UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM

(Mark One)

REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) OR (g) OF THE SECURITIES EXCHANGE ACT OF 1934

OR

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended

OR

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from __________ to __________

OR

SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

Date of event requiring this shell company report __________

Commission file number

(Exact name of Registrant as specified in its charter and translation of Registrant’s name into English)

(Jurisdiction of incorporation or organization)

(Address of principal executive offices)

Chief Executive Officer

Galapagos NV

Tel: +32 15 342 900 Fax: +

(Name, Telephone, E-mail and/or Facsimile number and Address of Company Contact Person)

Securities registered or to be registered pursuant to Section 12(b) of the Act.

|

Title of each class |

Trading Symbol(s) |

Name of each exchange on which registered |

|

American Depositary Shares, each representing one |

GLPG |

The Nasdaq Stock Market LLC |

|

ordinary share, no par value per share |

|

|

|

Ordinary shares, no par value per share* |

|

The Nasdaq Stock Market LLC* |

* Not for trading, but only in connection with the registration of the American Depositary Shares.

Securities registered or to be registered pursuant to Section 12(g) of the Act. None

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act. None

Indicate the number of outstanding shares of each of the issuer’s classes of capital or common stock as of the close of the period covered by the annual report.

Ordinary shares, no par value per share:

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. ☒

If this report is an annual or transition report, indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934. ☐ Yes ☒

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days ☒

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). ☒

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or an emerging growth company. See definition of “large accelerated filer,” “accelerated filer,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.:

| ☒ | Accelerated filer ☐ | Non-accelerated filer ☐ | Emerging growth company |

If an emerging growth company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards† provided pursuant to Section 13(a) of the Exchange Act.

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☒

† The term “new or revised financial accounting standard” refers to any update issued by the Financial Accounting Standards Board to its Accounting Standards Codification after April 5, 2012.

Indicate by check mark which basis of accounting the registrant has used to prepare the financial statements included in this filing:

|

|

International Financial Reporting Standards as issued |

Other ☐ |

|

|

|

by the International Accounting Standards Board ☒ |

|

|

|

If “Other” has been checked in response to the previous question, indicate by check mark which financial statement item the registrant has elected to follow. ☐ Item 17 ☐ Item 18 |

|

|

|

|

If this is an annual report, indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). ☐ Yes ☒ |

|

|

|

Unless otherwise indicated or unless the context requires otherwise, “GLPG,” “the company,” “our company,” “we,” “us,” and “our” refer to Galapagos NV and its consolidated subsidiaries.

We own various trademark registrations and applications, and unregistered trademarks, including GALAPAGOS and our corporate logo. All other trade names, trademarks and service marks referred to in this annual report on Form 20‑F, or this annual report, are the property of their respective owners. Trade names, trademarks and service marks of other companies appearing in this annual report are the property of their respective holders. Solely for convenience, the trademarks and trade names in this annual report may be referred to without the ® and ™ symbols, but such references should not be construed as any indicator that their respective owners will not assert, to the fullest extent under applicable law, their rights thereto. We do not intend to use or display other companies’ trademarks and trade names to imply a relationship with, or endorsement or sponsorship of us by, any other companies.

Our audited consolidated financial statements have been prepared in accordance with International Financial Reporting Standards, or IFRS, as issued by the International Accounting Standards Board, or IASB. Our consolidated financial statements are presented in euros. All references in this annual report to “$,” “US$,” “U.S.$,” “U.S. dollars,” “dollars,” and “USD” mean U.S. dollars and all references to “€” and “euros” mean euros, unless otherwise noted. Throughout this annual report, references to “ADSs” mean American Depositary Shares or ordinary shares represented by American Depositary Shares, as the case may be.

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

This annual report contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, or the Securities Act, and Section 21E of the Securities Exchange Act of 1934, as amended, or the Exchange Act, that are based on our management’s beliefs and assumptions and on information currently available to our management. All statements other than present and historical facts and conditions contained in this annual report, including statements regarding our future results of operations and financial positions, business strategy, plans and our objectives for future operations, are forward-looking statements. When used in this annual report, the words “anticipate,” “believe,” “can,” “could,” “estimate,” “expect,” “intend,” “is designed to,” “may,” “might,” “plan,” “potential,” “predict,” “objective,” “should,” or the negative of these and similar expressions identify forward-looking statements. Forward-looking statements include, but are not limited to, statements about:

| · | the initiation, timing, progress and results of our preclinical studies and clinical trials, and our research and development programs; | |

| · | our ability to advance product candidates into, and successfully complete, clinical trials; | |

| · |

our reliance on the success of our product candidate filgotinib and certain other product candidates; | |

| · |

the timing or likelihood of regulatory filings and approvals; | |

| · |

our ability to develop sales and marketing capabilities; | |

| · |

the commercialization of our product candidates, if approved; | |

| · |

the pricing and reimbursement of our product candidates, if approved; | |

| · |

the implementation of our business model, strategic plans for our business, product candidates and technology; | |

| · |

the scope of protection we are able to establish and maintain for intellectual property rights covering our product candidates and technology; | |

| · |

our ability to operate our business without infringing, misappropriating or otherwise violating the intellectual property rights and proprietary technology of third parties; |

| · | cost associated with enforcing or defending intellectual property infringement, misappropriation or violation; product liability; and other claims; | |

| · |

regulatory development in the United States, Europe, and other jurisdictions; | |

| · |

estimates of our expenses, future revenues, capital requirements and our needs for additional financing; | |

| · |

the potential benefits of strategic collaboration agreements and our ability to enter into strategic arrangements; | |

| · |

our ability to maintain and establish collaborations or obtain additional grant funding; | |

| · | the rate and degree of market acceptance of our product candidates if approved by regulatory authorities; | |

| · |

our financial performance; | |

| · |

developments relating to our competitors and our industry, including competing therapies; | |

| · |

our ability to effectively manage and anticipate growth; | |

| · | our ability to attract and retain qualified employees and key personnel; | |

| · |

statements regarding future revenue, hiring plans, expenses, capital expenditures, capital requirements and share performance; and | |

| · |

other risks and uncertainties, including those listed in the section of this annual report titled “Item 3.D.—Risk Factors.” |

You should refer to the section of this annual report titled “Item 3.D.—Risk Factors” for a discussion of important factors that may cause our actual results to differ materially from those expressed or implied by our forward-looking statements. As a result of these factors, we cannot assure you that the forward-looking statements in this annual report will prove to be accurate. Furthermore, if our forward-looking statements prove to be inaccurate, the inaccuracy may be material. In light of the significant uncertainties in these forward-looking statements, you should not regard these statements as a representation or warranty by us or any other person that we will achieve our objectives and plans in any specified time frame or at all. We undertake no obligation to publicly update any forward-looking statements, whether as a result of new information, future events or otherwise, except as required by law. Further, we cannot assess the impact of each such factor on our business or the extent to which any factor, or combination of factors, may cause actual results to be materially different from those contained in any forward-looking statement.

