U.S. SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 10-Q

x Quarterly report pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

For the period ended March 31, 2016

¨ Transition report pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

For the transition period from ___________ to ___________.

Commission File Number 001-34024

Sino-Global Shipping America, Ltd.

(Exact name of registrant as specified in its charter)

| Virginia | 11-3588546 | |

| (State or other jurisdiction of | (I.R.S. employer | |

| Incorporation or organization) | identification number) |

1044 Northern Boulevard, Suite 305

Roslyn, New York 11576-1514

(Address of principal executive offices and zip code)

(718) 888-1814

(Registrant’s telephone number, including area code)

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports) and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company.

| Large accelerated filer ¨ | Accelerated filer ¨ |

| Non-accelerated filer ¨ (Do not check if a smaller reporting company) | Smaller reporting company x |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No x

Indicate the number of shares outstanding of each of the issuer’s classes of common stock, as of the latest practicable date. As of May 3, 2016, the Company has 9,280,841 issued and outstanding shares of common stock.

SINO-GLOBAL SHIPPING AMERICA, LTD.

FORM 10-Q

INDEX

| 2 |

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

This document contains certain statements of a forward-looking nature. Such forward-looking statements, including but not limited to projected growth, trends and strategies, future operating and financial results, financial expectations and current business indicators are based upon current information and expectations and are subject to change based on factors beyond the control of the Company. Forward-looking statements typically are identified by the use of terms such as “look,” “may,” “will,” “should,” “might,” “believe,” “plan,” “expect,” “anticipate,” “estimate” and similar words, although some forward-looking statements are expressed differently. The accuracy of such statements may be impacted by a number of business risks and uncertainties that could cause actual results to differ materially from those projected or anticipated, including but not limited to the following:

| · | Our ability to timely and properly deliver shipping agency, ship management, shipping and chartering and inland transportation management services; |

| · | Our dependence on a limited number of major customers and related parties; |

| · | Political and economic factors in the Peoples’ Republic of China (“PRC”); |

| · | Our ability to expand and grow our lines of business; |

| · | Unanticipated changes in general market conditions or other factors, which may result in cancellations or reductions in the need for our services; |

| · | Economic conditions which would reduce demand for services provided by the Company and could adversely affect profitability; |

| · | The effect of terrorist acts, or the threat thereof, on consumer confidence and spending, or the production and distribution of product and raw materials which could, as a result, adversely affect the Company’s shipping agency services, operations and financial performance; |

| · | The acceptance in the marketplace of our new lines of services; |

| · | Foreign currency exchange rate fluctuations; |

| · | Hurricanes or other natural disasters; |

| · | The impact of quotas, tariffs or safeguards on our customer products that we service; and |

| · | Our ability to attract, retain and motivate skilled personnel. |

Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date hereof. The Company undertakes no obligation to update this forward-looking information. Nonetheless, the Company reserves the right to make such updates from time to time by press release, periodic report or other method of public disclosure without the need for specific reference to this Report. No such update shall be deemed to indicate that other statements not addressed by such update is incorrect or create an obligation to provide any other updates.

| 3 |

| Item 1. | Financial Statements |

SINO-GLOBAL SHIPPING AMERICA, LTD. AND AFFILIATES

INDEX TO FINANCIAL STATEMENTS

| F-1 |

| SINO-GLOBAL SHIPPING AMERICA, LTD. AND AFFILIATES |

| CONDENSED CONSOLIDATED BALANCE SHEETS |

| (UNAUDITED) |

| March 31, | June 30, | |||||||

| 2016 | 2015 | |||||||

| Assets | ||||||||

| Current assets | ||||||||

| Cash and cash equivalents | $ | 4,076,107 | $ | 730,322 | ||||

| Advances to suppliers | 6,207 | 50,975 | ||||||

| Accounts receivable, less allowance for doubtful accounts of $151,794 and $477,240 as of March 31, 2016 and June 30, 2015, respectively | 1,688,340 | 3,082,219 | ||||||

| Other receivables, less allowance for doubtful accounts of $125,244 and $241,604 as of March 31, 2016 and June 30, 2015, respectively | 316,603 | 191,972 | ||||||

| Prepaid expense and other current assets | 1,089,121 | 1,265,609 | ||||||

| Due from related parties, less allowance for doubtful accounts of $174,653 and nil as of March 31, 2016 and June 30, 2015, respectively | 1,062,687 | 2,784,591 | ||||||

| Total Current Assets | 8,239,065 | 8,105,688 | ||||||

| Property and equipment, net | 182,647 | 214,003 | ||||||

| Prepaid expenses | 188,268 | 436,351 | ||||||

| Other long-term assets | 38,323 | 2,773,908 | ||||||

| Deferred tax assets | - | 280,600 | ||||||

| Total Assets | $ | 8,648,303 | $ | 11,810,550 | ||||

| Liabilities and Equity | ||||||||

| Advances from customers | $ | 24,376 | $ | 126,201 | ||||

| Accounts payable | 312,009 | 691,588 | ||||||

| Taxes payable | 1,740,227 | 996,648 | ||||||

| Accrued expenses and other current liabilities | 83,468 | 99,607 | ||||||

| Total Current Liabilities | 2,160,080 | 1,914,044 | ||||||

| Total Liabilities | 2,160,080 | 1,914,044 | ||||||

| Commitments and Contingency | ||||||||

| Equity | ||||||||

| Preferred stock, 2,000,000 shares authorized, no par value, none issued. | - | - | ||||||

| Common stock, 50,000,000 shares authorized, no par value; 8,254,138 and 7,996,032 shares issued as of March 31, 2016 and June 30, 2015; 8,080,841 and 7,870,841 outstanding as of March 31, 2016 and June 30, 2015 | 15,320,391 | 16,303,327 | ||||||

| Additional paid-in capital | 1,144,842 | 1,144,842 | ||||||

| Treasury stock, at cost - 173,297 and 125,191 shares as of March 31, 2016 and June 30, 2015 | (415,978 | ) | (372,527 | ) | ||||

| Accumulated deficit | (4,606,020 | ) | (2,552,870 | ) | ||||

| Accumulated other comprehensive income | (94,913 | ) | 91,432 | |||||

| Unearned stock-based compensation | (7,760 | ) | (7,760 | ) | ||||

| Total Sino-Global Shipping America Ltd. Stockholders' Equity | 11,340,562 | 14,606,444 | ||||||

| Non-controlling Interest | (4,852,339 | ) | (4,709,938 | ) | ||||

| Total Equity | 6,488,223 | 9,896,506 | ||||||

| Total Liabilities and Equity | $ | 8,648,303 | $ | 11,810,550 | ||||

The accompanying notes are an integral part of these unaudited condensed consolidated financial statements

| F-2 |

| SINO-GLOBAL SHIPPING AMERICA, LTD. AND AFFILIATES | |

| CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS AND COMPREHENSIVE INCOME (LOSS) | |

| (UNAUDITED) |

| For the three months Ended March 31, | For the nine months Ended March 31, | |||||||||||||||

| 2016 | 2015 | 2016 | 2015 | |||||||||||||

| Net revenues | $ | 1,173,769 | $ | 2,526,762 | $ | 5,469,938 | $ | 8,225,267 | ||||||||

| Cost of revenues | (620,542 | ) | (1,220,577 | ) | (2,568,345 | ) | (4,304,591 | ) | ||||||||

| Gross profit | 553,227 | 1,306,185 | 2,901,593 | 3,920,676 | ||||||||||||

| General and administrative expenses | (1,190,614 | ) | (1,069,623 | ) | (4,084,858 | ) | (3,326,769 | ) | ||||||||

| Selling expenses | (23,353 | ) | (156 | ) | (67,478 | ) | (66,877 | ) | ||||||||

| (1,213,967 | ) | (1,069,779 | ) | (4,152,336 | ) | (3,393,646 | ) | |||||||||

| Operating income (loss) | (660,740 | ) | 236,406 | (1,250,743 | ) | 527,030 | ||||||||||

| Financial income (expense), net | 61,183 | 61,442 | (251,800 | ) | (59,892 | ) | ||||||||||

| Other income (loss), net | 10,402 | (2 | ) | 5,781 | 20,486 | |||||||||||

| 71,585 | 61,440 | (246,019 | ) | (39,406 | ) | |||||||||||

| Net income (loss) before provision for income taxes | (589,155 | ) | 297,846 | (1,496,762 | ) | 487,624 | ||||||||||

| Income tax (expense) benefit | (265,721 | ) | 34,067 | (839,076 | ) | 85,530 | ||||||||||

| Net income (loss) | (854,876 | ) | 331,913 | (2,335,838 | ) | 573,154 | ||||||||||

| Net loss attributable to non-controlling interest | (116,667 | ) | (19,070 | ) | (282,688 | ) | (246,710 | ) | ||||||||

| Net income (loss) attributable to Sino-Global Shipping America, Ltd. | $ | (738,209 | ) | $ | 350,983 | $ | (2,053,150 | ) | $ | 819,864 | ||||||

