Table of Contents

As filed with the Securities and Exchange Commission on September 8, 2020

Registration Statement No. 333-240381

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

AMENDMENT NO. 1

TO

FORM S-11

FOR REGISTRATION UNDER THE SECURITIES ACT OF 1933

OF SECURITIES OF CERTAIN REAL ESTATE COMPANIES

Broadstone Net Lease, Inc.

(Exact name of registrant as specified in its governing instruments)

800 Clinton Square

Rochester, New York 14604

(585) 287-6500

(Address, including Zip Code and Telephone Number, Including Area Code, of Registrant’s Principal Executive Offices)

Christopher J. Czarnecki

Chief Executive Officer and President

800 Clinton Square

Rochester, New York 14604

(585) 287-6500

(Name, Address, including Zip Code and Telephone Number, Including Area Code, of Agent for Service)

Copies to:

| Stuart A. Barr Fried, Frank, Harris, Shriver & Jacobson LLP 801 17th Street, NW Washington, DC 20006 (202) 639-7000 |

Kathleen L. Werner Jason D. Myers Clifford Chance US LLP 31 West 52nd Street New York, New York 10019 (212) 878-8000 |

Approximate date of commencement of proposed sale to the public:

As soon as practicable after this Registration Statement becomes effective.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box: ☐

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If delivery of the prospectus is expected to be made pursuant to Rule 434, check the following box. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ☐ | Accelerated filer | ☐ | |||

| Non-accelerated filer | ☒ | Smaller reporting company | ☐ | |||

| Emerging growth company | ☒ | |||||

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act ☒

CALCULATION OF REGISTRATION FEE

|

| ||||

| Title of Securities to be Registered | Proposed Maximum |

Amount of Registration Fee (3) | ||

| Class A Common Stock, $0.00025 par value per share |

$731,975,000 | $95,011 | ||

| Common Stock, $0.00025 par value per share (4) |

$— | $— | ||

|

| ||||

|

| ||||

| (1) | Estimated solely for the purpose of determining the registration fee in accordance with Rule 457(o) of the Securities Act of 1933, as amended. |

| (2) | Includes the offering price of Class A Common Stock that may be purchased by the underwriters upon the exercise of their option to purchase additional shares. |

| (3) | Calculated in accordance with Rule 457(o) under the Securities Act of 1933, as amended. Includes $12,980 previously paid. |

| (4) | In accordance with Rule 457(i) under the Securities Act, this registration statement also registers shares of Common Stock that are issuable upon automatic conversion of Class A Common Stock registered hereby 180 days after the completion of the offering. Under Rule 457(i), no additional filing fee is payable with respect to the shares of Common Stock issuable upon conversion of the Class A Common Stock because no additional consideration will be received in connection with the automatic conversion. The par value of the Common Stock is presented on a post-split basis. |

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment that specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, as amended, or until this registration statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

Table of Contents

The information in this preliminary prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

Subject to Completion, dated September 8, 2020

33,500,000 Shares

Class A Common Stock

Broadstone Net Lease, Inc.

Broadstone Net Lease, Inc., a Maryland corporation, is an internally-managed real estate investment trust (“REIT”) that acquires, owns, and manages primarily single-tenant, commercial real estate properties that are net leased on a long-term basis to a diversified group of tenants.

We are offering 33,500,000 shares of our Class A Common Stock, $0.00025 par value per share (the “Class A Common Stock”). All of the shares of Class A Common Stock offered by this prospectus are being sold by us. This is our initial public offering, and no public market currently exists for our Class A Common Stock. We expect the initial public offering price of our Class A Common Stock to be between $17.00 and $19.00 per share.

Our Class A Common Stock has been approved for listing, subject to notice of issuance, on the New York Stock Exchange under the symbol “BNL.”

We elected to qualify to be taxed as a REIT under the Internal Revenue Code of 1986, as amended (the “Code”), beginning with our taxable year ended December 31, 2008, and we believe we have been organized and operated in a manner that allowed us to qualify to be taxed as a REIT commencing with such year. We intend to continue to operate as a REIT in the future. Shares of our capital stock (including our Class A Common Stock) are subject to limitations on ownership and transfer that are primarily intended to assist us in maintaining our qualification as a REIT. Subject to certain exceptions, our Charter restricts the direct or indirect ownership by one person or entity to no more than 9.8% of the value of our then outstanding shares of capital stock and no more than 9.8% of the value or number of shares, whichever is more restrictive, of our then outstanding Common Stock (including our Class A Common Stock). See “Description of Stock—Restrictions on Ownership and Transfer” for a detailed description of the ownership and transfer restrictions applicable to our Common Stock (including our Class A Common Stock).

We are an “emerging growth company” under the U.S. federal securities laws and, as such, have elected to comply with certain reduced disclosure requirements in this prospectus and in future filings that we make with the Securities and Exchange Commission (the “SEC”). See “Prospectus Summary—Emerging Growth Company Status.”

Investing in our Class A Common Stock involves risks. See “Risk Factors” beginning on page 33 for factors you should consider before investing in our Class A Common Stock.

Neither the SEC nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

| Per Share | Total | |||||||

| Initial public offering price |

$ | $ | ||||||

| Underwriting discounts (1) |

$ | $ | ||||||

| Proceeds, before expenses, to us |

$ | $ | ||||||

| (1) | We refer you to “Underwriting” beginning on page 241 of this prospectus for additional information regarding underwriting compensation. |

To the extent that the underwriters sell more than 33,500,000 shares of our Class A Common Stock, the underwriters have the option, exercisable within 30 days from the date of this prospectus, to purchase up to an additional 5,025,000 shares from us at the initial public offering price less the underwriting discounts and commissions. The underwriters expect to deliver the shares of Class A Common Stock to purchasers on or about , 2020.

Joint Book-Running Managers

| J.P. Morgan | Goldman Sachs & Co. LLC | BMO Capital Markets | Morgan Stanley | |||

| Capital One Securities | Truist Securities | |||||

Co-Managers

| Regions Securities LLC | BTIG | KeyBanc Capital Markets | Ramirez & Co., Inc. |

Prospectus dated , 2020.

Table of Contents

$288mm Annualized Base Rent 44% Industrial 15% Restaurants 9% Retail 20% Healthcare 10% Office 2% Other 99.6% Leased1 34.4% Master Leases 11.0 Years WALT 2.1% Annual Escalation 93.9% Rent Collections in Q2 95.0% Financial Reporting2 633 Properties 41 States 1 Canadian Province >$600M Annual Acquisitions 2017 - 2019 182 / 168 / 54 Tenants / Brands / Industries 2.5% Top Tenant 18.8% Top Ten Tenants $900mm Revolver3 Baa3 Moody's Rating Source: Company filings and management provided info as of 6/30/20 1 Based on square footage 2 Includes 6.6% of tenants who are public filers 3 Pro forma for IPO and pending revolver refinancing

Table of Contents

| Page | ||||

| 1 | ||||

| 33 | ||||

| 70 | ||||

| 71 | ||||

| 72 | ||||

| 76 | ||||

| SELECTED CONSOLIDATED HISTORICAL AND PRO FORMA FINANCIAL AND OTHER DATA |

78 | |||

| MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS |

81 | |||

| 112 | ||||

| 123 | ||||

| 157 | ||||

| 166 | ||||

| 179 | ||||

| RECAPITALIZATION, INTERNALIZATION, AND STRUCTURE OF OUR COMPANY |

183 | |||

| 187 | ||||

| 189 | ||||

| 193 | ||||

| 200 | ||||

| 202 | ||||

| CERTAIN PROVISIONS OF MARYLAND LAW AND OF OUR CHARTER AND SECOND AMENDED AND RESTATED BYLAWS |

207 | |||

| 214 | ||||

| 216 | ||||

| 238 | ||||

| 240 | ||||

| 249 | ||||

| 249 | ||||

| 249 | ||||

We have not, and the underwriters have not, authorized anyone to provide you with information other than what is contained in this prospectus or in any free writing prospectus prepared by us. We are not, and the underwriters are not, making an offer to sell these securities in any jurisdiction where the offer or sale is not permitted. You should assume that the information appearing in this prospectus and any free writing prospectus prepared by us is accurate only as of their respective dates or on the date or dates which are specified in these documents. Our business, financial condition, liquidity, results of operations, and prospects may have changed since those dates.

We use market data and industry forecasts and projections throughout this prospectus and, in particular, in the sections entitled “Prospectus Summary,” “Market Opportunity,” and “Business and Properties.” We have obtained substantially all of this information from a market study prepared for us in connection with this offering by Rosen Consulting Group (“RCG”), a nationally recognized real estate consulting firm. Such information is included in this prospectus in reliance on RCG’s authority as an expert on such matters. Any forecasts prepared by RCG are based on data (including third party data), models, and experience of various professionals and are based on various assumptions, all of which are subject to change without notice. See “Experts.” In addition, we have obtained certain market and industry data from publicly available industry publications. These sources

i

Table of Contents

generally state that the information they provide has been obtained from sources believed to be reliable but that the accuracy and completeness of the information are not guaranteed. The forecasts and projections are based on industry surveys and the preparers’ experience in the industry, and there is no assurance that any of the projected amounts will be achieved. We have not independently verified this information.

