UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934 (Amendment No. _____)

Filed by a Party other than the Registrant o

Check the appropriate box:

o

Preliminary Proxy Statement

o

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

x

Definitive Proxy Statement

o

Definitive Additional Materials

o

Soliciting Material Under Rule 14a-12

Malvern Federal Bancorp, Inc.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than Registrant)

Payment of Filing Fee (Check the appropriate box):

x

No fee required.

o

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

(1)

Title of each class of securities to which transaction applies:

(2)

Aggregate number of securities to which transaction applies:

(3)

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

(4)

Proposed maximum aggregate value of transaction:

(5)

Total fee paid:

o

Fee paid previously with preliminary materials.

o

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the form or schedule and the date of its filing.

(1)

Amount previously paid:

(2)

Form, schedule or registration statement no.:

(3)

Filing party:

(4)

Date filed:

(A NEW PENNSYLVANIA CORPORATION)

AND

PROXY STATEMENT OF MALVERN FEDERAL BANCORP, INC.

(A FEDERAL CORPORATION)

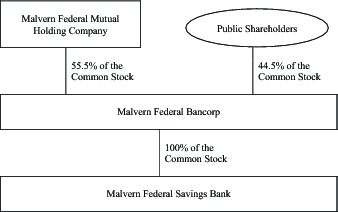

Federal Mutual Holding Company. Malvern Federal Mutual Holding Company, which owns 55.5% of the outstanding common stock of Malvern Federal Bancorp, intends to vote for the plan of conversion and reorganization. Malvern Federal Bancorp is holding a special meeting of shareholders at the Sheraton Great Valley Hotel, located at 707 East Lancaster Avenue, Frazer, Pennsylvania, on Tuesday, October 2, 2012 at 1:00 p.m., Eastern time, to consider and vote upon:

• |

2A—Approval of a provision in the articles of incorporation of Malvern Bancorp—New providing for the authorized capital stock of 50,000,000 shares of common stock and 10,000,000 shares of serial preferred stock compared to 15,000,000 shares of common stock and 5,000,000 shares of preferred stock in the charter of Malvern Federal Bancorp; |

• |

2B—Approval of a provision in the articles of incorporation of Malvern Bancorp—New requiring a super-majority shareholder approval for mergers, consolidations and similar transactions, unless they have been approved in advance by at least two-thirds of the board of directors of Malvern Bancorp—New; |

• |

2C—Approval of a provision in the articles of incorporation of Malvern Bancorp—New requiring a super-majority shareholder approval of amendments to certain provisions in the articles of incorporation and bylaws of Malvern Bancorp—New; and |

• |

2D—Approval of a provision in the articles of incorporation of Malvern Bancorp—New to limit the acquisition of shares in excess of 10% of the outstanding voting securities of Malvern Bancorp—New. |

42 East Lancaster Avenue

Paoli, Pennsylvania 19301

Attention: Investor Relations

(610) 644-9400

| Page | ||||||

|---|---|---|---|---|---|---|

Questions and

Answers for Shareholders of Malvern Federal Bancorp |

1 | |||||

Summary

|

4 | |||||

Risk Factors

|

18 | |||||

Information

About the Special Meeting of Shareholders |

26 | |||||

Proposal 1.

Approval of the Plan of Conversion and Reorganization |

28 | |||||

Proposal 2.

Informational Proposals Related to the Articles of Incorporation of Malvern Bancorp—New |

33 | |||||

Informational

Proposal 2A |

33 | |||||

Informational

Proposal 2B |

33 | |||||

Informational

Proposal 2C |

34 | |||||

Informational

Proposal 2D |

35 | |||||

Proposal 3.

Adjournment of the Special Meeting |

36 | |||||

Selected

Consolidated Financial and Other Data |

37 | |||||

Recent

Developments of Malvern Federal Bancorp |

39 | |||||

Forward-Looking Statements |

51 | |||||

Use of

Proceeds |

52 | |||||

Our Dividend

Policy |

53 | |||||

Market for

Our Common Stock |

54 | |||||

Regulatory

Capital Requirements |

55 | |||||

Our

Capitalization |

56 | |||||

Pro Forma

Data |

57 | |||||

Management’s Discussion and Analysis of Financial Condition and Results of Operations |

60 | |||||

Business

|

81 | |||||

Regulation

|

109 | |||||

Taxation

|

119 | |||||

Management

|

121 | |||||

Beneficial

Ownership of Common Stock |

127 | |||||

Proposed

Management Purchases |

129 | |||||

Interests of

Certain Persons in Matters to be Acted Upon |

130 | |||||

The

Conversion and Offering |

131 | |||||

Comparison of

Shareholder’ Rights |

156 | |||||

Restrictions

on Acquisition of Malvern Bancorp—New and Malvern Federal Savings Bank and Related Anti-Takeover Provisions |

164 | |||||

Description

of Our Capital Stock |

167 | |||||

Experts

|

168 | |||||

Transfer

Agent, Exchange Agent and Registrar |

168 | |||||

Legal and Tax

Opinions |

168 | |||||

Registration

Requirements |

168 | |||||

Where You Can

Find Additional Information |

168 | |||||

Shareholder

Proposals for the 2013 Annual Meeting |

169 | |||||

Index to

Consolidated Financial Statements |

F-1 | |||||

42 East Lancaster Avenue

Paoli, Pennsylvania 19301

(610) 644-9400

NOTICE OF SPECIAL MEETING OF SHAREHOLDERS

To Be Held on October 2, 2012

• |

2A—Approval of a provision in the articles of incorporation of Malvern Bancorp—New providing for the authorized capital stock of 50,000,000 shares of common stock and 10,000,000 shares of serial preferred stock compared to 15,000,000 shares of common stock and 5,000,000 shares of preferred stock in the charter of Malvern Federal Bancorp; |

• |

2B—Approval of a provision in the articles of incorporation of Malvern Bancorp—New requiring a super-majority shareholder approval for mergers, consolidations and similar transactions, unless they have been approved in advance by at least two-thirds of the board of directors of Malvern Bancorp—New; |

• |

2C—Approval of a provision in the articles of incorporation of Malvern Bancorp—New requiring a super-majority shareholder approval of amendments to certain provisions in the articles of incorporation and bylaws of Malvern Bancorp—New; and |

• |

2D—Approval of a provision in the articles of incorporation of Malvern Bancorp—New to limit the acquisition of shares in excess of 10% of the outstanding voting securities of Malvern Bancorp—New; |

Corporate Secretary

August 10, 2012

Q. |

What are shareholders being asked to approve? |

Q. |

What is the conversion? |

Q. |

What will shareholders receive for their existing Malvern Federal Bancorp shares? |

example, if you own 100 shares of Malvern Federal Bancorp common stock and the exchange ratio is 0.8127, after the conversion you will receive 81 shares of Malvern Bancorp—New common stock and $0.27 in cash, the value of the fractional share, based on the $10.00 per share offering price. Shareholders who hold shares in street-name at a brokerage firm will receive these funds in their brokerage account. Shareholders who have stock certificates will receive checks. The number of shares you will get will depend on the number of shares sold in the offering and will be based on an exchange ratio determined as of the closing of the conversion. The actual number of shares you receive will depend upon the number of shares we sell in our offering, which in turn will depend upon the final appraised value of Malvern Bancorp—New. The exchange ratio will adjust based on the number of shares sold in the offering. It will not depend on the market price of the common stock Malvern Federal Bancorp.

Q. |

What are the reasons for the conversion and offering? |

• |

In light of the risk profile posed by, among other factors, the increased levels of our non-performing assets in recent years and also based in part upon our communications with staff of the Office of the Comptroller of the Currency, we determined to increase the amount of capital we maintain at Malvern Federal Savings Bank. The additional funds raised in the offering will increase our capital (although Malvern Federal Savings Bank is deemed to be “well-capitalized”) and support our ability to operate in accordance with our business plan in the future. |

• |

Conversion to the fully public form of ownership will remove the uncertainties associated with the mutual holding company structure. We believe that the conversion and offering will result in a more familiar and flexible form of corporate organization and will better position us to continue to meet all current and future regulatory requirements, including regulatory capital requirements which may be imposed on savings and loan holding companies such as Malvern Bancorp—New, and, in light of the portion of the net proceeds of the offering to be retained by the new stock-form holding company, will facilitate the ability of Malvern Bancorp—New to serve as a source of strength for Malvern Federal Savings Bank. |

• |

The number of our outstanding shares after the conversion and offering will be greater than the number of shares currently held by public shareholders, so we expect our stock to have greater liquidity. |

Q. |

Why should I vote? |

Q. |

What happens if I don’t vote? |

Q. |

How do I vote? |

Q. |

If my shares are held in street name, will my broker automatically vote on my behalf? |

Q. |

What if I do not give voting instructions to my broker? |

Q. |

How will my existing Malvern Federal Bancorp shares be exchanged? |

Q. |

Should I submit my stock certificates now? |

Q. |

May I place an order to purchase shares in the offering, in addition to the shares that I will receive in the exchange? |

• |

2A—Approval of a provision in the articles of incorporation of Malvern Bancorp—New providing for the authorized capital stock of 50,000,000 shares of common stock and 10,000,000 shares of serial preferred stock compared to 15,000,000 shares of common stock and 5,000,000 shares of preferred stock in the charter of Malvern Federal Bancorp; |

• |

2B—Approval of a provision in the articles of incorporation of Malvern Bancorp—New requiring a super-majority shareholder approval for mergers, consolidations and similar transactions, unless they have been approved in advance by at least two-thirds of the board of directors of Malvern Bancorp—New; |

• |

2C—Approval of a provision in the articles of incorporation of Malvern Bancorp—New requiring a super-majority shareholder approval of amendments to certain provisions in the articles of incorporation and bylaws of Malvern Bancorp—New; and |

• |

2D—Approval of a provision in the articles of incorporation of Malvern Bancorp—New to limit the acquisition of shares in excess of 10% of the outstanding voting securities of Malvern Bancorp—New; |

2012, our commercial real estate loans amounted to $122.1 million, or 25.8% of our total loans, our total home equity loans and lines of credit amounted to $92.9 million, or 19.7% of our loan portfolio and our total construction and development loans amounted to $22.5 million, or 4.7% of our total loan portfolio.

