UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM

QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended

OR

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from ___ to ___

Commission file number

(Exact name of registrant as specified in its charter)

| ||

(State or other jurisdiction of incorporation or organization) |

| (I.R.S. Employer Identification No.) |

|

|

|

| ||

(Address of principal executive offices) |

| (Zip Code) |

(

(Registrant’s telephone number, including area code)

(Former name, former address and former fiscal year, if changed since last report)

Securities registered pursuant to Section 12(b) of the Act:

Title of each class |

| Ticker symbol(s) |

| Name of each exchange on which registered |

|

|

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files).

Indicate by check mark whether the registrant is a large, accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of “large, accelerated filer,” “accelerated filer” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

Large accelerated Filer ☐ |

|

|

| Accelerated Filer ☐ | ||

Smaller reporting company | ||||||

|

|

|

|

|

| Emerging growth company |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ◻

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

Yes

Shares of Common Stock outstanding as of January 26, 2022:

iBio, Inc.

TABLE OF CONTENTS

3 | ||

|

| |

3 | ||

Management’s Discussion and Analysis of Financial Condition and Results of Operations | 36 | |

44 | ||

44 | ||

|

|

|

45 | ||

|

| |

45 | ||

45 | ||

49 | ||

50 | ||

|

| |

52 | ||

2

PART I - FINANCIAL INFORMATION

Item 1. Financial Statements (Unaudited).

iBio, Inc. and Subsidiaries

Condensed Consolidated Balance Sheets

(In Thousands, except share and per share amounts)

December 31, | June 30, | |||||

2021 | 2021 | |||||

| (Unaudited) | (See Note 2) | ||||

Assets | ||||||

Current assets: | ||||||

Cash and cash equivalents | $ | | $ | | ||

Accounts receivable - trade |

| |

| | ||

Settlement receivable - current portion | | | ||||

Investments in debt securities |

| |

| | ||

Inventory | | | ||||

Prepaid expenses and other current assets |

| |

| | ||

Total Current Assets |

| |

| | ||

|

|

| ||||

Restricted cash | | | ||||

Convertible promissory note receivable and accrued interest | | | ||||

Settlement receivable - noncurrent portion | | | ||||

Finance lease right-of-use assets, net of accumulated amortization |

| |

| | ||

Operating lease right-of-use asset | | | ||||

Fixed assets, net of accumulated depreciation |

| |

| | ||

Intangible assets, net of accumulated amortization | | | ||||

Investment in equity security - at cost | | | ||||

Prepaid expenses - noncurrent | | | ||||

Security deposits | | | ||||

Total Assets | $ | | $ | | ||

|

|

|

| |||

Liabilities and Equity |

|

|

|

| ||

Current liabilities: |

|

|

|

| ||

Accounts payable | $ | | $ | | ||

Accrued expenses (related party of $ |

| |

| | ||

Acquisition Payable | | | ||||

Finance lease obligations - current portion | | | ||||

Operating lease obligation - current portion | | | ||||

Note payable - PPP loan - current portion | | | ||||

Contract liabilities |

| |

| | ||

Total Current Liabilities |

| |

| | ||

|

|

|

| |||

Finance lease obligations - net of current portion | | | ||||

Operating lease obligation - net of current portion | | | ||||

Term note payable - net of deferred financing costs | | | ||||

|

|

|

| |||

Total Liabilities |

| |

| | ||

|

|

|

| |||

Equity |

|

|

|

| ||

iBio, Inc. Stockholders’ Equity: |

|

|

|

| ||

Common stock - $ |

| |

| | ||

Additional paid-in capital |

| |

| | ||

Accumulated other comprehensive loss |

| ( |

| ( | ||

Accumulated deficit | ( | ( | ||||

Total iBio, Inc. Stockholders’ Equity |

| |

| | ||

Noncontrolling interest |

| |

| ( | ||

Total Equity |

| |

| | ||

Total Liabilities and Equity | $ | | $ | | ||

The accompanying notes are an integral part of these unaudited condensed consolidated financial statements.

3

iBio, Inc. and Subsidiaries

Condensed Consolidated Statements of Operations and Comprehensive Loss

(Unaudited; in Thousands, except per share amounts)

|

| Three Months Ended | Six Months Ended | |||||||||

| December 31, | December 31, | ||||||||||

|

| 2021 |

| 2020 | 2021 |

| 2020 | |||||

| ||||||||||||

Revenues | $ | | $ | | $ | | $ | | ||||

|

|

|

|

|

|

| ||||||

Cost of goods sold | | | | | ||||||||

Gross profit | | | | | ||||||||

Operating expenses: |

|

|

|

|

|

| ||||||

Research and development |

| |

| |

| |

| | ||||

General and administrative (related party of $ |

| |

| |

| |

| | ||||

Total operating expenses |

| |

| |

| |

| | ||||

|

|

|

|

|

|

|

|

| ||||

Operating loss |

| ( |

| ( |

| ( |

| ( | ||||

|

|

|

|

|

|

| ||||||

Other income (expense): |

|

|

|

|

|

| ||||||

Interest expense (related party of $ | ( | ( | ( | ( | ||||||||

Interest income |

| |

| |

| |

| | ||||

Royalty income |

| |

| |

| |

| | ||||

Forgiveness of note payable and accrued interest - SBA loan | | | | | ||||||||

Other | | | | | ||||||||

Total other income (expense) |

| ( |

| ( |

| ( |

| ( | ||||

|

|

|

|

|

|

| ||||||

Consolidated net loss |

| ( |

| ( |

| ( |

| ( | ||||

Net loss attributable to noncontrolling interest |

| |

| |

| |

| | ||||

Net loss attributable to iBio, Inc. |

| ( |

| ( |

| ( |

| ( | ||||

Preferred stock dividends |

| ( |

| ( |

| ( |

| ( | ||||

Net loss attributable to iBio, Inc. stockholders | $ | ( | $ | ( | $ | ( | $ | ( | ||||

|

|

|

|

|

|

| ||||||

Comprehensive loss: |

|

|

|

|

|

| ||||||

Consolidated net loss | $ | ( | $ | ( | $ | ( | $ | ( | ||||

Other comprehensive loss - unrealized loss on debt securities | ( | ( | ( | ( | ||||||||

|

|

|

|

|

|

|

|

| ||||

Comprehensive loss | $ | ( | $ | ( | $ | ( | $ | ( | ||||

|

|

|

|

|

|

|

|

| ||||

Loss per common share attributable to iBio, Inc. stockholders - basic and diluted | $ | ( | $ | ( | $ | ( | $ | ( | ||||

|

|

|

|

|

|

|

|

| ||||

Weighted-average common shares outstanding - basic and diluted |

| |

| |

| |

| | ||||

The accompanying notes are an integral part of these unaudited condensed consolidated financial statements.

4

iBio, Inc. and Subsidiaries

Condensed Consolidated Statements of Equity

(Unaudited; in thousands)

Six Months Ended December 31, 2021

| Accumulated | |||||||||||||||||||||||||

| Additional | Other | ||||||||||||||||||||||||

| Preferred Stock | Common Stock | Paid-In | Comprehensive | Accumulated | Noncontrolling | ||||||||||||||||||||

|

| Shares |

| Amount |

| Shares |

| Amount |

| Capital |

| Loss |

| Deficit |

| Interest |

| Total | ||||||||

Balance as of July 1, 2021 | — | $ | — | | $ | | $ | | $ | ( | $ | ( | $ | ( | $ | | ||||||||||

Exercise of stock options | — | — | | — | | — | — | — | | |||||||||||||||||

Share-based compensation |

| — |

| — |

| — |

| — |

| |

| — |

| — |

| — |

| | ||||||||

Unrealized loss on debt securities | — | — | — |

| — |

| — |

| ( |

| — |

| — |

| ( | |||||||||||

Net loss | — | — | — |

| — |

| — |

| — |

| ( |

| ( |

| ( | |||||||||||

Balance as of September 30, 2021 | — | $ | — | | $ | | $ | | $ | ( | $ | ( | $ | ( | $ | | ||||||||||

Vesting of RSUs | — | — | |

| |

| ( |

| — |

| — |

| — |

| — | |||||||||||

Warrant issued for Transaction | — | — | — |

| — |

| |

| — |

| — |

| — |

| | |||||||||||

Acquisition of remaining portion of iBio CDMO | — | — | — |

| — |

| ( |

| — |

| — |

| |

| ( | |||||||||||

Share-based compensation | — | — | — |

| — |

| |

| — |

| — |

| — |

| | |||||||||||

Unrealized loss on debt securities | — | — | — | — | — | ( | — | — | ( | |||||||||||||||||

Net loss | — | — | — |

| — |

| — |

| — |

| ( |

| — |

| ( | |||||||||||

Balance as of December 31, 2021 | — | $ | — | | $ | | $ | | $ | ( | $ | ( | $ | — | $ | | ||||||||||

The accompanying notes are an integral part of these unaudited condensed consolidated financial statements.

