U.S. SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 10-Q

x Quarterly report pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

For the period ended March 31, 2017

¨ Transition report pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

For the transition period from ___________ to ___________.

Commission File Number 001-34024

Sino-Global Shipping America, Ltd.

(Exact name of registrant as specified in its charter)

| Virginia | 11-3588546 | |

| (State or other jurisdiction of | (I.R.S. employer | |

| Incorporation or organization) | identification number) |

1044 Northern Boulevard, Suite 305

Roslyn, New York 11576-1514

(Address of principal executive offices and zip code)

(718) 888-1814

(Registrant’s telephone number, including area code)

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports) and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer ¨ | Accelerated filer ¨ |

| Non-accelerated filer ¨ (Do not check if a smaller reporting company) | Smaller reporting company x |

| Emerging growth company ¨ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No x

Indicate the number of shares outstanding of each of the issuer’s classes of common stock, as of the latest practicable date. As of May 12, 2017, the Company had 10,105,535 issued and outstanding shares of common stock.

SINO-GLOBAL SHIPPING AMERICA, LTD.

FORM 10-Q

INDEX

| 2 |

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

This document contains certain statements of a forward-looking nature. Such forward-looking statements, including but not limited to projected growth, trends and strategies, future operating and financial results, financial expectations and current business indicators are based upon current information and expectations and are subject to change based on factors beyond the control of Sino-Global Shipping America, Ltd. Forward-looking statements typically are identified by the use of terms such as “look,” “may,” “will,” “should,” “might,” “believe,” “plan,” “expect,” “anticipate,” “estimate” and similar words, although some forward-looking statements are expressed differently. The accuracy of such statements may be impacted by a number of business risks and uncertainties that could cause actual results to differ materially from those projected or anticipated, including but not limited to the following:

| · | Our ability to timely and properly deliver our services; |

| · | Our dependence on a limited number of major customers and related parties; |

| · | Political and economic factors in the Peoples’ Republic of China; |

| · | Our ability to expand and grow our lines of business; |

| · | Unanticipated changes in general market conditions or other factors, which may result in cancellations or reductions in the need for our services; |

| · | Economic conditions which would reduce demand for services provided by the Company and could adversely affect profitability; |

| · | The effect of terrorist acts, or the threat thereof, on the demand for the shipping and logistic industry which could, adversely affect the Company’s operations and financial performance; |

| · | The acceptance in the marketplace of our new lines of business; |

| · | Foreign currency exchange rate fluctuations; |

| · | Hurricanes or other natural disasters; and |

| · | Our ability to attract, retain and motivate skilled personnel. |

Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date hereof. The Company undertakes no obligation to update this forward-looking information unless required by applicable law or regulations.

| 3 |

| Item 1. | Financial Statements |

SINO-GLOBAL SHIPPING AMERICA, LTD. AND AFFILIATES

INDEX TO FINANCIAL STATEMENTS

| F-1 |

SINO-GLOBAL SHIPPING AMERICA, LTD. AND AFFILIATES

CONDENSED CONSOLIDATED BALANCE SHEETS

(UNAUDITED)

| March 31, | June 30, | |||||||

| 2017 | 2016 | |||||||

| Assets | ||||||||

| Current assets | ||||||||

| Cash and cash equivalents | $ | 8,840,189 | $ | 1,385,994 | ||||

| Accounts receivable, less allowance for doubtful accounts of $97,111 and $207,028 as of March 31, 2017 and June 30, 2016, respectively | 1,883,119 | 2,333,024 | ||||||

| Other receivables, less allowance for doubtful accounts of $145,235 and $145,186 as of March 31, 2017 and June 30, 2016, respectively | 103,325 | 290,907 | ||||||

| Advances to suppliers | 1,325,272 | 2,192,910 | ||||||

| Prepaid expenses and other current assets | 355,442 | 826,631 | ||||||

| Due from related parties | 4,406,186 | 1,622,519 | ||||||

| Total Current Assets | 16,913,533 | 8,651,985 | ||||||

| Property and equipment, net | 196,845 | 176,367 | ||||||

| Prepaid expenses | 49,699 | 178,982 | ||||||

| Other long-term assets | 60,481 | 46,810 | ||||||

| Deferred tax assets | 387,900 | - | ||||||

| Total Assets | $ | 17,608,458 | $ | 9,054,144 | ||||

| Liabilities and Equity | ||||||||

| Current Liabilities | ||||||||

| Advances from customers | $ | 344,470 | $ | 24,373 | ||||

| Accounts payable | 784,411 | 489,490 | ||||||

| Taxes payable | 1,792,099 | 1,637,197 | ||||||

| Due to related parties | 156,841 | - | ||||||

| Accrued expenses and other current liabilities | 800,916 | 286,322 | ||||||

| Total Current Liabilities | 3,878,737 | 2,437,382 | ||||||

| Total Liabilities | 3,878,737 | 2,437,382 | ||||||

| Commitments and Contingencies | - | - | ||||||

| Equity | ||||||||

| Preferred stock, 2,000,000 shares authorized, no par value, none issued. | - | - | ||||||

| Common stock, 50,000,000 shares authorized, no par value; 10,105,535 and 8,456,032 shares issued as of March 31, 2017 and June 30, 2016; 9,930,038 and 8,280,535 outstanding as of March 31, 2017 and June 30, 2016, respectively | 20,535,379 | 15,500,391 | ||||||

| Additional paid-in capital | 603,352 | 1,140,962 | ||||||

| Treasury stock, at cost, 175,497 shares as of March 31, 2017 and June 30, 2016 | (417,538 | ) | (417,538 | ) | ||||

| Accumulated deficit | (1,685,124 | ) | (4,518,799 | ) | ||||

| Accumulated other comprehensive loss | (503,703 | ) | (280,907 | ) | ||||

| Total Sino-Global Shipping America Ltd. Stockholders' Equity | 18,532,366 | 11,424,109 | ||||||

| Non-controlling Interest | (4,802,645 | ) | (4,807,347 | ) | ||||

| Total Equity | 13,729,721 | 6,616,762 | ||||||

| Total Liabilities and Equity | $ | 17,608,458 | $ | 9,054,144 | ||||

The accompanying notes are an integral part of these unaudited condensed consolidated financial statements

| F-2 |

SINO-GLOBAL SHIPPING AMERICA, LTD. AND AFFILIATES

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS AND COMPREHENSIVE INCOME (LOSS)

(UNAUDITED)

| For the Three Months Ended March 31, | For the Nine Months Ended March 31, | |||||||||||||||

| 2017 | 2016 | 2017 | 2016 | |||||||||||||

| Net revenues - third parties | $ | 1,984,834 | $ | 616,821 | $ | 4,591,381 | $ | 3,553,428 | ||||||||

| Net revenues - related party | 762,777 | 556,948 | 2,229,180 | 1,916,510 | ||||||||||||

| Total revenues | 2,747,611 | 1,173,769 | 6,820,561 | 5,469,938 | ||||||||||||

| Cost of revenues | (1,132,213 | ) | (620,542 | ) | (1,789,348 | ) | (2,568,345 | ) | ||||||||

| Gross profit | 1,615,398 | 553,227 | 5,031,213 | 2,901,593 | ||||||||||||

| General and administrative expenses | (612,441 | ) | (1,190,614 | ) | (2,248,639 | ) | (4,084,858 | ) | ||||||||

| Selling expenses | (41,245 | ) | (23,353 | ) | (153,429 | ) | (67,478 | ) | ||||||||

| Total operating expenses | (653,686 | ) | (1,213,967 | ) | (2,402,068 | ) | (4,152,336 | ) | ||||||||

| Operating income (loss) | 961,712 | (660,740 | ) | 2,629,145 | (1,250,743 | ) | ||||||||||

| Financial income (expense), net | 34,167 | 61,183 | (57,737 | ) | (251,800 | ) | ||||||||||

| Other income, net | - | 10,402 | - | 5,781 | ||||||||||||

| Total other income (expense) | 34,167 | 71,585 | (57,737 | ) | (246,019 | ) | ||||||||||

| Net income (loss) before provision for income taxes | 995,879 | (589,155 | ) | 2,571,408 | (1,496,762 | ) | ||||||||||

| Income tax benefit (expense) | 303,196 | (265,721 | ) | 158,184 | (839,076 | ) | ||||||||||

| Net income (loss) | 1,299,075 | (854,876 | ) | 2,729,592 | (2,335,838 | ) | ||||||||||

| Net income (loss) attributable to non-controlling interest | 4,021 | (116,667 | ) | (104,083 | ) | (282,688 | ) | |||||||||

| Net income (loss) attributable to Sino-Global Shipping America, Ltd. | $ | 1,295,054 | $ | (738,209 | ) | $ | 2,833,675 | $ | (2,053,150 | ) | ||||||

