united

states

securities and exchange commission

washington, d.c. 20549

form n-csr

certified shareholder report of registered management

investment companies

Investment Company Act file number 811-22153

Dunham Funds

(Exact name of registrant as specified in charter)

10251 Vista Sorrento Pkwy, Ste. 200, San Diego, CA 92121

(Address of principal executive offices) (Zip code)

Richard Malinowski

Gemini Fund Services, LLC., 80 Arkay Drive, Suite 110, Hauppauge, NY 11788

(Name and address of agent for service)

Registrant's telephone number, including area code: 631-470-2619

Date of fiscal year end: 10/31

Date of reporting period: 4/30/19

Item 1. Reports to Stockholders.

BEGINNING ON JANUARY 1, 2021, AS PERMITTED BY REGULATIONS ADOPTED BY THE SECURITIES AND EXCHANGE COMMISSION, PAPER COPIES OF THE DUNHAM FUNDS’ SHAREHOLDER REPORTS LIKE THIS ONE WILL NO LONGER BE SENT BY MAIL, UNLESS YOU SPECIFICALLY REQUEST PAPER COPIES OF THE REPORTS FROM THE DUNHAM FUNDS OR FROM YOUR FINANCIAL INTERMEDIARY, SUCH AS A BROKER-DEALER OR BANK. INSTEAD, THE REPORTS WILL BE MADE AVAILABLE ON A WEBSITE, AND YOU WILL BE NOTIFIED BY MAIL EACH TIME A REPORT IS POSTED AND PROVIDED WITH A WEBSITE LINK TO ACCESS THE REPORT.

IF YOU ALREADY ELECTED TO RECEIVE SHAREHOLDER REPORTS ELECTRONICALLY, YOU WILL NOT BE AFFECTED BY THIS CHANGE AND YOU NEED NOT TAKE ANY ACTION. YOU MAY ELECT TO RECEIVE SHAREHOLDER REPORTS AND OTHER COMMUNICATIONS FROM THE DUNHAM FUNDS ELECTRONICALLY BY CALLING (888)-3DUNHAM (338-6426) OR CONTACTING YOUR FINANCIAL INTERMEDIARY.

YOU MAY ELECT TO RECEIVE ALL FUTURE REPORTS IN PAPER FREE OF CHARGE. YOU CAN INFORM THE DUNHAM FUNDS OR YOUR FINANCIAL INTERMEDIARY THAT YOU WISH TO CONTINUE RECEIVING PAPER COPIES OF YOUR SHAREHOLDER REPORTS BY CALLING (888)-3DUNHAM (338-6426) OR CONTACTING YOUR FINANCIAL INTERMEDIARY. YOUR ELECTION TO RECEIVE REPORTS IN PAPER WILL APPLY TO ALL DUNHAM FUNDS HELD BY YOU OR THROUGH YOUR FINANCIAL INTERMEDIARY.

THIS SEMI-ANNUAL REPORT CONTAINS “FORWARD-LOOKING STATEMENTS” WITHIN THE MEANING OF THE PRIVATE SECURITIES LITIGATION REFORM ACT OF 1995. FORWARD-LOOKING STATEMENTS ALSO INCLUDE THOSE PRECEDED BY, FOLLOWED BY OR THAT INCLUDE THE WORDS “BELIEVES”, “EXPECTS”, “ANTICIPATES” OR SIMILAR EXPRESSIONS. SUCH STATEMENTS SHOULD BE VIEWED WITH CAUTION. ACTUAL RESULTS OR EXPERIENCE COULD DIFFER MATERIALLY FROM THE FORWARD-LOOKING STATEMENTS AS A RESULT OF MANY FACTORS. EACH FUND MAKES NO COMMITMENTS TO DISCLOSE ANY REVISIONS TO FORWARD-LOOKING STATEMENTS, OR ANY FACTS, EVENTS OR CIRCUMSTANCES AFTER THE DATE HEREOF THAT MAY BEAR UPON FORWARD-LOOKING STATEMENTS. IN ADDITION, PROSPECTIVE PURCHASERS OF THE FUNDS SHOULD CONSIDER CAREFULLY THE INFORMATION SET FORTH HERIN AND THE APPLICABLE FUND’S PROSPECTUS. OTHER FACTORS AND ASSUMPTIONS NOT IDENTIFIED ABOVE MAY ALSO HAVE BEEN INVOLVED IN THE DERIVATION OF THESE FORWARD-LOOKING STATEMENTS, AND THE FAILURE OF THESE OTHER ASSUMPTIONS TO BE REALIZED MAY ALSO CAUSE ACTUAL RESULTS TO DIFFER MATERIALLY FROM THOSE PROJECTED.

Dear Fellow Shareholders,

Volatility rocked global equity and bond markets during the six-month period as the Federal Reserve exhibited a hawkish stance in regards to monetary policy, trade tensions between the U.S and China escalated, China faced trouble in its own economy, and oil prices drastically declined. Nevertheless, global equities and bond markets ended the six-month period with gains, as these same key macro drivers reversed.

In December, the Federal Reserve bumped interest rates up 0.25 percent to a range of 2.25 percent to 2.50 percent. Even though the decision was planned months in advance, the move still unsettled markets. During the same month, the likelihood of a partial U.S government shutdown, deteriorating trade talks between the two largest economies, Brexit negotiations, and oil falling to around $40 a barrel were some events that pushed the S&P 500 Index approximately 16 percent lower within three weeks of December.

By January’s end, the S&P 500 had nearly climbed back to where it had started in December, as first quarter earnings season began to beat expectations and the Federal Reserve announced that it would not raise interest rates in the month of January. In addition, China announced in January that it would provide economic stimulus to its economy and oil prices rose to $54 a barrel.

By April’s end the largest surprise during the six-month period occurred when Chairman Jerome Powell announced the Federal Reserve would halt all interest rate hike plans in 2019 and end quantitative tightening of the balance sheet until further indication of inflation was seen. First quarter earnings season wound down with approximately 80 percent of companies, beating earnings. Furthermore, economic data of unemployment reaching a 50 year low, consumer sentiment reaching decade year highs, and first quarter GDP coming in better than expected at 3.2 percent all pointed to a heathy economy. Fears of a possible recession in 2019 were cast aside and markets roared to finish the six-month period ahead.

The rally in risk assets, lifted high-yield bonds higher as well, while many investors preferred corporate bonds with their fixed coupons over floating rate bonds due to fears of rising interest rates abating in the short term. Floating rates bonds, as measured by S&P / LSTA Leverage Loan Index, rose 2.1 percent, international bonds increased 3.3 percent, as measured by the Bloomberg Barclays Global Aggregate ex-U.S. bond index, corporate and government bonds rose by 5.5 percent, as measured by the Bloomberg Barclays Aggregate Bond Index, and high-yield bonds rose 6.2 percent, as measured by the Bloomberg Barclays High-Yield Ba/B 2% Issuer Cap Index. Dunham’s diversified fixed income stood strong, as the strategy remained balanced to corporate bonds, high yield bonds, and alternatives without overweighting low duration floating rate bonds.

During the six-month period, the Dow Jones Industrial Average rose 7.1 percent, the S&P increased 9.8 percent, and the NASDAQ Composite scaled 11.5 percent. The S&P’s impressive 10-year cumulative returns of 316 percent, a 15.3 percent annualized return, has most likely been on the minds of many investors due to their home-country bias. Much of this recent surge in 10-year performance has been caused by the extensive losses of the Great Financial Crisis rolling off, as March 2009 started the bull market. For perspective, the S&P 500 Index’s cumulative 10-year return as of the end of last year’s April 2018 (including the entire Great Financial Crisis in the 10-year history) was 163 percent – roughly a 10.2 percent annualized return. For these reasons, the concept of diversifying beyond large capitalization U.S. stocks is lost on many investors with the allure of these strong 10-year returns; however, Dunham remains steadfast in diversification beyond large capitalization U.S. stocks with international stocks and emerging markets stocks.

International diversification showed strength during the six-month period as, emerging market stocks, as measured by the MSCI ACWI Emerging Markets Index (Net), outperformed all U.S. markets by rising 13.8 percent, and international stocks, as measured by the MSCI ACWI ex US Index (Net), increased 9.1 percent, in-line with most broad U.S. markets.

We thank you for your continued trust and the confidence you have placed in us. We take that trust very seriously and look forward to servicing your investment needs for years to come.

Sincerely,

Jeffrey A. Dunham

President

Dunham & Associates

April 30, 2019

1

| Dunham Floating Rate Bond Fund (Unaudited) |

| Message from the Sub-Adviser (Newfleet Asset Management, LLC) |

Asset Class Recap

Retail investor outflows continued throughout the six-month period most likely driven by the Federal Reserve’s decision to not raise interest rates in 2019. Markets even began to price an interest rate cut by the end of 2019, which most likely caused investors to favor fixed-rate corporate bonds. Strong macroeconomic data and an acceptable earnings season all pointed to a lower probability of recession during 2019, which helped risk assets and may explain why equity sensitive high-yield bonds also rallied. However, during the last three months institutional CLO demand, loan repayments via high-yield issuance, and lower primary issuance supply offset retail redemptions and set up the market for loan price increases. By February 21, 2019, bank loans had regained previous losses and from that point on continued to rise through the end of April. During the six-month period, the bank loan space, as measured by the S&P LSTA Leveraged Loan Index, appreciated 2.1 percent. Corporate bonds in general, as measured by the ICE BofA Merrill Lynch Corporate Index, advanced 7.0 percent during the six-month period. High-yield bonds, as measured by the ICE BofA Merrill Lynch Cash Pay High-Yield Index, rose 5.6 percent during the six-month period.

The continued healthy backdrop was also attractive for credit spread portfolios and may have reduced investors’ default expectations. The loan market default rate stood at 1.01 percent in April, which was near a multi-year low. Loan market prices improved to 97.5 in April as investors sought opportunities in the secondary market, while the primary issuance market remained light. Loans rated BB were priced at 99.3, B rated loans were priced at 98.1, and CCC rated loans were priced at 86.6. Loan spreads to maturity closed at London Interbank Offered Rate LIBOR+389 in April, tighter by 78 basis points year-to-date, as investors and risk markets grew more comfortable with U.S. and global fundamental trends, specifically that economies were not entering a recession to start the year.

Allocation Review

During most of the six-month period, the Sub-Adviser was overweight the sector categories consumer non-durables, housing, and gaming, while underweight cyclical industries such as automotive and transportation. The Sub-Adviser was extremely underweight technology and retail companies. Security selection within the manufacturing, broadcasting, diversified media and food industries contributed to Fund performance, while security selection that detracted came from the consumer non-durables and energy industries during the second fiscal quarter.

Holdings Insights

During the six-month period, the top contributor to the Fund was CPI Card Group 8/17/2022 (BL1785619) (holding weight*: 0.54 percent). CPI Card Group manufactures physical debt and credit cards from Mastercard to Visa to dual interface to metal cards. Fourth quarter results marked the company’s third consecutive quarter of earnings stability, as card volumes recovered with cash flow up 55 percent year-over -year. The holding appreciated 18.9 percent during the six-month period. Another contributor to the Fund was IHeartCommunications, Inc. 9.0% 12/15/2019 (184502BL5) (holding weight*: 0.04 percent). IHeartCommunications, Inc. is the largest radio station owner in the U.S. and also has a substantial interest in the second largest outdoor advertising company in the world. A combination of better fourth quarter 2018 results and its pending exit from bankruptcy pushed the value of loans up over the six-month period. Overall, the holding gained 9.5 percent return during the time period. A third contributor to the Fund was PetSmart Inc. 3/11/2022 (BL226478) (holding weight*: 0.37 percent). The company is a retailer of pet animal products and services. The loan rose after the company announced it would seek an Initial Public Offering for its e-commerce website chewy.com. The holding climbed 16.1 percent during the six-month period.

