Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF

REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-22167

Allianz Funds Multi-Strategy Trust

(Exact name of registrant as specified in charter)

1633 Broadway, New York, NY 10019

(Address of principal executive offices) (Zip code)

Lawrence G. Altadonna

1633 Broadway, New York, NY 10019

(Name and address of agent for service)

Registrant’s telephone number, including area code: 212-739-3371

Date of fiscal year end: November 30, 2014

Date of reporting period: May 31, 2014

Table of Contents

Item 1. Report to Shareholders

Allianz Multi-Strategy Funds

SHARE CLASSES A, B, C, D, R, P, INSTITUTIONAL, R6, ADMINISTRATIVE

Semiannual Report

May 31, 2014

This material is authorized for use only when preceded or accompanied by the current Allianz Multi-Strategy Funds prospectus. Investors should consider the investment objectives, risks, charges and expenses of each Fund carefully before investing. This and other information is contained in the Funds’ prospectuses and summary prospectuses. Please read the prospectus carefully before you invest or send money.

Receive this report electronically and eliminate paper mailings.

To enroll, go to http://us.allianzgi.com/edelivery.

Table of Contents

A Word About Risk: A fund may be subject to various risks as described in its prospectus. Some of those risks may include, but are not limited to, the following: derivatives risk, smaller company risk, non-US investment risk, focused investment risk and specific sector investment risks. Use of derivative instruments may involve certain costs and risks such as liquidity risk, interest rate risk, market risk, credit risk, counterparty risk, management risk and the risk that a fund is unable to close out a position when it is most advantageous to do so. Portfolios investing in derivatives could lose more than the principal amount invested in those instruments. Investing in foreign securities may entail risk due to foreign economic and political developments; this risk may be enhanced when investing in emerging markets. Smaller companies may be more volatile than larger companies and may entail more risk. Concentrating investments in individual sectors may add additional risk and additional volatility compared to a diversified equity portfolio. AllianzGI target-date funds seek to manage risk and return by blending two separately-managed portfolios: a return-generating portfolio for growth potential, and a defensive portfolio for principal protection. The balance grows increasingly defensive over time until the target date is reached, after which the Fund’s assets roll into a retirement income strategy. The principal values of the Funds are not guaranteed at any time, including the target date. Please refer to the Fund’s applicable current prospectus for complete details.

Table of Contents

Letter from the President

| 2 | May 31, 2014 | | Semiannual Report |

Table of Contents

Outlook

We remain constructive on the US economic recovery and expect the first-quarter GDP decline to be followed by a meaningful bounce during the second quarter.

Federal Reserve officials have tied the outlook for monetary policy to incoming economic data. Based on our forecasts for growth, we believe that Fed asset purchases will end in the fourth quarter of 2014, with an increase in the Fed funds rate possible in mid-2015.

Additional Information

For many of our shareholders, especially those who are nearing or in retirement, income-generation is a top priority. But with continued low yields on investment-grade core bonds and the growing threat of interest-rate hikes, an overallocation to low-yielding, rate-sensitive securities may threaten today’s scarce income streams and put long-term goals in jeopardy.

If you’d like more information about this issue, talk to your financial advisor and consider reading our educational white paper, Strategies to Generate a Diversified Income Stream in a Low-Yield Environment.

Visit http://us.allianzgi.com/whitepaper to download a copy.

On behalf of Allianz Global Investors Fund Management and our Sub-Advisers, thank you for investing with us. We remain dedicated to serving your investment needs.

Sincerely,

Julian Sluyters

President & CEO

Past performance is no guarantee of future results. Unless otherwise noted, index returns reflect the reinvestment of income dividends and capital gains, if any, but do not reflect fees, brokerage commissions or other expenses of investing. It is not possible to invest directly in an index.

Receive this report electronically and eliminate paper mailings.

To enroll, go to http://us.allianzgi.com/edelivery.

| Semiannual Report | | May 31, 2014 | 3 |

Table of Contents

Unaudited

AllianzGI Target-Date and Target Risk Funds*

For the period of December 1, 2013, through May 31, 2014, as provided by the US Multi-Asset Group.

Market Review and Outlook

What Happened

The Fellowship of the Central Bankers

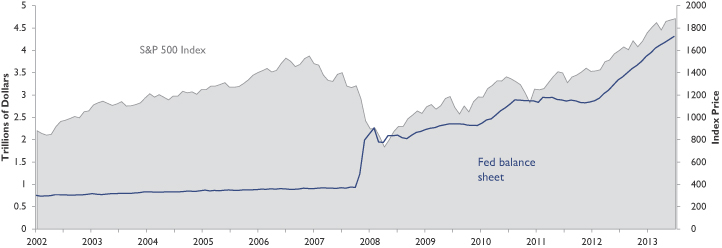

For the six months ending May 31, 2014, a handful of central banks and their leaders—what we have termed, the fellowship of the central bankers—remained a key driver of market returns. As has been the case for recent periods, we believe that this fellowship contributed to most risk assets around the world rising and most government bond yields around the world falling. This is evident in the chart below that tracks the unprecedented expansion of the Fed’s balance sheet and the persistent upward march of the S&P 500 Index.

In the US, the taper announcement came at the December Federal Open Market Committee (FOMC) meeting and was implemented in January with a $10 billion reduction to Treasury bonds and mortgage-backed security purchases. The new Chair of the Federal Reserve, Janet Yellen, assumed her position at the helm of the FOMC and did not waste time making changes. At her first meeting in March, she both changed the nature of the Fed’s forward guidance from quantitative (targeted at least in part to achieving 6.5% unemployment) to qualitative and refocused market attention on speculating about the end of the Fed’s Zero Interest Rate Policy (ZIRP), which has been in place now for five years. In the wake of the changes, US 10-year Treasury yields continued to plummet from their recent high of 3.00% in late December to a low of 2.44% on May 28, 2014.

Around the world, the fellowship of the central bankers continued to influence markets with the result similar to that of the chart below. In Europe, during the period, European Central Bank (ECB) president Mario Draghi’s comments about the appreciation of the Euro and his reference to the possibility of further quantitative easing contributed to peripheral bond yields falling. In Spain, the yield on 10-year government bonds fell from 4.24% on December 5, 2013 to 2.82% on May 28, 2014 and in Italy, the yield on such bonds fell from a high of 4.22% on December 5, 2013 to 2.91% on May 14, 2014. (Yields in each moved steadily downward in June as well). Evidence of an economic recovery in both the core countries of Europe, including Germany and France, as well as the periphery also contributed to bond price appreciation. Elsewhere, the Bank of Japan (BOJ) continued its aggressive quantitative easing program. In the United Kingdom, the Bank of England maintained its record low interest rate and left unchanged its stimulus program of holding 375 billion pounds in government bonds.

United States, Europe and Emerging Markets

In the US, in the period from January through March, market observers had two big questions: First, would US growth continue despite a soft patch related to bad weather throughout parts of the country; and second, would markets avoid a repeat of the “taper tantrum” episode observed last spring. As it turned out, we learned in April that the answer to both was “yes.” The employment, retail sales and manufacturing data for March showed significant improvement compared with February, and most major asset classes posted positive returns for the quarter.

For the six-month period ending May 31, 2014, US equities were up 7.62% based on the S&P 500 Index and 5 to 10-year Treasuries were up 2.28% based on the Barclays US Treasury 5-10Yr Index.

Globally, in broad terms, equities and bonds were up as well: MSCI ACWI returned 6.02% and the Barclays Global Aggregate Index returned 3.55%. In fixed income, as with the previous period, the “fellowship of the central bankers” influenced all bond markets—including US Treasuries, where yields fluctuated, but remained in a range.

Global equities benefited from a steady recovery in Europe, which attracted both attention and capital inflows and drove up the value of the euro. The core and periphery of Europe saw positive equity performance. The periphery outperformed, with Spain up 12.99% and Italy up 15.96% (each based on respective MSCI dollar-denominated indexes). In the developed world, Japan was an underperformer, returning -3.56% in dollar terms.

For the period, emerging markets (EM) underperformed developed markets. Performance in EM was mixed for the period. From December 1, 2013 through early February, the MSCI Emerging Markets Index lost roughly 9.5%. However, from February 5 through May 23, the index was up 13.8%. Overall, emerging market stocks finished the period up 1.89%. Despite uncertainties surrounding growth in several key emerging-market countries, commodity prices, which are generally tightly linked to EM, finished the period up 7.77% led by energy, including Natural Gas which was up 23.03% and petroleum up 6.03%, based on the Dow Jones UBS Commodity Index.

* The “Target-Date Funds” are the AllianzGI Retirement 2015 Fund, the AllianzGI Retirement 2020 Fund, the AllianzGI Retirement 2025 Fund, the AllianzGI Retirement 2030 Fund, the AllianzGI Retirement 2035 Fund, the AllianzGI Retirement 2040 Fund, the AllianzGI Retirement 2045 Fund, the AllianzGI Retirement 2050 Fund and the AllianzGI Retirement 2055 Fund. The “Target Risk Funds” are the AllianzGI Retirement Income Fund, the AllianzGI Global Allocation Fund and the AllianzGI Global Allocation Fund.

| 4 | May 31, 2014 | | Semiannual Report |

Table of Contents

Unaudited

AllianzGI Target-Date and Target Risk Funds (cont’d)

Outlook

At the close of the reporting period, we believe that investors are left with few options. The first is simply waiting out the central banks’ financial repression strategy, and slowly losing money in real terms with the losses adding up over time. At a 2.5% inflation rate, an account earning a zero nominal rate loses 14.0% of its value after six years.

Alternatively, investors can buy risky assets and follow the “Don’t Fight the Fed, ECB, BOE and BOJ” rule. Such an approach relies on further price/earnings expansion (or at least no contraction) and some earnings growth. This is an increasingly difficult proposition as global central banks push asset prices up and bond yields below inflation. This strategy involves hunting for still-undervalued assets to realize both earnings growth and expansions in valuation, as well as for sustainable and growing dividends. We believe that the opportunity set is limited.

Patience may turn out to be the best investment strategy during what is now the sixth year of financial repression. When spreads are tight, shorter-term real rates are negative and valuations are high almost everywhere, a slow but small loss of purchasing power is not the worst outcome. And recovering economies have pockets of value and opportunities for growth.

As a result, our favored investment themes are short-duration credit risk, high-quality dividends with growth and the few remaining value opportunities. Carefully building portfolios around these themes, while waiting out the recovery and central-bank normalization, is expected to pay off eventually. This is a global exercise. There will be times of stress that will be accompanied by sharp sell-offs. Since evidence indicates that the economy and equity markets could be in a long-term uptrend, these sell-offs, when acute, can be the time to buy.

At the end of the period, AllianzGI Target-Date Funds and AllianzGI Retirement Income Fund remain underweight hard duration and exposed to fixed-income strategies that may benefit in rising-rate environments. The portfolios remain modestly underweight commodities and real estate relative to their benchmarks. All of the portfolios are within their benchmark-determined risk budgets.

