UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington D.C. 20549

Form 10-K

(Mark One) | ||

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | ||

For the fiscal year ended December 31 , 2023

or

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | ||

For the transition period from _____ to _____

Commission File Number: 001-34112

(Exact Name of Registrant as Specified in its Charter) |

(State or Other Jurisdiction of Incorporation) | (I.R.S. Employer Identification No.) | ||||||||

(Address of Principal Executive Offices) (Zip Code)

(510 ) 483-7370

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Securities Exchange Act of 1934:

Title of each class | Trading Symbol | Name of each exchange on which registered | ||

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark whether the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☑ No ☐

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No ☑

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934

during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing

requirements for the past 90 days. Yes ☑ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of

Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such

files). Yes ☑ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See

the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange

Act:

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or

revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control

over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued

its audit report. ☑

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing

reflect the correction of an error to previously issued financial statements. ☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received

by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ☐ No ☑

The aggregate market value of the voting stock held by non-affiliates amounted to approximately $1.54 billion on June 30, 2023.

The number of shares of the registrant’s common stock outstanding as of February 15, 2024 was 57,078,540 shares.

DOCUMENTS INCORPORATED BY REFERENCE

in conjunction with the registrant’s 2024 Annual Meeting of Stockholders, which is expected to be filed not later than 120 days after the registrant’s fiscal year

ended December 31, 2023.

TABLE OF CONTENTS

Page | ||

Energy Recovery, Inc. | 2023 Form 10-K Annual Report

Forward-Looking Information

This Annual Report on Form 10-K for the year ended December 31, 2023, including Part II, Item 7, “Management’s Discussion and

Analysis of Financial Condition and Results of Operations” (the “MD&A”), contains forward-looking statements within the “safe harbor”

provisions of the Private Securities Litigation Reform Act of 1995. Forward-looking statements in this report include, but are not limited to,

statements about our expectations, objectives, anticipations, plans, hopes, beliefs, intentions or strategies regarding the future.

Forward-looking statements represent our current expectations about future events, are based on assumptions, and involve risks and

uncertainties. If the risks or uncertainties occur or the assumptions prove incorrect, then our results may differ materially from those set forth

or implied by the forward-looking statements. Our forward-looking statements are not guarantees of future performance or events.

Words such as “expects,” “anticipates,” “aims,” “projects,” “intends,” “plans,” “believes,” “estimates,” “seeks,” “continue,” “could,”

“may,” “potential,” “should,” “will,” “would,” variations of such words and similar expressions are also intended to identify such forward-looking

statements. These forward-looking statements are subject to risks, uncertainties and assumptions that are difficult to predict; therefore,

actual results may differ materially and adversely from those expressed in any forward-looking statement. Readers are directed to risks and

uncertainties identified under Part I, Item 1A, “Risk Factors,” and elsewhere in this report for factors that may cause actual results to be

different from those expressed in these forward-looking statements. Except as required by law, we undertake no obligation to revise or

update publicly any forward-looking statement for any reason.

Forward-looking statements in this report include, without limitation, statements about the following:

•our belief that the pressure exchanger is the industry standard for energy recovery in the seawater reverse osmosis desalination (“SWRO”) industry; |

•our belief that the scalability and versatility of our PX® Pressure Exchanger® (“PX”) can help us achieve success in emerging wastewater markets; |

•our belief that the Ultra PX™ addresses key challenges associated with treating wastewater in a range of reverse osmosis (“RO”) applications; |

•our belief that the Ultra PX addresses key challenges, such as energy intensity and environmental impacts associated with treating wastewater; |

•our belief that the Ultra PX can help make RO the preferred treatment option to achieve zero and minimum liquid discharge (“ZLD” and “MLD”, respectively) requirements by enhancing RO’s affordability and efficiency compared to thermal treatment options; |

•our belief that our PX has helped make SWRO an economically viable and more sustainable option in the production of potable water; |

•our expectation of greater demand of our PX in the wastewater market due to expanding environmental regulations; |

•our belief that our hydraulic turbochargers deliver substantial savings, operational benefits and ease of integration into desalination systems; |

•our anticipation that markets not traditionally associated with desalination, such as the United States of America (the “U.S.”) and China will inevitably develop and provide further revenue growth opportunities; |

•our belief that countries around the world will continue to mandate ZLD or MLD requirements for specific industries; |

•our belief that, as the existing thermal technology is replaced with RO technology, demand for our products will be created; |

•our belief that our PX offers market-leading value with the highest technological and economic benefit; |

•our belief that ongoing operating costs and life cycle costs rather than the initial capital expenditures are the key factor in the selection of an energy recovery device solution for megaproject (“MPD”) customers; |

•our belief that initial capital expenditure rather than future ongoing operating costs is more of a factor in the selection of an energy recovery device solution for original equipment manufacturer (“OEM”) projects; |

•our belief that our PX has a distinct competitive advantage in the market for desalination plants and numerous wastewater market verticals, because our PX 1) has minimal unplanned and planned downtime, resulting in lower lifecycle maintenance cost, 2) is a cost-effective energy recovery solution, 3) is made with highly durable and corrosion-resistant aluminum oxide (“alumina”) ceramic parts and outperforms our competition with respect to quality, flexibility and durability, and 4) is warrantied for high efficiencies; |

•our belief that leveraging our pressure exchanger technology will unlock new commercial opportunities in the future; |

Energy Recovery, Inc. | 2023 Form 10-K Annual Report | FLS 1

•our belief that our PX G1300™ can contribute to help make CO2-based refrigeration economically viable in a broader range of climates; |

•our belief that the PX G1300 could eventually alter the standard refrigeration system architecture by reducing costs for retail end users such as grocery stores; |

•our belief that there is a significant potential market for the PX G1300 in a variety of channels, such as supermarket chains and cold storage facilities. |

•our expectation that we will initially sell our PX G1300 to a variety of customers, such as to the OEMs themselves, potentially directly to end user supermarket chains or industrial sites, or to contractors who may retrofit our technology onto existing systems, and once the PX G1300 is established, our belief that our sales process will evolve to primarily selling through OEMs; |

•our belief that as CO2-based refrigeration systems become more prevalent, competitive technologies to the PX G1300 could arise; |

•our belief that the simplicity of installation and the ease of operations of the PX G1300 could encourage adoption of the PX G1300; |

•our belief that our current facilities will be adequate for the foreseeable future; |

•our belief that by investing in research and development, we will be well positioned to continue to execute on our product strategy; |

•our belief that our technology helps our customer achieve environmentally sustainable operations; |

•our expectation that sales outside of the U.S. will remain a significant portion of our revenue; |

•our belief that the integration of sustainability principles into our corporate and risk management strategies can strengthen our existing business as well as our efforts to develop new applications of pressure exchanger technology for high-pressure fluid- flow environments; |

•our belief that our sustainability goals are highly influential to our business success; |

•our belief that we contribute to our customers’ operational profitability while advancing environmental sustainability; |

•the timing of our receipt of payment for products or services from our customers; |

•our belief that our existing cash and cash equivalents, our short and/or long-term investments, and the ongoing cash generated from our operations, will be sufficient to meet our anticipated liquidity needs for the foreseeable future, with the exception of a decision to enter into an acquisition and/or fund investments in our latest technology arising from rapid market adoption that could require us to seek additional equity or debt financing; |

•our belief that our cash deposit risk at uninsured or under insured financial institutions will not materially affect our current liquidity; |

•our expectation that the lender under our current credit agreement, as amended, will continue to honor its commitments to us; |

•our expectation that, as we expand our international sales, a portion of our revenue could be denominated in foreign currencies and the impact of changes in exchange rates on our cash and operating results; |

