UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form

(Mark One)

FOR THE QUARTERLY PERIOD

ENDED:

For the transition period from __________ to __________

Commission File Number:

(Exact name of registrant as specified in its charter)

| (State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) |

(Address of principal executive offices, Zip Code)

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Ticker symbol(s) | Name of each exchange on which registered | ||

| N/A | N/A | N/A |

Indicate by check mark

whether the registrant (1) filed all reports required to be filed by Section 13 or 15(d) of the Exchange Act of 1934 during the preceding

12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing

requirements for the past 90 days.

Indicate by check mark

whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation

S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit

such files).

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ☐ | Accelerated filer | ☐ |

| ☒ | Smaller reporting company | ||

| Emerging growth company | |||

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark

whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No

As of November 14, 2022

there were

TABLE OF CONTENTS

| Page | ||

| PART I | ||

| Item 1. | Financial Statements. | 1 |

| Item 2. | Management’s Discussion and Analysis of Financial Condition and Results of Operations. | 26 |

| Item 3. | Quantitative and Qualitative Disclosures About Market Risk. | 40 |

| Item 4. | Controls and Procedures. | 40 |

| PART II | ||

| Item 1. | Legal Proceedings. | 41 |

| Item 1A. | Risk Factors. | 41 |

| Item 2. | Unregistered Sales of Equity Securities and Use of Proceeds. | 41 |

| Item 3. | Defaults Upon Senior Securities. | 41 |

| Item 4. | Mine Safety Disclosures. | 41 |

| Item 5. | Other Information. | 41 |

| Item 6. | Exhibits. | 42 |

| SIGNATURES | 43 | |

i

PART I - FINANCIAL INFORMATION

ITEM 1. FINANCIAL STATEMENTS

ORIGINCLEAR, INC. AND SUBSIDIARIES

CONDENSED CONSOLIDATED BALANCE SHEETS

| September 30, 2022 | December 31, 2021 | |||||||

| (Unaudited) | ||||||||

| ASSETS | ||||||||

| CURRENT ASSETS | ||||||||

| Cash | $ | $ | ||||||

| Restricted cash | ||||||||

| Contracts receivable | ||||||||

| Fair value investment in securities | ||||||||

| Contract assets | ||||||||

| Inventory assets | ||||||||

| Prepaid expenses | ||||||||

| TOTAL CURRENT ASSETS | ||||||||

| NET PROPERTY AND EQUIPMENT | ||||||||

| OTHER ASSETS | ||||||||

| Long term assets held for sale | ||||||||

| Fair value investment-securities | ||||||||

| Trademark | ||||||||

| TOTAL OTHER ASSETS | ||||||||

| TOTAL ASSETS | $ | $ | ||||||

| LIABILITIES AND SHAREHOLDERS' DEFICIT | ||||||||

| Current Liabilities | ||||||||

| Accounts payable and other payable | $ | $ | ||||||

| Accrued expenses | ||||||||

| Cumulative preferred stock dividends payable | ||||||||

| Contract liabilities | ||||||||

| Capital lease, current portion | ||||||||

| Tax liability 83(b) | - | |||||||

| Customer deposit | ||||||||

| Warranty reserve | ||||||||

| Loan payable, merchant cash advance | ||||||||

| Loans payable, SBA | ||||||||

| Derivative liabilities | ||||||||

| Series F 8% Preferred Stock, | ||||||||

| Series F 8% Preferred Stock, | ||||||||

| Series G 8% Preferred Stock, | ||||||||

| Series I 8% Preferred Stock, | ||||||||

| Series K 8% Preferred Stock, | ||||||||

| Convertible promissory notes, net of discount of $ | ||||||||

| Total Current Liabilities | ||||||||

| Long Term Liabilities | ||||||||

| Capital lease, long term portion | ||||||||

| Convertible promissory notes, net of discount of $ | ||||||||

| Total Long Term Liabilities | ||||||||

| Total Liabilities | ||||||||

| COMMITMENTS AND CONTINGENCIES (See Note 11) | ||||||||

| Series J Convertible Preferred Stock, | ||||||||

| Series L Convertible Preferred Stock, | ||||||||

| Series M Preferred Stock, | ||||||||

| Series O 8% Convertible Preferred Stock, | ||||||||

| Series P Convertible Preferred Stock, | ||||||||

| Series Q 12% Convertible Preferred Stock, | ||||||||

| Series R 12% Convertible Preferred Stock, | ||||||||

| Series S 12% Convertible Preferred Stock, | ||||||||

| Series T 10% Convertible Preferred Stock, | ||||||||

| Series U Convertible Preferred Stock, | ||||||||

| Series V Convertible Preferred Stock, | ||||||||

| Series W 12% Convertible Preferred Stock, | ||||||||

| Series X Convertible Preferred Stock, | ||||||||

| Series Z Convertible Preferred Stock, | ||||||||

| SHAREHOLDERS' DEFICIT | ||||||||

| Preferred stock, $ | ||||||||

| - | ||||||||

| Subscription payable to purchase | ||||||||

| Preferred treasury stock, | ||||||||

| Common stock, $ | ||||||||

| Additional paid in capital - Common stock | ||||||||

| Accumulated other comprehensive loss | ( | ) | ( | ) | ||||

| Accumulated deficit | ( | ) | ( | ) | ||||

| TOTAL SHAREHOLDERS' DEFICIT | ( | ) | ( | ) | ||||

| TOTAL LIABILITIES AND SHAREHOLDERS' DEFICIT | $ | $ | ||||||

The accompanying notes are an integral part of these unaudited condensed consolidated financial statements

1

ORIGINCLEAR, INC. AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

FOR THE THREE AND NINE MONTHS ENDED SEPTEMBER 30,2022 AND 2021

(Unaudited)

| Three Months Ended | Nine Months Ended | |||||||||||||||

| September 30, 2022 | September 30, 2021 | September 30, 2022 | September 30, 2021 | |||||||||||||

| Sales | $ | $ | $ | $ | ||||||||||||

| Cost of Goods Sold | ||||||||||||||||

| Gross Profit | ||||||||||||||||

| Operating Expenses | ||||||||||||||||

| Selling and marketing expenses | ||||||||||||||||

| General and administrative expenses | ||||||||||||||||

| Depreciation and amortization expense | ||||||||||||||||

| Total Operating Expenses | ||||||||||||||||

| Loss from Operations | ( | ) | ( | ) | ( | ) | ( | ) | ||||||||

| OTHER INCOME (EXPENSE) | ||||||||||||||||

| Other income | ||||||||||||||||

| Impairment of asset for sale | ( | ) | ( | ) | ||||||||||||

| Gain on write of loans payable | ||||||||||||||||

| Gain (Loss) on conversion of preferred stock | ( | ) | ( | ) | ( | ) | ( | ) | ||||||||

| Loss on exchange of preferred stock | ( | ) | ||||||||||||||

| Unrealized gain(loss) on investment securities | ( | ) | ( | ) | ( | ) | ||||||||||

| Cash settlement for non-conversion of common stock | ( | ) | ( | ) | ||||||||||||

| Gain (Loss) on net change in derivative liability and conversion of debt | ( | ) | ( | ) | ( | ) | ||||||||||

| Interest and dividend expense | ( | ) | ( | ) | ( | ) | ( | ) | ||||||||

| TOTAL OTHER (EXPENSE) INCOME | ( | ) | ( | ) | ( | ) | ||||||||||

| NET INCOME (LOSS) | $ | ( | ) | $ | $ | ( | ) | $ | ( | ) | ||||||

| WARRANTS DEEMED DIVIDENDS | ( | ) | ||||||||||||||

| NET (LOSS) ATTRIBUTABLE TO SHAREHOLDERS INCOME | $ | ( | ) | $ | $ | ( | ) | $ | ( | ) | ||||||

| BASIC EARNINGS (LOSS) PER SHARE ATTRIBUTABLE TO SHAREHOLDERS' | $ | ( | ) | $ | $ | ( | ) | $ | ( | ) | ||||||

| DILUTED EARNINGS (LOSS) PER SHARE ATTRIBUTABLE TO SHAREHOLDERS' | $ | ( | ) | $ | $ | ( | ) | $ | ( | ) | ||||||

| WEIGHTED-AVERAGE COMMON SHARES OUTSTANDING, | ||||||||||||||||

| BASIC | ||||||||||||||||

| DILUTED | ||||||||||||||||

The accompanying notes are an integral part of these unaudited condensed consolidated financial statements

2

ORIGINCLEAR, INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF SHAREHOLDERS' DEFICIT

