UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-Q

|

☒ |

Quarterly report pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 |

For the quarterly period ended September 30, 2019, or

|

☐ |

Transition report pursuant to section 13 or 15(d) of the Securities Exchange Act of 1934 |

Commission File Number 000-55774

BROADSTONE NET LEASE, INC.

(Exact name of registrant as specified in its charter)

|

Maryland |

26-1516177 |

|

(State or other jurisdiction of |

(I.R.S. Employer |

|

800 Clinton Square Rochester, New York |

14604 |

|

(Address of principal executive offices) |

(Zip Code) |

(585) 287-6500

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Exchange Act:

|

Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

|

None |

|

|

|

|

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15 (d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

|

Large accelerated filer |

|

☐ |

|

Accelerated filer |

|

☐ |

|

Non-accelerated filer |

|

☒ |

|

Smaller reporting company |

|

☐ |

|

Emerging growth company |

|

☒ |

|

|

|

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☒

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

There were 25,550,886.642 shares of the Registrant’s common stock, $0.001 par value per share, outstanding as of November 12, 2019.

TABLE OF CONTENTS

|

|

Page |

|

|

1 |

||

|

Item 1. |

1 |

|

|

|

1 |

|

|

|

Condensed Consolidated Statements of Income and Comprehensive Income (Unaudited) |

2 |

|

|

Condensed Consolidated Statements of Stockholders’ Equity (Unaudited) |

3 |

|

|

5 |

|

|

|

Notes to the Condensed Consolidated Financial Statements (Unaudited) |

6 |

|

Item 2. |

Management’s Discussion and Analysis of Financial Condition and Results of Operations |

30 |

|

|

30 |

|

|

|

31 |

|

|

|

43 |

|

|

|

47 |

|

|

|

47 |

|

|

|

47 |

|

|

|

48 |

|

|

|

50 |

|

|

|

52 |

|

|

|

52 |

|

|

Item 3. |

53 |

|

|

Item 4. |

54 |

|

|

55 |

||

|

Item 1. |

55 |

|

|

Item 1A. |

55 |

|

|

Item 2. |

57 |

|

|

Item 3. |

59 |

|

|

Item 4. |

59 |

|

|

Item 5. |

59 |

|

|

Item 6. |

60 |

|

Broadstone Net Lease, Inc. and Subsidiaries

Condensed Consolidated Balance Sheets

(Unaudited)

(in thousands, except per share amounts)

|

|

|

September 30, 2019 |

|

|

December 31, 2018 |

|

||

|

Assets |

|

|

|

|

|

|

|

|

|

Accounted for using the operating method, net of accumulated depreciation |

|

$ |

3,459,626 |

|

|

$ |

2,641,746 |

|

|

Accounted for using the direct financing method |

|

|

41,920 |

|

|

|

42,000 |

|

|

Investment in rental property, net |

|

|

3,501,546 |

|

|

|

2,683,746 |

|

|

Cash and cash equivalents |

|

|

14,008 |

|

|

|

18,612 |

|

|

Accrued rental income |

|

|

81,251 |

|

|

|

69,247 |

|

|

Tenant and other receivables, net |

|

|

861 |

|

|

|

1,026 |

|

|

Prepaid expenses and other assets |

|

|

34,594 |

|

|

|

4,316 |

|

|

Interest rate swap, assets |

|

|

1,120 |

|

|

|

17,633 |

|

|

Intangible lease assets, net |

|

|

342,478 |

|

|

|

286,258 |

|

|

Debt issuance costs – unsecured revolver, net |

|

|

2,679 |

|

|

|

2,261 |

|

|

Leasing fees, net |

|

|

13,251 |

|

|

|

13,698 |

|

|

Total assets |

|

$ |

3,991,788 |

|

|

$ |

3,096,797 |

|

|

|

|

|

|

|

|

|

|

|

|

Liabilities and equity |

|

|

|

|

|

|

|

|

|

Unsecured revolver |

|

$ |

303,300 |

|

|

$ |

141,100 |

|

|

Mortgages and notes payable, net |

|

|

112,562 |

|

|

|

78,952 |

|

|

Unsecured term notes, net |

|

|

1,671,511 |

|

|

|

1,225,773 |

|

|

Interest rate swap, liabilities |

|

|

37,489 |

|

|

|

1,820 |

|

|

Accounts payable and other liabilities |

|

|

34,008 |

|

|

|

24,394 |

|

|

Due to related parties |

|

|

433 |

|

|

|

114 |

|

|

Accrued interest payable |

|

|

9,482 |

|

|

|

9,777 |

|

|

Intangible lease liabilities, net |

|

|

94,503 |

|

|

|

85,947 |

|

|

Total liabilities |

|

|

2,263,288 |

|

|

|

1,567,877 |

|

|

|

|

|

|

|

|

|

|

|

|

Commitments and contingencies (See Note 16) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Equity |

|

|

|

|

|

|

|

|

|

Broadstone Net Lease, Inc. stockholders' equity: |

|

|

|

|

|

|

|

|

|

Preferred stock, $0.001 par value; 20,000 shares authorized, no shares issued or outstanding |

|

|

— |

|

|

|

— |

|

|

Common stock, $0.001 par value; 80,000 shares authorized, 25,482 and 22,014 shares issued and outstanding at September 30, 2019 and December 31, 2018, respectively |

|

|

25 |

|

|

|

22 |

|

|

Additional paid-in capital |

|

|

1,852,038 |

|

|

|

1,557,421 |

|

|

Cumulative distributions in excess of retained earnings |

|

|

(194,790 |

) |

|

|

(155,150 |

) |

|

Accumulated other comprehensive (loss) income |

|

|

(33,911 |

) |

|

|

14,806 |

|

|

Total Broadstone Net Lease, Inc. stockholders’ equity |

|

|

1,623,362 |

|

|

|

1,417,099 |

|

|

Non-controlling interests |

|

|

105,138 |

|

|

|

111,821 |

|

|

Total equity |

|

|

1,728,500 |

|

|

|

1,528,920 |

|

|

Total liabilities and equity |

|

$ |

3,991,788 |

|

|

$ |

3,096,797 |

|

The accompanying notes are an integral part of these condensed consolidated financial statements.

