Kareg Corporation

175 West 87th Street

Suite 7G

New York, NY 10024

917-470-4811

718-645-1130

sstanalyst@aol.com

| Sheldon S. Traube | |

| Director of Research | |

| July 9, 2014 |

INDEPENDENT INVESTMENT ReSEARCH

Initiating Coverage with a Speculative Buy Recommendation

GENSPERA CORPORATION

( GNSZ- OTC QB Exchange)

| Recent Price: | $0.90 | ||

| 52 wk hi lo | 1.80-0.77 | ||

| 2013* EPS | loss of 0.21 | 2013P/E | negative |

| Est 2014* EPS | loss of 0.32 | 2014P/E | negative |

| Indicated Dividend | none |

| Market Capitalization | $28,4 million |

| Average Daily Volume | 53,662 shares |

| Management/Insider Ownership | 32% |

| Corporate Address | 2511N. Loop 1604 W, Suite 204 |

| San Antonio, TX. 78258 | |

| Website | info@genspera.com |

*Fiscal years end December 31.

CAPITALIZATION

(March 31, 2014)

| Long-Term Debt | None | |||

| StockholdersEquity | $ | 622,000 | ** | |

| Total Assets: | $2.855 million | |||

| Total Liabilities | $ | 2.576.million | ||

| Common Shares Outstanding* | 31,556,070 | |||

| * —-fully diluted shares | 62.6 million | |||

| **—-as adjusted for May offering | $ | 3,530,000 |

The information contained herein has been prepared from sources believed to be reliable. However, its’ interpretation, correctness or accuracy and the accuracy of our estimates and projections cannot be assured. Nor should the report be used as a sole source of information. Kareg Corp. and its directors, its officers and its employees, from time to time may be long or short the securities mentioned herein. Kareg has received a cash fee of $10,800 for the preparation and publication of this report.

GNSZ is attractive for speculative accounts seeking above-average appreciation potential based upon the following considerations:

Summary and Conclusion:

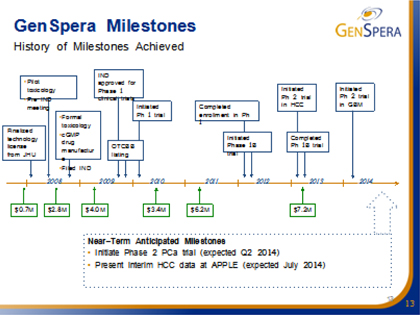

| 1. | GenSpera is focused on the development of prodrug cancer therapeutics based on a novel breakthrough proprietary technology platform which supports the development of a suite of drug compounds targeted at different cancer indications, as well as imaging applications. GenSpera’s approach is based on over $35M of funding ($15 million via various grants to Johns Hopkins and more than $20 million by the Company) and 15 years of research at Johns Hopkins Medical Center and other renowned research centers. |

| 2. | Its unique cytotoxin kills cancer cells independent of cell division; and is expected to eradicate cancer stem cells as well as slow and fast growing cancers. |

| 3. | Its tumor-specific activation of drug minimizes side-effects normally experienced with other cancer drug compounds. Traditional and emerging treatments for many late stage cancers struggle with potency issues and/ or side effects. Traditional therapies typically have serious side effects, face resistance, and have minimal effectiveness on slowly dividing cancer cells. Antibody drugs target high antigen expressing cells, and generally have a lower probability of tumor kill. Anti-Angiogenesis compounds typically offer limited survival benefits and cause serious side effects. |

| 4. | GenSpera’s drug candidates are based on chemical derivatives of a plant cytotoxin, called Thapsigargin, which is a potent inhibitor of the intracellular sarcoplasmic/endoplasmic reticulum calcium ATPase (SERCA) pump. The inhibition of the transport protein causes intracellular Ca2+ (calcium) to rise significantly and trigger apoptosis (cell death). Genspera masks Thapsigargin’s toxicity in the blood stream, and delivers and activates it only at the tumor site. |

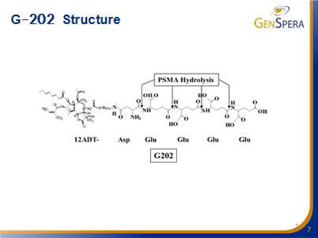

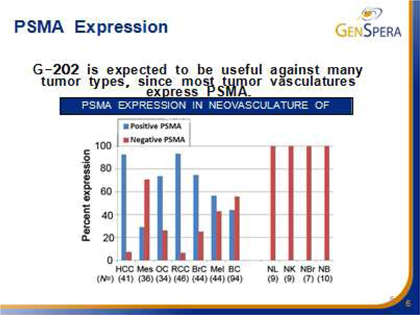

| 5. | GNSZ’s lead candidate, G-202, should be useful against most tumor types. Its first targeted indication is liver cancer, the third largest cancer killer worldwide. G-202 is a prodrug where the active cytotoxin, 12ADT, is masked by a peptide complex until it binds to and cleaved by the targeted Prostate-Specific Membrane Antigen (PSMA), thus triggering apoptosis. Nexavar, the currently only approved drug for this indication has more than $700 million in annual sales. |

| 6. | G-202 is showing excellent clinical results with Phase IB and early Phase II data in liver cancer, highly suggestive of clinical activity. Only a few easily managed, and predictable side effects in Phase 1 were observed. Early Phase II data look promising with a benign side-effect profile and impressive clinical results in advanced liver cancer patients. Phase II clinical trial in liver cancer is ongoing. GNSZ is now using DCE MRI imaging on newly-enrolled patients (in addition to X-ray), both, at baseline and after treatment intervals that the company thinks, could demonstrate the decreased blood flow to the tumor, and thus the successful killing of the cancerous cells. Typically in this very advanced liver cancer population, the shrinkage of the tumors are not visible on the x-rays due to intense scarring of the tissues. |

| 7. | GenSpera’s second targeted indication is glioblastoma, a form of brain cancer, with high unmet need. GNSZ’s drug does not need to cross the brain barrier. |

| 8. | Both indications require smaller clinical studies, and offer fast track to FDA approval. |

| 9. | Phase II clinical trial in glioblastoma was initiated in Q1 2014. |

| 10. | GNSZ’s patented technology platform has additional applications in other large cancer indications as well as imaging applications. |

