Incentive Compensation Plan as amended and restated (the “Amended Plan”) subject to approval by shareholders at the Annual Meeting. Approval of this proposal will also constitute approval of the “material terms of the performance goals” of the Amended Plan for purposes of Section 162(m) of the Internal Revenue Code. The Board of Directors has approved a number of amendments intended to provide greater flexibility to the Compensation Committee in granting awards and determining their terms and conditions. We believe the 2008 Plan has sufficient shares available for expected awards over the next five years, and no additional authorized shares are being sought in the Amended Plan. We believe the 2008 Plan is fulfilling its purpose of providing appropriate incentives to participants to achieve the Company’s goals, rewarding them for achievement of such goals and aligning their interest with those of shareholders, and we seek your approval of the Amended Plan to continue the incentive programs with those changes described more fully in the Proxy Statement. The Board recommends a vote FOR this proposal.

| Proposal No. 4 — Ratification of Independent Registered Public Accounting Firm (see page 61) |

The Audit Committee has appointed Deloitte & Touche LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2014. The submission of this matter for approval by shareholders is not legally required; however, the Board of Directors believes that such submission provides shareholders an opportunity to provide feedback on an important issue of corporate governance. Below is summary information regarding Deloitte & Touche LLP’s fees for services provided in 2012 and 2013. The Board recommends a vote FOR this proposal.

| Year Ended December 31, |

||||||||

| Fees by Type |

2013 | 2012 | ||||||

| (In 000s) | ||||||||

| Audit fees |

$ | 1,724 | $ | 1,661 | ||||

| Audit-related fees |

950 | 573 | ||||||

| Tax fees |

441 | 443 | ||||||

| All other fees |

— | — | ||||||

|

|

|

|

|

|||||

| Total |

$ | 3,115 | $ | 2,677 | ||||

|

|

|

|

|

|||||

Table of Contents

| Proposals No. 5 and 6 — Shareholder Proposals (see pages 65 and 68) |

The Company has received two shareholder proposals for inclusion in the Proxy Statement, if properly presented at the Annual Meeting. The first shareholder proposal relates to the disclosure of lobbying policies and practices. Our Board of Directors has considered the current proposal and believes that adopting the proposal is unnecessary and would not be in the best interests of the Company or its shareholders. The Board has considered similar proposals in 2011, 2012 and 2013. Although those proposals did not receive majority shareholder support, in 2013 we enhanced our policies and practices to provide for additional disclosure regarding Board oversight of political contributions and lobbying expenditures and provided additional disclosure regarding certain types of expenditures in the aggregate. In particular, the Company provides shareholders with information regarding the Company’s guidelines for government relations and political contributions as well as the total contributions made by the Company and its political action committee, which is available on the Company’s website (http://www.lorillard.com/responsibility/political-contributions/).

The second shareholder proposal relates to the additional disclosure of the health risks of smoking. The Company already has implemented and continues to implement responsible measures and other initiatives that render this proposal superfluous. The Company already addresses the matters raised by this proposal through its voluntary communications, programs implemented as part of its settlement with the various states and disclosures mandated by federal statutes, rules and regulations.

The Board recommends votes AGAINST both of these proposals.

| Annual Meeting of Shareholders for 2015 |

The deadline for submission of shareholder proposals for inclusion in the proxy statement for the Annual Meeting of Shareholders for 2015 is December 5, 2014.

Table of Contents

LORILLARD, INC.

2014 PROXY STATEMENT

Table of Contents

LORILLARD, INC.

714 Green Valley Road Greensboro, North Carolina 27408

PROXY STATEMENT FOR THE ANNUAL MEETING OF SHAREHOLDERS FOR 2014 TO BE HELD ON MAY 15, 2014

| ABOUT THE ANNUAL MEETING OF SHAREHOLDERS |

Who is soliciting my vote?

The Board of Directors of Lorillard, Inc., a Delaware corporation (“we,” “our,” “us,” “Lorillard” or the “Company”), is soliciting your vote at our Annual Meeting of Shareholders for 2014, and any adjournment or postponement thereof (the “Annual Meeting”), to be held on the date at the time and place, and for the purposes set forth in the accompanying notice. This Proxy Statement and Appendices A, B and C, the accompanying Notice of Annual Meeting, the enclosed proxy card and our Annual Report on Form 10-K for the year ended December 31, 2013 (the “2013 Annual Report”) filed with the Securities and Exchange Commission (“SEC”) on February 21, 2014 are being mailed to shareholders on or about April 4, 2014.

What is the purpose of the Annual Meeting?

At the Annual Meeting, shareholders will act on the matters outlined in the accompanying notice. The only matters scheduled to be acted upon at the Annual Meeting are (1) the election of the seven nominees named in this Proxy Statement to hold office until the Annual Meeting of Shareholders for 2015 (see page 9 of this Proxy Statement), (2) a non-binding, advisory vote to approve the Company’s executive compensation (see page 21 of this Proxy Statement), (3) approval of the 2008 Incentive Compensation Plan as amended and restated (see page 52 of this Proxy Statement), (4) the ratification of the selection of Deloitte & Touche LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2014 (see page 61 of this Proxy Statement), (5) a shareholder proposal on disclosure of lobbying policies and practices, if properly presented at the Annual Meeting (see page 65 of this Proxy Statement), (6) a shareholder proposal on additional disclosure of the health risks of smoking, if properly presented at the Annual Meeting (see page 68 of this Proxy Statement) and (7) to transact such other business as may properly come before the Annual Meeting or any adjournment or postponement thereof.

Who can attend the Annual Meeting?

Only shareholders of record as of March 24, 2014 (the “Record Date”), or their duly appointed proxies, may attend the Annual Meeting. Registration and seating for the Annual Meeting on May 15, 2014 will begin at 9:00 a.m. Shareholders will be asked to present valid picture identification, such as a driver’s license or passport. Cameras, recording devices and other electronic devices will not be permitted at the Annual Meeting.

Please note that if you hold your shares in “street name” (that is, through a broker or other nominee), you must bring either a copy of the voting instruction card provided by your broker or nominee or a copy of a brokerage statement reflecting your stock ownership as of the record date and check in at the registration desk at the Annual Meeting.

