Form 497K

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Share Class & Ticker |

|

Class A |

|

Class C |

|

Class T |

|

Class R |

|

Class R6 |

|

Institutional Class |

|

Class P |

|

Administrative Class |

|

Summary Prospectus February 1, 2020 |

| |

AGRAX |

|

ARTCX |

|

AVRTX |

|

ASRRX |

|

AVRIX |

|

AVRNX |

|

AGRPX |

|

ARAMX |

|

(as revised February 5, 2020) |

AllianzGI Multi Asset Income Fund

Beginning on January 1, 2021, as permitted by regulations

adopted by the Securities and Exchange Commission, paper copies of shareholder reports will no longer be sent by mail, unless you specifically request paper copies of the reports. Instead, the reports will be made available on the Fund’s

website (us.allianzgi.com), and you will be notified by mail each time a report is posted and provided with a website link to access the report. If you already elected to receive shareholder reports electronically, you will not be affected by this

change and you need not take any action. You may elect to receive shareholder reports and other communications from the Fund electronically anytime by contacting your financial intermediary (such as a broker-dealer or bank) or, if you are a direct

investor, by signing up for e-Delivery. If you prefer to receive paper copies of your shareholder reports after January 1, 2021, direct investors may inform the Fund at any time. If you invest through a financial intermediary, you should contact

your financial intermediary directly. Paper copies are provided free of charge and your election to receive reports in paper will apply to all funds held with the fund complex if you invest directly with the Fund or all funds held in your account if

you invest through your financial intermediary.

Before you invest, you may want to review the Fund’s statutory prospectus, which contains more

information about the Fund and its risks. You can find the Fund’s statutory prospectus and other information about the Fund, including its statement of additional information (SAI) and most recent reports to shareholders, online at

http://us.allianzgi.com/documents. You can also get this information at no cost by calling 1-800-988-8380 for Class A,

Class C, Class T and Class R shares and 1-800-498-5413 for Class R6, Institutional Class, Class P and

Administrative Class shares or by sending an email request to agid-marketingproduction@allianzinvestors.com. This Summary Prospectus incorporates by reference the Fund’s entire statutory prospectus and

SAI, each dated February 1, 2020, as further revised or supplemented from time to time.

The Fund seeks current income and, secondarily, capital appreciation. The Fund is intended for investors who have already retired or begun

withdrawing portions of their investments, or are seeking a conservative allocation fund.

|

| Fees and Expenses of the Fund |

The tables below describe the fees and expenses that you may pay if you buy and hold shares of the Fund. In addition to the fees and

expenses described below, you may also be required to pay brokerage commissions on purchases and sales of the Class P shares of the Fund. You may qualify for sales charge discounts if you and your family invest, or agree to invest in the future, at

least $50,000 in Class A shares of eligible funds that are part of the family of mutual funds sponsored by Allianz. More information about these and other discounts is available in the “Classes of Shares” section beginning on page 314

of the Fund’s prospectus or from your financial advisor. In addition, if you purchase shares through a specific intermediary, you may be subject to different sales charges including reductions in or waivers of such charges. More information about these intermediary-specific sales charge variations is available in Appendix A to the Fund’s prospectus (“Intermediary Sales Charge Discounts and Waivers”).

Shareholder Fees (fees paid directly from your investment)

|

|

|

|

|

| Share Class |

|

Maximum Sales Charge (Load) Imposed

on Purchases (as a percentage of offering price) |

|

Maximum Contingent Deferred Sales Charge (CDSC) (Load)

(as a percentage of the lower of original

purchase

price or NAV)(1) |

| Class A |

|

5.50% |

|

1% |

| Class C |

|

None |

|

1% |

| Class R |

|

None |

|

None |

| Class T |

|

2.50% |

|

None |

| Institutional |

|

None |

|

None |

| Class R6 |

|

None |

|

None |

| Class P |

|

None |

|

None |

| Administrative |

|

None |

|

None |

Annual Fund Operating Expenses (expenses that you pay each year as a percentage of the value of your investment)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Share Class |