FOR THE NINE MONTHS ENDED SEPTEMBER 30, 2022 AND 2021

| NINE MONTHS ENDED SEPTEMBER 30, 2021 | ||||||||||||||||||||||||||||||||||||||||

| Accumulated | ||||||||||||||||||||||||||||||||||||||||

| Preferred stock | Mezzanine | Common stock | Additional Paid-in- | Subscription | Other Comprehensive | Accumulated | ||||||||||||||||||||||||||||||||||

| Shares | Amount | Equity | Shares | Amount | Capital | Payable | loss | Deficit | Total | |||||||||||||||||||||||||||||||

| Balance at December 31, 2020 | $ | $ | $ | $ | $ | $ | ( | ) | $ | ( | ) | $ | ( | ) | ||||||||||||||||||||||||||

| Rounding | - | ( | ) | ( | ) | ( | ) | |||||||||||||||||||||||||||||||||

| Common stock issuance for conversion of debt and accrued interest | - | |||||||||||||||||||||||||||||||||||||||

| Common stock issued at fair value for services | - | |||||||||||||||||||||||||||||||||||||||

| Common stock issued for conversion of Series D1 Preferred stock | ( | ) | ( | ) | - | - | - | - | ||||||||||||||||||||||||||||||||

| Common stock issued for conversion of Series J Preferred stock | - | ( | ) | |||||||||||||||||||||||||||||||||||||

| Common stock issued for conversion of Series L Preferred stock | - | ( | ) | |||||||||||||||||||||||||||||||||||||

| Common stock issued for Series O Preferred stock dividends | - | ( | ) | |||||||||||||||||||||||||||||||||||||

| Common stock issued for conversion of Series O Preferred stock | - | ( | ) | |||||||||||||||||||||||||||||||||||||

| Common stock issued for conversion of Series P Preferred stock | - | ( | ) | |||||||||||||||||||||||||||||||||||||

| Common stock issued for make good shares for Series P Preferred stock | - | - | - | ( | ) | |||||||||||||||||||||||||||||||||||

| Common stock issued for conversion of Series Q Preferred stock | - | ( | ) | |||||||||||||||||||||||||||||||||||||

| Common stock issued for conversion of Series R Preferred stock | - | ( | ) | |||||||||||||||||||||||||||||||||||||

| Common stock issued for conversion of Series S Preferred stock | - | - | ( | ) | ||||||||||||||||||||||||||||||||||||

| Common stock issued in conjunction with the sale of Series X Preferred stock | - | - | - | ( | ) | |||||||||||||||||||||||||||||||||||

| Common stock issued for conversion of Series U Preferred stock | - | - | ( | ) | ||||||||||||||||||||||||||||||||||||

| Common stock issued for conversion of Series W Preferred stock | - | - | ( | ) | ||||||||||||||||||||||||||||||||||||

| Issuance of Series M Preferred stock through a private placement | - | - | ||||||||||||||||||||||||||||||||||||||

| Issuance of Series R Preferred stock through a private placement | - | - | ||||||||||||||||||||||||||||||||||||||

| Issuance of Series T Preferred stock in exchange for property | - | - | ||||||||||||||||||||||||||||||||||||||

| Issuance of Series U Preferred stock in exchange for property | - | - | ||||||||||||||||||||||||||||||||||||||

| Issuance of Series X Preferred stock through a private placement | - | - | ||||||||||||||||||||||||||||||||||||||

| Exchange of Series F Preferred Stock for Series Q Preferred stock | - | - | ||||||||||||||||||||||||||||||||||||||

| Exchange of Series G Preferred Stock for Series R Preferred stock | - | - | ||||||||||||||||||||||||||||||||||||||

| Exchange of Series G Preferred Stock for Series S Preferred stock | - | - | ||||||||||||||||||||||||||||||||||||||

| Exchange of Series I Preferred Stock for Series R Preferred stock | - | - | ||||||||||||||||||||||||||||||||||||||

| Exchange of Series I Preferred Stock for Series W Preferred stock | - | - | ||||||||||||||||||||||||||||||||||||||

| Exchange of Series K Preferred Stock for Series R Preferred stock | - | - | - | |||||||||||||||||||||||||||||||||||||

| Exchange of Series K Preferred Stock for Series W Preferred stock | - | - | ||||||||||||||||||||||||||||||||||||||

| Exchange of Series M Preferred Stock for Series R Preferred stock | - | - | ||||||||||||||||||||||||||||||||||||||

| Warrants purchased for cash | - | - | - | |||||||||||||||||||||||||||||||||||||

| Loss on issuance of Preferred Stock | - | - | ||||||||||||||||||||||||||||||||||||||

| Loss on conversion of Preferred Stock | - | - | ||||||||||||||||||||||||||||||||||||||

| Issuance of common stock warrants deemed dividends | - | - | ( | ) | ||||||||||||||||||||||||||||||||||||

| Adjustment to Series L Preferred stock | - | - | ( | ) | ( | ) | ||||||||||||||||||||||||||||||||||

| Stock based compensation | - | - | - | |||||||||||||||||||||||||||||||||||||

| Net Loss | - | - | ( | ) | ( | ) | ||||||||||||||||||||||||||||||||||

| Balance at September 30, 2021 (unaudited) | $ | $ | $ | $ | $ | ( | ) | $ | ( | ) | $ | ( | ) | |||||||||||||||||||||||||||

3

ORIGINCLEAR, INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF SHAREHOLDERS' DEFICIT

FOR THE NINE MONTHS ENDED SEPTEMBER 30, 2022 AND 2021

| NINE MONTHS ENDED SEPTEMBER 30, 2022 | ||||||||||||||||||||||||||||||||||||||||

| Preferred stock | Mezzanine | Common stock | Additional | Subscription | Other Comprehensive | Accumulated | ||||||||||||||||||||||||||||||||||

| Shares | Amount | Equity | Shares | Amount | Capital | Payable | loss | Deficit | Total | |||||||||||||||||||||||||||||||

| Balance at December 31, 2021 | $ | ( | ) | ( | ) | ( | ) | |||||||||||||||||||||||||||||||||

| Rounding | - | - | - | - | ( | ) | ( | ) | ||||||||||||||||||||||||||||||||

| Common stock issuance for conversion of debt and accrued interest | - | |||||||||||||||||||||||||||||||||||||||

| Common stock issued at fair value for services | - | |||||||||||||||||||||||||||||||||||||||

| Common stock issued for conversion of Series E Preferred stock | ( | ) | ( | ) | ||||||||||||||||||||||||||||||||||||

| Common stock issued for conversion of Series J Preferred stock | - | ( | ) | |||||||||||||||||||||||||||||||||||||

| Common stock issued for conversion of Series L Preferred stock | - | - | ( | ) | ||||||||||||||||||||||||||||||||||||

| Common stock issued for conversion of Series O Preferred stock | - | ( | ) | |||||||||||||||||||||||||||||||||||||

| Common stock issued for conversion of Series P Preferred stock | - | ( | ) | |||||||||||||||||||||||||||||||||||||

| Common stock issued for conversion of Series Q Preferred stock | - | ( | ) | |||||||||||||||||||||||||||||||||||||

| Common stock issued for conversion of Series R Preferred stock | - | ( | ) | - | ||||||||||||||||||||||||||||||||||||

| Common stock issued for conversion of Series T Preferred stock | - | ( | ) | |||||||||||||||||||||||||||||||||||||

| Common stock issued for conversion of Series U Preferred stock | - | ( | ) | |||||||||||||||||||||||||||||||||||||

| Common stock issued for conversion of Series W Preferred stock | - | - | ( | ) | ||||||||||||||||||||||||||||||||||||

| Common stock issued for conversion of Series Y Preferred stock | - | - | ( | ) | ||||||||||||||||||||||||||||||||||||

| Common stock issued for Series O Preferred stock dividends | - | - | - | ( | ) | |||||||||||||||||||||||||||||||||||

| Common stock issued for make good shares for Series P Preferred Stock | - | - | - | ( | ) | |||||||||||||||||||||||||||||||||||

| Common stock issued for make good shares for Series R Preferred Stock | - | ( | ) | |||||||||||||||||||||||||||||||||||||

| Common stock issued for conversion settlement | - | ( | ) | |||||||||||||||||||||||||||||||||||||

| Common stock returned for non conversion | - | - | - | ( | ) | ( | ) | ( | ) | ( | ) | |||||||||||||||||||||||||||||

| Issuance of Series Y Preferred stock through a private placement | - | - | ||||||||||||||||||||||||||||||||||||||

| Issuance of Series Z Preferred stock through a private placement | - | - | - | |||||||||||||||||||||||||||||||||||||

| Exchange of Series F Preferred Stock for Series Q Preferred stock | - | - | - | |||||||||||||||||||||||||||||||||||||

| Exchange of Series I Preferred Stock for Series W Preferred stock | - | - | ||||||||||||||||||||||||||||||||||||||

| Exchange of Series K Preferred Stock for Series W Preferred stock | - | - | ||||||||||||||||||||||||||||||||||||||

| Exchange of Series V Preferred Stock for Series Y Preferred stock | - | - | ||||||||||||||||||||||||||||||||||||||

| Loss on conversion of Preferred Stock | - | - | - | |||||||||||||||||||||||||||||||||||||

| Net Loss | - | - | ( | ) | ( | ) | ||||||||||||||||||||||||||||||||||

| Balance at September 30, 2022 (unaudited) | $ | $ | $ | $ | $ | $ | ( | ) | $ | ( | ) | $ | ( | ) | ||||||||||||||||||||||||||

