UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 10-K

☒ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2019

☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

Commission File Number: 333-148987

CUENTAS, INC.

(Exact name of Registrant as specified in its charter)

| Florida | 20-3537265 | |

(State or Other Jurisdiction of |

(I.R.S. Employer |

200 S BISCAYNE BLVD., 55TH FLOOR, MIAMI, FL 33131

(Address of principal executive offices)

800-611-3622

(Registrant’s telephone number)

Securities registered under Section 12(b) of the Act: None

Securities registered under Section 12(g) of the Act: Common Stock, $0.001 par value

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐ No ☒

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No ☒

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ☐ | Accelerated filer | ☐ |

| Non-accelerated filer | ☒ | Smaller reporting company | ☒ |

| Emerging growth company | ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ☐ No ☒

As of June 30, 2019, the last day of the registrant’s most recently completed second fiscal quarter, the aggregate market value of the Class A common stock outstanding, other than shares held by persons who may be deemed affiliates of the registrant, computed by reference to the closing sales price of the Class A common stock on June 28, 2019 was $1,866,858

The number of shares of Common Stock, $0.001 par value, outstanding on March 27, 2020 was 6,071,285 shares.

TABLE OF CONTENTS

i

FORWARD-LOOKING STATEMENTS

This report includes forward-looking statements as the term is defined in the Private Securities Litigation Reform Act of 1995 or by the U.S. Securities and Exchange Commission in its rules, regulations and releases, regarding, among other things, all statements other than statements of historical facts contained in this report, including statements regarding our future financial position, business strategy and plans and objectives of management for future operations. The words “believe,” “may,” “estimate,” “continue,” “anticipate,” “intend,” “should,” “plan,” “could,” “target,” “potential,” “is likely,” “will,” “expect” and similar expressions, as they relate to us, are intended to identify forward-looking statements. We have based these forward-looking statements largely on our current expectations and projections about future events and financial trends that we believe may affect our financial condition, results of operations, business strategy and financial needs. In addition, our past results of operations do not necessarily indicate our future results.

These statements include, among other things, statements regarding:

| ● | our ability to implement our business plan; |

| ● | our ability to attract key personnel; |

| ● | our ability to operate profitably; |

| ● | our ability to efficiently and effectively finance our operations; |

| ● | inability to raise additional financing for working capital; |

| ● | inability to efficiently manage our operations; |

| ● | the fact that our accounting policies and methods are fundamental to how we report our financial condition and results of operations, and they may require management to make estimates about matters that are inherently uncertain; |

| ● | changes in the legal, regulatory and legislative environments in the markets in which we operate; |

| ● | adverse state or federal legislation or regulation that increases the costs of compliance, or adverse findings by a regulator with respect to existing operations. |

Except as otherwise required by applicable laws and regulations, we undertake no obligation to publicly update or revise any forward-looking statements or the risk factors described in this report, whether as a result of new information, future events, changed circumstances after the date of this report. Neither the Private Securities Litigation Reform Act of 1995 nor Section 27A of the Securities Act of 1933 provides any protection to us for statements made in this report. You should not rely upon forward-looking statements as predictions of future events or performance. We cannot assure you that the events and circumstances reflected in the forward-looking statements will be achieved or occur. Although we believe that the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee future results, levels of activity, performance or achievements.

The Company maintains an internet website at www.cuentas.com. The Company makes available, free of charge, through the Investor Information section of the web site, its Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K, Section 16 filings and all amendments to those reports, as soon as reasonably practicable after such material is electronically filed with the Securities and Exchange Commission. Any of the foregoing information is available in print to any stockholder who requests it by contacting our Investor Relations Department.

Throughout this Annual Report references to “Cuentas”, “we”, “our”, “us”, “the Company”, and similar terms refer to Cuentas, Inc.

ii

| ITEM 1. | BUSINESS |

The Company

Cuentas, Inc. (the “Company”) is a corporation formed under the laws of Florida, which focuses on the business of using proprietary technology to provide e-banking and e-commerce services delivering mobile banking, online banking, prepaid debit and digital content services to the unbanked, underbanked and underserved communities. The Company’s exclusivity with CIMA’s proprietary software platform enables Cuentas to offer comprehensive financial services and additional robust functionality that is absent from other General-Purpose Reloadable Cards (“GRP”).

Operating Subsidiaries. The Company’s business operations are conducted primarily through its subsidiaries, described elsewhere in this report.

Properties. The Company’s headquarters are located in Miami, Florida.

Our Business

The Cuentas Fintech Card is a general-purpose reloadable card (“GPR”) integrated into a proprietary robust ecosystem that provides customers with a FDIC bank account at the physical point of presence where the Cuentas Fintech Card is purchased. The comprehensive financial services include:

| Direct ACH Deposits | ATM Cash Withdrawal | Bill Pay and Online Purchases |

| Money Remittance | Peer to Peer Payments | Mobile check deposit |

| Debit Card Network Processing | ATM Cash Withdrawals | Cash Reload at over 40,000 retailers |

| Online banking | Major Transit Authority Tokens | Discounted Gift Cards |

The Ecosystem includes a mobile wallet for digital currencies, stored value card balances, prepaid telecom minutes, loyalty reward points, and any purchases made in the Cuentas Virtual Marketplace. The Cuentas Fin Tech Card is integrated with the Los Angeles Metro, Utah Transit Authority and Grand Rapids Transit system to store mass transit currency and pay for transit access via the Cuentas Digital Wallet

The Cuentas Fintech Card stores products purchased in the Virtual Market Place where Tier-1 retailers, gaming currencies, amazon cash, and wireless telecom prepaid minutes “top ups”. Additionally, well-known brand name restaurants in the marketplace automatically discount purchases at POS when the customer pays the bill with the Cuentas Card.

The Latino Market

The name “Cuentas” is a Spanish word that has multiple meanings and was chosen for strategic reasons, to develop a close relationship with the Spanish speaking population. It means “Accounts” as in bank accounts and it can also mean “You can count on me” as in “Cuentas conmigo”. Aditionally, it can be used to “Pay or settle accounts” (saldar cuentas) , accountability (rendición de cuentas), to be accountable (rendir cuentas), and other significant meanings.

The U.S. Latino population numbers 43.8 million U.S. Immigrants, according to the 2017 FDIC Survey. It excludes immigrants, illegal aliens and undocumented individuals. The Federal Deposit Insurance Corporation (FDIC) defines the Unbankable as those adults without an account at a bank or other financial institution and are considered to be outside the mainstream for one reason or another. The Federal Reserve estimated that there were approximately 55 million unbanked or underbanked adult Americans in 2018, which account for 22 percent of U.S. households. The Latino demographic is more distrusting of banking institutions and generally have more identification, credit, and former bank account issues more so than any other U. S. minority.

The Cuentas FinTech Card is uniquely positioned to service the Latino demographic with comprehensive financial products that do not require any visits to bank branches, and our fees are completely transparent via the Cuentas Wallet and online banking. Most importantly our strategic banking partner, Sutton Bank, does not require a U.S. government issued identification card.

Products

The Cuentas General-Purpose Reloadable Card (“GPR”)

The Cuentas general-purpose reloadable (“GPR”) acts as a comprehensive banking solution marketed toward the 20 million+ unbanked U.S. Latino community (The unbanked is described by the Federal Deposit Insurance Corporation (FDIC) as those adults without an account at a bank or other financial institution and are considered to be outside the mainstream for one reason or another. The Federal Reserve estimated that there were approximately 55 million unbanked or underbanked adult Americans in 2018, which account for 22 percent of U.S. households). The Cuentas GPR is uniquely enabling access to the U.S. financial system to those without the necessary paperwork to bank at a traditional financial institution while enabling greater functionality than a traditional bank account. This proprietary GPR card allows consumers that reside in the US to acquire a Cuentas GPR prepaid debit card using their US or Foreign Passport, Driver’s License, Matricula Consular or certain US Residency documentation. The GPR Card provides an FDIC insured bank account with ATM, direct deposit, cash reload, fee free Cuentas App to Cuentas App fund transfers and mobile banking capabilities, among other key features such as purchasing discounted gift cards and adding Mass Transit Credits to digital accounts (available in California, Connecticut, Michigan and shortly, New York City). Upcoming App upgrades will also include international remittance and other services. Subsequent stages will see the integration of the Cuentas Store where consumers will be able to use funds in their account to purchase 3rd party digital and gift cards (many at discounted prices), US & International mobile phone top-ups, mass transportation and tolling access (select markets - CT, NYC, Grand Rapids-MI, LA, etc.) as well as digital Content for Gaming/Dining/Shopping and Cash reloads.

