3rd Quarter 2014 Earnings Conference Call Noranda Aluminum Holding Corp November 3, 2014 4:30 PM Eastern Exhibit 99.2

The presentation and comments made by Noranda’s management on the quarterly conference call contain “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements are statements about future, not past, events and involve certain important risks and uncertainties, any of which could cause the Company’s actual results to differ materially from those expressed in forward-looking statements, including, without limitation: the cyclical nature of the aluminum industry and fluctuating commodity prices, which cause variability in earnings and cash flows; a downturn in general economic conditions, including changes in interest rates, as well as a downturn in the end-use markets for certain of the Company’s products; fluctuations in the relative cost of certain raw materials and energy compared to the price of primary aluminum and aluminum rolled products; the effects of competition in Noranda’s business lines; Noranda’s ability to retain customers, a substantial number of which do not have long-term contractual arrangements with the Company; the ability to fulfill the business’ substantial capital investment needs; labor relations (i.e. disruptions, strikes or work stoppages) and labor costs; unexpected issues arising in connection with Noranda’s operations outside of the United States; the ability to retain key management personnel; and Noranda’s expectations with respect to its acquisition activity, or difficulties encountered in connection with acquisitions, dispositions or similar transactions. Forward-looking statements contain words such as “believes,” “expects,” “may,” “should,” “seeks,” “approximately,” “intends,” “plans,” “estimates,” “anticipates” or similar expressions that relate to Noranda’s strategy, plans or intentions. All statements Noranda makes relating to its estimated and projected earnings, margins, costs, expenditures, cash flows, growth rates and financial results or to the Company’s expectations regarding future industry trends are forward-looking statements. Noranda undertakes no obligation to publicly update or revise any forward-looking statement as a result of new information, future events or otherwise, except as otherwise required by law. Readers are cautioned not to place undue reliance on forward-looking statements, which speak only as of the date on which they are made and which reflect management's current estimates, projections, expectations or beliefs. For a discussion of additional risks and uncertainties that may affect the future results of Noranda, please see the Company’s filings with the Securities and Exchange Commission, including its Annual Report on Form 10-K and Quarterly Reports on Form 10-Q. Forward-Looking Statements & Non-GAAP Measures 2 This presentation contains non-GAAP financial measures as defined by SEC rules. We believe these measures are helpful to investors in measuring our financial performance and comparing our performance to our peers. However, our non-GAAP financial measures may not be comparable to similarly titled non-GAAP financial measures used by other companies. These non-GAAP financial measures have limitations as an analytical tool and should not be considered in isolation or as a substitute for U.S. GAAP financial measures. To the extent we disclose any non-GAAP financial measures, a reconciliation of each measure to the most directly comparable U.S. GAAP measure is available in the Press Release included as an exhibit to the Current Report on Form 8-K to which this presentation is also an exhibit. As such, this presentation should be read in conjunction with our Press Release. 2