•our expectation of increased sales and marketing expenditures for 2024 and 2025; |

•our belief that we will be in compliance with the terms of the existing credit agreement, as amended, in the future; |

•our expectation that we will continue to receive a tax benefit related to U.S. federal foreign-derived intangible income and California research and development tax credit; |

•our expectation that we will be able to enforce our intellectual property (“IP”) rights; |

•our expectation that the adoption of new accounting standards will not have a material impact on our financial position or results of operations; |

•the outcome of proceedings, lawsuits, disputes and claims; |

•the impact of losses due to indemnification obligations; |

•the impact of changes in internal control over financial reporting; and |

•other factors disclosed under Part I, Item 1, “Business,” Item 1A, “Risk Factors,” and Item 2, “Properties,” and Part II, Item 7, MD&A, and Item 7A, “Quantitative and Qualitative Disclosures about Market Risk,” and elsewhere in this Form 10‑K. |

Energy Recovery, Inc. | 2023 Form 10-K Annual Report | FLS 2

You should not place undue reliance on these forward-looking statements. These forward-looking statements reflect management’s

opinions only as of the date of the filing of this Annual Report on Form 10-K. All forward-looking statements included in this document are

subject to additional risks and uncertainties further discussed under Part I, Item 1A, “Risk Factors,” and are based on information available to

us as of February 21, 2024. We assume no obligation to update any such forward-looking statements. Certain risks and uncertainties could

cause actual results to differ materially from those projected in the forward-looking statements. These forward-looking statements are

disclosed from time to time in our Quarterly Reports on Form 10‑Q and Current Reports on Form 8‑K filed with, or furnished to, the Securities

and Exchange Commission (the “SEC”), as well as in Part I, Item 1A, “Risk Factors,” within this Annual Report on Form 10-K.

It is important to note that our actual results could differ materially from the results set forth or implied by our forward-looking

statements. The factors that could cause our actual results to differ from those included in such forward-looking statements are set forth

under the heading Item 1A, “Risk Factors,” in our Quarterly Reports on Form 10-Q, and in our Annual Reports on Form 10-K, and from time-

to-time, in our results disclosed in our Current Reports on Form 8-K.

We provide our Annual Reports on Form 10‑K, Quarterly Reports on Form 10‑Q, Current Reports on Form 8‑K, Proxy Statements on

Schedule 14A, Forms 3, 4 and 5 filed by or on behalf of directors, executive officers and certain large shareholders, and any amendments to

those documents filed or furnished pursuant to the Securities Exchange Act of 1934, free of charge on the Investor Relations section of our

website, www.energyrecovery.com. These filings will become available as soon as reasonably practicable after such material is

electronically filed with or furnished to the SEC. From time to time, we may use our website as a channel of distribution of material company

information.

We also make available in the Investor Relations section of our website our corporate governance documents including our code of

business conduct and ethics and the charters of the audit, compensation and nominating and governance committees. These documents, as

well as the information on the website, are not intended to be part of this Annual Report on Form 10-K. We use the Investor Relations

section of our website as a means of complying with our disclosure obligations under Regulation FD. Accordingly, you should monitor the

Investor Relations section of our website in addition to following our press releases, SEC filings and public conference calls and webcasts.

Energy Recovery, Inc. | 2023 Form 10-K Annual Report | FLS 3

PART I

Item 1 — Business

Overview

Energy Recovery, Inc. (the “Company”, “Energy Recovery”, “we”, “our” and “us”) is a trusted global leader in energy efficiency

technology. We design and manufacture reliable, high-performance solutions that provide cost savings through improved energy efficiency in

commercial and industrial processes, with applications across several industries. With a strong foundation in the desalination industry, we

have delivered transformative solutions that help our customers optimize their operations and reduce their energy consumption for more than

30 years. We believe that our customers do not have to sacrifice quality and cost savings for sustainability; and we are committed to

developing solutions that drive long-term value from a technical, financial, and environmental perspective.

We have been incorporated in the state of Delaware since 2001. Our corporate headquarters, principal research and development

(“R&D”), and manufacturing facility is located in San Leandro, California. In addition, we have manufacturing and warehouse space in Tracy,

California and offices, warehouse space and a yard in Katy, Texas. We have a global direct sales team and on-site technical support staff to

service customers in the United States of America (the “U.S.”), Europe, Latin America, the Middle East, and Asia.

Sustainability

Our technology harnesses the powerful combination of performance and energy efficiency to deliver operational profitability and help

our customers achieve environmentally sustainable operations. As such, we are committed to measuring and managing our own operational

impact, as well as producing high-quality energy recovery devices for our customers. While sustainability has always been central to our

business, four years ago we embarked on our formal sustainability journey to turn the lens on ourselves and provide our stakeholders with

further transparency around our company. Our integrated sustainability strategy includes a dedicated sustainability team, internal

sustainability programs focused on key goals with measurable targets, and sustainability solutions for our customers.

Our sustainability goals, which we believe are highly influential to our business, were first announced in our 2020 Sustainability

Report. These goals focus on four sustainability topics – Employees, Environmental & Climate Change Risks, Innovation & Opportunity, and

Products. These topics were identified by our management team and our stakeholders as material to our company’s ability to create value.

We believe our goals provide us with a strategic roadmap to become a more sustainable and resilient business, and hold us accountable as

we strive to be a responsible corporate citizen. In accordance with our strategic roadmap, we announced our first corporate emissions

reduction target in 2023 and have committed to reducing our greenhouse gas emissions as outlined in our 2022 Sustainability Report.

Employees. Our employees are integral to success and innovation. It is our firm commitment and responsibility to provide a safe and

supportive working environment for our staff where initiative is rewarded, suggestions are valued, and ideas to enhance our company or our

products are implemented. Likewise, it is our responsibility to offer ample opportunities for employees to develop their skills. For more

information on our employees and programs, please see Human Capital Resources below.

Environmental & Climate Change Risks. We are engaged in a comprehensive assessment to identify our short-, medium-, and long-

term climate-related risks and opportunities. As our business grows, we are vigilant in managing our climate-related risks to remain

successful and competitive in an ever-changing environment.

Innovation & Opportunity. Innovation and a trusted relationship with our customers and industry partners is pivotal to this goal, as this

allows us to understand our customers’ needs and pain points. By partnering with our customers and consistently striving to improve, we are

confident in our continued ability to contribute to our customers’ operational profitability while advancing environmental sustainability.

Products. We uphold the trust of the industries we serve by meticulously manufacturing products that not only deliver exceptional

performance and generate significant value, but also demonstrate reliability and safety. At our core, we aim to design and manufacture high-

quality innovative products that deliver significant value to customers and help foster environmentally sustainable operations.

In 2023, we surveyed and interviewed investors, employees, and customers to ensure our sustainability strategy remains aligned with

the evolution of our business. The results of this assessment process and any associated adjustments to our sustainability priorities, goals,

and roadmap will be disclosed in our forthcoming 2023 Sustainability Report.

Energy Recovery, Inc. | 2023 Form 10-K Annual Report | 1

Detailed disclosures on our sustainability performance can be found in our recent 2022 Sustainability Report, which is available for

download on our website at: https://energyrecovery.com/sustainability/. We have included this website address only as an inactive textual

reference and do not intend it to be an active link to our website.

Pressure Exchanger Technology

Our pressure exchanger technology platform is at the heart of many of our solutions. It is designed to efficiently capture and transfer

pressure energy, making commercial and industrial processes more efficient and environmentally sustainable, thereby lowering costs, saving

energy, and minimizing emissions. This versatile technology is applicable to a wide range of industries that utilize pressurized fluids,

including liquids and gas, and is ideal for a wide range of pressure ratings.