The largest detractor from Fund performance was Ditech Holding 6/30/2022 (BL249813) (holding weight*: 0.35 percent) an independent originator and servicer of mortgage loans and reverse mortgage loans. The loan fell after the company declared Chapter 11 bankruptcy for the second time in 14 months and was considering strategic alternatives, which included selling the company. During the six-month period, the holding lost 28.6 percent. The second largest detractor to the Fund was Isagenix Worldwide LLC 5/26/2025 (BL2682096) (holding weight*: 0.24 percent). The company is a multi-level marketer of weight management products and nutritional supplements. Low unemployment, increasing competition for workers in the gig economy, fiercer competition in the weight loss industry, and a saturated social media ecosystem negatively weighed on the company’s ability to attract employees. In addition, company specific issues—poor marketing message, failed product introduction, and a weak overseas launch—led to two consecutive quarters of mediocre operating performance. During the six-month period, the holding fell 16.8 percent. Another detractor from Fund performance was Gavilan Resources LLC 2/23/2024 (BL2367672) (holding weight*: 0.19 percent), which is a petroleum exploration and production company located in the Texan Eagle Ford basin. The company revealed lower drilling output during the previous fiscal quarter and the holding slid 16.4 percent during the six-month period.

Sub-Adviser Outlook

Relative to the start of the year, the Sub-Adviser believes there are fewer cheap opportunities; however, improved CLO issuance, high yield issuance for loan repayments and lower supply, the Sub-Adviser believes, should lead to price stability in the secondary market. In addition, the Sub-Adviser believes the loan market yield -to-maturity of 6.5 percent compares favorably to the high-yield market of 6.1 percent. Despite the prospect of no further rate hikes and continued retail investors outflows, the Sub-Adviser believes investors may benefit from a higher yield while maintaining a senior position in the issuer’s capital structure and a secured interest in all assets of the issuer, which is important as the credit cycle matures. With a strong start to the year, the Sub-Adviser has de -risked slightly to take advantage of the improvement in loan prices. Moving forward, the Sub-Adviser believes return will be driven by coupon payments rather than price appreciation and default rates should remain low.

| * | Holdings percentage(s) of total investments, excluding collateral for securities loaned, as of 4/30/2019. |

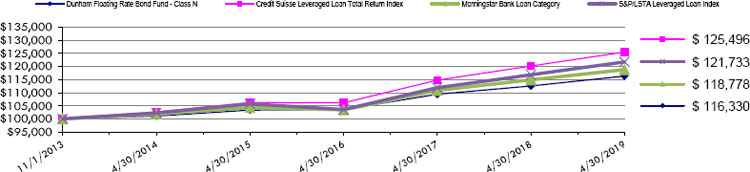

Growth of $100,000 Investment

Total Returns as of April 30, 2019

| Annualized | ||||

| Annualized | Since Inception | |||

| Six Months | One Year | Five Years | (11/1/13) | |

| Class N | 1.78% | 3.35% | 2.85% | 2.79% |

| Class C | 1.42% | 2.49% | 2.11% | 2.02% |

| Class A with load of 4.50% | (2.89)% | (1.57)% | 1.67% | 1.67% |

| Class A without load | 1.66% | 3.10% | 2.61% | 2.53% |

| Credit Suisse Leveraged Loan Total Return Index | 2.17% | 4.46% | 4.11% | 4.22% |

| S&P/LSTA Leveraged Loan 100 Index ** | 2.09% | 4.20% | 3.55% | 3.64% |

| Morningstar Bank Loan Category | 1.88% | 3.40% | 3.12% | 3.18% |

| ** | Change in Fund’s benchmark. As a result, the Fund’s performance is compared to both indices in the table above. |

The Credit Suisse Leveraged Loan Total Return Index tracks the investable market of the U.S. dollar denominated leveraged loan market. It consists of issues rated “5B” or lower, meaning that the highest rated issues included in this index are Moody’s/S&P ratings of Baa1/BB+ or Ba1/BBB+. All loans are funded term loans with a tenor of at least one year and are made by issuers domiciled in developed countries.

The S&P/LSTA Leveraged Loan 100 Index is designed to reflect the performance of the largest facilities in the leveraged loan market. Investors cannot invest directly in an index or benchmark.

The Morningstar Bank Loan Category is generally representative of mutual funds that primarily invest in floating-rate bank loans instead of bonds. These bank loans generally offer interest payments that typically float above a common short-term benchmark such as the London interbank offered rate, or LIBOR.

As disclosed in the Trust’s latest registration statement, the Fund’s total annual operating expenses, including cost of underlying funds, are 0.98% for Class N, 1.73% for Class C and 1.23% for Class A. Class A shares are subject to a sales load of 4.50% and a deferred sales charge of up to 0.75%. The performance data quoted here represents past performance, which is not indicative of future results. Current performance may be lower or higher than the performance data quoted. The investment return and NAV will fluctuate, so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Total returns are calculated assuming reinvestment of all dividends and capital gains distributions, if any. The returns do not reflect the deductions of taxes a shareholder would pay on the redemption of Fund shares or Fund distributions. For performance information current to the most recent month-end, please call 1-800-442-4358 or visit our website www.dunham.com

2

| SCHEDULE OF INVESTMENTS (Unaudited) |

| Dunham Floating Rate Bond Fund |

| April 30, 2019 |

| Variable | Principal | Interest | Maturity | |||||||||||||

| Security | Rate | Amount | Rate % | Date | Value | |||||||||||

| BANK LOANS - 92.1% | ||||||||||||||||

| BASIC MATERIALS - 3.2% | ||||||||||||||||

| Covia Holdings Corp., Initial Term Loan | LIBOR + 4.000% | $ | 565,725 | 6.592 | + | 5/31/2025 | $ | 504,604 | ||||||||

| Element Solutions, Inc., Initial Term Loan | LIBOR + 2.250% | 733,163 | 4.826 | + | 1/30/2026 | 735,226 | ||||||||||

| Graftech International Ltd., Initial Term Loan | LIBOR + 3.500% | 744,750 | 6.076 | + | 2/12/2025 | 745,681 | ||||||||||

| H.B. Fuller Co., Commitment Loan | LIBOR + 2.000% | 678,227 | 4.580 | + | 10/20/2024 | 676,850 | ||||||||||

| Ineos US Finance LLC, New 2024 Dollar Term Loan | LIBOR + 2.000% | 1,896,000 | 4.576 | + | 3/31/2024 | 1,890,179 | ||||||||||

| Kraton Polymers LLC, Dollar Replacement Term Loan (2018) | LIBOR + 2.500% | 389,809 | 5.076 | + | 3/08/2025 | 389,727 | ||||||||||

| New Arclin US Holding Corp., Replacement Term Loan (First Lien) | LIBOR + 3.500% | 262,530 | 6.076 | + | 2/14/2024 | 263,351 | ||||||||||

| Omnova Solutions, Inc., Term B-2 Loan | LIBOR + 3.250% | 498,354 | 5.826 | + | 8/24/2023 | 499,599 | ||||||||||

| US Salt LLC, Initial Term Loan | LIBOR + 4.750% | 275,000 | 7.326 | + | 1/16/2026 | 276,375 | ||||||||||

| 5,981,592 | ||||||||||||||||

| COMMUNICATIONS - 15.8% | ||||||||||||||||

| Advantage Sales & Marketing, Inc., Initial Term Loan (First Lien) | LIBOR + 3.250% | 388,286 | 5.826 | + | 7/24/2021 | 341,758 | ||||||||||

| Altice France SA, USD TLB-13 Incremental Term Loan | LIBOR + 4.000% | 233,825 | 6.588 | + | 8/14/2026 | 229,649 | ||||||||||

| Centurylink, Inc., Initial Term B Loan | LIBOR + 2.750% | 1,010,060 | 5.326 | + | 2/01/2025 | 1,005,222 | ||||||||||

| Charter Communications Operating LLC, Term B Loan | LIBOR + 2.000% | 2,256,438 | 4.576 | + | 4/30/2025 | 2,264,549 | ||||||||||

| Commscope, Inc., Initial Term Loan | LIBOR + 3.250% | 915,000 | 5.826 | + | 4/06/2026 | 924,292 | ||||||||||

| CSC Holdings, LLC, March 2017 Refinancing Term Loan | LIBOR + 2.250% | 1,756,299 | 4.838 | + | 7/16/2025 | 1,752,883 | ||||||||||

| CSC Holdings, LLC, October 2018 Incremental Term Loan | LIBOR + 2.250% | 379,050 | 4.838 | + | 1/16/2026 | 378,197 | ||||||||||

| CSC Holdings, LLC, January 2018 Incremental Term Loan | LIBOR + 2.500% | 128,700 | 5.088 | + | 1/24/2026 | 128,861 | ||||||||||

| E.W. Scripps Co., Term Loan B | LIBOR + 2.750% | 385,000 | 5.342 | + | 4/04/2026 | 386,444 | ||||||||||

| Frontier Communications Corp., Term B-1 Loan | LIBOR + 3.750% | 1,140,263 | 6.326 | + | 6/16/2024 | 1,115,081 | ||||||||||

| Go Daddy Operating Co. LLC, Tranche B-1 Term Loan | LIBOR + 2.000% | 751,686 | 4.576 | + | 2/16/2024 | 753,975 | ||||||||||

| Hoya Midco LLC., Initial Term Loan (First Lien) | LIBOR + 3.500% | 867,936 | 6.076 | + | 6/30/2024 | 863,058 | ||||||||||

| iHeart Communications, Inc., Tranche D Term Loan | LIBOR + 8.750% | 1,510,000 | 9.000 | + | 12/15/2019 | 1,125,426 | ||||||||||

| KSBR Holding Corp., Initial Term Loan | LIBOR + 4.500% | 140,000 | 7.088 | + | 4/16/2026 | 141,487 | ||||||||||

| Level 3 Financing, Inc., Tranche B 2024 Term Loan | LIBOR + 2.250% | 2,410,000 | 4.826 | + | 2/22/2024 | 2,414,217 | ||||||||||

| MCC Iowa LLC, Tranche M Term Loan | LIBOR + 2.000% | 783,187 | 4.583 | + | 1/16/2025 | 784,820 | ||||||||||

| Mcgraw-Hill Global Education Holdings LLC, Term B Loan (First Lien) | LIBOR + 4.000% | 1,475,136 | 6.576 | + | 5/04/2022 | 1,415,998 | ||||||||||

| Mediacom Illinois LLC, Tranche N Term Loan | LIBOR + 1.750% | 646,754 | 4.333 | + | 2/15/2024 | 645,295 | ||||||||||

| Meredith Corp., Tranche B-1 Term Loan | LIBOR + 2.750% | 613,750 | 5.326 | + | 2/01/2025 | 616,764 | ||||||||||

| Numericable US LLC, USD TLB-11 Term Loan | LIBOR + 2.750% | 638,625 | 5.326 | + | 8/01/2025 | 619,070 | ||||||||||

| Numericable US LLC, USD TLB-12 Term Loan | LIBOR + 3.688% | 323,219 | 6.275 | + | 2/01/2026 | 316,108 | ||||||||||

| Radiate Holdco LLC, Closing Date Term Loan | LIBOR + 3.000% | 854,604 | 5.576 | + | 1/31/2024 | 853,309 | ||||||||||

| Red Ventures LLC, Term B-1 Loan (First Lien) | LIBOR + 3.000% | 1,016,343 | 5.576 | + | 11/08/2024 | 1,021,424 | ||||||||||

| Rodan & Fields LLC, Closing Date Term Loan | LIBOR + 4.000% | 640,163 | 6.588 | + | 6/16/2025 | 569,745 | ||||||||||

| SBA Senior Finance II LLC, Initial Term Loan | LIBOR + 2.000% | 1,150,838 | 4.576 | + | 4/12/2025 | 1,145,803 | ||||||||||

| Securus Technologies Holdings, Inc., Initial Term Loan (First Lien) | LIBOR + 4.500% | 370,900 | 7.076 | + | 10/31/2024 | 365,954 | ||||||||||

| Securus Technologies Holdings, Inc., Initial Loan (Second Lien) | LIBOR + 8.250% | 255,000 | 10.826 | + | 10/31/2025 | 249,517 | ||||||||||

| Sinclair Television Group, Inc., Tranche B Term Loan | LIBOR + 2.250% | 361,064 | 4.826 | + | 1/04/2024 | 361,741 | ||||||||||

| Sprint Communications, Inc., Initial Term Loan | LIBOR + 2.500% | 1,043,243 | 5.076 | + | 2/02/2024 | 1,015,597 | ||||||||||