5

iBio, Inc. and Subsidiaries

Condensed Consolidated Statements of Equity

(Unaudited; in thousands)

Six Months Ended December 31, 2020

| Accumulated | |||||||||||||||||||||||||

| Additional | Other | ||||||||||||||||||||||||

| Preferred Stock | Common Stock | Paid-In | Comprehensive | Accumulated | Noncontrolling | ||||||||||||||||||||

|

| Shares |

| Amount |

| Shares |

| Amount |

| Capital |

| Loss |

| Deficit |

| Interest |

| Total | ||||||||

Balance as of July 1, 2020 | | $ | — | | $ | | $ | | $ | ( | $ | ( | $ | ( | $ | | ||||||||||

Capital raises | — | — | | | | — | — | — | | |||||||||||||||||

Costs to raise capital | — | — | — | — | ( | — | — | — | ( | |||||||||||||||||

Exercise of stock options | — | — | | — | | — | — | — | | |||||||||||||||||

Conversion of preferred stock to common stock | ( | — | | | ( | — | — | — | — | |||||||||||||||||

Share-based compensation |

|

| — |

| — |

| — |

|

| — |

|

| |

|

| — |

|

| — |

|

| — |

|

| | |

Unrealized loss on debt securities | — | — | — | — | — | ( | — | — | ( | |||||||||||||||||

Net loss | — | — | — |

| — |

| — |

| — |

| ( |

| ( |

| ( | |||||||||||

Balance as of September 30, 2020 |

| — |

| $ | — |

| |

| $ | |

| $ | |

| $ | ( |

| $ | ( |

| $ | ( |

| $ | | |

Capital raise | — | — | |

| |

| |

| — |

| — |

| — |

| | |||||||||||

Cost to raise capital | — | — | — |

| — |

| ( |

| — |

| — |

| — |

| ( | |||||||||||

Share-based compensation | — | — | — | — | | — | — | — | | |||||||||||||||||

Unrealized loss on debt securities | — | — | — | — | — | ( | — | — | ( | |||||||||||||||||

Net loss | — | — | — |

| — |

| — |

| — |

| ( |

| ( |

| ( | |||||||||||

Balance as of December 31, 2020 | — | $ | — | | $ | | $ | | $ | ( | $ | ( | $ | ( | $ | | ||||||||||

The accompanying notes are an integral part of these unaudited condensed consolidated financial statements.

6

iBio, Inc. and Subsidiaries

Condensed Consolidated Statements of Cash Flows

(Unaudited; in Thousands)

|

| Six Months Ended | ||||

| December 31, | |||||

|

| 2021 |

| 2020 | ||

| ||||||

Cash flows from operating activities: | ||||||

Consolidated net loss | $ | ( | $ | ( | ||

Adjustments to reconcile consolidated net loss to net cash used in operating activities: |

|

| ||||

Share-based compensation |

| |

| | ||

Amortization of intangible assets |

| |

| | ||

Amortization of finance lease right-of-use assets | | | ||||

Amortization of operating lease right-of-use assets | | | ||||

Depreciation of fixed assets |

| |

| | ||

Accrued interest receivable on convertible promissory note receivable | ( | ( | ||||

Amortization of premiums on debt securities | | | ||||

Forgiveness of note payable and accrued interest - SBA loan | ( | | ||||

Settlement of revenue contract | ( | | ||||

Reserve for loss on contract | | | ||||

Changes in operating assets and liabilities: |

|

| ||||

Accounts receivable – trade |

| |

| ( | ||

Accounts receivable – other | | ( | ||||

Inventory |

| ( |

| ( | ||

Prepaid expenses and other current assets |

| ( |

| ( | ||

Prepaid expenses - noncurrent | ( | | ||||

Security deposit |

| ( |

| | ||

Accounts payable |

| |

| | ||

Accrued expenses |

| |

| | ||

Operating lease obligations |

| ( |

| | ||

Contract liabilities |

| ( |

| ( | ||

|

|

|

| |||

Net cash used in operating activities |

| ( |

| ( | ||

|

|

| ||||

Cash flows from investing activities: |

|

| ||||

Purchases of debt securities | ( | ( | ||||

Redemption of debt securities | | | ||||

Purchase of equity security | ( | | ||||

Additions to intangible assets |

| ( |

| ( | ||

Purchases of fixed assets |

| ( |

| ( | ||

Issuance of note receivable | | ( | ||||

|

|

|

|

| ||

Net cash used in investing activities |

| ( |

| ( | ||

|

| |||||

Cash flows from financing activities: |

|

| ||||

Payment of finance lease obligation | ( | ( | ||||

Proceeds from sales of preferred and common stock |

| |

| | ||

Proceeds from subscription receivable | | | ||||

Proceeds from exercise of stock option | | | ||||

Proceeds from term note | | | ||||

Cost to attain term note | ( | | ||||

Acquisition of noncontrolling interest | ( | | ||||

Costs to raise capital |

| |

| ( | ||

|

|

|

| |||

Net cash provided by (used in) financing activities |

| ( |

| | ||

|

|

| ||||

Net increase (decrease) in cash, cash equivalents and restricted cash |

| ( |

| | ||

Cash, cash equivalents - beginning |

| |

| | ||

Cash, cash equivalents and restricted cash - end | $ | | $ | | ||

The accompanying notes are an integral part of these unaudited condensed consolidated financial statements.

7

iBio, Inc. and Subsidiaries

Condensed Consolidated Statements of Cash Flows

(Unaudited; in Thousands)

| Six Months Ended | |||||

December 31, | ||||||

|

| 2021 |

| 2020 | ||

Schedule of non-cash activities: |

|

| ||||

Increase in ROU operating assets and liabilities for new leases | $ | | $ | | ||

Unpaid portion of RubrYc transaction | $ | | $ | | ||

Fixed assets included in accounts payable in prior period, paid in current period | $ | | $ | |||

Unrealized loss on available-for-sale debt securities | $ | | $ | | ||

Lease incentive for construction in progress | $ | | $ | | ||

Unpaid fixed assets included in accounts payable | $ | | $ | | ||

Termination of finance ROU assets including issuance of warrant | $ | | $ | | ||

Note payable to acquire Facility | $ | | $ | | ||

Issuance of warrant for final finance lease obligation payment | $ | | $ | | ||

Unpaid intangible assets included in accounts payable | $ | | $ | | ||

Acquisition of noncontrolling interest | $ | | $ | | ||

Settlement of revenue contract | $ | | $ | | ||

Conversion of preferred stock shares into common stock | $ | | $ | | ||

|

|

| ||||

Supplemental cash flow information: |

|

| ||||

Cash paid during the period for interest | $ | | $ | | ||

The accompanying notes are an integral part of these unaudited condensed consolidated financial statements.

8

iBio, Inc. and Subsidiaries

Notes to Condensed Consolidated Financial Statements

(Unaudited)

1. Nature of Business

iBio, Inc. (“we”, “us”, “our”, “iBio”, “iBio, Inc” or the “Company”) is a developer of next-generation biopharmaceuticals and the pioneer of the sustainable FastPharming Manufacturing System ®. The Company is applying its technologies to research and develop novel product candidates to treat or prevent fibrotic diseases, cancers, and infectious diseases. The Company is using its FastPharming Manufacturing System (“FastPharming” or the “FastPharming System”) and Glycaneering Services TM to help rapidly and cost effectively build a portfolio of biologic drug candidates as well as to create proteins for others by contract or via the Company’s catalog.

The FastPharming System is iBio’s proprietary approach to plant-made pharmaceutical and protein production. It uses hydroponically grown, transiently-transfected plants, (typically Nicotiana benthamiana, a relative of the tobacco plant), novel expression vectors, a large-scale transient transfection method, and other technologies that can be used to produce complex therapeutic proteins emerging from our own, our clients’ and our potential clients’ pipelines. We believe the FastPharming System enables biologics production that is faster, more cost-effective and more environmentally friendly than other approaches.