Our pressure exchanger technology acts like a fluid piston, efficiently transferring energy between high- and low-pressure liquid and/

or gas through continuously rotating ducts. Key to the operation of a pressure exchanger is the micron-level clearances between the rotor

and the pressure exchanger’s stationary components, including the sleeve and the end covers. Fluid circulating within this clearance acts as

a lubricated bearing, minimizing frictional losses and wear for an extremely efficient exchange of pressure energy.

The original product application of our pressure exchanger technology, the PX® Pressure Exchanger® (“PX”) energy recovery device

was a major contributor to the advancement of seawater reverse osmosis desalination (“SWRO”) globally, addressing “energy intensity”,

which is a key pain point for the industry. The PX, which we believe is today’s industry standard in energy recovery in desalination, reduces

energy use by up to 60% in SWRO facilities. It is this significant savings that allowed SWRO to supplant thermal desalination as today’s

desalination technology of choice. Today we continue to push the boundaries of our core technology to handle different operating

environments and industrial applications and deliver reliable, high-performance solutions that generate cost savings and increase energy

efficiency for our customers.

Energy Recovery, Inc. | 2023 Form 10-K Annual Report | 2

Water Treatment

Markets

The need for clean water and energy optimization around the world is intensifying, driven by population growth, industrialization, rapid

urbanization, and climate change. Apart from seasonal variations, the attainable supply of fresh water generally remains fixed and is already

decreasing in some geographic areas, as we believe that the reliability of rainfall grows more erratic in many geographies, water levels drop

in rivers and aquifers, and rising oceans encroach on historically fresh water sources near the coasts. These trends make the markets we

serve, such as desalination and wastewater treatment, increasingly critical to meet growing global water demand. Our goal is to lower the

costs and emissions associated with water production and treatment in the desalination and wastewater markets, respectively. In addition,

we help the end user in their sustainability compliance goals.

Reverse osmosis (“RO”) is the preferred technology in the vast majority of desalination facilities and growing in importance in

wastewater applications. As an industry leader in energy recovery devices, we deliver efficient, scalable solutions for recovering otherwise

wasted energy in the RO process, thereby helping our customers lower their operating costs and reduce carbon emissions.

Desalination

Worldwide seawater desalination plants using our products produce over 30 million cubic meters of water per day (“m3/day”), enough

to provide for more than 25% of U.S. population’s daily water needs at home. As water scarcity grows in communities across the globe, we

are proud of our impact in enabling more affordable, sustainable access to this vital resource.

Typical Process Flow Diagram

* Main pump size reduced by up to 60% compared to a SWRO process not using any energy recovery device.

Energy Recovery, Inc. | 2023 Form 10-K Annual Report | 3

Seawater Reverse Osmosis Desalination. Energy intensive pumps are used to pressurize feed waters with varying concentrations of

salts, minerals and contaminants, which is then pumped through a semi-permeable membrane to achieve the desired water quantity and

quality. This process results in fresh water, suitable for potable, agricultural and industrial use and a highly concentrated and pressurized

concentrate or brine stream. Rather than dissipating or “wasting” the pressure energy from the discharge brine, our PX, the most commonly

adopted energy recovery solution, can transfer the pressure energy from the high-pressure discharge stream directly to a portion of the low-

pressure filtered feed water stream, thereby reducing the amount of flow required by the main high-pressure process pumps, which are the

largest consumers of power within the SWRO process. Our highly efficient technology can recycle this pressure energy at peak efficiencies

up to 98%. This results in a more efficient process as the size of the high-pressure pumps are greatly reduced, no longer needed to be sized

for full membrane feed flow, and are now re-sized for the permeate flow, thus reducing the energy usage by up to 60%, compared to a

system without energy recovery devices. As a result, our PXs have helped make seawater desalination an economically viable and more

sustainable option in the production of potable water.

Brackish Water Reverse Osmosis Desalination. The brackish RO process is similar to that of the SWRO process. Brackish water

typically has lower salt, mineral and contaminant content than seawater, therefore, fewer solids need to be removed and less energy is

expended on pressurizing the feed water. Due to the lower cost and available pressure energy involved, our low pressure PX and hydraulic

turbochargers generally have characteristics more applicable to the brackish process. The salt content in the feed water will ultimately

determine the system design and operating conditions which, in turn, will drive decisions related to the specification or type of energy

recovery device to be employed, if any.

Seawater desalination has been our primary market for revenue generation, and brackish water applications are an emerging area of

potential growth. These markets range from small, decentralized desalination plants, such as those used in cruise ships and resorts, to

large-scale project (“megaproject”) desalination plants, defined as those which produce over 50 thousand m3/day. Because of the

geographical location of many significant water desalination projects, geopolitical and economic events can influence the timing of expected

projects. We anticipate that markets traditionally not associated with desalination, such as the U.S. and China, will inevitably develop and

provide further revenue growth opportunities.

Both seawater and brackish market opportunities are represented by newly constructed (“greenfield”) and existing (“brownfield”) water

treatment projects. These opportunities include retrofits, upgrades, and plant expansions, that either operate without an energy recovery

device or utilize alternative energy recovery device technologies. The large-scale greenfield market has been the key market for our water

business and represents projects that are typically public in nature and involve a formal tendering process; while smaller projects, may be

private in nature, may or may not involve a formal tendering process. Typical brownfield facilities face higher energy consumption and

reduced plant availability due to legacy technologies and aging equipment and include improvements to existing operations, equipment

upgrades and potential expansions of existing capacity.

We work directly with the project bidders, generally large project developers, engineering, procurement, and construction firms (“EPC”

firm), end-users, and industry consultants, to specify our products prior to the project being awarded, where possible. Once the project is

awarded to an EPC firm, our normal sales process ensues. The greenfield market is highly competitive, and the tendering process pays

close attention to the cost to desalinate water (i.e., dollars per cubic meter of water produced). Retrofit opportunities may or may not have a

formal tendering process. We typically approach the plant owners, operators, and/or end-users of these facilities to present our leading life-

cycle cost value-proposition.

Wastewater

The wastewater market has more variety and covers a wide range of industries and geographies. As governments across the globe

increase their focus on water conservation, reuse, recycling, and limiting the amount of pollution, they are establishing more stringent

requirements for wastewater treatment to maximize water recovery, and to comply with growing freshwater withdrawal and discharge

regulations. Zero or minimum liquid discharge (“ZLD” and “MLD”, respectively) applications are being observed in countries throughout the

world. We expect this trend to continue to expand as we observe the implementation of regulations on the discharge of wastewater effluents

as the world responds to the growing gap between water availability and demand while focusing on minimizing and/or eliminating pollution

from these industries.

Energy Recovery, Inc. | 2023 Form 10-K Annual Report | 4

Energy Recovery Devices Utilized During Each Stage in the Treatment Train

Many municipal and industrial industries are willing to adopt more sustainable water reuse practices and to reduce their reliance on

existing water resources. Sectors such as automotive, including electric vehicles, chemicals, pulp and paper, textiles, semiconductors, and

other heavy industries are often large water consumers. Their water usage can compete with municipal and agricultural water resources,

further straining potable water supply in areas already struggling with water scarcity.

A variety of RO technologies may be utilized in the wastewater applications where our energy recovery solutions are applicable. Such

processes are typically multi-staged, with each stage increasing in pressure as the wastewater is filtered to recover clean water from a

wastewater stream and concentrate pollutants to a level where they can be economically utilized or safely disposed, rather than discharged

into the environment. Our energy recovery solutions, such as our hydraulic turbochargers, low-pressure PX, and our Ultra PX, can be

applied to each of these stages.