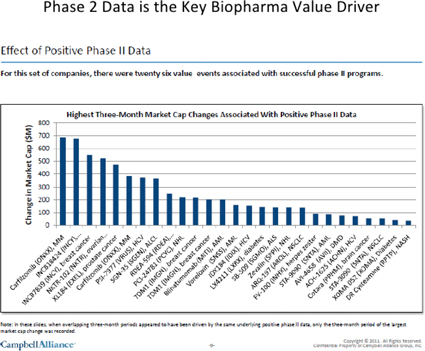

| 11. | GenSpera’s corporate strategy is to “de-risk” its products and thus harvest significant value via the development of drug compounds through Phase II clinical trials. Genspera’s strategy is to then monetize its efforts after conducting Phase II trials, through exit strategies, i.e. licensing or sale to “Big Pharma” without incurring the time, cost and risk of building a pharmaceutical marketing and sales organization. GNSZ has signed a number of NDA’s with mid-size and “Big Pharmas”. Drug development is increasingly being relegated to “junior companies” with big “Pharma” willing to acquire the technology or drug after it has been de-risked. For example, in 2010, companies with Phase II assets were acquired at a mean price of $85 million with milestone payments of $55.2 million, and the potential of a double digit royalty percentage. |

| 2 |

Cougar Biotech, a former Bulletin-Board listed company was acquired by Johnson & Johnson (NYSE:JNJ) in 2009 for $970M in cash for their prostate cancer drug (ZYTIGA™) which received FDA approval in April 2011.

| 12. | GenSpera has a robust global IP position, with a portfolio of filed and granted patents covering 12ADT and other derivatives of thapsagargin, peptide “masking/targeting” sequences and their prodrug conjugates. The patents are owned by GenSpera with no royalties or milestone payments payable to any third party. |

| 13. | GenSpera has an experienced and well-seasoned management and scientific team. Craig Dionne, PhD, CEO, has extensive experience in successfully identifying and bringing oncology treatments to the clinic while Senior Vice President of Research at Cephalon, Inc. (acquired by TEVA Pharmaceuticals). Its Board of Directors include senior executives in the pharmaceutical industry, with deep mergers and acquisitions (M&A) experience. |

| 14. | The company is expected to have steady news flow. Interim Phase II data are expected to be announced at the Apple Congress next week on Saturday, July 12, 2014. Positive interim data should positively impact the GNSZ stock price. Additionally, In the third quarter the company should initiate Phase II clinical trial in renal cell carcinoma, and in the first quarter of 2015 Genspera expects to present interim data for ongoing glioblastoma trial |

| 15. | Based on the company’s attractive growth prospects with a pipeline of products based upon its unique platform targeting large tumor applications; and strong development and experienced management team who have taken drugs successfully through clinical trials, we recommend the purchase of GNSZ stock for speculative accounts seeking long-term capital appreciation. Our target: More than a double within the next 12-24 months. |

Company Background

GenSpera Inc (GNSZ-OTC QB) founded in 2009, and based in San Antonio, Texas (a regional hub for cancer research, diagnostics and treatment) is a biotechnology company engaged in the development of targeted prodrug therapies for the treatment of human solid tumor cancers, as well as imaging applications. Its technology platform supports the development of a suite of drug compounds targeted at different cancer indications. The company’s drug development portfolio is based on a novel cytotoxin named thapsigargin, which is isolated from the seeds of a plant that grows naturally in countries around the Mediterranean. GenSpera utilizes a prodrug delivery mechanism that renders the cytotoxic agent inactive while specifically targeting the compound to cancerous tissue where it becomes bio activated back to its toxic form by natural enzymatic processes.

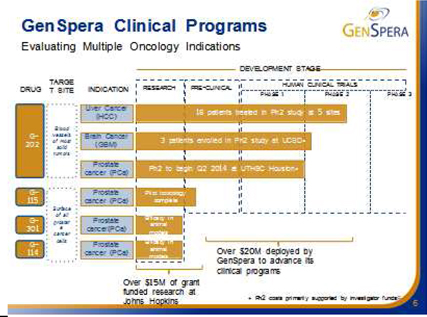

Genspera has four drug candidates in the pipeline, targeting three large and deadly global cancers that currently have poor or inadequate treatment options. Its lead drug candidate, G-202, is a prodrug formulation of a thapsigargin based cytotoxin that is bio activated by the enzyme Prostate Specific Membrane Antigen (PSMA). G-202 has a dual mechanism of action, attacking prostate cancer cells directly as well as the new and existing vasculature of a number of other solid tumor cancers. G-202 has encouraging Phase I and Phase II clinical results in liver cancer patients. A Phase II trial in glioblastoma patients was initiated in Q1 2014 and is currently in progress. Phase I trials are planned later this year for Prostate and Renal Cancers.

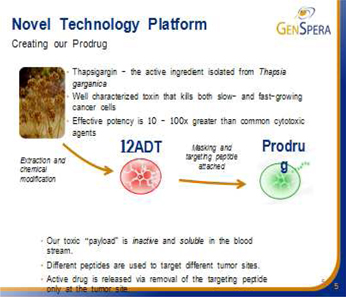

GenSpera’s Platform Technology

GenSpera’s approach is to identify specific enzymes that are found at high levels in tumors relative to other tissues in the body. Upon identifying these enzymes, the company attempts to develop a peptide that is recognized predominantly by those enzymes in the tumor, and not by enzymes in normal tissues. GNSZ then use the peptide as the masking/targeting agent and attaches it to its “cytotoxin” to create a prodrug. This double layer of recognition adds to the tumor-targeting capacity found in Genspera’s prodrugs.

| 3 |

Cytotoxin—Thapsigargin

GenSpera’s drug candidates are all based on chemical derivatives of a plant cytotoxin called thapsigargin. Thapsigargin is a cytotoxin found within the seeds of the plant Thapsia garganica, a species of the Carrot family that grows abundantly wild in the Mediterranean region. Medical uses of Thapsia garganica have been known for years, and the plant has been previously utilized for its emetic and purgative qualities; the ancient Greeks used it and Theophrastus, the successor to Aristotle wrote about the medical qualities of the Thapsia genus in one of his botany writings.