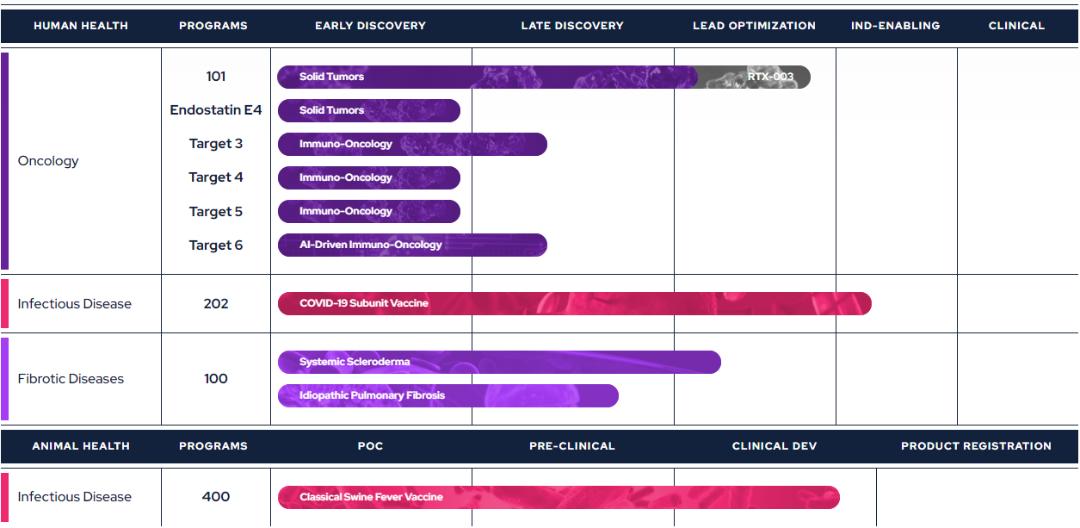

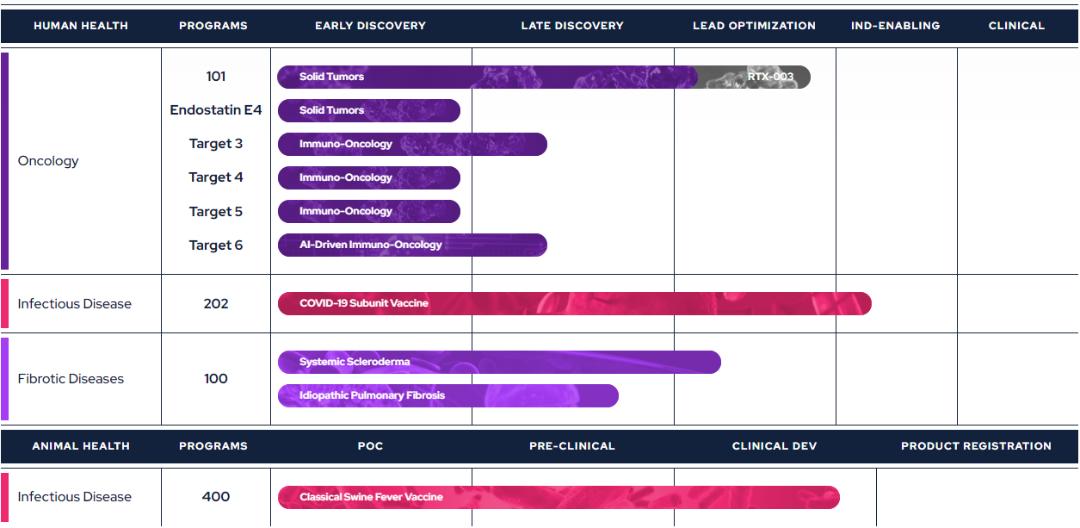

The Company operates in

Biopharmaceuticals:

iBio’s Biopharmaceutical segment currently focuses on developing products using the FastPharming System in the follow areas:

Therapeutics

Anti-Fibrotics

Fibrosis is a pathological disorder in which connective tissue replaces normal parenchymal tissue to the extent that it goes unchecked, leading to considerable tissue remodeling and the formation of permanent scar tissue. Fibrosis can occur in many tissues within the body, including the lungs (e.g., idiopathic pulmonary fibrosis (“IPF”) and skin (e.g., systemic scleroderma).

Oncology

iBio’s oncology efforts seek to identify therapeutics to aid in the treatment of cancer. Although there are a large number of cancer treatments available, significant unmet need exists in many types of cancer for improved treatments. Cancer remains the second most frequent cause of death worldwide. New research on cancers, especially on how to boost or support the immune system to treat cancer, is leading to a number of new treatments and new research programs with the potential to further improve cancer therapies.

iBio’s Glycaneering Services provides iBio an opportunity to develop cancer treatments with enhanced potency.

Vaccines

Human Health: SARS-CoV-2

Coronavirus disease 2019 is an infectious disease caused by severe acute respiratory syndrome coronavirus 2 (SARS-CoV-2) (“COVID”). It was first identified in December 2019 in Wuhan, Hubei, China, and has resulted in an ongoing pandemic. Common symptoms include fever, cough, fatigue, shortness of breath or breathing difficulties, and loss of smell and taste. Some people develop acute respiratory distress syndrome (ARDS), possibly precipitated by cytokine dysregulation, multi-organ failure, septic shock, and blood clots.

Animal Health: Classical Swine Fever

Classical swine fever (“CSF”) is a contagious, often fatal disease affecting both feral and domesticated pigs. Outbreaks in Europe, Asia, Africa, and South America have not only adversely impacted animal health and food security but have also had severe socioeconomic impacts on both the pig industry worldwide and small-scale pig farming. Currently available vaccines can be efficient at triggering rapid animal immune response and protecting swine populations when combined with culling of

9

infected pigs, but do not allow the differentiation of infected from vaccinated animals (“DIVA”), nor are they approved for use in the United States. The development of DIVA-compatible and efficacious vaccination solutions remains a top priority to prevent the economic impacts of a CSF outbreak including supply disruptions, export restrictions and reduced food security.

iBio’s current portfolio of products consists of the following:

Bioprocessing:

Services

iBio’s contract development and manufacturing services use iBio’s FastPharming and Glycaneering intellectual property and know how to develop or manufacture proteins for others per a contract or to provide bioprocess services.

Research & Bioprocess Products

iBio is developing proteins for use in cutting-edge research and cGMP manufacturing where the demand for high-quality products continues to evolve. The Company offers recombinant proteins for third parties on a catalog and custom basis. These catalog products often can lead to opportunities to provide CDMO services or identify in-licensing opportunities for our proprietary biotech pipeline.

2. Basis of Presentation

Interim Financial Statements

The accompanying unaudited condensed consolidated financial statements have been prepared from the books and records of the Company and include all normal and recurring adjustments which, in the opinion of management, are necessary for a fair presentation in accordance with accounting principles generally accepted in the United States (“U.S. GAAP”) for interim financial information and Rule 8-03 of Regulation S-X promulgated by the U.S. Securities and Exchange Commission (the “SEC”). Accordingly, these interim financial statements do not include all of the information and footnotes required for complete annual financial statements. Interim results are not necessarily indicative of the results that may be expected for the full year. Interim unaudited condensed consolidated financial statements should be read in conjunction with the audited financial statements and the notes thereto included in the Company’s Annual Report on Form 10-K for the year ended June 30, 2021, filed with the SEC on September 28, 2021, from which the accompanying condensed consolidated balance sheet dated June 30, 2021, was derived.

10

Principles of Consolidation

The condensed consolidated financial statements include the accounts of the Company and its wholly owned and majority-owned subsidiaries. Subsequent to November 1, 2021, all subsidiaries were wholly owned. See Note 5 below. All intercompany balances and transactions have been eliminated as part of the consolidation.

Liquidity

In the past, the history of significant losses, the negative cash flow from operations, the limited cash resources on hand and the dependence by the Company on its ability – about which there was uncertainty – to obtain additional financing to fund its operations after the current cash resources are exhausted raised substantial doubt about the Company's ability to continue as a going concern. Based on management projections and on the total cash and cash equivalents plus investments in debt securities of approximately $

3. Summary of Significant Accounting Policies

The Company’s significant accounting policies are described in Note 3 of the Notes to Financial Statements in the Annual Report.