You should read this annual report and the documents that we reference in this annual report and have filed as exhibits to this annual report completely and with the understanding that our actual future results may be materially different from what we expect. We qualify all of our forward-looking statements by these cautionary statements. In light of the significant risks and uncertainties to which our forward-looking statements are subject, you should not place undue reliance on or regard these statements as a representation or warranty by us or any other person that we will achieve our objectives and plans in any specified timeframe, or at all. We discuss many of these risks in greater detail in this annual report. For all forward-looking statements, we claim the protection of the safe harbor for forward-looking statements contained in the Private Securities Litigation Reform Act of 1995.

This annual report contains market data and industry forecasts that were obtained from third parties and industry publications. These data involve a number of assumptions and limitations, and you are cautioned not to give undue weight to such estimates. We have not independently verified any third-party information. While we believe the market position, market opportunity and market size information included in this annual report is generally reliable, such information is inherently imprecise.

Please see the Glossary of Terms at the end of Item 4 for definitions of scientific and other terms used in this annual report.

Summary of risk factors

We are heavily dependent upon our global R&D collaboration with Gilead and the amendment of our arrangement with Gilead for the commercialization and development of filgotinib including Gilead’s recruitment in the Phase 3 trial in Crohn’s disease. There can be no assurance that these arrangements will deliver the benefits we expect, including but not limited to the payment of potential future milestones, opt-in and/or royalty payments by Gilead.

The transition of European rights to filgotinib from Gilead to us will be a significant undertaking that may require additional substantial financial and managerial resources, and we may not be successful.

We have no historical product revenues, which makes it difficult to assess our future prospects and financial results.

We have limited sales and distribution experience and are currently building a marketing and sales organization. We expect to continue to invest significant financial and management resources to continue to build these capabilities and to establish a European commercial infrastructure. To the extent any of our product candidates for which we maintain commercial rights is approved for marketing, if we are unable to establish marketing and sales capabilities or enter into agreements with third parties to market and sell our product candidates, we may not be able to market and sell any product candidates effectively, or generate product revenues.

The marketing and sale of filgotinib or future approved products may be unsuccessful or less successful than anticipated. We are heavily dependent on the success of filgotinib, which is approved for the treatment of rheumatoid arthritis in Europe and Japan and marketed under the brand name Jyseleca, and under regulatory review in the European Union for the treatment of ulcerative colitis.

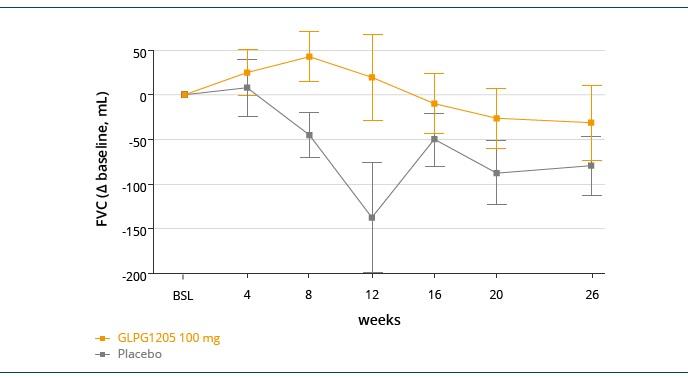

We are also dependent on the success of our other clinical-stage product candidates, such as our idiopathic pulmonary fibrosis candidates (GLPG1205 and GLPG4716 and other candidates), and our inflammation candidates/trials (such as GLPG3970, GLPG3667 GLPG3121, and GLPG4399, and the MANTA/MANTA RAy trials with filgotinib). We cannot give any assurance that any product candidate will successfully complete clinical trials or receive regulatory approval, which is necessary before it can be commercialized.

Clinical development is a lengthy and expensive process with an uncertain outcome, and results of earlier studies and trials as well as data from any interim analysis of ongoing clinical trials may not be predictive of future trial results or approved label for clinical use. Clinical failure can occur at any stage of clinical development.

Due to our limited resources and access to capital in the past, we have decided to prioritize development of certain product candidates and may have forgone the opportunity to capitalize on product candidates or indications that may ultimately have been more profitable or for which there was a greater likelihood of success.

We may not be successful in our efforts to use and expand our novel, proprietary target discovery platform to build a pipeline of product candidates.

The regulatory approval processes of the FDA, the EMA, the MHLW, and other comparable regulatory authorities are lengthy, time consuming and inherently unpredictable which may affect the commercial viability of our products in development. If we are unable ultimately to obtain regulatory approval for our product candidates, our business will be substantially harmed.

In connection with our global clinical trials, local regulatory authorities may have differing perspectives on clinical protocols and safety parameters, which impacts the manner in which we conduct these global clinical trials and could negatively impact our chances for obtaining regulatory approvals or marketing authorization in these jurisdictions, or for obtaining the requested label or dosage for our product candidates, if regulatory approvals or marketing authorizations are obtained.

Even if we receive regulatory approval for any of our product candidates, we will be subject to ongoing obligations and continued regulatory review, which may result in significant additional expense. Additionally, our product candidates, if approved, could be subject to labeling and other restrictions and market withdrawal and we may be subject to penalties if we fail to comply with regulatory requirements or experience unanticipated problems with our products.

Our future clinical trials or those of any of our collaborators may reveal significant adverse events not seen in our preclinical studies or earlier clinical trials and result in a safety profile that could inhibit regulatory approval or market acceptance of any of our product candidates.

Coverage and reimbursement decisions by third-party payers may have an adverse effect on pricing and market acceptance.

Legislative and regulatory activity may exert downward pressure on potential pricing and reimbursement for any of our product candidates, if approved, that could materially affect the opportunity to commercialize.

We face significant competition for our drug discovery and development efforts, and if we do not compete effectively, our commercial opportunities will be reduced or eliminated.

Our ability to compete may decline if we do not adequately protect our proprietary rights.

Our business, results of operations and future growth prospects could be materially and adversely affected by the COVID-19 pandemic.

The market price of the ADSs could be subject to wide fluctuations.

We may be at an increased risk of securities class action litigation.

Not applicable.

Not applicable.

Our audited consolidated financial statements have been prepared in accordance with IFRS, as issued by the IASB. We derived the selected statements of consolidated operations data, selected statements of consolidated financial position and selected statements of consolidated cash flows, each as of and for the years ended December 31, 2020, 2019 and 2018 from the audited consolidated financial statements, which are included herein. We derived the selected statements of consolidated operations data, selected statements of consolidated financial position and selected statements of consolidated cash flows, each as of and for the years ended December 2017 and 2016 from our audited consolidated financial statements, which are not included herein.

This data should be read together with, and is qualified in its entirety by reference to, “Item 5—Operating and financial review and prospects” as well as our financial statements and notes thereto appearing elsewhere in this annual report. Our historical results are not necessarily indicative of the results to be expected in the future.

