UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

(Mark One)

|

☒ |

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2017

OR

|

☐ |

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from _______ to _______

Commission file number 000-55774

BROADSTONE NET LEASE, INC.

(Exact name of registrant as specified in its charter)

|

Maryland |

26-1516177 |

|

(State or other jurisdiction of |

(I.R.S. Employer |

|

800 Clinton Square Rochester, New York |

14604 |

|

(Address of principal executive offices) |

(Zip Code) |

(585) 287-6500

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Securities Exchange Act of 1934: None

Securities registered pursuant to Section 12(g) of the Securities Exchange Act of 1934: Common Stock, par value $0.001 per share

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐ No ☒

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No ☒

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ☒ No ☐

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§ 229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ☒

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

|

Large accelerated filer |

☐ |

|

Accelerated filer |

☐ |

|

Non-accelerated filer |

☒ |

(Do not check if a smaller reporting company) |

Smaller reporting company |

☐ |

|

Emerging growth company |

☒ |

|

|

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☒

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ☐ No ☒

There is no established market for the registrant’s shares of common stock. There were approximately 16,367,512 shares of common stock held by non-affiliates as of June 30, 2017, the last business day of the registrant’s most recently completed second fiscal quarter, for an aggregate market value of $1,309,400,960, assuming a market value of $80 per share, the offering price per share as of June 30, 2017, in the registrant’s ongoing private offering exclusive of any available discounts for certain categories of purchasers.

There were 19,377,844 shares of the Registrant’s common stock, $0.001 par value per share, outstanding as of March 1, 2018.

Documents Incorporated by Reference

Part III, Items 10, 11, 12, 13, and 14 of this annual report incorporate by reference certain specific portions of Broadstone Net Lease, Inc.’s definitive proxy statement for its 2018 Annual Meeting of Stockholders, which will be filed with the Securities and Exchange Commission no later than 120 days after the end of the registrant’s fiscal year. Only those portions of the proxy statement that are specifically incorporated by reference herein shall constitute a part of this annual report.

TABLE OF CONTENTS

|

|

|

|

|

Page |

|

|

|

|

|

|

|

|

|

2 |

||

|

|

|

|

|

|

|

|

|

PART I |

|

|

|

|

|

|

|

|

|

Item 1. |

|

|

3 |

|

|

|

|

|

|

|

|

Item 1A. |

|

|

18 |

|

|

|

|

|

|

|

|

Item 1B. |

|

|

36 |

|

|

|

|

|

|

|

|

Item 2. |

|

|

36 |

|

|

|

|

|

|

|

|

Item 3. |

|

|

36 |

|

|

|

|

|

|

|

|

Item 4. |

|

|

36 |

|

|

|

|

|

|

|

|

|

|

PART II |

|

|

|

|

|

|

|

|

|

Item 5. |

|

|

37 |

|

|

|

|

|

|

|

|

Item 6. |

|

|

46 |

|

|

|

|

|

|

|

|

Item 7. |

|

Management’s Discussion and Analysis of Financial Condition and Results of Operations |

|

47 |

|

|

|

|

|

|

|

Item 7A. |

|

|

67 |

|

|

|

|

|

|

|

|

Item 8. |

|

|

69 |

|

|

|

|

|

|

|

|

Item 9. |

|

Changes in and Disagreements with Accountants on Accounting and Financial Disclosure |

|

146 |

|

|

|

|

|

|

|

Item 9A. |

|

|

146 |

|

|

|

|

|

|

|

|

Item 9B. |

|

|

146 |

|

|

|

|

|

|

|

|

|

|

PART III |

|

|

|

|

|

|

|

|

|

Item 10. |

|

|

147 |

|

|

|

|

|

|

|

|

Item 11. |

|

|

147 |

|

|

|

|

|

|

|

|

Item 12. |

|

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters |

|

147 |

|

|

|

|

|

|

|

Item 13. |

|

Certain Relationships and Related Transactions, and Director Independence |

|

147 |

|

|

|

|

|

|

|

Item 14. |

|

|

153 |

|

|

|

|

|

|

|

|

|

|

PART IV |

|

|

|

|

|

|

|

|

|

Item 15. |

|

|

154 |

|

|

|

|

|

|

|

|

Item 16. |

|

|

154 |

|

1

Cautionary Note Regarding Forward-Looking Statements

Except where the context suggests otherwise, as used in this Form 10-K, the terms “we,” “us,” “our,” and “our company” refer to Broadstone Net Lease, Inc., a Maryland corporation, and, as required by context, Broadstone Net Lease, LLC, a New York limited liability company, which we refer to as our “Operating Company,” and to their respective subsidiaries.

This Annual Report on Form 10-K may contain forward-looking statements within the meaning of Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), regarding, among other things, our plans, strategies, and prospects, both business and financial. Forward-looking statements include, but are not limited to, statements that represent our beliefs concerning future operations, strategies, financial results or other developments. Forward-looking statements can be identified by the use of forward-looking terminology such as, but not limited to, “may,” “should,” “expect,” “anticipate,” “estimate,” “would be,” “intend,” “believe,” or “continue” or the negative or other variations of comparable terminology.

Forward-looking statements are inherently subject to risks, uncertainties, and assumptions. Because these forward-looking statements are based on estimates and assumptions that are subject to significant business, economic, and competitive uncertainties, many of which are beyond our control or are subject to change, actual results could be materially different. Although we believe that our plans, intentions, and expectations reflected in or suggested by these forward-looking statements are reasonable, we cannot assure you that we will achieve or realize these plans, intentions or expectations.

The following are some, but not all, of the assumptions, risks, uncertainties, and other factors that could cause our actual results to differ materially from those presented in our forward-looking statements:

|

|

• |

Our ability to generate cash flows sufficient to pay our dividends to stockholders or meet our debt service obligations. |

|

|

• |

Our ability to achieve our investment objectives and growth plans. |

|

|

• |

Our dependence upon the financial health and performance of our Manager and Asset Manager and their ability to retain or hire key personnel. |

|

|

• |

We may be subject to substantial third-party fees, in some instances to affiliated third parties. |

|

|

• |

Potential conflicts of interest because of our UPREIT structure (as defined below) and the relationship with our Manager and Asset Manager. |

|

|

• |

General business and economic conditions, fluctuating interest rates, and volatility and uncertainty in the credit markets and broader financial markets. |

|

|

• |

Competition in the acquisition and disposition of properties and in the leasing of our properties, which may impact our ability to acquire, dispose of, or lease properties on advantageous terms. |

|

|

• |

Risks associated with investing in real estate, including tenant, geographic, and industry concentrations with respect to our properties; bankruptcies or insolvencies of tenants or from tenant defaults generally; impairments in the value of our real estate assets; the illiquidity of our real estate investments; potential liability relating to environmental matters; and potential damages from natural disasters, acts of terrorism, or war. |

|

|

• |

Our access to capital and ability to borrow money in sufficient amounts and on favorable terms. |

|

|

• |

Our continued qualification as a real estate investment trust (“REIT”) for U.S. federal income tax purposes and compliance with REIT requirements, including the annual distribution requirements. |

|

|

• |

Changes in applicable laws, rules, and regulations, including the tax laws. |

Additional factors that may cause risks and uncertainties include those discussed in the Item 1. “Business,” Item 1A. “Risk Factors,” and Item 7. “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in this Annual Report. Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date this Form 10-K is filed with the Securities and Exchange Commission (the “SEC”). Except as required by law, we do not undertake any obligation to update or revise any forward-looking statements contained in this Form 10-K.

