UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

(MARK ONE)

ý | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

FOR THE QUARTERLY PERIOD ENDED SEPTEMBER 30, 2017

OR

¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

FOR THE TRANSITION PERIOD FROM TO

Commission File Number 001-36779

On Deck Capital, Inc.

(Exact name of registrant as specified in its charter)

Delaware | 42-1709682 | |

(State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) | |

1400 Broadway, 25th Floor, New York, New York | 10018 | |

(Address of principal executive offices) | (Zip Code) | |

(888) 269-4246

(Registrant’s telephone number, including area code)

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. YES ý NO ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data file required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). YES ý NO ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and "emerging growth company" in Rule 12b-2 of the Exchange Act.

Large accelerated filer | ¨ | Accelerated filer | x | |||

Non-accelerated filer | ¨ (Do not check if a smaller reporting company) | Smaller reporting company | ¨ | |||

Emerging growth company | x | |||||

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. | x | |||||

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act.

YES ¨ NO x

The number of shares of the registrant’s common stock outstanding as of October 31, 2017 was 73,635,045.

On Deck Capital, Inc.

Table of Contents

Page | ||

PART I - FINANCIAL INFORMATION | ||

Item 1. | Financial Statements (Unaudited) | |

Unaudited Condensed Consolidated Balance Sheets | ||

Unaudited Condensed Consolidated Statements of Operations and Comprehensive Income | ||

Unaudited Condensed Consolidated Statements of Cash Flows | ||

Notes to Unaudited Condensed Consolidated Financial Statements | ||

Item 2. | Management’s Discussion and Analysis of Financial Condition and Results of Operations | |

Item 3. | Quantitative and Qualitative Disclosures About Market Risk | |

Item 4. | Controls and Procedures | |

PART II - OTHER INFORMATION | ||

Item 1. | Legal Proceedings | |

Item 1A. | Risk Factors | |

Item 2. | Unregistered Sales of Equity Securities and Use of Proceeds | |

Item 3. | Defaults Upon Senior Securities | |

Item 4. | Mine Safety Disclosures | |

Item 5. | Other Information | |

Item 6 | Exhibits | |

Signatures | ||

PART I

Item 1. | Financial Statements (Unaudited) |

ON DECK CAPITAL, INC. AND SUBSIDIARIES

Unaudited Condensed Consolidated Balance Sheets

(in thousands, except share and per share data)

September 30, | December 31, | ||||||

2017 | 2016 | ||||||

Assets | |||||||

Cash and cash equivalents | $ | 64,292 | $ | 79,554 | |||

Restricted cash | 56,729 | 44,432 | |||||

Loans held for investment | 957,203 | 1,000,445 | |||||

Less: Allowance for loan losses | (104,872 | ) | (110,162 | ) | |||

Loans held for investment, net | 852,331 | 890,283 | |||||

Loans held for sale | — | 373 | |||||

Property, equipment and software, net | 24,975 | 29,405 | |||||

Other assets | 17,069 | 20,044 | |||||

Total assets | $ | 1,015,396 | $ | 1,064,091 | |||

Liabilities and equity | |||||||

Liabilities: | |||||||

Accounts payable | $ | 2,918 | $ | 5,271 | |||

Interest payable | 2,213 | 2,122 | |||||

Funding debt | 702,998 | 726,639 | |||||

Corporate debt | 17,180 | 27,966 | |||||

Accrued expenses and other liabilities | 30,987 | 38,496 | |||||

Total liabilities | 756,296 | 800,494 | |||||

Commitments and contingencies (Note 9) | |||||||

Stockholders’ equity (deficit): | |||||||

Common stock—$0.005 par value, 1,000,000,000 shares authorized and 77,002,976 and 74,801,825 shares issued and 73,623,312 and 71,605,708 outstanding at September 30, 2017 and December 31, 2016, respectively. | 385 | 374 | |||||

Treasury stock—at cost | (7,561 | ) | (6,697 | ) | |||

Additional paid-in capital | 489,465 | 477,526 | |||||

Accumulated deficit | (227,973 | ) | (211,299 | ) | |||

Accumulated other comprehensive loss | (6 | ) | (379 | ) | |||

Total On Deck Capital, Inc. stockholders' equity | 254,310 | 259,525 | |||||

Noncontrolling interest | 4,790 | 4,072 | |||||

Total equity | 259,100 | 263,597 | |||||

Total liabilities and equity | $ | 1,015,396 | $ | 1,064,091 | |||

The accompanying notes are an integral part of these condensed consolidated financial statements.

3

ON DECK CAPITAL, INC. AND SUBSIDIARIES

Unaudited Condensed Consolidated Statements of Operations and Comprehensive Income

(in thousands, except share and per share data)

Three Months Ended September 30, | Nine Months Ended September 30, | ||||||||||||||

2017 | 2016 | 2017 | 2016 | ||||||||||||

Revenue: | |||||||||||||||

Interest income | $ | 80,122 | $ | 71,361 | $ | 250,954 | $ | 188,726 | |||||||

Gain on sales of loans | 146 | 2,670 | 1,890 | 12,594 | |||||||||||

Other revenue | 3,398 | 3,340 | 10,365 | 8,168 | |||||||||||

Gross revenue | 83,666 | 77,371 | 263,209 | 209,488 | |||||||||||

Cost of revenue: | |||||||||||||||

Provision for loan losses | 39,582 | 36,586 | 118,495 | 94,294 | |||||||||||

Funding costs | 11,330 | 8,452 | 34,223 | 22,548 | |||||||||||

Total cost of revenue | 50,912 | 45,038 | 152,718 | 116,842 | |||||||||||

Net revenue | 32,754 | 32,333 | 110,491 | 92,646 | |||||||||||

Operating expense: | |||||||||||||||

Sales and marketing | 11,903 | 16,789 | 42,090 | 50,094 | |||||||||||

Technology and analytics | 11,748 | 15,050 | 41,960 | 42,894 | |||||||||||

Processing and servicing | 4,160 | 5,181 | 13,521 | 14,261 | |||||||||||

General and administrative | 9,440 | 12,375 | 30,917 | 34,233 | |||||||||||

Total operating expense | 37,251 | 49,395 | 128,488 | 141,482 | |||||||||||

Loss from operations | (4,497 | ) | (17,062 | ) | (17,997 | ) | (48,836 | ) | |||||||

Other expense: | |||||||||||||||

Interest expense | (35 | ) | (111 | ) | (706 | ) | (186 | ) | |||||||

Total other expense | (35 | ) | (111 | ) | (706 | ) | (186 | ) | |||||||

Loss before provision for income taxes | (4,532 | ) | (17,173 | ) | (18,703 | ) | (49,022 | ) | |||||||

Provision for income taxes | — | — | — | — | |||||||||||

Net loss | (4,532 | ) | (17,173 | ) | (18,703 | ) | (49,022 | ) | |||||||

Net loss attributable to noncontrolling interest | 458 | 539 | 2,073 | 1,920 | |||||||||||

Net loss attributable to On Deck Capital, Inc. common stockholders | $ | (4,074 | ) | $ | (16,634 | ) | $ | (16,630 | ) | $ | (47,102 | ) | |||

Net loss per share attributable to On Deck Capital, Inc. common shareholders: | |||||||||||||||

Basic and diluted | $ | (0.06 | ) | $ | (0.23 | ) | $ | (0.23 | ) | $ | (0.67 | ) | |||

Weighted-average common shares outstanding: | |||||||||||||||

Basic and diluted | 73,272,085 | 70,971,895 | 72,613,221 | 70,750,037 | |||||||||||

Comprehensive loss: | |||||||||||||||

Net loss | $ | (4,532 | ) | $ | (17,173 | ) | $ | (18,703 | ) | $ | (49,022 | ) | |||

Other comprehensive loss: | |||||||||||||||

Foreign currency translation adjustment | 246 | 210 | 682 | 393 | |||||||||||

Comprehensive loss | (4,286 | ) | (16,963 | ) | (18,021 | ) | (48,629 | ) | |||||||

Comprehensive loss attributable to noncontrolling interests | (111 | ) | (95 | ) | (307 | ) | (177 | ) | |||||||

Net loss attributable to noncontrolling interest | 458 | 539 | 2,073 | 1,920 | |||||||||||

Comprehensive loss attributable to On Deck Capital, Inc. common stockholders | $ | (3,939 | ) | $ | (16,519 | ) | $ | (16,255 | ) | $ | (46,886 | ) | |||

The accompanying notes are an integral part of these condensed consolidated financial statements.

