UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(MARK ONE)

ý | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

FOR THE FISCAL YEAR ENDED DECEMBER 31, 2017

OR

¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

FOR THE TRANSITION PERIOD FROM TO

Commission File Number 001-36779

On Deck Capital, Inc.

(Exact name of registrant as specified in its charter)

Delaware | 42-1709682 |

(State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) |

1400 Broadway, 25th Floor

New York, New York 10018

(Address of principal executive offices)

(888) 269-4246

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

Title of each class | Name of each exchange on which registered |

Common Stock, par value $0.005 per share | New York Stock Exchange |

Securities registered pursuant to Section 12(g) of the Act:

None.

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. YES ¨ NO ý

Indicate by check mark whether the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. YES ¨ NO ý

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. YES ý NO ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data file required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). YES ý NO ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer,” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

Large accelerated filer | ¨ | Accelerated filer | x | |||

Non-accelerated filer | ¨ (Do not check if a smaller reporting company) | Smaller reporting company | ¨ | |||

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). YES ¨ NO ý

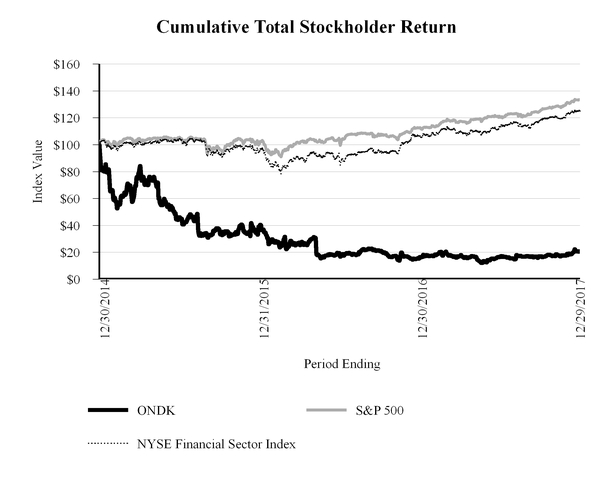

The aggregate market value of the common stock by non-affiliates of the registrant, based on the closing price of a share of the registrant’s common stock on June 30, 2017 (the last business day of the registrant's most recently completed second fiscal quarter) as reported by the New York Stock Exchange on such date was $232,319,356. Shares of the registrant’s common stock held by each executive officer, director and holder of 10% or more of the outstanding common stock have been excluded in that such persons may be deemed to be affiliates. This calculation does not reflect a determination that certain persons are affiliates of the registrant for any other purpose.

The number of shares of the registrant’s common stock outstanding as of February 20, 2018 was 74,028,096.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the registrant’s definitive Proxy Statement for its 2018 Annual Meeting of Stockholders are incorporated by reference in Part III of this Annual Report on Form 10-K. Such Proxy Statement will be filed with the U.S. Securities and Exchange Commission within 120 days after the end of the fiscal year to which this report relates. Except with respect to information specifically incorporated by reference in this Form 10-K, the Proxy Statement is not deemed to be filed as part of this Form 10-K.

On Deck Capital, Inc.

Table of Contents

Page | ||

Item 1. | ||

Item 1A. | ||

Item 1B. | ||

Item 2. | ||

Item 3. | ||

Item 4. | ||

Item 5. | ||

Item 6. | ||

Item 7. | ||

Item 7A. | ||

Item 8. | ||

Item 9. | ||

Item 9A. | ||

Item 9B. | ||

Item 10. | ||

Item 11. | ||

Item 12. | ||

Item 13. | ||

Item 14. | ||

Item 15. | ||

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This report contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 and other legal authority. These forward-looking statements concern our operations, economic performance, financial condition, goals, beliefs, future growth strategies, objectives, plans and current expectations.

Forward-looking statements appear throughout this report including in Item 1. Business, Item 1A. Risk Factors, Item 3. Legal Proceedings and Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations. Forward-looking statements can generally be identified by words such as “will,” “enables,” “expects,” "intends," "may," “allows,” "plan," “continues,” “believes,” “anticipates,” “estimates” or similar expressions.

Forward-looking statements are neither historical facts nor assurances of future performance. They are based only on our current beliefs, expectations and assumptions regarding the future of our business, anticipated events and trends, the economy and other future conditions. As such, they are subject to inherent uncertainties, risks and changes in circumstances that are difficult to predict and in many cases outside our control. Therefore, you should not rely on any of these forward-looking statements. Our expected results may not be achieved, and actual results may differ materially from our expectations.

Important factors that could cause or contribute to such differences include risks relating to: our ability to attract potential customers to our platform and broaden our distribution capabilities and offerings; the degree to which potential customers apply for loans, are approved and borrow from us; anticipated trends, growth rates, loan originations, volume of loans sold and challenges in our business and in the markets in which we operate; the ability of our customers to repay loans and our ability to accurately assess creditworthiness; our ability to adequately reserve for loan losses; the impact of our decision to tighten our credit policies; our liquidity and working capital requirements, including the availability and pricing of new debt facilities, extensions and increases to existing debt facilities, increases in our corporate line of credit, securitizations and OnDeck Marketplace® sales to fund our existing operations and planned growth, including the consequences of having inadequate resources to fund additional loans or draws on lines of credit; our reliance on our third-party service providers and the effect on our business of originating loans without third-party funding sources; the impact of increased utilization of cash or incurred debt to fund originations; the effect on our business of utilizing cash for voluntary loan purchases from third parties; the effect on our business of the current credit environment and increases in interest rate benchmarks; our ability to hire and retain necessary qualified employees in a competitive labor market; practices and behaviors of members of our funding advisor channel and other third parties who may refer potential customers to us; changes in our product distribution channel mix and/or our funding mix; our ability to anticipate market needs and develop new and enhanced offerings to meet those needs; lack of customer acceptance of possible increases in interest rates and origination fees on loans; maintaining and expanding our customer base; the impact of competition in our industry and innovation by our competitors; our anticipated and unanticipated growth and growth strategies, including the possible introduction of new products or features, our strategy to expand the availability of our platform to other lenders through OnDeck-as-a-Service and possible expansion in new or existing international markets, and our ability to effectively manage that growth; our reputation and possible adverse publicity about us or our industry; the availability and cost of our funding, including challenges faced by the expiration of existing debt facilities; the impact on our business of funding loans from our cash reserves; locating funding sources for new types of loans that are ineligible for funding under our existing credit or securitization facilities and the possibility of reducing originations of these loan types; the effect of potential selective pricing increases; our expected utilization of OnDeck Marketplace and the available OnDeck Marketplace premiums; our failure to anticipate or adapt to future changes in our industry; the impact of the Tax Cuts and Jobs Act of 2017 and any related Treasury regulations, rules or interpretations, if and when issued; our ability to offer loans to our small business customers that have terms that are competitive with alternative sources of capital; our ability to issue new loans to existing customers that seek additional capital; the evolution of technology affecting our offerings and our markets; our compliance with applicable local, state and federal and non-U.S. laws, rules and regulations and their application and interpretation, whether existing, modified or new; our ability to adequately protect our intellectual property; the effect of litigation or other disputes to which we are or may be a party; the increased expenses and administrative workload associated with being a public company; failure to maintain an effective system of internal controls necessary to accurately report our financial results and prevent fraud; the estimates and estimate methodologies used in preparing our consolidated financial statements; the future trading prices of our common stock, the impact of securities analysts’ reports and shares eligible for future sale on these prices; our ability to prevent or discover security breaks, disruption in service and comparable events that could compromise the personal and confidential information held in our data systems, reduce the attractiveness of our platform or adversely impact our ability to service our loans; and other risks, including those described in this report in Item 1A. Risk Factors and other documents that we file with the Securities and Exchange Commission, or SEC, from time to time which are available on the SEC website at www.sec.gov.