| Comprehensive income (loss) | ||||||||||||||||

| Net income (loss) | $ | 1,299,075 | $ | (854,876 | ) | $ | 2,729,592 | $ | (2,335,838 | ) | ||||||

| Other comprehensive income (loss) - foreign currency translation gain (loss) | 4,871 | (7,740 | ) | (114,011 | ) | (46,058 | ) | |||||||||

| Comprehensive income (loss) | 1,303,946 | (862,616 | ) | 2,615,581 | (2,381,896 | ) | ||||||||||

| Less: Comprehensive income (loss) attributable to non-controlling interest | (19,419 | ) | (141,532 | ) | 4,702 | (142,401 | ) | |||||||||

| Comprehensive income (loss) attributable to Sino-Global Shipping America Ltd. | $ | 1,323,365 | $ | (721,084 | ) | $ | 2,610,879 | $ | (2,239,495 | ) | ||||||

| Earnings (loss) per share | ||||||||||||||||

| -Basic | $ | 0.14 | $ | (0.09 | ) | $ | 0.33 | $ | (0.25 | ) | ||||||

| -Diluted | $ | 0.14 | $ | (0.09 | ) | $ | 0.33 | $ | (0.25 | ) | ||||||

| Weighted average number of common shares used in computation | ||||||||||||||||

| -Basic | 8,994,146 | 8,337,325 | 8,514,080 | 8,364,296 | ||||||||||||

| -Diluted | 9,028,928 | 8,337,325 | 8,534,701 | 8,364,296 | ||||||||||||

The accompanying notes are an integral part of these unaudited condensed consolidated financial statements

| F-3 |

SINO-GLOBAL SHIPPING AMERICA LTD. AND AFFILIATE

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(UNAUDITED)

| For the nine months ended March 31, | ||||||||

| 2017 | 2016 | |||||||

| Operating Activities | ||||||||

| Net income (loss) | $ | 2,729,592 | $ | (2,335,838 | ) | |||

| Adjustment to reconcile net income (loss) to net cash provided by operating activities: | ||||||||

| Amortization of stock-based compensation to consultants | 547,138 | 922,542 | ||||||

| Amortization of stock option expense | 77,320 | - | ||||||

| Depreciation and amortization | 36,432 | 44,017 | ||||||

| Provision for (recovery of) doubtful accounts | (107,608 | ) | 73,746 | |||||

| Provision for doubtful accounts on related party receivable | 174,604 | |||||||

| Deferred tax provision (benefit) | (387,900 | ) | 280,600 | |||||

| Changes in assets and liabilities | ||||||||

| Decrease in accounts receivable | 517,463 | 1,145,529 | ||||||

| Decrease (increase) in other receivables | 184,753 | (124,631 | ) | |||||

| Decrease in advances to suppliers | 816,715 | 44,768 | ||||||

| Decrease in prepaid expenses | 82,210 | 310,824 | ||||||

| Increase in other current assets | (16,931 | ) | (32,453 | ) | ||||

| Increase in other long-term assets | (14,185 | ) | (644 | ) | ||||

(Increase) decrease in due from related parties | (2,843,131 | ) | 1,721,904 | |||||

| Increase (decrease) in advances from customers | 324,476 | (101,825 | ) | |||||

| Increase (decrease) in accounts payable | 312,883 | (379,579 | ) | |||||

| Increase in taxes payable | 201,259 | 743,580 | ||||||

| Increase in due to related parties | 156,841 | - | ||||||

| Increase (decrease) in accrued expenses and other current liabilities | 514,445 | (16,144 | ) | |||||

| Net cash provided by operating activities | 3,131,772 | 2,471,000 | ||||||

| Investing Activities | ||||||||

| Acquisition of property and equipment | (55,474 | ) | (18,662 | ) | ||||

| Cash collected from the termination of vessel acquisition | - | 327,570 | ||||||

| Net cash provided by (used in) investing activities | (55,474 | ) | 308,908 | |||||

| Financing Activities | ||||||||

| Proceeds from issuance of common stock, net | 4,319,988 | 691,600 | ||||||

| Proceeds from exercise of stock options | 82,500 | - | ||||||

| Repurchase of common stock | - | (43,451 | ) | |||||

| Net cash provided by financing activities | 4,402,488 | 648,149 | ||||||

| Effect of exchange rate fluctuations on cash and cash equivalents | (24,591 | ) | (82,272 | ) | ||||

| Net increase in cash and cash equivalents | 7,454,195 | 3,345,785 | ||||||

| Cash and cash equivalents at beginning of period | 1,385,994 | 730,322 | ||||||

| Cash and cash equivalents at end of period | $ | 8,840,189 | $ | 4,076,107 | ||||

| Supplemental information | ||||||||

| Income taxes paid | $ | 89,324 | $ | - | ||||

| Non-cash investing and financing activities: | ||||||||

| Common stock issued for vessel acquisition | $ | - | $ | 2,220,000 | ||||

| Return of common stock issued for vessel acquisition | $ | - | $ | (2,220,000 | ) | |||

| Issuance of common stock to pay for professional services | $ | 632,500 | $ | 255,000 | ||||

The accompanying notes are an integral part of these unaudited condensed consolidated financial statements

| F-4 |

SINO-GLOBAL SHIPPING AMERICA, LTD. AND AFFILIATES

NOTES TO THE UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

Note 1. ORGANIZATION AND NATURE OF BUSINESS

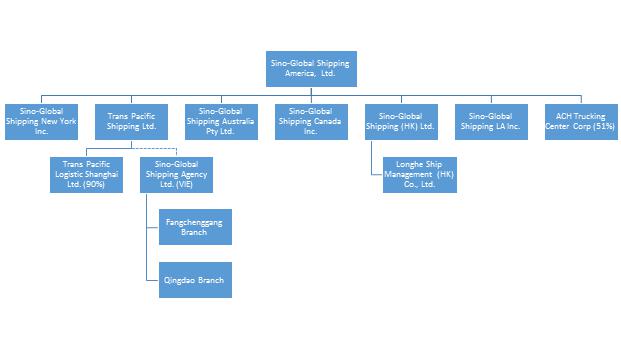

Founded in the United States (the “U.S.”) in 2001, Sino-Global Shipping America, Ltd., a Virginia corporation (“Sino-Global” or the “Company”), is a non-asset based global shipping and freight logistic integrated solution provider. The Company provides tailored solutions and value-added services for its customers to drive effectiveness and control in related links throughout the entire shipping and freight logistics chain. The Company conducts its business primarily through its wholly-owned subsidiaries in the U.S., the People’s Republic of China (the “PRC”) (including Hong Kong), Australia and Canada. Currently, a significant portion of the Company’s business is generated from clients located in the PRC, and its operations are currently primarily conducted in the PRC.

The Company’s Chinese subsidiary, Trans Pacific Shipping Limited, a wholly-owned foreign enterprise (“Trans Pacific Beijing”), is the 90% owner of Trans Pacific Logistics Shanghai Limited (“Trans Pacific Shanghai”). Trans Pacific Beijing and Trans Pacific Shanghai are referred to collectively as “Trans Pacific”.

Prior to fiscal year 2016, the Company’s shipping agency business was operated by its subsidiaries in the PRC (including Hong Kong). The Company’s ship management services were operated by its subsidiary in Hong Kong. The Company’s shipping and chartering services were operated by its subsidiaries in the U.S. and subsidiary in Hong Kong. Currently, the Company’s inland transportation management services are operated by its subsidiaries in the PRC and the U.S. The Company’s freight logistic services are operated by its subsidiaries in the PRC and the U.S. The Company’s container trucking services are currently operated by its subsidiaries in the PRC, and the Company expects to have more businesses involved in the U.S. from third quarter of fiscal year 2017 as the website version of our short haul container truck services platform launched in December 2016.

In January 2016, the Company formed a subsidiary, Sino-Global Shipping LA Inc., a California corporation (“Sino LA”), for the purpose of expanding its business to provide freight logistic services to importers who ship goods into the U.S. The Company expects to generate increased revenue from this new service platform in the coming fiscal year.

In fiscal year 2016, affected by worsening market conditions in the shipping industry, the Company’s shipping agency business segment suffered a significant decrease in revenue due to a reduced number of ships served. As a result, the Company has temporarily suspended its shipping agency services business. Also, as a result of these market condition changes, the Company has temporarily suspended its ship management services business. In addition, in December 2015, the Company temporarily suspended its shipping and chartering services business, primarily as a result of the termination of its previously contemplated vessel acquisition. As of March 31, 2016, the Company’s current service offerings consist of inland transportation management service, freight logistic services and container trucking services.