During the reporting period, several changes to the Target-Date and Target Risk Funds’ portfolios were made including, in the fixed income portion, a net reduction to hard duration through trimming the PIMCO Real Return Fund and the PIMCO Mortgage Opportunities Fund. To this end, the PIMCO Senior Floating Rate Fund was also added. There was an increase in the Funds’ exposure to equities in Spain, given the recovery in Europe and based on the team’s work to find opportunities based on valuations. Exposure to emerging market equities was reduced in early January and further reduced later in the period at least in part to further underweight markets that have not yet implemented what we believe are needed structural reforms.

| Semiannual Report | | May 31, 2014 | 5 |

Table of Contents

Unaudited

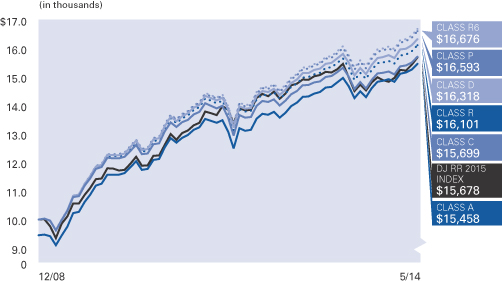

AllianzGI Retirement 2015 Fund

For the period of December 1, 2013 through May 31, 2014, as provided by the US Multi-Asset Group.

Fund Insights

| 6 | May 31, 2014 | | Semiannual Report |

Table of Contents

Unaudited

AllianzGI Retirement 2015 Fund (cont’d)

Average Annual Total Return for the period ended May 31, 2014

| 6 Month* | 1 Year | 5 Year | Since Inception† | |||||||||||||||

| AllianzGI Retirement 2015 Fund Class A | 4.04% | 5.39% | 8.60% | 9.50% | ||||||||||||||

|

|

AllianzGI Retirement 2015 Fund Class A (adjusted) | –1.68% | –0.41% | 7.38% | 8.37% | |||||||||||||

| AllianzGI Retirement 2015 Fund Class C | 3.68% | 4.61% | 7.79% | 8.68% | ||||||||||||||

|

|

AllianzGI Retirement 2015 Fund Class C (adjusted) | 2.68% | 3.61% | 7.79% | 8.68% | |||||||||||||

|

|

AllianzGI Retirement 2015 Fund Class D | 3.99% | 5.28% | 8.54% | 9.45% | |||||||||||||

|

|

AllianzGI Retirement 2015 Fund Class R | 3.90% | 5.04% | 8.28% | 9.19% | |||||||||||||

|

|

AllianzGI Retirement 2015 Fund Class P | 4.22% | 5.72% | 8.89% | 9.79% | |||||||||||||

|

|

AllianzGI Retirement 2015 Fund Class R6 | 4.27% | 5.83% | 8.98% | 9.89% | |||||||||||||

| AllianzGI Retirement 2015 Fund Administrative Class | 4.12% | 5.46% | 8.65% | 9.56% | ||||||||||||||

|

|

Dow Jones Real Return 2015 Index | 5.31% | 4.67% | 8.20% | 8.65% | |||||||||||||

| Lipper Mixed-Asset Target 2015 Funds Average | 4.28% | 8.63% | 10.43% | 10.96% | ||||||||||||||

† The Fund began operations on 12/29/08. Benchmark return comparisons began on the fund inception date. Lipper performance comparisons began on 12/31/08.

* Cumulative return.

Performance quoted represents past performance and is no guarantee of future results. Current performance may be lower or higher than performance shown. For performance current to the most recent month-end, visit our website at us.allianzgi.com. Investment return and the principal value will fluctuate. Shares may be worth more or less than original cost when redeemed. The adjusted returns take into account the maximum initial sales charge of 5.50% on Class A shares and the contingent deferred sales charge (CDSC) of 1% on Class C shares, which may apply to shares redeemed during the first year of ownership. Returns do not reflect deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares. See pages 86 and 87 for more information. The Fund’s gross expense ratios are 1.17% for Class A shares, 1.92% for Class C shares, 1.17% for Class D shares, 1.42% for Class R shares, 0.77% for Class P shares, 0.67% for Class R6 shares and 1.02% for Administrative Class shares. These ratios do not include an expense reduction, contractually guaranteed through at least 3/31/15. The Fund’s expense ratios net of this reduction are 0.97% for Class A shares, 1.72% for Class C shares, 1.07% for Class D shares, 1.32% for Class R shares, 0.67% for Class P shares, 0.57% for Class R6 shares and 0.92% for Administrative Class shares. Expense ratio information is as of the Fund’s current prospectus dated April 1, 2014, as supplemented to date.

| Semiannual Report | | May 31, 2014 | 7 |

Table of Contents

Unaudited

AllianzGI Retirement 2015 Fund (cont’d)

| Shareholder Expense Example | Actual Performance | |||||||||||||

| Class A | Class C | Class D | Class R | Class P | Class R6 | Administrative Class | ||||||||

| Beginning Account Value (12/1/13) | $1,000.00 | $1,000.00 | $1,000.00 | $1,000.00 | $1,000.00 | $1,000.00 | $1,000.00 | |||||||

| Ending Account Value (5/31/14) | $1,040.40 | $1,036.80 | $1,039.90 | $1,039.00 | $1,042.20 | $1,042.70 | $1,041.20 | |||||||

| Expenses Paid During Period | $2.03 | $5.84 | $2.54 | $3.81 | $0.51 | $— | $1.78 | |||||||

| Hypothetical Performance | ||||||||||||||

| (5% return before expenses) | ||||||||||||||

| Class A | Class C | Class D | Class R | Class P | Class R6 | Administrative Class | ||||||||

| Beginning Account Value (12/1/13) | $1,000.00 | $1,000.00 | $1,000.00 | $1,000.00 | $1,000.00 | $1,000.00 | $1,000.00 | |||||||

| Ending Account Value (5/31/14) | $1,022.94 | $1,019.20 | $1,022.44 | $1,021.19 | $1,024.43 | $1,024.93 | $1,023.19 | |||||||

| Expenses Paid During Period | $2.02 | $5.79 | $2.52 | $3.78 | $0.50 | $— | $1.77 | |||||||

For each class of the Fund, expenses (net of fee waiver and reimbursement, if any) are equal to the annualized expense ratio for the class (0.40% for Class A, 1.15% for Class C, 0.50% for Class D, 0.75% for Class R, 0.10% for Class P, 0.00% for Class R6 and 0.35% for Administrative Class), multiplied by the average account value over the period, multiplied by 182/365. The expense ratio does not include the expenses of the Underlying Funds, which based upon the allocation of the Fund’s assets among the Underlying Funds are indirectly borne by the shareholders of the Fund.

| 8 | May 31, 2014 | | Semiannual Report |

Table of Contents

Unaudited

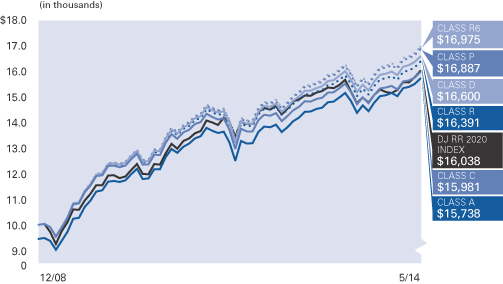

AllianzGI Retirement 2020 Fund

For the period of December 1, 2013 through May 31, 2014, as provided by the US Multi Asset Group.

Fund Insights

| Semiannual Report | | May 31, 2014 | 9 |

Table of Contents

Unaudited

AllianzGI Retirement 2020 Fund (cont’d)

Average Annual Total Return for the period ended May 31, 2014

| 6 Month* | 1 Year | 5 Year | Since Inception† | |||||||||||||||

| AllianzGI Retirement 2020 Fund Class A | 4.33% | 5.93% | 8.95% | 9.87% | ||||||||||||||

|

|

AllianzGI Retirement 2020 Fund Class A (adjusted) | –1.41% | 0.10% | 7.73% | 8.73% | |||||||||||||

| AllianzGI Retirement 2020 Fund Class C | 3.92% | 5.14% | 8.12% | 9.03% | ||||||||||||||

|

|

AllianzGI Retirement 2020 Fund Class C (adjusted) | 2.92% | 4.14% | 8.12% | 9.03% | |||||||||||||

|

|

AllianzGI Retirement 2020 Fund Class D | 4.24% | 5.78% | 8.88% | 9.80% | |||||||||||||

|

|

AllianzGI Retirement 2020 Fund Class R | 4.14% | 5.58% | 8.63% | 9.55% | |||||||||||||

|

|

AllianzGI Retirement 2020 Fund Class P | 4.48% | 6.24% | 9.24% | 10.15% | |||||||||||||

|

|

AllianzGI Retirement 2020 Fund Class R6 | 4.53% | 6.40% | 9.34% | 10.26% | |||||||||||||

| AllianzGI Retirement 2020 Fund Administrative Class | 4.36% | 5.96% | 9.00% | 9.92% | ||||||||||||||

|

|

Dow Jones Real Return 2020 Index | 5.45% | 5.28% | 8.61% | 9.11% | |||||||||||||

| Lipper Mixed-Asset Target 2020 Funds Average | 4.49% | 9.69% | 11.16% | 11.59% | ||||||||||||||

† The Fund began operations on 12/29/08. Benchmark return comparisons began on the fund inception date. Lipper performance comparisons began on 12/31/08.

* Cumulative return.

Performance quoted represents past performance and is no guarantee of future results. Current performance may be lower or higher than performance shown. For performance current to the most recent month-end, visit our website at us.allianzgi.com. Investment return and the principal value will fluctuate. Shares may be worth more or less than original cost when redeemed. The adjusted returns take into account the maximum initial sales charge of 5.50% on Class A shares and the contingent deferred sales charge (CDSC) of 1% on Class C shares, which may apply to shares redeemed during the first year of ownership. Returns do not reflect deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares. See pages 86 and 87 for more information. The Fund’s gross expense ratios are 1.19% for Class A shares, 1.94% for Class C shares, 1.19% for Class D shares, 1.44% for Class R shares, 0.79% for Class P shares, 0.69% for Class R6 shares and 1.04% for Administrative Class shares. These ratios do not include an expense reduction, contractually guaranteed through at least 3/31/15. The Fund’s expense ratios net of this reduction are 0.99% for Class A shares, 1.74% for Class C shares, 1.09% for Class D shares, 1.34% for Class R shares, 0.69% for Class P shares, 0.59% for Class R6 shares and 0.94% for Administrative Class shares. Expense ratio information is as of the Fund’s current prospectus dated April 1, 2014, as supplemented to date.