Technology Conversion

The thermal desalination process was the dominant seawater desalination technology employed throughout the 1990s. In this

process, thermal energy is used to evaporate water from heated seawater and subsequently condenses the vapor to produce fresh potable

water. Starting in the early 1990s, due to many factors including the introduction and greater usage of energy recovery devices, the process

of choice for the desalination industry shifted from thermal- to membrane-based RO desalination.

Over the past two decades RO desalination technology has become the predominant technology, supplanting thermal desalination

technology as today’s desalination technology of choice. As water desalination plants that use the thermal desalination technology age, the

industry expects the majority of these plant owners to replace their existing thermal technology with RO desalination technology. These

conversions are driving new demand for RO desalination equipment, which in turn creates demand for our products.

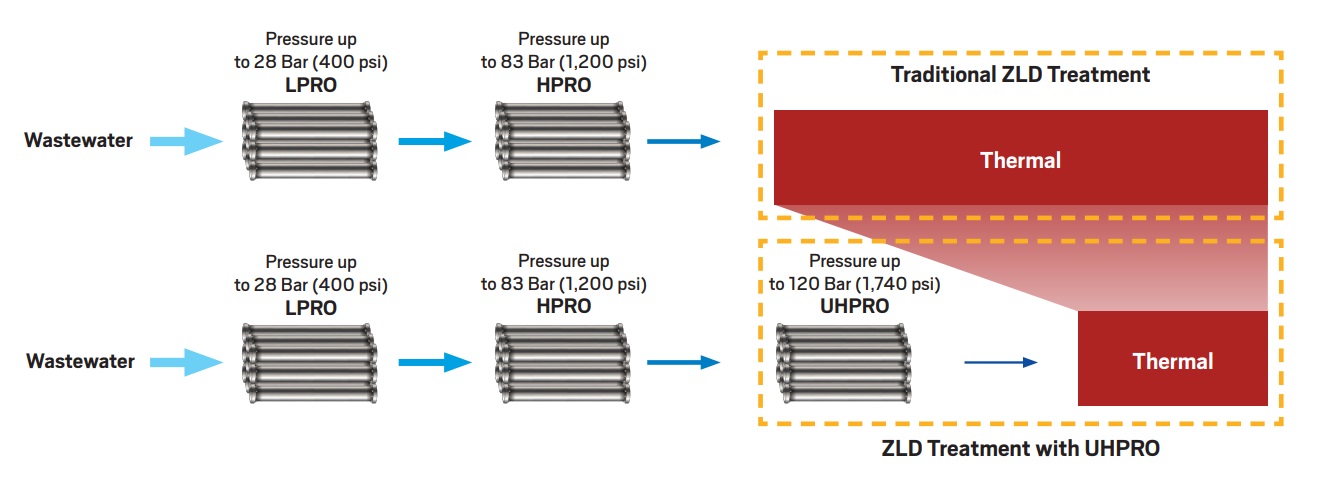

We also see a similar technology conversion in the wastewater market. Thermal technologies have been the technology of choice for

RO systems seeking to maximize the removal of waste from the water used in the manufacturing process, such as in “ZLD” processes, where

all water is recovered and contaminants are reduced to solid waste, and MLD processes, where near-ZLD processes produce small volumes

of liquid waste. Similar to seawater desalination, thermal technologies are an energy- and cost-intensive method for cleaning water in these

discharge processes, with up to 50 percent of costs typically stemming from thermal treatments. Adopting ultra high-pressure reverse

osmosis (“UHPRO”) treatment methods to achieve ZLD and MLD objectives moves the cost of these thermal technologies further

downstream. Our PX U Series pressure exchangers further reduce wasted energy of the UHPRO process by returning pressure energy to

the system, ultimately reducing overall energy costs and potentially lowering capital expenditures.

Energy Recovery, Inc. | 2023 Form 10-K Annual Report | 5

Water Treatment Solutions

Pressure Exchangers

Our line of pressure exchangers are high efficiency isobaric energy recovery devices made of a ceramic cartridge supported by a

highly efficient hydrodynamic and hydrostatic bearing system. Models in this product family are designed for use in a variety of reverse

osmosis systems within the water treatment industry, including seawater and brackish desalination, and wastewater treatment.

High Pressure PX Pressure Exchanger. Our highly efficient PX Pressure Exchanger family of energy recovery device

products delivers unmatched energy savings for water treatment systems. We offer a variety of sizes defined by the flow and

pressure requirements of the system ranging as low as 20 and up to 400 gallons per minute (“gpm”) (as low as 4.5 and up to

90.8 cubic meters of water per hour (“m3/h”)) per device at pressures between 400-1200 pounds per square inch (“psi”)

(28-84 kilograms per square centimeter (“bar”)); however, our customers can design their energy recovery systems to achieve

unlimited capacities by installing an array of PXs in parallel.

Small and large desalination projects around the world rely on our range of PXs to achieve optimal operations and

maximum energy savings, and we believe the scalability and versatility of our PX can achieve similar success in the emerging

wastewater markets we are targeting.

Ultra PX. Our Ultra PX energy recovery device which, we believe, addresses key challenges, such as energy intensity

and environmental impacts associated with treating wastewater in a variety of water treatment applications. Designed with

the pressure exchanger technology that powers our flagship high pressure PX, the Ultra PX, functions similarly to our PX but

can withstand higher pressures. We offer a variety of sizes defined by the flow and pressure requirements of the system

ranging as low as 10 and up to 250 gpm (or as low as 2.3 and up to 56.8 m3/h) per device at pressures between

1200-1800 psi (84-126 bar); however, by installing an array of PXs in parallel, our customers can design their energy

recovery system to achieve unlimited capacities.

While reverse osmosis adoption in wastewater treatment is growing, we believe our Ultra PX can help accelerate

further adoption of reverse osmosis in the growing zero and minimum liquid discharge markets by

enhancing RO’s affordability and efficiency compared to thermal treatment options, similar to the impact of

our PX in the seawater desalination market.

Low Pressure PX. Products in this family are ideal for municipal and industrial potable water reuse applications

that deploy low-pressure RO stages such as municipal wastewater reuse applications. We offer a variety of sizes defined

by the flow and pressure requirements of the system ranging as low as 30 and up to 260 gpm (or as low as 6.8 and up to

59.0 m3/h) per device at pressures between 80-400 psi (6-28 bar); however, by installing an array of PXs in parallel, our

customers can design their energy recovery system to achieve unlimited capacities.

Pumps and Turbochargers

We offer high-pressure centrifugal pumps designed to complement our energy recovery devices for a wide range of

RO plant capacities and applications.

Hydraulic turbochargers. Our AT and LPT hydraulic turbochargers are high efficiency centrifugal

energy recovery devices used in low-pressure brackish and high-pressure seawater desalination

systems and wastewater treatment markets. Our turbocharger product lines are highly efficient with

state-of-the-art engineering in a compact configuration. With custom-designed hydraulics that allow for

optimum performance over a wide range of operating conditions, our turbocharger technology offers

solutions to capital cost constrained single-stage RO applications, inter-stage boost applications

typically found in brackish water desalination and some wastewater treatment systems.

We believe our hydraulic turbochargers deliver substantial savings, operational benefits, and ease of integration into systems.

Energy Recovery, Inc. | 2023 Form 10-K Annual Report | 6

Pumps. RO requires specialized high-pressure membrane feed and, in pressure exchanger applications,

high-pressure circulation pumps. We manufacture and/or supply specialized high-pressure feed and circulation

pumps for only a portion of the markets served by our energy recovery solutions. Our high-pressure feed pumps

are designed to pressurize the membrane feed flow and overcome the osmotic pressure requirements of the feed

water resulting in the production of desalinated water. Our high-pressure circulation pumps are designed to

circulate and control the high-pressure flow through our PX and to compensate for small pressure losses across

the membranes, PX and associated process piping in many desalination and wastewater applications.