Resin extracted from the plant, and combined with wax, and alcohol, was later used by French doctors in a plaster as a counter-irritant for relief from rheumatic pains, despite the plaster itself being very harsh and irritating; frequently causing inflammation, eczema and terrible itching, often leading to scarring.

The irritative qualities from extracts of T. Garganica have been studied at the University of Copenhagen, and Soren Brogger Christensen, PhD, on GenSpera’s Scientific Advisory Board, was the first to identify the active ingredient, thapsigargin, and outline its chemical structure in a scientific paper published in 1988.

Subsequent investigation of thapsigargin and related compounds by the University of Copenhagen and Johns Hopkins discovered very significant cytotoxic qualities.

Thapsigargin is highly toxic, with effective potency levels 10 times to 100 times greater than commonly utilized cytotoxic agents, killing all cells in its path. This cytotoxin has been found to kill cancer cells independent of growth rate (fast, slow and non-dividing cells) and is the active toxic ingredient contained in GenSpera’s prodrugs. Thapsigargin is a potent inhibitor of the intracellular sarcoplasmic/endoplasmic reticulum calcium adenosine triphosphatase (SERCA) pump protein (crucial in maintaining the optimum calcium, Ca2+ concentrations within a cell) consequently causing calcium levels to rise significantly and trigger apoptosis (cell death). The SERCA family includes three different members, SERCA1, SERCA2, and SERCA3 which are expressed at various levels in different cell types. GNSZ chemically modifies thapsigargin to create the molecule 12ADT that retains all the potent cell-killing attributes of thapsigargin, but contains a new structure that can be coupled to a masking/targeting agent. The company’s prodrugs are manufactured by attaching a specifically developed peptide to 12ADT.

GNSZ uses peptides (short strings of amino-acids, the building blocks of many components found in cells) to mask the cytotoxin and target the tumor (masking/targeting agents). When attached to 12ADT, these peptides have the potential to make the cytotoxin inactive, and once the peptide is removed from 12ADT, the cytotoxin again becomes active (analogous to turning on a switch). The company’s technology takes advantage of the fact that the masking peptides can be removed by enzymes (chemical reactors in the body) and that the recognition of particular peptides by particular enzymes can be very specific. These peptides also make 12ADT soluble in blood. When the masking peptide is removed, 12ADT returns to its natural insoluble state and precipitates directly into nearby tumor cells.

| 4 |

GNSZ’s Prodrug Therapies

Cancer chemotherapy involves treating patients with cytotoxic drugs (compounds or agents that are toxic to cells). Chemotherapy is often combined with surgery or radiation in the treatment of early-stage disease and it is the sole treatment, or the preferred treatment option for many forms of later stage cancers. However, major disadvantages of chemotherapy include, but are not limited to:

• Serious Side effects: Non-cancer cells in the body are also affected, often leading to serious side effects, which may include the destruction of bone marrow, damage to digestive tract cells, and hair loss.

• Incomplete tumor kill: Many of the leading chemotherapeutic agents work during the process of cell division and may be effective only on tumors comprised of rapidly-dividing cells, but are much less effective (or even sometimes not effective at all) on tumors that contain slowly dividing cells.

• Resistance: Tumors typically develop resistance to current drugs after repeated exposure, thereby limiting the effectiveness of such therapies over multiple dosing.

Prodrug chemotherapy is a relatively new and novel approach to cancer treatment that is being explored as a means of delivering higher concentrations of cytotoxic agents at the tumor location, while avoiding or decreasing toxicity in the rest of the body. An inactive form of a cytotoxin is administered to the patient. The prodrug is then converted into the active cytotoxin, preferentially at the tumor site.

G-202, GenSpera’s lead compound may overcome a number of the just-discussed drawbacks associated with current cancer drugs, including:

| l | Reduced side effects: G-202 appears to be well tolerated in cancer patients with reduced side effects as opposed to traditional chemotherapy agents, particularly exhibiting lesser or no effect on the patient’s bone marrow. |

| l | Cell killing activity: G-202 has shown in animal studies the ability to kill not only fast developing cancers, but also slower dividing, and non-dividing cancer cells. |

| l | Lack of acquired drug resistance: No developing resistance to G-202 was observed in the animal studies after multiple treatment cycles. In addition, in the company’s Phase II trials, one patient has received 21 treatments to-date with no observed resistance development to G-202. |

GNSZ’s Prodrug Development Candidates

GenSpera has identified four prodrug candidates as summarized in the table below. The company is exclusively concentrating its efforts currently on the clinical development of G-202, and deferring further development of the other prodrug candidates.

| 5 |

| Prodrug Candidate |

Activating Enzyme |

Target Location of Active Enzyme |

Status | ||||

| G-202 | Prostate Specific Membrane Antigen (PSMA) | The blood vessels of most solid tumors | • | Phase II | |||

| G-115 | Prostate Specific Antigen (PSA) | Prostate cancers | • | Pilot toxicology completed | |||

| • | Limited pre-clinical development | ||||||

| G-114 | Prostate Specific Antigen (PSA) | Prostate cancers | • | Validated efficacy in pre-clinical animal models (Johns Hopkins University) | |||

| G-301 | Human glandular kallikrein 2 (hK2) | Prostate cancers | • | Validated efficacy in pre-clinical animal models (Johns Hopkins University) | |||

The enzymes that the company targets with its prodrugs are found in very specific places within the body and within the tumors. G-202 is activated by the enzyme Prostate Specific Membrane Antigen, or PSMA. Initially, PSMA was thought to be found only on the surface of prostate cancer cells. Later, PSMA was found to also be expressed in the vasculature of most tumors, but not in most other tissues or the vasculature of normal tissue. In other words, PSMA is found in prostate epithelial cells in the normal prostate, in prostate cancer cells, and in vascular endothelial cells (blood vessels) present in almost all solid tumors. G-202’s likely mechanism of action is the destruction of the tumor vasculature, thus starving the tumor to death. Animal studies with G-202 showed excellent results for multiple cancer models. Tolerance of intense dosing regimens, and no drug resistance were observed. Dramatic and uniform response even with short dosing regimens and tumor regression were observed in many cases. Thus, G-202 may be useful in the treatment of almost all solid tumors.

| 6 |

G-115 is activated by the enzyme Prostate Specific Antigen, or PSA, which is secreted by prostate epithelial cells in the normal prostate and by prostate cancer cells. PSA is found in the bloodstream and is a known tumor marker for prostate cancer, but it is inactive in the bloodstream due to potent binding by a protein inhibitor. However, PSA is enzymatically active on the surface of prostate cancer cells as it is being secreted, and this action forms the basis for G-115’s tumor targeting capability.