4

ON DECK CAPITAL, INC. AND SUBSIDIARIES

Unaudited Condensed Consolidated Statements of Cash Flows

(in thousands)

Nine Months Ended September 30, | |||||||

2017 | 2016 | ||||||

Cash flows from operating activities | |||||||

Net income (loss) | $ | (18,703 | ) | $ | (49,022 | ) | |

Adjustments to reconcile net loss to net cash provided by operating activities: | |||||||

Provision for loan losses | 118,495 | 94,294 | |||||

Depreciation and amortization | 7,623 | 6,887 | |||||

Amortization of debt issuance costs | 2,777 | 3,733 | |||||

Stock-based compensation | 9,521 | 11,423 | |||||

Amortization of net deferred origination costs | 36,419 | 25,837 | |||||

Changes in servicing rights, at fair value | 1,440 | 4,074 | |||||

Gain on sales of loans | (1,890 | ) | (12,594 | ) | |||

Unfunded loan commitment reserve | 227 | (405 | ) | ||||

Gain on extinguishment of debt | (312 | ) | (940 | ) | |||

Changes in operating assets and liabilities: | |||||||

Other assets | 2,106 | (1,221 | ) | ||||

Accounts payable | (2,353 | ) | 1,386 | ||||

Interest payable | 91 | 826 | |||||

Accrued expenses and other liabilities | (7,641 | ) | (844 | ) | |||

Originations of loans held for sale | (44,489 | ) | (238,077 | ) | |||

Capitalized net deferred origination costs of loans held for sale | (1,128 | ) | (8,074 | ) | |||

Proceeds from sale of loans held for sale | 45,921 | 246,051 | |||||

Principal repayments of loans held for sale | 1,039 | 6,189 | |||||

Net cash provided by operating activities | 149,143 | 89,523 | |||||

Cash flows from investing activities | |||||||

Change in restricted cash | (12,297 | ) | (4,364 | ) | |||

Purchases of property, equipment and software | (1,129 | ) | (6,337 | ) | |||

Capitalized internal-use software | (2,226 | ) | (3,702 | ) | |||

Originations of term loans and lines of credit, excluding rollovers into new originations | (1,302,889 | ) | (1,333,192 | ) | |||

Proceeds from sale of loans held for investment | 12,396 | 57,238 | |||||

Payments of net deferred origination costs | (32,747 | ) | (32,909 | ) | |||

Principal repayments of term loans and lines of credit | 1,220,673 | 881,077 | |||||

Other | — | (201 | ) | ||||

Purchase of loans | (13,730 | ) | (6,672 | ) | |||

Net cash used in investing activities | (131,949 | ) | (449,062 | ) | |||

Cash flows from financing activities | |||||||

Investments by noncontrolling interests | 3,443 | — | |||||

Purchase of treasury shares | (864 | ) | (576 | ) | |||

Proceeds from exercise of stock options and warrants | 490 | 131 | |||||

Issuance of common stock under employee stock purchase plan | 1,838 | 2,606 | |||||

Proceeds from the issuance of funding debt | 133,318 | 606,051 | |||||

Proceeds from the issuance of corporate debt | 24,200 | 10,000 | |||||

Payments of debt issuance costs | (3,228 | ) | (4,655 | ) | |||

Distribution to noncontrolling interest | (1,000 | ) | — | ||||

5

Nine Months Ended September 30, | |||||||

2017 | 2016 | ||||||

Repayments of funding debt principal | (156,477 | ) | (328,321 | ) | |||

Repayments of corporate debt principal | (35,000 | ) | — | ||||

Net cash provided by (used in) financing activities | (33,280 | ) | 285,236 | ||||

Effect of exchange rate changes on cash and cash equivalents | 824 | 429 | |||||

Net decrease in cash and cash equivalents | (15,262 | ) | (73,874 | ) | |||

Cash and cash equivalents at beginning of period | 79,554 | 159,822 | |||||

Cash and cash equivalents at end of period | $ | 64,292 | $ | 85,948 | |||

Supplemental disclosure of other cash flow information | |||||||

Cash paid for interest | $ | 31,467 | $ | 16,282 | |||

Supplemental disclosures of non-cash investing and financing activities | |||||||

Stock-based compensation included in capitalized internal-use software | $ | 154 | $ | 1,025 | |||

Loans transferred from loans held for sale to loans held for investment | $ | — | $ | 861 | |||

Unpaid principal balance of term loans rolled into new originations | $ | 220,925 | $ | 200,637 | |||

The accompanying notes are an integral part of these condensed consolidated financial statements.

6

ON DECK CAPITAL, INC. AND SUBSIDIARIES

Notes to Unaudited Condensed Consolidated Financial Statements

1. Organization and Summary of Significant Accounting Policies

On Deck Capital, Inc.’s principal activity is providing financing to small businesses located throughout the United States as well as Canada and Australia, through term loans and lines of credit. We use technology and analytics to aggregate data about a small business and then quickly and efficiently analyze the creditworthiness of the business using our proprietary credit-scoring model. We originate most of the loans in our portfolio and also purchase loans from our issuing bank partner. We subsequently transfer most loans into one of our wholly-owned subsidiaries or, from time to time, depending upon market conditions and other factors, may sell them through OnDeck Marketplace®.

Basis of Presentation and Principles of Consolidation

We prepare our condensed consolidated financial statements and footnotes in accordance with accounting principles generally accepted in the United States of America, or GAAP, as contained in the Financial Accounting Standards Board, or FASB, Accounting Standards Codification, or ASC. All intercompany transactions and accounts have been eliminated in consolidation. Certain reclassifications have been made to the prior year amounts to conform to the current year presentation. When used in these notes to condensed consolidated financial statements, the terms "we," "us," "our" or similar terms refers to On Deck Capital, Inc. and its consolidated subsidiaries.

We consolidate the financial position and results of operations of these entities. The noncontrolling interest, which is presented as a separate component of our consolidated equity, represents the minority owners' proportionate share of the equity of the jointly owned entities. The noncontrolling interest is adjusted for the minority owners' share of the earnings, losses, investments and distributions.

Use of Estimates

The preparation of financial statements in conformity with GAAP requires us to make estimates and assumptions that affect the reported amounts in the condensed consolidated financial statements and accompanying notes. Significant estimates include allowance for loan losses, valuation of warrants, stock-based compensation expense, servicing assets/liabilities, loans purchased, capitalized software development costs, the useful lives of long-lived assets and valuation allowance for deferred tax assets. We base our estimates on historical experience, current events and other factors we believe to be reasonable under the circumstances. These estimates and assumptions are inherently subjective in nature; actual results may differ from these estimates and assumptions.

Recently Adopted Accounting Standards

In March 2016, the FASB issued ASU 2016-09, Improvements to Employee Share-Based Payment Accounting. ASU 2016-09 simplifies several aspects of accounting for share-based payment award transactions which include the income tax consequences, classification of awards as either equity or liabilities, classification on the statement of cash flows and forfeiture rate calculations. We adopted the new standard effective January 1, 2017. The adoption of this standard did not have a material impact on our consolidated financial statements and no prior period amounts were adjusted.

Recent Accounting Pronouncements Not Yet Adopted

In May 2014, the FASB issued ASU 2014-09, Revenue Recognition, which creates ASC 606, Revenue from Contracts with Customers, and supersedes ASC 605, Revenue Recognition. ASU 2014-09 requires revenue to be recognized in an amount that reflects the consideration to which the entity expects to be entitled in exchange for goods or services and also requires additional disclosure about the nature, amount, timing, and uncertainty of revenue and cash flows from customer contracts. The new standard will be effective for annual reporting periods beginning after December 15, 2017, including interim periods within that reporting period. Early adoption is permitted for annual reporting periods beginning after December 15, 2016. In March 2016, the FASB issued ASU 2016-08, Principal versus Agent Considerations, which makes amendments to the new revenue standard on assessing whether an entity is a principal or an agent in a revenue transaction and impacts whether an entity reports revenue on a gross or net basis. In April 2016, the FASB issued ASU 2016-10, Identifying Performance Obligations and Licensing, which makes amendments to the new revenue standard regarding the identification of performance obligations and accounting for the license of intellectual property. In May 2016, the FASB issued ASU 2016-12, Narrow-Scope Improvements and Practical Expedients, which makes amendments to the new revenue standard regarding assessing collectibility, presentation of sales taxes, noncash consideration and completed contracts and contract modifications at the time of transition to the new standard. Each amendment has the same effective date and transition requirements as the new revenue recognition standard. We completed our initial assessment of the impact of the new revenue standard noting that revenue generated in accordance with ASC 310, Receivables, and ASC 860, Transfers and Servicing, is explicitly excluded from the scope of ASC 606. Accordingly, we have concluded that our interest income, gains on loan sales and loan servicing income will not be affected by the adoption of ASC 606. Marketing fees from our

7

issuing bank partner as well as certain fees associated with OnDeck-as-a-Service will be within the scope of ASC 606. We will adopt the requirements of the new standard effective January 1, 2018 and intend to apply the modified retrospective method of adoption with the cumulative effect of adoption, if material, recognized at the date of initial application. We believe that ASC 606 will have little, if any, impact on the timing and amount of revenue recognition as compared to the current standard and that there will be no material impact upon adoption.

In February 2016, the FASB issued ASU 2016-02, Leases, which creates ASC 842, Leases, and supersedes ASC 840, Leases. ASU 2016-02 requires lessees to recognize a right-of-use asset and lease liability for all leases with terms of more than 12 months. Recognition, measurement and presentation of expenses will depend on classification as a finance or operating lease. The new standard will be effective for annual reporting periods beginning after December 15, 2018, including interim periods within that reporting period and is applied retrospectively. Early adoption is permitted. We are currently assessing the impact that the adoption of this standard will have on our consolidated financial statements.