The Cuentas app is available for download now on the Apple App Store and on the Google Play Store for Android, allows consumers to easily activate their Cuentas prepaid Mastercard, review their account balance and conduct financial transactions. Cuentas is introducing fee free fund transfers to friends, family and vendors that have their own Cuentas App, which will be a very useful feature to compete with other popular Apps that charges fees for immediate fund transfers and availability on the same day.

1

The Cuentas Business Model

The Cuentas business model leverages profitability from multiple revenue sources, many of which are synergistic market segments.

The Cuentas GPR card has several revenue centers. The Company will receive a one time activation charge for each activated GPR card and a monthly recurring charge. These charges were designed to be very reasonable to both consumers and the Company. In addition to these charges, Cuentas will receive a commission each time funds are loaded and reloaded to the card. Additional fees as seen in the following short form table are designed to cover costs and potentially provide another revenue stream.

The Cuentas Wallet produces recurring profits and is an integral part of the Cuentas offering. It will produce revenue each time that consumers purchase third party gift cards, digital access, mass transit tickets, mobile phone topups (US & International) and more - most at discounted prices. The actual discount is shown to the consumer and is immediately applied to their purchase, so smart shoppers will be able to get everyday products and services at discounted prices.

The Cuentas Wallet is projected to add several new, profitable, mass market services including bill pay and international remittances.

Cuentas Rewards offers free long distance calling to its cardholders, who earn value with certain transactions. Our target demographic uses both internet and prepaid calling services to communicate with family members around the US and in their country. This added benefit is designed, at a very low cost, to provide extra benefits to our cardholders which should help to maintain and solidify valuable relationships with them.

Prepaid Debit Card Market Overview

The Research and Markets report titled “Prepaid Card Market: Payment Trends, Market Dynamics, and Forecasts 2020 - 2025” released in January 2020 states that “In the United States, prepaid cards remain the preferred choice for the unbanked market segment....” It also states that “The move towards a cashless society is substantial, further driving the prepaid card market.”

Major competitors to Cuentas are Green Dot, American Express Serve, Netspend Prepaid, Starbucks Rewards, Walmart Money card and Akimbo Prepaid.

Cuentas is strategically positioned in the marketplace to have a lower monthly fee and lower reload fees than most cards. Additional benefits and features should move the Cuentas card ahead of other offerings as consumers realize the value of the Cuentas wallet and Rewards program.

The Cuentas Technology platform

The Cuentas technology platform is comprised of CIMA Group’s Knetik and Auris software platforms. The platform is built on a powerful integrated component framework delivering a variety of capabilities accessible by a set of industry standard REST-based API endpoints. In addition to handling electronic transactions such as deposits and purchasing, the platform will have the capability of organizing virtual currencies into wallets, essentially future proofing it in todays’ evolving financial environment. It enables the organizing of the user’s monetary deposits into a tree-based set of wallets, through strictly enforced user permissions, to delineate proper controls in a tiered monetary asset organizational structure, thus providing a sound basis for family and/or corporate control and distribution of funds across individuals.

The Platform also contains a sound and proven gamification engine, capable of driving user behaviors in a manner that entices and rewards using incentivization based on proven behavioral science patterns. At the heart of this gamification engine lies a proven and robust rules engine which can easily integrate and modify process flows and orchestrations between disparate platforms, allowing for a quick and easy integration of complex, orchestrated integrations between internal process automation and invocations of external systems. The platform will provide Android and iOS software for users to execute a wide variety of transactions including, but not limited to, account balances, account transfers and in-app purchases. User messaging are also integrated and are achieved via SMS, email, in-app messaging, and voice.

2

The user management application uses rich metadata CRM and single-Sign-On (SSO) to track user behavior and personalize the user experience. It is fully integrated with our Strategic Partners, scalable and manages the digital ecosystem entitlements. The platform can process both physical and virtual goods, digital assets, real time currency value exchange, virtual currency support with current exchange rates and support nontraditional assets, in addition to credit card, POS, Debits, and digital wallet management.

The user management application uses rich metadata CRM and single-Sign-On (SSO) to track user behavior and personalize the user experience. The unique rules engine is capable of all aspects of gamification: badging, questing, leveling, points consumption, leader boards, loyalty and reward points and personalization with tracking and messaging to support behavior management. Business intelligence is used for reporting and communication of product management via Rate Deck Management, Pinless ANI Recognition, IV and Call Flows and Access Number Management. The platform has redundant reporting for enhanced billing and fraud control and itegrates customer service with Business Intelligence and platform integrity

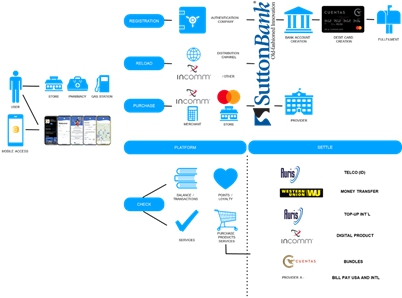

The graphic below illustrates Cuentas’ strategic agreements with Sutton Bank and InComm, Sutton Bank is the Issuer of the Cuentas GPR card while the InComm “Processor” relationship provides access to many third party products and services.

3

Strategic Partners

Sutton Bank (“Sutton”)

Sutton is our issuing bank for the Cuentas Fintech Card. Sutton provides online banking direct deposit, bank accounts, telephone support and debit functionality for our GPR cards. Sutton is responsible for know your client (KYC) compliance and enables customers to open bank accounts electronically with non-conventional documentation that may not be accepted at traditional banks. They accept over 13 forms of identification, which, when used together with either Social Security or ITIN, can be used for confirmation of identity: Passport, Driver’s License, Matricula Consular, US Residency documentation, among others.

Interactive Communications International, Inc. (“InComm”)

On July 23, 2019, the Company entered into a five (5) year Processing Services Agreement (“PSA”) with Incomm, a leading payments technology company, to power and expand the Company’s GPR card network. Incomm distributes Gift and GPR Cards to over 210,000 U.S. retailers and has long standing partnerships with over 1,000 of the most recognized brands that are eligible for Cuentas’ Discount Purchase Platform. Through its 94% owned subsidiary, Next Cala Inc., Cuentas previously branded a GPR card program with Incomm and was paid approximately $300,000 to develop the Mio GPR card for the telecom sector.

Under the PSA, InComm, through its VanillaDirect network, will act as prepaid card processor and expand the Company’s GPR Card network. VanillaDirect is currently available at major retailers such as: Walmart, Seven Eleven, Walgreens, CVS Pharmacy, Rite Aid and many more. In addition, the Company will implement the VanillaDirect cash reload services into its 31,600 U.S. locations under SDI NEXT.

Under the PSA, Incomm will provide processing services, Data Storage Services, Account Servicing, Reporting, Output and Hot Carding services to the Company. Processing Services will consist mainly of Authorization and Transaction Processing Services whereas InComm will process authorizations for transactions made with or on a Prepaid Product, and any payments or adjustments made to a Prepaid Product. InComm will also process Company’s Data and post entries in accordance with the Specifications. Data Storage Services will consist mainly of storage of the Company’s Data in a format that is accessible online by Company through APIs designated by InComm, subject to additional API and data sharing terms and conditions. Incomm will also provide Web/API services for Prepaid Cuentas GPR applications and transactions.

In consideration for Incomm’s services the company will pay an initial Program Setup & Implementation Fees in the amount of $500,000, which of $300,000 will be paid at the earlier of the Launch Date or three (3) months after contract execution, then $50,000 each at the beginning of the second, third, fourth and fifth anniversary of the agreement. In addition, the Company will pay a minimum monthly fee of $30,000 starting on the fourth month of the first year following the launch of the Cuentas GPR card, $50,000 during the second year following the launch of the Cuentas GPR card and $75,000 thereafter. The Company will as also pay 0.25% of all funds added to the Cuentas GPR cards, excluding Vanilla Direct Reload Network and an API Services fee of $0.005 per transaction. The Company may pay other fees as agreed between the Company and Incomm.

