UNITED STATES OF AMERICA

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 10-Q

(Mark One)

☒ QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(D) OF THE SECURITIES EXCHANGE ACT OF 1934

FOR THE NINE MONTH PERIOD ENDED: MARCH 31, 2020

☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(D) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from ______________ to ______________

Commission File Number: 333-148987

CUENTAS, INC.

(Exact name of Registrant as specified in its charter)

| Florida | 20-3537265 | |

(State or Other Jurisdiction of Incorporation or Organization) |

(I.R.S. Employer Identification No.) |

19 W. FLAGLER ST, SUITE 902, MIAMI, FL 33130

(Address of principal executive offices)

800-611-3622

(Registrant’s telephone number)

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ☐ | Accelerated filer | ☐ |

| Non-accelerated filer | ☒ | Smaller reporting company | ☒ |

| Emerging growth company | ☐ | ||

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

State the number of shares outstanding of each of the issuer’s classes of common equity, as of the latest practicable date: As of May 14, 2020, the issuer had 6,141,285 shares of its common stock issued and outstanding.

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered | ||

PART I – FINANCIAL INFORMATION

ITEM 1. FINANCIAL STATEMENTS

CUENTAS, INC.

CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

AS OF MARCH 31, 2020

TABLE OF CONTENTS

1

CONDENSED CONSOLIDATED BALANCE SHEETS

(U.S. dollars in thousands except share and per share data)

| March 31, 2020 | December 31, 2019 | |||||||

| Unaudited | Audited | |||||||

| ASSETS | ||||||||

| CURRENT ASSETS: | ||||||||

| Cash and cash equivalents | 21 | 16 | ||||||

| Marketable securities | 1 | 1 | ||||||

| Trade account receivables | 9 | - | ||||||

| Related parties | 61 | 54 | ||||||

| Other current assets | 21 | 94 | ||||||

| Total current assets | 113 | 165 | ||||||

| Property and Equipment, net | 5 | 5 | ||||||

| Intangible assets | 8,550 | 9,000 | ||||||

| Total assets | 8,668 | 9,170 | ||||||

| LIABILITIES AND STOCKHOLDERS’ EQUITY | ||||||||

| CURRENT LIABILITIES: | ||||||||

| Accounts payable | 1,599 | 1,525 | ||||||

| Other accounts liabilities | 591 | 741 | ||||||

| Deferred revenue | 550 | 537 | ||||||

| Notes and Loan payable | 110 | 109 | ||||||

| Convertible Note | - | 250 | ||||||

| Related parties’ payables | 10 | 10 | ||||||

| Derivative liability | - | 3 | ||||||

| Stock based liabilities | 143 | 742 | ||||||

| Total current liabilities | 3,003 | 3,917 | ||||||

| TOTAL LIABILITIES | 3,003 | 3,917 | ||||||

| STOCKHOLDERS’ EQUITY | ||||||||

| Series B preferred stock, $0.001 par value, designated 10,000,000; 10,000,000 issued and outstanding as of March 31, 2020 and December 31, 2019, respectively | 10 | 10 | ||||||

| Common stock, authorized 360,000,000 shares, $0.001 par value; 4,639,139 and 6,071,285 issued and outstanding as of March 31, 2020 and December 31, 2019, respectively | 6 | 5 | ||||||

| Additional paid in capital | 27,817 | 25,246 | ||||||

| Accumulated deficit | (21,553 | ) | (19,390 | ) | ||||

| Total Cuestas Inc. stockholders’ equity | 6,280 | 5,871 | ||||||

| Non-controlling interest in subsidiaries | (615 | ) | (618 | ) | ||||

| Total stockholders’ equity | 5,665 | 5,253 | ||||||

| Total liabilities and stockholders’ equity | 8,668 | 9,170 | ||||||

The accompanying notes are an integral part of these unaudited condensed consolidated financial statements

2

CONDENSED

CONSOLIDATED STATEMENTS OF OPERATIONS AND COMPREHENSIVE LOSS

(Unaudited)

(U.S. dollars in thousands except share and per share data)

| Three Months Ended March 31, | ||||||||

| 2020 | 2019 | |||||||

| REVENUE | 134 | 302 | ||||||

| COST OF REVENUE | 177 | 237 | ||||||

| GROSS PROFIT (LOSS) | (43 | ) | 65 | |||||

| OPERATING EXPENSES | ||||||||

| Amortization of Intangible assets | 450 | - | ||||||

| General and administrative | 2,089 | 490 | ||||||

| TOTAL OPERATING EXPENSES | 2,539 | 490 | ||||||

| OPERATING LOSS | (2,582 | ) | (425 | ) | ||||

| OTHER INCOME | ||||||||

| Other Income | 63 | 220 | ||||||

| Interest expense | (3 | ) | (60 | ) | ||||

| Gain (loss) on derivative liability | 3 | (1 | ) | |||||

| Gain (loss) from Change in fair value of stock-based liabilities | 359 | (54 | ) | |||||

| TOTAL OTHER INCOME | 422 | 105 | ||||||

| NET LOSS BEFORE CONTROLLING INTEREST | (2,160 | ) | (320 | ) | ||||

| NET LOSS ATTRIBUTILE TO NON-CONTROLLING INTEREST | (3 | ) | - | |||||

| NET LOSS ATTRIBUTILE TO NET INCOME (LOSS) ATTRIBUTILE TO CUENTAS INC. | (2,163 | ) | (320 | ) | ||||

| Net loss per basic share | (0.41 | ) | (0.18 | ) | ||||

| Net loss per diluted share | (0.41 | ) | (0.18 | ) | ||||

| Weighted average number of basic common shares outstanding | 5,251,347 | 1,808,142 | ||||||

| Weighted average number of diluted common shares outstanding | 5,251,347 | 1,808,142 | ||||||

The accompanying notes are an integral part of these unaudited condensed consolidated financial statements

3

CONDENSED

CONSOLIDATED STATEMENTS OF CASH FLOWS

(Unaudited)

(U.S. dollars in thousands)

| Three Months Ended March 31, | ||||||||

| 2019 | 2018 | |||||||

| Cash Flows from Operating Activities: | ||||||||

| Net loss before non-controlling interest | (2,160 | ) | (320 | ) | ||||

| Adjustments to reconcile net income (loss) to net cash used in operating activities: | ||||||||

| Stock based compensation and shares issued for services | 1,125 | 57 | ||||||

| Imputed interest | - | 58 | ||||||

| Loss on fair value of marketable securities | - | 24 | ||||||

| Interest and Debt discount amortization | 1 | (4 | ) | |||||

| Gain on derivative fair value adjustment | (3 | ) | 1 | |||||

| Gain from Change in on fair value of stock-based liabilities | (359 | ) | 53 | |||||

| Depreciation and amortization expense | 450 | - | ||||||

| Changes in Operating Assets and Liabilities: | ||||||||

| Accounts receivable | (9 | ) | 12 | |||||

| Other receivables | 73 | 18 | ||||||

| Accounts payable | 88 | (298 | ) | |||||

| Other Accounts payable | 43 | (35 | ) | |||||

| Deferred revenue | 13 | (31 | ) | |||||

| Net Cash Used by Operating Activities | (738 | ) | (465 | ) | ||||

| Cash Flows from Financing Activities: | ||||||||

| Related party, net | (7 | ) | (60 | ) | ||||

| Proceeds from issuance of Convertible notes | 750 | - | ||||||

| Proceeds from issuance of common stock, net of issuance expense | - | 50 | ||||||

| Proceeds from common stock subscriptions | - | 500 | ||||||

| Net Cash Provided by Financing Activities | 743 | 490 | ||||||

| Net Increase (Decrease) in Cash | 5 | 25 | ||||||

| Cash at Beginning of Period | 16 | 154 | ||||||

| Cash at End of Period | 21 | 179 | ||||||

| Supplemental disclosure of non-cash financing activities | ||||||||

| Common stock issued for conversion of convertible note principal | 250 | - | ||||||

| Common stock issued for settlement of stock-based liabilities and accrued salaries | 442 | 464 | ||||||

| Common stock issued for settlement of common stock subscribed | - | 100 | ||||||

