UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM

For the fiscal year ended

or

For the transition period from to

Commission file number:

(Exact name of registrant as specified in its charter)

| (State or Other jurisdiction of Incorporation or Organization) | (I.R.S. Employer Identification Number) |

(Address, including zip code, of registrant’s principal executive offices)

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

Securities registered pursuant to Section 12(g) of the Act:

None

Indicate by check mark if the registrant is a

well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐

Indicate by check mark if the registrant is not

required to file reports pursuant to Section 13 or 15(d) of the Exchange Act. Yes ☐

Indicate by check mark whether the registrant

(1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the past 12 months

(or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements

for the past 90 days.

Indicate by check mark whether the registrant

has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§ 232.405

of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files).

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company (as defined in Rule 12b-2 of the Exchange Act):

| Large accelerated filer ☐ | Accelerated filer ☐ |

| Smaller reporting company | |

| Emerging Growth Company |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant

has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial

reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or

issued its audit report. Yes ☐ No

Indicate by check mark whether the financial statements

of the registrant included in the filing reflect the correction of an error to previously issued financial statements.

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate by check mark whether the registrant

is a shell company (as defined in Rule 12b-2 of the Exchange Act) Yes ☐

State the aggregate market value of voting and

non-voting common equity held by non-affiliates computed by reference to the price at which the common equity was last sold, or the average

bid and asked price of such common equity, as of the last business day of the registrant’s most recently completed second fiscal

quarter: $

As of February 15, 2024, there were shares of the registrant’s common stock outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

The registrant intends to file a definitive proxy statement pursuant to Regulation 14A within 120 days after the end of the fiscal year ended December 31, 2023. Portions of such proxy statement are incorporated by reference into Part III of this Form 10-K.

ATOMERA INCORPORATED

TABLE OF CONTENTS

| i |

NOTE REGARDING FORWARD-LOOKING STATEMENTS

This Annual Report on Form 10-K contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, or the Exchange Act, that are intended to be covered by the “safe harbor” created by those sections. The words “believe,” “may,” “will,” “potentially,” “estimate,” “continue,” “anticipate,” “intend,” “could,” “would,” “should,” “ongoing,” “project,” “plan,” “expect” and similar expressions that convey uncertainty of future events or outcomes are intended to identify forward-looking statements. These forward-looking statements include, but are not limited to, statements concerning the following:

| · | our future financial and operating results; | |

| · | our intentions, expectations and beliefs regarding anticipated growth, technology adoption, market penetration and trends in our business; | |

| · | the timing and success of our plan of commercialization; | |

| · | our ability to operate our license and royalty-based business model; | |

| · | the effects of market conditions on our stock price and operating results; | |

| · | our ability to have our technology solutions gain market acceptance; | |

| · | the effects of competition in our market and our ability to compete effectively; | |

| · | our ability to maintain, protect and enhance our intellectual property; | |

| · | costs associated with initiating and defending intellectual property infringement and other claims; | |

| · | our expectations concerning our relationships with customers, potential customers, partners and other third parties; | |

| · | the attraction and retention of qualified employees and key personnel; | |

| · | future acquisitions of or investments in complementary companies or technologies; and | |

| · | our ability to comply with evolving legal standards and regulations, particularly concerning requirements for being a public company. |

These forward-looking statements are subject to a number of risks, uncertainties and assumptions, including those described in “Risk Factors” and elsewhere in this Annual Report and our subsequently filed Quarterly Reports on Form 10-Q. Moreover, we operate in a very competitive and rapidly changing environment, and new risks emerge from time to time. It is not possible for us to predict all risks, nor can we assess the impact of all factors on our business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statements we may make. In light of these risks, uncertainties and assumptions, the forward-looking events and circumstances discussed in this Annual Report may not occur and actual results could differ materially and adversely from those anticipated or implied in our forward-looking statements.

You should not rely upon forward-looking statements as predictions of future events. Although we believe that the expectations reflected in our forward-looking statements are reasonable, we cannot guarantee that the future results, levels of activity, performance or events and circumstances described in the forward-looking statements will be achieved or occur. Moreover, neither we nor any other person assumes responsibility for the accuracy and completeness of the forward-looking statements. We undertake no obligation to update publicly any forward-looking statements for any reason after the date of this Annual Report to conform these statements to actual results or to changes in our expectations, except as required by law.

You should read this Annual Report and the documents that we reference in this Annual Report and have filed with the Securities and Exchange Commission as exhibits with the understanding that our actual future results, levels of activity, performance and events and circumstances may be materially different from what we expect.

| ii |

PART I

| Item 1. | Business |

Company Overview

We are engaged in the business of developing, commercializing and licensing proprietary processes and technologies for the $530+ billion semiconductor industry. Our lead technology, named Mears Silicon Technology™, or MST®, is a thin film of reengineered silicon, typically 100 to 300 angstroms (or approximately 20 to 60 silicon atomic unit cells) thick. MST can be applied as a transistor channel enhancement to CMOS-type transistors, the most widely used transistor type in the semiconductor industry. MST is our proprietary and patent-protected performance enhancement technology that we believe addresses a number of key engineering challenges facing the semiconductor industry. We believe that by incorporating MST, transistors can be made smaller, with increased speed, reliability and power efficiency. In addition, since MST is an additive and low-cost technology, we believe it can be deployed on an industrial scale, with machines commonly used in semiconductor manufacturing. We believe that MST can be widely incorporated into the most common types of semiconductor products, including analog, logic, optical and memory integrated circuits.

We do not intend to design or manufacture integrated circuits directly. Instead, we develop and license technologies and processes that we believe offer the designers and manufacturers of integrated circuits a low-cost solution to the industry’s need for greater performance and lower power consumption. Our customers and partners include:

| · | foundries, which manufacture integrated circuits on behalf of fabless manufacturers; | |

| · | integrated device manufacturers, or IDMs, which are the fully-integrated designers and manufacturers of integrated circuits; | |

| · | fabless semiconductor manufacturers, which are designers of integrated circuits that outsource the manufacturing of their chips to foundries; | |

| · | original equipment manufacturers, or OEMs, that manufacture the epitaxial, or epi, machines used to deposit semiconductor layers, such as the MST film, onto silicon wafers; and | |

| · | electronic design automation companies, which make tools used throughout the industry to simulate performance of semiconductor products using different materials, design structures and process technologies. |

Our principal business objective is to enter into commercial license agreements that enable our customers to manufacture and sell MST-enabled products, generating license revenues and ongoing royalties. We also license our MSTcad® software to customers, enabling them to simulate the effects of MST on their products using Synopsys, Inc.’s technology computer-aided design, or TCAD, software. In addition, we offer fee-based engineering services to customers evaluating MST. Our goal is that MSTcad licensing and engineering service arrangements will be tools that demonstrate the benefits of MST and will lead customers to enter into full commercial licenses. A “full commercial license” involves a three-stage approach consisting of:

| 1. | An integration license that provides our customer the right to use MST technology (with MST film deposited for the customer by Atomera) in the manufacture of silicon wafers for internal testing and sampling; | |

| 2. | A manufacturing license, granting our customer the rights to install MST on a tool in their fab and to manufacture MST-enabled products for internal use only; and | |

| 3. | A distribution license which grants the rights to manufacture and sell MST-enabled products to their customers. |

| 1 |

Depending on our customers’ business needs and how we initially engaged with them, we may make these license grants in one or more separate contracts. The upfront license fee becomes larger at each stage. Upon the grant of a distribution license our licensees would also be required to make royalty payments to us based on the number and sales price of MST-enabled products they sell to their customers.

