Exhibit 99.1

STUDENT TRANSPORTATION INC.

ANNUAL INFORMATION FORM

September 25, 2015

TABLE OF CONTENTS

| GENERAL |

1 | |||

| CORPORATE STRUCTURE |

1 | |||

| STI |

1 | |||

| STA Holdings |

2 | |||

| Parkview Transit |

2 | |||

| STA Inc. |

2 | |||

| Ownership Structure |

2 | |||

| GENERAL DEVELOPMENT OF THE BUSINESS |

3 | |||

| DESCRIPTION OF THE BUSINESS |

6 | |||

| Business of the Issuer and the Company |

6 | |||

| Business of the Company and Subsidiaries |

6 | |||

| Our Competitive Strengths |

7 | |||

| Business and Growth Strategies |

9 | |||

| Recent Acquisitions and Contracts |

11 | |||

| Customers and Contracts |

12 | |||

| Operations |

13 | |||

| Sales and Marketing |

13 | |||

| Vehicle Fleet |

13 | |||

| Fleet Maintenance Expense |

14 | |||

| Bus Drivers |

14 | |||

| Insurance and Bonding |

15 | |||

| Safety |

15 | |||

| Technology Systems |

15 | |||

| Competitive Environment |

16 | |||

| Capital Expenditures |

17 | |||

| Currency Hedging Policy |

18 | |||

| Employees |

19 | |||

| Facilities |

19 | |||

| Environmental |

19 | |||

| Regulatory Environment |

20 | |||

| Oil and Gas Portfolio |

20 | |||

| THE ISSUER |

21 | |||

| Description of Common Shares and Share Capital of the Issuer |

21 | |||

| Dividend Policy |

22 | |||

| Dividend Reinvestment Plan |

24 | |||

| STA HOLDINGS |

25 | |||

| Capital of STA Holdings |

25 | |||

| Class A Shares |

26 | |||

| Class B Shares and Class C Shares |

26 | |||

| Preferred Shares |

28 | |||

| Distribution Policy |

28 | |||

| DIRECTORS, OFFICERS AND MANAGEMENT |

29 | |||

| STI |

29 | |||

| STA Holdings |

37 | |||

| Equity Incentive Plan |

37 | |||

| Deferred Share Unit Plan |

40 | |||

| Insurance Coverage for STI and Related Entities and Indemnification |

40 |

i

| AUDIT COMMITTEE AND AUDITOR’S FEES |

41 | |||

| Relevant Education and Experience of Audit Committee Members |

41 | |||

| Pre-Approval Policies and Procedures |

42 | |||

| External Auditor Service Fees |

43 | |||

| Audit Committee Oversight |

43 | |||

| RISK FACTORS |

43 | |||

| Risks Related to our Business |

43 | |||

| Risks Related to the Capital Structure |

52 | |||

| MARKET FOR SECURITIES |

56 | |||

| PRIOR ISSUANCES |

57 | |||

| INTEREST OF MANAGEMENT AND OTHERS IN MATERIAL TRANSACTIONS |

57 | |||

| INDEBTEDNESS OF DIRECTORS AND EXECUTIVE OFFICERS |

57 | |||

| CODE OF CONDUCT |

57 | |||

| TRANSFER AGENT AND REGISTRAR |

58 | |||

| MATERIAL CONTRACTS |

58 | |||

| NAMES OF EXPERTS AND INTEREST OF EXPERTS |

59 | |||

| ADDITIONAL INFORMATION |

59 |

SCHEDULE “A” – AUDIT COMMITTEE CHARTER

ii

STUDENT TRANSPORTATION INC.

GENERAL

The information, including any financial information, disclosed in this Annual Information Form of Student Transportation Inc. (“STI” or the “Issuer”) is stated as at June 30, 2015 or for the year ended June 30, 2015, as applicable, unless otherwise indicated. Unless otherwise indicated, all dollar amounts are expressed in U.S. dollars and references to “$” are to the lawful currency of the United States. References in this Annual Information Form to “the Company”, “we”, “us” or “our” refer to the combination of the two subsidiaries of STI which together own and control all of the operating subsidiaries of STI, namely Student Transportation of America Holdings, Inc. (“STA Holdings”) and Parkview Transit Inc. (“Parkview Transit”) and all of their respective direct and indirect subsidiaries.

Certain statements in this Annual Information Form are “forward looking statements”, which reflect the expectations of management regarding the Issuer’s and the Company’s future growth, results of operations, performance and business prospects and opportunities. These forward-looking statements reflect the Issuer’s current expectations regarding future events and operating performance and speak only as of the date of this Annual Information Form. Forward looking statements involve significant risks and uncertainties, should not be read as guarantees of future performance or results, and will not necessarily be accurate indications of whether or not or the times at or by which such performance or results will be achieved. A number of factors could cause actual results to differ materially from the results discussed in the forward looking statements, including, but not limited to, the factors discussed under the section titled “Risk Factors”. Although the forward looking statements contained in this Annual Information Form are based on what the Issuer and the Company believe to be reasonable assumptions, investors cannot be assured that actual results will be consistent with these forward looking statements, and the differences may be material. Material factors and assumptions that were relied upon in making the forward-looking statements include contract and customer retention, current and future expense levels, availability of quality acquisition, bid and conversion opportunities, current borrowing availability and financial ratios, as well as current and historical results of operations and performance. These forward-looking statements are made as of the date of this Annual Information Form and the Issuer and the Company assume no obligation to update or revise them to reflect new events or circumstances other than as required under applicable securities laws.

Financial information contained in this Annual Information Form is presented in accordance with accounting principles generally accepted in the United States (“US GAAP”). The Consolidated Financial Statements of the Company for the year ended June 30, 2015 are incorporated by reference herein and are available on the System for Electronic Document Analysis and Retrieval (“SEDAR”) at www.sedar.com or through the EDGAR website at www.sec.gov.