G-301 is activated by the enzyme Human Glandular Kallikrein 2, or hK2, which is secreted by prostate epithelial cells in the normal prostate and by prostate cancer cells. The enzyme hK2 is found in the bloodstream and is known as a tumor marker for prostate cancer but it is inactive in the bloodstream due to potent binding by a protein inhibitor. However, hK2 is enzymatically active on the surface of prostate cancer cells as it is being secreted, and this activity forms the basis for tumor targeting with G-301. Both G-115 and G-301 are believed to be useful in the treatment of prostate cancers only, and not to be useful for the treatment of other cancers.

Manufacturing

GenSpera is outsourcing the production of Thapsigargin to a GMP approved facility. There is only one known commercial supplier of Thapsia garganica seeds. The company has import permits from the USDA to import Thapsia garganica seeds and has a five year sole source agreement with Thapsibiza, with renewal rights for another five years, prior to the expiration date, with minimum purchase requirements per harvest. The company has sufficient supply of Thapsia garganica seeds in storage to complete clinical trials, through NDA approval, but in order to secure a long-term, stable supply of thapsigargin starting material, it is engaged in two ongoing research projects, including traditional cultivation and metabolic engineering of moss cells. GNSZ along with Thapsibiza are evaluating the most cost-effective way to produce thapsigargin, whether it is extracted from seedlings, early roots, stems and/or shoots or from seeds of the mature plant. At the current time, GenSpera believes that traditional cultivation, farming and harvesting of Thapsia garganica is the most reliable and straightforward source of thapsigargin.

The company is also co-funding a study at the University of Copenhagen with the goal to produce synthetic Thapsigargin in moss cells using recombinant DNA technology.

| 7 |

| G-202 CLINICAL DEVELOPMENT PIPELINE | ||

| Indication | Status | |

| Solid Tumors |

Completed Phase Ia/b safety, tolerability and dosing refinement study. Closed to further enrollment. | |

| Hepatocellular Carcinoma (liver cancer) | Ongoing Phase II trial with 18 patients treated to date. Received Orphan Drug designation. | |

| Glioblastoma (brain cancer) | Ongoing Phase II trial with four patients treated to date. | |

| Prostate Cancer | Anticipate commencing a Phase II trial in the second quarter of 2014. | |

GenSpera Drug Candidates Serve Large Attractive Potential Markets

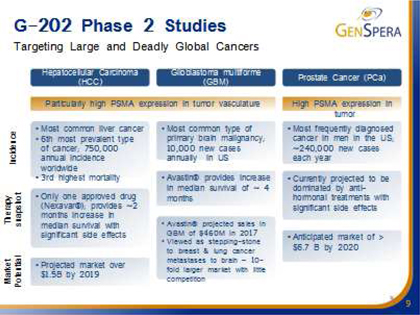

Genspera’s current drug candidates serve large Billion dollar potential markets.

The table below summarizes a number of the potential U.S. target markets for GNSZ’s proposed drug candidates:

| 2013 Estimated Cases of | New Cases | Deaths | ||||||

| Cancer Type | ||||||||

| Prostate | 238,590 | 29,720 | ||||||

| Breast | 232,340 | 39,620 | ||||||

| Liver & intrahepatic bile | 30,640 | 21,670 | ||||||

| Brain & other nervous system | 23,130 | 14,080 | ||||||

Source: CA Cancer JOURNAL Clin 2013; 63: 11-30

Current anti-angiogenesis drugs (drugs that disrupt the blood supply to tumors) validate the clinical approach and market potential of GNSZ’s platform and specifically G-202. Angiogenesis is the physiological process involving the growth of new blood vessels from pre-existing vessels and is a normal process in growth and development, as well as in wound healing. Angiogenesis is also a fundamental step in the development of tumors from a clinically insignificant size to a malignant state because tumors cannot grow beyond a few millimeters in size, without the nutrition and oxygenation that comes from an associated blood supply. Interruption of this process has been targeted as a point of intervention for slowing or reversing tumor growth. We are not aware of any competitor that is developing a drug that is designed to destroy both the existing and newly growing tumor vasculature in a manner similar to GNSZ’s approach, but there are several marketed drugs and drugs in development that attack tumor-associated blood vessels to some degree. For example, Avastin™ is a marketed product that acts mainly as an anti-angiogenic agent. Avastin™ is a monoclonal antibody that inhibits the activity of Vascular Endothelial Growth Factor, which is important for the growth and survival of endothelial cells. Zybrestat™, another drug in development is described as a vascular-disrupting agent that inhibits blood flow to tumors. Nexavar TM and Sutent TM are two other approved drugs that appear to work in part through anti-angiogenic mechanisms.