Starting in 2019, we began to develop deeper relationships with several potential large-scale customers who were evaluating MST across multiple manufacturing processes and product lines. Accordingly, we have engaged with certain customers under joint development agreements, or JDAs. Our JDAs include development, technology transfer, manufacturing and licensing components.

To date, application of our MST technology has been for power devices, RFSOI devices and advanced CMOS integrated circuits. CMOS integrated circuits are the most widely used type of integrated circuits in the semiconductor industry. As applied to CMOS-type transistors, MST functions as a transistor channel enhancement. We believe MST has the potential to overcome the key challenges found in the implementation of next generation nano-scale semiconductor devices incorporating CMOS type transistors, namely enhancing drive current, reducing gate leakage and reducing variability. In addition, we believe that MST has the potential to deliver these benefits through a single technology that requires relatively minor modifications to the industry-standard CMOS manufacturing flow. Consequently, we believe that by incorporating MST, designers can make transistors with increased speed, reliability and energy efficiency, without significantly altering the current fabrication process or cost of production.

We were organized as a Delaware limited liability company under the name Nanovis LLC on November 26, 2001. On March 13, 2007, we converted to a Delaware corporation under the name Mears Technologies, Inc. On January 12, 2016, we changed our name to Atomera Incorporated. Shares of our common stock are listed on the NASDAQ Capital Market under the symbol “ATOM”.

Industry Overview

Semiconductors, Generally

Recent years have seen a remarkable proliferation of consumer and commercial products, especially in wireless, automotive and high-speed devices. Cloud computing and artificial intelligence technologies have provided people with new ways to create, store and share information. At the same time, the increasing use of electronics in cars, buildings, appliances and other consumer products is creating a broad landscape of “smart” devices such as wearable technologies and The Internet of Things. These trends in both enterprise and consumer applications are driving increasing demand for integrated circuits and systems with greater functionality and performance, reduced size, and much less power consumption as key requirements. The COVID-19 pandemic accelerated trends toward remote work, cloud computing and mobile devices. These trends coincided with the rollout of 5G cellular networks and associated devices, augmented and virtual reality technologies, cryptocurrencies, and especially artificial intelligence technology, all of which require high levels of processing power.

These developments depend, in large part, on integrated circuits, or microchips, which are sets of electronic circuits on a single chip of semiconductor material, normally silicon. It is common for a single semiconductor chip to combine many components (processor, communications, memory, custom logic, input/output) resulting in highly complex chip designs. Transistors are the building blocks of integrated circuits and the most complex semiconductor chips today contain more than a billion transistors, each of which may have features that are much less than 1/1,000th the diameter of a human hair.

The most widely used transistors in semiconductor chips today are based on CMOS technology. Among its many attributes, CMOS allows for a higher density of transistors on a chip and lower power usage than non-CMOS technologies.

| 2 |

The Pursuit of Increased Semiconductor Performance

For years, the semiconductor industry was able to almost double the number of transistors it could pack into a single microchip about every two years, a rate of improvement commonly known as “Moore’s Law.” The semiconductor industry uses the term “node” to describe the minimum line width or geometry on a semiconductor chip, expressed in nanometers, or nm, for today’s technologies. Historically, smaller nodes enable more densely packed designs that produced less costly products on a per-transistor basis. Frequently, smaller nodes also correspond to an improvement in chip performance, making them the mile markers of Moore’s Law, with each node marking a new generation of chip-manufacturing technology.

Until recently, the industry succeeded at maintaining the rate of improvement predicted by Moore’s Law by scaling the key transistor parameters, such as shrinking feature sizes and reducing operating voltages, thereby allowing more transistors to be packed onto a single microchip. This trend was facilitated in large part by the development of CMOS technologies. However, a discontinuity in the rate of improvement delivered by scaling appeared when transistor technology reached feature sizes below 100 nanometers. The industry responded with advanced materials to supplement the ongoing geometry shrinks. Some of those materials advances included strained silicon, Silicon-on-Insulator and High-K/Metal Gate. Semiconductor makers also attempted to obtain performance improvements through more exotic design architectures which frequently required material innovations to support their manufacturability and reliability.

The designers and manufacturers of integrated circuits and systems — our targeted customers — are facing intense pressure to deliver innovative products while constantly reducing their time-to-market and prices. In other words, innovation in chip and system design today often hinges on “better, sooner and cheaper.” We believe that the semiconductor industry has accepted that moving forward in the nano-era will require adoption of new innovations that extend the scaling formula, including those based on the use of new engineered materials, a market opportunity our MST technology seeks to address. Because shrinking geometries at the smaller nodes incurs higher capital and manufacturing costs, only a limited number of companies can afford to continue investing in those nodes. We believe these constraints will cause semiconductor designers and manufacturers to turn to engineered materials, like MST, to solve this problem.

Vertical Disaggregation of the Industry

In trying to keep research and development costs manageable, while attempting to satisfy the demand for increasingly complex semiconductors, certain designers and manufacturers of integrated circuits have transitioned to a more open innovation model in which competing companies and third-party providers actively collaborate to address performance issues through various alliances, joint ventures, and licensing of externally developed technology.

Historically, most semiconductor companies were vertically integrated. They designed, fabricated, packaged and tested their semiconductors using internally developed software design tools and manufacturing processes and equipment. As the cost and skills required for designing and manufacturing complex semiconductors have increased, the semiconductor industry has become disaggregated, with companies concentrating on one or more individual stages of the semiconductor development and production process. This disaggregation has fueled the growth of fabless semiconductor companies, design tool vendors, semiconductor equipment manufacturers, third-party semiconductor manufacturers (or foundries), semiconductor assembly, package and test companies, and intellectual property companies that develop and license technology to others.