1

Broadstone Net Lease, Inc. and Subsidiaries

Condensed Consolidated Statements of Income and Comprehensive Income

(Unaudited)

(in thousands, except per share amounts)

|

|

|

For the three months ended September 30, |

|

|

For the nine months ended September 30, |

|

||||||||||

|

|

|

2019 |

|

|

2018 |

|

|

2019 |

|

|

2018 |

|

||||

|

Revenues |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Lease revenues |

|

$ |

76,401 |

|

|

$ |

61,764 |

|

|

$ |

213,884 |

|

|

$ |

174,385 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating expenses |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Depreciation and amortization |

|

|

28,392 |

|

|

|

21,869 |

|

|

|

77,989 |

|

|

|

61,303 |

|

|

Asset management fees |

|

|

5,610 |

|

|

|

4,663 |

|

|

|

16,048 |

|

|

|

13,119 |

|

|

Property management fees |

|

|

2,098 |

|

|

|

1,680 |

|

|

|

5,918 |

|

|

|

4,792 |

|

|

Property and operating expense |

|

|

3,855 |

|

|

|

2,777 |

|

|

|

11,497 |

|

|

|

7,926 |

|

|

General and administrative |

|

|

1,315 |

|

|

|

1,664 |

|

|

|

3,807 |

|

|

|

4,451 |

|

|

State, franchise and foreign tax |

|

|

405 |

|

|

|

58 |

|

|

|

1,153 |

|

|

|

811 |

|

|

Provision for impairment of investment in rental properties |

|

|

2,435 |

|

|

|

2,061 |

|

|

|

3,452 |

|

|

|

2,061 |

|

|

Total operating expenses |

|

|

44,110 |

|

|

|

34,772 |

|

|

|

119,864 |

|

|

|

94,463 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Other income (expenses) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Preferred distribution income |

|

|

— |

|

|

|

65 |

|

|

|

— |

|

|

|

440 |

|

|

Interest income |

|

|

5 |

|

|

|

16 |

|

|

|

6 |

|

|

|

178 |

|

|

Interest expense |

|

|

(18,465 |

) |

|

|

(14,484 |

) |

|

|

(51,025 |

) |

|

|

(38,115 |

) |

|

Cost of debt extinguishment |

|

|

(455 |

) |

|

|

(50 |

) |

|

|

(1,176 |

) |

|

|

(101 |

) |

|

Gain on sale of real estate |

|

|

12,585 |

|

|

|

2,025 |

|

|

|

16,772 |

|

|

|

9,620 |

|

|

Gain on sale of investment in related party |

|

|

— |

|

|

|

8,500 |

|

|

|

— |

|

|

|

8,500 |

|

|

Internalization expenses |

|

|

(923 |

) |

|

|

— |

|

|

|

(1,195 |

) |

|

|

— |

|

|

Net income |

|

|

25,038 |

|

|

|

23,064 |

|

|

|

57,402 |

|

|

|

60,444 |

|

|

Net income attributable to non-controlling interests |

|

|

(1,650 |

) |

|

|

(1,797 |

) |

|

|

(3,942 |

) |

|

|

(4,631 |

) |

|

Net income attributable to Broadstone Net Lease, Inc. |

|

$ |

23,388 |

|

|

$ |

21,267 |

|

|

$ |

53,460 |

|

|

$ |

55,813 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Weighted average number of common shares outstanding |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

|

|

24,642 |

|

|

|

20,554 |

|

|

|

23,394 |

|

|

|

19,850 |

|

|

Diluted |

|

|

26,379 |

|

|

|

22,291 |

|

|

|

25,131 |

|

|

|

21,496 |

|

|

Net earnings per common share |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic and diluted |

|

$ |

0.95 |

|

|

$ |

1.03 |

|

|

$ |

2.28 |

|

|

$ |

2.81 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Comprehensive income |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net income |

|

$ |

25,038 |

|

|

$ |

23,064 |

|

|

$ |

57,402 |

|

|

$ |

60,444 |

|

|

Other comprehensive income |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Change in fair value of interest rate swaps |

|

|

(16,380 |

) |

|

|

6,299 |

|

|

|

(52,182 |

) |

|

|

30,296 |

|

|

Realized gain on interest rate swaps |

|

|

(41 |

) |

|

|

(4 |

) |

|

|

(163 |

) |

|

|

(4 |

) |

|

Comprehensive income |

|

|

8,617 |

|

|

|

29,359 |

|

|

|

5,057 |

|

|

|

90,736 |

|

|

Comprehensive income attributable to non-controlling interests |

|

|

(557 |

) |

|

|

(2,288 |

) |

|

|

(315 |

) |

|

|

(6,931 |

) |

|

Comprehensive income attributable to Broadstone Net Lease, Inc. |

|

$ |

8,060 |

|

|

$ |

27,071 |

|

|

$ |

4,742 |

|

|

$ |

83,805 |

|

The accompanying notes are an integral part of these condensed consolidated financial statements.

2

Broadstone Net Lease, Inc. and Subsidiaries

Condensed Consolidated Statements of Stockholders’ Equity

(Unaudited)

(in thousands, except per share amounts)

|

|

|

Common Stock |

|

|

Additional Paid-in Capital |

|

|

Subscriptions Receivable |

|

|

Cumulative Distributions in Excess of Retained Earnings |

|

|

Accumulated Other Comprehensive (Loss) Income |

|

|

Non- controlling Interests |

|

|

Total |

|

|||||||

|

Balance, January 1, 2019 |

|

$ |

22 |

|

|

$ |

1,557,421 |

|

|

$ |

— |

|

|

$ |

(155,150 |

) |

|

$ |

14,806 |

|

|

$ |

111,821 |

|

|

$ |

1,528,920 |

|

|

Net income |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

13,938 |

|

|

|

— |

|

|

|

1,084 |

|

|

|

15,022 |

|

|

Issuance of 883 shares of common stock |

|

|

1 |

|

|

|

75,099 |

|

|

|

(225 |

) |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

74,875 |

|

|

Other offering costs |

|

|

— |

|

|

|

(300 |

) |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(300 |

) |

|

Distributions declared ($0.43 per share January 2019, $0.44 per share February through March 2019) |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(29,635 |

) |

|

|

— |

|

|

|

(2,348 |

) |

|

|

(31,983 |

) |

|

Change in fair value of interest rate swap agreements |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(11,713 |

) |

|

|

(911 |

) |

|

|

(12,624 |

) |

|

Realized gain on interest rate swap agreements |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(75 |

) |

|

|

(6 |

) |

|

|

(81 |

) |

|

Redemption of 21 shares of common stock |

|

|

— |

|

|

|

(1,803 |

) |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(1,803 |

) |

|

Balance, March 31, 2019 |

|

$ |

23 |

|

|

$ |

1,630,417 |

|

|

$ |

(225 |

) |

|

$ |

(170,847 |

) |

|

$ |

3,018 |

|

|

$ |

109,640 |

|

|

$ |

1,572,026 |

|

|

Net income |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

16,134 |

|

|

|

— |

|

|

|

1,208 |

|

|

|

17,342 |

|

|

Issuance of 892 shares of common stock |

|

|

1 |

|

|

|

76,004 |

|

|

|

225 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

76,230 |

|

|

Other offering costs |

|

|

— |

|

|

|

(300 |

) |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(300 |

) |

|

Distributions declared ($0.44 per share April through June 2019) |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(30,934 |