Avastin and the other anti-angiogenic drugs have only limited therapeutic effects with increased median patient survival times of only a few months. In contrast, GNSZ’s approach is designed to destroy both the existing, as well as newly growing tumor vasculature, rather than just blocking new blood vessel formation. This approach should lead to a more immediate collapse of the tumor’s nutrient supply and consequently an enhanced rate and degree of tumor destruction.

| 8 |

Hepatocellular Carcinoma (Liver Cancer or HCC): Large Market Opportunity

Cancer that forms in the tissues of the liver is known as primary hepatocellular carcinoma. There were an estimated 30,640 new cases and 21,670 deaths in 2013 for liver and intrahepatic bile duct cancer. Incidence of hepatocellular carcinoma in the U.S. is rising, principally due to the spread of hepatitis C infection. It is the most common form of cancer in some parts of the world, with more than 1 million new cases diagnosed each year. Hepatocellular carcinoma is potentially curable by surgical resection, but surgery is the treatment of choice for only a small fraction of patients that have localized disease. Prognosis depends on the degree of local tumor replacement and the extent of liver function impairment. Treatment options for people with liver cancer are surgery (including liver transplant), ablation, chemotherapy, embolization, targeted therapy, and radiation therapy, for which there is only one approved drug, Sorafenib (Nexavar) or a combination of these therapies. Sorafenib is priced at about $8,000 per month in the U.S. or $80,000 for a ten months dose. It has serious negative side effects and median increase survival rates are poor, at 2 months. There is no standard treatment for patients with advanced metastatic liver cancer. The market potential is quite large; estimated at more than $1.5 billion by 2019.

Just a couple of weeks ago, Lilly reported that Ramucirumab failed to hit its primary endpoint in the Phase III study so it may drop out of our lists of competitors in liver cancer.

G-202 Human Clinical Trials

In 2012, GenSpera completed a Phase Ia and Phase Ib Open Label, Single-Arm, Dose-Escalation Study of G-202 in patients with advanced solid tumors designed to evaluate safety, understand the pharmacokinetics (the process by which a compound is absorbed, distributed, metabolized, and eliminated by the body) of G-202 in humans, and to determine an appropriate dosing regimen for subsequent clinical studies.

In the Phase I trial, 28 patients were treated in eight individual cohorts with each subsequent cohort receiving a higher dose of drug until a Maximum Tolerated Dose (MTD) was identified. The Phase Ia portion was conducted in refractory cancer patients, over the ages of 18, (those who have relapsed after former treatments) with any type of solid tumors. This strategy was intended to facilitate enrollment and provide a preliminary indication of safety across a wider variety of patients with different prior treatment regimens. Pro-drug chemotherapy was administered by intravenous infusion over a one hour period on Days, 1, 2 and 3 of each 28 day cycle in patients with advanced solid tumors. Dosing ranged from 1.2 mg/m2/dose (approximately 2 mg/dose) up to 88 mg/m2/dose (approximately 150 mg/dose) of G-202 The drug exposure in patients receiving the higher doses of G-202 falls within the range associated with anti-tumor efficacy in animal models. The MTD of G-202 was identified in this dose escalation portion of the Phase Ia study.

| 9 |

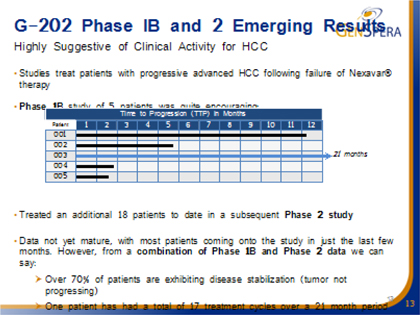

GNSZ evaluated G-202 in sixteen additional patients in a Phase Ib clinical trial. The Phase I trial was designed to further refine a dosing regimen, obtain more safety data and determine a recommended dose for the anticipated Phase II clinical studies. Of these sixteen patients, five were primary liver cancer patients who had tumor progression after previous treatment with Soraenib, the only drug approved for this indication. Median progression-free survival in this patient population is typically two months. Two of these liver cancer patients, who were enrolled with metastatic disease, experienced prolonged disease stabilization of 13 and 11 months after initiation of treatment with G-202. Although the Phase I study was not designed to determine the anti-tumor effects of G-202, signs of potential positive effects were observed. Only a few easily managed and predictable side effects were seen in Phase 1a and Phase 1B, and early Phase 2 data in liver cancer are highly suggestive of clinical activity (please read below).

With encouraging Phase Ib data on five patients with HCC the company initiated a Phase II trial evaluating the use of G-202 for Hepatocellular Carcinoma or Liver Cancer.

Phase II Clinical Development of G-202 – Hepatocellular Carcinoma (Liver Cancer)

In 2012, GNSZ obtained clearance from the FDA to initiate a Phase II clinical trial entitled, “A Phase II, Multicenter, single-arm study of G-202 as Second-Line Therapy Following Sorafenib for Adult Patients with Progressive Advanced Hepatocellular Carcinoma.” This trial is being conducted at multiple sites in the U.S. and requires seventeen evaluable patients for projected data analysis. Eighteen patients with failed Sorefanib therapy have been treated to date. The data is not yet mature with most patients coming into the study in just the last few months but the results continues to be positive, with 80% of patients with stable disease (no tumor growth) at two months. 50% of patients with stable disease (tumor not progressing) for ≥ 4 months. Long-term disease stabilization (≥ 9 months) in 15% of patients. One patient has had a total of 17 treatment cycles over a 21 months period and remains on treatment. There has been no effect on bone marrow. One patient with vertebral metastasis has reported cessation of bone pain.

GNSZ is now using DCE MRI imaging on newly-enrolled patients (in addition to X-ray), both, at baseline and at two months after treatment, that the company thinks could demonstrate the decreased blood flow to the tumor, and thus the successful killing of the tumor vasculature. This pharmacodynamic endpoint would lend strong objective support to the conclusion that the drug is working as conceived in human patients. Typically in this very advanced liver cancer population, the shrinkage of the tumors are not visible on the x-rays due to intense scarring of the tissues and cirrhosis.

| 10 |

New patients continue to be enrolled. The cost of the Phase II b trials (based upon similarly conducted trials by others for this indication) are currently anticipated to range between $13 to $25 million, depending upon numbers of patients, centers and trial design. A Phase I study in Asia is also likely to commence shortly.

If trials prove successful, FDA approval should be granted by 2019, and the drug should be selling in the US market by 2019 as well. Sorefanib (Nexavar) generated about $700 million in worldwide sales in 2013.

Glioblastoma Multiforme (Brain Cancer)

There are an estimated 10,000 new cases of malignant glioblastoma or brain cancer diagnosed each year in the United States, and despite optimal treatment, the median survival for these patients is only 12 – 15 months. The typical treatment regimen is surgery, followed by radiation, and the drug temozolomide. There are a few drugs that have been approved in patients that have recurrent tumors, but none have been shown to promote long-term tumor stabilization or significant survival.