4

SDI NEXT Distribution LLC (“SDI NEXT”)

On December 6, 2017, the Company completed its formation of SDI NEXT Distribution in which it owns a 51% membership interest, previously announced August 24, 2017 as a Letter of Intent with Fisk Holdings, LLC. As Managing Member of the newly formed LLC, the Company will contribute a total of $500,000, to be paid per an agreed-upon schedule over a twelve-month period. Fisk Holdings, LLC will contribute 30,000 (thirty thousand) active Point of Sale locations for distribution of retail telecommunications and prepaid financial products and services to include, but not be limited to: prepaid General Purpose Reload (“GPR”) cards, prepaid gift cards, prepaid money transfer, prepaid utility payments, and other prepaid products. The completed formation of an established distribution business for third-party gift cards, digital content, mobile top up, financial services and digital content, which presently includes more than 31,600 U.S. active Point of Sale locations, including store locations, convenience stores, bodegas, store fronts, etc. The parties agreed that additional product lines may be added with unanimous decision by the Managing Members of the LLC. During 2018, it was agreed between the parties to distribute the Company’s recently announced CUENTAS GPR card and mobile banking solution aimed to the unbanked, underbanked and financially underserved consumers, making them available to customers at the more than 31,600 retail locations SDI presently serves. It was also agreed between the parties to renegotiate the terms of the Company’s investment in and SDI NEXT Distribution LLC once the development of the GPR card and the retail stores system are completed and the GPR card is ready for distribution in the retail locations of SDI.

Cuentas is currently offering discounted prices to its cardholders, through the Cuentas Wallet for the following digital products and services as illustrated in the graphic below. We intend to work to increase the quantity of offerings considerably in the future.

The below graphic illustrates the elements that Cuentas has strategically developed to provide marketplace advantages.

The Cuentas Competitive GPR Advantages

5

Cuentas strategic overview to augment growth and minimize churn is illustrated below. The goal is to offer the consumer a One Stop Shop, easy to use, mobile wallet that can solve many of their daily needs and desires while saving them time and money.

The Cuentas ECO System

Recent Developments

In December 2019, a novel strain of coronavirus was reported to have surfaced in Wuhan, China, which has and is continuing to spread throughout China and other parts of the world, including the United States. On January 30, 2020, the World Health Organization declared the outbreak of the coronavirus disease (COVID-19) a “Public Health Emergency of International Concern.” On January 31, 2020, U.S. Health and Human Services Secretary Alex M. Azar II declared a public health emergency for the United States to aid the U.S. healthcare community in responding to COVID-19, and on March 11, 2020 the World Health Organization characterized the outbreak as a “pandemic”. A significant outbreak of COVID-19 and other infectious diseases could result in a widespread health crisis that could adversely affect the economies and financial markets worldwide, as well as our business and operations. The extent to which COVID-19 impacts our business and results of operations will depend on future developments, which are highly uncertain and cannot be predicted, including new information which may emerge concerning the severity of COVID-19 and the actions to contain COVID-19 or treat its impact, among others. If the disruptions posed by COVID-19 or other matters of global concern continue for an extensive period of time, our business and results of operations may be materially adversely affected.

LimeCom, Inc. (LimeCom”)

Pursuant to the Share Purchase Agreement, dated September 19, 2017 (the “Limecom Purchase Agreement”), the Company had rights to rescind the Limecom Acquisition. On January 29, 2019, the Company and Heritage entered into an amendment to the Limecom Purchase Agreement (the “Amendment”) under which the parties agreed to extend the right of the Company to rescind the Limecome Acquisition at its discretion, and in connection therewith to return the shares of Limecom to Heritage in consideration for the following:

(a) The 138,147 shares of the Company issued to Heritage and its Stockholders will not be returned to the Company, and the remaining 34,537 shares of the Company in escrow will not be issued to Heritage. Instead, the Company will issue an additional 90,000 shares of the Company as directed by Heritage.

6

(b) The $1,807,000 payment obligation under the LimeCom Purchase Agreement will be cancelled.

(c) The Employment Agreement with Orlando Taddeo as International CEO of LimeCom will be terminated.

(d) Heritage, its Stockholders and the current management of LimeCom agreed to indemnify and hold harmless Next Group Acquisition and the Company from any liabilities (known and unknown) incurred by LimeCom (accrued, disclosed or undisclosed by LimeCom) up to and including the rescission date.

(e) Heritage and LimeCom’s current management agreed to cooperate with Next Group Acquisition and/or the Company with any information required to be disclosed to the Securities and Exchange Commission (“SEC”) as a part of Cuentas’ SEC disclosure obligations with respect to the recession.

(f) Heritage, LimeCom and its current management and Stockholders agreed to cooperate with Cuentas’ auditors in providing all material information to Cuentas’ auditors as is reasonably required.

(g) Heritage and the LimeCom current management agreed that the intercompany loan in the approximate sum of $231,000 will be cancelled.

(h) Cuentas agreed to issue 20,740 shares of Cuentas restricted stock to several LimeCom employees in exchange for salaries due to them. Those shares will be issued and held in escrow until the full satisfaction of the terms of this Amendment.

(i) Cuentas agreed to advance the sum of $25,000 toward the payments agreed upon to be paid to American Express (“AMEX”) by Limecom, and Limecom agrees to pay the sum of $25,000 to AMEX and the balance of the payments under the Stipulation of Settlement with American Express as agreed upon by LimeCom.

On January 30, 2019, Cuentas sent an executed document to Limecom rescinding the acquisition of LimeCom, Inc. (“Limecom”) according to the Amendment signed January 29, 2019.

Cuentas fulfilled its obligation to pay $25,000 to AMEX pursuant to the Amendment dated January 29, 2019.

Entrance into a Term Sheet and Series of Integrated Agreements with Cima Telecom Inc. (“Cima”)

7

Series of Integrated Transactions

On December 31, 2019, the Company entered into a series of integrated transactions to license the Platforms from CIMA, through CIMA’s wholly owned subsidiaries Knetik, and Auris (the “Transaction Closing”) pursuant to that certain Platform License Agreement, dated December 31, 2019 by and among (i) the Company, (ii) CIMA, (iii) Knetik and (iv) Auris (the “License Agreement”) and the various other agreements listed below.

License Agreement

Contemporaneously with the Transaction Closing, on December 31, 2019 (the “Effective Date”) the Company entered into the License Agreement. Pursuant to the License Agreement, the Company has an exclusive, non-transferable, non-sublicensable, royalty-free license to access and use the Knetik and Auris technology platforms (collectively, the “Licensed Technology”) in the form provided to the Company via the Hosting Services (as defined in the License Agreement) and solely within the FINTECH space for the Company’s business purposes. Under the License Agreement Cima Group received a 1-time licensing fee in the amount of $9,000,000 in the form of a convertible note that may be converted, at the option of Cima, into up to 25% of the total shares of Common Stock of the Company, par value $0.001 per share (the “Common Stock”) on a fully diluted basis as of December 31, 2019. Pursuant to the License Agreement, the Company shall pay CIMA annual fees for the maintenance and support services in accordance with the following schedule: (i) for the first (1st) calendar year from the Effective Date, $300,000 to be paid on June 30, 2020; (ii) for the second (2nd) calendar year from the Effective Date, $500,000 to be paid on December 31, 2020; (iii) for the third (3rd) calendar year from the Effective Date, $700,000 to be paid on December 31, 2021; (iv) for the fourth (4th) calendar year from the Effective Date, $1,000,000 to be paid on December 31, 2022; (v) for the fifth (5th) calendar year from the Effective Date, $640,000 to be paid on December 31, 2022; and (vi) for each calendar year thereafter, $640,000 to be paid on the anniversary date.