| Sprint Communications, Inc., 2019 Incremental Term Loan | LIBOR + 3.000% | 369,075 | 5.576 | + | 2/02/2024 | 364,308 | ||||||||||

| Telenet Financing USD LLC., Term Loan AN Facility | LIBOR + 2.250% | 680,000 | 4.888 | + | 8/16/2026 | 678,980 | ||||||||||

| Tribune Media Co., Term B Loan | LIBOR + 3.000% | 22,405 | 5.576 | + | 12/28/2020 | 22,475 | ||||||||||

| Tribune Media Co., Term C Loan | LIBOR + 3.000% | 279,252 | 5.576 | + | 1/26/2024 | 279,907 | ||||||||||

| Univision Communications, Inc., 2017 Replacement Repriced First-Lien Term Loan | LIBOR + 2.750% | 2,264,710 | 5.326 | + | 3/16/2024 | 2,183,419 | ||||||||||

| Virgin Media Bristol LLC, K Facility | LIBOR + 2.500% | 690,000 | 5.088 | + | 1/16/2026 | 692,763 | ||||||||||

| West Corporation, Initial Term B Loan | LIBOR + 4.000% | 445,155 | 6.615 | + | 10/10/2024 | 431,914 | ||||||||||

| West Corporation, Incremental Term B-1 Loan | LIBOR + 3.500% | 248,125 | 6.115 | + | 10/10/2024 | 239,751 | ||||||||||

| Ziggo Secured Finance Partnership, Term Loan E Facility | LIBOR + 2.500% | 890,000 | 5.088 | + | 4/16/2025 | 883,418 | ||||||||||

| 29,583,179 | ||||||||||||||||

| CONSUMER, CYCLICAL - 19.0% | ||||||||||||||||

| 84 Lumber Co., Term B-1 Loan | LIBOR + 5.250% | 412,919 | 7.832 | + | 10/24/2023 | 414,467 | ||||||||||

| Accuride Corp., 2017 Refinancing Term Loan | LIBOR + 5.250% | 450,862 | 7.850 | + | 11/16/2023 | 399,013 | ||||||||||

| Affinity Gaming, Initial Term Loan | LIBOR + 3.250% | 358,330 | 5.826 | + | 6/30/2023 | 342,804 | ||||||||||

| American Airlines, Inc., 2017 Class B Term Loan | LIBOR + 2.000% | 87,220 | 4.579 | + | 4/28/2023 | 86,762 | ||||||||||

| American Airlines, Inc., 2017 Class B Term Loan | LIBOR + 2.000% | 489,559 | 4.588 | + | 12/14/2023 | 487,163 | ||||||||||

| American Airlines, Inc., 2018 Replacement Term Loan | LIBOR + 1.750% | 426,723 | 4.329 | + | 6/28/2025 | 421,686 | ||||||||||

| American Axle & Manufacturing, Inc., Tranche B Term Loan | LIBOR + 2.250% | 666,675 | 4.832 | + | 4/06/2024 | 658,342 | ||||||||||

| American Builders & Contractors Supply Co., Inc., Term B-2 Loan | LIBOR + 2.000% | 1,405,413 | 4.576 | + | 11/01/2023 | 1,396,334 | ||||||||||

| American Greetings Corp., Initial Term Loan | LIBOR + 4.500% | 342,413 | 7.076 | + | 4/06/2024 | 343,911 | ||||||||||

| Aramark Intermediate HoldCo Corp., U.S. Term B-2 Loan | LIBOR + 1.750% | 265,455 | 4.326 | + | 3/28/2024 | 265,754 | ||||||||||

| Aramark Intermediate HoldCo Corp., U.S. Term B-3 Loan | LIBOR + 1.750% | 1,357,024 | 4.326 | + | 3/12/2025 | 1,357,024 | ||||||||||

| Aristocrat Leisure Ltd., Term B-3 Loan | LIBOR + 1.750% | 1,553,214 | 4.330 | + | 10/20/2024 | 1,552,244 | ||||||||||

| Bass Pro Group LLC, Initial Term Loan | LIBOR + 5.000% | 933,703 | 7.576 | + | 9/24/2024 | 933,900 | ||||||||||

| Boyd Gaming Corp., Refinancing Term B Loan | LIBOR + 2.250% | 787,826 | 4.832 | + | 9/16/2023 | 789,303 | ||||||||||

See accompanying notes to financial statements.

3

| SCHEDULE OF INVESTMENTS (Unaudited) |

| Dunham Floating Rate Bond Fund (Continued) |

| April 30, 2019 |

| Variable | Principal | Interest | Maturity | |||||||||||||

| Security | Rate | Amount | Rate % | Date | Value | |||||||||||

| BANK LOANS - 92.1% (Continued) | ||||||||||||||||

| CONSUMER, CYCLICAL - 19.0% (Continued) | ||||||||||||||||

| Caesars Resort Collection LLC, Term B Loan | LIBOR + 2.750% | $ | 1,950,313 | 5.326 | + | 12/24/2024 | $ | 1,958,640 | ||||||||

| Carlisle FoodService Products, Inc., Initial Term Loan (First Lien) | LIBOR + 3.000% | 452,110 | 5.576 | + | 3/20/2025 | 437,982 | ||||||||||

| Carlisle FoodService Products, Inc., Delayed Draw Term Loan (First Lien) | LIBOR + 3.000% | 103,067 | — | + | 3/20/2025 | 100,426 | ||||||||||

| CBAC Borrower LLC, Term B Loan | LIBOR + 4.000% | 231,475 | 6.576 | + | 7/08/2024 | 232,151 | ||||||||||

| CDS US Intermediate Holdings, Inc., Term B Loan (First Lien) | LIBOR + 3.750% | 622,336 | 6.337 | + | 7/08/2022 | 605,614 | ||||||||||

| CEOC LLC, Term B Loan | LIBOR + 2.000% | 1,397,313 | 4.576 | + | 10/08/2024 | 1,392,946 | ||||||||||

| CityCenter Holdings LLC., Term B Loan | LIBOR + 2.250% | 1,173,815 | 4.826 | + | 4/18/2024 | 1,174,825 | ||||||||||

| Crown Finance US, Inc., Initial Dollar Tranche Term Loan | LIBOR + 2.250% | 571,657 | 4.826 | + | 2/28/2025 | 569,990 | ||||||||||

| CSC SW Holdco, Inc., Term B-1 Loan (First Lien) | LIBOR + 3.250% | 713,093 | 5.851 | + | 11/14/2022 | 706,112 | ||||||||||

| DexKo Global, Inc., Replacement U.S. Dollar Term B Loan (First Lien) | LIBOR + 3.500% | 513,514 | 6.076 | + | 7/24/2024 | 513,514 | ||||||||||

| Eldorado Resorts, Inc., Term Loan | LIBOR + 2.250% | 789,246 | 4.833 | + | 4/16/2024 | 790,067 | ||||||||||

| Formula One Management Ltd., Facility B3 (USD) | LIBOR + 2.500% | 615,202 | 5.122 | + | 1/31/2024 | 607,896 | ||||||||||

| Gateway Casinos & Entertainment Ltd., Initial Term Loan | LIBOR + 3.000% | 501,213 | 5.600 | + | 11/30/2023 | 504,345 | ||||||||||

| Global Appliance, Inc., Tranche B Term Loan | LIBOR + 4.000% | 926,926 | 6.576 | + | 9/28/2024 | 930,402 | ||||||||||

| Golden Nugget, Inc., Initial B Term Loan | LIBOR + 2.750% | 827,456 | 5.331 | + | 10/04/2023 | 829,615 | ||||||||||

| GVC Holdings PLC, Facility B2 (USD) | LIBOR + 2.500% | 569,250 | 5.076 | + | 3/28/2024 | 569,748 | ||||||||||

| HD Supply, Inc., Term B-5 Loan | LIBOR + 1.750% | 845,247 | 4.326 | + | 10/16/2023 | 848,417 | ||||||||||

| Hilton Worldwide Finance LLC, Series B-2 Term Loan | LIBOR + 1.750% | 1,208,345 | 4.332 | + | 10/24/2023 | 1,213,571 | ||||||||||

| Isagenix International LLC, Senior Lien Term Loan | LIBOR + 5.750% | 567,875 | 8.350 | + | 6/14/2025 | 457,139 | ||||||||||

| Libbey Glass, Inc., Initial Loan | LIBOR + 3.000% | 555,242 | 5.581 | + | 4/08/2021 | 508,046 | ||||||||||

| Michaels Stores, Inc., 2018 New Replacement Term B Loan | LIBOR + 2.500% | 515,943 | 5.077 | + | 1/30/2023 | 513,848 | ||||||||||

| Navistar, Inc., Tranche B Term Loan | LIBOR + 3.500% | 930,600 | 6.097 | + | 11/06/2024 | 932,810 | ||||||||||

| Neiman Marcus Group Ltd. LLC, Other Term Loan | LIBOR + 3.250% | 1,242,776 | 5.834 | + | 10/24/2020 | 1,154,228 | ||||||||||

| Panther BF Aggregator 2 LP, Term Loan B | LIBOR + 3.500% | 850,000 | 6.133 | + | 3/18/2026 | 854,509 | ||||||||||

| Patriot Container Corp., Closing Date Term Loan (First Lien) | LIBOR + 3.500% | 633,600 | 6.076 | + | 3/20/2025 | 632,412 | ||||||||||

| PetSmart, Inc., Amended Loan | LIBOR + 4.250% | 722,456 | 6.834 | + | 3/12/2022 | 698,474 | ||||||||||

| Playa Resorts Holding BV, Initial Term Loan | LIBOR + 2.750% | 839,722 | 5.326 | + | 4/28/2024 | 829,053 | ||||||||||

| Scientific Games International, Inc., Initial Term B-5 Loan | LIBOR + 2.750% | 799,932 | 5.326 | + | 8/14/2024 | 799,040 | ||||||||||

| Serta Simmons Bedding LLC, Initial Term Loan (First Lien) | LIBOR + 3.500% | 299,115 | 6.085 | + | 11/08/2023 | 219,208 | ||||||||||

| Siteone Landscape Supply LLC, Tranche E Term Loan | LIBOR + 2.750% | 692,511 | 5.330 | + | 10/28/2024 | 690,637 | ||||||||||

| SRAM LLC, New Term Loan (2018) (First Lien) | LIBOR + 2.750% | 501,834 | 5.386 | + | 3/16/2024 | 504,343 | ||||||||||

| Stars Group Holdings BV, USD Term Loan | LIBOR + 3.500% | 576,417 | 6.100 | + | 7/10/2025 | 579,887 | ||||||||||

| Station Casinos LLC, Term B Facility Loan | LIBOR + 2.500% | 868,895 | 5.076 | + | 6/08/2023 | 871,367 | ||||||||||

| Tenneco, Inc., Tranche B Term Loan | LIBOR + 2.750% | 793,013 | 5.326 | + | 9/30/2025 | 776,906 | ||||||||||

| TI Group Automotive Systems LLC, Initial US Term Loan | LIBOR + 2.500% | 356,576 | 5.076 | + | 6/30/2022 | 354,347 | ||||||||||

| Univar USA, Inc., Term B-3 Loan | LIBOR + 2.250% | 718,439 | 4.826 | + | 6/30/2024 | 720,236 | ||||||||||

| 35,531,458 | ||||||||||||||||

| CONSUMER, NON-CYCLICAL - 20.3% | ||||||||||||||||

| 21st Century Oncology, Inc., Tranche B Term Loan | LIBOR + 6.125% | 144,779 | 8.726 | + | 1/16/2023 | 120,746 | ||||||||||

| Accelerated Health Systems LLC, Initial Term Loan | LIBOR + 3.500% | 463,838 | 6.089 | + | 11/01/2025 | 466,013 | ||||||||||

| Acuity Specialty Products, Inc., Initial Term Loan (First Lien) | LIBOR + 4.000% | 275,800 | 6.600 | + | 8/12/2024 | 230,293 | ||||||||||

| Agiliti Health, Inc., Initial Term Loan | LIBOR + 3.000% | 435,000 | 5.595 | + | 1/04/2026 | 435,000 | ||||||||||