In June 2016, the FASB issued ASU 2016-13, Measurement of Credit Losses on Financial Instruments. ASU 2016-13 will change the impairment model and how entities measure credit losses for most financial assets. The standard requires entities to use the new expected credit loss impairment model which will replace the incurred loss model used today. The new standard will be effective for annual reporting periods beginning after December 15, 2019. Early adoption is permitted, but not prior to December 15, 2018. We are currently assessing the impact that the adoption of this standard will have on our consolidated financial statements.

2. Net Loss Per Common Share

Basic and diluted net loss per common share is calculated as follows (in thousands, except share and per share data):

Three Months Ended September 30, | Nine Months Ended September 30, | ||||||||||||||

2017 | 2016 | 2017 | 2016 | ||||||||||||

Numerator: | |||||||||||||||

Net loss | $ | (4,532 | ) | $ | (17,173 | ) | $ | (18,703 | ) | $ | (49,022 | ) | |||

Less: net loss attributable to noncontrolling interest | 458 | 539 | 2,073 | 1,920 | |||||||||||

Net loss attributable to On Deck Capital, Inc. common stockholders | $ | (4,074 | ) | $ | (16,634 | ) | $ | (16,630 | ) | $ | (47,102 | ) | |||

Denominator: | |||||||||||||||

Weighted-average common shares outstanding, basic and diluted | 73,272,085 | 70,971,895 | 72,613,221 | 70,750,037 | |||||||||||

Net loss per common share, basic and diluted | $ | (0.06 | ) | $ | (0.23 | ) | $ | (0.23 | ) | $ | (0.67 | ) | |||

Diluted loss per common share is the same as basic loss per common share for all periods presented because the effects of potentially dilutive items were anti-dilutive given our net losses. The following common share equivalent securities have been excluded from the calculation of weighted-average common shares outstanding because the effect is anti-dilutive for the periods presented:

Three Months Ended September 30, | Nine Months Ended September 30, | ||||||||||

2017 | 2016 | 2017 | 2016 | ||||||||

Anti-Dilutive Common Share Equivalents | |||||||||||

Warrants to purchase common stock | 22,000 | 22,000 | 22,000 | 22,000 | |||||||

Restricted stock units | 3,528,871 | 4,225,480 | 3,528,871 | 4,225,480 | |||||||

Stock options | 8,227,736 | 11,997,551 | 8,227,736 | 11,997,551 | |||||||

Employee stock purchase program | 34,820 | 40,706 | 34,820 | 40,706 | |||||||

Total anti-dilutive common share equivalents | 11,813,427 | 16,285,737 | 11,813,427 | 16,285,737 | |||||||

The weighted-average exercise price for warrants to purchase 2,007,846 shares of common stock was $10.70 as of September 30, 2017. For the three months and nine months ended September 30, 2017, and 2016 a warrant to purchase 1,985,846 and 2,206,496 shares of common stock, respectively, was excluded from anti-dilutive common share equivalents as performance conditions had not been met.

8

3. Loans Held for Investment and Allowance for Loan Losses

Loans held for investment consisted of the following as of September 30, 2017 and December 31, 2016 (in thousands):

September 30, 2017 | December 31, 2016 | ||||||

Term loans | $ | 815,043 | $ | 864,066 | |||

Lines of credit | 125,837 | 116,385 | |||||

Total unpaid principal balance | 940,880 | 980,451 | |||||

Net deferred origination costs | 16,323 | 19,994 | |||||

Total loans held for investment | $ | 957,203 | $ | 1,000,445 | |||

During the nine months ended September 30, 2017, we paid $13.7 million to purchase term loans that we previously sold to a third party which are included in the unpaid principal balance of loans held for investment.

We include both loans we originate and loans funded by our issuing bank partner and later purchased by us as part of our originations. During the three months ended September 30, 2017 and 2016, we purchased such loans from our issuing bank partner in the amount of $101.6 million and $147.3 million, respectively. During the nine months ended September 30, 2017 and 2016, we purchased such loans in the amount of $367.3 million and $381.0 million, respectively.

The activity in the allowance for loan losses for the three months ended September 30, 2017 and 2016 consisted of the following (in thousands):

Three Months Ended September 30, | Nine Months Ended September 30, | ||||||||||||||

2017 | 2016 | 2017 | 2016 | ||||||||||||

Balance at beginning of period | $ | 105,217 | $ | 73,849 | $ | 110,162 | $ | 53,311 | |||||||

Provision for loan losses | 39,582 | 36,586 | 118,495 | 94,294 | |||||||||||

Loans charged off | (45,257 | ) | (25,268 | ) | (135,958 | ) | (65,411 | ) | |||||||

Recoveries of loans previously charged off | 5,330 | 2,201 | 12,173 | 5,174 | |||||||||||

Allowance for loan losses at end of period | $ | 104,872 | $ | 87,368 | $ | 104,872 | $ | 87,368 | |||||||

When loans are charged-off, we may continue to attempt to recover amounts from the respective borrowers and guarantors, or pursue our rights through formal legal action. Alternatively, we may sell such previously charged-off loans to a third-party debt collector. The proceeds from these sales are recorded as a component of the recoveries of loans previously charged off. For the three months ended September 30, 2017 and 2016, previously charged-off loans sold accounted for $2.4 million and $1.2 million, respectively, of recoveries of loans previously charged off. For the nine months ended September 30, 2017 and 2016, previously charged-off loans sold accounted for $6.2 million and $3.1 million, respectively, of recoveries of loans previously charged off.

As of September 30, 2017 and December 31, 2016, our credit exposure related to the undrawn line of credit balances was $194.0 million and $164.5 million, respectively. The related reserve on unfunded loan commitments was $4.1 million and $3.9 million as of September 30, 2017 and December 31, 2016, respectively. Net adjustments to the accrual for unfunded loan commitments are included in general and administrative expenses.

The following table contains information, on a combined basis, regarding the unpaid principal balance of loans we originated and the amortized cost of loans purchased from third parties other than our issuing bank partner related to non-delinquent, paying and non-paying delinquent loans as of September 30, 2017 and December 31, 2016 (in thousands):

September 30, 2017 | December 31, 2016 | ||||||

Non-delinquent loans | $ | 835,320 | $ | 890,297 | |||

Delinquent: paying (accrual status) | 61,953 | 36,073 | |||||

Delinquent: non-paying (non-accrual status) | 43,607 | 54,081 | |||||

Total | $ | 940,880 | $ | 980,451 | |||

9

The portion of the allowance for loan losses attributable to non-delinquent loans was $60.6 million and $59.5 million as of September 30, 2017 and December 31, 2016, respectively, while the portion of the allowance for loan losses attributable to delinquent loans was $44.3 million and $50.7 million as of September 30, 2017 and December 31, 2016, respectively.

The following table shows an aging analysis of the unpaid principal balance related to loans held for investment by delinquency status as of September 30, 2017 and December 31, 2016 (in thousands):

September 30, 2017 | December 31, 2016 | ||||||

By delinquency status: | |||||||

Non-delinquent loans | $ | 835,320 | $ | 890,297 | |||

1-14 calendar days past due | 34,724 | 25,899 | |||||

15-29 calendar days past due | 20,055 | 15,990 | |||||

30-59 calendar days past due | 20,975 | 22,677 | |||||

60-89 calendar days past due | 15,658 | 13,952 | |||||

90 + calendar days past due | 14,148 | 11,636 | |||||

Total unpaid principal balance | $ | 940,880 | $ | 980,451 | |||

4. Servicing Rights

As of September 30, 2017 and December 31, 2016, we serviced term loans owned by others with a remaining unpaid principal balance of $141.0 million and $222.0 million, respectively. During the three months ended September 30, 2017 and 2016, we sold through OnDeck Marketplace loans with an unpaid principal balance of $5.3 million and $87.5 million, respectively, and during the nine months ended September 30, 2017 and 2016, we sold loans with an unpaid principal balance of $55.5 million and $284.9 million, respectively.

For the three months ended September 30, 2017 and 2016, we earned $0.4 million and $0.3 million of servicing revenue, respectively. For the nine months ended September 30, 2017 and 2016, we earned $1.3 million, and $0.9 million of servicing revenue, respectively.

The following table summarizes the activity related to the fair value of our servicing assets for the three and nine months ended September 30, 2017 (in thousands):

Three Months Ended September 30, | Nine Months Ended September 30, | ||||||||||||||

2017 | 2016 | 2017 | 2016 | ||||||||||||

Fair value at the beginning of period | $ | 701 | $ | 1,989 | $ | 1,131 | $ | 3,489 | |||||||

Addition: | |||||||||||||||

Servicing resulting from transfers of financial assets | 275 | 717 | 938 | 2,272 | |||||||||||

Changes in fair value: | |||||||||||||||

Other changes in fair value (1) | (347 | ) | (1,019 | ) | (1,440 | ) | (4,074 | ) | |||||||

Fair value at the end of period (Level 3) | $ | 629 | $ | 1,687 | $ | 629 | $ | 1,687 | |||||||

___________

(1) Represents changes due to collection of expected cash flows through September 30, 2017 and 2016.