• |

prohibit us from making or acquiring any new commercial real estate loans and/or commercial and industrial loans without the prior written non-objection of the Office of the Comptroller of the Currency (the “OCC”) (as successor to the Office of Thrift Supervision); |

• |

required us to develop a plan to reduce our problem assets; |

• |

required us to develop enhanced policies and procedures for identifying, monitoring and controlling the risks associated with concentrations of commercial real estate loans; |

• |

required that an independent third party undertake reviews of our commercial real estate loans, construction and development loans, multi-family residential mortgage loans and commercial loans not less than once every six months; and |

• |

prohibit Malvern Federal Bancorp from declaring or paying dividends or making any other capital distributions, such as repurchases of common stock, without the prior written approval of the Board of Governors of the Federal Reserve System (as successor to the Office of Thrift Supervision). |

Holding Company is owning more than a majority of the outstanding shares of common stock of Malvern Federal Bancorp. Malvern Federal Mutual Holding Company currently owns 3,383,875 shares of common stock of Malvern Federal Bancorp, which is 55.5% of the shares outstanding. Malvern Federal Mutual Holding Company will no longer exist upon completion of the conversion and offering and the shares of Malvern Federal Bancorp common stock that it holds will be canceled.

| Shares to be sold in the offering |

Shares of Malvern Bancorp—New stock to be issued in exchange for Malvern Federal Bancorp common stock |

|||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Amount |

Percent |

Amount |

Percent |

Total shares of Malvern Bancorp—New common stock to be outstanding after the conversion |

Exchange ratio |

100 shares of Malvern Federal Bancorp common stock would be exchanged for the following number of shares of Malvern Bancorp—New(1) |

Equivalent Per Share Value(2) |

|||||||||||||||||||||||||||

Minimum

|

2,337,500 | 55.4506 | % | 1,877,961 | 44.5494 | % | 4,215,461 | 0.6908 | 69 | $ | 6.91 | |||||||||||||||||||||||

Midpoint

|

2,750,000 | 55.4506 | 2,209,366 | 44.5494 | 4,959,366 | 0.8127 | 81 | 8.13 | ||||||||||||||||||||||||||

Maximum

|

3,162,500 | 55.4506 | 2,540,771 | 44.5494 | 5,703,271 | 0.9346 | 93 | 9.35 | ||||||||||||||||||||||||||

Maximum,

as adjusted |

3,636,875 | 55.4506 | 2,921,887 | 44.5494 | 6,558,762 | 1.0748 | 107 | 10.75 | ||||||||||||||||||||||||||

(1) |

Cash will be paid instead of issuing any fractional shares. |

(2) |

Represents the value of shares of Malvern Bancorp—New common stock to be received by a holder of one share of Malvern Federal Bancorp common stock at the exchange ratio, assuming a value of $10.00 per share. |

• |

In light of the risk profile posed by, among other factors, the increased levels of our non-performing assets in recent years and also based in part upon our communications with staff of the Office of the Comptroller of the Currency, we determined to increase the amount of capital we maintain at Malvern |

| Federal Savings Bank. The additional funds raised in the offering will increase our capital such that we meet all of the specific capital ratio targets that we have established (which exceed the regulatory thresholds for “well-capitalized” status) and support our ability to operate in accordance with our business strategy in the future. |

• |

Conversion to the fully public form of ownership will remove the uncertainties associated with the mutual holding company structure. We believe that the conversion and offering will result in a more familiar and flexible form of corporate organization and will better position us to continue to meet all current and future regulatory requirements, including regulatory capital requirements which may be imposed on savings and loan holding companies such as Malvern Bancorp—New, and, in light of the portion of the net proceeds of the offering to be retained by the new stock-form holding company, will facilitate the ability of Malvern Bancorp—New to serve as a source of strength for Malvern Federal Savings Bank. |

• |

The number of our outstanding shares after the conversion and offering will be greater than the number of shares currently held by public shareholders, so we expect our stock to have greater liquidity. |

• |

The plan of conversion and reorganization is approved by at least a majority of votes eligible to be cast by members of Malvern Federal Mutual Holding Company (who are the depositors and certain borrowers of Malvern Federal Savings Bank); |

• |

The plan of conversion and reorganization is approved by at least: |

• |

two-thirds of the outstanding shares of Malvern Federal Bancorp common stock; and |

• |

a majority of outstanding shares of Malvern Federal Bancorp common stock held by public shareholders; |

• |

We sell at least the minimum number of shares offered in the offering; and |

• |

We receive the final approval of the Federal Reserve Board to complete the conversion and offering and related transactions. |

the common stock at that time is either below $42.2 million or above $65.6 million, we will notify subscribers, return their funds, with interest, or cancel their deposit account withdrawal authorizations. If we decide to set a new offering range, subscribers will have the opportunity to place a new order. See “The Conversion and Offering—How We Determined the Price Per Share, the Offering Range and the Exchange Ratio” for a description of the factors and assumptions used in determining the stock price and offering range.

| Company Name and Ticker Symbol |

Exchange |

Headquarters |

Total Assets (in millions) |

|||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

ESSA

Bancorp, Inc. (ESSA) |

NASDAQ |

Stroudsburg, PA |

$ | 1,097 | ||||||||||

Cape

Bancorp, Inc. (CBNJ) |

NASDAQ |

Cape May Court House, NJ |

1,071 | |||||||||||

Beacon

Federal Bancorp, Inc. (BFED) |

NASDAQ |

East Syracuse, NY |

1,027 | |||||||||||

Ocean

Shore Holding Co. (OSHC) |

NASDAQ |

Ocean City, NJ |

995 | |||||||||||

Fox Chase

Bancorp, Inc. (FXCB) |

NASDAQ |

Hatboro, PA |

994 | |||||||||||

TF

Financial Corp. (THRD) |

NASDAQ |

Newtown, PA |

682 | |||||||||||

Oneida

Financial Corp. (ONFC) |

NASDAQ |

Oneida, NY |

656 | |||||||||||

Colonial

Financial Services, Inc. (COBK) |

NASDAQ |

Vineland, NJ |

604 | |||||||||||

Alliance

Bancorp, Inc. of PA (ALLB) |

NASDAQ |

Broomall, PA |

470 | |||||||||||

Standard

Financial Corp. (STND) |

NASDAQ |

Monroeville, PA |

437 | |||||||||||

• |

our historical, present and projected operating results including, but not limited to, historical income statement information such as return on assets, return on equity, net interest margin trends, operating expense ratios, levels and sources of non-interest income, and levels of loan loss provisions; |

• |

our historical, present and projected financial condition including, but not limited to, historical balance sheet size, composition and growth trends, loan portfolio composition and trends, liability composition and trends, credit risk measures and trends, and interest rate risk measures and trends; |

• |

the economic, demographic and competitive characteristics of Malvern Federal Bancorp’s primary market area including, but not limited to, employment by industry type, unemployment trends, size and growth of the population, trends in household and per capita income, deposit market share and largest competitors by deposit market share; |

• |

a comparative evaluation of the operating and financial statistics of Malvern Federal Bancorp’s with those of other similarly situated, publicly traded companies, which included a comparative analysis of balance sheet composition, income statement ratios, credit risk, interest rate risk and loan portfolio composition; |

• |

the impact of the offering on Malvern Federal Bancorp’s consolidated shareholders’ equity and earnings potential including, but not limited to, the increase in consolidated equity resulting from the offering, the estimated increase in earnings resulting from the reinvestment of the net proceeds of the offering and the effect of higher consolidated shareholders’ equity on Malvern Federal Bancorp’s future operations; |

• |

the impact of consolidation of Malvern Federal Mutual Holding Company with and into Malvern Federal Bancorp, including the impact of consolidation of Malvern Federal Mutual Holding Company’s assets and liabilities; and |

• |

the trading market for securities of comparable institutions and general conditions in the market for such securities. |

| Price to Earnings Multiple |

Price to Book Value Ratio |

Price to Tangible Book Value Ratio |

||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

Malvern

Bancorp—New (pro forma) |

||||||||||||||

Minimum

|

45.09 | x | 50.61 | % | 50.61 | % | ||||||||

Midpoint

|

51.68 | 56.85 | 56.85 | |||||||||||

Maximum

|

57.94 | 62.54 | 62.54 | |||||||||||

Maximum, as

adjusted |

64.77 | 68.49 | 68.49 | |||||||||||

Peer group

companies as of May 4, 2012 |

||||||||||||||

Average

|

18.40 | x | 78.42 | % | 85.17 | % | ||||||||

Median

|

17.00 | 74.90 | 83.11 | |||||||||||

Because the independent valuation is based on estimates and projections on a number of matters, all of which are subject to change from time to time, no assurance can be given that persons purchasing the common stock in the offering will be able to sell their shares at a price equal to or greater than the $10.00 purchase price. See “Risk Factors—Our Stock Price May Decline When Trading Commences,” “Pro Forma Data,” and “The Conversion and Offering—How We Determined the Price Per Share, The Offering Range and the Exchange Ratio.”