The accompanying notes are an integral part of these unaudited condensed consolidated financial statements

4

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(Amounts in U.S. dollar thousands, except share and per share data)

NOTE 1 – GENERAL

Cuentas, Inc. (the “Company”) together with its subsidiaries, is focused on financial technology (“FINTECH”) services, delivering mobile banking, online banking, prepaid debit and digital content services to unbanked, underbanked and underserved communities. The Company derives its revenue from the sales of prepaid and wholesale calling minutes. The Company’s exclusivity with CIMA’s proprietary software platform enables Cuentas to offer comprehensive financial services and additional robust functionality that is absent from other General-Purpose Reloadable Cards (“GRP”). Additionally, The Company has an agreement with Interactive Communications International, Inc. (“InComm”) a leading processor of GPR debit cards, to market and distribute a line of GPR cards targeted towards the Latin American market. The Cuentas Fintech Card stores products purchased in the Virtual Market Place where Tier-1 retailers, gaming currencies, amazon cash, and wireless telecom prepaid minutes “top ups”. Additionally, well-known brand name restaurants in the marketplace automatically discount purchases at POS when the customer pays the bill with the Cuentas Card.

On December 31, 2019, the Company entered into a series of integrated transactions to license the Platforms from CIMA, through CIMA’s wholly owned subsidiaries Knetik, and Auris (the “Transaction Closing”) pursuant to that certain Platform License Agreement, dated December 31, 2019 by and among (i) the Company, (ii) CIMA, (iii) Knetik and (iv) Auris (the “License Agreement”) and the various other agreements listed below. Under the License Agreement Cima Group received a 1-time licensing fee in the amount of $9,000 in the form of a convertible note that may be converted, at the option of Cima, into up to 25% of the total shares of Common Stock of the Company, par value $0.001 per share (the “Common Stock”) on a fully diluted basis as of December 31, 2019. On December 31, 2019, CIMA exercised its option to convert the Convertible Promissory Note into 1,757,478 shares of Common Stock of the Company.

The acquired intangible assets that consisted of perpetual software license had an estimated fair value of $9,000. The Company will amortize the intangible assets on a straight-line basis over their expected useful life of 60 months. Identifiable intangible assets were recorded as follows:

| Asset | Amount | Life (months) | ||||||

| Intangible Assets | $ | 9,000 | 60 | |||||

| Total | $ | 9,000 | 60 | |||||

Intangible assets with estimable useful lives are amortized over their respective estimated useful lives to their estimated residual values and reviewed periodically for impairment.

Amortization of intangible assets for each of the next five years and thereafter is expected to be as follows:

| Year ended December 31, | ||||

| 2020 | $ | 1,800 | ||

| 2021 | 1,800 | |||

| 2022 | 1,800 | |||

| 2023 | 1,800 | |||

| 2024 | 1,800 | |||

| Total | $ | 9,000 | ||

Amortization expense was $450 and $0 for the periods ended March 31, 2020 and 2019, respectively. Amortization expense for each period is included in operating expenses.

Pursuant to the License Agreement, the Company shall pay CIMA annual fees for the maintenance and support services in accordance with the following schedule: (i) for the first (1st) calendar year from the Effective Date, $300 to be paid on June 30, 2020; (ii) for the second (2nd) calendar year from the Effective Date, $500 to be paid on December 31, 2020; (iii) for the third (3rd) calendar year from the Effective Date, $700 to be paid on December 31, 2021; (iv) for the fourth (4th) calendar year from the Effective Date, $1,000 to be paid on December 31, 2022; (v) for the fifth (5th) calendar year from the Effective Date, $640 to be paid on December 31, 2022; and (vi) for each calendar year thereafter, $640 to be paid on the anniversary date.

5

CUENTAS, INC.

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(Amounts in U.S. dollar thousands, except share and per share data)

In December 2019, a novel strain of coronavirus was reported to have surfaced in Wuhan, China, which has and is continuing to spread throughout China and other parts of the world, including the United States. On January 30, 2020, the World Health Organization declared the outbreak of the coronavirus disease (COVID-19) a “Public Health Emergency of International Concern.” On January 31, 2020, U.S. Health and Human Services Secretary Alex M. Azar II declared a public health emergency for the United States to aid the U.S. healthcare community in responding to COVID-19, and on March 11, 2020 the World Health Organization characterized the outbreak as a “pandemic”. A significant outbreak of COVID-19 and other infectious diseases could result in a widespread health crisis that could adversely affect the economies and financial markets worldwide, as well as our business and operations. The extent to which COVID-19 impacts our business and results of operations will depend on future developments, which are highly uncertain and cannot be predicted, including new information which may emerge concerning the severity of COVID-19 and the actions to contain COVID-19 or treat its impact, among others. If the disruptions posed by COVID-19 or other matters of global concern continue for an extensive period of time, our business and results of operations may be materially adversely affected.

GOING CONCERN

The accompanying financial statements have been prepared assuming that the Company will continue as a going concern. As of March 31, 2020, the Company had approximately $21 in cash and cash equivalents, approximately $2,890 in negative working capital and an accumulated deficit of approximately $21,553. These conditions raise substantial doubt about the Company’s ability to continue as a going concern. Company’s ability to continue as a going concern is dependent upon raising capital from financing transactions and revenue from operations. Management anticipates their business will require substantial additional investments that have not yet been secured. Management is continuing in the process of fund raising in the private equity and capital markets as the Company will need to finance future activities. These financial statements do not include any adjustments that may be necessary should the Company be unable to continue as a going concern.

NOTE 2 – SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES AND BASIS OF PRESENTATION

Unaudited Interim Financial Statements

The accompanying unaudited consolidated financial statements include the accounts of the Company and its subsidiaries, prepared in accordance with accounting principles generally accepted in the United States of America (“GAAP”) and with the instructions to Form 10-Q and Article 10 of U.S. Securities and Exchange Commission Regulation S-X. Accordingly, they do not include all the information and footnotes required by generally accepted accounting principles for complete financial statements. In the opinion of management, the financial statements presented herein have not been audited by an independent registered public accounting firm but include all material adjustments (consisting of normal recurring adjustments) which are, in the opinion of management, necessary for a fair statement of the financial condition, results of operations and cash flows for the for three-months ended March 31, 2020. However, these results are not necessarily indicative of results for any other interim period or for the year ended December 31, 2020. The preparation of financial statements in conformity with GAAP requires the Company to make certain estimates and assumptions for the reporting periods covered by the financial statements. These estimates and assumptions affect the reported amounts of assets, liabilities, revenues and expenses. Actual amounts could differ from these estimates.

Certain information and footnote disclosures normally included in financial statements in accordance with generally accepted accounting principles have been omitted pursuant to the rules of the U.S. Securities and Exchange Commission (“SEC”). The accompanying unaudited consolidated financial statements should be read in conjunction with the consolidated financial statements and notes thereto included in our Annual Report on Form 10-K for the fiscal year ended December 31, 2019, filed with the SEC on March 30, 2020 (the “Annual Report”). For further information, reference is made to the consolidated financial statements and footnotes thereto included in the Company’s Annual Report on Form 10-K for the year ended December 31, 2019.

Principles of Consolidation

The consolidated financial statements are prepared in accordance with US GAAP. The consolidated financial statements of the Company include the Company and its wholly-owned and majority-owned subsidiaries. All inter-company balances and transactions have been eliminated.

Use of Estimates

The preparation of unaudited condensed consolidated financial statements in conformity with accounting principles generally accepted in the United States requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities, certain revenues and expenses, and disclosure of contingent assets and liabilities as of the date of the financial statements. Actual results could differ from those estimates. Estimates are used when accounting for going concern and stock-based compensation.

6

CUENTAS, INC.

