UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): April 17, 2012

RT Technologies, Inc.

(Exact name of registrant as specified in its charter)

| Nevada | 000-53009 | 57-1021913 | ||

| (State or other jurisdiction of incorporation) |

(Commission File Number) |

(IRS Employer Identification No.) |

| 9160 South 300 West, Suite 101, Sandy, UT | 84070 | |

| (Address of principal executive offices) | (Zip Code) |

Registrant’s telephone number, including area code: (801) 641-8766

2216 East Newcastle Drive, Sandy, Utah 84093

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

General Instruction A.2. below):f the Form 8-under the Securities Act (17 CFR 230.425)

General Instruction A.2. below):f the Form 8-under the Securities Act (17 CFR 230.425)

General Instruction A.2. below):f the Form 8-under the Securities Act (17 CFR 230.425) tisfy the filing

General Instruction communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

| 1 |

| 2 |

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This Current Report on Form 8-K, or Form 8-K, and other reports filed by us from time to time with the Securities and Exchange Commission (collectively the “Filings”) contain or may contain forward-looking statements and information that are based upon beliefs of, and information currently available to, our management as well as estimates and assumptions made by our management. When used in the filings the words “anticipate,” “believe,” “estimate,” “expect,” “future,” “intend,” “plan” or the negative of these terms and similar expressions as they relate to us or our management identify forward-looking statements. Such statements reflect the current view of our management with respect to future events and are subject to risks, uncertainties, assumptions and other factors (including the risks contained in the section of this report entitled “Risk Factors”) as they relate to our industry, our operations and results of operations, and any businesses that we may acquire. Should one or more of the events described in these risk factors materialize, or should our underlying assumptions prove incorrect, actual results may differ significantly from those anticipated, believed, estimated, expected, intended or planned.

Although we believe that the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee future results, levels of activity, performance or achievements. Except as required by applicable law, including the U.S. federal securities laws, we do not intend to update any of the forward-looking statements to conform them to actual results. The following discussion should be read in conjunction with our pro forma financial statements and the related notes that will be filed herein.

Item 1.01. Entry into a Material Definitive Agreement

On of April 17, 2012, RT Technologies, Inc., a Nevada corporation (including its successors and assigns, “RTTE” or “Registrant” or “Company”) and China Agriculture Media Group Co., Ltd, a development stage company organized and existing under the laws of the Hong Kong (including its successors and assigns “CAMG”) entered into a Plan of Exchange (the “POE” or “Agreement”) for the 100% acquisition of CAMG by RTTE.

The terms and conditions of the POE is discussed further in Item 2.01 of this Current Report on Form 8-K.

The POE is attached hereto as Exhibit 10.1.

| 3 |

Item 2.01. Completion of Acquisition or Disposition of Assets

The POE was executed on April 17, 2012 by and among RTTE, CAMG and the CAMG Shareholders. According to the Agreement, the capital of RTTE consists of 90,000,000 authorized shares of Common Stock, par value $.001, of which 3,392,147 were issued and outstanding at the time of signing. The capital of CAMG consists of 10,000 authorized Ordinary Shares, par value HK$1.00, of which 10,000 shares are currently issued and outstanding.

Under the terms of the POE, RTTE shall acquire one hundred percent (100%) of the issued and outstanding share capital of CAMG from the CAMG Shareholders in exchange for a new issuance 22,500,000 shares of common stock of RTTE and 1,000,000 shares of RTTE super-voting Preferred Stock to the CAMG shareholders, issued in the name of the CAMG shareholders and held in the escrow account of the escrow agent until closing. CAMG is currently 100% owned by Mr. Ka Siu Ping who holds his interest pursuant to a Chinese Entrustment Agreement (Form Chinese Entrustment Agreement attached hereto as Exhibit 10.4).

The POE states that CAMG and RTTE shall have secured shareholder approval for this transaction, if required, in accordance with the laws of its place of incorporation and its constituent documents and the board of directors of each of CAMG and RTTE shall have approved the transaction and the Agreement, in accordance with the laws of its place of incorporation and its constituent documents. Each party shall have furnished to the other party all corporate and financial information which is customary and reasonable, to conduct its respective due diligence, normal for this kind of transaction. If either party determines that there is a reason not to complete the POE as a result of their due diligence examination, then they must give written notice to the other party prior to the expiration of the due diligence examination period which shall have expired on April 21, 2012. Subsequent to closing of the POE, RTTE shall beneficially own 100% of the issued and outstanding shares of CAMG. Immediately upon the Closing date (as defined in the POE), RTTE shall issue to the CAMG shareholders 22,500,000 new investment shares of RTTE Common Stock and 1,000,000 shares of RTTE super-voting Preferred Stock to the CAMG Shareholders, issued in the name of the CAMG Shareholders and held in the escrow account of the escrow agent in exchange for 100% of the capital stock of CAMG, which will give the CAMG Shareholders a ‘controlling interest’ in RTTE representing 98% of the voting shares of RTTE and 90% of the issued and outstanding shares of Common Stock, after closing. RTTE shall issue 1,607,853 shares of Common Stock to RTTE management and an advisor. Angela Ross shall return 2,500,000 shares of Common stock to the RTTE treasury for immediate cancelation. CAMG and RTTE shall reorganize, such that RTTE shall acquire 100% the capital stock of CAMG, and CAMG shall become a wholly-owned subsidiary of RTTE.

| 4 |

DESCRIPTION OF RT TECHNOLOGIES, INC. BUSINESS

Since the termination of its prior business in 1998, the Company has had no operations and had been seeking an acquisition or merger to bring an operating entity into the Company. Until the POE, the Company was not conducting any business, nor has it conducted any business for several years. Therefore, it does not possess products or services, distribution methods, competitive business positions, or major customers.

| 5 |

DESCRIPTION OF CHINGA AGRICULTURE MEDIA GROUP CO., LTD. BUSINESS

Overview

China Agriculture Media Group Co., Ltd. is organized and exists under the laws of Hong Kong of the People’s Republic of China (the “PRC”) and was incorporated on March 30, 2011. CAMG focuses on developing the Chinese rural market. CAMG’s core business is organized into four areas: store rental, media, wholesale and retail, and value-added services.

CAMG aims to fully develop a network (the “Network”) of retail stores located in the Chinese rural market. The stores are currently operating under the state owned system of China Supply and Marketing Cooperative Association (“China Co-Op”) and China National Agricultural Means of Production Group Corporation (“National AMP”). Both are directly owned by Chinese Central Government.

In the first stage of 24-months, CAMG will complete the development of approximately 16,000 retail locations in Hebei province (“Hebei Network”) currently operating within the National AMP and China Co-Op retail framework. The Hebei Network is covers a rural population of more than 40 million people out of a total population of approximately 70 million in the province and is managed by National AMP’s Hebei province subsidiary (“Hebei AMP”)

CAMG plans to lease the retail stores’ areas from the Network and sub-lease them to chain store companies, product distributors and/or manufacturers (“Clients”) for store rental income. The stores will be remodeled as convenience stores which sell non-agricultural products such as homecare, personal care and healthcare products.

Advertising tools such as LCD displays, posters, and outdoor billboard will be available for Clients to advertise their products. These tools will also assist companies to build their corporate images, and assist government departments in providing general public service announcements to citizens the Chinese rural markets.

Clients can either directly manage their stores, or they pay for CAMG’s value-added management services. CAMG plans to roll out its services first in Hebei province, and then implement the same business model in different provinces throughout China.