The accompany notes are an integral part of these audited consolidated financial statements

4

ORIGINCLEAR, INC. AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

FOR THE NINE MONTHS ENDED SEPTEMBER 30, 2022 AND 2021

(Unaudited)

| Nine Months Ended | ||||||||

| September 30, 2022 | September 30, 2021 | |||||||

| CASH FLOWS FROM OPERATING ACTIVITIES: | ||||||||

| Net Income (loss) | $ | ( | ) | $ | ( | ) | ||

| Adjustment to reconcile net loss to net cash used in operating activities | ||||||||

| Depreciation and amortization | ||||||||

| Stock compensation expense | ||||||||

| Common and preferred stock issued for services | ||||||||

| (Gain) Loss on net change in valuation of derivative liability | ||||||||

| Debt discount recognized as interest expense | ||||||||

| Net unrealized (gain)loss on fair value of securities | ( | ) | ||||||

| Loss on exchange of preferred stock | ||||||||

| Loss on issuance of preferred stock | ||||||||

| SBA loan forgiven | ( | ) | ||||||

| Impairment of assets held for sale | ||||||||

| (Gain) Loss on conversion of preferred stock | ||||||||

| Gain on write off of payable | ( | ) | ( | ) | ||||

| Change in Assets (Increase) Decrease in: | ||||||||

| Contracts receivable | ( | ) | ||||||

| Contract asset | ( | ) | ||||||

| Inventory asset | ( | ) | ( | ) | ||||

| Prepaid expenses and other assets | ||||||||

| Other receivable | ||||||||

| Change in Liabilities Increase (Decrease) in: | ||||||||

| Accounts payable | ( | ) | ||||||

| Accrued expenses | ||||||||

| Tax liability 83(b) | ||||||||

| Contract liabilities | ( | ) | ||||||

| NET (CASH USED)/PROVIDED BY OPERATING ACTIVITIES | ( | ) | ( | ) | ||||

| CASH FLOWS USED FROM INVESTING ACTIVITIES: | ||||||||

| Purchase of fixed assets | ( | ) | ( | ) | ||||

| NET CASH USED IN INVESTING ACTIVITIES | ( | ) | ( | ) | ||||

| CASH FLOWS FROM FINANCING ACTIVITIES: | ||||||||

| Payments on capital lease | ( | ) | ( | ) | ||||

| Repayment of loans, net | ( | ) | ||||||

| Repayment of loans, related party, net | ( | ) | ||||||

| Net payments on cumulative preferred stock dividends payable | ||||||||

| Proceeds on convertible promissory notes | ||||||||

| Payoff on convertible promissory notes | ( | ) | ||||||

| Proceeds for the purchase of warrants | ||||||||

| Return of investment and common shares | ( | ) | ||||||

| Net proceeds for issuance of preferred stock for cash - mezzanine classification | ||||||||

| NET CASH PROVIDED BY FINANCING ACTIVITIES | ||||||||

| NET INCREASE IN CASH | ||||||||

| CASH BEGINNING OF PERIOD | ||||||||

| CASH END OF PERIOD | $ | $ | ||||||

| SUPPLEMENTAL DISCLOSURES OF CASH FLOW INFORMATION | ||||||||

| Interest and dividends paid | $ | $ | ||||||

| Taxes paid | $ | $ | ||||||

| SUPPLEMENTAL DISCLOSURES OF NON CASH TRANSACTIONS | ||||||||

| Common stock issued at fair value for conversion of debt, plus accrued interest, and other fees | $ | $ | ||||||

| Issuance of Series T preferred shares in exchange for property | $ | $ | ||||||

| Issuance of Series O dividends | $ | $ | ||||||

| Preferred stock converted to common stock - mezzanine | $ | $ | ||||||

| Exchange from mezzanine to liability | $ | $ | ||||||

| Issuance of warrants deemed dividends | $ | $ | ||||||

| Fair value of derivative at issuance | $ | $ | ||||||

| Common stock issued as settlement | $ | $ | ||||||

The accompanying notes are an integral part of these unaudited condensed consolidated financial statements

5

ORIGINCLEAR, INC. AND SUBSIDIARIES

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS-UNAUDITED

SEPTEMBER 30, 2022

| 1. | Basis of Presentation |

The accompanying unaudited condensed consolidated financial statements of OriginClear, Inc. (the “Company”) have been prepared in accordance with accounting principles generally accepted in the United States of America for interim financial information and with the instructions to Form 10-Q and Rule 10-01 of Regulation S-X. Accordingly, they do not include all of the information and footnotes required by generally accepted accounting principles for complete financial statements. In the opinion of management, all normal recurring adjustments considered necessary for a fair presentation have been included. Operating results for the nine months ended September 30, 2022 are not necessarily indicative of the results that may be expected for the year ending December 31, 2022. For further information refer to the financial statements and footnotes thereto included in the Company’s Form 10-K for the year ended December 31, 2021.

The Company

has implemented a new outsourced water treatment business called Water On Demand (“WOD”), which it will conduct through its

wholly owned subsidiary, Water on Demand, Inc. (“WODI”). The WOD model intends to offer private businesses water self-sustainability

as a service, the ability to pay for water treatment and purification services on a per-gallon basis. This is commonly known as

Design-Build-Own-Operate or “DBOO”. In addition to WODI, four subsidiaries have been

established to house capital dedicated to this program. For efficiency, the Company is reorganizing these subsidiaries into a single

WOD Subsidiary. As of the period ended September 30, 2022, the Company received aggregate funding in the amount of $

Going Concern

The accompanying financial statements have been prepared on a going concern basis of accounting, which contemplates continuity of operations, realization of assets and liabilities and commitments in the normal course of business. The accompanying financial statements do not reflect any adjustments that might result if the Company is unable to continue as a going concern. These factors, among others raise substantial doubt about the Company’s ability to continue as a going concern. Our independent auditors, in their report on our audited financial statements for the year ended December 31, 2021 expressed substantial doubt about our ability to continue as a going concern.

The ability

of the Company to continue as a going concern and appropriateness of using the going concern basis is dependent upon, among other things,

achieving a level of profitable operations and receiving additional cash infusions. During the nine months ended September 30, 2022,

the Company obtained funds from the sales of its preferred stock. Management believes this funding will continue from its’ current

investors and from new investors. For the nine months ended September 30, 2022, the Company generated revenue of $

| 2. | SUMMARY OF SIGNIFICANT ACCOUNTING POLICES |

This summary of significant accounting policies of the Company is presented to assist in understanding the Company’s financial statements. The financial statements and notes are representations of the Company’s management, which is responsible for their integrity and objectivity. These accounting policies conform to accounting principles generally accepted in the United States of America and have been consistently applied in the preparation of the financial statements.

6

Principles of Consolidation

The accompanying consolidated financial statements include the accounts of OriginClear, Inc. and its wholly owned operating subsidiaries, Progressive Water Treatment, Inc., Water On Demand, Inc. and OriginClear Technologies, Ltd. All material intercompany transactions have been eliminated upon consolidation of these entities.

Cash and Cash Equivalent

The Company considers all highly liquid investments with an original maturity of three months or less to be cash equivalents.

Use of Estimates

The preparation of financial statements in conformity with accounting principles generally accepted in the United States of America requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities, disclosure of contingent assets and liabilities at the date of the financial statements, and the reported amounts of revenues and expenses during the reporting period. Actual results could differ from those estimates. Significant estimates include estimates used to review the Company’s impairments and estimations of long-lived assets, revenue recognition on percentage of completion type contracts, allowances for uncollectible accounts, warranty reserves, inventory valuation, derivative liabilities and other conversion features, fair value investments, valuations of non-cash capital stock issuances and the valuation allowance on deferred tax assets. The Company bases its estimates on historical experience and on various other assumptions that are believed to be reasonable in the circumstances, the results of which form the basis for making judgments about the carrying values of assets and liabilities that are not readily apparent from other sources. Actual results may differ from these estimates under different assumptions or conditions.

Net Earnings (Loss) per Share Calculations

Basic loss per share calculation is computed by dividing income (loss) available to common shareholders by the weighted-average number of common shares available. Diluted earnings per share is computed similarly to basic earnings per share except that the denominator is increased to include securities or other contracts to issue common stock that would have been outstanding if the potential common shares had been issued and if the additional common shares were dilutive. The Company’s diluted earnings per share were not the same as the basic loss per share for the nine months ended September 30, 2022 and 2021, as the inclusion of any potential shares in the nine months ended September 30, 2022 and 2021, would have an anti-dilutive effect due to the Company generating a loss.

| For the Nine Months Ended | ||||||||

| 2022 | 2021 | |||||||

| Income (Loss) to common shareholders (Numerator) | $ | ( | ) | $ | ( | ) | ||

| Basic weighted average number of common shares outstanding (Denominator) | ||||||||

| Diluted weighted average number of common shares outstanding (Denominator) | ||||||||

The Company excludes issuable shares from warrants, convertible notes and preferred stock, if their impact on the loss per share is anti-dilutive and includes the issuable shares if their impact is dilutive.

Revenue Recognition

We recognize revenue when services are performed, and at the time of shipment of products, provided that evidence of an arrangement exists, title and risk of loss have passed to the customer, fees are fixed or determinable, and collection of the related receivable is reasonably assured.

7

Revenues and related costs on construction contracts are recognized as the performance obligations for work are satisfied over time in accordance with Accounting Standards Codification (“ASC”) 606, Revenue from Contracts with Customers. Under ASC 606, revenue and associated profit, will be recognized as the customer obtains control of the goods and services promised in the contract (i.e., performance obligations). All un-allocable indirect costs and corporate general and administrative costs are charged to the periods as incurred. However, in the event a loss on a contract is foreseen, the Company will recognize the loss as it is determined.

Revisions in cost and profit estimates during the course of the contract are reflected in the accounting period in which the facts for the revisions become known. Provisions for estimated losses on uncompleted contracts are made in the period in which such losses are determined. Changes in job performance, job conditions, and estimated profitability, including those arising from contract penalty provisions, and final contract settlements, may result in revisions to costs and income, which are recognized in the period the revisions are determined.

Contract receivables are recorded on contracts for amounts currently due based upon progress billings, as well as retention, which are collectible upon completion of the contracts. Accounts payable to material suppliers and subcontractors are recorded for amounts currently due based upon work completed or materials received, as are retention due subcontractors, which are payable upon completion of the contract. General and administrative expenses are charged to operations as incurred and are not allocated to contract costs.

Contract Receivable

The Company

bills its customers in accordance with contractual agreements. The agreements generally require billing to be on a progressive basis as

work is completed. Credit is extended based on evaluation of clients’ financial condition and collateral is not required. The Company

maintains an allowance for doubtful accounts for estimated losses that may arise if any customer is unable to make required payments.

Management performs a quantitative and qualitative review of the receivables past due from customers on a monthly basis. The Company records

an allowance against uncollectible items for each customer after all reasonable means of collection have been exhausted, and the potential

for recovery is considered remote. The allowance for doubtful accounts was

Prepaid Expenses

The Company

records expenditures that have been paid in advance as prepaid expenses. The prepaid expenses are initially recorded as assets, because

they have future economic benefits, and are expensed at the time the benefits are realized. The prepaid expenses balance was $

Indefinite Lived Intangibles and Goodwill Assets

The Company accounts for business combinations under the acquisition method of accounting in accordance with ASC 805, “Business Combinations,” where the total purchase price is allocated to the tangible and identified intangible assets acquired and liabilities assumed based on their estimated fair values. The purchase price is allocated using the information currently available, and may be adjusted, up to one year from acquisition date, after obtaining more information regarding, among other things, asset valuations, liabilities assumed and revisions to preliminary estimates. The purchase price in excess of the fair value of the tangible and identified intangible assets acquired less liabilities assumed is recognized as goodwill.

The Company tests for indefinite lived intangibles and goodwill impairment in the fourth quarter of each year and whenever events or circumstances indicate that the carrying amount of the asset exceeds its fair value and may not be recoverable. In accordance with its policies, the Company performed a qualitative assessment of indefinite lived intangibles and goodwill at September 30, 2022 and determined there was no impairment of indefinite lived intangibles and goodwill.

8

Property and Equipment

Property and equipment are stated at cost. Gain or loss is recognized upon disposal of property and equipment, and the asset and related accumulated depreciation are removed from the accounts. Expenditures for maintenance and repairs are charged to expense as incurred, while expenditures for addition and betterment are capitalized. Furniture and equipment are depreciated on the straight-line method and include the following categories:

| Estimated Life | ||||

| Machinery and equipment | ||||

| Furniture, fixtures and computer equipment | ||||

| Vehicles | ||||

| Leasehold improvements |

| Nine Months Ended 9/30/2022 |

Year Ended 12/31/21 |

|||||||

| Machinery and Equipment | $ | $ | ||||||

| Computer Equipment | ||||||||

| Furniture | ||||||||

| Leasehold Improvements | ||||||||

| Vehicles | ||||||||

| Demo Units | ||||||||

| Less accumulated depreciation | ( |

) | ( |

) | ||||

| Net Property and Equipment | $ | $ | ||||||

Long-lived assets held and used by the Company are reviewed for impairment whenever events or changes in circumstances indicate that the carrying amount of an asset may not be recoverable. In the event that the facts and circumstances indicate that the cost of any long-lived assets may be impaired, an evaluation of recoverability would be performed following generally accepted accounting principles.

Depreciation

expense during the nine months ended September 30, 2022 and 2021, was $

Inventory

The Company

expenses inventory on a first in, first out basis, and had raw materials of $

Stock-Based Compensation

The Company periodically issues stock options and warrants to employees and non-employees in non-capital raising transactions for services and for financing costs. The Company accounts for stock option and warrant grants issued and vesting to employees based on the authoritative guidance provided by the Financial Accounting Standards Board whereas the value of the award is measured on the date of grant and recognized over the vesting period. The Company accounts for stock option and warrant grants issued and vesting to non-employees in accordance with the authoritative guidance of the Financial Accounting Standards Board whereas the value of the stock compensation is based upon the measurement date as determined at either a) the date at which a performance commitment is reached, or b) at the date at which the necessary performance to earn the equity instruments is complete. Non-employee stock-based compensation charges generally are amortized over the vesting period on a straight-line basis. In certain circumstances where there are no future performance requirements by the non-employee, option grants vest immediately and the total stock-based compensation charge is recorded in the period of the measurement date.

Accounting for Derivatives

The Company evaluates all its financial instruments to determine if such instruments are derivatives or contain features that qualify as embedded derivatives. For derivative financial instruments that are accounted for as liabilities, the derivative instrument is initially recorded at its fair value and is then re-valued at each reporting date, with changes in the fair value reported in the statements of operations. For stock-based derivative financial instruments, the Company uses a probability weighted average series Binomial lattice option pricing models to value the derivative instruments at inception and on subsequent valuation dates.

9

The classification

of derivative instruments, including whether such instruments should be recorded as liabilities or as equity, is evaluated at the end

of each reporting period. Derivative instrument liabilities are classified in the balance sheet as current or non-current based on whether

or not the net-cash settlement of the derivative instrument could be required within

Fair Value of Financial Instruments

Fair Value of Financial Instruments requires disclosure of the fair value information, whether or not to recognized in the balance sheet, where it is practicable to estimate that value. As of September 30, 2022, the balances reported for cash, contract receivables, cost in excess of billing, prepaid expenses, accounts payable, billing in excess of cost, and accrued expenses approximate the fair value because of their short maturities.

We adopted ASC Topic 820 for financial instruments measured as fair value on a recurring basis. ASC Topic 820 defines fair value, established a framework for measuring fair value in accordance with accounting principles generally accepted in the United States and expands disclosures about fair value measurements.

Fair value is defined as the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date. ASC Topic 820 established a three-tier fair value hierarchy which prioritizes the inputs used in measuring fair value. The hierarchy gives the highest priority to unadjusted quoted prices in active markets for identical assets or liabilities (level 1 measurements) and the lowest priority to unobservable inputs (level 3 measurements). These tiers include:

| ● | Level 1, defined as observable inputs such as quoted prices for identical instruments in active markets; | |

| ● | Level 2, defined as inputs other than quoted prices in active markets that are either directly or indirectly observable such as quoted prices for similar instruments in active markets or quoted prices for identical or similar instruments in markets that are not active; and | |

| ● | Level 3, defined as unobservable inputs in which little or no market data exists, therefore requiring an entity to develop its own assumptions, such as valuations derived from valuation techniques in which one or more significant inputs or significant value drivers are unobservable. |

The following table presents certain investments and liabilities of the Company’s financial assets measured and recorded at fair value on the Company’s balance sheets on a recurring basis and their level within the fair value hierarchy as of September 30, 2022.

| Total | (Level 1) | (Level 2) | (Level 3) | |||||||||||||

| Investment at fair value-securities | $ | $ | $ | $ | ||||||||||||

| Total Assets measured at fair value | $ | $ | $ | $ | ||||||||||||

| Total | (Level 1) | (Level 2) | (Level 3) | |||||||||||||

| Derivative Liability, convertible notes | $ | $ | $ | $ | ||||||||||||

| Derivative Liability, warrants | $ | $ | $ | $ | ||||||||||||

| Total liabilities measured at fair value | $ | $ | $ | $ | ||||||||||||

The following is a reconciliation of the derivative liability for which level 3 inputs were used in determining the approximate fair value:

| Balance as of January 1, 2022 | $ | |||

| Fair value at issuance | ||||

| Loss on conversion of debt and change in derivative liability | ||||

| Balance as of September 30, 2022 | $ |

10

For purpose of determining the fair market value of the derivative liability, the Company used Binomial lattice formula valuation model. The significant assumptions used in the Binomial lattice formula valuation of the derivative are as follows:

| September 30, 2022 | ||||

| Risk free interest rate | ||||

| Stock volatility factor | ||||

| Weighted average expected option life | ||||

| Expected dividend yield |

Segment Reporting

The Company’s business currently operates in one segment based upon the Company’s organizational structure and the way in which the operations are managed and evaluated.

Marketable Securities

The Company adopted ASU 2016-01, “Financial Instruments – Recognition and Measurement of Financial Assets and Financial Liabilities.” ASU 2016-01 requires investments (except those accounted for under the equity method of accounting, or those that result in consolidation of the investee) to be measured at fair value with changes in fair value recognized in net income. It requires public business entities to use the exit price notion when measuring the fair value of financial instruments for disclosure purpose, and separate presentation of financial assets and financial liabilities by measurement category and form of financial asset. It eliminates the requirement for public business entities to disclose the method(s) and significant assumptions used to estimate the fair value that is required to be disclosed for financial instruments measured at amortized cost. The Company has evaluated the potential impact this standard may have on the condensed consolidated financial statements and determined that it had a significant impact on the condensed consolidated financial statements. The Company accounts for its investment in Water Technologies International, Inc. as available-for-sale securities, and the unrealized gain on the available-for-sale securities is recognized in net income.

Licensing agreement

The Company analyzed the licensing agreement using ASU 606 to determine the timing of revenue recognition. The licensing of the intellectual property (IP) is distinct from the non-license goods or services and has significant standalone functionality that provides a benefit or value. The functionality will not change during the license period due to the licensor’s activities. Because the significant standalone functionality is delivered immediately, the revenue is generally recognized when the license is delivered.

Work-in-Process

The Company recognizes as an asset the accumulated costs for work-in-process on projects expected to be delivered to customers. Work in Process includes the cost price of materials and labor related to the construction of equipment to be sold to customers.

Reclassification of Expenses and Income

Certain amounts in the 2021 financial statements have been reclassified to conform to the presentation used in the 2022 financial statements. There was no material effect on the Company’s previously issued financial statements.

Recently Issued Accounting Pronouncements

Management reviewed currently issued pronouncements and does not believe that any other recently issued, but not yet effective, accounting standards, if currently adopted, would have a material effect on the accompanying condensed financial statements.

11

| 3. | CAPITAL STOCK |

Preferred Stock

Series C

On March

14, 2017, the Board of Directors authorized the issuance of

Series D-1

On April

13, 2018, the Company designated

Series E

On August

14, 2018, the Company designated

Series F

On August

14, 2018, the Company designated

Series G

On January

16, 2019, the Company designated

12

Series I

On April

3, 2019,

Series J

On April

3, 2019, the Company designated

Series K

On June

3, 2019, the Company designated

13

Series L

On June

3, 2019, the Company designated

Series M

On July

1, 2020, the Company designated

Series O

On April

27, 2020, the Company designated

Series P

On April

27, 2020, the Company designated

14

Series Q

On August

21, 2020, the Company designated

Series R

On November

16, 2020, the Company designated

Series S

On February

5, 2021, the Company designated

15

Series T

On February

24, 2021, the Company designated

Series U

On May 26,

2021, the Company designated

16

Series W

On April

28, 2021, the Company designated

Series X

On August

10, 2021, the Company designated

Series Y

On December 6, 2021, the Company designated

17

Series Z

On February

11, 2022, the Company designated

As of September

30, 2022, the Company accrued aggregate dividends in the amount of $

The Series J, Series L, Series M, Series O, Series P, Series Q Series R, Series S, Series T, Series U, Series V, Series W, Series X, Series Y, and Series Z preferred stock are accounted for outside of permanent equity due to the terms of conversion at a market component or stated value of the preferred stock.

Common Stock

Nine months ended September 30, 2022

The Company

issued

The Company

issued

The Company

issued

The Company

issued

The Company

issued

Nine Months Ended September 30, 2021

The Company

issued

The Company

issued

The Company

issued

The Company

issued

The Company

issued

The Company issued 1,798,562 shares of common stock at a price of $0.0695 in conjunction with the sale of Series X preferred stock, and recognized a loss of $125,000 in the financial statements.

18

| 4. | RESTRICTED STOCK AND WARRANTS |

Restricted Stock to CEO

Between

May 12, 2016, and January 1, 2022, the Company entered into Restricted Stock Grant Agreements (“the RSGAs”) with its Chief

Executive Officer, Riggs Eckelberry, to create management incentives to improve the economic performance of the Company and to increase

its value and stock price. All shares issuable under the RSGAs are performance based shares.

Restricted Stock to the Board, Employees and Consultants

Between

May 12, 2016, and August 4, 2022, the Company entered into Restricted Stock Grant Agreements (“the BEC RSGAs”) with its members

of the Board, employees, and consultants to create management incentives to improve the economic performance of the Company and to increase

its value and stock price. All shares issuable under the BEC RSGAs are performance based shares.

On August

14, 2019, the Board of Directors approved an amendment to the RSGAs and BEC RSGAs to include an alternative vesting schedule for the Grantees

and on January 26, 2022, the Company amended the procedures for processing the RSGAs and BEC RSGAs. Once a Grantee is eligible to participate

in alternate vesting, then they will be added to the list of alternate vestees, enlarging the pool of vestees among which,

During the

nine months ended September 30, 2022, upon qualifying under the alternative vesting schedule, the Company issued an aggregate of

19

Warrants

During the

nine months ended September 30, 2022, the Company granted

| September 30, 2022 | ||||||||

| Number of Warrants | Weighted average exercise price | |||||||

| Outstanding - beginning of period | $ | |||||||

| Granted | $ | |||||||

| Exercised | ||||||||

| Expired/Exchanged | ( | ) | $ | |||||

| Outstanding - end of period | $ | |||||||

At September 30, 2022, the weighted average remaining contractual life of warrants outstanding:

| September 30, 2022 | ||||||||||||||

| Weighted Average |

||||||||||||||

| Remaining | ||||||||||||||

| Exercisable | Warrants | Warrants | Contractual | |||||||||||

| Prices | Outstanding | Exercisable | Life (years) | |||||||||||

| $ | ||||||||||||||

| $ | ||||||||||||||

| $ | ||||||||||||||

| $ | ||||||||||||||

| $ | ||||||||||||||

| $ | ||||||||||||||

| $ | ||||||||||||||

At

September 30, 2022, the aggregate intrinsic value of the warrants outstanding was $

| 5. | CONVERTIBLE PROMISSORY NOTES |

As of September 30, 2022, the outstanding convertible promissory notes are summarized as follows:

| Convertible Promissory Notes | $ | |||

| Less current portion | ||||

| Total long-term liabilities | $ |

20

Maturities of long-term debt for the next three years are as follows:

| Year Ending September 30, | Amount | |||

| 2023 | ||||

| 2024 | ||||

| 2025 | ||||

| $ | ||||

On various

dates from November 2014 through April 2015, the Company issued unsecured convertible promissory notes (the “2014-2015 Notes”),

that matured on various dates and were extended for an additional sixty (60) months from the effective date of each Note.