A list of shareholders entitled to vote at the Annual Meeting will be available for examination by any shareholder for any purpose germane to the Annual Meeting beginning ten days prior to the Annual Meeting during ordinary business hours at 714 Green Valley Road, Greensboro, North Carolina 27408, the Company’s principal place of business, and ending on the date of the Annual Meeting.

1

Table of Contents

Do I need a ticket to attend the Annual Meeting?

Yes. Attendance at the Annual Meeting will be limited to shareholders as of the Record Date, their authorized representatives and our guests. Admission will be by ticket only. For registered shareholders, the bottom portion of the proxy card enclosed with the Proxy Statement is the Annual Meeting ticket. If you are a beneficial owner and hold your shares in “street name,” or through an intermediary, such as a bank or broker, you should request tickets in writing from Lorillard, Inc., Attention: Investor Relations, 714 Green Valley Road, Greensboro, North Carolina 27408, and include proof of ownership, such as a bank or brokerage firm account statement or letter from the broker, trustee, bank or nominee holding your stock, confirming your beneficial ownership. Shareholders who do not obtain tickets in advance may obtain them on the Annual Meeting date at the registration desk upon verifying their stock ownership as of the Record Date. In accordance with our security procedures, all persons attending the Annual Meeting must present a picture identification along with their admission ticket or proof of beneficial ownership in order to gain admission. Admission to the Annual Meeting will be expedited if tickets are obtained in advance. Tickets may be issued to others at our discretion.

How many votes do I have?

You will have one vote for every share of our common stock, $0.01 par value, (“Common Stock”) you owned on the Record Date.

How many votes can be cast by all shareholders?

362,535,697 votes may be cast at the Annual Meeting, representing one vote for each share of our Common Stock that was outstanding on the Record Date. There is no cumulative voting, and the holders of our Common Stock vote together as a single class.

How many votes must be present to hold the Annual Meeting?

A majority of the outstanding shares of our Common Stock entitled to vote at the Annual Meeting must be represented, in person or by proxy, to constitute a quorum at the Annual Meeting. Abstentions will be counted as present in determining the existence of a quorum.

What is a broker non-vote?

Generally, a broker non-vote occurs when shares held by a bank or broker for a beneficial owner are not voted with respect to a particular proposal because (i) the bank or broker has not received voting instructions from the beneficial owner and (ii) the bank or broker lacks discretionary voting power to vote such shares on a particular matter. Under the New York Stock Exchange (the “NYSE”) regulations, a bank or broker does not have discretionary voting power with respect to “non-routine” matters. The NYSE rules classify Proposal Nos. 1, 2, 3, 5 and 6 in the Proxy Statement as non-routine matters which prevents banks and brokers from voting the shares of beneficial owners who do not provide voting instructions. As a result, banks and brokers do not have discretionary authority to vote the shares of beneficial owners for Proposal Nos. 1, 2, 3, 5 and 6. Banks and brokers have discretionary authority to vote on Proposal No. 4.

How many votes are required to elect directors and adopt any other proposals?

Proposal No. 1 — the election of each director nominee – requires the affirmative vote of a majority of the votes cast “for” or “against” each nominee’s election at the Annual Meeting, in person or by proxy. Votes may be cast “for” or “against” each nominee or a shareholder may abstain from voting with respect to one or more nominees. In determining whether the nominees have received the requisite number of affirmative votes, abstentions will have no effect on the outcome of the vote. Pursuant to NYSE regulations, brokers do not have discretionary voting power on this proposal, and broker non-votes will have no effect on the outcome of the vote. In the event of a contested election, the nominees will be elected by the affirmative vote of a plurality of the votes cast for the election of directors at the Annual Meeting.

2

Table of Contents

Proposal Nos. 2, 3, 4, 5 and 6 — the nonbinding, advisory vote to approve the Company’s executive compensation, the approval of the 2008 Incentive Compensation Plan as amended and restated, the ratification of the selection of our independent registered public accounting firm and two shareholder proposals — and generally all other matters that may come before the Annual Meeting, require the affirmative vote of the holders of a majority of the shares of our Common Stock represented, in person or by proxy, and entitled to vote on the specific proposal at the Annual Meeting. Votes may be cast “for” or “against” such proposals, or a shareholder may abstain from voting on such proposals. Abstentions will have the same effect as a negative vote on these proposals. Pursuant to NYSE regulations, brokers do not have discretionary voting power with respect to any of these proposals, except the ratification of the selection of our independent registered public accounting firm. Broker non-votes will have no effect on the outcome of the vote.

How do I vote?

You can vote in person or by valid proxy received by telephone, via the Internet or by mail. If voting by mail, you must:

| • | indicate your instructions on the proxy card; |

| • | date and sign the proxy card; |

| • | mail the proxy card promptly in the enclosed envelope; and |

| • | allow sufficient time for the proxy card to be received before the date of the Annual Meeting. |

Alternatively, in lieu of returning signed proxy cards, our shareholders of record can vote their shares by telephone or via the Internet. If you are a registered shareholder (that is, if you hold your stock in certificate form or book entry form on the records of our transfer agent), you may vote by telephone or electronically through the Internet by following the instructions included with your proxy card. The deadline for voting by telephone or electronically through the Internet is 11:59 p.m., eastern daylight time, on May 14, 2014. If your shares are held in “street name” such as in a stock brokerage account or by a bank or other nominee, please check your proxy card or contact your broker or nominee to determine whether you will be able to vote by telephone or electronically through the Internet.

Can I change my vote?

Yes. A proxy may be revoked at any time prior to the voting at the Annual Meeting by submitting a later dated proxy (including a proxy by telephone or electronically through the Internet), by giving timely written notice of such revocation to our Corporate Secretary or by attending the Annual Meeting and voting in person. However, if you hold shares in “street name,” you may not vote these shares in person at the Annual Meeting unless you bring with you a legal proxy from the shareholder of record.

What if I do not vote for some of the matters listed on my proxy card?

Shares of our Common Stock represented by proxies received by us (whether through the return of the enclosed proxy card, by telephone or through the Internet), where the shareholder has specified his or her choice with respect to the proposals described in this Proxy Statement will be voted in accordance with the specification(s) so made.