Consolidated statement of operations:

|

|

|

Year ended December 31, |

|||||||||||||

|

|

|

2020 |

|

2019 (*) |

|

2018 (*) |

|

2017 |

|

2016 |

|||||

|

|

|

|

(Euro, in thousands, except per share data) |

||||||||||||

|

Revenues |

|

€ |

478,053 |

|

€ |

834,901 |

|

€ |

278,666 |

|

€ |

127,087 |

|

€ |

129,519 |

|

Other income |

|

|

52,207 |

|

|

50,896 |

|

|

29,000 |

|

|

28,830 |

|

|

22,093 |

|

Total revenues and other income |

|

|

530,260 |

|

|

885,797 |

|

|

307,666 |

|

|

155,918 |

|

|

151,612 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Research and development expenses |

|

|

(523,667) |

|

|

(420,090) |

|

|

(316,222) |

|

|

(218,502) |

|

|

(139,573) |

|

Sales and marketing expenses |

|

|

(66,468) |

|

|

(24,577) |

|

|

(4,146) |

|

|

(2,803) |

|

|

(1,785) |

|

General and administrative expenses |

|

|

(118,757) |

|

|

(72,382) |

|

|

(34,377) |

|

|

(24,415) |

|

|

(21,744) |

|

Total operating expenses |

|

|

(708,892) |

|

|

(517,049) |

|

|

(354,746) |

|

|

(245,720) |

|

|

(163,103) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating income/loss (-) |

|

|

(178,632) |

|

|

368,748 |

|

|

(47,080) |

|

|

(89,802) |

|

|

(11,491) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Fair value re-measurement of share subscription agreement and warrants |

|

|

3,034 |

|

|

(181,644) |

|

|

— |

|

|

— |

|

|

57,479 |

|

Other financial income |

|

|

18,667 |

|

|

21,389 |

|

|

18,264 |

|

|

4,877 |

|

|

9,950 |

|

Other financial expenses |

|

|

(152,844) |

|

|

(59,968) |

|

|

(2,602) |

|

|

(30,582) |

|

|

(1,692) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Income/loss (-) before tax |

|

|

(309,775) |

|

|

148,525 |

|

|

(31,417) |

|

|

(115,507) |

|

|

54,246 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Income taxes |

|

|

(1,226) |

|

|

165 |

|

|

(822) |

|

|

(198) |

|

|

(235) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net income/loss (-) from continuing operations |

|

|

(311,001) |

|

|

148,689 |

|

|

(32,240) |

|

|

(115,704) |

|

|

54,012 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net income from discontinued operations, net of tax |

|

|

5,565 |

|

|

1,156 |

|

|

2,981 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net income/loss (-) |

|

€ |

(305,436) |

|

€ |

149,845 |

|

€ |

(29,259) |

|

€ |

(115,704) |

|

€ |

54,012 |

|

Net income/loss (-) attributable to: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Owners of the parent |

|

|

(305,436) |

|

|

149,845 |

|

|

(29,259) |

|

|

(115,704) |

|

|

54,012 |

|

Basic income/loss (-) per share |

|

€ |

(4.69) |

|

€ |

2.60 |

|

€ |

(0.56) |

|

€ |

(2.34) |

|

€ |

1.18 |

|

Diluted income/loss (-) per share |

|

€ |

(4.69) |

|

€ |

2.49 |

|

€ |

(0.56) |

|

€ |

(2.34) |

|

€ |

1.14 |

|

Basic income/loss (-) per share from continuing operations |

|

€ |

(4.78) |

|

€ |

2.58 |

|

€ |

(0.62) |

|

€ |

(2.34) |

|

€ |

1.18 |

|

Diluted income/loss (-) per share from continuing operations |

|

€ |

(4.78) |

|

€ |

2.47 |

|

€ |

(0.62) |

|

€ |

(2.34) |

|

€ |

1.14 |

|

Weighted average number of shares - Basic (in '000 shares) |

|

|

65,075 |

|

|

57,614 |

|

|

52,113 |

|

|

49,479 |

|

|

45,696 |

|

Weighted average number of shares - Diluted (in '000 shares) |

|

|

65,075 |

|

|

60,113 |

|

|

52,113 |

|

|

49,479 |

|

|

47,308 |

|

(*) The 2019 and 2018 comparatives have been restated to consider the impact of classifiying the Fidelta business as discontinued opearations in 2020. |

|||||||||||||||

Condensed consolidated statement of financial position:

|

|

|

December 31, |

|||||||||||||

|

|

|

2020 |

|

2019 |

|

2018 |

|

2017 |

|

2016 |

|||||

|

|

|

|

(Euro, in thousands) |

||||||||||||

|

Current financial investments |

|

€ |

3,026,278 |

|

€ |

3,919,216 |

|

€ |

— |

|

€ |

— |

|

€ |

— |

|

Cash and cash equivalents |

|

|

2,135,187 |

|

|

1,861,616 |

|

|

1,290,796 |

|

|

1,151,211 |

|

|

973,241 |

|

Cash and cash equivalents classified as assets held for sale |

|

|

7,884 |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

Total assets |

|

|

5,717,731 |

|

|

6,068,609 |

|

|

1,439,496 |

|

|

1,286,274 |

|

|

1,083,338 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Share capital |

|

|

291,312 |

|

|

287,282 |

|

|

236,540 |

|

|

233,414 |

|

|

223,928 |

|

Share premium account |

|

|

2,727,840 |

|

|

2,703,583 |

|

|

1,277,780 |

|

|

993,025 |

|

|

649,135 |

|

Total equity |

|

|

2,670,355 |

|

|

2,875,658 |

|

|

1,214,249 |

|

|

1,011,983 |

|

|

758,701 |

|

Total non-current liabilities |

|

|

2,412,101 |

|

|

2,621,158 |

|

|

5,342 |

|

|

102,592 |

|

|

220,846 |

|

Total current liabilities |

|

|

635,274 |

|

|

571,793 |

|

|

219,905 |

|

|

171,699 |

|

|

103,791 |

|

Total liabilities |

|

|

3,047,375 |

|

|

3,192,951 |

|

|

225,247 |

|

|

274,291 |

|

|

324,637 |

|

Total liabilities and equity |

|

€ |

5,717,731 |

|

€ |

6,068,609 |

|

€ |

1,439,496 |

|

€ |

1,286,274 |

|

€ |

1,083,338 |

Condensed consolidated statement of cash flows:

|

|

|

2020 |

|

2019 |

|

2018 |

|

2017 |

|

2016 |

|||||

|

|

|

(Euro, in thousands) |

|||||||||||||

|

Cash and cash equivalents at beginning of the period |

|

€ |

1,861,616 |

|

€ |

1,290,796 |

|

€ |

1,151,211 |

|

€ |

973,241 |

|

€ |

340,314 |

|

Net cash flows generated/used (-) in operating activities |

|

|

(427,336) |

|

|

3,208,617 |

|

|

(142,466) |

|

|

(147,030) |

|

|

239,403 |

|

Net cash flows generated/used (-) in investing activities |

|

|

757,288 |

|

|

(3,764,660) |

|

|

(15,914) |

|

|

(549) |

|

|

(7,287) |

|

Net cash flows generated in financing activities |

|

|

22,040 |

|

|

1,335,751 |

|

|

287,876 |

|

|

353,357 |

|

|

395,996 |

|

Transfer to current financial investments |

|

|

— |

|

|

(198,922) |

|

|

— |

|

|

— |

|

|

— |

|

Effect of exchange rate differences on cash and cash equivalents |

|

|

(70,539) |

|

|

(9,966) |

|

|

10,089 |

|

|

(27,808) |

|

|

4,816 |

|

Cash and cash equivalents at end of the period |

|

€ |

2,143,071 |

|

€ |

1,861,616 |

|

€ |

1,290,796 |

|

€ |

1,151,211 |

|

€ |

973,241 |

|

|

|

December 31, |

|||||||||||||

|

|

|

2020 |

|

2019 |

|

2018 |

|

2017 |

|

2016 |

|||||

|

|

|

|

(Euro, in thousands) |

||||||||||||

|

Current financial investments |

|

€ |

3,026,278 |

|

€ |

3,919,216 |

|

€ |

— |

|

€ |

— |

|

€ |

— |

|

Cash and cash equivalents from continuing operations |

|

|

2,135,187 |

|

|

1,861,616 |

|

|

1,290,796 |

|

|

1,151,211 |

|

|

973,241 |

|

Cash and cash equivalents classified as assets held for sale |

|

|

7,884 |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

Current financial investments and cash and cash equivalents |

|

€ |

5,169,349 |

|

€ |

5,780,832 |

|

€ |

1,290,796 |

|

€ |

1,151,211 |

|

€ |

973,241 |

|

B. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Not applicable. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

C. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Not applicable. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Our business is subject to significant risks. You should carefully consider all of the information set forth in this annual report and in our other filings with the U.S. Securities and Exchange Commission, or the SEC, including the following risk factors which we face, and which are faced by our industry. Our business, financial condition, or results of operations could be materially adversely affected by any of these risks. This report also contains forward-looking statements that involve risks and uncertainties. Our results could materially differ from those anticipated in these forward-looking statements, as a result of certain factors including the risks described below and elsewhere in this annual report and our other SEC filings. See “Special Note Regarding Forward-Looking Statements” above.

Risks related to commercialization

The marketing and sale of filgotinib or future approved products may be unsuccessful or less successful than anticipated. We are heavily dependent on the success of filgotinib, which is approved for the treatment of rheumatoid arthritis in Europe and Japan, and under regulatory review in the European Union for the treatment of ulcerative colitis.

We, and our collaboration partner, Gilead, began commercializing filgotinib in the European Union and Gilead began in Japan for the treatment of rheumatoid arthritis, or RA, following receipt in September 2020 of conditional marketing approval from the European Medicines Agency, or the EMA, and from the Japanese Ministry of Health, Labor and Welfare, or the MHLW. In November 2020, Gilead submitted a Marketing Authorization Application, or MAA, to the EMA for filgotinib for the treatment of ulcerative colitis, or UC. We expect Gilead to submit an application for approval to the MHLW for filgotinib for the treatment of UC in the first half of 2021.

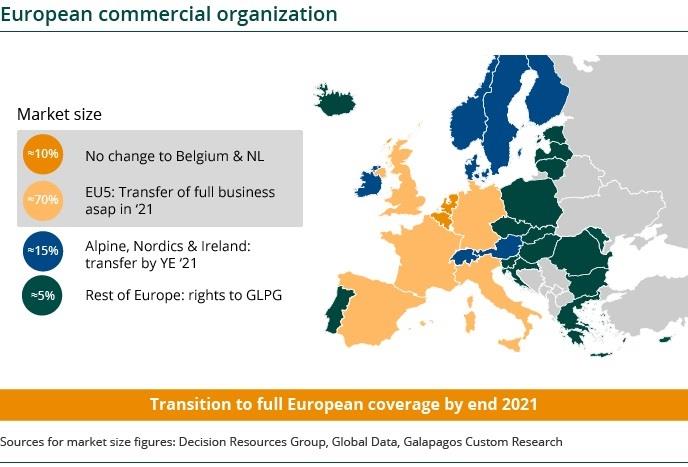

In December 2020, we and Gilead entered into a binding term sheet, pursuant to which we agreed to amend our arrangement so that we will assume sole responsibility in Europe for the commercialization of filgotinib as well as for all future indications for filgotinib, by the end of 2021, with Gilead maintaining commercialization rights and the marketing authorization holder for filgotinib and other future indications for filgotinib outside of Europe. We have limited experience as a commercial company, and there is limited information about our ability to overcome many of the risks and uncertainties encountered by companies commercializing products in the biopharmaceutical industry. To market and sell filgotinib, we will need to successfully:

| · |

establish and maintain, in the geographies where we hope to treat patients, relationships with qualified treatment centers who will be treating the patients who receive filgotinib and any future products; |

|

| · |

obtain adequate pricing and reimbursement for filgotinib and any future products in each of the jurisdictions in which we plan to commercialize approved products; |

|

| · |

gain regulatory acceptance for the development and commercialization of the product candidates in our pipeline; |

|

| · |

develop and maintain successful strategic alliances; and |

|

| · |

manage our spending as costs and expenses increase due to clinical trials, marketing approvals, and commercialization, including for any extension of marketing approval of filgotinib, and for any future products. |

If we are not successful in accomplishing these objectives, we may not be able to develop product candidates, commercialize filgotinib or any future products, raise capital, expand our business, or continue our operations. Further, to the extent that Gilead is commercializing filgotinib in one or more jurisdictions, we are significantly dependent on their successful accomplishment of these objectives, which is largely out of our control.

The commercial success of filgotinib and of any future products will depend upon the degree of market acceptance by physicians, healthcare payers, patients, and the medical community.

The commercial success of filgotinib and of any future products will depend in part on acceptance by the medical community, patients, and third-party or governmental payers as medically useful, cost-effective, and safe. Filgotinib and any other products that we and our current and future partners may bring to the market may not gain market acceptance by physicians, patients, third-party payers and others in the medical community. If these products do not achieve an adequate level of acceptance, we may not generate significant product revenue and may not become profitable. The degree of market acceptance of filgotinib and of any future products will depend on a number of factors, including:

| · |

the efficacy and safety as demonstrated in clinical trials; |

|

| · |

the timing of market introduction of the product as well as the timing of entry of competitive products; |

| · |

the clinical indications for which the product is approved; |

|

| · |

acceptance by physicians, the medical community, and patients of the product as a safe and effective treatment; |

|

| · |

the convenience of prescribing and initiating patients on the product; |

|

| · |

the potential and perceived advantages of such product over alternative treatments; |

|

| · |

the cost of treatment in relation to alternative treatments, including any similar generic treatments; |

|

| · |

the availability of coverage and adequate reimbursement and pricing by third-party payers and government authorities; |

|

| · |

relative convenience and ease of administration; |

|

| · |

the prevalence and severity of adverse side effects; and |

|

| · |

the effectiveness of sales and marketing efforts. |

Even if a product displays a favorable efficacy and safety profile in preclinical and clinical studies and receives regulatory approval, market acceptance of the product will not be known until after it is launched. Our efforts to educate the medical community and third-party payers on the benefits of our products may require significant resources and may never be successful. Our efforts to educate the marketplace may require more resources than are required by the conventional technologies marketed by our competitors. Any of these factors may cause filgotinib or any future products to be unsuccessful or less successful than anticipated.

We have limited sales and distribution experience and are currently building a marketing and sales organization. We expect to continue to invest significant financial and management resources to continue to build these capabilities and to establish a European commercial infrastructure. To the extent any of our product candidates for which we maintain commercial rights is approved for marketing, if we are unable to establish marketing and sales capabilities or enter into agreements with third parties to market and sell our product candidates, we may not be able to market and sell any product candidates effectively, or generate product revenues.

