Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF

REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-22167

Allianz Funds Multi-Strategy Trust

(Exact name of registrant as specified in charter)

1633 Broadway, New York, NY 10019

(Address of principal executive offices) (Zip code)

Lawrence G. Altadonna

1633 Broadway, New York, NY 10019

(Name and address of agent for service)

Registrant’s telephone number, including area code: 212-739-3371

Date of fiscal year end: November 30, 2015

Date of reporting period: May 31, 2015

Table of Contents

Item 1. Report to Shareholders

Allianz Multi-Strategy Funds

SHARE CLASSES A, B, C, D, R, P, INSTITUTIONAL, R6, ADMINISTRATIVE

Semiannual Report

May 31, 2015

This material is authorized for use only when preceded or accompanied by the current Allianz Multi-Strategy Funds prospectus. Investors should consider the investment objectives, risks, charges and expenses of each Fund carefully before investing. This and other information is contained in the Funds’ prospectuses and summary prospectuses. Please read the prospectus carefully before you invest or send money.

Receive this report electronically and eliminate paper mailings.

To enroll, go to http://us.allianzgi.com/edelivery.

Table of Contents

| 2–3 | Letter from the President | |||

| 4–105 | Fund Summaries | |||

| 106-107 | Important Information | |||

| 108-111 | Benchmark Descriptions | |||

| 112-166 | Schedules of Investments | |||

| 168-183 | Statements of Assets and Liabilities | |||

| 184-199 | Statements of Operations | |||

| 200-216 | Statements of Changes in Net Assets | |||

| 218-281 | Financial Highlights | |||

| 282-368 | Notes to Financial Statements | |||

| 369 | Shareholder Meeting Results/Changes to Board of Trustees | |||

| 370-375 | Matters Relating to the Trustees’ Consideration of the Investment Management and Sub-Advisory Agreements | |||

| 376-377 | Privacy Policy |

A Word About Risk: A fund may be subject to various risks as described in its prospectus. Some of those risks may include, but are not limited to, the following: derivatives risk, smaller company risk, non-US investment risk, focused investment risk and specific sector investment risks. Use of derivative instruments may involve certain costs and risks such as liquidity risk, interest rate risk, market risk, credit risk, counterparty risk, management risk and the risk that a fund is unable to close out a position when it is most advantageous to do so. Portfolios investing in derivatives could lose more than the principal amount invested in those instruments. Investing in foreign securities may entail risk due to foreign economic and political developments; this risk may be enhanced when investing in emerging markets. Smaller companies may be more volatile than larger companies and may entail more risk. Concentrating investments in individual sectors may add additional risk and additional volatility compared to a diversified equity portfolio. AllianzGI target-date funds seek to manage risk and return by blending two separately-managed portfolios: a return-generating portfolio for growth potential, and a defensive portfolio for principal protection. The balance grows increasingly defensive over time until the target date is reached, after which the Fund’s assets roll into a retirement income strategy. The principal values of the Funds are not guaranteed at any time, including the target date. Please refer to the Fund’s applicable current prospectus for complete details.

Table of Contents

| 2 | May 31, 2015 | | Semiannual Report |

Table of Contents

Outlook

For the second time in two years, the US economy stumbled during the first quarter. In both cases, this was partially attributed to extreme winter weather. Whether we see the type of snapback in 2015 that we saw in 2014 is subject to debate. One factor that is likely to play a pivotal role is consumer spending. Despite lower oil prices, a significant job recovery and stronger personal balance sheets than a few years ago, consumer spending during the first quarter of 2015 grew at a tepid pace. In our view, we should experience an uptick in spending in the coming quarters. In terms of the Fed and the projected start of interest rate “liftoff,” we believe Federal Reserve Chair Janet Yellen will be true to her word, as she said in late May, “…if the economy continues to improve as I expect, I think it will be appropriate at some point this year to take the initial step to raise the federal funds rate target and begin the process of normalizing monetary policy… After we begin raising the federal funds rate, I anticipate that the pace of normalization is likely to be gradual.”

On behalf of Allianz Global Investors Fund Management and our Sub-Advisers, thank you for investing with us. We encourage you to consult with your financial advisor and to visit our website, us.allianzgi.com, for additional information. We remain dedicated to serving your investment needs.

Sincerely,

Julian Sluyters

President & Chief Executive Officer

Past performance is no guarantee of future results. Unless otherwise noted, index returns reflect the reinvestment of income dividends and capital gains, if any, but do not reflect fees, brokerage commissions or other expenses of investing. It is not possible to invest directly in an index.

Receive this report electronically and eliminate paper mailings.

To enroll, go to http://us.allianzgi.com/edelivery.

| Semiannual Report | | May 31, 2015 | 3 |

Table of Contents

Unaudited

For the period of December 1, 2014 through May 31, 2015, as provided by the Multi-Asset US Group.

Fund Insights

For the reporting period ended May 31, 2015, all AllianzGI Target-Date Funds produced positive absolute returns. Each of the Funds underperformed its respective benchmark index (Morningstar Lifetime Conservative series) for the period.

Market Overview

For the six-month period of December 1, 2014 through May 31, 2015, global equities outperformed global bonds with developed country equities leading emerging market equities by more than 3%. In fixed income, global bonds fell 3.3% for the period as measured by the Barclays Global Aggregate Index. However, in the US, as uncertainty about the Fed’s future policy decisions persisted, yields on the 10-year Treasury fell marginally for the period and broad US bonds returned 1.1% as measured by the Barclays US Aggregate Bond Index.

Certain themes from late 2014 persisted in the period, including the continued strength of the US dollar against most major currencies. For the period, one of the best performing assets was the trade-weighted dollar, which returned 10.2%. On the other hand, commodities, led by energy, continued to weaken: commodities remained one of the worst performing asset classes, returning -10.6% for the period as measured by the Bloomberg Commodity Index.

Mid-April marked a period of dislocations across markets. A sell-off in European bonds, most notably in German bunds, which produced swings in bond yields globally, contributed to broad market volatility. The US dollar fell against every major developed market currency and most emerging market currencies in April, while the euro appreciated by 4.6% for the month. In commodities, oil entered positive territory for the year in mid-April, contributing to the perception of stability in oil prices. These events and trends culminated in a renewed focus on inflationary—as opposed to deflationary—trends in the global economy and a pickup in inflation expectations.

Mid-April Market Volatility

The magnitude and rapid pace of the move in European bond yields in late April was unprecedented. The spike in yields was most pronounced in German bunds, with the 10-year yield increasing from a low on April 17, 2015 of 0.05% to a high of 0.78% on May 7, 2015. Several factors contributed to the move, including speculation of tapering on the part of the European Central Bank (“ECB”) on the back of stronger macroeconomic data throughout the region. Concerns about the ability of Greece to reach a deal with the Eurogroup over its obligations to the International Monetary Fund (“IMF”) and other creditors intensified through April and early May, further contributing to bond market volatility. Stronger inflation data released in mid-April, including an increase in the Eurozone Aggregate Consumer Price Index of 1.1% month over month—nearly two times the increase of the previous month—contributed to higher inflation expectations, which in turn paved the way for higher yields. The increase in yields was not limited to Europe. Through mid-May, the US yield curve steepened as rates followed European yields higher and the US 10-year Treasury hit a high for the six-month period of 2.4% on May 12, 2015.

Currencies also underwent a temporary correction in April. The trade-weighted dollar suffered its first monthly decline since July 2014. For the month, the trade-weighted dollar fell 3.8%. In connection with the spike in yields on European bonds and the more solid inflation data, the euro increased more than 6% from its low in mid-April to the end of the month. However, in May, the dollar once again strengthened against all major currencies and the euro resumed its weaker trend against the dollar, falling 2.1%.

The Return of Inflation after Disinflation

Despite significant volatility during the period including a low close to $43 in mid-March, the price of WTI crude stabilized in the $58-60/barrel range by mid-April, leading to a jump in inflation expectations. For example, in late April, one of the Fed’s preferred market based inflation gauges, the 5 year/5 year forward breakeven inflation level from the Treasury Inflation Protected Securities (“TIPS”) market moved above the 2% threshold suggesting that, while short term inflation expectations still lag, the 5-year inflation expectation had reached—and exceeded—the Fed’s inflation target. In the context of moderate global growth, stable energy prices and initial increases in core consumer price inflation, overall inflation expectations inched closer to central bank targets during the period. This may finally signal the dawn of a new era of inflation.

Portfolio Review

Effective April 1, 2015, the Funds’ benchmark index changed from the Real Return Target series (white label) to the Morningstar Lifetime Conservative series, as the portfolio managers consider Morningstar Lifetime Conservative series to be a better representation of the Funds’ investment strategies. Previously, the Real Return Target series replaced the Dow Jones Real Retirement series. This change was due to a decision by the index provider to discontinue the index. With this mid-period change, differences between the two benchmarks should be considered for purposes of performance comparison.

Relative to the benchmark index, the Funds were underweight nominal bonds and overweight US inflation linked securities, while exposure to global equities was roughly in line with the benchmark. Within fixed income, the Funds were positioned with an overweight to credit and underweight to duration. Within global equities, the Funds were also overweight developed large-cap equities outside the US and were underweight US small-cap equities. The Funds also held opportunistic asset classes such as real estate, commodities and managed futures.