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(Amounts in U.S. dollar thousands, except share and per share data)

Deferred Revenue

Deferred revenue is comprised mainly of unearned revenue related to prepayments from retail consumers for telecommunications minutes. The following table represents the changes in deferred revenue for the three months ended March 31, 2020:

| Deferred Revenue | ||||

| Balance at December 31, 2019 | $ | 537 | ||

| Change in deferred revenue | 13 | |||

| Balance at March 31, 2020 | $ | 550 | ||

Revenue allocated to remaining performance obligations represent contracted revenue that has not yet been recognized (“contracted not recognized”). Contracted not recognized revenue was $550 as of March 31, 2020, of which the Company expects to recognize 100% of the revenue over the next 12 months.

Derivative and Fair Value of Financial Instruments

Fair value accounting requires bifurcation of embedded derivative instruments such as conversion features in convertible debt or equity instruments and measurement of their fair value for accounting purposes. In assessing the convertible debt instruments, management determines if the convertible debt host instrument is conventional convertible debt and further if there is a beneficial conversion feature requiring measurement. If the instrument is not considered conventional convertible debt under ASC 470, the Company will continue its evaluation process of these instruments as derivative financial instruments under ASC 815.

Once determined, derivative liabilities are adjusted to reflect fair value at each reporting period end, with any increase or decrease in the fair value being recorded in results of operations as an adjustment to fair value of derivatives.

Fair value of certain of the Company’s financial instruments including cash, accounts receivable, accounts payable, accrued expenses, notes payables, and other accrued liabilities approximate cost because of their short maturities. The Company measures and reports fair value in accordance with ASC 820, “Fair Value Measurements and Disclosure” defines fair value, establishes a framework for measuring fair value in accordance with generally accepted accounting principles and expands disclosures about fair value measurements.

Fair value, as defined in ASC 820, is the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date. The fair value of an asset should reflect its highest and best use by market participants, principal (or most advantageous) markets, and an in-use or an in-exchange valuation premise. The fair value of a liability should reflect the risk of nonperformance, which includes, among other things, the Company’s credit risk.

7

CUENTAS, INC.

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(Amounts in U.S. dollar thousands, except share and per share data)

Valuation techniques are generally classified into three categories: the market approach; the income approach; and the cost approach. The selection and application of one or more of the techniques may require significant judgment and are primarily dependent upon the characteristics of the asset or liability, and the quality and availability of inputs. Valuation techniques used to measure fair value under ASC 820 must maximize the use of observable inputs and minimize the use of unobservable inputs. ASC 820 also provides fair value hierarchy for inputs and resulting measurement as follows:

Level 1: Quoted prices (unadjusted) in active markets that are accessible at the measurement date for identical assets or liabilities.

Level 2: Quoted prices for similar assets or liabilities in active markets; quoted prices for identical or similar assets or liabilities in markets that are not active; inputs other than quoted prices that are observable for the asset or liability; and inputs that are derived principally from or corroborated by observable market data for substantially the full term of the assets or liabilities; and

Level 3: Unobservable inputs for the asset or liability that are supported by little or no market activity, and that are significant to the fair values.

Fair value measurements are required to be disclosed by the Level within the fair value hierarchy in which the fair value measurements in their entirety fall. Fair value measurements using significant unobservable inputs (in Level 3 measurements) are subject to expanded disclosure requirements including a reconciliation of the beginning and ending balances, separately presenting changes during the period attributable to the following: (i) total gains or losses for the period (realized and unrealized), segregating those gains or losses included in earnings, and a description of where those gains or losses included in earning are reported in the statement of income.

The Company’s financial assets and liabilities that are measured at fair value on a recurring basis by level within the fair value hierarchy are as follows:

| Balance as of March 31, 2020 | ||||||||||||||||

| Level 1 | Level 2 | Level 3 | Total | |||||||||||||

| Assets: | ||||||||||||||||

| Marketable securities | 1 | - | - | 1 | ||||||||||||

| Total assets | 1 | - | - | 1 | ||||||||||||

| Liabilities: | ||||||||||||||||

| Stock based liabilities | 143 | - | - | 143 | ||||||||||||

| Total liabilities | 143 | - | - | 143 | ||||||||||||

| Balance as of December 31, 2019 | ||||||||||||||||

| Level 1 | Level 2 | Level 3 | Total | |||||||||||||

| Assets: | ||||||||||||||||

| Marketable securities | 1 | - | - | 1 | ||||||||||||

| Total assets | 1 | - | - | 1 | ||||||||||||

| Liabilities: | ||||||||||||||||

| Stock based liabilities | 742 | - | - | 742 | ||||||||||||

| Short term derivative value | 3 | - | - | 3 | ||||||||||||

| Total liabilities | 745 | - | - | 745 | ||||||||||||

Basic Income (Loss) Per Share

Basic income (loss) per share is calculated by dividing the Company’s net loss applicable to common shareholders by the weighted average number of common shares during the period. Diluted earnings per share is calculated by dividing the Company’s net income available to common shareholders by the diluted weighted average number of shares outstanding during the year. The diluted weighted average number of shares outstanding is the basic weighted average number of shares adjusted for any potentially dilutive debt or equity.

8

CUENTAS, INC.

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(Amounts in U.S. dollar thousands, except share and per share data)

Recent Accounting Standards announced

In August 2018, the FASB issued ASU 2018-13, Fair Value Measurement (Topic 820): Disclosure Framework – Changes to the Disclosure Requirements for Fair Value Measurement. The amendments apply to reporting entities that are required to make disclosures about recurring or nonrecurring fair value measurements and should improve the cost, benefit, and effectiveness of the disclosures. ASU 2018-13 categorized the changes into those disclosures that were removed, those that were modified, and those that were added. The primary disclosures that were removed related to transfers between Level 1 and Level 2 investments, along with the policy for timing of transfers between levels. In addition, disclosing the valuation processes for Level 3 fair value measurements was removed. The amendments are effective for all organizations for fiscal years, and interim periods within those fiscal years, beginning after December 15, 2019. Early adoption is permitted. The Company notes that this guidance will impact its disclosures beginning January 1, 2020.

In June 2016, FASB issued ASU No. 2016-13, “Financial Instruments - Credit Losses (Topic 326): Measurement of Credit Losses on Financial Instruments”. In November 2018, FASB issued ASU No. 2018-19, “Codification Improvements to Topic 326, Financial Instruments-Credit Losses”, which amends the scope and transition requirements of ASU 2016-13. Topic 326 requires a financial asset (or a group of financial assets) measured at amortized cost basis to be presented at the net amount expected to be collected. The measurement of expected credit losses is based on relevant information about past events, including historical experience, current conditions and reasonable and supportable forecasts that affect the collectability of the reported amount. Topic 326 will originally become effective for the Company beginning January 1, 2020, with early adoption permitted, on a modified retrospective approach. As a smaller reporting company, the effective date for the Company has been delayed until fiscal years beginning after December 15, 2022, in accordance with ASU 2019-10, although early adoption is still permitted. This standard is not expected to have a material impact to the Company’s consolidated financial statements after evaluation.

In December 2019, the FASB issued ASU 2019-12, Income Taxes (Topic 740): Simplifying the Accounting for Income Taxes. The amendments in this ASU simplify the accounting for income taxes, eliminates certain exceptions to the general principles in Topic 740 and clarifies certain aspects of the current guidance to improve consistent application among reporting entities. ASU 2019-12 is effective for fiscal years beginning after December 15, 2021 and interim periods within annual periods beginning after December 15, 2022, though early adoption is permitted, including adoption in any interim period for which financial statements have not yet been issued. This standard is not expected to have a material impact to the Company’s consolidated financial statements after evaluation.