We currently are building a marketing and sales organization for the marketing, sales, and distribution of pharmaceutical products. In December 2020, we and Gilead entered into a binding term sheet pursuant to which we agreed to amend our arrangement so that we will assume sole responsibility in Europe for the commercialization of filgotinib, as well as for all future indications for filgotinib, by the end of 2021, which requires us to develop robust marketing and sales capabilities. We have limited experience as a commercial company and there is limited information about our ability to overcome many of the risks and uncertainties encountered by companies commercializing products in the biopharmaceutical industry. In order to commercialize independently filgotinib in Europe and any product candidates that receive marketing approval and for which we maintain commercial rights, we will need to build marketing, sales, distribution, managerial and other non-technical capabilities or make arrangements with third parties to perform these services, and we may not be successful in doing so. Further, in the event of successful development of any product candidates for which we maintain commercial rights, we may elect to build a targeted specialty sales force which will be expensive and time consuming. Any failure or delay in the development of our internal market access, sales, marketing and distribution capabilities would adversely impact the commercialization of these products. With respect to any proprietary product candidates we may have in the future, we may choose to partner with third parties that have direct sales forces and established distribution systems, either to augment our own sales force and distribution systems or in lieu of our own sales force and distribution systems.

If we are unable to continue to develop and scale our own sales, marketing and distribution capabilities for filgotinib in Europe, or for any future products which we choose to self-commercialize, we will not be able to successfully commercialize such products without reliance on third parties and, in the case of filgotinib, may be unable to realize all of the benefits of the transition of European rights to filgotinib from Gilead to us. Further, if we are unable to enter into collaborations with third parties for the commercialization of approved products, if any, on acceptable terms or at all, or if any such partner (such as Gilead, in the case of filgotinib and filgotinib for additional indications) does not devote sufficient resources to the commercialization of our product or otherwise fails in commercialization efforts, we may not be able to successfully commercialize any of our product candidates that receive regulatory approval. If we are not successful in commercializing our product candidates, either on our own or through collaborations with one or more third parties, our future revenue will be materially and adversely impacted.

Coverage and reimbursement decisions by third-party payers may have an adverse effect on pricing and market acceptance.

There is significant uncertainty related to the third-party coverage and reimbursement of newly approved drugs. To the extent that we retain commercial rights following clinical development, we would seek approval to market our product candidates in the United States, the European Union and other selected jurisdictions. Market acceptance and sales of our product candidates, if approved, in both domestic and international markets will depend significantly on the availability of adequate coverage and reimbursement from third-party payers for any of our product candidates and may be affected by existing and future healthcare reform measures. Third-party payers, such as government authorities, private health insurers and health maintenance organizations, decide which drugs they will cover and establish payment levels.

We cannot be certain that coverage and adequate reimbursement will be available for any of our product candidates, if approved. Also, we cannot be certain that reimbursement policies will not reduce the demand for, or the price paid for, any of our product candidates, if approved. If reimbursement is not available or is available on a limited basis for any of our product candidates, if approved, we may not be able to commercialize successfully any such product candidate. Reimbursement by a third-party payer may depend upon a number of factors, including, without limitation, the third-party payer’s determination that use of a product is:

| · |

a covered benefit under its health plan; |

|

| · |

safe, effective and medically necessary; |

|

| · |

appropriate for the specific patient; |

|

| · |

cost-effective; and neither experimental nor investigational. |

Obtaining coverage and reimbursement approval for a product from a government or other third-party payer is a time consuming and costly process that could require us to provide supporting scientific, clinical and cost-effectiveness data for the use of our products to the payer. We may not be able to provide data sufficient to gain acceptance with respect to coverage and reimbursement or to have pricing set at a satisfactory level. If reimbursement of our future products, if any, is unavailable or limited in scope or amount, or if pricing is set at unsatisfactory levels such as may result where alternative or generic treatments are available, we may be unable to achieve or sustain profitability.

In certain countries, particularly in the European Union, the pricing of prescription pharmaceuticals is subject to governmental control. In these countries, pricing negotiations with governmental authorities can take considerable time after the receipt of marketing approval for a product candidate. To obtain reimbursement or pricing approval in some countries, we may be required to conduct additional clinical trials that compare the cost-effectiveness of our product candidates to other available therapies. If reimbursement of any of our product candidates, if approved, is unavailable or limited in scope or amount in a particular country, or if pricing is set at unsatisfactory levels, we may be unable to achieve or sustain profitability of our products in such country.

The delivery of healthcare in the European Union, including the establishment and operation of health services and the pricing and reimbursement of medicines, is almost exclusively a matter for national, rather than EU, law and policy. National governments and health service providers have different priorities and approaches to the delivery of healthcare and the pricing and reimbursement of products in that context. In general, however, the healthcare budgetary constraints in most EU member states have resulted in restrictions on the pricing and reimbursement of medicines by relevant health service providers. Coupled with ever-increasing EU and national regulatory burdens on those wishing to develop and market products, this could prevent or delay marketing approval of our product candidates, restrict or regulate post-approval activities and affect our ability to commercialize any products for which we obtain marketing approval.

Legislative and regulatory activity may exert downward pressure on potential pricing and reimbursement for any of our product candidates, if approved, that could materially affect the opportunity to commercialize.

The United States and several other jurisdictions are considering, or have already enacted, a number of legislative and regulatory proposals to change the healthcare system in ways that could affect our ability to sell any of our product candidates profitably, if approved. Among policy-makers and payers in the United States and elsewhere, there is significant interest in promoting changes in healthcare systems with the stated goals of containing healthcare costs, improving quality and/or expanding access to healthcare. In the United States, the pharmaceutical industry has been a particular focus of these efforts and has been significantly affected by major legislative initiatives. There have been, and likely will continue to be, legislative and regulatory proposals at the federal and state levels directed at broadening the availability of healthcare and containing or lowering the cost of healthcare. We cannot predict the initiatives that may be adopted in the future.

The continuing efforts of the government, insurance companies, managed care organizations and other payers of healthcare services to contain or reduce costs of healthcare may adversely affect:

| · |

the demand for any of our product candidates, if approved; |

|

| · |

the ability to set a price that we believe is fair for any of our product candidates, if approved; |

|

| · |

our ability to generate revenues and achieve or maintain profitability; |

|

| · |

the level of taxes that we are required to pay; and |

|

| · |

the availability of capital. |

In 2010, the Patient Protection and Affordable Care Act, as amended by the Health Care and Education Reconciliation Act of 2010, or, collectively, the ACA, became law in the United States. The goal of the ACA is to reduce the cost of healthcare and substantially change the way healthcare is financed by both governmental and private insurers. The ACA may result in downward pressure on pharmaceutical reimbursement, which could negatively affect market acceptance of any of our product candidates, if they are approved. Provisions of the ACA relevant to the pharmaceutical industry include the following:

| · |

an annual, nondeductible fee on any entity that manufactures or imports certain branded prescription drugs and biologic products, apportioned among these entities according to their market share in certain government healthcare programs; |

|

| · |

an increase in the rebates a manufacturer must pay under the Medicaid Drug Rebate Program to 23.1% and 13% of the average manufacturer price for branded and generic drugs, respectively; |