In the fixed income portion of each Fund’s portfolio, performance trailed the benchmark primarily due to an emphasis on inflation linked securities, which trailed nominal treasuries over the full period. Each Fund’s portfolio benefited from the nominal portion of the portfolio, with an emphasis on credit related exposure through the AllianzGI Short Duration High Income Fund (+3%) and PIMCO Income Fund (+2%), which contributed to results.

| 4 | May 31, 2015 | | Semiannual Report |

Table of Contents

Unaudited

AllianzGI Target-Date Funds (cont’d)

In the equity portion of each Fund’s portfolio, allocation and selection effects ultimately detracted from the Funds’ overall relative result. In the US equity exposure, an underweight to small-cap equities relative to the benchmark index detracted from relative performance as small-caps outperformed the broader market. Outside the US, the Funds’ overweight to developed markets contributed to the Funds’ results. However, selection in emerging market equities detracted.

The Funds’ exposure to opportunistic asset classes, including commodities, detracted from results over the period. Partially offsetting this were positive contributions from exposure to global Real Estate Investment Trusts (REITs) and commodity-related equities, which posted positive results over the period.

In aggregate, the Funds’ emphasis on TIPS within the fixed income component and an underweight to small-cap stocks in the US detracted from relative results over the period. The AllianzGI Target-Date Funds place a strong emphasis on the Department of Labor’s guidelines for a Qualified Default Investment Alternative (“QDIA”), which contains language such as “to be diversified as to minimize the risk of large losses.” It is within this framework that the Funds continue to emphasize diversification in the portfolio construction process as well as to include commodities, real estate, convertible bonds, floating rate debt, frontier market equities, and emerging market bonds to provide potential benefits to clients’ retirement assets.

Outlook

We expect that the volatility experienced in the period will continue for the rest of 2015. Overall, we continue to expect global growth to slow in 2015 compared to 2014. Despite some softness in the US economy in the period, we expect the growth differential between the US and other developed countries to persist.

The objective of recent changes to the portfolios has been to further insulate them from risks. The Funds remain overweight US equities compared to other developed countries. Part of the international equity exposure remains dollar-hedged, reflecting our view that the USD will continue to benefit from divergent monetary policies and divergent GDP growth. We maintain the Funds’ exposure to frontier-market equities to help further diversify the portfolios.

On interest rates, the biggest question mark for 2015 continues to be the direction, magnitude and timing of short-term interest rate moves, especially in the US, and the overall steepness of the US yield curve. As a result of such uncertainty, we added some duration back into the portfolios through TIPS and US credit (investment grade and high yield). This is partly a way to express our view that core inflation expectations in the US have most likely bottomed. However, even with such changes, we remain close to benchmark duration.

We continue to see an important role for credit in the portfolios. If interest rates remain low or decline further, high yield and investment-grade credit are among the few remaining sectors that can earn income. In the event that US interest rates rise, it will likely be a result of improved economic fundamentals and pickup in inflation, which should benefit US companies. We remain overweight credit strategies that will benefit in a rising interest rate environment.

We remain underweight commodities and REITs. In commodities, we reduced exposure to energy futures during the period. We continue to hold commodity equities, however, and have benefitted during certain periods of commodity-price shocks, when commodity equities behave more like “equities” and less like “commodity futures,” as occurred in the first part of the period.

While the aforementioned risks loom large, the goal of our recent changes is to move closer to having all-weather portfolios that will be able to better withstand the ongoing volatility in oil and other commodity prices, the uncertainty surrounding short-term interest rates, and the slow overall global economic growth that may potentially impact equities. We remain vigilant and ready to respond if markets evolve in a different direction.

* The “Target-Date Funds” are the AllianzGI Retirement 2015 Fund, the AllianzGI Retirement 2020 Fund, the AllianzGI Retirement 2025 Fund, the AllianzGI Retirement 2030 Fund, the AllianzGI Retirement 2035 Fund, the AllianzGI Retirement 2040 Fund, the AllianzGI Retirement 2045 Fund, the AllianzGI Retirement 2050 Fund, and the AllianzGI Retirement 2055 Fund.

| Semiannual Report | | May 31, 2015 | 5 |

Table of Contents

Unaudited

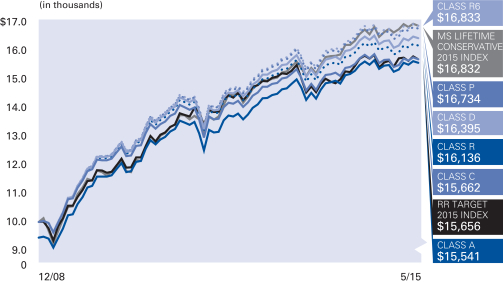

AllianzGI Retirement 2015 Fund

Average Annual Total Return for the period ended May 31, 2015

| 6 Month* | 1 Year | 5 Year | Since Inception† | |||||||||||||||

| AllianzGI Retirement 2015 Fund Class A | 0.50% | 0.55% | 5.77% | 8.06% | ||||||||||||||

|

|

AllianzGI Retirement 2015 Fund Class A (adjusted) | –5.03% | –4.98% | 4.58% | 7.11% | |||||||||||||

| AllianzGI Retirement 2015 Fund Class C | 0.08% | –0.22% | 4.97% | 7.24% | ||||||||||||||

|

|

AllianzGI Retirement 2015 Fund Class C (adjusted) | –0.89% | –1.19% | 4.97% | 7.24% | |||||||||||||

|

|

AllianzGI Retirement 2015 Fund Class D | 0.47% | 0.47% | 5.68% | 8.00% | |||||||||||||

|

|

AllianzGI Retirement 2015 Fund Class R | 0.30% | 0.20% | 5.43% | 7.74% | |||||||||||||

|

|

AllianzGI Retirement 2015 Fund Class P | 0.66% | 0.86% | 6.06% | 8.35% | |||||||||||||

|

|

AllianzGI Retirement 2015 Fund Class R6 | 0.69% | 0.94% | 6.16% | 8.45% | |||||||||||||

| AllianzGI Retirement 2015 Fund Administrative Class | 0.49% | 0.54% | 5.80% | 8.10% | ||||||||||||||

|

|

Morningstar Lifetime Conservative 2015 Index | 0.65% | 1.75% | 7.43% | 8.45% | |||||||||||||

|

|

Real Return Target 2015 Index** | 0.30% | –0.15% | 5.67% | 7.23% | |||||||||||||

| Lipper Mixed-Asset Target 2015 Funds Average | 1.68% | 3.41% | 8.11% | 9.87% | ||||||||||||||

† The Fund began operations on 12/29/08. Benchmark return comparisons began on the fund inception date. Lipper performance comparisons began on 12/31/08.

* Cumulative return

** Effective April 1, 2015, the Funds’ benchmark index changed from the Real Return Target series (white label) to the Morningstar Lifetime Conservative series, as the Morningstar Lifetime Conservative series is considered to be a better representation of the Funds’ investment strategies. Previously, the Real Return Target series replaced the Dow Jones Real Retirement series. This change was due to a decision by the index provider to discontinue the Index. With this mid-period change, differences between the two benchmarks should be considered for purposes of performance comparison.

Performance quoted represents past performance and is no guarantee of future results. Current performance may be lower or higher than performance shown. For performance current to the most recent month-end, visit our website at us.allianzgi.com. Investment return and the principal value will fluctuate. Shares may be worth more or less than original cost when redeemed. The adjusted returns take into account the maximum initial sales charge of 5.50% on Class A shares and the contingent deferred sales charge (CDSC) of 1% on Class C shares, which may apply to shares redeemed during the first year of ownership. Returns do not reflect deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares. See pages 106 and 107 for more information. The Fund’s gross expense ratios are 1.16% for Class A shares, 1.91% for Class C shares, 1.16% for Class D shares, 1.41% for Class R shares, 0.76% for Class P shares, 0.66% for Class R6 shares and 1.01% for Administrative Class shares. These ratios do not include an expense reduction, contractually guaranteed through at least 3/31/16. The Fund’s expense ratios net of this reduction are 0.97% for Class A shares, 1.72% for Class C shares, 1.07% for Class D shares, 1.32% for Class R shares, 0.67% for Class P shares, 0.57% for Class R6 shares and 0.92% for Administrative Class shares. Expense ratio information is as of the Fund’s current prospectus dated April 1, 2015, as supplemented to date.

| 6 | May 31, 2015 | | Semiannual Report |

Table of Contents

Unaudited

AllianzGI Retirement 2015 Fund (cont’d)

| Shareholder Expense Example | Actual Performance | |||||||||||||

| Class A | Class C | Class D | Class R | Class P | Class R6 | Administrative Class | ||||||||

| Beginning Account Value (12/1/14) | $1,000.00 | $1,000.00 | $1,000.00 | $1,000.00 | $1,000.00 | $1,000.00 | $1,000.00 | |||||||

| Ending Account Value (5/31/15) | $1,005.00 | $1,000.80 | $1,004.70 | $1,003.00 | $1,006.60 | $1,006.90 | $1,004.90 | |||||||

| Expenses Paid During Period | $2.50 | $6.24 | $3.00 | $4.29 | $1.05 | $0.45 | $2.25 | |||||||

| Hypothetical Performance | ||||||||||||||

| (5% return before expenses) | ||||||||||||||

| Class A | Class C | Class D | Class R | Class P | Class R6 | Administrative Class | ||||||||

| Beginning Account Value (12/1/14) | $1,000.00 | $1,000.00 | $1,000.00 | $1,000.00 | $1,000.00 | $1,000.00 | $1,000.00 | |||||||

| Ending Account Value (5/31/15) | $1,022.44 | $1,018.70 | $1,021.94 | $1,020.64 | $1,023.88 | $1,024.48 | $1,022.69 | |||||||

| Expenses Paid During Period | $2.52 | $6.29 | $3.02 | $4.33 | $1.06 | $0.45 | $2.27 | |||||||