CORPORATE STRUCTURE

STI

Student Transportation Inc. was incorporated on September 22, 2004 under the Business Corporations Act (Ontario). STI’s registered head office is located at 160 Saunders Road, Unit 6, Barrie, Ontario, L4N 9A4. STI currently holds all of the issued and outstanding class A common shares of STA Holdings (the “Class A Shares”), representing a 98.5% voting interest, and 100% of the issued and outstanding common shares of Parkview Transit. On November 16, 2009, the Issuer filed articles of amendment to change its corporate name from Student Transportation of America Ltd. to Student Transportation Inc.

1

STA Holdings

Student Transportation of America Holdings, Inc. is a Delaware corporation with its registered and head office located at 3349 Highway 138, Building A, Suite C, Wall, NJ 07719. STA Holdings owns all of the issued and outstanding common shares of Student Transportation of America, Inc. (“STA Inc.”), Student Transportation of America ULC (“STA ULC”) and Student Transportation of Ontario Inc.

Parkview Transit

Parkview Transit Inc. was incorporated by Articles of Amalgamation on March 3, 2008 under the Business Corporations Act (Ontario). Parkview Transit’s registered head office is located at160 Saunders Road, Unit 6, Barrie, Ontario, L4N 9A4.

STA Inc.

Student Transportation of America, Inc. is a Delaware corporation with its registered and head office located at 3349 Highway 138, Building A, Suite C, Wall, NJ 07719. STA Inc. has thirty wholly-owned operating subsidiaries.

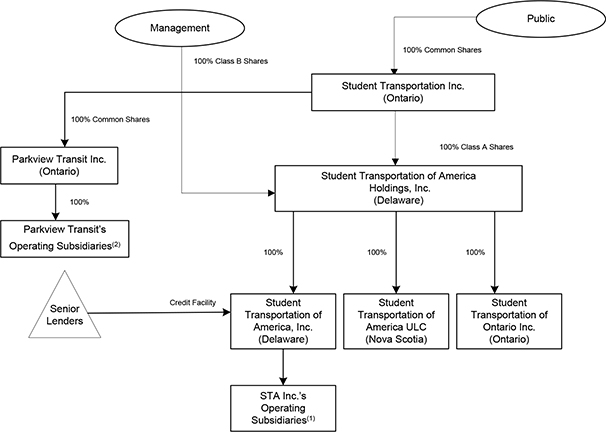

Ownership Structure

The following chart illustrates the ownership structure of the Issuer and the Company:

2

| (1) | STA Inc. has 30 wholly-owned operating subsidiaries, including: (i) Santa Barbara Transportation Corporation, a California corporation; (ii) Krise Bus Service, Inc., a Pennsylvania corporation; (iii) STA of Pennsylvania, Inc., a Pennsylvania corporation; (iv) Rick Bus Company, a New Jersey corporation; (v) Student Transportation of New Hampshire, Inc., a New Hampshire corporation; (vi) STA of Connecticut, Inc., a Connecticut corporation; (vii) Positive Connections Inc., an Illinois corporation; (viii) STA of New York, Inc., a New York corporation; (ix) Ledgemere Transportation, Inc., a Maine corporation; (x) Student Transportation of Canada Inc., an Ontario corporation; (xi) Mission School Transportation, Inc., a California corporation; (xii) Altoona Student Transportation, Inc., a Delaware corporation; (xiii) Student Transportation of Vermont, Inc., a Vermont corporation; (xiv) Jordan Transportation, Inc., a New Jersey corporation; (xv) Jordan Bus Service, Inc., a New Jersey corporation; (xvi) Student Transportation of Florida, Inc., a Florida corporation; (xvii) Grand Island Transit Corporation, a New York corporation: (xviii) Ocean State Transit, LLC, a Rhode Island limited liability company; (xix) Williams Bus Lines Co., a Pennsylvania corporation; (xx) Dairyland Buses, Inc., a Wisconsin corporation; (xxi) Dairyland-Hamilton Inc., a Wisconsin corporation; (xxii) Lakeland Area Bus Service, Inc., a Wisconsin corporation, (xxiii) Lakeside Buses of Wisconsin, a Wisconsin corporation; (xxiv) Student Transportation of Nebraska, Inc., a Nebraska corporation; (xxv) SafeStop, Inc., a Delaware corporation; (xxvi) SchoolWheels Direct Inc., a Delaware corporation; and (xxvii) Transportation Sector Consultants Inc., a Delaware corporation; (xxviii) STA of Missouri, Inc., a Missouri corporation; (xxix) STA of Colorado, Inc., a Colorado corporation; and (xxx) STA of Oregon, Inc., an Oregon corporation. |

| (2) | Parkview Transit Inc. has one wholly-owned operating subsidiary, Canadex Resources Inc., an Alberta corporation. |

GENERAL DEVELOPMENT OF THE BUSINESS

STI is a corporation established under the laws of the Province of Ontario. The Issuer, together with STA ULC, initially issued income participating securities (“IPS’s”) pursuant to its initial public offering in December 2004 combined with the exercise of an overallotment option in January 2005 (the “IPS Offering”) and in connection with two subsequent offerings: in October 2005 and June 2006. Each IPS consisted of one common share (a “Common Share”) of STI and Cdn $3.847 principal amount of 14% subordinated notes of STA ULC (the “Notes”). On December 21, 2009, the Company redeemed the remaining Notes, originally issued as a component of the IPSs, as the final step in the process of converting from the IPS structure to a traditional common share structure. The Issuer used the net proceeds from the IPO Offering and subsequent offerings to purchase 100% of the Class A Shares and 100% of the preferred shares of STA Holdings (the “Preferred Shares”), respectively. Certain existing investors in STA Inc. (the “Existing Investors”) retained 100% of the Class B Series One common shares (the “Class B-1 Shares”) of STA Holdings at the time of the IPS Offering. On December 22, 2006, the Company repurchased for cancellation all of the Class B-1 Shares of STA Holdings from the Existing Investors. Management owns 100% of the Class B Series Three common shares (the “Class B-3 Shares” and, together with the Class B Series Two common shares (the “Class B-2 Shares”) previously outstanding, (the “Class B Shares”) of STA Holdings pursuant to grants of shares under the STA Holdings Equity Incentive Plan (“EIP”). The holders of the Class B-1 Shares of STA Holdings were entitled to receive dividends, as and when declared by the board of directors of STA Holdings, approximately equivalent to the distributions per IPS received by the holders of IPS’s. The holders of the Class B-2 Shares were also entitled to receive dividends, as and when declared by the board of directors of STA Holdings, approximately equivalent to the distributions per IPS received historically by the holders of IPS’s when such distributions were paid. The holders of the Class B-3 Shares are entitled to receive dividends, as and when declared by the board of directors of STA Holdings, approximately equivalent to the dividends received by the holders of the Class A Shares.