3

Table of Contents

If you are a shareholder of record and you do not vote your proxy, no votes will be cast on your behalf on any of the proposals at the Annual Meeting. If you sign and return your proxy card without specific voting instructions, or if you vote by telephone or via the Internet without indicating how you want to vote, your shares will be voted in accordance with the Board’s voting recommendations as follows:

| Proposal |

Description |

Board’s Voting | ||

| 1 | Election of seven director nominees to hold office until the Annual Meeting of Shareholders for 2015, and until their respective successors are duly elected and qualified |

FOR (each Nominee) | ||

| 2 | Non-binding, advisory vote to approve the Company’s executive compensation |

FOR | ||

| 3 | Approval of the 2008 Incentive Compensation Plan as amended and restated |

FOR | ||

| 4 | Ratification of the selection of Deloitte & Touche LLP as the Company’s independent registered public accounting firm |

FOR | ||

| 5 | Shareholder proposal on disclosure of lobbying policies and practices |

AGAINST | ||

| 6 | Shareholder proposal on additional disclosure of the health risks of smoking |

AGAINST |

If you are a shareholder through a bank or broker, see “What is a broker non-vote?” above for more information on how shares may be voted in the absence of submitted voting instructions.

Could other matters be decided at the Annual Meeting?

The Board of Directors does not intend to bring any matter before the Annual Meeting other than those set forth above, and the Board is not aware of any matters that anyone else proposes to present for action at the Annual Meeting. However, if any other matters properly come before the Annual Meeting, the persons named in the enclosed proxy, or their duly constituted substitutes acting at the Annual Meeting, will be authorized to vote or otherwise act thereon in accordance with their judgment on such matters.

Who will pay for the cost of this proxy solicitation?

We will pay the cost of soliciting proxies. Our directors, officers and employees may solicit proxies on behalf of the Company in person or by telephone, facsimile or other electronic means. We have engaged Georgeson Shareholder Communications Inc. to assist us in the distribution and solicitation of proxies for a fee of $14,000 plus expenses. In accordance with the regulations of the SEC and the NYSE, we also reimburse brokerage firms and other custodians, nominees and fiduciaries for their expenses incurred in sending proxies and proxy materials to beneficial owners of our Common Stock as of the Record Date.

Has the Company adopted the new e-proxy rules for the delivery of the proxy materials?

No. We are delivering the proxy materials, including the 2013 Annual Report, the Proxy Statement and other materials, to all shareholders. We will evaluate whether to adopt the notice and access option under the e-proxy rules for delivery of proxy materials for future annual meetings.

How can I access the Company’s proxy materials and 2013 Annual Report electronically?

Copies of the 2013 Annual Report, the Proxy Statement and other materials filed by the Company with the SEC are available without charge to shareholders on our corporate website at www.lorillard.com or upon written request to Lorillard, Inc., Attention: Corporate Secretary, 714 Green Valley Road, Greensboro, North Carolina 27408. You can elect to receive future annual reports and proxy statements electronically by following the instructions provided if you vote via the Internet or by telephone.

4

Table of Contents

What financial information is accompanying the Proxy Statement?

Accompanying the Proxy Statement is the 2013 Annual Report. The 2013 Annual Report includes our audited consolidated financial statements as of December 31, 2013 and 2012 and for the years ended December 31, 2013, 2012 and 2011. Based on the inherent uncertainties of our business, the historical financial information included in the 2013 Annual Report and selected financial data may not be indicative of what our results of operations and financial position will be in the future.

Has the Proxy Statement been updated to reflect the Company’s three-for-one stock split on January 15, 2013?

Yes. The Company’s Board of Directors declared a three-for-one split of our Common Stock effected in the form of a 200% stock dividend. The record date of the stock split was December 14, 2012, and the additional shares were distributed January 15, 2013. All shares, per share amounts and exercise prices for all periods presented in this Proxy Statement have been adjusted for the stock split.

NO PERSON IS AUTHORIZED TO GIVE ANY INFORMATION OR TO MAKE ANY REPRESENTATION OTHER THAN THOSE CONTAINED IN THIS PROXY STATEMENT, AND, IF GIVEN OR MADE, SUCH INFORMATION MUST NOT BE RELIED UPON AS HAVING BEEN AUTHORIZED. THE DELIVERY OF THIS PROXY STATEMENT SHALL, UNDER NO CIRCUMSTANCES, CREATE ANY IMPLICATION THAT THERE HAS BEEN NO CHANGE IN THE AFFAIRS OF THE COMPANY SINCE THE DATE OF THIS PROXY STATEMENT.

5

Table of Contents

| BOARD OF DIRECTORS |

Our Board of Directors currently consists of nine members. Our Amended and Restated Certificate of Incorporation provides for annual election of directors for one-year terms, which began in 2013, and at each subsequent annual meeting directors will be elected for one-year terms resulting in the entire Board being elected annually beginning with the Annual Meeting of Shareholders for 2015. The following table sets forth certain information with respect to the members of our Board of Directors:

| Name |

Age |

Position(s) |

Term Expires |

|||||||

| Murray S. Kessler |

54 | Chairman of the Board, President and Chief Executive Officer | 2014 | |||||||

| Robert C. Almon |

62 | Director | 2015 | |||||||

| Dianne Neal Blixt |

54 | Director; Chair of the Compensation Committee | 2014 | |||||||

| Andrew H. Card, Jr. |

66 | Director | 2014 | |||||||

| Virgis W. Colbert |

74 | Lead Independent Director | 2014 | |||||||

| David E.R. Dangoor |

64 | Director | 2014 | |||||||

| Kit D. Dietz |

57 | Director; Chair of the Nominating and Corporate Governance Committee | 2015 | |||||||

| Jerry W. Levin |

69 | Director | 2014 | |||||||

| Richard W. Roedel |

64 | Director; Chair of the Audit Committee | 2014 | |||||||

Below are biographies for each of the director nominees and continuing directors which contain information regarding the individual’s service as a director of the Company, business experience, director positions held currently or at any time in the past five years, information regarding involvement in certain legal or administrative proceedings, if applicable, and the experiences, qualifications, attributes or skills that caused the Board to determine that such individual should serve as a director of the Company. The process undertaken by the Nominating and Corporate Governance Committee in recommending qualified director candidates to the Board is described below under “Corporate Governance–Nomination Process and Qualifications for Director Nominees” (see page 13 of this Proxy Statement).