Immediately prior to the closing of this offering, we will effect a recapitalization of our common stock, $0.001 par value per share (“Common Stock”), pursuant to which (i) we will establish a new class of Common Stock as “Class A Common Stock” for sale in this offering and (ii) we will effect a four-for-one stock split of our Common Stock that is outstanding immediately prior to the closing of this offering (the “REIT Recapitalization”); provided, however, that we shall issue no fractional shares of Common Stock as a result of the stock split, but shall instead pay to any stockholder who would be entitled to receive a fractional share as a result of the REIT Recapitalization a sum in cash equal to the fair market value of such fractional share as determined in good faith by our Board of Directors. The REIT Recapitalization shall be effected on a record holder-by-record holder basis, such that any fractional shares of Common Stock resulting from the REIT Recapitalization and held by a single record holder shall be aggregated.

The Class A Common Stock sold in this offering will be listed on the NYSE as of the closing of this offering and will be freely tradeable. Each share of our Class A Common Stock will automatically convert into one share of our Common Stock 180 days after the completion of this offering (the “Class A Conversion”). Immediately following the Class A Conversion, all outstanding shares of our Common Stock, including those shares of Common Stock issued upon conversion of the Class A Common Stock, will be listed on the NYSE and will be freely tradeable. In connection with the REIT Recapitalization, Broadstone Net Lease, LLC, a New York limited liability company and our operating company (the “OP”), will effect a recapitalization of its membership units (“OP Units”), pursuant to which it will effect a four-for-one split of its outstanding OP Units (collectively, with the REIT Recapitalization, the “Recapitalization”). Unless the context requires otherwise, all information set forth herein assumes the completion of the Recapitalization. For further information on the Recapitalization, refer to the section entitled “Recapitalization, Internalization, and Structure of our Company—Recapitalization.”

Unless otherwise indicated, the information contained in this prospectus assumes (1) that the underwriters’ option to purchase additional shares is not exercised and (2) that the Class A Common Stock to be sold in this offering is sold at $18.00 per share, which is the mid-point of the price range set forth on the front cover of this prospectus.

Certain Terms Used in This Prospectus

Unless the context otherwise requires, the following terms and phrases are used throughout this prospectus as described below:

| • | “2020 Equity Incentive Plan” means our 2020 Omnibus Equity and Incentive Plan, which was approved and adopted by our board of directors on August 4, 2020; |

| • | “2020 Unsecured Term Loan” means our $300 million unsecured term loan by and among the Company, the OP, JPMorgan Chase Bank, N.A., and the other lenders party thereto, dated August 2, 2019; |

| • | “annualized base rent” or “ABR” means the annualized contractual cash rent due for the last month of the reporting period, excluding the impacts of the short-term rent deferrals and abatements agreed to as a result of tenant requests for rent relief related to the global coronavirus (“COVID-19”) pandemic described under “Summary—COVID-19 Pandemic and Rent Collections”) and adjusted to remove rent from properties sold during the month and to include a full month of contractual cash rent for properties acquired during the last month; |

| • | “BRE” means Broadstone Real Estate, LLC; |

| • | “Cash Cap Rate” represents the estimated first year cash yield to be generated on a real estate investment property, which was estimated at the time of investment based on the contractually |

ii

Table of Contents

| specified cash base rent for the first full year after the date of the investment, divided by the purchase price for the property; |

| • | “CPI” means the Consumer Price Index for All Urban Consumers (CPI-U): U.S. City Average, All Items, as published by the U.S. Bureau of Labor Statistics, or other similar index which is a measure of the average change over time in the prices paid by urban consumers for a market basket of consumer goods and services; |

| • | “Exchange Act” means the Securities and Exchange Act of 1934, as amended; |

| • | “Founding Owners” means Amy Tait and certain affiliated members of her family; |

| • | “GAAP” means accounting principles generally accepted in the United States of America; |

| • | “gross asset value” means the undepreciated book value of an asset, which represents the fair value of the asset as of the date it was acquired, less any subsequent writedowns due to impairment charges; |

| • | “Industrial Portfolio Acquisition” refers to our acquisition of a portfolio of 23 industrial and office/flex assets on August 29, 2019; |

| • | “Internalization” means the internalization of the external management team and functions previously performed for the Company by BRE, which closed on February 7, 2020; |

| • | “JOBS Act” means the Jumpstart Our Business Startups Act; |

| • | “MGCL” means the Maryland General Corporation Law; |

| • | “NYSE” means the New York Stock Exchange; |

| • | “occupancy” or a specified percentage of our portfolio that is “occupied” means the quotient of (1) the total square footage of our properties minus the square footage of our properties that are vacant and from which we are not receiving any rental payment, and (2) the total square footage of our properties as of a specified date; |

| • | “Registration Rights Agreement” means that certain Registration Rights Agreement, dated February 7, 2020, among the Company, the Trident Owners, and the Founding Owners; |

| • | “rent coverage ratio” means the ratio of tenant-reported or, when unavailable, management’s estimate, based on tenant-reported financial information, of annual earnings before interest, taxes, depreciation, amortization, and cash rent attributable to the leased property (or properties, in the case of a master lease) to the annualized base rental obligation as of a specified date; |

| • | “Revolving Credit Facility” means our $600 million unsecured revolving credit facility, dated June 23, 2017, by and among the Company, the OP, Manufacturers and Traders Trust Company, and the other lenders party thereto, as amended from time to time, which, concurrently with the completion of this offering, will be terminated and, thereafter, “Revolving Credit Facility” means the new $900 million unsecured revolving credit facility by and among the Company, the OP, J.P. Morgan Chase Bank, N.A., and the other lenders party thereto that we will enter into concurrently with the completion of this offering; |

| • | “Sarbanes-Oxley” means the Sarbanes-Oxley Act of 2002, as amended; |

| • | “Securities Act” means the Securities Act of 1933, as amended; |

| • | “Trident Owners” means Trident BRE LLC and its affiliates, each of which is an affiliate of Stone Point Capital LLC; and |

| • | “we,” “our,” “us,” “BNL,” and “Company” mean Broadstone Net Lease, Inc., a Maryland corporation, together with its consolidated subsidiaries, including the OP. |

iii

Table of Contents

The following summary highlights information contained elsewhere in this prospectus. This summary is not complete and does not contain all of the information that you should consider before investing in our Class A Common Stock. You should read the entire prospectus carefully, including the section entitled “Risk Factors,” as well as the financial statements and related notes included elsewhere in this prospectus, before making an investment decision.

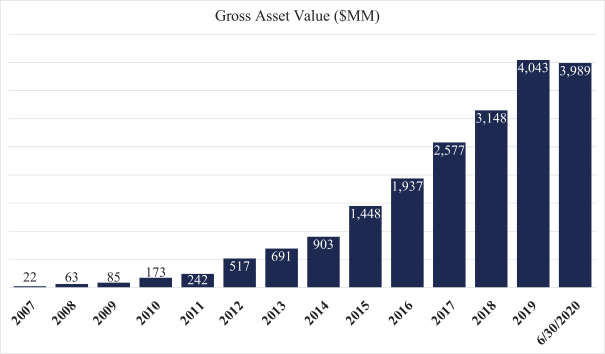

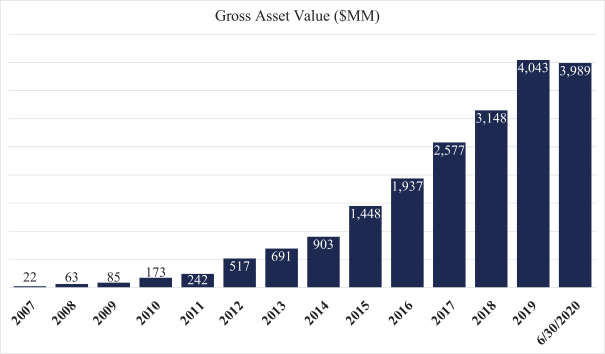

Our Company

We are an internally-managed REIT that acquires, owns, and manages primarily single-tenant commercial real estate properties that are net leased on a long-term basis to a diversified group of tenants. We utilize an investment strategy underpinned by strong fundamental credit analysis and prudent real estate underwriting. Since our inception in 2007, we have selectively invested in net leased real estate across the industrial, healthcare, restaurant, office, and retail property types, and as of June 30, 2020, our portfolio has grown to 632 properties in 41 U.S. states and one property in Canada, with an aggregate gross asset value of approximately $4.0 billion.