By utilizing existing resources, such as facilities, network and the experience of our strategic partner National AMP Group, CAMG can promptly establish its access to the rural retail market. We will act as the exclusive sales and advertising agent for 16,000 retail stores located in Hebei province and strive to assist our clients to promote products which are suitable for the rural population.

The existing Hebei Network has been operating for 60 years and draws a large percentage of the Hebei rural population consisting of farmers who visit the pre-existing National AMP Group and China Co-op stores in order to take advantage of government subsidies on state controlled agriculture products only sold within Hebei Network stores. Although farmers are free to visit stores outside of the Hebei Network, the restrictions on the sale of fertilizer products and subsidized pricing of the Hebei Network significantly reduce competition. As a result, our Network has a “captive” audience consisting of farmers who would otherwise be priced out of purchasing fertilizer at other locations because these government subsidies are only available within the Network stores.

Corporate Structure

China Agriculture Media Group Co., Ltd. is an investment holding company whose only asset a 100% equity interest in China Agriculture Media (Hong Kong) Group Co. Ltd. (“CAM HK”). CAM HK is a corporation organized and existing under the laws of Hong Kong and is an investment holding company whose only asset is a 60% equity interest in China Agriculture Media (Hebei) Co. Ltd. (the “CAM Hebei”). CAM Hebei is incorporated under the laws of the PRC with a registered capital of RMB 1,000,000 (approximately $156,250). CAM Hebei was incorporated on November 28, 2011. On April 21, 2012, and CAM HK and its joint venture partner Hebei AMP agreed to increase the registered capital of CAM Hebei such that CAM HK will own approximately 98% of CAM Hebei. The board of both companies has resolved to complete the increase in registered capital as soon as registration in the PRC can be completed which the Company expects will be complete in the next several months. Subsequent to the increase in registered capital which will effectively dilute Hebei AMP’s interest in CAM Hebei from 40% to 2%, our company will be structured as follows:

| 6 |

Subsidiaries

Our Products

Advertising Solutions

CAMG will generate advertising service revenues from the sale of advertising time slots in out-of-home television advertising networks, the sales of frame space on poster frame network, and on traditional billboard networks.

In its first stage, CAMG will establish an advertising network primarily by installing LCD displays in 16,000 retail stores covering approximately 40 million people in rural areas of Hebei province, China. Clients including service providers, product manufacturers and government will be able to utilize our advertising network to build corporate images, promote their products and spread the government latest policies and news. Compared to traditional printed ads and posters, we believe LCD displays are more appealing because:

l LCD’s are eye catching

l Allow high resolution for advertising

l Flexible distribution of media

Although LCD displays have many advantages, other advertising channels are also valuable. For example, a tire manufacturer may want to have outdoor billboards placed near highways to catch drivers’ attention; a manufacturer may want to use leaflets to promote their products; or an insurance company may prefer to use a brochure to elaborate on various insurance plans. Therefore, CAMG offers a choice of advertising channels including:

l LCD displays (26 or 32 inches)

l X-frame racks

l Posters

l Outdoor billboards

l Brochures and Leaflets

Clients can choose the means of advertising based on the characteristics of their products or their needs. The major advantages of using our advertising service include:

l High coverage

l High market penetration

l Cost effective and efficient

l Service package can be customized

Wholesale and Retail Solutions

CAMG currently has the sole right to distribute consumer goods directly to the Network rather than going through various levels of distributors. By utilizing the existing resources, such as facilities, network and the experience of our strategic partner National AMP Group, CAMG can promptly establish its access to the rural retail market. The main features of our merchandising service include:

l Providing our Clients an instant access to the rural retail market

l Lowering traditional barriers to entry into the rural marker

l Provide turnkey service including merchandising, logistics, and advertising services

l Save Clients’ time in establishing its own retail network

l Give Clients an opportunity to gain market share

Value-Added Service Solutions

The Clients can distribute their products by themselves, send promoters to the stores, and advertise products using own resources. However, they are free to choose our value-added services to ease operations and lower capital costs in the stores. CAMG offers logistic, storage, advertising, product and store management services for clients who are interested in minimizing the operating risk.

| 7 |

Business Revenue Model

During the first stage of 24-months, CAMG will focus on developing the Hebei Network.

Store Rental Business

CAMG will sublease retail store areas to chain store companies, product distributors and/or manufacturers for store rental revenue. The stores will be remodeled as convenience stores which sell non-agricultural products such as homecare, personal care and healthcare products etc.

Advertising Business

CAMG is in the process of installing a total of 3,000 LCD displays in the Network with an expected completion date of 2012 and an additional 4,000 by the end of 2013.

CAMG hopes to charge at least RMB2.54 per second for a 30 second video broadcasting 60 times per day within the Network. The LCD displays will operate 12 hours a day, and allow a maximum capacity of 15,768,000 seconds per year available for sale.

CAMG is also hoping to execute agreements for the development of outdoor billboards and hopes to operate approximately 20 locations by the end of 2012. In addition, clients can place posters in the Network of stores in Hebei Province.

Wholesale and Retail Business

CAMG hopes to generate wholesale and retail commission by selling different kinds of products in the Network. CAMG will select appropriate products among prospective product manufacturers and/or chain store companies so that the products match the needs of rural population.

Value-Added Services Business

CAMG provides store management service, logistic and storage service and advertising service. These value added services will be calculated based on a pre-determined percentage of the sales volume. Nine percent of merchandise sales revenue will be charged as logistics fee, 4% as a storage fee, 5% as an advertising fee, and 6% as a store management fee.

| 8 |

Contractual Agreements with Hebei Agricultural Means of Production Co., Ltd.

Advertising

Based on the joint venture agreement (the “JV Agreement” attached hereto as Exhibit 10.3) with Hebei Agricultural Means of Production Co. Ltd. (“HAMP”), CAMG is authorized as a sole agent to operate its advertising business in the Network. Pursuant to the JV Agreement, CAMG will sell and HAMP must buy a total of 15,768,000 seconds per year for the LCD advertising business (the “Seconds”). Under the terms of the JV Agreement, HAMP is required to purchase all of the Seconds at a rate of RMB 2.54 (approximately $.40) per second for the entire year on a monthly basis. As the Seconds are purchased each month, CAMG simultaneously and automatically receives an option to repurchase the Seconds at the same rate of RMB2.54. If CAMG can resell the Seconds for a higher price at any time during the month, we are able to exercise our option and repurchase the Seconds, but if the Seconds are not resold by CAMG, then CAMG keeps the proceeds from the sale of the minutes to HAMP. According to the JV Agreement CAMG will receive this income after the completion of installation of the first batch of 3,000 LCD displays within the Network.

Overview of the PRC Rural Market Development

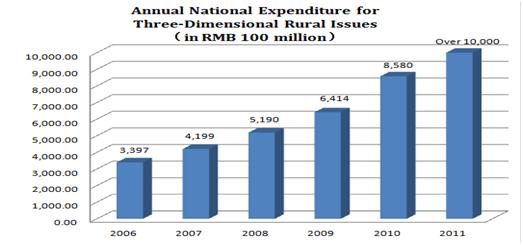

The annual national expenditure on the development of the rural market in the PRC grew from RMB 3.397 trillion (approximately $53 billion) in 2006 to more than RMB 10 trillion (approximately $156 billion) in 2011. This growth demonstrates the commitment of the government in stimulating domestic demand and promoting rural economic growth.

Source: National Bureau of Statistics of China

| 9 |

Overview of the PRC Advertising Industry

According to data released by National Bureau Statistics of China, sales revenue generated from the Chinese advertising industry in 2004 was RMB 12.65 billion (approximately $1.97 billion) and RMB 20.63 billion (approximately $3.22 billion) in 2009 representing an average growth rate of 10.3% per year.