| 10 | May 31, 2014 | | Semiannual Report |

Table of Contents

Unaudited

AllianzGI Retirement 2020 Fund (cont’d)

| Shareholder Expense Example | Actual Performance | |||||||||||||

| Class A | Class C | Class D | Class R | Class P | Class R6 | Administrative Class | ||||||||

| Beginning Account Value (12/1/13) | $1,000.00 | $1,000.00 | $1,000.00 | $1,000.00 | $1,000.00 | $1,000.00 | $1,000.00 | |||||||

| Ending Account Value (5/31/14) | $1,043.30 | $1,039.20 | $1,042.40 | $1,041.40 | $1,044.80 | $1,045.30 | $1,043.60 | |||||||

| Expenses Paid During Period | $2.04 | $5.85 | $2.55 | $3.82 | $0.51 | $— | $1.78 | |||||||

| Hypothetical Performance | ||||||||||||||

| (5% return before expenses) | ||||||||||||||

| Class A | Class C | Class D | Class R | Class P | Class R6 | Administrative Class | ||||||||

| Beginning Account Value (12/1/13) | $1,000.00 | $1,000.00 | $1,000.00 | $1,000.00 | $1,000.00 | $1,000.00 | $1,000.00 | |||||||

| Ending Account Value (5/31/14) | $1,022.94 | $1,019.20 | $1,022.44 | $1,021.19 | $1,024.43 | $1,024.93 | $1,023.19 | |||||||

| Expenses Paid During Period | $2.02 | $5.79 | $2.52 | $3.78 | $0.50 | $— | $1.77 | |||||||

For each class of the Fund, expenses (net of fee waiver and reimbursement, if any) are equal to the annualized expense ratio for the class (0.40% for Class A, 1.15% for Class C, 0.50% for Class D, 0.75% for Class R, 0.10% for Class P, 0.00% for Class R6 and 0.35% for Administrative Class), multiplied by the average account value over the period, multiplied by 182/365. The expense ratio does not include the expenses of the Underlying Funds, which based upon the allocation of the Fund’s assets among the Underlying Funds are indirectly borne by the shareholders of the Fund.

| Semiannual Report | | May 31, 2014 | 11 |

Table of Contents

Unaudited

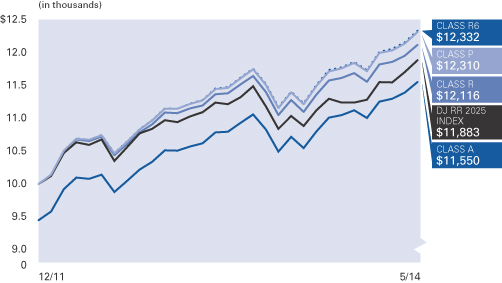

AllianzGI Retirement 2025 Fund

For the period of December 1, 2013 through May 31, 2014, as provided by the US Multi Asset Group.

Fund Insights

| 12 | May 31, 2014 | | Semiannual Report |

Table of Contents

Unaudited

AllianzGI Retirement 2025 Fund (cont’d)

Average Annual Total Return for the period ended May 31, 2014

| 6 Month* |

1 Year |

Since Inception† |

||||||||||||

| AllianzGI Retirement 2025 Fund Class A | 4.52% | 6.67% | 8.54% | |||||||||||

|

|

AllianzGI Retirement 2025 Fund Class A (adjusted) | –1.23% | 0.80% | 6.06% | ||||||||||

|

|

AllianzGI Retirement 2025 Fund Class R | 4.31% | 6.27% | 8.15% | ||||||||||

|

|

AllianzGI Retirement 2025 Fund Class P | 4.67% | 7.00% | 8.87% | ||||||||||

|

|

AllianzGI Retirement 2025 Fund Class R6 | 4.72% | 7.05% | 8.95% | ||||||||||

| AllianzGI Retirement 2025 Fund Administrative Class | 4.56% | 6.70% | 8.58% | |||||||||||

|

|

Dow Jones Real Return 2025 Index | 5.71% | 6.27% | 7.30% | ||||||||||

| Lipper Mixed-Asset Target 2025 Funds Average | 5.06% | 12.06% | 13.19% | |||||||||||

† The Fund began operations on 12/19/11. Benchmark return comparisons began on the fund inception date. Lipper performance comparisons began on 12/31/11.

* Cumulative return.

Performance quoted represents past performance and is no guarantee of future results. Current performance may be lower or higher than performance shown. For performance current to the most recent month-end, visit our website at us.allianzgi.com. Investment return and the principal value will fluctuate. Shares may be worth more or less than original cost when redeemed. The adjusted returns take into account the maximum initial sales charge of 5.50% on Class A shares. Returns do not reflect deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares. See pages 86 and 87 for more information. The Fund’s gross expense ratios are 1.21% for Class A shares, 1.46% for Class R shares, 0.81% for Class P shares, 0.71% for Class R6 shares and 1.06% for Administrative Class shares. These ratios do not include an expense reduction, contractually guaranteed through at least 3/31/15. The Fund’s expense ratios net of this reduction are 1.01% for Class A shares, 1.36% for Class R shares, 0.71% for Class P shares, 0.61% for Class R6 shares and 0.96% for Administrative Class shares. Expense ratio information is as of the Fund’s current prospectus dated April 1, 2014, as supplemented to date.

| Semiannual Report | | May 31, 2014 | 13 |

Table of Contents

Unaudited

AllianzGI Retirement 2025 Fund (cont’d)

| Shareholder Expense Example | Actual Performance | |||||||||

| Class A | Class R | Class P | Class R6 | Administrative Class | ||||||

| Beginning Account Value (12/1/13) | $1,000.00 | $1,000.00 | $1,000.00 | $1,000.00 | $1,000.00 | |||||

| Ending Account Value (5/31/14) | $1,045.20 | $1,043.10 | $1,046.70 | $1,047.20 | $1,045.60 | |||||

| Expenses Paid During Period | $2.04 | $3.82 | $0.51 | $— | $1.78 | |||||

| Hypothetical Performance | ||||||||||

| (5% return before expenses) | ||||||||||

| Class A | Class R | Class P | Class R6 | Administrative Class | ||||||

| Beginning Account Value (12/1/13) | $1,000.00 | $1,000.00 | $1,000.00 | $1,000.00 | $1,000.00 | |||||

| Ending Account Value (5/31/14) | $1,022.94 | $1,021.19 | $1,024.43 | $1,024.93 | $1,023.19 | |||||

| Expenses Paid During Period | $2.02 | $3.78 | $0.50 | $— | $1.77 | |||||

For each class of the Fund, expenses (net of fee waiver and reimbursement, if any) are equal to the annualized expense ratio for the class (0.40% for Class A, 0.75% for Class R, 0.10% for Class P, 0.00% for Class R6 and 0.35% for Administrative Class), multiplied by the average account value over the period, multiplied by 182/365. The expense ratio does not include the expenses of the Underlying Funds, which based upon the allocation of the Fund’s assets among the Underlying Funds are indirectly borne by the shareholders of the Fund.

| 14 | May 31, 2014 | | Semiannual Report |

Table of Contents

Unaudited

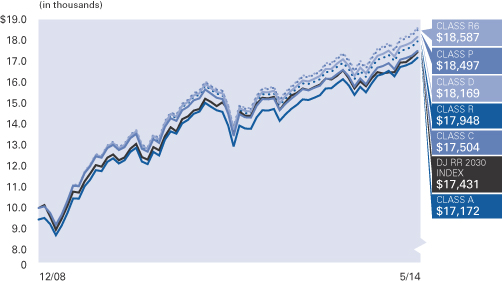

AllianzGI Retirement 2030 Fund

For the period of December 1, 2013 through May 31, 2014, as provided by the US Multi Asset Group.

Fund Insights

| Semiannual Report | | May 31, 2014 | 15 |

Table of Contents

Unaudited

AllianzGI Retirement 2030 Fund (cont’d)

Average Annual Total Return for the period ended May 31, 2014

| 6 Month* | 1 Year | 5 Year | Since Inception† | |||||||||||||||

| AllianzGI Retirement 2030 Fund Class A | 4.71% | 8.28% | 10.44% | 11.65% | ||||||||||||||

|

|

AllianzGI Retirement 2030 Fund Class A (adjusted) | –1.05% | 2.32% | 9.20% | 10.49% | |||||||||||||

| AllianzGI Retirement 2030 Fund Class C | 4.37% | 7.48% | 9.62% | 10.89% | ||||||||||||||

|

|

AllianzGI Retirement 2030 Fund Class C (adjusted) | 3.37% | 6.48% | 9.62% | 10.89% | |||||||||||||

|

|

AllianzGI Retirement 2030 Fund Class D | 4.71% | 8.21% | 10.39% | 11.65% | |||||||||||||

|

|

AllianzGI Retirement 2030 Fund Class R | 4.59% | 7.89% | 10.11% | 11.40% | |||||||||||||

|

|

AllianzGI Retirement 2030 Fund Class P | 4.92% | 8.61% | 10.73% | 12.01% | |||||||||||||

|

|

AllianzGI Retirement 2030 Fund Class R6 | 4.97% | 8.71% | 10.83% | 12.11% | |||||||||||||

| AllianzGI Retirement 2030 Fund Administrative Class | 4.78% | 8.32% | 10.50% | 11.78% | ||||||||||||||

|

|

Dow Jones Real Return 2030 Index | 6.10% | 7.66% | 10.09% | 10.80% | |||||||||||||

| Lipper Mixed-Asset Target 2030 Funds Average | 5.16% | 13.00% | 12.98% | 13.44% | ||||||||||||||

† The Fund began operations on 12/29/08. Benchmark return comparisons began on the fund inception date. Lipper performance comparisons began on 12/31/08.

* Cumulative return.

Performance quoted represents past performance and is no guarantee of future results. Current performance may be lower or higher than performance shown. For performance current to the most recent month-end, visit our website at us.allianzgi.com. Investment return and the principal value will fluctuate. Shares may be worth more or less than original cost when redeemed. The adjusted returns take into account the maximum initial sales charge of 5.50% on Class A shares and the contingent deferred sales charge (CDSC) of 1% on Class C shares, which may apply to shares redeemed during the first year of ownership. Returns do not reflect deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares. See pages 86 and 87 for more information. The Fund’s gross expense ratios are 1.28% for Class A shares, 2.03% for Class C shares, 1.28% for Class D shares, 1.53% for Class R shares, 0.88% for Class P shares, 0.78% for Class R6 shares and 1.13% for Administrative Class shares. These ratios do not include an expense reduction, contractually guaranteed through at least 3/31/15. The Fund’s expense ratios net of this reduction are 1.03% for Class A shares, 1.78% for Class C shares, 1.13% for Class D shares, 1.38% for Class R shares, 0.73% for Class P shares, 0.63% for Class R6 shares and 0.98% for Administrative Class shares. Expense ratio information is as of the Fund’s current prospectus dated April 1, 2014, as supplemented to date.