Use of Estimates

The preparation of financial statements in conformity with U.S. GAAP requires management to make estimates and assumptions that affect reported amounts of assets and liabilities, disclosures of contingent assets and liabilities at the date of the financial statements, and the reported amounts of revenues and expenses during the reporting period. These estimates include liquidity assertions, the discount rate utilized in lease accounting models, the valuation of intellectual property, legal and contractual contingencies and share-based compensation. Although management bases its estimates on historical experience and various other assumptions that are believed to be reasonable under the circumstances, actual results could differ from these estimates.

Accounts Receivable

Accounts receivable are reported at their outstanding unpaid principal balances net of allowances for uncollectible accounts. We provide for allowances for uncollectible receivables based on our estimate of uncollectible amounts considering age, collection history, and other factors considered appropriate. Our policy is to write off accounts receivable against the allowance for doubtful accounts when a balance is determined to be uncollectible. At December 31, 2021, and June 30, 2021, the Company determined that an allowance for doubtful accounts was not needed.

Revenue Recognition

The Company accounts for its revenue recognition under Accounting Standards Codification ("ASC") 606, “Revenue from Contracts with Customers. Under this standard, the Company recognizes revenue when a customer obtains control of promised services or goods in an amount that reflects the consideration to which the Company expects to receive in exchange for those goods or services. In addition, the standard requires disclosure of the nature, amount, timing, and uncertainty of revenue and cash flows arising from customer contracts.

The Company’s contract revenue consists primarily of amounts earned under contracts with third-party customers and reimbursed expenses under such contracts. The Company analyzes its agreements to determine whether the elements can be separated and accounted for individually or as a single unit of accounting. Allocation of revenue to individual elements that qualify for separate accounting is based on the separate selling prices determined for each component, and total contract consideration is then allocated pro rata across the components of the arrangement. If separate selling prices are not available, the Company will use its best estimate of such selling prices, consistent with the overall pricing strategy and after consideration of relevant market factors.

In general, the Company applies the following steps when recognizing revenue from contracts with customers: (i) identify the contract, (ii) identify the performance obligations, (iii) determine the transaction price, (iv) allocate the transaction price to the performance obligations and (v) recognize revenue when a performance obligation is satisfied. The nature of the Company’s contracts with customers generally falls within the three key elements of the Company’s business plan: CDMO Facility Activities; Product Candidate Pipeline, and Facility Design and Build-out /Technology Transfer services.

11

Recognition of revenue is driven by satisfaction of the performance obligations using one of two methods: revenue is either recognized over time or at a point in time. Contracts containing multiple performance obligations classify those performance obligations into separate units of accounting either as standalone or combined units of accounting. For those performance obligations treated as a standalone unit of accounting, revenue is generally recognized based on the method appropriate for each standalone unit. For those performance obligations treated as a combined unit of accounting, revenue is generally recognized as the performance obligations are satisfied, which generally occurs when control of the goods or services have been transferred to the customer or client or once the client or customer is able to direct the use of those goods and/or services as well as obtaining substantially all of its benefits. As such, revenue for a combined unit of accounting is generally recognized based on the method appropriate for the last delivered item but due to the specific nature of certain project and contract items, management may determine an alternative revenue recognition method as appropriate, such as a contract whereby one deliverable in the arrangement clearly comprises the overwhelming majority of the value of the overall combined unit of accounting. Under this circumstance, management may determine revenue recognition for the combined unit of accounting based on the revenue recognition guidance otherwise applicable to the predominant deliverable.

If a loss on a contract is anticipated, such loss is recognized in its entirety when the loss becomes evident. When the current estimates of the amount of consideration that is expected to be received in exchange for transferring promised goods or services to the customer indicates a loss will be incurred, a provision for the entire loss on the contract is made. At December 31, 2021, and June 30, 2021, the Company had

The Company generates (or may generate in the future) contract revenue under the following types of contracts:

Fixed-Fee

Under a fixed-fee contract, the Company charges a fixed agreed upon amount for a deliverable. Fixed-fee contracts have fixed deliverables upon completion of the project. Typically, the Company recognizes revenue for fixed-fee contracts after projects are completed, delivery is made and title transfers to the customer, and collection is reasonably assured.

Revenue can be recognized either 1) over time or 2) at a point in time. All revenue was recognized at a point in time for all periods presented.

Time and Materials

Under a time and materials contract, the Company charges customers an hourly rate plus reimbursement for other project specific costs. The Company recognizes revenue for time and material contracts based on the number of hours devoted to the project multiplied by the customer’s billing rate plus other project specific costs incurred.

Contract Assets

A contract asset is an entity’s right to payment for goods and services already transferred to a customer if that right to payment is conditional on something other than the passage of time. Generally, an entity will recognize a contract asset when it has fulfilled a contract obligation but must perform other obligations before being entitled to payment.

Contract assets consist primarily of the cost of project contract work performed by third parties for which the Company expects to recognize any related revenue at a later date, upon satisfaction of the contract obligations. At both December 31, 2021, and June 30, 2021, contract assets were $

Contract Liabilities

A contract liability is an entity’s obligation to transfer goods or services to a customer at the earlier of (1) when the customer prepays consideration or (2) the time that the customer’s consideration is due for goods and services the entity will yet provide. Generally, an entity will recognize a contract liability when it receives a prepayment.

Contract liabilities consist primarily of consideration received, usually in the form of payment, on project work to be performed whereby the Company expects to recognize any related revenue at a later date, upon satisfaction of the contract obligations. At December 31, 2021 and June 30, 2021, contract liabilities were $

12

Leases

The Company accounts for leases under the guidance of Accounting Standards Codification ("ASC") 842, "Leases" ("ASC 842"). The standard established a right-of-use (“ROU”) model requiring a lessee to record a ROU asset and a lease liability on the balance sheet for all leases with terms longer than 12 months and classified as either an operating or finance lease. The adoption of ASC 842 had a significant effect on the Company’s balance sheet, resulting in an increase in non-current assets and both current and non-current liabilities.

As the Company elected to adopt ASC 842 at the beginning of the period of adoption (July 1, 2019), the Company recorded the ROU and finance lease obligation as follows:

| 1. | ROU measured at the carrying amount of the leased assets under Topic 840. |

| 2. | Finance lease liability measured at the carrying amount of the capital lease obligation under Topic 840 at the beginning of the period of adoption. |

The Company elected the package of practical expedients as permitted under the transition guidance, which allowed it: (1) to carry forward the historical lease classification; (2) not to reassess whether expired or existing contracts are or contain leases; and (3) not to reassess the treatment of initial direct costs for existing leases.

In accordance with ASC 842, at the inception of an arrangement, the Company determines whether the arrangement is or contains a lease based on the unique facts and circumstances present and the classification of the lease including whether the contract involves the use of a distinct identified asset, whether the Company obtains the right to substantially all the economic benefit from the use of the asset, and whether the Company has the right to direct the use of the asset. Leases with a term greater than one year are recognized on the balance sheet as ROU assets, lease liabilities and, if applicable, long-term lease liabilities. The Company has elected not to recognize on the balance sheet leases with terms of one year or less under practical expedient in paragraph ASC 842-20-25-2. For contracts with lease and non-lease components, the Company has elected not to allocate the contract consideration and to account for the lease and non-lease components as a single lease component.

The lease liabilities and the corresponding ROU assets are recorded based on the present value of lease payments over the expected remaining lease term. The implicit rate within our existing finance (capital) lease was determinable and, therefore, used at the adoption date of ASC 842 to determine the present value of lease payments under the finance lease. The implicit rate within our operating lease was not determinable and, therefore, the Company used the incremental borrowing rate at the lease commencement date to determine the present value of lease payments. The determination of the Company’s incremental borrowing rate requires judgment. The Company will determine the incremental borrowing rate for each new lease using our estimated borrowing rate.

An option to extend the lease is considered in connection with determining the ROU asset and lease liability when it is reasonably certain we will exercise that option. An option to terminate is considered unless it is reasonably certain we will not exercise the option.

Cash, Cash Equivalents and Restricted Cash

The Company considers all highly liquid instruments purchased with an original maturity of three months or less to be cash equivalents. Cash equivalents at December 31, 2021 and June 30, 2021 consisted of money market accounts. Restricted cash consists of collateral held for letters of credit obtained related to the term note payable for the purchase of the Bryan Facility (see Note 5) and the San Diego operating lease (see Note 14). Restricted cash was $

The following table summarizes the components of total cash, cash equivalents and restricted cash in the condensed consolidated statement of cash flows (in thousands):

December 31, | June 30, | |||||

2021 | 2021 | |||||

Cash and equivalents | | $ | | $ | | |

Collateral held for letter of credit - term note payable | | | ||||

Collateral held for letter of credit - San Diego lease | | | | |||

Total cash, cash equivalents and restricted cash | | $ | | $ | | |

13

Investments in Debt Securities

Debt investments are classified as available-for-sale. Changes in fair value are recorded in other comprehensive income (loss). Fair value is calculated based on publicly available market information. Discounts and/or premiums paid when the debt securities are acquired are amortized to interest income over the terms of the debt securities.