While specialization has enabled greater development and manufacturing efficiency, it has also created an opportunity for licensing companies, such as Atomera, that develop and license technology to meet fundamental, industry-wide challenges. These intellectual property companies have been able to gain broad adoption of their technology throughout the industry by working with companies within the semiconductor supply chain to evaluate and integrate their technology. Manufacturers and designers of semiconductors increasingly find it more cost-effective to license technologies from IP-based companies than to develop processes internally that are not their core competence. We believe this collaboration and integration of externally-developed IP benefits semiconductor companies by enabling them to bring new technology to market faster and more cost-effectively.

| 3 |

Applications of Mears Silicon Technology

The initial applications of MST are for power devices, RFSOI devices and advanced CMOS integrated circuits. We offer MST-SP and MST-SPX, which are types of MST-enabled power devices that offer what we believe to be industry-leading on-resistance (also referred to as Rsp) and reduced footprint (enabling smaller devices). We believe that the MST-SP and MST-SPX devices will have immediate application in power management integrated circuits (or PMICs) which are pervasive in hand-held, battery-powered devices and elsewhere. We also believe that insertion of MST can provide higher current and improved control of dopants, leading to improved device scaling.

We believe MST has the potential to overcome the key challenges found in the implementation of next generation nano-scale semiconductor devices incorporating CMOS-type transistors, namely enhancing drive current, reducing gate leakage and reducing variability. In addition, we believe that MST has the potential to deliver these benefits through a single technology that requires relatively minor modifications to the industry standard CMOS manufacturing flow. Consequently, we believe that by incorporating MST, designers can make transistors with increased speed, reliability and energy efficiency, without significantly altering the current fabrication process or cost of production.

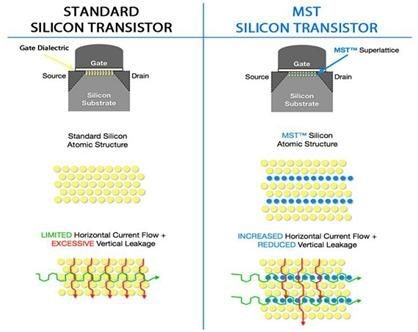

As illustrated by the accompanying diagram, MST is a “silicon-on-silicon” solution that provides multiple potential benefits through a relatively simple modification to the standard CMOS manufacturing flow. MST improvements are delivered through our proprietary and patent-protected approach that is based on the quantum mechanics of modern deep sub-micron devices. The MST film allows carriers (electrons and holes) to flow more freely in the plane of the transistor, thereby enhancing drive current, while reducing carrier flow or “leakage” in the transverse direction. Our MST film can also create more controlled doping profiles, which allow dopants to be held in the desired locations, thereby enabling optimized device designs, lower variability and improved production yield.

| 4 |

We believe the enhancements enabled by MST, as demonstrated in simulations and on our own and our customers’ test chips, are approximately equivalent to the enhancements enabled by one-half to a full node of improvement and, therefore, can extend the productive life of capital equipment and wafer fabrication facilities. The extent of MST-enabled enhancement depends on the device technology and application. We believe that MST compares favorably to other alternatives for enhancing performance of CMOS-type transistors as follows:

| · | Strained Silicon and Silicon-on-Insulator, or SOI: Unlike strained silicon or SOI, we believe that MST delivers multiple benefits in a single film in a cost-effective manner, including enhanced transistor drive current, reduced leakage, and reduced variability. Also, strained silicon tends to lose much of its effectiveness below 45nm, constraining its scalability, while our results to date indicate that the MST thin-film approach is scalable to the leading-edge nodes used for three-dimensional transistor devices using FinFET and “gate-all-around” structures. Based on our own research and development and third-party evaluations, we believe that MST can deliver improved cost-benefit performance, in most cases in an additive manner, compared to already successful strain technologies, such as dual stress liners and SiGe. Work with our foundry partners and fabless licensee shows potential for additive improvements on specialized SOI wafers used to manufacture radio frequency, or RF, devices, which are also referred to as RFSOI wafers. | |

| · | High-K/Metal Gate, or HKMG: Unlike HKMG, MST is silicon-based. As a “silicon-on-silicon” solution, MST does not require new materials or equipment, which in our opinion makes it much easier and less costly to adopt than HKMG for devices not requiring ultrathin gate dielectrics. For devices with HKMG, lab tests and simulations indicate that MST benefits transistor performance and variability in a similar manner to the benefits observed in non-HKMG devices. Testing conducted with our university research partners indicates that MST has the potential to provide additive performance benefits in devices using HKMG. |

Because of its physical characteristics in the channel region of the transistor, we believe MST has the further benefit of being complementary and additive to the performance-enhancing technologies noted above, making MST broadly applicable across multiple devices and process flows to meet a wide variety of customer design objectives. Given the costs of moving to more advanced technologies, we believe one of the most compelling aspects of MST is its cost/benefit profile. We believe that MST will provide a lower cost of production due to our technology’s potential to reduce die size while leveraging existing manufacturing tools, thereby providing chip makers with increased performance at all process nodes with significantly fewer disruptions to manufacturing processes and less incremental cost than other advanced technologies.

We believe MST can improve transistor performance in a variety of device types including microprocessors; logic products; analog, RF, and mixed-signal devices; as well as DRAM, SRAM, and other memory integrated circuits. We have therefore developed different MST product options that can be applied to the critical industry segments and technology nodes. As of the date of this Annual Report, we have done technology simulation work with universities and leading industry players at nodes from 180nm to 5nm. We have also simulated devices with leading industry research facilities and built and electrically verified test chips using MST in customer manufacturing facilities which have produced results that demonstrate many of the benefits described above.

Development Partnerships

Synopsys. Since 2017 we have worked in collaboration with Synopsys, Inc., a provider of the most broadly used TCAD simulation software in the semiconductor industry. As a result of our collaboration, Synopsys’ software now supports modeling of MST, which enables semiconductor manufacturers and designers to model the interaction of MST with other process steps. In December 2020, we announced availability of our MSTcad software which runs on Synopsys’ Sentaurus TCAD software and enables semiconductor engineers to simulate the benefits of integrating MST in a variety of devices. We continually refine our MSTcad software by calibrating our models against measured silicon results and we regularly release updates to that software. We believe these capabilities are helping us focus integration efforts for potential customers more quickly on those areas most likely to deliver benefits, thus shortening test cycles and, we believe, accelerating the time to a license decision. In the last three years, semiconductor fabs have generally been running at high capacity to keep up with industry supply shortages which has made it challenging for us to run wafers through our customers’ fabrication lines. MSTcad has been increasingly used by existing and potential customers to identify applications where MST can have the greatest benefit, without requiring access to customer fabs.

Epi Tool Lease. In August 2021 we entered into a five-year lease for an Applied Materials Centura epitaxial deposition reactor which handles both 200mm and 300mm wafers. We utilize this tool to perform deposition on both customer and internal R&D wafers. The terms of our tool lease include the lessor’s maintenance and support as well as access to a cleanroom with advanced cleaning and inspection tools.

| 5 |

MST Commercialization

We do not intend to design or manufacture integrated circuits directly. Instead, we develop and license technologies and processes that offer the designers and manufacturers of integrated circuits increased performance at a lower cost than currently available alternatives. Our customers and partners include foundries, integrated device manufacturers, or IDMs, fabless semiconductor manufacturers, OEMs that manufacture epitaxial deposition, or EPI, machines, and electronic design automation software companies, such as Synopsys.