Voting Agreement

Contemporaneously with the Transaction Closing, on December 31, 2019, the Company entered into that certain voting agreement and proxy (the “Voting Agreement”), by and among the Company, Arik Maimon, the Company’s Chief Executive Officer, Michael De Prado, the Company’s President, Dinar, and CIMA. Pursuant to the Voting Agreement, each of CIMA, Dinar and Mr. De Prado shall have the right to designate one director to the Company’s Board of Directors and Mr. Maimon will have the right to designate two directors to the Board as promptly as practicable after the Transaction Closing. At each meeting of the Company’s stockholders at which the election of directors is to be considered, each of CIMA, Dinar, Mr. Maimon and Mr. De Prado shall have the right to designate one nominee for election at such meeting. Additionally, the Company has granted CIMA board observer rights whereby CIMA shall have the right to invite one representative to attend all meetings of the Board in a non-voting observer capacity. The size of the Board and appointee rights are subject to change in the event that the Company’s shares of Common Stock become listed on the NASDAQ Capital Market (or if there is any other similar transaction which ultimately involves the listing of the Company’s capital stock, whether Common Stock or any other class or series of capital stock of the Company, on any exchange affiliated with or similar to NASDAQ). Furthermore, pursuant to the Voting Agreement, each of Mr. Maimon and Mr. De Prado appointed each of CIMA and Dinar as their proxy and attorney-in-fact, with full with full power of substitution and resubstitution, to vote or act by written consent with respect to the shares of Voting Stock (as defined in the Voting Agreement) representing each individual’s pro rata percentage of the CIMA Proxy Stock and Dinar Proxy Stock (as defined in the Voting Agreement), as may be recalculated from time to time subject to the terms and conditions of the Voting Agreement, until the CIMA Warrant is exercised and until the Dinar Warrant is exercised, respectively.

Note and Warrant Purchase Agreement

Contemporaneously with the Transaction Closing, the Company entered into a Note and Warrant Purchase Agreement (the “Purchase Agreement”) by and between the Company and CIMA, pursuant to which the Company made and sold to (i) CIMA a 3% convertible promissory note (the “Convertible Promissory Note”) in the principal amount of $9,000,000 and (ii) (a) CIMA a warrant (the “CIMA Warrant”) , to purchase from the Company an aggregate of duly authorized, validly issued, fully paid and nonassessable shares (the “Shares”) of common stock of the Company, par value $0.001 per share (the “Common Stock”), equal to twenty-five percent (25%) of shares of Common Stock or any other equity issued upon the conversion of the Series B preferred stock. The Purchase Agreement contained customary representations, warranties, covenants, and conditions, including indemnification. Among other conditions to closing, the Company has agreed to take all necessary steps to amend and restate its Articles of Incorporation (the “A&R Articles”) and to amend and restate its Bylaws (the “A&R Bylaws”) and properly file and effect such A&R Articles and A&R Bylaws with the Secretary of State of the State of Florida and the U.S. Securities and Exchange Commission, each as necessary, no later than June 30, 2020.

8

Convertible Promissory Note

Contemporaneously with the Transaction Closing, the Company made and sold to CIMA a convertible promissory note (the “CIMA Convertible Promissory Note”) in accordance with the Purchase Agreement. Pursuant to the Convertible Promissory Note, at any time on or before twelve (12) months after the date of the CIMA Convertible Promissory Note, CIMA may elect in its sole and absolute discretion to convert all unpaid principal and accrued and unpaid interest under the CIMA Convertible Promissory Note into 25% of the issued and outstanding Common Stock of the Company calculated on a fully diluted basis as of the conversion date, assuming the conversion, exercise, and exchange of all equity and debt securities of the Company which are convertible into, or exercisable or exchangeable for, Common Stock of the Company, but not including the Warrants. On December 31, 2019, CIMA exercised its option to convert the Convertible Promissory Note into 1,757,478 shares of Common Stock of the Company, which constitutes 25% of the issued and outstanding shares of Common Stock of the Company calculated on a fully diluted basis as of the same date.

Warrants

Contemporaneously with the Transaction Closing, the Company made and sold a warrant to each of (a) CIMA (the “CIMA Warrant”) and (b) Dinar (the “Dinar Warrant,” and together with the CIMA Warrant, the “Warrants”), each in accordance with the Purchase Agreement. Pursuant to the Warrants, upon exercise, each of CIMA and Dinar shall be entitled to purchase from the Company, in the aggregate, an amount of duly authorized, validly issued, fully paid and nonassessable shares of Common Stock equal to twenty-five percent (25%) of total outstanding shares of the Company on a fully-diluted basis (taking into account any warrants, options, debt convertible into shares or other rights underlying shares of the Company) as of the conversion date; provided, however, that each Warrant shall increase to include 25% of any additional shares (or warrants, options, debt convertible into shares or other rights underlying shares of the Company) of the Company only to the extent such shares are issued in breach of the Voting Agreement (as defined below). Pursuant to their terms, the Warrants are exercisable, in whole and not in part during the term commencing on December 31, 2019 and ending on the earlier of (a) thirty (30) days following the date on which the Company amends and restates its Articles of Incorporation, which is amendment and restatement is filed with and accepted by the Secretary of State of the State of Florida or (b) upon a Change of Control, as defined in the Warrants.

Asset Pledge Agreement

Contemporaneously with the Transaction Closing, the Company entered into an Asset Pledge Agreement with CIMA (the “Pledge Agreement”). Pursuant to the Pledge Agreement, the Company unconditionally and irrevocably pledged all of its rights, title and interest in and to the Licensed Technology and any rights and assets granted pursuant to the License Agreement to CIMA as a guarantee for the full and punctual fulfillment of its obligations under certain provisions of the Voting Agreement, and the issuance of the securities under the CIMA Convertible Promissory Note and the CIMA Warrant.

9

Side Letter Agreement

Contemporaneously with the Transaction Closing, the Company entered into a side letter agreement (the “Side Letter Agreement”), dated December 31, 2019, by and among the Company, Arik Maimon, Michael De Prado, Dinar and CIMA. Pursuant to the Side Letter Agreement, for as long as the License Agreement is in effect, the Convertible Promissory Note is outstanding and unpaid, or CIMA is a shareholder of the Company and owns at least 5% of the Company’s Common Stock, in addition to any other vote or approval required under the Company’s Articles of Incorporation, Bylaws, or any other agreement, each as amended from time to time, the Company has agreed not to take certain actions without certain approval thresholds of the directors appointed by CIMA, Dinar, Mr. Maimon and Mr. De Prado. These negative covenants restrict, among other things, the Company’s ability to incur additional debt, alter certain employment agreements currently in place, enter into any consolidation, combination, recapitalization or reorganization transactions, and issue additional capital stock. Additionally, pursuant to the Side Letter Agreement, upon conversion of the Convertible Promissory Note by CIMA, Cuentas shall have the primary right of first refusal, and each of Dinar, Mr. De Prado and Mr. Maimon have a secondary right of first refusal, to purchase any shares of Common Stock which CIMA intends to sell to the bona fide third party purchaser on the same terms and conditions as CIMA would have sold such shares of the Company’s Common Stock to any third party purchaser. Further, CIMA has a co-sale right to participate in a sale of shares of the Company’s Common Stock, in the event that Mr. De Prado, Mr. Maimon or any other director or officer of the Company holding greater than 1% of the Company’s Common Stock (on a fully diluted basis) proposes to sell any of his, her or its shares of Common Stock. In addition, CIMA and/or Dinar have been granted certain information rights, subject to their continued ownership of the CIMA Convertible Promissory Note or of 5% or more shares of the Company’s issued and outstanding Common Stock. Furthermore, pursuant to the Side Letter Agreement, upon a successful up-listing of the Company’s shares on the NASDAQ Capital Markets and once the market capitalization of the Company is greater than $50 million for a period of 10 consecutive trading days, Mr. Maimon and Mr. De Prado will have a right to earn a special bonus in the amount of $500,000 each.