| AHP Health Partners, Inc., Term Loan | LIBOR + 4.500% | 580,613 | 7.076 | + | 6/30/2025 | 582,973 | ||||||||||

| Albertson’s LLC, 2017-1 Term B-5 Loan | LIBOR + 3.000% | 644,688 | 5.601 | + | 12/20/2022 | 646,483 | ||||||||||

| Albertson’s LLC, 2018 Term B-7 Loan | LIBOR + 3.000% | 1,142,772 | 5.576 | + | 11/16/2025 | 1,145,515 | ||||||||||

| AlixPartners LLP, 2017 Refinancing Term Loan | LIBOR + 2.750% | 945,247 | 5.326 | + | 4/04/2024 | 947,535 | ||||||||||

| Allied Universal Holdco LLC, Incremental Term Loan (First Lien) | LIBOR + 4.250% | 448,875 | 6.826 | + | 7/28/2022 | 444,499 | ||||||||||

| Amneal Pharmaceuticals LLC, Initial Term Loan | LIBOR + 3.500% | 605,284 | 6.076 | + | 5/04/2025 | 608,235 | ||||||||||

| Atlantic Aviation FBO, Inc., Term Loan | LIBOR + 3.750% | 129,675 | 6.326 | + | 12/06/2025 | 131,458 | ||||||||||

| Avantor, Inc., Initial B-1 Dollar Term Loan | LIBOR + 3.750% | 624,449 | 6.326 | + | 11/20/2024 | 628,299 | ||||||||||

| Bausch Health Companies, Inc., Initial Term Loan | LIBOR + 3.000% | 1,163,518 | 5.584 | + | 6/02/2025 | 1,170,126 | ||||||||||

| Bausch Health Companies, Inc., First Incremental Term Loan | LIBOR + 2.750% | 204,250 | 5.334 | + | 11/28/2025 | 204,679 | ||||||||||

| Change Healthcare Holdings, Inc., Closing Date Term Loan | LIBOR + 2.750% | 955,200 | 5.326 | + | 2/29/2024 | 956,308 | ||||||||||

| CHG Healthcare Services, Inc., New Term Loan (2017) (First Lien) | LIBOR + 3.000% | 367,263 | 5.576 | + | 6/08/2023 | 367,915 | ||||||||||

| CHG PPC Parent LLC, Initial Term Loan (First Lien) | LIBOR + 2.750% | 585,575 | 5.326 | + | 4/01/2025 | 586,676 | ||||||||||

| Chobani LLC, New Term Loan (First Lien) | LIBOR + 3.500% | 843,429 | 6.076 | + | 10/10/2023 | 833,940 | ||||||||||

| Concordia International Corp., Initial Dollar Term Loan | LIBOR + 5.500% | 90,090 | 8.097 | + | 9/06/2024 | 84,769 | ||||||||||

| CPI Acquisition, Inc., Term Loan (First Lien) | LIBOR + 4.500% | 1,368,336 | 7.081 | + | 8/16/2022 | 1,022,831 | ||||||||||

| Diamond BV, Initial USD Term Loan | LIBOR + 3.000% | 782,120 | 5.576 | + | 9/06/2024 | 755,723 | ||||||||||

| Dole Food Company, Inc., Tranche B Term Loan | LIBOR + 2.750% | 916,375 | 5.331 | + | 4/06/2024 | 907,976 | ||||||||||

| Envision Healthcare Corp., Initial Term Loan | LIBOR + 3.750% | 1,560,667 | 6.326 | + | 10/10/2025 | 1,510,655 | ||||||||||

| Explorer Holdings, Inc., Initial Term Loan | LIBOR + 3.750% | 586,932 | 6.350 | + | 5/02/2023 | 587,759 | ||||||||||

| Fort Dearborn Holding Company, Inc., Initial Term Loan (First Lien) | LIBOR + 4.000% | 392,602 | 6.589 | + | 10/20/2023 | 390,639 | ||||||||||

| Greatbatch Ltd., New Term B Loan (2017) | LIBOR + 3.000% | 598,781 | 5.592 | + | 10/28/2022 | 601,916 | ||||||||||

| Greenrock Finance, Inc., Initial USD Term B Loan (First Lien) | LIBOR + 3.500% | 251,813 | 6.100 | + | 6/28/2024 | 251,499 | ||||||||||

| GW Honos Security Corp., Term B Loan | LIBOR + 3.500% | 227,198 | 6.108 | + | 5/24/2024 | 227,283 | ||||||||||

| Heartland Dental, LLC, Initial Term Loan | LIBOR + 3.750% | 606,576 | 6.326 | + | 4/30/2025 | 598,615 | ||||||||||

| Heartland Dental, LLC, Delayed Term Loan | LIBOR + 3.750% | 13,575 | 6.113 | + | 4/30/2025 | 13,397 | ||||||||||

| Herbalife Nutrition Ltd., Term Loan B | LIBOR + 3.250% | 243,775 | 5.826 | + | 8/18/2025 | 245,512 | ||||||||||

See accompanying notes to financial statements.

4

| SCHEDULE OF INVESTMENTS (Unaudited) |

| Dunham Floating Rate Bond Fund (Continued) |

| April 30, 2019 |

| Variable | Principal | Interest | Maturity | |||||||||||||

| Security | Rate | Amount | Rate % | Date | Value | |||||||||||

| BANK LOANS - 92.1% (Continued) | ||||||||||||||||

| CONSUMER, NON-CYCLICAL - 20.3% (Continued) | ||||||||||||||||

| H-Food Holdings LLC, Initial Term Loan | LIBOR + 3.688% | $ | 471,438 | 6.263 | + | 5/24/2025 | $ | 462,989 | ||||||||

| Hostess Brands LLC, November 2017 Refinancing Term B Loan | LIBOR + 2.250% | 920,764 | 4.826 | + | 8/04/2022 | 920,764 | ||||||||||

| Jaguar Holding Company I LLC, 2018 Term Loan | LIBOR + 2.500% | 934,743 | 5.076 | + | 8/18/2022 | 930,831 | ||||||||||

| JBS USA Lux S.A., Initial Term Loan | LIBOR + 2.500% | 836,900 | 5.081 | + | 10/30/2022 | 838,428 | ||||||||||

| JBS USA Lux S.A., Term Loan B | LIBOR + 2.500% | 740,000 | 5.082 | + | 4/24/2026 | 742,390 | ||||||||||

| Kronos Acquisition Intermediate, Inc., Initial Loan | LIBOR + 4.000% | 956,837 | 6.579 | + | 5/16/2023 | 920,788 | ||||||||||

| Milk Specialties Company, New Term Loan | LIBOR + 4.000% | 334,396 | 6.576 | + | 8/16/2023 | 335,650 | ||||||||||

| NAB Holdings LLC, 2018 Refinancing Term Loan | LIBOR + 3.000% | 576,254 | 5.600 | + | 6/30/2024 | 565,449 | ||||||||||

| National Mentor Holdings, Inc., Initial Term Loan (First Lien) | LIBOR + 4.250% | 127,105 | 6.826 | + | 3/08/2026 | 128,138 | ||||||||||

| National Mentor Holdings, Inc., Initial Term C Loan (First Lien) | LIBOR + 4.250% | 7,895 | 6.826 | + | 3/08/2026 | 7,959 | ||||||||||

| NVA Holdings, Inc., Term B-3 Loan (First Lien) | LIBOR + 2.750% | 772,220 | 5.326 | + | 2/02/2025 | 761,281 | ||||||||||

| NVA Holdings, Inc., Incremental Term B-4 Loan | LIBOR + 3.500% | 20,000 | 6.081 | + | 2/02/2025 | 20,075 | ||||||||||

| Ortho-Clinical Diagnostics, Inc., Second Amendment New Term Loan | LIBOR + 3.250% | 997,786 | 5.833 | + | 6/30/2025 | 999,158 | ||||||||||

| Parexel International Corp., Initial Term Loan | LIBOR + 2.750% | 615,625 | 5.326 | + | 9/28/2024 | 604,790 | ||||||||||

| Parfums Holding Co., Inc., Initial Term Loan (First Lien) | LIBOR + 4.250% | 637,041 | 6.865 | + | 6/30/2024 | 634,120 | ||||||||||

| PetVet Care Centers LLC, Initial Term Loan (First Lien) | LIBOR + 2.750% | 462,825 | 5.332 | + | 2/14/2025 | 447,783 | ||||||||||

| PetVet Care Centers LLC, Delayed Draw Term Loan (First Lien) | LIBOR + 2.750% | 136,879 | 4.622 | + | 2/14/2025 | 132,430 | ||||||||||

| Phoenix Guarantor, Inc., Initial Term Loan (First Lien) | LIBOR + 4.500% | 123,750 | 7.092 | + | 3/04/2026 | 124,807 | ||||||||||

| Phoenix Guarantor, Inc., Delayed Draw Term Loan (First Lien) | LIBOR + 4.500% | 11,250 | 7.107 | + | 3/05/2026 | 11,346 | ||||||||||

| Prime Security Services Borrower LLC, December 2018 Incremental Term B-1 Loan (First Lien) | LIBOR + 2.750% | 790,010 | 5.326 | + | 5/02/2022 | 792,163 | ||||||||||

| Prospect Medical Holdings, Inc., Term B-1 Loan | LIBOR + 5.500% | 253,088 | 8.084 | + | 2/22/2024 | 239,484 | ||||||||||

| Refinitiv US Holdings, Inc., Initial Dollar Term Loan | LIBOR + 3.750% | 937,650 | 6.326 | + | 9/30/2025 | 929,056 | ||||||||||

| Regionalcare Hospital Partners Holdings, Inc., Term B Loan (First Lien) | LIBOR + 4.500% | 802,988 | 7.080 | + | 11/16/2025 | 808,006 | ||||||||||

| Revlon Consumer Products Corp., Initial Term B Loan | LIBOR + 3.500% | 650,045 | 6.115 | + | 9/08/2023 | 509,678 | ||||||||||

| Select Medical Corp., Tranche B Term Loan | LIBOR + 2.500% | 563,789 | 5.080 | + | 3/06/2025 | 565,199 | ||||||||||

| Sigma Holdco BV, Facility B2 | LIBOR + 3.000% | 550,838 | 5.660 | + | 7/02/2025 | 546,106 | ||||||||||

| St. George’s University Scholastic Services LLC, Term Loan | LIBOR + 3.500% | 893,796 | 6.076 | + | 7/16/2025 | 896,312 | ||||||||||

| Sterigenics-Nordion Holdings LLC, Incremental Term Loan | LIBOR + 3.000% | 1,011,502 | 5.576 | + | 5/16/2022 | 1,006,065 | ||||||||||

| Surgery Center Holdings, Inc., Initial Term Loan | LIBOR + 3.250% | 753,525 | 5.826 | + | 9/02/2024 | 745,914 | ||||||||||

| Trans Union LLC, 2017 Replacement Term B-3 Loan | LIBOR + 2.000% | 1,489,492 | 4.576 | + | 4/10/2023 | 1,492,866 | ||||||||||

| U.S. Renal Care Inc., Initial Term Loan (First Lien) | LIBOR + 4.250% | 616,612 | 6.850 | + | 12/30/2022 | 618,027 | ||||||||||

| Viant Medical Holdings, Inc., Initial Term Loan (First Lien) | LIBOR + 3.750% | 174,125 | 6.350 | + | 7/02/2025 | 174,815 | ||||||||||

| Vizient, Inc., Term Loan B | LIBOR + 2.750% | 150,000 | 5.341 | + | 5/16/2026 | 151,031 | ||||||||||

| Wellpath Holdings, Inc., Initial Term Loan (First Lien) | LIBOR + 5.500% | 399,000 | 8.076 | + | 9/30/2025 | 386,531 | ||||||||||

| WEX, Inc., Term B-2 Loan | LIBOR + 2.250% | 881,257 | 4.826 | + | 6/30/2023 | 884,289 | ||||||||||

| 38,039,985 | ||||||||||||||||

| ENERGY - 4.0% | ||||||||||||||||

| California Resources Corp., Initial Loan | LIBOR + 4.750% | 405,000 | 7.329 | + | 1/01/2023 | 393,964 | ||||||||||