Completed Second-Step Offerings

Closing Dates between January 1, 2011 and May 4, 2012

| Percentage Price Change from Initial Trading Date |

|||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Company Name and Ticker Symbol |

Closing Date |

Exchange |

One Day |

One Week |

One Month |

Through May 4, 2012 |

|||||||||||||||||||||

Cheviot

Financial Corp. (CHEV) |

1/18/12 | NASDAQ | 3.1 | % | 2.6 | % | 3.5 | % | 9.7 | % | |||||||||||||||||

Naugatuck

Valley Fin. Corp. (NVSL) |

6/30/11 | NASDAQ | (1.3 | ) | (2.5 | ) | 1.9 | (6.1 | ) | ||||||||||||||||||

Rockville

Financial New, Inc. (RCKB) |

3/4/11 | NASDAQ | 6.0 | 6.5 | 5.0 | 14.6 | |||||||||||||||||||||

Eureka

Financial Corp. (EKFC) |

3/1/11 | OTCBB | 22.5 | 17.5 | 28.5 | 50.2 | |||||||||||||||||||||

Atlantic

Coast Fin. Corp. (ACFC) |

2/4/11 | NASDAQ | 0.5 | — | 2.0 | (77.5 | ) | ||||||||||||||||||||

Alliance

Bancorp, Inc. (ALLB) |

1/18/11 | NASDAQ | 10.0 | 6.8 | 11.9 | 16.5 | |||||||||||||||||||||

SI Financial

Group, Inc. (SIFI) |

1/13/11 | NASDAQ | 15.9 | 12.9 | 17.5 | 43.9 | |||||||||||||||||||||

Minden

Bancorp, Inc. (MDNB) |

1/5/11 | OTCBB | 28.0 | 28.5 | 30.0 | 42.5 | |||||||||||||||||||||

Average

|

10.6 | % | 9.0 | % | 12.5 | % | 11.7 | % | |||||||||||||||||||

Median

|

8.0 | 6.7 | 8.5 | 15.6 | |||||||||||||||||||||||

• |

prohibitions on the acquisition of more than 10% of our stock; |

• |

limitations on voting rights of shares held in excess of 10% thereafter; |

• |

staggered election of only approximately one-third of our board of directors each year; |

• |

limitations on the ability of shareholders to call special meetings; |

• |

advance notice requirements for shareholder nominations and new business; |

• |

removals of directors only for cause and by a majority vote of all shareholders; |

• |

requirement of a 75% vote of shareholders for certain amendments to the bylaws and certain provisions of the articles of incorporation; |

• |

the right of the board of directors to issue shares of preferred or common stock without shareholder approval; and |

• |

a 75% vote of shareholders’ requirement for the approval of certain business combinations not approved by two-thirds of the board of directors. |

• |

Loan delinquencies may increase further; |

• |

Problem assets and foreclosures may increase further; |

• |

Demand for our products and services may decline; |

• |

The carrying value of our other real estate owned may decline further; and |

• |

Collateral for loans made by us, especially real estate, may continue to decline in value, in turn reducing a customer’s borrowing power, and reducing the value of assets and collateral associated with our loans. |

than temporary impairment charges, and constrained access to debt markets at attractive rates. While the FHLB announced on February 22, 2012 that a dividend would be paid and capital stock repurchases would resume, capital stock repurchases from member banks are reviewed on a quarterly basis by the FHLB. Such dividends and capital stock repurchases may not continue in the future. As of March 31, 2012, we held $4.8 million of FHLB capital stock.

• |

restrictions on acquiring more than 10% of our common stock by any person and limitations on voting rights for positions of more than 10%; |

• |

the election of members of the board of directors to staggered three-year terms; |

• |

the absence of cumulative voting by shareholders in the election of directors; |

• |

provisions restricting the calling of special meetings of shareholders; |

• |

advance notice requirements for shareholder nominations and new business; |

• |

removals of directors only for cause and by a majority vote of all shareholders; |

• |

requirement of a 75% vote of shareholders for certain amendments to the bylaws and certain provisions of the articles of incorporation; |

• |

a 75% vote requirement for the approval of certain business combinations not approved by two-thirds of our board of directors; and |

• |

our ability to issue preferred stock and additional shares of common stock without shareholder approval. |

• |

Malvern Federal Mutual Holding Company will convert from mutual to stock form and simultaneously merge with and into Malvern Federal Bancorp, pursuant to which the mutual holding company will cease to exist and the shares of Malvern Federal Bancorp common stock held by the mutual holding company will be canceled; and |

• |

Malvern Federal Bancorp then will merge with and into the Malvern Bancorp—New with Malvern Bancorp—New being the survivor of such merger. |

• |

filing a written revocation of the proxy with the corporate secretary of Malvern Federal Bancorp; |

• |

submitting a signed proxy card bearing a later date; or |

• |

attending and voting in person at the special meeting, but you also must file a written revocation at the meeting with the corporate secretary of Malvern Federal Bancorp prior to the voting. |

shareholders of Malvern Federal Bancorp. The special meetings of members and of shareholders have been called for this purpose on October 2, 2012.

• |

In light of the risk profile posed by, among other factors, the increased levels of our non-performing assets in recent years and also based in part upon our communications with staff of the Office of the Comptroller of the Currency, we determined to increase the amount of capital we maintain at Malvern Federal Savings Bank. The additional funds raised in the offering will increase our capital such that we meet all of the specific capital ratio targets that we have established (which exceed the regulatory thresholds for “well-capitalized” status) and support our ability to operate in accordance with our business strategy in the future. |

• |

Conversion to the fully public form of ownership will remove the uncertainties associated with the mutual holding company structure. We believe that the conversion and offering will result in a more familiar and flexible form of corporate organization and will better position us to continue to meet all current and future regulatory requirements, including regulatory capital requirements which may be imposed on savings and loan holding companies such as Malvern Bancorp—New, and, in light of the portion of the net proceeds of the offering to be retained by the new stock-form holding company, will facilitate the ability of Malvern Bancorp—New to serve as a source of strength for Malvern Federal Savings Bank. |

• |

The number of our outstanding shares after the conversion and offering will be greater than the number of shares currently held by public shareholders, so we expect our stock to have greater liquidity. |

• |

the total number of shares of common stock to be issued in the conversion and offering; |

• |

the total shares of common stock outstanding after the conversion and offering; |

• |

the exchange ratio; and |

• |

the number of shares an owner of 100 shares of Malvern Federal Bancorp common stock will receive in the exchange, adjusted for the number of shares sold in the offering, and the assumed value of each of such shares. |

| Shares to be sold in the offering |

Shares of Malvern Bancorp—New stock to be issued in exchange for Malvern Federal Bancorp common stock |

|||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Amount |

Percent |

Amount |

Percent |

Total shares of Malvern Bancorp—New common stock to be outstanding after the conversion |

Exchange ratio |

100 shares of Malvern Federal Bancorp common stock would be exchanged for the following number of shares of Malvern Bancorp—New(1) |

Equivalent Per Share Value(2) |

|||||||||||||||||||||||||||

Minimum

|

2,337,500 | 55.4506 | % | 1,877,961 | 44.5494 | % | 4,215,461 | 0.6908 | 69 | $ | 6.91 | |||||||||||||||||||||||

Midpoint

|

2,750,000 | 55.4506 | 2,209,366 | 44.5494 | 4,959,366 | 0.8127 | 81 | 8.13 | ||||||||||||||||||||||||||

Maximum

|

3,162,500 | 55.4506 | 2,540,771 | 44.5494 | 5,703,271 | 0.9346 | 93 | 9.35 | ||||||||||||||||||||||||||

Maximum,

as adjusted |

3,636,875 | 55.4506 | 2,921,887 | 44.5494 | 6,558,762 | 1.0748 | 107 | 10.75 | ||||||||||||||||||||||||||

(1) |

Cash will be paid instead of issuing any fractional shares. |

(2) |

Represents the value of shares of Malvern Bancorp—New common stock to be received by a holder of one share of Malvern Federal Bancorp common stock at the exchange ratio, assuming a value of $10.00 per share. |

Bancorp—New common stock issued in the share exchange will have an initial value of $10.00 per share. Depending on the exchange ratio and the market value of Malvern Federal Bancorp common stock at the time of the exchange, the initial market value of the Malvern Bancorp—New common stock that Malvern Federal Bancorp shareholders receive in the share exchange could be less than the market value of the Malvern Federal Bancorp common stock that such persons currently own. If the conversion and offering is completed at the minimum of the offering range, each share of Malvern Federal Bancorp would be converted into 0.6908 shares of Malvern Bancorp—New common stock with an initial value of $6.91 based on the $10.00 offering price in the conversion. This compares to the closing sale price of $8.74 per share price for Malvern Federal Bancorp common stock on August 10, 2012, as reported on the Nasdaq Global Market. In addition, as discussed in “—Effect on Stockholders’ Equity per Share of the Shares Exchanged” below, pro forma stockholders’ equity per share following the conversion and offering will range between $19.76 and $15.99 at the minimum and the maximum of the offering range, respectively.