Investment in Equity Security

The Company applies the cost method for its investment in equity security. Under the cost method, the investment is recorded at cost, with gains and losses recognized as of the sale date, and income recorded when received. The Company reviews the carrying value of its equity security for impairment whenever events or changes in business circumstances indicate the carrying amount of such asset may not be fully recoverable. Impairments, if any, are based on the excess of the carrying amount over the recoverable amount of the asset. There were

Inventory

Inventory is stated at the lower of cost or net realizable value on the first-in, first-out basis. Inventory consists of the following (table in thousands):

December 31, | June 30, | |||||

2021 | 2021 | |||||

Raw materials | | $ | | $ | | |

Work in process | | | ||||

| $ | | $ | | ||

Research and Development

The Company accounts for research and development costs in accordance with the Financial Accounting Standards Board (“FASB”) ASC 730-10, Research and Development (“ASC 730-10”). Under ASC 730-10, all research and development costs must be charged to expense as incurred. Accordingly, internal research and development costs are expensed as incurred. Third-party research and development costs are expensed when the contracted work has been performed or as milestone results have been achieved.

Fixed Assets

Fixed assets are stated at cost net of accumulated depreciation. Depreciation is calculated using the straight-line method over the estimated useful lives of the assets ranging from to

Intangible Assets

The Company accounts for intangible assets at either their historical cost or allocated purchase price at asset acquisition and records amortization utilizing the straight-line method based upon their estimated useful lives. Patents are amortized over a period of

Share-based Compensation

The Company recognizes the cost of all share-based payment transactions at fair value. Compensation cost, measured by the fair value of the equity instruments issued, adjusted for estimated forfeitures, is recognized in the financial statements as the respective awards are earned over the performance or service period. The Company uses historical data to estimate forfeiture rates.

The impact that share-based payment awards will have on the Company’s results of operations is a function of the number of shares awarded, the trading price of the Company’s stock at the date of grant or modification, the vesting schedule and forfeitures. Furthermore, the application of the Black-Scholes option pricing model employs weighted-average assumptions for expected volatility of the Company’s stock, expected term until exercise of the options, the risk-free interest rate, and dividends, if any, to determine fair value.

14

Expected volatility is based on historical volatility of the Company’s common stock, par value $

Concentrations of Credit Risk

Cash

The Company maintains principally all cash balances in two financial institutions which, at times, may exceed the insured amounts. The exposure to the Company is solely dependent upon daily balances and the strength of the financial institutions. The Company has not incurred any losses on these accounts. At December 31, 2021, and June 30, 2021, amounts in excess of insured limits were approximately $

Revenue

During the three months ended December 31, 2021, the Company generated 100% of its revenue from

During the six months ended December 31, 2021, the Company generated 100% of its revenue from

Recently Issued Accounting Pronouncements

In June 2016, the FASB issued ASU 2016-13, Financial Instruments - Credit Losses (Topic 326): Measurement of Credit Losses on Financial Instruments (“ASU 2016-13”), which requires an entity to assess impairment of its financial instruments based on its estimate of expected credit losses. Since the issuance of ASU 2016-13, the FASB released several amendments to improve and clarify the implementation guidance. In November 2019, the FASB issued ASU 2019-10, Financial Instruments - Credit Losses (Topic 326), Derivatives and Hedging (Topic 815), and Leases (Topic 842): Effective Dates, which amended the effective date of the various topics. As the Company is a smaller reporting company, the provisions of ASU 2016-13 and the related amendments are effective for fiscal years, and interim periods within those fiscal years, beginning after December 15, 2022 (quarter ending September 30, 2023, for the Company). Entities are required to apply these changes through a cumulative-effect adjustment to retained earnings as of the beginning of the first reporting period in which the guidance is effective. The Company will evaluate the impact of ASU 2016-13 on the Company’s condensed consolidated financial statements in a future period closer to the date of adoption.

Effective July 1, 2019, the Company adopted ASU No. 2018-07, Compensation - Stock Compensation (Topic 718): Improvements to Nonemployee Share-Based Payment Accounting (“ASU 2018-07”). ASU No 2018-07 expands the scope of Topic 718 to include share-based payment transactions for acquiring goods and services from nonemployees. The guidance also specifies that Topic 718 applies to all share-based payment transactions in which a grantor acquires goods or services to be used or consumed in a grantor’s own operations by issuing share-based payment awards. The adoption of ASU 2018-07 did not have a significant impact on the Company’s condensed consolidated financial statements.

In December 2019, the FASB issued ASU 2019-12, Simplifying the Accounting for Income Taxes (“ASU 2019-12”) to reduce the cost and complexity in accounting for income taxes. ASU 2019-12 removes certain exceptions related to the approach for intra-period tax allocation, the methodology for calculating income taxes in an interim period, and the recognition of deferred tax liabilities for outside basis differences. ASU 2019-12 also amends other aspects of the guidance to help simplify and promote consistent application of U.S. GAAP. The guidance is effective for fiscal years and for interim periods within those fiscal years, beginning after December 15, 2020 (quarter ending September 30, 2021, for the Company), with early adoption permitted. An entity that elects early adoption must adopt all the amendments in the same period. Most amendments within ASU 2019-12 are required to be applied on a prospective basis, while certain amendments must be applied on a retrospective or modified retrospective basis. The adoption of ASU 2019-12 did not have a significant impact on the Company’s condensed consolidated financial statements.

Management does not believe that any other recently issued, but not yet effective, accounting standard if currently adopted would have a material effect on the accompanying condensed consolidated financial statements. Most of the newer standards issued represent

15

technical corrections to the accounting literature or application to specific industries which have no effect on the Company’s condensed consolidated financial statements.

4. Financial Instruments and Fair Value Measurement

The carrying values of cash and cash equivalents, accounts receivable, accounts payable, accrued expenses and term note payable in the Company’s condensed consolidated balance sheets approximated their fair values as of December 31, 2021, and June 30, 2021 due to their short-term nature. The carrying value of the convertible promissory note receivable and finance lease obligation approximated fair value as of December 31, 2021, and June 30, 2021 as the interest rates related to the financial instruments approximated market value.

The Company accounts for its investments in debt securities at fair value. The following provides a description of the three levels of inputs that may be used to measure fair value under the standard, the types of investments that fall under each category, and the valuation methodologies used to measure these investments at fair value.

| • | Level 1 – Inputs are based upon unadjusted quoted prices for identical instruments in active markets. |

| • | Level 2 – Inputs to the valuation include quoted prices for similar assets and liabilities in active markets, quoted prices for identical or similar assets or liabilities in inactive markets, inputs other than quoted prices that are observable for the asset or liability, and inputs that are derived principally from or corroborated by observable market data by correlation or other means. If the asset or liability has a specified (contractual) term, the Level 2 input must be observable for substantially the full term of the asset or liability. All debt securities were valued using Level 2 inputs. |

| • | Level 3 – Inputs to the valuation methodology are unobservable and significant to the fair value measurement. |

5. Significant Transactions

Affiliates of Eastern Capital Limited

On November 1, 2021, the Company and its subsidiary, iBio CDMO LLC (“iBio CDMO”, and collectively with the Company, the “Purchaser”) entered into a series of agreements (the “Transaction”) with College Station Investors LLC (“College Station”), and Bryan Capital Investors LLC (“Bryan Capital” and, collectively with College Station, “Seller”), each affiliates of Eastern Capital Limited ("Eastern," a former significant stockholder of the Company) described in more detail below whereby in exchange for a certain cash payment and a warrant the Company:

| (i) | acquired both the |

| (ii) | acquired all of the equity owned by one of the affiliates of Eastern in the Company and iBio CDMO; and |

| (iii) | otherwise terminated all agreements between the Company and the affiliates of Eastern. |

The Facility is a life sciences building located on land owned by the Board of Regents of the Texas A&M University System (“Texas A&M”) and is designed and equipped for the manufacture of plant-made biopharmaceuticals. iBio CDMO had held a sublease for the Facility through 2050, subject to extension until 2060 (the “Sublease”).

