2014 Q4 Earnings Release Exhibit 99.1

Exhibit 99.1

Noranda Reports Fourth Quarter Results,

Sequential and Year-over-Year Profit Improvement

Fourth Quarter 2014 Highlights

| |

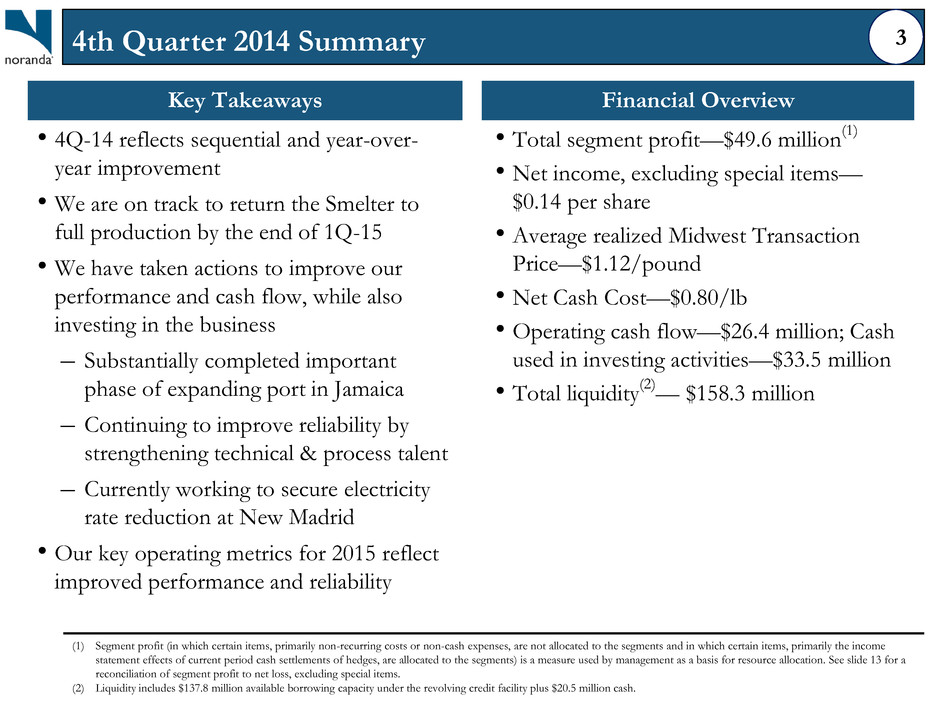

• | Excluding special items, earnings per share (“EPS”) was a $0.14 profit compared to a $0.15 loss in fourth quarter 2013; reported EPS was a $0.02 profit compared to a $0.26 loss in the fourth quarter 2013 |

| |

• | Total segment profit was $49.6 million compared to $36.6 million in third quarter 2014 and $20.8 million in fourth quarter 2013 |

| |

• | Average realized Midwest transaction price per pound shipped was $1.12 compared to $1.08 in third quarter 2014 and $0.90 in fourth quarter 2013 |

| |

• | Net Cash Cost was $0.80 per pound compared to $0.90 per pound in third quarter 2014; fourth quarter 2013 Net Cash Cost was $0.78 per pound |

| |

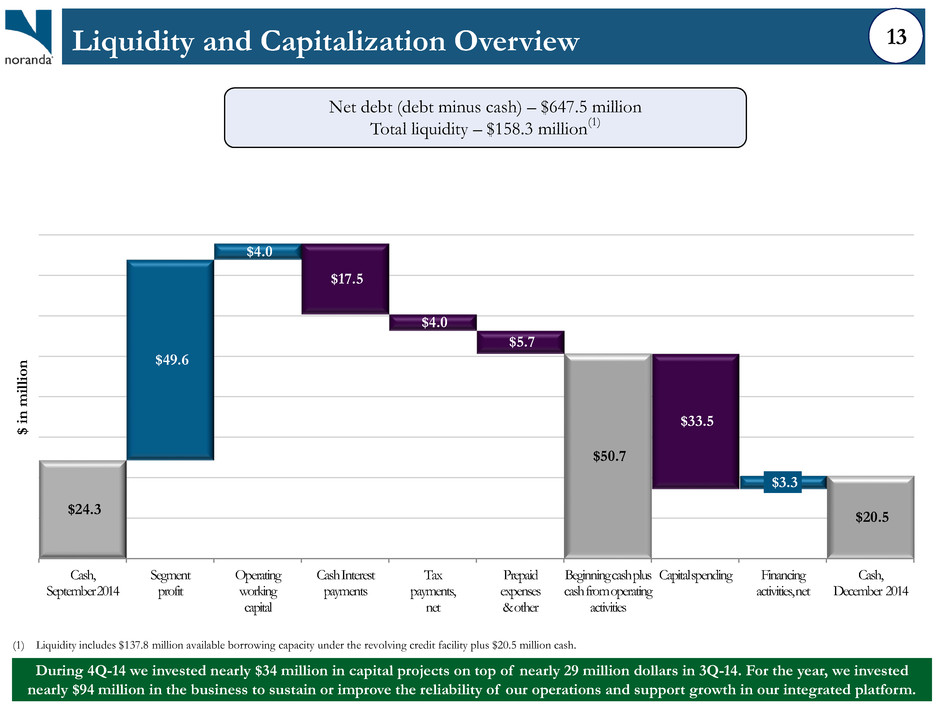

• | Cash and cash equivalents totaled $20.5 million and total available liquidity was $158.3 million as of December 31, 2014 |

Full Year 2014 Highlights

| |

• | Excluding special items, EPS was a $0.34 loss compared to a $0.68 loss in 2013; reported EPS was a $0.39 loss compared to a $0.70 loss in 2013 |

| |

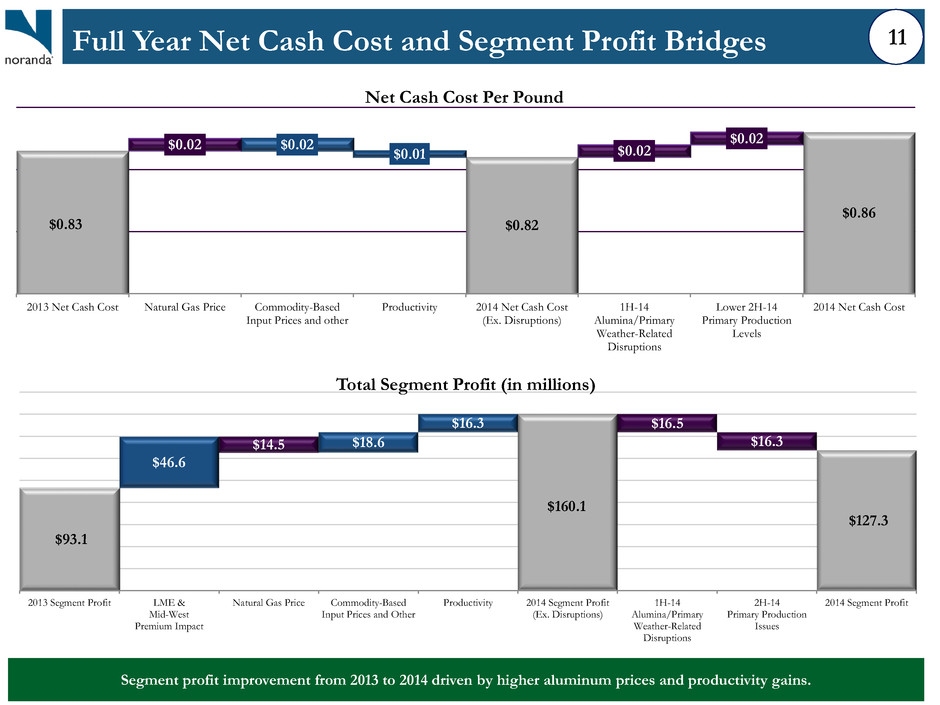

• | Total segment profit was $127.3 million compared to $93.1 million in 2013 |

| |

• | Average realized Midwest transaction price per pound shipped was $1.03 compared to $0.95 in 2013 |

| |

• | Net Cash Cost was $0.86 per pound compared to $0.83 per pound in 2013 |

Franklin, Tennessee – February 18, 2015 – Noranda Aluminum Holding Corporation (NYSE: NOR) today reported results for fourth quarter 2014.