| Comprehensive income (loss) | ||||||||||||||||

| Net income (loss) | $ | (854,876 | ) | $ | 331,913 | $ | (2,335,838 | ) | $ | 573,154 | ||||||

| Foreign currency translation (loss) gain | (7,740 | ) | 132,042 | (46,058 | ) | 127,721 | ||||||||||

| Comprehensive (loss) income | (862,616 | ) | 463,955 | (2,381,896 | ) | 700,875 | ||||||||||

| Less: Comprehensive loss attributable to non-controlling interest | (141,532 | ) | (187,796 | ) | (142,401 | ) | (187,796 | ) | ||||||||

| Comprehensive income (loss) attributable to Sino-Global Shipping America Ltd. | $ | (721,084 | ) | $ | 651,751 | $ | (2,239,495 | ) | $ | 888,671 | ||||||

| Earnings (deficit) per share | ||||||||||||||||

| -Basic and diluted | $ | (0.09 | ) | $ | 0.05 | $ | (0.25 | ) | $ | 0.13 | ||||||

| Weighted average number of common shares used in computation | ||||||||||||||||

| -Basic and diluted | 8,337,325 | 6,200,841 | 8,364,296 | 6,102,859 | ||||||||||||

| The accompanying notes are an integral part of these unaudited condensed consolidated financial statements |

| F-3 |

| SINO-GLOBAL SHIPPING AMERICA LTD. AND AFFILIATE |

| CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS |

| (UNAUDITED) |

| For the nine months ended March 31, | ||||||||

| 2016 | 2015 | |||||||

| US$ | US$ | |||||||

| Operating Activities | ||||||||

| Net income (loss) | $ | (2,335,838 | ) | $ | 573,154 | |||

| Adjustment to reconcile net income (loss) to net cash provided by (used in) operating activities | ||||||||

| Amortization of stock-based compensation to consultants | 922,542 | - | ||||||

| Amortization of stock option expense | - | 314,622 | ||||||

| Depreciation and amortization | 44,017 | 140,464 | ||||||

| Provision (recovery) of doubtful accounts on third party receivables | 73,746 | (17,009 | ) | |||||

| Provision of doubtful accounts on related party receivable | 174,604 | - | ||||||

| Deferred tax provision (benefit) | 280,600 | (91,300 | ) | |||||

| Loss on disposition of property and equipment | - | 1,485 | ||||||

| Changes in assets and liabilities | ||||||||

| Decrease (increase) in advances to suppliers | 44,768 | (678,086 | ) | |||||

| Decrease (increase) in accounts receivable | 1,145,529 | (1,529,255 | ) | |||||

| Increase in other receivables | (124,631 | ) | (522,823 | ) | ||||

| Decrease (increase) in prepaid expense | 310,824 | (152,589 | ) | |||||

| Increase in other current assets | (32,453 | ) | - | |||||

| Increase in other long-term assets | (644 | ) | - | |||||

| Decrease in due from related parties | 1,721,904 | 44,250 | ||||||

| (Decrease) increase in advances from customers | (101,825 | ) | 136,460 | |||||

| Decrease in accounts payable | (379,579 | ) | (175,195 | ) | ||||

| Increase (decrease) in accrued expenses | 35,868 | (145,641 | ) | |||||

| Increase in taxes payable | 743,580 | - | ||||||

| (Decrease) increase in other current liabilities | (52,012 | ) | 231,459 | |||||

| Net cash provided by (used in) operating activities | 2,471,000 | (1,870,004 | ) | |||||

| Investing Activities | ||||||||

| Acquisitions of property and equipment | (18,662 | ) | (84,086 | ) | ||||

| Cash collected from the termination of vessel acquisition | 327,570 | - | ||||||

| Collection of short-term loan from related party | - | 1,114,428 | ||||||

| Net cash provided by investing activities | 308,908 | 1,030,342 | ||||||

| Financing Activities | ||||||||

| Proceeds from issuance of common stock, net | 691,600 | 967,820 | ||||||

| Purchase of common stock | (43,451 | ) | - | |||||

| Net cash provided by financing activities | 648,149 | 967,820 | ||||||

| Effect of exchange rate fluctuations on cash and cash equivalents | (82,272 | ) | 76,508 | |||||

| Net increase in cash and cash equivalents | 3,345,785 | 204,666 | ||||||

| Cash and cash equivalents at beginning of period | 730,322 | 902,531 | ||||||

| Cash and cash equivalents at end of period | $ | 4,076,107 | $ | 1,107,197 | ||||

| Supplemental information | ||||||||

| Income taxes paid | - | 8,104 | ||||||

| Non-cash transactions of operating activities: | ||||||||

| Common stock issued for vessel acquisition | $ | 2,220,000 | $ | - | ||||

| Return of common stock issued for vessel acquisition | $ | (2,220,000 | ) | $ | - | |||

| Common stock issued for stock-based compensation to consultants | $ | 255,000 | $ | 672,000 | ||||

| Common stock issued for LSM acquisition | $ | - | $ | 83,500 | ||||

| The accompanying notes are an integral part of these unaudited condensed consolidated financial statements |

| F-4 |

SINO-GLOBAL SHIPPING AMERICA, LTD. AND AFFILIATES

NOTES TO THE UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

Note 1. ORGANIZATION AND NATURE OF BUSINESS

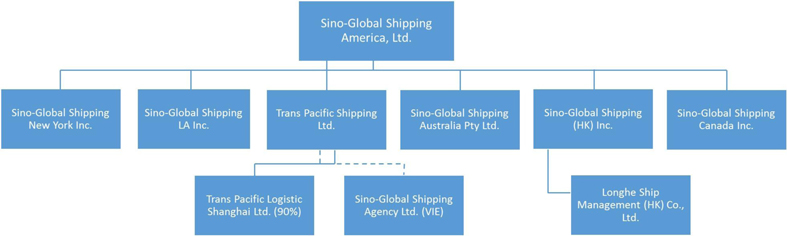

Founded in the United States (“US”) in 2001, Sino-Global Shipping America, Ltd. (“Sino-Global” or the “Company”) is a shipping agency, logistics and ship management services company. The Company’s current service offerings consist of shipping agency services, shipping and chartering services, inland transportation management services and ship management services. The Company conducts its business primarily through its wholly-owned subsidiaries in China, Hong Kong, Australia, and Canada. Substantially all of the Company’s business is generated from clients located in the People’s Republic of China (the “PRC”), and its operations are primarily conducted in the PRC.

The Company’s subsidiary in China, Trans Pacific Shipping Limited (“Trans Pacific Beijing”), a wholly owned foreign enterprise, invested in one 90%-owned subsidiary, Trans Pacific Logistics Shanghai Limited (“Trans Pacific Shanghai”. Trans Pacific Beijing and Trans Pacific Shanghai are referred to collectively as “Trans Pacific”). As PRC laws and regulations restrict foreign ownership of local shipping agency service businesses, the Company provided its shipping agency services in the PRC through Sino-Global Shipping Agency Ltd. (“Sino-China” or “VIE”), a Chinese legal entity, which holds the licenses and permits necessary to operate local shipping agency services in the PRC. Trans Pacific Beijing and Sino-China do not have a parent-subsidiary relationship. Trans Pacific Beijing has contractual arrangements with Sino-China and its shareholders that enable the Company to substantially control Sino-China. Through Sino-China, the Company has the ability to provide local shipping agency services in all commercial ports in the PRC. During fiscal year 2014, the Company completed a number of cost reduction initiatives and reorganized its shipping agency business in the PRC to improve its operating margin. In light of the Company’s decision not to pursue the local shipping agency business and as a result of the business reorganization efforts since approximately June 30, 2014, the Company no longer provides shipping agency services through its VIE structure and has not undertaken any business through or with Sino-China as of March 31, 2016 since approximately June 2014.

The Company’s shipping agency business is operated by its subsidiaries in Hong Kong and Australia. The Company’s ship management services are operated by its subsidiary in Hong Kong. The Company’s shipping and chartering services are operated by its company in the US and subsidiaries in HK. The Company’s inland transportation management services are operated by its subsidiary in China.

In January 2016, the Company formed a new subsidiary, Sino-Global Shipping LA Inc. (“Sino LA”), for the purpose of expanding its business to provide import security filing services with U.S Customs and Department of Homeland Security, on behalf of importers who ship goods into the U.S. and also providing inland transportation services to these importers in the U. S. The Company expects to generate increased revenue from this new service platform in the near future.

Note 2. LIQUIDITY

As reflected in the Company’s unaudited condensed consolidated financial statements, the Company had a net loss for the nine months ended March 31, 2016. Revenue from the Company’s shipping agency service business segment was in a decreasing trend due to higher overhead costs and decreased number of ships served. In addition, the Company terminated the vessel acquisition agreement during the quarter ended December 31, 2015, which also reduced the Company’s revenue source from the shipping and chartering service segment for the remaining period of fiscal year 2016.