The Purchase and Sale Agreement

On November 1, 2021, the Purchaser entered into a Purchase and Sale Agreement (the “Purchase and Sale Agreement”) with the Seller pursuant to which: (i) the Seller sold to Purchaser all of its rights, title and interest as the tenant in the Ground Lease Agreement (the “Ground Lease Agreement”) that it entered into with Texas A&M (the “Landlord’’) related to the property at which the Facility is located together with all improvements pertaining thereto (the “Property”), which previously had been the subject of the Sublease; (ii) the Seller sold to Purchaser all of its rights, title and interest to any tangible personal property owned by Seller and located on the Property including the Facility; (iii) the Seller sold to Purchaser all of its rights, title and interest to all licensed, permits and authorization for use of the Property; and (iv) College Station and iBio CDMO terminated the Sublease. The total purchase price for the Property, the termination of the Sublease and other agreements among the parties, and the equity described below is $

16

Ground Lease Agreement) of the Property. The Ground Lease Agreement includes various covenants, indemnities, defaults, termination rights, and other provisions customary for lease transactions of this nature.

The Equity Purchase Agreement

The Company also entered into an Equity Purchase Agreement with Bryan Capital on November 1, 2021 (the “Equity Purchase Agreement”) pursuant to which the Company acquired for $

The Credit Agreement

In connection with the Purchase and Sale Agreement, iBio CDMO entered into a Credit Agreement, dated November 1, 2021, with Woodforest National Bank (Woodforest") (the “Credit Agreement”) pursuant to which Woodforest provided iBio CDMO a $

The Credit Agreement contains customary events of default (which are in some cases subject to certain exceptions, thresholds, notice requirements and grace periods), including, but not limited to, nonpayment of principal or interest, failure to perform or observe covenants, breaches of representations and warranties, cross-defaults with certain other indebtedness, certain bankruptcy-related events or proceedings, final monetary judgments or orders and certain change of control events. The covenants include a prohibition on the incurrence of Debt (as defined in the Credit Agreement) except permitted Debt (as defined in the Credit Agreement) and Liens (as defined in the Credit Agreement) and termination of the Ground Lease Agreement. In addition, the Company must maintain unrestricted cash of no less than $

The Company opened an irrevocable letter of credit in the amount of approximately $

The proceeds of the Term Loan were used (a) to fund a portion of the purchase price under the Purchase Agreement, and (b) to pay closing costs in connection with the Credit Agreement. The term loan is secured by (a) a leasehold deed of trust on the Facility, (b) a letter of credit issued by JPMorgan Chase Bank, and (c) a first lien on all assets of iBio CDMO including the Facility.

At December 31, 2021, the Term Loan of $

Security and Pledge Agreements, Guaranties and Deed of Trust

iBio CDMO also entered into a Security Agreement on November 1, 2021 with Woodforest (the “Security Agreement”) providing Woodforest a security interest in the following assets of iBio CDMO (subject to certain exclusions): all personal and fixture property of every kind and nature, including, without limitation, all goods (including, but not limited to, all equipment and any accessions thereto), all inventory, instruments (including promissory notes), documents, accounts, chattel paper (whether tangible or electronic), deposit accounts, securities accounts, letter-of-credit rights (whether or not the letter of credit is evidenced by a writing), money, commercial tort claims, securities and all other investment property, supporting obligations, contracts, contract rights, other rights to the payment of money, insurance claims and proceeds, software, fixtures, vehicles and rolling stock (whether or not subject to a certificate of title statute), leasehold improvements, general intangibles (including all payment intangibles), and all of iBio CDMO’s company and other business books, reports, memoranda, customer lists, credit files, data compilations, and computer software, in any form, including, without limitation, whether on tape, disk, card, strip, cartridge, or any other form, pertaining to any and all of the foregoing property, and all products and proceeds of the foregoing.

The Company also entered into a Guaranty for the benefit of Woodforest (the “Guaranty”) pursuant to which it guaranteed all of the obligations of iBio CDMO to Woodforest.

In addition, iBio CDMO entered into a Leasehold Deed of Trust, Assignment of Rents, Security Agreement and UCC Financing Statement for Fixture Filing (the “Deed of Trust”) with the trustee named therein and Woodforest as beneficiary, securing all of iBio CDMO’s obligations to Woodforest by a senior priority security interest in the Property.

17

The Company and iBio CDMO also entered into an Environmental Indemnity Agreement in favor of Woodforest (the “Environmental Indemnity Agreement”).

The Warrant

As part of the consideration for the purchase and sale of the rights set forth above, the Company issued to Bryan Capital a Warrant to purchase

RubrYc

On August 23, 2021, the Company entered into a series of agreements with RubrYc Therapeutics, Inc. (“RubrYc”) described in more detail below:

Collaboration and License Agreement

The Company entered into a collaboration and licensing agreement (the “RTX-003 License Agreement”) with RubrYc to further develop RubrYc’s immune-oncology antibodies in its RTX-003 campaign. Under the terms of the agreement, the Company is solely responsible for worldwide research and development activities for development of the RTX-003 antibodies for use in pharmaceutical products in all fields. Contingent upon receipt by RubrYc of funding of its Series A-2 preferred stock offering (see below), during the term of the RTX-003 License Agreement, RubrYc granted the Company an exclusive worldwide sublicensable royalty-bearing license under the patents controlled by RubrYc that cover the RTX-003 antibodies. The commercial license exclusively permits the Company to research, develop, make, have made, manufacture, use, distribute, sell, offer for sale, import, and export antibodies in RubrYc’s RTX-003. Under the terms and conditions of the RTX-003 License Agreement, the Company agreed to use commercially reasonable efforts to develop and commercialize RTX-003 antibodies. If the Company fails to achieve certain timing milestones for starting GMP manufacturing and dosing human patients under an IND, it could be required to make a payment to RubrYc on the date the milestone is missed and on each anniversary of such date until the milestone is achieved, provided that the milestone was missed due to its failure to exercise commercially reasonable efforts.

iBio Development Milestones are set forth below. | ||

· | Successful 1st run GMP manufacture first licensed product | |

· | 1st patient dosed under a licensed product | |

Under the terms of the RTX-003 License Agreement, RubrYc is eligible to receive from the Company up to an aggregate of $

· | 5th patient dosed in a Phase I clinical study; | ||

· | 5th patient dosed in a Phase II clinical study; | ||

· | 4th patient dosed in a Phase III clinical study (payable in cash or our stock, at our discretion) and | ||

· | First commercial sale (payable in cash or our stock, at our discretion). | ||

RubrYc will also be entitled to receive royalties in the mid-single digits on net sales of RTX-003 antibodies, subject to adjustment under certain circumstances. Royalties are payable on a country-by-country basis until the latest to occur of: (i) the last-to-expire of specified patent rights in such country; (ii) expiration of marketing or regulatory exclusivity in such country; or (iii) (10) years after the first commercial sale of a product in such country, provided that no biosimilar product has been approved in such country.

If either the Company or RubrYc materially breaches the RTX-003 License Agreement and does not cure such breach within

18

by a set time defined in the RTX-003 License Agreement, the Company may terminate the RTX-003 License Agreement upon written notice to RubrYc within (30) days of the end of such period. Effective upon such termination, among other things, RubrYc shall assign to us exclusive ownership of the RTX-003, including all relevant intellectual property rights.

Collaboration, Option and License Agreement

The Company entered into an agreement with RubrYc to collaborate for up to

iBio Development Milestones are set forth below. | ||

· | Successful 1st run GMP manufacture of the first Collaboration Product | |

· | Initiate IND enabling studies for such Collaboration Product | |

· | 1st patient dosed under such Collaboration Product | |

Under the terms of the Collaboration Agreement, RubrYc is eligible to receive from us up to an aggregate of $

● 5th patient dosed in a Phase I clinical study; |

● 5th patient dosed in a Phase II clinical study; |

● 4th patient dosed in a Phase III clinical study (payable in cash or our stock, at our discretion) and |

● First commercial sale (payable in cash or our stock, at our discretion). |

RubrYc will also be entitled to receive tiered royalties ranging from low- to mid-single digits on net sales of Collaboration Products, subject to adjustment under certain circumstances. Royalties are payable on a country-by-country and collaboration product-by-collaboration product basis until the latest to occur of: (i) the last-to-expire of specified patent rights in such country; (ii) expiration of marketing or regulatory exclusivity in such country; or (iii) (10) years after the first commercial sale of a product in such country, provided that no biosimilar product has been approved in such country.