NOTE 3 – STOCK OPTIONS

The following table summarizes all stock option activity for the nine months ended March 31, 2020:

| Shares | Weighted- Average Exercise Price Per Share | |||||||

| Outstanding, December 31, 2019 | 212,044 | $ | 12.79 | |||||

| Granted | 198,000 | 5.74 | ||||||

| Forfeited | - | - | ||||||

| Outstanding, March 31, 2020 | 410,044 | $ | 9.39 | |||||

The following table discloses information regarding outstanding and exercisable options at March 31, 2020:

| Outstanding | Exercisable | |||||||||||||||||||||

| Exercise Prices | Number of Option Shares | Weighted Average Exercise Price | Weighted Average Remaining Life (Years) | Number of Option Shares | Weighted Average Exercise Price | |||||||||||||||||

| $ | 54.00 | 25,000 | $ | 54.00 | 1.0 | 25,000 | $ | 54.00 | ||||||||||||||

| 21.00 | 47,044 | 21.00 | 1.24 | 47,044 | 21.00 | |||||||||||||||||

| 5.74 | 198,000 | 5.74 | 5.74 | 198,000 | 5.74 | |||||||||||||||||

| 3.00 | 90,000 | 3.00 | 4.46 | 60,000 | 3.00 | |||||||||||||||||

| 2.09 | 50,000 | 2.09 | 2.09 | 50,000 | 2.09 | |||||||||||||||||

| 410,044 | $ | 9.38 | 2.04 | 380,044 | $ | 9.89 | ||||||||||||||||

On March 30, 2020, the Company issued 198,000 options to its Chief Executive Officer and President of the Company. The options carry an exercise price of $5.74 per share. All the options were vested immediately. The Options are exercisable until March 30, 2022. The Company has estimated the fair value of such options at a value of $456 at the date of issuance using the Black-Scholes option pricing model using the following assumptions:

| Common stock price | 2.54 | |||

| Dividend yield | 0 | % | ||

| Risk-free interest rate | 1.89 | % | ||

| Expected term (years) | 3 | |||

| Expected volatility | 328 | % |

9

CUENTAS, INC.

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(Amounts in U.S. dollar thousands, except share and per share data)

NOTE 4 – STOCKHOLDERS’ EQUITY

Common Stock

The following summarizes the Common Stock activity for the three months ended March 31, 2020:

| Summary of common stock activity for the three months ended March 31, 2020 | Outstanding shares | |||

| Balance, December 31, 2019 | 4,639,139 | |||

| Shares issued for Common Stock | 10,000 | |||

| Shares issued due to conversion of Convertible Promissory Note | 1,257,478 | |||

| Settlement of stock-based liabilities | 124,668 | |||

| Shares issued for services | 40,000 | |||

| Shares issued to employees | 58,334 | |||

| Balance, March 31, 2020 | 6,071,285 | |||

On January 3, 2020 Dinar Zuz provided an additional amount of $300 to the Company which was be provided in a form of the Optima Convertible Note pursuant to a securities purchase agreement between the Company and Optima, dated July 30, 2019. Additionally, on January 3, 2020, the Company issued 100,000 shares of its Common Stock to Dinar Zuz LLC, as a result of a conversion of the Dinar Convertible Note in the amount of $300.

On January 9, 2020, the Company issued 40,000 shares of its Common Stock pursuant to a service Agreement between the Company and a service provider, dated June 3, 2019. The fair market value of the shares at the issuance date was $240.

On January 14, 2020, the Company issued 66,334 shares of its Common Stock pursuant to a settlement of stock-based liabilities. The fair market value of the shares was $459.

On January 14, 2020, the Company issued 58,334 shares of Common Stock to employees. All shares were issued pursuant to the Company’s Share and Options Incentive Enhancement Plan (2016). The Company has estimated the fair value of such shares at $332.

On February 10, 2019, the Company issued 10,000 shares of its Common Stock pursuant to a securities purchase agreement between the Company and a private investor, dated October 25, 2018.

On March 3, 2020, Dinar Zuz provided an additional amount of $450 to the Company which was be provided in a form of the Dinar Zuz Convertible Note pursuant to a securities purchase agreement between the Company and Dinar Zuz, dated July 30, 2019. The Company issued 1,157,478 shares of its Common Stock to Dinar Zuz LLC, as a result of a conversion of the Dinar Convertible Note in the amount of $700.

10

CUENTAS, INC.

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(Amounts in U.S. dollar thousands, except share and per share data)

NOTE 5 – RELATED PARTY TRANSACTIONS

Related party balances at March 31, 2020 and December 31, 2019 consisted of the following:

Due from related parties

| March 31, 2020 | December 31, 2019 | |||||||

| (dollars in thousands) | ||||||||

| (a) Next Cala 360 | 61 | 54 | ||||||

| Total Due from related parties | 61 | 54 | ||||||

Related party payables, net of discounts

| December 31, 2019 | December 31, 2019 | |||||||

| (dollars in thousands) | ||||||||

| (b) Due to Next Communications, Inc. (current) | $ | 10 | $ | 10 | ||||

| Total Due from related parties | $ | 10 | $ | 10 | ||||

| (a) | Next Cala 360, is a Florida corporation established and managed by the Company’s Chief Executive Officer. |

| (b) | Next Communication, Inc. is a corporation in which the Company’s Chief Executive Officer a controlling interest and serves as the Chief Executive Officer. See disclosure above regarding payments by the Company in connection with the bankruptcy of Next Communication, Inc. |

11

CUENTAS, INC.

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(Amounts in U.S. dollar thousands, except share and per share data)

NOTE 6 – CUSTOMER CONCENTRATION

The Company did not have any one customer account for more than 10% of its revenues during the three months ended March 31, 2020 and 2019, respectively.

NOTE 7 – COMMITMENTS AND CONTINGENCIES

On February 12, 2018, the Company was served with a complaint from Viber Media, Inc. (“Viber”) for reimbursement of attorney’s fees and costs totaling $528 arising from a past litigation with Viber. The Company is vigorously defending their rights in this case as we believe this demand is premature as litigation is ongoing. The Company has no accrual related to this complaint as of March 31, 2020 given the premature nature of the motion.

On July 6, 2017, the Company received notice an existing legal claim against Accent InterMedia (“AIM”) had been amended to include claims against the Company. The claims brought against the Company include failure to comply with certain judgments for collection of funds by the plaintiff while having a controlling interest in AIM via its ownership of Transaction Processing Products (“TPP”). On April 17, 2019, the Company entered into a settlement agreement (the “SVS Settlement Agreement”) with Comdata, Inc. d/b/a Stored Value Solutions (“SVS”) whereby the Company will pay a total of $37 over 7 months, starting July 1, 2019. Only in the event that the Company defaults by failing to make timely payments, SVS may file in Kentucky for the judgment of $70. On February 13, 2020, the Company completed the payments in accordance with the SVS Settlement Agreement and the case was dismissed.

On December 20, 2017, a Complaint was filed by J. P. Carey Enterprises, Inc., alleging a claim for $473 related to the Franjose Yglesias-Bertheau filed lawsuit against PLKD listed above. Even though the Company made the agreed payment of $10 on January 2, 2017 and issued 12,002 shares as conversion of the $70 note as agreed in the settlement agreement, the Plaintiff alleges damages which the Company claims are without merit because they received full compensation as agreed. The Company is in the process of defending itself against these claims. On January 29, 2019, the Company was served with a complaint by J.P. Carey Enterprises, Inc., (“JP Carey”) which was filed in Fulton County, Georgia claiming similar issues as to the previous complaint, with the new claimed damages totaling $1,108. The Company has hired an attorney and feels these claims are frivolous and is defending the situation vigorously.

On September 28, 2018, the Company was notified of a complaint filed against it by a former supplier. The Company has not yet received formal service of the complaint and is awaiting such service at which time it can fully assess the complaint. The Company has not accrued any losses as of March 31, 2020 related to the complaint given the early nature of the process.

On November 7, 2018, the Company was served with a complaint by IDT Domestic Telecom, Inc. vs the Company and its subsidiary Limecom, Inc. for telecommunications services provided to the Subsidiary during 2018 in the amount of $50. The Company has no accrual as of March 31, 2020 related to the complaint given the early nature of the process. The Company intends to file a motion to dismiss the Company as a defendant since the Company has no contractual relationship with the plaintiff.