For each class of the Fund, expenses (net of fee waiver and reimbursement, if any) are equal to the annualized expense ratio for the class (0.50% for Class A, 1.25% for Class C, 0.60% for Class D, 0.86% for Class R, 0.21% for Class P, 0.09% for Class R6 and 0.45% for Administrative Class), multiplied by the average account value over the period, multiplied by 182/365. The expense ratio does not include the expenses of the Underlying Funds, which based upon the allocation of the Fund’s assets among the Underlying Funds are indirectly borne by the shareholders of the Fund.

| Semiannual Report | | May 31, 2015 | 7 |

Table of Contents

Unaudited

AllianzGI Retirement 2020 Fund

Average Annual Total Return for the period ended May 31, 2015

| 6 Month* | 1 Year |

5 Year |

Since Inception† | |||||||||||||||

| AllianzGI Retirement 2020 Fund Class A | 0.25% | 0.04% | 5.93% | 8.28% | ||||||||||||||

|

|

AllianzGI Retirement 2020 Fund Class A (adjusted) | –5.27% | –5.46% | 4.74% | 7.33% | |||||||||||||

| AllianzGI Retirement 2020 Fund Class C | –0.15% | –0.75% | 5.11% | 7.45% | ||||||||||||||

|

|

AllianzGI Retirement 2020 Fund Class C (adjusted) | –1.12% | –1.72% | 5.11% | 7.45% | |||||||||||||

|

|

AllianzGI Retirement 2020 Fund Class D | 0.19% | –0.06% | 5.84% | 8.21% | |||||||||||||

|

|

AllianzGI Retirement 2020 Fund Class R | 0.07% | –0.33% | 5.58% | 7.95% | |||||||||||||

|

|

AllianzGI Retirement 2020 Fund Class P | 0.43% | 0.33% | 6.22% | 8.56% | |||||||||||||

|

|

AllianzGI Retirement 2020 Fund Class R6 | 0.45% | 0.40% | 6.32% | 8.66% | |||||||||||||

| AllianzGI Retirement 2020 Fund Administrative Class | 0.26% | 0.06% | 5.96% | 8.32% | ||||||||||||||

|

|

Morningstar Lifetime Conservative 2020 Index | 0.83% | 2.16% | 8.18% | 9.35% | |||||||||||||

|

|

Real Return Target 2020 Index** | 0.36% | 0.00% | 5.97% | 7.64% | |||||||||||||

| Lipper Mixed-Asset Target 2020 Funds Average | 1.97% | 3.98% | 8.55% | 10.27% | ||||||||||||||

† The Fund began operations on 12/29/08. Benchmark return comparisons began on the fund inception date. Lipper performance comparisons began on 12/31/08.

* Cumulative return

** Effective April 1, 2015, the Funds’ benchmark index changed from the Real Return Target series (white label) to the Morningstar Lifetime Conservative series, as the Morningstar Lifetime Conservative series is considered to be a better representation of the Funds’ investment strategies. Previously, the Real Return Target series replaced the Dow Jones Real Retirement series. This change was due to a decision by the index provider to discontinue the Index. With this mid-period change, differences between the two benchmarks should be considered for purposes of performance comparison.

Performance quoted represents past performance and is no guarantee of future results. Current performance may be lower or higher than performance shown. For performance current to the most recent month-end, visit our website at us.allianzgi.com. Investment return and the principal value will fluctuate. Shares may be worth more or less than original cost when redeemed. The adjusted returns take into account the maximum initial sales charge of 5.50% on Class A shares and the contingent deferred sales charge (CDSC) of 1% on Class C shares, which may apply to shares redeemed during the first year of ownership. Returns do not reflect deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares. See pages 106 and 107 for more information. The Fund’s gross expense ratios are 1.17% for Class A shares, 1.92% for Class C shares, 1.17% for Class D shares, 1.42% for Class R shares, 0.77% for Class P shares, 0.67% for Class R6 shares and 1.02% for Administrative Class shares. These ratios do not include an expense reduction, contractually guaranteed through at least 3/31/16. The Fund’s expense ratios net of this reduction are 0.99% for Class A shares, 1.74% for Class C shares, 1.09% for Class D shares, 1.34% for Class R shares, 0.69% for Class P shares, 0.59% for Class R6 shares and 0.94% for Administrative Class shares. Expense ratio information is as of the Fund’s current prospectus dated April 1, 2015, as supplemented to date.

| 8 | May 31, 2015 | | Semiannual Report |

Table of Contents

Unaudited

AllianzGI Retirement 2020 Fund (cont’d)

| Shareholder Expense Example | Actual Performance | |||||||||||||

| Class A | Class C | Class D | Class R | Class P | Class R6 | Administrative Class | ||||||||

| Beginning Account Value (12/1/14) | $1,000.00 | $1,000.00 | $1,000.00 | $1,000.00 | $1,000.00 | $1,000.00 | $1,000.00 | |||||||

| Ending Account Value (5/31/15) | $1,002.50 | $998.50 | $1,001.90 | $1,000.70 | $1,004.30 | $1,004.50 | $1,002.60 | |||||||

| Expenses Paid During Period | $2.50 | $6.23 | $2.99 | $4.24 | $1.00 | $0.50 | $2.25 | |||||||

| Hypothetical Performance | ||||||||||||||

| (5% return before expenses) | ||||||||||||||

| Class A | Class C | Class D | Class R | Class P | Class R6 | Administrative Class | ||||||||

| Beginning Account Value (12/1/14) | $1,000.00 | $1,000.00 | $1,000.00 | $1,000.00 | $1,000.00 | $1,000.00 | $1,000.00 | |||||||

| Ending Account Value (5/31/15) | $1,022.44 | $1,018.70 | $1,021.94 | $1,020.69 | $1,023.93 | $1,024.43 | $1,022.69 | |||||||

| Expenses Paid During Period | $2.52 | $6.29 | $3.02 | $4.28 | $1.01 | $0.50 | $2.27 | |||||||

For each class of the Fund, expenses (net of fee waiver and reimbursement, if any) are equal to the annualized expense ratio for the class (0.50% for Class A, 1.25% for Class C, 0.60% for Class D, 0.85% for Class R, 0.20% for Class P, 0.10% for Class R6 and 0.45% for Administrative Class), multiplied by the average account value over the period, multiplied by 182/365. The expense ratio does not include the expenses of the Underlying Funds, which based upon the allocation of the Fund’s assets among the Underlying Funds are indirectly borne by the shareholders of the Fund.

| Semiannual Report | | May 31, 2015 | 9 |

Table of Contents

Unaudited

AllianzGI Retirement 2025 Fund

Average Annual Total Return for the period ended May 31, 2015

| 6 Month* | 1 Year | Since Inception† | ||||||||||||

| AllianzGI Retirement 2025 Fund Class A | 0.54% | 0.19% | 6.05% | |||||||||||

|

|

AllianzGI Retirement 2025 Fund Class A (adjusted) | –4.99% | –5.32% | 4.32% | ||||||||||

|

|

AllianzGI Retirement 2025 Fund Class R | 0.35% | –0.17% | 5.67% | ||||||||||

|

|

AllianzGI Retirement 2025 Fund Class P | 0.63% | 0.46% | 6.36% | ||||||||||

|

|

AllianzGI Retirement 2025 Fund Class R6 | 0.70% | 0.58% | 6.46% | ||||||||||

| AllianzGI Retirement 2025 Fund Administrative Class | 0.48% | 0.19% | 6.08% | |||||||||||

|

|

Morningstar Lifetime Conservative 2025 Index |

1.08% | 2.64% | 8.93% | ||||||||||

|

|

Real Return Target 2025 Index** | 0.43% | 0.13% | 5.17% | ||||||||||

| Lipper Mixed-Asset Target 2025 Funds Average | 2.31% | 4.72% | 10.70% | |||||||||||

† The Fund began operations on 12/19/11. Benchmark return comparisons began on the fund inception date. Lipper performance comparisons began on 12/31/11.

* Cumulative return

** Effective April 1, 2015, the Funds’ benchmark index changed from the Real Return Target series (white label) to the Morningstar Lifetime Conservative series, as the Morningstar Lifetime Conservative series is considered to be a better representation of the Funds’ investment strategies. Previously, the Real Return Target series replaced the Dow Jones Real Retirement series. This change was due to a decision by the index provider to discontinue the Index. With this mid-period change, differences between the two benchmarks should be considered for purposes of performance comparison.