Except as required by law, we undertake no duty to update any forward-looking statements. Readers are also urged to carefully review and consider all of the information in this report, as well as the other documents we make available through the SEC’s website.

1

When we use the terms “OnDeck,” the “Company,” “we,” “us” or “our” in this report, we are referring to On Deck Capital, Inc. and its consolidated subsidiaries unless the context requires otherwise.

2

PART I

Item 1. | Business |

Our Company

We are a leading platform for online small business lending. We continue to transform small business lending by making it efficient and convenient for small businesses to access capital. Our platform touches every aspect of the customer life cycle, including customer acquisition, sales, scoring and underwriting, funding, and servicing and collections. Enabled by our proprietary technology and analytics, we aggregate and analyze thousands of data points from dynamic, disparate data sources, and the relationships among those attributes, to assess the creditworthiness of small businesses rapidly and accurately. The data points include customer bank activity shown on their bank statements, business and personal credit bureau reports, government filings, tax and census data. In addition, in certain instances we also analyze reputation and social data. Small businesses can apply for a term loan or line of credit, 24 hours a day, 7 days a week, on our website in minutes and, using our proprietary OnDeck Score®, we can make a funding decision immediately and transfer funds as fast as the same day. We have originated more than $8 billion of loans since we made our first loan in 2007.

In 2017, 2016 and 2015, we originated $2.1 billion, $2.4 billion and $1.9 billion of loans, respectively. Our originations have been supported by a diverse and scalable set of funding sources, including committed debt facilities, securitization facilities and OnDeck Marketplace, our whole loan sale platform for institutional investors. In 2017, 2016 and 2015, we recorded gross revenue of $351.0 million, $291.3 million and $254.8 million, respectively, representing year-over-year growth of 20%, 14% and 61%, respectively. In 2017, 2016 and 2015, our net loss attributable to On Deck Capital, Inc. common stockholders was $11.5 million, $83.0 million and $1.3 million, respectively, our loss from operations was $13.6 million, $85.1 million and $1.9 million, respectively, and our Adjusted Net Income (Loss), a non-GAAP financial measure, was $1.0 million, $(67.0) million and $10.3 million respectively. See Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations—Non-GAAP Financial Measures for a discussion and reconciliation of Adjusted Net Income to net loss. As of December 31, 2017, our total assets were $996.0 million and the Unpaid Principal Balance on our loans outstanding was $936.2 million.

We were incorporated in the state of Delaware on May 4, 2006. We operate from our headquarters in New York, New York and also have offices in Arlington, Virginia, Denver, Colorado, Sydney, Australia and Toronto, Canada. Additional information about us is available on our website at http://www.ondeck.com. The information on our website is not incorporated herein by reference and is not a part of this report.

OnDeck, the OnDeck logo, OnDeck Score, OnDeck Marketplace and other trademarks or service marks of OnDeck appearing in this report are the property of OnDeck. Trade names, trademarks and service marks of other companies appearing in this report are the property of their respective holders. We have generally omitted the ® and TM designations, as applicable, for the trademarks used in this report.

Our Market and Solution

The small business lending market is vast and underserved. According to the FDIC, of business loans in the United States with originations under $250,000, there were $207 billion in outstanding business loans at June 30, 2017 across 24.7 million loans.

We offer small businesses a suite of financing options with our term loans and lines of credit that can meet the needs of small businesses throughout their life cycle. Since we made our first loan in 2007, we have originated more than $8 billion of loans across more than 700 industries in all 50 U.S. states, Canada and Australia. The top five states in which we, or our issuing bank partner, originated loans in 2017 were California, Florida, Texas, New York and Illinois, representing approximately 14%, 9%, 9%, 7% and 4% of our total loan originations, respectively. As of December 31, 2017, our customers have a median annual revenue of approximately $631,000, with 90% of our customers having between $162,106 and $3.8 million in annual revenue, and have been in business for a median of 8 years, with 90% in business between 2 and 30 years. During 2017, the average size of a term loan we made was approximately $57,000 and the average size of a line of credit extended to our customers was approximately $23,000.

We believe our scale offers significant benefits including lower customer acquisition costs, access to a broader dataset, better underwriting decisions and a lower cost of capital compared to certain smaller online lending businesses.

We believe our customers choose us because we provide the following key benefits sought by small business borrowers:

• | Tailored Solutions. We offer small businesses a suite of financing choices with our term loans and lines of credit that we believe can be tailored to effectively address small businesses' particular funding needs. We believe that small businesses |

3

prefer to work with providers with whom they can build long-term relationships and that the range of our offerings makes us an ideal lending partner. Our term loans are available from $5,000 up to $500,000 with maturities of three to 36 months and our lines of credit range from $6,000 to $100,000 and are generally repayable within six months of the date of most recent draw. We believe this provides a wider range of term lengths, pricing alternatives and repayment options than any other online small business lender. We also report back to several business credit bureaus, which can help small businesses build their business credit.

• | Simple. Small businesses can submit an application on our website in as little as minutes. We are able to provide many loan applicants with an immediate decision and, if approved, transfer funds as fast as the same day. Because we require no in-person meetings, collect comprehensive information electronically and have an intuitive online application form, we have been able to significantly increase the convenience and efficiency of the application process without burdensome documentation requirements. |

• | Human. Being “human” is about understanding, having empathy for our customers and treating them with respect. We employ a hybrid approach to delivering a "human" experience, where people and technology complement one another. Our internal sales force and customer service representatives provide assistance throughout the application process and the life of the loan. Our U.S-based representatives support customers in the U.S., and currently also Canada, and our separate Sydney-based representatives support customers in Australia. Our representatives are available Monday through Saturday before, during and after regular business hours to accommodate the busy schedules of small business owners. Our website enables our customers to complete the loan application process online, but they may also elect to mail, fax or email us their application and related documentation. We believe that our inclusion of the human element differentiates us from many digital lenders that attempt to complete transactions with no human interaction as well as from banks that, we believe, have a poor history of customer service and satisfaction. |

Our Competitive Strengths

We believe the following competitive strengths differentiate us and serve as barriers for others seeking to enter our market:

• | Significant Scale. We have originated over $8 billion in loans across more than 700 industries since we made our first loan in 2007 and maintain a proprietary database of more than 18 million small businesses. |

• | Proprietary Small Business Credit Evaluation. We use data analytics and technology to optimize our business operations and the customer experience. Our proprietary data and analytics engine and the OnDeck Score provide us with significant visibility and predictability to assess the creditworthiness of small businesses and allow us to better serve more customers across more industries. With each loan application, each originated loan and each payment received, our dataset expands and our OnDeck Score improves. We are able to lend to more small businesses than if we relied on personal credit scores alone. We are also able to use our proprietary data and analytics engine to pre-qualify customers and market to those customers we believe are predisposed to take a loan and have a higher likelihood of approval. When we believe it is warranted, we may also utilize our hybrid approach which utilizes our judgmental underwriting to help tailor the right financial solution for our customers. |