| CITGO Petroleum Corp., 2019 Incremental Term B Loan | LIBOR + 5.000% | 880,000 | 7.602 | + | 3/28/2024 | 880,365 | ||||||||||

| Fieldwood Energy LLC, Closing Date Loan (First Lien) | LIBOR + 5.250% | 180,554 | 7.826 | + | 4/12/2022 | 174,724 | ||||||||||

| Fieldwood Energy LLC, Closing Date Loan 2018 (Second Lien) | LIBOR + 7.250% | 81,748 | 9.826 | + | 4/12/2023 | 71,580 | ||||||||||

| Gavilan Resources LLC, Initial Term Loan (Second Lien) | LIBOR + 6.000% | 490,000 | 8.582 | + | 2/29/2024 | 369,705 | ||||||||||

| McDermott International, Inc., Term Loan | LIBOR + 5.000% | 707,850 | 7.576 | + | 5/12/2025 | 702,024 | ||||||||||

| Medallion Midland Acquisition LLC, Initial Term Loan | LIBOR + 3.250% | 767,813 | 5.826 | + | 10/30/2024 | 764,695 | ||||||||||

| MRC Global Inc., 2018 Refinancing Term Loan | LIBOR + 3.000% | 754,091 | 5.576 | + | 9/20/2024 | 757,394 | ||||||||||

| Paragon Offshore Finance Co., Term Loan | LIBOR + 2.750% | 1,153 | — | + | 7/16/2021 | — | ||||||||||

| Seadrill Operating LP, Initial Term Loan | LIBOR + 6.000% | 1,136,146 | 8.600 | + | 2/20/2021 | 912,166 | ||||||||||

| TerraForm Power Operating LLC, Specified Refinancing Term Loan | LIBOR + 2.000% | 602,375 | 4.576 | + | 11/08/2022 | 601,622 | ||||||||||

| Traverse Midstream Partners LLC, Advance | LIBOR + 4.000% | 651,725 | 6.576 | + | 9/28/2024 | 651,083 | ||||||||||

| Ultra Resources, Inc., Loan | LIBOR + 4.000% | 665,000 | 6.580 | + | 4/12/2024 | 566,361 | ||||||||||

| Weatherford International Ltd., Loan | LIBOR + 1.425% | 618,032 | 4.001 | + | 7/12/2020 | 607,025 | ||||||||||

| 7,452,708 | ||||||||||||||||

| FINANCIAL - 7.1% | ||||||||||||||||

| Asurion LLC, Amendment No. 14 Replacement B-4 Term Loan | LIBOR + 3.000% | 567,730 | 5.576 | + | 8/04/2022 | 570,660 | ||||||||||

| Asurion LLC, Replacement B-6 Term Loan | LIBOR + 3.000% | 323,924 | 5.576 | + | 11/04/2023 | 325,417 | ||||||||||

| Asurion LLC, New B-7 Term Loan | LIBOR + 3.000% | 387,075 | 5.576 | + | 11/04/2024 | 388,768 | ||||||||||

| Asurion LLC, Second Lien Replacement B-2 Term Loan | LIBOR + 6.500% | 787,456 | 9.076 | + | 8/04/2025 | 805,091 | ||||||||||

| Blackhawk Network Holdings, Inc., Term Loan (First Lien) | LIBOR + 3.000% | 570,688 | 5.576 | + | 6/16/2025 | 571,284 | ||||||||||

| Capital Automotive LP, Initial Tranche B-2 Term Loan (First Lien) | LIBOR + 2.500% | 623,998 | 5.076 | + | 3/24/2024 | 623,480 | ||||||||||

| Capital Automotive LP, Initial Tranche B Term Loan (Second Lien) | LIBOR + 6.000% | 572,573 | 8.576 | + | 3/24/2025 | 576,867 | ||||||||||

| Ditech Holding Corp., Tranche B Term Loan | LIBOR + 6.000% | 1,048,106 | 10.500 | + | 6/30/2022 | 674,063 | ||||||||||

| Ellie Mae, Inc., Term Loan (First Lien) | LIBOR + 4.000% | 705,000 | 6.591 | + | 4/16/2026 | 710,178 | ||||||||||

| FinCo I LLC, 2018 Replacement Loan | LIBOR + 2.000% | 325,100 | 4.576 | + | 12/28/2022 | 326,997 | ||||||||||

| iStar, Inc., Loan | LIBOR + 2.750% | 850,959 | 5.334 | + | 6/28/2023 | 852,002 | ||||||||||

| Lightstone Holdco LLC, Refinancing Term B Loan | LIBOR + 3.750% | 470,678 | 6.326 | + | 1/30/2024 | 469,353 | ||||||||||

| Lightstone Holdco LLC, Refinancing Term C Loan | LIBOR + 3.750% | 26,547 | 6.326 | + | 1/30/2024 | 26,472 | ||||||||||

| MGM Growth Properties Operating Partnership LP, Term B Loan | LIBOR + 2.000% | 912,869 | 4.576 | + | 3/20/2025 | 913,851 | ||||||||||

| Pl UK Holdco II Ltd., Facility B1 | LIBOR + 3.500% | 1,460,250 | 6.076 | + | 1/04/2025 | 1,462,995 | ||||||||||

See accompanying notes to financial statements.

5

| SCHEDULE OF INVESTMENTS (Unaudited) |

| Dunham Floating Rate Bond Fund (Continued) |

| April 30, 2019 |

| Variable | Principal | Interest | Maturity | |||||||||||||

| Security | Rate | Amount | Rate % | Date | Value | |||||||||||

| BANK LOANS - 92.1% (Continued) | ||||||||||||||||

| FINANCIAL - 7.1% (Continued) | ||||||||||||||||

| Sedgwick Claims Management Services, Inc., Initial Term Loan | LIBOR + 3.250% | $ | 1,010,000 | 5.826 | + | 1/01/2026 | $ | 1,365,208 | ||||||||

| TKC Holdings, Inc., Initial Term Loan (First Lien) | LIBOR + 3.750% | 908,237 | 6.326 | + | 1/31/2023 | 894,374 | ||||||||||

| UFC Holdings LLC, Term Loan (First Lien) | LIBOR + 3.250% | 908,237 | 5.850 | + | 8/18/2023 | 971,606 | ||||||||||

| UFC Holdings LLC, Term B Loan | LIBOR + 3.250% | 594,333 | 5.832 | + | 4/30/2026 | 95,467 | ||||||||||

| Uniti Group, Inc., Shortfall Term Loan | LIBOR + 5.000% | 576,541 | 7.576 | + | 10/24/2022 | 567,882 | ||||||||||

| 13,192,015 | ||||||||||||||||

| INDUSTRIALS - 13.4% | ||||||||||||||||

| Accuride Corp., 2017 Refinancing Term Loan | LIBOR + 5.250% | 436,937 | 5.826 | + | 2/01/2025 | 386,689 | ||||||||||

| Anchor Glass Container Corp., July 2017 Additional Term Loan (First Lien) | LIBOR + 2.750% | 428,075 | 5.332 | + | 12/08/2023 | 363,149 | ||||||||||

| Anchor Glass Container Corp., Term Loan (Second Lien) | LIBOR + 7.750% | 244,000 | 10.334 | + | 12/08/2024 | 139,486 | ||||||||||

| Berlin Packaging LLC, Initial Term Loan (First Lien) | LIBOR + 3.000% | 590,538 | 3.000 | + | 11/08/2025 | 584,387 | ||||||||||

| Berry Global, Inc., Term S Loan | LIBOR + 1.750% | 226,743 | 4.353 | + | 2/08/2020 | 226,938 | ||||||||||

| Berry Global, Inc., Term T Loan | LIBOR + 1.750% | 417,785 | 4.353 | + | 1/06/2021 | 417,843 | ||||||||||

| Berry Global, Inc., Term Q Loan | LIBOR + 2.000% | 308,192 | 4.603 | + | 9/30/2022 | 308,176 | ||||||||||

| Berry Global, Inc., Term R Loan | LIBOR + 2.000% | 521,370 | 4.603 | + | 1/20/2024 | 520,622 | ||||||||||

| Brand Energy & Infrastructure Services, Inc., Initial Term Loan | LIBOR + 4.250% | 698,067 | 6.838 | + | 6/20/2024 | 686,521 | ||||||||||

| Brookfield WEC Holdings, Inc., Initial Term Loan (First Lien) | LIBOR + 3.500% | 698,250 | 6.076 | + | 7/31/2025 | 703,487 | ||||||||||

| Brookfield WEC Holdings, Inc., Initial Term Loan (Second Lien) | LIBOR + 6.750% | 280,000 | 9.326 | + | 8/04/2026 | 285,250 | ||||||||||

| BWay Holding Co., Initial Term Loan | LIBOR + 3.250% | 481,425 | 5.851 | + | 4/04/2024 | 476,536 | ||||||||||

| Circor International, Inc., Initial Term Loan | LIBOR + 3.500% | 656,177 | 6.101 | + | 12/12/2024 | 655,974 | ||||||||||

| CPG International LLC, New Term Loan | LIBOR + 3.750% | 1,722,007 | 6.558 | + | 5/04/2024 | 1,720,578 | ||||||||||

| Deliver Buyer, Inc., Term Loan | LIBOR + 5.000% | 306,966 | 7.600 | + | 4/30/2024 | 307,063 | ||||||||||

| Dynasty Acquisition Co., Inc., Initial Term B-1 Loan | LIBOR + 4.000% | 399,965 | 6.589 | + | 4/06/2026 | 402,517 | ||||||||||

| Dynasty Acquisition Co., Inc., Initial Term B-2 Loan | LIBOR + 4.000% | 215,035 | 6.589 | + | 4/06/2026 | 216,407 | ||||||||||

| Energizer Holdings, Inc., Term Loan B | LIBOR + 2.250% | 303,600 | 4.826 | + | 12/16/2025 | 304,169 | ||||||||||

| Filtration Group Corp., Initial Dollar Term Loan | LIBOR + 3.000% | 856,350 | 5.576 | + | 3/28/2025 | 859,831 | ||||||||||

| Fluidra SA, USD Term Loan | LIBOR + 2.250% | 545,875 | 4.826 | + | 7/02/2025 | 546,102 | ||||||||||

| Gardner Denver, Inc., Tranche B-1 Dollar Term Loan | LIBOR + 2.750% | 999,411 | 5.326 | + | 7/30/2024 | 1,003,014 | ||||||||||

| Gates Global LLC, Initial B-2 Dollar Term Loan | LIBOR + 2.750% | 921,766 | 5.326 | + | 3/31/2024 | 924,596 | ||||||||||

| GFL Environmental, Inc., Effective Date Incremental Term Loan | LIBOR + 3.000% | 611,917 | 5.576 | + | 5/30/2025 | 607,900 | ||||||||||

| Gopher Resource LLC, Initial Term Loan | LIBOR + 3.250% | 477,038 | 5.826 | + | 3/06/2025 | 472,666 | ||||||||||

| Hexion, Inc., Initial Term Loan | LIBOR + 2.750% | 210,000 | 5.348 | + | 9/30/2020 | 210,722 | ||||||||||

| Hillman Group, Inc., Initial Term Loan | LIBOR + 4.000% | 704,675 | 6.576 | + | 5/30/2025 | 697,632 | ||||||||||

| Klockner Pentaplast Of America, Inc., Dollar Term Loan | LIBOR + 4.250% | 861,875 | 6.826 | + | 6/30/2022 | 767,069 | ||||||||||

| NN, Inc., 2017 Incremental Term Loan | LIBOR + 3.250% | 174,800 | 5.826 | + | 4/02/2021 | 171,141 | ||||||||||

| NN, Inc., Tranche B Term Loan | LIBOR + 3.750% | 213,121 | 6.326 | + | 10/20/2022 | 210,457 | ||||||||||

| Quikrete Holdings, Inc., Initial Loan (First Lien) | LIBOR + 2.750% | 786,538 | 5.326 | + | 11/16/2023 | 784,151 | ||||||||||

| RBS Global, Inc., Refinancing Term Loan | LIBOR + 2.000% | 800,971 | 4.576 | + | 8/20/2024 | 802,809 | ||||||||||