) |

|

|

— |

|

|

|

(2,297 |

) |

|

|

(33,231 |

) |

|

Change in fair value of interest rate swap agreements |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(21,564 |

) |

|

|

(1,614 |

) |

|

|

(23,178 |

) |

|

Realized gain on interest rate swap agreements |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(38 |

) |

|

|

(3 |

) |

|

|

(41 |

) |

|

Redemption of 38 shares of common stock |

|

|

— |

|

|

|

(3,210 |

) |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(3,210 |

) |

|

Balance, June 30, 2019 |

|

$ |

24 |

|

|

$ |

1,702,911 |

|

|

$ |

— |

|

|

$ |

(185,647 |

) |

|

$ |

(18,584 |

) |

|

$ |

106,934 |

|

|

$ |

1,605,638 |

|

|

Net income |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

23,388 |

|

|

|

— |

|

|

|

1,650 |

|

|

|

25,038 |

|

|

Issuance of 1,840 shares of common stock |

|

|

1 |

|

|

|

157,191 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

157,192 |

|

|

Other offering costs |

|

|

— |

|

|

|

(703 |

) |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(703 |

) |

|

Distributions declared ($0.44 per share July through September 2019) |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(32,531 |

) |

|

|

— |

|

|

|

(2,352 |

) |

|

|

(34,883 |

) |

|

Change in fair value of interest rate swap agreements |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(15,288 |

) |

|

|

(1,092 |

) |

|

|

(16,380 |

) |

|

Realized gain on interest rate swap agreements |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(39 |

) |

|

|

(2 |

) |

|

|

(41 |

) |

|

Redemption of 88 shares of common stock |

|

|

— |

|

|

|

(7,361 |

) |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(7,361 |

) |

|

Balance, September 30, 2019 |

|

$ |

25 |

|

|

$ |

1,852,038 |

|

|

$ |

— |

|

|

$ |

(194,790 |

) |

|

$ |

(33,911 |

) |

|

$ |

105,138 |

|

|

$ |

1,728,500 |

|

The accompanying notes are an integral part of these condensed consolidated financial statements.

3

Broadstone Net Lease, Inc. and Subsidiaries

Condensed Consolidated Statements of Stockholders’ Equity – (continued)

(Unaudited)

(in thousands, except per share amounts)

|

|

|

Common Stock |

|

|

Additional Paid-in Capital |

|

|

Subscriptions Receivable |

|

|

Cumulative Distributions in Excess of Retained Earnings |

|

|

Accumulated Other Comprehensive Income |

|

|

Non- controlling Interests |

|

|

Total |

|

|||||||

|

Balance, January 1, 2018 |

|

$ |

19 |

|

|

$ |

1,301,979 |

|

|

$ |

(15 |

) |

|

$ |

(120,280 |

) |

|

$ |

5,122 |

|

|

$ |

97,376 |

|

|

$ |

1,284,201 |

|

|

Net income |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

17,573 |

|

|

|

— |

|

|

|

1,422 |

|

|

|

18,995 |

|

|

Issuance of 710 shares of common stock |

|

|

1 |

|

|

|

57,154 |

|

|

|

(129 |

) |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

57,026 |

|

|

Other offering costs |

|

|

— |

|

|

|

(224 |

) |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(224 |

) |

|

Distributions declared ($0.415 per share January 2018, $0.43 per share February through March 2018) |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(24,476 |

) |

|

|

— |

|

|

|

(2,472 |

) |

|

|

(26,948 |

) |

|

Change in fair value of interest rate swap agreements |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

15,685 |

|

|

|

1,270 |

|

|

|

16,955 |

|

|

Conversion of eight membership units to eight shares of common stock |

|

|

— |

|

|

|

684 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(684 |

) |

|

|

— |

|

|

Redemption of 46 shares of common stock |

|

|

— |

|

|

|

(3,577 |

) |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(3,577 |

) |

|

Cancellation of nine shares of common stock |

|

|

— |

|

|

|

(748 |

) |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(748 |

) |

|

Balance, March 31, 2018 |

|

$ |

20 |

|

|

$ |

1,355,268 |

|

|

$ |

(144 |

) |

|

$ |

(127,183 |

) |

|

$ |

20,807 |

|

|

$ |

96,912 |

|

|

$ |

1,345,680 |

|

|

Net income |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

16,974 |

|

|

|

— |

|

|

|

1,412 |

|

|

|

18,386 |

|

|

Issuance of 695 shares of common stock |

|

|

— |

|

|

|

56,886 |

|

|

|

(356 |

) |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

56,530 |

|

|

Other offering costs |

|

|

— |

|

|

|

(301 |

) |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(301 |

) |

|

Issuance of 194 membership units |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

15,797 |

|

|

|

15,797 |

|

|

Distributions declared ($0.43 per share April through June 2018) |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(25,620 |

) |

|

|

— |

|

|

|

(2,383 |

) |

|

|

(28,003 |

) |

|

Change in fair value of interest rate swap agreements |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

6,503 |

|

|

|

539 |

|

|

|

7,042 |

|

|

Redemption of 28 shares of common stock |

|

|

— |

|

|

|

(2,312 |

) |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(2,312 |

) |

|

Balance, June 30, 2018 |

|

$ |

20 |

|

|

$ |

1,409,541 |

|

|

$ |

(500 |

) |

|

$ |

(135,829 |

) |

|

$ |

27,310 |

|

|

$ |

112,277 |

|

|

$ |

1,412,819 |

|

|

Net income |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

21,267 |

|

|

|

— |

|

|

|

1,797 |

|

|

|

23,064 |

|

|

Issuance of 870 shares of common stock |

|

|

1 |

|

|

|

72,770 |

|

|

|

(1,190 |

) |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

71,581 |

|

|

Other offering costs |

|

|

— |

|

|

|

(297 |

) |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(297 |

) |

|

Distributions declared ($0.43 per share July through September 2018) |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(26,555 |

) |

|

|

— |

|

|

|

(1,861 |

) |

|

|

(28,416 |

) |

|

Change in fair value of interest rate swap agreements |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

5,807 |

|

|

|

492 |

|

|

|

6,299 |

|

|

Realized gain on interest rate swap agreements |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(3 |

) |

|

|

(1 |

) |

|

|

(4 |

) |

|

Redemption of 32 shares of common stock |

|

|

— |

|

|

|

(2,675 |

) |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(2,675 |

) |

|

Balance, September 30, 2018 |

|

$ |

21 |

|

|

$ |

1,479,339 |

|

|

$ |

(1,690 |

) |

|

$ |

(141,117 |

) |

|

$ |

33,114 |

|

|

$ |

112,704 |

|

|

$ |

1,482,371 |

|

The accompanying notes are an integral part of these condensed consolidated financial statements.