| 16 | May 31, 2014 | | Semiannual Report |

Table of Contents

Unaudited

AllianzGI Retirement 2030 Fund (cont’d)

| Shareholder Expense Example | Actual Performance | |||||||||||||

| Class A | Class C | Class D | Class R | Class P | Class R6 | Administrative Class | ||||||||

| Beginning Account Value (12/1/13) | $1,000.00 | $1,000.00 | $1,000.00 | $1,000.00 | $1,000.00 | $1,000.00 | $1,000.00 | |||||||

| Ending Account Value (5/31/14) | $1,047.10 | $1,043.70 | $1,047.10 | $1,045.90 | $1,049.20 | $1,049.70 | $1,047.80 | |||||||

| Expenses Paid During Period | $1.79 | $5.60 | $2.30 | $3.57 | $0.26 | $— | $1.53 | |||||||

| Hypothetical Performance | ||||||||||||||

| (5% return before expenses) | ||||||||||||||

| Class A | Class C | Class D | Class R | Class P | Class R6 | Administrative Class | ||||||||

| Beginning Account Value (12/1/13) | $1,000.00 | $1,000.00 | $1,000.00 | $1,000.00 | $1,000.00 | $1,000.00 | $1,000.00 | |||||||

| Ending Account Value (5/31/14) | $1,023.19 | $1,019.45 | $1,022.69 | $1,021.44 | $1,024.68 | $1,024.93 | $1,023.44 | |||||||

| Expenses Paid During Period | $1.77 | $5.54 | $2.27 | $3.53 | $0.25 | $— | $1.51 | |||||||

For each class of the Fund, expenses (net of fee waiver and reimbursement, if any) are equal to the annualized expense ratio for the class (0.35% for Class A, 1.10% for Class C, 0.45% for Class D, 0.70% for Class R, 0.05% for Class P, 0.00% for Class R6 and 0.30% for Administrative Class), multiplied by the average account value over the period, multiplied by 182/365. The expense ratio does not include the expenses of the Underlying Funds, which based upon the allocation of the Fund’s assets among the Underlying Funds are indirectly borne by the shareholders of the Fund.

| Semiannual Report | | May 31, 2014 | 17 |

Table of Contents

Unaudited

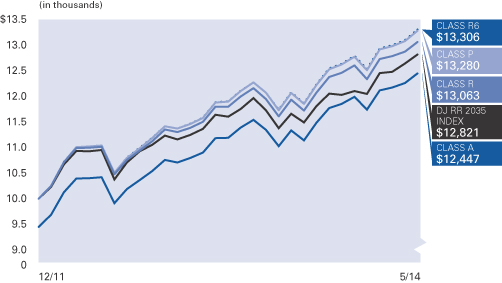

AllianzGI Retirement 2035 Fund

For the period of December 1, 2013 through May 31, 2014, as provided by the US Multi Asset Group.

Fund Insights

| 18 | May 31, 2014 | | Semiannual Report |

Table of Contents

Unaudited

AllianzGI Retirement 2035 Fund (cont’d)

Average Annual Total Return for the period ended May 31, 2014

| 6 Month* | 1 Year | Since Inception† |

||||||||||||

| AllianzGI Retirement 2035 Fund Class A | 5.00% | 9.68% | 11.91% | |||||||||||

|

|

AllianzGI Retirement 2035 Fund Class A (adjusted) | –0.77% | 3.65% | 9.36% | ||||||||||

|

|

AllianzGI Retirement 2035 Fund Class R | 4.81% | 9.32% | 11.54% | ||||||||||

|

|

AllianzGI Retirement 2035 Fund Class P | 5.18% | 10.03% | 12.28% | ||||||||||

|

|

AllianzGI Retirement 2035 Fund Class R6 | 5.29% | 10.20% | 12.37% | ||||||||||

| AllianzGI Retirement 2035 Fund Administrative Class | 5.05% | 9.78% | 11.98% | |||||||||||

|

|

Dow Jones Real Return 2035 Index | 6.57% | 9.34% | 10.69% | ||||||||||

| Lipper Mixed-Asset Target 2035 Funds Average | 5.40% | 14.54% | 15.70% | |||||||||||

† The Fund began operations on 12/19/11. Benchmark return comparisons began on the fund inception date. Lipper performance comparisons began on 12/31/11.

* Cumulative return.

Performance quoted represents past performance and is no guarantee of future results. Current performance may be lower or higher than performance shown. For performance current to the most recent month-end, visit our website at us.allianzgi.com. Investment return and the principal value will fluctuate. Shares may be worth more or less than original cost when redeemed. The adjusted returns take into account the maximum initial sales charge of 5.50% on Class A shares. Returns do not reflect deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares. See pages 86 and 87 for more information. The Fund’s gross expense ratios are 1.31% for Class A shares, 1.56% for Class R shares, 0.91% for Class P shares, 0.81% for Class R6 shares and 1.16% for Administrative Class shares. These ratios do not include an expense reduction, contractually guaranteed through at least 3/31/15. The Fund’s expense ratios net of this reduction are 1.06% for Class A shares, 1.41% for Class R shares, 0.76% for Class P shares, 0.66% for Class R6 shares and 1.01% for Administrative Class shares. Expense ratio information is as of the Fund’s current prospectus dated April 1, 2014, as supplemented to date.

| Semiannual Report | | May 31, 2014 | 19 |

Table of Contents

Unaudited

AllianzGI Retirement 2035 Fund (cont’d)

| Shareholder Expense Example | Actual Performance | |||||||||

| Class A | Class R | Class P | Class R6 | Administrative Class | ||||||

| Beginning Account Value (12/1/13) | $1,000.00 | $1,000.00 | $1,000.00 | $1,000.00 | $1,000.00 | |||||

| Ending Account Value (5/31/14) | $1,050.00 | $1,048.10 | $1,051.80 | $1,052.90 | $1,050.50 | |||||

| Expenses Paid During Period | $1.79 | $3.57 | $0.26 | $— | $1.53 | |||||

| Hypothetical Performance | ||||||||||

| (5% return before expenses) | ||||||||||

| Class A | Class R | Class P | Class R6 | Administrative Class | ||||||

| Beginning Account Value (12/1/13) | $1,000.00 | $1,000.00 | $1,000.00 | $1,000.00 | $1,000.00 | |||||

| Ending Account Value (5/31/14) | $1,023.19 | $1,021.44 | $1,024.68 | $1,024.93 | $1,023.44 | |||||

| Expenses Paid During Period | $1.77 | $3.53 | $0.25 | $— | $1.51 | |||||

For each class of the Fund, expenses (net of fee waiver and reimbursement, if any) are equal to the annualized expense ratio for the class (0.35% for Class A, 0.70% for Class R, 0.05% for Class P, 0.00% for Class R6 and 0.30% for Administrative Class), multiplied by the average account value over the period, multiplied by 182/365. The expense ratio does not include the expenses of the Underlying Funds, which based upon the allocation of the Fund’s assets among the Underlying Funds are indirectly borne by the shareholders of the Fund.

| 20 | May 31, 2014 | | Semiannual Report |

Table of Contents

Unaudited

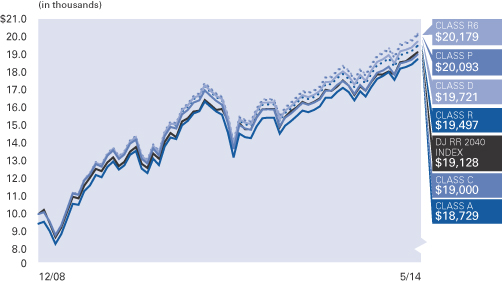

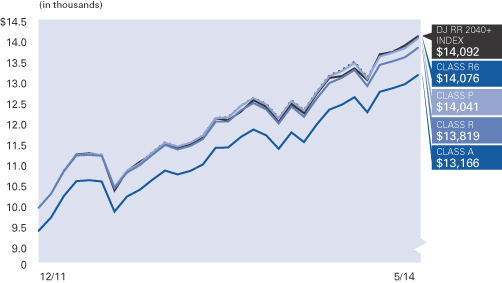

AllianzGI Retirement 2040 Fund

For the period of December 1, 2013 through May 31, 2014, as provided by the US Multi Asset Group.

Fund Insights

| Semiannual Report | | May 31, 2014 | 21 |

Table of Contents

Unaudited

AllianzGI Retirement 2040 Fund (cont’d)

Average Annual Total Return for the period ended May 31, 2014

| 6 Month* |

1 Year |

5 Year |

Since Inception† |

|||||||||||||||

| AllianzGI Retirement 2040 Fund Class A | 5.26% | 10.90% | 12.08% | 13.45% | ||||||||||||||

|

|

AllianzGI Retirement 2040 Fund Class A (adjusted) | –0.53% | 4.80% | 10.82% | 12.27% | |||||||||||||

| AllianzGI Retirement 2040 Fund Class C | 4.94% | 10.13% | 11.25% | 12.58% | ||||||||||||||

|

|

AllianzGI Retirement 2040 Fund Class C (adjusted) | 3.94% | 9.13% | 11.25% | 12.58% | |||||||||||||

|

|

AllianzGI Retirement 2040 Fund Class D | 5.28% | 10.82% | 12.00% | 13.35% | |||||||||||||

|

|

AllianzGI Retirement 2040 Fund Class R | 5.11% | 10.56% | 11.75% | 13.11% | |||||||||||||

|

|

AllianzGI Retirement 2040 Fund Class P | 5.45% | 11.27% | 12.38% | 13.74% | |||||||||||||

|

|

AllianzGI Retirement 2040 Fund Class R6 | 5.50% | 11.36% | 12.47% | 13.83% | |||||||||||||

| AllianzGI Retirement 2040 Fund Administrative Class | 5.32% | 10.99% | 12.14% | 13.50% | ||||||||||||||

|

|

Dow Jones Real Return 2040 Index | 6.99% | 10.93% | 11.77% | 12.72% | |||||||||||||

| Lipper Mixed-Asset Target 2040 Funds Average | 5.38% | 14.57% | 13.93% | 14.38% | ||||||||||||||

† The Fund began operations on 12/29/08. Benchmark return comparisons began on the fund inception date. Lipper performance comparisons began on 12/31/08.

* Cumulative return.