In assessing its liquidity, management monitors and analyzes the Company’s cash on-hand, its ability to generate sufficient revenue source in the future and its operating and capital expenditure commitments. The Company plans to fund continuing operations through identifying new prospective joint venture and strategic alliance opportunities for new revenue sources, financial support by major shareholders and reducing costs to improve profitability and replenish working capital.

Management believes that the foregoing measures collectively will provide sufficient liquidity for the Company to meet its future liquidity and capital obligations.

Note 3. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

(a) Basis of Presentation

The accompanying unaudited condensed consolidated financial statements have been prepared in accordance with accounting principles generally accepted in the United States of America (“US GAAP”) for interim financial information pursuant to the rules and regulations of the Securities and Exchange Commission (“SEC”). All significant intercompany transactions and balances have been eliminated in consolidation. In the opinion of management, all adjustments considered necessary to give a fair presentation have been included. Interim results are not necessarily indicative of results of a full year. The information in this Form 10-Q should be read in conjunction with information included in the Company’s 2015 annual report on Form 10-K filed on September 18, 2015.

| F-5 |

(b) Basis of Consolidation

The unaudited condensed consolidated financial statements include the accounts of the Company, its subsidiaries, and its affiliates. All significant intercompany transactions and balances are eliminated in consolidation. Sino-China is considered a variable interest entity (“VIE”), and the Company is the primary beneficiary. The Company through Trans Pacific Beijing entered into agreements with Sino-China, pursuant to which the Company receives 90% of Sino-China’s net income. The Company does not receive any payment from Sino-China unless Sino-China recognizes net income during its fiscal year. These agreements do not entitle the Company to any consideration if Sino-China incurs a net loss during its fiscal year. If Sino-China incurs a net loss during its fiscal year, the Company is not required to absorb such net loss.

As a VIE, Sino-China’s revenues are included in the Company’s total revenues, and its loss from operations is consolidated with that of the Company. Because of the contractual arrangements, the Company had a pecuniary interest in Sino-China that requires consolidation of the financial statements of the Company and Sino-China.

The Company has consolidated Sino-China’s operating results because the entities are under common control in accordance with ASC 805-10, “Business Combinations”. The agency relationship between the Company and Sino-China and its branches is governed by a series of contractual arrangements pursuant to which the Company has substantial control over Sino-China. Management makes ongoing reassessments of whether the Company is the primary beneficiary of Sino-China.

The carrying amount and classification of Sino-China's assets and liabilities included in the Company’s Unaudited Condensed Consolidated Balance Sheets were as follows:

| March 31, | June 30, | |||||||

| 2016 | 2015 | |||||||

| Total current assets | $ | 52,848 | $ | 59,069 | ||||

| Total assets | $ | 157,770 | $ | 189,499 | ||||

| Total current liabilities | $ | 11,071 | $ | 19,732 | ||||

| Total liabilities | $ | 11,071 | $ | 19,732 | ||||

(c) Revenue Recognition Policy

| · | Revenues from shipping agency services are recognized upon completion of services, which coincides with the date of departure of the relevant vessel from port. Advance payments and deposits received from customers prior to the provision of services and recognition of the related revenues are presented as advances from customers. |

| · | Revenues from shipping and chartering services are recognized upon performance of services as stipulated in the underlying contract. |

| · | Revenues from inland transportation management services are recognized when commodities are being released from the customer’s warehouse. |

| · | Revenues from ship management services are recognized when the related contractual services are rendered. |

(d) Translation of Foreign Currency

The accounts of the Company and its subsidiaries, including Sino-China and each of its branches are measured using the currency of the primary economic environment in which the entity operates (the “functional currency”). The Company’s functional currency is the US dollar (“USD”) while Sino-China reports its financial position and results of operations in Renminbi (“RMB”). The accompanying unaudited condensed consolidated financial statements are presented in US dollars. Foreign currency transactions are translated into USD using fixed exchange rates in effect at the time of the transaction. Generally foreign exchange gains and losses resulting from the settlement of such transactions are recognized in the unaudited condensed consolidated statements of operations. The Company translates foreign currency financial statements of Sino-China, Sino-Global Shipping Australia, Sino-Global Shipping Hong Kong, Sino-Global Shipping Canada and Trans Pacific Beijing in accordance with ASC 830-10, “Foreign Currency Matters”. Assets and liabilities are translated at current exchange rates quoted by the People’s Bank of China at the balance sheet dates and revenues and expenses are translated at average exchange rates in effect during the year. Resulting translation adjustments are recorded as other comprehensive income (loss) and accumulated as a separate component of equity of the Company and also included in non-controlling interest.

The exchange rates as of March 31, 2016 and June 30, 2015 and for the three and nine months ended March 31, 2016 and 2015 are as follows:

| March 31, | June 30, | Three months ended March 31, | Nine months ended March 31, | |||||||||||||||||||||

| 2016 | 2015 | 2016 | 2015 | 2016 | 2015 | |||||||||||||||||||

| Foreign currency | Balance Sheet | Balance Sheet | Profits/Loss | Profits/Loss | Profits/Loss | Profits/Loss | ||||||||||||||||||

| RMB:1USD | 6.4447 | 6.1988 | 6.5404 | 6.2364 | 6.4114 | 6.1831 | ||||||||||||||||||

| 1AUD:USD | 1.3026 | 1.2986 | 1.3861 | 1.2721 | 1.3848 | 1.1748 | ||||||||||||||||||

| 1HKD:USD | 7.7567 | 7.7520 | 7.7744 | 7.7558 | 7.7589 | 7.7542 | ||||||||||||||||||

| 1CAD:USD | 1.2967 | 1.2475 | 1.3730 | 1.2409 | 1.3391 | 1.1554 | ||||||||||||||||||

| F-6 |

(e) Cash and Cash Equivalents

Cash and cash equivalents consist of cash on hand, and other highly liquid investments which are unrestricted as to withdrawal or use, and which have maturities of three months or less when purchased. The Company maintains cash and cash equivalents with various financial institutions mainly in the PRC, Australia, Hong Kong and the United States. As of March 31, 2016 and June 30, 2015, cash balances of $3,906,278 and $65,191, respectively, maintained at financial institutions in the PRC, and are not insured by the Federal Deposit Insurance Corporation or other programs.

(f) Accounts Receivable

Accounts receivable are presented at net realizable value. The Company maintains allowances for doubtful accounts for estimated losses. The Company reviews the accounts receivable on a periodic basis and makes general and specific allowances when there is doubt as to the collectability of individual balances. In evaluating the collectability of individual receivable balances, the Company considers many factors, including the age of the balances, customers’ historical payment history, their current credit-worthiness and current economic trends. Receivables are considered past due after 365 days. Accounts Receivable are written off after exhaustive efforts at collection.

(g) Earnings (deficit) per Share

Basic earnings (deficit) per share is computed by dividing net income (loss) attributable to holders of common shares by the weighted average number of common shares outstanding during the applicable period. Diluted earnings (deficit) per share reflect the potential dilution that could occur if securities or other contracts to issue common shares were exercised or converted into common shares. Common share equivalents are excluded from the computation of diluted earnings per share if their effects would be anti-dilutive.

The effect of 66,000 stock options and 139,032 warrants for all periods presented were not included in the calculation of diluted EPS because they would be anti-dilutive as the exercise prices for such options and warrants were higher than the average market price for the nine months ended March 31, 2016 and 2015.

(h) Risks and Uncertainties

The Company’s business, financial position and results of operations may be influenced by the political, economic, and legal environments in the PRC, as well as by the general state of the PRC economy. The Company’s operations in the PRC are subject to special considerations and significant risks not typically associated with companies in North America and Western Europe. These include risks associated with, among others, the political, economic and legal environment and foreign currency exchange. The Company’s results may be adversely affected by changes in the political, regulatory and social conditions in the PRC, and by changes in governmental policies or interpretations with respect to laws and regulations, anti-inflationary measures, currency conversion, remittances abroad, and rates and methods of taxation, among other things. In addition, the Company only controls Sino-China through a series of agreements. If such agreements were cancelled, modified or otherwise not complied with, the Company may not be able to retain control of this consolidated entity and the impact could be material to the Company’s operations. Moreover, the Company’s ability to grow its business and maintain its profitability could be negatively affected by the nature and extent of services provided to its major customer, Tianjin Zhi Yuan Investment Group Co., Ltd. (the “Zhiyuan Investment Group”).