Sales and Marketing

Our strategically located direct sales force offers our products through capital sale to our customers around the world. We maintain a

sales and service footprint in strategic territories, such as in the U.S., China, India, Latin America, Spain, Saudi Arabia and the United Arab

Emirates, allowing rapid response to our customers’ needs. Our team is comprised of individuals with many years of desalination and

wastewater treatment industry expertise. Aligned to the geographic breadth of our current and potential future customers, our product

marketing approach includes a strategic presence at water industry events across various regions. In addition, we leverage our industry and

market intelligence to develop new solutions and services that can be adopted by our growing customer base.

A significant portion of our revenue is from outside of the U.S. Additional segment and geographical information regarding our

product revenue is included in Note 2, “Revenue,” Note 9, “Segment Reporting,” and Note 10, “Concentrations,” of the Notes to Consolidated

Financial Statements in Part II, Item 8, “Financial Statements and Supplementary Data,” of this Annual Report on Form 10-K (the “Notes”).

Competition

As the water industry has evolved, we faced, and continue to face, increasing worldwide competition based on product offerings and

service. While our technology has been embraced for many years as the industry standard in RO desalination plants, the competition has

increased over time whereby more companies are offering energy recovery devices similar to our devices. Furthermore, we expect our

competition to begin offering new products that incorporate newer technology and materials that may work with existing and new RO

desalination and wastewater operations. We believe our flagship PX has a competitive advantage over products offered by our competitors,

because our devices (1) are made with highly durable and corrosion-resistant aluminum oxide (“alumina”) ceramic parts that are designed for

a life of more than 25 years; (2) are, in certain circumstances, warrantied for high efficiencies; and (3) cause minimal unplanned and planned

downtime, resulting in lower lifecycle cost and cost-effective energy recovery solutions. In addition, our PX offers optimum scalability in both

the desalination and growing wastewater market with a quick startup and no scheduled maintenance, as well as having been proven in the

market and trusted by our customers.

Project Channels

We separate our Water segment sales into three distinct channels that are related to financial, other commercial, and technical

aspects of the projects. We identify these sales channels as megaproject (“MPD”), original equipment manufacturers (“OEM”) and

aftermarket (“AM”).

Megaproject. MPD customers are major firms that develop, design, build, own and/or operate large-scale desalination plants with

capacities greater than 13.2 million gallons/day (50 thousand m3/day). A majority of our water treatment revenue comes from this channel.

Our MPD customers have the required desalination expertise to engineer, undertake procurement for, construct, and sometimes own and

operate, large-scale desalination plants. Due to the project structures and capacities of these plants, ongoing operating costs and life cycle

costs, rather than the initial capital expenditures are the key factor in the customers’ selection of an energy recovery device solution. As

such, MPD customers most often select our PX, which we believe offers market-leading value with the highest technological and economic

benefit. We work with our MPD customers to specify and optimize our PX solutions for their plant designs. The typical desalination and

wastewater MPD project timeline between project tender and shipment generally ranges from 16 to 36 months; however, from time-to-time,

may exceed 36 months. Each project in this channel generally represents revenue opportunities over $1 million.

Energy Recovery, Inc. | 2023 Form 10-K Annual Report | 7

Original Equipment Manufacturer. OEM customers are companies that supply equipment, packaged systems, and various operating

and maintenance solutions for small- to medium-sized desalination and wastewater plants utilized by commercial and industrial entities, and

national, state, and local municipalities worldwide. We sell to our OEM customers a broad set of our products, including our PX, hydraulic

turbochargers, high-pressure pumps, circulation booster pumps, and associated services. As it relates to desalination and wastewater OEM

projects, these projects comprise of plants processing up to 13.2 million gallons/day (50 thousand m3/day), such as those located in hotels

and resorts, power plants, cruise ships, agricultural sectors, local and other municipal sites, and industrial facilities. In addition, these OEM

customers purchase our solutions for mobile, decentralized “quick water” or emergency water solutions. Unlike MPD projects, desalination

and wastewater OEM projects are smaller in scope and the initial capital expenditure, rather than future ongoing operating costs, is often

more of a factor in selection of an energy recovery device solution in desalination. Accordingly, we sell not only our PX, but also our

hydraulic turbochargers, which offer a lower cost alternative to our PX. The typical desalination and wastewater OEM project timeline from

project tender to shipment generally ranges from one to 16 months; however, from time-to-time, may exceed 16 months. Each project in this

channel typically represents revenue opportunities up to $1 million. Early stage revenue from these projects are dependent on the size of

system or retrofit of our customers’ projects.

Aftermarket. Aftermarket customers are desalination or wastewater plant owners and/or operators who can utilize our technology to

upgrade or keep their plant running optimally, and usually have our solutions installed and in operation. We provide spare parts, repair

services, field services and various commissioning activities. We leverage our industry expertise in supporting our existing installed base to

ensure that our energy recovery solutions are being operated effectively and efficiently in order to maximize plant availability and overall

profitability of the facility operations, as required by our industry partners and customers.

Seasonality

There is no specific seasonality to desalination or wastewater revenue. Desalination or wastewater revenue occurs throughout a

calendar year. We often experience substantial fluctuations in desalination or wastewater revenue from quarter-to-quarter and from year-to-

year primarily due to the timing and execution of our MPD shipments, which vary from year to year.

Emerging Technologies

Today, we are leveraging our pressure exchanger technology platform to develop new product applications and diversify into new

industries. We continue to push the limits of what our pressure exchanger technology can do, which we believe will unlock new commercial

opportunities in the future.

CO2

The global refrigeration and heating industries are major contributors to greenhouse gas emissions, of which the leakage of

hydrofluorocarbon (“HFC”) refrigerants within these closed systems are the leading cause. HFCs have been recognized as a significant

contributor to global warming, up to thousands of times more potent than carbon dioxide (“CO2”) used as a refrigerant. In 2016, much of the

world adopted the Kigali Amendment to the Montreal Protocol with the intent of reducing HFCs by 85% in developed nations by 2036, and

globally by 2047. The European Union’s consumption of HFCs was 55% below targets by end of 2022, and they plan to reduce by 80% by

2030. The U.S. first supported the reduction of HFCs in the American Innovation and Manufacturing Act in 2020, later ratified the Kigali

Amendment itself in October 2022, and the U.S. Environmental Protection Agency finalized the rules in July 2023 to reduce HFC production

and imports by 70% by end of 2029, and 85% by 2036.

CO2 used as a refrigerant is a climate-friendly alternative to greenhouse gas-emitting HFCs and has been the natural refrigerant of

choice for decades in Europe and Japan, where tens of thousands of CO2 implementations have occurred to date. CO2-based refrigeration

systems for commercial and industrial applications are safe, sustainable, and commercially available; however, a CO2-based refrigeration

system can also consume significant amounts of electricity, especially in warm environments, making them expensive to operate. We believe

our PX G1300™, which uses proven pressure exchanger technology to improve CO2-based refrigeration system performance, can contribute

to solving this challenge and help make CO2-based refrigeration economically viable in a broader range of climates. When integrated into

new or existing systems, the PX G1300 can reduce compressor workload to increase cooling capacity, system stability, and energy

efficiency.