Overview of the PRC Wholesale and Retail Industry

China

The sale of merchandise in China increased from $1,455.5 billion in 2005 to $3,143.2 billion in 2009 representing a growth rate of 115% over four years. Although the statistics of 2010 have not yet been published, we expect the sales volume will stay above $3,000 billion.

| Wholesale and Retail Industry in China | |||||

| 2005 | 2006 | 2007 | 2008 | 2009 | |

| Indicators | USD | USD | USD | USD | USD |

| Number of Legal Entities | 47698 | 51788 | 55737 | 100935 | 95468 |

| People working in this industry (in million) | 5.2 | 5.4 | 6.0 | 7.4 | 7.5 |

| Merchandise Purchase volume (in billion) | 1367.7 | 1611.5 | 2014.3 | 2875.6 | 2800.0 |

| Import volume (in billion) | 110.3 | 116.4 | 138.6 | 226.1 | 207.9 |

| Merchandise Sales volume (in billion) | 1455.5 | 1719.6 | 2074.1 | 3253.6 | 3143.2 |

| Export volume (in billion) | 132.7 | 149.5 | 174.3 | 216.2 | 174.6 |

| Merchandise inventory level (in billion) | 110.3 | 119.2 | 143.6 | 240.1 | 250.4 |

Source: Nation Bureau Statistics of China

Hebei Province

The table below shows that 2009 merchandise sales in Hebei Province was $57.3 billion which was comprised of $42.6 billion in wholesale revenue and $14.6 billion in retail revenue.

| 2009 Breakdown of the Wholesale and Retail Industry in Hebei Province and China | |||||

| 2009 | 2009 | 2009 | 2009 | 2009 | |

| Wholesale | Retail | Wholesale | Retail | Total | |

| Hebei | Hebei | China | China | China | |

| Indicators | USD | USD | USD | USD | USD |

| Number of Legal Entities | 805 | 1010 | 52853 | 42615 | 95468 |

| People working in this industry (in million) | 0.08 | 0.14 | 3.1 | 4.4 | 7.5 |

| Merchandise Purchase volume (in billion) | 35.59 | 12.52 | 2234.5 | 565.5 | 2800.0 |

| Import volume (in billion) | 0.55 | 0.04 | 198.4 | 9.5 | 207.9 |

| Merchandise Sales volume (in billion) | 42.67 | 14.69 | 2466.2 | 677.1 | 3143.2 |

| Export volume (in billion) | 0.82 | 0.00 | 174.3 | 0.3 | 174.6 |

| Merchandise inventory level (in billion) | 2.36 | 1.38 | 185.1 | 65.2 | 250.4 |

Source: Nation Bureau Statistics of China

| 10 |

Target Market and Target Audiences

China

According to the National Bureau Statistics of China, there were 712.8 million people (53.4% of total population) living in rural areas in China and the population increased at a natural birth rate of 5.05% per year. The Government recently released a series of policies regarding the renovation of the rural market and the improvement of living standards for the rural population. We believe that the growth in China will be driven by the rural market in the future.

Hebei Province

In the first stage, CAMG will focus on developing our business in the Hebei Network. Hebei province is an agriculturally dominant province and an ideal location for developing the Chinese rural market. The following lists some key attributes of Hebei province:

l 40.09 million rural population; total population of 70.34 million; ranked 6th in China.

l Natural birth rate is 6.5%.

l Gross GDP of RMB 1,338.7 billion; ranked 6th in China

l GDP per capita of RMB 19,363; ranked 11th in China.

l Gross production of grains in Hebei reached 29.012 billion kg which is 5.5% of the nation; ranked 7th in China

l Gross production of grain per capita is 430.76 kg

l One of the 13 grain production provinces in China; Hebei uses area of 9.237 million mu(approx. 1.5 million acres) as farmland for grains.

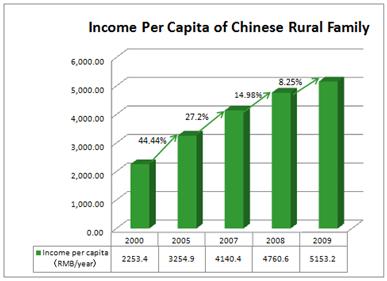

The income per capita of rural population increased from RMB 2,253 in 2000 to RMB 5,153.2 in 2009, and it is expected to keep increasing under a series of supportive governmental policies.

Source: Nation Bureau Statistics of China

Marketing Strategy

Market Development for Advertising Business

CAMG will target mature enterprises who want to build their corporate images in rural market. They include but not limited to China Mobile, China Unicom, McDonalds, and KFC.

Our own market research has indicated that local service providers such as banks and hospitals are using various channels such as newspaper and television to advertise their services in the rural markets. The Company will provide another channel for governmental departments to educate the rural population and spread news and the latest public policies. We provide a cost efficient and effective solution compared to TV advertising and focus on out of home rather than in home advertising.

Under the guidance of current rural development policy promulgated by the government, various programs such as culture broadcast programs, policy publishing and others could be implemented into our advertising channel.

Market Development for Wholesale and Retail Business

We believe that it will be easier for the Company to target enterprises that sell mature products in rural markets because they are willing to spend money to expand their sales network and maintain market shares. However, the profit margin of cooperating with these companies may be lower because their products are mature and they have relatively more bargaining power. CAMG will provide recommendations to prospective clients based on our market research of spending behavior in the rural market.

Early Phase Promotional Scheme

CAM will cooperate with other media companies such as radio stations, television stations, and magazines to promote its Clients.

Market Expansion for Advertising Business

CAMG will place LCD displays in each of the agricultural retail stores in Hebei province. The Company will also use outdoor billboards and poster frames as a medium for advertisement. Once we have achieved the goal of developing the Hebei Network, the Company will apply its business model to other northern provinces of China and hopes to gradually expand to all rural areas in China.

Cost Management

CAMG plans to control the costs of their advertising network by placing advertising channels such as LCD displays and kiosks in targeted public areas in order to take advantage of relatively low maintenance overhead.

Existing Client Base

Hebei AMP is the only company authorized by the PRC central government to sell chemical fertilizers in Hebei Province, and as a result, there is an existing pool of agricultural product manufacturers and consumers who are loyal to the Network stores. In 2010, Hebei AMP’s purchases of agricultural products (according to Hebei AMP), including chemical fertilizers and pesticides, was around RMB 3 billion. We believe this existing client base and loyalty towards the Network stores will create an opportunity for CAMG’s rapid growth in Hebei Province.

| 11 |

Competition

Competing Companies in Media Industry

Focus Media Holding Limited (“Focus Media”):

l Focus Media Holding Limited offers a comprehensive digital media platform that mainly targets white collar workers living in urban cities.

l In 2010, Focus Media generated revenues mainly from 5 different types of advertising networks: LCD display network, poster frame network, in-store network, traditional outdoor billboard network, and movie theater network.

l In 2010, Focus Media had revenue of $516 million, gross profit of $294 million (57%), operating income of $119 million (23%), and net income from continuing operations of $103 million (20%).

l More than 80% of total revenue is attributed to the LCD display network (57.6%) and poster frame network (23.6%) in 2010.

l Approximately 170,000 LCD displays were placed in about 90,500 commercial buildings primarily located in urban cities in China. LCD displays network broadcast advertisements for 12 hours a day.

l In October 2005, Focus Media acquired Framedia, which operated the largest in-elevator poster frame advertising network in China and provides brand advertisers and community service providers a direct channel to target urban residential communities. As of March 31, 2011, the poster frame network had 378,000 in-elevator poster and digital picture frames in residential buildings that covered more than 30 cities all over China.