(i) Recent Accounting Pronouncements

In January 2016, the FASB issued Accounting Standards Update (ASU) No. 2016-01, “Financial Instruments – Overall (Subtopic 825-10): Recognition and Measurement of Financial Assets and Financial Liabilities.” The new guidance is intended to improve the recognition and measurement of financial instruments. The new guidance makes targeted improvements to existing U.S. GAAP by: (1) Requiring equity investments (except those accounted for under the equity method of accounting, or those that result in consolidation of the investee) to be measured at fair value with changes in fair value recognized in net income. Requiring public business entities to use the exit price notion when measuring the fair value of financial instruments for disclosure purposes; (2) Requiring separate presentation of financial assets and financial liabilities by measurement category and form of financial asset (i.e., securities or loans and receivables) on the balance sheet or the accompanying notes to the financial statements; (3) Eliminating the requirement for public business entities to disclose the method(s) and significant assumptions used to estimate the fair value that is required to be disclosed for financial instruments measured at amortized cost on the balance sheet; and (4) Requiring a reporting organization to present separately in other comprehensive income the portion of the total change in the fair value of a liability resulting from a change in the instrument-specific credit risk (also referred to as “own credit”) when the organization has elected to measure the liability at fair value in accordance with the fair value option for financial instruments. The new guidance is effective for public companies for fiscal years beginning after December 15, 2017, including interim periods within those fiscal years. The Company does not expect this update will have a material impact on the Company's consolidated financial position, results of operations and cash flows.

| F-7 |

In February 2016, the FASB issued ASU 2016-02, “Leases (Topic 842),” which supersedes the existing guidance for lease accounting, Leases (Topic 840). ASU 2016-02 requires lessees to recognize leases on their balance sheets, and leaves lessor accounting largely unchanged. The amendments in this ASU are effective for fiscal years beginning after December 15, 2018 and interim periods within those fiscal years. Early application is permitted for all entities. ASU 2016-02 requires a modified retrospective approach for all leases existing at, or entered into after, the date of initial application, with an option to elect to use certain transition relief. The Company is currently evaluating the impact of this new standard on its consolidated financial statements.

In March 2016, the FASB issued Accounting Standards Update No. 2016-07, “Investments - Equity Method and Joint Ventures (Topic 323): Simplifying the Transition to the Equity Method of Accounting.” The amendments affect all entities that have an investment that becomes qualified for the equity method of accounting as a result of an increase in the level of ownership interest or degree of influence. The amendments eliminate the requirement that when an investment qualifies for use of the equity method as a result of an increase in the level of ownership interest or degree of influence, an investor must adjust the investment, results of operations, and retained earnings retroactively on a step-by-step basis as if the equity method had been in effect during all previous periods that the investment had been held. The amendments require that the equity method investor add the cost of acquiring the additional interest in the investee to the current basis of the investor’s previously held interest and adopt the equity method of accounting as of the date the investment becomes qualified for equity method accounting. Therefore, upon qualifying for the equity method of accounting, no retroactive adjustment of the investment is required. The amendments require that an entity that has an available-for-sale equity security that becomes qualified for the equity method of accounting recognize through earnings the unrealized holding gain or loss in accumulated other comprehensive income at the date the investment becomes qualified for use of the equity method. The amendments are effective for all entities for fiscal years, and interim periods within those fiscal years, beginning after December 15, 2016. The amendments should be applied prospectively upon their effective date to increases in the level of ownership interest or degree of influence that result in the adoption of the equity method. Earlier application is permitted. The Company is currently evaluating the impact of this new standard on its consolidated financial statements.

In April 2016, the FASB released ASU 2016-09, “Compensation - Stock Compensation (Topic 718): Improvements to Employee Share-Based Payment Accounting.” The ASU includes multiple provisions intended to simplify various aspects of the accounting for share-based payments. While aimed at reducing the cost and complexity of the accounting for share-based payments, the amendments are expected to significantly impact net income, EPS, and the statement of cash flows. Implementation and administration may present challenges for companies with significant share-based payment activities. The ASU is effective for public companies in annual periods beginning after December 15, 2016, and interim periods within those years. The Company is currently evaluating the impact of this new standard on its consolidated financial statements.

In April 2016, FASB issued Accounting Standards Update No. 2016-10, “Revenue from Contracts with Customers (Topic 606): Identifying Performance Obligations and Licensing.” The amendments clarify the following two aspects of Topic 606: (a) identifying performance obligations; and (b) the licensing implementation guidance. The amendments do not change the core principle of the guidance in Topic 606. The effective date and transition requirements for the amendments are the same as the effective date and transition requirements in Topic 606. Public entities should apply the amendments for annual reporting periods beginning after December 15, 2017, including interim reporting periods therein (i.e., January 1, 2018, for a calendar year entity). Early application for public entities is permitted only as of annual reporting periods beginning after December 15, 2016, including interim reporting periods within that reporting period. The Company is currently evaluating the impact of this new standard on its consolidated financial statements.

Note 4. ADVANCES TO SUPPLIERS

The Company’s advances to suppliers are as follows:

| March 31, | June 30, | |||||||

| 2016 | 2015 | |||||||

| Sainuo Investment Management Ltd (a) | $ | - | $ | 48,396 | ||||

| Others | 6,207 | 2,579 | ||||||

| Total | $ | 6,207 | $ | 50,975 | ||||

(a) On November 3, 2014, the Company entered into an advisory service agreement with Sainuo Investment Management Ltd. (“Sainuo”) whereby Sainuo, a professional services firm based in the PRC specializing in mergers and acquisitions, business restructuring and appraisal, had been engaged to assist the Company in the identification of suitable acquisition candidates, performance of required due diligence and other business advisory services. Pursuant to the service agreement, Sainuo is entitled to a service fee (which amount is calculated based on 8% of the value of the acquisition but not to exceed RMB 3.5 million). On November 24, 2014, the Company advanced RMB3.5 million to Sainuo in accordance with the service agreement, in connection with the Company’s decision to acquire Rong Zhou (see note 10) , a small oil/chemical product tanker identified by Sainuo as an acquisition candidate (the “Vessel Acquisition”). Sainuo, Rong Yao International Shipping Limited, a Hong Kong company (the “Vessel Seller”) and Sino-Global executed an agreement on April 22, 2015 whereby Sainuo shall collect a service fee of RMB300,000 from the Company and remit RMB3.2 million to the Vessel Seller as Sino-Global’s partial payment of the Vessel purchase price. The Company made a payment of RMB 3.5 million to Sainuo upon the earlier agreement, including RMB 300,000 (US $46,550) as its advance to Sainuo for the completion of the agreed-upon advisory services, in addition to the offer of the 1.2 million shares issued to the Vessel Seller (see note 10).

| F-8 |

On December 7, 2015, the Company and the Vessel Seller entered into a supplemental agreement to terminate the proposed Vessel Acquisition. Accordingly, the advance payment of RMB 300,000 to Sainuo for advisory services was recognized as consulting service charge and reflected in the unaudited condensed consolidated statements of operations and comprehensive income (loss) for the nine months ended March 31, 2016.

Note 5. ACCOUNTS RECEIVABLE, NET

The Company’s net accounts receivable is as follows:

| March 31, | June 30, | |||||||

| 2016 | 2015 | |||||||

| Trade accounts receivable | $ | 1,840,134 | $ | 3,559,459 | ||||

| Less: allowances for doubtful accounts | (151,794 | ) | (477,240 | ) | ||||

| Accounts receivables, net | $ | 1,688,340 | $ | 3,082,219 | ||||

For the three and nine months ended March 31, 2016, $0 and $365,622 accounts receivable were directly written off against previously allowance for doubtful accounts, respectively. There was no such write-off for the three and nine months ended March 31, 2016.

Note 6. OTHER RECEIVABLES

Other receivables represent mainly prepaid employee insurance and welfare benefit which will be subsequently deducted from the employee payroll, guarantee deposits on behalf of ship owners as well as office lease deposits with the landlords.

Note 7. PREPAID EXPENSES AND OTHER CURRENT ASSETS

The Company’s prepaid expenses and other current assets are as follows:

| March 31, | June 30, | |||||||

| 2016 | 2015 | |||||||

| Consultant fees (1) | $ | 1,033,989 | $ | 1,375,681 | ||||

| Advance to employees | 177,895 | 166,772 | ||||||

| Insurance | - | 77,584 | ||||||

| Other | 65,505 | 81,923 | ||||||

| Total | 1,277,389 | 1,701,960 | ||||||

| Less current portion | 1,089,121 | 1,265,609 | ||||||

| Total noncurrent portion | $ | 188,268 | $ | 436,351 | ||||

(1): The Company entered into management consulting and advisory services agreements with two consultants on June 6, 2014, pursuant to which the consultants should assist the Company in, among other things, financial and tax due diligence, business evaluation and integration, and development of pro forma financial statements. In return for their services, as approved by the Company’s Board of Directors, a total of 600,000 shares of the Company’s common stock were issued to these two consultants. During June 2014, a total of 200,000 shares of the Company’s common stock were issued to the consultants as a prepayment for their services. The value of their consulting services was determined using the fair value of the Company’s common stock of $2.34 per share when the shares were issued to the consultants. The remaining 400,000 shares of the Company's common stock were then issued to the consultants on August 29, 2014 at $1.68 per share. Their service agreements are for the period from July 1, 2014 to December 31, 2016.