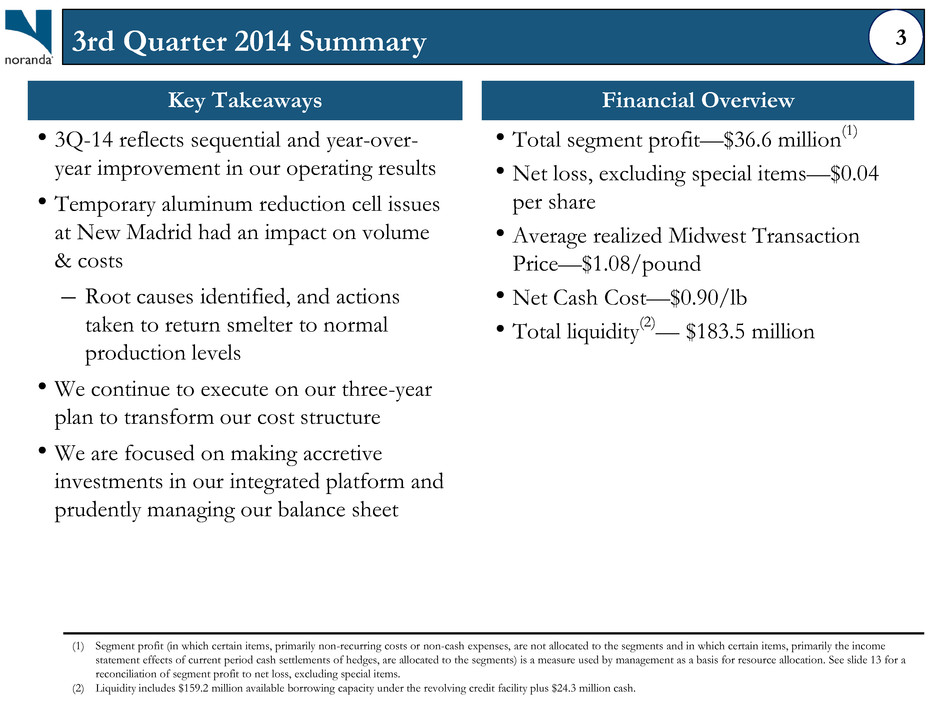

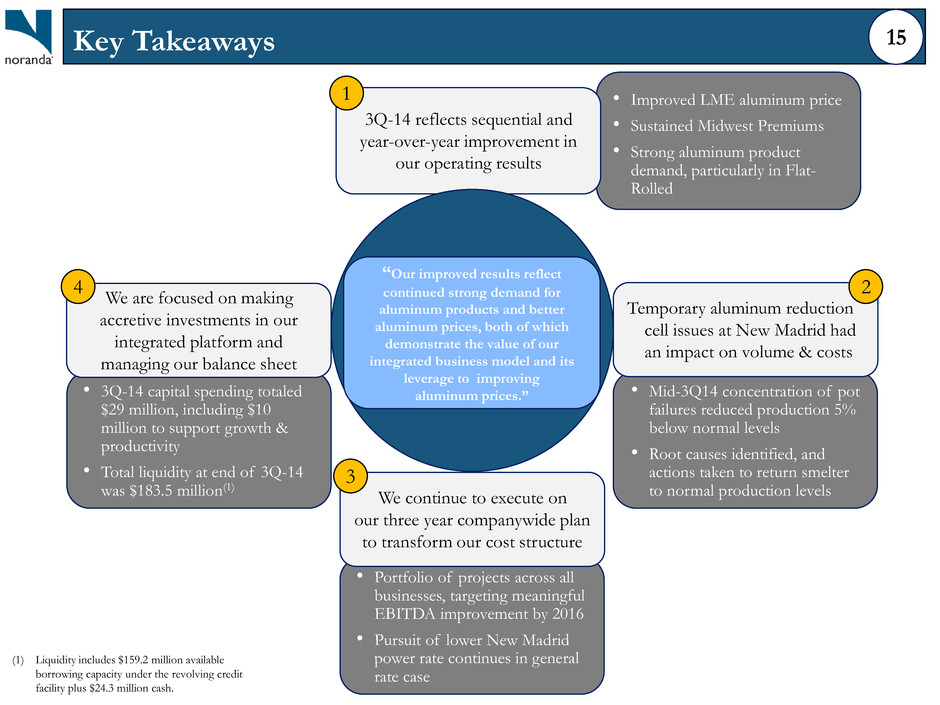

Key Takeaways • 3Q-14 reflects sequential and year-over- year improvement in our operating results • Temporary aluminum reduction cell issues at New Madrid had an impact on volume & costs – Root causes identified, and actions taken to return smelter to normal production levels • We continue to execute on our three-year plan to transform our cost structure • We are focused on making accretive investments in our integrated platform and prudently managing our balance sheet Financial Overview • Total segment profit—$36.6 million(1) • Net loss, excluding special items—$0.04 per share • Average realized Midwest Transaction Price—$1.08/pound • Net Cash Cost—$0.90/lb • Total liquidity(2)— $183.5 million 3rd Quarter 2014 Summary (1) Segment profit (in which certain items, primarily non-recurring costs or non-cash expenses, are not allocated to the segments and in which certain items, primarily the income statement effects of current period cash settlements of hedges, are allocated to the segments) is a measure used by management as a basis for resource allocation. See slide 13 for a reconciliation of segment profit to net loss, excluding special items. (2) Liquidity includes $159.2 million available borrowing capacity under the revolving credit facility plus $24.3 million cash. 3

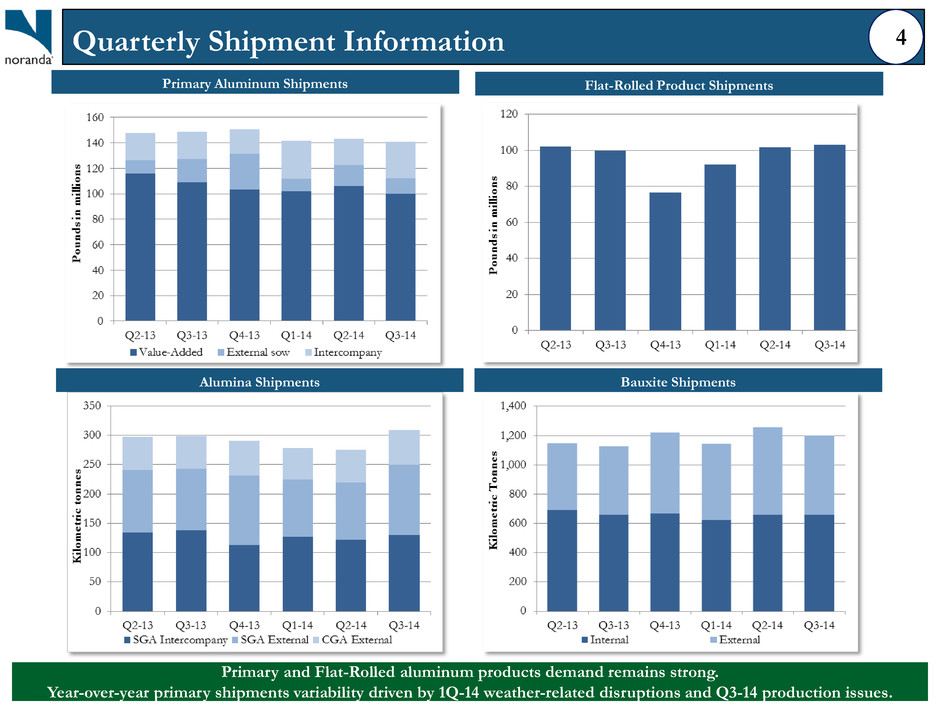

Primary Aluminum Shipments Bauxite Shipments Quarterly Shipment Information Flat-Rolled Product Shipments Alumina Shipments 4 Primary and Flat-Rolled aluminum products demand remains strong. Year-over-year primary shipments variability driven by 1Q-14 weather-related disruptions and Q3-14 production issues.