Performance quoted represents past performance and is no guarantee of future results. Current performance may be lower or higher than performance shown. For performance current to the most recent month-end, visit our website at us.allianzgi.com. Investment return and the principal value will fluctuate. Shares may be worth more or less than original cost when redeemed. The adjusted returns take into account the maximum initial sales charge of 5.50% on Class A shares and the contingent deferred sales charge (CDSC) of 1% on Class C shares, which may apply to shares redeemed during the first year of ownership. Returns do not reflect deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares. See pages 86 and 87 for more information. The Fund’s gross expense ratios are 1.34% for Class A shares, 2.09% for Class C shares, 1.34% for Class D shares, 1.59% for Class R shares, 0.94% for Class P shares, 0.84% for Class R6 shares and 1.19% for Administrative Class shares. These ratios do not include an expense reduction, contractually guaranteed through at least 3/31/15. The Fund’s expense ratios net of this reduction are 1.09% for Class A shares, 1.84% for Class C shares, 1.19% for Class D shares, 1.44% for Class R shares, 0.79% for Class P shares, 0.69% for Class R6 shares and 1.04% for Administrative Class shares. Expense ratio information is as of the Fund’s current prospectus dated April 1, 2014, as supplemented to date.

| 22 | May 31, 2014 | | Semiannual Report |

Table of Contents

Unaudited

AllianzGI Retirement 2040 Fund (cont’d)

| Shareholder Expense Example | Actual Performance | |||||||||||||

| Class A | Class C | Class D | Class R | Class P | Class R6 | Administrative Class | ||||||||

| Beginning Account Value (12/1/13) | $1,000.00 | $1,000.00 | $1,000.00 | $1,000.00 | $1,000.00 | $1,000.00 | $1,000.00 | |||||||

| Ending Account Value (5/31/14) | $1,052.60 | $1,049.40 | $1,052.80 | $1,051.10 | $1,054.50 | $1,055.00 | $1,053.20 | |||||||

| Expenses Paid During Period | $1.74 | $5.57 | $2.25 | $3.53 | $0.20 | $— | $1.48 | |||||||

| Hypothetical Performance | ||||||||||||||

| (5% return before expenses) | ||||||||||||||

| Class A | Class C | Class D | Class R | Class P | Class R6 | Administrative Class | ||||||||

| Beginning Account Value (12/1/13) | $1,000.00 | $1,000.00 | $1,000.00 | $1,000.00 | $1,000.00 | $1,000.00 | $1,000.00 | |||||||

| Ending Account Value (5/31/14) | $1,023.24 | $1,019.50 | $1,022.74 | $1,021.49 | $1,024.73 | $1,024.93 | $1,023.49 | |||||||

| Expenses Paid During Period | $1.72 | $5.49 | $2.22 | $3.48 | $0.20 | $— | $1.46 | |||||||

For each class of the Fund, expenses (net of fee waiver and reimbursement, if any) are equal to the annualized expense ratio for the class (0.34% for Class A, 1.09% for Class C, 0.44% for Class D, 0.69% for Class R, 0.04% for Class P, 0.00% for Class R6 and 0.29% for Administrative Class), multiplied by the average account value over the period, multiplied by 182/365. The expense ratio does not include the expenses of the Underlying Funds, which based upon the allocation of the Fund’s assets among the Underlying Funds are indirectly borne by the shareholders of the Fund.

| Semiannual Report | | May 31, 2014 | 23 |

Table of Contents

Unaudited

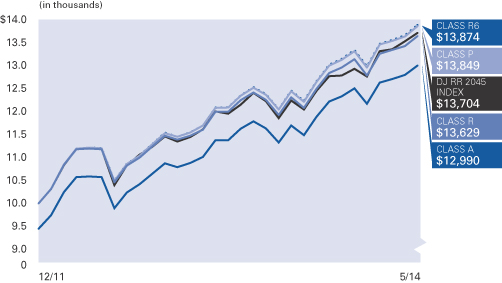

AllianzGI Retirement 2045 Fund

For the period of December 1, 2013 through May 31, 2014, as provided by the US Multi Asset Group.

Fund Insights

| 24 | May 31, 2014 | | Semiannual Report |

Table of Contents

Unaudited

AllianzGI Retirement 2045 Fund (cont’d)

Average Annual Total Return for the period ended May 31, 2014

| 6 Month* | 1 Year | Since Inception† | ||||||||||||

| AllianzGI Retirement 2045 Fund Class A | 5.38% | 11.69% | 13.87% | |||||||||||

|

|

AllianzGI Retirement 2045 Fund Class A (adjusted) | –0.41% | 5.54% | 11.27% | ||||||||||

|

|

AllianzGI Retirement 2045 Fund Class R | 5.23% | 11.31% | 13.47% | ||||||||||

|

|

AllianzGI Retirement 2045 Fund Class P | 5.58% | 12.05% | 14.21% | ||||||||||

|

|

AllianzGI Retirement 2045 Fund Class R6 | 5.60% | 12.13% | 14.30% | ||||||||||

| AllianzGI Retirement 2045 Fund Administrative Class | 5.44% | 11.80% | 13.89% | |||||||||||

|

|

Dow Jones Real Return 2045 Index | 7.26% | 12.18% | 13.74% | ||||||||||

| Lipper Mixed-Asset Target 2045 Funds Average | 5.53% | 15.59% | 17.07% | |||||||||||

† The Fund began operations on 12/19/11. Benchmark return comparisons began on the fund inception date. Lipper performance comparisons began on 12/31/11.

* Cumulative return.

Performance quoted represents past performance and is no guarantee of future results. Current performance may be lower or higher than performance shown. For performance current to the most recent month-end, visit our website at us.allianzgi.com. Investment return and the principal value will fluctuate. Shares may be worth more or less than original cost when redeemed. The adjusted returns take into account the maximum initial sales charge of 5.50% on Class A shares. Returns do not reflect deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares. See pages 86 and 87 for more information. The Fund’s gross expense ratios are 1.37% for Class A shares, 1.62% for Class R shares, 0.97% for Class P shares, 0.87% for Class R6 shares and 1.22% for Administrative Class shares. These ratios do not include an expense reduction, contractually guaranteed through at least 3/31/15. The Fund’s expense ratios net of this reduction are 1.10% for Class A shares, 1.45% for Class R shares, 0.80% for Class P shares, 0.70% for Class R6 shares and 1.05% for Administrative Class shares. Expense ratio information is as of the Fund’s current prospectus dated April 1, 2014, as supplemented to date.

| Semiannual Report | | May 31, 2014 | 25 |

Table of Contents

Unaudited

AllianzGI Retirement 2045 Fund (cont’d)

| Shareholder Expense Example | Actual Performance | |||||||||

| Class A | Class R | Class P | Class R6 | Administrative Class | ||||||

| Beginning Account Value (12/1/13) | $1,000.00 | $1,000.00 | $1,000.00 | $1,000.00 | $1,000.00 | |||||

| Ending Account Value (5/31/14) | $1,053.80 | $1,052.30 | $1,055.80 | $1,056.00 | $1,054.40 | |||||

| Expenses Paid During Period | $1.69 | $3.48 | $0.15 | $— | $1.43 | |||||

| Hypothetical Performance | ||||||||||

| (5% return before expenses) | ||||||||||

| Class A | Class R | Class P | Class R6 | Administrative Class | ||||||

| Beginning Account Value (12/1/13) | $1,000.00 | $1,000.00 | $1,000.00 | $1,000.00 | $1,000.00 | |||||

| Ending Account Value (5/31/14) | $1,023.29 | $1,021.54 | $1,024.78 | $1,024.93 | $1,023.54 | |||||

| Expenses Paid During Period | $1.66 | $3.43 | $0.15 | $— | $1.41 | |||||

For each class of the Fund, expenses (net of fee waiver and reimbursement, if any) are equal to the annualized expense ratio for the class (0.33% for Class A, 0.68% for Class R, 0.03% for Class P, 0.00% for Class R6 and 0.28% for Administrative Class), multiplied by the average account value over the period, multiplied by 182/365. The expense ratio excludes the expenses of the Underlying Funds, which based upon the allocation of the Fund’s assets among the Underlying Funds are indirectly borne by the shareholders of the Fund.

| 26 | May 31, 2014 | | Semiannual Report |

Table of Contents

Unaudited

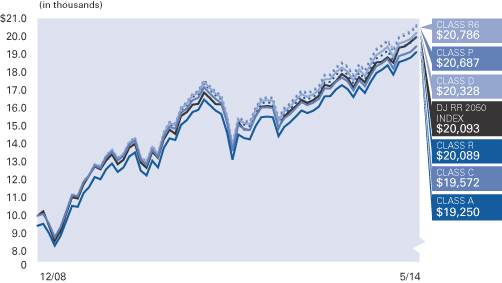

AllianzGI Retirement 2050 Fund

For the period of December 1, 2013 through May 31, 2014, as provided by the US Multi Asset Group.

Fund Insights

| Semiannual Report | | May 31, 2014 | 27 |

Table of Contents

Unaudited

AllianzGI Retirement 2050 Fund (cont’d)

Average Annual Total Return for the period ended May 31, 2014

| 6 Month* |

1 Year |

5 Year | Since Inception† |

|||||||||||||||

| AllianzGI Retirement 2050 Fund Class A | 5.49% | 12.10% | 12.73% | 14.03% | ||||||||||||||

|

|

AllianzGI Retirement 2050 Fund Class A (adjusted) | –0.31% | 5.94% | 11.47% | 12.85% | |||||||||||||

| AllianzGI Retirement 2050 Fund Class C | 5.11% | 11.27% | 11.88% | 13.20% | ||||||||||||||

|

|

AllianzGI Retirement 2050 Fund Class C (adjusted) | 4.11% | 10.27% | 11.88% | 13.20% | |||||||||||||

|

|

AllianzGI Retirement 2050 Fund Class D | 5.41% | 12.01% | 12.67% | 13.98% | |||||||||||||

|

|

AllianzGI Retirement 2050 Fund Class R | 5.34% | 11.75% | 12.40% | 13.73% | |||||||||||||

|

|

AllianzGI Retirement 2050 Fund Class P | 5.63% | 12.45% | 13.02% | 14.35% | |||||||||||||

|

|

AllianzGI Retirement 2050 Fund Class R6 | 5.71% | 12.53% | 13.12% | 14.45% | |||||||||||||

| AllianzGI Retirement 2050 Fund Administrative Class | 5.46% | 12.14% | 12.78% | 14.11% | ||||||||||||||

|

|

Dow Jones Real Return 2050 Index | 7.38% | 13.03% | 12.68% | 13.74% | |||||||||||||

| Lipper Mixed-Asset Target 2050+ Funds Average | 5.52% | 15.15% | 14.18% | 14.59% | ||||||||||||||

† The Fund began operations on 12/29/08. Benchmark return comparisons began on the fund inception date. Lipper performance comparisons began on 12/31/08.

* Cumulative return.

Performance quoted represents past performance and is no guarantee of future results. Current performance may be lower or higher than performance shown. For performance current to the most recent month-end, visit our website at us.allianzgi.com. Investment return and the principal value will fluctuate. Shares may be worth more or less than original cost when redeemed. The adjusted returns take into account the maximum initial sales charge of 5.50% on Class A shares and the contingent deferred sales charge (CDSC) of 1% on Class C shares, which may apply to shares redeemed during the first year of ownership. Returns do not reflect deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares. See pages 86 and 87 for more information. The Fund’s gross expense ratios are 1.40% for Class A shares, 2.15% for Class C shares, 1.40% for Class D shares, 1.65% for Class R shares, 1.00% for Class P shares, 0.90% for Class R6 shares and 1.25% for Administrative Class shares. These ratios do not include an expense reduction, contractually guaranteed through at least 3/31/15. The Fund’s expense ratios net of this reduction are 1.10% for Class A shares, 1.85% for Class C shares, 1.20% for Class D shares, 1.45% for Class R shares, 0.80% for Class P shares, 0.70% for Class R6 shares and 1.05% for Administrative Class shares. Expense ratio information is as of the Fund’s current prospectus dated April 1, 2014, as supplemented to date.