In addition, on May 5, 2015, the Company entered into management consulting and advisory services agreements with three consultants, pursuant to which the consultants should assist the Company in, among other things, review of time charter agreements; crew management advisory; development of permanent and preventive maintenance standards related to dry dockings and ship repairs; development of regular technical and marine vessel inspections and quality control procedures; and development and implementation of alternative remedial actions to address any technical problems that may arise. In return for their services, as approved by the Company’s Board of Directors, a total of 500,000 shares of the Company’s common stock were to be issued to these three consultants. Their service agreements are for a period of 18 months, effective May 2015. The related consulting fees will be ratably charged to expense over the term of the agreements. The value of their consulting services was determined using the fair value of the Company’s common stock of $1.50 per share when the shares were issued to the consultants.

| F-9 |

On December 9, 2015, the Company entered into a consulting and advisory services agreement with a consultant, pursuant to which the consultant will assist the Company for corporate restructuring, business evaluation and capitalization during the period from November 20, 2015 to November 19, 2016. In return for such services, the Company issued 250,000 shares of the Company’s common stock to this consultant for services to be rendered during the first half of the service period. Such shares were issued as restricted shares at $1.02 per share on December 9, 2015. The Company will issue additional 250,000 shares of common stock to this consultant or pay $30,000 per month to this consultant to cover the services from the seventh month to November 19, 2016.

The above mentioned consulting fees have been and will be ratably charged to expense over the terms of the above mentioned agreements.

Note 8. ACCRUED EXPENSES AND OTHER CURRENT LIABILITIES

Accrued expenses and other current liabilities represent mainly payroll and welfare payable, accrued expenses and other miscellaneous items.

Note 9. PROPERTY AND EQUIPMENT, NET.

The Company’s net property and equipment as follows:

| March 31, | June 30, | |||||||

| 2016 | 2015 | |||||||

| Land and building | $ | 208,858 | $ | 217,144 | ||||

| Motor vehicles | 513,500 | 534,825 | ||||||

| Computer equipment | 150,817 | 146,739 | ||||||

| Office equipment | 60,842 | 62,745 | ||||||

| Furniture and fixtures | 163,748 | 156,085 | ||||||

| System software | 123,593 | 128,286 | ||||||

| Leasehold improvement | 66,135 | 68,758 | ||||||

| Total | 1,287,493 | 1,314,582 | ||||||

| Less: Accumulated depreciation and amortization | 1,104,846 | 1,100,579 | ||||||

| Property and equipment, net | $ | 182,647 | $ | 214,003 | ||||

Depreciation and amortization expense for the three months ended March 31, 2016 and 2015 were $14,941 and $32,100, respectively. Depreciation and amortization expense for the nine months ended March 31, 2016 and 2015 were $44,017 and $140,464, respectively.

Note 10. OTHER LONG-TERM ASSETS

The Company’s other long-term assets are as follows:

| March 31, | June 30, | |||||||

| 2016 | 2015 | |||||||

| Installment payment related to Vessel acquisition (1) | $ | - | $ | 2,736,229 | ||||

| Rent deposit | 38,323 | 37,679 | ||||||

| Total | $ | 38,323 | $ | 2,773,908 | ||||

| F-10 |

| (1) | On April 10, 2015, the Company entered into an Asset Purchase Agreement with Rong Yao International Shipping Limited, a Hong Kong company (the “Vessel Seller”), pursuant to which the Company agreed to acquire, subject to a number of closing conditions, “Rong Zhou,” an 8,818 gross tonnage oil/chemical transportation tanker (the “Vessel”) from the Vessel Seller; and in connection therewith, the Company issued to the Vessel Seller 1.2 million shares of its restricted common stock representing $2,220,000 of the $10.5 million purchase price for the Vessel. The Company and the Vessel Seller agreed that each of the 1.2 million shares issued to the Vessel Seller was valued at $1.85 per share. In connection therewith, the Company filed a registration statement on April 15, 2015 covering the offer of the 1.2 million shares issued to the Vessel Seller. In addition, the Company previously advanced RMB3.5 million to third-party Sainuo for identification of a suitable acquisition candidate. In connection with a settlement agreement with Sainuo as discussed in Note 4, Sainuo transferred RMB3.2 million to the Vessel Seller. As of June 30, 2015, total installment payment for the Vessel of $2,736,229 was made up of the agreed-upon value of $2,220,000 related to the 1.2 million shares of Sino-Global’s restricted common stock issued to the Vessel Seller and RMB 3.2 million (US $516,229) remitted by Sainuo to the Vessel Seller as Sino-Global’s partial payment of the Vessel purchase price. Then the installment payment related to Vessel acquisition was recognized as other long-term asset as at the end of the previous financial year. |

In connection with the termination of the Assets Purchase Agreement as discussed in Note 4, the Vessel Seller agreed to return the 1.2 million shares to the Company, and in addition to refund approximately $330,000 in cash after all related charges, which has been accepted by both parties. The Company received the cash of $330,000 in December 2015 and the 1.2 million shares on February 12, 2016, and accordingly there was no such deposit balance reflected in the Company’s unaudited condensed consolidated balance sheets as of March 31, 2016.

Note 11. EQUITY TRANSACTIONS

On July 10, 2015, the Company sold 500,000 restricted shares of its common stock to Mr. Weixiong Yang in a private sale transaction. The aggregate offering price of the shares was $691,600, which was paid in cash. There were no underwriting discounts or commissions. The sale of stock was completed pursuant to an exemption from securities registration afforded by Section 4(a) (2) of the Securities Act of 1933, as amended, and Rule 506 of Regulation D promulgated thereunder. The shares were issued on July 13, 2015.

Effective February 11, 2016, the Compensation Committee of the Board of Directors of the Company granted 660,000 shares of common stock to seven directors and executive officers under the Company’s 2014 Stock Incentive Plan (the “Plan”). Pursuant to the terms and conditions of the Plan and the plan stock award agreements, these shares vested immediately, with a total value of $349,800, at $0.53 per share based on the Company’s stock price on February 10, 2016.

In connection with the termination of the Vessel Acquisition, the Seller returned the stock certificate for 1.2 million shares to the Company during the quarter ended March 31, 2016 and the Company's unaudited condensed consolidated balance sheets as of March 31, 2016 has reflected the reduction of the 1.2 million shares.

Note 12. NON-CONTROLLING INTEREST

The Company’s non-controlling interest consists of the following:

| March 31, | June 30, | |||||||

| 2016 | 2015 | |||||||

| Sino-China: | ||||||||

| Original paid-in capital | $ | 356,400 | $ | 356,400 | ||||

| Additional paid-in capital | 1,017 | 1,044 | ||||||

| Accumulated other comprehensive loss | 27 | (67,640 | ) | |||||

| Accumulated deficit | (5,229,258 | ) | (5,018,688 | ) | ||||

| (4,871,814 | ) | (4,728,884 | ) | |||||

| Trans Pacific Logistics Shanghai Ltd. | 19,475 | 18,946 | ||||||

| Total | $ | (4,852,339 | ) | $ | (4,709,938 | ) | ||

| F-11 |

Note 13. COMMITMENTS AND CONTIGENCIES

Lease Obligations

The Company leases certain office premises and apartments for employees under operating leases through April 16, 2020. Future minimum lease payments under operating lease agreements are as follows:

| Amount | ||||

| Twelve months ending March 31, | ||||

| 2017 | $ | 243,701 | ||

| 2018 | 152,092 | |||

| 2019 | 110,456 | |||

| 2020 | 72,960 | |||

| Thereafter | - | |||

| $ | 579,209 | |||

Rent expense for the three months ended March 31, 2016 and 2015 were $62,699 and $50,503, respectively. Rent expense for the nine months ended March 31, 2016 and 2015 were $170,890 and $150,724, respectively.

Legal proceedings

During the quarter ended December 31, 2015, a former Vice President of the Company, Mr. Alexander Chen, filed a complaint with the U.S. Department of Labor-Occupational Safety and Health Administration (“OSHA”) against the Company and three current or former executives. Mr. Chen is seeking $350,000 plus attorney’s fees for the alleged retaliation and a purported breach of his employment agreement. The Company has responded to the complaint filed with OSHA, providing argument and information supporting the Company’s position that no violation of law in connection with Chen’s employment. As of the date of this report, the complaint has not been settled and the company is unable to predict the outcome or impact of this pending legal proceeding.