On May 1, 2019, the Company received a Notice of Demand for Arbitration (the “Demand”) from Secure IP Telecom, Inc. (“Secure IP), who allegedly had a Reciprocal Carrier Services Agreement (RCS) exclusively with Limecom and not with Cuentas. The Demand originated from a Demand for Arbitration that Secure IP received from VoIP Capital International (“VoIP”) in March 2019, demanding $1,053 in damages allegedly caused by unpaid receivables that Limecom assigned to VoIP based on the RCS. The Company will vigorously defend its position to be removed as a named party in this action due to the fact that Cuentas rescinded the Limecom acquisition on January 30, 2019.

On January 24, 2020, the Company received a Corrected Notice of Hearing regarding Qualtel SA de CV, a Mexican Company vs Next Communications, Inc. for a “Plaintiff’s Motion for Order to Show Cause and/or for Contempt as to Non-Party, Cuentas, Inc.” The Company retained a counsel and will vigorously defend its position.

The Company executed a lease for office space effective November 1, 2019. The lease requires monthly rental payments of $6.

NOTE 8 – SUBSEQUENT EVENTS

On April 2, 2020, the Company issued 70,000 shares of its Common Stock pursuant to a securities purchase agreement between the Company and a private investor, dated October 25, 2018.

On April 6, 2020, the Company entered into 180 days Loan Agreement with Dinar Zuz LLC to borrow $250 at an annual interest rate of nine percent (9.0%) (the second “Dinar Zuz Note”).

12

ITEM 2. MANAGEMENT’S DISCUSSION AND ANALYSIS AND RESULTS OF OPERATIONS

The following discussion and analysis provide information which management of the Company believes to be relevant to an assessment and understanding of the Company’s results of operations and financial condition. This discussion should be read together with the Company’s financial statements and the notes to the financial statements, which are included in this report.

Forward-Looking Statements

This Report contains forward-looking statements that relate to future events or our future financial performance. Some discussions in this report may contain forward-looking statements that involve risk and uncertainty. A number of important factors could cause our actual results to differ materially from those expressed in any forward-looking statements made by us in this Report. Forward-looking statements are often identified by words like “believe,” “expect,” “estimate,” “anticipate,” “intend,” “project” and similar words or expressions that, by their nature, refer to future events.

In some cases, you can also identify forward-looking statements by terminology such as “may,” “will,” “should,” “plans,” “predicts,” “potential,” or “continue,” or the negative of these terms or other comparable terminology. These statements are only predictions and involve known and unknown risks, uncertainties, and other factors that may cause our actual results, levels of activity, performance or achievements to be materially different from any future results, levels of activity, performance or achievements expressed or implied by these forward-looking statements.

Although we believe that the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee future results, levels of activity, or achievements. You should not place undue certainty on these forward-looking statements, which apply only as of the date of this Report. These forward-looking statements are subject to certain risks and uncertainties that could cause actual results to differ materially from historical results or our predictions. Except as required by applicable law, including the securities laws of the United States, we do not intend to update any of the forward-looking statements in an effort to conform these statements to actual results.

Company Overview

Cuentas, Inc. (the “Company”) is a corporation formed under the laws of Florida, which focuses on the business of using proprietary technology to provide e-banking and e-commerce services delivering mobile banking, online banking, prepaid debit and digital content services to the unbanked, underbanked and underserved communities. The Company’s exclusivity with CIMA’s proprietary software platform enables Cuentas to offer comprehensive financial services and additional robust functionality that is absent from other General-Purpose Reloadable Cards (“GRP”).

Operating Subsidiaries. The Company’s business operations are conducted primarily through its subsidiaries, described elsewhere in this report.

Properties. The Company’s headquarters are located in Miami, Florida.

Our Business

The Cuentas Fintech Card is a general-purpose reloadable card (“GPR”) integrated into a proprietary robust ecosystem that provides customers with a FDIC bank account at the physical point of presence where the Cuentas Fintech Card is purchased. The comprehensive financial services include:

| Direct ACH Deposits | ATM Cash Withdrawal | Bill Pay and Online Purchases | ||

| Money Remittance | Peer to Peer Payments | Mobile check deposit | ||

| Debit Card Network Processing | ATM Cash Withdrawals | Cash Reload at over 40,000 retailers | ||

| Online banking | Major Transit Authority Tokens | Discounted Gift Cards |

13

The Ecosystem includes a mobile wallet for digital currencies, stored value card balances, prepaid telecom minutes, loyalty reward points, and any purchases made in the Cuentas Virtual Marketplace. The Cuentas Fin Tech Card is integrated with the Los Angeles Metro, Utah Transit Authority and Grand Rapids Transit system to store mass transit currency and pay for transit access via the Cuentas Digital Wallet

The Cuentas Fintech Card stores products purchased in the Virtual Market Place where Tier-1 retailers, gaming currencies, amazon cash, and wireless telecom prepaid minutes “top ups”. Additionally, well-known brand name restaurants in the marketplace automatically discount purchases at POS when the customer pays the bill with the Cuentas Card.

The Latino Market

The name “Cuentas” is a Spanish word that has multiple meanings and was chosen for strategic reasons, to develop a close relationship with the Spanish speaking population. It means “Accounts” as in bank accounts and it can also mean “You can count on me” as in “Cuentas conmigo”. Aditionally, it can be used to “Pay or settle accounts” (saldar cuentas) , accountability (rendición de cuentas), to be accountable (rendir cuentas), and other significant meanings.

The U.S. Latino population numbers 43.8 million U.S. Immigrants, according to the 2017 FDIC Survey. It excludes immigrants, illegal aliens and undocumented individuals. The Federal Deposit Insurance Corporation (FDIC) defines the Unbankable as those adults without an account at a bank or other financial institution and are considered to be outside the mainstream for one reason or another. The Federal Reserve estimated that there were approximately 55 million unbanked or underbanked adult Americans in 2018, which account for 22 percent of U.S. households. The Latino demographic is more distrusting of banking institutions and generally have more identification, credit, and former bank account issues more so than any other U. S. minority.

The Cuentas FinTech Card is uniquely positioned to service the Latino demographic with comprehensive financial products that do not require any visits to bank branches, and our fees are completely transparent via the Cuentas Wallet and online banking. Most importantly our strategic banking partner, Sutton Bank, does not require a U.S. government issued identification card.

Products

The Cuentas General-Purpose Reloadable Card (“GPR”)

The Cuentas general-purpose reloadable (“GPR”) acts as a comprehensive banking solution marketed toward the 20 million+ unbanked U.S. Latino community (The unbanked is described by the Federal Deposit Insurance Corporation (FDIC) as those adults without an account at a bank or other financial institution and are considered to be outside the mainstream for one reason or another. The Federal Reserve estimated that there were approximately 55 million unbanked or underbanked adult Americans in 2018, which account for 22 percent of U.S. households). The Cuentas GPR is uniquely enabling access to the U.S. financial system to those without the necessary paperwork to bank at a traditional financial institution while enabling greater functionality than a traditional bank account. This proprietary GPR card allows consumers that reside in the US to acquire a Cuentas GPR prepaid debit card using their US or Foreign Passport, Driver’s License, Matricula Consular or certain US Residency documentation. The GPR Card provides an FDIC insured bank account with ATM, direct deposit, cash reload, fee free Cuentas App to Cuentas App fund transfers and mobile banking capabilities, among other key features such as purchasing discounted gift cards and adding Mass Transit Credits to digital accounts (available in California, Connecticut, Michigan and shortly, New York City). Upcoming App upgrades will also include international remittance and other services. Subsequent stages will see the integration of the Cuentas Store where consumers will be able to use funds in their account to purchase 3rd party digital and gift cards (many at discounted prices), US & International mobile phone top-ups, mass transportation and tolling access (select markets - CT, NYC, Grand Rapids-MI, LA, etc.) as well as digital Content for Gaming/Dining/Shopping and Cash reloads.

14

The Cuentas app is available for download now on the Apple App Store and on the Google Play Store for Android, allows consumers to easily activate their Cuentas prepaid Mastercard, review their account balance and conduct financial transactions. Cuentas is introducing fee free fund transfers to friends, family and vendors that have their own Cuentas App, which will be a very useful feature to compete with other popular Apps that charges fees for immediate fund transfers and availability on the same day.