The Dow Jones Real Return 2050 Index inception date was 12/31/2009. Accordingly, Dow Jones Real Return 40+ Index performance is used for periods prior to 12/31/2009.

| 28 | May 31, 2014 | | Semiannual Report |

Table of Contents

Unaudited

AllianzGI Retirement 2050 Fund (cont’d)

| Shareholder Expense Example | Actual Performance | |||||||||||||

| Class A | Class C | Class D | Class R | Class P | Class R6 | Administrative Class | ||||||||

| Beginning Account Value (12/1/13) | $1,000.00 | $1,000.00 | $1,000.00 | $1,000.00 | $1,000.00 | $1,000.00 | $1,000.00 | |||||||

| Ending Account Value (5/31/14) | $1,054.90 | $1,051.10 | $1,054.10 | $1,053.40 | $1,056.30 | $1,057.10 | $1,054.60 | |||||||

| Expenses Paid During Period | $1.59 | $5.42 | $2.10 | $3.38 | $0.05 | $— | $1.33 | |||||||

| Hypothetical Performance | ||||||||||||||

| (5% return before expenses) | ||||||||||||||

| Class A | Class C | Class D | Class R | Class P | Class R6 | Administrative Class | ||||||||

| Beginning Account Value (12/1/13) | $1,000.00 | $1,000.00 | $1,000.00 | $1,000.00 | $1,000.00 | $1,000.00 | $1,000.00 | |||||||

| Ending Account Value (5/31/14) | $1,023.39 | $1,019.65 | $1,022.89 | $1,021.64 | $1,024.88 | $1,024.93 | $1,023.64 | |||||||

| Expenses Paid During Period | $1.56 | $5.34 | $2.07 | $3.33 | $0.05 | $— | $1.31 | |||||||

For each class of the Fund, expenses (net of fee waiver and reimbursement, if any) are equal to the annualized expense ratio for the class (0.31% for Class A, 1.06% for Class C, 0.41% for Class D, 0.66% for Class R, 0.01% for Class P, 0.00% for Class R6 and 0.26% for Administrative Class), multiplied by the average account value over the period, multiplied by 182/365. The expense ratio does not include the expenses of the Underlying Funds, which based upon the allocation of the Fund’s assets among the Underlying Funds are indirectly borne by the shareholders of the Fund.

| Semiannual Report | | May 31, 2014 | 29 |

Table of Contents

Unaudited

AllianzGI Retirement 2055 Fund

For the period of December 1, 2013 through May 31, 2014, as provided by the US Multi Asset Group.

Fund Insights

Average Annual Total Return for the period ended May 31, 2014

| 6 Month* | 1 Year | Since Inception† | ||||||||||||

| AllianzGI Retirement 2055 Fund Class A | 5.63% | 12.28% | 14.50% | |||||||||||

|

|

AllianzGI Retirement 2055 Fund Class A (adjusted) | –0.18% | 6.11% | 11.88% | ||||||||||

|

|

AllianzGI Retirement 2055 Fund Class R | 5.45% | 11.94% | 14.13% | ||||||||||

|

|

AllianzGI Retirement 2055 Fund Class P | 5.82% | 12.65% | 14.87% | ||||||||||

|

|

AllianzGI Retirement 2055 Fund Class R6 | 5.87% | 12.75% | 14.97% | ||||||||||

| AllianzGI Retirement 2055 Fund Administrative Class | 5.66% | 12.44% | 14.57% | |||||||||||

|

|

Dow Jones Real Return 2040+ Index | 7.24% | 13.53% | 15.04% | ||||||||||

| Lipper Mixed-Asset Target 2055+ Funds Average | 5.66% | 16.30% | 17.44% | |||||||||||

† The Fund began operations on 12/19/11. Benchmark return comparisons began on the fund inception date. Lipper performance comparisons began on 12/31/11.

* Cumulative return.

Performance quoted represents past performance and is no guarantee of future results. Current performance may be lower or higher than performance shown. For performance current to the most recent month-end, visit our website at us.allianzgi.com. Investment return and the principal value will fluctuate. Shares may be worth more or less than original cost when redeemed. The adjusted returns take into account the maximum initial sales charge of 5.50% on Class A shares. Returns do not reflect deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares. See pages 86 and 87 for more information. The Fund’s gross expense ratios are 1.40% for Class A shares, 1.65% for Class R shares, 1.00% for Class P shares, 0.90% for Class R6 shares and 1.25% for Administrative Class shares. These ratios do not include an expense reduction, contractually guaranteed through at least 3/31/15. The Fund’s expense ratios net of this reduction are 1.10% for Class A shares, 1.45% for Class R shares, 0.80% for Class P shares, 0.70% for Class R6 shares and 1.05% for Administrative Class shares. Expense ratio information is as of the Fund’s current prospectus dated April 1, 2014, as supplemented to date.

| 30 | May 31, 2014 | | Semiannual Report |

Table of Contents

Unaudited

AllianzGI Retirement 2055 Fund (cont’d)

| Shareholder Expense Example | Actual Performance | |||||||||

| Class A | Class R | Class P | Class R6 | Administrative Class | ||||||

| Beginning Account Value (12/1/13) | $1,000.00 | $1,000.00 | $1,000.00 | $1,000.00 | $1,000.00 | |||||

| Ending Account Value (5/31/14) | $1,056.30 | $1,054.50 | $1,058.20 | $1,058.70 | $1,056.60 | |||||

| Expenses Paid During Period | $1.54 | $3.33 | $— | $— | $1.28 | |||||

| Hypothetical Performance | ||||||||||

| (5% return before expenses) | ||||||||||

| Class A | Class R | Class P | Class R6 | Administrative Class | ||||||

| Beginning Account Value (12/1/13) | $1,000.00 | $1,000.00 | $1,000.00 | $1,000.00 | $1,000.00 | |||||

| Ending Account Value (5/31/14) | $1,023.44 | $1,021.69 | $1,024.93 | $1,024.93 | $1,023.68 | |||||

| Expenses Paid During Period | $1.51 | $3.28 | $— | $— | $1.26 | |||||

For each class of the Fund, expenses (net of fee waiver and reimbursement, if any) are equal to the annualized expense ratio for the class (0.30% for Class A, 0.65% for Class R, 0.00% for Class P, 0.00% for Class R6 and 0.25% for Administrative Class), multiplied by the average account value over the period, multiplied by 182/365. The expense ratio does not include the expenses of the Underlying Funds, which based upon the allocation of the Fund’s assets among the Underlying Funds are indirectly borne by the shareholders of the Fund.

| Semiannual Report | | May 31, 2014 | 31 |

Table of Contents

Unaudited

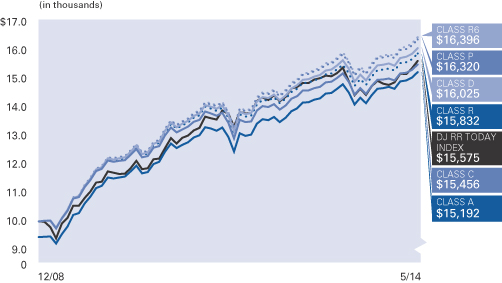

AllianzGI Retirement Income Fund

For the period of December 1, 2013 through May 31, 2014, as provided by the US Multi Asset Group.

Fund Insights

| 32 | May 31, 2014 | | Semiannual Report |

Table of Contents

Unaudited

AllianzGI Retirement Income Fund (cont’d)

Average Annual Total Return for the period ended May 31, 2014

| 6 Month* | 1 Year | 5 Year | Since Inception† | |||||||||||||||

| AllianzGI Retirement Income Fund Class A |

3.85% | 4.92% | 8.24% | 9.16% | ||||||||||||||

|

|

AllianzGI Retirement Income Fund Class A (adjusted) |

–1.86% | –0.85% | 7.02% | 8.03% | |||||||||||||

| AllianzGI Retirement Income Fund Class C |

3.50% | 4.15% | 7.45% | 8.36% | ||||||||||||||

|

|

AllianzGI Retirement Income Fund Class C (adjusted) |

2.50% | 3.15% | 7.45% | 8.36% | |||||||||||||

|

|

AllianzGI Retirement Income Fund Class D |

3.80% | 4.78% | 8.19% | 9.10% | |||||||||||||

|

|

AllianzGI Retirement Income Fund Class R |

3.64% | 4.54% | 7.91% | 8.84% | |||||||||||||

|

|

AllianzGI Retirement Income Fund Class P |

3.98% | 5.25% | 8.54% | 9.45% | |||||||||||||

|

|

AllianzGI Retirement Income Fund Class R6 |

4.05% | 5.34% | 8.64% | 9.56% | |||||||||||||

| AllianzGI Retirement Income Fund Administrative Class |

3.85% | 4.97% | 8.30% | 9.23% | ||||||||||||||

|

|

Dow Jones Real Return Today Index |

5.32% | 4.81% | 8.11% | 8.52% | |||||||||||||

| Lipper Mixed-Asset Target Today Funds Average |

3.72% | 6.24% | 8.16% | 8.57% | ||||||||||||||

† The Fund began operations on 12/29/08. Benchmark return comparisons began on the fund inception date. Lipper performance comparisons began on 12/31/08.

* Cumulative return.

Performance quoted represents past performance and is no guarantee of future results. Current performance may be lower or higher than performance shown. For performance current to the most recent month-end, visit our website at us.allianzgi.com. Investment return and the principal value will fluctuate. Shares may be worth more or less than original cost when redeemed. The adjusted returns take into account the maximum initial sales charge of 5.50% on Class A shares and the contingent deferred sales charge (CDSC) of 1% on Class C shares, which may apply to shares redeemed during the first year of ownership. Returns do not reflect deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares. See pages 86 and 87 for more information. The Fund’s gross expense ratios are 1.16% for Class A shares, 1.91% for Class C shares, 1.16% for Class D shares, 1.41% for Class R shares, 0.76% for Class P shares, 0.66% for Class R6 shares and 1.01% for Administrative Class shares. These ratios do not include an expense reduction, contractually guaranteed through at least 3/31/15. The Fund’s expense ratios net of this reduction are 0.95% for Class A shares, 1.70% for Class C shares, 1.05% for Class D shares, 1.30% for Class R shares, 0.65% for Class P shares, 0.55% for Class R6 shares and 0.90% for Administrative Class shares. Expense ratio information is as of the Fund’s current prospectus dated April 1, 2014, as supplemented to date.

| Semiannual Report | | May 31, 2014 | 33 |

Table of Contents

Unaudited

AllianzGI Retirement Income Fund (cont’d)

| Shareholder Expense Example | Actual Performance | |||||||||||||

| Class A | Class C | Class D | Class R | Class P | Class R6 | Administrative Class | ||||||||

| Beginning Account Value (12/1/13) | $1,000.00 | $1,000.00 | $1,000.00 | $1,000.00 | $1,000.00 | $1,000.00 | $1,000.00 | |||||||

| Ending Account Value (5/31/14) | $1,038.50 | $1,035.00 | $1,038.00 | $1,036.40 | $1,039.80 | $1,040.50 | $1,038.50 | |||||||

| Expenses Paid During Period | $1.93 | $5.73 | $2.44 | $3.71 | $0.46 | $— | $1.68 | |||||||

| Hypothetical Performance | ||||||||||||||

| (5% return before expenses) | ||||||||||||||

| Class A | Class C | Class D | Class R | Class P | Class R6 | Administrative Class | ||||||||

| Beginning Account Value (12/1/13) | $1,000.00 | $1,000.00 | $1,000.00 | $1,000.00 | $1,000.00 | $1,000.00 | $1,000.00 | |||||||

| Ending Account Value (5/31/14) | $1,023.04 | $1,019.30 | $1,022.54 | $1,021.29 | $1,024.48 | $1,024.93 | $1,023.29 | |||||||

| Expenses Paid During Period | $1.92 | $5.69 | $2.42 | $3.68 | $0.45 | $— | $1.66 | |||||||