If either the Company or RubrYc materially breaches the Collaboration Agreement and does not cure such breach within

In addition, if RubrYc is unable to complete a financing with proceeds of a certain agreed upon amount by a set time defined in the Collaboration Agreement, the Company may terminate the Collaboration Agreement upon written notice to RubrYc within (30) days of the end of such period. Effective upon such termination, among other things, RubrYc shall assign to the Company exclusive ownership of the Collaboration Hit Candidates (as defined in the Collaboration Agreement) that are in the then-current (un-terminated) discovery collaboration plans, including all relevant intellectual property rights.

In November 2021, the Company announced that the first new target is being optimized using RubrYc’s artificial intelligence discovery platform.

19

Stock Purchase Agreement

In connection with the entry into the Collaboration Agreement and RTX-003 License Agreement, the Company also entered into a Stock Purchase Agreement (“Stock Purchase Agreement”) with RubrYc whereby the Company purchased

The rights, preferences and privileges of the RubrYc Series A-2 Preferred Stock (“Series A-2 Preferred”) are set forth in the Third Amended and Restated Certificate of Incorporation of RubrYc Therapeutics, Inc. (the “Amended RubrYc COI”), and include a preferential eight percent (

The Investors’ Rights Agreement provides the holders of Senior Preferred Stock with, among things: (i) demand registration rights, under specified circumstances; (ii) piggyback registration rights in the event of a company registered offering; (iii) lock-up and market-standoff obligations following a registered underwritten public offering; (iv) preemptive rights on company offered securities; and (v) additional protective covenants that require the approval at least two of the three directors elected by the holders of the Senior Preferred Stock.

Pursuant to the Voting Agreement, certain RubrYc stockholders are contractually obligated to, among other things, vote for and maintain the authorized number of directors at five members, one of which the Company has the contractual right to elect subject to the conditions set forth above. Mr. Thomas Isett ("Isett"), our Chief Executive Officer and Chairperson, was appointed to the board of directors of RubrYc for which he receives no additional compensation from RubrYc.

The Company accounted for the agreements as an asset purchase and allocated the consideration to the various assets acquired. Total consideration was calculated to be $

The Company allocated the purchase price of $

Preferred stock | | $ | |

Intangible assets | | ||

Prepaid expenses | | | |

| $ | |

At September 30, 2021, the Company recorded a liability of $

20

6. Convertible Promissory Note Receivable

On October 1, 2020, the Company entered into a master services agreement with Safi Biosolutions, Inc. (“Safi”). In addition, the Company invested $

7. Investments in Debt and Equity Securities

Debt Securities

Investments in debt securities consist of AA and A rated corporate bonds bearing interest at rates from

December 31, | June 30, | |||||

2021 | 2021 | |||||

Adjusted cost | | $ | | $ | | |

Gross unrealized losses | | ( | ( | |||

Fair value | | $ | | $ | | |

The fair value of available-for-sale debt securities, by contractual maturity, as of September 30, 2021, was as follows (in thousands):

December 31, | June 30 | |||||

| 2021 | 2021 | ||||

2022 | | $ | $ | |||

2023 | ||||||

| $ | $ | ||||

Amortization of premiums paid on the debt securities amounted to $

Equity Security – at cost

As discussed above, the Company acquired Series A-2 Preferred shares of RubrYc valued at $

8. Finance Lease ROU Assets

As discussed above, the Company adopted ASC 842 effective July 1, 2019, using the modified retrospective approach for all leases entered into before the effective date.

From January 13, 2016, until November 1, 2021, iBio CDMO leased its facility (the “Facility”) in Bryan, Texas as well as certain equipment from College Station under a sublease (the "Sublease"). The Sublease was terminated on November 1, 2021, when iBio CDMO acquired the Facility and became the tenant under the ground lease for the property upon which the Facility is located.

The economic substance of the Sublease was that the Company is financing the acquisition of the Facility and equipment. As the Sublease involved real estate and equipment, the Company separated the equipment component and accounted for the Facility and equipment as if each were leased separately.

In addition, the Company also leases a mobile office trailer.

See Note 13 – Finance Lease Obligation for more details of the terms of the leases.

21

The following table summarizes by category the gross carrying value and accumulated amortization of finance lease ROU (in thousands):

| December 31, |

| June 30, | |||

2021 | 2021 | |||||

ROU - Facility | $ | | $ | | ||

ROU - Equipment |

| |

| | ||

| |

| | |||

Accumulated amortization |

| ( |

| ( | ||

Net finance lease ROU | $ | | $ | | ||

Amortization of finance lease ROU assets was approximately $

9. Operating Lease ROU Assets

On September 10, 2021, the Company entered into a lease for approximately

On November 1, 2021, as discussed above, iBio CDMO acquired the Facility and became the tenant under the ground lease for the property upon which the Facility is located. Based on the terms of the lease payments, the Company recorded an operating lease right-of-use asset of $

See Note 14 - Operating Lease Obligation for additional information.

The following table summarizes by category the net carrying values of operating lease ROU (in thousands):

| December 31, |

| June 30, | |||

2021 | 2021 | |||||

ROU - San Diego lease | $ | | $ | | ||

ROU - Texas Facility ground lease |

| |

| | ||

Net operating lease ROU | $ | | $ | | ||

10. Fixed Assets

The following table summarizes by category the gross carrying value and accumulated depreciation of fixed assets (in thousands):

| December 31, |

| June 30, | |||

2021 | 2021 | |||||

Facility and improvements | $ | | $ | | ||

Machinery and equipment |

| |

| | ||

Office equipment and software |

| |

| | ||

Construction in progress | | | ||||

| |

| | |||

Accumulated depreciation |

| ( |

| ( | ||

Net fixed assets | $ | | $ | | ||

As discussed above, on November 1, 2021, iBio CDMO acquired the Facility and medical equipment.

Depreciation expense was approximately $

22

11. Intangible Assets

The Company has two categories of intangible assets – intellectual property and patents. Intellectual property consists of all technology, know-how, data, and protocols for producing targeted proteins in plants and related to any products and product formulations for pharmaceutical uses and for other applications. Intellectual property includes, but is not limited to, certain technology for the development and manufacture of novel vaccines and therapeutics for humans and certain veterinary applications acquired in December 2003 from Fraunhofer USA Inc., acting through its Center for Molecular Biotechnology (“Fraunhofer”), pursuant to a Technology Transfer Agreement, as amended (the “TTA”). The Company designates such technology further developed and acquired from Fraunhofer as iBioLaunch(TM) or LicKM(TM) or FastPharming(R) technology. The value on the Company’s books attributed to patents owned or controlled by the Company is based only on payments for services and fees related to the protection of the Company’s patent portfolio. The intellectual property also includes certain trademarks.

On August 23, 2021, the Company entered into a series of agreements with RubrYc described in more detail above (see Note 5 – Significant Transactions) whereby in exchange for a $

In January 2014, the Company entered into a license agreement with the University of Pittsburgh whereby iBio acquired exclusive worldwide rights to certain issued and pending patents covering specific candidate products for the treatment of fibrosis (the "Licensed Technology") which license agreement was amended in August 2016 and again in December 2020. The license agreement provides for payment by the Company of a license issue fee, annual license maintenance fees, reimbursement of prior patent costs incurred by the university, payment of a milestone payment upon regulatory approval for sale of a first product, and annual royalties on product sales. In addition, the Company has agreed to meet certain diligence milestones related to product development benchmarks. As part of its commitment to the diligence milestones, the Company successfully commenced production of a plant-made peptide comprising the Licensed Technology before March 31, 2014. The next milestone – filing an Investigational New Drug Application with the FDA or foreign equivalent covering the Licensed Technology ("IND") – initially was required to be met by December 1, 2015, and on November 2, 2020, was extended to be required to be met by December 31, 2021. On February 3, 2022, the license agreement with University of Pittsburgh was further amended. The deadline for the next milestone was extended to December 31, 2023. In addition, the amounts of the annual license maintenance fee and payment upon completion of various regulatory milestones were amended.