Our business model is to enter into licensing arrangements whereby foundries and IDMs pay us a license fee for their use of MST technology in the manufacture of silicon wafers as well as a royalty for each silicon wafer (in the case of foundries) or device (in the case of IDMs) that they sell that incorporates MST. In the case of fabless semiconductor licensees, our strategy is to charge a royalty for each device they sell that incorporates our MST technology. The primary beneficiaries of our commercialization activities are the IDMs and fabless semiconductor manufacturers, as they produce and distribute integrated circuit devices which are enhanced when they incorporate MST technology. The foundries and OEMs also play an important role in our commercialization strategy because these parties traditionally seek to provide new and improved technologies to their customers – the fabless semiconductor manufacturers in the case of the foundries, and the IDMs and foundries in the case of the OEMs.

In the semiconductor industry, new technologies are vetted thoroughly and carefully by early adopters who are trying to achieve differentiation over competitors. After the early adopters prove the technology in production, it then tends to be broadly and relatively quickly adopted by “followers” who need to overcome their competitive disadvantage. Due to the cost and complexity of semiconductor manufacturing processes and the desire to maintain a stable and repeatable process flow, new technologies tend to be adopted broadly by the industry and, wherever possible, exploited for several generations until they are fully optimized and adoption costs are fully absorbed.

Although each customer or potential customer follows an evaluation and adoption model that is particular to its business model and product focus, our engagements generally consist of the following phases:

| 1. | Engineering Planning: In this phase we engage in a technical exchange of information under a non-disclosure agreement to understand the customer’s manufacturing process and to determine how best to integrate the deposition of MST film onto the customer’s semiconductor wafers. | |

| 2. | Set-up for MST Integration: We agree upon the technical evaluation details, including the expected rounds of evaluation testing, the parameters to be tested and allocation of costs. Customers provide us with wafers for our internal processing and physical characterization. Some customers work together with us to develop a TCAD model showing possible results of MST integration with their particular manufacturing process. | |

| 3. | MST Integration. Typically, this phase includes several rounds of tests that involve building test devices on a semiconductor wafer using our MST technology within the customer’s manufacturing process flow. In this phase, we perform the MST deposition on customer wafers, so wafers must be shipped back and forth between the customer and Atomera. We believe that this phase will continue to be the longest in our customer engagement process because integrating into a customer’s flow frequently requires us to conduct subsequent tests based on the result of earlier test runs. This phase also requires investment of time and resources by customers. In order to progress beyond this phase, we must demonstrate benefits at a commercially significant level. It is difficult for both customers and for Atomera to estimate the amount of time a customer will be in the integration phase. |

| 6 |

| 4. | Process Installation. Prior to enabling a customer to install and use MST technology on epitaxial deposition machines in their own fab, we require execution of a manufacturing license which grants rights limited to manufacturing MST-enabled products for internal R&D and qualification but does not give the customer the right to distribute or sell products that use MST. After installation of MST into the fab, the customer will continue development work to perfect the integration of MST technology into their transistor manufacturing process flow. Upon completion the customer will typically release a new Process Design Kit (PDK) which incorporates MST. Circuit designers will use the new PDK when developing new microchips for production. | |

| 5. | Technology qualification. The customer will conduct additional testing to ensure that the new products developed with the new PDK achieve manufacturing reliability under accelerated test conditions that simulate volume production. Upon successfully completing the qualification phase, products can be built and shipped using this manufacturing process. | |

| 6. | Production. Upon commencement of sales of wafers or devices built using MST, our customer will pay us a royalty that will be a percentage of the selling price of the wafer or device, depending on the type of customer. |

While the above steps describe a model customer engagement, we have engaged with some customers in ways that do not follow this precise order. JDAs are an example of an engagement format that may combine engineering service, development, manufacturing, process optimization and other joint activities that do not follow the order described above. In addition, we may from time to time enter into evaluation license agreements with certain customers under which they may install MST in their fabs to run internal tests only and not for commercial use or distribution. Other potential customers may run tests on wafers containing MST prior to further engagement with us to integrate MST into their manufacturing process.

We believe that our success is dependent upon the adoption of our MST technology through to commercial production by at least one IDM, foundry, or fabless semiconductor manufacturer. As of the date of this Annual Report, MST was in the integration phase (Phase Three as described above) on 14 different engagements and two engagements in Phase Four (process installation). Subject to process and subsequent product qualifications that demonstrate, in commercial scale production, the enhancements we believe our MST technology offers, including increased speed, reliability and energy efficiency, we expect that one or more of these companies will obtain licenses from us to take our MST technology to commercial production.

We are also working with OEMs on process development and equipment optimization to ensure that MST can be reliably and predictably deposited using their manufacturing tools. We have successfully deposited MST using tools made by each of the leading epitaxial deposition equipment suppliers and we believe that if we are successful in our commercialization efforts, these tool OEMs will promote the incorporation of our MST technology as an option to their standard offering. By doing so, we believe they will simultaneously stimulate additional sales of their capital equipment and encourage more customers to adopt MST.

Through our collaboration with Synopsys, we enable potential customers of MST to more quickly assess the potential benefits of MST to their semiconductor devices. By creating TCAD software models, we can work with manufacturers to assess which of their product types would most benefit from MST. We believe this modeling capability has shortened the time required for us to engage with new potential customers and should ultimately lead to a faster decision process by the customer regarding licensing MST.

We market our MST technology directly to the semiconductor industry through our significant industry contacts and relationships. We also sponsor academic research and participate in industry conferences and associations. In certain foreign jurisdictions, we engage sales representatives to assist us in establishing relationships with local customers.

| 7 |

Customers

In April 2023, we entered into a full commercial license agreement with STMicroelectronics, or ST, that authorizes ST to manufacture and distribute MST-enabled products to its customers. This agreement provides for payment of license fees payable upon reaching milestones consistent with our standard business model. Under an integration license agreement that we entered into with ST in 2018, we granted them an integration license pursuant to which they performed extensive evaluation of our MST technology. The April 2023 license agreement is based around two major milestones, namely the grant of a manufacturing license upon installation of MST in ST’s fab and qualification of an MST-enabled process. After process qualification is completed, ST will have the right to commercially distribute MST-enabled products and, assuming ST brings such products to market, we will receive royalties on all MST-enabled products manufactured for commercial purposes. This license agreement with ST is our first grant of commercial manufacturing and distribution rights and, assuming the successful installation of MST and related process qualification, would result in our first revenue from commercial use of MST-enabled products. In the fourth quarter of 2023, we completed the first major milestone under the ST license agreement by delivering our MST film recipe and ST accepting the film, resulting in our recognizing license revenue associated with that milestone. At that time, ST became our second customer to enter into Phase Four. We expect that ST will now proceed to completing process qualification with MST which would result in additional license fees for the distribution license upon completion of qualification, at which time ST would commence paying royalties on MST-enabled products they sell. There can be no assurance, however, that ST will complete their qualification and proceed to commercial sale of MST-enabled products.