| Reynolds Group Holdings, Inc., Incremental U.S. Term Loan | LIBOR + 2.750% | 1,181,607 | 5.326 | + | 2/04/2023 | 1,185,394 | ||||||||||

| Summit Materials LLC, New Term Loan | LIBOR + 2.000% | 1,147,142 | 4.576 | + | 11/20/2024 | 1,147,503 | ||||||||||

| Titan Acquisition Ltd., Initial Term Loan | LIBOR + 3.000% | 1,009,800 | 5.600 | + | 3/28/2025 | 973,195 | ||||||||||

| Transdigm, Inc., New Tranche F Term Loan (2018) | LIBOR + 2.500% | 1,092,105 | 5.076 | + | 6/08/2023 | 1,090,057 | ||||||||||

| Transdigm, Inc., New Tranche G Term Loan | LIBOR + 2.500% | 737,907 | 5.076 | + | 8/22/2024 | 735,811 | ||||||||||

| Transdigm, Inc., New Tranche E Term Loan (2018) | LIBOR + 2.500% | 797,143 | 5.076 | + | 5/30/2025 | 794,819 | ||||||||||

| Tricorbraun Holdings, Inc., Closing Date Term Loan (First Lien) | LIBOR + 3.750% | 637,833 | 6.350 | + | 11/30/2023 | 638,231 | ||||||||||

| Trident TPI Holdings, Inc., Tranche B-1 Term Loan | LIBOR + 3.250% | 726,394 | 5.826 | + | 10/16/2024 | 710,733 | ||||||||||

| Tunnel Hill Partners LP, Initial Term Loan | LIBOR + 3.500% | 655,000 | 6.076 | + | 2/06/2026 | 654,181 | ||||||||||

| US Farathane LLC, Term B-4 Loan | LIBOR + 3.500% | 376,714 | 6.100 | + | 12/24/2021 | 371,063 | ||||||||||

| 25,064,869 | ||||||||||||||||

| TECHNOLOGY - 7.8% | ||||||||||||||||

| Applied Systems, Inc., Closing Date Term Loan (First Lien) | LIBOR + 3.000% | 690,147 | 5.576 | + | 9/20/2024 | 690,488 | ||||||||||

| Applied Systems, Inc., Initial Term Loan (Second Lien) | LIBOR + 7.000% | 105,000 | 9.576 | + | 9/20/2025 | 107,152 | ||||||||||

| Blackboard, Inc., Term B-4 Loan (First Lien) | LIBOR + 5.000% | 587,246 | 7.581 | + | 6/30/2021 | 584,751 | ||||||||||

| Boxer Parent Company, Inc., Initial Dollar Term Loan | LIBOR + 4.250% | 1,436,400 | 6.850 | + | 10/02/2025 | 1,430,116 | ||||||||||

| Dell International LLC, Refinancing Term B Loan | LIBOR + 2.000% | 1,456,939 | 4.576 | + | 9/08/2023 | 1,459,401 | ||||||||||

| Dun & Bradstreet Corp., Initial Term Borrowing | LIBOR + 5.000% | 565,000 | 7.579 | + | 2/06/2026 | 569,947 | ||||||||||

| Everi Payments, Inc., Term B Loan | LIBOR + 3.000% | 739,039 | 5.576 | + | 5/08/2024 | 741,574 | ||||||||||

| First Data Corporation, 2022D New Dollar Term Loan | LIBOR + 2.000% | 861,265 | 4.586 | + | 7/08/2022 | 862,191 | ||||||||||

| Iqvia, Inc., Term B-1 Dollar Loan | LIBOR + 2.000% | 144,019 | 4.600 | + | 3/08/2024 | 144,307 | ||||||||||

| Iqvia, Inc., Incremental Term B-2 Dollar Loan | LIBOR + 2.000% | 73,875 | 4.600 | + | 1/16/2025 | 74,029 | ||||||||||

| Iqvia, Inc., Term B-3 Dollar Loan | LIBOR + 1.750% | 744,375 | 4.326 | + | 6/12/2025 | 742,749 | ||||||||||

| Kronos, Inc., Incremental Term Loan (First Lien) | LIBOR + 3.000% | 1,650,628 | 5.733 | + | 10/31/2023 | 1,655,134 | ||||||||||

| Kronos, Inc., Initial Term Loan (Second Lien) | LIBOR + 8.250% | 120,000 | 10.983 | + | 10/31/2024 | 124,276 | ||||||||||

| Neustar, Inc., TLB4 (First Lien) | LIBOR + 3.500% | 231,475 | 6.076 | + | 8/08/2024 | 226,942 | ||||||||||

| Presidio Holdings, Inc., Term B Loan | LIBOR + 2.750% | 528,809 | 5.345 | + | 2/02/2024 | 529,306 | ||||||||||

| Rackspace Hosting, Inc., Term B Loan (First Lien) | LIBOR + 3.000% | 564,349 | 5.734 | + | 11/04/2023 | 535,895 | ||||||||||

See accompanying notes to financial statements.

6

| SCHEDULE OF INVESTMENTS (Unaudited) |

| Dunham Floating Rate Bond Fund (Continued) |

| April 30, 2019 |

| Variable | Principal | Interest | Maturity | |||||||||||||

| Security | Rate | Amount | Rate % | Date | Value | |||||||||||

| BANK LOANS - 92.1% (Continued) | ||||||||||||||||

| TECHNOLOGY - 7.8% (Continued) | ||||||||||||||||

| SS&C Technologies Holdings, Inc., Term B-3 Loan | LIBOR + 2.250% | $ | 585,057 | 4.826 | + | 4/16/2025 | $ | 586,157 | ||||||||

| SS&C Technologies Holdings, Inc., Term B-4 Loan | LIBOR + 2.250% | 420,654 | 4.826 | + | 4/16/2025 | 421,445 | ||||||||||

| SS&C Technologies Holdings, Inc., Term B-5 Loan | LIBOR + 2.250% | 273,603 | 4.826 | + | 4/16/2025 | 274,049 | ||||||||||

| Tempo Acquisition LLC, Initial Term Loan | LIBOR + 3.000% | 550,200 | 5.576 | + | 4/30/2024 | 551,575 | ||||||||||

| Ultimate Software Group, Inc., Term Loan B | LIBOR + 3.750% | 410,000 | 6.334 | + | 4/08/2026 | 413,434 | ||||||||||

| Vertafore, Inc., Initial Term Loan (First Lien) | LIBOR + 3.250% | 1,840,388 | 5.826 | + | 7/02/2025 | 1,828,683 | ||||||||||

| 14,553,601 | ||||||||||||||||

| UTILITIES - 1.5% | ||||||||||||||||

| APLP Holdings LP, Term Loan | LIBOR + 2.750% | 276,536 | 5.326 | + | 4/12/2023 | 278,654 | ||||||||||

| Calpine Construction Finance Co. LP, Term B Loan | LIBOR + 2.500% | 715,109 | 5.076 | + | 1/16/2025 | 716,261 | ||||||||||

| Pacific Gas and Electric Company, Term Loan (DIP) | LIBOR + 2.250% | 155,000 | 4.764 | + | 12/31/2020 | 155,969 | ||||||||||

| Pacific Gas and Electric Company, Delayed Draw Term Loan (DIP) | LIBOR + 2.250% | 50,000 | 4.764 | + | 12/31/2020 | 50,312 | ||||||||||

| Talen Energy Supply LLC, Term B-1 Loan | LIBOR + 4.000% | 195,510 | 6.576 | + | 7/16/2023 | 196,060 | ||||||||||

| Talen Energy Supply LLC, Initial Term Loan | LIBOR + 4.000% | 326,290 | 6.576 | + | 4/16/2024 | 327,209 | ||||||||||

| Texas Competitive Electric Holdings Co. LLC Escrow Bonds | 635,000 | — | 10/01/2020 | 445 | ||||||||||||

| Vistra Operations Co. LLC, Initial Term Loan | LIBOR + 2.000% | 227,418 | 4.576 | + | 8/04/2023 | 227,910 | ||||||||||

| Vistra Operations Co. LLC, 2018 Incremental Term Loan | LIBOR + 2.000% | 868,438 | 4.587 | + | 1/01/2026 | 870,066 | ||||||||||

| 2,822,886 | ||||||||||||||||

| TOTAL BANK LOANS (Cost - $174,334,641) | 172,222,293 | |||||||||||||||

| BONDS & NOTES - 3.9% | ||||||||||||||||

| AUTO PARTS & EQUIPMENT - 0.0% | ||||||||||||||||

| Panther BF Aggregator 2 LP - 144A | 25,000 | 6.250 | 5/15/2026 | 26,094 | ||||||||||||

| CHEMICALS - 0.1% | ||||||||||||||||

| Hexion, Inc. | 105,000 | 6.625 | 4/15/2020 | 83,737 | ||||||||||||

| NOVA Chemicals Corp. - 144A | 65,000 | 4.875 | 6/01/2024 | 63,781 | ||||||||||||

| NOVA Chemicals Corp. - 144A | 40,000 | 5.000 | 5/01/2025 | 39,050 | ||||||||||||

| 186,568 | ||||||||||||||||

| COMPUTERS - 0.3% | ||||||||||||||||

| Exela Intermediate LLC - 144A | 520,000 | 10.000 | 7/15/2023 | 526,334 | ||||||||||||

| DIVERSIFIED FINANCIAL SERVICES - 0.1% | ||||||||||||||||

| Springleaf Finance Corp. | 250,000 | 6.125 | 5/15/2022 | 265,325 | ||||||||||||

| FOOD - 0.1% | ||||||||||||||||

| Dole Food Co., Inc. - 144A | 175,000 | 7.250 | 6/15/2025 | 162,750 | ||||||||||||

| HEALTHCARE-SERVICES - 0.6% | ||||||||||||||||

| Eagle Holding Co. II LLC - 144A | 175,000 | 7.625 | 5/15/2022 | 176,312 | ||||||||||||

| One Call Corp. - 144A | 613,426 | 7.500 | 7/01/2024 | 531,380 | ||||||||||||

| Tenet Healthcare Corp. | 405,000 | 4.625 | 7/15/2024 | 407,660 | ||||||||||||

| 1,115,352 | ||||||||||||||||

| HOME BUILDERS - 0.3% | ||||||||||||||||

| Lennar Corp. | 420,000 | 2.950 | 11/29/2020 | 416,850 | ||||||||||||

| TRI Pointe Group, Inc. | 70,000 | 4.375 | 6/15/2019 | 70,055 | ||||||||||||

| TRI Pointe Group, Inc. | 130,000 | 4.875 | 7/01/2021 | 132,275 | ||||||||||||

| 619,180 | ||||||||||||||||

| INSURANCE - 0.1% | ||||||||||||||||

| Acrisure LLC - 144A | 90,000 | 8.125 | 2/15/2024 | 94,275 | ||||||||||||

| LODGING - 0.2% | ||||||||||||||||

| Hilton Domestic Operating Co., Inc. - 144A | 295,000 | 5.125 | 5/01/2026 | 302,744 | ||||||||||||

| MEDIA - 0.2% | ||||||||||||||||

| CCO Holdings LLC - 144A | 180,000 | 4.000 | 3/01/2023 | 180,900 | ||||||||||||

| DISH DBS Corp. | 175,000 | 5.875 | 7/15/2022 | 171,404 | ||||||||||||

| iHeartCommunications, Inc. | 95,000 | 9.000 | 12/15/2019 | 70,775 | ||||||||||||

| 423,079 | ||||||||||||||||

| OIL & GAS - 0.1% | ||||||||||||||||

| Denbury Resources, Inc. - 144A | 60,000 | 9.250 | 3/31/2022 | 61,050 | ||||||||||||

| Denbury Resources, Inc. - 144A | 185,000 | 7.500 | 2/15/2024 | 171,125 | ||||||||||||

| 232,175 | ||||||||||||||||

See accompanying notes to financial statements.