On November 10, 2011, the Company rolled over and extended the maturity of the $35 million Senior Secured Notes (as defined below) for a five year term. The Senior Secured Notes now reflect a fixed coupon of 4.246% and a maturity date of November 10, 2016. In December 2006, the Company initially issued the senior secured notes (the “Senior Secured Notes”) under a note purchase agreement (the “Note Purchase Agreement”) with two Canadian insurance companies. The Senior Secured Notes consisted of $35.0 million of five year, fixed rate senior secured notes at an original coupon of 5.941%. The Senior Secured Notes rank pari passu with borrowings under the Credit Agreement.

In July, August and September, 2012, the Company entered into additional leases with six major financial institutions to lease approximately $29.7 million in replacement school vehicles for the 2012-2013 school year. The term of these leases is six years at effective fixed rates in the range of 2.8% to 4.6%. Annual lease payments on these additional leases will approximate $4.3 million per year for the term of the leases.

3

On October 3, 2012, the Issuer announced that it had exercised its right to redeem the remaining principal amount of its 7.5% convertible subordinated unsecured debentures due October 31, 2014 (the “7.5% Debentures”) in accordance with the terms of the trust indenture dated as of October 26, 2009 between STI and Computershare Trust Company of Canada governing the 7.5% Debentures. The redemption of the 7.5% Debentures was effective on November 2, 2012.

From July 1, 2012, through November 1, 2012, Cdn $22.4 million of the Issuer’s 7.5% Debentures were converted into 4,347,368 Common Shares. On November 2, 2012, the Issuer redeemed the remaining Cdn $0.3 million in principal amount of 7.5% Debentures for cash. During the 2012 and 2011 fiscal years Cdn $3.4 million and Cdn $25.7 million, respectively, of the 7.5% Debentures were converted into 656,297 common shares and 4,985,420 common shares, respectively.

On October 19, 2012, the TSX approved the Issuer’s notice of intention to renew its NCIB for a portion of its Common Shares as appropriate opportunities arise. The Issuer was permitted to commence purchasing Common Shares under the renewed normal course issuer bid on or about October 24, 2012. Pursuant to the notice, the Issuer was permitted to purchase up to Cdn $5.0 million of the Issuer’s Common Shares in the 12-month period commencing October 24, 2012 and ending on October 23, 2013. During the 2013 fiscal year, the Issuer purchased and cancelled 401,076 Common Shares having a fair value of $2.5 million pursuant to the NCIB.

On November 8, 2012 an additional allotment of 2,265,000 Class B-3 Shares was approved by the shareholders of the Company at the annual general and special meeting and made available for issuance under the EIP.

On December 18, 2012, the Company announced that it had secured the largest transportation agreement in its history to serve the Omaha and Millard Public Schools in Nebraska. Under the contract with the Metropolitan Omaha Education Consortium, Interlocal Transportation Association, the Company will provide approximately 530 vehicles including over 400 new fuel-efficient propane-powered vehicles, making it the nation’s largest propane-powered school bus fleet. The contract will add revenues of approximately $25 million a year for the potential six-year agreement.

On February 27, 2013, the Company signed a new five-year amended credit agreement with its senior lenders (as amended the “Credit Agreement”) to extend its current bank credit facility agreement to February 2018. The new $155 million amended facility is a $15 million increase over the prior one, included a lower base rate, maintained leverage covenants at existing levels and allowed additional flexibility to the Issuer for leasing and share buyback options, if needed. It also extended a $100 million “accordion feature” which allows the Company access to a larger facility should it ever be needed.

On April 8, 2013, the Company announced that it had been awarded several new school transportation contracts in Texas, Pennsylvania and in Ontario, Canada. All contracts are for five years or more and total over $10 million in annual revenues.

On April 18, 2013, the Company announced that it had been awarded a new school transportation contract with the Gateway School District in Pennsylvania for a term of seven years. The new contract includes 80 new school buses that will run on liquid propane gas. The new contract increases the regional density of the Company’s existing operations in Pennsylvania and will provide approximately $3.5 million in annual revenues.

4

On July 23, 2013 the Company acquired Scholastic Bus Co., located in Bergen County, New Jersey for approximately $2.4 million.

On August 27, 2013 the Company acquired Williams Bus Lines Co., located in Wilkes Barre, Pennsylvania for approximately $3.4 million.

On October 21, 2013, the TSX approved the Issuer’s notice of intention to renew its NCIB for a portion of its Common Shares as appropriate opportunities arise from time to time. The Issuer was permitted to commence purchasing Common Shares under the renewed NCIB on or about October 24, 2013. Pursuant to the notice, the Issuer was permitted to purchase up to a maximum number of Common Shares equal to the lesser of 4,086,569 Common Shares, being 5% of the issued and outstanding Common Shares as of October 14, 2013, and that number of Common Shares that can be purchased under the NCIB for an aggregate purchase price of Cdn $5 million in the 12-month period commencing October 24, 2013 and ending on October 23, 2014. During the 2014 fiscal year, the Issuer purchased and cancelled 399,089 Common Shares at a weighted average price of $6.27 per share pursuant to the NCIB.

On November 12, 2013, the Issuer issued to a syndicate of underwriters on a bought deal basis Cdn $75 million aggregate principal amount of 6.25% convertible unsecured subordinated debentures due June 30, 2019 (the “6.25% Canadian Debentures”). See the heading “The Issuer – Description of Common Shares and Share Capital of the Issuer – The Debentures” below.