Entrance into a Prepaid Card Program Management Agreement with Sutton Bank (“Sutton”)

On September 27, 2019, we entered into a Prepaid Card Program Management Agreement (“PCPMA”) with Sutton, an Ohio chartered bank Corporation. The PCPMA provides that Sutton operates a prepaid card service and is an approved issuer of prepaid cards on the Discover, Mastercard, and Visa networks and provides services in connection with card transactions processed on one or more networks. The PCPMA designates Cuentas to become manager of the “Cuentas Mastercard Prepaid Card” management program, a GPR debit card program, subject to the terms and conditions of the PCPMA.

Entrance into a Prepaid Services Agreement (PSA) with Interactive Communications International, Inc. (“InComm”)

On July 23, 2019, the Company entered into a five (5) year processing services agreement with Incomm, a leading payments technology company, to power and expand the Company’s GPR card network. Per the PSA, InComm, through its VanillaDirect network, will act as prepaid card processor and expand the Company’s GPR Card network. VanillaDirect is currently available at major retailers such as: Walmart, Seven Eleven, Walgreens, CVS Pharmacy, Rite Aid and many more. In addition, the Company will implement the VanillaDirect cash reload services into its 31,600 U.S. locations under SDI NEXT.

The GPR card is intended to be launched during the second quarter of 2020, provides comprehensive solution for the approximately twenty million unbanked community members in the United States, uniquely enabling access to the U.S. financial system to those without the necessary documentation to bank with the traditional financial institutions in the U.S. The GPR will provide an FDIC insured bank account and electronic wallet. The Cuentas FDIC insured bank account will be embed with functionality such as: international remittance, bill pay, ATM, direct deposit, cash reload and mobile banking capabilities. The Cuentas’ electronic wallet will have unique features such as, digital content, gaming, internet shopping, tolling and public transportation, food & restaurants as well as mobile topups.

Under the PSA, Incomm will provide processing services, Data Storage Services, Account Servicing, Reporting, Output and Hot Carding services to the Company. Processing Services will consist mainly of Authorization and Transaction Processing Services whereas InComm will process authorizations for transactions made with or on a Prepaid Product, and any payments or adjustments made to a Prepaid Product. InComm will also process Company’s Data and post entries in accordance with the Specifications. Data Storage Services will consist mainly of storage of the Company’s Data in a format that is accessible online by Company through APIs designated by InComm, subject to additional API and data sharing terms and conditions. Incomm will also provide Web/API services for Prepaid Cuentas GPR applications and transactions.

In consideration for Incomm’s services the company will pay an initial Program Setup & Implementation Fees in the amount of $500,000, which of $300,000 will be paid at the earlier of the Launch Date or three (3) months after contract execution, then $50,000 each at the beginning of the second, third, fourth and fifth anniversary of the agreement. In addition, the Company will pay a minimum monthly fee of $30,000 starting on the fourth month of the first year following the launch of the Cuentas GPR card, $50,000 during the second year following the launch of the Cuentas GPR card and $75,000 then after. The Company will as also pay an 0.25% of all funds added to Cuentas GPR cards excluding Vanilla Direct Reload Network and an API Services fee of $0.005 per transaction. The Company may pay other fees as agreed between the Company and Incomm in the future.

Next CALA

Our Next CALA subsidiary owned the NextCALA-branded Prepaid Visa® General Purpose Reloadable (“GPR”) prepaid debit cards, bearing the Next CALA Debit™ and Visa® logos but that program expired as the agreement with InComm was not renewed. The main reason this program was not renewed was because it was replaced by the new agreement with InComm and Sutton Bank for the Cuentas GPR card.

NxtGn

NxtGn. Our NxtGn subsidiary is a software company which designed and developed high performance video platforms, call processing engines, and worldwide telephony networks but these platforms have been replaced by recent technology acquisitions and are no longer part of our business plan.

10

Cuentas Mobile

Cuentas Mobile. Our Cuentas Mobile subsidiary is a Mobile Virtual Network Operator (or “MVNO”) which provided NextMobile360™ branded mobile phones and prepaid voice, text, and data mobile phone services to a customer base currently consisting of approximately 1,000 subscribers. The brand name of these services is being migrated to Cuentas Mobile. Cuentas Mobile operates this business pursuant to contracts with Sprint Corporation which allow Cuentas Mobile to use Sprint’s network infrastructure to operate a virtual telecommunications network providing voice, text, and data services of essentially the same quality as those Sprint provides to its own retail subscribers. MVNO Mobile Virtual Network Operators such as Cricket, Boost, Simple and Lyca Moble have been successful at creating brands, without owning the towers, hardware or network.

Graphic Description: Sample of creative message planned for future advertising campaign.

We believe that our potential customers worldwide will migrate away from legacy telephone and banking systems to enhanced mobility solutions, the Company’s technological advantage and the synergies created by its unique combination of reloadable bank card and mobile virtual network operator rights will make its products increasingly useful to un-banked, under-banked, under-served and other emerging niche markets.

11

M&M

M&M. Our M&M subsidiary is a wholesale and retail provider of domestic and international long-distance voice, text, and data telephony services to carriers and consumers in the United States and throughout the world. M&M holds International and Domestic Section 214 authority issued by the Federal Communications Commission. M&M operates the retail Tel3 business as a separate division. M&M has historically provided wholesale long distance telephone service to a number of leading domestic and international carriers.

The Transmission Medium. M&M uses both private and public Internet services to function as the backbone of the M&M Network.

Next Communications, Inc. Bankruptcy

The Company has historically received financing from Next Communications, Inc., an entity controlled by our CEO, and had a related party payable balance of approximately $10,000 as of December 31, 2019 and $ 2,972,000 due to Next Communications, Inc. as of December 31, 2018. During the first calendar quarter of 2017, Next Communications, Inc. filed for bankruptcy protection. As a result, the related party payable is being handled by a court appointed trustee as an asset of Next Communications, Inc.

As discussed in an 8-K filed with the SEC on February 5, 2019, on January 29, 2019, the United States Bankruptcy Court Southern District of Florida, Miami Division, approved the Plan of Reorganization for Next Communications, Inc., whereby Cuentas Inc. would pay $600,000 to a specific creditor (100 NWT) in consideration from forgiveness of the payable balance that was not paid in the first quarter of 2019.

On or about March 5, 2019, Cuentas and Next Communication. paid $100,000 to the trust account of Genovese Joblove Battista, counsel for 100 NWT. On April 30, 2019, Cuentas received a Notice of Default (the “Notice”) from Genovese Joblove Battista, contending that a $550,000 Payment was in default due to the non-payment ordered by the United States Bankruptcy Court Southern District of Florida, Miami Division, and the potential reinstatement of approximately $1,678,000 final Judgment in favor of 100 NWT if not cured by May 11, 2019. On May 10, 2019, the Company paid $550,000 to the trust account of the specific creditor per the order and satisfied its obligation under the Approved Plan of the Reorganization for Next Communications, Inc., that was approved by the United States Bankruptcy Court Southern District of Florida Miami Division on January 29, 2019. On March 10, 2019, the Company paid $50,000 to the trust account of the specific creditor, per the order, and on May 10, 2019, the Company paid $550,000 to the same trust account of the specific creditor, per the order, and satisfied its obligation under the Approved Plan of the Reorganization for Next Communications, Inc., that was approved by the United States Bankruptcy Court Southern District of Florida, Miami Division, on January 29, 2019.

Employees

As of December 31, 2019, we have three (3) officers who have employment agreements. We have six full-time employees: our chief financial officer, chief Operation officer, compliance officer, VP Finance, IT Director and VP Retail Operations for the United States market. For more information relating to the employment agreements, please see the section below entitled “Item 11. Executive Compensation.”

Available Information

We also make our annual reports on Form 10-K, quarterly reports on Form 10-Q and current reports on Form 8-K, and related amendments, available free of charge through our website at www.cuentas.com as soon as reasonably practicable after we electronically file such material with (or furnish such material to) the Securities and Exchange Commission. The information contained on our website is not incorporated by reference into this Annual Report on Form 10-K and should not be considered to be part of this Annual Report on Form 10-K.