The Cuentas Business Model

The Cuentas business model leverages profitability from multiple revenue sources, many of which are synergistic market segments.

The Cuentas GPR card has several revenue centers. The Company will receive a onetime activation charge for each activated GPR card and a monthly recurring charge. These charges were designed to be very reasonable to both consumers and the Company. In addition to these charges, Cuentas will receive a commission each time funds are loaded and reloaded to the card.

The Cuentas Wallet produces recurring profits and is an integral part of the Cuentas offering. It will produce revenue each time that consumers purchase third party gift cards, digital access, mass transit tickets, mobile phone topups (US & International) and more - most at discounted prices. The actual discount is shown to the consumer and is immediately applied to their purchase, so smart shoppers will be able to get everyday products and services at discounted prices.

The Cuentas Wallet is projected to add several new, profitable, mass market services including bill pay and international remittances.

Cuentas Rewards offers free long distance calling to its cardholders, who earn value with certain transactions. Our target demographic uses both internet and prepaid calling services to communicate with family members around the US and in their country. This added benefit is designed, at a very low cost, to provide extra benefits to our cardholders which should help to maintain and solidify valuable relationships with them.

Prepaid Debit Card Market Overview

The Research and Markets report titled “Prepaid Card Market: Payment Trends, Market Dynamics, and Forecasts 2020 - 2025” released in January 2020 states that “In the United States, prepaid cards remain the preferred choice for the unbanked market segment....” It also states that “The move towards a cashless society is substantial, further driving the prepaid card market.”

Major competitors to Cuentas are Green Dot, American Express Serve, Netspend Prepaid, Starbucks Rewards, Walmart Money card and Akimbo Prepaid.

Cuentas is strategically positioned in the marketplace to have a lower monthly fee and lower reload fees than most cards. Additional benefits and features should move the Cuentas card ahead of other offerings as consumers realize the value of the Cuentas wallet and Rewards program.

The Cuentas Technology platform

The Cuentas technology platform is comprised of CIMA Group’s Knetik and Auris software platforms. The platform is built on a powerful integrated component framework delivering a variety of capabilities accessible by a set of industry standard REST-based API endpoints. In addition to handling electronic transactions such as deposits and purchasing, the platform will have the capability of organizing virtual currencies into wallets, essentially future proofing it in todays’ evolving financial environment. It enables the organizing of the user’s monetary deposits into a tree-based set of wallets, through strictly enforced user permissions, to delineate proper controls in a tiered monetary asset organizational structure, thus providing a sound basis for family and/or corporate control and distribution of funds across individuals.

The Platform also contains a sound and proven gamification engine, capable of driving user behaviors in a manner that entices and rewards using incentivization based on proven behavioral science patterns. At the heart of this gamification engine lies a proven and robust rules engine which can easily integrate and modify process flows and orchestrations between disparate platforms, allowing for a quick and easy integration of complex, orchestrated integrations between internal process automation and invocations of external systems. The platform will provide Android and iOS software for users to execute a wide variety of transactions including, but not limited to, account balances, account transfers and in-app purchases. User messaging are also integrated and are achieved via SMS, email, in-app messaging, and voice.

15

The user management application uses rich metadata CRM and single-Sign-On (SSO) to track user behavior and personalize the user experience. It is fully integrated with our Strategic Partners, scalable and manages the digital ecosystem entitlements. The platform can process both physical and virtual goods, digital assets, real time currency value exchange, virtual currency support with current exchange rates and support nontraditional assets, in addition to credit card, POS, Debits, and digital wallet management.

The user management application uses rich metadata CRM and single-Sign-On (SSO) to track user behavior and personalize the user experience. The unique rules engine is capable of all aspects of gamification: badging, questing, leveling, points consumption, leader boards, loyalty and reward points and personalization with tracking and messaging to support behavior management. Business intelligence is used for reporting and communication of product management via Rate Deck Management, Pinless ANI Recognition, IV and Call Flows and Access Number Management. The platform has redundant reporting for enhanced billing and fraud control and itegrates customer service with Business Intelligence and platform integrity

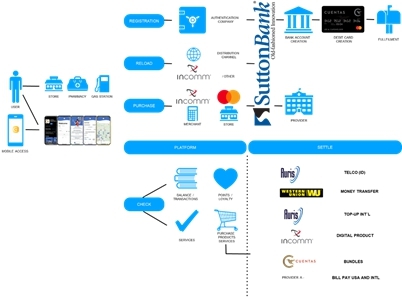

The graphic below illustrates Cuentas’ strategic agreements with Sutton Bank and InComm, Sutton Bank is the Issuer of the Cuentas GPR card while the InComm “Processor” relationship provides access to many third party products and services.

16

Strategic Partners

Sutton Bank (“Sutton”)

Sutton is our issuing bank for the Cuentas Fintech Card. Sutton provides online banking direct deposit, bank accounts, telephone support and debit functionality for our GPR cards. Sutton is responsible for know your client (KYC) compliance and enables customers to open bank accounts electronically with non-conventional documentation that may not be accepted at traditional banks. They accept over 13 forms of identification, which, when used together with either Social Security or ITIN, can be used for confirmation of identity: Passport, Driver’s License, Matricula Consular, US Residency documentation, among others.

Interactive Communications International, Inc. (“InComm”)

On July 23, 2019, the Company entered into a five (5) year Processing Services Agreement (“PSA”) with Incomm, a leading payments technology company, to power and expand the Company’s GPR card network. Incomm distributes Gift and GPR Cards to over 210,000 U.S. retailers and has long standing partnerships with over 1,000 of the most recognized brands that are eligible for Cuentas’ Discount Purchase Platform. Through its 94% owned subsidiary, Next Cala Inc., Cuentas previously branded a GPR card program with Incomm and was paid approximately $300,000 to develop the Mio GPR card for the telecom sector.

Under the PSA, InComm, through its VanillaDirect network, will act as prepaid card processor and expand the Company’s GPR Card network. VanillaDirect is currently available at major retailers such as: Walmart, Seven Eleven, Walgreens, CVS Pharmacy, Rite Aid and many more. In addition, the Company will implement the VanillaDirect cash reload services into its 31,600 U.S. locations under SDI NEXT.

Under the PSA, Incomm will provide processing services, Data Storage Services, Account Servicing, Reporting, Output and Hot Carding services to the Company. Processing Services will consist mainly of Authorization and Transaction Processing Services whereas InComm will process authorizations for transactions made with or on a Prepaid Product, and any payments or adjustments made to a Prepaid Product. InComm will also process Company’s Data and post entries in accordance with the Specifications. Data Storage Services will consist mainly of storage of the Company’s Data in a format that is accessible online by Company through APIs designated by InComm, subject to additional API and data sharing terms and conditions. Incomm will also provide Web/API services for Prepaid Cuentas GPR applications and transactions.

In consideration for Incomm’s services the company will pay an initial Program Setup & Implementation Fees in the amount of $500,000, which of $300,000 will be paid at the earlier of the Launch Date or three (3) months after contract execution, then $50,000 each at the beginning of the second, third, fourth and fifth anniversary of the agreement. In addition, the Company will pay a minimum monthly fee of $30,000 starting on the fourth month of the first year following the launch of the Cuentas GPR card, $50,000 during the second year following the launch of the Cuentas GPR card and $75,000 thereafter. The Company will as also pay 0.25% of all funds added to the Cuentas GPR cards, excluding Vanilla Direct Reload Network and an API Services fee of $0.005 per transaction. The Company may pay other fees as agreed between the Company and Incomm.