4

Broadstone Net Lease, Inc. and Subsidiaries

Condensed Consolidated Statements of Cash Flows

(Unaudited)

(in thousands)

|

|

|

For the nine months ended September 30, |

|

|||||

|

|

|

2019 |

|

|

2018 |

|

||

|

Operating activities |

|

|

|

|

|

|

|

|

|

Net income |

|

$ |

57,402 |

|

|

$ |

60,444 |

|

|

Adjustments to reconcile net income including non-controlling interest to net cash provided by operating activities: |

|

|

|

|

|

|

|

|

|

Depreciation and amortization including intangibles associated with investment in rental property |

|

|

75,661 |

|

|

|

61,515 |

|

|

Provision for impairment on investment in rental properties |

|

|

3,452 |

|

|

|

2,061 |

|

|

Amortization of debt issuance costs charged to interest expense |

|

|

1,655 |

|

|

|

1,303 |

|

|

Straight-line rent and financing lease adjustments |

|

|

(15,882 |

) |

|

|

(15,640 |

) |

|

Cost of debt extinguishment |

|

|

1,176 |

|

|

|

101 |

|

|

Gain on sale of real estate |

|

|

(16,772 |

) |

|

|

(9,620 |

) |

|

Settlement of interest rate swap |

|

|

— |

|

|

|

760 |

|

|

Gain on sale of investment in related party |

|

|

— |

|

|

|

(8,500 |

) |

|

Leasing fees paid |

|

|

(747 |

) |

|

|

(1,325 |

) |

|

Other non-cash items |

|

|

277 |

|

|

|

468 |

|

|

Changes in assets and liabilities: |

|

|

|

|

|

|

|

|

|

Tenant and other receivables |

|

|

165 |

|

|

|

(65 |

) |

|

Prepaid expenses and other assets |

|

|

(393 |

) |

|

|

(799 |

) |

|

Accounts payable and other liabilities |

|

|

5,234 |

|

|

|

(893 |

) |

|

Accrued interest payable |

|

|

(295 |

) |

|

|

3,707 |

|

|

Net cash provided by operating activities |

|

|

110,933 |

|

|

|

93,517 |

|

|

|

|

|

|

|

|

|

|

|

|

Investing activities |

|

|

|

|

|

|

|

|

|

Acquisition of rental property accounted for using the operating method, net of mortgages assumed of $49,782 and $20,845 in 2019 and 2018, respectively |

|

|

(957,820 |

) |

|

|

(329,664 |

) |

|

Acquisition of rental property accounted for using the direct financing method |

|

|

— |

|

|

|

(430 |

) |

|

Capital expenditures and improvements |

|

|

(4,044 |

) |

|

|

(4,326 |

) |

|

Proceeds from sale of investment in related party |

|

|

— |

|

|

|

18,500 |

|

|

Proceeds from disposition of rental property, net |

|

|

90,137 |

|

|

|

41,330 |

|

|

Change in deposits on investments in rental property |

|

|

1,500 |

|

|

|

— |

|

|

Net cash used in investing activities |

|

|

(870,227 |

) |

|

|

(274,590 |

) |

|

|

|

|

|

|

|

|

|

|

|

Financing activities |

|

|

|

|

|

|

|

|

|

Proceeds from issuance of common stock, net |

|

|

260,475 |

|

|

|

146,791 |

|

|

Redemptions of common stock |

|

|

(12,374 |

) |

|

|

(8,564 |

) |

|

Borrowings on mortgages, notes payable and unsecured term notes, net of mortgages assumed of $49,782 and $20,845 in 2019 and 2018, respectively |

|

|

750,000 |

|

|

|

415,000 |

|

|

Principal payments on mortgages, notes payable and unsecured term notes |

|

|

(316,191 |

) |

|

|

(33,930 |

) |

|

Borrowings on unsecured revolver |

|

|

389,100 |

|

|

|

189,500 |

|

|

Repayments on unsecured revolver |

|

|

(226,900 |

) |

|

|

(462,500 |

) |

|

Cash distributions paid to stockholders |

|

|

(45,219 |

) |

|

|

(38,410 |

) |

|

Cash distributions paid to non-controlling interests |

|

|

(6,980 |

) |

|

|

(6,630 |

) |

|

Debt issuance and extinguishment costs paid |

|

|

(7,491 |

) |

|

|

(2,255 |

) |

|

Net cash provided by financing activities |

|

|

784,420 |

|

|

|

199,002 |

|

|

Net increase in cash and cash equivalents and restricted cash |

|

|

25,126 |

|

|

|

17,929 |

|

|

Cash and cash equivalents and restricted cash at beginning of period |

|

|

18,989 |

|

|

|

10,099 |

|

|

Cash and cash equivalents and restricted cash at end of period |

|

$ |

44,115 |

|

|

$ |

28,028 |

|

|

|

|

|

|

|

|

|

|

|

|

Reconciliation of cash and cash equivalents and restricted cash |

|

|

|

|

|

|

|

|

|

Cash and cash equivalents at beginning of period |

|

$ |

18,612 |

|

|

$ |

9,355 |

|

|

Restricted cash at beginning of period |

|

|

377 |

|

|

|

744 |

|

|

Cash and cash equivalents and restricted cash at beginning of period |

|

$ |

18,989 |

|

|

$ |

10,099 |

|

|

|

|

|

|

|

|

|

|

|

|

Cash and cash equivalents at end of period |

|

$ |

14,008 |

|

|

$ |

17,301 |

|

|

Restricted cash at end of period |

|

|

30,107 |

|

|

|

10,727 |

|

|

Cash and cash equivalents and restricted cash at end of period |

|

$ |

44,115 |

|

|

$ |

28,028 |

|

The accompanying notes are an integral part of these condensed consolidated financial statements.