2

The Company

We are an externally managed real estate investment trust formed as a Maryland corporation in 2007 to acquire and hold single-tenant, commercial real estate properties throughout the United States that are leased to the properties’ operators under long-term net leases. Under a “net lease,” the tenant occupying the leased property (usually as a single tenant) does so in much the same manner as if the tenant were the owner of the property. There are various forms of net leases, most typically classified as triple-net or double-net. Triple-net leases typically require that the tenant pay all expenses associated with the property (e.g., real estate taxes, insurance, maintenance and repairs). Double net leases typically require that the tenant pay all operating expenses associated with the property (e.g., real estate taxes, insurance and maintenance), but exclude some or all major repairs (e.g., roof, structure and parking lot). Accordingly, the owner receives the rent “net” of these expenses, rendering the cash flow associated with the lease predictable for the term of the lease. Under a net lease, the tenant generally agrees to lease the property for a significant term and agrees that it will either have no ability or only limited ability to terminate the lease or abate rent prior to the expiration of the term of the lease as a result of real estate driven events such as casualty, condemnation or failure by the landlord to fulfill its obligations under the lease.

We focus on real estate that is operated by a single tenant where the real estate is an integral part of the tenant’s business. Our diversified portfolio of real estate includes retail properties, such as quick service and casual dining restaurants, healthcare facilities, industrial manufacturing facilities, warehouse and distribution centers, and corporate offices, among others. We target properties with credit-worthy tenants that look to engage in a long-term lease relationship. Through long-term leases, our tenants are able to retain operational control of their critical locations, while conserving their debt and equity capital to fund their fundamental business operations.

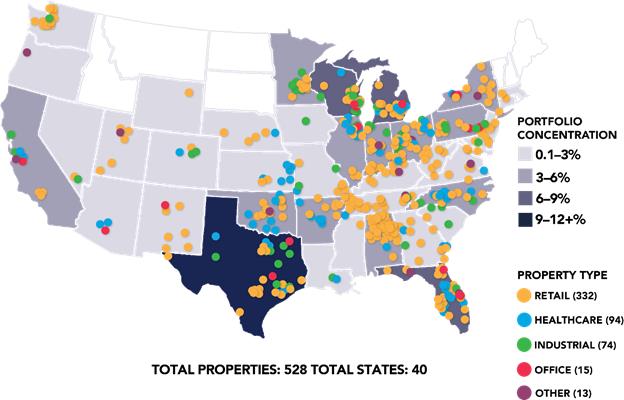

As of December 31, 2017, we owned a diversified portfolio of 528 individual net leased commercial properties located in 40 states comprising approximately 15.9 million rentable square feet of operational space. As of December 31, 2017, our properties were 100% leased to 134 different commercial tenants, with no single tenant accounting for more than 4% of our annual rental stream.

We elected to qualify as a REIT under the Internal Revenue Code of 1986, as amended (the “Internal Revenue Code”), beginning with our taxable year ended December 31, 2008. As a REIT, we are not subject to federal income tax to the extent that we meet certain requirements, including that we distribute at least 90% of our annual taxable income to our stockholders and satisfy other requirements based on the composition of our asset portfolio and sources of income.

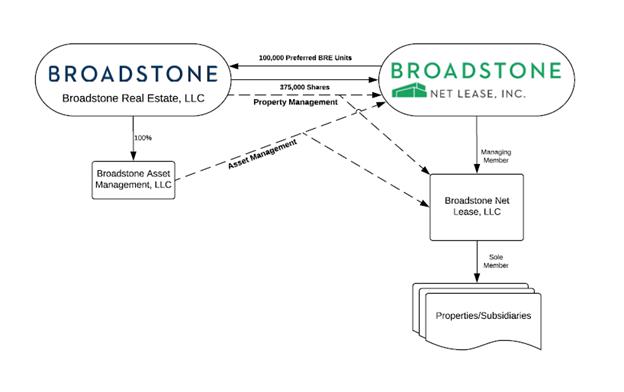

We operate under the direction of our board of directors, which is responsible for the management and control of our affairs. Our board of directors has retained Broadstone Real Estate, LLC (the “Manager”), to provide certain property management services for our properties, and Broadstone Asset Management, LLC, a wholly owned subsidiary of the Manager (the “Asset Manager”), to manage our day-to-day affairs and implement our investment strategy, subject to our board of directors’ direction, oversight, and approval. The agreements governing the services provided by the Manager and the Asset Manager have been renewed through the year ended December 31, 2021, and will automatically renew for successive additional three-year terms thereafter, subject to earlier termination as detailed in the respective agreements (as further discussed in Item 13. “Certain Relationships and Related Transactions, and Director Independence” within this Form 10-K).

We conduct substantially all of our activities through, and all of our properties are held directly or indirectly by, the Operating Company. We are the sole managing member of the Operating Company and as of December 31, 2017, we owned approximately 92.4% of its issued and outstanding membership units, with the remaining 7.6% of its membership units held by persons who were issued membership units in exchange for their interests in properties acquired by the Operating Company.

3

As we conduct substantially all of our operations through the Operating Company, we are structured as what is referred to as an Umbrella Partnership Real Estate Investment Trust (“UPREIT”). The UPREIT structure allows a property owner to contribute their property to the Operating Company in exchange for membership units in the Operating Company and generally defer taxation of a resulting gain until the contributor later disposes of the membership units or the property is sold in a taxable transaction. The membership units of the Operating Company held by members of the Operating Company other than us are referred to herein and in our consolidated financial statements as “non-controlling interests,” “non-controlling membership units,” or “membership units,” and are convertible into shares of our common stock on a one-for-one basis, subject to certain restrictions. We allocate consolidated earnings to holders of our common stock and non-controlling membership unit holders of the Operating Company based on the weighted average number of shares of our common stock and non-controlling membership units outstanding during the year. Approximately 1.6 million non-controlling membership units were outstanding as of December 31, 2017. For the year ended December 31, 2017, the weighted average number of units outstanding was 1.5 million.

We commenced our ongoing private offering of shares of our common stock (our “private offering”) in 2007. The first closing of our private offering occurred on December 31, 2007, and we have conducted additional closings at least once every calendar quarter since then. Currently, we close sales of additional shares of our common stock monthly. We instituted a monthly cap on new and additional investments in our common stock beginning in November 2017. The cap does not apply to investments made pursuant to our distribution reinvestment plan or equity capital received in connection with UPREIT transactions. See Item 5. “Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchase of Equity Securities” of this Form 10-K for further information.