17

SDI NEXT Distribution LLC (“SDI NEXT”)

On December 6, 2017, the Company completed its formation of SDI NEXT Distribution in which it owns a 51% membership interest, previously announced August 24, 2017 as a Letter of Intent with Fisk Holdings, LLC. As Managing Member of the newly formed LLC, the Company will contribute a total of $500,000, to be paid per an agreed-upon schedule over a twelve-month period. Fisk Holdings, LLC will contribute 30,000 (thirty thousand) active Point of Sale locations for distribution of retail telecommunications and prepaid financial products and services to include, but not be limited to: prepaid General Purpose Reload (“GPR”) cards, prepaid gift cards, prepaid money transfer, prepaid utility payments, and other prepaid products. The completed formation of an established distribution business for third-party gift cards, digital content, mobile top up, financial services and digital content, which presently includes more than 31,600 U.S. active Point of Sale locations, including store locations, convenience stores, bodegas, store fronts, etc. The parties agreed that additional product lines may be added with unanimous decision by the Managing Members of the LLC. During 2018, it was agreed between the parties to distribute the Company’s recently announced CUENTAS GPR card and mobile banking solution aimed to the unbanked, underbanked and financially underserved consumers, making them available to customers at the more than 31,600 retail locations SDI presently serves. It was also agreed between the parties to renegotiate the terms of the Company’s investment in and SDI NEXT Distribution LLC once the development of the GPR card and the retail stores system are completed and the GPR card is ready for distribution in the retail locations of SDI.

Cuentas is currently offering discounted prices to its cardholders, through the Cuentas Wallet for the following digital products and services as illustrated in the graphic below. We intend to work to increase the quantity of offerings considerably in the future.

The below graphic illustrates the elements that Cuentas has strategically developed to provide marketplace advantages.

The Cuentas Competitive GPR Advantages

18

Cuentas strategic overview to augment growth and minimize churn is illustrated below. The goal is to offer the consumer a One Stop Shop, easy to use, mobile wallet that can solve many of their daily needs and desires while saving them time and money.

The Cuentas ECO System

Cuentas, Inc. (the “Company”) invests in financial technology and engages in use of certain licensed technology to provide innovative telecommunications, mobility, and remittance solutions to unserved, unbanked, and emerging markets. The Company uses proprietary technology and certain licensed technology to provide innovative telecommunications and telecommunications mobility and remittance solutions in emerging markets. The Company also offers prepaid telecommunications minutes to consumers through its Tel3 division and also offers wholesale telecommunications minutes through its Limecom subsidiary.

The Company was incorporated under the laws of the State of Florida on September 21, 2005 to act as an holding company for its subsidiaries, both current and future. Its subsidiaries are Meimoun and Mammon, LLC (100% owned), Next Cala, Inc (94% owned), NxtGn, Inc. (65% owned) and Next Mobile 360, Inc. (100% owned), SDI Next Distribution LLC (51% owned). Additionally, Next Cala, Inc. has a 60% interest in NextGlocal, a subsidiary formed in May 2016. During the year ended December 31, 2016, the Company acquired a business segment, Tel3, from an existing corporation. Tel3 was merged into Meimoun and Mammon, LLC effective January 1, 2017.

Formation of SDI NEXT Distribution LLC (“SDI NEXT”)

On December 6, 2017, the Company completed its formation of SDI NEXT Distribution in which it owns a 51% membership interest, previously announced August 24, 2017 as a Letter of Intent with Fisk Holdings, LLC. As Managing Member of the newly formed LLC, the Company will contribute a total of $500,000, to be paid per an agreed-upon schedule over a twelve-month period. Fisk Holdings, LLC will contribute 30,000 (thirty thousand) active Point of Sale locations for distribution of retail telecommunications and prepaid financial products and services to include, but not be limited to: prepaid General Purpose Reload (“GPR”) cards, prepaid gift cards, prepaid money transfer, prepaid utility payments, and other prepaid products. The completed formation of an established distribution business for third-party gift cards, digital content, mobile top up, financial services and digital content, which presently includes more than 31,600 U.S. active Point of Sale locations, including store locations, convenience stores, bodegas, store fronts, etc. The parties agreed that additional product lines may be added with unanimous decision by the Managing Members of the LLC. During 2018, it was agreed between the parties to distribute the Company’s recently announced CUENTAS GPR card and mobile banking solution aimed to the unbanked, underbanked and financially underserved consumers, making them available to customers at the more than 31,600 retail locations SDI presently serves.

19

Results of operations for the three months ended March 31, 2020 and 2019

Revenue

The Company generates revenues through the sale and distribution of prepaid telecom minutes and other related telecom services.

| Three Months Ended March 31, | ||||||||

| 2020 | 2019 | |||||||

| Revenue from sales | 134 | 302 | ||||||

| Total revenue | 134 | 302 | ||||||

Revenues during the three months ended March 31, 2020 totaled $134,000 compared to $302,000 for the three months ended March 31, 2019.

Costs of Revenue

Costs of revenue consists of the purchase of wholesale minutes for resale and related telecom platform costs. Cost of revenues during the three months ended March 31, 2020 totaled $ 177,000 compared to $237,000 for the three months ended March 31, 2019.

Operating Expenses

Operating expenses totaled $2,539,000 during the three months ended March 31, 2020 compared to $490,000 during the three months ended March 31, 2019 representing a net increase of $2,049,000. The increase in the operating expenses is mainly due to the increase in the amortization expense of intangible assets, salary cost of our officers, Stock based compensation and shares issued for services expenses.

Other Income

The Company recognized other income of $422,000 during the three months ended March 31, 2020 compared to an income $105,000 during the three months ended March 31, 2019. The net change from the prior period is mainly due to the change in our stock-based liabilities. Gain from Change in Fair Value of stock-based liabilities for the three-month period ended March 31, 2020 was $359,000 as compared to a loss of $54,000 for the three-month period ended March 31, 2019. The gain (loss) is attributable to the decrease in the Fair Value of our stock-based liabilities mainly due to the decrease (increase) in the price of share of our common stock.

20

Net Income (Loss)

We incurred a net loss of $2,163,000 for the three-month period ended March 31, 2020, as compared to a net loss of $320,000 for the three-month period ended March 31, 2019.

Inflation and Seasonality

In management’s opinion, our results of operations have not been materially affected by inflation or seasonality, and management does not expect that inflation risk or seasonality would cause material impact on our operations in the future.

Liquidity and Capital Resources

Liquidity is the ability of a company to generate funds to support its current and future operations, satisfy its obligations, and otherwise operate on an ongoing basis. Significant factors in the management of liquidity are funds generated by operations, levels of accounts receivable and accounts payable and capital expenditures.

As of March 31, 2020, we had cash and cash equivalents of $21,000 as compared to $16,000 as of December 31, 2019. As of March 31, 2020, we had a working capital deficit of $2,890,000 thousand, as compared to a deficit of $3,752,000 as of December 31, 2019. The decrease in our working capital deficit was mainly attributable to the decrease of $599,000 in our stocked based liabilities and $250,000 in our Convertible notes payable.

Net cash used in operating activities was $738,000 for the three-month period ended March 31, 2020, as compared to cash used in operating activities of $465,000 for the three-month period ended March 31, 2019. The Company’s primary uses of cash have been for professional support and working capital purposes.

Net cash used in investing activities was $0 for the three-month period ended March 31, 2020 and 2019, respectively.

Net cash provided by financing activities was approximately $743,000 for the three-month period ended March 31, 2020, as compared to net cash provided by financing activities was approximately $490,000 for the three-month period ended March 31, 2019. We have principally financed our operations in 2019 through the sale of our common stock and the issuance of debt.

Due to our operational losses, we have principally financed our operations through the sale of our Common Stock and the issuance of convertible debt.

Despite the Capital raise that we have conducted the above conditions raise substantial doubt about our ability to continue as a going concern. Although we anticipate that cash resources will be available to the Company through its current operations, it believes existing cash will not be sufficient to fund planned operations and projects investments through the next 12 months. Therefore, we are still striving to increase our sales, attain profitability and raise additional funds for future operations. Any meaningful equity or debt financing will likely result in significant dilution to our existing stockholders. There is no assurance that additional funds will be available on terms acceptable to us, or at all.