For each class of the Fund, expenses (net of fee waiver and reimbursement, if any) are equal to the annualized expense ratio for the class (0.38% for Class A, 1.13% for Class C, 0.48% for Class D, 0.73% for Class R, 0.09% for Class P, 0.00% for Class R6 and 0.33% for Administrative Class), multiplied by the average account value over the period, multiplied by 182/365. The expense ratio does not include the expenses of the Underlying Funds, which based upon the allocation of the Fund’s assets among the Underlying Funds are indirectly borne by the shareholders of the Fund.

| 34 | May 31, 2014 | | Semiannual Report |

Table of Contents

Unaudited

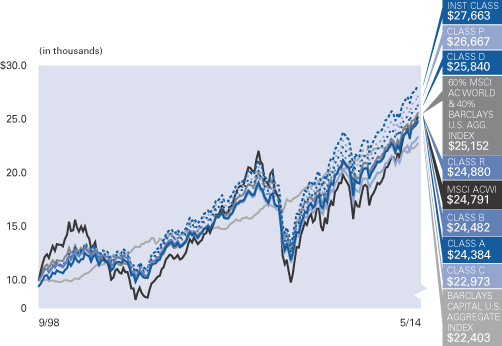

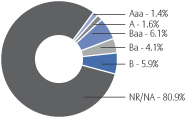

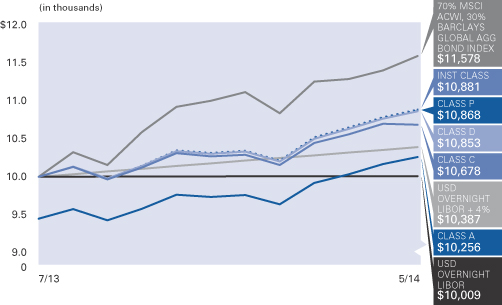

AllianzGI Global Allocation Fund

For the period of December 1, 2013 through May 31, 2014, as provided by the US Multi Asset Group.

Fund Insights

| Semiannual Report | | May 31, 2014 | 35 |

Table of Contents

Unaudited

AllianzGI Global Allocation Fund (cont’d)

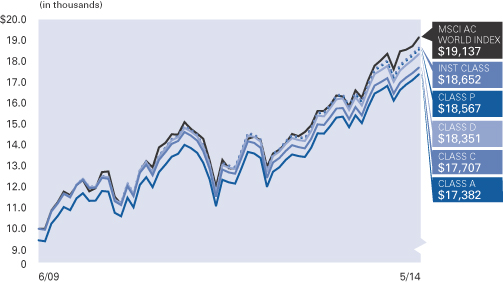

Average Annual Total Return for the period ended May 31, 2014

| 6 Month* | 1 Year |

5 Year |

10 Year |

Since Inception† | ||||||||||||||||||

| AllianzGI Global Allocation Fund Class A | 4.66% | 10.02% | 11.21% | 6.35% | 6.24% | |||||||||||||||||

|

|

AllianzGI Global Allocation Fund Class A (adjusted) | –1.10% | 3.97% | 9.96% | 5.75% | 5.86% | ||||||||||||||||

| AllianzGI Global Allocation Fund Class B | 4.32% | 9.22% | 10.41% | 5.79% | 5.88% | |||||||||||||||||

|

|

AllianzGI Global Allocation Fund Class B (adjusted) | –0.68% | 4.22% | 10.14% | 5.79% | 5.88% | ||||||||||||||||

| AllianzGI Global Allocation Fund Class C | 4.39% | 9.27% | 10.40% | 5.57% | 5.45% | |||||||||||||||||

|

|

AllianzGI Global Allocation Fund Class C (adjusted) | 3.39% | 8.27% | 10.40% | 5.57% | 5.45% | ||||||||||||||||

|

|

AllianzGI Global Allocation Fund Class D | 4.72% | 10.09% | 11.20% | 6.36% | 6.25% | ||||||||||||||||

|

|

AllianzGI Global Allocation Fund Class R | 4.60% | 9.81% | 10.95% | 6.11% | 5.99% | ||||||||||||||||

|

|

AllianzGI Global Allocation Fund Class P | 4.79% | 10.30% | 11.43% | 6.58% | 6.46% | ||||||||||||||||

|

|

AllianzGI Global Allocation Fund Institutional Class | 4.84% | 10.31% | 11.53% | 6.80% | 6.71% | ||||||||||||||||

| AllianzGI Global Allocation Fund Administrative Class | 4.71% | 9.93% | 11.23% | 6.40% | 6.29% | |||||||||||||||||

|

|

MSCI All Country World Index | 6.02% | 17.15% | 13.73% | 7.47% | 5.97% | ||||||||||||||||

|

|

60% MSCI AC World Index/40% Barclays U.S. Aggregate Index | 4.98% | 11.29% | 10.46% | 6.84% | 6.06% | ||||||||||||||||

|

|

Barclays U.S. Aggregate Index | 3.28% | 2.71% | 4.96% | 4.99% | 5.28% | ||||||||||||||||

| Lipper Mixed-Asset Target Allocation Moderate Funds Average | 5.09% | 11.11% | 11.38% | 6.08% | 5.71% | |||||||||||||||||

† The Fund began operations on 9/30/98. Benchmark return comparisons began on the fund inception date. Lipper performance comparisons began on 9/30/98.

* Cumulative return.

Performance quoted represents past performance and is no guarantee of future results. Current performance may be lower or higher than performance shown. For performance current to the most recent month-end, visit our website at us.allianzgi.com. Investment return and the principal value will fluctuate. Shares may be worth more or less than original cost when redeemed. The adjusted returns take into account the maximum sales charge of 5.50% on Class A shares, 5% contingent deferred sales charge (CDSC) on Class B shares and 1% CDSC on Class C shares. Returns do not reflect deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares. See pages 86 and 87 for more information. The Fund’s gross expense ratios are 2.09% for Class A shares, 2.91% for Class B shares, 2.83% for Class C shares, 2.12% for Class D shares, 2.27% for Class R shares, 1.86% for Class P shares, 1.84% for Institutional Class shares and 2.21% for Administrative Class shares. These ratios do not include an expense reduction, contractually guaranteed through at least 3/31/15. The Fund’s expense ratios net of this reduction are 1.13% for Class A shares, 1.84% for Class B shares, 1.86% for Class C shares, 1.13% for Class D shares, 1.29% for Class R shares, 0.89% for Class P shares, 0.89% for Institutional Class shares and 1.14% for Administrative Class shares. Expense ratio information is as of the Fund’s current prospectus dated April 1, 2014, as supplemented to date.

| 36 | May 31, 2014 | | Semiannual Report |

Table of Contents

Unaudited

AllianzGI Global Allocation Fund (cont’d)

| Shareholder Expense Example | Actual Performance | |||||||||||||||

| Class A | Class B | Class C | Class D | Class R | Class P | Institutional Class |

Administrative Class | |||||||||

| Beginning Account Value (12/1/13) | $1,000.00 | $1,000.00 | $1,000.00 | $1,000.00 | $1,000.00 | $1,000.00 | $1,000.00 | $1,000.00 | ||||||||

| Ending Account Value (5/31/14) | $1,046.60 | $1,043.20 | $1,043.90 | $1,047.20 | $1,046.00 | $1,047.90 | $1,048.40 | $1,047.10 | ||||||||

| Expenses Paid During Period | $2.04 | $5.65 | $5.76 | $1.89 | $2.86 | $0.82 | $0.82 | $2.09 | ||||||||

| Hypothetical Performance | ||||||||||||||||

| (5% return before expenses) | ||||||||||||||||

| Class A | Class B | Class C | Class D | Class R | Class P | Institutional Class |

Administrative Class | |||||||||

| Beginning Account Value (12/1/13) | $1,000.00 | $1,000.00 | $1,000.00 | $1,000.00 | $1,000.00 | $1,000.00 | $1,000.00 | $1,000.00 | ||||||||

| Ending Account Value (5/31/14) | $1,022.94 | $1,019.40 | $1,019.30 | $1,023.09 | $1,022.14 | $1,024.13 | $1,024.13 | $1,022.89 | ||||||||

| Expenses Paid During Period | $2.02 | $5.59 | $5.69 | $1.86 | $2.82 | $0.81 | $0.81 | $2.07 | ||||||||

For each class of the Fund, expenses (net of fee waiver and reimbursement, if any) are equal to the annualized expense ratio for the class (0.40% for Class A, 1.11% for Class B, 1.13% for Class C, 0.37% for Class D, 0.56% for Class R, 0.16% for Class P, 0.16% for Institutional Class and 0.41% for Administrative Class), multiplied by the average account value over the period, multiplied by 182/365. The expense ratio does not include the expenses of the Underlying Funds, which based upon the allocation of the Fund’s assets among the Underlying Funds are indirectly borne by the shareholders of the Fund.

| Semiannual Report | | May 31, 2014 | 37 |

Table of Contents

Unaudited

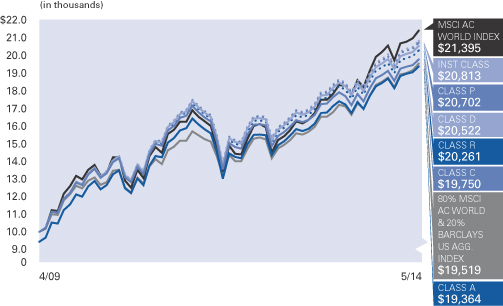

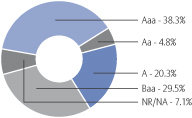

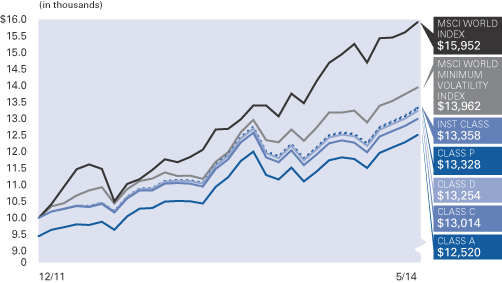

AllianzGI Global Growth Allocation Fund

For the period of December 1, 2013 through May 31, 2014, as provided by the US Multi Asset Group.