Murray S. Kessler joined Lorillard in September 2010 as Director, President and Chief Executive Officer, and assumed the role of Chairman of the Board on January 1, 2011. Prior to joining Lorillard, Mr. Kessler was Vice Chair of Altria Group, Inc. (“Altria”) and President and Chief Executive Officer of UST LLC, a wholly owned subsidiary of Altria. Mr. Kessler held this position from January 2009 through June 2009, the six months following the acquisition of UST, Inc. (“UST”) by Altria. Prior to 2009, Mr. Kessler had served as Chairman of the Board of UST, the principal businesses of which included U.S. Smokeless Tobacco Company (“USSTC”) and Ste. Michelle Wine Estates, since January 2008 and President and Chief Executive Officer of UST since January 2007. He was President and Chief Operating Officer from November 2005 to December 2006 and was President of USSTC from April 2000 through October 2005. Mr. Kessler served as a director of UST from 2005 through 2008. Prior to joining UST, Mr. Kessler had over 18 years of consumer packaged goods experience with companies, including Campbell Soup and Clorox. As a result of these and other professional experiences, Mr. Kessler has particular knowledge of and extensive experience in the leadership, operations, strategic planning, finance, sales and marketing of a major company in the tobacco industry, senior management of regulated consumer package goods companies as well as public company board and committee practices.

Robert C. Almon became a director of Lorillard in November 2008. Mr. Almon has served as Executive Vice President and Chief Financial Officer at Pace University in New York since September 2013 and from May 2010 through January 2012. From January 2012 to August 2013, he served as Senior Adviser to the President for Enterprise Finance and Long-range Financial Planning at Pace University. From 1998 until 2007, Mr. Almon was a principal of Ernst & Young LLP where he established and served as National Director of the Center for Strategic Transactions, a strategy consulting practice focused on enhancing shareholder value, and subsequently he served on Ernst & Young’s Partner Advisory Council. Prior to 1998, Mr. Almon was a Managing Director in

6

Table of Contents

Corporate Finance at Salomon Brothers (now Citigroup) and previously at Lehman Brothers. Before becoming an investment banker he held strategic and treasury positions with General Motors Corporation and General Motors Acceptance Corporation (now Ally Financial). Since May 2009, Mr. Almon has served as the independent trustee of GMAC Common Equity Trust I (“Trust”) with absolute discretion to manage approximately 10% of the common equity interests of GMAC and/or proceeds therefrom held by the Trust for the benefit of General Motors Company as sole beneficiary. As a result of these and other professional experiences, Mr. Almon has particular knowledge of and extensive experience in strategic consulting, capital structure, finance and risk management.

Dianne Neal Blixt became a director of Lorillard, Inc. in January 2011. Ms. Blixt served as Executive Vice President and Chief Financial Officer of Reynolds American Inc. (“RAI”) from July 2004 until her retirement in December 2007. Prior to that, she had served as Executive Vice President and Chief Financial Officer of R.J. Reynolds Tobacco Holdings, Inc., a wholly owned subsidiary of RAI, from July 2003 to June 2004. Ms. Blixt served in various roles of increasing responsibility with RAI and its subsidiaries since 1988. In addition to Lorillard, Inc., she also serves on the board of directors of Ameriprise Financial, Inc. Ms. Blixt served on the board of directors of LandAmerica Financial Group, Inc. from 2006 to 2009 and Metavante Technologies, Inc. from 2007 to 2009. She is also Chairperson of the board of directors for the Reynolda House Museum of American Art. As a result of these and other professional experiences, Ms. Blixt has particular knowledge and extensive experience in finance, accounting, risk management and strategic planning in the tobacco industry.

Andrew H. Card, Jr. became a director of Lorillard in August 2011. Mr. Card serves as Executive Director, Office of the Provost and Vice President for Academic Affairs at Texas A&M University. From July 2011 to July 2013, he served as the Acting Dean of the Bush School at Texas A&M University. He served as Chief of Staff to President George W. Bush from November 2000 to April 2006. Prior to serving on the White House staff, Mr. Card was Vice President, Government Relations for General Motors Corporation. From 1993 to 1998, Mr. Card was President and Chief Executive Officer of the American Automobile Manufacturers Association. Mr. Card served as the 11th Secretary of Transportation under President George H.W. Bush from 1992 to 1993. He also served as a Deputy Assistant to the President and Director of Intergovernmental Affairs for President Ronald Reagan. Mr. Card serves as a director of Union Pacific Corp. He also serves on the board of directors of the Museum of the American Revolution. As a result of these and other professional experiences, Mr. Card has particular knowledge of and extensive experience in top-level federal government relations, business leadership and economic affairs.

Virgis W. Colbert became a director of Lorillard in July 2008 and has served as Lead Independent Director since May 2013. Mr. Colbert served in a variety of key leadership positions with Miller Brewing Company since 1979, including Executive Vice President of Worldwide Operations from 1997 to 2005 and Senior Vice President of Operations from 1993 to 1997. He continues to serve as a Senior Advisor to MillerCoors LLC. Mr. Colbert serves on the Board of Directors of STAG Industrials, Inc. Mr. Colbert also served on the Board of Directors of Bank of America Corp. from 2009 to 2013, Stanley Black & Decker from 2009 to 2013, The Hillshire Brands Company (formerly known as Sara Lee Corporation) from 2006 to 2013, and The Manitowoc Company, Inc. from 2001 to 2012. He is Director Emeritus of the Board for the Thurgood Marshall Scholarship Fund and former Chairman of the Board of Trustees for Fisk University. He is a life member of the National Association for the Advancement of Colored People. As a result of these and other professional experiences, Mr. Colbert has particular knowledge of and extensive experience in public company board and committee practices and in the management and oversight of a regulated consumer business, including operations, logistics and strategic planning.

David E.R. Dangoor became a director of Lorillard in July 2008. Mr. Dangoor has been President of Innoventive Partners LLC, a firm providing consulting services in the fields of marketing strategy and public relations, since 2003. Mr. Dangoor retired from Philip Morris Companies Inc. (now known as Altria) in 2002 following more than 27 years in senior executive positions, which included Head of Marketing, Philip Morris Germany; President, Philip Morris Canada; Senior Vice President of Marketing, Philip Morris USA, and Executive Vice President, Philip Morris International. Mr. Dangoor serves as a director of Lifetime Brands, Inc.; Chairman of the Board of Directors of BioGaia AB; and a member of the Advisory Board of the Denihan

7

Table of Contents

Hospitality Group. As a result of these and other professional experiences, Mr. Dangoor has particular knowledge and extensive experience in marketing, finance and strategic planning in the tobacco industry.