Performance quoted represents past performance and is no guarantee of future results. Current performance may be lower or higher than performance shown. For performance current to the most recent month-end, visit our website at us.allianzgi.com. Investment return and the principal value will fluctuate. Shares may be worth more or less than original cost when redeemed. The adjusted returns take into account the maximum initial sales charge of 5.50% on Class A shares. Returns do not reflect deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares. See pages 106 and 107 for more information. The Fund’s gross expense ratios are 1.19% for Class A shares, 1.44% for Class R shares, 0.79% for Class P shares, 0.69% for Class R6 shares and 1.04% for Administrative Class shares. These ratios do not include an expense reduction, contractually guaranteed through at least 3/31/16. The Fund’s expense ratios net of this reduction are 1.01% for Class A shares, 1.36% for Class R shares, 0.71% for Class P shares, 0.61% for Class R6 shares and 0.96% for Administrative Class shares. Expense ratio information is as of the Fund’s current prospectus dated April 1, 2015, as supplemented to date.

| 10 | May 31, 2015 | | Semiannual Report |

Table of Contents

Unaudited

AllianzGI Retirement 2025 Fund (cont’d)

| Shareholder Expense Example | Actual Performance | |||||||||

| Class A | Class R | Class P | Class R6 | Administrative Class | ||||||

| Beginning Account Value (12/1/14) | $1,000.00 | $1,000.00 | $1,000.00 | $1,000.00 | $1,000.00 | |||||

| Ending Account Value (5/31/15) | $1,005.40 | $1,003.50 | $1,006.30 | $1,007.00 | $1,004.80 | |||||

| Expenses Paid During Period | $2.40 | $4.15 | $0.90 | $0.40 | $2.10 | |||||

| Hypothetical Performance | ||||||||||

| (5% return before expenses) | ||||||||||

| Class A | Class R | Class P | Class R6 | Administrative Class | ||||||

| Beginning Account Value (12/1/14) | $1,000.00 | $1,000.00 | $1,000.00 | $1,000.00 | $1,000.00 | |||||

| Ending Account Value (5/31/15) | $1,022.54 | $1,020.79 | $1,024.03 | $1,024.53 | $1,022.84 | |||||

| Expenses Paid During Period | $2.42 | $4.18 | $0.91 | $0.40 | $2.12 | |||||

For each class of the Fund, expenses (net of fee waiver and reimbursement, if any) are equal to the annualized expense ratio for the class (0.48% for Class A, 0.83% for Class R, 0.18% for Class P, 0.08% for Class R6 and 0.42% for Administrative Class), multiplied by the average account value over the period, multiplied by 182/365. The expense ratio does not include the expenses of the Underlying Funds, which based upon the allocation of the Fund’s assets among the Underlying Funds are indirectly borne by the shareholders of the Fund.

| Semiannual Report | | May 31, 2015 | 11 |

Table of Contents

Unaudited

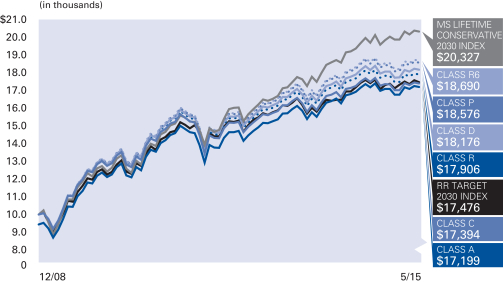

AllianzGI Retirement 2030 Fund

Average Annual Total Return for the period ended May 31, 2015

| 6 Month* | 1 Year | 5 Year | Since Inception† | |||||||||||||||

| AllianzGI Retirement 2030 Fund Class A | 0.64% | 0.16% | 7.08% | 9.78% | ||||||||||||||

|

|

AllianzGI Retirement 2030 Fund Class A (adjusted) | –4.89% | –5.34% | 5.88% | 8.82% | |||||||||||||

| AllianzGI Retirement 2030 Fund Class C | 0.24% | –0.62% | 6.29% | 9.01% | ||||||||||||||

|

|

AllianzGI Retirement 2030 Fund Class C (adjusted) | –0.72% | –1.57% | 6.29% | 9.01% | |||||||||||||

|

|

AllianzGI Retirement 2030 Fund Class D | 0.56% | 0.04% | 7.01% | 9.76% | |||||||||||||

|

|

AllianzGI Retirement 2030 Fund Class R | 0.44% | –0.23% | 6.75% | 9.50% | |||||||||||||

|

|

AllianzGI Retirement 2030 Fund Class P | 0.76% | 0.43% | 7.39% | 10.12% | |||||||||||||

|

|

AllianzGI Retirement 2030 Fund Class R6 | 0.84% | 0.56% | 7.50% | 10.23% | |||||||||||||

| AllianzGI Retirement 2030 Fund Administrative Class | 0.66% | 0.19% | 7.15% | 9.89% | ||||||||||||||

|

|

Morningstar Lifetime Conservative 2030 Index | 1.45% | 3.26% | 10.07% | 11.69% | |||||||||||||

|

|

Real Return Target 2030 Index** | 0.52% | 0.26% | 7.06% | 9.09% | |||||||||||||

| Lipper Mixed-Asset Target 2030 Funds Average | 2.67% | 5.17% | 10.34% | 12.07% | ||||||||||||||

† The Fund began operations on 12/29/08. Benchmark return comparisons began on the fund inception date. Lipper performance comparisons began on 12/31/08.

* Cumulative return

** Effective April 1, 2015, the Funds’ benchmark index changed from the Real Return Target series (white label) to the Morningstar Lifetime Conservative series, as the Morningstar Lifetime Conservative series is considered to be a better representation of the Funds’ investment strategies. Previously, the Real Return Target series replaced the Dow Jones Real Retirement series. This change was due to a decision by the index provider to discontinue the Index. With this mid-period change, differences between the two benchmarks should be considered for purposes of performance comparison.

Performance quoted represents past performance and is no guarantee of future results. Current performance may be lower or higher than performance shown. For performance current to the most recent month-end, visit our website at us.allianzgi.com. Investment return and the principal value will fluctuate. Shares may be worth more or less than original cost when redeemed. The adjusted returns take into account the maximum initial sales charge of 5.50% on Class A shares and the contingent deferred sales charge (CDSC) of 1% on Class C shares, which may apply to shares redeemed during the first year of ownership. Returns do not reflect deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares. See pages 106 and 107 for more information. The Fund’s gross expense ratios are 1.24% for Class A shares, 1.99% for Class C shares, 1.24% for Class D shares, 1.49% for Class R shares, 0.84% for Class P shares, 0.74% for Class R6 shares and 1.09% for Administrative Class shares. These ratios do not include an expense reduction, contractually guaranteed through at least 3/31/16. The Fund’s expense ratios net of this reduction are 1.03% for Class A shares, 1.78% for Class C shares, 1.13% for Class D shares, 1.38% for Class R shares, 0.73% for Class P shares, 0.63% for Class R6 shares and 0.98% for Administrative Class shares. Expense ratio information is as of the Fund’s current prospectus dated April 1, 2015, as supplemented to date.

| 12 | May 31, 2015 | | Semiannual Report |

Table of Contents

Unaudited

AllianzGI Retirement 2030 Fund (cont’d)

| Shareholder Expense Example | Actual Performance | |||||||||||||

| Class A | Class C | Class D | Class R | Class P | Class R6 | Administrative Class | ||||||||

| Beginning Account Value (12/1/14) | $1,000.00 | $1,000.00 | $1,000.00 | $1,000.00 | $1,000.00 | $1,000.00 | $1,000.00 | |||||||

| Ending Account Value (5/31/15) | $1,006.40 | $1,002.40 | $1,005.60 | $1,004.40 | $1,007.60 | $1,008.40 | $1,006.60 | |||||||

| Expenses Paid During Period | $2.30 | $6.04 | $2.80 | $4.05 | $0.80 | $0.30 | $2.05 | |||||||

| Hypothetical Performance | ||||||||||||||

| (5% return before expenses) | ||||||||||||||

| Class A | Class C | Class D | Class R | Class P | Class R6 | Administrative Class | ||||||||

| Beginning Account Value (12/1/14) | $1,000.00 | $1,000.00 | $1,000.00 | $1,000.00 | $1,000.00 | $1,000.00 | $1,000.00 | |||||||

| Ending Account Value (5/31/15) | $1,022.64 | $1,018.90 | $1,022.14 | $1,020.89 | $1,024.13 | $1,024.63 | $1,022.89 | |||||||

| Expenses Paid During Period | $2.32 | $6.09 | $2.82 | $4.08 | $0.81 | $0.30 | $2.07 | |||||||

For each class of the Fund, expenses (net of fee waiver and reimbursement, if any) are equal to the annualized expense ratio for the class (0.46% for Class A, 1.21% for Class C, 0.56% for Class D, 0.81% for Class R, 0.16% for Class P, 0.06% for Class R6 and 0.41% for Administrative Class), multiplied by the average account value over the period, multiplied by 182/365. The expense ratio does not include the expenses of the Underlying Funds, which based upon the allocation of the Fund’s assets among the Underlying Funds are indirectly borne by the shareholders of the Fund.

| Semiannual Report | | May 31, 2015 | 13 |

Table of Contents

Unaudited

AllianzGI Retirement 2035 Fund

Average Annual Total Return for the period ended May 31, 2015

| 6 Month* | 1 Year |

Since Inception† | ||||||||||||

| AllianzGI Retirement 2035 Fund Class A | 0.98% | 0.49% | 8.47% | |||||||||||

|

|

AllianzGI Retirement 2035 Fund Class A (adjusted) | –4.57% | –5.04% | 6.71% | ||||||||||

|

|

AllianzGI Retirement 2035 Fund Class R | 0.79% | 0.14% | 8.10% | ||||||||||

|

|

AllianzGI Retirement 2035 Fund Class P | 1.10% | 0.78% | 8.81% | ||||||||||

|

|

AllianzGI Retirement 2035 Fund Class R6 | 1.18% | 0.85% | 8.91% | ||||||||||

| AllianzGI Retirement 2035 Fund Administrative Class | 0.95% | 0.47% | 8.51% | |||||||||||

|

|

Morningstar Lifetime Conservative 2035 Index | 1.89% | 3.89% | 12.11% | ||||||||||

|

|

Real Return Target 2035 Index** | 0.64% | 0.38% | 7.59% | ||||||||||

| Lipper Mixed-Asset Target 2035 Funds Average | 3.06% | 5.94% | 12.73% | |||||||||||

† The Fund began operations on 12/19/11. Benchmark return comparisons began on the fund inception date. Lipper performance comparisons began on 12/31/11.