| 2,337,500 shares issued at minimum of offering range |

2,750,000 shares issued at midpoint of offering range |

3,162,500 shares issued at maximum of offering range |

3,636,875 shares issued at adjusted maximum of offering range(1) |

||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Amount |

Percent of Total |

Amount |

Percent of Total |

Amount |

Percent of Total |

Amount |

Percent of Total |

||||||||||||||||||||||||||||

Purchasers in

the stock offering |

2,337,500 | 55.5 | % | 2,750,000 | 55.5 | % | 3,162,500 | 55.5 | % | 3,636,875 | 55.5 | % | |||||||||||||||||||||||

Malvern Federal

Bancorp public shareholders in the exchange |

1,877,961 | 44.5 | 2,209,336 | 44.5 | 2,540,771 | 44.5 | 2,921,887 | 44.5 | |||||||||||||||||||||||||||

Total shares

outstanding after the conversion and offering |

4,215,461 | 100.0 | % | 4,959,366 | 100.0 | % | 5,703,271 | 100.0 | % | 6,558,762 | 100.0 | % | |||||||||||||||||||||||

(1) |

As adjusted to give effect to an increase in the number of shares that could occur due to an increase in the offering range of 15% to reflect changes in market and financial conditions before the conversion and offering is completed. |

shares held by public shareholders. Based on the pro forma information set forth for the three months ended March 31, 2012, in “Pro Forma Data,” annualized earnings per share of common stock following the conversion and offering will range from $0.74 to $0.48, respectively, for the minimum to the adjusted maximum of the offering range. As adjusted at that date for the exchange ratio, the effective annualized earnings per share for current shareholders would range from $0.51 to $0.52, respectively, for the minimum to the adjusted maximum of the offering range.

TO THE ARTICLES OF INCORPORATION OF MALVERN BANCORP—NEW

Bancorp, currently can effectively block any shareholder proposed change to the charter or bylaws of Malvern Federal Bancorp.

| At September 30, |

|||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| At March 31, 2012 |

2011 |

2010 |

2009 |

2008 |

2007 |

||||||||||||||||||||||

Selected Financial Condition Data: |

(Dollars in

thousands) |

||||||||||||||||||||||||||

Total assets

|

$ | 651,604 | $ | 666,568 | $ | 720,506 | $ | 691,639 | $ | 639,509 | $ | 551,932 | |||||||||||||||

Loans

receivable, net |

467,028 | 506,019 | 547,323 | 593,565 | 571,536 | 466,192 | |||||||||||||||||||||

Securities

held to maturity |

696 | 3,797 | 4,716 | 4,842 | 2,870 | 1,479 | |||||||||||||||||||||

Securities

available for sale |

81,701 | 74,389 | 40,719 | 27,098 | 21,969 | 29,098 | |||||||||||||||||||||

FHLB

borrowings |

48,593 | 49,098 | 55,334 | 99,621 | 113,798 | 71,387 | |||||||||||||||||||||

Deposits

|

537,029 | 554,455 | 596,858 | 516,511 | 453,493 | 433,488 | |||||||||||||||||||||

Shareholders’ equity |

61,903 | 60,284 | 66,207 | 69,842 | 68,836 | 44,039 | |||||||||||||||||||||

Allowance for

loan losses |

8,076 | 10,101 | 8,157 | 5,718 | 5,505 | 4,541 | |||||||||||||||||||||

Non-accrual

loans |

11,730 | 12,915 | 19,861 | 14,195 | 8,585 | 2,267 | |||||||||||||||||||||

Non-performing assets |

16,473 | 21,236 | 25,176 | 20,070 | 8,815 | 2,494 | |||||||||||||||||||||

Performing

troubled debt restructurings |

8,305 | 10,340 | 11,976 | 25 | 103 | 121 | |||||||||||||||||||||

Non-performing assets and performing troubled debt restructurings |

24,778 | 31,576 | 37,152 | 20,095 | 8,918 | 2,615 | |||||||||||||||||||||

| Six Months Ended March 31, |

Year Ended September 30, |

||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 2012 |

2011 |

2011 |

2010 |

2009 |

2008 |

2007 |

|||||||||||||||||||||||||

Selected Operating Data: |

(Dollars in

thousands, except per share data) |

||||||||||||||||||||||||||||||

Total

interest and dividend income |

$ | 13,346 | $ | 15,118 | $ | 29,726 | $ | 33,148 | $ | 34,701 | $ | 33,592 | $ | 32,769 | |||||||||||||||||

Total

interest expense |

4,404 | 5,411 | 10,198 | 13,641 | 18,681 | 19,105 | 19,235 | ||||||||||||||||||||||||

Net interest

income |

8,942 | 9,707 | 19,528 | 19,507 | 16,020 | 14,487 | 13,534 | ||||||||||||||||||||||||

Provision for

loan losses |

25 | 10,042 | 12,392 | 9,367 | 2,280 | 1,609 | 1,298 | ||||||||||||||||||||||||

Net interest

income (loss) after provision for loan losses |

8,917 | (335 | ) | 7,136 | 10,140 | 13,740 | 12,878 | 12,236 | |||||||||||||||||||||||

Total other

income |

1,868 | 871 | 1,729 | 1,941 | 2,013 | 1,846 | 1,453 | ||||||||||||||||||||||||

Total other

expenses |

8,727 | 8,958 | 18,556 | 17,105 | 14,501 | 12,642 | 10,154 | ||||||||||||||||||||||||

Income tax

(benefit) expense |

588 | (2,979 | ) | (3,579 | ) | (1,895 | ) | 242 | 630 | 1,123 | |||||||||||||||||||||

Net (loss)

income |

$ | 1,470 | $ | (5,443 | ) | $ | (6,112 | ) | $ | (3,129 | ) | $ | 1,010 | $ | 1,452 | $ | 2,412 | ||||||||||||||

Earnings

(loss) per share (1) |

$ | 0.25 | $ | (0.92 | ) | $ | (1.04 | ) | $ | (0.53 | ) | $ | 0.17 | $ | 0.05 | N/A | |||||||||||||||

Dividends per

share |

$ | — | $ | 0.03 | $ | 0.03 | $ | 0.12 | $ | 0.14 | $ | 0.04 | N/A | ||||||||||||||||||

| Six Months Ended March 31, |

Year Ended September 30, |

|||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 2012 |

2011 |

2011 |

2010 |

2009 |

2008 |

2007 |

||||||||||||||||||||||||||

| Selected Financial Ratios and Other Data

(1): |

||||||||||||||||||||||||||||||||

Performance Ratios: |

||||||||||||||||||||||||||||||||

Return on

assets (ratio of net income to average total assets) |

0.44 | % | (1.57 | )% | (0.90 | )% | (0.45 | )% | 0.15 | % | 0.25 | % | 0.45 | % | ||||||||||||||||||

Return on

average equity (ratio of net income to average equity) |

4.77 | (16.57 | ) | (9.64 | ) | (4.53 | ) | 1.46 | 2.78 | 5.76 | ||||||||||||||||||||||

Interest rate

spread (2) |

2.74 | 2.83 | 2.88 | 2.78 | 2.13 | 2.18 | 2.25 | |||||||||||||||||||||||||

Net interest

margin (3) |

2.86 | 2.96 | 3.02 | 2.98 | 2.46 | 2.61 | 2.65 | |||||||||||||||||||||||||

Non-interest

expenses to average total assets |

2.64 | 2.59 | 2.72 | 2.48 | 2.13 | 2.19 | 1.92 | |||||||||||||||||||||||||

Efficiency

ratio (4) |

80.73 | 84.69 | 87.29 | 79.75 | 80.42 | 77.40 | 67.75 | |||||||||||||||||||||||||

Asset

Quality Ratios: |

||||||||||||||||||||||||||||||||

Non-accrual

loans as a percent of gross loans |

2.48 | 3.05 | 2.52 | 3.60 | 2.38 | 1.52 | 0.51 | |||||||||||||||||||||||||

Non-performing assets as a percent of total assets |

2.53 | 3.20 | 3.19 | 3.49 | 2.90 | 1.38 | 0.45 | |||||||||||||||||||||||||

Non-performing assets and performing troubled debt restructurings as a percent of total assets |

3.80 | 4.89 | 4.74 | 5.16 | 2.91 | 1.39 | 0.47 | |||||||||||||||||||||||||

Allowance for

loan losses as a percent of gross loans |

1.71 | 1.97 | 1.97 | 1.48 | 0.96 | 0.96 | 0.97 | |||||||||||||||||||||||||

Allowance for

loan losses as a percent of non-accrual loans |

68.85 | 64.50 | 78.21 | 41.07 | 40.28 | 64.12 | 200.31 | |||||||||||||||||||||||||