10

5. Debt

The following table summarizes our outstanding debt as of September 30, 2017 and December 31, 2016 (in thousands):

Description | Type | Maturity Date | Weighted Average Interest Rate at September 30, 2017 | September 30, 2017 | December 31, 2016 | ||||||||

Funding Debt: | |||||||||||||

ODAST II Agreement | Securitization Facility | May 2020 (1) | 4.7% | $ | 250,000 | $ | 250,000 | ||||||

ODART Agreement | Revolving | March 2019 | 3.9% | 123,498 | 133,767 | ||||||||

RAOD Agreement | Revolving | November 2018 | 3.7% | 71,119 | 99,985 | ||||||||

ODAF I Agreement | Revolving | February 2020 (2) | 8.5% | 81,633 | 100,000 | ||||||||

ODAC Agreement | Revolving | May 2019 | 8.5% | 76,321 | 65,486 | ||||||||

PORT II Agreement | Revolving | December 2018 | 3.7% | 67,296 | 52,397 | ||||||||

Other Agreements | Various | Various (3) | Various | 39,385 | 30,887 | ||||||||

709,252 | 732,522 | ||||||||||||

Deferred Debt Issuance Cost | (6,254 | ) | (5,883 | ) | |||||||||

Total Funding Debt | $ | 702,998 | $ | 726,639 | |||||||||

Corporate Debt: | |||||||||||||

Square 1 Agreement | Revolving | October 2018 | 5.5% | 17,200 | 28,000 | ||||||||

Deferred Debt Issuance Cost | (20 | ) | (34 | ) | |||||||||

Total Corporate Debt | $ | 17,180 | $ | 27,966 | |||||||||

(1) | The period during which remaining cash flow can be used to purchase additional loans expires April 2018. |

(2) | The period during which new borrowings may be made under this facility expires in February 2019. |

(3) | Maturity dates range from October 2017 to December 2018. |

Certain of our loans held for investment are pledged as collateral for borrowings in our funding debt facilities. These loans totaled $773.7 million and $886.4 million as of September 30, 2017 and December 31, 2016, respectively. Our corporate debt facility is collateralized by substantially all of our assets.

ODAF I Agreement

On February 14, 2017, we entered into an amendment of the ODAF I Agreement which provided for an increase in the Lenders' revolving commitment from an aggregate amount of $100 million to $150 million, the extension of the revolving commitment termination date by approximately six months to February 14, 2019, and various technical, definitional, conforming and other changes.

ODART Agreement

On March 20, 2017, we entered into an amendment and restatement of the ODART Agreement which provided for a $50 million increase in the maximum amount of the Class A revolving loans and an increase up to $1.8 million in the maximum amount of the Class B revolving loans, thereby increasing the total facility size up to $214.1 million, an extension of the revolving commitment period during which ODART may utilize funding capacity under the Deutsche Bank Facility to March 20, 2019, a borrowing base advance rate for the Class A revolving loans of 85% and a borrowing base advance rate for the Class B revolving loans of 91%; and various technical, definitional, conforming and other changes.

ODAC Agreement

On May 4, 2017, we renewed the ODAC facility with amended terms, which provided for an increase in the revolving commitments from $75 million to $100 million and an extension of the revolving commitment period to May 3, 2019. The interest rate decreased to LIBOR (minimum of 0.75%) + 7.25% from LIBOR (minimum of 0.0%) + 9.25% and the advance rate increased from 75% to 85%.

11

RAOD Agreement

On May 25, 2017, we renewed the RAOD facility with amended terms which provided for an extension of the revolving commitment period to November 22, 2018; a decrease in the interest rate to LIBOR + 2.5% from LIBOR + 3.0%; and various technical, definitional, conforming and other changes.

6. Fair Value of Financial Instruments

Assets and Liabilities Measured at Fair Value on a Recurring Basis Using Significant Unobservable Inputs (Level 3)

We evaluate our financial assets and liabilities subject to fair value measurements on a recurring basis to determine the appropriate level at which to classify them for each reporting period. Due to the lack of transparency and quantity of transactions related to trades of servicing rights of comparable loans, we utilize an income valuation technique to estimate fair value. We utilize industry-standard modeling, such as discounted cash flow models, to arrive at an estimate of fair value and may utilize third-party service providers to assist in the valuation process. This determination requires significant judgments to be made.

The following tables present information about our assets and liabilities that are measured at fair value on a recurring basis as of September 30, 2017 and December 31, 2016 (in thousands):

September 30, 2017 | |||||||||||||||

Description | Level 1 | Level 2 | Level 3 | Total | |||||||||||

Assets: | |||||||||||||||

Servicing assets | $ | — | $ | — | $ | 629 | $ | 629 | |||||||

Total assets | $ | — | $ | — | $ | 629 | $ | 629 | |||||||

December 31, 2016 | |||||||||||||||

Description | Level 1 | Level 2 | Level 3 | Total | |||||||||||

Assets: | |||||||||||||||

Servicing assets | $ | — | $ | — | $ | 1,131 | $ | 1,131 | |||||||

Total assets | $ | — | $ | — | $ | 1,131 | $ | 1,131 | |||||||

There were no transfers between levels for the nine months ended September 30, 2017 or December 31, 2016.

The following tables presents quantitative information about the significant unobservable inputs used for certain of our Level 3 fair value measurement as of September 30, 2017 and December 31, 2016:

September 30, 2017 | ||||||||||

Unobservable input | Minimum | Maximum | Weighted Average | |||||||

Servicing assets | Discount rate | 30.00 | % | 30.00 | % | 30.00 | % | |||

Cost of service(1) | 0.09 | % | 0.14 | % | 0.12 | % | ||||

Renewal rate | 42.72 | % | 56.07 | % | 52.74 | % | ||||

Default rate | 10.22 | % | 11.00 | % | 10.84 | % | ||||

(1) Estimated cost of servicing a loan as a percentage of unpaid principal balance. | ||||||||||

12

December 31, 2016 | ||||||||||

Unobservable input | Minimum | Maximum | Weighted Average | |||||||

Servicing assets | Discount rate | 30.00 | % | 30.00 | % | 30.00 | % | |||

Cost of service(1) | 0.09 | % | 0.14 | % | 0.11 | % | ||||

Renewal rate | 46.20 | % | 56.54 | % | 50.14 | % | ||||

Default rate | 10.32 | % | 10.75 | % | 10.48 | % | ||||

(1) Estimated cost of servicing a loan as a percentage of unpaid principal balance. | ||||||||||

Changes in certain of the unobservable inputs noted above may have a significant impact on the fair value of our servicing asset. The following table summarizes the effect adverse changes in estimate would have on the fair value of the servicing asset as of September 30, 2017 and December 31, 2016 given hypothetical changes in default rate and cost to service (in thousands):

September 30, 2017 | December 31, 2016 | ||||||

Servicing Assets | |||||||

Default rate assumption: | |||||||

Default rate increase of 25% | $ | (62 | ) | $ | (98 | ) | |

Default rate increase of 50% | $ | (120 | ) | $ | (188 | ) | |

Cost to service assumption: | |||||||

Cost to service increase by 25% | $ | (48 | ) | $ | (60 | ) | |

Cost to service increase by 50% | $ | (95 | ) | $ | (120 | ) | |

Assets and Liabilities Disclosed at Fair Value

Because our loans held for investment, loans held for sale and fixed-rate debt are not measured at fair value, we are required to disclose their fair value in accordance with ASC 825. Due to the lack of transparency and comparable loans, we utilize an income valuation technique to estimate fair value. We utilize industry-standard modeling, such as discounted cash flow models, to arrive at an estimate of fair value and may utilize third-party service providers to assist in the valuation process. This determination requires significant judgments to be made. The following tables summarize the carrying value and fair value of our loans held for investment, loans held for sale and fixed-rate debt (in thousands):

September 30, 2017 | |||||||||||||||||||

Description | Carrying Value | Fair Value | Level 1 | Level 2 | Level 3 | ||||||||||||||

Assets: | |||||||||||||||||||

Loans held for investment | $ | 852,331 | $ | 934,867 | $ | — | $ | — | $ | 934,867 | |||||||||

Total assets | $ | 852,331 | $ | 934,867 | $ | — | $ | — | $ | 934,867 | |||||||||

Description | |||||||||||||||||||

Liabilities: | |||||||||||||||||||

Fixed-rate debt | $ | 276,324 | $ | 262,216 | $ | — | $ | — | $ | 262,216 | |||||||||

Total fixed-rate debt | $ | 276,324 | $ | 262,216 | $ | — | $ | — | $ | 262,216 | |||||||||

13

December 31, 2016 | |||||||||||||||||||

Description | Carrying Value | Fair Value | Level 1 | Level 2 | Level 3 | ||||||||||||||

Assets: | |||||||||||||||||||

Loans held for investment | $ | 890,283 | $ | 979,780 | $ | — | $ | — | $ | 979,780 | |||||||||

Loans held for sale | 373 | 394 | — | 394 | |||||||||||||||

Total assets | $ | 890,656 | $ | 980,174 | $ | — | $ | — | $ | 980,174 | |||||||||

Description | |||||||||||||||||||

Liabilities: | |||||||||||||||||||

Fixed-rate debt | $ | 280,886 | $ | 275,200 | $ | — | $ | — | $ | 275,200 | |||||||||

Total fixed-rate debt | $ | 280,886 | $ | 275,200 | $ | — | $ | — | $ | 275,200 | |||||||||

The following techniques and assumptions are used in estimating fair value:

Loans held for investment and loans held for sale - Fair value is based on discounted cash flow models which contain certain unobservable inputs such as discount rate, renewal rate and default rate.