In January 2021, we entered into a JDA with a leading semiconductor provider for integration of our MST technology into their manufacturing process. Under this JDA, we granted our customer a paid manufacturing license pursuant to which the customer installed the recipe for our MST film into a tool in their fab and was authorized to fabricate semiconductor wafers incorporating MST for internal use, resulting in this customer entering Phase Four. This JDA also included development milestones that we achieved in February 2022, resulting in additional revenue to us. Although this JDA does not confer commercial distribution rights, we believe that successful achievement of the JDA milestones is a significant step toward commercialization, as it should facilitate progress toward integrating MST into one or more of our customer’s multiple production lines and thus provide opportunities for additional license revenues and potential royalty streams. In April 2022, we entered into a JDA with a major semiconductor foundry which contains technical targets which, if achieved, should result in paid licenses and engineering services revenue. Although this JDA does not confer commercial distribution rights, we believe that achievement of the JDA’s technical objectives would be a significant step toward commercialization.

In September and October 2018, respectively, we entered into separate integration license agreements with Asahi Kasei Microdevices, or AKM, and ST, both of which are leading IDMs. In October 2019, we entered into an integration license agreement with a leading fabless RF semiconductor provider. In February 2022, we entered into an integration license agreement with a semiconductor foundry. Under the integration license agreements, these customers have paid us for the right to evaluate MST technology, which is integrated onto their semiconductor wafers. We deposit MST onto the customers’ wafers and the customer has the right under the license agreement to complete the manufacturing process, which enables them to evaluate our technology and to provide limited samples to their customers. AKM, our fabless licensee and our foundry licensee are in our Phase Three (MST Integration).

We intend that each of our integration license agreements and JDAs will result in full commercial licenses like our April 2023 agreement with ST which provides for substantially larger upfront license fee payments for grants of manufacturing and distribution rights than the integration licenses and will require royalty payments to us based on sales of MST-enabled products they sell to their customers. However, our ability to enter into royalty-based manufacturing and distribution agreements with licensees under our integration license agreements and JDAs will depend, in large part, on the performance of devices they build using MST and the successful integration of our MST technology on a high-volume production scale. There can be no assurance that our MST technology will deliver the performance, power, cost reduction or other requirements our customers seek for their products or that the integration of our technology with our customers’ manufacturing process will be successful in high volume. In addition, even if our MST technology meets our customers’ technical objectives one or more of our licensees may decide, for reasons unrelated to the price or performance of our MST technology, not to enter into manufacturing and distribution license agreements.

| 8 |

Competition

Our lead product, MST, is a proprietary and patent-protected performance enhancement technology that we believe addresses a number of key engineering challenges facing the semiconductor industry. Historically, development of a new material technology for the semiconductor industry has taken 10-20 years from conceptualization to volume production. Atomera’s MST technology has followed a similar trajectory, from early patents, publications and presentations to the industry to early evaluations and installation at customers.

We compete with IDMs, OEMs, foundries, fabless manufacturers of semiconductors and semiconductor IP licensing companies for the development and commercialization of technologies that improve the performance of semiconductors. Historically, when a new fabrication process proves to be a low-cost improvement to the standard fabrication process, and is additive, rather than in place of other performance technologies, it has been successfully adopted industry-wide. Good examples of such advances have been chemical mechanical polishing (or CMP), strained silicon and High-K/Metal-Gate. We believe that MST has the potential to be one of these low-cost additive technologies, in which case MST would not be subject to significant direct competition from other technologies. We are not aware of another technology being offered in the market which provides the same technical benefits as MST. Nevertheless, in some cases the engineering teams in our customers, who are developing their own process improvements, may view MST as competition to their internally-developed solutions.

Research and Development

The principal focus of our research and development efforts is on enabling existing and prospective customers to integrate MST into their manufacturing processes and enable them to commercialize MST-enabled semiconductor products. We also dedicate research and development resources to evolving and expanding our technology to address new process technologies in the semiconductor industry roadmap. Our research and development is conducted internally, but we work closely with third parties in the semiconductor industry to evaluate and qualify our technology for incorporation into semiconductor products and fabrication equipment. During the years ended December 31, 2023 and 2022, we incurred research and development expenses of approximately $12.5 million and $10.0 million, respectively.

We believe that our success depends in part on our ability to achieve the following in a cost-effective and timely manner:

| · | enable customers to integrate MST into their products; | |

| · | develop new technologies that meet the changing needs of the semiconductor industry; | |

| · | improve our existing technologies to enable growth into new application areas; and | |

| · | expand our intellectual property portfolio. |

Intellectual Property Rights

We regard the protection of our technologies and intellectual property rights as an important element of our business operations and crucial to our success. We rely primarily on a combination of patent laws, trade secret laws, confidentiality procedures, and contractual provisions to protect our proprietary technology. We require our employees, consultants, and advisors to enter into confidentiality agreements. These agreements provide that all confidential information developed or made known to the individual during the course of the individual’s relationship with us is to be kept confidential and not disclosed to third parties except under specific circumstances. In the case of our employees and consultants, the agreements provide that all of the technology that is conceived by the individual during the course of employment is our exclusive property. The development of our technology and many of our processes are dependent upon the knowledge, experience, and skills of key scientific and technical personnel.

| 9 |

As of December 31, 2023, we have been granted 103 patents in the U.S. and 113 abroad and we have 35 pending patent applications in the U.S. and 71 abroad. We believe our patents adequately block competitors from using our MST technology without our approval and our patent activity over the past five years has focused on extending the scope of our portfolio through a variety of means, including but not limited to patenting new structures, materials and methods uniquely enabled by MST technology. In addition, our MST film recipe is confidential know-how, which is only disclosed to customers who have been, at a minimum, a manufacturing licensee and who have executed the appropriate legal agreements. Unlike patents, know-how has no expiration and our film recipe is necessary in order to utilize MST technology. However, there can be no assurance that one or more of our patents would survive a legal challenge to their scope, validity, or enforceability, or provide significant protection for us. Protection of our film know-how depends on our licensee’s compliance with the terms of their contracts including non-disclosure provisions thereof. The failure of our patents, or the failure of trade secret laws, to adequately protect our technology, might make it easier for our competitors to offer similar products or technologies or for our potential customers to build products with methods and materials similar to MST without paying us a license fee. In addition, patents may not issue from any of our current or future applications.

We also hold registered trademarks in the United States for the marks “Atomera,” “MST” and “MSTcad” and in China for the mark “Mears”.

Employees and Human Capital Management

As of the date of this Annual Report, we employ 21 people on a full-time basis.

Our human capital resources objectives include, as applicable, identifying, recruiting, retaining, incentivizing and integrating our existing and new employees. The principal purposes of our equity incentive plans are to attract, retain and reward personnel through the granting of stock-based compensation awards that align their compensation with our business objectives and with creation of shareholder value.