US Aluminum Demand Growth Outlook Sector Noranda Product End-Use Applications US Demand Growth Outlook 1 Building & construction • Doors and windows • Curtain wall and store fronts • Shower and tub enclosures • Stadium seating 4% to 6% Electrical • Power transmission units and lines • Electrical wire • Various types of cable 4% to 5% Consumer durables • HVAC equipment • Recreational equipment (boats, golf-carts, etc.) 3% to 5% Foil & packaging • Semi-rigid containers • Flexible packaging • Household foil Flat Transportation • Component parts • Automotive HVAC • Trailers and semi’s • High purity for aerospace 7% to 10% 1 Based on CRU forecasts of US semi-finished goods consumption from 2014 to 2019; source: CRU Aluminum Market Outlook, October 2014 5 US aluminum demand supports improved LME prices, Midwest premiums, and product premiums. Strong demand also provides opportunities to grow with our current customers and to follow the spread of aluminum into new applications.

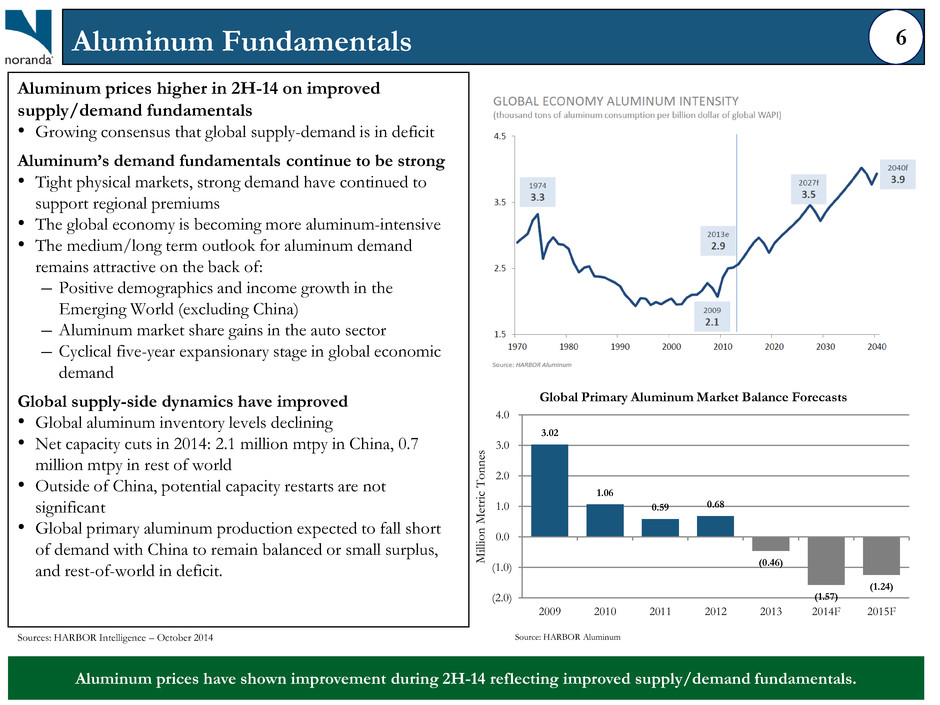

Aluminum prices higher in 2H-14 on improved supply/demand fundamentals • Growing consensus that global supply-demand is in deficit Aluminum’s demand fundamentals continue to be strong • Tight physical markets, strong demand have continued to support regional premiums • The global economy is becoming more aluminum-intensive • The medium/long term outlook for aluminum demand remains attractive on the back of: – Positive demographics and income growth in the Emerging World (excluding China) – Aluminum market share gains in the auto sector – Cyclical five-year expansionary stage in global economic demand Global supply-side dynamics have improved • Global aluminum inventory levels declining • Net capacity cuts in 2014: 2.1 million mtpy in China, 0.7 million mtpy in rest of world • Outside of China, potential capacity restarts are not significant • Global primary aluminum production expected to fall short of demand with China to remain balanced or small surplus, and rest-of-world in deficit. Aluminum Fundamentals Sources: HARBOR Intelligence – October 2014 6 Aluminum prices have shown improvement during 2H-14 reflecting improved supply/demand fundamentals. 3.02 1.06 0.59 0.68 (0.46) (1.57) (1.24) (2.0) (1.0) 0.0 1.0 2.0 3.0 4.0 2009 2010 2011 2012 2013 2014F 2015F Milli o n M etri c T o n n es Global Primary Aluminum Market Balance Forecasts Source: HARBOR Aluminum