Copies of the reports and other information we file with the Securities and Exchange Commission may also be examined by the public without charge at 100 F Street, N.E., Room 1580, Washington D.C., 20549, or on the internet at www.sec.gov. Copies of all or a portion of such materials can be obtained from the SEC upon payment of prescribed fees. Please call the SEC at 1-800-SEC-0330 for further information.

| ITEM 1A. | RISK FACTORS |

As a “smaller reporting company”, we are not required to provide the information required by this Item.

| ITEM 1B. | UNRESOLVED STAFF COMMENTS |

None.

| ITEM 2. | PROPERTIES |

We currently lease approximately 1,200 square feet of office space at 200 S Biscayne BLVD., 55TH Floor, Miami, FL, 33131 as our principal offices. We believe these facilities are in good condition, but that we may need to expand our leased space as our business efforts increase.

| ITEM 3. | LEGAL PROCEEDINGS |

From time to time, we may become involved in various lawsuits and legal proceedings which arise in the ordinary course of business. However, litigation is subject to inherent uncertainties, and an adverse result in these or other matters may arise from time to time that may harm our business.

12

On July 6, 2017, the Company received notice an existing legal claim against Accent InterMedia (“AIM”) had been amended to include claims against the Company. The claims brought against the Company include failure to comply with certain judgments for collection of funds by the plaintiff while having a controlling interest in AIM via its ownership of Transaction Processing Products (“TPP”). On April 17, 2019, the Company entered into a settlement agreement (the “SVS Settlement Agreement”) with Comdata, Inc. d/b/a Stored Value Solutions (“SVS”) whereby the Company will pay a total of $37,500 over 7 months, starting July 1, 2019. Cuentas made its final payment to Comdata in Feb 2020 and received an Agreed Judgment of Dismissal from the court dated Feb 13, 2020.

On December 20, 2017, a complaint was filed by J. P. Carey Enterprises, Inc. (“J.P Carey” or “Plaintiff”) alleging a claim for $473,000 related to the Franjose Yglesias-Bertheau, a former Vice President of PLKD who filed a lawsuit against PLKD listed above. Even though the Company made the agreed payment of $10,000 on January 2, 2017 and issued 12,002 shares of Common Stock as conversion of the $70,000 note as agreed in the settlement agreement, the Plaintiff alleges damages which the Company claims are without merit because the Plaintiff received full compensation as agreed. The Company is in the process of defending itself against these claims. The Company has not accrued losses related to this claim due to the early stages of litigation. On January 29, 2019, the Company was served with a complaint by J.P. Carey Enterprises, Inc., (“JP Carey”) claiming similar issues as to the previous complaint, with the new claimed damages totaling $1,108,037.85. The Company has hired an attorney and feels these claims are frivolous and is defending the situation vigorously.

On February 12, 2018, the Company was served with a complaint from Viber for reimbursement of attorney’s fees and costs totaling $528,000 arising. The Company is vigorously defending their rights in this case as we believe this demand is premature as litigation is ongoing. The Company has not accrued an estimated loss related to this complaint as of December 31, 2019 or December 31, 2018 given the premature nature of the motion.

On October 23, 2018, Cuentas was served by Telco Cuba Inc. for an amount in excess of $15,000 but the total amount was not specified. The Company was served on Dec. 7, 2018 with a complaint alleging damages including unspecified damages for product, advertising and other damages in addition to $50,000 paid to Defendants. Cuentas has hired an attorney and has taken steps to defend itself vigorously in this case. Depositions are in process of being scheduled.

On October 25, 2018, the Company was served with a complaint by former company CFO, Michael Naparstek, claiming breach of contract for 1,666,666 shares (pre-split), $25,554 of compensation and $8,823 of expenses. This case was withdrawn in Palm Beach County and on January 11, 2019, a similar complaint was filed in Miami-Dade county. Cuentas has hired an attorney and has taken steps to defend itself vigorously in this case.

On November 7, 2018, the Company and its now former subsidiary, Limecom, were served with a complaint by IDT Domestic Telecom, Inc. for telecommunications services provided to Limecom during 2018 in the amount of $50,000. The Company has no accrual expenses as of December 31, 2019 related to the complaint given the early nature of the process. Limecom was a subsidiary of the Company during this period but since the Stock Purchase Agreement with Limecom was rescinded on January 30, 2019, and Limecom agreed to indemnify and hold harmless Cuentas/NGH from this and other debts, Cuentas hired an attorney and is defending itself vigorously in this case.

On May 1, 2019, the Company received a Notice of Demand for Arbitration (the “Demand”) from Secure IP Telecom, Inc. (“Secure IP), who allegedly had a Reciprocal Carrier Services Agreement (RCS) exclusively with Limecom and not with Cuentas. The Demand originated from a Demand for Arbitration that Secure IP received from VoIP Capital International (“VoIP”) in March 2019, demanding $1,052,838.09 in damages allegedly caused by unpaid receivables that Limecom assigned to VoIP based on the RCS. The Company will vigorously defend its position to be removed as a named party in this action due to the fact that Cuentas rescinded the Limecom acquisition on January 30, 2019.

On January 24, 2020, the Company received a Corrected Notice of Hearing regarding Qualtel SA de CV, a Mexican Company vs Next Communications, Inc. for a “Plaintiff’s Motion for Order to Show Cause and/or for Contempt as to Non-Party, Cuentas, Inc.” The Company retained a counsel and will vigorously defend its position.

| ITEM 4. | MINE SAFETY DISCLOSUES. |

Not applicable.

13

| ITEM 5. | MARKET FOR COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND SMALL BUSINESS ISSUER PURCHASE OF EQUITY SECURITIES |

Market Information

Our common stock is thinly traded on the OTCQB market. Without an active public trading market, a stockholder may not be able to liquidate their shares. The price for our securities may be highly volatile and may bear no relationship to our actual financial condition or results of operations. Factors we discuss in this report, including the many risks associated with an investment in our securities, may have a significant impact on the market price of our common stock.

The ability of individual stockholders to trade their shares in a particular state may be subject to various rules and regulations of that state. A number of states require that an issuer’s securities be registered in their state or appropriately exempted from registration before the securities are permitted to trade in that state. Presently, we have no plans to register our securities in any particular state.

The table below sets forth the high and low bid prices for our common stock as reflected on the OTC Bulletin Board for the last two fiscal years. Quotations represent prices between dealers, do not include retail markups, markdowns or commissions, and do not necessarily represent prices at which actual transactions were affected. The priced set forth below were obtained from Yahoo Finance.

| Common Stock | ||||||||

Year Ended December 31, 2019 | High | Low | ||||||

| First Quarter | $ | 3.95 | $ | 1.20 | ||||

| Second Quarter | $ | 2.75 | $ | 0.85 | ||||

| Third Quarter | $ | 3.95 | $ | 1.20 | ||||

| Fourth Quarter | $ | 5.85 | $ | 2.1 | ||||

| Common Stock | ||||||||

Year Ended December 31, 2018 | High | Low | ||||||

| First Quarter | $ | 6.00 | $ | 1.48 | ||||

| Second Quarter | $ | 9.90 | $ | 3.45 | ||||

| Third Quarter | $ | 12.01 | $ | 7.24 | ||||

| Fourth Quarter | $ | 17.40 | $ | 7.80 | ||||

Holders of Common Stock

As of March 27, 2020, we had 6,071,285 common shares and 10,000,000 series B preferred shares issued and outstanding. Additionally, there were 212,044 options to purchase common stock issued of which 182,044 are exercisable as of March 31, 2020. Furthermore, there were 190,867 warrants to purchase common stock issued as of March 27, 2020. The Company is authorized to issue up to 360,000,000 shares of common stock and 50,000,000 blank check preferred stock, par value $0.001.

Dividends

The payment of dividends is subject to the discretion of our Board of Directors and depends, among other things, upon our earnings, our capital requirements, our financial condition, and other relevant factors. We have not paid any dividends upon our common stock since our inception. By reason of our present financial status and our contemplated financial requirements, we may not declare additional dividends upon our common or preferred stock in the foreseeable future.

14

We have never paid any cash dividends. We may not pay additional cash or stock dividends in the foreseeable future on the shares of common or preferred stock. We intend to reinvest any earnings in the development and expansion of our business. Any cash dividends in the future to common stockholders will be payable when, as and if declared by our Board of Directors, based upon the Board’s assessment of:

| ● | our financial condition; |

| ● | earnings; |

| ● | need for funds; |

| ● | capital requirements; |

| ● | prior claims of preferred stock to the extent issued and outstanding; and |

| ● | other factors, including any applicable laws. |

Therefore, there can be no assurance that any addition dividends on the common or preferred stock will be declared.