* Cumulative return

** Effective April 1, 2015, the Funds’ benchmark index changed from the Real Return Target series (white label) to the Morningstar Lifetime Conservative series, as the Morningstar Lifetime Conservative series is considered to be a better representation of the Funds’ investment strategies. Previously, the Real Return Target series replaced the Dow Jones Real Retirement series. This change was due to a decision by the index provider to discontinue the Index. With this mid-period change, differences between the two benchmarks should be considered for purposes of performance comparison.

Performance quoted represents past performance and is no guarantee of future results. Current performance may be lower or higher than performance shown. For performance current to the most recent month-end, visit our website at us.allianzgi.com. Investment return and the principal value will fluctuate. Shares may be worth more or less than original cost when redeemed. The adjusted returns take into account the maximum initial sales charge of 5.50% on Class A shares. Returns do not reflect deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares. See pages 106 and 107 for more information. The Fund’s gross expense ratios are 1.27% for Class A shares, 1.52% for Class R shares, 0.87% for Class P shares, 0.77% for Class R6 shares and 1.12% for Administrative Class shares. These ratios do not include an expense reduction, contractually guaranteed through at least 3/31/16. The Fund’s expense ratios net of this reduction are 1.06% for Class A shares, 1.41% for Class R shares, 0.76% for Class P shares, 0.66% for Class R6 shares and 1.01% for Administrative Class shares. Expense ratio information is as of the Fund’s current prospectus dated April 1, 2015, as supplemented to date.

| 14 | May 31, 2015 | | Semiannual Report |

Table of Contents

Unaudited

AllianzGI Retirement 2035 Fund (cont’d)

| Shareholder Expense Example | Actual Performance | |||||||||

| Class A | Class R | Class P | Class R6 | Administrative Class | ||||||

| Beginning Account Value (12/1/14) | $1,000.00 | $1,000.00 | $1,000.00 | $1,000.00 | $1,000.00 | |||||

| Ending Account Value (5/31/15) | $1,009.80 | $1,007.90 | $1,011.00 | $1,011.80 | $1,009.50 | |||||

| Expenses Paid During Period | $2.15 | $3.95 | $0.65 | $0.15 | $1.90 | |||||

| Hypothetical Performance | ||||||||||

| (5% return before expenses) | ||||||||||

| Class A | Class R | Class P | Class R6 | Administrative Class | ||||||

| Beginning Account Value (12/1/14) | $1,000.00 | $1,000.00 | $1,000.00 | $1,000.00 | $1,000.00 | |||||

| Ending Account Value (5/31/15) | $1,022.79 | $1,020.99 | $1,024.28 | $1,024.78 | $1,023.04 | |||||

| Expenses Paid During Period | $2.17 | $3.98 | $0.66 | $0.15 | $1.92 | |||||

For each class of the Fund, expenses (net of fee waiver and reimbursement, if any) are equal to the annualized expense ratio for the class (0.43% for Class A, 0.79% for Class R, 0.13% for Class P, 0.03% for Class R6 and 0.38% for Administrative Class), multiplied by the average account value over the period, multiplied by 182/365. The expense ratio does not include the expenses of the Underlying Funds, which based upon the allocation of the Fund’s assets among the Underlying Funds are indirectly borne by the shareholders of the Fund.

| Semiannual Report | | May 31, 2015 | 15 |

Table of Contents

Unaudited

AllianzGI Retirement 2040 Fund

Average Annual Total Return for the period ended May 31, 2015

| 6 Month* | 1 Year | 5 Year | Since Inception† | |||||||||||||||

| AllianzGI Retirement 2040 Fund Class A | 1.19% | 0.61% | 8.44% | 11.34% | ||||||||||||||

|

|

AllianzGI Retirement 2040 Fund Class A (adjusted) | –4.38% | –4.93% | 7.22% | 10.37% | |||||||||||||

| AllianzGI Retirement 2040 Fund Class C | 0.83% | –0.16% | 7.64% | 10.49% | ||||||||||||||

|

|

AllianzGI Retirement 2040 Fund Class C (adjusted) | –0.12% | –1.11% | 7.64% | 10.49% | |||||||||||||

|

|

AllianzGI Retirement 2040 Fund Class D | 1.19% | 0.52% | 8.36% | 11.25% | |||||||||||||

|

|

AllianzGI Retirement 2040 Fund Class R | 1.02% | 0.25% | 8.10% | 11.00% | |||||||||||||

|

|

AllianzGI Retirement 2040 Fund Class P | 1.35% | 0.91% | 8.76% | 11.64% | |||||||||||||

|

|

AllianzGI Retirement 2040 Fund Class R6 | 1.43% | 1.04% | 8.85% | 11.74% | |||||||||||||

| AllianzGI Retirement 2040 Fund Administrative Class | 1.14% | 0.56% | 8.48% | 11.38% | ||||||||||||||

|

|

Morningstar Lifetime Conservative 2040 Index | 2.29% | 4.36% | 11.70% | 13.53% | |||||||||||||

|

|

Real Return Target 2040 Index** | 0.79% | 0.53% | 8.41% | 10.73% | |||||||||||||

| Lipper Mixed-Asset Target 2040 Funds Average | 3.18% | 6.02% | 11.34% | 12.97% | ||||||||||||||

† The Fund began operations on 12/29/08. Benchmark return comparisons began on the fund inception date. Lipper performance comparisons began on 12/31/08.

* Cumulative return

** Effective April 1, 2015, the Funds’ benchmark index changed from the Real Return Target series (white label) to the Morningstar Lifetime Conservative series, as the Morningstar Lifetime Conservative series is considered to be a better representation of the Funds’ investment strategies. Previously, the Real Return Target series replaced the Dow Jones Real Retirement series. This change was due to a decision by the index provider to discontinue the Index. With this mid-period change, differences between the two benchmarks should be considered for purposes of performance comparison.

Performance quoted represents past performance and is no guarantee of future results. Current performance may be lower or higher than performance shown. For performance current to the most recent month-end, visit our website at us.allianzgi.com. Investment return and the principal value will fluctuate. Shares may be worth more or less than original cost when redeemed. The adjusted returns take into account the maximum initial sales charge of 5.50% on Class A shares and the contingent deferred sales charge (CDSC) of 1% on Class C shares, which may apply to shares redeemed during the first year of ownership. Returns do not reflect deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares. See pages 106 and 107 for more information. The Fund’s gross expense ratios are 1.30% for Class A shares, 2.05% for Class C shares, 1.30% for Class D shares, 1.55% for Class R shares, 0.90% for Class P shares, 0.80% for Class R6 shares and 1.15% for Administrative Class shares. These ratios do not include an expense reduction, contractually guaranteed through at least 3/31/16. The Fund’s expense ratios net of this reduction are 1.09% for Class A shares, 1.84% for Class C shares, 1.19% for Class D shares, 1.44% for Class R shares, 0.79% for Class P shares, 0.69% for Class R6 shares and 1.04% for Administrative Class shares. Expense ratio information is as of the Fund’s current prospectus dated April 1, 2015, as supplemented to date.

| 16 | May 31, 2015 | | Semiannual Report |

Table of Contents

Unaudited

AllianzGI Retirement 2040 Fund (cont’d)

| Shareholder Expense Example | Actual Performance | |||||||||||||

| Class A | Class C | Class D | Class R | Class P | Class R6 | Administrative Class | ||||||||

| Beginning Account Value (12/1/14) | $1,000.00 | $1,000.00 | $1,000.00 | $1,000.00 | $1,000.00 | $1,000.00 | $1,000.00 | |||||||

| Ending Account Value (5/31/15) | $1,011.90 | $1,008.30 | $1,011.90 | $1,010.20 | $1,013.50 | $1,014.30 | $1,011.40 | |||||||

| Expenses Paid During Period | $2.06 | $5.81 | $2.56 | $3.81 | $0.55 | $0.05 | $1.81 | |||||||

| Hypothetical Performance | ||||||||||||||

| (5% return before expenses) | ||||||||||||||

| Class A | Class C | Class D | Class R | Class P | Class R6 | Administrative Class | ||||||||

| Beginning Account Value (12/1/14) | $1,000.00 | $1,000.00 | $1,000.00 | $1,000.00 | $1,000.00 | $1,000.00 | $1,000.00 | |||||||

| Ending Account Value (5/31/15) | $1,022.89 | $1,019.15 | $1,022.39 | $1,021.14 | $1,024.38 | $1,024.88 | $1,023.14 | |||||||

| Expenses Paid During Period | $2.07 | $5.84 | $2.57 | $3.83 | $0.56 | $0.05 | $1.82 | |||||||

For each class of the Fund, expenses (net of fee waiver and reimbursement, if any) are equal to the annualized expense ratio for the class (0.41% for Class A, 1.16% for Class C, 0.51% for Class D, 0.76% for Class R, 0.11% for Class P, 0.01% for Class R6 and 0.36% for Administrative Class), multiplied by the average account value over the period, multiplied by 182/365. The expense ratio does not include the expenses of the Underlying Funds, which based upon the allocation of the Fund’s assets among the Underlying Funds are indirectly borne by the shareholders of the Fund.