Our shares of common stock are sold by us at a price equal to a determined share value (the “Determined Share Value”), which is established quarterly by the committee of our board of directors comprised of our independent directors (“Independent Directors Committee”) based on the net asset value (“NAV”) of our portfolio, input from management and third-party consultants, and other such factors as the Independent Directors Committee may determine. Our determination of NAV applies valuation definitions and methodologies prescribed by the Accounting Standards Codification (“ASC”) 820, Fair Value Measurements and Disclosures, in order to fair value our net assets. Our net assets are primarily comprised of our investment in rental property and debt. See further discussion related to Determined Share Value in Item 5. “Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities” of this Form 10-K under the caption Determined Share Value. Shares of our common stock are currently being offered in our private offering at $81.00 per share, provided that the per share offering price may be adjusted quarterly by the Independent Directors Committee based on the Determined Share Value. For the year ended December 31, 2017, we issued 3.8 million shares of our common stock in our private offering, including 0.5 million shares of common stock issued pursuant to our Distribution Reinvestment Plan (“distribution reinvestment plan” or “DRIP”). Cash received for newly issued shares totaled $263.1 million and shares with a value of $40.2 million were issued pursuant to DRIP transactions. In addition, we issued 161,418 units in our Operating Company valued at $12.9 million during the year ended December 31, 2017, in exchange for properties contributed through UPREIT transactions. We intend to use substantially all of the net proceeds from our private offering, supplemented with additional borrowings, to continue to invest in additional net leased properties and for general corporate purposes. We conduct our private offering in reliance upon the exemption from registration under the Securities Act of 1933, as amended (the “Securities Act”), provided by Rule 506(c) of Regulation D promulgated under the Securities Act.

As of December 31, 2017, there were 18.9 million shares of our common stock issued and outstanding, and 1.6 million membership units in the Operating Company issued and outstanding.

2017 Highlights

|

|

• |

Increased total revenues to $181.6 million, representing growth of 27.1% compared to the year ended December 31, 2016. |

|

|

• |

Generated earnings per share on a GAAP basis (as defined below), including amounts attributable to non-controlling interests, of $3.21, representing an increase of $0.45 per diluted share compared to the year ended December 31, 2016. |

4

|

|

• |

Generated funds from operations (“FFO”), a non-GAAP financial measure, of $6.00 per diluted share. |

|

|

• |

Generated adjusted funds from operations (“AFFO”), a non-GAAP financial measure, of $5.38 per diluted share. |

|

|

• |

Increased our monthly distribution to stockholders from $0.41 per share at December 31, 2016, to $0.415 per share in February 2017. Subsequent to year end, our board of directors increased the distribution to $0.43 per share, commencing with the payment to be made in March 2017. |

|

|

• |

Increased the Determined Share Value from $77.00 per share at December 31, 2016, to $81.00 at December 31, 2017, representing a 5.2% increase. The Determined Share Value will remain in effect through April 30, 2018. |

|

|

• |

Closed 29 real estate acquisitions totaling $683.6 million, excluding capitalized acquisition expenses, adding 124 new properties with a weighted average initial cash capitalization rate of 7.2%. The properties acquired had a weighted average lease term of 15.0 years at the time of acquisition and weighted average annual rent increases of 1.8%. |

|

|

• |

Received $316.2 million in investments from new and existing stockholders, including property contributed in exchange for Operating Company membership units through UPREIT transactions, and had more than 2,600 stockholders as of the end of the year. |

|

|

• |

Continued to focus on optimizing our portfolio by selectively pruning and strategically disposing of 13 properties, representing approximately 2.9% of our portfolio value as of December 31, 2016, for $63.3 million in net proceeds. |

|

|

• |

Successfully enhanced and diversified our sources of debt capital. In April 2017, we issued $150.0 million of unsecured, fixed-rate, interest-only senior notes (“Senior Notes”) through a private placement. In June 2017, together with the Operating Company, we closed an $800.0 million unsecured credit facility, which includes an accordion feature that permits an increase in the facility up to a total of $1.0 billion. In November 2017, we expanded the credit facility to $880.0 million of available borrowing capacity. |

|

|

• |

Collected more than 99% of rents due during 2017 and maintained a 100% leased portfolio throughout the year. |

FFO and AFFO are performance measures that are not calculated in accordance with accounting principles generally accepted in the United States of America (“GAAP”). We present these non-GAAP measures as we believe certain investors and other users of our financial information use them as part of their evaluation of our historical operating performance. Please see our discussion in Item 7. “Management’s Discussion and Analysis of Financial Condition and Results of Operations” of this Form 10-K under the heading Net Income and Non-GAAP Measures (FFO and AFFO), which includes discussion of the definition, purpose, and use of these non-GAAP measures as well as a reconciliation of each to the most comparable GAAP measure.

Our Properties and Investment Objectives

We target acquisitions of fee simple interests in individual properties priced between $5 million and $75 million. Portfolios may be significantly larger, depending on balance sheet capacity and whether the portfolio is diversified or concentrated by tenant, geography, or brand. Our investment policy (“Investment Policy”) has three primary objectives that drive the investments we make:

|

|

• |

preserve, protect, and return capital to investors, |

|

|

• |

realize increased cash available for distributions and long-term capital appreciation from growth in the rental income and value of our properties, and |

|

|

• |

maximize the level of sustainable cash distributions to our investors. |

5

We primarily acquire freestanding, single-tenant commercial properties located in the United States either directly from our credit-worthy tenants in sale-leaseback transactions, where they sell us their properties and simultaneously lease them back through long-term, net leases, or through the purchase of properties already under a net lease (i.e., a lease assumption). Under either scenario, our properties are generally under lease and fully occupied at the time of acquisition. Our real estate portfolio as of December 31, 2017, is reflective of our Investment Policy, with a focus on properties in growth markets with at least ten years of lease term remaining. Throughout much of 2017, the Investment Policy required that the portfolio achieve financial returns on equity of greater than 10%, net of fees, provided that all acquisitions must have had a minimum remaining lease term of seven years and a minimum return on equity of 9.5%, unless approved by our Independent Directors Committee. As part of its regular review of our Investment Policy at its November 2017 meeting, the Independent Directors Committee approved an update to such policy to require a 9.5% minimum return on equity, net of fees, calculated based on the average return recognized across all acquisitions during a calendar year, with a minimum required return of 8.5%, net of fees, for any particular transaction. We believe the changes will allow us greater flexibility in deploying capital in investment opportunities that maximize the risk-adjusted return to our stockholders. Our criteria for selecting properties (“Property Selection Criteria”) is based on the following underwriting principles:

|

|

• |

fundamental value and characteristics of the underlying real estate, |

|

|

• |

creditworthiness of the tenant, and |

|

|

• |

transaction structure and pricing. |

We believe we can achieve an appropriate risk-adjusted return through these underwriting principles and conservatively project a property’s potential to generate targeted returns from current and future cash flows. We believe targeted returns are achieved through a combination of in-place income at the time of acquisition, rent growth, and a property’s potential for appreciation.

To achieve an appropriate risk-adjusted return, we maintain a diversified portfolio of real estate spread across multiple tenants, industries, and geographic locations. The following charts summarize our portfolio diversification by property type and geographic location as of December 31, 2017. The percentages below are calculated based on our contractual rental revenue over the next 12 months (“NTM Rent”) as of December 31, 2017, on a per property type basis divided by total NTM Rent. Late payments, non-payments, or other unscheduled payments are not considered in the calculation. NTM Rent includes the impact of contractual rent escalations.

6

Property Type, by % of NTM Rent

|

Property Type |

|

% NTM Rent |

|

|

|

Retail – casual dining |

|

|

11.8 |

% |

|

Retail – other |

|

|

11.7 |

% |

|

Retail – quick service restaurants (QSR) |

|

|

10.7 |

% |

|

Retail Total |

|

|

34.2 |

% |

|

Industrial – warehouse/distribution |

|

|

11.5 |

% |

|

Industrial – manufacturing |

|

|

10.5 |

% |

|

Industrial – flex |

|

|

5.7 |

% |

|

Industrial – other |

|

|

3.4 |

% |

|

Industrial Total |

|

|

31.1 |

% |

|

Healthcare – clinical |

|

|

11.8 |

% |

|

Healthcare – surgical |

|

|

5.0 |

% |

|

Healthcare – other |

|

|

4.4 |

% |

|

Healthcare Total |

|

|

21.2 |

% |

|

Office |

|

|

9.7 |

% |

|

Other |

|

|

3.8 |

% |

|

|

|

|

|

|

7

|

Top Tenant Industries |

|

|||

|

Industry |

|

% NTM Rent |

|

|

|

Restaurants |

|

|

22.5 |

% |

|

Healthcare Facilities |

|

|

18.4 |

% |

|

Home Furnishing Retail |

|

|

4.9 |

% |

|

Specialized Consumer Services |

|

|

4.9 |

% |

|

Packaged Foods & Meats |

|

|

4.6 |

% |

|

Auto Parts & Equipment |

|

|

4.5 |

% |

|

Healthcare Services |

|

|

2.8 |

% |

|

Industrial Conglomerates |

|

|

2.3 |

% |

|

Multi-line Insurance |

|

|

2.1 |

% |

|

Life Sciences Tools & Services |

|

|

2.0 |

% |

|

Distributors |

|

|

2.0 |

% |

|

Air Freight & Logistics |

|

|

1.9 |

% |

|

Industrial Machinery |

|

|

1.8 |

% |

|

Food Retail |

|

|

1.7 |

% |

|

Metal & Glass Containers |

|

|

1.6 |

% |

|

Top 15 Tenant Industries |

|

|

78.0 |

% |

|

Other (28 industries) |

|

|

22.0 |

% |

|

Total |

|

|

100.0 |

% |

Geographic Diversification, by % of NTM Rent

8

Substantially all of our leases are triple-net, meaning that our tenants are responsible for the maintenance, insurance, and property taxes associated with the properties they lease from us. At December 31, 2017, all of our properties are subject to leases. We do not currently engage in the development of real estate, which could cause a delay in timing between the funds used to invest in properties and the corresponding cash inflows from rental receipts. Our cash flows from operations are primarily generated through our real estate investment portfolio and the monthly lease payments under our long-term leases with our tenants.

To increase value to our stockholders, we strive to implement periodic rent escalations within our leases. As of December 31, 2017, nearly all of our leases had contractual rent escalations, with a 2.0% weighted average. A substantial majority of our leases have fixed annual rent increases, and the remaining leases have annual lease escalations based on increases in the Consumer Price Index (“CPI”), or periodic escalations over the term of the lease (e.g., a 10% increase every five years). These lease escalations mitigate exposure to fixed income streams in the case of an inflationary economic environment, and provide increased return in otherwise stable market conditions. Our focus on single-tenant, triple-net leases shifts certain risks to the tenant and shelters us from volatility in the cost of taxes, insurance, services, and maintenance of the property. An insignificant portion of our tenants have leases that are not fully triple-net, and, therefore, we bear responsibility for certain maintenance and structural component replacements (e.g., roof, structure, or parking lot) that may be required in the future, although the tenants are still required to pay all operating expenses associated with the property (e.g., real estate taxes, insurance and maintenance). In the limited circumstances where we cannot implement a triple-net lease, we attempt to limit our exposure through the use of warranties and other remedies that reduce the likelihood of a significant capital outlay during the term of the lease. We will also occasionally incur nominal property-level expenses that are not paid by our tenants. We do not currently anticipate making significant capital expenditures or incurring other significant property costs during the term of a property lease.

Due to the fact that all of our properties are leased to single tenants under long-term leases, we are not currently required to perform significant ongoing leasing activities on our properties. The leases for only three of our properties, representing less than 1% of our annual rental streams (calculated based on NTM Rent), will expire before 2020. As of December 31, 2017, the weighted average remaining term of our leases (calculated based on NTM Rent) was approximately 13.1 years, excluding renewal options, which are exercisable at the option of our tenants upon expiration of their initial lease term. Less than 5% of the properties in our portfolio are subject to leases without at least one renewal option. Furthermore, the weighted average lease term on the $683.6 million in properties acquired during the year ended December 31, 2017, was 15.0 years. More than 50% of our rental revenue is derived from leases that expire during 2030 and thereafter. As of December 31, 2017, no more than 10% of our rental revenue is derived from leases that expire in any single year in the decade between 2020 and 2030. The following chart sets forth our lease expirations based upon the terms of our leases in place as of December 31, 2017.

9

Lease Maturity Schedule, by % of NTM Rent

The following table presents the lease expirations by year, including the number of tenants and properties with leases expiring, the square footage covered by the leases expiring, the NTM Rent, and the percentage of NTM Rent for the leases expiring. Late payments, non-payments or other unscheduled payments are not considered in the NTM Rent amounts. NTM Rent includes the impact of contractual rent escalations. Amounts are in thousands, except the number of tenants and properties.

|

Year |

|

Number of Tenants |

|

|

Number of Properties |

|

|

Square Footage |

|

|

NTM Rent |

|

|

Percentage of NTM Rent |

|

|||||

|

2018 |

|

|

1 |

|

|

|

1 |

|

|

|

2 |

|

|

$ |

106 |

|

|

|

0.1 |

% |

|

2019 |

|

|

2 |

|

|

|

2 |

|

|

|

8 |

|

|

|

280 |

|

|

|

0.1 |

% |

|

2020 |

|

|

3 |

|

|

|

3 |

|

|

|

95 |

|

|

|

1,099 |

|

|

|

0.6 |

% |

|

2021 |

|

|

2 |

|

|

|

4 |

|

|

|

9 |

|

|

|

578 |

|

|

|

0.3 |

% |

|

2022 |

|

|

4 |

|

|

|

3 |

|

|

|

87 |

|

|

|

2,442 |

|

|

|

1.3 |

% |

|

2023 |

|

|

9 |

|

|

|

13 |

|

|

|

724 |

|

|

|

6,836 |

|

|

|

3.6 |

% |

|

2024 |

|

|

12 |

|

|

|

15 |

|

|

|

1,741 |

|

|

|

14,023 |

|

|

|

7.3 |

% |

|

2025 |

|

|

2 |

|

|

|

8 |

|

|

|

28 |

|

|

|

1,038 |

|

|

|

0.5 |

% |

|

2026 |

|

|

18 |

|

|

|

28 |

|

|

|

801 |

|

|

|

11,970 |

|

|

|

6.2 |

% |

|

2027 |

|

|

19 |

|

|

|

35 |

|

|

|

1,726 |

|

|

|

18,596 |

|

|

|

9.7 |

% |

|

2028 |

|

|

15 |

|

|

|

29 |

|

|

|

1,169 |

|

|

|

13,563 |

|

|

|

7.1 |

% |

|

2029 |

|

|

15 |

|

|

|

62 |

|

|

|

2,664 |

|

|

|

17,901 |

|

|

|

9.3 |

% |

|

2030 and thereafter |

|

|

73 |

|

|

|

325 |

|

|

|

6,874 |

|

|

|

103,945 |

|

|

|

53.9 |

% |

10

Our top tenants and brands at December 31, 2017, are listed in the tables below. The percentages are calculated based on our NTM Rent on a per property type basis divided by total NTM Rent. Late payments, non-payments or other unscheduled payments are not considered in the calculation. NTM Rent includes the impact of contractual rent escalations.

Top Ten Tenants, by % of NTM Rent

|

(1) |

Tenant’s properties include 22 Outback Steakhouse restaurants and two Carrabba’s Italian Grill restaurants. |

Top Ten Brands, by % of NTM Rent

|

Brand |

|

Property Type |

|

% NTM Rent |

|

|

Properties |

|

||

|

|

Industrial/Retail |

|

|

3.8 |

% |

|

|

27 |

|

|

|

Red Lobster |

|

Retail |

|

|

3.8 |

% |

|

|

25 |

|

|

Art Van Furniture |

|

Retail |

|

|

3.4 |

% |

|

|

9 |

|

|

Jack's Family Restaurants |

|

Retail |

|

|

3.0 |

% |

|

|

36 |

|

|

Taco Bell |

|

Retail |

|

|

2.7 |

% |

|

|

41 |

|

|

Wendy's |

|

Retail |

|

|

2.6 |

% |

|

|

35 |

|

|

Outback Steakhouse |

|

Retail |

|

|

2.4 |

% |

|

|

22 |

|

|

Big Tex Trailers |

|

Industrial/Retail/Office |

|

|

2.4 |

% |

|

|

17 |

|

|

Siemens |

|

Industrial |

|

|

2.3 |

% |

|

|

2 |

|

|

Nestle' |

|

Industrial |

|

|

2.2 |

% |

|

|

1 |

|

|

Total |

|

|

|

|

28.6 |

% |

|

|

215 |

|

|

All Other |

|

|

|

|

71.4 |

% |

|

|

313 |

|

|

(1) |

Brand includes two BEF Foods, Inc. properties and 25 Bob Evans Restaurants, LLC restaurants. |

11

Our Investment Policy generally requires us to seek diversification of our investments. The Independent Directors Committee approved certain updates to our Investment Policy following the regular annual review of the policy at the November 2017 meeting of our board of directors. Based on the NTM rent of the properties in the portfolio, determined as of the date of the prior quarter end, new investments may not cause us to exceed:

|

|

• |

5% in any single property; |

|

|

• |

8% leased to any single tenant or brand; |

|

|

• |

10% located in any single metropolitan statistical area; or |

|

|

• |

20% located in any single state. |

We may exceed these diversification targets from time to time with the approval of the Independent Directors Committee. To avoid undue risk concentrations in any single asset class or category, long-term asset allocation will be set with the following target percentages and within the following ranges, although these ranges may be temporarily waived by the Independent Directors Committee:

|

Asset Category |

|

Target |

|

|

Range |

|

|

Retail |

|

|

30 |

% |

|

15-45% |

|

Healthcare |

|

|

20 |

% |

|

15-45% |

|

Industrial |

|

|

25 |

% |

|

15-45% |

|

Office |

|

|

15 |

% |

|

10-20% |

|

Other |

|

|

10 |

% |

|

5-15% |

While the Independent Directors Committee establishes diversification thresholds to manage risk, the management team does not review discrete financial information at this level. Refer to our discussion regarding segment reporting under the caption Segment Reporting in Note 2, “Summary of Significant Accounting Policies” within the Notes to the Consolidated Financial Statements within Item 8. “Financial Statements and Supplementary Data” of this Form 10-K.

We do not currently engage in the development of real estate, but may do so in the future. Our Investment Policy provides the Asset Manager with the authority to make, on our behalf, any acquisition or sale of any property or group of related properties involving up to $50 million for any single or portfolio transaction, $75 million per cumulative tenant concentration, or $100 million per cumulative brand concentration, without approval of the Independent Directors Committee, provided that the transaction otherwise meets our Investment Policy and Property Selection Criteria, and any financing related to any such acquisition does not violate our Leverage Policy (as defined below), as established by the Independent Directors Committee from time to time. Our Investment Policy permits investments in properties that do not otherwise meet our Investment Policy or Property Selection Criteria with the approval of the Independent Directors Committee.

Underwriting Criteria

When evaluating a property acquisition, our underwriting guidelines require that we consider the condition of the property, the creditworthiness of the tenant, the strength of any personal or corporate guarantees, the tenant’s historic performance at the property or similar properties, the location of the property, the overall economic condition of the community in which the property is located, and the property’s potential for appreciation. We apply our credit underwriting guidelines prior to acquiring a property, periodically throughout the lease term, and when we are re-leasing properties in our portfolio. While we seek creditworthy tenants, we do not require them to be investment grade credit-rated. Our credit review process includes analyzing a tenant’s financial statements and other available information. When we obtain guarantees on our leases, we also analyze the creditworthiness of the guarantors. Depending on the circumstances, our process will include discussions with the tenant’s management team surrounding their business plan and strategy.

12

We evaluate the creditworthiness of our existing tenants on an ongoing basis through the use of regularly scheduled real estate portfolio reviews, reviewing updated tenant financial statements on a quarterly or annual basis, depending on the terms of the lease, analysis of updated tenant credit ratings, and our ongoing analysis of the economy and trends in the industries in which our tenants operate. Our portfolio review committee, which includes members of our senior management and our Manager’s portfolio management team, perform an in-depth review of each property in our portfolio at least once every 18 months. The review includes an analysis of the tenant’s recent financial statements, including key metrics such as rent coverage and leverage levels, among other applicable credit metrics, credit ratings, and economic considerations relevant to the tenant. The Manager’s asset management team also periodically reviews tenant financial statements and relevant credit performance metrics. Our credit monitoring procedures also include regular communications with tenants, who are required to communicate certain events to us under the terms of our leases, such as events of default and property damage. We believe our ongoing credit monitoring will enable us to identify material changes to a tenant’s credit quality in a timely basis and preserve our financial position. We have not identified any material changes to the credit quality of the tenants in our real estate portfolio as of December 31, 2017.

Leverage Policy

In March of 2016, Moody’s Investors Service (“Moody’s”) assigned the Operating Company an investment grade credit rating of Baa3 with a stable outlook. Moody’s re-affirmed the investment grade credit rating in March of 2017. The investment grade credit rating allowed us to take advantage of preferential borrowing margins on our outstanding debt, including the credit facility we entered into on June 23, 2017. The investment grade credit rating will also allow us more attractive access to the debt private placement markets. The rating is based on a number of factors, including an assessment of our financial strength, portfolio size and diversification, credit and operating metrics, corporate governance policies, and sustainability of cash flow and earnings. We are strongly committed to maintaining modest leverage, commensurate with our investment grade rating. While Moody’s utilizes other factors outside of our leverage ratio, our leverage policy (“Leverage Policy”) is to maintain a leverage ratio in the 35% to 45% range based on the market value of assets, recognizing that the actual leverage ratio will vary over time and there may be opportunistic reasons to exceed a 45% leverage ratio; provided, however, that we cannot exceed a 50% leverage ratio without the approval of the Independent Directors Committee.