On July 8, 2014, the Issuer announced that it had recently completed negotiations for the conversion of three school district transportation systems in Pennsylvania, Vermont, and Idaho. The three new, long-term contracts will add over 290 vehicles and increase current fiscal year revenues by US$11 million annually. The contracts all include annual increases and two of the three customers will be supplying the fuel for their contracts.

On July 15, 2014, the Issuer announced that it was awarded a new four-year contract (2 year term with 2 year renewal) with St. Paul Public Schools in Minnesota. The initial award reflected 60 routes, which was subsequently reduced to 42 routes by the school district for the annual contract that started in August 2014. The contract is expected to generate approximately US$2.7 million in annual revenue and features new propane-powered vehicles and a refurbished facility located in St. Paul.

On August 19, 2014, the Issuer entered into a new extension to its Credit Agreement led by BMO Harris Bank of Chicago. In addition to BMO Harris Bank, the syndicate previously included The Bank of Montreal, The Bank of Nova Scotia, The Toronto Dominion Bank, Fifth Third Bank, Siemens Financial Services and Raymond James Bank. The new amended credit facility will increase commitments by US$60 million from the current US$165 million to US$225 million and the termination date has been extended to August 19, 2019, or if earlier, 90 days prior to the maturity of the Issuer’s senior secured notes. The increase in the size of the facility comes from the addition of HSBC Bank Canada and National Bank of Canada joining the syndicate group, as well as increased positions made by The Toronto Dominion Bank and Fifth Third Bank. The new amended facility also provides for a US$100 million “accordion feature” which provides access to a larger facility should it be needed in the future.

On October 21, 2014, the Issuer announced that it had renewed its normal course issuer bid. Pursuant to the issuer bid, the Issuer was permitted to acquire up to a maximum number of Common Shares equal to the lesser of 4,158,553 Common Shares, being 5% of the issued and outstanding Common Shares as of October 14, 2014, and that number of Common Shares that can be purchased under the normal course issuer bid for an aggregate purchase price of Cdn $5 million in the 12-month period commencing October 24, 2014 and ending on October 23, 2015.

5

On February 4, 2015, the Issuer announced that it had locked in lower fuel costs relative to prior agreements for a portion of its fuel costs for fiscal 2016. Based on current fuel prices, the Company anticipates fuel expense for the current fiscal year will be in the range of 7.5% to 7.7% of revenue compared to the 8.8% reflected in the fiscal year 2014 results.

On March 6, 2015, the Issuer issued 11,983,000 Common Shares pursuant to a bought deal for total gross cash proceeds of approximately $69.1 million (Cdn $86.3 million), including 1,563,000 Common Shares pursuant to an over-allotment option. The net proceeds (after commissions and fees) of such issuances were used to repay debt (including the 6.75% Debentures due June 30, 2015, as discussed below) and for general corporate purposes.

On June 26, 2015, the Issuer announced that it called for the maturity and settlement of the 6.75% convertible subordinated unsecured debentures due June 30, 2015 (the “6.75% Debentures”) and would delist those at the close of business on June 30, 2015. During fiscal year 2015, Cdn $0.1 million of the 6.75% Debentures were converted into 18,342 common shares. On June 30, 2015, the Company redeemed the remaining Cdn $49.9 million of 6.75% Debentures for US$ 40.1 million in cash in accordance with the terms of the trust indenture dated as of June 21, 2010 between STI and Computershare Trust Company of Canada governing the 6.75% Debentures.

Additional developments impacting the 2015 – 2016 school year are included under the heading “Description of the Business – Recent Acquisitions and Contracts” below.

DESCRIPTION OF THE BUSINESS

Business of the Issuer and the Company

STI currently holds a 98.5% interest in STA Holdings. The balance of the common shares is held by management through the EIP. The Issuer and STA Holdings do not have any ongoing business operations of their own. STA Holdings depends on the operations and assets of its wholly-owned subsidiary, STA Inc., for cash distributions. As the holder of 100% of the outstanding common shares of Parkview Transit, STI depends on STA Holdings and Parkview Transit for cash distributions to satisfy the interest obligations of the Debentures and to pay dividends on the Common Shares. The Company has two segments, a transportation segment and an oil and gas segment. The transportation segment provides school bus management services to public and private schools in North America. The oil and gas segment represents the Company’s investments as a non-operator in oil and gas interests. The oil and gas interests are non-core and represent approximately 0.5% of the Company’s overall revenues.

Business of the Company and Subsidiaries

Business Overview

Founded in 1997 by industry executive, Denis J. Gallagher, we are the third largest provider of school bus transportation services in North America, conducting operations through wholly owned operating subsidiaries. We have become a leading school bus transportation company, aggregating operations through the consolidation of existing providers, targeted bid-ins and conversion of in-house operations in a fragmented industry. Based on industry sources, educational institutions in North America spend approximately $24 billion annually on school bus transportation. We currently provide school bus transportation services in Ontario, Canada and the following U.S. states: California, Connecticut, Florida, Idaho, Illinois, Maine, Minnesota, Nebraska, New Hampshire, New Jersey, New York, Pennsylvania, Rhode Island, South Carolina, Texas, Washington, Wisconsin, Vermont and we operate a business development, technology and innovation office in South Carolina.

6

Our services include home-to-school busing, special needs transportation and extracurricular and charter trips for school and other groups. Our primary service of transporting students to and from school (referred to as “home-to-school” busing) comprises approximately 88% of revenue. Included in home-to-school busing is the transportation of students with special needs, or special education transportation. Special education transportation typically requires the transportation of students to destinations outside their home district and usually is performed with smaller monitored vehicles. Extracurricular transportation typically accounts for 6% of revenue. We also provide charter services for athletic events, field trips, summer camp routes and other non-school related charter services and receive revenue associated with the oil and gas portfolio of assets acquired in connection with the acquisition of Canadex. These services and revenues account for approximately 6% of revenue. By successfully executing a business strategy that emphasizes safe, reliable, cost-efficient service we have experienced strong and consistent growth in revenue, margins, Adjusted EBITDA and EBITDA. Approximately 88% of our revenue is contracted with an average term of three to eight years. Our growth through strategic acquisitions, targeted bid-in and conversion opportunities and, more recently, management services contracts, has successfully leveraged management strength and created operating efficiencies.