Since inception, we have financed our cash flow requirements through issuance of common stock, related party advances and debt. As we expand our activities, we may, and most likely will, continue to experience net negative cash flows from operations. Additionally, we anticipate obtaining additional financing to fund operations through common stock offerings, to the extent available, or to obtain additional financing to the extent necessary to augment our working capital. In the future we need to generate sufficient revenues from sales in order to eliminate or reduce the need to sell additional stock or obtain additional loans. There can be no assurance we will be successful in raising the necessary funds to execute our business plan.

We anticipate that we will incur operating losses in the next twelve months. Our lack of operating history makes predictions of future operating results difficult to ascertain. Our prospects must be considered in light of the risks, expenses and difficulties frequently encountered by companies in their early stage of development, particularly companies in new and rapidly evolving markets. Such risks for us include, but are not limited to, an evolving and unpredictable business model and the management of growth.

To address these risks, we must, among other things, implement and successfully execute our business and marketing strategy surrounding our Cuentas braded general-purpose reloadable cards, continually develop and upgrade our website, respond to competitive developments, lower our financing costs and specifically our accounts receivable factoring costs, and attract, retain and motivate qualified personnel. There can be no assurance that we will be successful in addressing such risks, and the failure to do so can have a material adverse effect on our business prospects, financial condition and results of operations.

21

Off-Balance Sheet Arrangements

As at March 31, 2020, we had no off-balance sheet arrangements of any nature.

Critical Accounting Policies

The preparation of financial statements in conformity with GAAP in the United States requires our management to make assumptions, estimates and judgments that affect the amounts reported in the financial statements, including the notes thereto, and related disclosures of commitments and contingencies, if any. Note 3 to our consolidated audited financial statements filed with the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2019 describes the significant accounting policies and methods used in the preparation of our financial statements. We consider our critical accounting policies to be those related to share-based payments because they are both important to the portrayal of our financial condition and require management to make judgments and estimates about uncertain matters.

Recent Accounting Standards announced

In August 2018, the FASB issued ASU 2018-13, Fair Value Measurement (Topic 820): Disclosure Framework – Changes to the Disclosure Requirements for Fair Value Measurement. The amendments apply to reporting entities that are required to make disclosures about recurring or nonrecurring fair value measurements and should improve the cost, benefit, and effectiveness of the disclosures. ASU 2018-13 categorized the changes into those disclosures that were removed, those that were modified, and those that were added. The primary disclosures that were removed related to transfers between Level 1 and Level 2 investments, along with the policy for timing of transfers between levels. In addition, disclosing the valuation processes for Level 3 fair value measurements was removed. The amendments are effective for all organizations for fiscal years, and interim periods within those fiscal years, beginning after December 15, 2019. Early adoption is permitted. The Company notes that this guidance will impact its disclosures beginning January 1, 2020.

In June 2016, FASB issued ASU No. 2016-13, “Financial Instruments - Credit Losses (Topic 326): Measurement of Credit Losses on Financial Instruments”. In November 2018, FASB issued ASU No. 2018-19, “Codification Improvements to Topic 326, Financial Instruments-Credit Losses”, which amends the scope and transition requirements of ASU 2016-13. Topic 326 requires a financial asset (or a group of financial assets) measured at amortized cost basis to be presented at the net amount expected to be collected. The measurement of expected credit losses is based on relevant information about past events, including historical experience, current conditions and reasonable and supportable forecasts that affect the collectability of the reported amount. Topic 326 will originally become effective for the Company beginning January 1, 2020, with early adoption permitted, on a modified retrospective approach. As a smaller reporting company, the effective date for the Company has been delayed until fiscal years beginning after December 15, 2022, in accordance with ASU 2019-10, although early adoption is still permitted. This standard is not expected to have a material impact to the Company’s consolidated financial statements after evaluation.

In December 2019, the FASB issued ASU 2019-12, Income Taxes (Topic 740): Simplifying the Accounting for Income Taxes. The amendments in this ASU simplify the accounting for income taxes, eliminates certain exceptions to the general principles in Topic 740 and clarifies certain aspects of the current guidance to improve consistent application among reporting entities. ASU 2019-12 is effective for fiscal years beginning after December 15, 2021 and interim periods within annual periods beginning after December 15, 2022, though early adoption is permitted, including adoption in any interim period for which financial statements have not yet been issued. This standard is not expected to have a material impact to the Company’s consolidated financial statements after evaluation.

Recently adopted accounting pronouncements

The significant accounting policies applied in the annual financial statements of the Company as of December 31, 2019 are applied consistently in these financial statements.

ITEM 3. QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK.

As a smaller reporting company, we are not required to provide the information required by this item.

ITEM 4. CONTROLS AND PROCEDURES.

Evaluation of Disclosure Controls and Procedures

Evaluation of Disclosure Controls and Procedures. We maintain “disclosure controls and procedures” as such term is defined in Rule 13a-15(e) under the Securities Exchange Act of 1934. In designing and evaluating our disclosure controls and procedures, our management recognized that disclosure controls and procedures, no matter how well conceived and operated, can provide only reasonable, not absolute, assurance that the objectives of disclosure controls and procedures are met. Additionally, in designing disclosure controls and procedures, our management necessarily was required to apply its judgment in evaluating the cost-benefit relationship of possible disclosure controls and procedures. The design of any disclosure controls and procedures is also based in part upon certain assumptions about the likelihood of future events, and there can be no assurance that any design will succeed in achieving its stated goals under all potential future conditions.

22

The Company’s Chief Executive Officer and Chief Financial Officer have evaluated the effectiveness of our disclosure controls and procedures as of the end of the period covered by this report. Based on such evaluation, and as discussed in greater detail below, the Chief Executive Officer and Chief Financial Officer have concluded that, as of the end of the period covered by this report, disclosure controls and procedures are not effective:

| ● | to give reasonable assurance that the information required to be disclosed in reports that are file under the Securities Exchange Act of 1934 is recorded, processed, summarized and reported within the time periods specified in the Securities and Exchange Commission’s rules and forms, and | |

| ● | to ensure that information required to be disclosed in the reports that are file or submitted under the Securities Exchange Act of 1934 is accumulated and communicated to management, including our CEO and our Treasurer, to allow timely decisions regarding required disclosure. |

Based on that evaluation, management concluded that, during the period covered by this report, such internal controls and procedures were not effective due to the following material weakness identified:

| ● | Lack of appropriate segregation of duties, |

| ● | Lack of information technology (“IT”) controls over revenue, |

| ● | Lack of adequate review of internal controls to ascertain effectiveness, |

| ● | Lack of control procedures that include multiple levels of supervision and review, and |

Implemented or Planned Remedial Actions in response to the Material Weaknesses

We will continue to strive to correct the above noted weakness in internal control once we have adequate funds to do so. We believe appointing a director who qualifies as a financial expert will improve the overall performance of our control over our financial reporting.

Because of its inherent limitations, internal control over financial reporting may not prevent or detect misstatements. Projections of any evaluation of effectiveness to future periods are subject to the risk that controls may become inadequate because of changes in conditions, or that the degree of compliance with the policies or procedures may deteriorate.

Management is in the process of determining how best to change our current system and implement a more effective system to ensure that information required to be disclosed has been recorded, processed, summarized and reported accurately. Our management acknowledges the existence of this issue, and intends to develop procedures to address it to the extent possible given limitations in financial and human resources in and to remediate all the material weaknesses by the end of the fiscal quarter ending March 31, 2020.

Changes in Internal Controls over Financial Reporting

Our management, with the participation of our CEO and CFO, performed an evaluation to determine whether any change in our internal controls over financial reporting (as defined in Rule 13a-15(f) under the Exchange Act) occurred during the three-month period ended March 31, 2019. Based on that evaluation, our CEO and our CFO concluded that no change occurred in the Company’s internal controls over financial reporting during the three-month period ended March 31, 2020 that has materially affected, or is reasonably likely to materially affect, the Company’s internal controls over financial reporting.

23

PART II – OTHER INFORMATION

ITEM 1. LEGAL PROCEEDINGS

From time to time, we may become involved in various lawsuits and legal proceedings which arise in the ordinary course of business. However, litigation is subject to inherent uncertainties, and an adverse result in these or other matters may arise from time to time that may harm our business.