The unsecured

convertible promissory notes (the “OID Notes”) had an aggregate remaining balance of $

The Company

issued various, unsecured convertible promissory notes (the “2015 Notes”), on various dates with the last of the 2015 Notes

being issued in August 2015. The 2015 Notes matured and were extended from the date of each tranche through maturity dates ending on February

2024 through March 2024, and April 2024 through August 2024. The 2015 Notes bear interest at

The Company

issued a convertible note (the “Dec 2015 Note”) in exchange for accounts payable in the amount of $

21

The Company

issued a convertible note (the “Sep 2016 Note”) in exchange for accounts payable in the amount of $

The Company

issued two (2) unsecured convertible promissory notes (the “Apr & May 2018 Notes”), in the aggregate amount of $

The Company

entered into an unsecured convertible promissory note (the “Nov 20 Note”), on November 19, 2020 in the amount of $

The Company

entered into an unsecured convertible promissory note (the “Jan 21 Note”), on January 25, 2021 in the amount of $

22

We evaluated the financing transactions in accordance with ASC Topic 815, Derivatives and Hedging, and determined that the conversion feature of the convertible promissory notes was not afforded the exemption for conventional convertible instruments due to its variable conversion rate. The note has no explicit limit on the number of shares issuable, so they did not meet the conditions set forth in current accounting standards for equity classification. The Company elected to recognize the note under paragraph 815-15-25-4, whereby, there would be a separation into a host contract and derivative instrument. The Company elected to initially and subsequently measure the note in its entirety at fair value, with changes in fair value recognized in earnings. The Company recorded a derivative liability representing the imputed interest associated with the embedded derivative. The derivative liability is adjusted periodically according to the stock price fluctuations.

The derivative

liability recognized in the financial statements as of September 30, 2022 was $

| 6. | REVENUE FROM CONTRACTS WITH CUSTOMERS |

Equipment Contracts

Revenues and related costs on equipment contracts are recognized as the performance obligations for work are satisfied over time in accordance with Accounting Standards Codification (“ASC”) 606, Revenue from Contracts with Customers. Under ASC 606, revenue and associated profit will be recognized as the customer obtains control of the goods and services promised in the contract (i.e., performance obligations). All un-allocable indirect costs and corporate general and administrative costs are charged to the periods as incurred. However, in the event a loss on a contract is foreseen, the Company will recognize the loss as it is determined.

The following table represents a disaggregation of revenue by type of good or service from contracts with customers for the September 30, 2022 and 2021.

| Nine Months Ended | ||||||||

| September 30, | ||||||||

| 2022 | 2021 | |||||||

| Equipment Contracts | $ | $ | ||||||

| Component Sales | ||||||||

| Waste Water Treatment Systems | ||||||||

| Pump Stations | ||||||||

| Rental Income | ||||||||

| Services Sales | ||||||||

| $ | $ | |||||||

Revenue recognition for other sales arrangements, such as sales for components, and service sales will remain materially consistent.

Contract

assets represents revenues recognized in excess of amounts billed on contracts in progress. Contract liabilities represents billings in

excess of revenues recognized on contracts in progress. Assets and liabilities related to long-term contracts are included in current

assets and current liabilities in the accompanying balance sheets, as they will be liquidated in the normal course of the contract completion.

The contract asset for the nine months ended September 30, 2022 and the year ended December 31, 2021, was $

23

| 7. | FINANCIAL ASSETS |

Fair value investment in Securities

On November

12, 2021, the Company served a conversion notice to WTII and recorded additional interest and fees of $

On May 15,

2018,

| 8. | LOANS PAYABLE |

Secured Loans Payable

Small Business Administration Loans

Between

April 30, 2020 and September 12, 2020, the Company received total loan proceeds in the amount of $

| 9. | CAPITAL LEASES |

The Company

entered into a capital lease for the purchase of equipment during the year ended December 31, 2018. The lease is for a

| 10. | FOREIGN SUBSIDIARY |

On January 22, 2020 the Company entered into a strategic partnership with Permionics Separations Solutions, Inc., a unit of India’s Permionics Group (“Permionics”) for the Asia-Pacific Region. This strategic partnership assists the Company with overcoming the typical hurdles in commercializing a technology overseas with engineering support, developing customer proposals, infrastructure to handle logistics and purchasing, inventory and shipping from and into foreign countries, customer training, startup assistance and service.

24

The Company believes that Permionics is best suited to accomplish all of the above for its customers in the Asia-Pacific countries and as a result, has terminated all activities of its fully owned subsidiary, OriginClear Technologies Limited, in Hong Kong, China, working instead with Permionics when applicable.

| 11. | ASSETS HELD FOR SALE |

The Company

acquired real estate assets to be held for sale to finance their water projects, by issuing

| 12. | COMMITMENTS AND CONTINGENCIES |

Facility Rental – Related Party

Our Dallas

based subsidiary, PWT, rents an approximately

Warranty Reserve

Generally,

a PWT project is guaranteed against defects in material and workmanship for one year from the date of completion, while certain areas

of construction and materials may have guarantees extending beyond one year. The Company has various insurance policies relating to the

guarantee of completed work, which in the opinion of management will adequately cover any potential claims. A warranty reserve has been

provided under PWT based on the opinion of management and based on Company history in the amount of $

Litigation

There are no material updates to the litigation matters with C6 Capital, LLC nor Auctus Fund, LLC as previously disclosed in the Form 10-Q filed on August 15, 2022.

| 13. | SUBSEQUENT EVENTS |

Management has evaluated subsequent events according to the requirements of ASC TOPIC 855 and has determined that there are the following subsequent events:

Between October 7, 2022

and October 28, 2022, the Company entered into subscription agreements with certain accredited investors pursuant to which the Company

sold an aggregate of

Between October 18, 2022 and November 2, 2022,

the Company issued to consultants an aggregate of

On October 19, 2022, OriginClear, Inc. (the “Company”)

entered into an Equity Financing Agreement (“Financing Agreement”) with GHS Investments, LLC (“GHS”), whereby

GHS agreed to purchase, through puts made from time to time by the Company, up to $

On October 20, 2022, holders of the Company’s

Series Y preferred stock converted an aggregate of

On October 25, 2022, holders of the Company’s

Series U preferred stock converted an aggregate of

On November 3, 2022, holders of the Company’s

Series T preferred stock converted an aggregate of

25

ITEM 2. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

This Quarterly Report on Form 10-Q contains forward-looking statements that are subject to a number of risks and uncertainties, many of which are beyond our control, which may include statements about our:

| ● | business strategy; |

| ● | financial strategy; |

| ● | intellectual property; |

| ● | production; |

| ● | future operating results; and |

| ● | plans, objectives, expectations, and intentions contained in this report that are not historical. |

All statements, other than statements of historical fact included in this report, regarding our strategy, intellectual property, future operations, financial position, estimated revenues and losses, projected costs, prospects, plans and objectives of management are forward-looking statements. When used in this report, the words “could,” “believe,” “anticipate,” “intend,” “estimate,” “expect,” “project” and similar expressions are intended to identify forward-looking statements, although not all forward-looking statements contain such identifying words. All forward-looking statements speak only as of the date of this report. You should not place undue reliance on these forward-looking statements. Although we believe that our plans, intentions and expectations reflected in or suggested by the forward-looking statements we make in this report are reasonable, we can give no assurance that these plans, intentions or expectations will be achieved. These statements may be found under “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” as well as in this report generally. Actual events or results may differ materially from those discussed in forward-looking statements as a result of various factors. In light of these risks and uncertainties, there can be no assurance that the forward-looking statements contained in this filing will in fact occur.

Organizational History

OriginClear, Inc. (“we”, “us”, “our”, the “Company” or “OriginClear”) was incorporated on June 1, 2007 under the laws of the State of Nevada. We have been engaged in business operations since June 2007. In 2015, we moved into the commercialization phase of our business plan having previously been primarily involved in research, development and licensing activities. Our principal offices are located at 13575 58th Street North, Suite 200, Clearwater, FL 33760. Our main telephone number is (727) 440-4603. Our website address is www.OriginClear.com. The information contained on, connected to or that can be accessed via our website is not part of this report.

Overview of Business

OriginClear is a company that today, develops unique water assets for eventual launch as their own companies. This new role was indicated water technology company which has developed in-depth capabilities over the eight years since it began to operate in the water industry.

Pursuant to this new mission, OriginClear’s assets, subsidiaries and product offerings consist of:

| ● | The Intellectual Property of Daniel M. Early (the “Early IP”), consisting of five patents and related knowhow and trade secrets, which are intended to take the place of the applications for the company’s original technology developments. |

| ● | The brand, Modular Water Systems (MWS), featuring products differentiated by the Early IP and complemented with additional knowhow and trade secrets. MWS is in commercial operation and operates as a division of Progressive Water Treatment, Inc. (“PWT”), a wholly owned subsidiary of the Company based in McKinney, Texas. The Company is currently developing MWS as a discrete line of business for an eventual spinoff. In addition, the Company intends to separate the EveraMOD Pump Station product line as a standalone business. |

26

| ● | PWT is responsible for a significant percentage of the company’s revenue, specializing in engineered water treatment solutions and custom treatment systems. We believe that PWT has knowhow with intellectual property potential. |

| ● | OriginClear has incubated a new outsourced water treatment business called Water On Demand (“WOD”). |

| o | The WOD model intends to offer private businesses water self-sustainability as a service - the ability to pay for water treatment and purification services on a per-gallon basis. This is commonly known as Design-Build-Own-Operate or “DBOO”. |

| o | Four subsidiaries have been established to house capital dedicated to this program (“the WOD Subsidiaries”). For efficiency, the Company is reorganizing these subsidiaries into a single WOD Subsidiary. |

| o | On April 13, 2022, the Company’s Board of Directors approved the plan to spin off its Water On Demand business into a newly formed wholly-owned subsidiary, Water On Demand Inc. (“WODI”), which will hold the assets, liabilities, intellectual property and business operations of the Water On Demand business. WODI is designed to select projects, fully qualify them, provide financing for DBOO service contracts, and thereafter manage assets, contracts, clients, investors, strategic partners and vendors. |

As they are subject to a security guaranty by the Company, the WOD Subsidiaries, and the capital raised for them through the Company’s Series Y offering, shall continue to be held by the Company. This capital will be made available to WODI to be deployed, subject to a planned management contract.

Developing Water Businesses

The Company develops and incubates businesses in its role as the Clean Water Innovation Hub™ (“CWIB”). The mission of CWIB in general, is to create valuable properties through an incubation process that results in the launching of valuable spinoffs that add value to the world’s water industry.

The first such spinoff was on April 13, 2022, when the Company’s Board of Directors approved the plan to spin off its Water On Demand business into a newly formed wholly-owned subsidiary, Water On Demand Inc., which will hold the assets, liabilities, intellectual property and business operations of the Water On Demand business.

Further businesses can be expected to be spun off, as the Company announced on April 26, 2022:

“The launch of Water on Demand is the first of several anticipated business property spinoffs. Other Company business properties include Modular Water Systems, which owns a master license to five key international patents for prefabricated, highly-durable modular water treatment and pumping products. Being a proprietary technology, MWS frequently qualifies as “Basis of Design” for projects, which means that competitors cannot easily undercut MWS.”

(https://www.originclear.com/company-news/originclear-to-launch-water-on-demand-fintech-startup)

CWIB’s ongoing operations include:

| 1. | Building a line of customer-facing water brands to expand global market presence and technical expertise. These include the wholly-owned subsidiary, Progressive Water Treatment, Inc., and the Modular Water Systems brand. |

27

| 2. | Managing relationships with partners worldwide who are licensees and business partners. | |

| 3. | Developing the capability of partners to build systems and to deliver Operation & Maintenance (“O&M”) capability at scale, to support Water On Demand outsourced treatment and purification programs. | |

| 4. | Continue to study the streamlining of water assets and royalties through the blockchain, as part of the $H2O™ concept. At this time there is no plan to actively develop a blockchain-based asset. | |

| 5. | Prepare properties for eventual spinoff. |

On July 8, 2022, the Company announced that it booked combined purchase orders in excess of $5 million in the first nine months of 2022, more than double the order volume for the comparable period in 2021.

On September 21, 2022, the Company announced its collaboration with PhilanthroInvestors™ to develop off-grid housing solutions. PhilanthroInvestors™ promotes human welfare while earning a financial return.

https://www.originclear.com/company-news/originclear-teams-up-with-real-estate-leader-for-off-grid-housing

On October 18, 2022, the Company announced that its pump station product line is showing commercial success. Known as EveraMOD in the Modular Water Systems (MWS) lineup, this durable, modular system is being adopted by customers, often as a simple yet vital retrofit for existing, obsolete installations.

In addition, the Company indicated that it may spin off EveraMOD as its next independent company as part of CWIB.

https://www.originclear.com/company-news/originclears-pump-station-line-rapidly-expands

On October 25, 2022, the Company announced that it entered an Equity Financing Agreement with GHS Investments (GHS). Pursuant to the Agreement, GHS has agreed to purchase up to $25.0 million in registered common stock, with timing and amounts of the purchases to be determined at the sole discretion of the Company.

On November 7, 2022, the Company announced that it retained The Basile Law Firm, P.C. (www.thebasilelawfirm.com), to explore a potential business combination with a NASDAQ-listed Special Purpose Acquisition Corporation (SPAC). OriginClear cautions that a specific SPAC has not been definitively identified, the prospective terms are unknown, and there is no assurance any transaction may occur.

Milestones

Progressive Water Treatment Inc.

On October 1, 2015, the Company completed the acquisition of Dallas-based Progressive Water Treatment Inc. (“PWT”), a designer, builder and service provider for a wide range of industrial water treatment applications. PWT, together with MWS, other proprietary technologies and potential future acquisitions, aims to offer a complementary, end-to-end offering to serve growing corporate demand for outsourced water treatment.

PWT’s Business

Since 1995, PWT has been designing and manufacturing a complete line of water treatment systems for municipal, industrial and pure water applications. PWT designs and manufactures a complete line of water treatment systems for municipal, industrial and pure water applications. Its uniqueness is its ability to gain an in-depth understanding of customer’s needs and then to design and build an integrated water treatment system using multiple technologies to provide a complete solution for its customers.

PWT utilizes a wide range of technologies, including chemical injection, media filters, membrane, ion exchange and SCADA (supervisory control and data acquisition) technology in turnkey systems. PWT also offers a broad range of services including maintenance contracts, retrofits and replacement assistance. In addition, PWT rents equipment in contracts of varying duration. Customers are primarily served in the United States and Canada, with the company’s reach extending worldwide from Siberia to Argentina to the Middle East.

PWT Milestones

In the first quarter of 2019, the Company increased the number of the manufacturer’s representatives for its operating units, PWT and Modular Water Systems (“MWS”).

28

On Nov 7, 2019, the Company published a case study showing how its Modular Water System may help automotive dealerships expand into rural land. The case study shows how point-of-use treatment solves lack of access to the public sewer system.

On March 5, 2020, the Company announced disruptive pump and lift station pricing, stating that its prefabricated modules with a lifespan of up to 100 years now compete with precast concrete.

On April 15, 2021, the Company announced that its Progressive Water Treatment division is now shipping BroncBoost™, its workhorse Booster Pump Station equipment line. Engineered and built in Texas, BroncBoost allows customers to control water flow rates and pressure for mission critical water distribution systems.

On August 25, 2021, PWT entered into a Master Services Agreement (MSA) with a large US public utility company for water filtration systems that will provide process water at three power plants. The utility issued a purchase order for approximately $1.8 million, for the first power plant. The total purchase price payable to PWT under the MSA is approximately $5 million, subject to certain conditions, including receipt and acceptance by PWT of additional purchase orders. We expect the overall contract to take up to two years to deliver from the date of the MSA.

Modular Water Systems

On June 22, 2018, OriginClear signed an exclusive worldwide licensing agreement with Daniel “Dan” Early P. E. for his proprietary technology for prefabricated water transport and treatment systems. On July 19, 2018, the Company began incubating its Modular Water Treatment Division (MWS) around Mr. Early’s technology and perspective customers. The Company has funded the development of this division with internal cash flow. In Q1 of 2020, the Company fully integrated MWS with wholly-owned Progressive Water Treatment Inc. The Company is currently developing MWS as a discrete line of business for an eventual spinoff. Mr. Early currently serves as Chief Engineer for OriginClear.