Note 14. INCOME TAXES

Income tax expense for the three months and nine months ended March 31, 2016 and 2015 varied from the amount computed by applying the statutory income tax rate to income before taxes. Reconciliations between the expected federal income tax rate using the federal statutory tax rate of 35% to the Company’s effective tax rate are as follows:

| For the three months ended March 31, | For the nine months ended March 31, | |||||||||||||||

| 2016 | 2015 | 2016 | 2015 | |||||||||||||

| % | % | % | % | |||||||||||||

| U.S. expected federal income tax benefit | 35.0 | 35.0 | 35.0 | 35.0 | ||||||||||||

| U.S state, local tax net of federal benefit | 10.9 | 10.9 | 10.9 | 10.9 | ||||||||||||

| U.S. permanent difference | (0.6 | ) | (0.2 | ) | (0.6 | ) | (0.2 | ) | ||||||||

| U.S. temporary difference | (45.3 | ) | (45.7 | ) | (45.3 | ) | (45.7 | ) | ||||||||

| Permanent difference related to other countries | 70.1 | 36.4 | 81.1 | 46.9 | ||||||||||||

| PRC statutory income tax expense | (25.0 | ) | (25.0 | ) | (25.0 | ) | (25.0 | ) | ||||||||

| Hong Kong statutory income tax rate | (16.5 | ) | (16.5 | ) | (16.5 | ) | (16.5 | ) | ||||||||

| Hong Kong income tax benefit | 16.5 | 16.5 | 16.5 | 12.1 | ||||||||||||

| Total tax benefit | 45.1 | 11.4 | 56.1 | 17.5 | ||||||||||||

The U.S. temporary difference was mainly comprised of unearned compensation amortization and provision for allowance for doubtful accounts.

| F-12 |

The income tax (expense) benefit for the three and nine months ended March 31, 2016 and 2015 are as follows:

For the three months ended March 31, | For the nine months ended March 31, | |||||||||||||||

| 2016 | 2015 | 2016 | 2015 | |||||||||||||

| Current | ||||||||||||||||

| USA | $ | - | $ | - | $ | - | $ | - | ||||||||

| Hong Kong | - | - | - | (5,770 | ) | |||||||||||

| China | (265,721 | ) | - | (558,476 | ) | - | ||||||||||

| (265,721 | ) | - | (558,476 | ) | (5,770 | ) | ||||||||||

| Deferred | ||||||||||||||||

| USA | - | 34,067 | (280,600 | ) | 91,300 | |||||||||||

| Other countries | - | - | - | - | ||||||||||||

| - | 34,067 | (280,600 | ) | 91,300 | ||||||||||||

| Total income tax (expense) benefit | $ | (265,721 | ) | $ | 34,067 | $ | (839,076 | ) | $ | 85,530 | ||||||

The Company’s deferred tax assets are comprised of the following:

| March 31, | June 30, | |||||||

| 2016 | 2015 | |||||||

| Allowance for doubtful accounts | $ | 220,000 | $ | 248,000 | ||||

| Stock-based compensation | 627,000 | 382,000 | ||||||

| Net operating loss | 3,530,000 | 2,176,000 | ||||||

| Total deferred tax assets | 4,377,000 | 2,806,000 | ||||||

| Valuation allowance | (4,377,000 | ) | (2,525,400 | ) | ||||

| Deferred tax assets, net - long-term | $ | - | $ | 280,600 | ||||

Our operations in the U.S. have incurred a cumulative net operating loss of approximately $8,669,000 and $5,590,560, respectively, as of March 31, 2016 and June 30, 2015, which may reduce future taxable income. This carry-forward will expire if not utilized by 2035. As of March 31, 2016 and June 30, 2015, major components of our deferred tax assets included net operating loss of our U.S entities, stock-based compensation and allowance for doubtful accounts.

The Company periodically evaluates the likelihood of the realization of deferred tax assets, and reduces the carrying amount of the deferred tax assets by a valuation allowance to the extent it believes a portion will not be realized. The Company considers many factors when assessing the likelihood of future realization of the deferred tax assets, including its recent cumulative earnings experience, expectation of future income, the carry forward periods available for tax reporting purposes, and other relevant factors. Due to the termination of the proposed vessel acquisition in December 2015, management concluded that the chances for the Company’s U.S. entities to be profitable in the foreseeable future became remote, and accordingly 100% of the deferred tax assets balance has been provided a valuation allowance as of March 31, 2016 based on management’s estimate.

The Company’s taxes payable consists of the following:

| March 31, | June 30, | |||||||

| 2016 | 2015 | |||||||

| VAT tax payable | $ | 484,954 | $ | 296,935 | ||||

| Corporate income tax payable | 1,193,670 | 664,132 | ||||||

| Others | 61,603 | 35,581 | ||||||

| Total | $ | 1,740,227 | $ | 996,648 | ||||

| F-13 |

Note 15. CONCENTRATIONS

Major Customers

For the nine months ended March 31, 2016, two customers accounted for 35% and 24% of the Company’s revenues, respectively. For the nine months ended March 31, 2015, three customers accounted for 22%, 21% and 14% of the Company’s revenues, respectively.

Major Suppliers

For the nine months ended March 31, 2016, two suppliers accounted for 31% and 14% of the total cost of revenues, respectively. For the nine months ended March 31, 2015, three suppliers accounted for 54%, 19% and 9% of the total cost of revenues, respectively.

Note 16. SEGMENT REPORTING

ASC 280, “Segment Reporting, ” establishes standards for reporting information about operating segments on a basis consistent with the Company's internal organizational structure as well as information about geographical areas, business segments and major customers in financial statements for details on the Company's business segments.

The Company's chief operating decision maker has been identified as the Chief Executive Officer who reviews the financial information of separate operating segments when making decisions about allocating resources and assessing performance of the group. Based on management's assessment, the Company has determined that it has three operating segments: shipping agency service, shipping and chartering services, and inland transportation management services.

The following tables present summary information by segment for the three and nine months ended March 31, 2016 and 2015, respectively:

| For the three months Ended March 31, 2016 | ||||||||||||||||

| Shipping Agency & Ship Management Services | Shipping & Chartering Services | Inland Transportation Management Services | Total | |||||||||||||

| Revenues | $ | 232,901 | $ | - | $ | 940,868 | $ | 1,173,769 | ||||||||

| Cost of revenues | $ | 184,388 | $ | - | $ | 436,154 | $ | 620,542 | ||||||||

| Gross profit | $ | 48,513 | $ | - | $ | 504,714 | $ | 553,227 | ||||||||

| Depreciation and amortization | $ | 8,622 | $ | 1,093 | $ | 5,226 | $ | 14,941 | ||||||||

| Total capital expenditures | $ | - | $ | 15,360 | $ | - | $ | 15,360 | ||||||||

| Total assets | $ | 685,601 | $ | 540,132 | $ | 7,422,570 | $ | 8,648,303 | ||||||||

| For the three months Ended March 31, 2015 | ||||||||||||||||

| Shipping Agency & Ship Management Services | Shipping & Chartering Services | Inland Transportation Management Services | Total | |||||||||||||

| Revenues | $ | 1,231,182 | $ | - | $ | 1,295,580 | $ | 2,526,762 | ||||||||

| Cost of revenues | $ | 980,136 | $ | - | $ | 240,441 | $ | 1,220,577 | ||||||||

| Gross profit | $ | 251,046 | $ | - | $ | 1,055,139 | $ | 1,306,185 | ||||||||

| Depreciation and amortization | $ | 29,511 | $ | - | $ | 2,589 | $ | 32,100 | ||||||||

| Total capital expenditures | $ | 56,978 | $ | - | $ | - | $ | 56,978 | ||||||||

| Total assets | $ | 7,869,985 | $ | - | $ | 231,746 | $ | 8,101,731 | ||||||||

| F-14 |

| For the nine months Ended March 31, 2016 | ||||||||||||||||

| Shipping Agency & Ship Management Services | Shipping & Chartering Services | Inland Transportation Management Services | Total | |||||||||||||

| Revenues | $ | 1,782,157 | $ | 462,218 | $ | 3,225,563 | $ | 5,469,938 | ||||||||

| Cost of revenues | $ | 1,427,989 | $ | 212,510 | $ | 927,846 | $ | 2,568,345 | ||||||||

| Gross profit | $ | 354,168 | $ | 249,708 | $ | 2,297,717 | $ | 2,901,593 | ||||||||

| Depreciation and amortization | $ | 25,562 | $ | 3,051 | $ | 15,404 | $ | 44,017 | ||||||||

| Total capital expenditures | $ | 3,302 | $ | 15,360 | $ | - | $ | 18,662 | ||||||||

| Total assets | $ | 685,601 | $ | 540,132 | $ | 7,422,570 | $ | 8,648,303 | ||||||||

| For the nine months Ended March 31, 2015 | ||||||||||||||||

| Shipping Agency & Ship Management Services | Shipping & Chartering Services | Inland Transportation Management Services | Total | |||||||||||||

| Revenues | $ | 4,690,972 | $ | - | $ | 3,534,295 | $ | 8,225,267 | ||||||||

| Cost of revenues | $ | 3,756,926 | $ | - | $ | 547,665 | $ | 4,304,591 | ||||||||

| Gross profit | $ | 934,046 | $ | - | $ | 2,986,630 | $ | 3,920,676 | ||||||||

| Depreciation and amortization | $ | 132,203 | $ | - | $ | 8,261 | $ | 140,464 | ||||||||