Kit D. Dietz became a director of Lorillard in June 2008. Mr. Dietz is the principal of Dietz Consulting LLC, a consulting firm founded in 2004 to provide consulting services for the convenience industry in the United States and Canada. In 2003, Mr. Dietz was a Senior Vice President with Willard Bishop Consulting LTD, which provides consulting services to companies in the food industry, including consumer packaged goods companies. Mr. Dietz also served as Chairman of Tripifoods, Inc. and president of J.F. Walker Company, Inc., L&L Jiroch Distributing Company, Inc. and United Wholesale Company, Inc. In addition, Mr. Dietz has served on the Board of Directors of the American Wholesale Marketer’s Association, an international trade organization working on behalf of convenience distributors in the United States, and was the Chairman of its Industry Education Committee. Mr. Dietz continues to provide consulting services to the American Wholesale Marketer’s Association and leading consumer packaged goods manufacturers to enhance their market strategies and efficiencies in the convenience channel. As a result of these and other professional experiences, Mr. Dietz has particular knowledge of and extensive experience with supply chain and strategic consulting in the tobacco industry and its distribution channels.

Jerry W. Levin became a director of Lorillard in March 2014. Mr. Levin has served as Executive Chairman of Wilton Brands Inc., a creative consumer products company, since October 2009. He served as Chief Executive Officer of Wilton Brands Inc. from October 2009 to March 2014. Mr. Levin also served as Chairman and Chief Executive Officer of JW Levin Partners LLC, a management and investment firm, since founding the firm in February 2005. He served as Vice Chairman of Clinton Group, a private diversified asset management company, from December 2007 until October 2008. Mr. Levin served as Chairman of Sharper Image Corporation, a specialty retailer, from September 2006 until April 2008 and as interim Chief Executive Officer from September 2006 until April 2007. From 1998 until January 2005, Mr. Levin served as the Chairman and Chief Executive Officer of American Household, Inc. (formerly Sunbeam Corporation), a leading consumer products company. Prior to that, he served as chief executive officer for a number of large consumer product companies. Mr. Levin serves on the Board of Directors of U.S. Bancorp and Ecolab Inc. He served on the Board of Directors of Saks Incorporated from 2007 to 2013. As a result of these and other professional experiences, Mr. Levin has particular knowledge of and extensive experience in senior management of consumer product businesses, including extensive experience in leadership, marketing, operations, mergers and acquisitions and strategic planning.

Richard W. Roedel became a director of Lorillard in June 2008. He is also a director and member of the Audit Committee and Chairman of the Risk Committee of IHS, Inc., a director and member of the Audit Committee of Six Flags Entertainment Corporation, and a director and non-executive chairman of Luna Innovations Incorporated. From 1985 through 2000, Mr. Roedel was employed by the accounting firm BDO Seidman LLP, the United States member firm of BDO International, as an Audit Partner, being promoted in 1990 to Managing Partner in Chicago, and then to Managing Partner in New York in 1994, and finally in 1999 to Chairman and Chief Executive. Mr. Roedel joined the Board of Directors of Take-Two Interactive Software, Inc., a publisher of video games, in November 2002 and served in various capacities with that company through June 2005 including Chairman and Chief Executive Officer. Mr. Roedel served on the Boards of Directors of Brightpoint, Inc. from 2002 to 2012 and Sealy Corporation from 2006 to March 2013. He also served as a director and chairman of the audit committee of Broadview Network Holdings, Inc., a private company, until 2012. Mr. Roedel was appointed to the Public Accounting Oversight Board’s Standing Advisory Group for a three-year term commencing January 1, 2014. He is also a director of the Association of Audit Committee Members, Inc., a non-profit association of audit committee members dedicated to strengthening the audit committee by developing best practices. Mr. Roedel is a certified public accountant. As a result of these and other professional experiences, Mr. Roedel has particular knowledge of and extensive experience in finance, accounting and risk management and in public company board and committee practices.

8

Table of Contents

| INDEPENDENCE OF THE BOARD OF DIRECTORS |

Under the rules of the NYSE, our Board of Directors is required to affirmatively determine which directors are independent and to disclose such determination in the proxy statement for each annual meeting of shareholders. On February 20, 2014, (March 26, 2014 for Mr. Levin), our Board of Directors reviewed each director’s relationships with us in conjunction with our Independence Standards for Directors (the “Independence Standards”) and Section 303A of the NYSE’s Listed Company Manual (the “NYSE Listing Standards”). A copy of our Independence Standards is attached to this Proxy Statement as Appendix B and is available on our corporate website at www.lorillard.com under the heading “Investor Relations — Governance.” A copy of our Independence Standards is also available to shareholders upon request, addressed to the Corporate Secretary at 714 Green Valley Road, Greensboro, North Carolina 27408. The Board, upon the recommendation of the Nominating and Corporate Governance Committee, affirmatively determined that all non-executive directors — Ms. Blixt and Messrs. Almon, Card, Colbert, Dangoor, Dietz, Levin and Roedel — meet the categorical standards under the Independence Standards and are independent directors under the NYSE Listing Standards.

The Board determined that Mr. Kessler, who serves as an executive officer of the Company, is not an independent director. Accordingly, eight of the nine members of our Board of Directors are independent in compliance with our Corporate Governance Guidelines, which require a majority of independent directors.

| PROPOSAL NO. 1 — ELECTION OF SEVEN DIRECTOR NOMINEES |

The Board of Directors has nominated Ms. Blixt and Messrs. Card, Colbert, Dangoor, Kessler, Levin and Roedel to be elected at the Annual Meeting to serve for a one-year term ending at the Annual Meeting of Shareholders for 2015 and until their respective successors are duly elected and qualified. Each of the nominees is currently an incumbent director of the Company. Mr. Levin was identified as a director candidate by a third-party search firm retained by the Nominating and Corporate Governance Committee.