|

Advisory

Fees |

|

Distribution Fee

and/or Service

(12b-1) Fees |

|

Other

Expenses(2) |

|

Acquired

Fund Fees

and

Expenses |

|

Total Annual

Fund Operating

Expenses |

|

Expense

Reductions(3) |

|

Total Annual

Fund Operating

Expenses After

Expense

Reductions(3) |

| Class A |

|

0.05% |

|

0.25% |

|

0.30% |

|

0.53% |

|

1.13% |

|

(0.18)% |

|

0.95% |

| Class C |

|

0.05 |

|

1.00 |

|

0.30 |

|

0.53 |

|

1.88 |

|

(0.18) |

|

1.70 |

| Class R |

|

0.05 |

|

0.50 |

|

0.30 |

|

0.53 |

|

1.38 |

|

(0.08) |

|

1.30 |

| Class T |

|

0.05 |

|

0.25 |

|

0.30 |

|

0.53 |

|

1.13 |

|

(0.18) |

|

0.95 |

| Institutional |

|

0.05 |

|

None |

|

0.10 |

|

0.53 |

|

0.68 |

|

(0.08) |

|

0.60 |

| Class R6 |

|

0.05 |

|

None |

|

0.05 |

|

0.53 |

|

0.63 |

|

(0.08) |

|

0.55 |

| Class P |

|

0.05 |

|

None |

|

0.15 |

|

0.53 |

|

0.73 |

|

(0.08) |

|

0.65 |

| Administrative |

|

0.05 |

|

0.25 |

|

0.15 |

|

0.53 |

|

0.98 |

|

(0.08) |

|

0.90 |

| (1) |

For Class A shares, the CDSC is imposed only in certain circumstances where shares are purchased without a front-end sales charge at the time of purchase. For Class C shares, the CDSC is imposed only on shares redeemed in the first year. |

| (2) |

Other Expenses represent administrative fees paid by the Fund to Allianz Global Investors U.S. LLC (“AllianzGI

U.S.” or the “Manager”) pursuant to an Administration Agreement between AllianzGI U.S. and the Trust. |

| (3) |

AllianzGI U.S. has contractually agreed, until January 31, 2021, to irrevocably waive its advisory and administrative fees

and reimburse any additional Other Expenses or Acquired Fund Fees and Expenses, to the extent that Total Annual Fund Operating Expenses After Expense Reductions, excluding interest, tax, and extraordinary expenses, exceed 0.95% for Class A

shares, 1.70% for Class C shares, 1.30% for Class R shares, 0.95% for Class T shares, 0.60% for Institutional Class shares, 0.55% for Class R6 shares, 0.65% for Class P shares and 0.90% for Administrative

Class shares. Under the Expense Limitation Agreement, the Manager may recoup waived or reimbursed amounts for three years, provided total expenses, including such recoupment, do not exceed the annual expense limit in effect at the time of such

waiver/reimbursement or recoupment. The Expense Limitation Agreement is terminable by the Trust or by mutual agreement of the parties. |

AllianzGI Multi Asset Income Fund

Examples. The Examples are intended to help you compare the cost of investing in

shares of the Fund with the costs of investing in other mutual funds. The Examples assume that you invest $10,000 in the noted class of shares for the time periods indicated, your investment has a 5% return each year, and the Fund’s operating

expenses remain the same. Although your actual costs may be higher or lower, the Examples show what your costs would be based on these assumptions. The Examples are based, for the first year, on Total Annual Fund Operating Expenses After Expense

Reductions and, for all other periods, on Total Annual Fund Operating Expenses.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Example: Assuming you redeem your shares at the end of each period |