| Total capital expenditures | $ | 84,086 | $ | - | $ | - | $ | 84,086 | ||||||||

| Total assets | $ | 7,869,985 | $ | - | $ | 231,746 | $ | 8,101,731 | ||||||||

Note 17. RELATED PARTY TRANSACTIONS

In June 2013, the Company signed a 5-year global logistic service agreement with TEWOO Chemical & Light Industry Zhiyuan Trade Co., Ltd. and TianJin Zhi Yuan Investment Group Co., Ltd. (together, “Zhiyuan”). TianJin Zhi Yuan Investment Group Co., Ltd. (the “Zhiyuan Investment Group”) is owned by Mr. Zhang, the largest shareholder of the Company. In September 2013, the Company executed an inland transportation management service contract with the Zhiyuan Investment Group whereby it would provide certain advisory services and help control its potential commodities loss during the transportation process. As a result of the inland transportation management services provided to Zhiyuan, the net amount due from Zhiyuan Investment Group was $2,609,831 at June 30, 2015. During the nine months ended March 31, 2016, the Company continued to provide inland transportation management services to Zhiyuan and also collected approximately $3.4 million (RMB 22.1 million) from Zhiyuan to reduce the outstanding accounts receivable. As of March 31, 2016, the net amount due from Zhiyuan was $1,062,687. Management expects that such receivable will be substantially collected in the second half of 2016.

At June 30, 2015, the Company was owed $174,759 from Sino-G Trading Inc. (“Sino-G”), an entity that is owned by the former brother-in-law of the Company’s CEO. Sino-G previously served as a funds transfer agent for the Company’s services in Tianjin, PRC. During the quarter ended December 31, 2015, management reassessed the collectability of such receivable due from Sino-G and concluded that the likelihood to collect such balance became doubtful since such amount has been past due for a long time. As a result, a 100% valuation allowance has been applied against this past due amount. There was no additional related party transaction with Sino-G for the quarter ended March 31, 2016.

Note 18. SUBSEQUENT EVENTS

On April 18, 2016, Sino LA signed a Memorandum of Understanding (“MOU”) with Yaxin International Co., Ltd.(“Yaxin”), pursuant to which Sino LA will provide logistics services to Yaxin, who ships goods via containers into the U.S and places them on Amazon.com. The services include cargo forwarding, customs filing and declaration, trucking and others.

| F-15 |

| Item 2. | Management’s Discussion and Analysis of Financial Condition and Results of Operations |

The following discussion and analysis of our Company’s financial condition and results of operations should be read in conjunction with our unaudited condensed consolidated financial statements and the related notes included elsewhere in this report. This discussion contains forward-looking statements that involve risks and uncertainties. Actual results and the timing of selected events could differ materially from those anticipated in these forward-looking statements as a result of various factors.

Overview

Sino-Global Shipping America, Ltd. was incorporated in the United States (“U.S.”) in 2001, and has been engaged in providing professional shipping, logistics, and ship management services to our customers. The shares of the Company has been listed on NASDAQ since April 2008.

We conduct our business primarily through our wholly-owned subsidiaries in Mainland China, Hong Kong, Australia, Canada and New York.

The formation of interconnected subsidiaries will be sustained by continuous business development of the Company. It’s considered as an essential foothold of the Company in shipping market to offer professional logistics and shipping services. The Company’s goal is to multiply its businesses by strengthening its interconnections and expanding its services.

In January 2016, we formed a new subsidiary Sino-Global Shipping LA Inc. for the purpose of expand our business into providing importer security filing services with U.S. Customs and Department of Homeland Security, on behalf of importers who ship goods into the U.S., and also provide logistic services including cargo forwarding and truck transportation services to customers. We expect starting this new business line will help us to expand our platform to generate increased revenue in the near future.

Company Structure & Function

As of the date herein, the management team of the Company envisions the Company to vertically conduct its operation, development through the following subsidiaries:

l Sino-Global Shipping New York Inc., Sino-Global Shipping LA Inc. and Sino-Global Shipping Canada Inc. shall offer bilateral logistics, transportation and warehousing services generated from trades between China, U.S. and Canada;

l Trans Pacific Shipping Limited and Trans Pacific Logistics Shanghai Limited shall offer domestic logistics and transportation services, marketing services, and bilateral logistics, transportation and warehousing services generated from trades between China and U.S., Canada and Australia;

l Sino-Global Shipping Agency Ltd. (“VIE”) shall offer shipping agency services and marketing services. We have suspended doing business with the VIE in June 2014 due to potential negative impact that may be brought to the VIE as a result of government adjustment on economy in China;

l Sino-Global Shipping Australia Pty Ltd. shall offer bilateral logistics, transportation and warehousing services generated from trades between China and Australia;

l Sino-Global Shipping (HK) Inc. shall offer shipping agency & ship management services.

| 4 |

l In January 2016, Sino-Global Shipping LA Inc. was formed in California, USA, which is expected to provide logistic services including cargo forwarding, custom filing and declaration, and truck transportation.

Business Segments

We currently deliver the following services: shipping agency and ship management services, shipping and chartering services, and inland transportation management services.

The following table presents summary information by segment for the three and nine months ended March 31, 2016 and 2015:

| For the three months ended March 31, 2016 | For the three months ended March 31, 2015 | |||||||||||||||||||||||||||||||

| Shipping | Shipping | |||||||||||||||||||||||||||||||

| Agency and | Inland | Agency and | Inland | |||||||||||||||||||||||||||||

| Ship | Shipping and | Transportation | Ship | Shipping and | Transportation | |||||||||||||||||||||||||||

| Management Services | Chartering Services | Management Services | Consolidated | Management Services | Chartering Services | Management Services | Consolidated | |||||||||||||||||||||||||

| Revenues | $ | 232,901 | $ | - | $ | 940,868 | $ | 1,173,769 | $ | 1,231,182 | $ | - | $ | 1,295,580 | $ | 2,526,762 | ||||||||||||||||

| Cost of revenues | $ | 184,388 | - | $ | 436,154 | $ | 620,542 | $ | 980,136 | - | $ | 240,441 | $ | 1,220,577 | ||||||||||||||||||

| Gross profit | $ | 48,513 | - | $ | 504,714 | $ | 553,227 | $ | 251,046 | - | $ | 1,055,139 | $ | 1,306,185 | ||||||||||||||||||

| Gross margin | 20.8 | % | - | 53.6 | % | 47.1 | % | 20.4 | % | - | 81.4 | % | 51.7 | % | ||||||||||||||||||

| For the nine months ended March 31, 2016 | For the nine months ended March 31, 2015 | |||||||||||||||||||||||||||||||

| Shipping | Shipping | |||||||||||||||||||||||||||||||

| Agency and | Inland | Agency and | Inland | |||||||||||||||||||||||||||||

| Ship | Shipping and | Transportation | Ship | Shipping and | Transportation | |||||||||||||||||||||||||||

| Management Services | Chartering Services | Management Services | Consolidated | Management Services | Chartering Services | Management Services | Consolidated | |||||||||||||||||||||||||

| Revenues | $ | 1,782,157 | $ | 462,218 | $ | 3,225,563 | $ | 5,469,938 | $ | 4,690,972 | $ | - | $ | 3,534,295 | $ | 8,225,267 | ||||||||||||||||

| Cost of revenues | $ | 1,427,989 | 212,510 | $ | 927,846 | $ | 2,568,345 | $ | 3,756,926 | - | $ | 547,665 | $ | 4,304,591 | ||||||||||||||||||

| Gross profit | $ | 354,168 | 249,708 | $ | 2,297,717 | $ | 2,901,593 | $ | 934,046 | - | $ | 2,986,630 | $ | 3,920,676 | ||||||||||||||||||

| Gross margin | 19.9 | % | 54.0 | % | 71.2 | % | 53.0 | % | 19.9 | % | - | 84.5 | % | 47.7 | % | |||||||||||||||||

Revenues

(1) Revenues from Shipping Agency and Ship Management Services

Revenue from Shipping Agency Services

Under this segment, we provide two types of shipping agency services: loading/discharging services and protective agency services. For loading/discharging agency services, we receive the total amount from our customers and pay the port charges on behalf of customers. For protective agency services, we charge a fixed amount as agent fee while customers are responsible for the payment of port costs and expenses. Under these circumstances, we generally require payments in advance from customers and bill the balances within 30 days after the transactions are completed. We believe the most significant factors that directly or indirectly affect our shipping agency service revenues are:

| ¨ | the number of ship-times to which we provide port loading/discharging services; | |

| ¨ | the size and types of ships we serve; | |

| ¨ | the type of services we provide; | |

| ¨ | the rate of service fees we charge; | |

| ¨ | the number of ports at which we provide services; and | |

| ¨ | the number of customers we serve. |

| 5 |

For the three months ended March 31, 2016 and 2015, our revenue generated from the shipping agency segment was $232,901 and $1,231,182, respectively. The quarterly revenues were negatively impacted by the decrease in the total number of ships we served from 20 for the three months ended March 31, 2015 to only 1 for the same period in 2016. For the nine months ended March 31, 2016 and 2015, our revenue generated from the shipping agency segment was $1,782,157 and $4,500,897, respectively. The decline in revenues was mainly due to the decrease in the total number of ships the Company served from 117 for the nine months ended March 31, 2015 to only 19 for the same period in 2016. The decrease in the number of ships served for the three and nine months ended March 31, 2016 was largely affected by the general economy slow-down and rising labor costs in China, and also driven by intense competition in the industry, with established and new competitors offering rates that in many cases are much lower than we can offer. On the other hand, the rising labor and other overhead costs reduced our gross margin in this segment. As a result, management decided to temporarily suspend the shipping agency business starting from the current quarter.