The Company accounts for intangible assets at their historical cost and records amortization utilizing the straight-line method based upon their estimated useful lives. Patents are amortized over a period of

The following table summarizes by category the gross carrying value and accumulated amortization of intangible assets (in thousands):

|

| December 31, |

| June 30, | ||

2021 | 2021 | |||||

Intellectual property – gross carrying value | $ | | $ | | ||

Patents and licenses – gross carrying value |

| |

| | ||

| |

| | |||

Intellectual property – accumulated amortization |

| ( |

| ( | ||

Patents and licenses – accumulated amortization |

| ( |

| ( | ||

| ( |

| ( | |||

Net intangible assets | $ | | $ | | ||

Amortization expense was approximately $

23

12. Note Payable – PPP Loan

On April 16, 2020, the Company received $

On July 21, 2021, iBio was granted forgiveness in repaying the loan. In accordance with ASC 405-20-40, “Liabilities - Extinguishments of Liabilities – Derecognition”, the Company derecognized the liability and accrued interest in the first quarter of Fiscal 2022. At June 30, 2021, the Company owed $

13. Finance Lease Obligation

Sublease

As discussed above, until November 1, 2021, iBio CDMO leased the Facility as well as certain equipment from College Station under the Sublease.

The Sublease was terminated on November 1, 2021, when iBio CDMO acquired the Facility and became the tenant under the ground lease for the property upon which the Facility is located. See Note 14 for additional information related to the ground lease.

Prior terms of the Sublease which determined the accounting through October 31, 2021, included:

| ● | The |

| ● | In addition to the base rent, iBio CDMO was required to pay, for each calendar year during the term, a portion of the total gross sales for products manufactured or processed at the facility, equal to |

Accrued expenses at December 31, 2021, and June 30, 2021 due College Station amounted to $

Mobile Office Trailer

Commencing April 1, 2021, the Company is leasing a mobile office trailer at a monthly rental of $

24

The following tables present the components of lease expense and supplemental balance sheet information related to the finance lease obligation (in thousands).

| Three Months Ended | Three Months Ended | ||||

December 31, | December 31, | |||||

2021 | 2020 | |||||

Finance lease cost: |

|

|

| |||

Amortization of right-of-use assets | $ | | $ | | ||

Interest on lease liabilities |

| |

| | ||

CPI lease cost |

| |

| | ||

Total lease cost | $ | | $ | | ||

|

|

|

| |||

Other information: |

|

|

|

| ||

Cash paid for amounts included in the measurement lease liabilities: |

|

|

|

| ||

Operating cash flows from finance lease - CPI rent | $ | | $ | | ||

Financing cash flows from finance lease obligations | $ | | $ | | ||

| Six Months Ended | Six Months Ended | ||||

December 31, | December 31, | |||||

2021 | 2020 | |||||

Finance lease cost: |

|

|

| |||

Amortization of right-of-use assets | $ | | $ | | ||

Interest on lease liabilities |

| |

| | ||

CPI lease cost |

| |

| | ||

Total lease cost | $ | | $ | | ||

|

|

|

| |||

Other information: |

|

|

|

| ||

Cash paid for amounts included in the measurement lease liabilities: |

|

|

|

| ||

Operating cash flows from finance lease - CPI rent | $ | | $ | | ||

Financing cash flows from finance lease obligations | $ | | $ | | ||

December 31, | June 30, | |||||||

2021 | 2021 | |||||||

Finance lease right-of-use assets | $ | | $ | | ||||

Finance lease obligation - current portion | $ | | $ | | ||||

Finance lease obligation - noncurrent portion | $ | | $ | | ||||

Weighted average remaining lease term - finance lease |

| | years |

| years | |||

Weighted average discount rate - finance lease obligation |

| | % |

| | % | ||

Future minimum payments under the finance lease obligation are due as follows (in thousands):

Fiscal period ending on December 31: |

| Principal |

| Interest |

| Total | |||

2022 | $ | | $ | | $ | | |||

2023 | | | | ||||||

2024 |

| |

| |

| | |||

|

|

|

|

|

| ||||

Total minimum lease payments |

| | $ | | $ | | |||

Less: current portion |

| ( |

|

|

|

| |||

Long-term portion of minimum lease obligations | $ | |

|

|

|

| |||

25

14. Operating Lease Obligation

Texas Ground Lease

As discussed above, as part of the Transaction, iBio CDMO became the tenant under the Ground Lease Agreement for the Property until 2060 upon exercise of available extensions. The base rent payable under the Ground Lease Agreement, which was $

San Diego

On September 10, 2021, the Company entered into a lease for approximately

| ● | The length of term of the lease is |

| ● | The lease commencement date was estimated to be on or around January 1, 2022. |

| ● | The monthly rent for the first year of the lease is $ |

| ● | The lease provides for a base rent abatement for months through in the first year of the lease. |

| ● | The landlord is providing a tenant improvement allowance of $ |

| ● | The Company is responsible for other expenses such as electric, janitorial, etc. |

| ● | The Company opened an irrevocable letter of credit in the amount of $ |

As discussed above, the lease provides for scheduled increases in base rent and scheduled rent abatements. Rent expense is charged to operations using the straight-line method over the term of the lease which results in rent expense being charged to operations at inception of the lease in excess of required lease payments. This excess (formerly classified as deferred rent) is shown as a reduction of the operating lease right-of-use asset in the accompanying balance sheet. As the Company has already started making improvements to the facility, the rent expense will be recognized.

The following tables present the components of lease expense and supplemental balance sheet information related to the operating lease obligation (in thousands).

Three Months Ended | ||

December 31, | ||

2021 | ||

Operating lease cost: | $ | |

Total lease cost | $ | |

|

| |

Other information: |

|

|

Cash paid for amounts included in the measurement lease liability: |

|

|

Operating cash flows from operating lease | $ | |

Operating cash flows from operating lease obligation | $ | |

Six Months Ended | ||

December 31, | ||

2021 | ||

Operating lease cost: | $ | |

Total lease cost | $ | |

|

| |

Other information: |

|

|

Cash paid for amounts included in the measurement lease liability: |

|

|

Operating cash flows from operating lease | $ | |

Operating cash flows from operating lease obligation | $ | |

26

Future minimum payments under the operating lease obligation are due as follows (in thousands):

Fiscal period ending on December 31: |

| Principal |

| Imputed Interest |

| Total | |||

2022 | $ | | $ | | $ | | |||

2023 | | | | ||||||

2024 |

| |

| |

| | |||

2025 |

| |

| |

| | |||

2026 |

| |

| |

| | |||

Thereafter |

| |

| |

| | |||

|

|

|

|

|

| ||||

Total minimum lease payments |

| | $ | | $ | | |||

Less: current portion |

| ( |

|

|

|

| |||

Long-term portion of minimum lease obligation | $ | |

|

|

|

| |||

15. Stockholders’ Equity

Preferred Stock

The Company’s Board of Directors is authorized to issue, at any time, without further stockholder approval, up to

iBio CMO Preferred Tracking Stock

On February 23, 2017, the Company entered into an exchange agreement with Bryan Capital pursuant to which the Company acquired substantially all of the interest in iBio CDMO held by Bryan Capital and issued

On February 23, 2017, the Board of Directors of the Company created the Preferred Tracking Stock out of the Company’s

On November 1, 2021, iBio purchased the iBio CMO Preferred Tracking Stock held by Bryan Capital.

Series A Convertible Preferred Stock, par value $

On June 20, 2018, the Board of Directors of the Company created the Series A Preferred and Series B Preferred Stock and designated

On October 28, 2019, the Board of Directors of the Company created the Series C Preferred. On October 29, 2019, the Company issued

27

Common Stock

The number of authorized shares of Common Stock is

Recent issuances of Common Stock include the following:

Vesting of Restricted Stock Units “RSUs”

In December 2021, RSUs for

Exercise of Stock Options

In late September 2021, options for

Cantor Fitzgerald Underwriting

On November 25, 2020, the Company entered into a Controlled Equity OfferingSM Sales Agreement (the “Sales Agreement”) with Cantor Fitzgerald & Co. ("Cantor Fitzgerald") to sell shares of Common Stock, from time to time, through an “at the market offering” program having an aggregate offering price of up to $

On December 8, 2020, the Company entered into the Underwriting Agreement with Cantor Fitzgerald, pursuant to which the Company (i) agreed to issue and sell in an underwritten public offering (the “Offering”)

On January 11, 2021, the Company issued an additional

On February 24, 2021, Cantor Fitzgerald sold as sales agent pursuant to the Sales Agreement

On May 7, 2021, Cantor Fitzgerald sold as sales agent pursuant to the Sales Agreement

Warrants

The Company issued