7

| SCHEDULE OF INVESTMENTS (Unaudited) |

| Dunham Floating Rate Bond Fund (Continued) |

| April 30, 2019 |

| Principal | Interest | Maturity | ||||||||||||

| Security | Amount | Rate % | Date | Value | ||||||||||

| BONDS & NOTES - 3.9% (Continued) | ||||||||||||||

| PACKAGING & CONTAINERS - 0.3% | ||||||||||||||

| Ardagh Packaging Finance PLC - 144A | $ | 235,000 | 6.000 | 2/15/2025 | $ | 237,350 | ||||||||

| BWAY Holding Co. - 144A | 265,000 | 5.500 | 4/15/2024 | 264,178 | ||||||||||

| 501,528 | ||||||||||||||

| PHARMACEUTICALS - 0.2% | ||||||||||||||

| Bausch Health Companies, Inc. - 144A | 445,000 | 5.500 | 11/01/2025 | 457,100 | ||||||||||

| PIPELINES - 0.1% | ||||||||||||||

| Energy Transfer Operating LP | 190,000 | 4.250 | 3/15/2023 | 194,969 | ||||||||||

| PRIVATE EQUITY - 0.2% | ||||||||||||||

| Icahn Enterprises LP | 310,000 | 6.250 | 2/01/2022 | 320,162 | ||||||||||

| REAL ESTATE INVESTMENT TRUSTS - 0.2% | ||||||||||||||

| iStar Financial, Inc. | 60,000 | 6.000 | 4/01/2022 | 61,575 | ||||||||||

| iStar Financial, Inc. | 335,000 | 5.250 | 9/15/2022 | 338,350 | ||||||||||

| 399,925 | ||||||||||||||

| RETAIL - 0.1% | ||||||||||||||

| Cumberland Farms, Inc. - 144A | 125,000 | 6.750 | 5/01/2025 | 132,188 | ||||||||||

| SEMICONDUCTORS - 0.5% | ||||||||||||||

| Broadcom, Inc. - 144A | 1,000,000 | 3.125 | 10/15/2022 | 995,544 | ||||||||||

| SOFTWARE - 0.2% | ||||||||||||||

| First Data Corp. - 144A | 190,000 | 5.375 | 8/15/2023 | 194,731 | ||||||||||

| First Data Corp. - 144A | 90,000 | 5.000 | 1/15/2024 | 92,316 | ||||||||||

| First Data Corp. - 144A | 25,000 | 5.750 | 1/15/2024 | 25,859 | ||||||||||

| 312,906 | ||||||||||||||

| TELECOMMUNICATIONS - 0.0% | ||||||||||||||

| Frontier Communications Corp. | 90,000 | 8.500 | 4/15/2020 | 86,175 | ||||||||||

| TOTAL BONDS & NOTES (Cost - $7,467,472) | 7,354,373 | |||||||||||||

| Shares | ||||||||||||||

| RIGHTS - 0.0% | ||||||||||||||

| TRA Rights | 10,588 | 8,142 | ||||||||||||

| TOTAL RIGHTS (Cost - $17,470) | ||||||||||||||

| Principal | ||||||||||||||

| Amount | ||||||||||||||

| U.S. GOVERNMENT - 1.0% | ||||||||||||||

| Treasury Bill | $ | 1,885,000 | 2.360 | + | 9/05/2019 | 1,869,290 | ||||||||

| TOTAL U.S. GOVERNMENT (Cost - $1,868,641) | ||||||||||||||

| Shares | ||||||||||||||

| SHORT-TERM INVESTMENT - 5.1% | ||||||||||||||

| MONEY MARKET FUND - 5.1% | ||||||||||||||

| Fidelity Investments Money Market Fund - Class I | 9,483,324 | 2.310 | + | 9,483,324 | ||||||||||

| TOTAL SHORT-TERM INVESTMENT - (Cost - $9,483,324) | ||||||||||||||

| TOTAL INVESTMENTS - 102.1% (Cost - $193,171,548) | 190,937,422 | |||||||||||||

| LIABILITIES IN EXCESS OF OTHER ASSETS - (2.1)% | (3,931,807 | ) | ||||||||||||

| NET ASSETS - 100.0% | $ | 187,005,615 | ||||||||||||

LP - Limited Partnership.

LLC - Limited Liability Company.

LLP - Limited Liability Partnership

PLC - Public Limited Company

144A - Security exempt from registration under Rule 144A of the Securities Act of 1933. These securities may be sold in transactions exempt from registration, normally to qualified institutional buyers. As of April 30, 2019 the total market value of 144A securities is $4,735,061 or 2.53% of net assets.

| + | Variable rate security. Interest rate is as of April 30, 2019. |

See accompanying notes to financial statements.

8

| SCHEDULE OF INVESTMENTS (Unaudited) |

| Dunham Floating Rate Bond Fund (Continued) |

| April 30, 2019 |

| Portfolio Composition *- (Unaudited) | ||||||||||

| Bank Loans | 90.2 | % | Financial | 0.6 | % | |||||

| Short-Term Investment | 5.0 | % | Communications | 0.3 | % | |||||

| U.S. Government | 1.0 | % | Industrial | 0.2 | % | |||||

| Technology | 0.9 | % | Energy | 0.2 | % | |||||

| Consumer, Non-Cyclical | 0.9 | % | Basic Materials | 0.1 | % | |||||

| Consumer, Cyclical | 0.6 | % | Rights | 0.0 | % | |||||

| Total | 100.0 | % | ||||||||

| * | Based on total value of investments as of April 30, 2019 |

Percentage may differ from Schedule of Investments which are based on Fund net assets.

See accompanying notes to financial statements.

9

| Dunham Long/Short Credit Fund (Unaudited) |

| Message from the Sub-Adviser (MetLife Investment Management) |

Asset Class Recap

The start to 2019 was by many metrics the strongest start to the year for credit markets since 2003. The sharp selloff at the end of 2018 presented investors with more attractive valuations to begin the new year, while seemingly every macro headwind at year-end became a tailwind. This was primarily bolstered by comments from the Federal Reserve, which orchestrated a dovish pivot that culminated in a “pause” in the rate hiking cycle. While Treasuries and investment grade bonds generally appreciated in the tumultuous final months of 2018, high-yield bonds saw this recent gain as a welcomed swift reversal. Therefore, long/short credit strategies, as measured by the Morningstar MSCI Long/Short Credit Index, were generally tested by the whipsaw. Specifically, as many long/short credit strategies attempt to extract spreads between various bond sectors, credit qualities, and even individual securities, relatively large movements like those seen in the last six months can stress both the long positions and short positions in the strategy. During the primarily negative months of November and December, long/short credit strategies in general declined 0.8 percent. As the new year commenced with a rebound, long/short credit strategies broadly increased close to 5 percent in the first four months of the calendar year.

Allocation Review

As the Sub-Adviser implements multiple strategy types within the Fund, the largest allocations during the six-month period were to the long strategy and the rate hedging strategy. While interest rates generally fell and nearly all bond sectors experienced gains, the rate hedging strategy and other strategies with a short bias generally detracted from performance. However, since the majority of the Fund was investing in long-biased positions, the overall impact was positive. The short-biased strategies had helped to reduce volatility and drawdowns in the volatile end to 2018, where some of 2019’s strongest performers experienced sizeable declines.

The Fund’s exposure to pairs trades and catalyst driven positions generally provided stability during the six-month period and comprised close to 20 percent of the Fund. As the higher octane areas of the fixed income markets advanced during the fiscal quarter, the Sub-Adviser generally added to its short positions in those areas, paring back its long positions.

Holdings Insights

Given the strength and breadth of positive performance in the most recent fiscal quarter, the short positions such as the SWAP on the iBoxx USD Liquid High-Yield Index (IBOXHY) (holding weight*: -7.22 percent) and Commonwealth Bank of Australia credit default SWAP (holding weight*: -0.06 percent) were some of the Fund’s largest detractors. During the most recent fiscal quarter, IBOXHY and Commonwealth Bank of Australia bond each increased, detracting 1.7 percent and 18.4 percent, respectively from the Fund. The Sub-Adviser had been increasing its short position in IBOXHY as the high-yield rally appeared to be pricing in the best outcomes from prevailing macro themes, including a successful trade deal with China. The Sub-Adviser believed that the real estate concerns in Australia would lead its central bank to additional monetary easing, but it simply maintained its historically low interest rates. Further easing was expected to put additional pressure on banks that primarily provide home loans, further compressing their already record-low interest rate spreads. Despite the bleak outlook for spread widening and a lack of additional stimulus for the suffering housing market, the Commonwealth Bank of Australia bonds appreciated during the fiscal quarter. Not all detractors were in short positions, as the Weight Watchers International, Inc. bank loan (BL2563049) (holding weight*: 1.62 percent) suffered a significant drop in subscriptions that many attributed to the material shift in their ad campaign. Since the Weight Watchers bank loan was added to the Fund at the end of January through the end of the second fiscal quarter, the bank loan’s price declined 4.3 percent.

One of the larger detractors in the November and December decline was Freeport-McMoran Inc.’s bond maturing in 2043 (35671DBC8) (holding weight*: 0.95 percent), one of the largest molybdenum and copper producers in the world. After the price of the bonds declined 10.6 percent during the first two months of the fiscal year, primarily due to global growth concerns, the Freeport-McMoran bonds surged 19.4 percent in the proceeding four months, bringing the overall total return for the first half of the fiscal year, including interest, to 10.0 percent. Another holding that experienced a similar decline and recovery was the Reynolds American Inc. bond maturing in 2037 (761713AT3) (holding weight*: 1.70 percent). As a potential ban on menthol cigarettes was weighed, the tobacco sector took a sizeable hit, and the Reynolds American bond’s price declined 8.4 percent in the first fiscal quarter. However, as additional information released showed signs that any ban’s implementation would be years away, the sector broadly rebounded and the Reynolds American bond recovered 9.2 percent in the second fiscal quarter. Since the beginning of the fiscal year through the end of the most recent fiscal quarter, the Reynolds American bond returned 3.1 percent when including the effect of the 7.25 percent coupon.

Sub-Adviser Outlook

The Sub-Adviser continues to believe that fundamentals and economic data may have peaked, using the increased valuations to generally exit long positions and allocate to sub-strategies that are less dependent on the market continuing upward. In addition, while the Sub-Adviser does not see the conditions in place for an impending recession, it believes the widespread bouts of bearishness warrants being cautious and selective - investing in credit situations where the Sub-Adviser can get comfortable that the valuations are not commensurate with the fundamentals. The Sub-Adviser anticipates maintaining a net exposure slightly below average and adding as opportunities arise.

| * | Holdings percentage(s) of total investments, excluding collateral for securities loaned, as of 4/30/2019. |

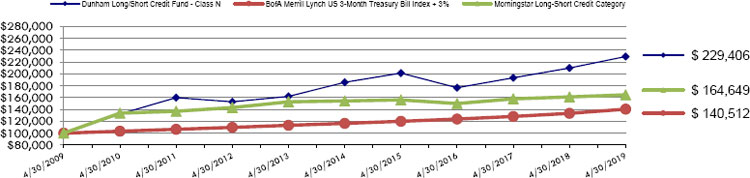

Growth of $100,000 Investment

| Total Returns as of April 30, 2019 | ||||

| Annualized | Annualized | |||

| Six Months | One Year | Five Years | Ten Years | |

| Class N | 2.70% | 9.25% | 4.30% | 8.66% |

| Class C | 2.18% | 8.10% | 3.25% | 7.58% |

| Class A with load of 5.75% | (3.32)% | 2.64% | 2.79% | 7.75% |

| Class A without load | 2.58% | 8.92% | 4.03% | 8.39% |

| BofA Merrill Lynch US 3-Month Treasury Bill Index +3% | 2.64% | 5.24% | 3.81% | 3.46% |

| Morningstar Long-Short Credit Category | 2.56% | 2.21% | 1.29% | 5.11% |

The BofA Merrill Lynch US 3-Month Treasury Bill Index +3% is comprised of a single issue purchased at the beginning of the month and held for a full month. At the end of the month that issue is sold and rolled in a newly selected issue. The issue selected at each month-end rebalancing is the outstanding Treasury Bill that matures closet to, but not beyond, three months from the rebalancing date. To qualify for selection, an issue must have settled on or before the month-end rebalancing date. Plus an annualized return of 3%.