School bus transportation revenue has historically been seasonal, based on the school calendar and holiday schedule. During the summer school break, revenue is derived primarily from summer camps and private charter services. Since schools are not in session, there is no school bus transportation revenue. Thus, the Company incurs operating losses during the first quarter of the fiscal year, which encompasses the summer school break. In addition, the Company purchases a majority of its replacement capital expenditures, along with investment capital spending for new bids and contracts awarded for the upcoming school year in the same time period. These purchases have historically been funded by borrowings on the Company’s credit facility and through operating lease financings.

Our Competitive Strengths

We possess a number of competitive advantages that management believes will allow us to sustain our proven track record of profitability and expand our position as a leading provider of school bus transportation services in North America, including the following:

Stable and Diversified Contract Base. We currently operate over 275 contracts with a fleet of approximately 12,000 vehicles for school districts in Ontario, Canada and eighteen U.S. states. As our largest contract represents approximately 5% of contract revenue, we do not face significant risks related to customer concentration, as management believes that the loss of a single contract would not have a significant impact on our performance. Additionally, we enjoy a stable and consistent revenue stream, due in part to the fact that our contracts have an average term of three to eight years. Since the inception of the Company in 1997, we have renewed 815 of the approximately 875 contracts (including annual contract renewals in New Jersey) that have been up for renewal, including renewals for the 2015-2016 school year.

Focus on Rural and Suburban Markets. In contrast to our large, national competitors, we target school districts located in rural and suburban markets, which provide the following advantages:

| • | Improved Contract Stability and Retention — Rural and suburban school districts are more likely than urban school districts to renegotiate and extend contracts with quality incumbent providers, rather than embark on a competitive re-bidding process. A re-bidding process may require extensive effort and expense for the school district. Incumbent providers who deliver a high level of service and have generally competitive pricing experience little or no significant contract attrition. In contrast, large school districts and districts in urban areas typically award contracts on the basis of the lowest bid price as opposed to lowest responsible bid, which considers qualitative factors. Additionally, large urban school districts usually employ multiple contractors for price advantages. As a result, rural and suburban contracts offer higher margins and greater stability for contract renewals and extensions. |

7

| • | Reduced Competition — We encounter national competitors less frequently in rural and suburban markets than we would if we operated in urban markets. Our national competitors are focused primarily on large, urban markets, with the objective of implementing homogeneous operations. Our local competitors often lack the financial resources to meet increasingly stringent contract requirements. Specifically, management believes that these smaller competitors often lack resources to meet customers’ growing needs and increased government regulations. In contrast, we are large, growing, consistently profitable and, unlike our smaller competitors, leverage our size and infrastructure to provide service to our customers at a profit. We intend to continue to use our significant market presence to our advantage in further penetrating our target markets. Our emphasis on local markets, combined with our national operating efficiencies, allows us to enjoy significant competitive advantages. |

| • | Lower Operating Costs — Rural and suburban markets possess several attributes that allow us to operate at a low comparable cost relative to urban markets, including the following: (i) driver wage components are significantly lower than in urban markets and there is generally less driver turnover and absenteeism; (ii) the risk of unionization of employees is lower; (iii) facilities are easier to obtain and facility costs are substantially lower; (iv) maintenance costs are significantly lower, due to less wear and tear on the vehicles on rural and suburban routes; and (v) vehicle and workers’ compensation insurance premiums are less expensive in these markets. |

| • | Increased Safety — Driving conditions in rural and suburban markets are generally safer, resulting in fewer accidents. Furthermore, less driver turnover and absenteeism results in fewer accidents. Management believes that these factors have contributed to our strong safety record. |

Proven Acquisition, Bid and Conversion Experience. In order to grow in the consolidating private student transportation industry, a company must have the ability to identify and acquire targets and successfully integrate the acquired target into its operations. We have proven acquisition experience, successfully acquiring 52 school bus contractors since our inception in 1997. Moreover, upon acquiring these targets, we have been able to create incremental value through the operating leverage in our current infrastructure. Similarly, we have the proven ability to successfully win contracts in a competitive bidding process and identify school districts whose boards would be willing to convert their school bus transportation services to private operators and work with these districts throughout the conversion process. Since being founded in 1997, we have successfully won 108 new school district contracts and completed twelve school district conversions (from public to private provision of school bus services).

Focus on Long-Term Partnerships with Customers. We have a clear understanding of the issues facing school districts and are extremely effective at designing customized solutions for each district’s transportation needs. Our representatives meet with district officials to educate them about the advantages of outsourcing. Following an acquisition or conversion of a school district’s transportation program, we often hire the current bus drivers and district staff, maintaining consistency for the children and emphasizing the partnership with the school district. We work closely with each of our customers to optimize routing and bell times to achieve daily operating efficiencies. In addition, we assist our customers in maximizing reimbursement from governmental entities for their transportation programs.

Experienced Management. Led by Denis Gallagher, our chief executive officer, our management team has extensive experience, with an average of approximately 25 years experience and over 500 years of collective experience in the student and passenger transportation industry. Moreover, many of the members of senior management worked together in the student transportation operations of Laidlaw Transit during the period from 1985 to 2002. Our senior management team has proven itself by

8

successfully growing our business since inception through the implementation of a disciplined acquisition, bid and conversion program. At the regional level, our operations are managed by seasoned industry executives and/or former owners who have extensive experience and knowledge of the school districts and competitors in their region.

Business and Growth Strategies

Our primary strategic objective is to increase cash flow and profitability by (i) growing organically; (ii) leveraging our operating and financial infrastructure within our regional platforms through acquisitions, bid awards and conversions, including management services contracts; and (iii) expanding into new geographic markets.

Grow Organically. Organic growth from our existing contracts is driven primarily by inflation related escalators built into our contracts and increased enrolment in schools. The U.S. Department of Education’s National Center For Education Statistics projects that public school enrolments in the United States will increase by 6% between 2012 and 2024. Regionally, enrolments in the western United States are projected to increase by 11% between 2012 and 2024 and enrolments in the southern United States are projected to increase by 9% between 2012 and 2024. We have monitored, and will continue to monitor, school enrolment trends in order to ensure that our operations are in a position to benefit from emerging trends. As an example, our west coast regional operations are well positioned to take advantage of the expected above average increase of the population in the western United States.