In August 2016, the Company’s Board of Directors (the “Board”) authorized management to move forward with the development of a mobile application that will provide a full-service logistics platform between the U.S. and the PRC for short-haul trucking in the U.S. The Board’s decision followed an extensive review by the Company's management team and the Board in identifying Sino-Global's key competitive advantages as an expert in global logistics between the U.S. and the PRC, and then leveraging that experience to both address the needs of its customer base and to provide new solutions to contemporary issues affecting the logistics and supply chain. The Company completed a market analysis and feasibility study related to building a mobile based logistics application for short-haul trucking in U.S. ports to better manage the over 25 million containers, or “TEU”, moving between the PRC and the U.S. each year.

| F-5 |

Sino-Global completed development of a full-service logistics platform as of December 2016. Upon the completion of the platform, the Company signed two significant agreements with COSCO Beijing International Freight Co., Ltd. (“COSFRE Beijing”) and Sinotrans Guangxi in December 2016. Pursuant to the agreement with COSFRE Beijing, the Company will receive a percentage of the total amount of each transportation fee for the arrangement of inland transportation services for COSFRE Beijing’s container shipments into U.S. ports. For the strategic cooperation framework agreement with Sinotrans Guangxi, which is a subsidiary of Sinotrans Limited, the Company expects to utilize both parties’ existing resources and establish an integrated logistics plan to provide an end-to-end supply chain solution for customers shipping soybeans and sulfur products from the U.S. to the southern PRC via container.

On January 5, 2017, the Company entered into a joint venture agreement and formed a new joint venture company named ACH Trucking Center Corp. (“ACH Trucking Center”) with Jetta Global Logistics Inc. (“Jetta Global”). Along with the establishment of ACH Trucking Center, the Company began providing short haul trucking transportation and logistics services to customers located in the New York and New Jersey areas. The Company holds a 51% ownership stake in ACH Trucking Center. The financial statements of ACH Trucking Center has been included in the consolidated financial statements of the Company.

On January 9, 2017, the Company entered into a strategic cooperation agreement with China Ocean Shipping Agency Qingdao Co. Ltd. (“COSCO Qingdao”). COSCO Qingdao will utilize the Company’s full-service logistics platform to arrange the transport of its container shipments into U.S. ports. Sino-Global will receive a percentage of the total amount of each transportation fee in exchange for the arrangement of inland transportation services for COSCO Qingdao’s container shipments into U.S. ports.

On February 18, 2017, the Company entered into a cooperative transportation agreement with Zhiyuan International Investment & Holding Group (Hong Kong) Co., Ltd. (the “Buyer” or “Zhiyuan Hong Kong”). Zhiyuan Hong Kong in joint entity with China Minmetals Corporation and China Metallurgical Group Corporation acts as the general designer, general equipment provider and general service contractor in the upgrade and renovation project of Perwaja Steel Indonesia which is located in Malaysia (the “Project”). The Company is contracted to provide high-quality services including detailed transportation plan design, plan execution and necessary supervision of the execution at Zhiyuan Hong Kong’s demand, and the Company will receive from the Buyer 1% - 1.25% of the total transportation expense incurred in the Project as commission for its professional design and execution of transportation plan as a general agent (see Note 16).

Note 2. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

(a) Basis of Presentation

The accompanying unaudited condensed consolidated financial statements have been prepared in accordance with accounting principles generally accepted in the U.S. (“US GAAP”) for interim financial information pursuant to the rules and regulations of the U.S. Securities and Exchange Commission (“SEC”). All significant intercompany transactions and balances have been eliminated in consolidation. In the opinion of management, all adjustments considered necessary to give a fair presentation have been included. Interim results are not necessarily indicative of full-year results. The information in this Form 10-Q should be read in conjunction with information included in the Company’s annual report on Form 10-K for the fiscal year ended June 30, 2016 filed with the SEC on September 19, 2016.

(b) Basis of Consolidation

The unaudited condensed consolidated financial statements include the accounts of the Company, its subsidiaries, and its affiliates. All significant intercompany transactions and balances are eliminated in consolidation. Sino-Global Shipping Agency Ltd., a PRC corporation (“Sino-China”), is considered a variable interest entity (“VIE”), with the Company as the primary beneficiary. The Company, through Trans Pacific Beijing, entered into certain agreements with Sino-China, pursuant to which the Company receives 90% of Sino-China’s net income. The Company does not receive any payments from Sino-China unless Sino-China recognizes net income during its fiscal year. These agreements do not entitle the Company to any consideration if Sino-China incurs a net loss during its fiscal year. If Sino-China incurs a net loss during its fiscal year, the Company is not required to absorb such net loss.

| F-6 |

As a VIE, Sino-China’s revenues are included in the Company’s total revenues, and any loss from operations is consolidated with that of the Company. Because of contractual arrangements between the Company and Sino-China, the Company has a pecuniary interest in Sino-China that requires consolidation of the financial statements of the Company and Sino-China.

The Company has consolidated Sino-China’s operating results because the entities are under common control in accordance with ASC 805-10, “Business Combinations”. The agency relationship between the Company and Sino-China and its branches is governed by a series of contractual arrangements pursuant to which the Company has substantial control over Sino-China. Management makes ongoing reassessments of whether the Company remains the primary beneficiary of Sino-China. As mentioned elsewhere in this report, due to the worsening market conditions in the shipping industry, Sino-China’s shipping agency business suffered a significant decrease in revenue due to a reduced number of ships served. As a result, the Company has temporarily suspended this business.

The carrying amount and classification of Sino-China's assets and liabilities included in the Company’s unaudited condensed consolidated balance sheets were as follows:

| March 31, | June 30, | |||||||

| 2017 | 2016 | |||||||

| Total current assets | $ | 7,683,369 | $ | 31,128 | ||||

| Total assets | 7,822,687 | 129,463 | ||||||

| Total current liabilities | 3,256 | 7,222 | ||||||

| Total liabilities | 3,256 | 7,222 | ||||||

(c) Use of Estimates and Assumptions

The preparation of the Company’s unaudited condensed consolidated financial statements in conformity with US GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the dates of the financial statements and the reported amounts of revenues and expenses during the reporting periods. Estimates are adjusted to reflect actual experience when necessary. Significant accounting estimates reflected in the Company’s unaudited condensed consolidated financial statements include revenue recognition, fair value of stock based compensation, cost of revenues, allowance for doubtful accounts, deferred income taxes, and the useful lives of property and equipment. Since the use of estimates is an integral component of the financial reporting process, actual results could differ from those estimates.

(d) Revenue Recognition Policy

| ● | Revenues from shipping agency services are recognized upon completion of services, which coincides with the date of departure of the relevant vessel from port. Advance payments and deposits received from customers prior to the provision of services and recognition of the related revenues are presented as advances from customers. |

| ● | Revenues from shipping and chartering services are recognized upon performance of services as stipulated in the underlying contracts. |

| ● | Revenues from inland transportation management services are recognized when commodities are being released from the customers’ warehouse. |

| ● | Revenues from ship management services are recognized when the related contractual services are rendered. |

| ● | Revenues from freight logistic services are recognized when the related contractual services are rendered. |

| ● | Revenues from container trucking services are recognized when the related contractual services are rendered. |

| F-7 |

(e) Translation of Foreign Currency

The accounts of the Company and its subsidiaries, including Sino-China and each of its branches are measured using the currency of the primary economic environment in which the entity operates (the “functional currency”). The Company’s functional currency is the U.S. dollar (“USD”) while its subsidiaries in the PRC, including Sino-China, report their financial positions and results of operations in Renminbi (“RMB”). The accompanying unaudited condensed consolidated financial statements are presented in USD. Foreign currency transactions are translated into USD using the fixed exchange rates in effect at the time of the transaction. Generally, foreign exchange gains and losses resulting from the settlement of such transactions are recognized in the unaudited condensed consolidated statements of operations. The Company translates the foreign currency financial statements of Sino-China, Sino-Global Shipping Australia, Sino-Global Shipping Hong Kong, Sino-Global Shipping Canada, Trans Pacific Beijing and Trans Pacific Shanghai in accordance with ASC 830-10, “Foreign Currency Matters”. Assets and liabilities are translated at current exchange rates quoted by the People’s Bank of China at the balance sheet dates and revenues and expenses are translated at average exchange rates in effect during the year. The resulting translation adjustments are recorded as other comprehensive income (loss) and accumulated other comprehensive loss as a separate component of equity of the Company, and also included in non-controlling interests.