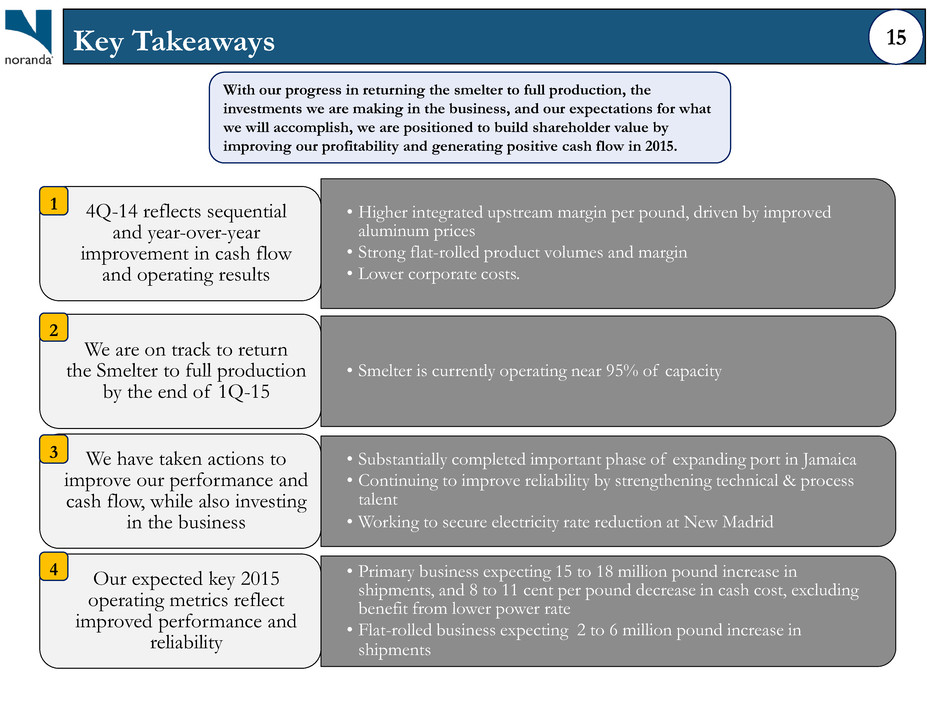

“Our fourth quarter 2014 performance reflects a sequential and year-over-year improvement in our operating results,” said Layle K. Smith, Noranda’s President and Chief Executive Officer. “We achieved this improvement despite the negative impact of an unusually high concentration of reduction cell failures which began in mid-third quarter 2014 at our New Madrid smelter. We expect the smelter to be back to full production by the end of March 2015, and that facility is currently running at nearly 95% of capacity.”

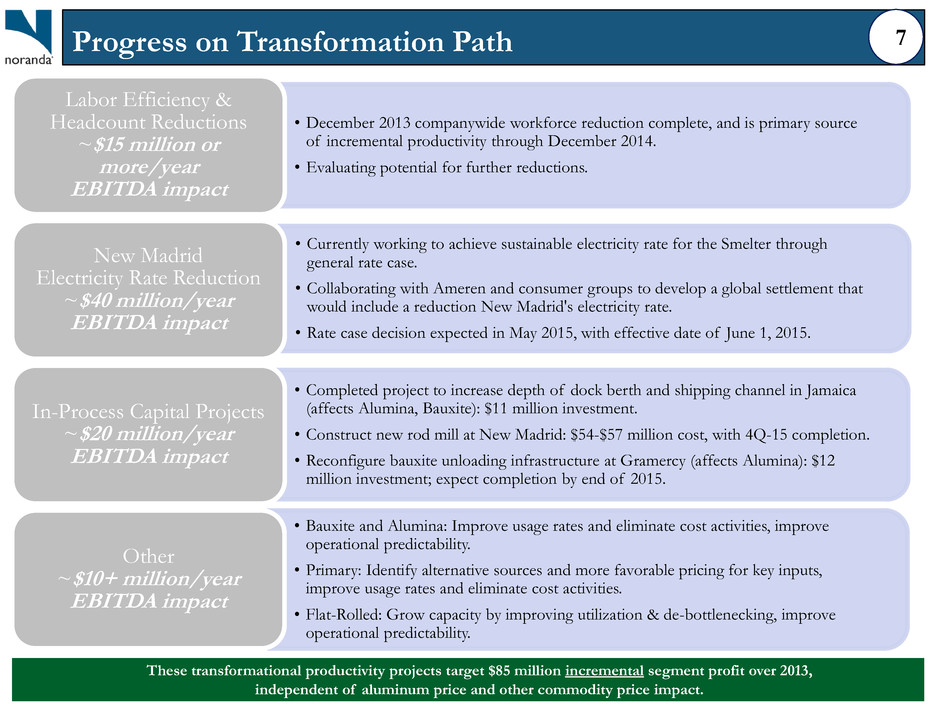

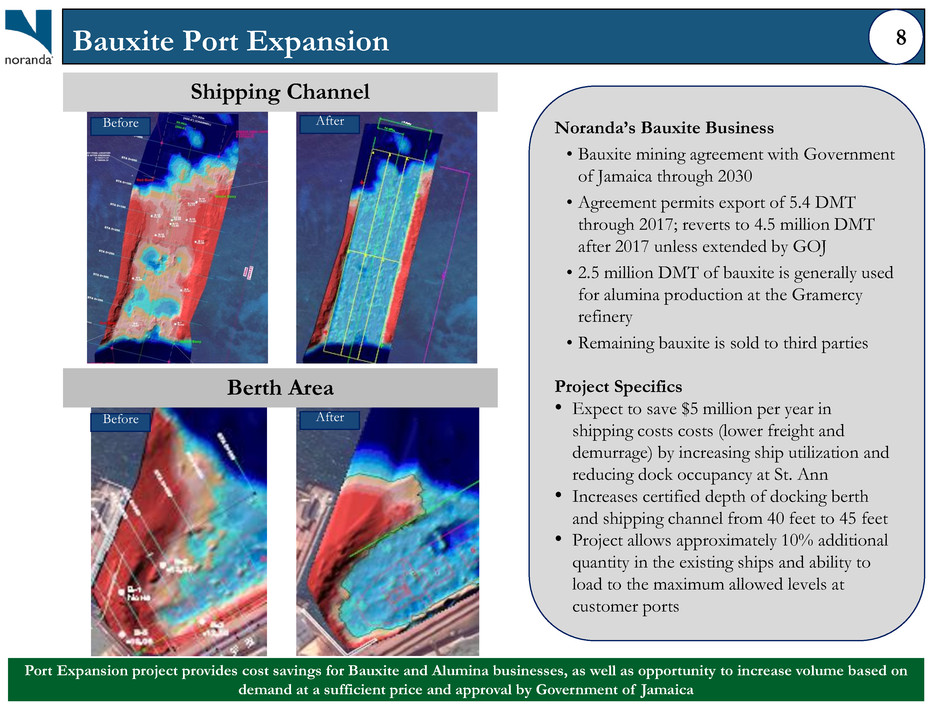

“In addition to working aggressively to return the smelter to full production, we have taken actions to improve our cash flow generation while making necessary investments in the business. We have substantially completed an important phase of expanding our port in Jamaica. We continue to improve the reliability of our operations by strengthening the technical and process talent of our workforce. We are collaborating with our power provider and consumer groups to develop a global settlement that would include a reduction of the electricity rate at New Madrid. With our progress in returning the smelter to full production, the investments we are making in the business, and our expectations for what we will accomplish, we are positioned to build shareholder value by improving our profitability and generating positive cash flow in 2015.”

Fourth Quarter 2014 Results

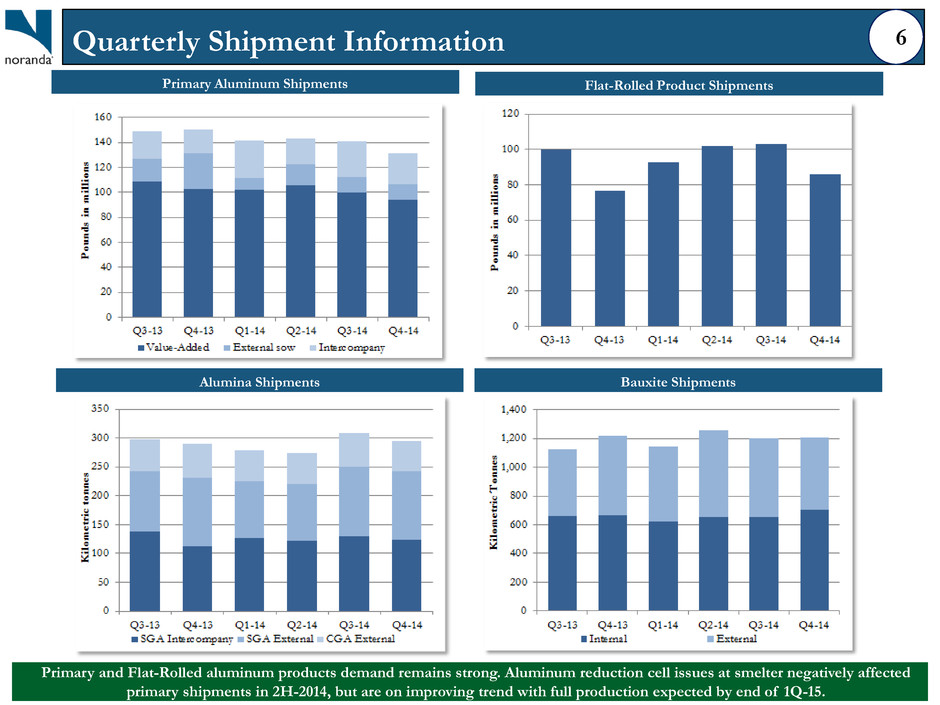

Sales for fourth quarter 2014 were $336.2 million compared to $361.4 million in third quarter 2014 and $313.2 million in fourth quarter 2013.