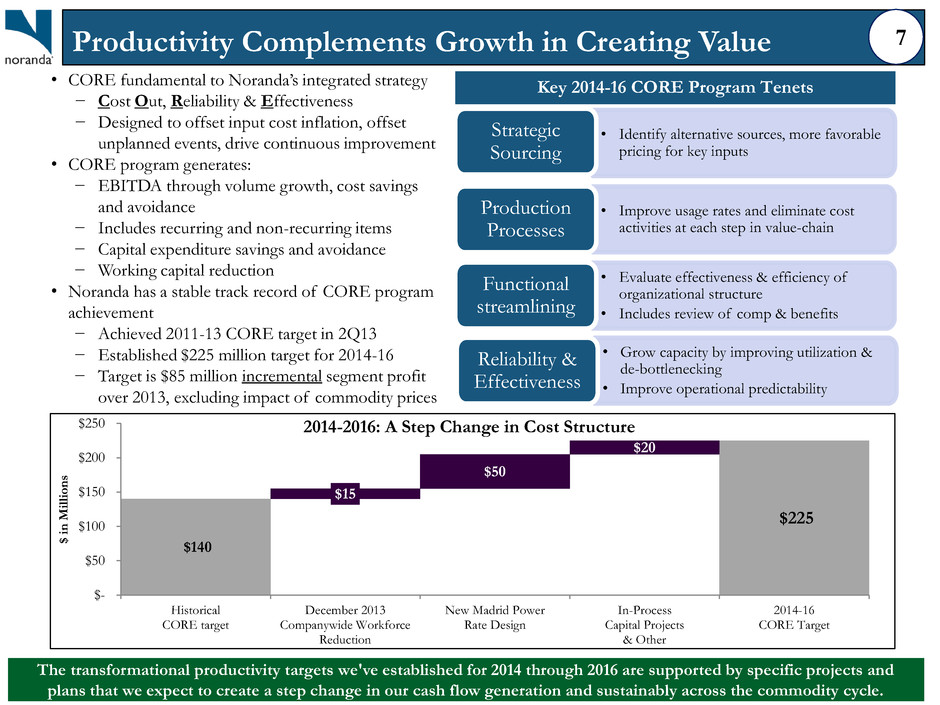

Productivity Complements Growth in Creating Value • CORE fundamental to Noranda’s integrated strategy − Cost Out, Reliability & Effectiveness − Designed to offset input cost inflation, offset unplanned events, drive continuous improvement • CORE program generates: − EBITDA through volume growth, cost savings and avoidance − Includes recurring and non-recurring items − Capital expenditure savings and avoidance − Working capital reduction • Noranda has a stable track record of CORE program achievement − Achieved 2011-13 CORE target in 2Q13 − Established $225 million target for 2014-16 − Target is $85 million incremental segment profit over 2013, excluding impact of commodity prices • Evaluate effectiveness & efficiency of organizational structure • Includes review of comp & benefits Functional streamlining • Improve usage rates and eliminate cost activities at each step in value-chain Production Processes • Identify alternative sources, more favorable pricing for key inputs Strategic Sourcing • Grow capacity by improving utilization & de-bottlenecking • Improve operational predictability Reliability & Effectiveness Key 2014-16 CORE Program Tenets $140 $225 $15 $50 $20 $- $50 $100 $150 $200 $250 Historical CORE target December 2013 Companywide Workforce Reduction New Madrid Power Rate Design In-Process Capital Projects & Other 2014-16 CORE Target $ i n M il li on s 2014-2016: A Step Change in Cost Structure 7 The transformational productivity targets we've established for 2014 through 2016 are supported by specific projects and plans that we expect to create a step change in our cash flow generation and sustainably across the commodity cycle.