The exchange rates as of March 31, 2017 and June 30, 2016 and for the three and nine months ended March 31, 2017 and 2016 are as follows:

| March 31, | June 30, | Three months ended March 31, | Nine months ended March 31, | |||||||||||||||||||||

| 2017 | 2016 | 2017 | 2016 | 2017 | 2016 | |||||||||||||||||||

| Foreign currency | Balance Sheet | Balance Sheet | Profits/Loss | Profits/Loss | Profits/Loss | Profits/Loss | ||||||||||||||||||

| RMB:1USD | 6.8887 | 6.6487 | 6.8885 | 6.5404 | 6.7960 | 6.4114 | ||||||||||||||||||

| AUD:1USD | 1.3093 | 1.3433 | 1.3196 | 1.3861 | 1.3249 | 1.3848 | ||||||||||||||||||

| HKD:1USD | 7.7713 | 7.7595 | 7.7604 | 7.7744 | 7.7582 | 7.7589 | ||||||||||||||||||

| CAD:1USD | 1.3320 | 1.2992 | 1.3233 | 1.3730 | 1.3210 | 1.3391 | ||||||||||||||||||

(f) Cash and Cash Equivalents

Cash and cash equivalents consist of cash on hand and other highly liquid investments which are unrestricted as to withdrawal or use, and which have an original maturity of three months or less when purchased. The Company maintains cash and cash equivalents with various financial institutions mainly in the PRC, Australia, Hong Kong, Canada and the U.S. As of March 31, 2017 and June 30, 2016, cash balances of $4,976,980 and $1,333,713, respectively, were maintained at financial institutions in the PRC, and are not insured by the Federal Deposit Insurance Corporation or other programs.

(g) Accounts Receivable

Accounts receivable are presented at net realizable value. The Company maintains allowances for doubtful accounts and for estimated losses. The Company reviews the accounts receivable on a periodic basis and makes general and specific allowances when there is doubt as to the collectability of individual receivable balances. In evaluating the collectability of individual receivable balances, the Company considers many factors, including the age of the balances, customers’ historical payment history, their current credit-worthiness and current economic trends. Receivables are considered past due after 365 days. Accounts Receivable is written off against the allowances only after exhaustive collection efforts.

(h) Earnings (loss) per Share

Basic earnings (loss) per share is computed by dividing net income (loss) attributable to holders of common shares of the Company by the weighted average number of common shares of the Company outstanding during the applicable period. Diluted earnings per share reflect the potential dilution that could occur if securities or other contracts to issue common shares of the Company were exercised or converted into common shares of the Company. Common share equivalents are excluded from the computation of diluted earnings per share if their effects would be anti-dilutive.

| F-8 |

For the three and nine months ended March 31, 2017, the basic average shares outstanding and diluted average shares of the Company outstanding were not the same because the effect of potential shares of common stock of the Company was dilutive since the exercise prices for options were lower than the average market price for the related periods. As a result, for the three and nine months ended March 31, 2017, a total of 34,782 and 20,621 unexercised options were dilutive, respectively, and were included in the computation of diluted EPS. For the three and nine months ended March 31, 2016, no unexercised warrants and options were dilutive.

(i) Stock-based Compensation

Valuations are based upon highly subjective assumptions about the future, including stock price volatility and exercise patterns. The fair value of share-based payment awards was estimated using the Black-Scholes option pricing model. Expected volatilities are based on the historical volatility of the Company’s stock. The Company uses historical data to estimate option exercise and employee terminations. The expected term of options granted represents the period of time that options granted are expected to be outstanding. The risk-free rate for periods within the expected life of the option is based on the U.S. Treasury yield curve in effect at the time of the grant.

(j) Risks and Uncertainties

The Company’s business, financial position and results of operations may be influenced by the political, economic, and legal environments in the PRC, as well as by the general state of the PRC economy. The Company’s operations in the PRC are subject to special considerations and significant risks not typically associated with companies in North America and Western Europe. These include risks associated with, among others, the political, economic and legal environment and foreign currency exchange. The Company’s results may be adversely affected by changes in the political, regulatory and social conditions in the PRC, and by changes in governmental policies or interpretations with respect to laws and regulations, anti-inflationary measures, currency conversion, remittances abroad, and rates and methods of taxation, among other things. Moreover, the Company’s ability to grow its business and maintain its profitability could be negatively affected by the nature and extent of services provided to its major customers, Tianjin Zhiyuan Investment Group Co., Ltd. (the “Zhiyuan Investment Group”) and Tengda Northwest Ferroalloy Co., Ltd. (“Tengda Northwest”).

(k) Reclassifications

Certain prior year amounts have been reclassified to conform to the current period presentation. These reclassifications have no effect on the results of operations and cash flows.

(l) Recent Accounting Pronouncements

In December 2016, the Financial Accounting Standards Board (FASB) issued Accounting Standard Update (ASU) No. 2016-20, "Technical Corrections and Improvements to Topic 606," which includes thirteen technical corrections or improvements that affect only narrow aspects of the guidance in ASU No. 2014-09. ASU No. 2014-09 and all of the related ASUs have the same effective date. On July 9, 2015, the FASB deferred the effective date of ASU No. 2014-09 for annual reporting periods beginning after December 15, 2017, including interim periods within that reporting period. Early adoption is permitted as of the original effective date, which is annual reporting periods beginning after December 15, 2016 and interim periods within those annual periods. The new standard is to be applied retrospectively and permits the use of either the retrospective or cumulative effect transition method. The Company is currently evaluating the effect that the adoption of this update will have on its unaudited condensed consolidated financial statements.

In January 2017, the FASB issued ASU No. 2017-01, "Business Combinations (Topic 805): Clarifying the Definition of a Business". The amendments in this ASU clarify the definition of a business with the objective of adding guidance to assist entities with evaluating whether transactions should be accounted for as acquisitions (or disposals) of assets or businesses. Basically, these amendments provide a screen to determine when a set is not a business. If the screen is not met, the amendments in this ASU first require that to be considered a business, a set must include, at a minimum, an input and a substantive process that together significantly contribute to the ability to create output, and second, they require removal of the evaluation of whether a market participant could replace missing elements. These amendments take effect for public businesses for fiscal years beginning after December 15, 2017 and interim periods within those periods, and all other entities should apply these amendments for fiscal years beginning after December 15, 2018, and interim periods within annual periods beginning after December 15, 2019. The Company does not expect that the adoption of this guidance will have a material impact on its unaudited condensed consolidated financial statements.

In May 2017, the FASB issued ASU 2017-09, Scope of Modification Accounting, which amends the scope of modification accounting for share-based payment arrangements, provides guidance on the types of changes to the terms or conditions of share-based payment awards to which an entity would be required to apply modification accounting under ASC 718. For all entities, the ASU is effective for annual reporting periods, including interim periods within those annual reporting periods, beginning after December 15, 2017. Early adoption is permitted, including adoption in any interim period. The Company does not expect that the adoption of this guidance will have a material impact on its unaudited condensed consolidated financial statements

| F-9 |

Note 3. ADVANCES TO SUPPLIERS

The Company’s advances to suppliers are as follows:

| March 31, | June 30, | |||||||

| 2017 | 2016 | |||||||

| Freight fees | $ | 1,316,562 | $ | 2,192,910 | ||||

| Others | 8,710 | - | ||||||

| Total | $ | 1,325,272 | $ | 2,192,910 | ||||

On June 10, 2016, the Company entered into a Memorandum of Understanding (the “MOU”) with Singapore Metals & Minerals Pte Ltd. (the “Buyer”) and Galasi Jernsih Sdn BHD (the “Seller”), whereby the Buyer will purchase 3,000,000 metric tons of bauxite per year from Seller, subject to the results of certain tests in order to satisfy the Buyer’s requirements. Both the Buyer and the Seller agree that the Company shall be appointed as general agent to handle logistics and transportation including ocean shipping and inland transportation for both sides, and all door-to-door transportation services for the shipping of the bauxite to be sold by the Seller and to be purchased by the Buyer as referenced in the MOU. On the same day, the Company signed a supplementary agreement with the Buyer, stating that the Company shall assist the Buyer in handling transportation services from the source mine to dock to help the Buyer to fulfill the delivery favorably and close the deal smoothly; in connection with this supplementary agreement, the Company agreed to make advance payments for freight charges on behalf of the Buyer, while the Buyer agrees to repay the advances to the Company according to the progress of the cooperation. On April 15, 2017, the Company signed a Supplemental Receipt Agreement with Singapore Metals & Minerals Pte Ltd. Pursuant to the agreement, both parties agreed to terminate the MOU, and Singapore Metals & Minerals Pte Ltd will return approximately $3.77 million (RMB 26 million) to the Company. This includes approximately $3.49 million (RMB 24.09 million) advanced freight expenses paid by the Company, and the remaining $0.28 million (RMB 1.91 million) will be recognized as net service revenue for the Company in the fourth quarter of 2017.