| |

• | Sequentially (comparing fourth quarter 2014 to third quarter 2014) sales decreased $25.2 million, or 7.0%, primarily driven by seasonal customer destocking in the Flat-Rolled Products segment. The positive effects to sales from higher realized Midwest Transaction Prices were largely offset by the effects of smelter production levels which, as expected, were sequentially lower. The Company expects the smelter to return to full production by the end of first quarter 2015. |

| |

• | Year-over-year (comparing fourth quarter 2014 to fourth quarter 2013) sales increased $23.0 million, or 7.3%. Higher realized LME aluminum prices ($0.10 per pound increase) and Midwest premiums ($0.13 per pound increase) increased revenues by $39.6 million. Higher Flat-Rolled products volumes contributed $13.2 million to the increase in sales, as fourth quarter customer destocking was less severe than in 2013; also there were no significant rolling mill production outages in 2014 where fourth quarter 2013 flat-rolled production was negatively affected by a planned mill turn-around at the largest rolling mill. These improvements were offset by lower volumes in the Primary Aluminum segment because of the lower production levels. |

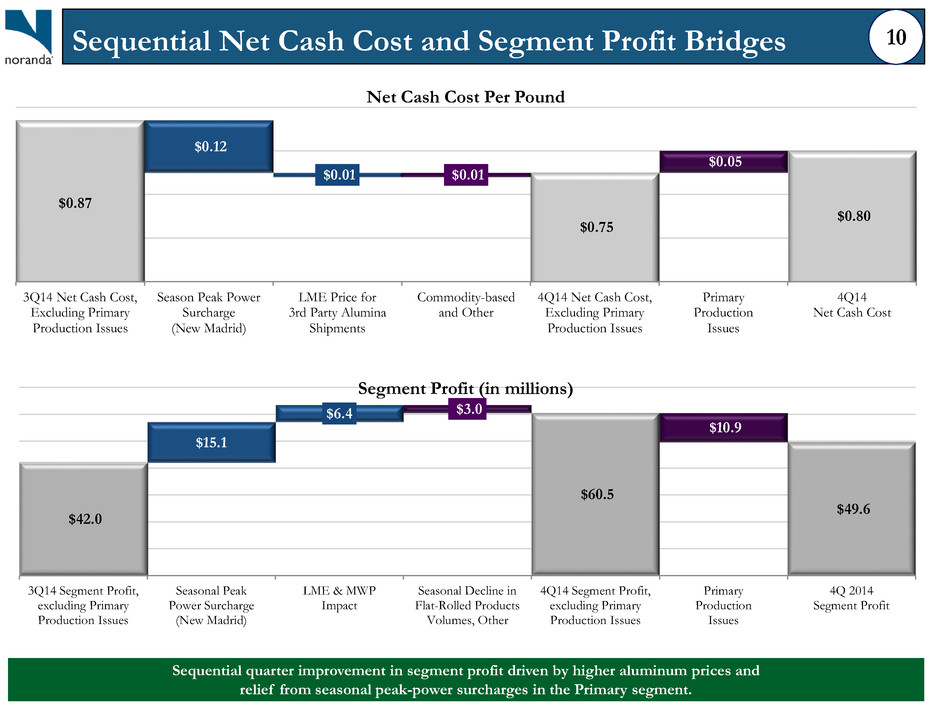

Total fourth quarter 2014 segment profit was $49.6 million, compared to $36.6 million in third quarter 2014 and $20.8 million in fourth quarter 2013.

| |

• | Sequentially, segment profit increased $13.0 million. Results improved primarily due to seasonal reduction in Primary Aluminum segments electricity costs ($15.1 million) and higher LME aluminum prices and Midwest premiums ($6.4 million), partially offset by the volume decreases in the Flat-Rolled Products and Primary segments. |

| |

• | Year-over-year, segment profit increased $28.8 million largely due to a $39.6 million impact from higher LME aluminum prices and Midwest premiums. This improvement was partially offset by the $10.9 million negative impact from production issues in the Primary Aluminum segment, which caused lower volumes and higher electricity and material usage costs. |

Reported fourth quarter 2014 results were net income of $1.7 million (income of $0.02 per diluted share), compared to a $3.9 million third quarter 2014 net loss ($0.06 loss per diluted share) and a $17.7 million fourth quarter 2013 net loss ($0.26 loss per diluted share).

Excluding special items, Noranda’s fourth quarter 2014 results were a net income of $9.6 million (income of $0.14 per diluted share), versus a net loss of $2.8 million ($0.04 loss per diluted share) in third quarter 2014 and a net loss of $10.2 million ($0.15 loss per diluted share) in fourth quarter 2013. The $12.4 million sequential increase in net income (excluding special items) primarily reflects a $13.0 million ($12.0 million after-tax) improvement in segment profit. The $19.8 million year-over-year increase in net income (excluding special items) reflects a $28.8 million improvement in segment profit ($26.7 million after-tax), partially offset by a $5.4 million change in last in first out inventory valuation.

2014 Full Year Results

Sales in the year ended December 31, 2014 were $1.355 billion compared to $1.344 billion in the year ended December 31, 2013, an increase of 0.9%. Of the $11.6 million increase in sales, higher LME aluminum prices and Midwest premiums increased sales $42.5 million. Increased shipment volumes in the Bauxite, Alumina and Flat-Rolled Products segments increased sales $28.8 million. Offsetting these improvements was a 10% decrease in external Primary Aluminum shipments which had a $56.0 million unfavorable impact, driven by lower production levels in the second half of 2014.

Total segment profit was $127.3 million and $93.1 million for the years ended December 31, 2014 and December 31, 2013 respectively. Improvements in realized aluminum prices, driven largely by higher Midwest Premiums in 2014, contributed $46.6 million to the year-over-year increase in segment profit. Lower commodity-based input prices (other than natural gas), and productivity gains contributed a total of $34.9 million. These improvements were partially offset by higher natural gas prices and the $32.8 million impact of certain 2014 operating disruptions in the Alumina and Primary Aluminum segments. These operating disruptions arose from extreme weather-related conditions in the first half of 2014 ($16.5 million) and lower production volumes in the Primary business during the second half of 2014 ($16.3 million.)

Segment Information

|

| | | | | | | | | |

| Three months ended |

| December 31,

2014 | September 30,

2014 | December 31,

2013 |

Key Primary Aluminum segment metrics: | | | |

Average realized Midwest transaction price (per pound) | $ | 1.12 |

| $ | 1.08 |

| $ | 0.90 |

|

Net Cash Cost (per pound shipped) | $ | 0.80 |

| $ | 0.90 |

| $ | 0.78 |

|

Total primary aluminum shipments (pounds, in millions) | 131.4 |

| 140.9 |

| 150.5 |

|

Segment profit (loss) (in millions): | | | |

Bauxite | $ | (6.3 | ) | $ | (1.5 | ) | $ | 1.0 |

|

Alumina | 17.1 |

| 6.5 |

| 2.8 |

|

Primary Aluminum | 31.7 |

| 20.4 |

| 14.9 |

|

Eliminations | (0.2 | ) | (0.4 | ) | 0.5 |

|

Total integrated upstream business segment profit | 42.3 |

| 25.0 |

| 19.2 |

|

Flat-Rolled Products | 12.3 |

| 17.6 |

| 8.4 |

|

Corporate | (5.0 | ) | (6.0 | ) | (6.8 | ) |

Total segment profit | $ | 49.6 |

| $ | 36.6 |

| $ | 20.8 |

|

Bauxite. The Bauxite segment reported a $6.3 million segment loss in fourth quarter 2014 compared to a $1.5 million loss in third quarter 2014 and a profit of $1.0 million in fourth quarter 2013.

| |

• | Sequentially, Bauxite segment results reflect an $8.4 million negative impact of adjustments to the internal transfer pricing for bauxite sold to the Alumina segment offset by a reduction to the production levy obligation to the Government of Jamaica (“GOJ”). |

| |

• | Year-over year the $7.3 million unfavorable swing results from the transfer price discussed above, lower external selling prices and $1.0 million in higher demurrage fees. These changes are partially offset by lower fuel costs, shorter mining routes and a reduction to the production levy obligation to the GOJ. |

Alumina. The Alumina segment reported a $17.1 million segment profit in fourth quarter 2014 compared to segment profit of $6.5 million in third quarter 2014 and segment profit of $2.8 million in fourth quarter 2013.

| |

• | Sequentially, the $10.6 million improvement primarily results from the transfer price adjustment discussed above, lower maintenance costs from completion of third quarter projects and favorable alumina prices. Partially offsetting these improvements is the fact that third quarter results benefited from a favorable inventory adjustment that occurred in the third quarter of 2014 but did not repeat in the fourth quarter. |

| |

• | Year-over-year, the $14.3 million increase in Alumina segment profit predominantly reflects the higher retro-price adjustment from the Bauxite segment ($8.7 million) and benefit from higher LME-linked alumina selling prices ($4.1 million), offset by higher natural gas prices ($1.8 million) and the timing of maintenance projects. |

Primary Aluminum. Segment profit in fourth quarter 2014 was $31.7 million, compared to $20.4 million in third quarter 2014 and a segment profit of $14.9 million in fourth quarter 2013.

