Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-22167

Allianz Funds Multi-Strategy Trust

(Exact name of registrant as specified in charter)

1633 Broadway, New York, NY 10019

(Address of principal executive offices) (Zip code)

Lawrence G. Altadonna

1633 Broadway, New York, NY 10019

(Name and address of agent for service)

Registrant’s telephone number, including area code: 212-739-3371

Date of fiscal year end: September 30

Date of reporting period: March 31, 2017

Table of Contents

Item 1. Report to Shareholders

Allianz Multi-Strategy Funds

SHARE CLASSES A, C, R, P, INSTITUTIONAL, R6, ADMINISTRATIVE

Semiannual Report

March 31, 2017

This material is authorized for use only when preceded or accompanied by the current Allianz Multi-Strategy Funds prospectus. Investors should consider the investment objectives, risks, charges and expenses of each Fund carefully before investing. This and other information is contained in the Funds’ prospectuses and summary prospectuses. Please read the prospectus carefully before you invest or send money.

Receive this report electronically and eliminate paper mailings.

To enroll, go to http://us.allianzgi.com/edelivery.

Table of Contents

| 2–3 | Letter from the President | |||

| 4–132 | Fund Summaries | |||

| 133–134 | Important Information | |||

| 135–139 | Benchmark Descriptions | |||

| 140–199 | Schedules of Investments | |||

| 200–213 | Statements of Assets and Liabilities | |||

| 214–227 | Statements of Operations | |||

| 228–243 | Statements of Changes in Net Assets | |||

| 244–311 | Financial Highlights | |||

| 312–393 | Notes to Financial Statements | |||

| 394–395 | Matters Relating to the Trustees’ Consideration of the Investment Management and Sub-Advisory Agreements | |||

| 396–397 | Privacy Policy |

A Word About Risk: A fund may be subject to various risks as described in its prospectus. Some of those risks may include, but are not limited to, the following: derivatives risk, smaller company risk, non-US investment risk, focused investment risk and specific sector investment risks. Use of derivative instruments may involve certain costs and risks such as liquidity risk, interest rate risk, market risk, credit risk, counterparty risk, management risk and the risk that a fund is unable to close out a position when it is most advantageous to do so. Portfolios investing in derivatives could lose more than the principal amount invested in those instruments. Investing in foreign securities may entail risk due to foreign economic and political developments; this risk may be enhanced when investing in emerging markets. Smaller companies may be more volatile than larger companies and may entail more risk. Concentrating investments in individual sectors may add additional risk and additional volatility compared to a diversified equity portfolio. AllianzGI target-date funds seek to manage risk and return by blending two separately-managed portfolios: a return-generating portfolio for growth potential, and a defensive portfolio for principal protection. The balance grows increasingly defensive over time until the target date is reached, after which the Fund’s assets roll into a retirement income strategy. The principal values of the Funds are not guaranteed at any time, including the target date. Please refer to the Fund’s applicable current prospectus for complete details.

Table of Contents

| 2 | March 31, 2017 | | Semiannual Report |

Table of Contents

Outlook

Looking ahead, we believe investors should expect muted growth as the US enters its late-cycle period, Japan struggles with its aging population and Europe suffers from the uncertainties related to“Brexit.” In our view, the US and European Union should ultimately avoid recessions, but remain mired in a relatively weak economic expansion. We expect the Fed to continue modestly increasing rates in 2017, prompting central banks in emerging markets to lower their rates as inflation falls. Elsewhere we predict the European Central Bank (“ECB”) and Bank of Japan should maintain their accommodative monetary policies. We believe we have passed peak global liquidity as central banks have pushed past negative interest rate policies to begin supporting government spending.

The tides of deregulation continued shifting in 2016, and nationalism and populism gained ground. Given the results from the November elections in the US and significant upcoming elections in Europe, politics should remain a key investment consideration. We also believe that monetary policy will become more political. As to where governments will spend the money their central banks print, we believe domestic infrastructure and defense spending will be the focus of many countries in the coming years.

Against this backdrop, we believe markets are increasingly susceptible to volatility as politics, geopolitics, divergent monetary policies and internal market structures all converge and evolve. We believe that navigating this sea of uncertainty requires a clear direction and an active management approach, with investors staying agile in their asset allocations, confident in their processes and thorough in their research.

On behalf of Allianz Global Investors U.S. LLC and NFJ Investment Group LLC, the sub-adviser to certain funds, thank you for investing with us. We encourage you to consult with your financial advisor and to visit our website, us.allianzgi.com, for additional information. We remain dedicated to serving your investment needs.

Sincerely,

Thomas J. Fuccillo

President & Chief Executive Officer

Past performance is no guarantee of future results. Unless otherwise noted, index returns reflect the reinvestment of income dividends and capital gains, if any, but do not reflect fees, brokerage commissions or other expenses of investing. It is not possible to invest directly in an index.

Receive this report electronically and eliminate paper mailings.

To enroll, go to http://us.allianzgi.com/edelivery.

| Semiannual Report | | March 31, 2017 | 3 |

Table of Contents

Unaudited

For the period of October 1, 2016 through March 31, 2017, as provided by the Multi-Asset US Group.

Fund Insights

For the six-month period ended March 31, 2017, Class A shares at net asset value (“NAV”) of the AllianzGI Target-Date Funds (the “Funds”) returned between 2.82% and 8.15% with longer dated Funds posting more favorable results. In terms of relative performance, all strategies outperformed their respective benchmarks (Morningstar Lifetime Moderate series) for the six-month period.

Market Overview

For the six-month period ending March 31, 2017, markets were dominated by the surprising outcome of the US presidential election relative to prevailing market expectations. The Trump victory ushered in a period of uncertainty regarding the magnitude and timing of future policy changes at the same time that it seemed to instill general optimism in market participants. The theme of reflation against the backdrop of supportive fiscal policy and stronger consumer demand percolated through markets for the period.

Throughout the first quarter, risk assets continued to outperform in a low volatility environment despite significant policy setbacks (including the failure to pass healthcare reform) and continued uncertainty about the future of US domestic and foreign policy. Moreover, global risk assets rallied in the context of the US Federal Reserve (the ‘‘Fed’’) hiking interest rates by 50 basis points in the period. Tighter Fed policy signaled a new regime of tighter global monetary policy in the future (even if the European Central Bank and Bank of Japan reiterated their current commitments to accommodative policies).

During the period, US stocks rallied in the aftermath of the election and continued to gain throughout the first quarter with US Small Cap stocks in particular leading the way: The Russell 2000 Index gained 11.5% and the Russell 2000 Value Index gained 13.9% outpacing larger stocks, which gained 10.1%, as measured by the Russell 1000 Index.

Global growth remained healthy as fundamental macro-economic data continued to either match or outperform economists’ expectations. During the first quarter, the gap between hard data and soft data, as measured by surveys of purchasing managers and consumers, widened substantially, revealing that much of what underpinned the rally in risk assets was associated with future expectations (as opposed to the current economic environment alone).

Optimistic assessments of global growth affected both developed and emerging markets: In broad terms, the MSCI All Country World Index returned 8.2% only slightly outpacing Emerging Markets, which returned 6.8%. Better economic data helped boost European equities for the period, despite persistent uncertainties about key elections in 2017 (in the Netherlands, France and Germany). For the period, the best performing stock markets were Spain and Italy, which returned 17.3% and 17.6% respectively (MSCI country indexes in USD).

Global Bonds declined for the period with the Bloomberg Barclays Global Aggregate Bond Index losing 5.4%. The long end of the US curve had the worst performance as long Treasuries (20+ years) lost 10.9% in the period due in part to a sharp initial increase in inflation expectations and a spike in yields. While the 10-year yield on US Treasuries initially increased by about 75 basis points from the election through mid-December, it remained relatively range bound for most of the first quarter, making US Treasuries one of the worst performing asset classes for the period. The Bloomberg Barclays US Aggregate Bond Index lost 2.2% for the period. Within fixed income, US High Yield was the best performer. Globally, Emerging Market hard currency debt outperformed developed market government bonds. Commodities, most notably precious metals and gold, were among the worst performing asset classes in the period.

Portfolio Review

Overweight positions to global equities provided tailwinds to performance, which were expressed by allocations to AllianzGI Global Dynamic Allocation and equity products featuring the Best Styles investment process. A strategic exposure to minimum volatility during the period was a detractor, as markets shifted to a risk-on environment following the US elections. The strategies benefited from below benchmark duration as yields rose in anticipation of a reflationary environment following the US election. Results further benefited from an overweight to corporate debt in the fixed income portion of the portfolio, as companies benefited from the anticipated fiscal reforms and improved global growth prospects.

At the end of the period, the portfolio maintained an underweight position in US government bonds (duration weighted) and an overweight to global equities including Emerging Markets, against a backdrop of favorable trend and fundamental views across risk assets.

Outlook

Looking ahead, we expect that global inflation will continue to steadily rise, in part attributable to firmer commodity prices and narrowing output gaps throughout developed markets. Emerging markets are expected to continue to post solid growth in the near term, providing opportunities for much needed structural reforms that will ultimately contribute to longer term stability. We expect the global economy will likely continue to benefit from debt-financed growth for the foreseeable future on the back of leveraged households and businesses. We expect monetary policy to continue to tighten in the US, albeit at a slow and measured pace, while global central bank liquidity will remain abundant at least through 2018.

However, risks abound, including increased political risks, most notably in Europe in light of the busy election calendar but also in key emerging markets. In addition, we believe charged rhetoric about protectionism and zero-sum interactions threaten to undermine longstanding commitments to global trade in goods and financial assets. Finally, we believe risks related to inflated expectations on the part of market participants as well as market complacency may potentially intensify should stocks reverse their recent rally.

| 4 | March 31, 2017 | | Semiannual Report |

Table of Contents

Unaudited

AllianzGI Target-Date Funds (cont’d)

As of the end of the period, we expect to remain overweight risk assets and underweight most sovereign bonds with the idea in mind that sovereigns are nearing the end of a secular bull market. We believe the reflationary economic environment persists for now as long as the possibility of US Fiscal stimulus remains and cyclical data continue to show signs of improvement. We maintain a positive outlook on emerging markets while recognizing that an unexpected slowdown in the US or other developed markets would have real and immediate implication for EM broadly. We remain vigilant in this low volatility environment and are focused on monitoring cyclical data and relative valuations across asset classes.