Securities Authorized for Issuance under Equity Compensation Plans

We currently do not maintain any equity compensation plans.

Recent Sales of Unregistered Securities

On January 31, 2019, the Company issued 16,667 shares of its Common Stock pursuant to a Common Stock subscription. We issued such shares in reliance on the exemptions from registration pursuant to Section 4(a)(2) of the Securities Act.

15

On January 31, 2019, the Company received $50,000 under a private placement of and issued 16,667 shares of its Common Stock and warrants to purchase up to 16,667 shares of its Common Stock at an exercise price equal to $3.25 per share. We issued such shares in reliance on the exemptions from registration pursuant to Section 4(a)(2) of the Securities Act.

On January 31, 2019, the Company issued 17,333 shares of its Common Stock pursuant to a Common Stock subscription. We issued such shares in reliance on the exemptions from registration pursuant to Section 4(a)(2) of the Securities Act.

On January 31, 2019, the Company issued 107,910 shares of Common Stock to Heritage and its officers under the Amendment to rescind the Company’s option to sell the stock in Limecom back to Heritage. We issued such shares in reliance on the exemptions from registration pursuant to Section 4(a)(2) of the Securities Act.

On February 12, 2019, the Company issued warrants to purchase up to 35,834 shares of its Common Stock at an exercise price equal to $3.25 per share required by the anti-dilution provisions under the October 25, 2018 private placement. We issued such shares in reliance on the exemptions from registration pursuant to Section 4(a)(2) of the Securities Act.

On February 28, 2018, the Company issued 309,497 shares of its Common Stock pursuant to a settlement of stock-based liabilities. The fair market value of the shares was $464,000. We issued such shares in reliance on the exemptions from registration pursuant to Section 4(a)(2) of the Securities Act.

On February 28, 2019, The Company signed the Optima Term Sheet for a total investment of $2,500,000 over one year and received the first deposit of $500,000 on the same date. Under the Optima Term Sheet, it was agreed that the initial invested amount of $500,000 will in consideration for 166,667 shares of Common Stock of the Company. It was also agreed that Optima may purchase the Optima Convertible Note in the amount of $2,000,000, which may be funded on a quarterly basis. The term of the Optima Convertible Note shall be three years and it may be converted at a price per share equal to 75% of the public per share price on the date of conversion, but in any case, not less than $3 per share. Optima will additionally get a proxy to vote with the Controlling Shareholders of the Company’s par value $0.001 per Series B Preferred share (the “Preferred Stock”) held by the Company’s Chief Executive Officer and President.. The total investment in the Company shall be not be less than 25% of the outstanding shares at the first anniversary of the Optima Term Sheet. On May 10, 2019, the Company signed the First Amendment to the Optima Term Sheet with Optima Where Optima will make an additional deposit of $550,000 to the Company and that additional deposit will be provided to the Company in the form of a Convertible Note as discussed above. It was also agreed that Optima will provide an additional amount of $1,450,000 to the Company which will be provided in a form of a Convertible Note pursuant to the following schedule:

| Date | Amount | |||

| 05/28/2019 | $ | 200,000 | ||

| 08/28/2019 | $ | 500,000 | ||

| 11/28/2019 | $ | 500,000 | ||

| 02/28/2020 | $ | 250,000 | ||

All the other terms and conditions of the Optima Term Sheet, will remain in full force and effect. On May 11, 2019 the Company received a second deposit of $550,000 and on May 28, 2019 the Company received a third deposit of $200,000.

On July 18, 2019, the Company issued 65,978 shares of its Common Stock pursuant to a securities purchase agreement between the Company and a private investor, dated October 25, 2018. We issued such shares in reliance on the exemptions from registration pursuant to Section 4(a)(2) of the Securities Act.

On July 30, 2019, Optima assigned its rights under the Optima Term Sheet to Dinar Zuz. On the same date, the Company and Dinar Zuz executed the Dinar Subscription Agreement with the same terms as reflected in the Optima Term Sheet and its First Amendment. Under the Dinar Subscription Agreement, Dinar Zuz made an additional deposit of $250,000 and agreed to provide an additional amount of $1,000,000 to the Company which will be provided in a form of a Convertible Note pursuant to the following schedule:

| Date | Amount | |||

| 10/26/2019 | $ | 500,000 | ||

| 01/26/2020 | $ | 500,000 | ||

On August 12, 2019, the Company issued 166,666 shares of its Common Stock to Dinar Zuz pursuant to a securities purchase agreement entered into between the Company and Dinar Zuz on July 30, 2019. Additionally, the Company issued 333,334 shares of its Common Stock to Dinar Zuz LLC, as a result of a conversion of the Dinar Convertible Note in the amount of $1,000,000. We issued such shares in reliance on the exemptions from registration pursuant to Section 4(a)(2) of the Securities Act.

16

On September 11, 2019, the Company issued 25,000 shares of its Common Stock pursuant to a service Agreement between the Company and a service provider, dated May 16, 2019. The fair market value of the shares at the issuance date was $49,000. We issued such shares in reliance on the exemptions from registration pursuant to Section 4(a)(2) of the Securities Act.

On September 11, 2019, the Company issued 10,000 shares of its Common Stock pursuant to a service agreement dated April 17, 2019 between the Company and a service provider. The fair market value of the shares at the issuance date was $20,000. We issued such shares in reliance on the exemptions from registration pursuant to Section 4(a)(2) of the Securities Act.

On September 18, 2019, the Company issued 61,226 shares of its Common Stock pursuant to a securities purchase agreement between the Company and a private investor, dated October 25, 2018. We issued such shares in reliance on the exemptions from registration pursuant to Section 4(a)(2) of the Securities Act.

On September 24, 2019, the Company issued 62,248 shares of its Common Stock in gross consideration of $62,000 and net consideration of $54,000 pursuant to a securities purchase agreement between the Company and a private investor, dated September 23, 2019. We issued such shares in reliance on the exemptions from registration pursuant to Section 4(a)(2) of the Securities Act.

On October 1, 2019, the Company issued 34,859 shares of its Common Stock in gross consideration of $34,000 and net consideration of $32,000 pursuant to a securities purchase agreement dated September 27, 2019 between the Company and a private investor. We issued such shares in reliance on the exemptions from registration pursuant to Section 4(a)(2) of the Securities Act.

On October 23, 2019 Dinar Zuz provided an additional amount of $250,000 to the Company which was be provided in a form of the Optima Convertible Note pursuant to a securities purchase agreement between the Company and Optima, dated July 30, 2019.

On November 5, 2019 our Compensation Committee approved an issuance 200,000 Shares of Common Stock of the Company for certain employees of the Company at January 1, 2020 pursuant to the Company’s Share and Options Incentive Enhancement Plan (2016) (the “2016 Incentive Plan). The shares will have 3 years vesting period which third will be vested at January 1, 2020, third will be vested on December 31, 2021 and the third will be vested on December 31, 2022. The Company has estimated the fair value of such shares at $1,140,000. On January 14, 2020, the Company issued 58,334 shares of Common Stock to employees. All shares were issued pursuant to the Company’s Share and Options Incentive Enhancement Plan (2016). The Company has estimated the fair value of such shares at $332,000. We issued such shares in reliance on the exemptions from registration pursuant to Section 4(a)(2) of the Securities Act.

On December 31, 2019, the Company issued 65,334 shares of its Common Stock pursuant to a settlement of stock-based liabilities. The fair market value of the shares was $372,404. We issued such shares in reliance on the exemptions from registration pursuant to Section 4(a)(2) of the Securities Act.

On December 31, 2019 and pursuant to the CIMA Convertible Promissory Note, CIMA exercised its option to convert the Convertible Promissory Note into 1,757,478 shares of Common Stock of the Company. We issued such shares in reliance on the exemptions from registration pursuant to Section 4(a)(2) of the Securities Act.