5

Broadstone Net Lease, Inc. and Subsidiaries

Notes to the Condensed Consolidated Financial Statements (Unaudited)

(in thousands)

1. Business Description

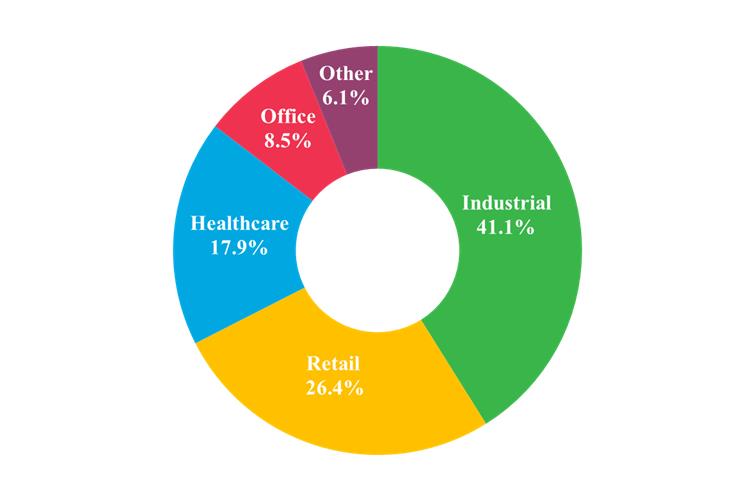

Broadstone Net Lease, Inc. (the “Corporation”) is a Maryland corporation formed on October 18, 2007, that elected to be taxed as a real estate investment trust (“REIT”) commencing with the taxable year ended December 31, 2008. The Corporation focuses on investing in income-producing, net leased commercial properties, primarily in the United States. The Corporation leases properties to retail, healthcare, industrial, office, and other commercial businesses under long-term lease agreements. At September 30, 2019, the Corporation owned a diversified portfolio of 662 individual net leased commercial properties located in 42 states throughout the continental United States and in British Columbia, Canada.

Broadstone Net Lease, LLC (the “Operating Company”), is the entity through which the Corporation conducts its business and owns (either directly or through subsidiaries) all of the Corporation’s properties. The Corporation is the sole managing member of the Operating Company. The remaining interests in the Operating Company, which are referred to as non-controlling interests, are held by members who acquired their interest by contributing property to the Operating Company in exchange for membership units of the Operating Company. As the Corporation conducts substantially all of its operations through the Operating Company, it is structured as what is referred to as an umbrella partnership real estate investment trust (“UPREIT”). The following table summarizes the economic ownership interest in the Operating Company:

|

Percentage of shares owned by |

|

September 30, 2019 |

|

|

December 31, 2018 |

|

||

|

Corporation |

|

|

93.6 |

% |

|

|

92.7 |

% |

|

Non-controlling interests |

|

|

6.4 |

% |

|

|

7.3 |

% |

|

|

|

|

100.0 |

% |

|

|

100.0 |

% |

The Corporation operates under the direction of its board of directors (the “Board of Directors”), which is responsible for the management and control of the Company’s (as defined below) affairs. The Corporation is currently externally managed and its Board of Directors has retained the Corporation’s sponsor, Broadstone Real Estate, LLC (the “Manager”) and Broadstone Asset Management, LLC (the “Asset Manager”) to manage the Corporation’s day-to-day affairs, to implement the Corporation’s investment strategy, and to provide certain property management services for the Corporation’s properties, subject to the Board of Directors’ direction, oversight, and approval. The Asset Manager is a wholly owned subsidiary of the Manager and all of the Corporation’s officers are employees of the Manager. Accordingly, both the Manager and the Asset Manager are related parties of the Company. Refer to Note 3 for further discussion concerning related parties and related party transactions.

2. Summary of Significant Accounting Policies

Interim Information

The accompanying Condensed Consolidated Financial Statements have been prepared in accordance with accounting principles generally accepted in the United States of America (“GAAP”) for interim financial information (Accounting Standards Codification (“ASC”) 270, Interim Reporting) and Article 10 of the Securities and Exchange Commission’s (“SEC”) Regulation S-X. Accordingly, the Corporation has omitted certain footnote disclosures which would substantially duplicate those contained within the audited consolidated financial statements for the year ended December 31, 2018, included in the Company’s 2018 Annual Report on Form 10-K, filed with the SEC on March 14, 2019. Therefore, the readers of this quarterly report should refer to those audited consolidated financial statements, specifically Note 2, Summary of Significant Accounting Policies, for further discussion of significant accounting policies and estimates. The Corporation believes all adjustments necessary for a fair presentation have been included in these interim Condensed Consolidated Financial Statements (which include only normal recurring adjustments).

Principles of Consolidation

The Condensed Consolidated Financial Statements include the accounts and operations of the Corporation, the Operating Company and its consolidated subsidiaries, all of which are wholly owned by the Operating Company (collectively, the “Company”). All intercompany balances and transactions have been eliminated in consolidation.

6

To the extent the Corporation has a variable interest in entities that are not evaluated under the variable interest entity (“VIE”) model, the Corporation evaluates its interests using the voting interest entity model. The Corporation has complete responsibility for the day-to-day management, authority to make decisions, and control of the Operating Company. Based on consolidation guidance, the Corporation has concluded that the Operating Company is a VIE as the members in the Operating Company do not possess kick-out rights or substantive participating rights. Accordingly, the Corporation consolidates its interest in the Operating Company. However, as the Corporation holds the majority voting interest in the Operating Company, it qualifies for the exemption from providing certain disclosure requirements associated with investments in VIEs.

The portion of the Operating Company not owned by the Corporation is presented as non-controlling interests as of and during the periods presented.

Basis of Accounting

The Condensed Consolidated Financial Statements have been prepared in accordance with GAAP.

Use of Estimates

The preparation of Condensed Consolidated Financial Statements in conformity with GAAP requires management to make certain estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the Condensed Consolidated Financial Statements and the reported amounts of revenues and expenses during the reporting periods. Significant estimates include, but are not limited to, the allocation of purchase price between investment in rental property and intangible assets acquired and liabilities assumed, the value of long-lived assets, the provision for impairment, the depreciable lives of rental property, the amortizable lives of intangible assets and liabilities, the allowance for doubtful accounts, the fair value of assumed debt and notes payable, the fair value of the Company’s interest rate swap agreements, and the determination of any uncertain tax positions. Accordingly, actual results may differ from those estimates.

The Company reviews long-lived assets to be held and used for possible impairment when events or changes in circumstances indicate that their carrying amounts may not be recoverable. If, and when, such events or changes in circumstances are present, an impairment exists to the extent the carrying value of the asset or asset group exceeds the sum of the undiscounted cash flows expected to result from the use of the asset or asset group and its eventual disposition. Such cash flows include expected future operating income, as adjusted for trends and prospects, as well as the effects of demand, competition, and other factors. An impairment loss is measured as the amount by which the carrying amount of the asset or asset group exceeds the fair value of the asset or asset group. A significant judgment is made as to if and when impairment should be taken. If the Company’s strategy, or one or more of the assumptions described above were to change in the future, an impairment may need to be recognized.