* The “Target-Date Funds” are the AllianzGI Retirement 2020 Fund, the AllianzGI Retirement 2025 Fund, the AllianzGI Retirement 2030 Fund, the AllianzGI Retirement 2035 Fund, the AllianzGI Retirement 2040 Fund, the AllianzGI Retirement 2045 Fund, the AllianzGI Retirement 2050 Fund, and the AllianzGI Retirement 2055 Fund.

Certain changes to the Target Date Funds’ investment strategy, benchmarks and portfolio management team became effective on October 1, 2016. Please see the prospectus for complete details.

| Semiannual Report | | March 31, 2017 | 5 |

Table of Contents

Unaudited

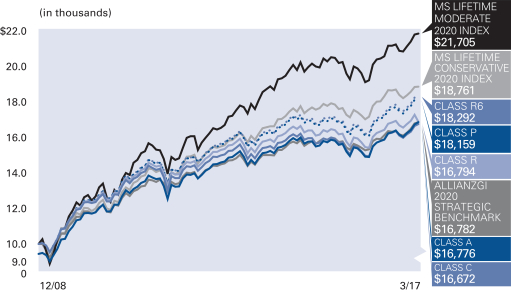

AllianzGI Retirement 2020 Fund

Average Annual Total Return for the period ended March 31, 2017

| 6 Month** | 1 Year | 5 Year | Since Inception† | |||||||||||||||

| AllianzGI Retirement 2020 Fund Class A | 2.82% | 8.72% | 3.93% | 7.20% | ||||||||||||||

|

|

AllianzGI Retirement 2020 Fund Class A (adjusted) | –2.83% | 2.74% | 2.76% | 6.47% | |||||||||||||

| AllianzGI Retirement 2020 Fund Class C | 2.43% | 7.91% | 3.14% | 6.39% | ||||||||||||||

|

|

AllianzGI Retirement 2020 Fund Class C (adjusted) | 1.43% | 6.91% | 3.14% | 6.39% | |||||||||||||

|

|

AllianzGI Retirement 2020 Fund Class R | –0.37% | 5.22% | 2.96% | 6.48% | |||||||||||||

|

|

AllianzGI Retirement 2020 Fund Class P | 2.95% | 9.08% | 4.24% | 7.50% | |||||||||||||

|

|

AllianzGI Retirement 2020 Fund Class R6 | 3.02% | 9.14% | 4.33% | 7.59% | |||||||||||||

| AllianzGI Retirement 2020 Fund Administrative Class | 2.84% | 8.76% | 3.97% | 7.25% | ||||||||||||||

|

|

Morningstar Lifetime Moderate 2020 Index* | 2.81% | 8.60% | 6.30% | 9.85% | |||||||||||||

|

|

AllianzGI 2020 Strategic Benchmark* | 2.93% | 6.74% | 3.81% | 6.48% | |||||||||||||

|

|

Morningstar Lifetime Conservative 2020 Index | 0.90% | 6.04% | 4.76% | 7.92% | |||||||||||||

| Lipper Mixed-Asset Target 2020 Funds Average | 3.07% | 8.24% | 5.57% | 8.60% | ||||||||||||||

† The Fund began operations on December 29, 2008. Benchmark return comparisons began on the fund inception date. Lipper performance comparisons began on December 31, 2008.

* The Morningstar Lifetime Moderate series replaced the Morningstar Lifetime Conservative series as the Target Date Funds’ primary benchmark, and the AllianzGI Strategic Benchmark replaced the Real Return Target series (white label) as the Target Date Funds’ secondary benchmark as of October 1, 2016 in connection with certain changes to the Target Date Funds’ investment strategies that took effect on October 1, 2016.

** Cumulative returns.

Performance quoted represents past performance and is no guarantee of future results. Current performance may be lower or higher than performance shown. For performance current to the most recent month-end, visit our website at us.allianzgi.com. Investment return and the principal value will fluctuate. Shares may be worth more or less than original cost when redeemed. The adjusted returns take into account the maximum initial sales charge of 5.50% on Class A shares and the contingent deferred sales charge (CDSC) of 1% on Class C shares, which may apply to shares redeemed during the first year of ownership. Returns do not reflect deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares. See pages 133 and 134 for more information. The Fund’s gross expense ratios are 1.26% for Class A shares, 2.01% for Class C shares, 1.51% for Class R shares, 0.86% for Class P shares, 0.76% for Class R6 shares, and 1.11% for Administrative Class shares. These ratios do not include an expense reduction, contractually guaranteed through at least January 31, 2020. The Fund’s expense ratios net of this reduction are 0.95% for Class A shares, 1.70% for Class C shares, 1.30% for Class R shares, 0.65% for Class P shares, 0.55% for Class R6 shares and 0.90% for Administrative Class shares. Expense ratio information is as of the Fund’s current prospectus dated February 1, 2017, as revised April 10, 2017.

| 6 | March 31, 2017 | | Semiannual Report |

Table of Contents

Unaudited

AllianzGI Retirement 2020 Fund (cont’d)

| Shareholder Expense Example | Actual Performance | |||||||||||

| Class A | Class C | Class R | Class P | Class R6 | Administrative Class | |||||||

| Beginning Account Value (10/1/16) | $1,000.00 | $1,000.00 | $1,000.00 | $1,000.00 | $1,000.00 | $1,000.00 | ||||||

| Ending Account Value (3/31/17) | $1,028.20 | $1,024.30 | $996.30 | $1,029.50 | $1,030.20 | $1,028.40 | ||||||

| Expenses Paid During Period | $1.87 | $5.65 | $3.58 | $0.35 | $— | $1.62 | ||||||

| Hypothetical Performance | ||||||||||||

| (5% return before expenses) | ||||||||||||

| Class A | Class C | Class R | Class P | Class R6 | Administrative Class | |||||||

| Beginning Account Value (10/1/16) | $1,000.00 | $1,000.00 | $1,000.00 | $1,000.00 | $1,000.00 | $1,000.00 | ||||||

| Ending Account Value (3/31/17) | $1,023.09 | $1,019.35 | $1,021.34 | $1,024.58 | $1,024.93 | $1,023.34 | ||||||

| Expenses Paid During Period | $1.87 | $5.64 | $3.63 | $0.35 | $— | $1.61 | ||||||

For each class of the Fund, expenses (net of fee waiver and reimbursement, if any) are equal to the annualized expense ratio for the class (0.37% for Class A, 1.12% for Class C, 0.72% for Class R, 0.07% for Class P, 0.00% for Class R6 and 0.32% for Administrative Class), multiplied by the average account value over the period, multiplied by 182/365. These expenses do not include the expenses of the investment companies in which the Fund invests, which are indirectly borne by Fund shareholders.

| Semiannual Report | | March 31, 2017 | 7 |

Table of Contents

Unaudited

AllianzGI Retirement 2025 Fund

Average Annual Total Return for the period ended March 31, 2017

| 6 Month** | 1 Year | 5 Year | Since Inception† | |||||||||||||||

| AllianzGI Retirement 2025 Fund Class A | 4.15% | 10.40% | 4.40% | 5.44% | ||||||||||||||

|

|

AllianzGI Retirement 2025 Fund Class A (adjusted) | –1.58% | 4.33% | 3.22% | 4.32% | |||||||||||||

|

|

AllianzGI Retirement 2025 Fund Class R | 3.90% | 9.96% | 4.02% | 5.05% | |||||||||||||

|

|

AllianzGI Retirement 2025 Fund Class P | 4.30% | 10.74% | 4.71% | 5.75% | |||||||||||||

|

|

AllianzGI Retirement 2025 Fund Class R6 | 4.37% | 10.87% | 4.81% | 5.85% | |||||||||||||

| AllianzGI Retirement 2025 Fund Administrative Class | 4.18% | 10.42% | 4.43% | 5.47% | ||||||||||||||

|

|

Morningstar Lifetime Moderate 2025 Index* | 3.75% | 10.09% | 7.15% | 9.23% | |||||||||||||

|

|

AllianzGI 2025 Strategic Benchmark* | 4.27% | 8.50% | 4.43% | 5.51% | |||||||||||||

|

|

Morningstar Lifetime Conservative 2025 Index | 1.42% | 7.02% | 5.42% | 6.95% | |||||||||||||

| Lipper Mixed-Asset Target 2025 Fundw Average | 4.17% | 9.79% | 6.77% | 8.13% | ||||||||||||||

† The Fund began operations on December 19, 2011. Benchmark return comparisons began on the fund inception date. Lipper performance comparisons began on December 31, 2011.

* The Morningstar Lifetime Moderate series replaced the Morningstar Lifetime Conservative series as the Target Date Funds’ primary benchmark, and the AllianzGI Strategic Benchmark replaced the Real Return Target series (white label) as the Target Date Funds’ secondary benchmark as of October 1, 2016 in connection with certain changes to the Target Date Funds’ investment strategies that took effect on October 1, 2016.

** Cumulative returns.

Performance quoted represents past performance and is no guarantee of future results. Current performance may be lower or higher than performance shown. For performance current to the most recent month-end, visit our website at us.allianzgi.com. Investment return and the principal value will fluctuate. Shares may be worth more or less than original cost when redeemed. The adjusted returns take into account the maximum initial sales charge of 5.50% on Class A shares. Returns do not reflect deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares. See pages 133 and 134 for more information. The Fund’s gross expense ratios are 1.29% for Class A shares, 1.54% for Class R shares, 0.89% for Class P shares, 0.79% for Class R6 shares and 1.14% for Administrative Class Shares. These ratios do not include an expense reduction, contractually guaranteed through at least January 31, 2020. The Fund’s expense ratios net of this reduction are 0.95% for Class A shares, 1.30% for Class R shares, 0.65% for Class P shares, 0.55% for Class R6 shares and 0.90% for Administrative Class shares. Expense ratio information is as of the Fund’s current prospectus dated February 1, 2017, as revised April 10, 2017.