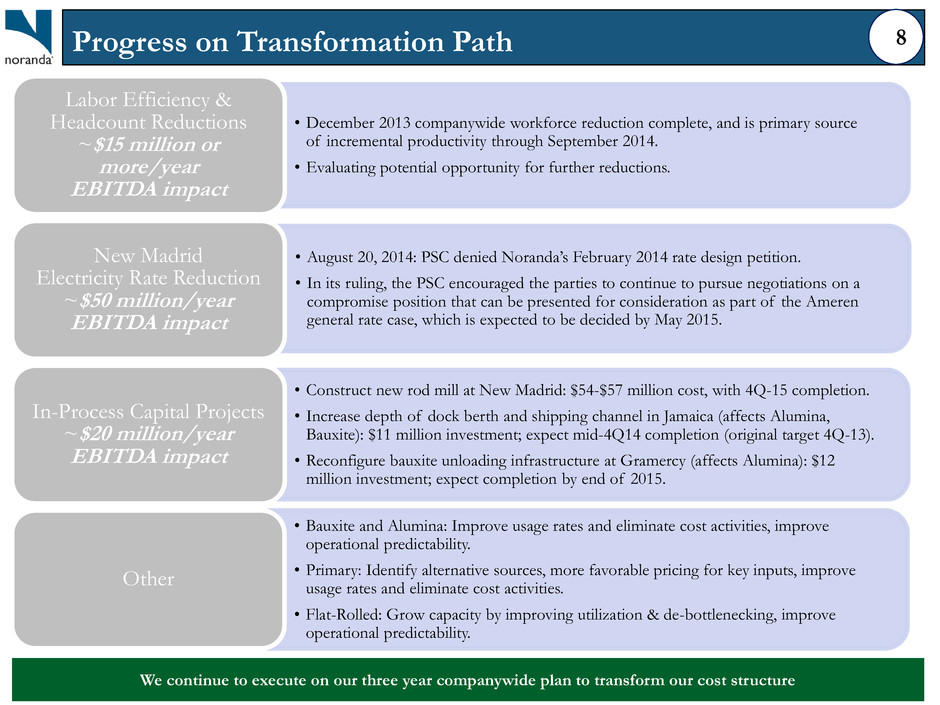

Progress on Transformation Path 8 We continue to execute on our three year companywide plan to transform our cost structure • December 2013 companywide workforce reduction complete, and is primary source of incremental productivity through September 2014. • Evaluating potential opportunity for further reductions. Labor Efficiency & Headcount Reductions ~$15 million or more/year EBITDA impact • August 20, 2014: PSC denied Noranda’s February 2014 rate design petition. • In its ruling, the PSC encouraged the parties to continue to pursue negotiations on a compromise position that can be presented for consideration as part of the Ameren general rate case, which is expected to be decided by May 2015. New Madrid Electricity Rate Reduction ~$50 million/year EBITDA impact • Construct new rod mill at New Madrid: $54-$57 million cost, with 4Q-15 completion. • Increase depth of dock berth and shipping channel in Jamaica (affects Alumina, Bauxite): $11 million investment; expect mid-4Q14 completion (original target 4Q-13). • Reconfigure bauxite unloading infrastructure at Gramercy (affects Alumina): $12 million investment; expect completion by end of 2015. In-Process Capital Projects ~$20 million/year EBITDA impact • Bauxite and Alumina: Improve usage rates and eliminate cost activities, improve operational predictability. • Primary: Identify alternative sources, more favorable pricing for key inputs, improve usage rates and eliminate cost activities. • Flat-Rolled: Grow capacity by improving utilization & de-bottlenecking, improve operational predictability. Other

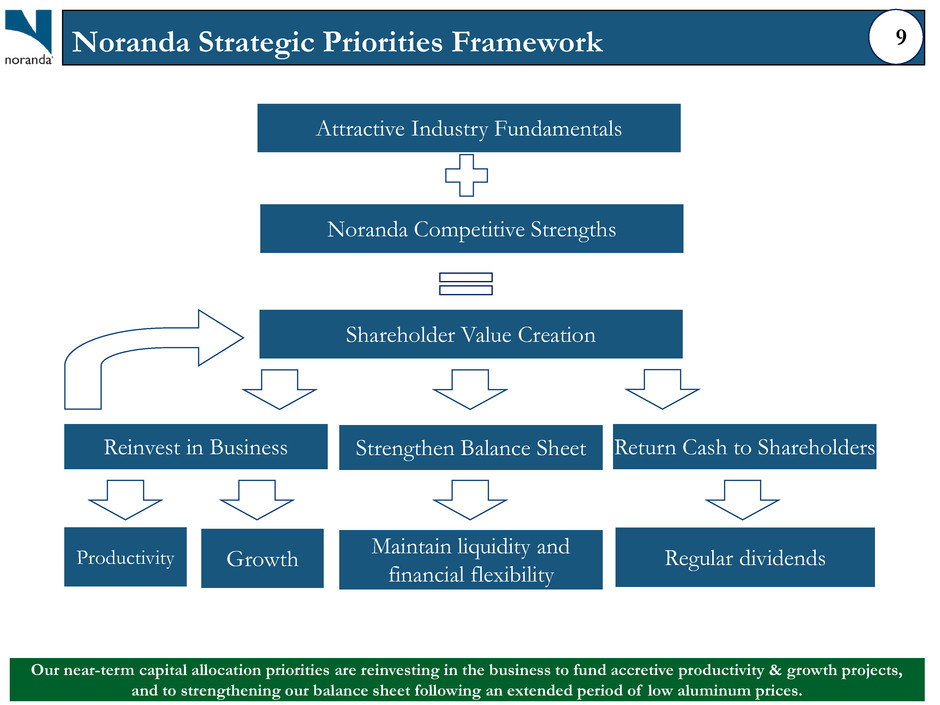

Noranda Strategic Priorities Framework Attractive Industry Fundamentals Noranda Competitive Strengths Shareholder Value Creation Reinvest in Business Return Cash to Shareholders Regular dividends Productivity Growth Strengthen Balance Sheet Maintain liquidity and financial flexibility 9 Our near-term capital allocation priorities are reinvesting in the business to fund accretive productivity & growth projects, and to strengthening our balance sheet following an extended period of low aluminum prices.