| |

• | Sequentially, Primary Aluminum segment profit increased by $11.3 million. Primary Aluminum benefited from sequential non-peak season electricity pricing ($15.1 million) and higher realized Midwest Transaction Prices ($5.4 million) which were partially offset by higher electricity and material usage costs due to the impact of lower production levels. |

| |

• | Year-over-year, Primary Aluminum segment profit increased by $16.8 million. This improvement was driven largely by the higher realized aluminum prices ($28.6 million, net) partially offset by the effects of lower second half 2014 production levels. |

Net Integrated Aluminum Cash Cost. Net Cash Cost in fourth quarter 2014 was $0.80 per pound, compared to $0.90 per pound in third quarter 2014 and $0.78 per pound in fourth quarter 2013.

| |

• | Sequentially, Net Cash Cost decreased by $0.10 per pound, with the predominant factors being the switch out of seasonal peak power rates in the Primary Aluminum segment, which had a favorable impact on Net Cash Cost by $0.12 per pound. |

| |

• | Year-over-year, Net Cash Cost increased $0.02 per pound resulting from temporary operational production issues in the Primary Aluminum segment partially offset by improved Alumina prices and savings from the Company’s CORE program combined with lower key production input prices. |

Flat-Rolled Products. Segment profit in fourth quarter 2014 was $12.3 million, compared to $17.6 million in third quarter 2014 and $8.4 million in fourth quarter 2013.

| |

• | Sequentially, the $5.3 million decrease in Flat-Rolled Products segment profit was due primarily to lower seasonal volume ($3.2 million) and unfavorable metal timing. |

| |

• | Year-over-year, Flat-Rolled Products segment profit increased $3.9 million due primarily to a lower fourth quarter 2014 seasonal decline in customer demand than that experienced in 2013. CORE productivity savings, and favorable metal timing also contributed to year-over-year improvement in fourth quarter Flat-Rolled Products results. |

Corporate. Corporate expenses in fourth quarter 2014 were $5.0 million, compared to $6.0 million in third quarter 2014 and $6.8 million in fourth quarter 2013. Sequentially, corporate expenses decreased primarily due to lower employee benefits costs. Year-over-year, lower corporate costs primarily reflect labor savings and lower professional fees.

Liquidity and Capital Resources

At December 31, 2014, the Company had $20.5 million of cash and cash equivalents. As of December 31, 2014, available borrowing capacity under the Company’s asset-based revolving credit facility was $137.8 million, which is net of $39.8 million in outstanding letters of credit. The Company’s total available liquidity from December 31, 2014 was $158.3 million.

In fourth quarter 2014, the Company invested $19.3 million in the new rod mill being constructed at New Madrid which is expected to be completed near the end of 2015. The Company also invested approximately $3.5 million in the expansion of its port facility in Jamaica, a project that was substantially completed in February 2015.

The table below summarizes the key drivers behind changes in the Company’s cash positions for each period:

|

| | | | | | | | | |

| Three months ended |

(in millions) | December 31,

2014 | September 30,

2014 | December 31,

2013 |

Segment profit | $ | 49.6 |

| $ | 36.6 |

| $ | 20.8 |

|

Prepaid expenses and other | (5.7 | ) | (4.6 | ) | (3.9 | ) |

Interest paid | (17.5 | ) | (7.7 | ) | (21.5 | ) |

Taxes (paid) refunded | (4.0 | ) | (5.7 | ) | 2.4 |

|

Operating working capital | 4.0 |

| 2.8 |

| 25.6 |

|

Cash provided by operating activities | 26.4 |

| 21.4 |

| 23.4 |

|

Cash used in investing activities | (33.5 | ) | (28.8 | ) | (17.0 | ) |

Cash provided by (used in) financing activities | 3.3 |

| (1.2 | ) | 9.1 |

|

Change in cash and cash equivalents | $ | (3.8 | ) | $ | (8.6 | ) | $ | 15.5 |

|

NORANDA ALUMINUM HOLDING CORPORATION

CONSOLIDATED STATEMENTS OF OPERATIONS

(dollars in millions, except per share data and where noted)

(unaudited)

|

| | | | | | | | | | | | |

| Three months ended December 31, | Twelve months ended December 31, |

| 2014 | 2013 | 2014 | 2013 |

Sales | $ | 336.2 |

| $ | 313.2 |

| $ | 1,355.1 |

| $ | 1,343.5 |

|

Operating costs and expenses: | | | | |

Cost of sales | 298.9 |

| 298.8 |

| 1,261.8 |

| 1,271.9 |

|

Selling, general and administrative expenses | 18.1 |

| 27.3 |

| 76.2 |

| 97.1 |

|

Total operating costs and expenses | 317.0 |

| 326.1 |

| 1,338.0 |

| 1,369.0 |

|

Operating income (loss) | 19.2 |

| (12.9 | ) | 17.1 |

| (25.5 | ) |

Other (income) expense: | | | | |

Interest expense, net | 12.7 |

| 12.6 |

| 50.4 |

| 47.5 |

|

(Gain) loss on hedging activities, net | (2.4 | ) | 2.3 |

| (4.6 | ) | 2.3 |

|

Debt refinancing expense | — |

| — |

| — |

| 2.5 |

|

Total other expense, net | 10.3 |

| 14.9 |

| 45.8 |

| 52.3 |

|

Income (loss) before income taxes | 8.9 |

| (27.8 | ) | (28.7 | ) | (77.8 | ) |

Income tax expense (benefit) | 7.2 |

| (10.1 | ) | (2.1 | ) | (30.2 | ) |

Net income (loss) | $ | 1.7 |

| $ | (17.7 | ) | $ | (26.6 | ) | $ | (47.6 | ) |

Net income (loss) per common share: | | | | |

Basic | $ | 0.02 |

| $ | (0.26 | ) | $ | (0.39 | ) | $ | (0.70 | ) |

Diluted | $ | 0.02 |

| $ | (0.26 | ) | $ | (0.39 | ) | $ | (0.70 | ) |

Weighted-average common shares outstanding: |

|

|

|

| | |

Basic (shares, in millions) | 68.87 |

| 68.05 |

| 68.68 |

| 67.94 |

|

Diluted (shares, in millions) | 70.08 |

| 68.05 |

| 68.68 |

| 67.94 |

|

Cash dividends declared per common share | $ | 0.01 |

| $ | 0.01 |

| $ | 0.04 |

| $ | 0.13 |

|

External sales by segment: | | | | |

Bauxite | $ | 10.9 |

| $ | 13.0 |

| $ | 47.4 |

| $ | 46.8 |

|

Alumina | 55.9 |

| 53.7 |

| 206.3 |

| 196.6 |

|

Primary Aluminum | 133.2 |

| 135.2 |

| 524.6 |

| 543.8 |

|

Flat-Rolled Products | 136.2 |

| 111.3 |

| 576.8 |

| 556.3 |

|

Total | $ | 336.2 |

| $ | 313.2 |

| $ | 1,355.1 |

| $ | 1,343.5 |

|

Segment profit (loss): | | | | |

Bauxite | $ | (6.3 | ) | $ | 1.0 |

| $ | (6.6 | ) | $ | 8.2 |

|

Alumina | 17.1 |

| 2.8 |

| 8.5 |

| 13.6 |

|

Primary Aluminum | 31.7 |

| 14.9 |

| 95.6 |

| 51.9 |

|

Flat-Rolled Products | 12.3 |

| 8.4 |

| 55.9 |

| 50.0 |

|

Corporate | (5.0 | ) | (6.8 | ) | (25.0 | ) | (31.1 | ) |

Eliminations | (0.2 | ) | 0.5 |

| (1.1 | ) | 0.5 |

|

Total | $ | 49.6 |

| $ | 20.8 |

| $ | 127.3 |

| $ | 93.1 |

|

Financial and other data: | | | | |

Average realized Midwest transaction price (per pound) | $ | 1.12 |

| $ | 0.90 |

| $ | 1.03 |

| $ | 0.95 |

|

Net Cash Cost (per pound shipped) | $ | 0.80 |

| $ | 0.78 |

| $ | 0.86 |

| $ | 0.83 |

|

Shipments: | | | | |

External shipments: | | | | |

Bauxite (kMts) | 501.6 |

| 554.7 |

| 2,166.3 |

| 1,983.8 |

|

Alumina (kMts) | 170.6 |

| 177.0 |

| 653.1 |

| 625.0 |

|

Primary Aluminum (pounds, in millions) | 106.4 |

| 131.5 |

| 452.8 |

| 504.8 |

|

Flat-Rolled Products (pounds, in millions) | 85.7 |

| 76.6 |

| 383.0 |

| 372.5 |

|

Intersegment shipments: | | | | |

Bauxite (kMts) | 707.4 |

| 666.8 |

| 2,646.2 |

| 2,723.6 |

|

Alumina (kMts) | 124.1 |

| 112.7 |

| 502.8 |

| 535.8 |

|

Primary Aluminum (pounds, in millions) | 25.0 |

| 19.0 |

| 104.6 |

| 84.4 |

|

NORANDA ALUMINUM HOLDING CORPORATION

CONSOLIDATED BALANCE SHEETS

(in millions, except par value)