On January 3, 2020 Dinar Zuz provided an additional amount of $300,000 to the Company which was be provided in a form of the Dinar Zuz Convertible Note pursuant to a securities purchase agreement between the Company and Dinar Zuz, dated July 30, 2019. Additionally, on January 3, 2020, the Company issued 100,000 shares of its Common Stock to Dinar Zuz LLC, as a result of a conversion of the Dinar Convertible Note in the amount of $300,000. We issued such shares in reliance on the exemptions from registration pursuant to Section 4(a)(2) of the Securities Act.

On January 9, 2020, the Company issued 40,000 shares of its Common Stock pursuant to a service Agreement between the Company and a service provider, dated June 3, 2019. The fair market value of the shares at the issuance date was $240,000. We issued such shares in reliance on the exemptions from registration pursuant to Section 4(a)(2) of the Securities Act.

On January 14, 2020, the Company issued 124,668 shares of its Common Stock pursuant to a settlement of stock-based liabilities. The fair market value of the shares was $890,323. We issued such shares in reliance on the exemptions from registration pursuant to Section 4(a)(2) of the Securities Act.

On February 10, 2019, the Company issued 10,000 shares of its Common Stock pursuant to a securities purchase agreement between the Company and a private investor, dated October 25, 2018. We issued such shares in reliance on the exemptions from registration pursuant to Section 4(a)(2) of the Securities Act.

On March 3, 2020 Dinar Zuz provided an additional amount of $450,000 to the Company which was be provided in a form of the Dinar Zuz Convertible Note pursuant to a securities purchase agreement between the Company and Dinar Zuz, dated July 30, 2019. Additionally, on February 10, 2020 the Company issued 1,157,478 shares of its Common Stock to Dinar Zuz LLC, as a result of a conversion of the Dinar Convertible Note in the amount of $700,000. We issued such shares in reliance on the exemptions from registration pursuant to Section 4(a)(2) of the Securities Act.

Each of the transactions described in this Item II give effect to the Reverse Stock Split (as defined below) and were exempt from the registration requirements of the Securities Act of 1933, as amended (“Securities Act”), in reliance upon Section 4(a)(2) of the Securities Act, Regulation D promulgated under the Securities Act and, in the case of sales to investors who are non-US persons, Regulation S promulgated under the Securities Act.

| ITEM 6. | SELECTED FINANCIAL DATA |

Not applicable.

17

| ITEM 7. | MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS |

Except for the historical information, the following discussion contains forward-looking statements that are subject to risks and uncertainties. We caution you not to put undue reliance on any forward-looking statements, which speak only as of the date of this report. Our actual results or actions may differ materially from these forward-looking statements for many reasons, including the risks described in “Risk Factors” and elsewhere in this annual report. Our discussion and analysis of our financial condition and results of operations should be read in conjunction with the financial statements and related notes and with the understanding that our actual future results may be materially different from what we currently expect.

OVERVIEW AND OUTLOOK

The Company was incorporated in September 2005 to act as a holding company for its subsidiaries in the technology, telecom and banking industries.

RESULTS OF OPERATIONS

Revenue

The Company generates revenues through the sale and distribution of prepaid telecom minutes and other related telecom services.

| Year ended December 31, | ||||||||

| 2019 | 2018 | |||||||

| Thousands | Thousands | |||||||

| Revenue from sales | $ | 967 | $ | 24,983 | ||||

| Revenue, sales to related parties | - | 49,667 | ||||||

| Total revenue | $ | 967 | $ | 74,650 | ||||

Revenues during the year ended December 31, 2019 totaled $967,000 compared to $74,650,000 for the year ended December 31, 2018. The decrease in the total revenue is mainly due to the rescission of the LimeCom acquisition which was consolidated for the year ended December 31, 2018 and not consolidated in the year ended December 31, 2019. The Company no longer owns LimeCom as of January 2019.

Costs of Revenue

Costs of revenue consists of the purchase of wholesale minutes for resale and related telecom platform costs. Cost of revenues during the year ended December 31, 2019 totaled $808,000 compared to $74,177,000 for the year ended December 31, 2018. The decrease in the total Cost of Revenue is mainly due to the rescission of the LimeCom acquisition which was consolidated for during the year ended December 31, 2018 and not consolidated in the year ended December 31, 2019. The Company no longer owns LimeCom as of January 2019.

18

Operating Expenses

Operating expenses totaled $2,305,000 during the year ended December 31, 2019 compared to $5,686,000 during the year ended December 31, 2018 representing a net decrease of $3,381,000. The decrease in the operating expenses is mainly due to Loss on disposal and impairment of assets in the amount of $1,917,000 that the Company recorded in 2018 and the rescission of the LimeCom acquisition which was consolidated for the full twelve months ended December 31, 2018 and not consolidated in the twelve-month period ended December 31, 2019. The Company no longer owns LimeCom as of January 2019.

Other Income

The Company recognized other income of $860,000 during the year ended December 31, 2019 compared to an income $1,628,000 during the year ended December 31, 2018. The net change from the prior period is mainly due to other income in the amount of $2,362,000 from the satisfaction of the Company’s obligation under the Approved Plan of the Reorganization for Next Communications, Inc., that was approved by the United States Bankruptcy Court Southern District of Florida, Miami Division, on January 29, 2019 pursuant to which we paid $600,000 to satisfy an obligation of approximately $2,962,000. It is also due to the change in the gain recognized on the fair value measurement of our derivative and stock-based liabilities. The fair value measurements related to derivative liabilities is driven by market inputs and inherently subject to volatility. Loss from Change in Fair Value of stock-based liabilities for year ended December 31, 2019 was $560,000 as compared to a gain of $2,314,000 for the year ended December 31, 2018.

Net Loss

We incurred a net loss of $1,320,000 for the year ended December 31, 2019, as compared to a net loss of $3,562,000 for the year ended December 31, 2018 for the reasons described above.

Liquidity and Capital Resources

Liquidity is the ability of a company to generate funds to support its current and future operations, satisfy its obligations, and otherwise operate on an ongoing basis. Significant factors in the management of liquidity are funds generated by operations, levels of accounts receivable and accounts payable and capital expenditures.

As of December 31, 2019, the Company had $16,000 of cash, total current assets of $165,000 and total current liabilities of $3,917,000 creating a working capital deficit of $3,752,000. Current assets as of December 31, 2019 consisted of $16,000 of cash, marketable securities in the amount of $1,000, related parties of $54,000 and other current assets of $94,000.

As of December 31, 2018, the Company had $154,000 of cash, total current assets of $4,033,000 and total current liabilities of $11,581,000 creating a working capital deficit of $7,548,000. Current assets as of December 31, 2018 consisted of $154,000 of cash, marketable securities in the amount of $79,000, accounts receivable net of allowance of $3,673,000, related parties of $36,000 and other current assets of $91,000.

19

The decrease in our working capital deficit was mainly attributable to the decrease of $1,659,000 in our trade account payables and decrease of $4,927,000 in our short-term related parties’ payables, which was mitigated by a decrease of $3,673,000 in our trade account receivables.

Net cash used in operating activities was $1,315,000 for the year ended December 31, 2019, as compared to cash used in operating activities of $517,000 for the year ended December 31, 2018. The Company’s primary uses of cash have been for professional support, marketing expenses and working capital purposes.

Net cash used in investing activities was $0 for the year ended December 31, 2019, as compared to net cash generated from investing activities of $9,000 for the year ended December 31, 2018.

Net cash provided by financing activities was approximately $1,177,000 for the year ended December 31, 2019, as compared to approximately $587,000 for the year ended December 31, 2018. We have principally financed our operations in 2019 through the sale of our Common Stock and the issuance of debt.

Due to our operational losses, we have principally financed our operations through the sale of our Common Stock and the issuance of convertible debt.

As discussed in an 8-K filed with the SEC on February 5, 2019, on January 29, 2019, the United States Bankruptcy Court Southern District of Florida, Miami Division, approved the Plan of Reorganization for Next Communications, Inc., whereby Cuentas Inc. would pay $600,000 to a specific creditor (100 NWT) in consideration from forgiveness of the payable balance that was not paid in the first quarter of 2019.