l In 2010, only the gross margin of LCD displays network was higher than 50%.

n LCD display network (77.3%)

n poster frame network (38.0%)

n in-store network (30.7%)

n traditional outdoor billboard network (21.6%)

n movie theater network. (42.1%)

AirMedia Group Inc. (“AirMedia”):

l AirMedia Group Inc. operates the largest digital media network in China dedicated to air travel advertising.

l AirMedia operates digital TV screens in 37 major airports, including 25 out of 30 largest airports in China. It also operates digital frames in 32 major airports, including the 15 largest airports in China.

l AirMedia sells advertisements on the routes operated by eight airlines, including the three largest airlines in China.

l In selected major airports, AirMedia also operates traditional media platforms, such as billboards and light boxes, and other digital media, such as mega LED screens.

l In 2010, AirMedia had a revenue of $254 million, a gross profit of $32.6 million (12.8%), an operating margin of -6.6%, and a net income of -$9.11 million (-3.58%)

l Its diluted EPS was -$0.15 in 2010 and price per share was $3.19 on 30 Nov 2011

VisionChina Media, Inc.(“VisionChina”):

l VisionChina Media, Inc. using is digital mobile television broadcasts to deliver content and advertising to displays on mass transportation systems such as bus and subway networks.

l As of December 31, 2010, its network and supplemental subway advertising platform covered 23 cities in China and consisted of approximately 137,395 digital displays.

l VisionChina sells its advertising time through direct sales force and third party advertising agencies.

l VisionChina’s revenue increased by 14.3%, from $120 million in 2009 to $138 million in 2010. However the cost of revenue increased from $61.1 million in 2009 to $121 million in 2010.

l Diluted EPS was -$0.15 in 2010 and price per share was $1.09 on 30 Nov 2011

| 12 |

Comparison to Competitors and Competitive Advantage

Developing the Rural Market.

Focus Media, AirMedia and VisionChina mainly expand their advertising networks within commercial buildings in urban cities, airports, and mass transportation systems respectively. Our advertising business model is very similar to the business model of our competitors, but CAMG focuses on the national rural market which has relatively less competition compared to the urban areas. Although the income per capita of rural population is less than that of urban population, the volume of this market should compensate for the income gap between the rural and urban population.

Rural LCD Network

LCD display advertising is relatively new in rural areas of the PRC. Most of our target audience do not have televisions at home and may have never actually seen an LCD in person. We believe LCD technology could attract the attention of local people who may be curious about the new technology and as a result buy our advertised merchandise.

Mature Network

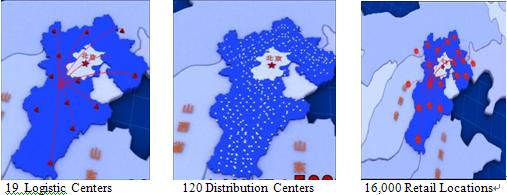

The Hebei Network has over 60 years of history, Hebei AMP has developed 19 large-scale logistic centers, more than 120 regional distribution centers, and 16,000 retails locations (including those under China Co-Op) in Hebei province.

Network Distribution in Hebei province

Barriers to entry

Hebei AMP has an established sales network in Hebei province with the brand name “Fengzeyuan”, including 19 logistics centers, 12 storage centers, and approximately 6,000 chain-stores within the network of 16,000 retail locations covering approximately 40 million people in Hebei Province.

The barriers to entering the advertising market Hebei Province and establishing an LCD network of this size would be unattainable without enormous amounts of capital. By leveraging the preexisting Hebei Network, and utilizing existing logistics systems we believe that we can effectively reduce our startup costs and substantially lower the barriers to entry to this market. Since Hebei AMP is a state owned company and the Chinese government has effectively granted them a monopoly on the importation and exportation of wholesale chemical fertilizers in Hebei province we believe that other outdoor advertising companies will be at a competitive disadvantage to us.

| 13 |

Organizational Structure

CAMG is currently developing its organizational structure and establishing its departments and sales process. The responsibilities of each department are summarized below:

Sales & Marketing Department

l Generate revenue

l Gather information from the prospective clients

l Confirm clients’ cooperation intent and assist in creating sales proposals

l Create promotional plans

l Maintain client relationships

l Responsible for post sales customer service

Property Management Department

l Manage the existing stores

l Responsible for all the repair and maintenance

Advertising Department

l Design advertising proposals for clients who have special requests

l Outsource and monitor the production of advertising materials

l Maintain relationships with advertising agencies

l Manage LCD display ads

Merchandising Department

l Design merchandising proposals for clients who have special requests.

l Delivering merchandise to the retail network

l Responsible for merchandise quality control and re-order

l Inventory count

l Report sales to finance department

Engineering Department

l Monitor the installation of advertising tools and LCD displays

l Monitor the remodeling of retail stores

l Maintain and repair advertising equipment

l Outsourcing for LCD installation

Administrative Department

l Perform administrative duties of the company

l Establish cooperation agreements between the company and stores

l Maintain relationships with retail stores

l Monitor HR and IT departments

Finance Department

l Determine feasibility of sales proposals

l Calculate sales commission charged to clients

l Calculate commission paid to employees and/or agencies

l General bookkeeping and accounting

l Payroll and cash management

l Ensure the company complies with PRC accounting and tax rules

Public Relations Department

l Responsible for organizing public information

l Responsible for any inquiries from the general public about the company

China Agriculture Media (Hebei) Co. Ltd., as of March 21, 2012, had 11 full time employees and 5 part-time employees. The company expects to hire 10 more employees in 2012 and 14 more employees by 2013.

In addition CAMG will share Hebei AMP’s existing workforce during the initial phase of development.

| 14 |

Outsourcing

The development of our LCD network will be work intensive and likely require us to outsource additional employees for installation of the LCD screens. By the end of 2012, the company hopes to install 3,000 LCD displays in the Hebei Network. These stores are unevenly distributed amongst the rural areas of Hebei, and it is difficult to calculate the exact travel distance between each of them. The management team believes that it is not feasible to build a single engineering team to complete this task, therefore CAMG will outsource the installation to third parties. The price of each LCD display including installation is estimated to be approximately RMB 3,500 (approximately $546).

Employees

Employee benefits include five state-mandated insurance plans:

· Pension insurance: We withhold 8% of each employee’s average monthly salary from the prior year and contribute an additional 20% of such average monthly salary.

· Medical insurance: We withhold approximately 2% of each employee’s average monthly salary from the prior year and contribute an additional amount totaling approximately 8% of such average monthly salary.

· Unemployment insurance: We withhold approximately 1% of each employee’s average monthly salary from the prior year, and contribute an additional amount totaling approximately 2% of such average monthly salary.

· Maternity insurance: We contribute an amount totaling approximately 0.8% of each employee’s average monthly salary from the prior year.

· Work related injury insurance: we contribute an amount totaling approximately 0.5% of each employee’s average monthly salary from the prior year.