(unaudited)

|

| | | | |

| December 31,

2014 | December 31,

2013 |

| $ | $ |

ASSETS | | |

Current assets: | | |

Cash and cash equivalents | 20.5 |

| 79.4 |

|

Accounts receivable, net | 102.5 |

| 86.7 |

|

Inventories, net | 196.7 |

| 178.7 |

|

Other current assets | 27.4 |

| 19.5 |

|

Total current assets | 347.1 |

| 364.3 |

|

Property, plant and equipment, net | 695.0 |

| 677.2 |

|

Goodwill | 137.6 |

| 137.6 |

|

Other intangible assets, net | 49.3 |

| 55.2 |

|

Other assets | 89.1 |

| 87.8 |

|

Total assets | 1,318.1 |

| 1,322.1 |

|

LIABILITIES AND EQUITY | | |

Current liabilities: | | |

Accounts payable | 122.6 |

| 89.2 |

|

Accrued liabilities | 59.1 |

| 65.0 |

|

Deferred tax liabilities | 11.7 |

| 2.1 |

|

Current portion of long-term debt | 11.6 |

| 4.9 |

|

Total current liabilities | 205.0 |

| 161.2 |

|

Long-term debt, net | 656.4 |

| 654.2 |

|

Pension and other post-retirement benefit (“OPEB”) liabilities | 195.4 |

| 115.8 |

|

Other long-term liabilities | 45.9 |

| 50.0 |

|

Long-term deferred tax liabilities | 143.3 |

| 193.6 |

|

Shareholders’ equity: | | |

Preferred stock (25.0 shares authorized, $0.01 par value; no shares issued and outstanding at December 31, 2014 and December 31, 2013) | — |

| — |

|

Common stock (200.0 shares authorized; $0.01 par value; 68.9 shares issued and outstanding at December 31, 2014; 68.1 shares issued and outstanding at December 31, 2013) | 0.7 |

| 0.7 |

|

Capital in excess of par value | 243.6 |

| 239.7 |

|

Accumulated deficit | (68.2 | ) | (38.7 | ) |

Accumulated other comprehensive loss | (110.0 | ) | (60.4 | ) |

Total shareholders’ equity | 66.1 |

| 141.3 |

|

Non-controlling interest | 6.0 |

| 6.0 |

|

Total equity | 72.1 |

| 147.3 |

|

Total liabilities and equity | 1,318.1 |

| 1,322.1 |

|

NORANDA ALUMINUM HOLDING CORPORATION

CONSOLIDATED STATEMENTS OF CASH FLOWS

(in millions)

(unaudited)

|

| | | | | | | | |

| Three months ended December 31, | Twelve months ended December 31, |

| 2014 | 2013 | 2014 | 2013 |

| $ | $ | $ | $ |

OPERATING ACTIVITIES | | | | |

Net income (loss) | 1.7 |

| (17.7 | ) | (26.6 | ) | (47.6 | ) |

Adjustments to reconcile net income (loss) to cash provided by operating activities: | |

|

| | |

Depreciation and amortization | 23.8 |

| 25.1 |

| 89.5 |

| 96.0 |

|

Non-cash interest expense | 0.7 |

| 0.6 |

| 2.7 |

| 2.6 |

|

Last in, first out and lower of cost or market inventory adjustments | 1.7 |

| (3.7 | ) | 4.9 |

| (2.6 | ) |

Asset impairment | — |

| 3.2 |

| — |

| 5.9 |

|

(Gain) loss on disposal of assets | 0.2 |

| — |

| 0.4 |

| (0.5 | ) |

(Gain) loss on hedging activities, excluding cash settlements | 0.1 |

| (0.4 | ) | (0.7 | ) | (6.1 | ) |

Debt refinancing expense | — |

| — |

| — |

| 2.5 |

|

Deferred income taxes | 18.0 |

| (9.5 | ) | (11.7 | ) | (32.6 | ) |

Share-based compensation expense | 1.0 |

| 1.4 |

| 3.4 |

| 4.8 |

|

Changes in other assets | (4.6 | ) | 3.5 |

| (10.3 | ) | 1.0 |

|

Changes in pension, other post-retirement and other long-term liabilities | 2.0 |

| (0.6 | ) | (2.4 | ) | 7.2 |

|

Changes in current operating assets and liabilities: | | | | |

Accounts receivable, net | 24.3 |

| 19.1 |

| (15.8 | ) | 19.9 |

|

Inventories, net | (1.3 | ) | 18.2 |

| (25.0 | ) | 19.5 |

|

Taxes receivable and taxes payable | (14.9 | ) | 1.8 |

| (1.4 | ) | (1.0 | ) |

Other current assets | 3.9 |

| 2.6 |

| 0.7 |

| 12.3 |

|

Accounts payable | (19.0 | ) | (11.7 | ) | 28.2 |

| (19.3 | ) |

Accrued liabilities | (11.2 | ) | (8.5 | ) | (5.3 | ) | 2.2 |

|

Cash provided by operating activities | 26.4 |

| 23.4 |

| 30.6 |

| 64.2 |

|

INVESTING ACTIVITIES | | | | |

Capital expenditures | (33.6 | ) | (17.0 | ) | (93.5 | ) | (72.7 | ) |

Proceeds from sale of property, plant and equipment | 0.1 |

| — |

| 0.3 |

| 0.9 |

|

Cash used in investing activities | (33.5 | ) | (17.0 | ) | (93.2 | ) | (71.8 | ) |

FINANCING ACTIVITIES | | | | |

Shares tendered for taxes, net of proceeds from issuance of common shares for share-based payment arrangements | (0.1 | ) | (0.1 | ) | (1.2 | ) | (0.2 | ) |

Dividends paid to shareholders | (0.6 | ) | (0.6 | ) | (2.7 | ) | (8.8 | ) |

Repayments of long-term debt | (1.3 | ) | (1.2 | ) | (4.9 | ) | (280.0 | ) |

Borrowings on revolving credit facility | 87.0 |

| — |

| 173.0 |

| 11.0 |

|

Repayments on revolving credit facility | (87.0 | ) | — |

| (173.0 | ) | (11.0 | ) |

Borrowings on long-term debt, net | 5.3 |

| 11.0 |

| 12.5 |

| 342.8 |

|

Payments of financing costs | — |

| — |

| — |

| (2.9 | ) |

Cash provided by financing activities | 3.3 |

| 9.1 |

| 3.7 |

| 50.9 |

|

Change in cash and cash equivalents | (3.8 | ) | 15.5 |

| (58.9 | ) | 43.3 |

|

Cash and cash equivalents, beginning of period | 24.3 |

| 63.9 |

| 79.4 |

| 36.1 |

|

Cash and cash equivalents, end of period | 20.5 |

| 79.4 |

| 20.5 |

| 79.4 |

|

NORANDA ALUMINUM HOLDING CORPORATION

SEGMENT RESULTS

(in millions)

(unaudited)

|

| | | | | | | | | | | | | | |

| Three months ended December 31, 2014 |

| Bauxite | Alumina | Primary Aluminum | Flat-Rolled Products | Corporate | Eliminations | Consolidated |

| $ | $ | $ | $ | $ | $ | $ |

Sales: | | | | | | | |

External customers | 10.9 |

| 55.9 |

| 133.2 |

| 136.2 |

| — |

| — |

| 336.2 |

|

Intersegment | 11.9 |

| 34.8 |

| 27.6 |

| — |

| — |

| (74.3 | ) | — |

|

Total sales | 22.8 |

| 90.7 |

| 160.8 |

| 136.2 |

| — |

| (74.3 | ) | 336.2 |

|

| | | | | | | |

Capital expenditures | 3.9 |

| 4.1 |

| 25.3 |

| 0.2 |

| 0.1 |

| — |

| 33.6 |

|

Reconciliation of segment profit (loss) to operating income (loss): |

Segment profit (loss) | (6.3 | ) | 17.1 |

| 31.7 |

| 12.3 |

| (5.0 | ) | (0.2 | ) | 49.6 |

|

Depreciation and amortization | (3.4 | ) | (6.0 | ) | (9.6 | ) | (4.4 | ) | (0.4 | ) | — |

| (23.8 | ) |

Last in, first out and lower of cost or market inventory adjustments | — |

| — |

| 1.3 |

| (3.0 | ) | — |

| — |

| (1.7 | ) |

Loss on disposal of assets | — |

| — |

| — |

| (0.2 | ) | — |

| — |

| (0.2 | ) |

Non-cash pension, accretion and stock compensation | — |

| (0.2 | ) | (0.7 | ) | (0.5 | ) | (1.1 | ) | — |

| (2.5 | ) |

Restructuring, relocation and severance | — |

| (0.1 | ) | (0.2 | ) | (0.6 | ) | (0.1 | ) | — |

| (1.0 | ) |

Consulting fees | (0.3 | ) | — |

| — |

| — |

| (0.1 | ) | — |

| (0.4 | ) |

Cash settlements on hedging transactions | — |

| — |

| (0.2 | ) | (1.7 | ) | — |

| — |

| (1.9 | ) |

Other, net | — |

| (0.2 | ) | — |

| — |

| 1.0 |

| 0.3 |

| 1.1 |

|

Operating income (loss) | (10.0 | ) | 10.6 |

| 22.3 |

| 1.9 |

| (5.7 | ) | 0.1 |

| 19.2 |

|

Interest expense, net | 12.7 |

|

Gain on hedging activities, net | (2.4 | ) |

Total other expense, net | 10.3 |

|

Income before taxes | 8.9 |

|

NORANDA ALUMINUM HOLDING CORPORATION

SEGMENT RESULTS

(in millions)