• | End-to-End Integrated Technology Platform. We built our integrated platform specifically to meet the financing needs of small businesses. Our platform touches every aspect of the customer life cycle, including customer acquisition, sales, scoring and underwriting, funding, and servicing and collections. This purpose-built infrastructure is enhanced by robust fraud protection, multiple layers of security and proprietary application programming interfaces. It enables us to deliver a superior customer experience and facilitates agile decision making. We use our platform to underwrite, process and service all of our small business loans regardless of distribution channel. |

• | Diversified Distribution Channels. We are enhancing distribution capabilities through diversified distribution channels, including direct marketing, strategic partnerships and funding advisors. Our direct marketing includes direct mail, outbound calling, social media and other online marketing channels. Our strategic partners, including banks, payment processors and small business-focused service providers, offer us access to their base of small business customers, and data that can be used to enhance our targeting capabilities. We also have relationships with a large network of funding advisors, including businesses that provide loan brokerage services, which drive distribution and aid brand awareness. Our internal sales force contacts potential customers, responds to inbound inquiries from potential customers, and is available to assist all customers throughout the application process. |

• | Singular Focus and Visibility. We are passionate about small businesses. Since we began lending in 2007, we have focused exclusively on assessing and delivering credit to small businesses. We believe this passion, focus and small business credit expertise provides us with significant competitive advantages, including deep insight into small businesses and their financing needs. Our partnerships with well-known companies such as JPMorgan Chase Bank, National Association, or JPM, Intuit Inc. and others also help increase our visibility and validate our brand. As an NYSE listed company, we |

4

are required to meet high standards of transparency and financial reporting as well as to satisfy numerous other legal requirements. We believe the combination of these factors strengthens our position as we compete for customers.

• | High Customer Satisfaction and Repeat Customer Base. Our strong value proposition has been validated by our customers. We achieved an overall Net Promoter Score of 79 for the three months ended December 31, 2017 based on our internal survey of U.S. customers in all three of our distribution channels. The Net Promoter Score is a widely used index ranging from negative 100 to 100 that measures customer loyalty. Our score places us at the upper end of customer satisfaction ratings and compares favorably to the average Net Promoter Score of 35 for the financial services industry. We have also consistently achieved an A+ rating from the Better Business Bureau. We believe that high customer satisfaction has played an important role in repeat borrowing by our customers. In 2017, 2016, and 2015, 52%, 53% and 57%, respectively, of loan originations were by repeat term loan customers, who either replaced their existing term loan with a new, usually larger, term loan or took out a new term loan after paying off their existing OnDeck term loan in full. Repeat customers generally demonstrate improvements in key metrics such as revenue and bank balance when they return for an additional loan. From our 2015 customer cohort, customers who took at least three loans grew their revenue and bank balance, respectively, on average by 37% and 50% from their initial loan to their third loan. Similarly, from our 2016 customer cohort, customers who took at least three loans grew their revenue and bank balance, respectively, on average by 35% and 42%. Approximately 27.7% percent of our origination volume from repeat customers in 2017 was due to unpaid principal balances rolled from existing loans directly into new loans. Each repeat customer seeking another term loan must meet the following standards: |

• | the business must be approximately 50% paid down on its existing loan; |

• | the business must be current on its outstanding OnDeck loan with no material delinquency history; and |

• | the business must be fully re-underwritten and determined to be of adequate credit quality. |

• | Durable Business Model. Since we began lending in 2007, we have successfully operated our business through both strong and weak economic environments. Our real-time data, short duration loans, automated daily and weekly collections, risk management capabilities and unit economics enable us to react rapidly to changing market conditions. |

• | Differentiated Funding Platform. We source capital through multiple channels, including debt facilities, securitizations and OnDeck Marketplace, a whole loan sale platform for institutional investors. This diversity provides us with a mix of scalable funding sources, long-term capital commitments and access to flexible funding for growth. In addition, because we contribute a portion of the capital for each loan we fund via our debt facilities and securitizations, we are able to align interests with our investors. |

Our Strategy for Growth

Our vision is to become the first choice lender to underserved small businesses, and to accomplish this, we intend to:

• | Expand Offerings. We will continue developing financing solutions and enhancements for underserved small businesses throughout their life cycle. We offer lines of credit with limits up to $100,000 and term loans up to $500,000 with terms up to 36-months. In 2018, we plan to launch a real-time funding option to small businesses via their debit cards through our agreements with Ingo Money and Visa. In addition, based on successful testing in 2017, we expect to introduce other new features to make our offerings more relevant and flexible. Our goal in expanding our offerings is to provide more comprehensive solutions for our current customers as well as to attract more new OnDeck customers. We regularly evaluate our product range and explore new ideas including variations of existing loans through test pilot programs before new loans or loan enhancements are fully introduced. |

• | Continue to Acquire Customers Through Direct Marketing and Sales. We plan to continue efficient investment in direct marketing and sales to add new customers and increase our brand awareness. Through this channel, we make contact with prospective customers utilizing direct mail, outbound calling, social media and online marketing. As our dataset expands, we will continue to pre-qualify and market to those customers we believe are predisposed to take a loan and have a higher likelihood of approval. We have seen success from this strategy as the Direct Marketing channel contributed more than any other channel, in terms of absolute dollars, to our originations in 2017 and over the same period achieved lower customer acquisition costs on a per dollar funded basis. |

• | Broaden Distribution Capabilities Through Strategic Partners and Funding Advisors. Through our Strategic Partner channel, we are introduced to prospective customers by third parties that serve or otherwise have access to the small business community in the regular course of their business. Strategic partners conduct their own marketing activities which may include email marketing, leveraging existing business relationships and direct mail. Strategic partners include, among others, small business-focused service providers, other financial institutions, financial and accounting solution |

5

providers, payment processors, independent sales organizations and financial and other websites. Our business development team is dedicated to expanding our network of strategic partners and leveraging their relationships with small businesses to acquire new customers. In general, if a strategic partner refers a customer that takes a loan from us, we pay that strategic partner a fee based on the amount of the originated loan. Strategic partners differ from funding advisors (described below) in that strategic partners generally provide a referral to our direct sales team and our direct sales team is the main point of contact with the customer. On the other hand, funding advisors serve as the main points of contact with the customer on its initial loan and may help a customer access multiple funding options besides those we offer. As such, funding advisors' commissions generally exceed strategic partners' referral fees. We generally do not recover these commissions or fees upon default of a loan. Generally, no other fees are paid to strategic partners.

Through our Funding Advisor Program, we make contact with prospective customers by entering into relationships with third-party independent advisors, known as Funding Advisor Program partners, or FAPs, that typically offer a variety of financial services to small businesses. FAPs conduct their own marketing activities, which may include direct mail, online marketing, paid leads, television and radio advertising or leveraging existing business relationships. FAPs include independent sales organizations, commercial loan brokers and equipment leasing firms. FAPs act as intermediaries between potential customers and lenders by brokering business loans on behalf of potential customers. As part of our FAP strategy, we require a detailed certification process, including background checks, to approve a FAP, and annual recertifications in order to remain a FAP. We also employ a senior compliance officer whose responsibilities include overseeing compliance matters involving our Funding Advisor Program channel. Our relationships with FAPs provide for the payment of a commission at the time the term loan is originated or line of credit account is opened. We generally do not recover these commissions upon default of a loan. As of December 31, 2017, we had active relationships with more than 400 FAPs, and in 2017, 2016 and 2015, no single FAP was associated with more than 2%, 2%, and 2% of our total originations, respectively.