In 2011, our average compensation per employee per month was RMB4,000, or approximately $625. We also pay benefits in the form of social security insurance fees for employees as required pursuant to relevant insurance laws in the PRC.

| 15 |

Government Regulations

Tax

The newly enacted New Law, and the implementation regulations to the New Law issued by the PRC State Council, became effective as of January 1, 2008. Under the New Law, China adopted a uniform tax rate of 25% for all enterprises (including domestically-owned enterprises and foreign-invested enterprises) and revoked the previous tax exemption, reduction and preferential treatments applicable to foreign-invested enterprises. There is a transition period for enterprises, whether foreign-invested or domestic, which received preferential tax treatments granted by relevant tax authorities prior to January 1, 2008. Enterprises that were subject to an enterprise income tax rate lower than 25% prior to January 1, 2008 may continue to enjoy the lower rate and gradually transition to the new tax rate within five years after the effective date of the New Law subject to relevant transaction rules. Enterprises that were entitled to exemptions or reductions from the standard income tax rate for a fixed term prior to January 1, 2008 may continue to enjoy such treatment until the fixed term expires. Preferential tax treatments may be granted to industries and projects that are strongly supported and encouraged by the state, and enterprises that qualify as “High and New Technology Enterprise” (“HNTE”) are entitled to a 15% enterprise income tax rate.

Foreign Currency Exchange

Under the PRC foreign currency exchange regulations applicable to us, the RMB is convertible for current account items, including the distribution of dividends, interest payments, trade and service-related foreign exchange transactions. Conversion of RMB for capital account items, such as direct investment, loan, security investment and repatriation of investment, however, is still subject to the approval of the PRC State Administration of Foreign Exchange, or SAFE. Foreign-invested enterprises may only buy, sell and/or remit foreign currencies at those banks authorized to conduct foreign exchange business after providing valid commercial documents and, in the case of capital account item transactions, obtaining approval from the SAFE. Capital investments by foreign-invested enterprises outside of the PRC are also subject to limitations, which include approvals by the Ministry of Commerce, the SAFE and the State Reform and Development Commission.

Dividend Distributions

Under applicable PRC regulations, foreign-invested enterprises in the PRC may pay dividends only out of their accumulated profits, if any, determined in accordance with PRC accounting standards and regulations. In addition, a foreign-invested enterprise in the PRC are required to set aside at least 10% of their after-tax profit based on PRC accounting standards each year to its general reserves until the accumulative amount of such reserves reach 50% of its registered capital. These reserves are not distributable as cash dividends.

Approvals, Licenses and Certificates

We require a number of approvals, licenses and certificates in order to operate our business. Our principal approvals, licenses and certificates are set forth below.

China Agriculture Media (Hebei) Co. Ltd.

· Business License (No. 130100400009277) issued by the Shijiazhuang Administration of Industry and Commerce, valid from November 28, 2011 to November 27, 2031.

| 16 |

The following statements describe the major risks to our business and should be considered carefully. Any of these factors could significantly and negatively affect our business, prospects, financial condition, operating results or credit ratings, which could cause the trading price of our common stock to decline. The risks described below are not the only risks we may face. Additional risks and uncertainties not presently known to us, or risks that we currently consider immaterial, could also negatively affect our business, our results and operations.

Our business operations are conducted entirely in the PRC. Because China’s economy and its laws, regulations and policies are different from those typically found in the west and are continually changing, we face certain risks, as summarized below.

Risks Related To Our Business and Industry

Our failure to comply with certain aspects of applicable PRC laws and regulations could adversely affect our business operations and corporate structure.

In order to conduct our business operations through our PRC operating subsidiaries, we are required to comply with a range of PRC laws and regulations, including laws and regulations applicable to contractual arrangements among our operating subsidiaries, requirements to register the equity pledges relating to those contractual arrangements, other registration requirements under State Administration for Industry and Commerce, or SAIC, rules and regulations, and obligations by us, our management and our PRC shareholders or beneficial owners to comply with the State Administration of Foreign Exchange, or SAFE, registration and disclosure requirements.

Due to uncertainties in the law, the lack of implementing regulations and, in some instances, our delay in complying with some of these rules, there is a risk that we could be found to have violated rules and regulations relating to our corporate structure, SAFE and SAIC registration and PRC foreign exchange rules. As detailed in the risk factor paragraphs below, if we are found to have failed to comply with or breached PRC laws and regulations applicable to us and our PRC operating subsidiaries we could be subject to, among other things, penalties including fines, revocation of business licenses of the PRC entities or requirements to restructure our business operations. Our failure to comply with PRC laws and regulations relating to the registration of equity pledges under our contractual arrangements with our PRC operating affiliates could also render the equity pledge, and the structure, unenforceable.

Further, advertising businesses conducted by our operating subsidiaries are subject to certain risks associated with PRC laws and regulations on foreign investment in advertising businesses in China. If the PRC government determines that the ownership structure of our operating subsidiaries or our operating affiliates, or the agreements that establish the structure for operating our China business do not comply with current or future PRC governmental restrictions on foreign investment in the advertising industry, we could be subject to penalties which may materially and adversely affect our business or financial condition.”

If we were subject to any such penalties or negative consequences, our business and operations could be materially and adversely affected.

| 17 |

Due to uncertainties in the implementation of PRC laws and regulations, we may be put at risk from failures to comply with all such laws.

We use contractual arrangements with our PRC partners of our China operations, and uncertainties in the PRC legal system could limit our ability to enforce these contractual arrangements and thus our ability to conduct our business. PRC regulations relating to offshore investment activities by PRC residents may increase our administrative burden and restrict our overseas and cross-border investment activity. A failure by us or our shareholders or beneficial owners who are PRC citizens or residents in China to comply with such regulations could restrict our ability to distribute profits, restrict our overseas and cross-border investment activities or subject us to liability under PRC laws, which could adversely affect our business and financial condition. This could subject us to fines or other penalties, which could negatively impact our revenues or interfere with our ability to operate our business” relating to the failure of some of our indirect operating subsidiaries or our operating affiliates to register with the relevant local branch of SAIC for their expansion of business or for their branch offices in each of the cities where we operate.

If the PRC government determines that the ownership structure of our company, or the agreements that establish the structure for operating our China business do not comply with current or future PRC governmental restrictions on foreign investment in the advertising industry, we could be subject to severe penalties.

Substantially all of our operations will rely on our relationship with the National AMP Group and China Co-op, and through our contractual arrangements with our consolidated affiliated entities in China. PRC regulations require any foreign entities that invest directly in the advertising services industry to have at least two years of direct operations in the advertising industry outside of China. Since December 10, 2005, foreign investors have been allowed to own directly 100% of PRC companies operating an advertising business if the foreign entity has at least three years of direct operations in the advertising business outside of China or less than 100% if the foreign investor has at least two years of direct operations in the advertising industry outside of China.

If we, our existing or future PRC operating subsidiaries and operating affiliates or their ownership structure or the contractual arrangements are found to be in violation of any existing or future PRC laws or regulations, or our existing or future PRC operating subsidiaries or operating affiliates fail to obtain or maintain any of the required permits or approvals, the relevant PRC regulatory authorities, including the State Administration for Industry and Commerce, or SAIC, which regulates advertising companies, and the Ministry of Commerce, which regulates foreign investments in China, would have broad discretion in dealing with such violations, including:

l imposing fines or other monetary penalties on our PRC subsidiaries or affiliates;

l revoking the business and operating licenses of our PRC subsidiaries;

l discontinuing or restricting our PRC subsidiaries’ and affiliates’ operations;

l imposing conditions or requirements with which we or our PRC subsidiaries may not be able to comply;

l requiring us or our PRC subsidiaries to restructure the relevant ownership structure or operations; or

l restricting or prohibiting our use of the proceeds of any offering or from other sources to finance our business and operations in China.

The imposition of any of these penalties could result in additional administrative and legal costs, less favorable business relationships or other regulatory burdens or otherwise materially and adversely affect our business.