Energy Recovery, Inc. | 2023 Form 10-K Annual Report | 8

PX G1300. Our refrigeration-focused product leverages our existing ceramics, material science, and

manufacturing expertise. The PX G1300 can reduce the energy consumption and operating costs of CO2-based

refrigeration systems in a broad range of operating conditions. We see this as potentially a significant accelerator for

adoption of CO2-based refrigeration system globally as our PX G1300 could eventually alter the standard refrigeration

system architecture by reducing costs for end users, such as grocery stores.

We designed the PX G1300 to be integrated into new or existing CO2-based refrigeration systems. The

PX G1300 can integrate with any existing rack controller and is easy to operate and maintain. We believe the simplicity

of installation and the ease of operations could encourage adoption of this new technology.

Sales and Marketing

We believe there is a significant potential market for the PX G1300 in a variety of channels, such as supermarket chains and cold

storage facilities. The build of these commercial and industrial refrigeration systems is large enough and demands enough flow of CO2

refrigerant to warrant the use of our device, which today implies any system 80 kilowatt in size or greater.

In understanding the market for the PX G1300, we have identified three major value propositions:

1.Energy Savings and Emissions Reduction. The PX G1300 recycles the high-pressure energy of a CO2 system by compressing a

portion of the gas flow for “free.” This “free” compression provided by the PX G1300 allows the main electrical refrigeration

compressor to work less to keep the refrigeration system at the same temperature. In this way, our PX G1300 contributes to

lower energy consumption and lower costs by reducing the amount of cycles the main compressor operates, and thereby lower

emissions in a CO2 refrigeration system.

2.Increased Cooling Capacity. The PX G1300 can add compression capacity to a transcritical CO2-based refrigeration system to

safeguard against high discharge pressure failures, which occur during heatwaves when refrigeration systems are under stress.

3.Initial Capital Investment. When designed into a new CO2-based refrigeration system, the PX G1300 may offset some initial

capital investment due to the extra compression capacity it provides, allowing for the reduction or removal of other components.

The magnitude of each of these value propositions, or lack thereof, will greatly depend on the geographic location of a refrigeration

system and temperature ranges that location experiences, the cost of energy at that location, the specific architecture of the refrigeration

system itself and possibly other parameters.

Channels and Customers

CO2 sales are reported under our OEM sales channel. This includes direct sales to commercial or industrial customers, such as

supermarket chains, cold storage facilities, and other industrial users. Also, included are sales to intermediaries, such as refrigeration system

installers or refrigeration OEMs, to whom we sell the PX G1300 and associated services for inclusion in these customers’ entire new

packaged or retrofit of existing systems.

The commercial refrigeration market ecosystem has multiple players who integrate the components to build a system. These players

include supermarkets, which are the end users of the systems; contractors and installers that assist with the installation and maintenance of

the systems; refrigeration OEMs; and design consultants that assist in designing and specifying the systems for end users and in providing

the component specifications to the refrigeration OEMs.

We initially sold the PX G1300 to a variety of customers, such as directly to an end user supermarket chain and OEMs. We believe

that once the PX G1300 is more established, our sales process will evolve primarily to sell through OEMs, who in turn build and install

refrigeration systems at sites maintained by end users.

Energy Recovery, Inc. | 2023 Form 10-K Annual Report | 9

Competition

The concept of energy recovery is a new one in the refrigeration industry. Therefore, unlike in our water markets, there is no direct

analogous competitor to our pressure exchanger technology. However, there are a variety of cost saving methods, as well as alternative

devices, that refrigeration manufacturers may try to introduce into their configurations to reduce energy consumption within their CO2-based

refrigeration systems. These cost saving methods include utilizing novel system architectures, new and improved equipment or materials,

ejectors or other energy recovery devices, and/or other technologies that could improve energy efficiency. These cost savings methods may

or may not be compatible with the PX G1300. As CO2-based refrigeration systems become more prevalent, we believe competitive

technologies and devices could arise.

Seasonality

There is no specific CO2 revenue seasonality to highlight in the early stages of this product lifecycle.

Manufacturing

Our products, including our PX, hydraulic turbochargers, high-pressure pumps, and circulation booster pumps, are designed,

manufactured, assembled, and tested in two facilities located in California. Our facilities include advanced ceramics manufacturing and

testing equipment.

We obtain raw, processed, and certain pre-machined materials from various suppliers to support our manufacturing operations. A

limited number of these suppliers are single source to maintain material consistency and support new product development. However,

although we may purchase from certain single source suppliers, we have qualified redundant source(s) to ensure consistent supply for many

of our critical raw materials and manufactured components. Alumina ceramic components for our PX products are manufactured in-house

from high-purity alumina to the final product. We are able to leverage our ceramics manufacturing across all of our PX product lines.

Through our vertically integrated ceramics precision manufacturing process, we ensure that all components meet our high standards for

quality, durability, and reliability. The components for our other products undergo final precision machining to protect the proprietary nature of

our manufacturing methods and product designs, and to maintain premium quality standards.

We are committed to reducing the environmental impact of our operations. We recognize that as we pursue our strategy of diversified

and disciplined growth, our operations and our impact on the environment may increase. Some of the ways we currently seek to minimize

our environmental impact are by reducing consumption of resources through waste management strategies, optimizing the use of renewable

energy, and monitoring key environmental indicators. For example, as part of our waste management strategies, during the machining

phase, when the solid components are shaped, excess high-purity alumina powder is collected, processed, and then reused. Further, we

have incorporated in our testing process multiple test loops, which allows us to test products we manufacture to their operating conditions.

These test loops, which are a major driver of our water usage, have been modified to allow us to recycle most of the water used in these

testing cycles. Our efforts to measure and manage our impact will continue to evolve as our business grows.

Research, Development and Technology

Research and development (“R&D”) has been, and remains, an essential part of our history, culture and corporate strategy. Since our

formation, we have developed leading technology and engineering expertise through the evolution of our pressure exchanger technology,

which can enhance environmental sustainability and improve productivity by reducing energy consumption in pressurized fluid-flow systems.

This versatile technology works as a platform to build product applications and is at the heart of many of our products. In addition, we have

engineered and developed ancillary devices, such as our hydraulic turbochargers and circulation booster pumps that complement our energy

recovery devices.

Today, we are applying our pressure exchanger technology in new and important ways, building new products to accelerate

environmental sustainability across more industries. Our investments into R&D are focused on (1) advancing our solutions to better service

historical markets, such as desalination; (2) applying our pressure exchanger technology to new markets, such as our recent entries into the

wastewater and CO2 markets; and (3) fundamental research into new applications of our pressure exchanger technology in existing and new

verticals.

Energy Recovery, Inc. | 2023 Form 10-K Annual Report | 10

We recognize the importance of carefully stewarding resources to support our ongoing R&D program. We maintain advanced

analytical and testing capabilities to evaluate our solutions at all company sites. We have developed complex analytical tools which allow us

to be less reliant on full-scale testing that is costly and often uses considerable amounts of water and consumable energy. Our advanced

numerical modeling and analytical tools allow for 3-dimensional, multi-phase, multi-physics, and multi-scale, computational fluid dynamics,

fluid structure interactions, thermodynamics, and system analysis. Leading-edge modeling and analytical techniques coupled with extensive

state of the art experimental capabilities allow us to further refine our existing water and refrigeration technologies, as well as developing new

derivatives of our pressure exchanger technology for complex systems and applications.

Our highly skilled engineering team, many of whom carry accreditation from world-recognized engineering organizations, specialize in

a range of technical fields critical to support our current product lines and advance our incubation initiatives, including core engineering

competencies of fluid mechanics and aerodynamics, solid mechanics with expertise in computational fluid dynamics and finite element

analysis, bearings design (roller-element, hydrostatic, and hydrodynamic), multi-phase flow, dynamics and controls, acoustics and vibrations,

tribology, material science and coatings, pumps and turbines, turbo-machinery, and rotating equipment.