Phase II Clinical Development of G-202 – Glioblastoma (Brain Cancer)

In the first quarter of 2014, GNSZ entered into a collaborative arrangement with University of California San Diego Moores Cancer Center to conduct a Phase II clinical trial entitled, “An Open-Label, Single-Arm, phase II study to Evaluate the Efficacy, Safety and CNS Exposure of G-202 in Patients with Recurrent or Progressive Glioblastoma.” This trial is being conducted at a single site in the U.S., with a Simon Two Stage Design and is expected to enroll up to 34 patients. Enrollment is under way and to-date, four patients have been treated. The primary end point is progression free survival, at six months.

The company expects to report interim Phase II data at the Apple Conference next week on Saturday, July 12, 2014. Positive interim data should positively impact the GNSZ stock price.

| 11 |

If clinical trials prove successful we anticipate FDA approvals for both Liver and Brain cancers by 2019. We also expect both drugs to generate revenues in 2019 as well.

The company plans to use its injectable formulation thus potentially eliminating the need for intravenous administration, a significant improvement.

Prostate Cancer: A Huge Market Opportunity

Prostate cancer forms in tissues of the prostate (a gland in the male reproductive system found below the bladder and in front of the rectum). Second to skin cancer, prostate cancer is the most common cancer in American men, and is the second leading cause of cancer death in American men, behind only lung cancer. Estimates for prostate cancer in the U.S. for 2013 are about 238,590 new cases and about 29,720 deaths. About 1 man in 6 will be diagnosed with prostate cancer during his lifetime. Prostate cancer occurs mainly in men aged 65 or older. Depending on the situation, the treatment options for men with prostate cancer may include: expectant management (watchful waiting) or active surveillance; surgery; radiation therapy; cryosurgery; hormone therapy; chemotherapy; and vaccine treatment. These treatments are generally used one at a time, although in some cases they may be combined

The Prostate cancer market is crowded with a number drugs including JEVTANA ®, ZYTIGA™ and PROVENGE® approved for advanced prostate cancer, and several more are under development. However, these drug candidates have mechanisms of action that either inhibits androgen production or androgen binding to receptors on the cancer cell surfaces. These drugs, however, have different mechanisms-of-action to GenSpera’s G-202. Eventually, all patients will become refractory to anti-androgen and chemotherapies, while cellular therapy only extends survival by approximately 4.5 months. Virtually all involve castration. Current views regarding treatment are evolving with the view now that chemotherapy has a positive effect upon the disease.

Dendreon (Nasdaq:DNDN) has FDA approval for PROVENGE® (Sipuleucel-T) therapy for the treatment of asymptomatic or minimally symptomatic metastatic castrate resistant (hormone refractory) prostate cancer. PROVENGE is an autologous cellular immunotherapy that uses a patient’s own immune cells to kill prostate cancer cells. The therapy works by targeting the antigen prostatic acid phosphatase (PAP) found on the surface of prostate cancer cells. In clinical studies, PROVENGE therapy showed an overall survival benefit of about 4.5 months. PROVENGE costs approximately $93,000 per course of therapy. Provenge has not really been a commercial success.

| 12 |

Johnson & Johnson (NYSE:JNJ) through their acquisition of Cougar Biotechnology acquired the rights to Cougar’s abiraterone acetate drug ZYTIGA™. In April, 2011 the FDA approved ZYTIGA in combination with prednisone (a steroid) to treat patients with late-stage (metastatic) castration-resistant prostate cancer who have undergone prior docetaxel treatment. ZYTIGA works via the inhibition of a protein called CYP17A1, which plays a key role in the production of testosterone in testicular, adrenal, and prostatic tumor tissues. The inhibition of testosterone production in these tissues cuts off the androgens that promote the growth of prostate cancer. ZYTIGA costs about $40,000 per course of therapy.

Medivation (NASDAQ: MVDN) received FDA approval for Xtandi (previously known as MDV3100) in 2012, an oral, triple-acting androgen receptor antagonist for the treatment of early-stage as well as advanced prostate cancers. Xtandi’s multiple mechanisms of action block testosterone from binding to the androgen receptor, impedes movement of the androgen receptor to the nucleus of prostate cancer cells, and inhibits binding to DNA.

Millennium Pharmaceuticals, Inc., / Takeda (Tokyo: 4502) through its oncology subsidiary Millennium Pharmaceuticals (acquired in 2008) was developing TAK700 for the treatment of metastatic castration resistant prostate cancer (mCRPC). TAK700 is an oral, selective, non-steroidal androgen synthesis inhibitor of the 17,20 lyase, a key enzyme in the production of steroidal hormones. Millennium voluntarily ceased Phase III trials when TAK 700 was not successful in extending survival rates.

Sanofi-Aventis (NYSE: SNY) received FDA approval for JEVTANA® (cabazitaxel) n June 2010. JEVTANA, a second generation taxotere drug is a microtubule inhibitor, administered in combination with prednisone for treatment of patients with hormone-refractory metastatic prostate cancer after being treated before with a docetaxel-containing treatment regimen. Phase III clinical trials showed a median survival benefit of 2.4 months in the treatment arm of JEVTANA and prednisone versus mixantrone and prednisone. JEVTANA, has some serious side effects, most notably, a black box warning of potential neutropenic death.

Preclinical testing of three different human prostate cancer cell line xenographs in nude mice (inactive immune system) showed material degrees of tumor inhibition, regression and resolution using G-202.

GenSpera is conducting a Phase II prostate cancer trial in the neo-adjuvant setting (newly diagnosed treatment naive patients) prior to removal of the prostate via prostatectomy. We view this as a strategically impressive move to first demonstrate clinical efficacy in prostate cancer before embarking upon larger studies in a disease that is now crowded with newly approved drugs, most with significant side effects associated with chemical castration. We believe that, if the trial is successful, the study should potentially add significant increased valuation to the company as it negotiates the worth of G-202 with a potential corporate partner.