We focus on investing in real estate that is operated by creditworthy single tenants in industries characterized by positive business drivers and trends, where the properties are an integral part of the tenants’ businesses and there are opportunities to secure long-term net leases. Through long-term net leases, our tenants are able to retain operational control of their strategically important locations, while allocating their debt and equity capital to fund their core business operations rather than real estate ownership.

| • | Diversified Portfolio. As of June 30, 2020, our portfolio comprised approximately 27.4 million rentable square feet of operational space, and was highly diversified based on property type, geography, tenant, and industry: |

| • | Property Type: We are focused primarily on industrial, healthcare, restaurant, office, and retail property types based on our extensive experience in and conviction around these sectors. Within these sectors, we have meaningful concentrations in manufacturing, distribution and warehouse, clinical, casual dining, quick service restaurant, strategic operations, corporate headquarters, food processing, flex/research and development, and cold storage. |

| • | Geographic Diversity: Our properties are located in 41 U.S. states and British Columbia, Canada, with no single geographic concentration exceeding 10.4% of our ABR. |

| • | Tenant and Industry Diversity: Our properties are occupied by approximately 182 different commercial tenants who operate 168 different brands that are diversified across 54 differing industries, with no single tenant accounting for more than 2.5% of our ABR. |

| • | Strong In-Place Leases with Significant Remaining Lease Term. As of June 30, 2020, our portfolio was 99.6% leased based on rentable square footage with an ABR weighted average remaining lease term of approximately 11.0 years, excluding renewal options. |

| • | Standard Contractual Base Rent Escalation. Approximately 98.2% of our leases have contractual rent escalations, with an ABR weighted average minimum increase of 2.1%. |

| • | Extensive Tenant Financial Reporting. Approximately 88.4% of our ABR is received from tenants that are required to provide us with specified financial information on a periodic basis. An additional 6.6% of our ABR is received from tenants that are public companies, which are required to file financial statements with the SEC, although they are not required to provide us with specified financial information under the terms of our lease. |

1

Table of Contents

From our inception in 2007 through 2015, our portfolio grew to over 300 properties with a gross asset value of $1.4 billion. Growth further accelerated under the leadership of Christopher J. Czarnecki, our Chief Executive Officer since 2017, who joined us in 2009 and was instrumental in building our senior leadership team, developing our strategy, and increasing our level of acquisition activity. Our team has acquired more than $500 million of net leased real estate each year from 2015 to 2019, including acquisition activity of approximately $1.0 billion during 2019, and has grown our portfolio to 633 properties with a gross asset value of approximately $4.0 billion as of June 30, 2020. In order to benefit from increasing economies of scale as we continue to grow, and as a part of our evolution toward entering the public markets, our board of directors made the decision to internalize the external management team and functions previously performed by BRE and its affiliates through a series of mergers that became effective on February 7, 2020. Upon closing of the Internalization, each member of our senior management team became a full-time employee of BNL.

Our Competitive Strengths

We believe we possess the following competitive strengths that enable us to implement our business and growth strategies and distinguish our Company from other market participants, allowing us to compete effectively in the single-tenant, net lease market:

| • | Diversified Portfolio of High-Quality Properties that are Key to Tenant Operations. Our portfolio is diversified by property type, geography, tenant, and industry, and is cross-diversified within each (e.g., property-type diversification within a geographic concentration). Our portfolio is primarily focused in industrial, healthcare, restaurant, office, and retail property types, with approximately 182 tenants operating 168 different brands across 54 different industries. Our top ten tenants represented only 18.8% of our portfolio ABR as of June 30, 2020, with no single tenant representing more than 2.5%. We focus on maintaining a diversified portfolio of properties that are strategically located or important to the tenant’s business. We believe that our highly diversified portfolio provides us with acquisition flexibility, positioning us for significant growth, and helps mitigate the risks inherent in a |

2

Table of Contents

| concentration in only one or a few property types, geographies, tenants, or industries, including risks presented by tenant bankruptcies, adverse industry trends, and economic downturns in a particular geographic area and the ongoing COVID-19 pandemic. |

| • | Scalable Net Lease Platform Well Positioned for Significant Growth. With 73 employees who have extensive net lease expertise and significant experience managing our portfolio, our platform is highly scalable. We have developed leading institutional capabilities across origination, transaction negotiation and documentation, underwriting, financing, and property and asset management. In tandem with our highly diversified portfolio, we have structured our acquisition, property management, and credit underwriting personnel in teams of experienced, dedicated industry specialists focused on each of our core property types. Given our team and organizational structure, we expect that as our portfolio grows, we will experience limited increases in general and administrative expenses, as those expenses are expected to grow at a significantly slower rate than the overall portfolio and corresponding lease revenues. |

| • | Meaningful Value Creation and Risk Mitigation through Active Asset Management. Our asset and property management teams focus on creating value post-acquisition through active tenant engagement and risk monitoring and mitigation. As experienced through our requests for rent relief from tenants related to COVID-19, we leveraged our strong tenant relationships to find mutually agreeable terms that seek to protect and in certain circumstances improve our position by negotiating enhanced tenant financial reporting, lease extensions, or the early exercise of tenant renewal options. Approximately 88.4% of our ABR is received from tenants that are required to periodically provide us with certain financial information and an additional 6.6% of our ABR is received from tenants that are public companies, which are required to file financial statements with the SEC. We believe this enhances our ability to actively monitor our investments, negotiate lease renewals, and proactively manage our portfolio to protect stockholder value. |

| • | Strong Balance Sheet with Investment Grade Credit Rating. Upon completion of this offering, we expect to have pro forma total debt outstanding of $1,549.9 million, approximately $900.0 million of borrowing capacity under our Revolving Credit Facility, approximately $82.8 million of cash and cash equivalents, and a pro forma net debt to annualized adjusted EBITDAre ratio of approximately 5.23x. Our disciplined ownership and operation of our business is reflected in our investment grade credit rating from Moody’s Investors Service (“Moody’s”) of Baa3 with a stable outlook. We believe we are well positioned to grow our portfolio successfully while maintaining an attractive leverage profile. |

| • | Experienced and Innovative Senior Leadership Team with Proven Net Lease Track Record. Our senior management team has significant net lease real estate, public company, finance, and capital markets experience. Our Chief Executive Officer, Christopher J. Czarnecki, has over 13 years of experience in the real estate industry and joined us in 2009. Our senior management team also has a strong track record working together and collectively managing our business, operations, and portfolio, having acquired $3.4 billion of net leased real estate from 2015 to 2019. Our senior management team also has an extensive network of relationships in the net lease real estate business, as well as in the investment banking, real estate broker, financial advisory, and lending communities, which will continue to underpin the expansion of our platform. Our Chief Financial Officer, Ryan M. Albano, who joined us in 2013, has extensive experience in finance and real estate and has significantly contributed to our debt capital markets strategy, particularly since becoming our Chief Financial Officer in 2017, having executed more than $2 billion of debt transactions in that time. Our Chief Investment Officer, Sean T. Cutt, who joined us in 2012, has extensive experience in real estate and has led the sourcing, underwriting, and execution of our acquisitions and dispositions strategies since 2016. Our Chief Operating Officer, John D. Moragne, who joined us in 2016, has extensive experience in real estate and corporate operations, and was instrumental in leading our transition to a public reporting company in 2017. |

3

Table of Contents

Our Business and Growth Strategies

Our primary business objectives are to maximize cash flows, the value of our portfolio, and total returns to our stockholders through pursuit of the following business and growth strategies:

| • | Internal Growth through Long-Term Net Leases with Strong Contractual Rent Escalations. We seek to enter into long-term net leases that include strong rent escalations over the lease term. As of June 30, 2020, substantially all of our portfolio (based on ABR) was subject to net leases, our leases had an ABR weighted average remaining lease term of approximately 11.0 years, excluding renewal options, and approximately 98.2% of our leases had contractual rent escalations, with an ABR weighted average minimum increase of 2.1%. |

| • | Disciplined and Targeted Acquisition Growth while Maintaining Our Diversified Portfolio. We plan to continue our disciplined and targeted acquisition strategy to identify properties that are both individually compelling and contribute to our portfolio’s overall diversification based on property type, geography, tenant, and industry. We also are highly focused on growing our business where we can capture the best opportunities across different property types while maintaining the overall diversity of our portfolio. We believe our reputation, in-depth market knowledge, and extensive network of established relationships in the net lease industry will continue to provide us access to potential attractive investment opportunities. |

| • | Selectively Identify Attractive Adjacent Opportunities to Our Core Property Types. We have and will continue to seek attractive adjacent opportunities to our core property types in the net lease space, which have historically provided us the opportunity to earn higher relative returns. For example, in 2015, we began acquiring and structuring long-term net leases for laboratory facilities, veterinary clinics, and cold storage facilities prior to what we believe was the more general market acceptance of these asset types in the healthcare and industrial sectors. We intend to continue opportunistically employing this strategy where we believe we can generate appropriate risk-adjusted returns for our stockholders on a long-term basis. |

| • | Actively Manage Our Balance Sheet to Maximize Capital Efficiency. We seek to maintain a prudent balance between debt and equity financing and to maintain funding sources that lock in long-term investment spreads, limit interest rate sensitivity, and align with our lease terms. As of June 30, 2020, on a pro forma basis, we had $1,549.9 million of total debt outstanding, net debt of $1,466.5 million, a ratio of net debt to annualized adjusted EBITDAre of 5.23x, $900 million of borrowing capacity under our Revolving Credit Facility, and $82.8 million of cash and cash equivalents. In the future, we will seek to maintain on a sustained basis a level of net debt that is generally less than six times our annualized adjusted EBITDAre. |

| • | Proactively Manage Our Portfolio. We believe our proactive approach to asset management and property management helps enhance the performance of our portfolio through risk mitigation strategies and opportunistic sales. We believe that our proactive approach to asset management helps to identify and address issues, such as tenant credit deterioration, changes in real estate fundamentals, general market disruption such as from the COVID-19 pandemic, or otherwise, including determining to sell any of our properties where we believe the risk profile has changed and become misaligned with our then current risk-adjusted return objectives. From 2015 through June 30, 2020, we sold 110 properties for an aggregate sales price of approximately $407.1 million, resulting in a 21.0% gain over book value and a 15.0% gain over original purchase price. |

4

Table of Contents

Our Real Estate Investment Portfolio

To achieve an appropriate risk-adjusted return, we intend to maintain a highly diversified portfolio of primarily single-tenant commercial real estate properties spread across multiple property types, geographic locations, tenants, and industries and that have cross-diversification within each. The following discussion summarizes our portfolio diversification by property type, tenant, industry, and geographic location as of June 30, 2020. The percentages below are calculated based on our ABR as of June 30, 2020.

As of June 30, 2020, our top ten tenants (based on ABR) represented only 18.8% of our total ABR and included Red Lobster, Jack’s Family Restaurants, Axcelis, Hensley, Outback Steakhouse, Krispy Kreme, BluePearl, Big Tex Trailer Manufacturing, Siemens, and Nestle. For additional information regarding these tenants, including the number of properties each tenant leases from us, please see “Business and Properties—Our Real Estate Portfolio—Top 20 Tenants.”

Diversification by Property Type. We are focused primarily on industrial, healthcare, restaurant, office, and retail property types based on our extensive experience in and conviction around these sectors. Within these sectors, we have meaningful concentrations in manufacturing, distribution and warehouse, clinical, casual dining, quick service restaurant, strategic operations, corporate headquarters, food processing, flex/research and development, and cold storage.

5

Table of Contents

Diversification by Property Type

(based on ABR)

6

Table of Contents

| Property Type |

# Properties |

ABR ($000s) |

ABR as a % of Total Portfolio |

Square Feet (000s) |

SF as a % of Total Portfolio |

|||||||||||||||

| Industrial |

||||||||||||||||||||

| Manufacturing |

56 | $ | 40,360 | 14.0 | % | 7,686 | 28.0 | % | ||||||||||||

| Distribution & Warehouse |

32 | 39,589 | 13.8 | % | 7,013 | 25.6 | % | |||||||||||||

| Food Processing |

14 | 18,194 | 6.3 | % | 2,131 | 7.8 | % | |||||||||||||

| Flex and R&D |

7 | 16,432 | 5.7 | % | 1,457 | 5.3 | % | |||||||||||||

| Cold Storage |

4 | 12,258 | 4.3 | % | 933 | 3.4 | % | |||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Industrial Total |

113 | 126,833 | 44.1 | % | 19,220 | 70.1 | % | |||||||||||||

| Healthcare |

||||||||||||||||||||

| Clinical |

50 | 25,371 | 8.8 | % | 1,081 | 3.9 | % | |||||||||||||

| Surgical |

16 | 9,690 | 3.4 | % | 369 | 1.3 | % | |||||||||||||

| Animal Health Services |

20 | 8,072 | 2.8 | % | 314 | 1.2 | % | |||||||||||||

| Life Science |

9 | 7,394 | 2.6 | % | 549 | 2.0 | % | |||||||||||||

| Healthcare Services |

26 | 6,761 | 2.3 | % | 262 | 1.0 | % | |||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Healthcare Total |

121 | 57,288 | 19.9 | % | 2,575 | 9.4 | % | |||||||||||||

| Restaurant |

||||||||||||||||||||

| Quick Service Restaurants |

152 | 24,845 | 8.6 | % | 511 | 1.9 | % | |||||||||||||

| Casual Dining |

91 | 19,956 | 6.9 | % | 579 | 2.1 | % | |||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Restaurant Total |

243 | 44,801 | 15.5 | % | 1,090 | 4.0 | % | |||||||||||||

| Office |

||||||||||||||||||||

| Strategic Operations |

7 | 13,554 | 4.7 | % | 1,021 | 3.7 | % | |||||||||||||

| Corporate Headquarters |

6 | 9,583 | 3.3 | % | 671 | 2.5 | % | |||||||||||||

| Call Center |

4 | 5,564 | 2.0 | % | 392 | 1.4 | % | |||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Office Total |

17 | 28,701 | 10.0 | % | 2,084 | 7.6 | % | |||||||||||||

| Retail |

||||||||||||||||||||

| Automotive |

56 | 9,697 | 3.4 | % | 784 | 2.9 | % | |||||||||||||

| General Merchandise |

57 | 8,425 | 2.9 | % | 677 | 2.5 | % | |||||||||||||

| Home Furnishings |

15 | 7,175 | 2.5 | % | 860 | 3.1 | % | |||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Retail Total |

128 | 25,297 | 8.8 | % | 2,321 | 8.5 | % | |||||||||||||

| Other |

11 | 4,963 | 1.7 | % | 117 | 0.4 | % | |||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total |

633 | $ | 287,883 | 100.0 | % | 27,407 | 100.0 | % | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

Diversification by Tenant. Our properties are occupied by approximately 182 different commercial tenants, with no single tenant accounting for more than 2.5% of our ABR.

Diversification by Industry and Brand. Our properties were occupied by commercial tenants who operate 168 different brands that are diversified across 54 differing industries. Tenants operating in the industrial, healthcare, and restaurant industries provided 44.1%, 19.9%, and 15.5%, respectively, of our ABR.

Diversification by Geography. We have a diversified portfolio of 632 properties located in 41 states, including Texas, which represented 10.4% of our ABR, and one property located in British Columbia, Canada.

Lease Maturity. As of June 30, 2020, approximately 99.6% of our portfolio’s rentable square footage, representing all but seven of our properties, was subject to a lease. As of June 30, 2020, the ABR weighted average remaining term of our leases was approximately 11.0 years, excluding renewal options. Approximately 58.8% of our rental revenue was derived from leases that expire during 2030 and thereafter, and no more than

7

Table of Contents

9.1% of our rental revenue was derived from leases that expire in any single year prior to 2030. The following chart sets forth our lease expirations based upon the terms of our leases in place as of June 30, 2020.

| Expiration Year |

2020 | 2021 | 2022 | 2023 | 2024 | 2025 | 2026 | 2027 | 2028 | 2029 | 2030 | 2031 | 2032 | 2033 | 2034 | 2035 | 2036 | 2037 | 2038 | 2039 | 2040+ | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Number of properties |

1 | 9 | 4 | 8 | 11 | 19 | 34 | 30 | 33 | 60 | 88 | 16 | 36 | 37 | 30 | 49 | 28 | 27 | 32 | 12 | 62 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Number of leases |

2 | 9 | 5 | 9 | 11 | 21 | 26 | 24 | 27 | 28 | 41 | 11 | 17 | 11 | 15 | 10 | 6 | 10 | 28 | 7 | 11 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Substantially all of our leases provide for periodic contractual rent escalations. As of June 30, 2020, leases contributing 98.2% of our ABR provided for increases in future annual base rent, generally ranging from 1.5% to 2.5% annually, with an ABR weighted average annual minimum increase equal to 2.1% of base rent. Generally, our rent escalators increase rent on specified dates by a fixed percentage. Our escalations provide us with a source of organic growth and a measure of inflation protection. Additional information on lease escalation frequency and weighted average annual escalation rates as of June 30, 2020 is displayed below.

| Lease Escalation Frequency |

% of ABR | Weighted Average Annual Minimum Increase (1) |

||||||

| Annually |

80.5 | % | 1.9% | |||||

| Every 2 years |

0.1 | % | 1.8% | |||||

| Every 3 years |

3.1 | % | 2.2% | |||||

| Every 4 years |

1.3 | % | 2.4% | |||||

| Every 5 years |

7.9 | % | 2.0% | |||||

| Other escalation frequencies |

5.3 | % | 1.7% | |||||

| Flat |

1.8 | % | N/A | |||||

|

|

|

|||||||

| Total/Weighted Average (2) |

100.0 | % | 2.1% | |||||

|

|

|

|||||||

8

Table of Contents

| (1) | Represents the ABR weighted average annual minimum increase of the entire portfolio as if all escalations occurred annually. For leases where rent escalates by the greater of a stated fixed percentage or the change in CPI, we have assumed an escalation equal to the stated fixed percentage in the lease. As of June 30, 2020, leases contributing 10.5% of our ABR provide for rent increases equal to the lesser of a stated fixed percentage or the change in CPI. As any future increase in CPI is unknowable at this time, we have not included an increase in the rent pursuant to these leases in the weighted average annual minimum increase presented. |

| (2) | Weighted by ABR. |

COVID-19 Pandemic and Rent Collections

As of the date of this prospectus, we have successfully resolved all active tenant requests for rent relief and our cash collections totaled approximately 93.9%, 96.5%, and 98.2% of second quarter, July, and August base rents due, respectively. If we collect the remaining amount owed to us pursuant to the terms of a court approved settlement with the Art Van bankruptcy estate (please see below for additional information), we will have collected approximately 95.5% of base rents due for the second quarter of 2020. The following chart summarizes our second quarter 2020 rent collections to date:

| 1 | Relates to post-petition rents due from one tenant who had filed for bankruptcy. |

For the second quarter of 2020:

| • | Other than one tenant that filed for bankruptcy, all but one tenant paid their rent due for the second quarter, either in full or in accordance with the terms of the agreed-upon rent relief agreements. Uncollected base rent not subject to deferment, abatement, or bankruptcy, represents less than 0.02% of base rents due. |

| • | We granted partial rent relief requests to 15 tenants related to 93 properties whose total base contractual rents represent 9.7% of our ABR as of June 30, 2020, compared with total requests received from 59 tenants related to 295 properties whose total base contractual rents represented 33.7% of our ABR as of June 30, 2020. Of the 33.7% of our ABR that was the subject of a rent relief request, we declined 15.3%, granted 9.7%, and 8.7% was either rescinded or the tenant ceased pursuing the request. |

9

Table of Contents

| • | We collected 100% of rents due from tenants to whom we declined to provide relief or who withdrew or ceased pursuit of their deferral requests and 100% of base rents due under the terms of partial deferral and abatement agreements. |

| • | We agreed to partial rent deferrals with 14 tenants ranging in length between two and six months, with a weighted average deferral of 3.4 months and repayment periods ranging from three months to one year, with a weighted average repayment period of 5.6 months beginning in July 2020. We have received 100% of deferred rent that was required to be repaid in July and August 2020. |

| • | We agreed to a partial abatement of rent with one tenant for rents over a nine-month period with the minimum required rent payable increasing during the period. In exchange, we negotiated a three-year lease term extension and an upside percentage rent clause during the abatement period, which we expect to provide us with long-term value accretion. Additionally, as of June 30, 2020, we had received payment of the base amounts due for the second and third quarters of 2020 under the agreement. |

| • | Approximately 2.0% of our base rent outstanding for the second quarter relates to Art Van Furniture, LLC (“Art Van”), which is currently subject to Chapter 7 bankruptcy proceedings. Pursuant to the terms of a court approved settlement with the Art Van bankruptcy estate, we collected $1.175 million of the base rent outstanding from Art Van in August 2020 and have a right to collect an additional $1.175 million in September 2020. If the September payment is collected, we will have received approximately 95.5% of base rents due for the second quarter of 2020. We successfully re-tenanted six of 10 properties previously leased to Art Van under new long-term leases as of June 30, 2020 with base rents equivalent to approximately 71.5% of the base rent previously received from Art Van for those six properties. |

The following tables present information concerning our collections for rent due in the second quarter by tenant industry and property type:

| % Base Rent Collected | % Q2 Base Rent Not Collected | |||||||||||||||||||||||||||||||

| Tenant Industry |

% of June ABR |

April | May | June | Q2 | Deferred | Abated | Bankruptcy | ||||||||||||||||||||||||

| Restaurants |

15.8 | % | 97.0 | % | 84.0 | % | 83.9 | % | 88.7 | % | 4.4 | % | 6.9 | % | 0.0 | % | ||||||||||||||||

| Home Furnishing Retail |

3.3 | % | 91.2 | % | 26.9 | % | 26.9 | % | 48.3 | % | 4.8 | % | 0.0 | % | 46.9 | % | ||||||||||||||||

| Specialty Stores |

2.2 | % | 68.3 | % | 68.3 | % | 68.3 | % | 68.3 | % | 31.7 | % | 0.0 | % | 0.0 | % | ||||||||||||||||

| Industrial Machinery |

1.9 | % | 84.6 | % | 84.6 | % | 84.6 | % | 84.6 | % | 15.4 | % | 0.0 | % | 0.0 | % | ||||||||||||||||

| Home Furnishings |

1.8 | % | 72.9 | % | 72.9 | % | 72.9 | % | 72.9 | % | 27.1 | % | 0.0 | % | 0.0 | % | ||||||||||||||||

| Life Sciences Tools & Services |

1.4 | % | 81.8 | % | 81.8 | % | 81.8 | % | 81.8 | % | 18.2 | % | 0.0 | % | 0.0 | % | ||||||||||||||||

| Movies & Entertainment(1) |

1.1 | % | 100.0 | % | 50.0 | % | 50.0 | % | 66.7 | % | 33.3 | % | 0.0 | % | 0.0 | % | ||||||||||||||||

| All Other |

72.5 | % | 100.0 | % | 100.0 | % | 100.0 | % | 100.0 | % | 0.0 | % | 0.0 | % | 0.0 | % | ||||||||||||||||

|

|

|

|||||||||||||||||||||||||||||||

| Grand Total |

100.0 | % | 97.4 | % | 92.1 | % | 92.1 | % | 93.9 | % | 3.0 | % | 1.1 | % | 2.0 | % | ||||||||||||||||

|

|

|

|||||||||||||||||||||||||||||||

| (1) | Industrial tenant. |

| % Base Rent Collected | % Q2 Base Rent Not Collected | |||||||||||||||||||||||||||||||

| Property Type |

% of June ABR |

April | May | June | Q2 | Deferred | Abated | Bankruptcy | ||||||||||||||||||||||||

| Industrial |

44.1 | % | 96.2 | % | 95.0 | % | 95.0 | % | 95.4 | % | 4.6 | % | 0.0 | % | 0.0 | % | ||||||||||||||||

| Healthcare |

19.9 | % | 98.6 | % | 98.6 | % | 98.6 | % | 98.6 | % | 1.4 | % | 0.0 | % | 0.0 | % | ||||||||||||||||

| Restaurant |

15.5 | % | 97.0 | % | 83.8 | % | 83.7 | % | 88.4 | % | 4.5 | % | 7.1 | % | 0.0 | % | ||||||||||||||||

| Office |

10.0 | % | 100.0 | % | 100.0 | % | 100.0 | % | 100.0 | % | 0.0 | % | 0.0 | % | 0.0 | % | ||||||||||||||||

| Retail |

8.8 | % | 98.2 | % | 69.9 | % | 69.9 | % | 79.3 | % | 0.0 | % | 0.0 | % | 20.7 | % | ||||||||||||||||

| Other |

1.7 | % | 100.0 | % | 100.0 | % | 100.0 | % | 100.0 | % | 0.0 | % | 0.0 | % | 0.0 | % | ||||||||||||||||

|

|

|

|||||||||||||||||||||||||||||||

| Grand Total |

100.0 | % | 97.4 | % | 92.1 | % | 92.1 | % | 93.9 | % | 3.0 | % | 1.1 | % | 2.0 | % | ||||||||||||||||

|

|

|

|||||||||||||||||||||||||||||||

10

Table of Contents

The following tables present information concerning the rent relief requests we have received as of the date of this prospectus by tenant industry and property type:

| COVID-19 Rent Relief Requests | Portfolio Diversification | |||||||||||||||||||||||||||

| Tenant Industry |

# Properties |

ABR ($000s) |

% of Portfolio ABR |

% of Tenant Industry ABR |

# Properties |

ABR ($000s) |

% of Portfolio ABR |

|||||||||||||||||||||

| Restaurants |

176 | $ | 31,693 | 11.0 | % | 69.7 | % | 242 | $ | 45,465 | 15.8 | % | ||||||||||||||||