| Semiannual Report | | May 31, 2015 | 17 |

Table of Contents

Unaudited

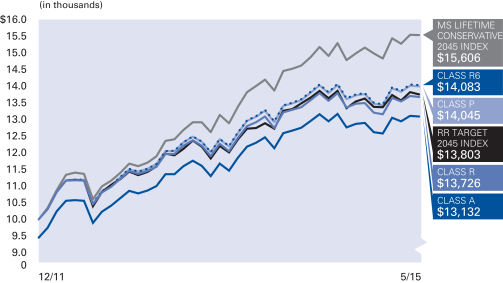

AllianzGI Retirement 2045 Fund

Average Annual Total Return for the period ended May 31, 2015

| 6 Month* | 1 Year |

Since Inception† |

||||||||||||

| AllianzGI Retirement 2045 Fund Class A | 1.58% | 1.10% | 10.01% | |||||||||||

|

|

AllianzGI Retirement 2045 Fund Class A (adjusted) | –4.01% | –4.46% | 8.22% | ||||||||||

|

|

AllianzGI Retirement 2045 Fund Class R | 1.40% | 0.71% | 9.62% | ||||||||||

|

|

AllianzGI Retirement 2045 Fund Class P | 1.73% | 1.42% | 10.35% | ||||||||||

|

|

AllianzGI Retirement 2045 Fund Class R6 | 1.79% | 1.53% | 10.44% | ||||||||||

| AllianzGI Retirement 2045 Fund Administrative Class | 1.53% | 1.06% | 10.01% | |||||||||||

|

|

Morningstar Lifetime Conservative 2045 Index | 2.53% | 4.51% | 13.78% | ||||||||||

|

|

Real Return Target 2045 Index** | 0.95% | 0.72% | 9.80% | ||||||||||

| Lipper Mixed-Asset Target 2045 Funds Average | 3.34% | 6.40% | 13.92% | |||||||||||

† The Fund began operations on 12/19/11. Benchmark return comparisons began on the fund inception date. Lipper performance comparisons began on 12/31/11.

* Cumulative return

** Effective April 1, 2015, the Funds’ benchmark index changed from the Real Return Target series (white label) to the Morningstar Lifetime Conservative series, as the Morningstar Lifetime Conservative series is considered to be a better representation of the Funds’ investment strategies. Previously, the Real Return Target series replaced the Dow Jones Real Retirement series. This change was due to a decision by the index provider to discontinue the Index. With this mid-period change, differences between the two benchmarks should be considered for purposes of performance comparison.

Performance quoted represents past performance and is no guarantee of future results. Current performance may be lower or higher than performance shown. For performance current to the most recent month-end, visit our website at us.allianzgi.com. Investment return and the principal value will fluctuate. Shares may be worth more or less than original cost when redeemed. The adjusted returns take into account the maximum initial sales charge of 5.50% on Class A shares. Returns do not reflect deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares. See pages 106 and 107 for more information. The Fund’s gross expense ratios are 1.33% for Class A shares, 1.58% for Class R shares, 0.93% for Class P shares, 0.83% for Class R6 shares and 1.18% for Administrative Class shares. These ratios do not include an expense reduction, contractually guaranteed through at least 3/31/16. The Fund’s expense ratios net of this reduction are 1.10% for Class A shares, 1.45% for Class R shares, 0.80% for Class P shares, 0.70% for Class R6 shares and 1.05% for Administrative Class shares. Expense ratio information is as of the Fund’s current prospectus dated April 1, 2015, as supplemented to date.

| 18 | May 31, 2015 | | Semiannual Report |

Table of Contents

Unaudited

AllianzGI Retirement 2045 Fund (cont’d)

| Shareholder Expense Example | Actual Performance | |||||||||

| Class A | Class R | Class P | Class R6 | Administrative Class | ||||||

| Beginning Account Value (12/1/14) | $1,000.00 | $1,000.00 | $1,000.00 | $1,000.00 | $1,000.00 | |||||

| Ending Account Value (5/31/15) | $1,015.80 | $1,014.00 | $1,017.30 | $1,017.90 | $1,015.30 | |||||

| Expenses Paid During Period | $2.01 | $3.77 | $0.50 | $— | $1.76 | |||||

| Hypothetical Performance | ||||||||||

| (5% return before expenses) | ||||||||||

| Class A | Class R | Class P | Class R6 | Administrative Class | ||||||

| Beginning Account Value (12/1/14) | $1,000.00 | $1,000.00 | $1,000.00 | $1,000.00 | $1,000.00 | |||||

| Ending Account Value (5/31/15) | $1,022.94 | $1,021.19 | $1,024.43 | $1,024.93 | $1,023.19 | |||||

| Expenses Paid During Period | $2.02 | $3.78 | $0.50 | $— | $1.77 | |||||

For each class of the Fund, expenses (net of fee waiver and reimbursement, if any) are equal to the annualized expense ratio for the class (0.40% for Class A, 0.75% for Class R, 0.10% for Class P, 0.00% for Class R6 and 0.35% for Administrative Class), multiplied by the average account value over the period, multiplied by 182/365. The expense ratio does not include the expenses of the Underlying Funds, which based upon the allocation of the Fund’s assets among the Underlying Funds are indirectly borne by the shareholders of the Fund.

| Semiannual Report | | May 31, 2015 | 19 |

Table of Contents

Unaudited

AllianzGI Retirement 2050 Fund

Average Annual Total Return for the period ended May 31, 2015

| 6 Month* | 1 Year | 5 Year | Since Inception† | |||||||||||||||

| AllianzGI Retirement 2050 Fund Class A | 1.53% | 0.91% | 9.13% | 11.88% | ||||||||||||||

|

|

AllianzGI Retirement 2050 Fund Class A (adjusted) | –4.06% | –4.64% | 7.90% | 10.90% | |||||||||||||

| AllianzGI Retirement 2050 Fund Class C | 1.20% | 0.16% | 8.30% | 11.06% | ||||||||||||||

|

|

AllianzGI Retirement 2050 Fund Class C (adjusted) | 0.25% | –0.77% | 8.30% | 11.06% | |||||||||||||

|

|

AllianzGI Retirement 2050 Fund Class D | 1.55% | 0.84% | 9.05% | 11.83% | |||||||||||||

|

|

AllianzGI Retirement 2050 Fund Class R | 1.39% | 0.54% | 8.78% | 11.57% | |||||||||||||

|

|

AllianzGI Retirement 2050 Fund Class P | 1.71% | 1.24% | 9.44% | 12.20% | |||||||||||||

|

|

AllianzGI Retirement 2050 Fund Class R6 | 1.75% | 1.32% | 9.54% | 12.30% | |||||||||||||

| AllianzGI Retirement 2050 Fund Administrative Class | 1.53% | 0.96% | 9.18% | 11.95% | ||||||||||||||

|

|

Morningstar Lifetime Conservative 2050 Index | 2.60% | 4.44% | 12.00% | 13.91% | |||||||||||||

|

|

Real Return Target 2050 Index** | 1.15% | 1.00% | 9.30% | 11.66% | |||||||||||||

| Lipper Mixed-Asset Target 2050 Funds Average | 3.36% | 6.34% | 11.65% | 13.23% | ||||||||||||||

† The Fund began operations on 12/29/08. Benchmark return comparisons began on the fund inception date. Lipper performance comparisons began on 12/31/08.

* Cumulative return

** Effective April 1, 2015, the Funds’ benchmark index changed from the Real Return Target series (white label) to the Morningstar Lifetime Conservative series, as the Morningstar Lifetime Conservative series is considered to be a better representation of the Funds’ investment strategies. Previously, the Real Return Target series replaced the Dow Jones Real Retirement series. This change was due to a decision by the index provider to discontinue the Index. With this mid-period change, differences between the two benchmarks should be considered for purposes of performance comparison.

Performance quoted represents past performance and is no guarantee of future results. Current performance may be lower or higher than performance shown. For performance current to the most recent month-end, visit our website at us.allianzgi.com. Investment return and the principal value will fluctuate. Shares may be worth more or less than original cost when redeemed. The adjusted returns take into account the maximum initial sales charge of 5.50% on Class A shares and the contingent deferred sales charge (CDSC) of 1% on Class C shares, which may apply to shares redeemed during the first year of ownership. Returns do not reflect deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares. See pages 106 and 107 for more information. The Fund’s gross expense ratios are 1.35% for Class A shares, 2.10% for Class C shares, 1.35% for Class D shares, 1.60% for Class R shares, 0.95% for Class P shares, 0.85% for Class R6 shares and 1.20% for Administrative Class shares. These ratios do not include an expense reduction, contractually guaranteed through at least 3/31/16. The Fund’s expense ratios net of this reduction are 1.10% for Class A shares, 1.85% for Class C shares, 1.20% for Class D shares, 1.45% for Class R shares, 0.80% for Class P shares, 0.70% for Class R6 shares and 1.05% for Administrative Class shares. Expense ratio information is as of the Fund’s current prospectus dated April 1, 2015, as supplemented to date.

| 20 | May 31, 2015 | | Semiannual Report |

Table of Contents

Unaudited

AllianzGI Retirement 2050 Fund (cont’d)

| Shareholder Expense Example | Actual Performance | |||||||||||||

| Class A | Class C | Class D | Class R | Class P | Class R6 | Administrative Class | ||||||||

| Beginning Account Value (12/1/14) | $1,000.00 | $1,000.00 | $1,000.00 | $1,000.00 | $1,000.00 | $1,000.00 | $1,000.00 | |||||||

| Ending Account Value (5/31/15) | $1,015.30 | $1,012.00 | $1,015.50 | $1,013.90 | $1,017.10 | $1,017.50 | $1,015.30 | |||||||

| Expenses Paid During Period | $1.81 | $5.57 | $2.31 | $3.56 | $0.30 | $— | $1.56 | |||||||

| Hypothetical Performance | ||||||||||||||

| (5% return before expenses) | ||||||||||||||

| Class A | Class C | Class D | Class R | Class P | Class R6 | Administrative Class | ||||||||

| Beginning Account Value (12/1/14) | $1,000.00 | $1,000.00 | $1,000.00 | $1,000.00 | $1,000.00 | $1,000.00 | $1,000.00 | |||||||

| Ending Account Value (5/31/15) | $1,023.14 | $1,019.40 | $1,022.64 | $1,021.39 | $1,024.63 | $1,024.93 | $1,023.39 | |||||||

| Expenses Paid During Period | $1.82 | $5.59 | $2.32 | $3.58 | $0.30 | $— | $1.56 | |||||||