Intellectual Property

We seek patent protection for new technologies, inventions, and improvements that are likely to be incorporated into our solutions.

We rely on patents, trade secret laws, and contractual safeguards to protect the proprietary tooling, processing techniques, and other know-

how used in the production of our solutions. We have a robust intellectual property (“IP”) portfolio consisting of U.S. and international issued

patents as well as pending patent applications.

We have registered the following trademarks with the United States Patent and Trademark office: “ERI,” “PX,” “PX Pressure

Exchanger,” “Pressure Exchanger,” “Ultra PX,” “PX PowerTrain,” “PX G1300,” and the Energy Recovery logo. We have also applied for and

received registrations in international trademark offices.

Human Capital Resources

Our employees are key to our Company’s success. We believe we have a talented, motivated and dedicated team, and we work to

create an inclusive, exciting, safe, and supportive environment, for all of our employees. Our company is built around innovation and driven

by diversity of thought and background. Our employees challenge the status quo, actively partner to resolve challenges, and seek to

continuously improve themselves as well as our operations.

As of December 31, 2023, we had 269 full-time employees, which is approximately 100% of our staffing, and include both permanent

and leased employees. Our leased employees include sales and service agents worldwide, and IT support. Our employees are not

unionized, and we consider our relations with our employees to be good.

We are proud to have built a global workforce to match our global customer base. Our employees represent a broad array of

backgrounds, professionally and personally, and we believe that this diversity of experience and perspectives is a competitive advantage that

allows us to better serve the needs of our customers.

Our Code of Business Conduct (our “Code”) serves as a critical tool to help all of us recognize and report unethical conduct, while

preserving and nurturing our culture. Our Code is reflected in our employee manual, which we provide to all of our employees, and training

programs. Both our employee manual and training programs include our policies against harassment and bullying, and the elimination of

bias in the workplace.

Recruiting, Training and Retention

Our focus is to create an engaged employee experience, throughout the process of attracting, onboarding, developing, and retaining

employees. We are committed to supporting employee development as well as providing competitive benefits and a safe workplace. We

support and develop our employees through global training and development programs that build and strengthen employees’ leadership and

professional skills while striving to enhance our employee’s financial, mental and physical wellness. To assess and improve employee

retention and engagement, we survey our employees with the assistance of a third-party employee engagement survey, and take action to

address areas of employees’ concerns.

Energy Recovery, Inc. | 2023 Form 10-K Annual Report | 11

Our employee engagement efforts include newsletters and all-employee town hall meetings, as well as informational meetings, which

includes our executive staff meeting with small groups of employees in an informal setting, through which we aim to keep all of our

employees well-informed, increase transparency and promote a culture of open communication. Our values and ethics serve as the guiding

force through which we proactively maintain the highest standards of business conduct.

Compensation and Benefits

We believe that compensation should be competitive and equitable, and should enable our employees to share in our company’s

success. In addition, we recognize our employees are most likely to thrive when they have the resources to meet their needs and the time

and support to succeed in their professional and personal lives. In support of this, we offer a wide variety of benefits for our employees and

we invest in tools and resources that are designed to support our employees’ individual growth and development.

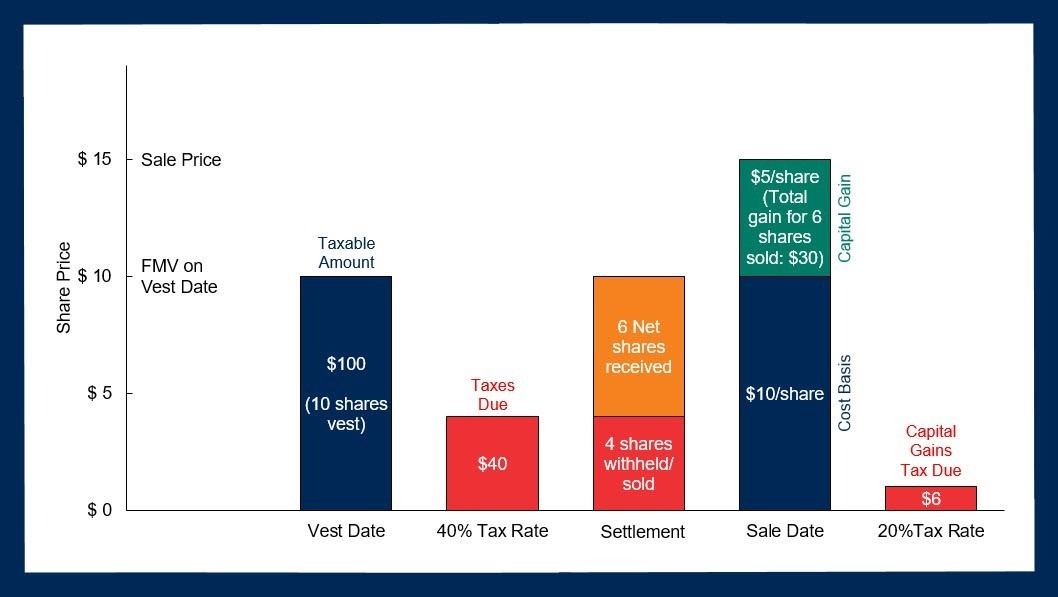

Our compensation and benefit programs are designed to recognize our employees’ contributions to value, ingenuity and business

results, including variable pay, which rewards each employee for the Company’s and individual’s performance. All full-time and full-time

equivalent employees, where allowed, are included in our share-based equity incentive program, and are offered health and welfare benefits,

mental wellness programs, development programs and training courses. In addition, all employees are afforded the opportunity to give back

to our communities through donations of time and money through our company sponsored programs.

Workplace Heath and Safety

We are committed to providing a safe and healthy workplace. We continuously strive to meet or exceed compliance with all laws,

regulations and accepted practices pertaining to workplace safety. All employees are required to comply with established safety policies,

standards and procedures, and to attend and complete annual safety training based on their job function. To accomplish our safety goals, we

developed and maintain company-wide policies to ensure the safety of each employee, as well as compliance with domestic and international

safety standards. In addition, we foster work/life balance for our employees that provides significant flexibility surrounding work location and

work schedules.

Additional Information

Our website is https://energyrecovery.com. We also maintain an Investor Relations website as a routine channel for distribution of

important information, including news releases, presentations, and financial statements (https://ir.energyrecovery.com). We intend to use our

Investor Relations website as a means of complying with our disclosure obligations under Regulation FD. Accordingly, investors should

monitor our Investor Relations website in addition to press releases, Securities and Exchange Commission (“SEC”) filings, and public

conference calls and webcasts. Our Annual Report on Form 10‑K, Quarterly Reports on Form 10‑Q, Current Reports on Form 8‑K, all

amendments to those reports, and the Proxy Statement for our Annual Meeting of Stockholders are made available, free of charge, in the

Investor Relations section of our website, as soon as reasonably practicable after the reports have been filed with, or furnished to, the SEC.

The information contained on our website, or any other website, is not part of this report nor is it considered to be incorporated by reference

herein or with any other filing we make with the SEC. Our headquarters and primary manufacturing center is located at 1717 Doolittle Drive,

San Leandro, California 94577, and our main telephone number is (510) 483-7370. The SEC maintains an internet site that contains reports,

proxy and information statements and other information regarding issuers that file electronically with the SEC. The address of the SEC

website is http://www.sec.gov. We have included this website address only as an inactive textual reference and do not intend it to be an

active link to the SEC website.