Fixed-rate debt - Our ODAST II Agreement and certain other agreements are considered fixed-rate debt. Fair value of our fixed-rate debt is based on a discounted cash flow model with an unobservable input of discount rate. For our variable rate debt, carrying value approximates fair value.

14

7. Noncontrolling Interest

The following tables summarize changes in equity, including the equity attributable to noncontrolling interests, for the nine months ended September 30, 2017 and September 30, 2016 (in thousands):

Nine Months Ended September 30, 2017 | ||||||||||||

On Deck Capital, Inc.'s stockholders' equity | Noncontrolling interest | Total | ||||||||||

Balance as of January 1, 2017 | $ | 259,525 | $ | 4,072 | $ | 263,597 | ||||||

Net income (loss) | (16,630 | ) | (2,073 | ) | (18,703 | ) | ||||||

Stock based compensation | 9,115 | — | 9,115 | |||||||||

Exercise of options and warrants | 490 | — | 490 | |||||||||

Employee stock purchase plan | 2,299 | — | 2,299 | |||||||||

Cumulative translation adjustment | 375 | 307 | 682 | |||||||||

Purchase of shares for treasury | (864 | ) | — | (864 | ) | |||||||

Investments by noncontrolling interests | — | 3,443 | 3,443 | |||||||||

Return of equity to noncontrolling interest | — | (959 | ) | (959 | ) | |||||||

Balance at September 30, 2017 | 254,310 | 4,790 | 259,100 | |||||||||

Comprehensive loss: | ||||||||||||

Net loss | (16,630 | ) | (2,073 | ) | (18,703 | ) | ||||||

Other comprehensive income (loss): | ||||||||||||

Foreign currency translation adjustment | 375 | 307 | 682 | |||||||||

Comprehensive income (loss): | $ | (16,255 | ) | $ | (1,766 | ) | $ | (18,021 | ) | |||

Nine Months Ended September 30, 2016 | ||||||||||||

On Deck Capital, Inc.'s stockholders' equity | Noncontrolling interest | Total | ||||||||||

Balance as of January 1, 2016 | $ | 322,813 | $ | 6,609 | $ | 329,422 | ||||||

Net income (loss) | (47,102 | ) | (1,920 | ) | (49,022 | ) | ||||||

Stock based compensation | 11,399 | — | 11,399 | |||||||||

Exercise of options and warrants | 168 | — | 168 | |||||||||

Employee stock purchase plan | 3,996 | — | 3,996 | |||||||||

Cumulative translation adjustment | 216 | 177 | 393 | |||||||||

Purchase of shares for treasury | (576 | ) | — | (576 | ) | |||||||

Balance at September 30, 2016 | 290,914 | 4,866 | 295,780 | |||||||||

Comprehensive loss: | ||||||||||||

Net loss | (47,102 | ) | (1,920 | ) | (49,022 | ) | ||||||

Other comprehensive income (loss): | ||||||||||||

Foreign currency translation adjustment | 216 | 177 | 393 | |||||||||

Comprehensive income (loss): | $ | (46,886 | ) | $ | (1,743 | ) | $ | (48,629 | ) | |||

In the third quarter of 2015, we acquired a 67% interest in an entity with the remaining 33% owned by an unrelated third party strategic partner for the purpose of providing small business loans to customers of the third party. We consolidate the financial position and results of operations of that entity. On June 29, 2017, OnDeck purchased the loans owned by that entity for an immaterial amount. That entity made a liquidating distribution to us of approximately $2 million and to the unrelated third

15

party of approximately $1 million representing our respective proportionate share of the equity in that entity. The loan sale and distribution effectively ended the operations of that entity. No material gain or loss was recorded.

8. Stock-Based Compensation

Options

The following is a summary of option activity for the nine months ended September 30, 2017:

Number of Options | Weighted- Average Exercise Price | Weighted- Average Remaining Contractual Term (in years) | Aggregate Intrinsic Value (in thousands) | ||||||||||

Outstanding at January 1, 2017 | 11,426,296 | $ | 6.10 | — | — | ||||||||

Granted | 368,894 | $ | 4.13 | — | — | ||||||||

Exercised | (1,351,648 | ) | $ | 0.87 | — | — | |||||||

Forfeited | (1,095,455 | ) | $ | 9.07 | — | — | |||||||

Expired | (1,120,351 | ) | $ | 11.36 | — | — | |||||||

Outstanding at September 30, 2017 | 8,227,736 | $ | 5.76 | 6.7 | $ | 13,831 | |||||||

Exercisable at September 30, 2017 | 5,948,010 | $ | 4.98 | 6.1 | $ | 13,510 | |||||||

Vested or expected to vest as of September 30, 2017 | 8,164,605 | $ | 5.75 | 6.7 | $ | 13,827 | |||||||

Total compensation cost related to nonvested option awards not yet recognized as of September 30, 2017 was $7.3 million and will be recognized over a weighted-average period of approximately 1.8 years. The aggregate intrinsic value of employee options exercised during the nine months ended September 30, 2017 and 2016 was $5.0 million and $2.4 million, respectively.

Restricted Stock Units

The following table summarizes our activities of Restricted Stock Units ("RSUs") and Performance Restricted Stock Units ("PRSUs") during the nine months ended September 30, 2017:

Number of RSUs | Weighted-Average Grant Date Fair Value | |||||

Unvested at January 1, 2017 | 3,888,768 | $ | 8.46 | |||

RSUs and PRSUs granted | 1,791,690 | $ | 4.50 | |||

RSUs vested | (546,671 | ) | $ | 9.09 | ||

RSUs and PRSUs forfeited/expired | (1,604,916 | ) | $ | 8.15 | ||

Unvested at September 30, 2017 | 3,528,871 | $ | 6.30 | |||

Expected to vest after September 30, 2017 | 3,121,430 | $ | 6.36 | |||

As of September 30, 2017, there was $16.3 million of unrecognized compensation cost related to unvested RSUs and PRSUs, which is expected to be recognized over the next 2.7 years.

16

Stock-based compensation expense related to stock options, RSUs, PRSUs and Employee Stock Purchase Program are included in the following line items in our accompanying condensed consolidated statements of operations for the three and nine months ended September 30, 2017 and 2016 (in thousands):

Three Months Ended September 30, | Nine Months Ended September 30, | ||||||||||||||

2017 | 2016 | 2017 | 2016 | ||||||||||||

Sales and marketing | $ | 538 | $ | 920 | $ | 1,830 | $ | 2,749 | |||||||

Technology and analytics | 499 | 793 | 1,824 | 2,437 | |||||||||||

Processing and servicing | 99 | 227 | 429 | 781 | |||||||||||

General and administrative | 1,920 | 1,821 | 5,438 | 5,456 | |||||||||||

Total | $ | 3,056 | $ | 3,761 | $ | 9,521 | $ | 11,423 | |||||||

9. Commitments and Contingencies

Concentrations of Credit Risk

Financial instruments that potentially subject us to significant concentrations of credit risk consist principally of cash, cash equivalents, restricted cash and loans. We hold cash, cash equivalents and restricted cash in accounts at regulated domestic financial institutions in amounts that exceed or may exceed FDIC insured amounts and at non-U.S. financial institutions where deposited amounts may be uninsured. We believe these institutions to be of acceptable credit quality and we have not experienced any related losses to date.

There is no single customer or group of customers that comprise a significant portion of our loan portfolio.

Contingencies

From time to time we are subject to legal proceedings and claims in the ordinary course of business. The results of such matters cannot be predicted with certainty. However, we believe that the final outcome of any such current matters will not result in a material adverse effect on our consolidated financial condition, consolidated results of operations or consolidated cash flows.

Item 2. | Management’s Discussion and Analysis of Financial Condition and Results of Operations |

You should read the following discussion and analysis of our financial condition and results of operations together with our condensed consolidated financial statements and the related notes and other financial information included elsewhere in this report. Some of the information contained in this discussion and analysis, including information with respect to our plans and strategy for our business, includes forward-looking statements that involve risks and uncertainties. You should review the “Cautionary Note Regarding Forward-Looking Statements” and Part II — Item 1A. "Risk Factors" sections of this report for a discussion of important factors that could cause actual results to differ materially from the results described in or implied by the forward-looking statements contained in the following discussion and analysis.