Inputs used in establishing fair value for real estate assets generally fall within Level 3 of the fair value hierarchy, which are characterized as requiring significant judgment as little or no current market activity may be available for validation. The main indicator used to establish the classification of the inputs is current market conditions, as derived through the use of published commercial real estate market information. The Company determines the valuation of impaired assets using generally accepted valuation techniques including discounted cash flow analysis, income capitalization, analysis of recent comparable sales transactions, actual sales negotiations, and bona fide purchase offers received from third parties. Management may consider a single valuation technique or multiple valuation techniques, as appropriate, when estimating the fair value of its real estate.

During the three and nine months ended September 30, 2019, the Company recorded impairment charges of $2,435 and $3,452, respectively. During the three and nine months ended September 30, 2018, the Company recorded impairment charges of $2,061. Impairment indicators were identified due to concerns over the tenant’s future viability, property vacancies, and changes to the overall investment strategy for the real estate assets. The amount of the impairment charges were based on management’s consideration of the factors detailed above. In determining the fair value of the impaired assets at September 30, 2019 and March 31, 2019, the measurement dates, the Company utilized a capitalization rate of 14.58%, a weighted average discount rate of 8.00%, and a weighted average price per square foot of $226. In determining the fair value of the impaired assets at September 30, 2018, the measurement date, the Company utilized capitalization rates ranging from 7.50% to 10.00%, and a weighted average discount rate of 8.00%.

Revenue Recognition

The Company commences revenue recognition on its leases based on a number of factors, including the initial determination that the contract is or contains a lease. Generally, all of the Company’s property related contracts are or contain leases, and therefore revenue is recognized when the lessee takes possession of or controls the physical use of the leased assets. In most instances this occurs on the lease commencement date. At the time of lease assumption or at the inception of a new lease, including new leases that arise from amendments, the Company assesses the terms and conditions of the lease to determine the proper lease classification.

7

Certain of the Company’s leases require tenants to pay rent based upon a percentage of the property’s net sales (“percentage rent”) or contain rent escalators indexed to future changes in the Consumer Price Index. Lease income associated with such provisions is considered variable lease income and therefore is not included in the initial measurement of the lease receivable, or in the calculation of straight-line rent revenue. Such amounts are recognized as income when the amounts are determinable.

As described in Recently Adopted Accounting Standards elsewhere in Note 2, the Company adopted the provisions of Accounting Standards Update (“ASU”) 2016-02, Leases (Topic 842) and related ASUs subsequently issued (collectively, “ASC 842”) as of January 1, 2019.

Leases Executed on or After Adoption of ASC 842

A lease is classified as an operating lease if none of the following criteria are met: (i) ownership transfers to the lessee at the end of the lease term, (ii) the lessee has a purchase option that is reasonably expected to be exercised, (iii) the lease term is for a major part of the economic life of the leased property, (iv) the present value of the future lease payments and any residual value guaranteed by the lessee that is not already reflected in the lease payments equals or exceeds substantially all of the fair value of the leased property, and (v) the leased property is of such a specialized nature that it is expected to have no future alternative use to the Company at the end of the lease term. If one or more of these criteria are met, the lease will generally be classified as a sales-type lease, unless the lease contains a residual value guarantee from a third party other than the lessee, in which case it would be classified as a direct financing lease under certain circumstances in accordance with ASC 842.

ASC 842 requires the Company to account for the right to use land as a separate lease component, unless the accounting effect of doing so would be insignificant. Determination of significance requires management judgment. In determining whether the accounting effect of separately reporting the land component from other components for its real estate leases is significant, the Company assesses: (i) whether separating the land component impacts the classification of any lease component, (ii) the value of the land component in the context of the overall contract, and (iii) whether the right to use the land is coterminous with the rights to use the other assets.

Leases Executed Prior to Adoption of ASC 842

A lease arrangement was classified as an operating lease if none of the following criteria were met: (i) ownership transferred to the lessee prior to or shortly after the end of the lease term, (ii) the lessee had a bargain purchase option during or at the end of the lease term, (iii) the lease term was greater than or equal to 75% of the underlying property’s estimated useful life, or (iv) the present value of the future minimum lease payments (excluding executory costs) was greater than or equal to 90% of the fair value of the leased property. If one or more of these criteria were met, and the minimum lease payments were determined to be reasonably predictable and collectible, the lease arrangement was generally accounted for as a direct financing lease. Consistent with ASC 840, Leases, if the fair value of the land component was 25% or more of the total fair value of the leased property, the land was considered separately from the building for purposes of applying the lease term and minimum lease payments criterion in (iii) and (iv) above.

Revenue recognition methods for operating leases, direct financing leases, and sales-type leases are described below:

Rental property accounted for under operating leases – Revenue is recognized as rents are earned on a straight-line basis over the non-cancelable terms of the related leases. For leases that have fixed and measurable rent escalations, the difference between such rental income earned and the cash rent due under the provisions of the lease is recorded as Accrued rental income on the Condensed Consolidated Balance Sheets.

Rental property accounted for under direct financing leases – The Company utilizes the direct finance method of accounting to record direct financing lease income. The net investment in the direct financing lease represents receivables for the sum of future lease payments to be received and the estimated residual value of the leased property, less unamortized unearned income (which represents the difference between undiscounted cash flows and discounted cash flows). Unearned income is deferred and amortized into income over the lease terms so as to produce a constant periodic rate of return on the Company’s net investment in the leases.

Rental property accounted for under sales-type leases – For leases accounted for as sales-type leases, the Company records selling profit arising from the lease at inception, along with the net investment in the lease. The Company leases assets through the assumption of existing leases or through sale-leaseback transactions, and records such assets at their fair value at the time of acquisition, which in most cases coincides with lease inception. As a result, the Company does not generally recognize selling profit on sales-type leases. The net investment in the sales-type lease represents receivables for the sum of future lease payments and the estimated unguaranteed residual value of the leased property, each measured at net present value. Interest income is recorded over the lease terms so as to produce a constant periodic rate of return on the Company’s net investment in the leases.

8

Certain of the Company’s contracts contain nonlease components (e.g., charges for management fees, common area maintenance, and reimbursement of third-party maintenance expenses) in addition to lease components (i.e., monthly rental charges). Services related to nonlease components are provided over the same period of time as, and billed in the same manner as, monthly rental charges. The Company elected to apply the practical expedient available under ASC 842, for all classes of assets, not to separate the lease components from the nonlease components when accounting for operating leases. Since the lease component is the predominant component under each of these leases, combined revenues from both the lease and nonlease components are reported as Lease revenues in the accompanying Condensed Consolidated Statements of Income and Comprehensive Income.