The Morningstar Long-Short Credit Category is generally representative of funds that purchase or sell bonds, credit default swaps, or other credit derivatives to potentially benefit from changes in the credit markets and/or individual issuers.

As disclosed in the Trust’s latest registration statement as supplemented the Fund’s total annual operating expenses, including the cost of underlying funds, are 1.66% for Class N, 2.66% for Class C and 1.91% for Class A. Class A shares are subject to a sales load of 5.75% and a deferred sales charge of up to 0.75%. The performance data quoted here represents past performance, which is not indicative of future results. Current performance may be lower or higher than the performance data quoted. The investment return and NAV will fluctuate, so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Total returns are calculated assuming reinvestment of all dividends and capital gains distributions, if any. The returns do not reflect the deductions of taxes a shareholder would pay on the redemption of Fund shares or Fund distributions. For performance information current to the most recent month-end, please call 1-800-442-4358 or visit our website www.dunham.com

10

| SCHEDULE OF INVESTMENTS (Unaudited) |

| Dunham Long/Short Credit Fund |

| April 30, 2019 |

| Security | Shares | Value | ||||||||||||||

| COMMON STOCK - 0.0% | ||||||||||||||||

| TELECOMMUNICATIONS - 0.0% | ||||||||||||||||

| NII Holdings, Inc. * | 10,000 | $ | 19,600 | |||||||||||||

| TOTAL COMMON STOCK (Cost - $57,730) | ||||||||||||||||

| Variable | Principal | Interest | Maturity | |||||||||||||

| Rate | Amount | Rate % | Date | |||||||||||||

| BONDS & NOTES - 29.8% | ||||||||||||||||

| AGRICULTURE - 4.4% | ||||||||||||||||

| Altria Group, Inc. | $ | 915,000 | 4.800 | 2/14/2029 | 951,586 | |||||||||||

| Altria Group, Inc. | 880,000 | 5.800 | 2/14/2039 | 942,993 | ||||||||||||

| Reynolds American, Inc. | 1,000,000 | 7.250 | 6/15/2037 | 1,199,910 | ||||||||||||

| 3,094,489 | ||||||||||||||||

| BANKS - 1.3% | ||||||||||||||||

| Wachovia Capital Trust II | 3 mo. LIBOR + 0.500% | 1,000,000 | 3.097 | + | 1/15/2027 | 923,390 | ||||||||||

| COMPUTERS - 1.3% | ||||||||||||||||

| Harland Clarke Holdings Corp. - 144A | 1,000,000 | 8.375 | 8/15/2022 | 892,500 | ||||||||||||

| DIVERSIFIED FINANCIAL SERVICES - 2.1% | ||||||||||||||||

| GE Capital International Funding Co. Unlimited Co. | 325,000 | 2.342 | 11/15/2020 | 321,588 | ||||||||||||

| GE Capital International Funding Co. Unlimited Co. | 1,240,000 | 4.418 | 11/15/2023 | 1,163,550 | ||||||||||||

| 1,485,138 | ||||||||||||||||

| ENTERTAINMENT - 1.7% | ||||||||||||||||

| Enterprise Development Authority - 144A | 1,175,000 | 12.000 | 7/15/2024 | 1,210,250 | ||||||||||||

| FOOD - 4.6% | ||||||||||||||||

| JBS Investments GmbH - 144A | 1,350,000 | 6.250 | 2/5/2023 | 1,375,312 | ||||||||||||

| Mars, Inc. - 144A | 965,000 | 3.600 | 4/1/2034 | 966,104 | ||||||||||||

| Smithfield Foods, Inc. - 144A | 835,000 | 5.200 | 4/1/2029 | 855,089 | ||||||||||||

| 3,196,505 | ||||||||||||||||

| FOREST PRODUCTS & PAPER - 1.0% | ||||||||||||||||

| Suzano Austria GmbH- 144A | 655,000 | 7.000 | 3/16/2047 | 729,022 | ||||||||||||

| INSURANCE - 1.4% | ||||||||||||||||

| United Insurance Holdings Corp. | 1,000,000 | 6.250 | 12/15/2027 | 1,017,978 | ||||||||||||

| IRON/STEEL - 2.0% | ||||||||||||||||

| CSN Resources | 1,405,000 | 6.500 | 7/21/2020 | 1,433,100 | ||||||||||||

| MEDIA - 2.3% | ||||||||||||||||

| American Media LLC - 144A | 100,000 | 10.500 | 12/31/2026 | 103,750 | ||||||||||||

| Viacom, Inc. | 3 mo. LIBOR + 3.899% | 1,500,000 | 6.250 | + | 2/28/2057 | 1,548,900 | ||||||||||

| 1,652,650 | ||||||||||||||||

| MINING - 2.1% | ||||||||||||||||

| Freeport-McMoRan, Inc. | 740,000 | 5.450 | 3/15/2043 | 671,550 | ||||||||||||

| New Gold, Inc. - 144A | 900,000 | 6.250 | 11/15/2022 | 821,250 | ||||||||||||

| 1,492,800 | ||||||||||||||||

| OIL & GAS - 2.4% | ||||||||||||||||

| Transocean Poseidon Ltd. - 144A | 1,600,000 | 6.875 | 2/1/2027 | 1,708,000 | ||||||||||||

| PIPELINES - 1.0% | ||||||||||||||||

| Rockies Express Pipeline LLC - 144A | 725,000 | 4.950 | 7/15/2029 | 726,428 | ||||||||||||

See accompanying notes to financial statements.

11

| SCHEDULE OF INVESTMENTS (Unaudited) |

| Dunham Long/Short Credit Fund (Continued) |

| April 30, 2019 |

| Variable | Principal | Interest | Maturity | |||||||||||||

| Security | Rate | Amount | Rate % | Date | Value | |||||||||||

| BONDS & NOTES - 29.8% (Continued) | ||||||||||||||||

| TELECOMMUNICATIONS - 2.2% | ||||||||||||||||

| Gogo Intermediate Holdings LLC - 144A | $ | 500,000 | 9.875 | 5/1/2024 | $ | 512,355 | ||||||||||

| Sprint Spectrum Co. LLC - 144A | 1,000,000 | 4.738 | 3/20/2025 | 1,021,250 | ||||||||||||

| 1,533,605 | ||||||||||||||||

| TOTAL BONDS & NOTES (Cost - $20,178,932) | 21,095,855 | |||||||||||||||

| BANK LOANS - 2.9% | ||||||||||||||||

| HEALTHCARE PRODUCTS - 1.6% | ||||||||||||||||

| Weight Watchers International, Inc. | LIBOR + 4.750% | 1,184,211 | 0.000 | + | 11/29/2024 | 1,142,023 | ||||||||||

| TECHNOLOGY - 1.3% | ||||||||||||||||

| First Data Corp. | LIBOR + 2.000% | 900,000 | 4.212 | + | 4/26/2024 | 900,846 | ||||||||||

| SS&C Technologies, Inc. | LIBOR + 2.250% | 2,310 | 4.550 | + | 4/16/2025 | 2,314 | ||||||||||

| 903,160 | ||||||||||||||||

| TOTAL BANK LOANS (Cost - $2,075,429) | 2,045,183 | |||||||||||||||

| U.S. GOVERNMENT - 53.3% | ||||||||||||||||

| TREASURY BILLS - 43.2% | ||||||||||||||||

| Treasury Bill | 10,150,000 | 2.369 | + | 5/2/2019 | 10,149,332 | |||||||||||

| Treasury Bill | 10,155,000 | 2.364 | + | 5/7/2019 | 10,150,842 | |||||||||||

| Treasury Bill | 10,275,000 | 2.386 | + | 5/21/2019 | 10,260,864 | |||||||||||

| 30,561,038 | ||||||||||||||||

| TREASURY NOTES/BONDS - 10.1% | ||||||||||||||||

| Treasury Note / Bond | 1,575,000 | 2.625 | 12/31/2023 | 1,598,963 | ||||||||||||

| Treasury Note / Bond | 925,000 | 2.500 | 2/28/2026 | 931,468 | ||||||||||||

| Treasury Note / Bond | 790,000 | 2.625 | 2/15/2029 | 798,147 | ||||||||||||

| Treasury Note / Bond | 1,910,000 | 3.000 | 8/15/2048 | 1,931,786 | ||||||||||||

| Treasury Note / Bond | 1,710,000 | 3.375 | 11/15/2048 | 1,859,358 | ||||||||||||

| 7,119,722 | ||||||||||||||||

| TOTAL U.S. GOVERNMENT (Cost - $37,594,441) | 37,680,760 | |||||||||||||||

| Shares | ||||||||||||||||

| SHORT-TERM INVESTMENT - 13.3% | ||||||||||||||||

| MONEY MARKET FUND - 13.3% | ||||||||||||||||

| First American Government Obligations Fund - Class Z | 9,422,912 | 2.320 | + | 9,422,912 | ||||||||||||

| TOTAL SHORT-TERM INVESTMENT (Cost - $9,422,912) | ||||||||||||||||

| TOTAL INVESTMENTS - 99.3% (Cost - $69,329,444) | $ | 70,264,310 | ||||||||||||||

| OTHER ASSETS IN EXCESS OF LIABILITIES - 0.7% | 481,137 | |||||||||||||||

| TOTAL NET ASSETS - 100.0% | $ | 70,745,447 | ||||||||||||||

LLC - Limited Liability Company

| * | Non-income producing security. |

| + | Variable rate security. Interest rate is as of April 30, 2019. |

144A - Security exempt from registration under Rule 144A of the Securities Act of 1933. These securities may be sold in transactions exempt from registration, normally to qualified institutional buyers. As of April 30, 2019 the total market value of 144A securities is $10,921,310 or 15.5% of net assets.

See accompanying notes to financial statements.

12

| SCHEDULE OF INVESTMENTS (Unaudited) |

| Dunham Long/Short Credit Fund (Continued) |

| April 30, 2019 |

| Unrealized | ||||||||||||

| Short | Maturity | Appreciation/ | ||||||||||

| Security | Contracts | Notional | Date | (Depreciation) | ||||||||

| OPEN SHORT FUTURES CONTRACTS - (0.2)% | ||||||||||||

| U.S. 5 Year Treasury Note | 14 | $ | 1,618,969 | June-19 | $ | (13,562 | ) | |||||

| U.S 10 Year Treasury Note | 46 | 5,688,906 | June-19 | (33,602 | ) | |||||||

| U.S. Treasury Long Bond | 58 | 8,553,188 | June-19 | (116,000 | ) | |||||||

| NET UNREALIZED LOSS FROM OPEN SHORT FUTURE CONTRACTS | $ | (163,164 | ) | |||||||||

| CREDIT DEFAULT SWAPS | ||||||||||||||||

| Unrealized | ||||||||||||||||

| Notional at | Premium | Maturity | Appreciation/ | |||||||||||||

| Description (1) | Counterparty | April 30, 2019 | Paid (Received) | Date | (Depreciation) | |||||||||||

| To Buy Protection - Commonwealth Bank of Australia | Goldman Sachs | $ | 2,000,000 | $ | (15,499 | ) | 12/20/2023 | $ | (28,595 | ) | ||||||

| To Buy Protection - Xerox Corp. | JPMorgan | 3,000,000 | 179,980 | 6/20/2024 | 2,042 | |||||||||||

| To Sell Protection - Dell, Inc. | JPMorgan | (3,000,000 | ) | (170,136 | ) | 6/20/2024 | 13,581 | |||||||||

| NET UNREALIZED LOSS FROM CREDIT DEFAULT SWAPS | $ | (12,972 | ) | |||||||||||||

| TOTAL RETURN SWAPS | ||||||||||||||||||

| Unrealized | ||||||||||||||||||

| Notional Value at | Maturity | Appreciation/ | ||||||||||||||||

| Reference Entity | Shares | Counterparty | April 30, 2019 | Interest Rate | Date | (Depreciation) | ||||||||||||

| iBoxx USD Liquid High Yield Index | (17,621 | ) | JPMorgan | 5,000,000 | 3 mo. LIBOR + 0.000% | 6/20/2019 | $ | (87,070 | ) | |||||||||

| NET UNREALIZED LOSS FROM TOTAL RETURN SWAPS | $ | (87,070 | ) | |||||||||||||||