(unaudited)

|

| | | | | | | | | | | | | | |

| Three months ended December 31, 2013 |

| Bauxite | Alumina | Primary Aluminum | Flat-Rolled Products | Corporate | Eliminations | Consolidated |

| $ | $ | $ | $ | $ | $ | $ |

Sales: | | | | | | | |

External customers | 13.0 |

| 53.7 |

| 135.2 |

| 111.3 |

| — |

| — |

| 313.2 |

|

Intersegment | 19.5 |

| 28.7 |

| 16.9 |

| — |

| — |

| (65.1 | ) | — |

|

Total sales | 32.5 |

| 82.4 |

| 152.1 |

| 111.3 |

| — |

| (65.1 | ) | 313.2 |

|

| | | | | | | |

Capital expenditures | 2.1 |

| 2.9 |

| 8.0 |

| 3.5 |

| 0.5 |

| — |

| 17.0 |

|

Reconciliation of segment profit (loss) to operating income (loss): |

Segment profit (loss) | 1.0 |

| 2.8 |

| 14.9 |

| 8.4 |

| (6.8 | ) | 0.5 |

| 20.8 |

|

Depreciation and amortization | (1.6 | ) | (6.1 | ) | (10.3 | ) | (6.9 | ) | (0.2 | ) | — |

| (25.1 | ) |

Last in, first out and lower of cost or market inventory adjustments | — |

| — |

| 1.3 |

| 2.0 |

| — |

| 0.4 |

| 3.7 |

|

Asset impairment | — |

| — |

| — |

| (3.2 | ) | — |

| — |

| (3.2 | ) |

Non-cash pension, accretion and stock compensation | — |

| (0.2 | ) | (1.8 | ) | (2.1 | ) | (1.7 | ) | — |

| (5.8 | ) |

Restructuring, relocation and severance | (0.7 | ) | (0.7 | ) | (1.9 | ) | (1.5 | ) | (1.2 | ) | — |

| (6.0 | ) |

Consulting fees | — |

| — |

| — |

| — |

| (0.1 | ) | — |

| (0.1 | ) |

Cash settlements on hedging transactions | — |

| — |

| 0.4 |

| 2.1 |

| — |

| — |

| 2.5 |

|

Other, net | — |

| (0.3 | ) | — |

| (0.1 | ) | 1.1 |

| (0.4 | ) | 0.3 |

|

Operating income (loss) | (1.3 | ) | (4.5 | ) | 2.6 |

| (1.3 | ) | (8.9 | ) | 0.5 |

| (12.9 | ) |

Interest expense, net | 12.6 |

|

Loss on hedging activities, net | 2.3 |

|

Total other expense, net | 14.9 |

|

Loss before income taxes | (27.8 | ) |

NORANDA ALUMINUM HOLDING CORPORATION

SEGMENT RESULTS

(in millions)

(unaudited)

|

| | | | | | | | | | | | | | |

| Twelve months ended December 31, 2014 |

| Bauxite | Alumina | Primary Aluminum | Flat-Rolled Products | Corporate | Eliminations | Consolidated |

| $ | $ | $ | $ | $ | $ | $ |

Sales: | | | | | | | |

External customers | 47.4 |

| 206.3 |

| 524.6 |

| 576.8 |

| — |

| — |

| 1,355.1 |

|

Intersegment | 66.3 |

| 132.1 |

| 107.8 |

| — |

| — |

| (306.2 | ) | — |

|

Total sales | 113.7 |

| 338.4 |

| 632.4 |

| 576.8 |

| — |

| (306.2 | ) | 1,355.1 |

|

| | | | | | | |

Capital expenditures | 11.3 |

| 13.1 |

| 58.3 |

| 9.7 |

| 1.1 |

| — |

| 93.5 |

|

Reconciliation of segment profit (loss) to operating income (loss): |

Segment profit (loss) | (6.6 | ) | 8.5 |

| 95.6 |

| 55.9 |

| (25.0 | ) | (1.1 | ) | 127.3 |

|

Depreciation and amortization | (10.8 | ) | (21.2 | ) | (38.4 | ) | (18.2 | ) | (0.9 | ) | — |

| (89.5 | ) |

Last in, first out and lower of cost or market inventory adjustments | — |

| — |

| (1.8 | ) | (2.9 | ) | — |

| (0.2 | ) | (4.9 | ) |

Gain (loss) on disposal of assets | — |

| — |

| 0.1 |

| (0.5 | ) | — |

| — |

| (0.4 | ) |

Non-cash pension, accretion and stock compensation | (0.1 | ) | (0.8 | ) | (3.0 | ) | (1.8 | ) | (3.9 | ) | — |

| (9.6 | ) |

Restructuring, relocation and severance | — |

| (0.1 | ) | (0.9 | ) | (0.3 | ) | — |

| — |

| (1.3 | ) |

Consulting fees | (0.3 | ) | — |

| — |

| — |

| (0.4 | ) | — |

| (0.7 | ) |

Cash settlements on hedging transactions | — |

| — |

| (0.6 | ) | (4.3 | ) | — |

| — |

| (4.9 | ) |

Other, net | — |

| (0.6 | ) | — |

| (0.1 | ) | 0.9 |

| 0.9 |

| 1.1 |

|

Operating income (loss) | (17.8 | ) | (14.2 | ) | 51.0 |

| 27.8 |

| (29.3 | ) | (0.4 | ) | 17.1 |

|

Interest expense, net | 50.4 |

|

Gain on hedging activities, net | (4.6 | ) |

Total other expense, net | 45.8 |

|

Loss before income taxes | (28.7 | ) |

NORANDA ALUMINUM HOLDING CORPORATION

SEGMENT RESULTS

(in millions)

(unaudited)

|

| | | | | | | | | | | | | | |

| Twelve months ended December 31, 2013 |

| Bauxite | Alumina | Primary Aluminum | Flat-Rolled Products | Corporate | Eliminations | Consolidated |

| $ | $ | $ | $ | $ | $ | $ |

Sales: | | | | | | | |

External customers | 46.8 |

| 196.6 |

| 543.8 |

| 556.3 |

| — |

| — |

| 1,343.5 |

|

Intersegment | 82.2 |

| 144.2 |

| 79.1 |

| — |

| — |

| (305.5 | ) | — |

|

Total sales | 129.0 |

| 340.8 |

| 622.9 |

| 556.3 |

| — |

| (305.5 | ) | 1,343.5 |

|

| | | | | | | |

Capital expenditures | 10.8 |

| 16.0 |

| 31.2 |

| 12.2 |

| 2.5 |

| — |

| 72.7 |

|

Reconciliation of segment profit (loss) to operating income (loss): |

Segment profit (loss) | 8.2 |

| 13.6 |

| 51.9 |

| 50.0 |

| (31.1 | ) | 0.5 |

| 93.1 |

|

Depreciation and amortization | (9.5 | ) | (22.7 | ) | (41.7 | ) | (21.3 | ) | (0.8 | ) | — |

| (96.0 | ) |

Last in, first out and lower of cost or market inventory adjustments | — |

| — |

| 4.0 |

| (1.4 | ) | — |

| — |

| 2.6 |

|

Gain (loss) on disposal of assets | (0.1 | ) | 0.5 |

| 0.1 |

| — |

| — |

| — |

| 0.5 |

|

Asset impairment | — |

| — |

| — |

| (5.9 | ) | — |

| — |

| (5.9 | ) |

Non-cash pension, accretion and stock compensation | 0.1 |

| (0.9 | ) | (7.1 | ) | (6.5 | ) | (6.1 | ) | — |

| (20.5 | ) |

Restructuring, relocation and severance | (0.7 | ) | (0.9 | ) | (2.2 | ) | (1.6 | ) | (2.5 | ) | — |

| (7.9 | ) |

Consulting fees | — |

| — |

| — |

| — |

| (0.5 | ) | — |

| (0.5 | ) |

Cash settlements on hedging transactions | — |

| — |

| 1.7 |

| 7.4 |

| — |

| — |

| 9.1 |

|

Other, net | — |

| (0.6 | ) | — |

| (0.1 | ) | 0.7 |

| — |

| — |

|

Operating income (loss) | (2.0 | ) | (11.0 | ) | 6.7 |

| 20.6 |

| (40.3 | ) | 0.5 |

| (25.5 | ) |

Interest expense, net | 47.5 |

|

Gain on hedging activities, net | 2.3 |

|

Debt refinancing expense | 2.5 |

|

Total other expense, net | 52.3 |

|

Loss before income taxes | (77.8 | ) |

ADJUSTED EBITDA

(in millions)

(unaudited)