Available Information

Our website is located at www.atomera.com. The information on or accessible through our website is not part of this Annual Report on Form 10-K. Copies of our Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K and amendments to these reports filed or furnished pursuant to Section 13(a) or 15(d) of the Exchange Act are available free of charge, on our investor relations website as soon as reasonably practicable after we file such material electronically with or furnish it to the Securities and Exchange Commission, or the SEC. A copy of this Annual Report on Form 10-K is also located at the SEC’s Public Reference Room at 100 F Street, NE, Washington, D.C. 20549. Information on the operation of the Public Reference Room can be obtained by calling the SEC at 1-800-SEC-0330. The SEC also maintains an internet site that contains reports and other information regarding our filings at www.sec.gov.

| Item 1A. | Risk Factors |

We are subject to various risks that may harm our business, prospects, financial condition and results of operation or prevent us from achieving our goals. If any of these risks occur, our business, financial condition or results of operation may be materially adversely affected. In such case, the trading price of our common stock could decline and investors could lose all or part of their investment.

| 10 |

Risks Related to Our Business

We have generated limited revenue to date, so it is difficult for potential investors to evaluate our business. To date, our operations have consisted of technology research and development, testing, and joint development work with customers, potential customers and strategic partners. Our business model is to derive our revenue primarily from license fees and royalties, but to date we have only recognized minimal revenues. Our limited operating history makes it difficult to evaluate the commercial value of our technology, the viability of our licensing model or our prospective operations. As an early-stage company, we are subject to all the risks inherent in the initial organization, financing, expenditures, complications and delays in a new business, including, without limitation:

| · | the timing and success of our plan of commercialization and the fact that we have entered into only one full commercial license with a customer, ST; | |

| · | our ability to replicate on a large commercial scale the benefits of our MST technology that we have demonstrated in preliminary testing; | |

| · | our ability to execute joint development agreements with potential customers; | |

| · | our ability to structure, negotiate and enforce license agreements that will allow us to operate profitably; | |

| · | our ability to advance our license agreement with ST through the qualification phase, complete the distribution license milestone with ST and earn the corresponding license fee and subsequently reach the phase in which ST ships royalty-bearing products, which is core to our business model; | |

| · | our ability to advance the licensing arrangements Asahi Kasei Microdevices, our foundry licensee and our RF licensee, to manufacturing and distribution licenses and to shipment of royalty-bearing products; | |

| · | our success in capitalizing on the achievement of the technical milestones in our first JDA in order to enter into one or more distribution and royalty agreements with business units of that JDA customer as well as our success in meeting technical milestones in the JDA with our second JDA customer; | |

| · | our ability to convert licensees of our MSTcad software to licenses of our MST technology under commercial license agreements and to successfully utilize MSTcad in both internal development and customer evaluations; | |

| · | our ability to protect our intellectual property rights; and | |

| · | our ability to raise additional capital as and when needed. |

Investors should evaluate an investment in us in light of the uncertainties encountered by developing companies in a competitive environment. There can be no assurance that our efforts will be successful or that we will ultimately be able to attain profitability.

| 11 |

We have a history of significant operating losses and anticipate continued operating losses for at least the near term. For the years ended December 31, 2023 and 2022, we have incurred net losses of approximately $19.8 million and $17.4 million, respectively, and our operations have used approximately $14.6 million and $12.5 million of cash, respectively. As of December 31, 2023, we had an accumulated deficit of approximately $203.1 million. We will continue to experience negative cash flows from operations until at least such time as we are able to secure manufacturing and distribution license agreements with one or more foundries, IDMs or fabless semiconductor manufacturers and such customers ship sufficient volumes of royalty-bearing products and pay upfront license fees to support our cash requirements. While management will endeavor to generate positive cash flows from the commercialization of our MST technology, there can be no assurance that we will be successful in doing so. If we are unable to generate positive cash flow within a reasonable period of time, we may be unable to further pursue our business plan or continue operations.

While we have entered into one commercial license agreement, four integration license agreements and two joint development agreements, there can be no assurance that any of these relationships will advance to further licensing stages or to royalty-based distribution license agreements. In September and October 2018, respectively, we entered into separate license agreements with AKM and ST, both of which are leading IDMs. In October 2019, we entered into a license agreement with a leading RF semiconductor supplier. In December 2021, we entered into a JDA with a leading semiconductor manufacturer. In February 2022, we entered into an integration license agreement with a semiconductor foundry. In April 2022 we entered into a JDA with a major semiconductor foundry. Our integration licensees have paid us licensing fees for the right to build products that integrate MST technology onto their semiconductor wafers, but the agreements do not grant the licensees the right to sell products incorporating MST. Such rights require our integration licensees to enter into additional license agreements that, if executed, would allow each licensee or their foundry to manufacture MST-enabled products and to sell them to their customers. Manufacturing and distribution agreements such as our license agreement with ST provide for substantially larger upfront license fee payments than integration license fees and such agreements require licensees to make royalty payments to us based the number and sales price of MST-enabled products they sell to their customers. Our first JDA customer paid us for a manufacturing license in the first quarter of 2021 when we delivered our MST recipe to them. In February 2022, we successfully achieved all the development milestones in the JDA resulting in additional revenue. Nevertheless, neither of our JDAs commits the customers to take MST to production. ST has successfully installed our MST film recipe and they have accepted our film under the license agreement, resulting in the grant of a manufacturing license to them for internal use, but they will now enter a qualification phase and there can be no assurance that our MST technology will deliver the performance, power or other requirements that ST or our other customers seek for their products or that the integration of our technology with our customers’ manufacturing process will be successful in high volume. In addition, even if our MST technology is successfully integrated into the licensees’ products, any or all of our licensees may decide, for reasons unrelated to the price or performance of our MST technology, not to enter the subsequent license phases or execute the additional license agreements required to take MST to commercial production.

We expect that our product qualification and licensing cycle will be lengthy and costly, and our marketing, engineering and sales efforts may be unsuccessful. We have incurred significant engineering, marketing and sales expenses during customer engagements without entering into license agreements, generating a license fee or establishing a royalty stream from the customer and we expect that such investments ahead of license revenue will continue to be necessary in the future. The introduction of any new process technology into semiconductor manufacturing is a lengthy process and we cannot forecast with any degree of assurance the length of time it takes to establish a new licensing relationship. However, based on our engagements with potential customers to date, we believe the time from initial engagement until our customers incorporate our technologies in their semiconductor products can take 18 to 36 months or longer. Our integration license agreements with our current licensees do not commit them to manufacturing or distribution licenses and we expect those licensees to perform additional tests on evaluation wafers under their respective integration licenses before deciding whether to enter the next stages of licensing MST. As such, we will incur additional expenses in our engagements with our licensees before we receive license fees, if any, for manufacturing and distribution and before any subsequent royalty stream begins. Although we have successfully completed the objectives of our first JDA and granted that customer a manufacturing license, the agreement does not commit our customer to a distribution license. While we believe our JDAs and our integration license agreements should accelerate licensing decisions by other customers, the evaluation process for new technologies in the semiconductor industry is inherently long and complex and there can be no assurance that we will successfully convert other customer prospects into paying customers or that any of these customers will generate sufficient revenue to cover our expenses.