• | Extend Customer Lifetime Value. We believe we have an opportunity to increase revenue and loyalty from new and existing customers, thereby extending customer lifetime value. We seek to accomplish this by accommodating our customers’ needs as they grow and as their funding needs increase and change. We continue to add benefits to our customer offerings to increase engagement and usage of our platform. For example, in 2016, we introduced new online features including downloadable monthly statements and payment transaction reports, and new digital content, and in 2017 we continued to explore opportunities to incorporate flexibility into our funding features. |

• | Funnel Optimization. During 2017, we strategically tightened our credit policy in light of higher than expected loss rates within several areas of our 2016 and older loan cohorts. We believe we have now identified several opportunities to further refine our decisioning model which will allow us to responsibly grant credit to certain portions of populations that underperformed historically. In addition, we will issue more conservative loan offers to populations that in the past might have received higher loan amounts or longer terms, reducing risk in those populations through lower payment stress and duration risk. |

• | OnDeck-as-a-Service. We believe that an opportunity exists to leverage the decisioning strength of our platform and the OnDeck Score, as evidenced by our partnership with JPM, which uses our platform to make loan decisions for their own customers. We are actively seeking to expand the availability of OnDeck-as-a-Service to other appropriate partners, and expect to announce another major bank partner in 2018. |

• | International Growth. We plan to grow our business, while closely monitoring and adjusting our pricing and acquisition costs, in both Canada and Australia, where we believe the markets for online small business loans are still relatively new and underserved. Although we believe there are other promising international markets, our near term plans do not include expansion into additional countries. |

Our Loans and Loan Pricing

We offer term loans and lines of credit to eligible small businesses. We currently offer term loans from $5,000 to $500,000. The principal amount of our term loan is a function of our credit risk and cash flow assessments of the customer’s ability to repay the loan. The original term of each individual term loan ranges from 3 to 36 months. Customers repay our term loans through fixed, automatic ACH collections from their business bank account on either a daily or weekly basis. Certain term loans are originated by our issuing bank partner and loans that we purchase from our issuing bank partner have similar performance and characteristics to loans that we originate. We offer a revolving line of credit with fixed six month level-yield amortization on amounts outstanding and automated weekly payments. We currently offer lines of credit from $6,000 to $100,000. A customer may be offered a line of credit based on our credit risk assessment of the customer’s ability to repay the line of credit. During the first quarter of 2016, we began to purchase lines of credit from our issuing bank partner.

Our loans are priced based on a risk assessment generated by our proprietary data and analytics engine, which includes the OnDeck Score. Customer pricing is determined primarily based on the customer’s OnDeck Score, the loan term and origination

6

channel. Loans originated through direct marketing and strategic partners are generally priced lower than loans originated through FAPs due to the commission structure of the FAP program. Additionally, we may offer discounts to qualified repeat customers as part of our loyalty program.

For all of our term loans and lines of credit, our customers are quoted multiple pricing metrics to provide transparency and help them better understand the cost of their loan, including:

•the total payback cost in dollars;

•the annual percentage rate, or APR;

•the average monthly payment amount; and

•the “Cents on Dollar,” or COD, which expresses the total amount of interest that will be paid per dollar

borrowed.

While APR is provided to all of our customers for comparison purposes, we do not use APR to determine the interest we will charge a customer on a particular loan. We believe APR is most useful when comparing longer-term loans (12 months or more) of similar expected duration and is less useful when comparing shorter-term loans (12 months or less). Given the use case and payback period associated with our loans, we believe our customers understand pricing on a “dollars in, dollars out” basis and are primarily focused on total payback cost. For example, as of December 31, 2017, our customers pay between $0.003 and $0.04 per month in interest for every dollar they borrow under one of our term loans.

We believe that our product pricing has historically fallen between traditional bank loans to small businesses and certain non-bank small business financing alternatives such as merchant cash advances. From 2013 to 2016, the weighted average APR for term loans and lines of credit declined from 63.4% in 2013 to 41.4% in 2016. During the same period, the weighted average COD per dollar borrowed per month for term loans declined from 2.65 cents in 2013 to 1.82 cents in 2016. During the second half of 2016 and throughout 2017, we implemented price increases which began to increase our weighted average COD and weighted average APR. For the year ended December 31, 2017, our weighted average COD per dollar borrowed per month and weighted average APR were 1.95 cents and 43.7%, respectively. We intend to continue to manage the pricing of our loans to optimize between risk-adjusted yields and loan origination volume. See Item 7. Management's Discussion and Analysis of Financial Condition and Results of Operations —Key Factors Affecting Our Performance—Pricing.

In order to provide our customers with additional information, during the fourth quarter of 2016, we adopted the SMART Box™ - which stands for “Straightforward Metrics Around Rate and Total cost,” a model pricing disclosure and comparison tool introduced by the Innovative Lending Platform Association, or ILPA, of which we are a founding member. The SMART Box presents prospective customers with several standardized pricing metrics to evaluate the cost of the term loan or line of credit, including the total cost of capital, APR, the average monthly payback amount, and the cents on dollar cost of the loan.

Cents on Dollar borrowed reflects the monthly interest paid by a customer to us for a loan, and does not include the loan origination fee and the repayment of the principal of the loan. The APRs of our term loans currently range from 5.9% to 99.7% and the APRs of our lines of credit currently range from 11.0% to 60.8%. As noted above, because many of our loans are short term in nature and APR is calculated on an annualized basis, we believe that small business customers tend to evaluate these short term loans primarily on a Cents on Dollar borrowed basis rather than APR.

Our Risk Management

Our management team has operated the business through both strong and weak economic environments and has developed significant risk management experience and protocols.

We make credit decisions based on real-time performance data about our small business customers. We believe that the data and analytics powering the OnDeck Score can predict the creditworthiness of a small business better than models that rely solely on the personal credit score of the small business owner. Our analysis suggests that the current iteration of our proprietary credit-scoring model has become more accurate than previous versions at identifying credit risk in small businesses across a range of credit risk profiles than personal credit scores alone.

In addition, because our loans generally require automated payback either each business day or weekly and allow for ongoing data collection, we obtain early-warning indicators that provide a higher degree of visibility not just on individual loans, but also on macro portfolio trends. Insights gleaned from such real-time performance data provide the opportunity for us to be agile and adapt to changing conditions. For the year ended December 31, 2017, the average length of a term loan at origination was

7

approximately 12.1 months compared to 13.2 months for the year ended December 31, 2016. We believe the rapid amortization and recovery of amounts from the short duration of our portfolio helps to mitigate our overall loss exposure.

Organizationally, we have a risk management committee, comprised of certain members of our board of directors, which meets regularly to examine our credit risks and enterprise risks. We also have subcommittees of our risk management committee that are comprised of members of our management team that monitor our credit risks, enterprise risks and other risks.

In addition, we have teams of non-management employees within the company that monitor these and other risks. Our credit risk team is responsible for portfolio management, allowance for loan losses, or ALLL, credit model validation and underwriting performance. This team engages in numerous risk management activities, including reporting on performance trends, and monitoring of portfolio concentrations.

Our enterprise risk team focuses on the following additional risks:

• | ensuring our IT systems, security protocols, change management process and business continuity plans are well established, reviewed and tested; |

• | establishing and testing internal controls with respect to financial reporting; |

• | regularly reviewing the regulatory environment to ensure compliance with existing laws and anticipate future regulatory changes that may impact us; and |

• | talent recruitment and retention. |

Our management team also closely monitors our competitive landscape in order to assess competitive threats. Finally, from a capital availability perspective, we employ a diverse and scalable funding strategy that allows us to access debt facilities, the securitization markets and institutional capital through OnDeck Marketplace, reducing our dependence on any one source of capital.