Management uses “Adjusted EBITDA”, referred to as “EBITDA” in the Company’s debt agreements, as a liquidity measure. The Company’s debt agreements do not require it to achieve any specified level of Adjusted EBITDA, or ratio of Adjusted EBITDA to any other financial metric, in order to avoid a default (subject, in the case of the senior secured revolving credit facility, to its maintaining minimum availability thereunder). As used herein, Adjusted EBITDA means net income before income taxes, net interest expense, depreciation and amortization, adjusted to eliminate certain non-cash expenses and other specified items of income or expense as outlined below (in millions):

|

| | | | | | | | |

| Three months ended December 31, | Year ended December 31, |

| 2014 | 2013 | 2014 | 2013 |

| $ | $ | $ | $ |

Adjusted EBITDA | 49.6 |

| 20.8 |

| 127.3 |

| 93.1 |

|

Last in, first out and lower of cost or market inventory adjustments (a) | (1.7 | ) | 3.7 |

| (4.9 | ) | 2.6 |

|

Gain (loss) on disposal of assets | (0.2 | ) | — |

| (0.4 | ) | 0.5 |

|

Asset impairment | — |

| (3.2 | ) | — |

| (5.9 | ) |

Non-cash pension, accretion and stock compensation | (2.5 | ) | (5.8 | ) | (9.6 | ) | (20.5 | ) |

Restructuring, relocation and severance | (1.0 | ) | (6.0 | ) | (1.3 | ) | (7.9 | ) |

Consulting fees | (0.4 | ) | (0.1 | ) | (0.7 | ) | (0.5 | ) |

Debt refinancing expense | — |

| — |

| — |

| (2.5 | ) |

Non-cash derivative gains (losses) (b) | 0.5 |

| 0.2 |

| (0.3 | ) | 6.8 |

|

Other, net | 1.1 |

| 0.3 |

| 1.1 |

| — |

|

Depreciation and amortization | (23.8 | ) | (25.1 | ) | (89.5 | ) | (96.0 | ) |

Interest expense, net | (12.7 | ) | (12.6 | ) | (50.4 | ) | (47.5 | ) |

Income tax benefit (expense) | (7.2 | ) | 10.1 |

| 2.1 |

| 30.2 |

|

Net income (loss) | 1.7 |

| (17.7 | ) | (26.6 | ) | (47.6 | ) |

| |

(a) | The New Madrid smelter and rolling mills use the LIFO method of inventory accounting for financial reporting and tax purposes. This adjustment restates net income to the FIFO method by eliminating LIFO expenses related to inventories held at the New Madrid smelter and the rolling mills. Product inventories at Gramercy and St. Ann and supplies inventories at New Madrid are stated at lower of weighted-average cost or market, and are not subject to the LIFO adjustment. The Company also reduces inventories to the lower of cost (adjusted for purchase accounting) or market value. |

| |

(b) | The Company uses derivative financial instruments to mitigate effects of fluctuations in aluminum and natural gas prices. This adjustment eliminates the non-cash gains and losses resulting from fair market value changes of aluminum swaps. Cash settlements (received) or paid, except settlements on hedge terminations, related to derivatives are included in Adjusted EBITDA. |

Adjusted EBITDA is not a measure of financial performance under U.S. GAAP, and may not be comparable to similarly titled measures used by other companies in the Company’s industry. Adjusted EBITDA should not be considered in isolation from or as an alternative to net income (loss), income (loss) from continuing operations, operating income (loss) or any other performance measures derived in accordance with U.S. GAAP. Adjusted EBITDA has limitations as an analytical tool and you should not consider it in isolation or as a substitute for analysis of the Company’s results as reported under U.S. GAAP. For example, Adjusted EBITDA excludes certain tax payments that may represent a reduction in cash available to the Company; does not reflect any cash requirements for the assets being depreciated and amortized that may have to be replaced in the future; does not reflect capital cash expenditures, future requirements for capital expenditures or contractual commitments; does not reflect changes in, or cash requirements for, the Company’s working capital needs; and does not reflect the significant interest expense, or the cash requirements necessary to service interest or principal payments on the Company’s indebtedness. Adjusted EBITDA also includes incremental stand-alone costs and adds back non-cash hedging gains and losses, and certain other non-cash charges that are deducted in calculating net income. However, these are expenses that may recur, vary greatly and are difficult to predict. In addition, certain of these expenses can represent the reduction of cash that could be used for other corporate purposes. You should not consider the Company’s Adjusted EBITDA as an alternative to operating income or net income, determined in accordance with U.S. GAAP, as an indicator of the Company’s operating performance, or as an alternative to cash flows from operating activities, determined in accordance with U.S. GAAP, as an indicator of the Company’s cash flows or as a measure of liquidity.

The following table reconciles Adjusted EBITDA to cash flow from operating activities for the periods presented (in millions):

|

| | | | | | | | |

| Three months ended December 31, | Year ended December 31, |

| 2014 | 2013 | 2014 | 2013 |

| $ | $ | $ | $ |

Adjusted EBITDA | 49.6 |

| 20.8 |

| 127.3 |

| 93.1 |

|

Share-based compensation expense | 1.0 |

| 1.4 |

| 3.4 |

| 4.8 |

|

Changes in other assets | (4.6 | ) | 3.5 |

| (10.3 | ) | 1.0 |

|

Changes in pension, other post-retirement liabilities and other long-term liabilities | 2.0 |

| (0.6 | ) | (2.4 | ) | 7.2 |

|

Changes in current operating assets and liabilities | (18.2 | ) | 21.5 |

| (18.6 | ) | 33.6 |

|

Changes in current income taxes | 10.8 |

| 0.6 |

| (9.6 | ) | (2.4 | ) |

Changes in accrued interest | (12.0 | ) | (12.0 | ) | (47.7 | ) | (44.9 | ) |

Non-cash pension, accretion and stock compensation | (2.5 | ) | (5.8 | ) | (9.6 | ) | (20.5 | ) |

Restructuring, relocation and severance | (1.0 | ) | (6.0 | ) | (1.3 | ) | (7.9 | ) |

Consulting and sponsor fees | (0.4 | ) | (0.1 | ) | (0.7 | ) | (0.5 | ) |

Other, net | 1.7 |

| 0.1 |

| 0.1 |

| 0.7 |

|

Cash provided by operating activities | 26.4 |

| 23.4 |

| 30.6 |

| 64.2 |

|

NORANDA ALUMINUM HOLDING CORPORATION

NET CASH COST OF PRIMARY ALUMINUM

(unaudited)

Net cash cost of primary aluminum per pound represents the costs of producing commodity grade aluminum net of value-added premiums on primary aluminum sales. The Company has provided net cash cost per pound of aluminum shipped because it provides investors with additional information to measure operating performance. Using this metric, investors are able to assess the prevailing LME price plus Midwest premium per pound versus unit net costs per pound shipped. Net cash cost per pound is positively or negatively impacted by changes in primary aluminum, alumina and bauxite production and sales volumes, natural gas and oil related costs, seasonality in electrical contract rates, and increases or decreases in other production related costs. Net cash cost per pound is not a measure of financial performance under U.S. GAAP and may not be comparable to similarly titled measures used by other companies. Net cash cost per pound shipped should not be considered in isolation from or as an alternative to any performance measures derived in accordance with U.S. GAAP. The following table shows the calculation of net cash cost of primary aluminum:

|

| | | | | | | | | | | | |

| Three months ended December 31, | Year ended December 31, |

| 2014 | 2013 | 2014 | 2013 |

Total primary aluminum cash cost (in millions)(a) | $ | 104.8 |

| $ | 117.3 |

| $ | 478.8 |

| $ | 487.8 |

|

Total shipments (pounds in millions) | 131.4 |

| 150.5 |

| 557.4 |

| 589.2 |

|

Net Cash Cost (per pound shipped) (b) | $ | 0.80 |

| $ | 0.78 |

| $ | 0.86 |

| $ | 0.83 |

|

| | | | |

(a) Total primary aluminum cash cost is calculated below (in millions): | | | | |

Total primary aluminum revenue | $ | 160.8 |

| $ | 152.1 |

| $ | 632.4 |

| $ | 622.9 |

|

Less fabrication premiums and other revenue | (13.7 | ) | (15.6 | ) | (57.2 | ) | (60.9 | ) |

Realized Midwest transaction price revenue | 147.1 |

| 136.5 |

| 575.2 |

| 562.0 |

|

| | | | |

Primary Aluminum segment profit (loss) | 31.7 |

| 14.9 |

| 95.6 |

| 51.9 |

|

Alumina segment profit (loss) | 17.1 |

| 2.8 |

| 8.5 |

| 13.6 |

|

Bauxite segment profit (loss) | (6.3 | ) | 1.0 |

| (6.6 | ) | 8.2 |

|

Profit eliminations | (0.2 | ) | 0.5 |

| (1.1 | ) | 0.5 |

|

Total | 42.3 |

| 19.2 |

| 96.4 |

| 74.2 |

|

Total primary aluminum cash cost (in millions) | $ | 104.8 |

| $ | 117.3 |

| $ | 478.8 |

| $ | 487.8 |

|

| |

(b) | Net Cash Cost may not recalculate precisely as shown due to rounding. |

NORANDA ALUMINUM HOLDING CORPORATION

CALCULATION OF DILUTED EARNINGS (LOSS) PER SHARE,

EXCLUDING SPECIAL ITEMS

(in millions, except per share information)

(unaudited)

“Net income (loss), excluding special items” means net income (loss) adjusted to eliminate the impact of certain transactions and events referred to as “special items,” as listed herein. “Diluted earnings (loss) per share, excluding special items” refers to net income (loss) excluding special items, divided by the number of diluted weighted-average common shares outstanding. Management has provided net income (loss), excluding special items and diluted earnings (loss) per share, excluding special items because the measure provides investors with additional information with which to measure operating results. Using these metrics, investors are able to assess the impact of certain transactions and events on earnings and to compare net income (loss) from period to period with the impact of those transactions and events removed from all periods. Management believes this metric is a valuable tool in assisting investors to compare financial results from period to period.