| 12 |

Qualification of our MST technology requires access to our potential customers’ manufacturing tools and facilities, as well as to leased tools and facilities, which may not be available on a timely basis or at all. The qualification of a new process technology like MST entails the integration of our MST film into the complex manufacturing processes employed by our potential customers. In order to validate the benefits of MST, our customer engagement process involves fabrication of wafers that incorporate MST deposited by us using our epitaxial deposition tools and then completing the manufacturing of the wafers in our customers’ facilities using their tools. The semiconductor industry in 2023 exceeded $530 billion in sales, and over the past three years the industry has been characterized by product shortages as strong demand has outstripped supply, resulting in tight capacity among our potential customers. Although these supply/demand imbalances and tight capacity conditions have eased throughout 2023, we have experienced delays in completing the processing of evaluation wafers by our customers as those customers prioritize utilization of their equipment for production use. If our customers do not dedicate their equipment and facilities to testing our products in a timely fashion, we may experience delays that will increase our expenses and delay our customers’ decisions on entering into commercial licenses with us. Additionally, we conduct our ongoing research and development and portions of our customer evaluation activities using leased epitaxial (epi) deposition tools that we believe will accelerate internal development work and customer engagements. However, epi tools require ongoing, complex maintenance and they have been and will continue to be subject to both planned and unplanned downtime. Any interruption in our epi tool availability may negatively impact the progress of customer work as well as our internal research and development and accordingly could delay or prevent customers from entering into commercial licenses.

The long-term success of our business is dependent on a royalty-based business model, which is inherently risky. The long-term success of our business is dependent on future royalties paid to us by licensee-customers, whose business requires them to market products to their end customers. Royalty payments under our licenses are generally expected to be based on a percentage (i) in the case of foundries, the selling price of wafers made using MST and (ii) in the case of IDMs and fabless vendors, the selling price of MST-enabled semiconductor die sold. We will depend upon our ability to structure, negotiate and enforce agreements for the determination and payment of royalties, as well as upon our licensees’ compliance with their agreements. We face risks inherent in a royalty-based business model, many of which are outside of our control, such as the following:

| · | the rate of adoption and incorporation of our technology by semiconductor designers and manufacturers and the manufacturers of semiconductor fabrication equipment; | |

| · | customers’ willingness to agree to an ongoing royalty model, which may impact their wafer or chip costs and margins; | |

| · | our licensee customers’ ability to successfully market MST-enabled products to their end customers; | |

| · | the length of the design cycle and the ability to successfully integrate our MST technology into integrated circuits; | |

| · | the demand for products incorporating semiconductors that use our licensed technology; | |

| · | the cyclicality of supply and demand for products using our licensed technology; | |

| · | the impact of economic downturns; and | |

| · | the timing of receipt of royalty reports and the applicable revenue recognition criteria, which may result in fluctuation in our results of operations. |

| 13 |

We may need additional financing to execute our business plan and fund operations, which additional financing may not be available on reasonable terms or at all. As of December 31, 2023, we had total assets of approximately $24.0 million, cash, cash-equivalents and short-term investments of approximately $19.5 million and working capital of approximately $16.6 million. We believe that we have sufficient capital to fund our current business plans and obligations over, at least, the 12 months following the date of this Annual Report. However, even after installation of MST in a customer’s fab under a manufacturing license, the full production qualification of a new technology like MST can take more than an additional year, and we have limited ability to influence our customers’ testing and qualification processes. Accordingly, we may require additional capital prior to obtaining a royalty-based license or prior to such a license generating sufficient royalty income to cover our ongoing operating expenses. In the event we require additional capital over and above the amount of our presently available working capital, we will endeavor to seek additional funds through various financing sources, including the sale of our equity and debt securities, licensing fees for our technology and joint ventures with industry partners. In addition, we will consider alternatives to our current business plan that may enable us to achieve material revenue with a smaller amount of capital. However, there can be no guarantees that such funds will be available on commercially reasonable terms, if at all. If such financing is not available on satisfactory terms, we may be unable to further pursue our business plan and we may be unable to continue operations.

Unfavorable geopolitical and macroeconomic developments could adversely affect our business, financial condition or results of operations. Our business could be adversely affected by conditions in the U.S. and global economies, the United States and global financial markets and adverse geopolitical and macroeconomic developments, including inflation rates, the COVID-19 pandemic, the Ukrainian/Russian and Israeli/Palestinian conflicts and related sanctions, bank failures, and economic uncertainties related to these conditions.

For example, increased inflation may result in increases in our operating costs (including our labor costs), reduced liquidity and limits on our ability to access credit or otherwise raise capital on acceptable terms, if at all. In response to rising inflation, the U.S. Federal Reserve has raised interest rates, which, coupled with reduced government spending and volatility in financial markets, may have the effect of further increasing economic uncertainty and heightening these risks.

Additionally, financial markets around the world experienced volatility following the invasion of Ukraine by Russia in February 2022 and the eruption of the Israeli/Palestinian conflict in October 2023, including as a result of economic sanctions and export controls against Russia and countermeasures taken by Russia. The full economic and social impact of these sanctions and countermeasures, in addition to the ongoing military conflicts in Ukraine and Gaza, which could conceivably expand, remains uncertain; however, both the conflicts and related sanctions have resulted and could continue to result in disruptions to trade, commerce, pricing stability, credit availability, and/or supply chain continuity, in both Europe and globally, and has introduced significant uncertainty into global markets. While we do not currently operate in Russia, Ukraine or the Middle East, as the adverse effects of these conflicts continue to develop our business and results of operations may be adversely affected.

Recent efforts to create national self-sufficiency of the semiconductor supply chain by various countries around the world creates new competitive and economic dynamics that are difficult to predict and may lead to semiconductor industry instability. Increased restrictions on the availability and use of critical semiconductor IP and equipment by various foreign entities may limit Atomera’s ability to license our IP in some parts of the world.