Our Subsidiaries

We conduct certain of our operations through subsidiaries that support our business. Seven of our subsidiaries are special purpose vehicles acting as the borrower in different asset-backed revolving debt facilities and one other subsidiary is a special purpose vehicle acting as the issuer under our current asset-backed securitization vehicle.

See Item 7. Management's Discussion and Analysis of Financial Condition and Results of Operations—Liquidity and Capital Resources and Note 8 of Notes to Consolidated Financial Statements elsewhere in this report for more information regarding our subsidiaries.

Our Information Technology and Security

Our Information Security program is based principles that reflect our goals and that form the foundation of the policies, standards and procedures of our Information Security Policy. These underlying principles expand on traditional confidentiality, integrity and availability models to provide a framework for: safeguarding critical and sensitive company, customer and other information we maintain in many formats including databases, electronic mail and paper documents; protecting critical company business applications, both those under development and those in live production environments; securing many types of computing devices including server farms and storage systems through desktop and laptop computers; protecting company communications networks including wireless, voice over IP and Internet connectivity; and facilitating discussions with third parties when establishing contracts or service level agreements governing information security arrangements.

Our network is configured with multiple layers of security with the goal of detecting, preventing, and responding to unauthorized access to or probing of our information. In addition to regular internal vulnerability scans, we submit to external penetration testing to validate our defenses and to identify areas for improvement.

Our applications are engineered with a focus on security and protected using a number of preventative controls in addition to in-code measures. We also use security protocols for communication among applications. All of our public APIs and websites use Transport Layer Security. Applications are analyzed for security flaws internally by a dedicated team in order to maintain our security posture through continued development and functional improvement.

8

Our systems infrastructure is deployed on a private cloud hosted in co-located redundant data centers in New Jersey and Colorado. We believe that we have enough physical capacity to support our operations for the foreseeable future. We have multiple layers of redundancy to support the reliability of network service and achieved 99.9% monthly uptime. We also have a working data redundancy model with comprehensive backups of our databases and software.

Our Intellectual Property

We protect our intellectual property through a combination of trademarks, trade dress, domain names, copyrights and trade secrets, as well as contractual provisions and restrictions on access to our proprietary technology.

We have registered trademarks in the United States, Canada and Australia for “OnDeck,” “OnDeck Score,” “OnDeck Marketplace,” the OnDeck logo and many other trademarks. We also have filed other trademark applications in the United States and certain other jurisdictions and will pursue additional trademark registrations to the extent we believe it will be beneficial.

Our Employees

As of December 31, 2017, we had 475 full-time employees located throughout our New York, Denver, Virginia, Sydney, Australia, and Toronto, Canada offices as well as several remote employees. In February and May 2017, we announced reductions in our headcount as a result of announced layoffs and scheduled attrition, which together represented approximately 27% of our year end 2016 work force. We expect the number of full-time employees to increase in 2018 as we grow our business again and expand our offerings and features.

We are proud of our culture, which is anchored by four key values:

Ingenuity | We create new solutions to old problems. We imagine what’s possible and seek out innovation and technology to reinvent small business financing and delight our customers. | |

Passion | We think big and act boldly. We care intensely about each other, our company, and the small businesses we serve. | |

Openness | We are collaborative and accessible. We know that the best outcomes come when we work together. | |

Impact | We focus on results. We are committed to making every day count and constantly strive to improve our business. We work to make a difference to small businesses, their customers and our employees. | |

We consider our relationship with our employees to be good and we have not had any work stoppages. Additionally, none of our employees are represented by a labor union or covered by a collective bargaining agreement.

Government Regulation

We are affected by laws and regulations, and judicial interpretations of those laws and regulations, that apply to businesses in general, as well as to commercial lending. This includes a range of laws, regulations and standards that address information security, data protection, privacy, fair lending and anti-discrimination, transparency, licensing and interest rates, among other things. Because we are not a bank and are engaged in commercial lending, we are not subject to certain of the laws and rules that only apply to banks and consumer lenders. However, we purchase term loans and lines of credit from our issuing bank partner that is subject to laws and rules applicable to banks and commercial lenders. We may explore, among other regulatory alternatives, the U.S. Office of the Comptroller of the Currency’s declared interest in offering a special purpose national bank charter for FinTech companies. Additionally, we are actively engaged in promoting industry standards and best practices as exemplified by our launch and adoption of the SMART Box. The SMART Box includes clear and consistent pricing metrics, metric calculations, and metric explanations to help small businesses understand and assess the costs of their small business finance options. The SMART Box model disclosure was made available for adoption by other capital providers through the ILPA. We have also adopted the ILPA’s Code of Ethics, which sets forth best practices for providing, facilitating and supporting the provision of capital to small businesses.

State Lending Regulations

Interest Rate Regulations

9

Although the federal government does not regulate the maximum interest rates that may be charged on commercial loan transactions, some states have enacted commercial rate laws specifying the maximum legal interest rate at which commercial loans can be made in their state. We only originate commercial loans. All loans originated directly by us provide that they are to be governed by Virginia law. Virginia does not have rate limitations on commercial loans of $5,000 or more or licensing requirements for commercial lenders making such loans. Our underwriting, servicing, operations and collections teams are headquartered in Arlington, Virginia, and that is where our commercial loan contracts are made. With respect to loans where we work with a partner or issuing bank, the issuing bank may utilize the law of the jurisdiction applicable to the bank in connection with its commercial loans.

Licensing Requirements

In states and jurisdictions that do not require a license to make commercial loans, we make term loans and extend lines of credit directly to customers pursuant to Virginia law, which is the governing law we require in the underlying loan agreements with our customers. There are four states that have licensing requirements where we do not make any term loans and instead purchase term loans made by an issuing bank partner: California, Nevada, North Dakota and South Dakota. Beginning in 2016, we began to acquire line of credit draws under lines of credit extended by our issuing bank partner in those four states and Vermont. Due to regulatory limitations, we do not originate lines of credit directly in those five states. In addition to those five states, there are other states and jurisdictions that require a license or have other requirements to make certain commercial loans, including both term loans and lines of credit, and may not honor a Virginia choice of law. In these other states, historically we have originated some term loans and lines of credit directly but purchased other term loans and lines of credit from issuing bank partners, the foregoing depending on the requirements of these other states. Those other states assert either that their own licensing laws and requirements should generally apply to commercial loans made by nonbanks, or apply to commercial loans made by nonbanks of certain principal amounts, with certain interest rates, to certain business entity types or based on other terms. In such other states and jurisdictions and in some other circumstances, term loans and lines of credit are made by an issuing bank partner that is not subject to state licensing, and may be sold to us. Certain lines of credit are extended by an issuing bank partner in all 50 states in the U.S. and we may purchase extensions under those lines of credit. For the years ended December 31, 2017, 2016 and 2015, loans made by issuing bank partners constituted 22.6%, 22.2% and 15.3%, respectively, of our total loan originations (including both term loans and draws on lines of credit).