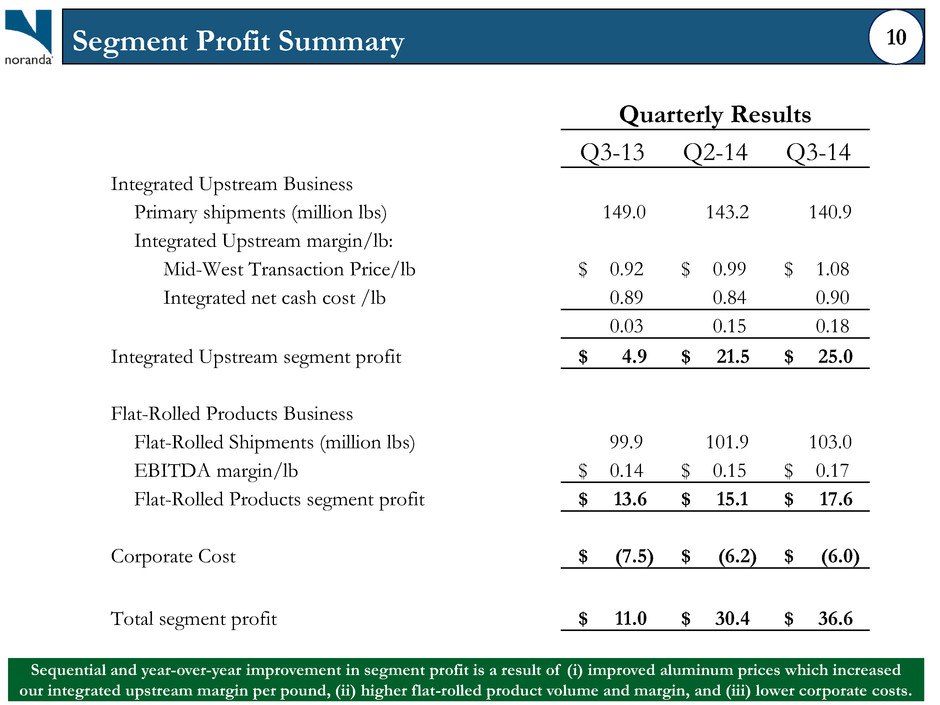

Segment Profit Summary Quarterly Results Q3-13 Q2-14 Q3-14 Integrated Upstream Business Primary shipments (million lbs) 149.0 143.2 140.9 Integrated Upstream margin/lb: Mid-West Transaction Price/lb $ 0.92 $ 0.99 $ 1.08 Integrated net cash cost /lb 0.89 0.84 0.90 0.03 0.15 0.18 Integrated Upstream segment profit $ 4.9 $ 21.5 $ 25.0 Flat-Rolled Products Business Flat-Rolled Shipments (million lbs) 99.9 101.9 103.0 EBITDA margin/lb $ 0.14 $ 0.15 $ 0.17 Flat-Rolled Products segment profit $ 13.6 $ 15.1 $ 17.6 Corporate Cost $ (7.5) $ (6.2) $ (6.0) Total segment profit $ 11.0 $ 30.4 $ 36.6 10 Sequential and year-over-year improvement in segment profit is a result of (i) improved aluminum prices which increased our integrated upstream margin per pound, (ii) higher flat-rolled product volume and margin, and (iii) lower corporate costs.

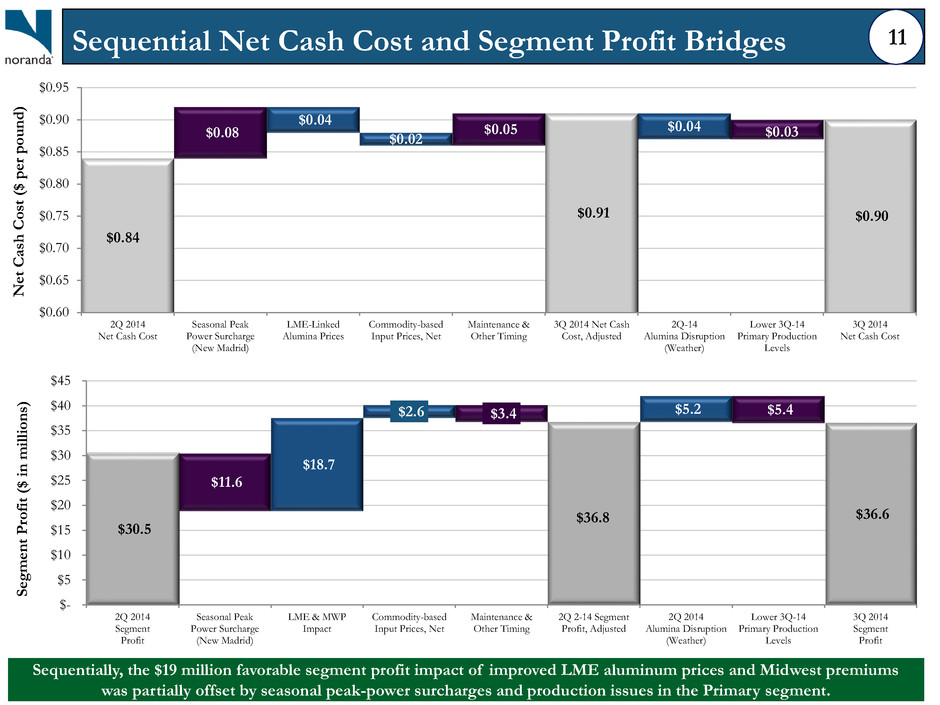

Sequential Net Cash Cost and Segment Profit Bridges $0.91 $0.90 $0.04 $0.02 $0.04 $0.08 $0.05 $0.03 $0.84 $0.60 $0.65 $0.70 $0.75 $0.80 $0.85 $0.90 $0.95 2Q 2014 Net Cash Cost Seasonal Peak Power Surcharge (New Madrid) LME-Linked Alumina Prices Commodity-based Input Prices, Net Maintenance & Other Timing 3Q 2014 Net Cash Cost, Adjusted 2Q-14 Alumina Disruption (Weather) Lower 3Q-14 Primary Production Levels 3Q 2014 Net Cash Cost N et Ca sh Co st ($ pe r p o u n d ) $36.8 $36.6 $11.6 $3.4 $5.4 $18.7 $2.6 $5.2 $30.5 $- $5 $10 $15 $20 $25 $30 $35 $40 $45 2Q 2014 Segment Profit Seasonal Peak Power Surcharge (New Madrid) LME & MWP Impact Commodity-based Input Prices, Net Maintenance & Other Timing 2Q 2-14 Segment Profit, Adjusted 2Q 2014 Alumina Disruption (Weather) Lower 3Q-14 Primary Production Levels 3Q 2014 Segment Profit Seg m en t P ro fi t ($ in m illi o ns ) 11 Sequentially, the $19 million favorable segment profit impact of improved LME aluminum prices and Midwest premiums was partially offset by seasonal peak-power surcharges and production issues in the Primary segment.