|

|

Example: Assuming you do not redeem your shares |

|

| Share Class |

|

1 Year |

|

|

3 Years |

|

|

5 Years |

|

|

10 Years |

|

|

1 Year |

|

|

3 Years |

|

|

5 Years |

|

|

10 Years |

|

| Class A |

|

|

$642 |

|

|

|

$872 |

|

|

|

$1,122 |

|

|

|

$1,834 |

|

|

|

$642 |

|

|

|

$872 |

|

|

|

$1,122 |

|

|

|

$1,834 |

|

| Class C |

|

|

273 |

|

|

|

573 |

|

|

|

999 |

|

|

|

2,186 |

|

|

|

173 |

|

|

|

573 |

|

|

|

999 |

|

|

|

2,186 |

|

| Class R |

|

|

132 |

|

|

|

429 |

|

|

|

748 |

|

|

|

1,650 |

|

|

|

132 |

|

|

|

429 |

|

|

|

748 |

|

|

|

1,650 |

|

| Class T |

|

|

345 |

|

|

|

583 |

|

|

|

840 |

|

|

|

1,575 |

|

|

|

345 |

|

|

|

583 |

|

|

|

840 |

|

|

|

1,575 |

|

| Institutional |

|

|

61 |

|

|

|

210 |

|

|

|

371 |

|

|

|

839 |

|

|

|

61 |

|

|

|

210 |

|

|

|

371 |

|

|

|

839 |

|

| Class R6 |

|

|

56 |

|

|

|

194 |

|

|

|

343 |

|

|

|

779 |

|

|

|

56 |

|

|

|

194 |

|

|

|

343 |

|

|

|

779 |

|

| Class P |

|

|

66 |

|

|

|

225 |

|

|

|

398 |

|

|

|

899 |

|

|

|

66 |

|

|

|

225 |

|

|

|

398 |

|

|

|

899 |

|

| Administrative |

|

|

92 |

|

|

|

304 |

|

|

|

534 |

|

|

|

1,194 |

|

|

|

92 |

|

|

|

304 |

|

|

|

534 |

|

|

|

1,194 |

|

Portfolio Turnover. The Fund pays transaction costs, such as commissions, when it buys and sells securities (or

“turns over” its portfolio). The Fund’s portfolio turnover rate for the fiscal year ended September 30, 2019 was 277% of the average value of its portfolio. High levels of portfolio turnover may indicate higher transaction costs

and may result in higher taxes for you if your Fund shares are held in a taxable account. These costs, which are not reflected in Total Annual Fund Operating Expenses or in the Examples above, can adversely affect the Fund’s investment

performance.

|

| Principal Investment Strategies |

The Fund seeks to achieve its investment objective through a combination of active allocation between asset classes and the

use of both actively managed and passive strategies within those asset classes. The Fund allocates its investments among asset classes in response to changing market, economic, and political factors and events that the portfolio managers believe may

affect the ability of the Fund to generate current income or may impact the value of the Fund’s investments. The Fund invests directly and indirectly in a globally diversified portfolio of equity securities, including emerging market equities,

and in global fixed income securities, including high yield debt (commonly known as “junk bonds”), convertible bonds, emerging market debt and volatility-linked derivatives. The Fund pursues its income objective with an emphasis on the

preservation of capital and prudent investment management. To gain exposure to the various asset classes, the Fund incorporates actively managed strategies and/or passive instruments by investing in certain affiliated mutual funds managed by

AllianzGI U.S. and/or its affiliates (the “Affiliated Underlying Funds”), unaffiliated funds and other pooled vehicles (collectively, with the Affiliated Underlying Funds, “Underlying Funds”), exchange-traded funds

(“ETFs”) and derivative instruments that give synthetic exposure substantially similar to that of a security, basket of securities or other assets that would otherwise be included in such asset classes. The Fund may invest without limit in

Underlying Funds and may invest a significant percentage of assets in a small number, or even one, of the Underlying Funds.

The Fund targets a long-term average

strategic asset allocation of 30% to global equity exposure, including REITs (the “Equity Component”) and 70% to global fixed income asset classes (the “Fixed Income Component”). The Fund may also use actively managed strategies

that attempt to generate capital gains in addition to dividends and coupons to support distributions. The Fixed Income Component may include non-U.S. investment grade debt, high yield debt from the United

States and other developed markets, convertible bonds and emerging markets debt of any quality.

The Fund will also be permitted to have up to a 30% allocation to

other income generating instruments on an opportunistic basis (the “Opportunistic Component”), including preferred securities, bank loans and master limited partnerships (MLPs), as well as other opportunistic investments (e.g.,

commodities, managed futures strategies and volatility-linked derivatives), to seek to improve the Fund’s diversification profile.

Only securities, instruments

or actively managed strategies whose primary purpose is to gain exposure to one or more of the opportunistic asset classes are considered by the portfolio managers to be part of the Opportunistic Component. Thus, exposure to

“opportunistic” asset classes resulting from investments in diversified underlying strategies are not included in the calculation of the Opportunistic Component 30% limit.

Depending on market conditions, the Equity Component may range between approximately 10% and 40% of the Fund’s assets and the Opportunistic Component may range

between approximately 0% and 30% of the Fund’s assets. Within the Fixed Income Component, the total allocation to global high yield bonds, emerging market debt, and other areas of the fixed income market that the portfolio managers consider to

have higher risk can range between 0% to 30% of the Fund’s portfolio; however, allocations to these higher-risk fixed income asset classes within underlying funds and allocations to lower volatility short-term high yield strategies are exempt

from this restriction.

Although the portfolio managers expect that the Fund’s actual allocations will be relatively close to the strategic allocation on average

and over a full market cycle, the portfolio managers may change the Fund’s actual allocation from time to time according to the previously defined process and allocation ranges.

The portfolio managers analyze market cycles, economic cycles, valuations and yields of each asset class and their

components and may adjust the Fund’s exposures to individual holdings and asset classes. Adjustments to the Fund’s exposure to equities, fixed income, and other asset classes are made in an effort to mitigate downside risk, including in

times of severe market stress, and to increase the return potential in favorable markets. While the portfolio managers attempt to mitigate the downside risk to stabilize performance, there can be no assurance that the Fund will be successful in

doing so. The portfolio managers expect to make use of volatility-linked derivatives to take advantage of differences between realized and implied volatility on a range of asset classes and to hedge risks in the portfolio. The portfolio managers

analyze momentum and momentum reversion as part of the investment process for the Fund.

In addition to momentum and momentum reversion signals, the portfolio

managers also analyze the levels of qualified income and overall yields, combined with an assessment of potential risks and other fundamentally based assessments to locate opportunities to seek to improve the Fund’s ability to distribute income

and its overall return.

After determining the asset allocation among the Components, the portfolio managers select particular investments in an effort to obtain

exposure to the relevant mix of asset classes and to generate current income. The Fund strategy focuses on investments in mutual funds and ETFs. The Fund may invest in any type of equity or fixed income security, including common and preferred

stocks, warrants and convertible securities, mortgage-backed securities, asset-backed securities and government and corporate bonds. The Fund may invest in securities of companies of any capitalization, including smaller capitalization companies.

The Fund also may make investments intended to provide exposure to one or more commodities or securities indices, currencies, and real estate-related securities. The Fund is expected to be highly diversified across industries, sectors, and

countries. The Fund may liquidate a holding if it locates another instrument that offers a more attractive exposure to an asset class or when there is a change in the Fund’s target asset allocation, or if the holding is otherwise deemed

inappropriate.

In implementing these investment strategies, the Fund will make substantial use of futures and forward contracts, both long and short, for bonds,

equities, REITs and currencies. The use of futures and forward contracts allows the Fund to tactically adjust its equity, bond and currency exposures and to avoid frequent trades in underlying mutual funds, as frequent trading in underlying mutual

funds may generate higher trading costs and taxable distributions in those underlying funds. The Fund may also incorporate other over-the-counter (OTC) or

exchange-traded derivatives to gain, adjust or hedge exposure to different asset classes or market segments. This may include interest rate swaps, total return swaps, credit default swaps, options (puts and calls) purchased or sold by the Fund and

structured notes. When making use of volatility-linked derivatives as part of its Opportunistic Component, the Fund will enter into instruments such as variance swaps, volatility futures and similar volatility instruments that reference indexes

representing targeted asset classes, such as variance swaps on the S&P 500 Index or on the Euro Stoxx 50 Index. The Fund may maintain a significant percentage of its assets in cash and cash equivalents which will serve as margin or collateral

for the Fund’s obligations under derivative transactions.

As a result of its derivative positions, the Fund may have gross investment exposures in excess of

100% of its net assets (i.e., the Fund may be leveraged) and therefore subject to heightened risk of loss. The Fund’s performance can depend substantially on the performance of assets or indices underlying its derivatives even though it does

not directly or indirectly own those underlying assets or indices.

The principal risks of investing in the Fund, which could adversely affect its net asset value, yield and total return, are

(in alphabetical order after the first six risks):

Allocation Risk: The Fund’s investment performance depends upon how its assets are

allocated and reallocated among particular Underlying Funds and other investments. The Manager’s allocation techniques and decisions and/or the Manager’s selection of Underlying Funds and other investments may not produce the desired

results.

Underlying Fund Risks: The Fund will be indirectly affected by factors, risks and performance specific to any other fund in which it

invests.

Market Risk: The Fund will be affected by factors influencing the U.S. or global economies and securities markets or relevant

industries or sectors within them.

Issuer Risk: The Fund will be affected by factors specific to the issuers of securities and other instruments in

which the Fund invests, including actual or perceived changes in the financial condition or business prospects of such issuers.

Equity Securities

Risk: Equity securities may react more strongly to changes in an issuer’s financial condition or prospects than other securities of the same issuer.

Fixed Income Risk: Fixed income (debt) securities are subject to greater levels of credit and liquidity risk, may be speculative and may decline in

value due to changes in interest rates or an issuer’s or counterparty’s deterioration or default.

Commodity Risk: Commodity-linked

derivative instruments may increase volatility.

Convertible Securities Risk: Convertible securities are subject to greater levels of credit and

liquidity risk, may be speculative and may decline in value due to increases in interest rates or an issuer’s deterioration or default.

Credit and

Counterparty Risk: An issuer or counterparty may default on obligations.

Currency Risk: The values of

non-U.S. securities may fluctuate with currency exchange rates and exposure to non-U.S. currencies may subject the Fund to the risk that those currencies will decline in

value relative to the U.S. dollar.

Derivatives Risk: Derivative instruments are complex, have different characteristics than their underlying

assets and are subject to additional risks, including leverage, liquidity and valuation.

Emerging Markets

Risk: Non-U.S. investment risk may be particularly high to the extent that the Fund invests in emerging market securities. These securities may present market, credit, currency, liquidity,

legal, political, technical and other risks different from, or greater than, the risks of investing in developed countries.

Focused Investment

Risk: To the extent the Fund focuses its investments on a limited number of issuers, sectors, industries or geographic regions, it may be subject to increased risk and volatility.

High Yield Risk: High-yield or junk bonds are subject to greater levels of credit and liquidity risk, may

be speculative and may decline in value due to increases in interest rates or an issuer’s deterioration or default.

Index Risk: Investments in

index-linked derivatives are subject to the risks associated with the applicable index.

Interest Rate Risk: Fixed income securities may decline in

value because of increases in interest rates.

IPO Risk: Securities purchased in initial public offerings have no trading history, limited issuer

information and increased volatility.

Leveraging Risk: Instruments and transactions that constitute leverage magnify gains or losses and increase

volatility.

Liquidity Risk: To the extent the Fund invests in less liquid securities or the level of liquidity in a particular market is

constrained, the lack of an active market for investments may cause delay in disposition or force a sale below fair value.

Management Risk: The

Fund will be affected by the allocation determinations, investment decisions and techniques of the Fund’s management.

Mortgage-Related and Other Asset-Backed

Risk: Investing in mortgage- and asset-backed securities involves interest rate, credit, valuation, extension and liquidity risks and the risk that payments on the underlying assets are delayed, prepaid, subordinated or defaulted on.

Non-U.S. Investment Risk: Non-U.S. securities markets and issuers

may be more volatile, smaller, less liquid, less transparent and subject to less oversight, particularly in emerging markets.

REIT and Real Estate-Related

Investment Risk: Adverse changes in the real estate markets may affect the value of REIT investments or real estate-linked derivatives.

Short

Selling Risk: Short selling enhances leveraging risk and involves counterparty risk and the risk of unlimited loss.

Smaller Company

Risk: Securities issued by smaller companies may be more volatile and present increased liquidity risk relative to securities issued by larger companies.

Tax Risk: Income from commodity-linked investments may limit the Fund’s ability to qualify as a “regulated investment company” for U.S.

federal income tax purposes.

Variable Distribution Risk: Periodic distributions by investments of variable or floating interest rates vary with

fluctuations in market interest rates.

Please see “Summary of Principal Risks” in the Fund’s prospectus for a more detailed description of the

Fund’s risks. It is possible to lose money on an investment in the Fund. An investment in the Fund is not a deposit of a bank and is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency.

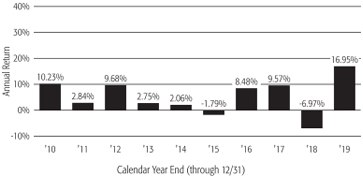

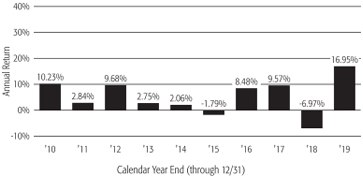

The performance information below provides some indication of the risks of investing in the Fund by showing changes in its

total return from year to year and by comparing the Fund’s average annual total returns with those of two broad-based market indexes, the AllianzGI Multi Asset Income Strategic Benchmark and a performance average of similar mutual funds. The

bar chart and the information to its right show performance of the Fund’s Class A shares, but do not reflect the impact of sales charges (loads). If they did, returns would be lower than those shown. Other share

classes would have different performance due to the different expenses they bear. Performance in the Average Annual Total Returns table reflects the impact of sales charges. Prior to October 1, 2016, the Fund was managed pursuant to a

different investment strategy and would not necessarily have achieved the performance results shown below for periods prior to October 1, 2016 under its current investment strategy. For

periods prior to the inception date of a share class, performance information shown for such class may be based on the performance of an older class of shares that dates back to the Fund’s inception, as adjusted to reflect fees and expenses

paid by the newer class. These adjustments generally result in estimated performance results for the newer class that are different from the actual results of the predecessor class, due to differing levels of fees and expenses

paid. Past performance, before and after taxes, is not necessarily predictive of future performance. Visit us.allianzgi.com for more current performance information.

Calendar Year Total Returns — Class A

|

|

|

|

|

| Highest and Lowest Quarter Returns |

|

| (for periods shown in the bar chart) |

|

| Highest 01/01/2019–03/31/2019 |

|

|

7.72% |

|

| Lowest 07/01/2011–09/30/2011 |

|

|

-5.55% |

|

Average Annual Total Returns (for periods ended 12/31/19)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

1 Year |

|

|

5 Years |

|

|

10 Years |

|

|

Fund Inception

(12/29/08) |

|

| Class A — Before Taxes |

|

|

10.52% |

|

|

|

3.72% |

|

|

|

4.58% |

|

|

|

6.02% |

|

| Class A — After Taxes on Distributions |

|

|

7.97% |

|

|

|

1.49% |

|

|

|

2.70% |

|

|

|

4.10% |

|

| Class A — After Taxes on Distributions and Sale of Fund Shares |

|

|

6.15% |

|

|

|

1.82% |

|

|

|

2.74% |

|

|

|

3.91% |

|

| Class C — Before Taxes |

|

|

14.98% |

|

|

|

4.10% |

|

|

|

4.38% |

|

|

|

5.77% |

|

| Class R — Before Taxes |

|

|

16.47% |

|

|

|

4.53% |

|

|

|

4.83% |

|

|

|

6.22% |

|

| Class T — Before Taxes |

|

|

14.03% |

|

|

|

4.37% |

|

|

|

4.91% |

|

|

|

6.32% |

|

| Class R6 — Before Taxes |

|

|

17.35% |

|

|

|

5.32% |

|

|

|

5.58% |

|

|

|

6.97% |

|

| Institutional Class — Before Taxes |

|

|

17.30% |

|

|

|

5.26% |

|

|

|

5.52% |

|

|

|

6.91% |

|

| Class P — Before Taxes |

|

|

17.28% |

|

|

|

5.21% |

|

|

|

5.48% |

|

|

|

6.87% |

|

| Administrative Class — Before Taxes |

|

|

15.56% |

|

|

|

4.47% |

|

|

|

4.99% |

|

|

|

6.40% |

|

| Bloomberg Barclays U.S. Universal Bond Index (reflects no deduction for fees, expenses or taxes) |

|

|

9.29% |

|

|

|

3.44% |

|

|

|

4.12% |

|

|

|

4.52% |

|

| AllianzGI Multi Asset Income Strategic Benchmark |

|

|

14.31% |

|

|

|

4.71% |

|

|

|

4.85% |

|

|

|

5.66% |

|

| MSCI World High Dividend Yield Index (returns reflect no deduction for fees or expenses but are net of dividend tax withholding) |