Each nominee has consented to being named in this Proxy Statement and to serve if elected. If, prior to the Annual Meeting, any nominee should become unavailable to serve, the shares of our Common Stock represented by a properly executed and returned proxy (whether through the return of the enclosed proxy card, by telephone or electronically through the Internet) will be voted for such other person as shall be designated by the Board of Directors, unless the Board of Directors determines to reduce the number of directors in accordance with our Amended and Restated Certificate of Incorporation and Amended and Restated By-Laws.

Vote Required

Directors are elected by a majority of the votes cast “for” or “against” the nominee at the Annual Meeting, in person or by proxy, except in a contested election which will use a plurality voting standard. Votes may be cast “for” or “against” each nominee, or a shareholder may abstain from voting for one or more nominees. Pursuant to applicable Delaware law, in determining whether such nominees have received the requisite number of affirmative votes, abstentions will have no effect on the outcome of the vote. Pursuant to NYSE regulations, brokers do not have discretionary voting power on this proposal, and broker non-votes will have no effect on the outcome of the vote.

THE BOARD OF DIRECTORS RECOMMENDS A VOTE “FOR” THE ELECTION OF EACH DIRECTOR NOMINEE.

9

Table of Contents

| COMMITTEES OF THE BOARD |

The Board of Directors has a standing Audit Committee, Compensation Committee and Nominating and Corporate Governance Committee consisting of directors who have been affirmatively determined to be “independent” as defined in our Independence Standards, the NYSE Listing Standards and applicable SEC regulations. Each of these committees operates pursuant to a written charter approved by the Board of Directors and available on our corporate website at www.lorillard.com under the heading “Investor Relations —Governance.” A copy of each committee charter is also available to shareholders upon request, addressed to the Corporate Secretary at 714 Green Valley Road, Greensboro, North Carolina 27408.

Committee Membership

| Name |

Director Since |

Independent | Committee Membership | |||||||||||

| Audit | Compensation | Nominating | ||||||||||||

| Robert C. Almon |

2008 | Yes | * | X | X | |||||||||

| Dianne Neal Blixt |

2011 | Yes | * | X | Chair | |||||||||

| Andrew H. Card, Jr. |

2011 | Yes | X | |||||||||||

| Virgis W. Colbert |

2008 | Yes | X | X | ||||||||||

| David E.R. Dangoor |

2008 | Yes | X | X | ||||||||||

| Kit D. Dietz |

2008 | Yes | X | Chair | ||||||||||

| Murray S. Kessler |

2010 | No | ||||||||||||

| Jerry W. Levin |

2014 | Yes | ||||||||||||

| Richard W. Roedel |

2008 | Yes | * | Chair | X | |||||||||

| Committee Meetings in 2013 |

9 | 5 | 4 |

| * | Our Board of Directors has determined that Ms. Blixt and Messrs. Almon and Roedel qualify as “audit committee financial experts” as that term is defined by SEC regulations. |

Audit Committee

The Audit Committee has sole authority and responsibility to select, determine the compensation of, evaluate and, when appropriate, replace our independent registered public accounting firm. The Audit Committee assists our Board of Directors with oversight of:

| • | the integrity of our accounting and financial reporting processes and financial statements; |

| • | the scope and results of the audit by the independent registered public accounting firm; |

| • | the qualifications, independence, performance and compensation of our independent registered public accounting firm; |

| • | the performance of our internal audit staff and our independent registered public accounting firm; |

| • | compliance with legal and regulatory requirements; |

| • | our system of internal control over financial reporting; and |

| • | our enterprise risk management process. |

Compensation Committee

The Compensation Committee is responsible for, among other things:

| • | annually reviewing and approving the corporate goals and objectives relevant to the compensation of the Chief Executive Officer and evaluating his or her performance in light of these goals; |

| • | determining the compensation of our executive officers and other appropriate officers; |

| • | reviewing and reporting to the Board of Directors on compensation of directors and board committee chairs; |

10

Table of Contents

| • | administering the Company’s incentive compensation programs and equity incentive plans, including the 2008 Incentive Compensation Plan; and |

| • | reviewing incentive compensation arrangements to ensure that the structure of such plans does not encourage unnecessary risk taking. |

See “Executive Compensation” for additional information regarding the process for the determination and consideration of executive compensation, including the involvement of management and compensation consultants.

Nominating and Corporate Governance Committee

The Nominating and Corporate Governance Committee is responsible for, among other things:

| • | identifying, evaluating and recommending nominees for our Board of Directors for each annual meeting (see “Nomination Process and Qualifications for Director Nominees” below); |

| • | evaluating the composition, organization and governance of our Board of Directors and its committees; |

| • | developing and recommending corporate governance principles and policies applicable to the Company; |

| • | overseeing the annual self-evaluation of the Board and its committees; and |

| • | reviewing the Company’s political contribution and lobbying policies, procedures and expenditures. |

| BOARD, COMMITTEE AND SHAREHOLDER MEETINGS |

In 2013, our Board of Directors held ten meetings and the three standing committees of the Board of Directors held an aggregate of 18 meetings. All incumbent directors during 2013 attended at least 75% of the aggregate number of meetings of the Board of Directors and Committees of the Board of Directors on which they served in 2013. All directors are expected to attend each regularly scheduled Board of Directors meeting as well as each Annual Meeting of our Shareholders (subject to limited exceptions). All of our incumbent directors during 2013, except Ms. Blixt who was unable to attend due to illness, attended the Company’s Annual Meeting of Shareholders for 2013.

| DIRECTOR COMPENSATION |

The Compensation Committee is responsible for reviewing and recommending to the Board of Directors the compensation of our non-executive directors. Mr. Kessler, who serves as our Chairman, President and Chief Executive Officer, does not receive compensation for serving as a director (other than travel-related expenses for Board meetings held outside of our corporate offices). The following table sets forth the annual retainer and stipend compensation for non-executive directors in 2013.

| Compensation | ||||

| Annual Non-Executive Director Cash Retainer |

$ | 100,000 | ||

| Annual Non-Executive Director Equity Retainer |

150,000 | |||

| Lead Independent Director Stipend |

25,000 | |||

| Audit Committee Chair Stipend |

20,000 | |||

| Compensation Committee Chair Stipend |

15,000 | |||

| Nominating and Corporate Governance Committee Chair Stipend |

10,000 | |||

The annual non-executive director cash retainer, the Lead Independent Director and the Committee Chair stipends set forth in the table above are paid in equal quarterly installments in the first week of each calendar quarter. The annual non-executive director equity retainer is granted in the form of restricted stock annually on January 1 of each calendar year. The number of shares of restricted stock is determined by dividing the amount of the annual non-executive director equity retainer by the closing price of our Common Stock on the date of