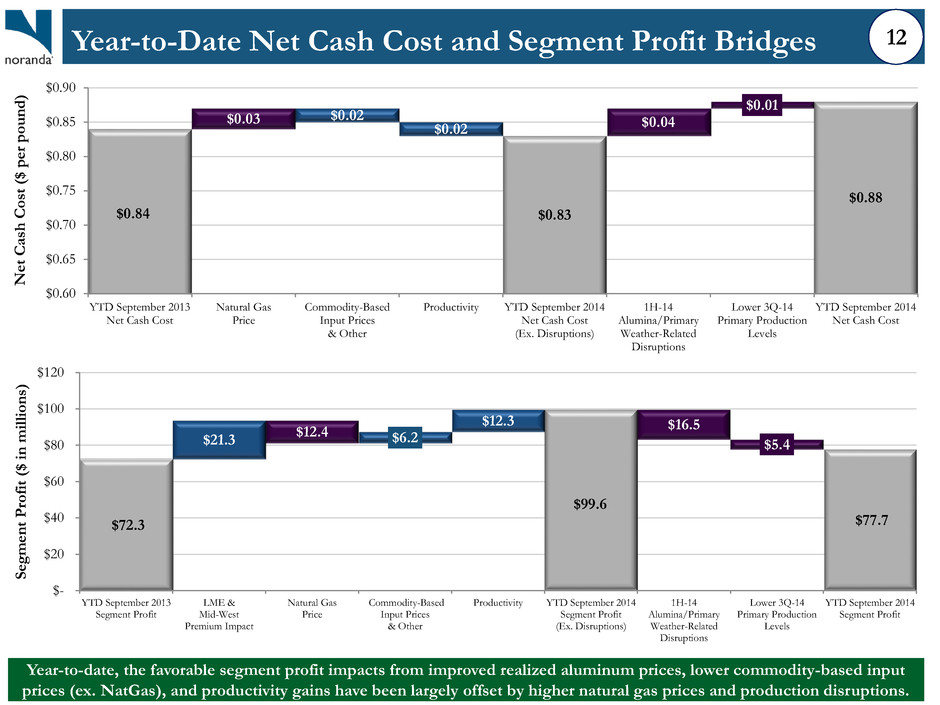

Year-to-Date Net Cash Cost and Segment Profit Bridges $0.83 $0.88 $0.02 $0.02 $0.03 $0.04 $0.01 $0.84 $0.60 $0.65 $0.70 $0.75 $0.80 $0.85 $0.90 YTD September 2013 Net Cash Cost Natural Gas Price Commodity-Based Input Prices & Other Productivity YTD September 2014 Net Cash Cost (Ex. Disruptions) 1H-14 Alumina/Primary Weather-Related Disruptions Lower 3Q-14 Primary Production Levels YTD September 2014 Net Cash Cost N et Ca sh Co st ($ pe r p o u n d ) $99.6 $77.7 $12.4 $16.5 $5.4 $21.3 $6.2 $12.3 $72.3 $- $20 $40 $60 $80 $100 $120 YTD September 2013 Segment Profit LME & Mid-West Premium Impact Natural Gas Price Commodity-Based Input Prices & Other Productivity YTD September 2014 Segment Profit (Ex. Disruptions) 1H-14 Alumina/Primary Weather-Related Disruptions Lower 3Q-14 Primary Production Levels YTD September 2014 Segment Profit Seg m en t P ro fi t ($ in m illi o ns ) 12 Year-to-date, the favorable segment profit impacts from improved realized aluminum prices, lower commodity-based input prices (ex. NatGas), and productivity gains have been largely offset by higher natural gas prices and production disruptions.