Leverage our Infrastructure within our Regional Platforms. We establish platform companies in targeted markets, usually via acquisitions or substantial bid awards, and create regional density by executing our “Acquisition-Bid-Conversion” strategy through the addition of “tuck-in” acquisitions, bid awards and conversions. This strategy enables us to enjoy the benefits of financial and operating leverage, as a larger contracted revenue base is achieved without a corresponding rise in fixed costs. This emphasis on regional density, combined with our national scope, creates greater economies of scale in the areas of finance, purchasing and marketing through the integration of these businesses and contracts. Since being founded in 1997, we have acquired and integrated 52 school bus contractors, won 108 new school district contracts and completed twelve school district conversions (from public to private provision of school bus services) as illustrated in the chart below:

9

Subsequent to June 30, 2015 we have secured 14 new bid contracts (including 3 new states – Colorado, Missouri and Oregon) and 1 new conversion contract, (not included in the 275 contracts noted above).

Acquisitions. The fragmentation of the school bus market provides us with significant consolidation opportunities. Specifically, an estimated 4,000 private contractors account for approximately 33% of the industry’s revenues. Accordingly, there exists an opportunity to acquire and consolidate many of these private operators, as they lack the financial resources needed to meet increasingly stringent contract requirements and are unable to compete with the economies of scale of national providers such as ourselves. We execute our acquisition program by acquiring regional platform companies that are capable of operating effectively on a decentralized basis. These platforms utilize local management teams that are familiar with the market to begin to build our regional presence. We create regional density when these platform companies are supplemented with “tuck-in” acquisitions. As a result, we are able to grow our regional platforms, realize operating synergies and improve profit margins. Our key acquisition criteria are geographic market, strength of management, quality of contracts and customer relationships and profitability.

Bids. Bidding activities are directed toward school districts that have chosen to solicit bids from private operators for their school bus transportation contracts. These contracts are primarily awarded by school districts based on a public bidding process or Request for Proposal, on the basis of the lowest “responsible” bid. Lowest responsible bids enable school districts to consider factors other than price in awarding a bid, such as safety records and initiatives, driver training programs, community involvement and quality of service.

Our experience has been that these bid-in contract awards are substantially accretive to earnings. In particular, the ability to leverage our existing operating and management infrastructure is a key variable when bidding for contracts. New contracts provide incremental revenue spread over a largely fixed regional cost base, as the new contracts share existing hub facilities, maintenance and management personnel. We have successfully won 108 bids since inception by emphasizing our qualitative advantages and leveraging our cost efficiencies within the regional platform.

Conversions. We target school district-owned and managed fleets for conversion. It is estimated that school districts operate approximately 66% of the approximately 510,000 school buses in North America. Capital expenditures related to growing fleet sizes and year-round school and safety regulations, coupled with rising costs associated with fleet management and driver unionization, create fiscal constraints for school districts. Management believes that many private operators such as ourselves have demonstrated the ability to operate at a savings compared to district operators. As a result, some school districts are pursuing a strategy of conversion. Our conversion program operates similarly to our bid-in program, as we focus on privatizing school districts in regions contiguous to our existing operations. Conversions also take advantage of operating and financial benefits by sharing fixed costs and, as a result, are accretive to earnings. We have been successful in completing twelve conversion opportunities since inception.

One distinctive feature of conversions is that they can be structured as management contracts under which the contractor manages the transportation for the school district and the district continues to own the school bus fleet and facilities. School districts sometimes elect a management contract approach in order to maintain a degree of control through the ownership of the fleet and facilities. In addition, we have entered into operating lease agreements to lease replacement school vehicles each year since the 2006 – 2007 school year. Such managed services contracts and leased vehicles require lower up front capital investment (as the school district maintains ownership of the managed fleet and the lessor maintains ownership of the leased fleet) resulting in lower annual depreciation expense on an ongoing basis. Currently, leased and managed buses account for approximately 30% of our fleet. We intend to review leasing alternatives on an annual basis based on the economics of the lease financing. While the current lease of vehicles has been an attractive alternative to purchasing such vehicles due to the low cost of financing, it effectively accelerates expense recognition through lease payments over the six year lease term compared to depreciation of purchased vehicles which would be depreciated over a period of nine years to 11 years.

10

The following table is a summary of our revenue under existing contracts by type:

Expand into New Markets. Management believes that we are well positioned to take advantage of considerable expansion opportunities in new markets. Although we have historically focused on school districts that understand the benefits of outsourcing, a majority of school districts in the United States continue to manage student transportation internally. We continue to believe that large portions of the southeast and the southwest regions of the United States could represent significant opportunity for conversion, as outsourcing currently represents less than 20% of the student transportation market in those regions.

Recent Acquisitions and Contracts

We recently completed the following acquisitions and were awarded the following contracts for the 2015 – 2016 school year:

On December 9, 2014, the Issuer announced that it had been awarded a new contract with Columbia Public Schools in Columbia, Missouri. The initial three-year contract, with the option for additional renewal years, will commence in August 2015 and feature 212 new state-of-the-art school vehicles, bringing in annual revenues exceeding US$10 million. Other terms of the contract include fuel protection for the Company for all fuel in excess of one dollar per gallon, as well as the Company’s agreement to use district-owned facilities as part of this public-private partnership.

On March 18, 2015, the Company announced that STA Inc. had been awarded a new school transportation contract in Colorado, adding 140 new vehicles, including 122 cleaner-burning liquid propane gas fueled vehicles and approximately $6 million in estimated new annualized revenues.

On March 24, 2015 the Company announced that STA Inc. had been awarded a new seven year school transportation contract in Pennsylvania, adding 77 new, cleaner-burning liquid propane gas vehicles and approximately $3.7 million in estimated new annualized revenues.