Rent Received in Advance

Rent received in advance represents tenant payments received prior to the contractual due date, and is included in Accounts payable and other liabilities on the Condensed Consolidated Balance Sheets. Rent received in advance is as follows:

|

(in thousands) |

|

September 30, 2019 |

|

|

December 31, 2018 |

|

||

|

Rent received in advance |

|

$ |

10,694 |

|

|

$ |

7,832 |

|

Allowance for Doubtful Accounts

Prior to the adoption of ASC 842, provisions for doubtful accounts were recorded as bad debt expense and included in General and administrative expenses on the accompanying Condensed Consolidated Statements of Income and Comprehensive Income. Subsequent to the adoption of ASC 842, provisions for doubtful accounts are recorded prospectively as an offset to Lease revenues on the accompanying Condensed Consolidated Statements of Income and Comprehensive Income.

Fair Value Measurements

ASC 820, Fair Value Measurements and Disclosures, defines fair value as the price that would be received for an asset or paid to transfer a liability (an exit price) in the principal or most advantageous market for the asset or liability in an orderly transaction between market participants on the measurement date. ASC 820 also establishes a three-tier fair value hierarchy, which prioritizes the inputs used in measuring fair value.

The balances of financial instruments measured at fair value on a recurring basis are as follows (see Note 10):

|

|

|

September 30, 2019 |

|

|||||||||||||

|

(in thousands) |

|

Total |

|

|

Level 1 |

|

|

Level 2 |

|

|

Level 3 |

|

||||

|

Interest rate swap, assets |

|

$ |

1,120 |

|

|

$ |

— |

|

|

$ |

1,120 |

|

|

$ |

— |

|

|

Interest rate swap, liabilities |

|

|

(37,489 |

) |

|

|

— |

|

|

|

(37,489 |

) |

|

|

— |

|

|

|

|

$ |

(36,369 |

) |

|

$ |

— |

|

|

$ |

(36,369 |

) |

|

$ |

— |

|

|

|

|

December 31, 2018 |

|

|||||||||||||

|

(in thousands) |

|

Total |

|

|

Level 1 |

|

|

Level 2 |

|

|

Level 3 |

|

||||

|

Interest rate swap, assets |

|

$ |

17,633 |

|

|

$ |

— |

|

|

$ |

17,633 |

|

|

$ |

— |

|

|

Interest rate swap, liabilities |

|

|

(1,820 |

) |

|

|

— |

|

|

|

(1,820 |

) |

|

|

— |

|

|

|

|

$ |

15,813 |

|

|

$ |

— |

|

|

$ |

15,813 |

|

|

$ |

— |

|

The Company has estimated that the carrying amount reported on the Condensed Consolidated Balance Sheets for Cash and cash equivalents, Prepaid expenses and other assets, Tenant and other receivables, net, and Accounts payable and other liabilities, approximates their fair values due to their short-term nature.

The fair value of the Company’s debt was estimated using Level 2 and Level 3 inputs based on recent financing transactions, estimates of the fair value of the property that serves as collateral for such debt, historical risk premiums for loans of comparable quality, current London Interbank Offered Rate (“LIBOR”), U.S. treasury obligation interest rates, and on the discounted estimated future cash payments to be made on such debt. The discount rates estimated reflect the Company’s judgment as to the approximate current lending rates for loans or groups of loans with similar maturities and assumes that the debt is outstanding through maturity. Market information, as available, or present value techniques were utilized to estimate the amounts required to be disclosed. Since such amounts are estimates that are based on limited available market information for similar transactions and do not acknowledge transfer or other repayment restrictions that may exist on specific loans, it is unlikely that the estimated fair value of any such debt could be realized by immediate settlement of the obligation.

9

The following table summarizes the carrying amount reported on the Condensed Consolidated Balance Sheets and the Company’s estimate of the fair value of the Mortgages and notes payable, net, Unsecured term notes, net, and Unsecured revolver:

|

(in thousands) |

|

September 30, 2019 |

|

|

December 31, 2018 |

|

||

|

Carrying amount |

|

$ |

2,096,235 |

|

|

$ |

1,450,551 |

|

|

Fair value |

|

|

2,180,100 |

|

|

|

1,439,264 |

|

As disclosed under Long-lived Asset Impairment elsewhere in Note 2, the Company’s non-recurring fair value measurements consisted of the fair value of impaired real estate assets that were determined using Level 3 inputs.

Right-of-Use Assets and Lease Liabilities

In accordance with ASC 842, the Company records right-of-use assets and lease liabilities associated with leases of land where it is the lessee under non-cancelable operating leases (“ground leases”). The lease liability is equal to the net present value of the future payments to be made under the lease, discounted using estimates based on observable market factors. The right-of-use asset is generally equal to the lease liability plus initial direct costs associated with the leases. The Company includes in the recognition of the right-of-use asset and lease liability those renewal periods that are reasonably certain to be exercised, based on the facts and circumstances that exist at lease inception. Amounts associated with percentage rent provisions are considered variable lease costs and are not included in the initial measurement of the right-of-use asset or lease liability. As allowed under ASC 842, the Company has made an accounting policy election, applicable to all asset types, to not separate lease from nonlease components when allocating contract consideration related to ground leases.

Right-of-use assets and lease liabilities associated with ground leases were included in the accompanying Condensed Consolidated Balance Sheets as follows:

|

|

|

|

|

September 30, |

|

|

|

(in thousands) |

|

Financial Statement Presentation |

|

2019 |

|

|

|

Right-of-use assets |

|

Prepaid expenses and other assets |

|

$ |

1,654 |

|

|

Lease liabilities |

|

Accounts payable and other liabilities |

|

|

1,246 |

|

Taxes Collected From Tenants and Remitted to Governmental Authorities

A majority of the Company’s properties are leased on a triple-net basis, which provides that the tenants are responsible for the payment of all property operating expenses, including, but not limited to, property taxes, maintenance, insurance, repairs, and capital costs, during the lease term. The Company records such expenses on a net basis. In other situations, the Company may collect property taxes from its tenants and remit those taxes to governmental authorities. Taxes collected from tenants and remitted to governmental authorities are presented on a gross basis, where amounts billed to tenants are included in Lease revenues, and the corresponding expense is included in Property and operating expense, in the accompanying Condensed Consolidated Statements of Income and Comprehensive Income.

Rental Expense

Rental expense associated with ground leases is recorded on a straight-line basis over the term of each lease, for leases that have fixed and measurable rent escalations. Under the provisions of ASC 842, the difference between rental expense incurred on a straight-line basis and the cash rental payments due under the provisions of the lease is recorded as part of the right-of-use asset in the accompanying September 30, 2019 Condensed Consolidated Balance Sheet. Prior to the adoption of ASC 842, at December 31, 2018, this difference was recorded as a deferred liability and was included as a component of Accounts payable and other liabilities in the accompanying Condensed Consolidated Balance Sheets. Amounts associated with percentage rent provisions based on the achievement of sales targets are recognized as variable rental expense when achievement of the sales targets is considered probable. Rental expense is included in Property and operating expenses on the accompanying Condensed Consolidated Statements of Income and Comprehensive Income.