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This report contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 and other legal authority. These forward-looking statements concern our operations, economic performance, financial condition, goals, beliefs, future growth strategies, objectives, plans and current expectations.

Forward-looking statements appear throughout this report including in Item 2. Management’s Discussion and Analysis of Financial Condition and Results of Operations. Forward-looking statements can generally be identified by words such as “will,” “enables,” “expects,” "intends," "may," “allows,” "plan," “continues,” “believes,” “anticipates,” “estimates” or similar expressions.

Forward-looking statements are neither historical facts nor assurances of future performance. They are based only on our current beliefs, expectations and assumptions regarding the future of our business, anticipated events and trends, the economy and other future conditions. As such, they are subject to inherent uncertainties, risks and changes in circumstances that are difficult to predict and in many cases outside our control. Therefore, you should not rely on any of these forward-looking statements. Our expected results may not be achieved, and actual results may differ materially from our expectations.

17

Important factors that could cause or contribute to such differences include risks relating to: our ability to attract potential customers to our platform and broaden our distribution capabilities and offerings; the degree to which potential customers apply for loans, are approved and borrow from us; anticipated trends, growth rates, loan originations, volume of loans sold and challenges in our business and in the markets in which we operate; the ability of our customers to repay loans and our ability to accurately assess creditworthiness; our ability to adequately reserve for loan losses; the impact of our decision to tighten credit policies; our liquidity and working capital requirements, including the availability and pricing of new debt facilities, extensions and increases to existing debt facilities, increases in our corporate line of credit, securitizations and OnDeck Marketplace® sales to fund our existing operations and planned growth, including the consequences of having inadequate resources to fund additional loans or draws on lines of credit; the impact on our customers of Hurricane Harvey and Hurricane Irma, which may reduce demand for our loans or cause our customers to suffer significant losses and/or incur significant disruption in their respective operations, which may affect their ability to repay their loans; our reliance on our third-party service providers and the effect on our business of originating loans without third-party funding sources; the impact of increased utilization of cash or incurred debt to fund originations; the effect on our business of utilizing cash for voluntary loan purchases from third parties; the effect on our business of the current credit environment and increases in interest rate benchmarks; our ability to hire and retain necessary qualified employees, particularly following our workforce reductions announced in February and May 2017; our continuing compliance measures related to our funding advisor channel and their impact; changes in our product distribution channel mix and/or our funding mix; our ability to anticipate market needs and develop new and enhanced offerings to meet those needs; anticipated interest rate increases and origination fees on loans; maintaining and expanding our customer base; the impact of competition in our industry and innovation by our competitors; our anticipated and unanticipated growth and growth strategies, including the possible introduction of new types of loans and possible expansion into new international markets, and our ability to effectively manage that growth; our reputation and possible adverse publicity about us or our industry; the availability and cost of our funding, including challenges faced by the expiration of existing debt facilities; the impact on our business of funding loans from our cash reserves; locating funding sources for new types of loans that are ineligible for funding under our existing credit or securitization facilities and the possibility of reducing originations of these loan types; the effect of potential selective pricing increases; our expected utilization of OnDeck Marketplace and the available OnDeck Marketplace premiums; our failure to anticipate or adapt to future changes in our industry; the lack of customer acceptance or failure of our loans; our ability to offer loans to our small business customers that have terms that are competitive with alternative sources of capital; our ability to issue new loans to existing customers that seek additional capital; the evolution of technology affecting our offerings and our markets; our compliance with applicable local, state and federal and non-U.S. laws, rules and regulations and their application and interpretation, whether existing, modified or new; our ability to adequately protect our intellectual property; the effect of litigation or other disputes to which we are or may be a party; the increased expenses and administrative workload associated with being a public company; failure to maintain an effective system of internal controls necessary to accurately report our financial results and prevent fraud; the estimates and estimate methodologies used in preparing our consolidated financial statements; the future trading prices of our common stock, the impact of securities analysts’ reports and shares eligible for future sale on these prices; our ability to prevent or discover security breaks, disruption in service and comparable events that could compromise the personal and confidential information held in our data systems, reduce the attractiveness of our platform or adversely impact our ability to service our loans; and other risks, including those described in Part II - Item 1A. "Risk Factors" included elsewhere in this report, Part I - Item 1A. "Risk Factors" in our most recent Annual Report on Form 10-K, Part II - Item 1A. "Risk Factors" in our Quarterly Report for the quarter ended June 30, 2017 and other documents that we file with the Securities and Exchange Commission, or SEC, from time to time which are available on the SEC website at www.sec.gov.

Except as required by law, we undertake no duty to update any forward-looking statements. Readers are also urged to carefully review and consider all of the information in this report, as well as the other documents we make available through the SEC’s website.

When we use the terms “OnDeck,” the “Company,” “we,” “us” or “our” in this report, we are referring to On Deck Capital, Inc. and its consolidated subsidiaries unless the context requires otherwise.

18

Overview

We are a leading online platform for small business lending. We are seeking to make it efficient and convenient for small businesses to access capital. Enabled by our proprietary technology and analytics, we aggregate and analyze thousands of data points from dynamic, disparate data sources to assess the creditworthiness of small businesses rapidly and accurately. Small businesses can apply for a term loan or line of credit on our website in minutes and, using our proprietary OnDeck Score®, we can make a funding decision immediately and, if approved, transfer funds as fast as the same day. Qualified customers may carry both a term loan and line of credit simultaneously which we believe provides additional repeat business opportunities, as well as increased value to our customers. We have originated more than $7 billion of loans since we made our first loan in 2007.

We generate the majority of our revenue through interest income and fees earned on the term loans we retain. Our term loans, which we offer in principal amounts ranging from $5,000 to $500,000 and with maturities of 3 to 36 months, feature fixed dollar repayments. Our lines of credit range from $6,000 to $100,000, and are generally repayable within six months of the date of the most recent draw. We earn interest on the balance outstanding and lines of credit are subject to a monthly fee unless the customer makes a qualifying minimum draw, in which case it may be waived under certain circumstances. The balance of our other revenue primarily comes from our servicing and other fee income, most of which consists of marketing fees from our issuing bank partner, fees generated by OnDeck-as-a-Service, and fees we receive for servicing loans owned by third-parties.

We rely on a diversified set of funding sources for the capital we lend to our customers. Our primary source of this capital has historically been debt facilities with various financial institutions. We have also used proceeds from operating cash flow to fund loans in the past and continue to finance a portion of our outstanding loans with these funds. As of September 30, 2017, we had $709.3 million of funding debt principal outstanding and $983.1 million of total borrowing capacity under such debt facilities, subject to borrowing conditions. During the third quarter of 2017 and 2016, we sold approximately $5.5 million and $89.9 million, respectively, of loans to OnDeck Marketplace purchasers. Of our total principal outstanding as of September 30, 2017, including our loans held for investment and loans sold to OnDeck Marketplace purchasers which had a balance remaining as of September 30, 2017, 3% were funded via OnDeck Marketplace purchasers, 58% were funded via our debt facilities, 30% were financed via proceeds raised from our securitization transaction and 9% were funded via our own equity.

We originate loans throughout the United States, Canada and Australia, although, to date, substantially all of our revenue has been generated in the United States. These loans are originated through our direct marketing, including direct mail, social media and other online marketing channels, and also originated through our outbound sales team, referrals from our strategic partners, including banks, payment processors and small business-focused service providers, and through funding advisors who advise small businesses on available funding options.

Key Financial and Operating Metrics

We regularly monitor a number of metrics in order to measure our current performance and project our future performance. These metrics aid us in developing and refining our growth strategies and making strategic decisions.

As of or for the Three Months Ended September 30, | As of or for the Nine Months Ended September 30, | ||||||||||||||

2017 | 2016 | 2017 | 2016 | ||||||||||||

(dollars in thousands) | (dollars in thousands) | ||||||||||||||

Originations | $ | 530,926 | $ | 612,557 | $ | 1,568,303 | $ | 1,771,906 | |||||||

Effective Interest Yield | 33.4 | % | 32.8 | % | 33.4% | 33.4 | % | ||||||||

Marketplace Gain on Sale Rate | 2.7 | % | 3.0 | % | 3.3 | % | 4.3 | % | |||||||

Cost of Funds Rate | 6.4 | % | 5.7 | % | 6.2% | 5.9 | % | ||||||||

Provision Rate | 7.5 | % | 6.9 | % | 7.8 | % | 6.4 | % | |||||||

Reserve Ratio | 11.1 | % | 9.8 | % | 11.1 | % | 9.8 | % | |||||||

15+ Day Delinquency Ratio | 7.5 | % | 6.2 | % | 7.5 | % | 6.2 | % | |||||||

Net Charge-off Rate | 16.9 | % | 11.0 | % | 16.8% | 11.0 | % | ||||||||

Net Interest Margin * | 29.1 | % | 29.4 | % | 29.4 | % | 30.0 | % | |||||||

Net Interest Margin After Credit Losses (NIMAL) * | 12.2 | % | 18.7 | % | 12.6% | 19.1 | % | ||||||||

Adjusted Expense Ratio (AER) * | 12.6 | % | 16.5 | % | 13.7% | 17.0 | % | ||||||||

Adjusted Operating Yield (AOY) * | (0.4 | )% | 2.2 | % | (1.1 | )% | 2.1 | % | |||||||

19

* See "Non-GAAP Financial Measures" below for an explanation of this non-GAAP measure and a reconciliation to the nearest GAAP measure.