| 8 | March 31, 2017 | | Semiannual Report |

Table of Contents

Unaudited

AllianzGI Retirement 2025 Fund (cont’d)

| Shareholder Expense Example | Actual Performance | |||||||||

| Class A | Class R | Class P | Class R6 | Administrative Class | ||||||

| Beginning Account Value (10/1/16) | $1,000.00 | $1,000.00 | $1,000.00 | $1,000.00 | $1,000.00 | |||||

| Ending Account Value (3/31/17) | $1,041.50 | $1,039.00 | $1,043.00 | $1,043.70 | $1,041.80 | |||||

| Expenses Paid During Period | $1.73 | $3.51 | $0.20 | $— | $1.48 | |||||

| Hypothetical Performance | ||||||||||

| (5% return before expenses) | ||||||||||

| Class A | Class R | Class P | Class R6 | Administrative Class | ||||||

| Beginning Account Value (10/1/16) | $1,000.00 | $1,000.00 | $1,000.00 | $1,000.00 | $1,000.00 | |||||

| Ending Account Value (3/31/17) | $1,023.24 | $1,021.49 | $1,024.73 | $1,024.93 | $1,023.49 | |||||

| Expenses Paid During Period | $1.72 | $3.48 | $0.20 | $— | $1.46 | |||||

For each class of the Fund, expenses (net of fee waiver and reimbursement, if any) are equal to the annualized expense ratio for the class (0.34% for Class A, 0.69% for Class R, 0.04% for Class P, 0.00% for Class R6 and 0.29% for Administrative Class), multiplied by the average account value over the period, multiplied by 182/365. These expenses do not include the expenses of the investment companies in which the Fund invests, which are indirectly borne by Fund shareholders.

| Semiannual Report | | March 31, 2017 | 9 |

Table of Contents

Unaudited

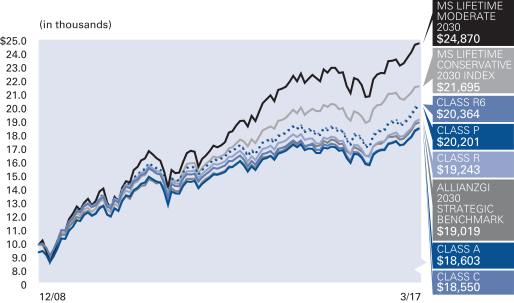

AllianzGI Retirement 2030 Fund

Average Annual Total Return for the period ended March 31, 2017

| 6 Month** | 1 Year | 5 Year | Since Inception† | |||||||||||||||

| AllianzGI Retirement 2030 Fund Class A | 5.52% | 11.79% | 4.89% | 8.55% | ||||||||||||||

|

|

AllianzGI Retirement 2030 Fund Class A (adjusted) | –0.29% | 5.65% | 3.71% | 7.81% | |||||||||||||

| AllianzGI Retirement 2030 Fund Class C | 5.05% | 10.94% | 4.10% | 7.78% | ||||||||||||||

|

|

AllianzGI Retirement 2030 Fund Class C (adjusted) | 4.05% | 9.94% | 4.10% | 7.78% | |||||||||||||

|

|

AllianzGI Retirement 2030 Fund Class R | 5.30% | 11.39% | 4.52% | 8.25% | |||||||||||||

|

|

AllianzGI Retirement 2030 Fund Class P | 5.64% | 12.17% | 5.21% | 8.89% | |||||||||||||

|

|

AllianzGI Retirement 2030 Fund Class R6 | 5.70% | 12.28% | 5.31% | 9.00% | |||||||||||||

| AllianzGI Retirement 2030 Fund Administrative Class | 5.53% | 11.86% | 4.95% | 8.65% | ||||||||||||||

|

|

Morningstar Lifetime Moderate 2030 Index* | 5.00% | 11.95% | 8.00% | 11.67% | |||||||||||||

|

|

AllianzGI 2030 Strategic Benchmark* | 5.45% | 10.23% | 5.07% | 8.11% | |||||||||||||

|

|

Morningstar Lifetime Conservative 2030 Index | 2.30% | 8.43% | 6.25% | 9.84% | |||||||||||||

| Lipper Mixed-Asset Target 2030 Funds Average | 5.05% | 11.36% | 7.09% | 10.20% | ||||||||||||||

† The Fund began operations on December 29, 2008. Benchmark return comparisons began on the fund inception date. Lipper performance comparisons began on December 31, 2008.

* The Morningstar Lifetime Moderate series replaced the Morningstar Lifetime Conservative series as the Target Date Funds’ primary benchmark, and the AllianzGI Strategic Benchmark replaced the Real Return Target series (white label) as the Target Date Funds’ secondary benchmark as of October 1, 2016 in connection with certain changes to the Target Date Funds’ investment strategies that took effect on October 1, 2016.

** Cumulative returns.

Performance quoted represents past performance and is no guarantee of future results. Current performance may be lower or higher than performance shown. For performance current to the most recent month-end, visit our website at us.allianzgi.com. Investment return and the principal value will fluctuate. Shares may be worth more or less than original cost when redeemed. The adjusted returns take into account the maximum initial sales charge of 5.50% on Class A shares and the contingent deferred sales charge (CDSC) of 1% on Class C shares, which may apply to shares redeemed during the first year of ownership. Returns do not reflect deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares. See pages 133 and 134 for more information. The Fund’s gross expense ratios are 1.24% for Class A shares, 1.99% for Class C shares, 1.49% for Class R shares, 0.84% for Class P shares, 0.74% for Class R6 shares and 1.09% for Administrative Class shares. These ratios do not include an expense reduction, contractually guaranteed through at least January 31, 2020. The Fund’s expense ratios net of this reduction are 0.95% for Class A shares, 1.70% for Class C shares, 1.30% for Class R shares, 0.65% for Class P shares, 0.55% for Class R6 shares and 0.90% for Administrative Class shares. Expense ratio information is as of the Fund’s current prospectus dated February 1, 2017, as revised April 10, 2017.

| 10 | March 31, 2017 | | Semiannual Report |

Table of Contents

Unaudited

AllianzGI Retirement 2030 Fund (cont’d)

| Shareholder Expense Example | Actual Performance | |||||||||||

| Class A | Class C | Class R | Class P | Class R6 | Administrative Class | |||||||

| Beginning Account Value (10/1/16) | $1,000.00 | $1,000.00 | $1,000.00 | $1,000.00 | $1,000.00 | $1,000.00 | ||||||

| Ending Account Value (3/31/17) | $1,055.20 | $1,050.50 | $1,053.00 | $1,056.40 | $1,057.00 | $1,055.30 | ||||||

| Expenses Paid During Period | $1.79 | $5.62 | $3.58 | $0.26 | $— | $1.54 | ||||||

| Hypothetical Performance | ||||||||||||

| (5% return before expenses) | ||||||||||||

| Class A | Class C | Class R | Class P | Class R6 | Administrative Class | |||||||

| Beginning Account Value (10/1/16) | $1,000.00 | $1,000.00 | $1,000.00 | $1,000.00 | $1,000.00 | $1,000.00 | ||||||

| Ending Account Value (3/31/17) | $1,023.19 | $1,019.45 | $1,021.44 | $1,024.68 | $1,024.93 | $1,023.44 | ||||||

| Expenses Paid During Period | $1.77 | $5.54 | $3.53 | $0.25 | $— | $1.51 | ||||||

For each class of the Fund, expenses (net of fee waiver and reimbursement, if any) are equal to the annualized expense ratio for the class (0.35% for Class A, 1.10% for Class C, 0.70% for Class R, 0.05% for Class P, 0.00% for Class R6 and 0.30% for Administrative Class), multiplied by the average account value over the period, multiplied by 182/365. These expenses do not include the expenses of the investment companies in which the Fund invests, which are indirectly borne by Fund shareholders.

| Semiannual Report | | March 31, 2017 | 11 |

Table of Contents

Unaudited

AllianzGI Retirement 2035 Fund

Average Annual Total Return for the period ended March 31, 2017

| 6 Month** | 1 Year | 5 Year | Since Inception† | |||||||||||||||

| AllianzGI Retirement 2035 Fund Class A | 6.82% | 13.15% | 5.50% | 7.13% | ||||||||||||||

|

|

AllianzGI Retirement 2035 Fund Class A (adjusted) | 0.94% | 6.93% | 4.32% | 5.99% | |||||||||||||

|

|

AllianzGI Retirement 2035 Fund Class R | 6.62% | 12.69% | 5.13% | 6.76% | |||||||||||||

|

|

AllianzGI Retirement 2035 Fund Class P | 7.04% | 13.54% | 5.83% | 7.47% | |||||||||||||

|

|

AllianzGI Retirement 2035 Fund Class R6 | 7.03% | 13.58% | 5.93% | 7.56% | |||||||||||||

| AllianzGI Retirement 2035 Fund Administrative Class | 6.86% | 13.23% | 5.55% | 7.19% | ||||||||||||||

|

|

Morningstar Lifetime Moderate 2035 Index* | 6.23% | 13.71% | 8.61% | 11.07% | |||||||||||||

|

|

AllianzGI 2035 Strategic Benchmark* | 6.56% | 11.92% | 5.69% | 7.52% | |||||||||||||

|

|

Morningstar Lifetime Conservative 2035 Index | 3.55% | 10.29% | 7.13% | 9.21% | |||||||||||||

| Lipper Mixed-Asset Target 2035 Funds Average | 6.16% | 12.75% | 7.90% | 9.56% | ||||||||||||||

† The Fund began operations on December 19, 2011. Benchmark return comparisons began on the fund inception date. Lipper performance comparisons began on December 31, 2011.

* The Morningstar Lifetime Moderate series replaced the Morningstar Lifetime Conservative series as the Target Date Funds’ primary benchmark, and the AllianzGI Strategic Benchmark replaced the Real Return Target series (white label) as the Target Date Funds’ secondary benchmark as of October 1, 2016 in connection with certain changes to the Target Date Funds’ investment strategies that took effect on October 1, 2016.

** Cumulative returns.

Performance quoted represents past performance and is no guarantee of future results. Current performance may be lower or higher than performance shown. For performance current to the most recent month-end, visit our website at us.allianzgi.com. Investment return and the principal value will fluctuate. Shares may be worth more or less than original cost when redeemed. The adjusted returns take into account the maximum initial sales charge of 5.50% on Class A shares. Returns do not reflect deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares. See pages 133 and 134 for more information. The Fund’s gross expense ratios are 1.16% for Class A shares, 1.41% for Class R shares, 0.76% for Class P shares, 0.66% for Class R6 shares and 1.01% for Administrative Class shares. These ratios do not include an expense reduction, contractually guaranteed through at least January 31, 2020. The Fund’s expense ratios net of this reduction are 0.95% for Class A shares, 1.30% for Class R shares, 0.65% for Class P shares, 0.55% for Class R6 shares and 0.90% for Administrative Class shares. Expense ratio information is as of the Fund’s current prospectus dated February 1, 2017, as revised April 10, 2017.

| 12 | March 31, 2017 | | Semiannual Report |

Table of Contents

Unaudited

AllianzGI Retirement 2035 Fund (cont’d)

| Shareholder Expense Example | Actual Performance | |||||||||

| Class A | Class R | Class P | Class R6 | Administrative Class | ||||||

| Beginning Account Value (10/1/16) | $1,000.00 | $1,000.00 | $1,000.00 | $1,000.00 | $1,000.00 | |||||

| Ending Account Value (3/31/17) | $1,068.20 | $1,066.20 | $1,070.40 | $1,070.30 | $1,068.60 | |||||

| Expenses Paid During Period | $2.17 | $3.97 | $0.62 | $0.10 | $1.91 | |||||

| Hypothetical Performance | ||||||||||

| (5% return before expenses) | ||||||||||

| Class A | Class R | Class P | Class R6 | Administrative Class | ||||||

| Beginning Account Value (10/1/16) | $1,000.00 | $1,000.00 | $1,000.00 | $1,000.00 | $1,000.00 | |||||

| Ending Account Value (3/31/17) | $1,022.84 | $1,021.09 | $1,024.33 | $1,024.83 | $1,023.09 | |||||

| Expenses Paid During Period | $2.12 | $3.88 | $0.61 | $0.10 | $1.87 | |||||

For each class of the Fund, expenses (net of fee waiver and reimbursement, if any) are equal to the annualized expense ratio for the class (0.42% for Class A, 0.77% for Class R, 0.12% for Class P, 0.02% for Class R6 and 0.37% for Administrative Class), multiplied by the average account value over the period, multiplied by 182/365. These expenses do not include the expenses of the investment companies in which the Fund invests, which are indirectly borne by Fund shareholders.

| Semiannual Report | | March 31, 2017 | 13 |

Table of Contents

Unaudited

AllianzGI Retirement 2040 Fund

Average Annual Total Return for the period ended March 31, 2017

| 6 Month** | 1 Year | 5 Year | Since Inception† | |||||||||||||||

| AllianzGI Retirement 2040 Fund Class A | 7.55% | 13.88% | 5.83% | 9.83% | ||||||||||||||

|

|

AllianzGI Retirement 2040 Fund Class A (adjusted) | 1.64% | 7.62% | 4.64% | 9.08% | |||||||||||||

| AllianzGI Retirement 2040 Fund Class C | 7.19% | 13.08% | 5.06% | 9.00% | ||||||||||||||

|

|

AllianzGI Retirement 2040 Fund Class C (adjusted) | 6.19% | 12.08% | 5.06% | 9.00% | |||||||||||||

|

|

AllianzGI Retirement 2040 Fund Class R | 7.40% | 13.53% | 5.49% | 9.49% | |||||||||||||

|

|

AllianzGI Retirement 2040 Fund Class P | 7.80% | 14.25% | 6.17% | 10.14% | |||||||||||||

|

|

AllianzGI Retirement 2040 Fund Class R6 | 7.82% | 14.33% | 6.26% | 10.23% | |||||||||||||

| AllianzGI Retirement 2040 Fund Administrative Class | 7.61% | 13.92% | 5.88% | 9.88% | ||||||||||||||

|

|

Morningstar Lifetime Moderate 2040 Index* | 7.05% | 14.90% | 8.88% | 12.43% | |||||||||||||

|

|

AllianzGI 2040 Strategic Benchmark* | 7.32% | 13.40% | 6.16% | 9.35% | |||||||||||||

|

|

Morningstar Lifetime Conservative 2040 Index | 4.89% | 12.19% | 7.84% | 11.40% | |||||||||||||

| Lipper Mixed-Asset Target 2040 Funds Average | 6.49% | 13.47% | 7.92% | 10.95% | ||||||||||||||

† The Fund began operations on December 29, 2008. Benchmark return comparisons began on the fund inception date. Lipper performance comparisons began on December 31, 2008.

* The Morningstar Lifetime Moderate series replaced the Morningstar Lifetime Conservative series as the Target Date Funds’ primary benchmark, and the AllianzGI Strategic Benchmark replaced the Real Return Target series (white label) as the Target Date Funds’ secondary benchmark as of October 1, 2016 in connection with certain changes to the Target Date Funds’ investment strategies that took effect on October 1, 2016.

** Cumulative returns.

Performance quoted represents past performance and is no guarantee of future results. Current performance may be lower or higher than performance shown. For performance current to the most recent month-end, visit our website at us.allianzgi.com. Investment return and the principal value will fluctuate. Shares may be worth more or less than original cost when redeemed. The adjusted returns take into account the maximum initial sales charge of 5.50% on Class A shares and the contingent deferred sales charge (CDSC) of 1% on Class C shares, which may apply to shares redeemed during the first year of ownership. Returns do not reflect deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares. See pages 133 and 134 for more information. The Fund’s gross expense ratios are 1.11% for Class A shares, 1.86% for Class C shares, 1.36% for Class R shares, 0.71% for Class P shares, 0.61% for Class R6 shares and 0.96% for Administrative Class shares. These ratios do not include an expense reduction, contractually guaranteed through at least January 31, 2020. The Fund’s expense ratios net of this reduction are 0.95% for Class A shares, 1.70% for Class C shares, 1.30% for Class R shares, 0.65% for Class P shares, 0.55% for Class R6 shares and 0.90% for Administrative Class shares. Expense ratio information is as of the Fund’s current prospectus dated February 1, 2017, as revised April 10, 2017.

| 14 | March 31, 2017 | | Semiannual Report |

Table of Contents

Unaudited

AllianzGI Retirement 2040 Fund (cont’d)

| Shareholder Expense Example | Actual Performance | |||||||||||

| Class A | Class C | Class R | Class P | Class R6 | Administrative Class | |||||||

| Beginning Account Value (10/1/16) | $1,000.00 | $1,000.00 | $1,000.00 | $1,000.00 | $1,000.00 | $1,000.00 | ||||||

| Ending Account Value (3/31/17) | $1,075.50 | $1,071.90 | $1,074.00 | $1,078.00 | $1,078.20 | $1,076.10 | ||||||

| Expenses Paid During Period | $2.43 | $6.30 | $4.24 | $0.88 | $0.36 | $2.17 | ||||||

| Hypothetical Performance | ||||||||||||

| (5% return before expenses) | ||||||||||||

| Class A | Class C | Class R | Class P | Class R6 | Administrative Class | |||||||

| Beginning Account Value (10/1/16) | $1,000.00 | $1,000.00 | $1,000.00 | $1,000.00 | $1,000.00 | $1,000.00 | ||||||

| Ending Account Value (3/31/17) | $1,022.59 | $1,018.85 | $1,020.84 | $1,024.08 | $1,024.58 | $1,022.84 | ||||||

| Expenses Paid During Period | $2.37 | $6.14 | $4.13 | $0.86 | $0.35 | $2.12 | ||||||

For each class of the Fund, expenses (net of fee waiver and reimbursement, if any) are equal to the annualized expense ratio for the class (0.47% for Class A, 1.22% for Class C, 0.82% for Class R, 0.17% for Class P, 0.07% for Class R6 and 0.42% for Administrative Class), multiplied by the average account value over the period, multiplied by 182/365. These expenses do not include the expenses of the investment companies in which the Fund invests, which are indirectly borne by Fund shareholders.

| Semiannual Report | | March 31, 2017 | 15 |

Table of Contents

Unaudited

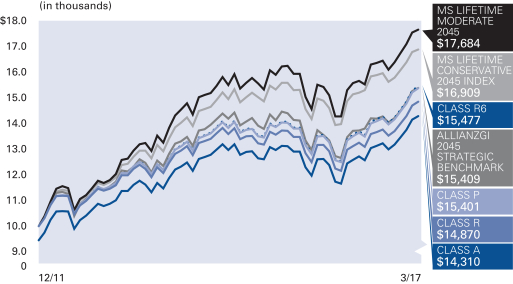

AllianzGI Retirement 2045 Fund

Average Annual Total Return for the period ended March 31, 2017

| 6 Month** | 1 Year | 5 Year | Since Inception† | |||||||||||||||

| AllianzGI Retirement 2045 Fund Class A | 8.06% | 14.86% | 6.22% | 8.17% | ||||||||||||||

|

|

AllianzGI Retirement 2045 Fund Class A (adjusted) | 2.12% | 8.55% | 5.03% | 7.02% | |||||||||||||

|

|

AllianzGI Retirement 2045 Fund Class R | 7.87% | 14.50% | 5.85% | 7.80% | |||||||||||||

|

|

AllianzGI Retirement 2045 Fund Class P | 8.27% | 15.31% | 6.55% | 8.52% | |||||||||||||

|

|

AllianzGI Retirement 2045 Fund Class R6 | 8.32% | 15.40% | 6.66% | 8.62% | |||||||||||||

| AllianzGI Retirement 2045 Fund Administrative Class | 8.07% | 14.92% | 6.25% | 8.20% | ||||||||||||||

|

|

Morningstar Lifetime Moderate 2045 Index* | 7.37% | 15.40% | 8.87% | 11.40% | |||||||||||||

|

|

AllianzGI 2045 Strategic Benchmark* | 7.74% | 14.27% | 6.33% | 8.53% | |||||||||||||

|

|

Morningstar Lifetime Conservative 2045 Index | 5.80% | 13.51% | 8.15% | 10.46% | |||||||||||||

| Lipper Mixed-Asset Target 2045 Funds Average | 7.02% | 13.99% | 8.43% | 10.32% | ||||||||||||||

† The Fund began operations on December 19, 2011. Benchmark return comparisons began on the fund inception date. Lipper performance comparisons began on December 31, 2011.

* The Morningstar Lifetime Moderate series replaced the Morningstar Lifetime Conservative series as the Target Date Funds’ primary benchmark, and the AllianzGI Strategic Benchmark replaced the Real Return Target series (white label) as the Target Date Funds’ secondary benchmark as of October 1, 2016 in connection with certain changes to the Target Date Funds’ investment strategies that took effect on October 1, 2016.

** Cumulative returns.

Performance quoted represents past performance and is no guarantee of future results. Current performance may be lower or higher than performance shown. For performance current to the most recent month-end, visit our website at us.allianzgi.com. Investment return and the principal value will fluctuate. Shares may be worth more or less than original cost when redeemed. The adjusted returns take into account the maximum initial sales charge of 5.50% on Class A shares. Returns do not reflect deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares. See pages 133 and 134 for more information. The Fund’s gross expense ratios are 1.08% for Class A shares, 1.33% for Class R shares, 0.68% for Class P shares, 0.58% for Class R6 shares and 0.93% for Administrative Class shares. These ratios do not include an expense reduction, contractually guaranteed through at least January 31, 2020. The Fund’s expense ratios net of this reduction are 0.95% for Class A shares, 1.30% for Class R shares, 0.65% for Class P shares, 0.55% for Class R6 shares and 0.90% for Administrative Class shares. Expense ratio information is as of the Fund’s current prospectus dated February 1, 2017, as revised April 10, 2017.

| 16 | March 31, 2017 | | Semiannual Report |

Table of Contents

Unaudited

AllianzGI Retirement 2045 Fund (cont’d)

| Shareholder Expense Example | Actual Performance | |||||||||

| Class A | Class R | Class P | Class R6 | Administrative Class | ||||||

| Beginning Account Value (10/1/16) | $1,000.00 | $1,000.00 | $1,000.00 | $1,000.00 | $1,000.00 | |||||

| Ending Account Value (3/31/17) | $1,080.60 | $1,078.70 | $1,082.70 | $1,083.20 | $1,080.70 | |||||

| Expenses Paid During Period | $2.54 | $4.35 | $0.99 | $0.47 | $2.28 | |||||

| Hypothetical Performance | ||||||||||

| (5% return before expenses) | ||||||||||

| Class A | Class R | Class P | Class R6 | Administrative Class | ||||||

| Beginning Account Value (10/1/16) | $1,000.00 | $1,000.00 | $1,000.00 | $1,000.00 | $1,000.00 | |||||

| Ending Account Value (3/31/17) | $1,022.49 | $1,020.74 | $1,023.98 | $1,024.48 | $1,022.74 | |||||

| Expenses Paid During Period | $2.47 | $4.23 | $0.96 | $0.45 | $2.22 | |||||

For each class of the Fund, expenses (net of fee waiver and reimbursement, if any) are equal to the annualized expense ratio for the class (0.49% for Class A, 0.84% for Class R, 0.19% for Class P, 0.09% for Class R6 and 0.44% for Administrative Class), multiplied by the average account value over the period, multiplied by 182/365. These expenses do not include the expenses of the investment companies in which the Fund invests, which are indirectly borne by Fund shareholders.

| Semiannual Report | | March 31, 2017 | 17 |

Table of Contents

Unaudited

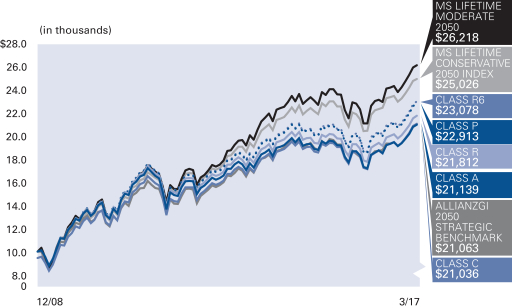

AllianzGI Retirement 2050 Fund

Average Annual Total Return for the period ended March 31, 2017

| 6 Month** | 1 Year | 5 Year | Since Inception† | |||||||||||||||

| AllianzGI Retirement 2050 Fund Class A | 8.15% | 14.96% | 6.25% | 10.24% | ||||||||||||||

|

|

AllianzGI Retirement 2050 Fund Class A (adjusted) | 2.20% | 8.64% | 5.06% | 9.49% | |||||||||||||

| AllianzGI Retirement 2050 Fund Class C | 7.75% | 14.15% | 5.44% | 9.43% | ||||||||||||||

|

|

AllianzGI Retirement 2050 Fund Class C (adjusted) | 6.75% | 13.15% | 5.44% | 9.43% | |||||||||||||

|

|

AllianzGI Retirement 2050 Fund Class R | 7.91% | 14.49% | 5.87% | 9.91% | |||||||||||||

|

|

AllianzGI Retirement 2050 Fund Class P | 8.32% | 15.36% | 6.57% | 10.56% | |||||||||||||

|

|

AllianzGI Retirement 2050 Fund Class R6 | 8.39% | 15.53% | 6.67% | 10.67% | |||||||||||||

| AllianzGI Retirement 2050 Fund Administrative Class | 8.22% | 15.11% | 6.30% | 10.32% | ||||||||||||||

|

|

Morningstar Lifetime Moderate 2050 Index* | 7.42% | 15.53% | 8.78% | 12.39% | |||||||||||||

|

|

AllianzGI 2050 Strategic Benchmark* | 7.87% | 14.51% | 6.35% | 9.45% | |||||||||||||

|

|

Morningstar Lifetime Conservative 2050 Index | 6.26% | 14.20% | 8.23% | 11.76% | |||||||||||||

| Lipper Mixed-Asset Target 2050 Funds Average | 6.90% | 14.17% | 8.29% | 11.15% | ||||||||||||||

† The Fund began operations on December 29, 2008. Benchmark return comparisons began on the fund inception date. Lipper performance comparisons began on December 31, 2008.

* The Morningstar Lifetime Moderate series replaced the Morningstar Lifetime Conservative series as the Target Date Funds’ primary benchmark, and the AllianzGI Strategic Benchmark replaced the Real Return Target series (white label) as the Target Date Funds’ secondary benchmark as of October 1, 2016 in connection with certain changes to the Target Date Funds’ investment strategies that took effect on October 1, 2016.

** Cumulative returns.

Performance quoted represents past performance and is no guarantee of future results. Current performance may be lower or higher than performance shown. For performance current to the most recent month-end, visit our website at us.allianzgi.com. Investment return and the principal value will fluctuate. Shares may be worth more or less than original cost when redeemed. The adjusted returns take into account the maximum initial sales charge of 5.50% on Class A shares and the contingent deferred sales charge (CDSC) of 1% on Class C shares, which may apply to shares redeemed during the first year of ownership. Returns do not reflect deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares. See pages 133 and 134 for more information. The Fund’s gross expense ratios are 1.07% for Class A shares, 1.82% for Class C shares, 1.32% for Class R shares, 0.67% for Class P shares, 0.57% for Class R6 shares and 0.92% for Administrative Class shares. These ratios do not include an expense reduction, contractually guaranteed through at least January 31, 2020. The Fund’s expense ratios net of this reduction are 0.95% for Class A shares, 1.70% for Class C shares, 1.30% for Class R shares, 0.65% for Class P shares, 0.55% for Class R6 shares and 0.90% for Administrative Class shares. Expense ratio information is as of the Fund’s current prospectus dated February 1, 2017, as revised April 10, 2017.

| 18 | March 31, 2017 | | Semiannual Report |

Table of Contents

Unaudited

AllianzGI Retirement 2050 Fund (cont’d)

| Shareholder Expense Example | Actual Performance | |||||||||||

| Class A | Class C | Class R | Class P | Class R6 | Administrative Class | |||||||

| Beginning Account Value (10/1/16) | $1,000.00 | $1,000.00 | $1,000.00 | $1,000.00 | $1,000.00 | $1,000.00 | ||||||

| Ending Account Value (3/31/17) | $1,081.50 | $1,077.50 | $1,079.10 | $1,083.20 | $1,083.90 | $1,082.20 | ||||||

| Expenses Paid During Period | $2.59 | $6.47 | $4.41 | $1.04 | $0.52 | $2.34 | ||||||

| Hypothetical Performance | ||||||||||||

| (5% return before expenses) | ||||||||||||

| Class A | Class C | Class R | Class P | Class R6 | Administrative Class | |||||||

| Beginning Account Value (10/1/16) | $1,000.00 | $1,000.00 | $1,000.00 | $1,000.00 | $1,000.00 | $1,000.00 | ||||||

| Ending Account Value (3/31/17) | $1,022.44 | $1,018.70 | $1,020.69 | $1,023.93 | $1,024.43 | $1,022.69 | ||||||

| Expenses Paid During Period | $2.52 | $6.29 | $4.28 | $1.01 | $0.50 | $2.27 | ||||||

For each class of the Fund, expenses (net of fee waiver and reimbursement, if any) are equal to the annualized expense ratio for the class (0.50% for Class A, 1.25% for Class C, 0.85% for Class R, 0.20% for Class P, 0.10% for Class R6 and 0.45% for Administrative Class), multiplied by the average account value over the period, multiplied by 182/365. These expenses do not include the expenses of the investment companies in which the Fund invests, which are indirectly borne by Fund shareholders.

| Semiannual Report | | March 31, 2017 | 19 |

Table of Contents

Unaudited

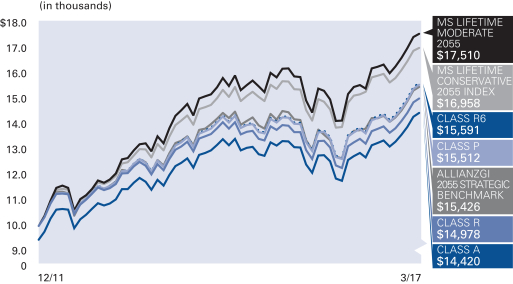

AllianzGI Retirement 2055 Fund

Average Annual Total Return for the period ended March 31, 2017

| 6 Month** | 1 Year | 5 Year | Since Inception† | |||||||||||||||

| AllianzGI Retirement 2055 Fund Class A | 8.09% | 14.64% | 6.24% | 8.33% | ||||||||||||||

|

|

AllianzGI Retirement 2055 Fund Class A (adjusted) | 2.15% | 8.33% | 5.04% | 7.17% | |||||||||||||

|

|

AllianzGI Retirement 2055 Fund Class R | 7.88% | 14.24% | 5.88% | 7.96% | |||||||||||||

|

|

AllianzGI Retirement 2055 Fund Class P | 8.26% | 15.03% | 6.58% | 8.67% | |||||||||||||

|

|

AllianzGI Retirement 2055 Fund Class R6 | 8.35% | 15.10% | 6.66% | 8.76% | |||||||||||||

| AllianzGI Retirement 2055 Fund Administrative Class | 8.15% | 14.75% | 6.29% | 8.37% | ||||||||||||||

|

|

Morningstar Lifetime Moderate 2055 Index* | 7.40% | 15.57% | 8.65% | 11.19% | |||||||||||||

|

|

AllianzGI 2055 Strategic Benchmark* | 7.87% | 14.51% | 6.35% | 8.55% | |||||||||||||

|

|

Morningstar Lifetime Conservative 2055 Index | 6.37% | 14.44% | 8.17% | 10.52% | |||||||||||||

| Lipper Mixed-Asset Target 2055 Funds Average | 7.32% | 14.32% | 8.81% | 10.65% | ||||||||||||||

† The Fund began operations on December 19, 2011. Benchmark return comparisons began on the fund inception date. Lipper performance comparisons began on December 31, 2011.