The issuing bank partner establishes its underwriting criteria for the issuing bank partner program in consultation with us. We recommend commercial loans to the issuing bank partner that meet the bank partner's underwriting criteria, at which point the issuing bank partner may elect to fund the term loan or extend the line of credit. If the issuing bank partner decides to fund the loan (including term loans and line of credit extensions), it retains the economics on the loan for the period that it owns the loan. The issuing bank partner earns origination fees from the customers who borrow from it and in addition retains the interest paid during the period that the issuing bank partner owns the loan. In exchange for recommending loans to an issuing bank partner, we earn a marketing referral fee based on the loans recommended to, and originated by, that issuing bank partner. Historically, we have been the purchaser of the loans that we refer to issuing bank partners. Our agreement with our issuing bank partner also provides for a collateral account, which is maintained at the issuing bank. The account serves as cash collateral for the performance of our obligations under the agreements, which among other things may include compliance with certain covenants, and also serves to indemnify the issuing bank partner for breaches by us of representations and warranties where it suffers damages as a result of the loans that we refer to it. The initial term of our agreement with our issuing bank partner, Celtic Bank, or Celtic, expires October 2018 and the agreement automatically extends for one-year periods unless terminated by either party. Celtic is an industrial bank chartered by the state of Utah and makes small business and certain other loans. The agreement with Celtic may not be assigned without the prior written consent of the non-assigning party. We may in the future and from time to time work with a different bank partner, or multiple bank partners.

We are not required to have licenses to make commercial loans under state law as currently in effect and our operations as presently conducted. Virginia, unlike some other jurisdictions, does not require licensing of commercial lenders. Because we make loans from Virginia in accordance with the Virginia choice of law in our loan agreements, we are not required to be licensed as a lender in other jurisdictions that honor the Virginia choice of law.

Federal Lending Regulations

We are a commercial lender and as such there are federal laws and regulations that affect our and other lenders’ lending operations. These laws include, among others, portions of the Wall Street Reform and Consumer Protection Act or the Dodd-Frank Act, the Equal Credit Opportunity Act, the Fair Credit Reporting Act, Economic and Trade Sanctions rules, the Electronic Signatures in Global and National Commerce Act, the Service Members Civil Relief Act, the Telephone Consumer Protection Act of 1991, and Section 5 of the FTC Act prohibiting unfair and deceptive acts or practices. In addition, there are other federal laws that do

10

not directly govern our business but with respect to which we have established certain procedures, including procedures to designed to protect our platform from being used to launder money.

Competition

The small business lending market is highly competitive and fragmented and we expect it to remain so in the future. Our principal competitors include traditional banks, legacy merchant cash advance providers, and newer, technology-enabled lenders. We believe the principal factors that generally determine a company’s competitive advantage in our market include the following:

• | ease of process to apply for a loan; |

• | brand recognition and trust; |

• | loan features, including amount, rate, term and pay-back method; |

• | loan product fit for business purpose; |

• | transparent description of key terms; |

• | effectiveness of underwriting; |

• | effectiveness of operational processes; |

• | effectiveness of customer acquisition; and |

• | customer experience. |

See Item 7. Management's Discussion and Analysis of Financial Condition and Results of Operations—Key Factors Affecting Our Performance - Competition.

Disclosure of Information

We recognize that in today’s environment, our current and potential investors, the media and others interested in us look to social media and other online sources for information about us. We believe that these sources represent important communication channels for disseminating information about us, including information that could be deemed to constitute material non-public information. As a result, in addition to our investor relations website (http://investors.ondeck.com), filings made with the SEC, press releases we issue from time to time, and public webcasts and conference calls, we have used, and intend to continue to use, various social media and other online sources to disseminate information about us and, without limitation, our general business developments; financial performance; product and service offerings; research, development and other technical updates; relationships with customers, platform providers and other strategic partners and others; and market and industry developments.

We intend to use the following social media and other websites for the dissemination of information:

Our blog: https://www.ondeck.com/blog

Our Twitter feed: http://twitter.com/ondeckcapital

Our Facebook page: http://www.facebook.com/ondeckcapital

Our corporate LinkedIn page: https://www.linkedin.com/company/ondeck

We invite our current and potential investors, the media and others interested in us to visit these sources for information related to us. Please note that this list of social media and other websites may be updated from time to time on our investor relations website and/or filings we make with the SEC.

Copies of our Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K, and amendments to these reports filed or furnished pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of 1934, as amended, or Exchange Act, are available, free of charge, on our investor relations website as soon as reasonably practicable after we file such materials electronically with or furnish it to the SEC. Information contained on, or that can be accessed through, our website or the social media and other websites noted above, do not constitute part of this Annual Report on Form 10-K and the inclusion of our website address and social media addresses in this Annual Report is an inactive textual reference only. The SEC also maintains a website that contains our SEC filings. The website of the SEC site is www.sec.gov.

11

Industry and Market Data

This report contains estimates, statistical data, and other information concerning our industry that are based on industry publications, surveys and forecasts. The industry and market information included in this report involves a number of assumptions and limitations, and you are cautioned not to give undue weight to such information.

The sources of industry and market data contained in this report are listed below:

• | FDIC, Loans to Small Businesses and Farms, FDIC-Insured Institutions 1995-2017, Q2 2017. |

The industry in which we operate is subject to a high degree of uncertainty and risk due to a variety of factors, including those described in Item 1A. Risk Factors and elsewhere in this report. These and other factors could cause our actual results to differ materially from those expressed in the estimates made by the independent parties and by us.

12

Item 1A. | Risk Factors |

Our current and prospective investors should carefully consider the following risks and all other information contained in this report, including our consolidated financial statements and the related notes, “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and the “Cautionary Note Regarding Forward-Looking Statements,” before making investment decisions regarding our securities. The risks and uncertainties described below are not the only ones we face, but include the most significant factors currently known by us. Additional risks and uncertainties that we are unaware of, or that we currently believe are not material, also may become important factors that affect us. If any of the following risks materialize, our business, financial condition and results of operations could be materially harmed. In that case, the trading price of our securities could decline, and you may lose some or all of your investment.

We have a history of losses and may not achieve consistent profitability in the future.

We generated net losses of $14.3 million, $85.5 million and $2.2 million in 2017, 2016 and 2015, respectively. As of December 31, 2017, we had an accumulated deficit of $222.8 million. We will need to generate and sustain increased revenue levels in future periods in order to become profitable in the future, and, even if we do, we may not be able to maintain or increase our level of profitability. We intend to continue to expend significant funds on our marketing and sales operations, increasing our investment in technology and analytics capabilities, increasing our customer service and general loan servicing capabilities, meeting the increased compliance requirements associated with our operation as a public company and changing regulatory requirements, and upgrading our technology infrastructure and expanding in existing or possibly new markets. In addition, we record our loan loss provision as an expense to account for the possibility that loans we intend to hold (rather than sell) may not be repaid in full. Because we incur a given loan loss expense at the time that we issue the loans we intend to hold, we expect the aggregate amount of this expense to grow as we increase the total amount of loans we make to our customers.

Our efforts to grow our business may be more costly than we expect, and we may not be able to increase our revenue enough to offset our higher operating expenses. We may incur significant losses in the future for a number of reasons, including the other risks described in this report, and unforeseen expenses, difficulties, complications and delays, and other unknown events. If we are unable to achieve and sustain profitability, the market price of our common stock may significantly decrease.

Worsening economic conditions may result in decreased demand for our loans, cause our customers’ default rates to increase and harm our operating results.

Uncertainty and negative trends in general economic conditions in the United States and abroad, including significant tightening of credit markets, historically have created a difficult environment for companies in the lending industry. Many factors, including factors that are beyond our control, may have a detrimental impact on our operating performance. These factors include general economic conditions, unemployment levels, energy costs and interest rates, as well as events such as natural disasters, acts of war, terrorism and catastrophes.