Net

charge-offs to average loans outstanding |

0.84 | 2.91 | 1.97 | 1.19 | 0.35 | 0.12 | 0.03 | |||||||||||||||||||||||||

Capital

Ratios (5): |

||||||||||||||||||||||||||||||||

Total

risk-based capital to risk weighted assets |

13.71 | 12.51 | 12.01 | 12.85 | 12.67 | 13.33 | 11.24 | |||||||||||||||||||||||||

Tier 1

risk-based capital to risk weighted assets |

12.45 | 11.25 | 10.76 | 11.83 | 11.96 | 12.40 | 10.36 | |||||||||||||||||||||||||

Tangible

capital to tangible assets |

8.27 | 8.01 | 7.54 | 8.24 | 9.07 | 9.64 | 8.03 | |||||||||||||||||||||||||

Tier 1

leverage (core) capital to adjusted tangible assets |

8.27 | 8.01 | 7.54 | 8.24 | 9.07 | 9.64 | 8.03 | |||||||||||||||||||||||||

Shareholders’ equity to total assets |

9.50 | 8.90 | 9.04 | 9.19 | 10.10 | 10.76 | 7.98 | |||||||||||||||||||||||||

Tangible

shareholders’ equity to total assets |

9.50 | 8.90 | 9.04 | 9.19 | 10.10 | 10.76 | 7.98 | |||||||||||||||||||||||||

Other

Data: |

||||||||||||||||||||||||||||||||

Number of

full service financial center offices |

8 | 8 | 8 | 8 | 7 | 7 | 7 | |||||||||||||||||||||||||

(1) |

Earnings per share for the fiscal year ended September 30, 2008, is for period from May 20, 2008, the date of Malvern Federal Bancorp’s initial stock issuance, through September 30, 2008. |

(2) |

Represents the difference between the weighted average yield on interest earning assets and the weighted average cost of interest bearing liabilities. |

(3) |

Net interest income divided by average interest earning assets. |

(4) |

Represents the ratio obtained from dividing non-interest expense by the sum of net interest income and total other income. |

(5) |

Other than shareholders’ equity to total assets and tangible shareholders’ equity to total assets, all capital ratios are for Malvern Federal Savings Bank only. |

| At June 30, 2012 |

At September 30, 2011 |

||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|

| (Dollars in thousands) | |||||||||||

Selected

Financial Condition Data |

|||||||||||

Total assets

|

$ | 654,051 | $ | 666,568 | |||||||

Loans

receivable, net |

465,618 | 506,019 | |||||||||

Securities

held to maturity |

679 | 3,797 | |||||||||

Securities

available for sale |

84,795 | 74,389 | |||||||||

FHLB

borrowings |

48,340 | 49,098 | |||||||||

Deposits

|

538,245 | 554,455 | |||||||||

Shareholders’ equity |

62,204 | 60,284 | |||||||||

Allowance for

loan losses |

7,983 | 10,101 | |||||||||

Non-accrual

loans |

10,628 | 12,915 | |||||||||

Non-performing assets |

14,844 | 21,236 | |||||||||

Performing

troubled debt restructurings |

8,258 | 10,340 | |||||||||

Non-performing assets and performing troubled debt restructurings |

23,102 | 31,576 | |||||||||

| For the Three Months Ended June 30, |

For the Nine Months Ended June 30, |

||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 2012 |

2011 |

2012 |

2011 |

||||||||||||||||

| (Dollars in thousands, except per share amounts) | |||||||||||||||||||

Selected

Operating Data |

|||||||||||||||||||

Total

interest and dividend income |

$ | 6,321 | $ | 7,430 | $ | 19,667 | $ | 22,548 | |||||||||||

Total

interest expense |

2,016 | 2,428 | 6,420 | 7,839 | |||||||||||||||

Net interest

income |

4,305 | 5,002 | 13,247 | 14,709 | |||||||||||||||

Provision for

loan losses |

335 | 600 | 360 | 10,642 | |||||||||||||||

Net interest

income after provision for loan losses |

3,970 | 4,402 | 12,887 | 4,067 | |||||||||||||||

Total other

income |

506 | 434 | 2,374 | 1,305 | |||||||||||||||

Total other

expenses |

4,172 | 4,476 | 12,899 | 13,434 | |||||||||||||||

Income tax

(benefit) expense |

32 | (4 | ) | 620 | (2,983 | ) | |||||||||||||

Net (loss)

income |

$ | 272 | $ | 364 | $ | 1,742 | $ | (5,079 | ) | ||||||||||

Earnings

(loss) per share |

$ | 0.05 | $ | 0.06 | $ | 0.29 | $ | (0.86 | ) | ||||||||||

| As of or For the Three Months Ended June 30, |

As of or For the Nine Months Ended June 30, |

||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 2012 |

2011 |

2012 |

2011 |

||||||||||||||||

| Selected Financial Ratios and Other Data

(1): |

|||||||||||||||||||

Performance Ratios: |

|||||||||||||||||||

Return on

assets (ratio of net income to average total assets) |

0.17 | % | 0.22 | % | 0.35 | % | (0.99 | )% | |||||||||||

Return on

average equity (ratio of net income to average equity) |

1.74 | 2.39 | 3.75 | (10.36 | ) | ||||||||||||||

Interest rate

spread (2) |

2.67 | 3.03 | 2.70 | 2.89 | |||||||||||||||

Net interest

margin (3) |

2.80 | 3.16 | 2.84 | 3.03 | |||||||||||||||

Non-interest

expenses to average total assets |

2.57 | 2.67 | 2.62 | 2.61 | |||||||||||||||

Efficiency

ratio (4) |

86.72 | 82.34 | 82.58 | 83.89 | |||||||||||||||

Asset

Quality Ratios: |

|||||||||||||||||||

Non-accrual

loans as a percent of gross loans |

2.26 | % | 3.51 | % | 2.26 | % | 3.51 | % | |||||||||||

Non-performing assets as a percent of total assets |

2.27 | 3.65 | 2.27 | 3.65 | |||||||||||||||

Non-performing assets and performing troubled debt restructurings as a percent of total assets |

3.53 | 5.42 | 3.53 | 5.42 | |||||||||||||||

Allowance for

loan losses as a percent of gross loans |

1.69 | 1.91 | 1.69 | 1.91 | |||||||||||||||

Allowance for

loan losses as a percent of non- accrual loans |

75.11 | 54.57 | 75.11 | 54.57 | |||||||||||||||

Net

charge-offs to average loans outstanding |

0.09 | 0.18 | 0.68 | 2.18 | |||||||||||||||

Capital

Ratios (5): |

|||||||||||||||||||

Total

risk-based capital to risk weighted assets |

14.13 | % | 12.03 | % | 14.13 | % | 12.03 | % | |||||||||||

Tier 1

risk-based capital to risk weighted assets |

12.87 | 10.77 | 12.87 | 10.77 | |||||||||||||||

Tangible

capital to tangible assets |

8.39 | 7.62 | 8.39 | 7.62 | |||||||||||||||

Tier 1

leverage (core) capital to adjusted tangible assets |

8.39 | 7.62 | 8.39 | 7.62 | |||||||||||||||

Shareholders’ equity to total assets |

9.51 | 9.03 | 9.51 | 9.03 | |||||||||||||||

Tangible

shareholders’ equity to total assets |

9.51 | 9.03 | 9.51 | 9.03 | |||||||||||||||

Other

Data: |

|||||||||||||||||||

Number of

full service financial center offices |

8 | 8 | 8 | 8 | |||||||||||||||

(1) |

With the exception of end of period ratios, all ratios are based on average monthly balances during the period and have been annualized where appropriate. |

(2) |

Represents the difference between the weighted average yield on interest earning assets and the weighted average cost of interest bearing liabilities. |

(3) |

Net interest income divided by average interest earning assets. |

(4) |

Represents the ratio obtained from dividing non-interest expense by the sum of net interest income and total other income. |

(5) |

Other than shareholders’ equity to total assets and tangible shareholders’ equity to total assets, all capital ratios are for Malvern Federal Savings Bank only. |

| June 30, 2012 |

March 31, 2012 |

September 30, 2011 |

|||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| (Dollars in thousands) | |||||||||||||||