On May 18, 2015, the Company announced that STA Inc. had been awarded a new school transportation contract in Oregon, adding 60 new vehicles, including 52 clean-burning propane autogas vehicles and approximately $3 million in estimated new annualized revenues.

11

On May 21, 2015, the Company announced that Goldstar Transit Inc. had been awarded school transportation contracts at four school districts in Texas, adding approximately 200 vehicles (including school district owned vehicles) and approximately $8.6 million in estimated new annualized revenues.

On August 27, 2015 the Company amended its current NCIB to increase the maximum amount of common shares that the Company is permitted to acquire to 6,806,591 common shares from the number of common shares that could be purchased for an aggregated purchase price of Cdn$ 5.0 million. The amended NCIB will still cover the twelve month period commencing October 24, 2014 and ending on October 23, 2015. Upon expiration of the current NCIB, the Company can renew the NCIB for another twelve month period.

Customers and Contracts

We currently operate over 275 contracts with a fleet of approximately 12,000 vehicles as at June 30, 2015, for school districts in Ontario, Canada and eighteen US states. Our contracts have an average term of three to eight years, with payments generally made as services are provided from September through June. Compensation under school bus transportation contracts is generally based on a daily rate per vehicle. Contracts generally provide for an annual escalator clause for inflation based on the consumer price index and often provide for additional protection for fuel increases. Approximately 59% of our contracts include some form of protection against fuel increases, including through reimbursement by the school district. The majority of the contracts (representing approximately 96% of the fleet) require the Company to provide vehicles.

As our average contract accounts for less than 1% of contract revenue and our largest contract represents approximately 5.0% of contract revenue, management believes that the loss of a single contract would not have a material impact on our performance. Since our inception in 1997, we have renewed 815 of the approximately 875 contracts (including annual contract renewals in New Jersey) that have been up for renewal over that period, including renewals for the 2015-2016 school year. One factor contributing to this high level of retention is that in rural and suburban areas, being the markets in which we operate, school districts tend to extend existing contracts rather than solicit bids from potential replacement contractors, unless applicable law requires otherwise or the school district is dissatisfied with the service of its current school bus transportation contractor. Some districts believe that replacing an existing contractor through a bidding process can result in higher prices than contract extensions due to the significant fleet investment and start-up costs that a replacement contractor requires.

Management attributes our successful contract renewal rate to the following:

| • | management’s experience in the student transportation industry; |

| • | our reputation for passenger safety and providing efficient, on-time service; |

| • | the preference of school districts, and particularly those in the rural and suburban markets in which we operate, to maintain continuity of service; |

| • | our success in operating as a local company, including maintaining the local brand, participating in local school programs and emphasizing our commitment to the local community; |

| • | proactively renegotiating and extending existing contracts before maturity; and |

| • | operating in states where regulations allow contracts to be extended without mandatory public bids. |

12

Operations

Our operating strategy is to conduct business on a decentralized basis through regional platform operations, as well as to leverage our operating, management and financial infrastructure to create efficiencies. Management has been able to enhance the value of our regional platforms by implementing operating efficiencies in such areas as driver recruitment and training, fleet management, facilities management and vehicle maintenance. As well, we have utilized our national economies of scale for purchasing benefits in fleet procurement, vehicle parts, insurance and safety programs.

We currently operate 145 terminal locations, seventeen of which are owned, organized into seven regional divisions: Northeast (Maine, New Hampshire, Vermont, Rhode Island, Connecticut and New York), New Jersey, Pennsylvania, Central (Nebraska, Texas, Illinois, Wisconsin and Minnesota), South (Florida and South Carolina), West (California, Idaho and Washington) and Ontario, Canada. These regional platforms have been established in states that are favourable to private contracting of school transportation. Regions are led by regional operating officers, who have overall responsibility for growth and operational performance. The structure enables us to add contracts with minimal increases to our overhead, taking advantage of the inherent operating leverage.

Our executive office in Wall, New Jersey, provides national support to the regions through the consolidation of the accounts payable, treasury and finance functions, and coordination of the legal, insurance, fleet procurement, administration and human resources functions. The senior management team sets our overall strategic direction and leads the execution of our business strategy. The senior management team reviews and approves each of the financial models developed for potential acquisitions, bids and conversions and is directly involved in the negotiation and execution of all acquisitions, bids and conversions. In addition, the senior management team reviews and approves each of the regional divisions’ annual operating plans.

Sales and Marketing

All three levels of our management, including senior management, regional operating vice presidents and local terminal managers, execute sales and marketing functions in our core school bus transportation business. The senior and regional management team consists of industry veterans with an average tenure of 25 years in the school bus transportation industry. The local terminal managers have a deep knowledge of their respective markets and continuously search for potential bid and conversion opportunities. Our senior management team evaluates over 100 acquisitions, bid and conversion opportunities each year, and the team includes our business development staff who, working together with our local management, continuously identifies and explores potential acquisition, bid and conversion targets. Once we complete an acquisition, bid award or conversion, the sales and marketing process then focuses on customer service execution. The regional vice presidents, regional management teams and local terminal managers and employees are all responsible for customer service execution, which is intended to enhance our reputation for quality service and increase the likelihood of contract renewal.

Vehicle Fleet

We operate a fleet approximately 12,000 school buses, vans and other vehicles as at June 30, 2015. Buses range in size from 7 to 84 passengers, and have an average cost of $73,800. We purchase our buses from quality suppliers such as Navistar International Corp., Freightliner/Thomas Built Buses, General Motors, Collins Bus Corporation, and Blue Bird Corporation. Management believes that the Company’s savings approximate 10% - 15% on vehicle purchases compared to smaller operators, due to a higher volume of annual purchase activity and that our fleet purchasing power is comparable to other national operators.

13

Our fleet is properly maintained, resulting in lower annual maintenance expenses and reduced capital expenditures. The average age of vehicles in our fleet at June 30, 2015 was 5.7 years. Additionally, our vehicles are subject to inspection by government authorities that ensure our buses comply with the applicable regulations.