Net income (loss), excluding special items may not be comparable to similarly titled measures used by other companies. Net income (loss), excluding special items should not be considered in isolation from or as an alternative to net income (loss) or any other performance measures derived in accordance with U.S. GAAP. Net income (loss), excluding special items has limitations as an analytical tool and you should not consider it in isolation or as a substitute for analysis of results as reported under U.S. GAAP.

Special items and diluted earnings (loss) per share, excluding special items are outlined below (in millions):

|

| | | | | | | | |

| Three months ended December 31, | Year ended December 31, |

| 2014 | 2013 | 2014 | 2013 |

| $ | $ | $ | $ |

| Increase (decrease) to net income | Increase (decrease) to net income |

Special items: | | | | |

Gain (loss) on hedging activities: (6) | | | | |

GAAP mark-to-market gain (loss) | 2.4 |

| (2.3 | ) | 4.6 |

| (2.3 | ) |

Cash settlements received (paid) | 1.9 |

| (2.5 | ) | 4.9 |

| (9.1 | ) |

Amount treated as special item | 0.5 |

| 0.2 |

| (0.3 | ) | 6.8 |

|

Workforce reduction and other termination expenses (1) | (1.1 | ) | (7.2 | ) | (1.3 | ) | (7.2 | ) |

Non-recurring consulting fees | (0.4 | ) | — |

| (0.7 | ) | — |

|

Asset impairment (2) | — |

| (5.5 | ) | — |

| (5.5 | ) |

Debt refinancing expense (3) | — |

| — |

| — |

| (2.5 | ) |

Other, net | (0.2 | ) | — |

| (0.6 | ) | — |

|

Pre-tax gain (loss) from special items | (1.2 | ) | (12.5 | ) | (2.9 | ) | (8.4 | ) |

Diluted loss per share, excluding special items: | | | |

Pre-tax income (loss) | 8.9 |

| (27.8 | ) | (28.7 | ) | (77.8 | ) |

Exclude pre-tax impact of special items | 1.2 |

| 12.5 |

| 2.9 |

| 8.4 |

|

Pre-tax income (loss), excluding special items | 10.1 |

| (15.3 | ) | (25.8 | ) | (69.4 | ) |

Income tax expense (benefit), excluding special items (4) | 0.5 |

| (5.1 | ) | (2.7 | ) | (23.2 | ) |

Net income (loss), excluding special items | 9.6 |

| (10.2 | ) | (23.1 | ) | (46.2 | ) |

Weighted-average common shares outstanding, diluted (shares, in millions) (5) | 70.08 |

| 68.05 |

| 68.68 |

| 67.94 |

|

Diluted income (loss) per share, excluding special items | 0.14 |

| (0.15 | ) | (0.34 | ) | (0.68 | ) |

| |

(1) | The Company recorded $0.8 million related to workforce reductions at its Newport, AR light gauge facility and Primary Aluminum facility, and $0.3 million related to various other termination expenses in fourth quarter 2014. The Company recorded expense of $0.8 million related to an executive separation agreement in fourth quarter 2013 and $6.4 million for severance and other termination benefits in connection with its October 2013 workforce reduction at its Salisbury, NC Flat-Rolled Products facility and its Company-wide workforce reduction in December 2013. |

| |

(2) | The Company accelerated depreciation of $2.3 million and recorded impairment expense of $3.2 million in selling, general and administrative expenses to reduce the carrying value of certain fixed assets and other assets in connection with the workforce reduction at its Salisbury, NC Flat-Rolled Products facility. |

| |

(3) | Debt refinancing expense for the year ended December 31, 2013 includes the write-off of deferred financing costs and third party fees related to the AcquisitionCo Notes due 2015 in connection with the first quarter 2013 Refinancing. |

| |

(4) | Income taxes, excluding special items were calculated using the Company’s estimated annual effective tax rate from continuing operations 7.4% for the year ended December 31, 2014 and 33.5% for the year ended December 31, 2013. The income tax rate used to calculate special items is calculated by jurisdiction, which was 21.5% for the United States and 0% for Jamaica for the year ended December 31, 2014. Individual quarters may not recalculate to the year to date amount due to changes made quarterly to the estimated annual effective tax rate. |

| |

(5) | For periods with a net loss, potential common shares were excluded from the weighted-average common shares outstanding because these potential shares would have been antidilutive. |

| |

(6) | Prior periods have been recalculated to conform to the current period calculation of the special items impact of gain (loss) on hedging activities. |

Forward-Looking Statements

This press release contains “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements are statements about future, not past, events and involve certain important risks and uncertainties, any of which could cause the Company’s actual results to differ materially from those expressed in forward-looking statements, including, without limitation: the cyclical nature of the aluminum industry and fluctuating commodity prices, which cause variability in earnings and cash flows; a downturn in general economic conditions, including changes in interest rates, as well as a downturn in the end-use markets for certain of the Company’s products; fluctuations in the relative cost of certain raw materials and energy compared to the price of primary aluminum and aluminum rolled products; the effects of competition in Noranda’s business lines; Noranda’s ability to retain customers, a substantial number of which do not have long-term contractual arrangements with the Company; the ability to fulfill the business’s substantial capital investment needs; labor relations (i.e. disruptions, strikes or work stoppages) and labor costs; unexpected issues arising in connection with Noranda’s operations outside of the United States; the ability to retain key management personnel; environmental, safety, production and product regulations or concerns; eliminate change legislation or regulations; natural disaster and Noranda’s expectations with respect to its acquisition activity, or difficulties encountered in connection with acquisitions, dispositions or similar transactions.

Forward-looking statements contain words such as “believes,” “expects,” “will,” “may,” “should,” “seeks,” “approximately,” “intends,” “plans,” “estimates,” or “anticipates” or similar expressions that relate to Noranda’s strategy, plans or intentions. All statements Noranda makes relating to its estimated and projected earnings, margins, costs, expenditures, cash flows, growth rates and financial results or to the Company’s expectations regarding future industry trends are forward-looking statements. Noranda undertakes no obligation to publicly update or revise any forward-looking statement as a result of new information, future events or otherwise except as otherwise required by law. Readers are cautioned not to place undue reliance on forward-looking statements, which speak only as of the date on which they are made and which reflect management’s current estimates, projections, expectations or beliefs.

For a discussion of additional risks and uncertainties that may affect the future results of Noranda, please see the Company’s filings with the Securities and Exchange Commission, including its Annual Report on Form 10-K and its Quarterly Reports on Form 10-Q.

Non-GAAP Financial Measures

This press release and the presentation slides for the earnings call contain non-GAAP financial measures as defined by SEC rules. Management believes that these measures are helpful to investors in measuring financial performance and comparing performance to that of its peers. However, these non-GAAP financial measures may not be comparable to similarly titled non-GAAP financial measures used by other companies. These non-GAAP financial measures have limitations as an analytical tool and should not be considered in isolation or as a substitute for U.S. GAAP financial measures. To the extent non-GAAP financial measures are discussed on the earnings call, a reconciliation of each measure to the most directly comparable U.S. GAAP measure will be available within this press release or within the presentation slides filed as Exhibit 99.2 to the Current Report on Form 8-K furnished to the SEC concurrent with the issuance of this press release.

About the Company

Noranda Aluminum Holding Corporation is a leading North American integrated producer of value-added primary aluminum products, as well as high quality rolled aluminum coils. Noranda is a public company affiliated with its private equity sponsor.

Earnings Conference Call

At 10:00 AM Eastern / 9:00 AM Central on February 18, 2015, Noranda Aluminum Holding Corporation (NYSE: NOR) will host a conference call to discuss results for fourth quarter 2014. The call will be broadcast over the Internet on the Company’s homepage at www.norandaaluminum.com/investor. The webcast will be archived shortly after the conference call concludes and will be available for replay. Please dial the appropriate number below at least 15 minutes prior to the start of the call to participate in the question-and-answer session.

Conference Call Information

U.S. participants: (855) 232-8956

International participants: (315) 625-6978

Participant Passcode: 82779177

Contact

Noranda Aluminum Holding Corporation

Dale W. Boyles

Chief Financial Officer

(615) 771-5789

dale.boyles@noralinc.com

John A. Parker

Vice President of Communication and Investor Relations

(615) 771-5734

john.parker@noralinc.com