Non-accruing

loans: |

|||||||||||||||

Residential mortgage |

$ | 4,118 | $ | 4,425 | $ | 2,866 | |||||||||

Construction and Development: |

|||||||||||||||

Residential

and commercial |

2,659 | 3,210 | 6,617 | ||||||||||||

Commercial: |

|||||||||||||||

Commercial

real estate |

2,814 | 2,822 | 1,765 | ||||||||||||

Multi-family

|

— | — | — | ||||||||||||

Other

|

201 | 201 | 229 | ||||||||||||

Consumer: |

|||||||||||||||

Home equity

lines of credit |

23 | 43 | 61 | ||||||||||||

Second

mortgages |

813 | 1,029 | 1,377 | ||||||||||||

Other

|

— | — | — | ||||||||||||

Total

non-accruing loans |

10,628 | 11,730 | 12,915 | ||||||||||||

Accruing

loans delinquent more than 90 days past due |

— | — | — | ||||||||||||

Real estate

owned and other foreclosed assets: |

|||||||||||||||

Residential mortgage |

$ | 1,341 | $ | 1,374 | $ | 3,872 | |||||||||

Construction and Development: |

|||||||||||||||

Residential

and commercial |

— | — | — | ||||||||||||

Land

|

99 | 164 | |||||||||||||

Commercial: |

|||||||||||||||

Commercial

real estate |

2,742 | 3,171 | 4,415 | ||||||||||||

Multi-family

|

— | — | — | ||||||||||||

Other

|

34 | 34 | 34 | ||||||||||||

Consumer: |

|||||||||||||||

Second

mortgages |

— | — | — | ||||||||||||

Total

|

4,216 | 4,743 | 8,321 | ||||||||||||

Total

non-performing assets |

$ | 14,844 | $ | 16,473 | $ | 21,236 | |||||||||

Performing

troubled debt-restructurings: |

|||||||||||||||

Residential mortgage |

870 | 876 | 1,049 | ||||||||||||

Construction and Development: |

|||||||||||||||

Land loans

|

1,151 | 1,154 | 1,160 | ||||||||||||

Commercial: |

|||||||||||||||

Commercial

real estate |

6,062 | 6,100 | 7,919 | ||||||||||||

Multi-family

|

— | — | — | ||||||||||||

Other

|

175 | 175 | 175 | ||||||||||||

Consumer: |

|||||||||||||||

Home equity

lines of credit |

— | — | 37 | ||||||||||||

Total

performing troubled debt restructurings |

8,258 | 8,305 | 10,340 | ||||||||||||

Total

non-performing assets and performing troubled debt restructurings |

$ | 23,102 | $ | 24,778 | $ | 31,576 | |||||||||

Ratios: |

|||||||||||||||

Total

non-accrual loans as a percent of gross loans |

2.26 | % | 2.48 | % | 2.52 | % | |||||||||

Total

non-performing assets as a percent of total assets |

2.27 | % | 2.53 | % | 3.19 | % | |||||||||

Total

non-performing assets and performing troubled debt restructurings as a percent of total assets |

3.53 | % | 3.80 | % | 4.74 | % | |||||||||

| At June 30, 2012 Loans Delinquent For: |

|||||||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 31-89 Days |

90 Days and Over |

Total Delinquent Loans |

|||||||||||||||||||||||||||||||||||||

| Number |

Amount |

Percent of Total Delinquent Loans 31-89 Days |

Number |

Amount |

Percent of Total Delinquent Loans 90 Days and Over |

Number |

Amount |

Percent of Total Delinquent Loans Greater Than 30 Days |

|||||||||||||||||||||||||||||||

| (Dollars in thousands) | |||||||||||||||||||||||||||||||||||||||

Residential mortgage |

7 | $ | 1,225 | 29.2 | % | 17 | $ | 4,118 | 38.8 | % | 24 | $ | 5,343 | 36.1 | % | ||||||||||||||||||||||||

Construction and Development: |

|||||||||||||||||||||||||||||||||||||||

Residential

and commercial |

2 | 1,050 | 25.1 | 3 | 2,659 | 25.0 | 5 | 3,709 | 25.0 | ||||||||||||||||||||||||||||||

Commercial: |

|||||||||||||||||||||||||||||||||||||||

Commercial

real estate |

— | — | — | 3 | 2,814 | 26.5 | 3 | 2,814 | 19.0 | ||||||||||||||||||||||||||||||

Multi-family

|

1 | 587 | 14.0 | — | — | — | 1 | 587 | 4.0 | ||||||||||||||||||||||||||||||

Other

|

— | — | — | 1 | 201 | 1.9 | 1 | 201 | 1.3 | ||||||||||||||||||||||||||||||

Consumer: |

|||||||||||||||||||||||||||||||||||||||

Home equity

lines of credit |

1 | 15 | 0.4 | 1 | 23 | 0.2 | 2 | 38 | 0.3 | ||||||||||||||||||||||||||||||

Second

mortgages |

19 | 1,313 | 31.3 | 11 | 813 | 7.6 | 30 | 2,126 | 14.3 | ||||||||||||||||||||||||||||||

Other

|

— | — | — | — | — | — | — | — | — | ||||||||||||||||||||||||||||||

Total

|

30 | $ | 4,190 | 100.00 | % | 36 | $ | 10,628 | 100.00 | % | 66 | $ | 14,818 | 100.00 | % | ||||||||||||||||||||||||

| June 30, 2012 |

March 31, 2012 |

September 30, 2011 |

|||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| (Dollars in thousands) | |||||||||||||||

Classified

assets: |

|||||||||||||||

Substandard

(1) |

$ | 31,724 | $ | 33,200 | $ | 39,860 | |||||||||

Doubtful

|

— | 443 | 1,095 | ||||||||||||

Loss

|

— | — | — | ||||||||||||

Total

classified assets |

31,724 | 33,643 | 40,955 | ||||||||||||

Special

mention assets |

19,960 | 11,267 | 12,685 | ||||||||||||

Total

classified and special mention assets |

$ | 51,684 | $ | 44,910 | $ | 53,640 | |||||||||

(1) |

Includes other real estate owned. |

| Three Months Ended June 30, |

|||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 2012 |

2011 |

||||||||||||||||||||||||||

| Average Outstanding Balance |

Interest Earned/Paid |

Average Yield/ Rate |

Average Outstanding Balance |

Interest Earned/Paid |

Average Yield/ Rate |

||||||||||||||||||||||

| (Dollars in Thousands) | |||||||||||||||||||||||||||

Interest

Earning Assets: |

|||||||||||||||||||||||||||

Loans

receivable (1) |

$ | 472,086 | $ | 5,894 | 4.99 | % | $ | 525,058 | $ | 7,034 | 5.36 | % | |||||||||||||||

Investment

securities |

88,214 | 410 | 1.86 | 80,709 | 390 | 1.93 | |||||||||||||||||||||

Deposits in

other banks |

50,695 | 16 | 0.13 | 22,265 | 6 | 0.11 | |||||||||||||||||||||

FHLB stock

|

4,662 | 1 | 0.09 | 5,724 | — | 0.00 | |||||||||||||||||||||

Total

interest earning assets (1) |

615,657 | 6,321 | 4.11 | 633,756 | 7,430 | 4.69 | |||||||||||||||||||||

Non-interest

earning assets |

34,022 | 36,613 | |||||||||||||||||||||||||

Total assets

|

$ | 649,679 | $ | 670,369 | |||||||||||||||||||||||

Interest

Bearing Liabilities: |

|||||||||||||||||||||||||||

Demand and

NOW accounts |

$ | 93,715 | 60 | 0.26 | $ | 93,432 | 123 | 0.53 | |||||||||||||||||||

Money market

accounts |

76,138 | 85 | 0.45 | 89,056 | 252 | 1.13 | |||||||||||||||||||||

Savings

accounts |

47,791 | 12 | 0.10 | 46,570 | 22 | 0.19 | |||||||||||||||||||||

Certificate

accounts |

294,654 | 1,432 | 1.94 | 306,684 | 1,600 | 2.09 | |||||||||||||||||||||

Total

deposits |

512,298 | 1,589 | 1.24 | 535,742 | 1,997 | 1.49 | |||||||||||||||||||||

Borrowed

funds |

48,468 | 427 | 3.52 | 49,476 | 431 | 3.48 | |||||||||||||||||||||

Total

interest-bearing liabilities |

560,766 | 2,016 | 1.44 | 585,218 | 2,428 | 1.66 | |||||||||||||||||||||

Non-interest

bearing liabilities |

26,364 | 24,260 | |||||||||||||||||||||||||

Total

liabilities |

587,130 | 609,478 | |||||||||||||||||||||||||

Shareholders’ equity |

62,549 | 60,891 | |||||||||||||||||||||||||

Total

liabilities and shareholders’ equity |

$ | 649,679 | $ | 670,369 | |||||||||||||||||||||||

Net

Interest-earning assets |

$ | 54,891 | $ | 48,538 | |||||||||||||||||||||||

Net interest

income |

$ | 4,305 | $ | 5,002 | |||||||||||||||||||||||

Net interest

spread |

2.67 | % | 3.03 | % | |||||||||||||||||||||||

Net interest

margin (2) |

2.80 | % | 3.16 | % | |||||||||||||||||||||||

Average

interest-earning assets to average interest-bearing liabilities |

109.79 | % | 108.29 | % | |||||||||||||||||||||||

(1) |

Includes non-accrual loans during the respective periods. Calculated net of deferred fees and discounts and allowance for loan losses. |

(2) |

Equals net interest income divided by average interest-earning assets. |

| Nine Months Ended June 30, |

|||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 2012 |

2011 |

||||||||||||||||||||||||||

| Average Outstanding Balance |

Interest Earned/Paid |

Average Yield/ Rate |

Average Outstanding Balance |

Interest Earned/Paid |

Average Yield/ Rate |

||||||||||||||||||||||

| (Dollars in Thousands) | |||||||||||||||||||||||||||

Interest

Earning Assets: |

|||||||||||||||||||||||||||

Loans

receivable (1) |

$ | 482,023 | $ | 18,352 | 5.07 | % | $ | 534,284 | $ | 21,398 | 5.33 | % | |||||||||||||||