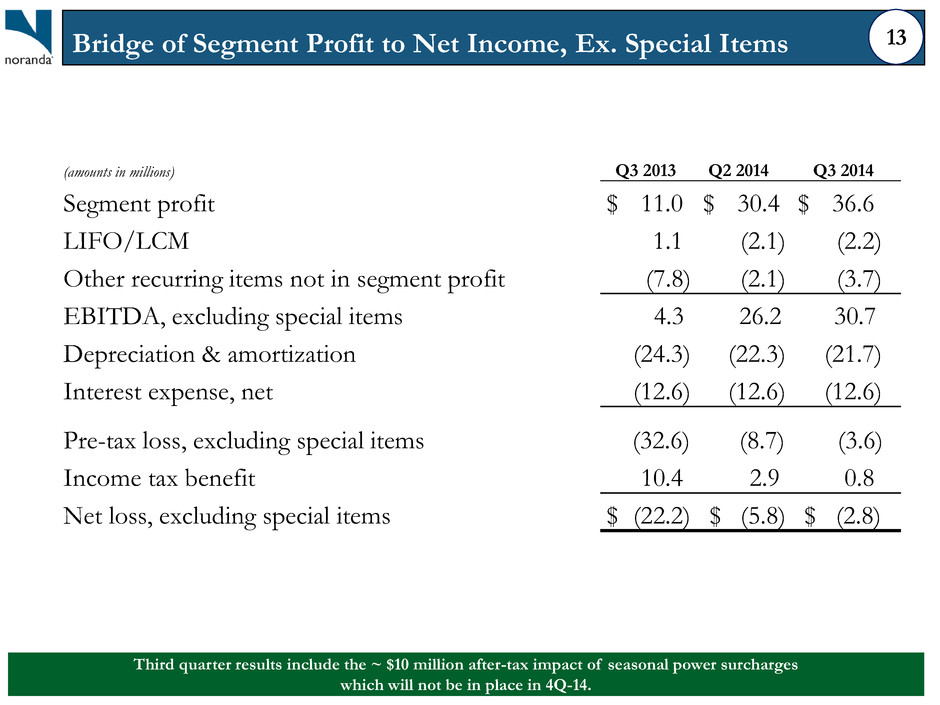

(amounts in millions) Q3 2013 Q2 2014 Q3 2014 Segment profit $ 11.0 $ 30.4 $ 36.6 LIFO/LCM 1.1 (2.1) (2.2) Other recurring items not in segment profit (7.8) (2.1) (3.7) EBITDA, excluding special items 4.3 26.2 30.7 Depreciation & amortization (24.3) (22.3) (21.7) Interest expense, net (12.6) (12.6) (12.6) Pre-tax loss, excluding special items (32.6) (8.7) (3.6) Income tax benefit 10.4 2.9 0.8 Net loss, excluding special items $ (22.2) $ (5.8) $ (2.8) Bridge of Segment Profit to Net Income, Ex. Special Items 13 Third quarter results include the ~ $10 million after-tax impact of seasonal power surcharges which will not be in place in 4Q-14.

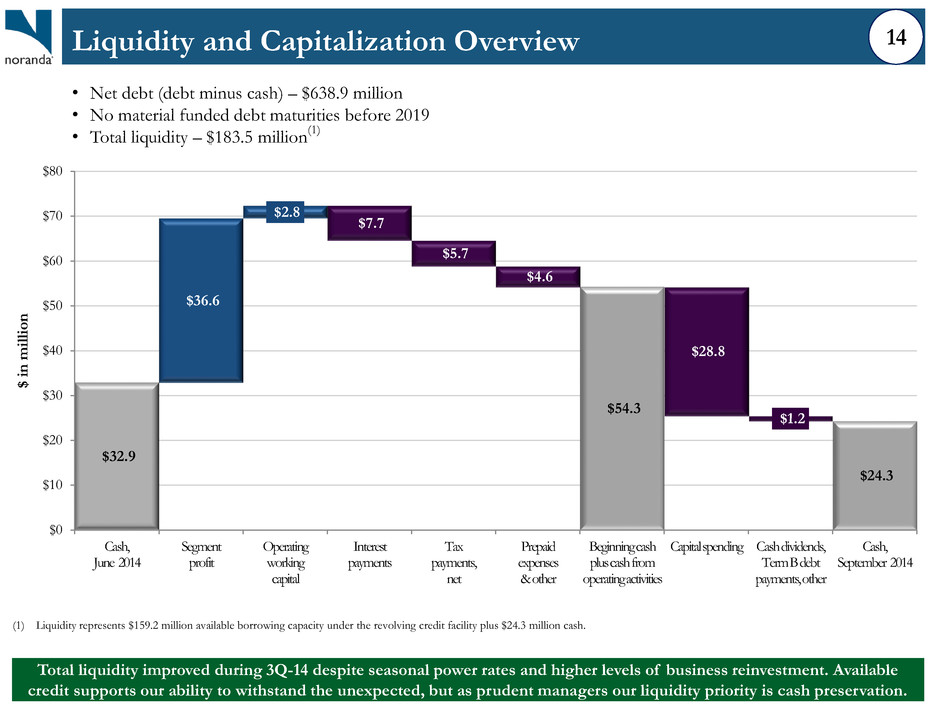

Liquidity and Capitalization Overview $54.3 $24.3 $7.7 $5.7 $4.6 $28.8 $1.2 $36.6 $2.8 $32.9 $0 $10 $20 $30 $40 $50 $60 $70 $80 Cash, June 2014 Segment profit Operating working capital Interest payments Tax payments, net Prepaid expenses & other Beginning cash pluscash from operating activities Capital spending Cash dividends, Term B debt payments, other Cash, September 2014 $ in m illi o n (1) Liquidity represents $159.2 million available borrowing capacity under the revolving credit facility plus $24.3 million cash. • Net debt (debt minus cash) – $638.9 million • No material funded debt maturities before 2019 • Total liquidity – $183.5 million (1) 14 Total liquidity improved during 3Q-14 despite seasonal power rates and higher levels of business reinvestment. Available credit supports our ability to withstand the unexpected, but as prudent managers our liquidity priority is cash preservation.

• Portfolio of projects across all businesses, targeting meaningful EBITDA improvement by 2016 • Pursuit of lower New Madrid power rate continues in general rate case • 3Q-14 capital spending totaled $29 million, including $10 million to support growth & productivity • Total liquidity at end of 3Q-14 was $183.5 million(1) • Mid-3Q14 concentration of pot failures reduced production 5% below normal levels • Root causes identified, and actions taken to return smelter to normal production levels • Improved LME aluminum price • Sustained Midwest Premiums • Strong aluminum product demand, particularly in Flat- Rolled Key Takeaways We are focused on making accretive investments in our integrated platform and managing our balance sheet We continue to execute on our three year companywide plan to transform our cost structure Temporary aluminum reduction cell issues at New Madrid had an impact on volume & costs 3Q-14 reflects sequential and year-over-year improvement in our operating results “Our improved results reflect continued strong demand for aluminum products and better aluminum prices, both of which demonstrate the value of our integrated business model and its leverage to improving aluminum prices.” 1 2 4 3 15 (1) Liquidity includes $159.2 million available borrowing capacity under the revolving credit facility plus $24.3 million cash.