Robust Intellectual Property Position

GenSpera has 11 issued U.S. patents, which expire between 2018 and 2029, on composition and methods directed to: peptide specific prodrugs (targeting hK2, PSA, PSMA); thapsigargin derivatives; methods of making the same; and, methods of treatment using the same. It also has a pending U.S. provisional applications covering additional peptide specific prodrugs (targeting fibroblast activation protein-alpha, “FAP”); injectable formulations of peptide prodrugs (PSMA, PSA, hK2, and FAP); methods for producing the same; and methods of treatment using the same. If allowed, these applications would expire between 2027 and 2034. It also has two pending Patent Cooperation Treaty, or PCT, application; and 1 pending European patent application (also registered in Hong Kong), which relates to the PCT application. The pending PCT, and its European Union and U.S. counterparts, contain claims directed to compositions and methods for detecting and imaging cancer, and if issued, expire in 2030. GNSZ owns all of its patents outright, with no royalties or other payments due to any third parties.

G-202 has been granted orphan drug designation for the treatment of hepatocellular carcinoma which provides the company with seven years of exclusivity after approval. During the seven year period, the FDA may not grant marketing authorization (e.g. to a generic manufacturer) for the same drug for the orphan indication.

| 13 |

GNSZ is currently involved in legal proceedings related to certain of its licensed patents with a former Hopkins researcher. The company believes the suit has no merit, and is vigorously defending against the action, expending about $1 million in legal costs to-date. The Judge in the case has indicated that he will rule in GenSpera’s favor on the summary judgment motion to dismiss the suit that would have added the investigator to GenSpera’s patents. There is a second summary judgment motion in court to dismiss the case on statue of limitations grounds. The company expects the judge will comment on these summary judgment motions before year- end.

Management Team

GenSpera has a strong, experienced management, and seasoned scientific team.

CraigA. Dionne, PhD serves as the company’s Chief Executive Officer, Chief Financial Officer, President, and Chairman of the Board of Directors and was the co-founder of GNSZ. He has over 25 years of experience in the pharmaceutical industry, including direct experience identifying promising oncology treatments and bringing them through clinical trials. Dr. Dionne served for five years as Vice President of Discovery Research at Cephalon Inc. (acquired by Teva Pharmaceuticals), where he was responsible for its oncology and neurobiology drug discovery and development programs. Dr. Dionne has also recently served as Executive Vice President at the Prostate Cancer Research Foundation. Dr. Dionne‘s work has led to 6 issued patents and he has co-authored many scientific papers. Dr. Dionne earned his BS in biochemistry in 1979 from Louisiana State University, Baton Rouge, Louisiana and his PhD in biochemistry in 1984 from the University of Texas at Austin. Dr. Dionne received post-doctoral training at the Dana-Farber Cancer Institute with a joint appointment at Harvard Medical School.

Russell Richerson, PhD serves as the company’s Chief Operations Officer and Secretary. Dr. Richerson has over 25 years of experience in the biotechnology/diagnostics industry, including 11 years at Abbott Laboratories in numerous management roles. From 2001-2004, he served as the Vice President of Diagnostic Research and Development at Prometheus Laboratories, and then from 2005-2008 as the Chief Operating Officer of the Molecular Profiling Institute. Dr. Richerson from 2005 to 2008 also served as Vice President of Operations of International Genomics Consortium (IGC) and has served on its Board of Directors since August of 2011. He received his BS in 1974 from Louisiana State University, Baton Rouge, Louisiana and his PhD from the University of Texas at Austin in 1983.

Peter E. Grebow, PhD has served on the company’s Board of Directors since May, 2012. Dr. Grebow has over 37 years of experience in the pharmaceutical industry. Since 2011, Dr. Grebow has served as President and founder of P.E. Grebow Consulting, Inc. Since October, 2013 he has served as Executive Vice President of Research and Development at Eagle Pharmaceuticals, Inc. From 1991 to 2011, Dr. Grebow held several key positions with Cephalon, Inc. (now Teva Pharmaceuticals), a biopharmaceutical company, including Executive Vice President, Cephalon Ventures, Executive Vice President of Technical Operations, Senior Vice President, Worldwide Business Development and Senior Vice President, Drug Development. Prior to joining Cephalon, he was the Vice President, Drug Development for Rorer Central Research, a division of Rhone-Poulenc Rorer Pharmaceuticals Inc., a pharmaceutical company, from 1986 to 1990. Dr. Grebow served as a director of Optimer Pharmaceuticals from February 2009 until October, 2013. Dr. Grebow also serves as a director of Q Holdings, Inc. since December 2011, and Complexa, Inc. since 2011. Dr. Grebow received his undergraduate degree from Cornell University, an MS in Chemistry from Rutgers University and a PhD in physical biochemistry from the University of California, Santa Barbara.

Bo Jesper Hansen, MD, PhD serves as a member of the Board of Directors since August 2010. Dr. Hansen has since January 2010 served as the Executive Chairman of the Board of Swedish Orphan Biovitrum AB (STO: SOBI), an international growth company specializing in the development, registration, marketing and distribution of pharmaceutical drugs for rare and life-threatening diseases. Prior to the merger, Dr. Hansen served in numerous positions with Swedish Orphan International AB Group, including, from 1998 to 2010, CEO, President and Director of the Board. Dr. Hanson’s responsibilities at the company include establishment, development and expansion of the company’s operations in Europe, Japan, the Americas and Australia. Dr. Hansen holds a Doctor of Medicine degree from the University of Copenhagen with a specialty in urology. Dr. Hansen also serves on the boards of CMC AB, Orphazyme ApS, Newron (SIX; NWRN) and TopoTarget A/S (NASDAQ OMX: TOPO), and Hyperion Therapeutics Inc. (NASDAQ, HPTX), and Ablynx NV (ABLX).