11

Table of Contents

grant (rounding up to the nearest whole share). The restricted stock vests in full on the first anniversary of the date of grant, subject to the director’s continued service through such date (or on the earlier of the death or disability of such director). In July 2013, based upon an evaluation of non-executive director compensation relative to the Company’s peer group, the Compensation Committee recommended, and the Board of Directors approved, an increase in the annual non-executive equity retainer to $150,000, which was implemented on a pro rata basis for 2013. Directors may use Company leased or fractionally-owned aircraft for travel to and from Board meetings and are reimbursed for other travel-related expenses for Board and committee meetings. The Board has also adopted a reimbursement policy for director attendance at third-party director education programs (up to $7,500 per year). In addition, the Company has established Stock Ownership Guidelines requiring non-executive directors to hold shares of Company Common Stock at least equal to five times the annual non-executive director cash retainer. Beginning in 2014, the Company established a matching gifts program for directors. Under the matching gifts program, the Company matches contributions by a director to approved charitable organizations up to $15,000 per calendar year. We do not maintain a pension plan, incentive plan or deferred compensation arrangements for non-executive directors. Non-executive directors did not receive any other compensation for 2013.

Director Compensation Table

The following table sets forth the compensation paid to or earned by each non-executive director for 2013:

| Non-Executive Director(1) |

Fees Earned or Paid in Cash(2) |

Stock Awards(3) |

Total | |||||||||

| Robert C. Almon |

$ | 100,000 | $ | 135,575 | $ | 235,575 | ||||||

| Dianne Neal Blixt |

107,500 | 135,575 | 243,075 | |||||||||

| Andrew H. Card, Jr. |

100,000 | 135,575 | 235,575 | |||||||||

| Virgis W. Colbert |

127,500 | 135,575 | 263,075 | |||||||||

| David E.R. Dangoor |

100,000 | 135,575 | 235,575 | |||||||||

| Kit D. Dietz |

110,000 | 135,575 | 245,575 | |||||||||

| Richard W. Roedel |

145,000 | 135,575 | 280,575 | |||||||||

| (1) | Mr. Levin joined the Board in March 2014 and is not included in the table for 2013. |

| (2) | The fees include four quarterly retainer payments of $25,000 to each non-executive director in 2013. In addition, Messrs. Roedel, Colbert and Dietz and Ms. Blixt received $45,000, $27,500, $10,000 and $7,500, respectively, representing the annual stipends for their respective service as Lead Independent Director and chair of the Audit Committee, chair of the Compensation Committee and chair of the Nominating and Corporate Governance Committee during 2013. As part of the Board’s evaluation of its governance structure and rotation of Board leadership positions in 2013, Mr. Colbert was elected to succeed Mr. Roedel as Lead Independent Director, and Ms. Blixt was elected to succeed Mr. Colbert as Chair of the Compensation Committee in May 2013. The foregoing amounts reflect pro rata payments to Mr. Colbert and Ms. Blixt for their new Board leadership positions. |

| (3) | The amount shown reflects the grant date fair value of the restricted stock awarded to each non-executive director in 2013, calculated under FASB ASC Topic 718 using the closing price for our Common Stock on the date of grant. Each director received an annual non-executive director equity retainer award of 3,216 shares of restricted stock on January 1, 2013 and 247 shares of restricted stock on July 31, 2013 in accordance with the pro rated annual non-executive director equity award increase on July 31, 2013. The closing price of our Common Stock was $38.89 on December 31, 2012, the effective stock price for the January 1, 2013 grant, and $42.53 on July 31, 2013. Each restricted stock grant vests in full on the first anniversary of the date of grant if the director continues to serve as a director on such date (or on the earlier of the death or disability of such director). Non-executive directors received payment of dividends on unvested restricted stock awarded for each dividend declared for all shareholders. All share amounts and prices have been adjusted to reflect the three-for-one stock split effected on January 15, 2013. |

| CORPORATE GOVERNANCE |

Corporate Governance Guidelines

The Board of Directors has adopted Corporate Governance Guidelines to assist the Board of Directors in monitoring the effectiveness of policy and decision making, both at the Board of Directors and management levels with a view to enhancing shareholder value over the long term. The Corporate Governance Guidelines outline, among other things, the following:

| • | the composition of the Board of Directors, including director qualification standards; |

12

Table of Contents

| • | the responsibilities of the Board of Directors, including access to management and independent advisors; |

| • | the responsibilities of the Lead Independent Director; |

| • | the process for interested parties to communicate with the Board of Directors; |

| • | the conduct of Board of Directors and committee meetings; |

| • | succession planning for our Chief Executive Officer; and |

| • | the process for evaluating the performance of and compensation for the Board of Directors and the Chief Executive Officer. |

Our Corporate Governance Guidelines are available on our corporate website at www.lorillard.com under the heading “Investor Relations — Governance.” A copy of our Corporate Governance Guidelines is also available to shareholders upon request, addressed to the Corporate Secretary at 714 Green Valley Road, Greensboro, North Carolina 27408.

Code of Business Conduct and Ethics

We are committed to maintaining high standards for honest and ethical conduct in all of our business dealings and complying with applicable laws, rules and regulations. In furtherance of this commitment, our Board of Directors promotes ethical behavior and has adopted a Code of Business Conduct and Ethics (the “Code of Conduct”) that is applicable to all of our employees, including our directors and officers. The Code of Conduct provides, among other things:

| • | guidelines with respect to ethical handling of possible conflicts of interest, corporate opportunities and protection of corporate assets; |

| • | standards for dealing with customers, suppliers, employees and competitors; |

| • | a requirement to comply with all applicable laws, rules and regulations, including, but not limited to, insider trading prohibitions; |

| • | standards for promoting full, fair, accurate, timely and understandable disclosure in periodic reports required to be filed by us; |

| • | reporting procedures promoting prompt internal communication of any suspected violations of the Code of Conduct to the appropriate person or persons; and |

| • | disciplinary measures for violations of the Code of Conduct. |

The Code of Conduct is available on our corporate website at www.lorillard.com under the heading “Investor Relations — Governance.” We will post any amendments to the Code of Conduct, or waivers of the provisions thereof, to our corporate website under the heading “Investor Relations — Governance.” A copy of the Code of Conduct is also available to shareholders upon request, addressed to the Corporate Secretary at 714 Green Valley Road, Greensboro, North Carolina 27408.