Our internal computer systems, or those of our collaborators or other contractors or consultants, may fail or suffer security breaches, which could result in a material disruption of our development programs. Our internal computer systems and those of our current and any future collaborators and other contractors or consultants are vulnerable to damage from computer viruses, unauthorized access, natural disasters, terrorism, war and telecommunication and electrical failures. While we have not experienced any such material system failure, accident or security breach to date, if such an event were to occur and cause interruptions in our operations, it could result in a disruption of our development programs and our business operations, whether due to a loss of our or our customers’ trade secrets or other proprietary information or other similar disruptions. To the extent that any disruption or security breach were to result in a loss of, or damage to, our data or applications, or inappropriate disclosure of confidential or proprietary information, we could incur liability, our competitive position could be harmed and the further development and commercialization of our technology could be delayed.

| 14 |

We could be subject to risks caused by misappropriation, misuse, leakage, falsification or intentional or accidental release or loss of information maintained in the information systems and networks of our company and our vendors, including personal or confidential information of our employees, customers and vendors. In addition, outside parties may attempt to penetrate our systems or those of our customers or vendors or fraudulently induce our personnel or the personnel of our customers or vendors to disclose sensitive information in order to gain access to our data and/or systems. We may experience threats to our data and systems, including malicious codes and viruses, phishing and other cyberattacks. The number and complexity of these threats continue to increase over time. If a material breach of, or accidental or intentional loss of data from, our information technology systems or those of our customers or vendors occurs, the market perception of the effectiveness of our security measures could be harmed and our reputation and credibility could be damaged. We could be required to expend significant amounts of money and other resources to repair or replace information systems or networks. In addition, we could be subject to regulatory actions and/or claims made by individuals and groups in private litigation involving privacy issues related to data collection and use practices and other data privacy laws and regulations, including claims for misuse or inappropriate disclosure of data, as well as unfair or deceptive practices.

Although we develop and maintain systems and controls designed to prevent these events from occurring, and we have a process to identify and mitigate threats, the development and maintenance of these systems, controls and processes is costly and requires ongoing monitoring and updating as technologies change and efforts to overcome security measures become increasingly sophisticated. Moreover, despite our efforts, the possibility of these events occurring cannot be eliminated entirely. As we outsource more of our information systems to vendors, engage in more electronic transactions with customers and vendors, and rely more on cloud-based information systems, the related security risks will increase and we will need to expend additional resources to protect our technology and information systems. In addition, there can be no assurance that our internal information technology systems or those of our third-party contractors, or our consultants’ efforts to implement adequate security and control measures, will be sufficient to protect us against breakdowns, service disruption, data deterioration or loss in the event of a system malfunction, or prevent data from being stolen or corrupted in the event of a cyberattack, security breach, industrial espionage attacks or insider threat attacks which could result in financial, legal, business or reputational harm.

Our revenues may be concentrated in a few customers and if we lose any of these customers, or these customers do not pay us, our revenues could be materially adversely affected. If we are able to secure the adoption of our MST by one or more foundries, IDMs or fabless semiconductor manufacturers, we expect that for at least the first few years substantially all of our revenue will be generated from license fees and engineering services before customers commence royalty-bearing shipments. Due to the concentration and ongoing consolidation within the semiconductor industry, we may also find that over the longer term our royalty-based revenues are dependent on a relatively few customers. If we lose any of these customers, or these customers do not pay us, our revenues could be materially adversely affected.

If we are unable to manage future expansion effectively, our business, operations and financial condition may suffer significantly, resulting in decreased productivity. If our MST proves to be commercially valuable, it is likely that we will experience a rapid growth phase that could place a significant strain on our managerial, administrative, technical, operational and financial resources. Our organization, procedures and management may not be adequate to fully support the expansion of our operations or the efficient execution of our business strategy. If we are unable to manage future expansion effectively, our business, operations and financial condition may suffer significantly, resulting in decreased productivity.

It may be difficult for us to verify royalty amounts owed to us under our licensing agreements, and this may cause us to lose revenues. We will endeavor to provide that the terms of our license agreements require our licensees to document their use of our technology and report related data to us on a regular basis. We will endeavor to provide that the terms of our license agreements give us the right to audit books and records of our licensees to verify this information, however audits can be expensive, time consuming, and may not be cost justified based on our understanding of our licensees’ businesses. We will endeavor to audit certain licensees to review the accuracy of the information contained in their royalty reports in an effort to decrease the likelihood that we will not receive the royalty revenues to which we are entitled under the terms of our license agreements, but we cannot give assurances that such audits will be effective to that end.

| 15 |

Our business operations could suffer in the event of information technology systems’ failures or security breaches. While we believe that we have implemented adequate security measures within our internal information technology and networking systems, our information technology systems may be subject to security breaches, damages from computer viruses, natural disasters, terrorism, and telecommunication failures. Any system failure or security breach could cause interruptions in our operations, including but not limited to our technology computer-aided design, or TCAD, modeling using Synopsys software, in addition to the possibility of losing proprietary information and trade secrets. To the extent that any disruption or security breach results in inappropriate disclosure of our confidential information, our competitive position may be adversely affected, and we may incur liability or additional costs to remedy the damages caused by these disruptions or security breaches.

If integrated circuits incorporating our technologies are used in defective products, we may be subject to product liability or other claims. If our MST technology is used in defective or malfunctioning products, we could be sued for damages, especially if the defect or malfunction causes physical harm to people. While we will endeavor to carry product liability insurance, contractually limit our liability and obtain indemnities from our customers, there can be no assurance that we will be able to obtain insurance at satisfactory rates or in adequate amounts or that any insurance and customer indemnities will be adequate to defend against or satisfy any claims made against us. The costs associated with legal proceedings are typically high, relatively unpredictable and not completely within our control. Even if we consider any such claim to be without merit, significant contingencies may exist, similar to those summarized in the above risk factor concerning intellectual property litigation, which could lead us to settle the claim rather than incur the cost of defense and the possibility of an adverse judgment. Product liability claims in the future, regardless of their ultimate outcome, could have a material adverse effect on our business, financial condition and reputation, and on our ability to attract and retain licensees and customers.

Effective as of January 31, 2024, we lost access to certain semiconductor manufacturing and engineering services which may be difficult and/or costly to replace. From April 2016 through January 2024, we worked with TSI Technology Development & Commercialization Services LLC, or TSI under a Master R&D Services Agreement and a Manufacturing Agreement. Under these agreements, TSI provided us with foundry services, consisting of engineering and manufacturing services. In August 2023, TSI was acquired by Robert Bosch Semiconductor LLC, or Bosch. In October 2023, Bosch advised us that on January 31, 2024 it would cease providing engineering and manufacturing services to third parties, including Atomera, in order to commence the conversion of the TSI fab to production of Silicon Carbide semiconductor products, As of the date of this Annual Report we are no longer working with TSI. We are in active discussions with potential replacement providers of foundry services. However, there are few foundries that offer R&D services that are comparable to those provided by TSI, so we may face difficulty in replacing the services that TSI had provided. We have utilized TSI’s services for a portion of our internal R&D which required complete semiconductor device fabrication. No wafers sold or licensed to any customer have been fabricated at TSI. Accordingly, we do not believe that the loss of TSI’s services will have a meaningful impact on any of our ongoing client engagements. However, our access to foundry services was interrupted while we were working to reach an agreement with a replacement foundry and adapt our R&D processes to those used at our replacement foundry. This transition may cause us to incur meaningful startup costs, may divert engineering resources from ongoing R&D activities and may increase our ongoing spending on outsourced engineering services. The potential inability to replace the TSI services in a timely manner may have a material adverse effect on the timing and cost of continuing to develop example applications and devices which exhibit the advantages of our MST technology.

| 16 |

Risks Related to Intellectual Property