Energy Recovery, Inc. | 2023 Form 10-K Annual Report | 12

Item 1A — Risk Factors

The following discussion sets forth what management currently believes could be the most significant risks and uncertainties that

could impact our businesses, results of operations, and financial condition. Other risks and uncertainties, including those not currently known

to us or our management, could also negatively impact our businesses, results of operations, and financial conditions. Accordingly, the

following should not be considered a complete discussion of all of the risks and uncertainties we may face. We may amend or supplement

these risk factors from time to time in other reports we file with the SEC.

Risks Related to our Water Segment

Our Water segment revenues largely depend on the construction of new large-scale desalination plants and the retrofit of existing

desalination plants, and as a result, our operating results have historically experienced, and may continue to experience,

significant variability due to volatility in capital spending, availability of project financing, project timing, execution and other

factors affecting the broader water desalination industry.

We currently derive the majority of our Water segment revenues from sales of energy recovery products and services used in newly

constructed, large-scale desalination plants and the retrofit of existing desalination plants, particularly in dry or drought-ridden regions of the

world. The demand for our products used in the Water segment may decrease if the construction of these large-scale desalination plants or

the retrofit of existing plants declines for any reason, including, any global or regional economic downturns, worsening global or regional

political conflicts, worsening regional conditions, changing government priorities, or the impact of any global or regional conflicts.

Other factors that could affect the number and capacity of large-scale desalination plants built or the timing of their completion, include

the availability of required engineering and design resources; availability of credit and other forms of financing; the health of the global

economy; inflation rates; changes in government regulation, permitting requirements, or priorities; and reduced capital spending for water

desalination solutions. Each of these factors could result in reduced or uneven demand for our products. Pronounced variability or delays in

the construction of such plants or reductions in spending for desalination in general could negatively impact our Water segment sales, which

in turn could have an adverse effect on our entire business, financial condition, or results of operations, and make it difficult for us to

accurately forecast our future sales.

Our Water segment faces competition from a number of companies that offer competing energy recovery solutions. If any of these

companies produce superior products or offers their products at substantially lower prices, our competitive position in the market

could be harmed and our revenues may decline.

The market for energy recovery devices for desalination and other water treatment plants is becoming increasingly competitive and

we expect this competition to intensify as the desalination and wastewater markets continue to grow. Competitors have introduced products

that are similar to, and directly compete with, our key energy recovery products. In addition, we expect new competitors to enter the market,

and existing competitors to introduce improvements to their existing products and introduce new products that are directly competitive to our

solutions. Our competitors’ existing, new, and improved products may be superior to our products and/or could be offered at prices that are

considerably less than the cost of our products. The performance and pricing pressure of such new products could cause us to adjust the

prices of certain products to remain competitive, or we may not be able to continue to win large contracts, which could adversely affect our

market share, competitive position and margins. Some of our current and potential competitors may have significantly greater financial,

technical, marketing, and other resources; longer operating histories; or greater name recognition. They may also have more extensive

products and product lines that would enable them to offer multi-product or packaged solutions as well as competing products at lower prices

or with other more favorable terms and conditions. As a result, our ability to sustain our market share may be adversely impacted, which

would affect our business, product margins, operating results, and financial condition. In addition, if one of our competitors were to merge or

partner with another company, the change in the competitive landscape could adversely affect our continuing ability to compete effectively.

Energy Recovery, Inc. | 2023 Form 10-K Annual Report | 13

A sustained downturn in the economy or global unrest could impact the future of new, and the retrofit of existing, desalination

plants, and the treatment of various wastewater verticals, which could result in decreased demand for our water products and

services.

The demand for our water products and services depends primarily on the continued construction of new large-scale desalination

plants, the retrofit of existing plants, and the construction of wastewater treatment facilities, particularly in the countries that are part of the

Gulf Cooperation Council, China, and India. Weak economic conditions, inflation and global uncertainty including the continuing conflicts in

Ukraine and many parts of the Middle East may have a negative economic impact on these and other countries, which may impact the levels

of spending on, timing of, delays to, and availability of, project financing for new desalination and retrofit plant projects. The inability of our

customers to secure credit or financing for these projects, may result in the postponement or cancellation of these projects. In addition, the

change in government priorities and/or their reduction in spending for water treatment projects could result in decreased demand for our

products and services, which could have an adverse effect on our business, financial condition or results of operations.

We may not be successful in developing suitable market adoption for our products in the wastewater market.

We have introduced a number of products designed specifically for the wastewater market, including the Ultra PX family of products

and the low pressure PX. The wastewater market is evolving and covers a wide range of industries and geographies, and utilizes a variety of

RO technologies. While our products can be a potential solution to these different applications, there is no guarantee that we will be

successful in developing market adoption of our wastewater products. While countries like China and India are beginning to mandate zero or

minimum liquid discharge (“ZLD” and “MLD”, respectively) requirements for specific industries, in many parts of the world there are no

regulations or minimal regulations for treating wastewater. Accordingly, end users in such areas may not be willing to implement wastewater

treatment at all or, if they do plan to implement a wastewater treatment program, they may select a competitive or alternative wastewater

treatment technology. Similar to the desalination market, there are many competitors and competitive products that can service wastewater

industries that do not include RO technologies or utilize our products. These competitors may have existing relationships with end users,

greater name recognition, and/or significantly greater financial, technical, marketing and other resources that may make it challenging for us

to compete in this industry. As a result of the foregoing, we may not be able to successfully develop our wastewater business, develop any

market share, or win any large contracts, which would affect our business, operating results and financial condition.

Risks Related to our Emerging Technologies Segment

We may not be able to successfully compete in the CO2-based refrigeration system market.

For the past decade, the global commercial and industrial refrigeration industry has been shifting away from HFC-based refrigerants

to natural refrigerants, such as CO2-based refrigerants in response to the global HFC-based refrigerant phase-down and subsequent

environmental regulations. We introduced the PX G1300 energy recovery device for use in CO2-based refrigeration systems in 2021 and

continue to work on developing market adoption of this new technology. While interest in the PX G1300 has been positive, there is no

guarantee that we will be successful in generating sustained interest and, more importantly, adoption of our technology on a timeline

necessary to meet our goals, or at all. The global commercial and industrial refrigeration industry can be slow to adopt new technologies and

alternative technologies or new refrigerants may emerge, slowing the adoption of the PX G1300. In addition, we may encounter new

technological challenges that we will need to solve in order to achieve adoption of the technology. The global commercial and industrial

refrigeration industry is also saturated with very large, established companies who have greater experience and resources and may provide

cost saving methods that utilize novel system architectures, new and improved equipment or materials, ejectors and/or other energy recovery

devices, all or some of which could improve energy efficiency that compete against the PX G1300. If we are unable to solve any

technological challenges, generate and sustain sufficient interest for our CO2-based refrigeration technology, we may not be able to

successfully compete in the CO2-based refrigeration market, which could have an adverse effect on our CO2 business, and our Emerging

Technologies segment financial condition or results of operation.

Energy Recovery, Inc. | 2023 Form 10-K Annual Report | 14

We may not be able to develop future new technologies successfully.

We have made a substantial investment in R&D and sales and marketing to execute on our diversification strategy into fluid flow

markets, including our recent commercial refrigeration products. While we see diversification as core to our growth strategy, there is no

guarantee that we will be successful in our efforts. Our model for growth is based in part on our ability to initiate and embrace disruptive

technology trends, to enter new markets, both in terms of geographies and product areas, and to drive broad adoption of the products and

services that we develop and market. Our competitive position and future growth depend upon a number of factors, including our ability to

successfully: (i) innovate, develop and maintain competitive products, and services to address emerging trends and meet customers’ needs,

(ii) defend our market share against an ever-expanding number of competitors, (iii) enhance our product and service offerings by adding