Fund Insights

Average Annual Total Return for the period ended May 31, 2014

| 6 Month* | 1 Year | 5 Year | Since Inception† | |||||||||||||||

| AllianzGI Global Growth Allocation Fund Class A | 5.08% | 12.54% | 12.94% | 15.13% | ||||||||||||||

|

|

AllianzGI Global Growth Allocation Fund Class A (adjusted) | –0.70% | 6.35% | 11.67% | 13.86% | |||||||||||||

| AllianzGI Global Growth Allocation Fund Class C | 4.65% | 11.69% | 12.13% | 14.29% | ||||||||||||||

|

|

AllianzGI Global Growth Allocation Fund Class C (adjusted) | 3.75% | 10.72% | 12.13% | 14.29% | |||||||||||||

|

|

AllianzGI Global Growth Allocation Fund Class D | 5.10% | 12.56% | 12.96% | 15.15% | |||||||||||||

|

|

AllianzGI Global Growth Allocation Fund Class R | 4.95% | 12.29% | 12.69% | 14.87% | |||||||||||||

|

|

AllianzGI Global Growth Allocation Fund Class P | 5.16% | 12.73% | 13.17% | 15.36% | |||||||||||||

|

|

AllianzGI Global Growth Allocation Fund Institutional Class | 5.23% | 12.84% | 13.29% | 15.48% | |||||||||||||

| AllianzGI Global Growth Allocation Fund Administrative Class | 5.07% | 12.54% | 13.00% | 15.19% | ||||||||||||||

|

|

MSCI AC World Index | 6.02% | 17.15% | 13.73% | 16.11% | |||||||||||||

|

|

80% MSCI ACWI 20% Barclays US Agg. Index | 5.51% | 14.21% | 12.14% | 14.04% | |||||||||||||

| Lipper Global Flexible Port Fund Average | 4.53% | 8.72% | 10.50% | 11.92% | ||||||||||||||

† The Fund began operations on 4/27/09. Benchmark return comparisons began on the fund inception date. Lipper performance comparisons began on 4/30/09.

* Cumulative return.

Performance quoted represents past performance and is no guarantee of future results. Current performance may be lower or higher than performance shown. For performance current to the most recent month-end, visit our website at us.allianzgi.com. Investment return and the principal value will fluctuate. Shares may be worth more or less than original cost when redeemed. The adjusted returns take into account the maximum initial sales charge of 5.50% on Class A shares and the contingent deferred sales charge (CDSC) of 1% on Class C shares, which may apply to shares redeemed during the first year of ownership. Returns do not reflect deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares. See pages 86 and 87 for more information. The Fund’s gross expense ratios are 4.67% for Class A shares, 5.36% for Class C shares, 4.99% for Class D shares, 5.11% for Class R shares, 4.59% for Class P shares, 4.31% for Institutional Class shares and 4.62% for Administrative Class shares. These ratios do not include an expense reduction, contractually guaranteed through at least 3/31/15. The Fund’s expense ratios net of this reduction are 1.23% for Class A shares, 2.01% for Class C shares, 1.23% for Class D shares, 1.46% for Class R shares, 1.06% for Class P shares, 0.96% for Institutional Class shares and 1.21% for Administrative Class shares. Expense ratio information is as of the Fund’s current prospectus dated April 1, 2014, as supplemented to date.

| 38 | May 31, 2014 | | Semiannual Report |

Table of Contents

Unaudited

AllianzGI Global Growth Allocation Fund (cont’d)

| Shareholder Expense Example | Actual Performance | |||||||||||||

| Class A | Class C | Class D | Class R | Class P | Institutional Class |

Administrative Class | ||||||||

| Beginning Account Value (12/1/13) | $1,000.00 | $1,000.00 | $1,000.00 | $1,000.00 | $1,000.00 | $1,000.00 | $1,000.00 | |||||||

| Ending Account Value (5/31/14) | $1,050.80 | $1,046.50 | $1,051.00 | $1,049.50 | $1,051.60 | $1,052.30 | $1,050.70 | |||||||

| Expenses Paid During Period | $2.05 | $6.02 | $2.05 | $3.22 | $1.18 | $0.67 | $1.94 | |||||||

| Hypothetical Performance | ||||||||||||||

| (5% return before expenses) | ||||||||||||||

| Class A | Class C | Class D | Class R | Class P | Institutional Class |

Administrative Class | ||||||||

| Beginning Account Value (12/1/13) | $1,000.00 | $1,000.00 | $1,000.00 | $1,000.00 | $1,000.00 | $1,000.00 | $1,000.00 | |||||||

| Ending Account Value (5/31/14) | $1,022.94 | $1,019.05 | $1,022.94 | $1,021.79 | $1,023.78 | $1,024.28 | $1,023.04 | |||||||

| Expenses Paid During Period | $2.02 | $5.94 | $2.02 | $3.18 | $1.16 | $0.66 | $1.92 | |||||||

For each class of the Fund, expenses (net of fee waiver and reimbursement, if any) are equal to the annualized expense ratio for the class (0.40% for Class A, 1.18% for Class C, 0.40% for Class D, 0.63% for Class R, 0.23% for Class P, 0.13% for Institutional Class and 0.38% for Administrative Class), multiplied by the average account value over the period, multiplied by 182/365. The expense ratio does not include the expenses of the Underlying Funds, which based upon the allocation of the Fund’s assets among the Underlying Funds are indirectly borne by the shareholders of the Fund.

| Semiannual Report | | May 31, 2014 | 39 |

Table of Contents

Unaudited

AllianzGI Behavioral Advantage Large Cap Fund

For the period of December 1, 2013 through May 31, 2014, as provided by Raife Giovinazzo, CFA, PhD, Portfolio Manager.

Fund Insights

Average Annual Total Return for the period ended May 31, 2014

| 6 Month* | 1 Year | Since Inception† |

||||||||||||

| AllianzGI Behavioral Advantage Large Cap Fund Class A | 5.25% | 20.09% | 23.83% | |||||||||||

|

|

AllianzGI Behavioral Advantage Large Cap Fund Class A (adjusted) | –0.54% | 13.48% | 21.28% | ||||||||||

| AllianzGI Behavioral Advantage Large Cap Fund Class C | 4.87% | 19.17% | 22.88% | |||||||||||

|

|

AllianzGI Behavioral Advantage Large Cap Fund Class C (adjusted) | 3.87% | 18.17% | 22.88% | ||||||||||

|

|

AllianzGI Behavioral Advantage Large Cap Fund Class D | 5.26% | 20.08% | 23.81% | ||||||||||

|

|

AllianzGI Behavioral Advantage Large Cap Fund Class P | 5.37% | 20.32% | 24.09% | ||||||||||

|

|

AllianzGI Behavioral Advantage Large Cap Fund Institutional Class | 5.42% | 20.43% | 24.21% | ||||||||||

|

|

S&P 500 Index | 7.62% | 20.45% | 22.05% | ||||||||||

| Lipper Multi-Cap Core Fund Average | 6.27% | 19.48% | 18.85% | |||||||||||

† The Fund began operations on 9/8/11. Benchmark return comparisons began on the fund inception date. Lipper performance comparisons began on 8/31/11.

* Cumulative return.

Performance quoted represents past performance and is no guarantee of future results. Current performance may be lower or higher than performance shown. For performance current to the most recent month-end, visit our website at us.allianzgi.com. Investment return and the principal value will fluctuate. Shares may be worth more or less than original cost when redeemed. The adjusted returns take into account the maximum initial sales charge of 5.50% on Class A shares and the contingent deferred sales charge (CDSC) of 1% on Class C shares, which may apply to shares redeemed during the first year of ownership. Returns do not reflect deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares. See pages 86 and 87 for more information. The Fund’s gross expense ratios are 1.25% for Class A shares, 2.08% for Class C shares, 2.08% for Class D shares, 1.20% for Class P shares and 1.05% for Institutional Class shares. These ratios do not include an expense reduction, contractually guaranteed through at least 3/31/15. The Fund’s expense ratios net of this reduction are 0.81% for Class A shares, 1.57% for Class C shares, 0.81% for Class D shares, 0.65% for Class P shares and 0.55% for Institutional Class shares. Expense ratio information is as of the Fund’s current prospectus dated April 1, 2014, as supplemented to date.

| 40 | May 31, 2014 | | Semiannual Report |

Table of Contents

Unaudited

AllianzGI Behavioral Advantage Large Cap Fund (cont’d)

| Shareholder Expense Example | Actual Performance | |||||||||

| Class A | Class C | Class D | Class P | Institutional Class | ||||||

| Beginning Account Value (12/1/13) | $1,000.00 | $1,000.00 | $1,000.00 | $1,000.00 | $1,000.00 | |||||

| Ending Account Value (5/31/14) | $1,052.50 | $1,048.70 | $1,052.60 | $1,053.70 | $1,054.20 | |||||

| Expenses Paid During Period | $4.20 | $8.02 | $4.15 | $3.33 | $2.82 | |||||

| Hypothetical Performance | ||||||||||

| (5% return before expenses) | ||||||||||

| Class A | Class C | Class D | Class P | Institutional Class | ||||||

| Beginning Account Value (12/1/13) | $1,000.00 | $1,000.00 | $1,000.00 | $1,000.00 | $1,000.00 | |||||

| Ending Account Value (5/31/14) | $1,020.84 | $1,017.10 | $1,020.89 | $1,021.69 | $1,022.19 | |||||

| Expenses Paid During Period | $4.13 | $7.90 | $4.08 | $3.28 | $2.77 | |||||

For each class of the Fund, expenses (net of fee waiver and reimbursement, if any) are equal to the annualized expense ratio for the class (0.82% for Class A, 1.57% for Class C, 0.81% for Class D, 0.65% for Class P and 0.55% for Institutional Class), multiplied by the average account value over the period, multiplied by 182/365.

| Semiannual Report | | May 31, 2014 | 41 |

Table of Contents

Unaudited

AllianzGI Best Styles Global Equity Fund

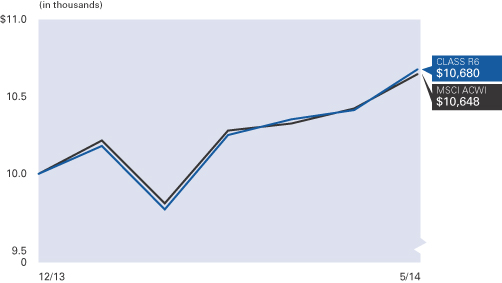

Since the Fund’s inception on December 2, 2013 through May 31, 2014, as provided by Klaus Teloeken, Portfolio Manager.

Fund Insights

Cumulative Return for the period ended May 31, 2014

| Since Inception† | ||||||

|

|

AllianzGI Best Styles Global Equity Fund Class R6 | 6.80% | ||||

|

|

MSCI AC World Index | 6.48% | ||||

| Lipper Global Multi-Cap Core Fund Avg. | 5.12% | |||||

† The Fund began operations on 12/2/2013. Benchmark return comparisons began on the fund inception date. Lipper performance comparisons began on 11/30/2013.

Performance quoted represents past performance and is no guarantee of future results. Current performance may be lower or higher than performance shown. For performance current to the most recent month-end, visit our website at us.allianzgi.com. Investment return and the principal value will fluctuate. Shares may be worth more or less than original cost when redeemed. Returns do not reflect deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares. See pages 86 and 87 for more information. The Fund’s gross expense ratio is 3.25% for Class R6 shares. This ratio does not include an expense reduction, contractually guaranteed through at least 3/31/15. The Fund’s expense ratio net of this reduction ratio is 0.40% for Class R6 shares. Expense ratio information is as of the Fund’s current prospectus dated April 1, 2014, as supplemented to date.