Note 4. ACCOUNTS RECEIVABLE, NET

The Company’s net accounts receivable are as follows:

| March 31, | June 30, | |||||||

| 2017 | 2016 | |||||||

| Trade accounts receivable | $ | 1,980,230 | $ | 2,540,052 | ||||

| Less: allowances for doubtful accounts | (97,111 | ) | (207,028 | ) | ||||

| Accounts receivables, net | $ | 1,883,119 | $ | 2,333,024 | ||||

For the three months ended March 31, 2017, the Company provided provisions for doubtful accounts receivable of $736. For the three months ended March 31, 2016, recovery of doubtful accounts receivable was $548,965.

For the nine months ended March 31, 2017, recovery of doubtful accounts receivable was $107,608. For the nine months ended March 31, 2016, the Company provided provisions for doubtful accounts receivable of $248,350, which amount was included in general and administrative expenses.

| F-10 |

Note 5. OTHER RECEIVABLES

The Company’s other receivables represent mainly prepaid employee insurance and welfare benefits, which will be subsequently deducted from the employee payroll, guarantee deposits on behalf of ship owners as well as office lease deposits.

Note 6. PREPAID EXPENSES AND OTHER CURRENT ASSETS

The Company’s prepaid expenses and other current assets are as follows:

| March 31, | June 30, | |||||||

| 2017 | 2016 | |||||||

| Consultant fees (1) | $ | 247,687 | $ | 845,420 | ||||

| Advance to employees | 74,731 | 105,137 | ||||||

| Other | 82,723 | 55,056 | ||||||

| Total | 405,141 | 1,005,613 | ||||||

| Less current portion | 355,442 | 826,631 | ||||||

| Total noncurrent portion | $ | 49,699 | $ | 178,982 | ||||

(1) The Company entered into a management consulting services agreement with a consulting company on November 12, 2015, pursuant to which the consulting company shall assist the Company with its regulatory filings during the period from July 1, 2016 to June 30, 2018. In return for its services, as approved by the Board, a total of RMB 2,100,000 ($316,298) was paid to the consulting company.

The above-mentioned consulting fees have been and will be ratably charged to expense over the terms of the above-mentioned agreements.

Note 7. PROPERTY AND EQUIPMENT, NET

The Company’s net property and equipment are as follows:

| March 31, | June 30, | |||||||

| 2017 | 2016 | |||||||

| Land and buildings | $ | 195,397 | $ | 202,450 | ||||

| Motor vehicles | 533,579 | 497,006 | ||||||

| Computer equipment | 153,734 | 156,890 | ||||||

| Office equipment | 64,234 | 59,899 | ||||||

| Furniture and fixtures | 162,047 | 164,701 | ||||||

| System software | 115,969 | 119,964 | ||||||

| Leasehold improvements | 61,871 | 64,105 | ||||||

| Total | 1,286,831 | 1,265,015 | ||||||

| Less: Accumulated depreciation and amortization | 1,089,986 | 1,088,648 | ||||||

| Property and equipment, net | $ | 196,845 | $ | 176,367 | ||||

| F-11 |

Depreciation and amortization expenses for the three months ended March 31, 2017 and 2016 were $11,025 and $14,941, respectively. Depreciation and amortization expenses for the nine months ended March 31, 2017 and 2016 were $36,432 and $44,017, respectively.

Note 8. ACCRUED EXPENSES AND OTHER CURRENT LIABILITIES

The Company’s accrued expenses and other current liabilities represent mainly payroll and welfare payable, accrued expenses and other miscellaneous items.

Note 9. SHARE-BASED COMPENSATION

The issuance of the Company’s options is exempted from registration under of the Securities Act of 1933, as amended (the “Act”). The Common Stock underlying the Company’s options granted may be sold in compliance with Rule 144 under the Act. Each option may be exercised to purchase one share of the common stock of the Company, no par value per share (the “Common Stock”). Payment for the options may be made in cash or by exchanging shares of Common Stock at their fair market value. The fair market value will be equal to the average of the highest and lowest registered sales prices of Company Stock on the date of exercise.

Pursuant to the Company’s 2014 Stock Incentive Plan, effective on July 26, 2016, the Company granted 150,000 options to purchase an aggregate of 150,000 shares of Common Stock to two employees with a one-year vesting period, one half of which vested on October 26, 2016, and the other half will vest on July 26, 2017. The exercise price of the 150,000 options is $1.10, which was equal to the share price of the Company’s Common Stock on July 26, 2016. The grant date fair value of such options was $0.77 per share. The fair value of the 150,000 options was calculated using the Black-Scholes options pricing model with the following assumptions: volatility of 99.68%, risk free interest rate of 1.15%, and expected life of 5 years. The total fair value of the options was $115,979. In accordance with the vesting periods, $28,995 and $77,320 were recorded as general and administrative expenses related to these options for the three months and nine months ended March 31, 2017, respectively. In February 2017, 75,000 of these options were exercised by the two employees of the Company.

Pursuant to the Company’s 2014 Stock Incentive Plan, the Company granted 800,000 options on December 14, 2016, to purchase an aggregate of 800,000 shares of Common Stock to seven employees, with a vesting period from one to three years. The grant date fair value of such options was $2.24 per option. The fair value of the 800,000 options was calculated using the Black-Scholes options pricing model with the following assumptions: volatility of 112.70%, risk free interest rate of 2.02%, and expected life of 5 years. The total fair value of the options was $1,788,985. With the seven employees’ consent, the Company cancelled the 800,000 options, effective February 16, 2017 and $nil was recorded as part of general and administrative expenses related to these options for the three months and nine months ended March 31, 2017.

A summary of the options is presented in the table below:

| Shares | Weighted Average Exercise Price | |||||||

| Options outstanding, as of June 30, 2016 | 66,000 | $ | 6.88 | |||||

| Granted | 950,000 | 2.78 | ||||||

| Exercised | (75,000 | ) | 1.1 | |||||

| Cancelled, forfeited or expired | (800,000 | ) | 3.1 | |||||

| Options outstanding, as of March 31, 2017 | 141,000 | $ | 3.81 | |||||

| Options exercisable, as of March 31, 2017 | 64,000 | $ | 7.03 | |||||

| F-12 |

The following is a summary of the status of options outstanding and exercisable at March 31, 2017:

| Outstanding Options | Exercisable Options | |||||||||||||||||||

| Exercise Price | Number | Average Remaining Contractual Life | Average Exercise Price | Number | Average Remaining Contractual Life | |||||||||||||||

| $ | 7.75 | 56,000 | 1.13 years | $ | 7.75 | 56,000 | 1.13 years | |||||||||||||

| $ | 2.01 | 10,000 | 5.84 years | $ | 2.01 | 8,000 | 5.84 years | |||||||||||||

| $ | 1.10 | 75,000 | 4.32 years | $ | - | - | - | |||||||||||||

| 141,000 | 64,000 | |||||||||||||||||||

The following is a summary of the status of warrants outstanding and exercisable at March 31, 2017:

| Warrants Outstanding | Warrants Exercisable | Weighted Average Exercise Price | Average Remaining Contractual Life | |||||||||

| 139,032 | 139,032 | $ | 9.30 | 1.13 years | ||||||||

Note 10. EQUITY TRANSACTIONS

On June 6, 2014, the Company entered into management consulting and advisory services agreements with two consultants, pursuant to which the consultants should assist the Company in, among other things, financial and tax due diligence, business evaluation and integration, development of pro forma financial statements. In return for their services, as approved by the Company’s Board of Directors, a total of 600,000 shares of the Company’s common stock were to be issued to these two consultants. During June 2014, a total of 200,000 shares of the Company’s common stock were issued to the consultants as a prepayment for their services. The value of their consulting services was determined using the fair value of the Company’s common stock of $2.34 per share when the shares were issued to the consultants. Their service agreements are for the period July 1, 2014 to December 31, 2016. The remaining 400,000 shares of the Company's common stock were then issued to the consultants on September 30, 2014 at $1.68 per share, and the service terms are from September 2014 to November 2016. The related consulting fees have been ratably charged to expense over the term of the agreements.

On May 5, 2015, the Company entered into management consulting and advisory services agreements with three consultants, pursuant to which the consultants should assist the Company in, among other things, review of time charter agreements; crew management advisory; development of permanent and preventive maintenance standards related to dry dockings and ship repairs; development of regular technical and marine vessel inspections and quality control procedures; and development and implementation of alternative remedial actions to address any technical problems that may arise. In return for their services, as approved by the Company’s Board of Directors, a total of 500,000 shares of the Company’s common stock were to be issued to these three consultants at $1.50 per share. Their service agreements are for a period of 18 months, effective May 2015. The related consulting fees have been ratably charged to expense over the term of the agreements.

On December 9, 2015, the Company entered into a consulting and advisory services agreement with a consultant, pursuant to which the consultant should assist the Company for corporate restructuring, business evaluation and capitalization during the period from May 2016 to November 2016. In return for such services, the Company issued 250,000 shares of the Company’s common stock to this consultant at $0.72 per share on May 23, 2016.