Nomination Process and Qualifications for Director Nominees

The Board of Directors has established certain procedures and criteria for the selection of nominees for election as a member of our Board of Directors. Pursuant to its charter, the Nominating and Corporate Governance Committee is responsible for screening candidates, for developing and recommending to the Board criteria for nominees and for recommending to the Board a slate of nominees for election to the Board at the annual meeting of shareholders. In recommending candidates, the committee may consider criteria it deems appropriate, including judgment, skill, diversity, experience with businesses and other organizations, the interplay of the candidate’s experience with the experience of the other directors and the extent to which the candidate would be a desirable addition to the Board of Directors. The Company does not have a formal policy with regard to diversity although the Board and the Nominating and Corporate Governance Committee believe

13

Table of Contents

that it is essential that members of the Board represent a diversity of backgrounds, experience and viewpoints. In considering a candidate for nomination to the Board, the Nominating and Corporate Governance Committee considers the sum of his or her qualifications in the context of the foregoing criteria.

Our Amended and Restated By-Laws provide the procedure for shareholders to make director nominations either at any annual meeting of shareholders or at any special meeting of shareholders called for the purpose of electing directors. A shareholder who is a shareholder of record on the date of notice, is entitled to vote at such meeting and who complies with the notice procedures set forth in our Amended and Restated By-Laws can nominate persons for election to our Board of Directors either at an annual meeting of shareholders or at any special meeting of shareholders called for the purpose of electing directors. The Nominating and Corporate Governance Committee considers all nominee candidates in its screening process. To be timely, the notice must be delivered to or mailed and received by the Corporate Secretary at 714 Green Valley Road, Greensboro, North Carolina 27408:

| • | in the case of an annual meeting of shareholders, not later than the close of business on the ninetieth (90th) day, nor earlier than the close of business on the one hundred twentieth (120th) day prior to the first anniversary of the preceding year’s annual meeting of shareholders; provided, however, that in the event that the date of the annual meeting is more than thirty (30) days before or more than seventy (70) days after such anniversary date, notice by the shareholder must be so delivered not earlier than the close of business on the one hundred twentieth (120th) day prior to such annual meeting and not later than the close of business on the later of the ninetieth (90th) day prior to such annual meeting or the tenth (10th) day following the day on which public announcement of the date of such annual meeting is first made, and |

| • | in the case of a special meeting of shareholders called for the purpose of electing directors, not earlier than the close of business on the one hundred twentieth (120th) day prior to such special meeting and not later than the close of business on the later of the ninetieth (90th) day prior to such special meeting or the tenth (10th) day following the day on which public announcement is first made of the date of such special meeting and of the nominees proposed by the Board of Directors to be elected at such meeting. |

In no event shall the public announcement of an adjournment or postponement of an annual meeting or special meeting commence a new time period (or extend any time period) for the giving of a shareholder’s notice as described above. Furthermore, in the event that the number of directors to be elected to the Board of Directors at the annual meeting is increased effective after the time period for which nominations would otherwise be due and there is no public announcement naming the nominees for the additional directorships at least one hundred (100) days prior to the first anniversary of the preceding year’s annual meeting, a shareholder’s notice shall also be considered timely, but only with respect to nominees for the additional directorships, if it is delivered to the Corporate Secretary not later than the close of business on the tenth (10th) day following the day on which such public announcement is first made.

To be in proper written form, the shareholder’s notice to our Corporate Secretary must set forth (a) as to each person whom the shareholder proposes to nominate for election as a director, (i) all information relating to such person that is required to be disclosed in solicitations of proxies for election of directors in an election contest, or is otherwise required, in each case pursuant to and in accordance with Section 14(a) of the Exchange and (ii) such person’s written consent to being named in the proxy statement as a nominee and to serving as a director if elected; and (b) as to the shareholder giving the notice and the beneficial owner, if any, on whose behalf the nomination is made:

| • | the name and record address of the shareholder and any such beneficial owner; |

| • | the class or series and number of shares of our capital stock which are owned beneficially or of record by the shareholder and such beneficial owner; |

| • | a description of any agreement, arrangement or understanding between or among the shareholder and/or such beneficial owner, any of their respective affiliates or associates, and any others acting in concert with any of the foregoing, including the nominee; |

14

Table of Contents

| • | a description of any agreement, arrangement or understanding (including any derivative or short positions, profit interests, options, warrants, convertible securities, stock appreciation or similar rights, hedging transactions, and borrowed or loaned shares) that has been entered into as of the date of the shareholder’s notice by, or on behalf of, such shareholder and such beneficial owners, whether or not such instrument or right shall be subject to settlement in underlying shares of capital stock, the effect or intent of which is to mitigate loss to, manage risk or benefit of share price changes for, or increase or decrease the voting power of, such shareholder or such beneficial owner; |

| • | a representation that the shareholder is a holder of record of stock and entitled to vote at such meeting and intends to appear in person or by proxy at the meeting to propose such nomination; |

| • | a representation whether the shareholder or the beneficial owner, if any, intends or is part of a group which intends (a) to deliver a proxy statement and/or form of proxy to holders of at least the percentage of the outstanding capital stock required to elect the nominee and/or (b) otherwise to solicit proxies or votes from shareholders in support of such nomination; and |

| • | any other information relating to the shareholder and beneficial owner, if any, that would be required to be disclosed in a proxy statement or other filings required to be made in connection with solicitations of proxies for election of directors pursuant to Section 14(a) of the Exchange Act and the rules and regulations promulgated thereunder. |

Communication with Non-Executive Directors

In accordance with our Corporate Governance Guidelines, interested parties, including shareholders, may communicate with the Board of Directors, the non-executive directors as a group, the Lead Independent Director or any individual director by forwarding such communication to the attention of the Corporate Secretary at 714 Green Valley Road, Greensboro, North Carolina 27408. The Corporate Secretary shall forward all interested party communications to the appropriate members of the Board.

Board Leadership Structure