For each class of the Fund, expenses (net of fee waiver and reimbursement, if any) are equal to the annualized expense ratio for the class (0.36% for Class A, 1.11% for Class C, 0.46% for Class D, 0.71% for Class R, 0.06% for Class P, 0.00% for Class R6 and 0.31% for Administrative Class), multiplied by the average account value over the period, multiplied by 182/365. The expense ratio does not include the expenses of the Underlying Funds, which based upon the allocation of the Fund’s assets among the Underlying Funds are indirectly borne by the shareholders of the Fund.

| Semiannual Report | | May 31, 2015 | 21 |

Table of Contents

Unaudited

AllianzGI Retirement 2055 Fund

Average Annual Total Return for the period ended May 31, 2015

| 6 Month* | 1 Year |

Since Inception† | ||||||||||||

| AllianzGI Retirement 2055 Fund Class A | 1.62% | 0.97% | 10.40% | |||||||||||

|

|

AllianzGI Retirement 2055 Fund Class A (adjusted) | –3.97% | –4.58% | 8.61% | ||||||||||

|

|

AllianzGI Retirement 2055 Fund Class R | 1.45% | 0.65% | 10.04% | ||||||||||

|

|

AllianzGI Retirement 2055 Fund Class P | 1.79% | 1.31% | 10.76% | ||||||||||

|

|

AllianzGI Retirement 2055 Fund Class R6 | 1.78% | 1.36% | 10.84% | ||||||||||

| AllianzGI Retirement 2055 Fund Administrative Class | 1.58% | 0.94% | 10.44% | |||||||||||

|

|

Morningstar Lifetime Conservative 2055 Index | 2.61% | 4.29% | 13.85% | ||||||||||

|

|

Real Return Target 2040+ Index** | 1.26% | 1.15% | 10.78% | ||||||||||

| Lipper Mixed-Asset Target 2055+ Funds Average | 3.49% | 6.54% | 14.20% | |||||||||||

† The Fund began operations on 12/19/11. Benchmark return comparisons began on the fund inception date. Lipper performance comparisons began on 12/31/11.

* Cumulative return

** Effective April 1, 2015, the Funds’ benchmark index changed from the Real Return Target series (white label) to the Morningstar Lifetime Conservative series, as the Morningstar Lifetime Conservative series is considered to be a better representation of the Funds’ investment strategies. Previously, the Real Return Target series replaced the Dow Jones Real Retirement series. This change was due to a decision by the index provider to discontinue the Index. With this mid-period change, differences between the two benchmarks should be considered for purposes of performance comparison.

Performance quoted represents past performance and is no guarantee of future results. Current performance may be lower or higher than performance shown. For performance current to the most recent month-end, visit our website at us.allianzgi.com. Investment return and the principal value will fluctuate. Shares may be worth more or less than original cost when redeemed. The adjusted returns take into account the maximum initial sales charge of 5.50% on Class A shares. Returns do not reflect deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares. See pages 106 and 107 for more information. The Fund’s gross expense ratios are 1.35% for Class A shares, 1.60% for Class R shares, 0.95% for Class P shares, 0.85% for Class R6 shares and 1.20% for Administrative Class shares. These ratios do not include an expense reduction, contractually guaranteed through at least 3/31/16. The Fund’s expense ratios net of this reduction are 1.10% for Class A shares, 1.45% for Class R shares, 0.80% for Class P shares, 0.70% for Class R6 shares and 1.05% for Administrative Class shares. Expense ratio information is as of the Fund’s current prospectus dated April 1, 2015, as supplemented to date.

| 22 | May 31, 2015 | | Semiannual Report |

Table of Contents

Unaudited

AllianzGI Retirement 2055 Fund (cont’d)

| Shareholder Expense Example | Actual Performance | |||||||||

| Class A | Class R | Class P | Class R6 | Administrative Class | ||||||

| Beginning Account Value (12/1/14) | $1,000.00 | $1,000.00 | $1,000.00 | $1,000.00 | $1,000.00 | |||||

| Ending Account Value (5/31/15) | $1,016.20 | $1,014.50 | $1,017.90 | $1,017.80 | $1,015.80 | |||||

| Expenses Paid During Period | $1.86 | $3.62 | $0.35 | $— | $1.61 | |||||

| Hypothetical Performance | ||||||||||

| (5% return before expenses) | ||||||||||

| Class A | Class R | Class P | Class R6 | Administrative Class | ||||||

| Beginning Account Value (12/1/14) | $1,000.00 | $1,000.00 | $1,000.00 | $1,000.00 | $1,000.00 | |||||

| Ending Account Value (5/31/15) | $1,023.09 | $1,021.34 | $1,024.58 | $1,024.93 | $1,023.34 | |||||

| Expenses Paid During Period | $1.87 | $3.63 | $0.35 | $— | $1.61 | |||||

For each class of the Fund, expenses (net of fee waiver and reimbursement, if any) are equal to the annualized expense ratio for the class (0.37% for Class A, 0.72% for Class R, 0.07% for Class P, 0.00% for Class R6 and 0.32% for Administrative Class), multiplied by the average account value over the period, multiplied by 182/365. The expense ratio does not include the expenses of the Underlying Funds, which based upon the allocation of the Fund’s assets among the Underlying Funds are indirectly borne by the shareholders of the Fund.

| Semiannual Report | | May 31, 2015 | 23 |

Table of Contents

Unaudited

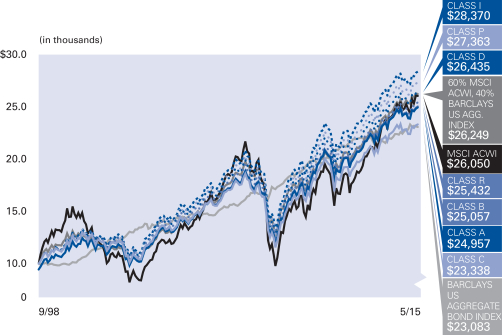

AllianzGI Retirement Income Fund

For the period of December 1, 2014 through May 31, 2015, as provided by the US Multi-Asset Group.

Fund Insights

For the reporting period ended May 31, 2015, Class A shares at NAV of the AllianzGI Retirement Income Fund (the “Fund”) returned 0.57%, outperforming the Morningstar Lifetime Conservative Income Index (the “benchmark index”), which returned 0.38%.

Market Overview

For the six-month period of December 1, 2014 through May 31, 2015, global equities outperformed global bonds with developed country equities leading emerging market equities by more than 3%. In fixed income, global bonds fell 3.3% for the period as measured by the Barclays Global Aggregate Index. However, in the US, as uncertainty about the Fed’s future policy decisions persisted, yields on the 10-year Treasury fell marginally for the period and broad US bonds returned 1.1% as measured by the Barclays US Aggregate Bond Index.

Certain themes from late 2014 persisted in the period, including the continued strength of the US dollar against most major currencies. For the period, one of the best performing assets was the trade-weighted dollar, which returned 10.2%. On the other hand, commodities, led by energy, continued to weaken: commodities remained one of the worst performing asset classes returning, -10.6% for the period as measured by the Bloomberg Commodity Index.

Mid-April marked a period of dislocations across markets. A sell-off in European bonds, most notably in German bunds, which produced swings in bond yields globally, contributed to broad market volatility. The US dollar fell against every major developed market currency and most emerging market currencies in April, while the euro appreciated by 4.6% for the month. In commodities, oil entered positive territory for the year in mid-April, contributing to the perception of stability in oil prices. These events and trends culminated in a renewed focus on inflationary—as opposed to deflationary—trends in the global economy and a pickup in inflation expectations.

Mid-April Market Volatility

The magnitude and rapid pace of the move in European bond yields in late April was unprecedented. The spike in yields was most pronounced in German bunds, with the 10-year yield increasing from a low on April 17, 2015 of 0.05% to a high of 0.78% on May 7, 2015. Several factors contributed to the move, including speculation of tapering on the part of the ECB on the back of stronger macroeconomic data throughout the region. Concerns about the ability of Greece to reach a deal with the Eurogroup over its obligations to the IMF and other creditors intensified through April and early May, further contributing to bond market volatility. Stronger inflation data released in mid-April, including an increase in the Eurozone Aggregate Consumer Price Index of 1.1% month over month—nearly two times the increase of the previous month—contributed to higher inflation expectations, which in turn paved the way for higher yields. The increase in yields was not limited to Europe. Through mid-May, the US yield curve steepened as rates followed European yields higher and the US 10-year Treasury hit a high for the six-month period of 2.4% on May 12, 2015.

Currencies also underwent a temporary correction in April. The trade-weighted dollar suffered its first monthly decline since July 2014. For the month, the trade-weighted dollar fell 3.8%. In connection with the spike in yields on European bonds and the more solid inflation data, the euro increased more than 6% from its low in mid-April to the end of the month. However, in May, the dollar once again strengthened versus all major currencies and the euro resumed its weaker trend against the dollar, falling 2.1%.