In March 2017, the Company entered into a consulting and advisory services agreement with Jianwei Li, who will provide management consulting services that include: marketing program designing and implementation; and cooperative partner select and management. The service period is from March 2017 to February 2020. The Company issued 250,000 shares of common stock as the remuneration of the service, which were issued as restricted shares at $2.53 per share on March 22, 2017 to the consultant.

| F-13 |

$17,569 and $373,625 were charged to expenses during the three months ended March 31, 2017 and 2016. $547,138 and $922,542 were charge to expenses during the nine months ended March 31, 2017 and 2016.

On February 21, 2017, the Company completed a sale of 1.5 million registered shares of its common stock, no par value, at a purchase price of $3.18 per share, to three institutional investors, for aggregate gross proceeds to the Company of $4.77 million. The Company’s net proceeds from the offering, after deducting estimated offering expenses and placement agent fees in the amount of $0.45 million, were approximately $4.32 million. Sino-Global will use the net proceeds of the offering for working capital and general corporate purposes.

Note 11. NON-CONTROLLING INTEREST

The Company’s non-controlling interest consists of the following:

| March 31, | June 30, | |||||||

| 2017 | 2016 | |||||||

| Sino-China | ||||||||

| Original paid-in capital | $ | 356,400 | $ | 356,400 | ||||

| Additional paid-in capital | 1,044 | 1,044 | ||||||

| Accumulated other comprehensive income | 266,805 | 157,019 | ||||||

| Accumulated deficit | (5,483,672 | ) | (5,349,210 | ) | ||||

| (4,859,423 | ) | (4,834,747 | ) | |||||

| Trans Pacific Logistics Shanghai Ltd. | 29,744 | 27,400 | ||||||

| ACH Trucking Center Corp. | 27,034 | - | ||||||

| Total | $ | (4,802,645 | ) | $ | (4,807,347 | ) | ||

Note 12. COMMITMENTS AND CONTINGENCIES

Lease Obligations

The Company leases certain office premises and apartments for employees under operating lease agreements with terms through April 16, 2020. Future minimum lease payments under the operating lease agreements are as follows:

| Amount | ||||

| Twelve months ending March 31, | ||||

| 2018 | $ | 163,041 | ||

| 2019 | 110,348 | |||

| 2020 | 72,849 | |||

2021 | 3,819 | |||

| $ | 350,057 | |||

Rent expense for the three months ended March 31, 2017 and 2016 was $66,642 and $62,699, respectively. Rent expense for the nine months ended March 31, 2017 and 2016 was $194,532 and $170,890, respectively.

| F-14 |

Legal Proceedings

During the quarter ended December 31, 2015, a former vice president of the Company (the “Former Officer”) filed a complaint with the U.S. Department of Labor-Occupational Safety and Health Administration (“OSHA”) against the Company and three current or former executives. The Former Officer sought $350,000 in damages plus attorney’s fees for alleged retaliation and a purported breach of his employment agreement. The Company responded to the complaint filed with OSHA and provided arguments and information supporting the Company’s position that no violation of law in connection with the Former Officer’s employment occurred. The complaint was settled on January 24, 2017, and the Company is required to pay a total of $185,000, of which $60,000 was paid on February 6, 2017 to the Former Officer. The settlement payment of $185,000 included the Former Officer’s salary, unemployment compensation and legal expenses incurred in connection with the complaint, which has been fully recorded and included in general and administrative expenses. The balance of $125,000 was paid to the Former Officer on April 26, 2017.

Contingencies

The Labor Contract Law of the PRC requires employers to insure the liability of the severance payments for terminated employees that have worked for the employers for at least two years prior to January 1, 2008. The employers will be liable for one month for severance pay for each year of the service provided by the employees. As of March 31, 2017 and June 30, 2016, the Company has estimated its severance payments of approximately $51,900 and $62,500, respectively, which have not been reflected in its unaudited condensed consolidated financial statements, because management cannot predict what the actual payment, if any, will be in the future.

Note 13. INCOME TAXES

The Company’s income tax benefit (expense) for the three months and nine months ended March 31, 2017 and 2016 are as follows:

| For the three months

ended March 31, | For the nine months ended March 31, | |||||||||||||||

| 2017 | 2016 | 2017 | 2016 | |||||||||||||

| Current | ||||||||||||||||

| Hong Kong | (36,966 | ) | - | (71,067 | ) | - | ||||||||||

| PRC | (47,738 | ) | (265,721 | ) | (158,649 | ) | (558,476 | ) | ||||||||

| (84,704 | ) | (265,721 | ) | (229,716 | ) | (558,476 | ) | |||||||||

| Deferred | ||||||||||||||||

| U.S. | 387,900 | - | 387,900 | (280,600 | ) | |||||||||||

| 387,900 | - | 387,900 | (280,600 | ) | ||||||||||||

| Total income tax benefit (expense) | $ | 303,196 | $ | (265,721 | ) | $ | 158,184 | $ | (839,076 | ) | ||||||

The Company’s deferred tax assets are comprised of the following:

| March 31, | June 30, | |||||||

| 2017 | 2016 | |||||||

| Allowance for doubtful accounts | $ | 84,000 | $ | 112,000 | ||||

| Stock-based compensation | 774,000 | 735,000 | ||||||

| Net operating loss | 3,040,000 | 3,752,000 | ||||||

| Total deferred tax assets | 3,898,000 | 4,599,000 | ||||||

| Valuation allowance | (3,510,100 | ) | (4,599,000 | ) | ||||

| Deferred tax assets, net - long-term | $ | 387,900 | $ | - | ||||

The Company’s operations in the U.S. have incurred a cumulative net operating loss of approximately $6,787,000 and $8,378,000, respectively, as of March 31, 2017 and June 30, 2016, which may reduce future taxable income. During the three months ended March 31, 2017, the amount of utilization of Federal Net Operating Losses (“NOL”) was $650,000 and the tax benefit derived from such NOL was $292,000; in the corresponding period for the three months ended March 31, 2016, the utilization of NOL was nil and no tax was benefit derived from NOL. During the nine months ended March 31, 2017, the amount of utilization of NOL was $1,591,000 and the tax benefit derived from such NOL was $712,000; in the corresponding period for the nine months ended March 31, 2016, the utilization of NOL was nil and no tax benefit was derived from NOL. This carry-forward will expire if not utilized by 2036.

| F-15 |

The Company periodically evaluates the likelihood of the realization of deferred tax assets, and reduces the carrying amount of the deferred tax assets by a valuation allowance to the extent it believes a portion will not be realized. The Company considers many factors when assessing the likelihood of future realization of the deferred tax assets, including its recent cumulative earnings experience, expectation of future income, the carry forward periods available for tax reporting purposes, and other relevant factors. Part of the Company’s traditional business, such as shipping agency services and shipping and chartering services, is temporarily suspended. Management has determined a 90% valuation allowance against the deferred tax assets balance as of March 31, 2017 based on the estimates of profitability of the Company’s U.S. entities in the coming year. The net decrease in the valuation allowance for the three months ended March 31, 2017 was $684,900 and the net increase in the valuation allowance for the same period of 2016 was $699,000. The net decrease in the valuation allowance for the nine months ended March 31, 2017 was $1,088,900 and the net increase in valuation allowance for the same period in 2016 was $1,851,600.

The Company’s taxes payable consist of the following:

| March 31, | June 30, | |||||||

| 2017 | 2016 | |||||||

| VAT tax payable | $ | 491,791 | $ | 475,066 | ||||

| Corporate income tax payable | 1,227,783 | 1,100,380 | ||||||

| Others | 72,525 | 61,751 | ||||||

| Total | $ | 1,792,099 | $ | 1,637,197 | ||||

Note 14. CONCENTRATIONS

Major Customers

For the three months ended March 31, 2017, three customers accounted for 28%, 28% and 27% of the Company’s revenues, respectively. At March 31, 2017, one of these three customers accounted for 27% of the Company’s accounts due from related parties (See Note 16) and the remaining two customers accounted for approximately 75% of the Company’s accounts receivable.

For the three months ended March 31, 2016, two customers accounted for 47% and 33% of the Company’s revenues, respectively. At March 31, 2016, one of these two customers accounted for approximately 100% of the Company’s accounts due from related party balance and the remaining one customer accounted for 78% of the Company’s accounts receivable.

For the nine months ended March 31, 2017, three customers accounted for 33%, 33% and 16% of the Company’s revenues, respectively. At March 31, 2017, one of these three customers accounted for 27% of the Company’s accounts due from related parties (See Note 16) and the remaining two customers accounted for approximately 75% of the Company’s accounts receivable.