Investment

securities |

85,690 | 1,279 | 1.99 | 77,183 | 1,125 | 1.95 | |||||||||||||||||||||

Deposits in

other banks |

48,025 | 34 | 0.09 | 29,606 | 25 | 0.11 | |||||||||||||||||||||

FHLB stock

|

4,934 | 2 | 0.05 | 6,063 | — | 0.00 | |||||||||||||||||||||

Total

interest earning assets (1) |

621,672 | 19,667 | 4.21 | 647,136 | 22,548 | 4.64 | |||||||||||||||||||||

Non-interest

earning assets |

35,782 | 38,190 | |||||||||||||||||||||||||

Total assets

|

$ | 657,454 | $ | 685,326 | |||||||||||||||||||||||

Interest

Bearing Liabilities: |

|||||||||||||||||||||||||||

Demand and

NOW accounts |

$ | 91,315 | 209 | 0.31 | $ | 90,910 | 421 | 0.61 | |||||||||||||||||||

Money market

accounts |

82,326 | 370 | 0.60 | 87,370 | 732 | 1.12 | |||||||||||||||||||||

Savings

accounts |

46,015 | 36 | 0.11 | 42,889 | 60 | 0.19 | |||||||||||||||||||||

Certificate

accounts |

301,273 | 4,516 | 2.00 | 326,502 | 5,316 | 2.17 | |||||||||||||||||||||

Total

deposits |

520,929 | 5,131 | 1.31 | 547,671 | 6,529 | 1.59 | |||||||||||||||||||||

Borrowed

funds |

48,721 | 1,289 | 3.53 | 50,094 | 1,310 | 3.49 | |||||||||||||||||||||

Total

interest-bearing liabilities |

569,650 | 6,420 | 1.51 | 597,765 | 7,839 | 1.75 | |||||||||||||||||||||

Non-interest

bearing liabilities |

25,852 | 23,462 | |||||||||||||||||||||||||

Total

liabilities |

595,502 | 621,227 | |||||||||||||||||||||||||

Shareholders’ equity |

61,952 | 64,099 | |||||||||||||||||||||||||

Total

liabilities and shareholders’ equity |

$ | 657,454 | $ | 685,326 | |||||||||||||||||||||||

Net

Interest-earning assets |

$ | 52,022 | $ | 49,371 | |||||||||||||||||||||||

Net interest

income |

$ | 13,247 | $ | 14,709 | |||||||||||||||||||||||

Net interest

spread |

2.70 | % | 2.89 | % | |||||||||||||||||||||||

Net interest

margin (2) |

2.84 | % | 3.03 | % | |||||||||||||||||||||||

Average

interest- earning assets to average interest- bearing liabilities |

109.13 | % | 108.26 | % | |||||||||||||||||||||||

(1) |

Includes non-accrual loans during the respective periods. Calculated net of deferred fees and discounts and allowance for loan losses. |

(2) |

Equals net interest income divided by average interest-earning assets. |

increase in the third quarter of fiscal 2012 was due to a $28.4 million increase in the average balance of deposits in other banks.

| Three Months Ended June 30, |

Nine Months Ended June 30, |

||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 2012 |

2011 |

2012 |

2011 |

||||||||||||||||

| (Dollars in thousands) | |||||||||||||||||||

Balance at

beginning of period |

$ | 8,076 | $ | 10,366 | $ | 10,101 | $ | 8,157 | |||||||||||

Provision for

loan losses |

335 | 600 | 360 | 10,642 | |||||||||||||||

Charge-offs: |

|||||||||||||||||||

Residential mortgage |

140 | 48 | 1,115 | 2,319 | |||||||||||||||

Construction and Development: |

|||||||||||||||||||

Residential

and commercial |

199 | — | 611 | 107 | |||||||||||||||

Commercial: |

|||||||||||||||||||

Commercial

real estate |

— | 203 | 855 | 2,417 | |||||||||||||||

Multi-family

|

— | — | — | 164 | |||||||||||||||

Other

|

— | 278 | 88 | 278 | |||||||||||||||

Consumer: |

|||||||||||||||||||

Home equity

lines of credit |

21 | 40 | 72 | 166 | |||||||||||||||

Second

mortgages |

110 | 386 | 975 | 3,366 | |||||||||||||||

Other

|

— | 1 | 22 | 3 | |||||||||||||||

Total

charge-offs |

470 | 956 | 3,738 | 8,820 | |||||||||||||||

Recoveries: |

|||||||||||||||||||

Residential mortgage |

— | 1 | — | 1 | |||||||||||||||

Construction and Development: |

|||||||||||||||||||

Residential

and commercial |

— | — | 1,139 | — | |||||||||||||||

Commercial: |

|||||||||||||||||||

Commercial

real estate |

— | — | — | 1 | |||||||||||||||

Multi-family

|

— | — | — | 1 | |||||||||||||||

Other

|

— | 1 | 2 | 2 | |||||||||||||||

Consumer: |

|||||||||||||||||||

Home equity

lines of credit |

1 | — | 1 | 3 | |||||||||||||||

Second

mortgages |

39 | 30 | 114 | 50 | |||||||||||||||

Other

|

2 | 4 | 4 | 9 | |||||||||||||||

Total

recoveries |

42 | 36 | 1,260 | 67 | |||||||||||||||

Net

charge-offs |

428 | 920 | 2,478 | 8,753 | |||||||||||||||

Balance at

end of period |

$ | 7,983 | $ | 10,046 | $ | 7,983 | $ | 10,046 | |||||||||||

Ratios: |

|||||||||||||||||||

Ratio of

allowance for loan losses to non-accrual loans |

75.11 | % | 54.47 | % | 75.11 | % | 54.47 | % | |||||||||||

Ratio of net

charge-offs to average loans outstanding (1) |

0.09 | % | 0.18 | % | 0.68 | % | 2.18 | % | |||||||||||

Ratio of net

charge-offs to total allowance for loan losses (1) |

21.45 | % | 36.63 | % | 41.39 | % | 116.18 | % | |||||||||||

(1) |

Annualized. |

| Three Months Ended June 30, |

Nine Months Ended June 30, |

||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 2012 |

2011 |

2012 |

2011 |

||||||||||||||||

| (Dollars in Thousands) | |||||||||||||||||||

Other

Income: |

|||||||||||||||||||

Service

charges and other fees |

$ | 218 | $ | 229 | $ | 686 | $ | 700 | |||||||||||

Rental income

— other real estate owned |

104 | — | 503 | — | |||||||||||||||

Rental income

— other |

59 | 66 | 192 | 196 | |||||||||||||||

Gain on sale

of investments, net |

40 | — | 663 | — | |||||||||||||||

(Loss) gain

on sale of other real estate owned, net |

(49 | ) | 3 | (70 | ) | (4 | ) | ||||||||||||

Earnings on

bank-owned life insurance |

134 | 136 | 400 | 413 | |||||||||||||||

Total other

income |

$ | 506 | $ | 434 | $ | 2,374 | $ | 1,305 | |||||||||||

| Three Months Ended June 30, |

Nine Months Ended June 30, |

||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 2012 |

2011 |

2012 |

2011 |

||||||||||||||||

| (Dollars in Thousands) | |||||||||||||||||||

Other

Expense: |

|||||||||||||||||||

Salaries and

employee benefits |

$ | 1,689 | $ | 1,633 | $ | 5,001 | $ | 4,790 | |||||||||||

Occupancy

expense |

520 | 538 | 1,568 | 1,647 | |||||||||||||||

Federal

deposit insurance premium |

204 | 313 | 657 | 1,016 | |||||||||||||||

Advertising

|

159 | 160 | 581 | 585 | |||||||||||||||

Data

processing |

319 | 279 | 939 | 841 | |||||||||||||||

Professional

fees |

279 | 433 | 1,193 | 1,277 | |||||||||||||||

Other real

estate owned expense |

550 | 656 | 1,563 | 1,889 | |||||||||||||||

Other

operating expenses |

452 | 464 | 1,397 | 1,389 | |||||||||||||||

Total other

expenses |

$ | 4,172 | $ | 4,476 | $ | 12,889 | $ | 13,434 | |||||||||||

• |

statements of goals, intentions and expectations; |

• |

statements regarding prospects and business strategy; |

• |

statements regarding asset quality and market risk; and |

• |

estimates of future costs, benefits and results. |

• |

general economic conditions, either nationally or in our market area, that are worse than expected; |

• |

changes in the interest rate environment that reduce our interest margins or reduce the fair value of financial instruments; |

• |

increased competitive pressures among financial services companies; |

• |

changes in consumer spending, borrowing and savings habits; |

• |

legislative or regulatory changes that adversely affect our business; |

• |

adverse changes in the securities markets; |

• |

our ability to successfully manage our growth; |

• |

changes in accounting policies and practices, as may be adopted by the bank regulatory agencies, the Securities and Exchange Commission or the Financial Accounting Standards Board (the “FASB”); and |

• |

our ability to successfully implement our branch expansion strategy, enter into new markets and/or expand product offerings successfully and take advantage of growth opportunities. |

| Minimum of Offering Range |

Midpoint of Offering Range |

Maximum of Offering Range |

15% Above Maximum of Offering Range |

||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 2,337,500 Shares at $10.00 Per Share |

Percent of Net Proceeds |

2,750,000 Shares at $10.00 Per Share |

Percent of Net Proceeds |

3,162,500 Shares at $10.00 Per Share |

Percent of Net Proceeds |

3,636,875 Shares at $10.00 Per Share |

Percent of Net Proceeds |

||||||||||||||||||||||||||||

| (Dollars in thousands) |

|||||||||||||||||||||||||||||||||||

Offering

proceeds |

$ | 23,375 | $ | 27,500 | $ | 31,625 | $ | 36,369 | |||||||||||||||||||||||||||

Less:

offering expenses |

(2,083 | ) | (2,248 | ) | (2,413 | ) | (2,603 | ) | |||||||||||||||||||||||||||

Net offering

proceeds |

21,292 | 100.0 | % | 25,252 | 100.0 | % | 29,212 | 100.0 | % | 33,766 | 100.0 | % | |||||||||||||||||||||||