We primarily utilize unsecured term and revolving debt to finance acquisitions, while obtaining mortgage loans and notes payable to a lesser degree. The mix of financing sources may change over time based on market conditions. The unsecured loans generally contain affirmative and negative covenants which are tested against our financial performance.

When utilized, mortgage loans and notes payable (“mortgage financing”) typically cover a single property or a group of related properties acquired from a single seller. The loans may be further secured by guarantees from us or the Operating Company, provided that we attempt to limit the use of guarantees to the extent possible. The Operating Company may assume debt when conducting a transaction or it may mortgage existing properties. As of December 31, 2017, 11 of our 528 properties were secured by mortgage financing, and the aggregate outstanding principal balance of mortgage loans and notes payable was approximately $68.5 million.

To reduce its exposure to variable-rate debt, the Operating Company enters into interest rate swap agreements to fix the rate of interest as a hedge against interest rate fluctuations. These interest rate hedges have staggered maturities to reduce the exposure to interest rate fluctuations in any one year, and generally extend up to 10 years. The interest rate swaps are applied against a pool of debt, which offers flexibility in maintaining our hedge designation concurrent with our ongoing capital markets activity. We attempt to limit our total exposure to floating-rate debt to be within a target of no more than 5% of the market value of total assets, measured at quarter end.

To reduce counterparty concentration risk with respect to our interest rate hedges, we diversify the institutions that serve as swap counterparties, and no more than 30% of the nominal value of our total hedged debt may be with any one institution, to be measured at the time we enter into an interest rate swap transaction and at quarter end.

13

During the year ended December 31, 2017, we added $150.0 million of unsecured, interest-only Senior Notes to our capital structure. The Senior Notes bear interest at a fixed rate of 4.84% per annum, with a 10-year maturity. We strategically use this channel of long-term, fixed-rate debt capital to help mitigate interest rate risk, lengthen our maturity profile, and diversify our sources of debt capital.

The Independent Directors Committee reviews our Leverage Policy at least annually; however, depending on market conditions and other factors, they may change our Leverage Policy from time to time.

As of December 31, 2017, our total outstanding indebtedness was $1,181.5 million and the ratio of our total indebtedness to the market value of our assets was approximately 41.6%.

Corporate Governance

We operate under the direction of our board of directors, which is responsible for the management and control of our affairs. Our board of directors has retained the Manager and the Asset Manager to manage our day-to-day affairs, to implement our investment strategy, and to provide certain property management services for our properties, with both subject to our board of directors’ direction, oversight, and approval. All of our officers are employees of the Manager.

Our board of directors is currently comprised of nine directors, six of whom are independent directors and serve on the Independent Directors Committee. The Independent Directors Committee reviews our relationship with, and the performance of, the Manager and the Asset Manager, and approves the terms of any affiliate transactions. In addition, the Independent Directors Committee is responsible for, among other things, approving our property and portfolio valuation policy, setting the Determined Share Value for our ongoing private offering, approving and setting our Investment Policy, Property Selection Criteria, and Leverage Policy, and approving acquisitions above certain thresholds or outside of the criteria set forth in our Investment Policy.

Management and Our Structure

Pursuant to the terms of the asset management agreement among us, the Operating Company, and the Asset Manager (as amended, the “Asset Management Agreement”), the Asset Manager is responsible for, among other things, managing our day-to-day operations, establishing and monitoring acquisition and disposition strategies, overseeing all marketing communications and services related to our ongoing private offering, arranging mortgage and other financing, overseeing the acquisition of properties and their initial lease-up if they are not already subject to a net lease upon acquisition, providing support for the good faith valuation of our property portfolio and the setting of the Determined Share Value by the Independent Directors Committee, overseeing investor closings and transfers, arranging our annual stockholder meetings, and servicing and communicating with investors, including providing investment projections and reports. The Asset Manager also has the power pursuant to the Asset Management Agreement to designate two of the nine directors who serve on our board of directors. The Manager owns and controls the Asset Manager.

Pursuant to the property management agreement among us, the Operating Company, and the Manager (as amended, the “Property Management Agreement”), the Manager provides property management services to our properties, including management, rent collection, and re-leasing services. In June 2015, Trident BRE, LLC, an affiliate of Stone Point Capital LLC (“Trident BRE”), acquired through an equity investment an approximate 45.6% equity ownership interest in the Manager. As of December 31, 2017, the Manager is owned, on a fully diluted basis, (i) approximately 44.44% by Trident BRE, (ii) approximately 44.44% by Amy L. Tait, our Executive Chairman of the board of directors and Chief Investment Officer, Tait family trusts, and an investment entity for the families of Ms. Tait and the late Norman Leenhouts, one of our founders, and (iii) approximately 11.12% by employees of the Manager. The Manager is controlled by a four-person board of managers, two of whom are appointed by Trident BRE. In June 2015, in connection with Trident BRE’s investment in the Manager, (i) we acquired 100,000 convertible preferred interests in the Manager (the “Convertible Preferred BRE Units”), for $100 per Convertible Preferred BRE Unit, in exchange for the issuance to the Manager of 138,889 shares of our common stock, then valued at $72.00 per share, and (ii) the Manager purchased 510,416 shares of our common stock, for $72.00 per share. The Manager currently owns 375,000, or approximately 2.0%, of the issued and outstanding shares of our common stock. The Independent Directors Committee approved our investment in the Convertible Preferred BRE Units.

14

As of December 31, 2017, the Manager employed approximately 24 individuals fully-dedicated to our business and operations. Additionally, the Manager employed approximately 38 additional individuals who dedicate a significant portion of their time to our business and operations, in addition to various other tasks and responsibilities on behalf of the Manager and its affiliates.

For more information regarding the relationships among our company, Trident BRE, the Manager, and the Asset Manager and the fees we pay to the Manager and the Asset Manager pursuant to the Property Management Agreement and the Asset Management Agreement, see Item 13. “Certain Relationships and Related Transactions, and Director Independence” of this Form 10-K.

The chart below illustrates the relationships among our company, the Operating Company, the Manager, and the Asset Manager as of December 31, 2017.

Regulation

Our investments are subject to various federal, state, and local laws, ordinances, and regulations, including, among other things, zoning regulations, land use controls, and environmental controls relating to air and water quality, noise pollution, and indirect environmental impacts. We believe that we have all permits and approvals necessary under current law to operate our investments.

15

Emerging Growth Company Status

We are an emerging growth company, as defined in the Jumpstart Our Business Startups Act (the “JOBS Act”), and as such we are eligible to take advantage of certain exemptions from various reporting requirements that are applicable to other public companies that are not emerging growth companies, including, but not limited to, not being required to comply with the auditor attestation requirements of Section 404 of the Sarbanes-Oxley Act of 2002, reduced disclosure obligations regarding executive compensation in our periodic reports and proxy statements, and exemptions from the requirements of holding a nonbinding advisory vote on executive compensation and stockholder approval of any golden parachute payments not previously approved. A number of these exemptions are not currently relevant to us due to our external management structure, and in any event, we do not currently intend to take advantage of any of these exemptions.

In addition, Section 107 of the JOBS Act provides that an emerging growth company can use the extended transition period provided in Section 13(a) of the Exchange Act for complying with new or revised accounting standards. This permits an emerging growth company to delay the adoption of certain accounting standards until those standards would otherwise apply to private companies. We have irrevocably elected not to take advantage of this extended transition period and, as a result, we will adopt new or revised accounting standards on the relevant dates on which adoption of such standards is required for other public companies.