For the nine months ended March 31, 2016, two customers accounted for 35% and 24% of the Company’s revenues, respectively. At March 31, 2016, one of these two customers accounted for approximately 100% of the Company’s accounts due from related party balance and the remaining customer accounted for 78% of the Company’s accounts receivable.

| F-16 |

Major Suppliers

For the three months ended March 31, 2017, two suppliers accounted for 65% and 13% of the total costs of revenue. For the three months ended March 31, 2016, no suppliers accounted for 10% or more of the total costs of revenue.

For the nine months ended March 31, 2017, one supplier accounted for 51% of the total costs of revenue, respectively. For the nine months ended March 31, 2016, two suppliers accounted for 31% and 14% of the total costs of revenue, respectively.

Note 15. SEGMENT REPORTING

ASC 280, “Segment Reporting”, establishes standards for reporting information about operating segments on a basis consistent with the Company's internal organizational structure as well as information about geographical areas, business segments and major customers in financial statements for detailing the Company's business segments.

The Company's chief operating decision maker is the Chief Executive Officer, who reviews the financial information of the separate operating segments when making decisions about allocating resources and assessing the performance of the group. The Company has determined that it has five operating segments: (1) shipping agency and ship management services; (2) shipping and chartering services; (3) inland transportation management services; (4) freight logistics services; and (5) container trucking services. However, due to the downturn in the shipping industry, the Company has decided to temporarily suspend to its shipping agency and ship management services and shipping and chartering services.

The following tables present summary information by segment for the three and nine months ended March 31, 2017 and 2016, respectively:

| For the three months Ended March 31, 2017 | ||||||||||||||||||||||||

| Shipping Agency & Ship Management Services | Shipping & Chartering Services | Inland Transportation Management Services | Freight Logistic Services | Container Trucking Services | Total | |||||||||||||||||||

| Revenues | ||||||||||||||||||||||||

| - Related party | $ | - | $ | - | $ | 762,777 | $ | - | $ | - | $ | 762,777 | ||||||||||||

| - Third parties | $ | - | $ | - | $ | 771,063 | $ | 827,908 | $ | 385,863 | $ | 1,984,834 | ||||||||||||

| Cost of revenues | $ | - | $ | - | $ | 79,983 | $ | 699,578 | $ | 352,652 | $ | 1,132,213 | ||||||||||||

| Gross profit | $ | - | $ | - | $ | 1,453,857 | $ | 128,330 | $ | 33,211 | $ | 1,615,398 | ||||||||||||

| Depreciation and amortization | $ | - | $ | - | $ | 5,655 | $ | 5,370 | $ | - | $ | 11,025 | ||||||||||||

| Total capital expenditures | $ | - | $ | - | $ | 55,474 | $ | - | $ | - | $ | 55,474 | ||||||||||||

| For the three months Ended March 31, 2016 | ||||||||||||||||

| Shipping Agency & Ship Management Services | Shipping & Chartering Services | Inland Transportation Management Services | Total | |||||||||||||

| Revenues | ||||||||||||||||

| - Related party | $ | - | $ | - | $ | 556,948 | $ | 556,948 | ||||||||

| - Third parties | $ | 232,901 | $ | - | $ | 383,920 | $ | 616,821 | ||||||||

| Cost of revenues | $ | 184,388 | $ | - | $ | 436,154 | $ | 620,542 | ||||||||

| Gross profit | $ | 48,513 | $ | - | $ | 504,714 | $ | 553,227 | ||||||||

| Depreciation and amortization | $ | 8,622 | $ | 1,093 | $ | 5,226 | $ | 14,941 | ||||||||

| Total capital expenditures | $ | - | $ | 15,360 | $ | - | $ | 15,360 | ||||||||

| F-17 |

| For the nine months ended March 31, 2017 | ||||||||||||||||||||||||

| Shipping Agency & Ship Management Services | Shipping & Chartering Services | Inland Transportation Management Services | Freight Logistic Services | Container Trucking Services | Total | |||||||||||||||||||

| Revenues | ||||||||||||||||||||||||

| - Related party | $ | - | $ | - | $ | 2,229,180 | $ | - | $ | - | $ | 2,229,180 | ||||||||||||

| - Third parties | $ | - | $ | - | $ | 2,241,998 | $ | 1,803,641 | $ | 545,742 | $ | 4,591,381 | ||||||||||||

| Cost of revenues | $ | - | $ | - | $ | 271,784 | $ | 1,068,951 | $ | 448,613 | $ | 1,789,348 | ||||||||||||

| Gross profit | $ | - | $ | - | $ | 4,199,394 | $ | 734,690 | $ | 97,129 | $ | 5,031,213 | ||||||||||||

| Depreciation and amortization | $ | - | $ | - | $ | 20,322 | $ | 16,110 | $ | - | $ | 36,432 | ||||||||||||

| Total capital expenditures | $ | - | $ | - | $ | 55,474 | $ | - | $ | - | $ | 55,474 | ||||||||||||

| For the nine months ended March 31, 2016 | ||||||||||||||||

| Shipping Agency & Ship Management Services | Shipping & Chartering Services | Inland Transportation Management Services | Total | |||||||||||||

| Revenues | ||||||||||||||||

| - Related party | $ | - | $ | - | $ | 1,916,510 | $ | 1,916,510 | ||||||||

| - Third parties | $ | 1,782,157 | $ | 462,218 | $ | 1,309,053 | $ | 3,553,428 | ||||||||

| Cost of revenues | $ | 1,427,989 | $ | 212,510 | $ | 927,846 | $ | 2,568,345 | ||||||||

| Gross profit | $ | 354,168 | $ | 249,708 | $ | 2,297,717 | $ | 2,901,593 | ||||||||

| Depreciation and amortization | $ | 25,562 | $ | 3,051 | $ | 15,404 | $ | 44,017 | ||||||||

| Total capital expenditures | $ | 3,302 | $ | 15,360 | $ | - | $ | 18,662 | ||||||||

Total assets as of:

| March 31, | June 30, | |||||||

| 2017 | 2016 | |||||||

| Shipping Agency & Ship Management Services | $ | - | $ | 1,271,948 | ||||

| Shipping & Chartering Services | - | 534,896 | ||||||

| Inland Transportation Management Services | 9,745,774 | 7,247,300 | ||||||

| Freight Logistic Services | 7,159,321 | - | ||||||

| Container Trucking Services | 703,363 | - | ||||||

| Total Assets | $ | 17,608,458 | $ | 9,054,144 | ||||

Note 16. RELATED PARTY TRANSACTIONS

As of March 31, 2017 and June 30, 2016, the outstanding amounts due from related parties consist of the following:

| March 31, | June 30, | |||||||

| 2017 | 2016 | |||||||

| Tianjin Zhiyuan Investment Group Co., Ltd. | $ | 1,195,130 | $ | 1,622,519 | ||||

| Zhiyuan International Investment & Holding Group (Hong Kong) Co., Ltd. | 3,211,056 | - | ||||||

| Total | $ | 4,406,186 | $ | 1,622,519 | ||||

| F-18 |

In June 2013, the Company signed a five-year global logistic service agreement with Tianjin Zhiyuan Investment Group Co., Ltd. (the “Zhiyuan Investment Group”) and TEWOO Chemical & Light Industry Zhiyuan Trade Co., Ltd. (together with Zhiyuan Investment Group, “Zhiyuan”). Zhiyuan Investment Group is owned by Mr. Zhang, the largest shareholder of the Company. In September 2013, the Company executed an inland transportation management service contract with the Zhiyuan Investment Group whereby it would provide certain advisory services and help control potential commodities loss during the transportation process. As a result of the inland transportation management services provided to Zhiyuan, the Company generated revenue of $762,777 (28% of the Company’s total revenue) and $556,948 (47% of the Company’s total revenue) for the three months ended March 31, 2017 and 2016, respectively. The Company generated revenue of $2,229,180 (33% of the Company’s total revenue) and $1,916,510 (35% of the Company’s total revenue) for the nine months ended March 31, 2017 and 2016, respectively. The amount due from Zhiyuan Investment Group at June 30, 2016 was $1,622,519. During the nine months ended March 31, 2017, the Company continued to provide inland transportation management services to Zhiyuan and also collected approximately $2.7 million from Zhiyuan to reduce the outstanding accounts receivable. As of March 31, 2017, the amount due from Zhiyuan was $1,195,130, the aging of which is less than 180 days.

On February 18, 2017, Trans Pacific Beijing (subsidiary) and Sino China (VIE) (collectively, the “Seller”), a subsidiary and VIE of the Company, entered into a Cooperative Transportation Agreement (the “Agreement”) with Zhiyuan International Investment & Holding Group (Hong Kong) Co., Ltd. (the “Buyer” or “Zhiyuan Hong Kong”). The Buyer is also invested by Mr. Zhang, the largest shareholder of the Company. Pursuant to the Agreement, the Buyer in joint entity with China Minmetals Corporation and China Metallurgical Group Corporation acts as the general designer, general equipment provider and general service contractor in the upgrade and renovation project of Perwaja Steel Indonesia which locate in Malaysia (the “Project”). The Seller shall be appointed as general agent to handle all related logistics and transportation occurring in the Project, ranging from equipment manufacturing, assembling, processing to installment as referenced in the Agreement. The Seller agrees to make certain advance transportation payments during the Project on the basis of current practice in China transportation agency industry; while the Buyer agrees to repay the advances to the Seller at any time as requested and instructed by the Seller, to satisfy the security repayment test in light of the Seller’s listed company profile. The Seller is contracted to provide high-quality services including detailed transportation plan design, plan execution and necessary supervision of the execution at the Buyer’s demand, and shall receive from the Buyer 1% - 1.25% of the total transportation expense incurred in the Project as commission for its professional design and execution of transportation plan as the general agent. As of March 31, 2017, the amount due from Zhiyuan Hong Kong was $3,211,056 (see Note 1).

As of March 31, 2017 and June 30, 2016, the outstanding amounts due to related parties consist of the following:

| March 31, | June 30, | |||||||

| 2017 | 2016 | |||||||

| ACH Logistic Inc. | $ | 104,779 | $ | - | ||||

| Jetta Global Logistics Inc. | 52,062 | - | ||||||

| Total | $ | 156,841 | $ | - | ||||

In December 2016, the Company entered into a joint venture agreement with Jetta Global to form ACH Trucking Center to provide short-haul trucking transportation and logistics services to customers located in the New York and New Jersey areas. ACH Logistic Inc. (ACH Logistic) and Jetta Global are invested by the same owner and both of the companies provided freight logistic service and container trucking service to the Company. For the three and nine months ended March 31, 2017, ACH Logistic and Jetta Global provided services in the amount of $146,879 and $61,062 to the Company, respectively. As of March 31, 2017, the amount due to ACH Logistic and Jetta Global was $104,779 and $52,062, respectively.

| F-19 |

Note 17. SUBSEQUENT EVENTS

On April 20, 2017, the Company signed a Strategic Cooperation Agreement (the SCA "Agreement") with Ningbo Xinyang Shipping Co., Ltd ("COSCO Xinyang"). The SCA Agreement with COSCO Xinyang is a continuation of the Company's ongoing partnership with China Ocean Shipping Company ("COSCO"). Pursuant to the Agreement with COSCO Xinyang, and similar to that of the Company's previously announced inland transportation agreements with COSCO, Sino-Global will receive a percentage of the total amount of each transportation fee in exchange for the arrangement of inland transportation services for COSCO Xinyang's container shipments into U.S. ports. The Company continues to work to expand its business to provide logistics services to customers who ship goods into the U.S.

| F-20 |

| Item 2. | Management’s Discussion and Analysis of Financial Condition and Results of Operations |

The following discussion and analysis of our company’s financial condition and results of operations should be read in conjunction with our unaudited condensed consolidated financial statements and the related notes included elsewhere in this report. This discussion contains forward-looking statements that involve risks and uncertainties. Actual results and the timing of selected events could differ materially from those anticipated in these forward-looking statements as a result of various factors.

Overview

Third Quarter Highlights

Sales in the third quarter of 2017 increased by $1,573,842, or 134.1%, from $1,173,769 for the three months ended March 31, 2016, to $2,747,611 for the comparable period in 2017. The increase was mainly due to:

| · | The Company’s subsidiary, Trans Pacific Shanghai, began providing container trucking services in the second quarter of fiscal year 2017. In addition to the launch of our full-service logistics platform, Trans Pacific Shanghai signed a service agreement with Shanghai International Port (Group) Co. Ltd., resulting in a significant increase in the subsidiary revenues. Trans Pacific Shanghai’s revenues generated by its container trucking services segment and revenues from freight logistic services increased approximately 167% and 220%, respectively, compared with the previous quarter. |

| · | Pursuant to the Strategic Cooperation Agreement with COSCO Logistics (Americas) Inc. (“COSCO Logistics”), signed in July 2016, starting in the third quarter of fiscal year 2017, the Company’s subsidiary in Los Angeles, California began providing freight logistic services and container trucking services to COSCO Logistics. |

| · | Pursuant to an agreement with signed in December 2016, the Company and Jetta Global Inc. (“Jetta Global”) established ACH Trucking Center Corp. (“ACH Trucking Center”), a joint venture based in New York that provides trucking services. During the third quarter of fiscal year 2017, ACH Trucking Center began providing freight logistic services and container trucking services to COSCO Beijing International Freight Co., Ltd. (“COSFRE Beijing”) in the New York and New Jersey areas. |

On February 16, 2017, the Company raised capital by issuing 1.5 million shares of common stock to three institutional investors at a purchase price of $3.18 per share. The aggregate gross proceeds of the sale to the Company totaled $4.77 million, and net proceeds after deducting offering expenses and placement agent fees, equaled approximately $4.3 million. The Company will use the funds for working capital and general corporate purposes.

Other 2017 Highlights:

| · | In July 2016, the Company signed a Strategic Cooperation Agreement with COSCO Logistics, which is owned by the PRC’s largest integrated shipping company, China COSCO Holdings Company Ltd.. Pursuant to that agreement, both parties will provide logistics services between the PRC and the U.S. and develop shipping customers as an end-to-end global logistics service. Starting in the third quarter of fiscal year 2017, the Company and COSCO Logistics began providing container trucking services on the west coast of the U.S.. The Company expects to increase its cooperation with COSCO Logistics and to provide inland transportation services in the U.S. for shipments to and from the PRC. According to the agreement, the two companies will also assess locations in the U.S. to potentially establish warehouse and/or distribution facilities in the coming months and share pricing information for short-haul trucking services across selected regions of the U.S.. |

| 4 |

| · | In December 2016, the Company completed the development of its full-service logistics platform, and a website portal to seamlessly connect shipping customers with short-haul trucking transportation services throughout the U.S. is now accessible through the Company’s website. In connection with the new platform, the Company signed strategic cooperation agreements with one major Chinese shipping company, COSCO (consisting of both COSFRE Beijing and COSCO Qingdao) in December 2016 and January 2017, respectively. We believe that the Company’s cooperation with COSCO should increase door-to-door short-haul trucking volumes and boost revenues from inland transportation services in the U.S. |

| · | On April 20, 2017, the Company signed a Strategic Cooperation Agreement with Ningbo Xinyang Shipping Co., Ltd ("COSCO Xinyang"). This agreement with COSCO Xinyang is a continuation of the Company's ongoing partnership with China Ocean Shipping Company ("COSCO"). Pursuant to the agreement with COSCO Xinyang, which is similar with the Company's previously announced inland transportation agreements with COSCO, Sino-Global will receive a percentage of the total amount of each transportation fee for arranging inland transportation services for COSCO Xinyang's container shipments into U.S. ports. The Company continues to work to expand its business to provide logistics services to customers who ship goods into the U.S. |

In the remaining periods of fiscal year 2017, the Company will continue marketing itself to state-owned shipping companies in the PRC, promoting our inland transportation services, including freight logistics and container trucking, in the U.S., and using containers for our bulk shipping projects. In the interim, we will continue to establish our services network in the U.S. in order to increase our sales revenue and leverage our fundamentals using our new profit model, i.e., developing inland transportation services (including freight logistics and container tracking service).

Company Structure

The Company, founded in 2001, is a non-asset based global shipping and freight logistic integrated solution provider. We provide tailored solutions and value-added services for our customers to drive effectiveness and control in related aspects throughout the entire shipping and freight logistic chain. Our current service offerings consist of inland transportation management services, freight logistic services and container trucking services. We have temporarily suspended our shipping agency and ship management services primarily due to market condition changes. We have also temporarily suspended our shipping and chartering services, primarily because of the termination of our planned vessel acquisition in December 2015.

The Company conducts its business primarily through its wholly-owned subsidiaries in the PRC (including Hong Kong), Australia, Canada, and the U.S. (specifically, New York and Los Angeles). In the quarter ended March 31, 2017, ACH Trucking Center was been established as a joint venture in New York by the Company and Jetta Global. The Company owns 51% ownership of ACH Trucking Center.

| 5 |

Currently, the Company’s inland transportation management services are operated by its subsidiaries in the PRC (including Hong Kong) and the U.S. Our freight logistic services are operated by the Company’s subsidiaries in the PRC, New York and Los Angeles. Our container trucking services are mainly operated by our subsidiaries and joint venture company in the PRC, New York and Los Angeles.

Results of Operations

The Three Months Ended March 31, 2017 Compared to the Three Months Ended March 31, 2016