* The Morningstar Lifetime Moderate series replaced the Morningstar Lifetime Conservative series as the Target Date Funds’ primary benchmark, and the AllianzGI Strategic Benchmark replaced the Real Return Target series (white label) as the Target Date Funds’ secondary benchmark as of October 1, 2016 in connection with certain changes to the Target Date Funds’ investment strategies that took effect on October 1, 2016.

** Cumulative returns.

Performance quoted represents past performance and is no guarantee of future results. Current performance may be lower or higher than performance shown. For performance current to the most recent month-end, visit our website at us.allianzgi.com. Investment return and the principal value will fluctuate. Shares may be worth more or less than original cost when redeemed. The adjusted returns take into account the maximum initial sales charge of 5.50% on Class A shares. Returns do not reflect deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares. See pages 133 and 134 for more information. The Fund’s gross expense ratios are 1.07% for Class A shares, 1.32% for Class R shares, 0.67% for Class P shares, 0.57% for Class R6 shares and 0.92% for Administrative Class shares. These ratios do not include an expense reduction, contractually guaranteed through at least January 31, 2020. The Fund’s expense ratios net of this reduction are 0.95% for Class A shares, 1.30% for Class R shares, 0.65% for Class P shares, 0.55% for Class R6 shares and 0.90% for Administrative Class shares. Expense ratio information is as of the Fund’s current prospectus dated February 1, 2017, as revised April 10, 2017.

| 20 | March 31, 2017 | | Semiannual Report |

Table of Contents

Unaudited

AllianzGI Retirement 2055 Fund (cont’d)

| Shareholder Expense Example | Actual Performance | |||||||||

| Class A | Class R | Class P | Class R6 | Administrative Class | ||||||

| Beginning Account Value (10/1/16) | $1,000.00 | $1,000.00 | $1,000.00 | $1,000.00 | $1,000.00 | |||||

| Ending Account Value (3/31/17) | $1,080.90 | $1,078.80 | $1,082.60 | $1,083.50 | $1,081.50 | |||||

| Expenses Paid During Period | $2.65 | $4.46 | $1.09 | $0.57 | $2.39 | |||||

| Hypothetical Performance | ||||||||||

| (5% return before expenses) | ||||||||||

| Class A | Class R | Class P | Class R6 | Administrative Class | ||||||

| Beginning Account Value (10/1/16) | $1,000.00 | $1,000.00 | $1,000.00 | $1,000.00 | $1,000.00 | |||||

| Ending Account Value (3/31/17) | $1,022.39 | $1,020.64 | $1,023.88 | $1,024.38 | $1,022.64 | |||||

| Expenses Paid During Period | $2.57 | $4.33 | $1.06 | $0.56 | $2.32 | |||||

For each class of the Fund, expenses (net of fee waiver and reimbursement, if any) are equal to the annualized expense ratio for the class (0.51% for Class A, 0.86% for Class R, 0.21% for Class P, 0.11% for Class R6 and 0.46% for Administrative Class), multiplied by the average account value over the period, multiplied by 182/365. These expenses do not include the expenses of the investment companies in which the Fund invests, which are indirectly borne by Fund shareholders.

| Semiannual Report | | March 31, 2017 | 21 |

Table of Contents

Unaudited

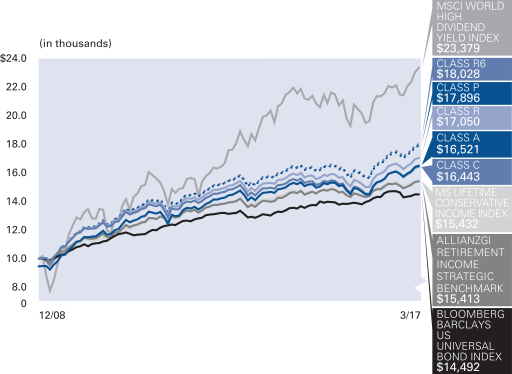

AllianzGI Retirement Income Fund

For the period of October 1, 2016 through March 31, 2017, as provided by the Multi-Asset US Group.

Fund Insights

For the six-month period ended March 31, 2017, Class A shares at net asset value (‘‘NAV’’) of the AllianzGI Retirement Income Fund (the “Fund”) returned 2.52%, outperforming the Bloomberg Barclay’s US Universal Bond Index (the “benchmark”), which returned -1.54%.

Market Overview

For the six-month period ending March 31, 2017, markets were dominated by the surprising outcome of the US presidential election relative to prevailing market expectations. The Trump victory ushered in a period of uncertainty regarding the magnitude and timing of future policy changes at the same time that it seemed to instill general optimism in market participants. The theme of reflation against the backdrop of supportive fiscal policy and stronger consumer demand percolated through markets for the period.

Throughout the first quarter, risk assets continued to outperform in a low volatility environment despite significant policy setbacks (including the failure to pass healthcare reform) and continued uncertainty about the future of US domestic and foreign policy. Moreover, global risk assets rallied in the context of the Federal Reserve (the ’’Fed’’) hiking interest rates by 50 basis points in the period. Tighter Fed policy signaled a new regime of tighter global monetary policy in the future (even if the European Central Bank and Bank of Japan reiterated their current commitments to accommodative policies).

During the period, US stocks rallied in the aftermath of the election and continued to gain throughout the first quarter with US Small Cap stocks in particular leading the way: The Russell 2000 Index gained 11.5% and the Russell 2000 Value Index gained 13.9% outpacing larger stocks, which gained 10.1%, as measured by the Russell 1000 Index.

Global growth remained healthy as fundamental macro-economic data continued to either match or outperform economists’ expectations. During the first quarter, the gap between hard data and soft data, as measured by surveys of purchasing managers and consumers widened substantially, revealing that much of what underpinned the rally in risk assets was associated with future expectations (as opposed to the current economic environment alone).

Optimistic assessments of global growth affected both developed and emerging markets: In broad terms, the MSCI All Country World Index returned 8.2% only slightly outpacing Emerging Markets (“EM”), which returned 6.8%. Better economic data, helped boost European equities for the period, despite persistent uncertainties about key elections in 2017 (in the Netherlands, France and Germany). For the period, the best performing stock markets were Spain and Italy, which returned 17.3% and 17.6% respectively (MSCI country indexes in USD).

Global Bonds declined for the period with the Bloomberg Barclays Global Aggregate Bond Index losing 5.4%. The long end of the US curve had the worst performance as long Treasuries (20+ years) lost 10.9% in the period due in part to a sharp initial increase in inflation expectations and a spike in yields. While the 10-year yield on US Treasuries initially increased by about 75 basis points from the election through mid-December, it remained relatively range bound for most of the first quarter, making US Treasuries one of the worst performing asset classes for the period. The Bloomberg Barclays US Aggregate Bond Index lost 2.2% for the period. Within fixed income, US High Yield was the best performer. Globally, Emerging Market hard currency debt outperformed developed market government bonds. Commodities, most notably precious metals and gold, were among the worst performing asset classes in the period.

Portfolio Review

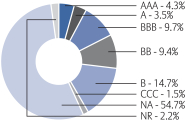

Against a backdrop of favorable trend and fundamental views across risk assets, the portfolio expressed overweights to both US investment grade and high yield corporate bonds. Over the period, the Fund added an emphasis on higher yielding real estate investment trusts (“REITs”) while the emphasis on higher yielding credits was maintained. The emphasis on higher yielding issues contributed to results as reflected by the BofA Merrill Lynch High Yield Master II Index gaining 4.6% while the Bloomberg Barclays US Aggregate Bond Index conversely declined -2.2%.

At the end of the period, the portfolio maintained a positive view on risk assets including high yield bonds and higher yielding segments within US REITs.

Outlook

Looking ahead, we expect that global inflation will continue to steadily rise, in part attributable to firmer commodity prices and narrowing output gaps throughout developed markets. Emerging markets are expected to continue to post solid growth in the near term, providing opportunities for much needed structural reforms that will ultimately contribute to longer term stability. We expect the global economy will likely continue to benefit from debt-financed growth for the foreseeable future on the back of leveraged households and businesses. We expect monetary policy to continue to tighten in the US, albeit at a slow and measured pace, while global central bank liquidity will remain abundant at least through 2018.

However, risks abound, including increased political risks, most notably in Europe in light of the busy election calendar but also in key emerging markets. In addition, we believe charged rhetoric about protectionism and zero-sum interactions threaten to undermine longstanding commitments to global trade in goods and financial assets. Finally, we believe risks related to inflated expectations on the part of market participants as well as market complacency may potentially intensify should stocks reverse their recent rally.

As of the end of the period, we expect to remain overweight risk assets and underweight most sovereign bonds with the idea in mind that sovereigns are nearing the end of a secular bull market. We believe the “Reflation Trade” persists for now as long as the possibility of US Fiscal stimulus remains and cyclical data continue to show signs of improvement. We maintain a positive outlook on emerging markets while recognizing that an unexpected slowdown in the US or other developed markets would have real and immediate implication for EM broadly. We remain vigilant in this low volatility environment and are focused on monitoring cyclical data and relative valuations across asset classes.

Certain changes to the Fund’s investment strategy, benchmarks and portfolio management team became effective on October 1, 2016. Please see the prospectus for complete details.

| 22 | March 31, 2017 | | Semiannual Report |

Table of Contents

Unaudited

AllianzGI Retirement Income Fund (cont’d)

Average Annual Total Return for the period ended March 31, 2017

| 6 Month** | 1 Year | 5 Year | Since Inception† | |||||||||||||||

| AllianzGI Retirement Income Fund Class A | 2.52% | 9.75% | 4.08% | 7.00% | ||||||||||||||

|

|

AllianzGI Retirement Income Fund Class A (adjusted) | –3.12% | 3.71% | 2.91% | 6.27% | |||||||||||||

| AllianzGI Retirement Income Fund Class C | 2.15% | 8.91% | 3.31% | 6.21% | ||||||||||||||

|

|

AllianzGI Retirement Income Fund Class C (adjusted) | 1.15% | 7.91% | 3.31% | 6.21% | |||||||||||||

|

|

AllianzGI Retirement Income Fund Class R | 2.39% | 9.43% | 3.73% | 6.67% | |||||||||||||

|

|

AllianzGI Retirement Income Fund Class P | 2.70% | 10.13% | 4.42% | 7.30% | |||||||||||||

|

|

AllianzGI Retirement Income Fund Class R6 | 2.76% | 10.22% | 4.51% | 7.41% | |||||||||||||

| AllianzGI Retirement Income Fund Administrative Class | 2.57% | 8.68% | 3.92% | 6.93% | ||||||||||||||

|

|

Bloomberg Barclays US Universal Bond Index* | –1.54% | 1.92% | 2.83% | 4.60% | |||||||||||||

|

|

AllianzGI Retirement Income Strategic Benchmark* | 0.98% | 4.47% | 2.96% | 5.38% | |||||||||||||

|

|

MSCI World High Dividend Yield Index | 5.57% | 11.54% | 8.37% | 10.84% | |||||||||||||

|

|

Morningstar Lifetime Conservative Income Index | 0.50% | 4.15% | 2.93% | 5.40% | |||||||||||||

| Lipper Mixed-Asset Target Today Funds Average | 1.79% | 6.09% | 3.95% | 6.58% | ||||||||||||||

† The Fund began operations on December 29, 2008. Benchmark return comparisons began on the fund inception date. Lipper performance comparisons began on December 31, 2008.