We will remain an emerging growth company until the earliest to occur of (1) the last day of the first fiscal year in which our annual gross revenues exceed $1 billion, (2) the date on which we become a “large accelerated filer” as defined in Rule 12b-2 under the Exchange Act, (3) the date on which we have issued more than $1 billion in non-convertible debt during the preceding three-year period, and (4) the end of the year in which the five-year anniversary of our initial public offering of our common stock occurs.

Competition

The commercial real estate market is highly competitive. We compete for tenants to occupy our properties in all of our markets with other owners and operators of commercial real estate. We compete based on a number of factors that include location, rental rates, security, suitability of the property’s design to prospective tenants’ needs, and the manner in which the property is operated and marketed. The number of competing properties in a particular market could have a material effect on our occupancy levels, rental rates and the operating expenses of certain of our properties.

In addition, we compete with other entities engaged in real estate investment activities to locate suitable properties to acquire and purchasers to buy our properties. These competitors include other REITs, specialty finance companies, savings and loan associations, sovereign wealth funds, banks, mortgage bankers, insurance companies, institutional investors, investment banking firms, lenders, governmental bodies, and other entities. Some of these competitors, including larger REITs, have substantially greater marketing and financial resources than we have. The relative size of their portfolios may allow them to absorb properties with lower returns and allow them to accept more risk on a given property than we can prudently manage, including risks with respect to the creditworthiness of tenants. In addition, these same entities may seek financing through similar channels to us. Competition from these REITs and other third party real estate investors may limit the number of suitable investment opportunities available to us. It also may result in higher prices, lower yields, and a narrower spread of yields over our borrowing costs, making it more difficult for us to acquire new investments on attractive terms.

Seasonality

Our investments are not materially impacted by seasonality.

Employees

We have no employees. Our officers are employees of our Manager or its affiliates and are not compensated by us for their service as our officers. The employees of our Manager and its affiliates manage our day-to-day operations and provide management, acquisition, advisory, and certain administrative services for us.

16

We have elected to be taxed as a REIT under the Internal Revenue Code and have operated as such commencing with the taxable year ended December 31, 2008. To qualify as a REIT, we must meet certain organizational and operational requirements, including a requirement to distribute at least 90% of our annual REIT taxable income to our stockholders, which is computed without regard to the dividends paid deduction and excluding net capital gain and does not necessarily equal net income as calculated in accordance with GAAP. As a REIT, we generally will not be subject to federal income tax to the extent we distribute qualifying dividends to our stockholders. If we fail to qualify as a REIT in any taxable year, we will be subject to federal income tax on our taxable income at regular corporate income tax rates and generally will not be permitted to qualify for treatment as a REIT for federal income tax purposes for the four taxable years following the year during which qualification is lost unless the Internal Revenue Service grants us relief under certain statutory provisions.

Financial Information about Industry Segments

We currently operate in a single reportable segment, which includes the acquisition, leasing, and ownership of net leased properties. Refer to the caption Segment Reporting in Note 2, “Summary of Significant Accounting Policies” within the Notes to the Consolidated Financial Statements within Item 8. “Financial Statements and Supplementary Data” of this Form 10-K.

Company Information

Our principal executive offices are located at 800 Clinton Square, Rochester, New York, 14604, and our telephone number is (585) 287-6500.

Our filings with the SEC, including our annual report on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K, and amendments to those reports, filed or furnished pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of 1934, as well as our proxy statements, are accessible free of charge at http://investors.bnl.broadstone.com as soon as reasonably practicable after we electronically file such material with, or furnish it to, the SEC. You may read and copy any materials we file with the SEC at the SEC’s Public Reference Room at 100 F Street, NE, Washington, D.C. 20549, or you may access them through the EDGAR database at the SEC’s website at http://www.sec.gov.

We have adopted our Code of Ethics to ensure that our business is conducted in accordance with the highest moral, legal, and ethical standards by our officers and directors as well as the Manager, the Asset Manager, and the Manager’s employees. The Code of Ethics is available on our website, http://investors.bnl.broadstone.com, together with the charters of the Board’s Independent Directors Committee, Audit Committee, and Nominating and Corporate Governance Committee. Amendments to, and waivers granted to our directors and executive officers under our codes of ethics, if any, will be posted in this area of our website. Copies of these materials are available in print to any stockholder who requests them. Stockholders should direct such requests in writing to Investor Relations Department, Broadstone Net Lease, Inc., 800 Clinton Square, Rochester, New York 14604. Stockholders may also call 1-585-287-6500.

The information about our website and its content is for your convenience only. The content of our website is not deemed to be incorporated by reference in this report or filed with the SEC.

17

The following are some of the risks and uncertainties that could cause our actual results to differ materially from those presented in our forward-looking statements. You should consider carefully the risks described below and the other information in this Form 10-K, including our consolidated financial statements and the related notes. The risks and uncertainties described below are not the only ones we face but do represent those risks and uncertainties that we believe are material to us. Additional risks and uncertainties not presently known to us or that we currently deem immaterial may also harm our business.

General Investment Risks

We may not be able to make distributions to our stockholders at the times or in the amounts we expect, or at all.

We may not be able to continue to generate sufficient cash flow from our properties and from possible distributions on our Convertible Preferred BRE Units, if declared and paid, to permit us to make the distributions we expect. If we pay distributions from the proceeds of our securities offering or from borrowings, the amount of capital we ultimately invest may be reduced, which may reduce the value of an investment in us.

There is no public trading market for our common stock and we are not required to effectuate a liquidity event by a certain date or at all, and transfers of shares of our common stock are subject to a number of restrictions. As a result, it will be difficult for our stockholders to sell shares of our common stock and, if they are able to sell their shares, they are likely to sell them at a discount.

There is no current public market for our common stock, we do not expect that any such public market will develop in the future, and we have no obligation to list our shares on any public securities market or provide any other type of liquidity to our stockholders by a particular date, or at all. The shares of our common stock are not registered under the Securities Act or state securities laws and therefore cannot be resold unless they are subsequently registered under such laws or unless an exemption from registration is available. Although we have adopted our share redemption program pursuant to which our stockholders may request that we redeem shares of our common stock, it is subject to a number of restrictions. Accordingly, our investors should not expect to be able to sell their shares or otherwise liquidate their investment promptly, if at all, and there can be no assurance that the sales price of any shares which are sold would equal or exceed the price originally paid for the shares. Our investors must be prepared to bear the economic risk of holding their shares of our common stock for an indefinite period of time.

Our stockholders are limited in their ability to sell shares of our common stock pursuant to our share redemption program. Our stockholders may not be able to sell any of their shares of our common stock back to us, and if they do sell their shares, they may not receive the price they paid.