|

| · |

a new Medicare Part D coverage gap discount program, in which manufacturers must agree to offer 50% point-of-sale discounts (increased to 70% as of January 1, 2019 pursuant to the Bipartisan Budget Act of 2018) on negotiated prices of applicable brand drugs to eligible beneficiaries during their coverage gap period, as a condition for the manufacturer’s outpatient drugs to be covered under Medicare Part D; |

|

| · |

extension of the manufacturers’ Medicaid rebate liability to covered drugs dispensed to individuals who are enrolled in Medicaid managed care organizations; |

|

| · |

expansion of the eligibility criteria for Medicaid programs by, among other things, allowing states to offer Medicaid coverage to additional individuals and by adding new mandatory eligibility categories for certain individuals with income at or below 133% of the Federal Poverty Level, thereby potentially increasing manufacturers’ Medicaid rebate liability; |

| · |

expansion of the entities eligible for discounts under the Public Health Service pharmaceutical pricing program; |

|

| · |

requirements under the federal Open Payments program and its implementing regulations for the disclosure by certain drug, biologic product, device and medical supply manufacturers of payments made to physicians (currently defined to include doctors, dentists, optometrists, podiatrists and chiropractors), physician assistants, nurse practitioners, clinical nurse specialists, certified registered nurse anesthetists and teaching hospitals and of ownership or investment interests held by physicians and their immediate family members in these manufacturers; |

|

| · |

expansion of healthcare fraud and abuse laws, including the federal False Claims Act and the federal Anti-Kickback Statute, new government investigative powers and enhanced penalties for noncompliance; |

|

| · |

a licensure framework for follow-on biologic products; and |

|

| · |

a new Patient-Centered Outcomes Research Institute to oversee, identify priorities in and conduct comparative clinical effectiveness research, along with funding for such research. |

Since its enactment, there have been numerous judicial, administrative, executive, and legislative challenges to certain aspects of the ACA, and we expect there will be additional challenges and amendments to the ACA in the future. Various portions of the ACA are currently undergoing legal and constitutional challenges in the United States Supreme Court and members of Congress have introduced several pieces of legislation aimed at significantly revising or repealing the ACA. The United States Supreme Court is expected to rule on a legal challenge to the constitutionality of the ACA in early 2021. The implementation of the ACA is ongoing, the law appears likely to continue the downward pressure on pharmaceutical pricing, especially under the Medicare program, and may also increase our regulatory burdens and operating costs. Litigation and legislation related to the ACA are likely to continue, with unpredictable and uncertain results.

Risks related to product development and regulatory approval

We are also dependent on the success of our other clinical-stage product candidates, such as our idiopathic pulmonary fibrosis candidates (GLPG1205 and GLPG4716 and other candidates), and our inflammation candidates (such as GLPG3970, GLPG3667 GLPG3121, and GLPG4399). We cannot give any assurance that any product candidate will successfully complete clinical trials or receive regulatory approval, which is necessary before it can be commercialized.

Filgotinib is in Phase 3 trials in Crohn’s disease, or CD. Our business and future success is substantially dependent on our ability to commercialize filgotinib and to develop, obtain regulatory approval for, and then successfully commercialize filgotinib in additional indications. Our business and future success also depend on our ability to develop successfully, obtain regulatory approval for, and then successfully commercialize our other clinical-stage product candidates, including GLPG1205, GLPG4716, GLPG3970, GLPG3667, GLPG3121 and GLPG4399.

Our product candidates will require additional clinical development, management of clinical and manufacturing activities, regulatory approval in multiple jurisdictions (if regulatory approval can be obtained at all), securing sources of commercial manufacturing supply, building of, or partnering with, a commercial organization, substantial investment and significant marketing, sales and distribution efforts before any revenues can be generated from product sales. We are not permitted to market or promote any of our product candidates before we receive regulatory approval from the FDA, the EMA, or any other comparable regulatory authority such as the MHLW, and we may never receive such regulatory approval for any of our product candidates. We cannot assure you that our clinical trials for filgotinib in additional indications, GLPG1205, GLPG4716, GLPG3970, GLPG3667, GLPG3121 and GLPG4399 and other candidates will be completed in a timely manner, or at all, or that we will be able to obtain approval from the FDA, the EMA, the MHLW, or any other comparable regulatory authority for any of these product candidates. We cannot be certain that we will advance any other product candidates into clinical trials. If any of filgotinib in additional indications, GLPG1205, GLPG4716, GLPG3970, GLPG3667, GLPG3121 or GLPG4399 or any future product candidate is not approved and commercialized, we will not be able to generate any product revenues for that product candidate. Moreover, any delay or setback in the development of any product candidate could adversely affect our business and cause the price of the American Depositary Shares, or ADSs, or our ordinary shares to fall.

Due to our limited resources and access to capital in the past, we have decided to prioritize development of certain product candidates and may have forgone the opportunity to capitalize on product candidates or indications that may ultimately have been more profitable or for which there was a greater likelihood of success.

Because we had limited resources in the past, we had to decide which product candidates to pursue and the amount of resources to allocate to each. Consequently, we are currently primarily focused on the commercialization of filgotinib and the development of filgotinib in other indications, as well as on advancing our clinical-stage pipeline, including filgotinib, GLPG3970, GLPG3667, GLPG3121, GLPG4399, GLPG1205 and GLPG4716. Our decisions concerning the allocation of research, collaboration, management, commercial and financial resources toward particular compounds, product candidates or therapeutic areas may not lead to the development of viable commercial products, we may forgo or delay pursuit of opportunities with other product candidates, or for other indications that may prove to have greater commercial potential. Similarly, our potential decisions to delay, terminate or collaborate with third parties in respect of certain product development programs may also prove not to be optimal and could cause us to miss valuable opportunities. If we make incorrect determinations regarding the market potential of our product candidates or misread trends in the pharmaceutical industry, our business, financial condition and results of operations could be materially adversely affected.

The regulatory approval processes of the FDA, the EMA, the MHLW and other comparable regulatory authorities are lengthy, time consuming and inherently unpredictable which may affect the commercial viability of our products in development. If we are unable ultimately to obtain regulatory approval for our product candidates, our business will be substantially harmed.

The time required to obtain approval by the FDA, the EMA, the MHLW and other comparable regulatory authorities is unpredictable but typically takes many years following the commencement of clinical trials and depends upon numerous factors, including the substantial discretion of the regulatory authorities. In addition, approval policies, regulations, or the type and amount of clinical data necessary to gain approval may change during the course of a product candidate’s clinical development and may vary among jurisdictions. Although we and Gilead have received regulatory approval for filgotinib in Europe and Japan, and filgotinib is currently under regulatory review in Europe for the treatment of UC, it is possible that none of our other existing product candidates or any product candidates we may seek to develop in the future will ever obtain regulatory approval.