| Health Care Facilities |

26 | 7,732 | 2.7 | % | 17.1 | % | 95 | 45,320 | 15.7 | % | ||||||||||||||||||

| Food Distributors |

1 | 1,031 | 0.4 | % | 8.1 | % | 7 | 12,755 | 4.4 | % | ||||||||||||||||||

| Auto Parts & Equipment |

20 | 7,495 | 2.6 | % | 74.0 | % | 31 | 10,130 | 3.5 | % | ||||||||||||||||||

| Home Furnishing Retail |

2 | 1,318 | 0.5 | % | 13.9 | % | 19 | 9,453 | 3.3 | % | ||||||||||||||||||

| Specialized Consumer Services |

36 | 9,138 | 3.2 | % | 97.4 | % | 37 | 9,380 | 3.3 | % | ||||||||||||||||||

| Health Care Services |

1 | 1,082 | 0.4 | % | 13.2 | % | 16 | 8,177 | 2.8 | % | ||||||||||||||||||

| Air Freight & Logistics |

1 | 2,767 | 1.0 | % | 43.1 | % | 3 | 6,422 | 2.2 | % | ||||||||||||||||||

| Specialty Stores |

1 | 2,615 | 0.9 | % | 42.2 | % | 15 | 6,192 | 2.2 | % | ||||||||||||||||||

| Industrial Machinery |

6 | 2,695 | 0.9 | % | 49.2 | % | 15 | 5,474 | 1.9 | % | ||||||||||||||||||

| Home Furnishings |

2 | 5,185 | 1.8 | % | 100.0 | % | 2 | 5,185 | 1.8 | % | ||||||||||||||||||

| Life Sciences Tools & Services |

3 | 1,449 | 0.5 | % | 36.5 | % | 5 | 3,973 | 1.4 | % | ||||||||||||||||||

| Paper Packaging |

1 | 793 | 0.3 | % | 20.1 | % | 3 | 3,948 | 1.4 | % | ||||||||||||||||||

| Movies & Entertainment (1) |

1 | 3,124 | 1.1 | % | 100.0 | % | 1 | 3,125 | 1.1 | % | ||||||||||||||||||

| Personal Products |

1 | 1,311 | 0.4 | % | 45.2 | % | 2 | 2,899 | 1.0 | % | ||||||||||||||||||

| Distillers & Vintners |

1 | 2,344 | 0.8 | % | 100.0 | % | 1 | 2,344 | 0.8 | % | ||||||||||||||||||

| Electronic Manufacturing Services |

1 | 2,062 | 0.7 | % | 100.0 | % | 1 | 2,062 | 0.7 | % | ||||||||||||||||||

| Construction Machinery & Heavy Trucks |

1 | 1,972 | 0.7 | % | 100.0 | % | 1 | 1,972 | 0.7 | % | ||||||||||||||||||

| Automotive Retail |

3 | 742 | 0.3 | % | 37.8 | % | 8 | 1,964 | 0.7 | % | ||||||||||||||||||

| Food Retail |

1 | 1,860 | 0.6 | % | 100.0 | % | 1 | 1,860 | 0.6 | % | ||||||||||||||||||

| Footwear |

1 | 1,761 | 0.6 | % | 100.0 | % | 1 | 1,761 | 0.6 | % | ||||||||||||||||||

| Publishing |

3 | 1,759 | 0.6 | % | 100.0 | % | 3 | 1,759 | 0.6 | % | ||||||||||||||||||

| Data Processing & Outsourced Services |

1 | 1,580 | 0.5 | % | 100.0 | % | 1 | 1,580 | 0.5 | % | ||||||||||||||||||

| Marine |

1 | 1,571 | 0.5 | % | 100.0 | % | 1 | 1,571 | 0.5 | % | ||||||||||||||||||

| Commodity Chemicals |

3 | 783 | 0.3 | % | 56.3 | % | 4 | 1,392 | 0.5 | % | ||||||||||||||||||

| Automobile Manufacturers |

1 | 1,126 | 0.4 | % | 100.0 | % | 1 | 1,126 | 0.4 | % | ||||||||||||||||||

| Miscellaneous |

— | — | — | — | 117 | 90,594 | 31.6 | % | ||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| Total |

295 | $ | 96,988 | 33.7 | % | N/A | 633 | $ | 287,883 | 100.0 | % | |||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| (1) | Industrial tenant |

11

Table of Contents

| Portfolio Diversification | COVID-19 Related Requests | |||||||||||||||||||||||||||

| Property Type |

# Properties |

ABR ($000s) |

% of Portfolio ABR |

# Properties |

ABR ($000s)3 |

% of Portfolio ABR |

% of Prop Type ABR |

|||||||||||||||||||||

| Industrial |

||||||||||||||||||||||||||||

| Manufacturing |

56 | $ | 40,360 | 14.0 | % | 24 | $ | 14,728 | 5.1 | % | 11.6 | % | ||||||||||||||||

| Distribution & Warehouse |

32 | 39,589 | 13.8 | % | 11 | 16,000 | 5.5 | % | 12.6 | % | ||||||||||||||||||

| Food Processing |

14 | 18,194 | 6.3 | % | 2 | 3,375 | 1.2 | % | 2.6 | % | ||||||||||||||||||

| Flex and R&D |

7 | 16,432 | 5.7 | % | 1 | 3,124 | 1.1 | % | 2.5 | % | ||||||||||||||||||

| Cold Storage |

4 | 12,258 | 4.3 | % | 1 | 2,767 | 1.0 | % | 2.2 | % | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| Industrial Total |

113 | 126,833 | 44.1 | % | 39 | 39,994 | 13.9 | % | 31.5 | % | ||||||||||||||||||

| Healthcare |

||||||||||||||||||||||||||||

| Clinical |

50 | 25,371 | 8.8 | % | 16 | 5,705 | 2.0 | % | 9.9 | % | ||||||||||||||||||

| Surgical |

16 | 9,690 | 3.4 | % | 1 | 268 | 0.1 | % | 0.5 | % | ||||||||||||||||||

| Animal Health Services |

20 | 8,072 | 2.8 | % | — | — | 0.0 | % | 0.0 | % | ||||||||||||||||||

| Life Science |

9 | 7,394 | 2.6 | % | 4 | 2,531 | 0.9 | % | 4.4 | % | ||||||||||||||||||

| Healthcare Services |

26 | 6,761 | 2.3 | % | 9 | 1,758 | 0.6 | % | 3.1 | % | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| Healthcare Total |

121 | 57,288 | 19.9 | % | 30 | 10,262 | 3.6 | % | 17.9 | % | ||||||||||||||||||

| Restaurant |

||||||||||||||||||||||||||||

| Quick Service |

152 | 24,845 | 8.6 | % | 91 | 13,104 | 4.5 | % | 29.2 | % | ||||||||||||||||||

| Casual Dining |

91 | 19,956 | 6.9 | % | 85 | 18,589 | 6.5 | % | 41.5 | % | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| Restaurant Total |

243 | 44,801 | 15.5 | % | 176 | 31,693 | 11.0 | % | 70.7 | % | ||||||||||||||||||

| Office |

||||||||||||||||||||||||||||

| Strategic Operations |

7 | 13,554 | 4.7 | % | 1 | 1,571 | 0.5 | % | 5.5 | % | ||||||||||||||||||

| Corporate Headquarters |

6 | 9,583 | 3.3 | % | 3 | 3,679 | 1.3 | % | 12.8 | % | ||||||||||||||||||

| Call Center |

4 | 5,564 | 2.0 | % | — | — | 0.0 | % | 0.0 | % | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| Office Total |

17 | 28,701 | 10.0 | % | 4 | 5,250 | 1.8 | % | 18.3 | % | ||||||||||||||||||

| Retail |

||||||||||||||||||||||||||||

| Automotive |

56 | 9,697 | 3.4 | % | 45 | 7,929 | 2.8 | % | 31.3 | % | ||||||||||||||||||

| General Merchandise |

57 | 8,425 | 2.9 | % | — | — | 0.0 | % | 0.0 | % | ||||||||||||||||||

| Home Furnishings |

15 | 7,175 | 2.5 | % | — | — | 0.0 | % | 0.0 | % | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| Retail Total |

128 | 25,297 | 8.8 | % | 45 | 7,929 | 2.8 | % | 31.3 | % | ||||||||||||||||||

| Other |

11 | 4,963 | 1.7 | % | 1 | 1,860 | 0.6 | % | 37.5 | % | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

| Total |

633 | 287,883 | 100.0 | % | 295 | 96,988 | 33.7 | % | N/A | |||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

12

Table of Contents

Historical Acquisitions and Dispositions

The following charts illustrate our annual acquisition and disposition activity from 2015 through June 30, 2020. The acquisition dollar amounts are based on investment cost and the disposition dollar amounts reflect the sale prices of the properties sold:

Historical Acquisitions ($ in thousands)

We did not acquire any new properties during the six months ended June 30, 2020.