Recently Adopted Accounting Standards

In February 2016, the FASB issued ASU 2016-02, Leases (Topic ASC 842), which superseded the existing guidance for lease accounting, ASC 840. ASC 842 is effective January 1, 2019, with early adoption permitted. The guidance requires lessees to recognize a right-of-use asset and a corresponding lease liability, initially measured at the present value of lease payments, for both operating and financing leases. Under the new pronouncement, lessor accounting is largely unchanged from prior GAAP, however disclosures were expanded. The Company adopted ASC 842 on January 1, 2019 on a modified retrospective basis and elected the following practical expedients:

10

|

|

• |

The “Package of Three,” which allows an entity to not reassess (i) whether any expired or existing contracts are, or contain, leases, (ii) the lease classification for any expired or existing leases, and (iii) initial direct costs for existing leases. |

|

|

• |

The optional transition method to initially apply the guidance of ASC 842 at the adoption date and to recognize a cumulative-effect adjustment to the opening balance of retained earnings. As a result of electing this practical expedient, the Company’s reporting for the comparative periods presented will continue to be in accordance with ASC 840, including the required disclosures. |

|

|

• |

The ability to make an accounting policy election, by class of underlying asset, to not separate nonlease components from the associated lease component and to account for those components as a single component if certain conditions are met. |

ASC 842 requires all income from leases to be presented as a single line item, rather than the prior presentation where rental income from leases was shown separately from amounts billed and collected as reimbursements from tenants on the Condensed Consolidated Statements of Income and Comprehensive Income. In addition, bad debt expense is required to be recorded as an adjustment to Lease revenues, rather than recorded within Operating expenses on the Condensed Consolidated Statements of Income and Comprehensive Income, as had previously been the case.

The Company is primarily a lessor and therefore adoption of ASC 842 did not have a material impact on its Condensed Consolidated Financial Statements. Upon adoption of ASC 842, it was not necessary for the Company to record a cumulative-effect adjustment to the opening balance of retained earnings, however the Company recognized a right-of-use asset and corresponding lease liability as of January 1, 2019, of $1,687 and $1,261, respectively, related to operating leases where it is the lessee (see Note 16). The right-of-use asset was recorded net of a previously recorded straight-line rent liability of $7 and ground lease intangible asset, net of $432 as of the date of adoption.

In October 2018, the FASB issued ASU 2018-16, Derivatives and Hedging (Topic 815): Inclusion of the Secured Overnight Financing Rate (SOFR) Overnight Index Swap (OIS) Rate as a Benchmark Interest Rate for Hedge Accounting Purposes. Previously under Topic 815, the eligible benchmark interest rates in the United States were the interest rates on direct Treasury obligations of the U.S. government (UST), the LIBOR swap rate, the OIS Rate based on the Fed Funds Effective Rate, and the Securities Industry and Financial Markets Association (SIFMA) Municipal Swap Rate, which was introduced in ASU 2017-12, Derivatives and Hedging (Topic 815): Targeted Improvements to Accounting for Hedging Activities (“ASU 2017-12”). The amendments in ASU 2018-16 permit the use of the OIS rate based on SOFR as a benchmark interest rate for hedge accounting purposes under Topic 815. The amendments in this update were effective for fiscal years beginning after December 15, 2018, and interim periods within those fiscal years for public business entities that already adopted the amendments in ASU 2017-12 (which the Company adopted effective January 1, 2018). The Company adopted ASU 2018-16 as of January 1, 2019 on a prospective basis for qualifying new or redesignated hedging relationships entered into on or after the date of adoption. Adoption of this guidance had no impact on the Condensed Consolidated Financial Statements.

Other Recently Issued Accounting Standards

In June 2016, the FASB issued ASU 2016-13, Financial Instruments – Credit Losses which changes how entities measure credit losses for most financial assets. Financial assets that are measured at amortized cost will be required to be presented at the net amount expected to be collected with an allowance for credit losses deducted from the amortized cost basis. The guidance requires an entity to utilize broader information in estimating the expected credit loss, including forecasted information. In November 2018, the FASB issued ASU 2018-19, Codification Improvements to Topic 326, Financial Instruments – Credit Losses which clarified that operating lease receivables recorded by lessors are explicitly excluded from the scope of this guidance. In May 2019, the FASB issued ASU 2019-05, Financial Instruments – Credit Losses (Topic 326): Targeted Transition Relief, which provides entities with an option to irrevocably elect the fair value option for eligible instruments upon adoption of Topic 326. ASU 2016-13 is effective January 1, 2020, with early adoption permitted beginning on January 1, 2019, under a modified retrospective application. The Company continues to evaluate the impact this new standard will have on its Condensed Consolidated Financial Statements, including the transition relief provisions, but does not expect such impact will be material based upon the composition of its current lease portfolio.

In August 2018, the FASB issued ASU 2018-13, Fair Value Measurement (Topic 820) Disclosure Framework – Changes to the Disclosure Requirements for Fair Value Measurement. The amendments under ASU 2018-13 remove, add, and modify certain disclosure requirements on fair value measurements in ASC 820. The amendments are effective for fiscal years, and interim periods within those fiscal years, beginning after December 15, 2019, with early adoption permitted. The Company is currently evaluating the impact the new standard will have on its Condensed Consolidated Financial Statements and expects to adopt the new disclosures on a prospective basis on January 1, 2020.

In April 2019, the FASB issued ASU 2019-04, Codification Improvements to Topic 326, Financial Instruments – Credit Losses, Topic 815, Derivatives and Hedging, and Topic 825, Financial Instruments which clarifies and improves guidance within the recently issued standards on credit losses, hedging, and recognition and measurement of financial instruments. The Company will assess the impact of the changes to Topic 326 in connection with its adoption of ASU 2018-13 discussed above. The provisions of ASU 2019-04 relating

11

to Topics 815 and 825 are effective on January 1, 2020. The Company is currently evaluating the impact of adopting ASU 2019-04, but does not anticipate that it will have a material impact on its financial statements.

Reclassifications

Certain prior-period amounts have been reclassified to conform with the current period’s presentation, including certain items described below which resulted from the adoption of ASC 842.

Components of revenue that were previously reported as Rental income from operating leases, Earned income from direct financing leases, Operating expenses reimbursed from tenants, and Other income from real estate transactions, on the Condensed Consolidated Statements of Income and Comprehensive Income, have been combined and reported as Lease revenues on the Condensed Consolidated Statements of Income and Comprehensive Income as follows:

|

As originally reported |

|

For the three months ended |

|

|

For the nine months ended |

|

||

|

(in thousands) |

|