We have adopted a share redemption program to provide an opportunity for our stockholders to have shares of our common stock repurchased at a price equal to or at a discount from the current Determined Share Value in effect as of the date the shares are tendered for redemption, subject to a number of restrictions and limitations. No shares may be repurchased under our share redemption program until after the first anniversary of the date of purchase of such shares without approval from our Independent Directors Committee. Further, we are not obligated to repurchase shares of our common stock under the share redemption program. Notwithstanding the procedures outlined in the share redemption program, our board of directors or Independent Directors Committee may, in its sole discretion, reject any share redemption request made by any stockholder at any time. In addition, the share redemption program limits the number of shares that may be redeemed in any quarter. The total number of shares redeemed in any quarter pursuant to the share redemption program may not exceed (i) 1% of the total number of shares outstanding at the beginning of the applicable calendar year, plus (ii) 50% of the total number of any additional shares of our common stock issued during the prior calendar quarter pursuant to our DRIP; provided, however, that the total number of shares redeemed during any calendar year may not exceed 5% of the number of shares outstanding as of the first day of such calendar year. There is no fee in connection with a repurchase of shares pursuant to our share redemption program. Finally, our board of directors reserves the right to amend, suspend, or terminate the share redemption program at any time upon 30 days’ notice to our stockholders. As a result of the foregoing, a stockholder may not be able to sell any of its shares of our common stock back to us pursuant to our share redemption program. Moreover, if a stockholder does sell its shares of our common stock back to us pursuant to the share redemption program, the stockholder may not receive the same price it paid for any shares of our common stock being redeemed.

18

The Independent Directors Committee establishes the Determined Share Value on a quarterly basis. The Determined Share Value is not directly derived from any independent valuation, nor from the value of the existing property portfolio. Investors should use caution in using the Determined Share Value as the current value of shares of our common stock.

On a quarterly basis, the Independent Directors Committee establishes a Determined Share Value per share of our common stock, based on the net asset value of the portfolio, input from management and third-party consultants, and such other factors as the Independent Directors Committee may, in its sole discretion, determine, which we refer to as the Determined Share Value. See the caption Determined Share Value in Item 5. “Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities” within this Form 10-K for a complete discussion of the policies, procedures, and parties involved in calculating and reviewing the net asset value of the portfolio and setting the Determined Share Value. Shares of our common stock are offered in our ongoing private offering at a price per share equal to the current Determined Share Value and cash distributions can be reinvested in additional shares of our common stock pursuant to our distribution reinvestment plan at a price per share equal to 98% of the current Determined Share Value. In addition, shares of our common stock are redeemed by us pursuant to the terms of our share redemption program at a per share price equal to or at a discount to the current Determined Share Value. The Independent Directors Committee may, and currently does, engage consultants, appraisers, and other real estate or investment professionals to assist in their establishment of the Determined Share Value, but the Independent Directors Committee is not required to do so. As a result, the price of the shares of our common stock may not necessarily bear a direct relationship to our book or asset values or to any other established criteria for valuing issued or outstanding common stock and the actual value of an investor’s investment in shares of our common stock could be substantially less than what the stockholder may have paid to purchase the shares.

As with any valuation method, the methods used to determine the Determined Share Value are based upon a number of assumptions, estimates and judgments that may not be accurate or complete. Our assets are valued based upon appraisal standards and the values of our assets using these methods are not required to be a reflection of market value and will not necessarily result in a reflection of fair value under GAAP. Further, different parties using different property-specific and general real estate and capital market assumptions, estimates, judgments, and standards could derive different Determined Share Values, which could be significantly different from the Determined Share Values determined by the Independent Directors Committee. The Determined Share Value established as of any given time is not a direct representation or indication that, among other things, (i) a stockholder would be able to realize the full Determined Share Value if he or she attempts to sell their shares, (ii) a stockholder would ultimately realize distributions per share equal to the Determined Share Value upon liquidation of our assets and settlement of our liabilities or upon a sale of our company, (iii) shares of our common stock would trade at the Determined Share Value on a national securities exchange, (iv) a third party would offer the Determined Share Value in an arms-length transaction to purchase all or substantially all of our shares of common stock, or (v) the methodologies used to estimate the Determined Share Value would be acceptable to the requirements of any regulatory agency.

In order to qualify as a REIT, we retain the right to prohibit certain acquisitions and transfers of shares of our common stock, which limits our investors’ ability to purchase or sell shares.

We cannot maintain our qualification as a REIT if, among other requirements: (i) more than 50% of the value of our outstanding common stock is owned, directly or indirectly, by five or fewer stockholders during the last half of each taxable year, or (ii) fewer than 100 persons own our outstanding common stock during at least 335 days of a 12-month taxable year. In order to assist us in meeting certain REIT qualification requirements, our Articles of Incorporation restrict the direct or indirect ownership by one person or entity to no more than 9.8% of the value of our then outstanding shares of capital stock (which includes common stock and any preferred stock we may issue) and no more than 9.8% of the value or number of shares, whichever is more restrictive, of our then outstanding common stock unless exempted by our board of directors. We may, therefore, prohibit certain acquisitions and transfers of shares in an attempt to ensure our continued qualification as a REIT. These prohibitions may prevent our existing stockholders from acquiring additional shares, redeeming their shares, or selling their shares to others who may be deemed to, directly or indirectly, beneficially own our common stock.

19

Our success is dependent on the performance of our Manager and Asset Manager and any adverse change in their financial health could cause our operations to suffer.

Our ability to achieve our investment objectives and to pay distributions is dependent upon the performance of our Manager and Asset Manager and any adverse change in their financial health could cause our operations to suffer. Our Manager and Asset Manager are sensitive to trends in the general economy, as well as the commercial real estate and related markets. An economic downturn could result in reductions in overall transaction volume and size of sales and leasing activities, and would put downward pressure on our Manager’s and Asset Manager’s revenues and operating results. To the extent that any decline in revenues and operating results impacts the performance of our Manager or Asset Manager, our operating results could suffer.

Loss of key personnel of the Manager could delay or hinder our investment strategy, which could limit our ability to make distributions and decrease the value of an investment in us.

We are dependent upon the contributions of key personnel of the Manager. Our overall success and the achievement of our investment objectives depends upon the performance of our senior leadership team, each of whom is an employee of the Manager. We rely on our senior leadership team to, among other things, identify and consummate acquisitions, design and implement our financing strategies, manage our investments, and conduct our day-to-day operations. Members of our senior leadership team could choose to leave employment with the Manager for any number of reasons. We rely on the experience, efforts, and abilities of these individuals, each of whom would be difficult to replace. The loss of services of one or more members of our senior leadership team, or the Manager’s inability to attract and retain highly qualified personnel, could adversely affect our business, diminish our investment opportunities, and weaken our relationships with lenders, business partners, existing and prospective tenants, and industry participants, all of which could materially and adversely affect us.

In particular, Amy L. Tait and Christopher J. Czarnecki, our Executive Chairman of the board of directors and Chief Investment Officer and our Chief Executive Officer, respectively, and employees of the Manager, have significant real estate experience which would be difficult to replace. Each of Ms. Tait and Mr. Czarnecki has an employment agreement with the Manager which includes non-competition and non-solicitation covenants; however, these agreements could be amended by the Manager from time to time. Although the Manager has “key employee” life and disability insurance on each of Ms. Tait and Mr. Czarnecki, the proceeds of that insurance will be used as determined by the board of managers of the Manager, which consists of two appointees of the Manager’s management and two appointees of Trident BRE, and may be diverted to uses other than replacing the deceased or incapacitated executive. We may suffer direct, reputational, and other costs in the event of the loss of the services of either Ms. Tait or Mr. Czarnecki.