13

Table of Contents

Historical Dispositions ($ in thousands)

Market Opportunity

Outlook

Rosen Consulting Group (“RCG)” has a long-term positive outlook on the net lease real estate market generally and on certain segments of property types for the following reasons:

| • | Net leases offer multiple benefits for property owners and tenants, including, for property owners, rental income stability, inflation mitigation and potential residual property value appreciation, and for tenants, the opportunity to monetize real properties and allocate capital more efficiently. |

| • | RCG estimates the total value of owner-occupied commercial real estate in the U.S. is in the $1.5 to $2.0 trillion range as of 2019. RCG believes that many of these owner-occupied properties could become net leased assets, increasing the size of the net lease market through sale-leaseback transactions. |

| • | RCG believes that the net lease market generally can increase in size and will accommodate a substantial increase in investment activity. |

| • | Economic uncertainty from COVID-19 pandemic-related economic shutdowns may lead to net lease acquisition opportunities from smaller investors and corporate owner-users seeking liquidity via monetization of real property assets. |

Net Lease Real Estate Overview

The net lease market is characterized primarily by single-tenant properties occupied by tenants across a range of industries, including corporate headquarters, manufacturing and distribution facilities, quick service restaurants and healthcare. The structure of a net lease can result in passive and stable cash flows for the owner with the benefit of potential property value appreciation. Net leases are often executed for seven to 15 years or

14

Table of Contents

more. Lease agreements typically include tenant options to renew, further extending the life of a net lease beyond the initial term. Comparatively, multitenant real estate properties with gross leases typically have average lease terms between five and ten years with fewer options to extend. Within the lease term, net leases may feature rent escalations of a fixed percentage or in relation to an inflation measure such as the CPI. This allows a net lease investment to provide some mitigation against inflation pressures or economic downturns. As a result, net leases can offer stable, predictable and passive cash flows over time, similar to interest-bearing corporate bonds but with potential upside for appreciation in property values and inflation mitigation.

The structure of a net lease can be beneficial in several ways to lessees:

| • | Tenants are able to occupy and control locations for longer periods than a standard lease while preserving needed capital for core business operations. |

| • | Assists corporate tenants with expansion opportunities by foregoing capital-intensive ownership and property development alternatives. |

| • | Allows an owner-occupier to monetize real estate through a sale-leaseback transaction, which can provide capital for expansion opportunities, to retire debt or reinvest in the business platform. |

For property owners, there are multiple benefits of a net lease structure:

| • | A net lease offers greater rental income stability and predictability than traditional leases. The longer term and agreed upon rent escalations can create stable cash flows over an extended period of time, potentially outlasting economic downturns. |

| • | The contractual rent increases, often at an annual frequency, can serve to hedge against rising inflation. With the tenant financially responsible for most expenses, the landlord is further insulated against potential surges in inflation. Furthermore, minimal operating expenses borne by the lessor combined with the net lease structure can translate to a more consistent and predictable rental income stream. |

| • | Tenants with strong corporate financial metrics can minimize the vacancy risk to property owners of real estate assets. As net-leased locations are often critical to core businesses, tenants that occupy these mission-critical net-leased properties are likely to maintain lease payments even in the case of corporate reorganizations, bankruptcy filings or mergers. Should a net lease tenant relocate or go out of business, the real estate asset often holds residual value, which may be substantial, depending upon the characteristics and location of the property. |

| • | Even without a tenant and the recurring cash flow, the building may be repositioned to a single tenant or multitenant facility with the potential to secure a new cash flow stream. The underlying land also holds value regardless of the existing structure, particularly well-located sites in urban areas or within proximity to transportation infrastructure, business customers or consumers. |

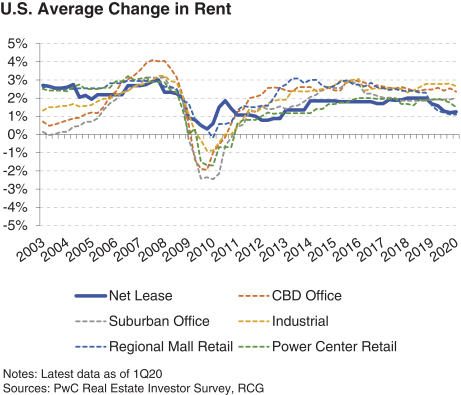

| • | Finally, the long-term nature of the lease may offer some protection for property owners against economic volatility because short-term fluctuations in market-rate rents should not materially impact the in-place rental income from a net lease property. In both economic expansions and downturns, net lease rent growth exhibits less volatility than most other commercial real estate categories. During 2008 and 2009, one of the most severe economic downturns in modern times, rent growth for net-leased properties remained positive while average rent growth declined among other commercial property types. As the current economic downturn caused by the outbreak of COVID-19 progresses, a similar trend may occur as market-rate rents decline while in-place net lease rents remain stable or increase due to contractual rent increases. Economic cycles can often cause shifts in real estate occupancy and rental income, but the long-term lease structure of net lease real estate can often be more resistant to market downturns and volatile periods. |

15

Table of Contents

The fragmented and evolving nature of ownership in the net lease market make it difficult to quantify the overall market size. Net lease tenants constantly expand into new locations and owner-occupiers engage in sale-leaseback and other net lease transactions, adding to and removing properties from the universe of investable net lease real estate properties. RCG estimates the total value of owner-occupied real estate in the U.S. is in the $1.5 to $2.0 trillion range as of 2019. Many of these owner-occupied properties could become net leased assets, increasing the size of the net lease market through sale-leaseback transactions. This estimate is a modest portion of the nearly 71 billion square feet of commercial real estate located in the 200 largest markets in the U.S. in 2018, according to an estimate by the National Association of Real Estate Investment Trusts. With this magnitude, there is considerable potential for the net lease market to expand as owner-occupiers sell properties to raise capital and corporations expand operations.

Net Lease Real Estate Investment Trends

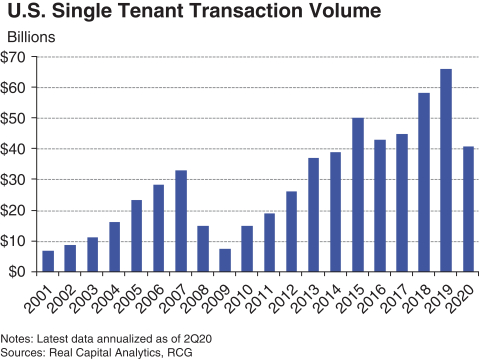

In line with the challenge of measuring the size of the net lease market, assessing the volume of transactions in net lease real estate is similarly challenging. However, sales volume of single tenant properties can be a helpful proxy for net lease transactions as a large share of single tenant properties are net leased. Through the second quarter of 2020 as the economic impacts of the COVID-19 pandemic began to impact real estate transactions, single tenant investment sales activity reached an annualized figure of $40.8 billion, significantly lower than 2018 and 2019, according to Real Capital Analytics. During the five-year period from 2015 through 2019, single tenant investment sales reached $262.9 billion, or $52.6 billion on average each year.

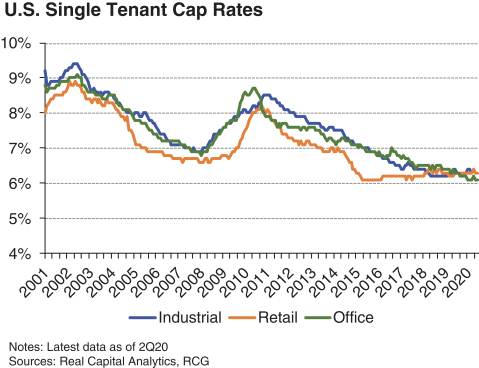

The high level of interest from investors has continued to place pressure on cap rates for single tenant real estate assets, even as transaction volume slowed in 2020. The average single tenant transactional cap rate remained near historical lows at 6.3% through the second quarter of 2020, according to Real Capital Analytics. The average cap rates are based on properties throughout the country and contain tenants of varying credit ratings and, as such, there is a range of cap rates. Generally, cap rates may be lower than the average for high-quality properties and properties with investment-grade tenants.

Even as single tenant cap rates remained near historical lows, the spread to corporate and sovereign bonds widened as 10-year Treasury yields declined. Through the second quarter of 2020, the single tenant cap rate spread to 10-year Treasury bond yields was 557 basis points, compared with the average spread of 463 basis points since 2010. Even as bond yields moved lower, the average cap rate was stable, leading to widened spreads and potential opportunities for greater investment returns relative to a comparable investment class.

Economic Overview of Selected Markets

Industrial. The movement of materials and goods between producers, wholesalers, retailers, businesses and consumers is an essential part of the economy. In recent years, growth in online sales activities continued to drive an increase in freight traffic as businesses and consumers increased consumption. During the economic shutdowns, the need for continued distribution to stores and distribution centers for online purchases underscored the essential nature of industrial businesses and underlying real estate. As consumers transition to a new normal as economies reopen, many purchases will remain online. Online, or e-commerce, sales increased to $160.3 billion in the first quarter of 2020, up from $39.3 billion in the first quarter of 2010, according to the Census Bureau, and may increase further despite the pandemic-induced recession as consumers leverage the convenience and contact-free nature of online shopping. The Transportation Services Index for freight remained stable for much of 2019, and decreased only slightly from the peak in 2019 in early 2020 to 135.5, according to the Bureau of Transportation Services.