On July 19, 2018, the Company launched its Modular Water Treatment Division, offering a unique product line of prefabricated water transport and treatment systems. Daniel “Dan” Early P.E. (Professional Engineer) heads the Modular Water Systems (“MWS”) division. On June 25, 2018, Dan Early granted the Company a worldwide, exclusive non-transferable license to the technology and knowhow behind MWS (See “Intellectual Property”). A ten-year renewal on May 20, 2020 added the right to sublicense and create manufacturing joint ventures. On July 25, 2018, MWS received its first order, for a brewery wastewater treatment plant.

With PWT and other companies as fabricators and assemblers, MWS designs, manufactures and delivers prefabricated water transport (pump and lift stations) under the EveraMOD™ brand; and wastewater treatment plant (“WWTP”) products under the EveraSKID™ and EveraTREAT™ brands to customers and end-users which are required to clean their own wastewater, such as schools, small communities, institutional facilities, real estate developments, factories, and industrial parks.

On September 28, 2021, the Company announced that MWS deployed its pilot Pondster™ brand modular lagoon treatment system at a Mobile Home Park (MHP) or trailer park, in Troy, Alabama.

On June 16, 2022 the Company announced that MWS received purchase orders for approximately $1.5 Million in May of 2022. This compared to $1,774,880 in purchase orders for the entire year 2021.

On July 25, 2022 the Company announced that decentralized water treatment, long pioneered by OriginClear’s Modular Water Systems™ (MWS), is now being mandated by major US cities to recycle water in large new buildings.

On August 12, 2022 the Company announced the inaugural delivery and installation of its pre-engineered EveraBOX™ to implement a low-risk Liquid Ammonium Sulfate (LAS) disinfectant system for Pennsylvania’s Beaver Falls Municipal Water Authority (BFMA). Typical of MWS products, EveraBOX is manufactured using inexpensive, long-lasting High-Density Polyethylene (HDPE) or Polypropylene (PP) materials. These materials have proven to be less affected by supply chain issues currently impacting metal and fiberglass construction.

29

Water on Demand™: a new strategic direction.

OriginClear is also developing a new outsourced water treatment business called “Water On Demand”: or “WOD” as a potential revenue source. The WOD model intends to offer private businesses the ability to pay for water treatment and purification services on a per-gallon basis. This is commonly known as Design-Build-Own-Operate or “DBOO”. On April 13, 2021, we announced formation of a wholly-owned subsidiary called Water On Demand #1, Inc. (“WOD #1”) to pursue capitalization of the equipment required. The WOD Subsidiaries, Water On Demand #2, Inc. (“WOD #2”), Water On Demand #3, Inc. (“WOD #3”), Water On Demand #4, Inc. (“WOD #4”) were separately created to permit optional segmenting of capital pools according to strategic partnerships. The Company is now simplifying this structure by placing all funds in WOD #1 and tracking the partnerships within that company. As they are subject to a security guaranty by the Company, the WOD Subsidiaries, and the capital raised for them through the Company’s Series Y offering, shall continue to be held by the Company. This capital will be made available to WODI to be deployed, subject to a planned management contract.

The Company intends to pilot a first DBOO contract and thereafter, work with regional water service companies to build and operate the water treatment systems it finances. Additional financing hubs could be set up in world financial centers.

Delegating the building and operating of WOD-financed systems to regional water companies under performance contract, with the aim of developing a network of such partners, is expected to enable rapid scale-up of the WOD program, and the partner network would create a high barrier to entry for competitors.

On April 13, 2022, the Company’s Board of Directors approved the plan to spin off its Water On Demand business into a newly formed wholly-owned subsidiary, Water On Demand Inc., which will hold the assets, liabilities, intellectual property and business operations of the Water On Demand business.

The Company stipulates that it has excluded the WOD Subsidiaries, and all capital already raised and to be raised in the future in its Series Y offering, from this assignment of assets and will make the capital available as part of a planned management contract. The Company intends to also register a Regulation A offering by WODI which is intended to accumulate capital for WODI to direct toward WOD projects.

To enable rapid scaling, WODI does not initially intend to build, maintain or service the water treatment systems it finances, but instead contract with regional water service companies to carry out these functions. On April 6, 2022, an agreement in principle was reached to work with the first of these intended contractors, Envirogen Technologies (www.envirogen.com), a 30-year international provider of environmental technology and process solutions (www.originclear.com/company-news/originclear-and-envirogen-to-partner-on-water-on-demand). Future resources to build, maintain and service these financed systems may come from acquisitions; however, these are not actively being planned.

At the time of this filing, WODI had no staff or independent resources. Under a prospective management services contract, OCLN is providing all staffing and administrative resources, as well as access to the funds it has raised for WOD investments.

30

Market Opportunity

On a global basis, only twenty percent (20%) of all sewage and thirty percent (30%) of all industrial waste are ever treated. Water leakage results in the loss of thirty-five percent (35%) of all clean water across the planet. Cutting that number in half would provide clean water for 100 million people. This is a situation of great danger, but also great potential.

We believe businesses can no longer rely on giant, centralized water utilities to meet the challenge. That is why more and more business users are doing their own water treatment and recycling. Whether by choice or necessity, those businesses that invest in onsite water systems gain a tangible asset on their business and real estate and can enjoy better water quality at a lower cost, especially if treated water is recycled.

We believe self-reliant businesses are quietly building “decentralized water wealth” for themselves while also helping their communities. Environmental, social and governance (ESG) investing guidelines, which drive about a quarter of all professionally managed assets around the world, specifically include the key factor of how well corporations manage water.

As civil infrastructure ages and fails and as the costs for new and replacement infrastructure increase year over year, we believe engineers and end-users will search for new ways and methods of deploying water and wastewater systems that are less expensive to deliver and much less expensive to own and operate with the mission intent of substantially increasing the replacement intervals currently experienced by conventional materials of construction and conventional product delivery models.

Reducing Risk through Outsourcing

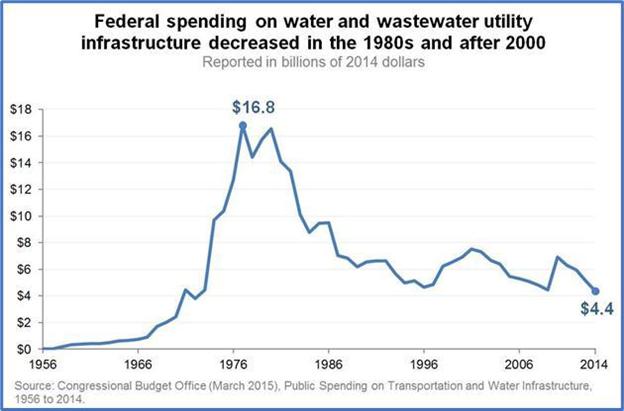

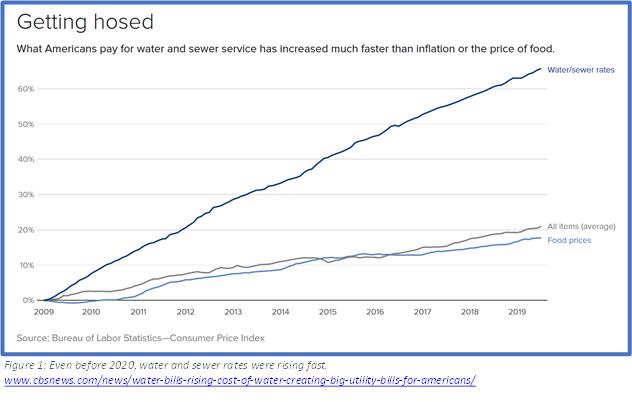

Inflation of water rates greatly exceeds core inflation (see Figure 2), creating a risk for managers of businesses served by municipalities. We believe this creates an incentive for self-treatment; but these businesses may lack the capital for large water plant expenditures, and the in-house expertise to manage them. Outsourcing through what we call Water on Demand™ means that these companies do not have to worry about the problem, either financing it or managing it.

As an example, in information technology, few companies operate their own server in-house powering their website. Rather, such servers are typically managed by professionals through a service level agreement. In the water industry, when applied to outsourced water treatment, a service level agreement is known as O&M agreement. When the vendor retains ownership of the equipment, the concept is expanded to “Own and Operate”, an extension of the basic “Design and Build”, for a full offering known as DBOO, which is very similar to the solar energy programs known as Power Purchase Agreements (“PPAs”).