Similarly, if our relationship with National AMP Group and China Co-op is terminated, we may not be able to operate at all within the Hebei Network. While we do not believe these relationships will be terminated in the near future, we rely heavily on these strategic partners and any use of their retail networks will continue to be pursuant to the JV Agreement and the discretion of the PRC government.

| 18 |

We plan to use contractual arrangements with the Hebei Network locations to generate rental income for a portion of our China operations, and uncertainties in the PRC legal system could limit our ability to enforce these contractual arrangements and thus our ability to conduct our business.

Lease or sublease agreements in the PRC are governed by PRC law and provide for the resolution of disputes through either arbitration or litigation in the PRC. Accordingly, these contracts would be interpreted in accordance with PRC law and any disputes would be resolved in accordance with PRC legal procedures. The legal environment in the PRC is not as developed as in other jurisdictions, such as the United States. As a result, uncertainties in the PRC legal system could limit our ability to enforce these contractual arrangements.

We may rely principally on dividends and other distributions on equity paid by our WFOE operating subsidiaries to fund any cash and financing requirements we may have, and any limitation on the ability of our operating subsidiaries to pay dividends to us could have a material adverse effect on our ability to conduct our business.

We are a holding company, and we may rely principally on dividends and other distributions on equity paid by our operating subsidiaries for our cash requirements, including the funds necessary to service any debt we may incur. If any of our operating subsidiaries incurs debt on its own behalf, the instruments governing the debt may restrict their ability to pay dividends or make other distributions to us. In addition, the PRC tax authorities may require us to adjust our taxable income in a manner that would materially and adversely affect our operating subsidiaries’ ability to pay dividends and other distributions to us. Furthermore, relevant PRC laws and regulations permit payments of dividends by our PRC operating subsidiaries only out of their retained earnings, if any, determined in accordance with PRC accounting standards and regulations.

Under PRC laws and regulations, each of our PRC operating subsidiaries is also required to set aside a portion of its net income each year to fund specific reserve funds. These reserves are not distributable as cash dividends. In particular, subject to certain cumulative limits, the statutory general reserve fund requires annual appropriations of 10% of after-tax income to be set aside prior to payment of dividends. Our operating subsidiaries will have to allocate annual after-tax profits to each of their respective reserve funds in compliance with these laws and regulations. Any limitation on the ability of our operating subsidiaries to receive distributions or pay dividends to us could materially and adversely limit our ability to grow, make investments or acquisitions that could be beneficial to our businesses, pay dividends, or otherwise fund and conduct our business. A failure by our shareholders or beneficial owners who are PRC citizens or residents in China to comply with such regulations could restrict our ability to distribute profits, restrict our overseas and cross-border investment activities or subject us to liability under PRC laws, which could adversely affect our business and financial condition.

| 19 |

PRC regulation of loans and direct investment by offshore holding companies to PRC entities may delay or prevent us from making loans or additional capital contributions to our PRC operating subsidiaries.

As an offshore holding company of our PRC operating subsidiaries, we may make loans to our PRC subsidiaries and consolidated PRC affiliated entities, or we may make additional capital contributions to our WFOE operating subsidiaries. Any loans to our PRC subsidiaries or consolidated PRC affiliated entities are subject to PRC regulations and approvals. For example:

l loans by us to our foreign invested enterprises to finance their respective activities cannot exceed statutory limits and must be registered with the PRC State Administration of Foreign Exchange or its local counterpart; and

l loans by us in foreign exchange to our PRC operating affiliates and our PRC operating subsidiaries owned by our operating subsidiaries, which are domestic PRC enterprises, must be approved by the relevant government authorities and must also be registered with the PRC State Administration of Foreign Exchange or its local counterpart. In practice, it is very difficult if not impossible in most cases, to obtain the approval of or complete the registration regarding our loan to any PRC operating affiliate.

We may also determine to finance our PRC foreign invested enterprises by means of capital contributions. These capital contributions must be approved by the PRC Ministry of Commerce or its local counterpart. We cannot assure you that we can obtain these government registrations or approvals on a timely basis, if at all, with respect to future loans or capital contributions by us to our PRC operating affiliates and our PRC operating subsidiaries owned by our operating subsidiaries. If we fail to receive such registrations or approvals, our ability to capitalize our PRC operations would be negatively affected which would adversely and materially affect our liquidity and our ability to expand our business.

| 20 |

We may be deemed a PRC resident enterprise under the PRC Enterprise Income Tax Law and be subject to the PRC taxation on our worldwide income.

The newly enacted PRC Enterprise Income Tax Law, or the New Law, and the implementation regulations to the New Law issued by the PRC State Council, became effective as of January 1, 2008. The New Law provides that enterprises established outside of China whose “de facto management bodies” are located in China are considered “resident enterprises” and are generally subject to the uniform 25% enterprise income tax rate as to their worldwide income. Under the implementation regulations for the New Law issued by the PRC State Council, “de facto management body” is defined as a body that has material and overall management and control over the manufacturing and business operations, personnel and human resources, finances and treasury, and acquisition and disposition of properties and other assets of an enterprise.

Further, on April 22, 2009, the State Administration of Tax (“SAT”) issued a Tax Circular, Guoshuifa [2009] No. 82 on Certain Issues regarding the Determination of Offshore Companies Controlled by PRC Companies as Resident Enterprises pursuant to “De Facto Management Bodies” Standard, or Circular 82, which took effect on January 1, 2008. According to Circular 82, any company established pursuant to laws and regulations other than PRC laws but that is controlled by companies or company groups within China shall be deemed as a resident enterprise for PRC tax purposes if all the following conditions are met: (i) the senior management in charge of the daily operation and management of the company is based within China or the premises where the senior management performs its duties are located within China; (ii) the financial matters (such as raising funds, financing or financial risk management) and human resources matters (such as appointment and dismissal of employees or their payrolls) are decided by companies or individuals within China or require approval from companies or individuals within China; (iii) primary property, books and accounts, company seals and board and shareholder meeting minutes are kept or placed within China; and (iv) 50% or more of the directors with voting rights or senior management habitually reside within China. According to this Circular 82, in determining the location of de facto management, “substance over form” principle should be followed. Although Circular 82 was issued to regulate the PRC tax resident judgment of companies established overseas and controlled by PRC companies, which is not applicable in our case, the criteria in Circular 82 should be used as a reference to the SAT’s view on this issue.

Most of our major board decisions, such as those relating to strategic planning, significant investments, raising funds and all matters related to capital market activities are made outside of the PRC. We are based in Hong Kong, however there is uncertainty regarding whether PRC tax authorities would deem us to be a PRC resident enterprise. If we are treated as a resident enterprise for PRC tax purposes, we will be subject to PRC tax on our worldwide income, which would have an adverse effect on our effective tax rate and net income.

| 21 |

PRC regulations relating to offshore investment activities by PRC residents may increase our administrative burden and restrict our overseas and cross-border investment activity. A failure by us or our shareholders or beneficial owners who are PRC citizens or residents in China to comply with such regulations could restrict our ability to distribute profits, restrict our overseas and cross-border investment activities or subject us to liability under PRC laws, which could adversely affect our business and financial condition.

The PRC National Development and Reform Commission, or NDRC, and SAFE promulgated regulations that require PRC residents and PRC corporate entities to register with and obtain approvals from relevant PRC government authorities in connection with their direct or indirect offshore investment activities and subsequent round trip investment into China. These regulations apply to our shareholders who are PRC residents and may apply to any offshore acquisitions that we make in the future.