The Return of Inflation after Disinflation

Despite significant volatility during the period including a low close to $43 in mid-March, the price of WTI crude stabilized in the $58-60/barrel range by mid-April, leading to a jump in inflation expectations. For example, in late April, one of the Fed’s preferred market based inflation gauges, the 5 year/5 year forward breakeven inflation level from the TIPS market moved above the 2% threshold suggesting that, while short term inflation expectations still lag, the 5-year inflation expectation had reached—and exceeded—the Fed’s inflation target. In the context of moderate global growth, stable energy prices and initial increases in core consumer price inflation, overall inflation expectations inched closer to central bank targets during the period. This may finally signal the dawn of a new era of inflation.

Portfolio Review

Effective April 1, 2015, the Fund’s benchmark index changed from the Real Return Target Today Index to the Morningstar Lifetime Conservative Income Index as the portfolio managers consider Morningstar Lifetime Conservative Income Index to be a better representation of the Fund’s investment strategy. Previously, the Real Return Target Today Index replaced the Dow Jones Real Return Target Today Index. This change was due to a decision by the index provider to discontinue the index. With this mid-period change, differences between the two benchmarks should be considered for purposes of performance comparison.

During the six-month period ending May 31, 2015, and relative to the benchmark, the Fund was positioned with a roughly neutral weight to fixed income, an overweight to global equities, and an underweight to cash/equivalents. During the period, the Fund also held opportunistic asset classes such as real estate and managed futures. Within the fixed income exposure, the Fund favored US inflation linked securities with a modest overweight and conversely was underweight nominal bonds. Within global equities, the Fund favored large-cap equities outside the US with an overweight and was conversely underweight US small-cap equities.

In the fixed income portion of the portfolio, performance ended roughly in-line with the benchmark index. Results benefited from an emphasis on credit related exposures gained in part through the AllianzGI Short Duration High Income Fund (+3%) and PIMCO Income Fund (+2%). The Fund also benefited from the non-US fixed income exposure, outpacing the return of the benchmark index’s non-US fixed income holdings. This contribution was partially offset by the inflation linked exposure. The modest overweight to inflation linked securities was a headwind for the period as the Barclays US TIPS Index’s returned 0.19%, trailing the 1.09% return of the Barclays US Aggregate Bond Index.

| 24 | May 31, 2015 | | Semiannual Report |

Table of Contents

Unaudited

AllianzGI Retirement Income Fund (cont’d)

In the equity portion of the portfolio, performance ended roughly in line with the benchmark index. Results benefited from an overweight to developed markets outside the US. This contribution to results was conversely limited by an underweight to the strong performance of small-cap equities in the US, as reflected by the 6.94% return of the Russell 2000 Index. Selections in emerging market equities also impacted returns in the segment.

The Fund’s exposure to opportunistic asset classes contributed to results over the period. The off-benchmark positions in global real estate and commodity related equities respectively returned 1.0% and 4.5%, contributing to the overall result. The Fund also included exposure to commodities which generally declined over the period. However, relative to the benchmark index, the Fund was underweight this asset class, contributing to relative results over the period.

In aggregate, the Fund’s equity and fixed income positioning ended roughly in-line with the benchmark index returns, while positioning in the Fund’s opportunistic exposure and an underweight to cash/equivalents contributed to the period’s favorable relative result. The AllianzGI Target-Date Funds place a strong emphasis on the Department of Labor’s guidelines for a Qualified Default Investment Alternative (“QDIA”), which contains language such as “to be diversified as to minimize the risk of large losses.” It is within this framework that the Funds continue to include commodities, real estate, convertible bonds, floating rate debt, frontier market equities, and emerging market bonds to help provide diversification benefits to clients’ retirement assets.

Outlook

We expect that the volatility experienced in the period will continue for the rest of 2015. Overall, we continue to expect global growth to slow in 2015 compared to 2014. Despite some softness in the US economy in the first quarter, we expect the growth differential between the US and other developed countries to persist.

The objective of recent changes to the portfolios has been to further insulate them from risks. The Funds remain overweight US equities compared to other developed countries. Part of the international equity exposure remains dollar-hedged, reflecting our view that the USD will continue to benefit from divergent monetary policies and divergent GDP growth. We maintain the Fund’s exposure to frontier-market equities to help further diversify the portfolios.

On interest rates, the biggest question mark for 2015 continues to be the direction, magnitude and timing of short-term interest rate moves, especially in the US, and the overall steepness of the US yield curve. As a result of such uncertainty, we added some duration back into the portfolios through TIPS and US credit (investment grade and high yield). This is partly a way to express our view that core inflation expectations in the US have most likely bottomed. However, even with such changes, we remain close to benchmark duration.

We continue to see an important role for credit in the portfolios. If interest rates remain low or decline further, high yield and investment-grade credit are among the few remaining sectors that can earn income. In the event that US interest rates rise, it will likely be a result of improved economic fundamentals and pickup in inflation, which should benefit US companies. We remain overweight credit strategies that will benefit in a rising interest rate environment.

We remain underweight commodities and REITs. In commodities, we reduced exposure to energy futures during the period. We continue to hold commodity equities, and have benefitted during certain periods of commodity-price shocks, when commodity equities behave more like “equities” and less like “commodity futures,” as occurred in the first part of the period.

While the aforementioned risks loom large, the goal of our recent changes is to move closer to having all-weather portfolios that will be able to better withstand the ongoing volatility in oil and other commodity prices, the uncertainty surrounding short-term interest rates, and the slow overall global economic growth that may potentially impact equities. We remain vigilant and ready to respond if markets evolve in a different direction.

| Semiannual Report | | May 31, 2015 | 25 |

Table of Contents

Unaudited

AllianzGI Retirement Income Fund (cont’d)

Average Annual Total Return for the period ended May 31, 2015

| 6 Month* | 1 Year | 5 Year | Since Inception† | |||||||||||||||

| AllianzGI Retirement Income Fund Class A | 0.57% | 0.66% | 5.57% | 7.79% | ||||||||||||||

|

|

AllianzGI Retirement Income Fund Class A (adjusted) | –4.96% | –4.88% | 4.38% | 6.84% | |||||||||||||

| AllianzGI Retirement Income Fund Class C | 0.19% | –0.13% | 4.78% | 6.99% | ||||||||||||||

|

|

AllianzGI Retirement Income Fund Class C (adjusted) | –0.77% | –1.07% | 4.78% | 6.99% | |||||||||||||

|

|

AllianzGI Retirement Income Fund Class D | 0.51% | 0.55% | 5.49% | 7.72% | |||||||||||||

|

|

AllianzGI Retirement Income Fund Class R | 0.38% | 0.29% | 5.22% | 7.46% | |||||||||||||

|

|

AllianzGI Retirement Income Fund Class P | 0.70% | 0.94% | 5.88% | 8.08% | |||||||||||||

|

|

AllianzGI Retirement Income Fund Class R6 | 0.77% | 1.07% | 5.97% | 8.19% | |||||||||||||

| AllianzGI Retirement Income Fund Administrative Class | 0.31% | 0.42% | 5.57% | 7.81% | ||||||||||||||

|

|

Morningstar Lifetime Conservative Income Index | 0.38% | 0.77% | 5.36% | 6.28% | |||||||||||||

|

|

Real Return Target Today Index** | 0.30% | –0.16% | 5.59% | 7.08% | |||||||||||||

| Lipper Mixed-Asset Target Today Funds Average | 1.23% | 2.45% | 5.93% | 7.55% | ||||||||||||||

† The Fund began operations on 12/29/08. Benchmark return comparisons began on the fund inception date. Lipper performance comparisons began on 12/31/08.

* Cumulative return

** Effective April 1, 2015, the Funds’ benchmark index changed from the Real Return Target series (white label) to the Morningstar Lifetime Conservative series, as the Morningstar Lifetime Conservative series is considered to be a better representation of the Funds’ investment strategies. Previously, the Real Return Target series replaced the Dow Jones Real Retirement series. This change was due to a decision by the index provider to discontinue the Index. With this mid-period change, differences between the two benchmarks should be considered for purposes of performance comparison.

Performance quoted represents past performance and is no guarantee of future results. Current performance may be lower or higher than performance shown. For performance current to the most recent month-end, visit our website at us.allianzgi.com. Investment return and the principal value will fluctuate. Shares may be worth more or less than original cost when redeemed. The adjusted returns take into account the maximum initial sales charge of 5.50% on Class A shares and the contingent deferred sales charge (CDSC) of 1% on Class C shares, which may apply to shares redeemed during the first year of ownership. Returns do not reflect deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares. See pages 106 and 107 for more information. The Fund’s gross expense ratios are 1.15% for Class A shares, 1.90% for Class C shares, 1.15% for Class D shares, 1.40% for Class R shares, 0.75% for Class P shares, 0.65% for Class R6 shares and 1.00% for Administrative Class shares. These ratios do not include an expense reduction, contractually guaranteed through at least 3/31/16. The Fund’s expense ratios net of this reduction are 0.95% for Class A shares, 1.70% for Class C shares, 1.05% for Class D shares, 1.30% for Class R shares, 0.65% for Class P shares, 0.55% for Class R6 shares and 0.90% for Administrative Class shares. Expense ratio information is as of the Fund’s current prospectus dated April 1, 2015, as supplemented to date.

| 26 | May 31, 2015 | | Semiannual Report |

Table of Contents

Unaudited

AllianzGI Retirement Income Fund (cont’d)

| Shareholder Expense Example | Actual Performance | |||||||||||||

| Class A | Class C | Class D | Class R | Class P | Class R6 | Administrative Class | ||||||||

| Beginning Account Value (12/1/14) | $1,000.00 | $1,000.00 | $1,000.00 | $1,000.00 | $1,000.00 | $1,000.00 | $1,000.00 | |||||||