* The Bloomberg Barclays US Universal Bond Index replaced the Morningstar Lifetime Conservative Income Index as the Fund’s primary benchmark and the MSCI World High Dividend Yield Index and the AllianzGI Strategic Benchmark replaced the Real Return Target Today Index as the Fund’s secondary benchmarks as of October 1, 2016 in connection with certain changes to the Fund’s investment strategies that took effect on October 1, 2016.

** Cumulative returns.

Performance quoted represents past performance and is no guarantee of future results. Current performance may be lower or higher than performance shown. For performance current to the most recent month-end, visit our website at us.allianzgi.com. Investment return and the principal value will fluctuate. Shares may be worth more or less than original cost when redeemed. The adjusted returns take into account the maximum initial sales charge of 5.50% on Class A shares and the contingent deferred sales charge (CDSC) of 1% on Class C shares, which may apply to shares redeemed during the first year of ownership. Returns do not reflect deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares. See pages 133 and 134 for more information. The Fund’s gross expense ratios are 1.20% for Class A shares, 1.95% for Class C shares, 1.45% for Class R shares, 0.80% for Class P shares, 0.70% for Class R6 shares and 1.05% for Administrative Class shares. These ratios do not include an expense reduction, contractually guaranteed through at least January 31, 2020. The Fund’s expense ratios net of this reduction are 0.95% for Class A shares, 1.70% for Class C shares, 1.30% for Class R shares, 0.65% for Class P shares, 0.55% for Class R6 shares and 0.90% for Administrative Class shares. Expense ratio information is as of the Fund’s current prospectus dated February 1, 2017, as revised April 10, 2017.

| Semiannual Report | | March 31, 2017 | 23 |

Table of Contents

Unaudited

AllianzGI Retirement Income Fund (cont’d)

| Shareholder Expense Example | Actual Performance | |||||||||||

| Class A | Class C | Class R | Class P | Class R6 | Administrative Class | |||||||

| Beginning Account Value (10/1/16) | $1,000.00 | $1,000.00 | $1,000.00 | $1,000.00 | $1,000.00 | $1,000.00 | ||||||

| Ending Account Value (3/31/17) | $1,025.20 | $1,021.50 | $1,023.90 | $1,027.00 | $1,027.60 | $1,025.70 | ||||||

| Expenses Paid During Period | $1.62 | $5.39 | $3.38 | $0.10 | $0.01 | $1.36 | ||||||

| Hypothetical Performance | ||||||||||||

| (5% return before expenses) | ||||||||||||

| Class A | Class C | Class R | Class P | Class R6 | Administrative Class | |||||||

| Beginning Account Value (10/1/16) | $1,000.00 | $1,000.00 | $1,000.00 | $1,000.00 | $1,000.00 | $1,000.00 | ||||||

| Ending Account Value (3/31/17) | $1,023.34 | $1,019.60 | $1,021.59 | $1,024.83 | $1,024.92 | $1,023.59 | ||||||

| Expenses Paid During Period | $1.61 | $5.39 | $3.38 | $0.10 | $0.01 | $1.36 | ||||||

For each class of the Fund, expenses (net of fee waiver and reimbursement, if any) are equal to the annualized expense ratio for the class (0.32% for Class A, 1.07% for Class C, 0.67% for Class R, 0.02% for Class P, 0.00% for Class R6 and 0.27% for Administrative Class), multiplied by the average account value over the period, multiplied by 182/365. These expenses do not include the expenses of the investment companies in which the Fund invests, which are indirectly borne by Fund shareholders.

| 24 | March 31, 2017 | | Semiannual Report |

Table of Contents

(THIS PAGE INTENTIONALLY LEFT BLANK)

| Semiannual Report | | March 31, 2017 | 25 |

Table of Contents

Unaudited

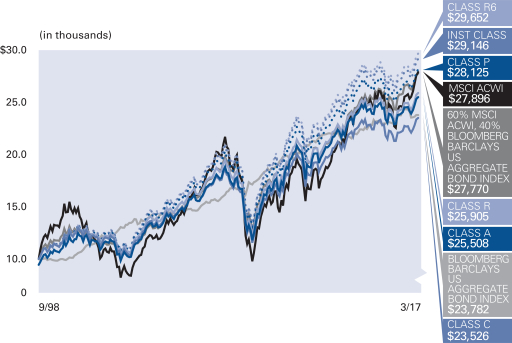

AllianzGI Global Allocation Fund

For the period of October 1, 2016 through March 31, 2017, as provided by the Multi-Asset US Group.

Fund Insights

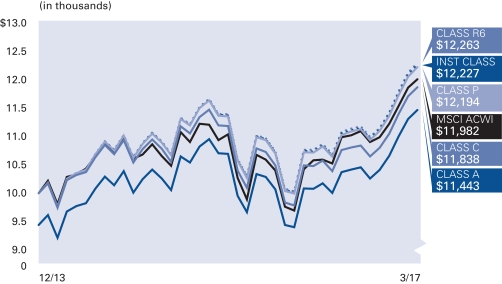

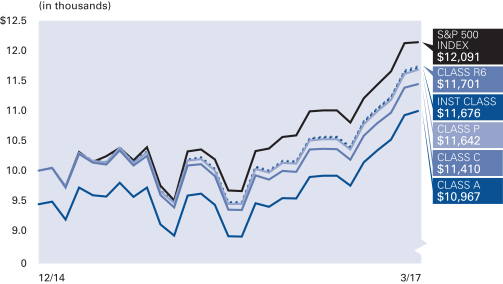

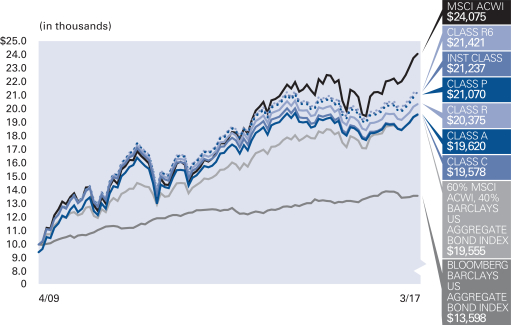

For the six-month period ended March 31, 2017, Class A shares at net asset value (‘‘NAV’’) of the AllianzGI Global Allocation Fund (the “Fund”) returned 3.88%, underperforming the 60% MSCI ACWI, 40% Bloomberg Barclays US Aggregate Bond Index (the “benchmark”), which returned 3.94%.

Market Overview

For the six-month period, markets were dominated by the surprising outcome of the US presidential election relative to prevailing market expectations. The Trump victory ushered in a period of uncertainty regarding the magnitude and timing of future policy changes at the same time that it seemed to instill general optimism in market participants. The theme of reflation against the backdrop of supportive fiscal policy and stronger consumer demand percolated through markets for the period.

Throughout the first quarter, risk assets continued to outperform in a low volatility environment despite significant policy setbacks (including the failure to pass healthcare reform) and continued uncertainty about the future of US domestic and foreign policy. Moreover, global risk assets rallied in the context of the Federal Reserve (the ‘‘Fed’’) raising interest rates by 50 basis points in the period. Tighter Fed policy signaled a new regime of tighter global monetary policy in the future (even if the European Central Bank and Bank of Japan reiterated their current commitments to accommodative policies).

During the period, US stocks rallied in the aftermath of the election and continued to gain throughout the first quarter with US Small Cap stocks in particular leading the way: The Russell 2000 Index gained 11.5% and the Russell 2000 Value Index gained 13.9% outpacing larger stocks, which gained 10.1%, as measured by the Russell 1000 Index.

Global growth remained healthy as fundamental macro-economic data continued to either match or outperform economists’ expectations. During the first quarter, the gap between hard data and soft data, as measured by surveys of purchasing managers and consumers, widened substantially, revealing that much of what underpinned the rally in risk assets was associated with future expectations (as opposed to the current economic environment alone).

Optimistic assessments of global growth affected both developed and emerging markets: In broad terms, the MSCI All Country World Index returned 8.2% only slightly outpacing Emerging Markets, which returned 6.8%. Better economic data helped boost European equities for the period despite persistent uncertainties about key elections in 2017 (in the Netherlands, France and Germany). For the period, the best performing stock markets were Spain and Italy, which returned 17.3% and 17.6% respectively (MSCI country indexes in USD).

Global Bonds declined for the period with the Bloomberg Barclays Global Aggregate Bond Index losing 5.4%. The long end of the US curve had the worst performance as long Treasuries (20+ years) lost 10.9% in the period due in part to a sharp initial increase in inflation expectations and a spike in yields. While the 10-year yield on US Treasuries initially increased by about 75 basis points from the election through mid-December, it remained relatively range bound for most of the first quarter, making US Treasuries one of the worst performing asset classes for the period. The Bloomberg Barclays US Aggregate Bond Index lost 2.2% for the period. Within fixed income, US High Yield was the best performer. Globally, Emerging Market hard currency debt outperformed developed market government bonds. Commodities, most notably precious metals and gold, were among the worst performing asset classes in the period.

Portfolio Review

Overweights to global equities provided a tailwind to performance during the period, particularly in North America, as the US equity market experienced strong performance following the US presidential election. The portfolio’s overweight to US Government debt detracted during the fourth quarter of 2016, as rates rallied sharply in the aftermath of the US election.

At the end of the period, the portfolio maintained an underweight position in US government bonds (duration weighted) and an overweight to global equities including Emerging Markets, against a backdrop of favorable trend and fundamental views across risk assets.