Under such SAFE regulations, PRC residents who make, or have previously made, direct or indirect investments in offshore companies will be required to register those investments. In addition, any PRC resident who is a direct or indirect shareholder of an offshore company is required to file with the local branch of SAFE, with respect to that offshore company, any material change involving capital variation, such as an increase or decrease in capital, transfer or swap of shares, merger, division, long term equity or debt investment or creation of any security interest over the assets located in China. The SAFE regulations also impose obligations on onshore subsidiaries of the offshore special purpose company to coordinate with and supervise the beneficial owners of the offshore entity who are PRC residents to complete the SAFE registration process. If any PRC resident fails to comply with such SAFE regulations, the PRC subsidiaries of that offshore parent company may be prohibited from distributing their profits and the proceeds from any reduction in capital, share transfer or liquidation, to their offshore parent company, and the offshore parent company may also be prohibited from injecting additional capital into their PRC subsidiaries. Moreover, failure to comply with the various SAFE registration requirements described above could result in liability under PRC laws for evasion of applicable foreign exchange restrictions, such as fines.

| 22 |

A failure to comply with PRC regulations regarding the registration of shares and share options held by our employees who are PRC citizens may subject such employees or us to fines and legal or administrative sanctions.

Pursuant to the Implementation Rules of the Administrative Measures on Individual Foreign Exchange, or the Individual Foreign Exchange Rules, promulgated on January 5, 2007 by SAFE and a relevant guidance issued by SAFE in March 2007, PRC citizens who are granted shares or share options by an overseas-listed company according to its employee share option or share incentive plan are required, through the PRC subsidiaries of such overseas-listed company or other qualified PRC agents, to register with SAFE and complete certain other procedures related to the share option or other share incentive plan. In addition, the overseas listed company or its PRC subsidiaries or other qualified PRC agent is required to appoint an asset manager or administrator and a custodian bank, and open special foreign currency accounts to handle transactions relating to the share option or other share incentive plan. If we make equity compensation grants to persons who are PRC citizens, they may be required to register with SAFE. We may also face regulatory uncertainties that could restrict our ability to adopt an equity compensation plan for our directors and employees and other parties under PRC law.

On April 6, 2007, SAFE issued the Operating Procedures for Administration of Domestic Individuals Participating in the Employee Stock Ownership Plan or Stock Option Plan of An Overseas Listed Company, also known as Circular 78. It is not clear whether Circular 78 covers all forms of equity compensation plans or only those which provide for the granting of stock options. For any plans which are so covered and are adopted by a non-PRC listed company after April 6, 2007, Circular 78 requires all participants who are PRC citizens to register with and obtain approvals from SAFE prior to their participation in the plan. In addition, Circular 78 also requires PRC citizens to register with SAFE and make the necessary applications and filings if they participated in an overseas listed company's covered equity compensation plan prior to April 6, 2007. We intend to adopt an equity compensation plan in the future and make option grants to our officers and directors, most of whom are PRC citizens. Circular 78 may require our officers and directors who receive option grants and are PRC citizens to register with SAFE. We believe that the registration and approval requirements contemplated in Circular 78 will be burdensome and time-consuming. If it is determined that any of our equity compensation plans is subject to Circular 78, failure to comply with such provisions may subject us and participants of our equity incentive plan who are PRC citizens to fines and legal sanctions and prevent us from being able to grant equity compensation to our PRC employees. In that case, our ability to compensate our employees and directors through equity compensation would be hindered and our business operations may be adversely affected.

We will derive a substantial majority of our revenues from the provision of advertising services, and advertising is particularly sensitive to changes in economic conditions and advertising trends.

Demand for advertising time slots and advertising frame space on our networks, and the resulting advertising spending by our clients, is particularly sensitive to changes in general economic conditions and advertising spending typically decreases during periods of economic downturn. Advertisers may reduce the money they spend to advertise on our networks for a number of reasons, including:

l a general decline in economic conditions;

l a decline in economic conditions in the particular cities where we conduct business;

l a decision to shift advertising expenditures to other available advertising media;

l a decline in advertising spending in general; or

l a decrease in demand for advertising media in general and for our advertising services in particular would materially and adversely affect our ability to generate revenue from our advertising services, and our financial condition and results of operations.

In 2008, due to the global economic downturn, growth in consumer spending in China slowed which resulted in a corresponding slowdown in advertising spending growth. If there is another deterioration in economic conditions in China, our revenues, net income and results of operations could be materially adversely affected.

| 23 |

Our quarterly operating results are difficult to predict and may fluctuate significantly from period to period in the future.

Our quarterly operating results are difficult to predict and may fluctuate significantly from period to period based on the seasonality of consumer spending and corresponding advertising trends in China. In addition, advertising spending generally tends to decrease during January and February each year due to the Chinese Lunar New Year holiday. Factors that are likely to cause our operating results to fluctuate, such as the seasonality of advertising spending in China, the effect of the global economic downturn on spending in China, a further deterioration of economic conditions in China and potential changes to the regulation of the advertising industry in China, are discussed elsewhere in this annual report. If our revenues for a particular quarter are lower than we expect, we may be unable to reduce our operating expenses for that quarter by a corresponding amount, which would harm our operating results for that quarter relative to our operating results from other quarters.

Our failure to maintain existing relationships with National AMP and China Co-op or obtain new relationships that allow us to place our LCD flat-panel displays, advertising poster frames and outdoor traditional and LED digital billboards in desirable locations would harm our business and prospects.

Failure to manage our growth and operations could strain our management, operational and other resources and we may not be able to achieve anticipated levels of growth in the new networks and media platforms we operate, either of which could materially and adversely affect our business and growth potential.

To manage our growth and operations, we must develop and improve our existing administrative and operational systems and our financial and management controls and further expand, train and manage our work force. As we continue this effort, we may incur substantial costs and expend substantial resources in connection with any such expansion or to react to more challenging market conditions, due to, among other things, different technology standards, legal considerations and cultural differences. We may not be able to manage our current or future international operations effectively and efficiently or compete effectively in such markets. We cannot assure you that we will be able to efficiently or effectively manage the growth or changes in our operations, recruit top talent and train our personnel. Any failure to efficiently manage our expansion or changes in operations may materially and adversely affect our business and future growth.

If advertisers or the viewing public do not accept, or lose interest in, our advertising network, our revenues may be negatively affected and our business may not expand or be successful.

The market for out-of-home advertising networks in China is relatively new and its potential is uncertain. We compete for advertising spending with many forms of more established advertising media. Our success depends on the acceptance of our out-of-home advertising network by advertisers and their continuing interest in these mediums as components of their advertising strategies. Our success also depends on the viewing public continuing to be receptive towards our advertising network. Advertisers may elect not to use our services if they believe that consumers are not receptive to our networks or that our networks do not provide sufficient value as effective advertising mediums. If a substantial number of advertisers lose interest in advertising on our advertising network for these or other reasons, we will be unable to generate sufficient revenues and cash flow to operate our business, and our advertising service revenue, liquidity and results of operations could be negatively affected.

| 24 |

If we are unable to adapt to changing regulatory requirements or advertising trends and the technology needs of advertisers and consumers, we will not be able to compete effectively and we will be unable to increase or maintain our revenues which may materially and adversely affect our business prospects and revenues.

The market for advertising requires us to continuously identify new advertising trends and the technology needs of advertisers and consumers, which may require us to develop new features and enhancements for our advertising network. The majority of our displays will use 26 or 32 inch liquid crystal displays screens. We may be required to incur development and acquisition costs in order to keep pace with new technology needs but we may not have the financial resources necessary to fund and implement future technological innovations or to replace obsolete technology. Furthermore, we may fail to respond to these changing technology needs. For example, if the use of broadband networking capabilities on our advertising network becomes a commercially viable alternative and meets all applicable PRC legal and regulatory requirements, and we fail to implement such changes on our network or fail to do so in a timely manner, our competitors or future entrants into the market who do take advantage of such initiatives could gain a competitive advantage over us. If we cannot succeed in complying with new regulatory requirements or developing and introducing new features on a timely and cost-effective basis, advertiser demand for our advertising networks may decrease and we may not be able to compete effectively or attract advertising clients, which would have a material and adverse effect on our business prospects and revenues.