Mr. Scott V. Ogilvie, Board Member. He has served as a director on Genspera’s board since February 2008. Mr. Ogilvie is currently the President of AFIN International, Inc., a private equity/business advisory firm, which he founded in 2006. Additionally, Mr. Ogilvie has served as a partner of Wirthlin Worldwide International, a private strategic advisory and M&A firm, since September 2011. Prior to December 31, 2009, he was CEO of Gulf Enterprises International, Ltd, a company that brings strategic partners, expertise and investment capital to the Middle East and North Africa. He held this position since August 2006. Mr. Ogilvie previously served as Chief Operating Officer of CIC Group, Inc., an investment manager, a position he held from 2001 to 2007. He began his career as a corporate and securities lawyer with Hill, Farrer & Burrill, and has extensive public and private corporate management and board experience in finance, real estate, and technology companies. Mr. Ogilvie currently serves on the board of directors of Neuralstem, Inc. (NYSE MKT: CUR) and Research Solutions, Inc. (OTCBB: RRS). Mr. Ogilvie also served on the board of directors of Preferred Voice Inc. (OTCQB: PRFV), Innovative Card Technologies, Inc. (OTCBB: INVC), National Healthcare Exchange, Inc. (OTCBB: NHXS) and Derycz Scientific, Inc. (OTCQB: DYSC).

| 14 |

Dividends

The company does not pay a dividend. Management believes that shareholders are best served by raising money to build shareholder value by developing drugs, and conducting drug trials to ultimately obtain regulatory FDA approval.

Revenues and Earnings:

As a biotechnology development company, since inception, GNSZ has generated no revenues and has incurred losses. We expect GenSpera to continue reporting losses for the next few years as it conducts FDA trials with the goal of obtaining FDA and other national regulatory approvals and generate revenues by 2019 for both Liver and Brain Cancer.; and conduct trials for other cancers. In 2013 the company reported an operating loss of $6.4 million, but after a benefit of $1.09 million from an increase in the fair value of warrant or derivative liability, the bottom line loss was $5.3 million or a loss of $0.21 per share (on 24.8 million shares outstanding) against a loss of $6.92 million (with a $50,000 positive impact on derivative warrant valuation) or a loss of $0.32 per share for the 2013 year. In the first quarter of 2014, ended March 30, 2014, the company reported a loss of $1.94 million or a loss of $0.07 per share (on 27.3 million shares) versus a loss of $1.3 million, or six cents per share (on 22.8 million shares). For the full 2014 year we project a loss of about $11.7 million. Gross product margins should be high: above an estimated 80%, and may even potentially be improved with manufacturing process improvements.

We anticipate timely and steady news flow over the next few years:

Finances

As of March 30, 2014, the Company had current assets of $2,273,000 including $2,233,000 in cash and current liabilities of $2,233,000. Total assets were $2,855,000 versus total liabilities of $ 2,233,000. The company has no long-term debt. The company has 62.6 million shares on a fully-diluted basis. Dr. Dione, the company’s CEO owns nearly 20 percent of the stock (includes the underlying shares of the convertible), Russell Richerson holds about 12%, and John Isaacs and Samuel Denmeade (a scientific advisor) each hold about 5%, and Kihong Kwon, MD holds nearly 13%. Institutional owners consists of a few small funds, who hold a relatively small percentage of the stock. Hence, there is good opportunity for strong potential appreciation as the story garners more “Wall Street” interest.

| 15 |

The company has recently bolstered its weak balance sheet. In late June, 2014 GNSZ raised about $770,000 via a private placement of units priced at $0.80 per unit. Each unit consists of one share of common stock and a warrant to purchase 0.50 shares at a $1.15 strike price (per share) with a five year term with a 6 months lock up clause. On May 30th, 2014 the company raised approximately $3 million in net proceeds through a private placement unit offering via Wainwight Securities to fund the current Phase II Liver trial and for general corporate purposes. Units were priced at $0.80 each, and included a half of a Series A warrant exercisable for five years (from the date of the offering) at $1.15 per share; one Series B warrant, with a nine-month term, exercisable at $0.85 per share; one Series C Warrant, with a one year term, exercisable at $0.85 per share. There are an additional 18.6 million in options, warrants, and convertible securities outstanding, at prices ranging from $0.50 to $3.50 per share with a weighted average price of $2.15 per share; and 3.5 million shares reserved under an employee option plan.

As of March 31, 2014, the only debt on the books are three convertible promissory notes, payable to Dr. Dionne, the CEO of the company. The notes have an annual interest rate of 4.2%. The aggregate balance of the notes is $105,000 in principal and $26,847 in accrued interest. The notes and accrued interest are convertible into 263,695 shares of common stock at $0.50 per share.

The company operates on a virtual basis with only a handful of full-time employees, and uses outside consultants and experts as required who operate under the supervision of its officers. Thus, the current burn rate is extremely low, particularly considering Phase II FDA trials in progress. The bulk of the current trials are investigator-funded but the company has control of the data and full ownership of the technology.

GenSpera currently has enough cash to fund operations through mid-2015. The company is currently expanding its Phase II liver study, and could cost about $13 million to $25 million, depending upon the studies’ design, patient population size, number of centers, nature of the study, and targeted endpoints. Potential product sales or licenses could generate significant additional cash. Management has stated that it intends to pursue licensing arrangements during Phase II trials. We believe these potential arrangements will likely be back-ended (i.e. more cash later) and milestone-driven. Thus, we anticipate the likely need for additional equity funding.

Valuation

GNSZ sells at a price below its peers in the early stage cancer market players with a market capitalization of about $28.7 million, particularly since it already has two drug therapeutics in early Phase II trials and its strategy of accelerated regulatory approval should enable the company over the next three years to move into Phase III or Registration trials for Liver and Brain Cancer and be well into Prostate trials (thereby demonstrating its usefulness in the treatment of a number of different solid tumors). and shifting the company into the later stage and typically higher market capitalization category.

| 16 |

Risks

Genspera is subject to all of the usual operational, financial and other exogenous risks associated with a junior biotechnology company including: regulatory risk; product line concentration; patent litigation; dependence on a small management, partners, and scientific team; market risk; competition; and risk of not raising adequate capital among others. Its stock is subject to the risks associated with low-priced equities trading on the NASDAQ QB markets, including potential lack of liquidity, and sector rotation.

Our price target: $More than a double within the next 12-24 months.

| Sheldon S. Traube | |

| Director of Research |

| 17 |