|

|

23.15% |

|

|

|

7.31% |

|

|

|

8.22% |

|

|

|

10.39% |

|

| Lipper Mixed-Asset Target Today Funds Average |

|

|

13.07% |

|

|

|

4.21% |

|

|

|

5.10% |

|

|

|

6.24% |

|

After-tax returns are estimated using the highest historical individual federal marginal income

tax rates and do not reflect the impact of state and local taxes. Actual after-tax returns depend on an investor’s tax situation and may differ from those shown.

After-tax returns are not relevant to investors who hold Fund shares through tax-advantaged arrangements such as 401(k) plans or individual retirement accounts. In some

cases the return after taxes may exceed the return before taxes due to an assumed tax benefit from any losses on a sale of Fund shares at the end of the measurement period. After-tax returns are for

Class A shares only. After-tax returns for other share classes will vary.

Investment Manager

Allianz Global Investors

U.S. LLC

Portfolio Managers

Alistair Bates, CFA, portfolio manager and

assistant vice president, has managed the Fund since 2016.

Claudio Marsala, portfolio manager and director, has managed the Fund since 2015.

Paul Pietranico, CFA, lead portfolio manager and director, has managed the Fund since 2008.

|

| Purchase and Sale of Fund Shares |

You may purchase or sell (redeem) shares of the Fund on any business day through a broker, dealer, or other financial intermediary (for

Class T shares, such intermediary must have an agreement with the Distributor to sell Class T shares), or directly from the Fund’s distributor by mail (Allianz Global Investors Distributors LLC, P.O. Box 219723, Kansas City, MO

64121-9723) for Class A, Class C and Class R shares, or directly from the Fund’s transfer agent by mail (Allianz Institutional Funds, P.O. Box 219968, Kansas City, MO 64121-9968) for Institutional Class, Class R6,

Class P and Administrative Class shares, or as further described in the Fund’s prospectus and SAI. Additionally, certain direct shareholders may be able to purchase or redeem shares of the Fund online by visiting our website,

https://us.allianzgi.com, clicking on the “Login” link in the top-right corner of that webpage, and following instructions. Some restrictions may apply. To avoid delays in a purchase or redemption, please call 1-800-988-8380 for Class A, Class C, Class R and Class T shares and 1-800-498-5413 for Institutional Class, Class R6, Class P and Administrative Class shares with any questions about the requirements before submitting a

request. Generally, purchase

and redemption orders for Fund shares are processed at the net asset value (NAV) next calculated after an order is received by the distributor or an authorized intermediary. NAVs are determined

only on days when the New York Stock Exchange is open for regular trading. For Class A, Class C and Class T shares, the minimum initial investment in the Fund is $1,000 and the minimum subsequent investment is $50. For Class R

shares, specified benefit plans may establish various minimum investment and account size requirements; ask your plan administrator for more information. For Institutional Class, Class P and Administrative Class shares, the minimum initial

investment in the Fund is $1 million and no minimum is needed to add to an existing account, though minimums may be modified for certain financial intermediaries that aggregate trades on behalf of investors. For Class R6 shares, there is

no minimum initial investment and no minimum is needed to add to an existing account for specified benefit plans and other eligible investors.

The Fund’s distributions are generally taxable to you as ordinary income or capital gains, unless you are investing through a tax-advantaged arrangement, such as a 401(k) plan or an individual retirement account.

|

| Payments to Broker-Dealers and Other Financial

Intermediaries |

If you purchase shares of the Fund through a broker-dealer or other financial intermediary (such as a bank), the Fund, its distributor,

its investment manager or their affiliates may pay the intermediary for the sale of Fund shares and related services. These payments may create a conflict of interest by influencing the broker-dealer or intermediary and your salesperson to recommend

the Fund over another investment. Ask your salesperson or visit your financial intermediary’s Web site for more information.

Sign up for e-Delivery

To get future prospectuses online

and to eliminate mailings, go to:

http://us.allianzgi.com/edelivery

AZ845SP_020520