Originations

Originations represent the total principal amount of the term loans we made during the period, plus the total amount drawn on lines of credit during the period. Many of our repeat term loan customers renew their term loan before their existing term loan is fully repaid. In accordance with industry practice, originations of such repeat term loans are presented as the full renewal loan principal, rather than the net funded amount, which would be the renewal term loan’s principal net of the unpaid principal balance on the existing term loan. Loans referred to, and originated by, our issuing bank partner and later purchased by us are included as part of our originations. Unless otherwise specified or the context otherwise requires, the term originations refers to the dollar amount of loans originated and not to the number of loans, which we refer to as units.

Effective Interest Yield

Effective Interest Yield is the rate of return we achieve on loans outstanding during a period. It is calculated as our business day adjusted annualized interest income divided by average loans. Annualization is based on 252 business days per year, which is typical weekdays per year less U.S. Federal Reserve Bank holidays.

Net deferred origination costs in loans held for investment and loans held for sale consist of deferred origination fees and costs. Deferred origination fees include fees paid up front to us by customers when loans are originated and decrease the carrying value of loans, thereby increasing the Effective Interest Yield earned. Deferred origination costs are limited to costs directly attributable to originating loans such as commissions, vendor costs and personnel costs directly related to the time spent by the personnel performing activities related to loan origination and increase the carrying value of loans, thereby decreasing the Effective Interest Yield earned.

Recent pricing trends are discussed under the subheading “Key Factors Affecting Our Performance - Pricing.”

Marketplace Gain on Sale Rate

Marketplace Gain on Sale Rate equals our gain on sale revenue from loans sold through OnDeck Marketplace divided by the carrying value of loans sold, which includes both unpaid principal balance sold and the remaining carrying value of the net deferred origination costs. A portion of loans regularly sold through OnDeck Marketplace are or may be loans which were initially designated as held for investment upon origination. The portion of such loans sold in a given period may vary materially depending upon market conditions and other circumstances.

Cost of Funds Rate

Cost of Funds Rate is our funding cost, which is the interest expense, fees and amortization of deferred debt issuance costs we incur in connection with our lending activities across all of our debt facilities, divided by average funding debt outstanding. For full years, it is calculated as our funding cost divided by Average Funding Debt Outstanding and for interim periods it is calculated as our annualized funding cost for the period divided by Average Funding Debt Outstanding.

Provision Rate

Provision Rate equals the provision for loan losses divided by the new originations volume of loans held for investment, net of originations of sales of such loans within the period. Because we reserve for probable credit losses inherent in the portfolio upon origination, this rate is significantly impacted by the expectation of credit losses for the period’s originations volume. This rate may also be impacted by changes in loss estimates for loans originated prior to the commencement of the period.

The denominator of the Provision Rate formula includes the new originations volume of loans held for investment, net of originations of sales of such loans within the period. However, the numerator primarily reflects the additional provision required to provide for loan losses on the net funded amount during such period. Therefore, all other things equal, an increased volume of loan rollovers and line of credit repayments and re-borrowings in a period will reduce the Provision Rate.

The Provision Rate is not directly comparable to the net cumulative lifetime charge-off ratio because (i) the Provision Rate reflects estimated losses at the time of origination while the net cumulative lifetime charge-off ratio reflects actual charge-offs, (ii) the Provision Rate includes provisions for losses on both term loans and lines of credit while the net cumulative lifetime charge-off ratio reflects only charge-offs related to term loans and (iii) the Provision Rate for a period reflects the provision for losses related to all loans held for investment while the net cumulative lifetime charge-off ratio reflects lifetime charge-offs of term loans related to a particular cohort of term loans.

20

Reserve Ratio

Reserve Ratio is our allowance for loan losses as of the end of the period divided by the Unpaid Principal Balance as of the end of the period.

15+ Day Delinquency Ratio

15+ Day Delinquency Ratio equals the aggregate Unpaid Principal Balance for our loans that are 15 or more calendar days past due as of the end of the period as a percentage of the Unpaid Principal Balance. The Unpaid Principal Balance for our loans that are 15 or more calendar days past due includes loans that are paying and non-paying. Because our loans require weekly or daily repayments, excluding weekends and holidays, they may be deemed delinquent more quickly than loans from traditional lenders that require only monthly payments. As of September 30, 2017, a majority of our loans required weekly repayments.

15+ Day Delinquency Ratio is not annualized, but reflects balances as of the end of the period.

Net Charge-off Rate

Net Charge-off Rate is calculated as our annualized net charge-offs for the period divided by the average Unpaid Principal Balance outstanding. Annualization is based on four quarters per year and is not business day adjusted. Net charge-offs are charged-off loans in the period, net of recoveries.

Net Interest Margin

Net Interest Margin is calculated as business day adjusted annualized Net Interest Income divided by average Interest Earning Assets. Interest Earning Assets represents the sum of Unpaid Principal Balance plus the amount of principal outstanding of loans held for sale at the end of the period. It excludes net deferred origination costs, allowance for loan losses and any loans sold or held for sale at the end of the period. Average Interest Earnings Assets is calculated as the average of Interest Earnings Assets at the beginning of the period and the end of each month in the period.

Net Interest Income represents interest income less funding cost during the period. Interest income is net of fees on loans held for investment and held for sale. Net deferred origination costs in loans held for investment and loans held for sale consist of deferred origination costs as offset by corresponding deferred origination fees. Deferred origination fees include fees paid up front to us by customers when loans are originated. Deferred origination costs are limited to costs directly attributable to originating loans such as commissions, vendor costs and personnel costs directly related to the time spent by the personnel performing activities related to loan origination. Funding cost is the interest expense, fees, and amortization of deferred debt issuance costs we incur in connection with our lending activities across all of our debt facilities. Annualization is based on 252 business days per year, which is typical weekdays per year less U.S. Federal Reserve Bank holidays.

Net Interest Margin After Credit Losses (NIMAL)

Net Interest Margin After Credit Losses (NIMAL), is calculated as our business day adjusted annualized Net Interest Income After Credit Losses divided by average Interest Earning Assets. Net Interest Income After Credit Losses represents interest income less funding cost and net charge-offs during the period. Interest income is net of deferred costs and fees on loans held for investment and held for sale. Net deferred origination costs in loans held for investment and loans held for sale consist of deferred origination costs as offset by corresponding deferred origination fees. Deferred origination fees include fees paid up front to us by customers when loans are originated. Deferred origination costs are limited to costs directly attributable to originating loans such as commissions, vendor costs and personnel costs directly related to the time spent by the personnel performing activities related to loan origination. Funding cost is the interest expense, fees, and amortization of deferred debt issuance costs we incur in connection with our lending activities across all of our debt facilities. Net charge-offs are charged-off loans in the period, net of recoveries. Annualization is based on 252 business days per year, which is typical weekdays per year less U.S. Federal Reserve Bank holidays.

Adjusted Expense Ratio (AER)

Adjusted Expense Ratio (AER) represents our annualized operating expense, adjusted to exclude the impact of stock-based compensation, divided by average Loans Under Management. Loans Under Management represents the Unpaid Principal Balance plus the unpaid principal balance of loans held for sale, excluding net deferred origination costs, plus the amount of principal outstanding of term loans we serviced for others at the end of the period. Average Loans Under Management is calculated as the average of Loans Under Management at the beginning of the period and the end of each month in the period. Annualization is based on 252 business days per year, which is typical weekdays per year less U.S. Federal Reserve Bank holidays.

Adjusted Operating Yield (AOY)

Adjusted Operating Yield (AOY) represents our Net Interest Margin After Credit Losses (NIMAL) less the Adjusted Expense Ratio (AER).