| For the three months ended March 31, | For the nine months ended March 31, | |||||||||||||||||||||||||||||||

| 2016 | 2015 | Change | % | 2016 | 2015 | Change | % | |||||||||||||||||||||||||

| Number of ships served | ||||||||||||||||||||||||||||||||

| Loading/discharging | 1 | 19 | (18 | ) | (95 | ) | 19 | 49 | (30 | ) | (61 | ) | ||||||||||||||||||||

| Protective | - | 1 | (1 | ) | (100 | ) | - | 68 | (68 | ) | (100 | ) | ||||||||||||||||||||

| Total | 1 | 20 | (19 | ) | (95 | ) | 19 | 117 | (98 | ) | (84 | ) | ||||||||||||||||||||

Revenue from Ship Management Services

We did not generate any revenue from the ship management service segment for the three and nine months ended March 31, 2016. Comparatively, in connection with our acquisition of Longhe Ship Management (Hong Kong) Co. Limited in 2014 and the later suspension of services to vessel owners with questionable financial viability in early 2015, we generated $0 of revenue for the three months ended March 31, 2015, and $190,075 of revenue from the closing date of our acquisition of LSM to March 31, 2015. Considering the market trend, risk control and development for ship management services, and our expenses and gross profit margin generated from this business section, management decided to temporarily suspend the ship management business starting from the current quarter.

(2) Revenues from Shipping and Chartering Services

Since the Company terminated the purchase agreement and chartering agreements regarding to the acquisition of Rong Yao International Shipping Limited (“Rong Yao”) on December 7, 2015, based on adjustment on the Company’s developing strategy and the forecast of market trend, there were no revenues from shipping and chartering services following that date.

(3) Revenues from Inland Transportation Management Services

In September 2013, the Company executed an inland transportation management service contract with Zhiyuan Investment Group (“Zhiyuan”) whereby the Company would provide certain advisory services to help control potential commodities loss during the transportation process. The Company started to provide inland transportation management services to a third-party customer, Tengda Northwest Ferroalloy Co., Ltd. (“Tengda Northwest”), following the quarter ended September 2014. As a result, for the three months ended March 31, 2016 and 2015, the inland transportation management services generated revenues of $940,868 and $1,295,580, and gross profit of $504,714 and $1,055,139, respectively. The decrease was a result of the downturn of the economy in China. The decrease was also affected by the long holiday leave during the Chinese Spring Festival. For the nine months ended March 31, 2016 and 2015, the inland transportation management services generated revenues of $3,225,563 and $3,534,295, and gross profit of $2,297,717 and $2,986,630, respectively.

| 6 |

Operating Costs and Expenses

The following tables set forth the components of the Company’s costs and expenses for the periods indicated.

| For the three months ended March 31, | ||||||||||||||||||||||||

| 2016 | 2015 | Change | ||||||||||||||||||||||

| US$ | % | US$ | % | US$ | % | |||||||||||||||||||

| Revenues | 1,173,769 | 100.0 | % | 2,526,762 | 100.0 | % | (1,352,993 | ) | (53.5 | )% | ||||||||||||||

| Cost of revenues | 620,542 | 52.9 | % | 1,220,577 | 48.3 | % | (600,035 | ) | (49.2 | )% | ||||||||||||||

| Gross margin | 47.1 | % | 51.7 | % | (4.6 | )% | ||||||||||||||||||

| General and administrative expenses | 1,190,614 | 101.4 | % | 1,069,623 | 42.3 | % | 120,991 | 11.3 | % | |||||||||||||||

| Selling expenses | 23,353 | 2.0 | % | 156 | 0.0 | % | 23,197 | 14869.9 | % | |||||||||||||||

| Total Costs and Expenses | 1,834,509 | 156.3 | % | 2,290,356 | 90.6 | % | (455,847 | ) | (19.9 | )% | ||||||||||||||

| For the nine months ended March 31, | ||||||||||||||||||||||||

| 2016 | 2015 | Change | ||||||||||||||||||||||

| US$ | % | US$ | % | US$ | % | |||||||||||||||||||

| Revenues | 5,469,938 | 100.0 | % | 8,225,267 | 100.0 | % | (2,755,329 | ) | (33.5 | )% | ||||||||||||||

| Cost of revenues | 2,568,345 | 47.0 | % | 4,304,591 | 52.3 | % | (1,736,246 | ) | (40.3 | )% | ||||||||||||||

| Gross margin | 53.0 | % | 47.7 | % | 5.3 | % | ||||||||||||||||||

| General and administrative expenses | 4,084,858 | 74.7 | % | 3,326,769 | 40.4 | % | 758,089 | 22.8 | % | |||||||||||||||

| Selling expenses | 67,478 | 1.2 | % | 66,877 | 0.8 | % | 601 | 0.9 | % | |||||||||||||||

| Total Costs and Expenses | 6,720,681 | 122.9 | % | 7,698,237 | 93.5 | % | (977,556 | ) | (12.7 | )% | ||||||||||||||

Costs of Revenues

The overall cost of revenues as a percentage of our revenues increased from 48.3% for three months ended March 31, 2015 to 52.9% for the three months ended March 31, 2016. Due to the decrease in our operation in the shipping agency service segment, we assigned more employees for developing new business, maintaining customer relationship and collecting outstanding accounts receivables. As a result, our cost of revenue increased for the quarter ended March 31, 2016 as compared to the same period of 2015.

The overall cost of revenues as a percentage of our revenues decreased from 52.3% for nine months ended March 31, 2015 to 47.0% for the nine months ended March 31, 2016. The decrease in total costs and expenses was mainly due to the decrease in cost of shipping agency and ship management services that were characterized as higher overhead costs and lower profit margin than our inland transportation service segment. For the nine months ended March 31, 2015, significant of our revenue was generated from our shipping agency segment and accordingly we incurred higher overhead costs in 2015. Presently, the inland transportation service segment was considered as our essential revenue source.

General and Administrative Expenses

Our general and administrative expenses consist primarily of salaries and benefits, business development expenses, office rent, office expenses, regulatory filing and listing fees, amortization of stock-based compensation expenses, legal, accounting and other professional service fees. The increase in our general and administrative expense for the three months ended March 31, 2016 as compared to the same period of 2015 was due mainly to increased stock-based compensation expense and higher business development expenses. The increase in our general and administrative expense for the nine months ended March 31, 2016 as compared to the same period of 2015 was due mainly to the higher allowance accrued for doubtful accounts, increased stock-based compensation expense, as well as the professional service fees incurred in connection with our securities registration activities. As a percentage of revenue, our general and administrative expenses increased from 42.3% to 101.4% of the revenues for the three months ended March 31, 2015 and 2016, respectively, and increased from 40.4% to 74.7% of the revenues for the nine months ended March 31, 2015 and 2016, respectively.

Selling Expenses

The selling expenses consist primarily of commissions for our operating staff to the ports at which we provide services.

As a percentage of revenue, our selling expenses increased from 0.0% to 2.0% for the three months ended March 31, 2015 and 2016, respectively, and increased from 0.8% to 1.2% for the nine months ended March 31, 2015 and 2016. During the three and nine months ended March 31, 2016, we put more efforts on business development while maintaining our current customer relationship. On the other hand, the labor costs were constantly rising. These factors led to our overall selling expense to increase as compared to the same periods of 2015.

Critical Accounting Policies

The Company prepares the unaudited condensed consolidated financial statements in accordance with accounting principles generally accepted in the United States of America (“US GAAP”). These accounting principles require us to make judgments, estimates and assumptions on the reported amounts of assets and liabilities at the end of each fiscal period, and the reported amounts of revenues and expenses during each fiscal period. We continually evaluate these judgments and estimates based on our own historical experience, knowledge and assessment of current business and other conditions, our expectations regarding the future based on available information and assumptions that we believe to be reasonable.

| 7 |

There have been no material changes during the three and nine months ended March 31, 2016 in our significant accounting policies to those previously disclosed in our annual report on Form 10-K for the fiscal year ended June 30, 2015.