Our customers are small businesses. Accordingly, our customers historically have been, and may in the future remain, more likely to be affected or more severely affected than large enterprises by adverse economic conditions. These conditions may result in a decline in the demand for our loans by potential customers, higher default rates, or both by our existing customers. If a customer defaults on a loan payable to us, the loan enters a collections process where our systems and collections teams initiate contact with the customer for payments owed. If a loan is subsequently charged off, historically we had generally sold the loan to a third-party collection agency in exchange for only a small fraction of the remaining amount payable to us.

In addition, we recently changed and expect to continue our collections strategy to retain more and sell fewer charged-off loans, with the goal of achieving higher recoveries. There is no assurance that this strategy will be successful, and it could result in lower recoveries than we have realized historically from selling charged-off loans. It may also lead to increased litigation, negative publicity and harm to our reputation.

There can be no assurance that economic conditions will remain favorable for our business or that demand for our loans or default rates by our customers will remain at current levels. Reduced demand for our loans would negatively impact our growth and revenue, while increased default rates by our customers may inhibit our access to capital, including debt warehouse facilities, securitizations and OnDeck Marketplace, and negatively impact our profitability. Customer default rates and changes in the financial markets, including changes in credit markets and interest rates, can also impact the price that investors are willing to pay for our loans through OnDeck Marketplace, if at all, which can adversely impact our gain on sale revenue and limit our financing alternatives. Furthermore, we have received a large number of applications from potential customers who do not satisfy the requirements for an OnDeck loan. If an insufficient number of qualified small businesses apply for our loans, our growth and revenue could decline.

13

An increase in customer default rates may reduce our overall profitability and could also affect our ability to attract institutional funding. Further, historical default rates may not be indicative of future results.

Customer default rates may be significantly affected by economic downturns or general economic conditions beyond our control and beyond the control of individual customers. In particular, loss rates on customer loans may increase due to factors such as prevailing interest rates, the rate of unemployment, the level of consumer and business confidence, commercial real estate values, the value of the U.S. dollar, energy prices, changes in consumer and business spending, the number of personal and business bankruptcies, disruptions in the credit markets and other factors. We offer both our term loan and line of credit loans to the same customers, subject to customary credit and loan underwriting procedures. To the extent that our customers borrow from us under both types of loans and default, our losses could be greater than if we had offered them only one type of loan. In addition, as of December 31, 2017, approximately 27.9% of our total loans outstanding related to customers with fewer than five years of operating history. While our OnDeck Score is designed to establish that, notwithstanding such limited operating and financial history, customers would be a reasonable credit risk, our loans may nevertheless be expected to have a higher default rate than loans made to customers with more established operating and financial histories. In addition, if default rates, delinquency rates or certain performance metrics reach certain levels, the principal of our securitized notes or other borrowings may be required to be paid down, and we may no longer be able to borrow from our debt facilities to fund future loans. In addition, if customer default rates increase beyond forecast levels, returns for investors in our OnDeck Marketplace program will decline and demand by investors to participate in this program will decrease, each of which will harm our reputation and operating results.

Our risk management efforts may not be effective.

We could incur substantial losses and our business operations could be disrupted if we are unable to effectively identify, manage, monitor and mitigate financial risks, such as credit risk, interest rate risk, liquidity risk, and other market-related risk, as well as operational risks related to our business, assets and liabilities. To the extent our models used to assess the creditworthiness of potential customers do not adequately identify potential risks, the OnDeck Score produced would not adequately represent the risk profile of such customers and could result in higher risk than anticipated. Our risk management policies, procedures, and techniques, including our use of our proprietary OnDeck Score technology, may not be sufficient to identify all of the risks we are exposed to, mitigate the risks that we have identified or identify concentrations of risk or additional risks to which we may become subject in the future. Furthermore, there may be a lag in the time in which a customer begins to show signs of an inability to pay back a loan and when we begin to take remedial action in respect this loan, and as a consequence this could impair our eventual ability to receive repayment on the loan.

We rely on our proprietary credit models in the forecasting of loss rates. If we are unable to effectively forecast loss rates, it can materially adversely affect our operating results. Our use of judgmental underwriting has similar risks.

In making a decision whether to extend credit to prospective customers, we rely primarily on our OnDeck Score, the credit score generated by our proprietary credit-scoring model and decisioning system, an empirically derived suite of statistical models built using third-party data, data from our customers and our credit experience gained through monitoring the performance of our customers over time. If our proprietary credit-scoring model and decisioning system fails to adequately predict the creditworthiness of our customers, including because the factors used to determine the customer's creditworthiness were not representative of such customer's true credit risk profile, we have in the past recorded, and may in the future need to record, additional provision expense and/or experience higher than forecasted losses. In addition, if our proprietary cash flow analytics system fails to assess prospective customers’ financial ability to repay their loans, or if any portion of the information pertaining to the prospective customer is false, inaccurate or incomplete, and our systems did not detect such falsities, inaccuracies or incompleteness, or any or all of the other components of our credit decision process fails, we may experience higher than forecasted losses. Furthermore, if we are unable to access the third-party data used in our OnDeck Score, or our access to such data is limited, our ability to accurately evaluate potential customers will be compromised, and we may be unable to effectively predict probable credit losses inherent in our loan portfolio, which would negatively impact our results of operations.

Additionally, if we make errors in the development and validation of any of the models or tools we use to underwrite the loans that we securitize or sell to investors, these investors may experience higher delinquencies and losses and we may be subject to liability. Moreover, if future performance of our customers’ loans differs from past experience (driven by factors, including but not limited to, macroeconomic factors, policy actions by regulators, lending by other institutions and reliability of data used in the underwriting process), which experience has informed the development of the underwriting procedures employed by us, delinquency rates and losses to investors of our securitized debt from our customers’ loans could increase, thereby potentially subjecting us to liability. This inability to effectively forecast loss rates could also inhibit our ability to borrow from our debt facilities, which could further hinder our growth and harm our financial performance.

14

Our allowance for loan losses is determined based upon both objective and subjective factors and may not be adequate to absorb loan losses.

We face the risk on the loans that we hold that our customers will fail to repay their loans in full. We reserve for such losses by establishing an allowance for loan losses, the increase of which results in a reduction of our earnings as we recognize a provision expense for loan losses. We have established an evaluation process designed to determine the adequacy of our allowance for loan losses. While this evaluation process uses historical and other objective information, the classification of loans and the forecasts and establishment of loan losses are also dependent on our subjective assessment based upon our experience and judgment. Actual losses are difficult to forecast, especially if such losses stem from factors beyond our experience, and unlike traditional banks, we are not subject to periodic review by bank regulatory agencies of our allowance for loan losses. In addition, for our line of credit product we estimate probable losses on unfunded loan commitments in a process similar to that used for the allowance for loan losses.

As a result, there can be no assurance that our allowance for loan losses or accrual for probable losses on unfunded line of credit commitments will be comparable to that of traditional banks subject to regulatory oversight or sufficient to absorb losses or prevent a material adverse effect on our business, financial condition and results of operations.

Our business may be adversely affected by disruptions in the credit markets, our failure to comply with our debt agreements, or the termination of our debt agreements, any of which could result in reduced access to credit and other financing. Additionally, OnDeck Marketplace has continued to decline as a part of our overall funding strategy and there is no assurance that OnDeck Marketplace participants will continue to purchase our loans.