21

On Deck Capital, Inc. and Subsidiaries

Consolidated Average Balance Sheets

(in thousands, except share and per share data)

Three Months Ended September 30, | Nine Months Ended September 30, | ||||||||||||||

2017 | 2016 | 2017 | 2016 | ||||||||||||

Assets | |||||||||||||||

Cash and cash equivalents | $ | 59,530 | $ | 72,309 | $ | 58,595 | $ | 90,321 | |||||||

Restricted cash | 58,659 | 46,478 | 59,316 | 38,884 | |||||||||||

Loans held for investment | 960,587 | 851,457 | 1,001,697 | 739,946 | |||||||||||

Less: Allowance for loan losses | (103,397 | ) | (81,118 | ) | (109,486 | ) | (68,775 | ) | |||||||

Loans held for investment, net | 857,190 | 770,339 | 892,211 | 671,171 | |||||||||||

Loans held for sale | — | 4,846 | 462 | 9,051 | |||||||||||

Property, equipment and software, net | 25,919 | 30,328 | 27,480 | 29,636 | |||||||||||

Other assets | 17,843 | 19,676 | 18,483 | 21,376 | |||||||||||

Total assets | $ | 1,019,141 | $ | 943,976 | $ | 1,056,547 | $ | 860,439 | |||||||

Liabilities and equity | |||||||||||||||

Liabilities: | |||||||||||||||

Accounts payable | $ | 3,077 | $ | 3,332 | $ | 3,377 | $ | 4,203 | |||||||

Interest payable | 2,300 | 1,313 | 2,322 | 1,060 | |||||||||||

Funding debt | 710,601 | 597,678 | 737,864 | 505,406 | |||||||||||

Corporate debt | 11,078 | 7,699 | 20,213 | 4,698 | |||||||||||

Accrued expenses and other liabilities | 32,276 | 32,876 | 33,786 | 32,460 | |||||||||||

Total liabilities | 759,332 | 642,898 | 797,562 | 547,827 | |||||||||||

Total On Deck Capital, Inc. stockholders' equity | 254,731 | 295,989 | 253,716 | 306,913 | |||||||||||

Noncontrolling interest | 5,077 | 5,089 | 5,269 | 5,699 | |||||||||||

Total equity | 259,808 | 301,078 | 258,985 | 312,612 | |||||||||||

Total liabilities and equity | $ | 1,019,140 | $ | 943,976 | $ | 1,056,547 | $ | 860,439 | |||||||

Memo: | |||||||||||||||

Unpaid Principal Balance | $ | 944,372 | $ | 836,542 | $ | 983,230 | $ | 727,038 | |||||||

Interest Earning Assets | $ | 944,372 | $ | 841,270 | $ | 983,689 | $ | 735,825 | |||||||

Loans | $ | 960,587 | $ | 856,303 | $ | 1,002,159 | $ | 748,997 | |||||||

Loans Under Management | $ | 1,089,406 | $ | 1,087,641 | $ | 1,159,438 | $ | 1,015,768 | |||||||

Average Balance Sheet Items for the period represent the average as of the beginning of the month in the period and as of the end of each month in the period.

Non-GAAP Financial Measures

We believe that the non-GAAP metrics in this report can provide useful supplemental measures for period-to-period comparisons of our core business and useful supplemental information to investors and others in understanding and evaluating our operating results. However, non-GAAP metrics are not calculated in accordance with GAAP, and should not be considered an alternative to any measures of financial performance calculated and presented in accordance with GAAP. Other companies may calculate these non-GAAP metrics differently than we do. The reconciliations below reconcile each of our non-GAAP metrics to their most comparable respective GAAP metric.

Adjusted EBITDA

Adjusted EBITDA represents our net income (loss), adjusted to exclude interest expense associated with debt used for corporate purposes (rather than funding costs associated with lending activities), income tax expense, depreciation and amortization,

22

stock-based compensation expense and warrant liability fair value adjustments. Stock-based compensation includes employee compensation as well as compensation to third-party service providers.

Our use of Adjusted EBITDA has limitations as an analytical tool, and you should not consider it in isolation or as a substitute for analysis of our results as reported under GAAP. Some of these limitations are:

• | although depreciation and amortization are non-cash charges, the assets being depreciated and amortized may have to be replaced in the future, and Adjusted EBITDA does not reflect cash capital expenditure requirements for such replacements or for new capital expenditure requirements; |

• | Adjusted EBITDA does not reflect changes in, or cash requirements for, our working capital needs; |

• | Adjusted EBITDA does not reflect the potentially dilutive impact of equity-based compensation; |

• | Adjusted EBITDA does not reflect interest associated with debt used for corporate purposes or tax payments that may represent a reduction in cash available to us; |

• | Adjusted EBITDA does not reflect the potential costs we would incur if certain of our warrants were settled in cash. |

The following table presents a reconciliation of net loss to Adjusted EBITDA for each of the periods indicated:

Three Months Ended September 30, | Nine Months Ended September 30, | ||||||||||||||

2017 | 2016 | 2017 | 2016 | ||||||||||||

(in thousands) | (in thousands) | ||||||||||||||

Reconciliation of Net Income (Loss) to Adjusted EBITDA | |||||||||||||||

Net loss | $ | (4,532 | ) | $ | (17,173 | ) | $ | (18,703 | ) | $ | (49,022 | ) | |||

Adjustments: | |||||||||||||||

Corporate interest expense | 35 | 111 | 706 | 186 | |||||||||||

Income tax expense | — | — | — | — | |||||||||||

Depreciation and amortization | 2,451 | 2,452 | 7,623 | 6,887 | |||||||||||

Stock-based compensation expense | 3,056 | 3,761 | 9,521 | 11,423 | |||||||||||

Adjusted EBITDA | $ | 1,010 | $ | (10,849 | ) | $ | (853 | ) | $ | (30,526 | ) | ||||

Adjusted Net (Loss) Income

Adjusted Net (Loss) Income represents our net loss adjusted to exclude stock-based compensation expense and warrant liability fair value adjustment, each on the same basis and with the same limitations as described above for Adjusted EBITDA.

The following table presents a reconciliation of net loss to Adjusted Net (Loss) Income for each of the periods indicated:

Three Months Ended September 30, | Nine Months Ended September 30, | ||||||||||||||

2017 | 2016 | 2017 | 2016 | ||||||||||||

(in thousands) | (in thousands) | ||||||||||||||

Reconciliation of Net Income (Loss) to Adjusted Net (Loss) Income | |||||||||||||||

Net loss | $ | (4,532 | ) | $ | (17,173 | ) | $ | (18,703 | ) | $ | (49,022 | ) | |||

Adjustments: | |||||||||||||||

Net loss attributable to noncontrolling interest | 458 | 539 | 2,073 | 1,920 | |||||||||||

Stock-based compensation expense | 3,056 | 3,761 | 9,521 | 11,423 | |||||||||||

Adjusted Net Loss | $ | (1,018 | ) | $ | (12,873 | ) | $ | (7,109 | ) | $ | (35,679 | ) | |||

23

Net Interest Margin

Net Interest Margin, is calculated as business day adjusted annualized Net Interest Income divided by average Interest Earning Assets. Net Interest Income represents interest income less funding cost during the period. Interest income is net of fees on loans held for investment and held for sale. Net deferred origination costs in loans held for investment and loans held for sale consist of deferred origination costs as offset by corresponding deferred origination fees. Deferred origination fees include fees paid up front to us by customers when loans are originated. Deferred origination costs are limited to costs directly attributable to originating loans such as commissions, vendor costs and personnel costs directly related to the time spent by the personnel performing activities related to loan origination. Funding cost is the interest expense, fees, and amortization of deferred debt issuance costs we incur in connection with our lending activities across all of our debt facilities. Annualization is based on 252 business days per year, which is typical weekdays per year less U.S. Federal Reserve Bank holidays.

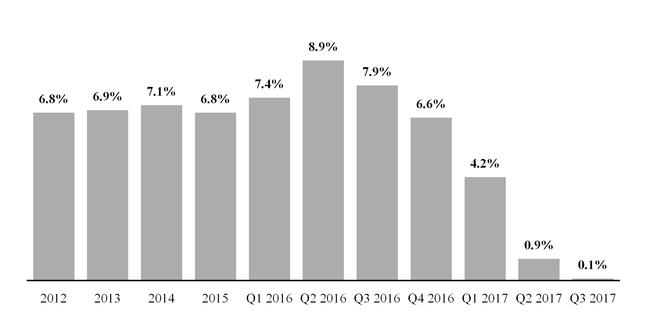

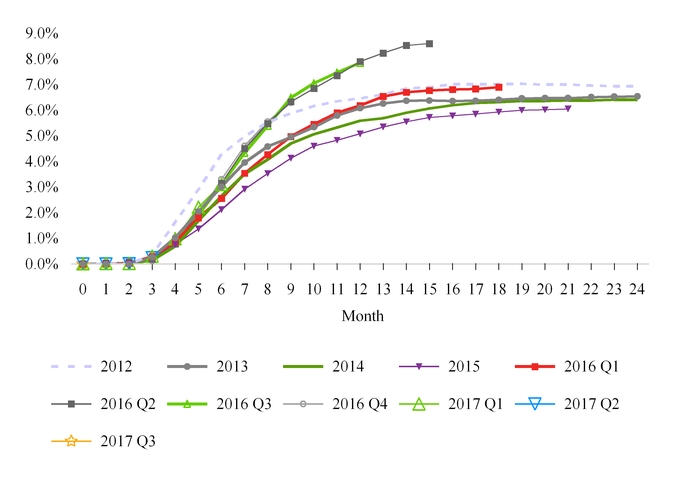

Our use of Net Interest Margin has limitations as an analytical tool, and you should not consider it in isolation or as a substitute for analysis of our results as reported under GAAP. Some of these limitations are: