flxn-10q_20170630.htm

+

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-Q

(Mark One)

|

☒ |

QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

FOR THE QUARTERLY PERIOD ENDED JUNE 30, 2017

or

|

☐ |

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

FOR THE TRANSITION PERIOD FROM TO

Commission file number: 001-36287

Flexion Therapeutics, Inc.

(Exact name of registrant as specified in its charter)

|

Delaware |

|

26-1388364 |

|

(State or Other Jurisdiction of

Incorporation or Organization) |

|

(I.R.S. Employer

Identification No.) |

|

|

|

|

|

10 Mall Road, Suite 301

Burlington, Massachusetts |

|

01803 |

|

(Address of Principal Executive Offices) |

|

(Zip Code) |

(781) 305-7777

(Registrant’s Telephone Number, Including Area Code)

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ☒ No ☐

Indicate by check mark whether registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer”, “accelerated filer”, “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

|

Large accelerated filer |

|

☐ |

Accelerated filer |

|

☒ |

|

|

|

|

|

|

|

|

Non-accelerated filer |

|

☐ (Do not check if a smaller reporting company) |

Smaller reporting company |

|

☐ |

|

Emerging growth company |

|

☒ |

|

|

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act ☒

Indicate by check mark whether registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). ☐ Yes ☒ No

As of August 3, 2017 the registrant had 31,905,664 shares of Common Stock ($0.001 par value) outstanding.

1

FLEXION THERAPEUTICS, INC.

TABLE OF CONTENTS

2

PART I. FINANCIAL INFORMATION

Item 1. Financial Statements

Flexion Therapeutics, Inc.

Condensed Consolidated Balance Sheets

(Unaudited in thousands, except share amounts)

|

|

|

June 30,

2017 |

|

|

December 31,

2016 |

|

|

Assets |

|

|

|

|

|

|

|

|

|

Current assets: |

|

|

|

|

|

|

|

|

|

Cash and cash equivalents |

|

$ |

197,179 |

|

|

$ |

30,915 |

|

|

Marketable securities |

|

|

162,680 |

|

|

|

174,688 |

|

|

Prepaid expenses and other current assets |

|

|

2,334 |

|

|

|

3,790 |

|

|

Total current assets |

|

$ |

362,193 |

|

|

$ |

209,393 |

|

|

Property and equipment, net |

|

|

11,863 |

|

|

|

11,664 |

|

|

Long-term investments |

|

|

— |

|

|

|

4,725 |

|

|

Restricted cash |

|

|

600 |

|

|

|

480 |

|

|

Total assets |

|

$ |

374,656 |

|

|

$ |

226,262 |

|

|

Liabilities and Stockholders’ Equity |

|

|

|

|

|

|

|

|

|

Current liabilities: |

|

|

|

|

|

|

|

|

|

Accounts payable |

|

$ |

2,741 |

|

|

$ |

2,161 |

|

|

Accrued expenses and other current liabilities |

|

|

7,097 |

|

|

|

6,245 |

|

|

Current portion of long-term debt |

|

|

9,967 |

|

|

|

9,134 |

|

|

Total current liabilities |

|

$ |

19,805 |

|

|

$ |

17,540 |

|

|

Long-term debt, net |

|

|

17,584 |

|

|

|

21,399 |

|

|

2024 convertible notes, net |

|

|

133,484 |

|

|

|

- |

|

|

Other long-term liabilities |

|

|

404 |

|

|

|

291 |

|

|

Total liabilities |

|

$ |

171,277 |

|

|

$ |

39,230 |

|

|

Commitments and contingencies |

|

|

|

|

|

|

|

|

|

Preferred stock, $0.001 par value; 10,000,000 shares authorized at June 30, 2017

and December 31, 2016 and 0 shares issued and outstanding at June 30, 2017

and December 31, 2016 |

|

|

— |

|

|

|

— |

|

|

Stockholders’ equity: |

|

|

|

|

|

|

|

|

|

Common stock, $0.001 par value; 100,000,000 shares authorized; 31,904,926 and

31,667,469 shares issued and outstanding, at June 30, 2017 and

December 31, 2016, respectively |

|

|

32 |

|

|

|

32 |

|

|

Additional paid-in capital |

|

|

467,874 |

|

|

|

398,757 |

|

|

Accumulated other comprehensive income |

|

|

(77 |

) |

|

|

(71 |

) |

|

Accumulated deficit |

|

|

(264,450 |

) |

|

|

(211,686 |

) |

|

Total stockholders’ equity |

|

|

203,379 |

|

|

|

187,032 |

|

|

Total liabilities and stockholders’ equity |

|

$ |

374,656 |

|

|

$ |

226,262 |

|

The accompanying notes are an integral part of these condensed consolidated financial statements.

3

Flexion Therapeutics, Inc.

Condensed Consolidated Statements of Operations and Comprehensive Loss

(Unaudited in thousands, except per share amounts)

|

|

|

Three Months Ended

June 30, |

|

|

Six Months Ended

June 30, |

|

|

|

|

|

2017 |

|

|

2016 |

|

|

2017 |

|

|

2016 |

|

|

|

Revenue |

|

$ |

— |

|

|

$ |

— |

|

|

$ |

— |

|

|

$ |

— |

|

|

|

Operating expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Research and development |

|

|

11,769 |

|

|

|

8,905 |

|

|

|

22,524 |

|

|

|

20,886 |

|

|

|

General and administrative |

|

|

15,133 |

|

|

|

5,215 |

|

|

|

28,158 |

|

|

|

9,907 |

|

|

|

Total operating expenses |

|

|

26,902 |

|

|

|

14,120 |

|

|

|

50,682 |

|

|

|

30,793 |

|

|

|

Loss from operations |

|

|

(26,902 |

) |

|

|

(14,120 |

) |

|

|

(50,682 |

) |

|

|

(30,793 |

) |

|

|

Other income (expense): |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest income |

|

|

797 |

|

|

|

295 |

|

|

|

1,355 |

|

|

|

631 |

|

|

|

Interest expense |

|

|

(2,887 |

) |

|

|

(202 |

) |

|

|

(3,520 |

) |

|

|

(478 |

) |

|

|

Other income (expense), net |

|

|

112 |

|

|

|

(158 |

) |

|

|

83 |

|

|

|

(360 |

) |

|

|

Total other income (expense) |

|

|

(1,978 |

) |

|

|

(65 |

) |

|

|

(2,082 |

) |

|

|

(207 |

) |

|

|

Net loss |

|

$ |

(28,880 |

) |

|

$ |

(14,185 |

) |

|

$ |

(52,764 |

) |

|

$ |

(31,000 |

) |

|

|

Net loss per share basic and diluted |

|

$ |

(0.91 |

) |

|

$ |

(0.63 |

) |

|

$ |

(1.66 |

) |

|

$ |

(1.40 |

) |

|

|

Weighted average common shares outstanding, basic and diluted |

|

|

31,826 |

|

|

|

22,666 |

|

|

|

31,765 |

|

|

|

22,115 |

|

|

|

Other comprehensive (loss) income: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Unrealized (loss) from available-for-sale securities, net of tax

of $0 |

|

|

(17 |

) |

|

|

(18 |

) |

|

|

(6 |

) |

|

|

(108 |

) |

|

|

Total other comprehensive (loss) income |

|

|

(17 |

) |

|

|

(18 |

) |

|

|

(6 |

) |

|

|

(108 |

) |

|

|

Comprehensive loss |

|

$ |

(28,897 |

) |

|

$ |

(14,203 |

) |

|

$ |

(52,770 |

) |

|

$ |

(31,108 |

) |

|

The accompanying notes are an integral part of these condensed consolidated financial statements.

4

Flexion Therapeutics, Inc.

Condensed Consolidated Statements of Changes in Stockholder’s Equity (Deficit)

(Unaudited in thousands)

|

|

|

|

Common Stock |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Shares |

|

|

Par Value |

|

|

Additional Paid-in-Capital |

|

|

Accumulated Other Comprehensive Income (Loss) |

|

|

Accumulated Deficit |

|

|

Total Stockholder's Equity (Deficit) |

|

|

Balance at December 31, 2014 |

|

|

|

21,440 |

|

|

$ |

21 |

|

|

$ |

238,402 |

|

|

$ |

(5 |

) |

|

$ |

(93,477 |

) |

|

$ |

144,941 |

|

|

Exercise of stock options |

|

|

|

109 |

|

|

|

1 |

|

|

|

592 |

|

|

|

|

|

|

|

|

|

|

$ |

593 |

|

|

Employee Stock Purchase Plan |

|

|

|

21 |

|

|

|

— |

|

|

|

276 |

|

|

|

|

|

|

|

|

|

|

|

276 |

|

|

Stock-based compensation expense |

|

|

|

|

|

|

|

|

|

|

|

4,583 |

|

|

|

|

|

|

|

|

|

|

|

4,583 |

|

|

Net loss |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(46,315 |

) |

|

|

(46,315 |

) |

|

Other comprehensive loss |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(92 |

) |

|

|

|

|

|

|

(92 |

) |

|

Balance at December 31, 2015 |

|

|

|

21,570 |

|

|

$ |

22 |

|

|

$ |

243,853 |

|

|

$ |

(97 |

) |

|

$ |

(139,792 |

) |

|

$ |

103,986 |

|

|

Issuance of Common Stock net of issuance costs |

|

|

|

10,040 |

|

|

|

10 |

|

|

|

147,491 |

|

|

|

|

|

|

|

|

|

|

|

147,501 |

|

|

Exercise of stock options |

|

|

|

30 |

|

|

|

- |

|

|

|

167 |

|

|

|

|

|

|

|

|

|

|

|

167 |

|

|

Employee Stock Purchase Plan |

|

|

|

27 |

|

|

|

— |

|

|

|

476 |

|

|

|

|

|

|

|

|

|

|

|

476 |

|

|

Stock-based compensation expense |

|

|

|

|

|

|

|

|

|

|

|

6,770 |

|

|

|

|

|

|

|

|

|

|

|

6,770 |

|

|

Net loss |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(71,894 |

) |

|

|

(71,894 |

) |

|

Other comprehensive loss |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

26 |

|

|

|

|

|

|

|

26 |

|

|

Balance at December 31, 2016 |

|

|

|

31,667 |

|

|

$ |

32 |

|

|

$ |

398,757 |

|

|

$ |

(71 |

) |

|

$ |

(211,686 |

) |

|

$ |

187,032 |

|

|

Exercise of stock options |

|

|

|

182 |

|

|

|

— |

|

|

|

1,457 |

|

|

|

|

|

|

|

|

|

|

$ |

1,457 |

|

|

Employee Stock Purchase Plan |

|

|

|

56 |

|

|

|

— |

|

|

|

453 |

|

|

|

|

|

|

|

|

|

|

|

453 |

|

|

Stock-based compensation expense |

|

|

|

|

|

|

|

|

|

|

|

4,741 |

|

|

|

|

|

|

|

|

|

|

|

4,741 |

|

|

Convertible debt |

|

|

|

|

|

|

|

|

|

|

|

62,466 |

|

|

|

|

|

|

|

|

|

|

|

62,466 |

|

|

Net loss |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(52,764 |

) |

|

|

(52,764 |

) |

|

Other comprehensive loss |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(6 |

) |

|

|

|

|

|

|

(6 |

) |

|

Balance at June 30, 2017 |

|

|

|

31,905 |

|

|

$ |

32 |

|

|

$ |

467,874 |

|

|

$ |

(77 |

) |

|

$ |

(264,450 |

) |

|

$ |

203,379 |

|

The accompanying notes are an integral part of these condensed consolidated financial statements.

5

Flexion Therapeutics, Inc.

Condensed Consolidated Statements of Cash Flows

(Unaudited in thousands)

|

|

|

Six Months Ended

June 30, |

|

|

|

|

2017 |

|

|

2016 |

|

|

Cash flows from operating activities |

|

|

|

|

|

|

|

|

|

Net loss |

|

$ |

(52,764 |

) |

|

$ |

(31,000 |

) |

|

Adjustments to reconcile net loss to cash used in operating activities: |

|

|

|

|

|

|

|

|

|

Depreciation |

|

|

927 |

|

|

|

269 |

|

|

Stock-based compensation expense |

|

|

4,741 |

|

|

|

3,260 |

|

|

Amortization of premium (discount) on marketable securities |

|

|

259 |

|

|

|

345 |

|

|

Loss on disposal of fixed assets |

|

|

— |

|

|

|

2,278 |

|

|

Amortization of convertible debt discount and debt issuance costs |

|

|

1,190 |

|

|

|

18 |

|

|

Premium paid on securities purchased |

|

|

(580 |

) |

|

|

(22 |

) |

|

Changes in operating assets and liabilities: |

|

|

|

|

|

|

|

|

|

Accounts receivable |

|

|

— |

|

|

|

(6 |

) |

|

Prepaid expenses, other current and long-term assets |

|

|

1,456 |

|

|

|

(353 |

) |

|

Accounts payable |

|

|

736 |

|

|

|

412 |

|

|

Accrued expenses and other current and long-term liabilities |

|

|

1,796 |

|

|

|

(517 |

) |

|

Net cash used in operating activities |

|

|

(42,239 |

) |

|

|

(25,316 |

) |

|

Cash flows from investing activities |

|

|

|

|

|

|

|

|

|

Purchases of property and equipment |

|

|

(1,682 |

) |

|

|

(7,678 |

) |

|

Change in restricted cash |

|

|

(120 |

) |

|

|

— |

|

|

Purchases of marketable securities |

|

|

(118,320 |

) |

|

|

(10,804 |

) |

|

Sale and redemption of marketable securities |

|

|

135,363 |

|

|

|

21,997 |

|

|

Net cash provided by investing activities |

|

|

15,241 |

|

|

|

3,515 |

|

|

Cash flows from financing activities |

|

|

|

|

|

|

|

|

|

Proceeds from the issuance of 2024 convertible notes |

|

|

201,250 |

|

|

|

— |

|

|

Payment of debt issuance costs |

|

|

(6,470 |

) |

|

|

(42 |

) |

|

Proceeds from the offering of common stock |

|

|

— |

|

|

|

77,644 |

|

|

Payments on notes payable |

|

|

(3,333 |

) |

|

|

— |

|

|

Payments of public offering costs |

|

|

(95 |

) |

|

|

(31 |

) |

|

Proceeds from the exercise of stock options |

|

|

1,457 |

|

|

|

56 |

|

|

Proceeds from Employee Stock Purchase Plan |

|

|

453 |

|

|

|

240 |

|

|

Net cash provided by financing activities |

|

|

193,262 |

|

|

|

77,867 |

|

|

Net increase in cash and cash equivalents |

|

|

166,264 |

|

|

|

56,066 |

|

|

Cash and cash equivalents at beginning of period |

|

|

30,915 |

|

|

|

62,944 |

|

|

Cash and cash equivalents at end of period |

|

$ |

197,179 |

|

|

$ |

119,010 |

|

|

Supplemental disclosures of cash flow information: |

|

|

|

|

|

|

|

|

|

Cash paid for interest |

|

$ |

921 |

|

|

$ |

477 |

|

|

Supplemental disclosures of non-cash financing activities: |

|

|

|

|

|

|

|

|

|

Purchases of property and equipment in accounts payable and accrued expenses |

|

$ |

66 |

|

|

$ |

154 |

|

The accompanying notes are an integral part of these condensed consolidated financial statements.

6

Flexion Therapeutics, Inc.

Notes to Condensed Consolidated Financial Statements (Unaudited)

1. Overview and Nature of the Business

Flexion Therapeutics, Inc. (“Flexion” or the “Company”) was incorporated under the laws of the state of Delaware on November 5, 2007. Flexion is a specialty pharmaceutical company focused on the development and commercialization of novel, local therapies for the treatment of patients with musculoskeletal conditions, beginning with osteoarthritis (“OA”), a type of degenerative arthritis. In May 2016, the U.S Food and Drug Administration, or FDA, informed us that the safety and efficacy data from the registration program for ZilrettaTM (FX006), our lead investigational product candidate, were acceptable to support the submission of a new drug application, or NDA. In December 2016, we submitted the NDA for Zilretta, and in February 2017, we announced that the FDA accepted the Zilretta NDA for filing and has established a user fee goal date under the Prescription Drug User Fee Act, or PDUFA, of October 6, 2017.

The Company is subject to risks and uncertainties common to pre-commercial companies in the biopharmaceutical industry, including, but not limited to, new technological innovations, dependence on key personnel, protection of proprietary technology, compliance with government regulations, and the ability to secure additional capital to fund operations. Product candidates currently under development will require significant additional research and development efforts, including extensive preclinical and clinical testing and regulatory approval prior to commercialization. These efforts require significant amounts of additional capital, adequate personnel infrastructure and extensive compliance reporting capabilities. The Company’s product candidates are all in the development stage. There can be no assurance that development efforts, including clinical trials, will be successful. Even if the Company’s product development efforts are successful, it is uncertain when, if ever, the Company will realize significant revenue from product sales.

2. Summary of Significant Accounting Policies

Basis of Presentation

The accompanying condensed consolidated financial statements as of June 30, 2017, and for the three and six months ended June 30, 2017 and 2016, have been prepared in accordance with the rules and regulations of the Securities and Exchange Commission (the “SEC”) and Generally Accepted Accounting Principles (“GAAP”) for consolidated financial information including the accounts of the Company and its wholly-owned subsidiary after elimination of all significant intercompany accounts and transactions. Accordingly, they do not include all of the information and footnotes required by GAAP for complete financial statements. In the opinion of management, these condensed consolidated financial statements reflect all adjustments which are necessary for a fair statement of the Company’s financial position and results of its operations, as of and for the periods presented. These condensed consolidated financial statements should be read in conjunction with the consolidated financial statements and notes thereto contained in the Company’s Annual Report on Form 10-K filed with the SEC on March 10, 2017.

The information presented in the condensed consolidated financial statements and related notes as of June 30, 2017, and for the three and six months ended June 30, 2017 and 2016, is unaudited. The December 31, 2016 consolidated balance sheet included herein was derived from the audited financial statements as of that date, but does not include all disclosures, including notes, required by GAAP for complete financial statements.

Interim results for the three and six months ended June 30, 2017 are not necessarily indicative of the results that may be expected for the fiscal year ending December 31, 2017, or any future period.

The accompanying condensed consolidated financial statements have been prepared on a basis which assumes that the Company will continue as a going concern and which contemplates the realization of assets and satisfaction of liabilities and commitments in the normal course of business. The Company has incurred recurring losses and negative cash flows from operations. As of June 30, 2017 the Company had cash, cash equivalents, marketable securities, and long-term investments of approximately $359,859,000. Management believes that current cash, cash equivalents and marketable securities on hand at June 30, 2017, which includes the net proceeds of its convertible note offering of approximately $194,780,000 described in note ten, should be sufficient to fund operations for at least the next twelve months from the issuance date of these financial statements. The future viability of the Company is dependent on its ability to raise additional capital to finance its operations, to fund increased research and development costs in order to seek approval for commercialization of its product candidates, and to successfully commercialize Zilretta, if approved. The Company’s failure to raise capital as and when needed would have a negative impact on its financial condition and its ability to pursue its business strategies as this capital is necessary for the Company to perform the research and development activities required to develop and seek approval for commercialization of the Company’s product candidates, to establish a commercial infrastructure in order to generate future revenue streams, and to successfully commercialize Zilretta, if approved.

In May 2014, the FASB issued guidance which supersedes all existing revenue recognition requirements, including most industry-specific guidance. The new standard requires a company to recognize revenue when it transfers goods or services to

7

customers in an amount that reflects the consideration that the company expects to receive for those goods or services. In August 2015, the FASB issued Accounting Standards Update 2015-14, Revenue from Contracts with Customers: Deferral of the Effective Date. This latest standard defers the effective date of revenue standard ASU 2014-09 by one year and permits early adoption on a limited basis. Since the Company has not generated revenue to date, this guidance will only impact future periods, if any, when revenue is earned. This update will replace existing revenue recognition guidance under GAAP when it becomes effective for the Company beginning January 1, 2018, with early adoption permitted in the first quarter of 2017. The updated standard will permit the use of either the retrospective or cumulative effect transition method. The Company adopted this guidance as of January 1, 2017 and is currently evaluating the potential impact that the adoption of this guidance may have on the Company’s future financial statements.

In November 2015, the FASB issued ASU 2015-17, Income Taxes (Topic 740), to simplify the presentation of deferred income taxes. Under the new standard, both deferred tax liabilities and assets are required to be classified as noncurrent in a classified balance sheet. ASU 2015-17 became effective for the Company’s 2017 fiscal year. Given the Company has a full valuation against its deferred tax assets and liabilities, the impact of adopting this guidance was not material to the Company’s financial statements.

In February 2016, the FASB issued ASU 2016-02, Leases (“ASU 2016-02”), to increase transparency and comparability among organizations by recognizing lease assets and liabilities, including for operating leases, on the balance sheet and disclosing key information about leasing arrangements. ASU 2016-02 is effective for fiscal years, and interim periods within those fiscal years, beginning after December 15, 2018. The Company is currently evaluating the impact that the adoption of this guidance may have on the Company’s financial statements.

In March 2016, the FASB released ASU 2016-09, which amends ASC Topic 718, Compensation-Stock Compensation, to require changes to several areas of employee share-based payment accounting in an effort to simplify share-based reporting. The update revises requirements in the following areas: minimum statutory withholding, accounting for income taxes, forfeitures, and intrinsic value accounting for private entities. For public companies, the new rules became effective for annual reporting periods beginning after December 15, 2016, and interim reporting periods within such annual period. The Company adopted this guidance beginning on January 1, 2017 and no longer records stock compensation expense net of forfeitures. The Company adopted this guidance using a modified retrospective approach to reflect forfeitures as they occurred in the total stock based compensation expense recorded in the Company’s financial statements. The impact of this adoption was not material to the Company’s financial statements.

In August 2016, the FASB issued ASU 2016-15, Statement of cash flows (Topic 230), to increase the consistency of presentation in how certain cash receipts and cash payments are presented and classified in the statement of cash flows. ASU 2016-15 will become effective for fiscal years, and the interim periods within those years, beginning after December 15, 2017. The Company is currently evaluating the potential impact that the adoption of this guidance may have on the Company’s financial statements.

Consolidation

The accompanying condensed consolidated financial statements include the Company and its wholly-owned subsidiary, Flexion Securities Corporation, Inc. The Company has eliminated all intercompany transactions for the three and six months ended June 30, 2017 and the year ended December 31, 2016.

Use of Estimates

The preparation of financial statements in conformity with GAAP requires management to make estimates and judgments that may affect the reported amounts of assets and liabilities, expenses and related disclosures. The Company bases estimates and judgments on historical experience and on various other factors that it believes to be reasonable under the circumstances. The most significant estimates in these condensed consolidated financial statements include useful lives with respect to long-lived assets, such as property and equipment and leasehold improvements, accounting for stock-based compensation, and accrued expenses, including clinical research costs. The Company’s actual results may differ from these estimates under different assumptions or conditions. The Company evaluates its estimates on an ongoing basis. Changes in estimates are reflected in reported results in the period in which they become known by the Company’s management.

8

Property and Equipment

Property and equipment are stated at cost less accumulated depreciation. Depreciation and amortization expense is recognized using the straight-line method over the following estimated useful lives:

|

|

|

Estimated

Useful Life

(Years) |

|

Computers, office equipment, and minor computer software |

|

3 |

|

Computer software |

|

7 |

|

Manufacturing equipment |

|

7-10 |

|

Furniture and fixtures |

|

5 |

Leasehold improvements are amortized over the shorter of the lease term or the estimated useful life of the related asset. Costs of major additions and improvements are capitalized and depreciated on a straight-line basis over their useful lives. Repairs and maintenance costs are expensed as incurred. Upon retirement or sale, the cost of assets disposed of and the related accumulated depreciation are removed from the accounts and any resulting gain or loss is credited or charged to income. Property and equipment includes construction-in-progress that is not yet in service.

Foreign Currencies

The Company maintains a bank account denominated in British Pounds. All foreign currency payables and cash balances are measured at the applicable exchange rate at the end of the reporting period. All associated gains and losses from foreign currency transactions are reflected in the consolidated statements of operations.

3. Fair Value of Financial Assets and Liabilities

The following tables present information about the Company’s assets that are measured at fair value on a recurring basis as of June 30, 2017 and December 31, 2016 and indicate the level of the fair value hierarchy utilized to determine such fair value:

|

|

|

Fair Value Measurements as of June 30, 2017 Using: |

|

|

(In thousands) |

|

Level 1 |

|

|

Level 2 |

|

|

Level 3 |

|

|

Total |

|

|

Assets: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cash equivalents |

|

$ |

— |

|

|

$ |

168,473 |

|

|

$ |

— |

|

|

$ |

168,473 |

|

|

Marketable securities |

|

|

— |

|

|

|

162,680 |

|

|

|

— |

|

|

|

162,680 |

|

|

|

|

$ |

— |

|

|

$ |

331,153 |

|

|

$ |

— |

|

|

$ |

331,153 |

|

|

|

|

Fair Value Measurements as of December 31, 2016 Using: |

|

|

(In thousands) |

|

Level 1 |

|

|

Level 2 |

|

|

Level 3 |

|

|

Total |

|

|

Assets: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cash equivalents |

|

$ |

— |

|

|

$ |

9,830 |

|

|

$ |

— |

|

|

$ |

9,830 |

|

|

Marketable securities |

|

|

— |

|

|

|

179,414 |

|

|

|

— |

|

|

|

179,414 |

|

|

|

|

$ |

— |

|

|

$ |

189,244 |

|

|

$ |

— |

|

|

$ |

189,244 |

|

As of June 30, 2017 and December 31, 2016, the Company’s cash equivalents that are invested in money market funds and overnight repurchase contracts are valued using Level 2 inputs and primarily rely on quoted prices in active markets for similar securities. The Company measures the fair value of marketable securities, which consist of U.S. government obligations, commercial paper, and corporate bonds, using Level 2 inputs and primarily relies on quoted prices in active markets for similar marketable securities. During the six months ended June 30, 2017 and year ended December 31, 2016, there were no transfers between Level 1, Level 2, and Level 3.

The carrying values of accounts receivable, prepaid expenses, other current assets, accounts payable and accrued expenses approximate their fair value due to the short-term nature of these balances.

The Company has a term loan outstanding under its 2015 credit facility with MidCap Financial Funding XIII Trust and Silicon Valley Bank (the “2015 term loan”). The amount outstanding on its 2015 term loan is reported at its carrying value in the

9

accompanying balance sheet. The Company determined the fair value of the 2015 term loan using an income approach that utilizes a discounted cash flow analysis based on current market interest rates for debt issuances with similar remaining years to maturity, adjusted for credit risk. The 2015 term loan was valued using Level 2 inputs as of June 30, 2017 and December 31, 2016. The result of the calculation yielded a fair value that approximates its carrying value.

The Company issued convertible notes on May 2, 2017 with embedded conversion features. The Company estimated the fair value of the convertible notes using a discounted cash flow approach to derive the value of a debt instrument using the expected cash flows and the estimated yield related to the convertible notes. The significant assumptions used in estimating the expected cash flows were: the estimated market yield based on an implied yield and credit quality analysis of a term loan with similar attributes, and the average implied volatility of the Company’s traded and quoted options available as of May 2, 2017. The Company recorded approximately $136.7 million as the fair value of the liability on May 2, 2017, with a corresponding amount recorded as a discount on the initial issuance of the 2024 Convertible Notes of approximately $64.5 million. The debt discount was recorded to equity and is being amortized to the debt liability over the life of the 2024 Convertible Notes using the effective interest method. As of June 30, 2017 the debt liability had a fair value that approximated fair value at issuance.

4. Marketable Securities

As of June 30, 2017 and December 31, 2016 the fair value of available-for-sale marketable securities by type of security was as follows:

|

|

|

June 30, 2017 |

|

|

(In thousands) |

|

Amortized Cost |

|

|

Gross Unrealized

Gains |

|

|

Gross Unrealized

Losses |

|

|

Fair Value |

|

|

U.S. government obligations |

|

$ |

46,475 |

|

|

$ |

— |

|

|

$ |

(9 |

) |

|

$ |

46,466 |

|

|

Commercial paper |

|

|

14,445 |

|

|

|

— |

|

|

|

— |

|

|

|

14,445 |

|

|

Corporate bonds |

|

|

101,837 |

|

|

|

3 |

|

|

|

(71 |

) |

|

|

101,769 |

|

|

|

|

$ |

162,757 |

|

|

$ |

3 |

|

|

$ |

(80 |

) |

|

$ |

162,680 |

|

|

|

|

December 31, 2016 |

|

|

(In thousands) |

|

Amortized Cost |

|

|

Gross Unrealized

Gains |

|

|

Gross Unrealized

Losses |

|

|

Fair Value |

|

|

Commercial paper |

|

$ |

7,769 |

|

|

$ |

— |

|

|

$ |

— |

|

|

$ |

7,769 |

|

|

U.S. government obligations |

|

|

75,524 |

|

|

|

5 |

|

|

|

(12 |

) |

|

|

75,517 |

|

|

Corporate bonds |

|

|

96,193 |

|

|

|

1 |

|

|

|

(66 |

) |

|

|

96,128 |

|

|

|

|

$ |

179,486 |

|

|

$ |

6 |

|

|

$ |

(78 |

) |

|

$ |

179,414 |

|

As of June 30, 2017 and December 31, 2016, marketable securities consisted of approximately $162,680,000 and $174,688,000, respectively, of investments that mature within twelve months and as of December 31, 2016 approximately $4,725,000 of investments that mature within fifteen months. As of June 30, 2017 there were no marketable securities with maturities beyond twelve months.

5. Property and Equipment, Net

Property and equipment, net, as of June 30, 2017 and December 31, 2016 consisted of the following:

|

(In thousands) |

|

June 30,

2017 |

|

|

December 31,

2016 |

|

|

Manufacturing equipment |

|

$ |

11,505 |

|

|

$ |

10,099 |

|

|

Computer and office equipment |

|

|

772 |

|

|

|

573 |

|

|

Software |

|

|

434 |

|

|

|

434 |

|

|

Construction—in progress |

|

|

568 |

|

|

|

1,254 |

|

|

Furniture and fixtures |

|

|

426 |

|

|

|

402 |

|

|

Leasehold improvements |

|

|

461 |

|

|

|

278 |

|

|

|

|

|

14,166 |

|

|

|

13,040 |

|

|

Less: Accumulated depreciation |

|

|

(2,303 |

) |

|

|

(1,376 |

) |

|

Total property and equipment, net |

|

$ |

11,863 |

|

|

$ |

11,664 |

|

Depreciation expense for the six months ended June 30, 2017 and 2016 was approximately $927,000 and $269,000, respectively. No property and equipment was disposed of during the six months ended June 30, 2017. Approximately $2,265,000 in

10

manufacturing equipment located at the Evonik facility was disposed of, resulting in a loss of $2,180,000 which was recorded in research and development expenses for the six months ended June 30, 2016. Construction in progress primarily consists of amounts related to equipment purchased for the Company’s portfolio expansion efforts.

|

6. |

Prepaid Expenses and Other Current Assets |

Prepaid expenses and other current assets and other assets consisted of the following as of June 30, 2017 and December 31, 2016:

|

(In thousands) |

|

June 30,

2017 |

|

|

December 31,

2016 |

|

|

Prepaid Expenses |

|

$ |

1,661 |

|

|

$ |

1,085 |

|

|

Deposits |

|

|

61 |

|

|

|

2,099 |

|

|

Interest receivable on marketable securities |

|

|

611 |

|

|

|

605 |

|

|

Employee Advance |

|

|

1 |

|

|

|

1 |

|

|

Total prepaid expenses and other current assets |

|

$ |

2,334 |

|

|

$ |

3,790 |

|

On December 1, 2016, Flexion paid a refundable NDA fee in the amount of $2,038,100 to the FDA. The Company evaluated each of the published criteria to qualify for a waiver and concluded all criteria were met and thus, obtaining a refund of the fee was probable. As of December 31, 2016 the NDA fee was classified as a deposit in other current assets. On May 16, 2017, Flexion received the full refund of this NDA fee.

7. Accrued Expenses and Other Current Liabilities

Accrued expenses and other current liabilities consisted of the following:

|

(In thousands) |

|

June 30,

2017 |

|

|

December 31,

2016 |

|

|

Research and Development |

|

$ |

402 |

|

|

$ |

1,606 |

|

|

Payroll and other employee-related expenses |

|

|

3,154 |

|

|

|

3,393 |

|

|

Professional services fees |

|

|

1,957 |

|

|

|

926 |

|

|

Other |

|

|

319 |

|

|

|

159 |

|

|

Interest expense |

|

|

1,265 |

|

|

|

161 |

|

|

Total accrued expenses and other current liabilities |

|

$ |

7,097 |

|

|

$ |

6,245 |

|

8. Stock-Based Compensation

Stock Option Valuation

The fair value of each of the Company’s stock option grants is estimated on the date of grant using the Black-Scholes option-pricing model. The Company currently estimates its expected stock volatility based on the historical volatility of its publicly-traded peer companies and expects to continue to do so until such time as it has adequate historical data regarding the volatility of its own publicly-traded stock price. The expected term of the Company’s stock options has been determined utilizing the “simplified” method for awards that qualify as “plain vanilla” options. The expected term of stock options granted to non-employees is equal to the contractual term of the option award. The risk-free interest rate is determined by reference to the U.S. Treasury yield curve in effect at the time of grant of the award for time periods approximately equal to the expected term of the award. Expected dividend yield is based on the fact that the Company has never paid cash dividends and does not expect to pay any cash dividends in the foreseeable future. The relevant data used to determine the value of the stock option grants for the six months ended June 30, 2017 and 2016 are as follows:

|

|

|

Six months ended

June 30, |

|

|

|

|

2017 |

|

|

2016 |

|

|

Risk-free interest rates |

|

1.97-2.29% |

|

|

1.08-1.90% |

|

|

Expected dividend yield |

|

|

0.00 |

% |

|

|

0.00 |

% |

|

Expected term (in years) |

|

|

6.0 |

|

|

|

6.0 |

|

|

Expected volatility |

|

69.9-72.8% |

|

|

79.8-87.9% |

|

11

The following table summarizes stock option activity for the six months ended June 30, 2017:

|

(In thousands, except per share amounts) |

|

Shares Issuable

Under Options |

|

|

Weighted Average

Exercise Price |

|

|

Outstanding as of December 31, 2016 |

|

|

3,268 |

|

|

$ |

14.84 |

|

|

Granted |

|

|

879 |

|

|

|

22.03 |

|

|

Exercised |

|

|

(182 |

) |

|

|

8.01 |

|

|

Cancelled |

|

|

(89 |

) |

|

|

17.17 |

|

|

Outstanding as of June 30, 2017 |

|

|

3,876 |

|

|

$ |

17.60 |

|

|

Options vested and expected to vest at June 30, 2017 |

|

|

3,876 |

|

|

$ |

17.60 |

|

|

Options exercisable at June 30, 2017 |

|

|

1,353 |

|

|

$ |

14.15 |

|

Approximately 189,300 outstanding restricted stock units (“RSUs”) are included in stock options outstanding at June 30, 2017. The RSUs are performance based awards which will only begin vesting if and when a specified corporate performance based milestone is achieved. No outstanding performance awards were vested as of June 30, 2017.

The aggregate intrinsic value of options is calculated as the difference between the exercise price of the options and the fair value of the Company’s common stock for those options that had exercise prices lower than the fair value of the Company’s common stock. A total of approximately 182,000 options, with an aggregate intrinsic value of approximately $2,146,000, were exercised during the six months ended June 30, 2017.

At June 30, 2017 and 2016, there were options for the purchase of approximately 3,876,000 and 2,300,000 shares of the Company’s common stock outstanding, respectively, with a weighted average remaining contractual term of 8.3 years and with a weighted average exercise price of $17.60 and $15.07 per share, respectively.

The weighted average grant date fair value of options granted during the six months ended June 30, 2017 and 2016 was $14.14 and $11.85, respectively.

Stock-based Compensation

The Company recorded stock-based compensation expense related to stock options for the three and six months ended June 30, 2017 and 2016 as follows:

|

|

|

Three months ended

June 30, |

|

|

Six months ended

June 30, |

|

|

|

(In thousands) |

|

2017 |

|

|

2016 |

|

|

2017 |

|

|

2016 |

|

|

|

Research and development |

|

$ |

923 |

|

|

$ |

576 |

|

|

$ |

1,802 |

|

|

$ |

1,113 |

|

|

|

General and administrative |

|

|

1,440 |

|

|

|

1,043 |

|

|

|

2,939 |

|

|

|

2,147 |

|

|

|

|

|

$ |

2,363 |

|

|

$ |

1,619 |

|

|

$ |

4,741 |

|

|

$ |

3,260 |

|

|

As of June 30, 2017, unrecognized stock-based compensation expense for stock options outstanding was approximately $27,369,000 which is expected to be recognized over a weighted average period of 3.0 years.

Restricted Stock Units

On January 4, 2016, the Company granted RSUs with performance and time-based vesting conditions to certain executives. These RSUs vest, and the underlying shares of common stock become deliverable, in the event the Company receives approval from the FDA of an NDA for Zilretta (the “Milestone”). Depending on when and if the Milestone is achieved, the maximum aggregate number of shares of the Company’s common stock available to be earned under these awards is 189,300 with an approximate value of $3,997,000 as of the grant date. The amount of earned shares decreases the longer it takes to achieve the Milestone. If the Milestone is not achieved prior to July 1, 2018, these awards will not vest, will be forfeited in their entirety and no shares of common stock will be delivered. Since it is not possible for the Company to determine the probability of the performance condition being achieved, no compensation costs will be recorded until the Milestone is achieved. If the Milestone is achieved prior to the termination date, compensation costs will be recognized over the remaining requisite service period of these awards, beginning on the Milestone achievement date.

12

9. Net Loss per Share

Basic and diluted net loss per share was calculated as follows for the three and six months ended June 30, 2017 and 2016:

|

|

|

For the three months ended

June 30, |

|

|

For the six months ended

June 30, |

|

|

|

(In thousands) |

|

2017 |

|

|

2016 |

|

|

2017 |

|

|

2016 |

|

|

|

Numerator: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net loss |

|

$ |

(28,880 |

) |

|

$ |

(14,185 |

) |

|

$ |

(52,764 |

) |

|

$ |

(31,000 |

) |

|

|

Net loss: |

|

$ |

(28,880 |

) |

|

$ |

(14,185 |

) |

|

$ |

(52,764 |

) |

|

$ |

(31,000 |

) |

|

|

Denominator: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Weighted average common shares outstanding, basic and

diluted |

|

|

31,826 |

|

|

|

22,666 |

|

|

|

31,765 |

|

|

|

22,115 |

|

|

|

Net loss per share, basic and diluted |

|

$ |

(0.91 |

) |

|

$ |

(0.63 |

) |

|

$ |

(1.66 |

) |

|

$ |

(1.40 |

) |

|

The following common stock equivalents were excluded from the calculation of diluted net loss per share for the periods indicated as including them would have an anti-dilutive effect:

|

|

For the three months ended

June 30, |

|

|

For the six months ended

June 30, |

|

|

|

|

2017 |

|

|

2016 |

|

|

2017 |

|

|

2016 |

|

|

|

Shares issuable upon conversion of the 2024 convertible notes |

|

4,926,458 |

|

|

|

— |

|

|

|

2,463,229 |

|

|

|

— |

|

|

|

Stock options |

|

3,479,243 |

|

|

|

2,208,247 |

|

|

|

3,413,197 |

|

|

|

2,249,559 |

|

|

|

Restricted stock units |

|

189,300 |

|

|

|

189,130 |

|

|

|

189,300 |

|

|

|

186,078 |

|

|

|

Total |

|

8,595,001 |

|

|

|

2,397,377 |

|

|

|

6,065,726 |

|

|

|

2,435,637 |

|

|

10. Debt

Term Loan

On August 4, 2015, the Company entered into a credit and security agreement with MidCap Financial Trust, as agent, and MidCap Financial Funding XIII Trust and Silicon Valley Bank, as lenders, (the “Lenders”), to borrow up to $30,000,000 in term loans. The Company concurrently borrowed an initial term loan of $15,000,000 under the facility. The Company granted the Lenders a security interest in substantially all of its personal property, rights and assets, other than intellectual property, to secure the payment of all amounts owed under the credit facility. The Company agreed not to encumber any of its intellectual property without the Lenders’ prior written consent. The Company also agreed to maintain a balance in cash or cash equivalents at Silicon Valley Bank equal to the principal balance of the loan plus 5% for so long as the Company maintains any cash or cash equivalents in non-secured bank accounts.

On July 22, 2016, the Company borrowed the remaining $15,000,000 under the credit and security agreement, in the form of a second term loan after receiving positive Phase 3 Zilretta clinical trial data meeting the trial’s primary endpoint and which is sufficient to file an NDA for Zilretta. The second term loan is subject to the same credit terms as the initial term loan under the facility.

The credit and security agreement also contains certain representations, warranties, and covenants of the Company as well as a material adverse event clause. As of June 30, 2017, the Company was compliant with all covenants.

Borrowings under the credit facility accrue interest monthly at a fixed interest rate of 6.25% per annum. Following an interest-only period of 19 months, principal will be due in 36 equal monthly installments commencing March 1, 2017 and ending February 1, 2020 (the “maturity date”). Upon the maturity date, the Company will be obligated to pay a final payment equal to 9% of the total principal amounts borrowed under the facility. The final payment amount is being accreted to the carrying value of the debt using the straight line method, which approximates the effective interest method. As of June 30, 2017, the carrying value of the term loan was approximately $27,551,000, of which $9,967,000 was due within 12 months and $17,584,000 was due in greater than 12 months.

In connection with the credit and security agreement, the Company incurred debt issuance costs totaling approximately $150,000. These costs are being amortized over the estimated term of the debt using the straight-line method which approximates the

13

effective interest method. The Company deducted the debt issuance costs from the carrying amount of the debt as of June 30, 2017 and December 31, 2016.

As of June 30, 2017, annual principal and interest payments due under the 2015 term loan are as follows:

|

Year |

|

Aggregate

Minimum

Payments

(in thousands) |

|

|

2017 |

|

$ |

5,781 |

|

|

2018 |

|

|

11,082 |

|

|

2019 |

|

|

10,448 |

|

|

2020 |

|

|

4,383 |

|

|

Total |

|

$ |

31,694 |

|

|

Less interest |

|

|

(1,443 |

) |

|

Less final payment |

|

|

(2,700 |

) |

|

Total |

|

$ |

27,551 |

|

2024 Convertible Notes

On May 2, 2017 the Company issued an aggregate of $201.3 million principal amount of the 2024 Convertible Notes. The 2024 Convertible Notes have a maturity date of May 1, 2024 are unsecured and accrue interest at a rate of 3.375% per annum, payable semi-annually on May 1 and November 1 of each year, beginning November 1, 2017. The Company received $194.8 million for the sale of the 2024 Convertible Notes, after deducting fees and expenses of $6.5 million.

The 2024 Convertible Notes are senior unsecured obligations and bear interest at a rate of 3.375% per year, payable semi-annually in arrears on May and November 1st of each year. The 2024 Convertible Notes will mature on May 1, 2024, unless earlier repurchased or converted. Upon conversion of the 2024 Convertible Notes, at the election of each holder of a 2024 Convertible Note (the Holder), will be convertible into cash, shares of the Company’s common stock, or a combination thereof, at the Company’s election (subject to certain limitations in the 2015 term loan), at a conversion rate of approximately 37.3413 shares of common stock per $1,000 principal amount of the 2024 Convertible Notes, which corresponds to an initial conversion price of approximately $26.78 per share of the Company’s common stock.

The Conversion Rate is subject to adjustment from time to time upon the occurrence of certain events, including, but not limited to, fundamental change events and certain corporate events that occur prior to the maturity date of the notes. In addition, if the Company delivers a notice of redemption, the Company will increase, in certain circumstances, the conversion rate for a Holder who elects to convert its notes in connection with such a corporate event or notice of redemption, as the case may be. At any time prior to the close of business on the business day immediately preceding February 1, 2024, Holders may convert all, or any portion, of the 2024 Convertible Notes at their option only under the following circumstances:

|

|

(1) |

during any calendar quarter commencing after the calendar quarter ending on June 30, 2017 (and only during such calendar quarter), if the last reported sale price of the common stock for at least 20 trading days (whether or not consecutive) during a period of 30 consecutive trading days ending on the last trading day of the immediately preceding calendar quarter is greater than or equal to 130% of the conversion price on each applicable trading day; |

|

|

(2) |

during the five business day period after any ten consecutive trading day period (the “measurement period”) in which the trading price per $1,000 principal amount of notes for each trading day of the measurement period was less than 98% of the product of the last reported sale price of the Company’s common stock and the conversion rate on each such trading day; |

|

|

(3) |

if the Company calls any or all of the notes for redemption, at any time prior to the close of business on the business day immediately preceding the redemption date; and |

|

|

(4) |

upon the occurrence of specified corporate events. |

On or after February 1, 2024, until the close of business on the business day immediately preceding the maturity date, holders may convert their notes at any time, regardless of the foregoing circumstances.

The 2024 Convertible Notes are considered convertible debt with a cash conversion feature. Per ASC 470-20, Debt with Conversion and Other Options, the Company has separated the convertible debt into liability and equity components based on

14

the fair value of a similar debt instrument excluding the embedded conversion option. The carrying amount of the liability component was calculated by measuring the fair value of a similar liability that does not have an associated convertible feature. The allocation was performed in a manner that reflected our non-convertible debt borrowing rate for similar debt. The equity component of the 2024 Convertible Notes was recognized as a debt discount and represents the difference between the proceeds from the issuance of the 2024 Convertible Notes and the fair value of the liability of the 2024 Convertible Notes on their respective dates of issuance. The excess of the principal amount of the liability component over its carrying amount (“debt discount”) is amortized to interest expense using the effective interest method over seven years. The equity component is not re-measured as long as it continues to meet the conditions for equity classification. The liability component of $136.7 million was recorded as long-term debt at May 2, 2017 with the remaining equity component of $64.5 million recorded as additional paid-in capital.

In connection with the issuance of the 2024 Convertible Notes, we incurred approximately $6.5 million of debt issuance costs, which primarily consisted of underwriting, legal and other professional fees, and allocated these costs to the liability and equity components based on the allocation of the proceeds. Of the total debt issuance costs, $4.4 million were allocated to the liability component and are recorded as a reduction of the 2024 Convertible Notes in our consolidated balance sheets. The remaining $2.1 million was allocated to the equity component and is recorded as a reduction to additional paid-in capital.

Debt discount and issuance costs of $68.9 million are being amortized to interest expense over the life of the 2024 Convertible Notes using the effective interest rate method. As of June 30, 2017, the stated interest rate was 3.375%, and the effective interest rate was 9.71%. Interest expense related to the 2024 Convertible Notes for the three months ended June 30, 2017 was $2,302,606, including $1,083,687 related to amortization of the debt discount.

The table below summarizes the carrying value of the 2024 Convertible Notes as of June 30, 2017:

|

|

|

(in thousands) |

|

|

Gross proceeds |

|

$ |

201,250 |

|

|

Portion allocated to equity (additional paid-in capital) |

|

|

(64,541 |

) |

|

Debt issuance costs |

|

|

(6,470 |

) |

|

Portion allocated to equity (additional paid-in capital) |

|

|

2,075 |

|

|

Amortization of debt discount and debt issuance costs |

|

|

1,170 |

|

|

Carrying value 2024 Convertible Notes |

|

$ |

133,484 |

|

11. Foreign Currency

The Company maintains a bank account denominated in British Pounds. All foreign currency payables and cash balances are measured at the applicable exchange rate at the end of the reporting period. All associated gains and losses from foreign currency transactions are reflected in the consolidated statements of operations. Foreign currency losses for the three and six months ended June 30, 2017 were $0.2 million and $0.4 million, respectively, compared to zero for the three and six months ended June 30, 2016.

12. Commitments and Contingencies

Operating Leases

In May 2013, the Company entered into a lease for office space in Burlington, Massachusetts. The lease is for a 42-month term with minimum monthly lease payments beginning at $17,588 per month and escalating over the lease term. The Company provided a letter of credit to the lessor in the amount of $98,000 as a security deposit pursuant to the lease agreement to secure its obligations under the lease. During 2015, this letter of credit was reduced to $50,000 pursuant to the original lease agreement.

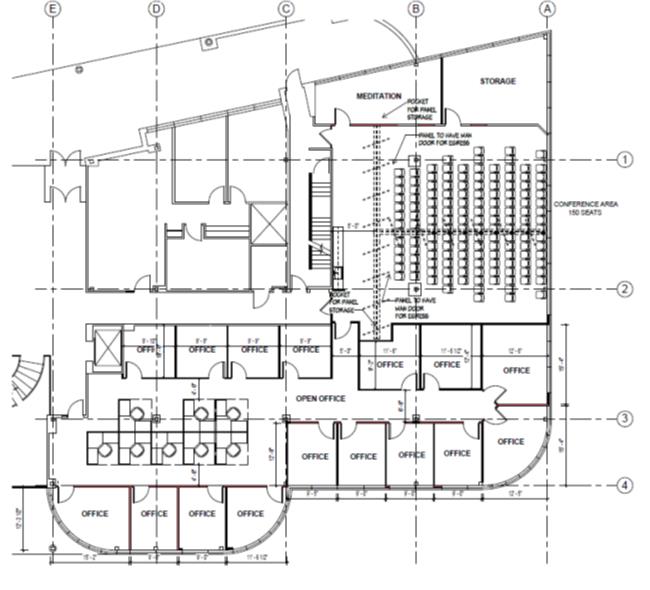

In July 2015, the Company entered into a first amendment to its existing lease for approximately 4,700 square feet of additional office space (the “Additional Space”) in Burlington, Massachusetts, as well as approximately 6,700 square feet of temporary space to be leased prior to the delivery of the Additional Space (which occurred on May 1, 2016). The amendment extended the term of the original lease through October 31, 2019, contemporaneous with the Additional Space, and also provided the Company with an option to lease an additional 5,400 square feet of office space (the “Option Space”). On September 30, 2015, the Company exercised its option for the Option Space. In addition, the Company has the option to extend the term of a portion or the entire lease space for one additional three-year period. The Company may terminate the amendment for convenience with nine months’ notice upon the occurrence of certain events connected to its clinical stage programs. In addition to the base rent, the Company is also responsible for its share of operating expenses and real estate taxes.