Historically, we have depended on debt facilities and other forms of debt in order to finance most of the loans we make to our customers. However, we cannot guarantee that these financing sources will continue to be available beyond the current maturity date of each debt facility, on reasonable terms or at all. As the volume of loans that we make to customers on our platform increases, we may require the expansion of our borrowing capacity of our existing debt facilities and other debt arrangements or the addition of new sources of capital. The availability of these financing sources depends on many factors, some of which are outside of our control. We may also experience the occurrence of events of default or breaches of financial performance or other covenants under our debt agreements, which could reduce or terminate our access to institutional funding.

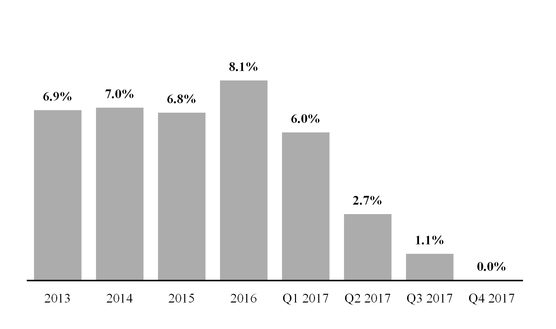

In addition, OnDeck Marketplace has substantially declined as a portion of our funding strategy. For each of the three months ended March 31, 2017, June 30, 2017, September 30, 2017, and December 31, 2017 OnDeck Marketplace represented 9.1%, 2.3%, 1.3% and 3.9% of our term loan originations, respectively. In addition, the premiums we were paid in 2017 were lower than those received in 2016. By selling fewer loans via OnDeck Marketplace and at lower premiums, we realized lower gain on sale of loans and hold more of our term loan originations on our balance sheet, which requires us to self-fund or finance a larger amount of loans. As a result, we have used, and may continue to use, available cash on hand to fund originations. While the premiums on sales of loans via OnDeck Marketplace have decreased, we have continued selling a portion of our loans through OnDeck Marketplace to maintain active relationships with institutional loan purchasers and to obtain additional funding. However, to the extent that institutional investors that purchase loans from us through OnDeck Marketplace rely on credit to finance those loan purchases, disruptions in the credit market could further harm our ability to grow or maintain OnDeck Marketplace. We may continue selling a portion of our loans via OnDeck Marketplace, however, there can be no assurance that these investors will continue to purchase our loans via OnDeck Marketplace.

We also rely on securitization as part of our funding strategy and have executed two securitization transactions, one of which, with $250 million of capacity, is currently outstanding under which cash flow can be used to purchase additional loans through April 30, 2018. There can be no assurance that we will be able to successfully access the securitization markets again. In the event of a sudden or unexpected shortage of funds in the banking and financial system, we cannot be sure that we will be able to maintain necessary levels of funding without incurring high funding costs, a reduction in the term of funding instruments or the liquidation of certain assets.

Furthermore, during 2018, several of our debt facilities are scheduled to mature, representing an aggregate of $313.2 million of debt capacity, including $30 million in October 2018, $119.7 million in November 2018, $125 million in December 2018 and an aggregate of $38.5 million under other facilities at various dates throughout 2018. We may not be able to extend or renew these maturing debt facilities.

Accordingly, if we are unable to renew or otherwise replace these facilities or generally arrange new or alternative methods of financing, our ability to finance additional loans utilizing these financing sources will end. The interest rates and other costs of new, renewed or amended facilities may also be higher than those currently in effect. If we are unable to renew or otherwise replace these facilities or generally arrange new or alternative methods of financing on favorable terms, we may be

15

forced to curtail our origination of loans or reduce operations, which would have a material adverse effect on our business, financial condition, operating results and cash flow.

Increases in customer default rates could make us and our loans less attractive to lenders under debt facilities and investors in securitizations and institutional purchasers in OnDeck Marketplace which may adversely affect our access to financing and our business.

We principally rely on credit facilities, securitizations and OnDeck Marketplace to fund our loans. Increases in customer default rates could make us and our loans less attractive to our existing (or prospective) funding sources. If our existing funding sources do not achieve their desired financial returns or if they suffer losses, they (or prospective funding sources) may increase the cost of providing future financing or refuse to provide future financing on terms acceptable to us or at all.

Our debt facilities for our funding debt and our securitization are non-recourse to On Deck Capital, Inc. and are collateralized by our loans. If the loans securing such debt facilities and securitization fail to perform as expected, the lenders under our credit facilities and investors in our securitization, or future lenders or investors in similar arrangements, may increase the cost of providing financing or refuse to provide financing on terms acceptable to us or at all.

If we were to be unable to arrange new or alternative methods of financing on favorable terms, we may have to curtail or cease our origination of loans, which could have a material adverse effect on our business, financial condition, operating results and cash flow.

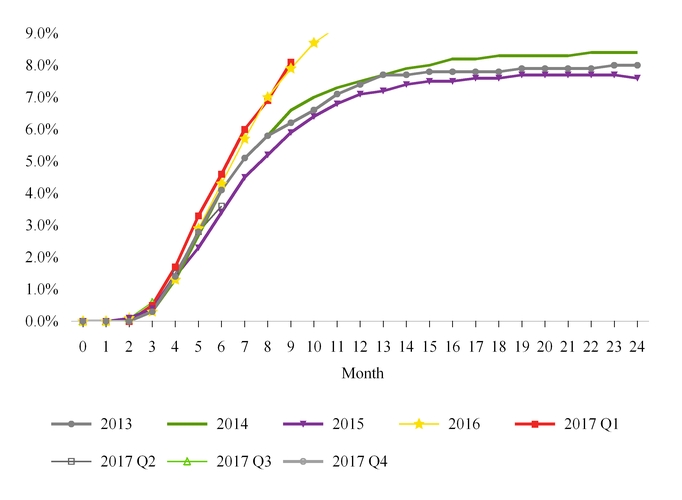

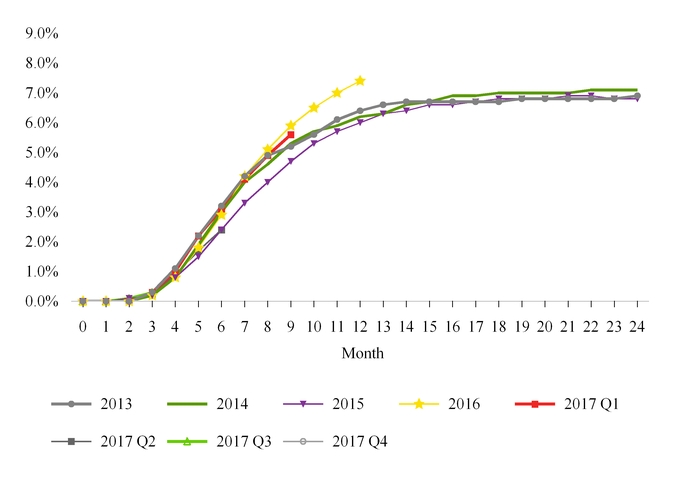

Purchasers of loans in OnDeck Marketplace bear the risks of loan ownership. Unsatisfactory performance of our loans may reduce investor confidence and reduce the willingness of investors to participate in OnDeck Marketplace, which could harm our ability to grow or maintain OnDeck Marketplace. In addition, the gain on sale of loans through OnDeck Marketplace has declined from $14.4 million, or 5.0% of gross revenue in 2016 to $2.5 million, or 0.7% of our gross revenue in 2017 reflecting a lower percentage of our terms loans sold into OnDeck Marketplace. Because we decided to hold more loans on our balance sheet and sell fewer loans through OnDeck Marketplace, our provision expense and interest expense have increased, reducing our operating results.

Our recent growth may not be indicative of our future growth and, if we continue to grow, we may not be able to manage our growth effectively.