Outlook

Looking ahead, we expect that global inflation will continue to steadily rise, partly attributable to firmer commodity prices and narrowing output gaps throughout developed markets. Emerging markets are expected to continue to post solid growth in the near term, providing opportunities for much needed structural reforms that will ultimately contribute to longer term stability. We believe the global economy will likely continue to benefit from debt-financed growth for the foreseeable future on the back of leveraged households and businesses. We expect monetary policy to continue to tighten in the US, albeit at a slow and measured pace, while global central bank liquidity will remain abundant at least through 2018.

However, we believe that risks abound, including increased political risks, most notably in Europe in light of the busy election calendar, but also in key emerging markets. In addition, charged rhetoric about protectionism and zero-sum interactions may, in our opinion, threaten to undermine longstanding commitments to global trade in goods and financial assets. Finally, risks related to inflated expectations on the part of market participants as well as market complacency may potentially intensify should stocks reverse their recent rally.

As of the end of the period, we remain overweight risk assets and underweight most sovereign bonds with the idea in mind that sovereigns are nearing the end of a secular bull market. The “Reflation Trade” persists for now as long as the possibility of US fiscal stimulus remains and cyclical data continue to show signs of improvement. We maintain a positive outlook on emerging markets while recognizing that an unexpected slowdown in the US or other developed markets would have real and immediate implication for Emerging Markets (‘‘EM’’) broadly. We remain vigilant in this low volatility environment and are focused on monitoring cyclical data and relative valuations across asset classes.

| 26 | March 31, 2017 | | Semiannual Report |

Table of Contents

Unaudited

AllianzGI Global Allocation Fund (cont’d)

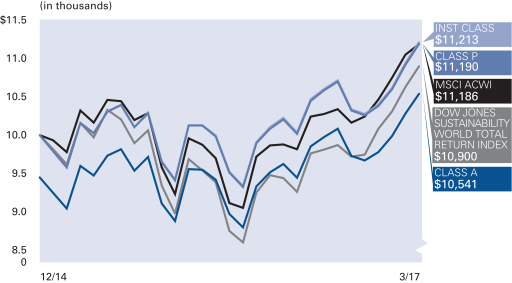

Average Annual Total Return for the period ended March 31, 2017

| 6 Month* | 1 Year | 5 Year | 10 Year | Since Inception† | ||||||||||||||||||

| AllianzGI Global Allocation Fund Class A | 3.88% | 7.23% | 4.87% | 3.97% | 5.52% | |||||||||||||||||

|

|

AllianzGI Global Allocation Fund Class A (adjusted) | –1.83% | 1.33% | 3.69% | 3.38% | 5.19% | ||||||||||||||||

| AllianzGI Global Allocation Fund Class C | 3.55% | 6.37% | 4.10% | 3.20% | 4.73% | |||||||||||||||||

|

|

AllianzGI Global Allocation Fund Class C (adjusted) | 2.55% | 5.37% | 4.10% | 3.20% | 4.73% | ||||||||||||||||

|

|

AllianzGI Global Allocation Fund Class R | 3.87% | 7.04% | 4.70% | 3.75% | 5.28% | ||||||||||||||||

|

|

AllianzGI Global Allocation Fund Class P | 4.13% | 7.60% | 5.13% | 4.21% | 5.75% | ||||||||||||||||

|

|

AllianzGI Global Allocation Fund Institutional Class | 4.09% | 7.49% | 5.12% | 4.31% | 5.95% | ||||||||||||||||

|

|

AllianzGI Global Allocation Fund Class R6 | 4.10% | 7.52% | 5.21% | 4.40% | 6.05% | ||||||||||||||||

| AllianzGI Global Allocation Fund Administrative Class | 3.96% | 7.22% | 4.88% | 4.00% | 5.56% | |||||||||||||||||

|

|

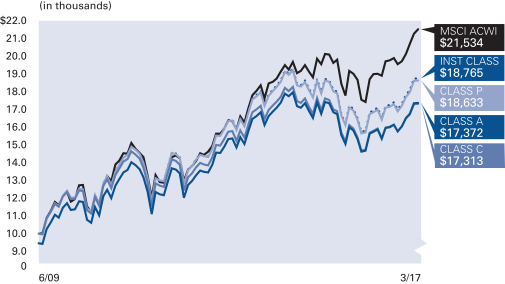

MSCI ACWI | 8.18% | 15.04% | 8.37% | 4.00% | 5.70% | ||||||||||||||||

|

|

60% MSCI ACWI, 40% Bloomberg Barclays US Aggregate Bond Index | 3.94% | 9.02% | 6.09% | 4.48% | 5.68% | ||||||||||||||||

|

|

Bloomberg Barclays US Aggregate Bond Index | –2.18% | 0.44% | 2.34% | 4.27% | 4.79% | ||||||||||||||||

| Lipper Alternative Global Macro Funds Average | 2.06% | 6.41% | 2.36% | 3.21% | 5.30% | |||||||||||||||||

† The Fund began operations on September 30,1998. Benchmark return comparisons began on the fund inception date. Lipper performance comparisons began on September 30,1998.

* Cumulative returns.

Performance quoted represents past performance and is no guarantee of future results. Current performance may be lower or higher than performance shown. For performance current to the most recent month-end, visit our website at us.allianzgi.com. Investment return and the principal value will fluctuate. Shares may be worth more or less than original cost when redeemed. The adjusted returns take into account the maximum sales charge of 5.50% on Class A shares and the contingent deferred sales charge (CDSC) of 1% on Class C shares, which may apply to shares redeemed during the first year of ownership. Returns do not reflect deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares. See pages 133 and 134 for more information. The Fund’s gross expense ratios are 1.56% for Class A shares, 2.33% for Class C shares, 1.76% for Class R shares, 1.26% for Class P shares, 1.35% for Institutional Class shares, 1.26% for Class R6 shares and 1.51% for Administrative Class shares. These ratios do not include an expense reduction, contractually guaranteed through at least January 31, 2018. The Fund’s expense ratios net of this reduction are 1.03% for Class A shares, 1.80% for Class C shares, 1.23% for Class R shares, 0.83% for Class P shares, 0.83% for Institutional Class shares, 0.73% for Class R6 shares and 0.98% for Administrative Class shares. Expense ratio information is as of the Fund’s current prospectus dated February 1, 2017, as revised April 10, 2017.

| Semiannual Report | | March 31, 2017 | 27 |

Table of Contents

Unaudited

AllianzGI Global Allocation Fund (cont’d)

| Shareholder Expense Example | Actual Performance | |||||||||||||

| Class A | Class C | Class R | Class P | Institutional Class |

Class R6 | Administrative Class | ||||||||

| Beginning Account Value (10/1/16) | $1,000.00 | $1,000.00 | $1,000.00 | $1,000.00 | $1,000.00 | $1,000.00 | $1,000.00 | |||||||

| Ending Account Value (3/31/17) | $1,038.80 | $1,035.50 | $1,038.70 | $1,041.30 | $1,040.90 | $1,041.00 | $1,039.60 | |||||||

| Expenses Paid During Period | $3.05 | $6.85 | $4.02 | $1.48 | $1.93 | $1.43 | $2.70 | |||||||

| Hypothetical Performance | ||||||||||||||

| (5% return before expenses) | ||||||||||||||

| Class A | Class C | Class R | Class P | Institutional Class |

Class R6 | Administrative Class | ||||||||

| Beginning Account Value (10/1/16) | $1,000.00 | $1,000.00 | $1,000.00 | $1,000.00 | $1,000.00 | $1,000.00 | $1,000.00 | |||||||

| Ending Account Value (3/31/17) | $1,021.94 | $1,018.20 | $1,020.99 | $1,023.49 | $1,023.04 | $1,023.54 | $1,022.29 | |||||||

| Expenses Paid During Period | $3.02 | $6.79 | $3.98 | $1.46 | $1.92 | $1.41 | $2.67 | |||||||

For each class of the Fund, expenses (net of fee waiver and reimbursement, if any) are equal to the annualized expense ratio for the class (0.60% for Class A, 1.35% for Class C, 0.79% for Class R, 0.29% for Class P, 0.38% for Institutional Class, 0.28% for Class R6 and 0.53% for Administrative Class), multiplied by the average account value over the period, multiplied by 182/365. These expenses do not include the expenses of the investment companies in which the Fund invests, which are indirectly borne by Fund shareholders.

| 28 | March 31, 2017 | | Semiannual Report |

Table of Contents

(THIS PAGE INTENTIONALLY LEFT BLANK)

| Semiannual Report | | March 31, 2017 | 29 |

Table of Contents

Unaudited

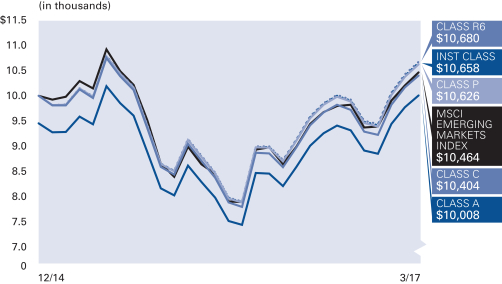

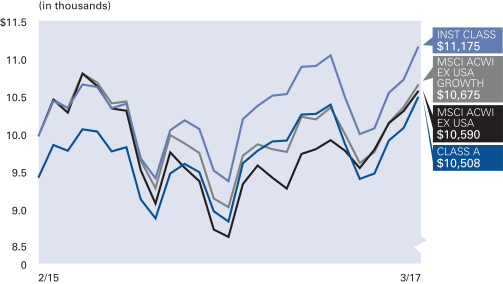

AllianzGI Global Megatrends Fund

For the period of October 1, 2016 through March 31, 2017, as provided by John Schroer, CFA, Portfolio Manager.

Fund Insights

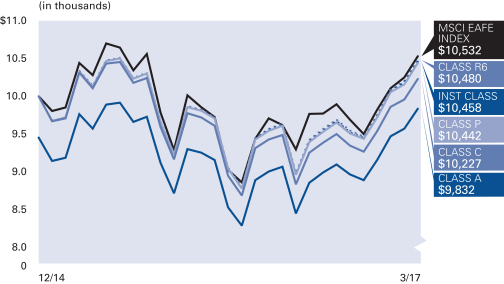

For the six-month period ended March 31, 2017, Class A shares at net asset value (‘‘NAV’’) of the AllianzGI Global Megatrends Fund (the “Fund”) returned 3.24%, underperforming the MSCI ACWI (the “benchmark”), which returned 8.18%.

Market Overview