In order to transport goods to stores, provide food to restaurants and take-out services, and ship items to consumers, retailers typically employ distribution activities from warehouse facilities located across the country.

16

Table of Contents

In particular, last mile delivery locations to consumers and businesses can be mission-critical for distribution and logistics services. The essential nature of delivery services was highlighted as local economies shutdown due to the COVID-19 pandemic and consumers increased the volume of deliveries to their homes. With more households eating meals at home, consumer demand for perishable food items such as produce, meat and frozen food rose during the economic shutdowns, offsetting some of the decline in activity by wholesale deliveries to dine-in restaurants and bars. As businesses reopen, demand for food items should be additive, driving a recovery in demand for cold storage warehouse and distribution space close to farms and producers as well as in proximity to retailers, restaurants and consumers. The increase in consumer demand for organic food products of the last few years should continue and, in conjunction with the growing online grocery sector, will increase demand for specialized storage and distribution facilities. Warehouses and distribution facilities particularly those serving essential businesses, with proximity to consumers or storefronts and prime transportation infrastructure access will remain highly sought after by retailers and wholesalers.

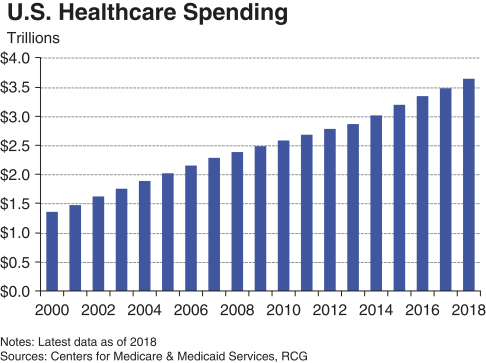

Healthcare. Access to high quality healthcare has never been more important than as during the COVID-19 pandemic. Prior to the pandemic, healthcare spending increased annually, driven not only by increasing costs but also a growing population and increased access to healthcare through insurance. The expansion of public health insurance programs combined with a large share of the population employed resulted in approximately 91.5% of the U.S. population in 2018 under health insurance at some point during the year, according to the Census Bureau. National healthcare spending increased to $3.6 trillion in 2018, the latest data available, an increase of 4.6% from the previous year, according to the U.S. Centers for Medicare & Medicaid Services. While healthcare providers will be strained by the delivery of services during the COVID-19 pandemic as well as enhancing safety protocols throughout medical and dental offices, the continued support of the federal government through aid packages will help offset some of the increased costs. As the delivery of healthcare normalizes, a return to longer term trends should take hold with healthcare demand driven by demographic trends, including an aging population, extended life expectancy and large portions of the population transitioning into life stages that typically indicate an increase in healthcare utilization. While many healthcare providers and systems are under increasing pressure from the ongoing pandemic in the near term, longer term trends such as increased patient referrals to outpatient facilities for procedures and increased usage of preventative and alternative healthcare should drive continued increase in demand for healthcare services outside of hospital system campuses. The essential nature of medical services combined with locations accessible by patients and providers or with proximity to hospital systems should culminate in heightened long-term demand for select net leased real estate.

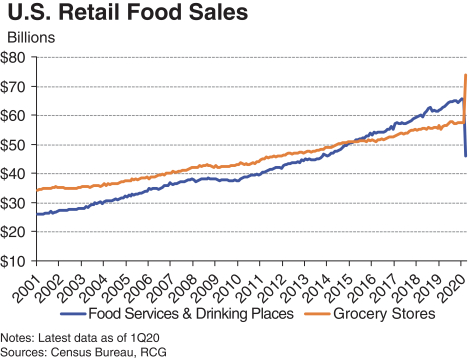

Restaurants. During the COVID-19 pandemic, food service establishments with takeout, delivery or drive-through meals underscored the critical mission of providing prepared food to individuals and families. While legal restrictions adopted by many U.S. states temporarily prohibited indoor dining and more households turned to grocery stores for food to cook at home, many restaurants were able to remain open in order to provide food throughout the crisis through takeout and drive-through options. While some food service establishments increased sales during the economic shutdowns, the loss of dine-in options hurt most restaurants. Spending in restaurants and bars declined in the first quarter of 2020, according to the Census Bureau, as many consumers cooked at home instead of dining out. The reduction in sales due to the prohibition of indoor dining and “shelter in place” orders underscored the importance of well-capitalized tenants that may be better able to adjust to evolving market conditions. Many of these casual dining restaurants and fast food outlets were able to serve customers via curbside pickup and drive-throughs.

As local economies have reopened and more forms of dining have been permitted in some regions, many diners returned to restaurants, highlighting the potential for in-person dining to recover once the pandemic is over. Restaurant concepts with financial strength and flexibility may be able better positioned to respond to evolving consumer preferences, including online menus, virtual ordering and contactless payment systems. These more resilient food service establishments should recover from the economic shutdowns and support additional opportunities for net lease real estate investments.

17

Table of Contents

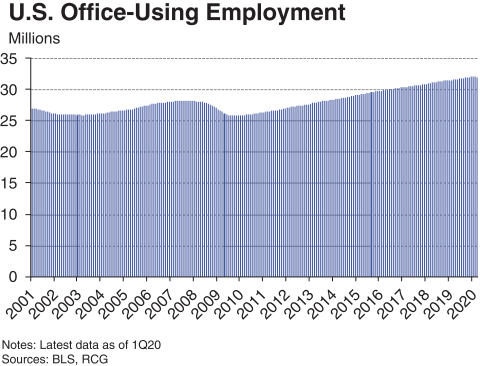

Office. While the COVID-19 pandemic will drive shifts in tenant location preferences and utilization of space, the extent of the shift is unclear as many office workforces have yet to return to the workplace. Office-using employment is a key indicator of the demand for office space. In recent years, hiring accelerated and there were nearly 32.1 million office-using employees in 2019. With the onset of the COVID-19 economic shutdowns, many office-using employees were able to transition to work-from-home environments, preventing a further decline in employment levels. Through the first quarter of 2020, office-using employment was stable even as job losses began in the service industries.

In the near term, as companies return to leased office space, employees are likely to be spaced farther apart, allowing more physical distance between workers. This reversal of the densification trend of the past several years may lead some tenants to require larger office footprints to house employees. Conversely, some tenants may allow employees to work remotely, leading to a decreased need for office space. While the exact balance of tenant demand is unknown, the mission-critical nature of headquarters and other key office sites is likely to increase in importance for business continuity plans. For some tenants, shifting part of the mission-critical workforce from a downtown area to a suburban location may mean that there are now multiple key sites, leading to additional opportunities for net lease investors.

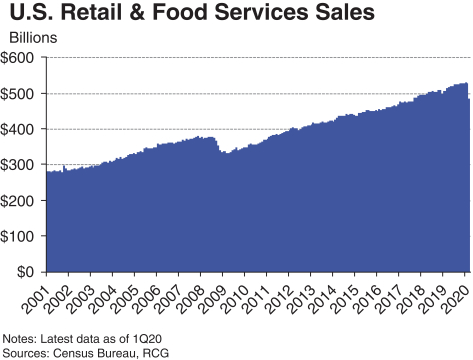

Retail. The effects of the COVID-19 pandemic are likely to accelerate many of the recent shifts in the retail industry with more purchase activity moving online. Innovative retailers with stronger balance sheets may be able to respond to shifting consumer shopping behavior more quickly, allowing these retailers to increase market share. The ability to purchase online and pick up items curbside, for example, may remain popular with consumers long after the pandemic is over. Larger retailers with omnichannel sales strategies likely weathered the economic shutdowns better than those that relied solely on physical storefronts for sales revenue. Essential retail, such as grocery stores, pharmacies, automotive parts and supplies, home improvement, gas stations, and pet stores, among others, are a large and vital segment of the retail industry and occupy a large share of retail real estate. During the pandemic, relatively strong consumer activity underscored the resiliency of essential retailers and highlighted the attractiveness to consumers of storefronts that offered curbside pickup, drive-throughs and delivery services.

Consumer spending, as measured by seasonally adjusted retail and food services sales, had increased since 2009 prior to the economic shutdowns resulting from the COVID-19 pandemic. In 2019, retail sales increased to more than $6.2 trillion, an average of $518 billion per month and an increase of 3.6% from 2018. By the end of the first quarter of 2020, as initial economic shutdowns hit several major metropolitan areas, monthly retail sales decreased to $483.9 billion. As economies reopen and more stores are allowed to welcome customers, retail sales may recover. In recent years, online sales growth accelerated faster than overall retail sales, and the pandemic may shift additional sales activity. With approximately 11.8% of retail sales conducted online in the first quarter of 2020, according to the Census Bureau, there is ample room for additional purchasing activity, and innovative and well-capitalized retailers may be poised to expand market share and provide additional tenant opportunities for net lease real estate.

Corporate Responsibility—Environmental, Social, and Governance (ESG)