Our product candidates could fail to receive regulatory approval for many reasons, including the following:

| · |

the FDA, the EMA, the MHLW or other comparable regulatory authorities may disagree with the design or implementation of our clinical trials; |

|

| · |

we may be unable to demonstrate to the satisfaction of the FDA, the EMA, the MHLW or other comparable regulatory authorities that a product candidate is safe and effective for its proposed indication; |

|

| · |

the results of clinical trials may not meet the level of statistical significance required by the FDA, the EMA, the MHLW or other comparable regulatory authorities for approval; |

|

| · |

we may be unable to demonstrate that a product candidate’s clinical and other benefits outweigh its safety risks; |

|

| · |

filgotinib and many of our other product candidates are developed to act against targets discovered by us, and because many of our product candidates are novel mode of action products, they can carry an additional risk regarding the desired level of efficacy and safety profile; |

|

| · |

the FDA, the EMA, the MHLW or other comparable regulatory authorities may disagree with our interpretation of data from preclinical studies or clinical trials; |

| · |

the data collected from clinical trials of our product candidates may not be sufficient to support the submission of an NDA, supplemental NDA, biologics license application, or BLA, or other submission or to obtain regulatory approval in the United States, Europe or elsewhere; |

|

| · |

the FDA, the EMA, the MHLW or other comparable regulatory authorities may find deficiencies with or fail to approve the manufacturing processes or facilities of third-party manufacturers with which we contract for clinical and commercial supplies or such processes or facilities may not pass a pre-approval inspection; and |

|

| · |

the approval policies or regulations of the FDA, the EMA, the MHLW or other comparable regulatory authorities may change or differ from one another significantly in a manner rendering our clinical data insufficient for approval. |

This lengthy approval process as well as the unpredictability of future clinical trial results may result in our or our collaboration partners’ failure to obtain regulatory approval to market filgotinib in additional indications, GLPG1205, GLPG4716, GLPG3970, GLPG3667, GLPG3121, GLPG4399 and/or other product candidates, which would harm our business, results of operations and prospects significantly. In addition, even if we were to obtain approval, regulatory authorities may approve any of our product candidates for fewer or more limited indications than we request, may grant approval contingent on the performance of costly post-marketing clinical trials, or may approve a product candidate with a label that does not include the labeling claims necessary or desirable for the successful commercialization of that product candidate. In certain jurisdictions, regulatory authorities may not approve the price we intend to charge for our products. Any of the foregoing scenarios could materially harm the commercial prospects for our product candidates.

We cannot be certain that any of our product candidates will be successful in clinical trials or receive regulatory approval. Further, our product candidates may not receive regulatory approval even if they are successful in clinical trials. If we do not receive regulatory approvals for our product candidates, we may not be able to continue our operations. Even though we have successfully obtained regulatory approval for filgotinib in several jurisdictions and even if we successfully obtain regulatory approvals to market one or more of our product candidates, our revenues will be dependent, to a significant extent, upon the size of the markets in the territories for which we gain regulatory approval and have commercial rights or share in revenues from the exercise of such rights. If the markets for patient subsets that we are targeting (such as UC) are not as significant as we estimate, we may not generate significant revenues from sales of such products, if approved.

Additionally, as of June 23, 2020, the FDA noted it is continuing to ensure timely reviews of applications for medical products during the COVID-19 pandemic in line with its user fee performance goals; however, the FDA may not be able to continue its current pace and approval timelines could be extended, including where a pre-approval inspection or an inspection of clinical sites is required and due to the COVID-19 pandemic and travel restrictions the FDA is unable to complete such required inspections during the review period.

In connection with our global clinical trials, local regulatory authorities may have differing perspectives on clinical protocols and safety parameters, which impacts the manner in which we conduct these global clinical trials and could negatively impact our chances for obtaining regulatory approvals or marketing authorization in these jurisdictions, or for obtaining the requested label or dosage for our product candidates, if regulatory approvals or marketing authorizations are obtained.

In connection with our global clinical trials, we are obliged to comply with the requirements of local regulatory authorities in each jurisdiction where we execute and locate a clinical trial. Local regulatory authorities can request specific changes to the clinical protocol or specific safety measures that differ from the positions taken in other jurisdictions. For example, filgotinib received approval in RA from the EMA in Europe and the MHLW in Japan, yet a CRL from the FDA in the United States. The FDA, EMA, and MHLW will receive the data from the MANTA and MANTA-RAy male semen parameter studies conducted in parallel to the FINCH Phase 3 program in RA. We cannot assure you that the same view of the MANTA and MANTA-RAy results will be adopted by regulatory authorities at the marketing authorization stage, now that filgotinib completed registrational Phase 3 trials for UC and received marketing authorization in Europe and Japan for RA. Even though filgotinib received regulatory approval or marketing authorization in Europe and Japan for RA, the FDA or other regulatory authorities may approve different labels, including for whom the drug is indicated or require different warnings or precautions, or impose dosing restrictions that differ from the approved dosing regimen in other jurisdictions, and these differences could have a material adverse effect on our ability to commercialize our products in these jurisdictions.

Even if we receive regulatory approval for any of our product candidates, we will be subject to ongoing obligations and continued regulatory review, which may result in significant additional expense. Additionally, our product candidates, if approved, could be subject to labeling and other restrictions and market withdrawal and we may be subject to penalties if we fail to comply with regulatory requirements or experience unanticipated problems with our products.

Any regulatory approvals that we receive for our product candidates may also be subject to limitations on the approved indicated uses for which the product may be marketed or to the conditions of approval, or contain requirements for potentially costly post-marketing testing, including Phase 4 clinical trials, and surveillance to monitor the safety and efficacy of the product candidate, and we may be required to include labeling that includes significant use or distribution restrictions or significant safety warnings, including boxed warnings.

If the FDA, EMA, the MHLW, or any other comparable regulatory authority approves any of our product candidates, the manufacturing processes, labeling, packaging, distribution, adverse event reporting, storage, advertising, promotion and recordkeeping for the product will be subject to extensive and ongoing regulatory requirements. These requirements include submissions of safety and other post-marketing information and reports, registration requirements and continued compliance with current good manufacturing practices, or cGMPs, and good clinical practices, or GCPs, for any clinical trials that we conduct post-approval. Later discovery of previously unknown problems with a product, including adverse events of unanticipated severity or frequency, or with our third-party manufacturers or manufacturing processes, or failure to comply with regulatory requirements, may result in, among other things:

| · | restrictions on the marketing or manufacturing of the product, withdrawal of the product from the market, or voluntary or mandatory product recalls; | |

| · | fines, untitled or warning letters or holds on clinical trials; | |

| · | refusal by the FDA, the EMA, the MHLW, or any other comparable regulatory authority to approve pending applications or supplements to approved applications filed by us, or suspension or revocation of product approvals or licenses; | |

| · | product seizure or detention, or refusal to permit the import or export of products; and | |

| · | injunctions or the imposition of civil or criminal penalties. |

For example, the Medicines and Healthcare products Regulatory Agency of the United Kingdom has assigned a black triangle to filgotinib, indicating that it is on a list of medicines subject to additional monitoring. The policies of the FDA, the EMA, the MHLW, and other comparable regulatory authorities may change, and additional government regulations may be enacted that could prevent, limit or delay regulatory approval of our product candidates. If we are slow or unable to adapt to changes in existing requirements or the adoption of new requirements or policies, or if we are not able to maintain regulatory compliance, we may lose any marketing approval that we may have obtained, which would adversely affect our business, prospects and ability to achieve or sustain profitability.