15

On September 21, 2016, the Company entered into a second amendment to its existing lease for approximately 6,748 additional square feet of rented space located in Burlington, Massachusetts. The lease began October 1, 2016 and expires on October 31, 2017. During October 2016, the Company’s lease payment for this additional space was $18,300 per month in incremental rent. Beginning in November 2016, through October 2017, the Company’s lease payments for the additional space increased to $19,000 per month.

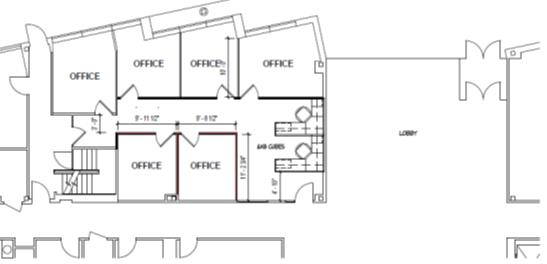

On April 7, 2017, the Company entered into an amendment to its existing lease for approximately 1,471 additional square feet of rented space located in Burlington, Massachusetts and an extension of the current lease term through October 2023. The amendment also gives the Company the option to lease approximately 6,450 of additional square feet beginning in 2018.

Future minimum lease payments under the Company’s lease obligations are as follows:

|

Year |

|

Aggregate

Minimum

Payments |

|

|

2017 |

|

$ |

589,554 |

|

|

2018 |

|

|

1,225,490 |

|

|

2019 |

|

|

1,261,051 |

|

|

2020 |

|

|

1,296,776 |

|

|

2021 |

|

|

1,332,670 |

|

|

2022 |

|

|

1,197,370 |

|

|

2023 |

|

|

990,561 |

|

|

Total |

|

$ |

7,893,472 |

|

|

|

|

|

|

|

|

|

|

|

|

|

16

ITEM 2. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

The following discussion and analysis should be read in conjunction with our financial statements and accompanying notes included in this Quarterly Report on Form 10-Q and the financial statements and accompanying notes thereto for the fiscal year ended December 31, 2016 and the related Management’s Discussion and Analysis of Financial Condition and Results of Operations, both of which are contained in our Annual Report on Form 10-K filed by us with the Securities and Exchange Commission, or SEC, on March 10, 2017.

Forward-Looking Statements

This discussion and analysis contains “forward-looking statements” that is statements related to future, not past, events – as defined in Section 21E of the Securities Exchange Act of 1934, as amended, or the Exchange Act that reflect our current expectations regarding future development activities, results of operations, financial condition, cash flows, performance and business prospects, and opportunities, as well as assumptions made by and information currently available to our management. Forward looking statements, include any statement that does not directly related to a current historical fact. The Company has tried to identify forward-looking statements by using words such as “may,” “will,” “expect,” “anticipate,” “estimate,” “intend,” “plan,” “predict,” “potential,” “believe,” “should” and similar expressions. Although we believe the expectations reflected in these forward-looking statements are reasonable, we cannot guarantee future results, events, levels of activity, performance or achievement. We undertake no obligation to update these forward-looking statements to reflect events or circumstances after the date of this report or to reflect actual outcomes.

Overview

We are a specialty pharmaceutical company focused on the development and commercialization of novel, local therapies for the treatment of patients with musculoskeletal conditions, beginning with osteoarthritis, a type of degenerative arthritis, referred to as OA.

In May 2016, the U.S Food and Drug Administration, or FDA, informed us that the safety and efficacy data from the registration program for ZilrettaTM (FX006), our lead investigational product candidate, were acceptable to support the submission of a new drug application, or NDA. In December 2016, we submitted the NDA for Zilretta, and in February 2017, we announced that the FDA accepted the Zilretta NDA for filing and has established a user fee goal date under the Prescription Drug User Fee Act, or PDUFA, of October 6, 2017.

We were incorporated in Delaware in November 2007, and to date we have devoted substantially all of our resources to developing our product candidates, including conducting clinical trials with our product candidates, providing general and administrative support for these operations and protecting our intellectual property. We do not have any products approved for sale and have not generated any revenue from product sales. From our inception through June 30, 2017, we have funded our operations primarily through the sale of our common stock, convertible preferred stock, convertible debt, and debt financing. From our inception through June 30, 2017, we have raised approximately $624 million from such transactions, including from our initial and follow-on public offerings and the issuance of convertible notes. Until such time, if ever, as we can generate substantial product revenue, we expect to finance our cash needs through a combination of equity offerings, debt financings, government or third-party funding, and licensing or collaboration arrangements.

Product Candidates:

Zilretta (FX006) —Late Stage Candidate for Intra-articular Therapy for Patients with Moderate to Severe OA Pain

Zilretta is an injectable, extended-release, intra-articular, or IA, meaning “in the joint,” steroid that we are developing as a treatment for patients with moderate to severe OA pain. Zilretta combines a commonly administered steroid, triamcinolone acetonide, or TA, with poly lactic-co-glycolic acid, referred to as PLGA, with the goal of delivering a 32 mg dose to provide extended therapeutic concentrations in the joint and persistent analgesic effect. Zilretta is intended to address the limitations of current IA therapies by providing extended, local analgesia while avoiding systemic side effects, which are effects that can occur throughout the body as a result of drug that is released from the site of injection into circulating blood. The overall frequency of treatment-related adverse events in these trials has been similar to those observed with placebo and no drug-related serious adverse events have been reported. Both the magnitude and duration of pain relief provided by Zilretta in clinical trials have been shown to be clinically meaningful with the magnitude of pain relief amongst the largest seen to date in OA clinical trials.

17

Based on the strength of our pivotal and other clinical trials, we believe that Zilretta has the potential to address a significant unmet medical need for OA pain management by providing safe, effective and extended pain relief. Zilretta is an injectable, IA, extended-release investigational treatment for patients with moderate to severe OA pain, and we believe it is uniquely distinguished by the following attributes:

|

|

• |

significant improvements in validated OA specific measures compared to the current injectable standard of care; |

|

|

• |

significant pain relief against placebo as measured by the weekly mean of the Average Daily Pain, or ADP, score in the Phase 3 trial: |

|

|

• |

demonstrating at week 12, the primary endpoint, at p value of <0.0001, 2 sided |

|

|

• |

at each week beginning at week 1 and continuing through week 16 |

|

|

• |

demonstrating, on average, an approximately 50 percent reduction in pain from baseline over weeks 1 through 12 |

|

|

• |

persistent therapeutic concentrations of drug in the joint and durable efficacy; |

|

|

• |

statistically significant (p<0.05, 2-sided) reduction in the rise of blood glucose compared to that observed following immediate-release TA injection in Type 2 diabetic patients who also have knee OA; |

|

|

• |

reduced rescue medicine consumption compared with placebo and immediate-release TA; |

|

|

• |

an acceptable safety profile with limited systemic exposures and the potential for fewer serious side effects compared to oral treatment options for OA pain, and |

|

|

• |