Less: |

|||||||||||||||||||||||||||||||||||

Proceeds

contributed to Malvern Federal Savings Bank |

14,904 | 70.0 | % | 17,676 | 70.0 | % | 20,448 | 70.0 | % | 23,636 | 70.0 | % | |||||||||||||||||||||||

Proceeds

remaining for Malvern Bancorp—New |

$ | 6,388 | 30.0 | % | $ | 7,576 | 30.0 | % | $ | 8,764 | 30.0 | % | $ | 10,130 | 30.0 | % | |||||||||||||||||||

• |

to invest in securities; |

• |

to repurchase shares of its common stock, subject to regulatory restrictions; |

• |

to pay dividends or shares of its common stock, subject to regulatory restrictions; and |

• |

for general corporate purposes. |

• |

to fund new loans; |

• |

to invest in short-term investment securities and mortgage-backed securities; and |

• |

for general corporate purposes. |

| Stock Price Per Share |

||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Quarter ended: |

High |

Low |

Cash Dividends Per Share |

|||||||||||

September 30,

2012 (through August 10, 2012) |

$ | 9.70 | $ | 8.01 | $ | — | ||||||||

June 30, 2012

|

9.00 | 7.76 | — | |||||||||||

March 31,

2012 |

8.93 | 5.90 | — | |||||||||||

December 31,

2011 |

6.57 | 5.51 | — | |||||||||||

September 30,

2011 |

7.75 | 6.53 | — | |||||||||||

June 30, 2011

|

8.72 | 6.76 | — | |||||||||||

March 31,

2011 |

8.99 | 7.10 | — | |||||||||||

December 31,

2010 |

7.50 | 5.05 | 0.03 | |||||||||||

September 30,

2010 |

8.65 | 6.66 | 0.03 | |||||||||||

June 30, 2010

|

9.85 | 8.40 | 0.03 | |||||||||||

March 31,

2010 |

9.80 | 9.00 | 0.03 | |||||||||||

December 31,

2009 |

9.70 | 9.05 | 0.03 | |||||||||||

| Pro Forma at March 31, 2012 |

|||||||||||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Minimum of Offering Range |

Midpoint of Offering Range |

Maximum of Offering Range |

15% Above Maximum of Offering Range |

||||||||||||||||||||||||||||||||||||||||

| Malvern Federal Savings Bank Historical at March 31, 2012 |

2,337,500 Shares At $10.00 per Share |

2,750,000 Shares At $10.00 Per Share |

3,162,500 Shares at $10.00 Per Share |

3,636,875 Shares at $10.00 Per Share |

|||||||||||||||||||||||||||||||||||||||

| (Unaudited) | |||||||||||||||||||||||||||||||||||||||||||

| Amount |

Percent of Assets (1) |

Amount |

Percent of Assets |

Amount |

Percent of Assets |

Amount |

Percent of Assets |

Amount |

Percent of Assets |

||||||||||||||||||||||||||||||||||

| (Dollars in Thousands) | |||||||||||||||||||||||||||||||||||||||||||

GAAP capital

|

$ | 58,131 | 8.94 | % | $ | 73,135 | 11.00 | % | $ | 75,907 | 11.37 | % | $ | 78,679 | 11.73 | % | $ | 81,867 | 12.15 | % | |||||||||||||||||||||||

Tier 1

capital: |

|||||||||||||||||||||||||||||||||||||||||||

Actual

|

$ | 53,442 | 8.27 | % | $ | 68,446 | 10.36 | % | $ | 71,218 | 10.73 | % | $ | 73,990 | 11.10 | % | $ | 77,178 | 11.53 | % | |||||||||||||||||||||||

Requirement

|

25,838 | 4.00 | 26,434 | 4.00 | 26,545 | 4.00 | 26,656 | 4.00 | 26,783 | 4.00 | |||||||||||||||||||||||||||||||||

Excess

|

$ | 27,604 | 4.27 | % | $ | 42,012 | 6.36 | % | $ | 44,673 | 6.73 | % | $ | 47,334 | 7.10 | % | $ | 50,395 | 7.53 | % | |||||||||||||||||||||||

Tier 1

risk-based capital: |

|||||||||||||||||||||||||||||||||||||||||||

Actual

|

$ | 53,442 | 12.45 | % | $ | 68,446 | 15.83 | % | $ | 71,218 | 16.47 | % | $ | 73,990 | 17.07 | % | $ | 77,178 | 17.78 | % | |||||||||||||||||||||||

Requirement

|

17,174 | 4.00 | 17,293 | 4.00 | 17,315 | 4.00 | 17,337 | 4.00 | 17,363 | 4.00 | |||||||||||||||||||||||||||||||||

Excess

|

$ | 36,268 | 8.45 | % | $ | 51,153 | 11.83 | % | $ | 53,903 | 12.47 | % | $ | 56,653 | 13.07 | % | $ | 59,815 | 13.78 | % | |||||||||||||||||||||||

Total

capital: |

|||||||||||||||||||||||||||||||||||||||||||

Actual

|

$ | 58,842 | 13.71 | % | $ | 73,846 | 17.08 | % | $ | 76,618 | 17.70 | % | $ | 79,390 | 18.32 | % | $ | 82,578 | 19.02 | % | |||||||||||||||||||||||

Requirement

|

34,348 | 8.00 | 34,586 | 8.00 | 34,630 | 8.00 | 34,675 | 8.00 | 34,726 | 8.00 | |||||||||||||||||||||||||||||||||

Excess

|

$ | 24,494 | 5.71 | % | $ | 39,260 | 9.08 | % | $ | 41,988 | 9.70 | % | $ | 44,715 | 10.32 | % | $ | 47,852 | 11.02 | % | |||||||||||||||||||||||

Reconciliation of capital infused into Malvern Federal Savings Bank: |

|||||||||||||||||||||||||||||||||||||||||||

Net proceeds

infused |

$ | 14,904 | $ | 17,676 | $ | 20,448 | $ | 23,636 | |||||||||||||||||||||||||||||||||||

Plus: |

|||||||||||||||||||||||||||||||||||||||||||

Net assets

received from mutual holding company |

100 | 100 | 100 | 100 | |||||||||||||||||||||||||||||||||||||||

Pro forma

increase in GAAP and regulatory capital |

$ | 15,004 | $ | 17,776 | $ | 20,548 | $ | 23,736 | |||||||||||||||||||||||||||||||||||

(1) |

Adjusted total or adjusted risk-weighted assets, as appropriate. |

| Malvern Bancorp—New—Pro Forma Based Upon Sale at $10.00 Per Share |

|||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Malvern Federal Bancorp Historical Capitalization |

2,337,500 Shares (Minimum of Offering Range) |

2,750,000 Shares (Midpoint of Offering Range) |

3,162,500 Shares (Maximum of Offering Range) |

3,636,875 Shares(1) (15% above Maximum of Offering Range) |

|||||||||||||||||||

| (Dollars in thousands) | |||||||||||||||||||||||

Deposits (2)

|

$ | 537,029 | $ | 537,029 | $ | 537,029 | $ | 537,029 | $ | 537,029 | |||||||||||||

Borrowings

|

48,593 | 48,593 | 48,593 | 48,593 | 48,593 | ||||||||||||||||||

Total

deposits and borrowings |

$ | 585,622 | $ | 585,622 | $ | 585,622 | $ | 585,622 | $ | 585,622 | |||||||||||||

Shareholders’ equity: |

|||||||||||||||||||||||

Preferred

stock, $.01 par value, 10,000,000 shares authorized (post-offering); none to be issued |

$ | — | $ | — | $ | — | $ | — | $ | — | |||||||||||||

Common stock,

$.01 par value, (post-offering) 50,000,000 shares authorized (post-offering); shares to be issued as reflected (3) |

62 | 42 | 50 | 57 | 66 | ||||||||||||||||||

Additional

paid-in capital (3) |

25,861 | 47,173 | 51,125 | 55,078 | 59,623 | ||||||||||||||||||

Retained

earnings (4) |

38,107 | 38,107 | 38,107 | 38,107 | 38,107 | ||||||||||||||||||

Plus: |

|||||||||||||||||||||||

Equity

received from mutual holding company |

— | 100 | 100 | 100 | 100 | ||||||||||||||||||

Accumulated

other comprehensive income |

455 | 455 | 455 | 455 | 455 | ||||||||||||||||||

Less: |

|||||||||||||||||||||||

Common stock

held by the employee stock ownership plan |

(2,105 | ) | (2,105 | ) | (2,105 | ) | (2,105 | ) | (2,105 | ) | |||||||||||||

Treasury

stock |

(477 | ) | (477 | ) | (477 | ) | (477 | ) | (477 | ) | |||||||||||||

Total

shareholders’ equity |

$ | 61,903 | $ | 83,295 | $ | 87,255 | $ | 91,215 | $ | 95,769 | |||||||||||||

Ratio of

total shareholders’ equity to total assets |