Filgotinib, if approved, may be subject to box warnings, labeling restrictions or dose limitations in certain jurisdictions, which could have a material adverse impact on our ability to market filgotinib in these jurisdictions.

Based on preclinical findings, we expect that filgotinib, if approved in the U.S. or in other jurisdictions, may have a labeling statement warning female patients of childbearing age to take precautionary measures of birth control to protect against pregnancy. Additionally, filgotinib, if approved, may have a labeling statement warning for male patients. In animal toxicology studies, filgotinib induced adverse effect on the male reproductive system. We and Gilead are conducting dedicated male semen analysis studies in CD and UC patients (MANTA) and in RA, PsA, and AS patients (MANTA-RAy). In the EU and Japan where filgotinib has been approved for RA, those regulatory authorities could impose new labeling or other requirements upon learning of new information related to filgotinib.

Even if filgotinib receives regulatory approval or marketing authorization, the FDA or other regulatory authorities may impose dosing restrictions that differ from the approved dosing regimens in other jurisdictions.

Box warnings, labeling restrictions, dose limitations and similar restrictions on use could have a material adverse effect on our ability to commercialize filgotinib in those jurisdictions where such restrictions apply.

Clinical development is a lengthy and expensive process with an uncertain outcome, and results of earlier studies and trials as well as data from any interim analysis of ongoing clinical trials may not be predictive of future trial results or approved label for clinical use. Clinical failure can occur at any stage of clinical development.

Clinical testing is expensive and can take many years to complete, and its outcome is inherently uncertain. Failure can occur at any time during the clinical trial process. Although product candidates may demonstrate promising results in early clinical (human) trials and preclinical (animal) studies, they may not prove to be effective in subsequent clinical trials. For example, testing on animals may occur under different conditions than testing in humans and therefore the results of animal studies may not accurately predict human experience. Likewise, early clinical studies may not be predictive of eventual safety or effectiveness results in larger-scale pivotal clinical trials. The results of preclinical studies and previous clinical trials as well as data from any interim analysis of ongoing clinical trials of our product candidates, as well as studies and trials of other products with similar mechanisms of action to our product candidates, may not be predictive of the results of ongoing or future clinical trials. For example, the positive results generated to date in preclinical studies and Phase 1, Phase 2 and Phase 3 clinical trials for filgotinib in RA and UC and in the Phase 2 clinical trials for CD do not ensure that later clinical trials, including any post-approval clinical trials for approved products, will continue to demonstrate similar results or observations, including the Phase 3 studies in CD, currently ongoing. Product candidates in later stages of clinical trials may fail to show the desired safety and efficacy traits despite having progressed through preclinical studies and earlier clinical trials. In addition to the safety and efficacy traits of any product candidate, clinical trial failures may result from a multitude of factors including flaws in trial design, dose selection, placebo effect and patient enrollment criteria. A number of companies in the pharmaceutical industry have suffered significant setbacks in advanced clinical trials due to lack of efficacy or adverse safety profiles, notwithstanding promising results in earlier trials, and it is possible that we will as well. Based upon negative or inconclusive results, we or our collaboration partners may decide, or regulators may require us, to conduct additional clinical trials or preclinical studies. In addition, data obtained from trials and studies are susceptible to varying interpretations, and regulators may not interpret our data as favorably as we do, which may delay, limit or prevent regulatory approval.

We may experience delays in our ongoing clinical trials and we do not know whether planned clinical trials will begin on time, need to be redesigned, enroll patients on time or be completed on schedule, if at all. Clinical trials can be delayed for a variety of reasons, including delays related to:

| · | obtaining regulatory approval to commence a trial; | |

| · | reaching agreement on acceptable terms with prospective contract research organizations, or CROs, and clinical trial sites, the terms of which can be subject to extensive negotiation and may vary significantly among different CROs and trial sites; | |

| · | obtaining Institutional Review Board, or IRB, or ethics committee approval at each site; | |

| · | obtaining regulatory concurrence on the design and parameters for the trial; | |

| · | obtaining approval for the designs of our clinical development programs for each country targeted for trial enrollment; | |

| · | recruiting suitable patients to participate in a trial, which may be impacted by the number of competing trials that are enrolling patients; | |

| · |

having patients complete a trial or return for post-treatment follow-up; | |

| · | clinical sites deviating from trial protocol or dropping out of a trial; | |

| · | adding new clinical trial sites; | |

| · | manufacturing sufficient quantities of product candidate or obtaining sufficient quantities of comparator drug for use in clinical trials; | |

| · | the availability of adequate financing and other resources; or | |

| · | the ongoing COVID-19 pandemic. |

We could encounter delays if a clinical trial is suspended or terminated by us, our collaboration partners, by the IRBs or ethics committees of the institutions in which such trials are being conducted, or by the FDA, the EMA, MHLW, or other comparable regulatory authorities, or recommended for suspension or termination by the Data Monitoring Committee, or the DMC, for such trial. A suspension or termination may be imposed due to a number of factors, including failure to conduct the clinical trial in accordance with regulatory requirements or our clinical protocols, inspection of the clinical trial operations or trial site by the FDA, the EMA, MHLW, or other comparable regulatory authorities resulting in the imposition of a clinical hold, safety issues or adverse side effects, including those seen in the class to which our product candidates belong, failure to demonstrate a benefit from using a drug, changes in governmental regulations or administrative actions, manufacturing issues or lack of adequate funding to continue the clinical trial. For example, it is possible that safety issues or adverse side effects could be observed in trials for filgotinib in RA, UC, and CD; for GLPG1205, and GPG4716 in IPF; for GLPG3970, GLPG3667 or GLPG3121 in inflammation, which could result in a delay, suspension or termination of the ongoing trials of filgotinib (in one or more indications), GLPG1205, GLPG4716, GLPG4399, GLPG3970, GLPG3667, and GLPG3121. If we experience delays in the completion of, or termination of, any clinical trial of our product candidates, the commercial prospects of our product candidates will be harmed, and our ability to generate product revenues from any of these product candidates will be delayed. In addition, any delays in completing our clinical trials will increase our costs, slow down our product candidate development and approval process and jeopardize our ability to commence product sales and generate revenues. Any of these occurrences may harm our business, financial condition and prospects significantly. In addition, many of the factors that cause or lead to a delay in the commencement or completion of clinical trials may also ultimately lead to the denial of regulatory approval of our product candidates.

If filgotinib in additional indications, GLPG1205, GLPG4716, GLPG4399, GLPG3970, GLPG3667, or GLPG3121, or any other product candidate is found to be unsafe or lack efficacy, we will not be able to obtain regulatory approval for it and our business would be materially harmed.

In some instances, there can be significant variability in safety and/or efficacy results between different trials of the same product candidate due to numerous factors, including changes in trial protocols, differences in composition of the patient populations, adherence to the dosing regimen and other trial protocols and the rate of dropouts among clinical trial participants. We do not know whether any Phase 2, Phase 3, or other clinical trials we or any of our collaboration partners may conduct will demonstrate consistent or adequate efficacy and safety to obtain regulatory approval to market our product candidates. If we are unable to bring any of our current or future product candidates to market, our ability to create long-term shareholder value will be limited.