We may be subject to, and may expend significant resources in defending against, government actions and civil suits based on the content and services we provide through our advertising networks or Internet advertising services network.

PRC advertising laws and regulations require advertisers, advertising operators and advertising distributors, including businesses such as ours, to ensure that the content of the advertisements they prepare or distribute is fair and accurate and is in full compliance with applicable law. Violation of these laws or regulations may result in penalties, including fines, confiscation of advertising fees, orders to cease dissemination of the advertisements and orders to publish an advertisement correcting the misleading information. In circumstances involving serious violations, the PRC government may revoke a violator’s license for advertising business operations.

As an advertising service provider, we are obligated under PRC laws and regulations to monitor the advertising content that is shown on our advertising networks for compliance with applicable law.

China has also enacted regulations governing telecommunication service providers and the distribution of news and other information. In the past, the Chinese government has stopped the distribution of information over the Internet and telecommunications networks that it believes to violate Chinese law, including content that is pornographic or obscene, incites violence, endangers national security, is contrary to the national interest or is defamatory. If any of the content that we deliver through our Internet advertising network is found to violate Chinese laws and regulations, we could be subject to fines or suspensions.

| 25 |

Moreover, civil claims may be filed against us for fraud, defamation, subversion, negligence, copyright or trademark infringement or other violations due to the nature and content of the information displayed on our advertising network. If consumers find the content displayed on our advertising network to be offensive, landlords, property managers, other location providers or telecommunication network operators may seek to hold us responsible for any consumer claims or may terminate their relationships with us.

In addition, if the security of our content management system is breached through the placement of unauthorized compact flash, or CF cards in our flat-panel displays and unauthorized images, text or audio sounds are displayed on our advertising network, viewers or the PRC government may find these images, text or audio sounds to be offensive, which may subject us to civil liability or government censure despite our efforts to ensure the security of our content management system. Any such event may also damage our reputation. If our advertising viewers do not believe our content is reliable or accurate, our business model may become less appealing to viewers in China and our advertising clients may be less willing to place advertisements on our advertising network.

We may be subject to intellectual property infringement claims, which may force us to incur substantial legal expenses and, if determined adversely against us, may materially disrupt our business.

We cannot be certain that our advertising displays or other aspects of our business do not or will not infringe upon patents, copyrights or other intellectual property rights held by third parties. Although we are not aware of any such claims, we may become subject to legal proceedings and claims from time to time relating to the intellectual property of others in the ordinary course of our business. If we are found to have violated the intellectual property rights of others, we may be enjoined from using such intellectual property, and we may incur licensing fees or be forced to develop alternatives. In addition, we may incur substantial expenses in defending against these third party infringement claims, regardless of their merit. Successful infringement or licensing claims against us may result in substantial monetary liabilities, which may materially and adversely disrupt our business.

| 26 |

We face significant competition, and if we do not compete successfully against new and existing competitors, we may lose our market share, and our profitability may be adversely affected.

We compete with other advertising companies in China. We compete for advertising clients primarily on the basis of network size and coverage, location, price, the range of services that we offer and brand name. We also face competition from other out-of-home television advertising network operators for access to the most desirable locations in cities in China. Individual buildings, hotels, restaurants and other commercial locations and hypermarket, supermarket and convenience store chains may also decide to independently, or through third-party technology providers, install and operate their own flat-panel television advertising screens. Our network faces competition with similar networks operated by domestic out-of-home advertising companies. In the future, we may also face competition from new entrants into the out-of-home television advertising sector.

Increased competition could reduce our operating margins and profitability and result in a loss of market share. Some of our existing and potential competitors may have competitive advantages, such as significantly greater financial, marketing or other resources, or exclusive arrangements with desirable locations, and others may successfully mimic and adopt our business model. Moreover, increased competition will provide advertisers with a wider range of media and advertising service alternatives, which could lead to lower prices and decreased revenues, gross margins and profits. We cannot assure you that we will be able to successfully compete against new or existing competitors.

We do not maintain any business liability disruption or litigation insurance coverage for our operations, and any business liability, disruption or litigation we experience might result in our incurring substantial costs and the diversion of resources.

The insurance industry in China is still at an early stage of development. Insurance companies in China offer limited business insurance products and do not, to our knowledge, offer business liability insurance. While business disruption insurance is available to a limited extent in China, we have determined that the risks of disruption, cost of such insurance and the difficulties associated with acquiring such insurance on commercially reasonable terms make it impractical for us to have such insurance. As a result, we do not have any business liability, disruption or litigation insurance coverage for our operations in China. Any business disruption or litigation may result in our incurring substantial costs and the diversion of resources.

Our business operations may be affected by legislative or regulatory changes.

There are no existing PRC laws or regulations that specifically define or regulate out-of-home digital media. Changes in laws and regulations or the enactment of new laws and regulations governing placement or content of out-of-home advertising, our business licenses or otherwise affecting our business in China may materially and adversely affect our business prospects and results of operations.

| 27 |

Risks Relating to the People’s Republic of China

Substantially all of our assets are located in China and substantially all of our revenues are derived from our operations in China. Accordingly, our business, financial condition, results of operations and prospects are subject, to a significant extent, to economic, political and legal developments in China.

The PRC’s economic, political and social conditions, as well as governmental policies, could affect the financial markets in China and our liquidity and access to capital and our ability to operate our business.

The PRC economy differs from the economies of most developed countries in many respects, including the amount of government involvement, level of development, growth rate, control of foreign exchange and allocation of resources. While the PRC economy has experienced significant growth over the past, growth has been uneven, both geographically and among various sectors of the economy. The PRC government has implemented various measures to encourage economic growth and guide the allocation of resources. Some of these measures benefit the overall PRC economy, but may also have a negative effect on us. For example, under current PRC regulations, since December 10, 2005, foreign entities have been allowed to directly own 100% of a PRC advertising business if the foreign entity has at least three years of direct operations of an advertising business outside of China, or to directly own less than 100% of a PRC advertising business if the foreign entity has at least two years of direct operations of an advertising business outside of China. This may encourage foreign advertising companies with more experience, greater technological know-how and more extensive financial resources than we have to compete against us and limit the potential for our growth. Moreover, our financial condition and results of operations may be adversely affected by government control over capital investments or changes in tax regulations that are applicable to us.

| 28 |

The PRC economy has been transitioning from a planned economy to a more market-oriented economy. Although the PRC government has implemented measures since the late 1970s emphasizing the utilization of market forces for economic reform, the reduction of state ownership of productive assets and the establishment of improved corporate governance in business enterprises, a substantial portion of productive assets in China is still owned by the PRC government. In addition, the PRC government continues to play a significant role in regulating industry development by imposing industrial policies. The PRC government also exercises significant control over China’s economic growth through the allocation of resources, controlling payment of foreign currency- denominated obligations, setting monetary policy and providing preferential treatment to particular industries or companies. Since late 2003, the PRC government implemented a number of measures, such as raising bank reserves against deposit rates to place additional limitations on the ability of commercial banks to make loans and raise interest rates, in order to slow down specific segments of China’s economy which it believed to be overheating. These actions, as well as future actions and policies of the PRC government, could materially affect our liquidity and access to capital and our ability to operate our business.