Our regional operating density allows us to efficiently deploy our fleet of vehicles, which increases asset utilization and reduces annual vehicle maintenance capital expenditures. We manage our fleet at the regional operating level and are capable of moving equipment within a given region, based on varying contracted vehicle age requirements. We estimate that we save at least $3.0 million to $5.0 million per year in annual maintenance capital expenditures by re-deploying our bus fleet.

We continue to focus on our managed and leased fleet. As of our most recent fiscal year-end, leased and managed vehicles represented approximately 30% of revenue vehicles. Managed services contracts and leased vehicles require lower up-front capital investment (as the school district maintains ownership of the managed fleet and the lessor maintains ownership of the leased fleet), resulting in lower annual depreciation expense on an ongoing basis. Conversions usually drive an increase in managed business, as school districts opt for outsourced providers while maintaining ownership of their bus fleet. We have entered into operating lease agreements to lease replacement school vehicles each year since the 2006 – 2007 school year. We intend to review leasing alternatives on an annual basis, based on the economics of the lease financing. While the current lease of vehicles has been an attractive alternative to purchasing due to the low cost of financing, it effectively accelerates expense recognition as lease payments are expensed over the 6 year lease term to a residual value in the 25% to 30% range, as compared to purchased vehicles, which would be depreciated over a period of nine years to 11 years.

Fleet Maintenance Expense

Maintenance of the bus fleet is a critical factor in maximizing service and minimizing the high cost of repairs. These operating expenses are distinct from maintenance capital expenditures, which refer to those expenditures that are required to upgrade existing infrastructure, including the replacement of school buses and vans.

We have a comprehensive preventive maintenance program for our equipment to minimize equipment downtime and prolong equipment life. Programs implemented by us include standard maintenance, regular safety checks, lubrication, wheel alignment and oil and filter changes, all of which are performed on a regularly scheduled basis. Approximately 99% of our fleet is maintained by our trained technicians at 144 of our 145 terminal locations. The remaining buses are maintained by local truck service contractors who adhere to strict state, provincial and federal regulations as well as our standards.

Bus Drivers

The ability to recruit, hire and retain drivers is critical. Drivers generally work less than 1,000 hours a year and generally earn wages of between $10.00 and $27.00 per hour, depending on seniority and local wage competition. We believe that we provide competitive driver compensation, as evidenced by what we believe to be a relatively low attrition rate of our drivers. In addition, we generate opportunities for drivers to earn supplemental wages by providing charter or extracurricular assignments. We target homemakers with children in the school system and early retirees as ideal driver candidates. We require our drivers to complete a comprehensive training process to fully satisfy or exceed federal and state regulatory requirements, as well as local contract requirements.

14

Insurance and Bonding

The Company maintains various forms of liability insurance against claims for bodily injury or property damage. In the U.S., such insurance consists primarily of: (i) automobile and general liability insurance with a primary limit of $5 million per occurrence, subject to a $250,000 retention per occurrence; (ii) automobile and general liability excess insurance with an aggregate limit of $50 million; (iii) statutory workers’ compensation and employers’ liability insurance, subject to a $250,000 retention per occurrence; and (iv) all risk property damage insurance (excluding automobiles) covering replacement value and/or building contents as required by lease terms, subject to a $10,000 deductible per occurrence for most causes of loss. In addition, the Company insures its U.S. vehicles at 100% of full current book (depreciated) value for physical damage, up to an overall sublimit of 90% of book value per location. Auto physical damage coverage is written with the same $250,000 retention per incident as the liability coverage.

In Canada, the Company maintains property insurance on a replacement cost basis, subject to a Cdn $1,000 deductible. Auto liability and commercial general liability coverage each have primary limits of Cdn $10 million, with a shared excess limit of Cdn $10 million. Auto physical damage coverage is based on stated (book) value, subject to a Cdn $1,000 deductible.

In addition to property/casualty insurance programs, the Company maintains coverage for Directors and Officers Liability with an aggregate limit of liability of $40 million and an excess limit of $15 million that is available solely to the individual directors and officers. In the U.S., the Company also carries Employment Practices Liability with limits and coverage terms commensurate with its exposures in these areas.

Where appropriate, the Company maintains current levels of insurance coverage of acquired companies for a transition period before rolling up the acquisition exposures into the Company programs described above. Certain of our customer contracts contain protections against increases in our insurance costs.

Certain of our school bus revenue contracts contain performance or surety bond requirements. These bonds are written by certified surety underwriters with whom we have longstanding relationships. For the 2014-2015 school year, our outstanding performance bonds aggregated $94.6 million, at an annual cost of approximately $0.7 million.

Safety

We have an excellent safety record. We are subject to occupational safety and health regulations in both the U.S. and Canada and have had no material citations or violations. Also, state authorities conduct both scheduled and random inspections of our fleet to ensure that we comply with applicable regulations. We believe that we are in material compliance with all current United States and Canadian federal, state and provincial safety laws and regulations. Management has developed a corporate culture focused on passenger safety and service. In support of this commitment, we employ approximately 350 school bus safety instructors, all certified where required by law. These instructors are responsible for the implementation of safety and training programs. Management believes that our emphasis on passenger safety and service is a major contributor to our success in winning new contracts.

Technology Systems

Management believes that our technology systems and competency in regular and accurate financial reporting amount to a strong competitive advantage. Our enterprise applications are on demand, web and mobile based and delivered securely to employees. Vehicles and other assets are monitored using a fixed asset management system. Our core accounting software package and asset management system are hosted by a third party provider.

15

Throughout the Company, a personnel management system is used to report on and enhance compliance with state and federal driver requirements for safety training, physicals and testing.

The Company historically installed global positioning systems (“GPS”) and mobile surveillance systems on its vehicles as needed or required by customers, however we have started to install GPS on a standard basis for a majority of new fleet units that we deploy. The Company works with multiple routing software platforms when requested or, on a case-by-case basis, we install routing and planning software in locations as needed or as required by customers. In connection with some of our smaller rural and suburban markets, we have determined that routing and mapping tools commonly available on the internet are adequate in certain situations. The Company also utilizes a charter trip management system that automates dispatch and billing.

The Company has also developed a mobile application (“SafeStop”) that connects parents and school administrators with the vehicles transporting their students. The SafeStop application provides real-time map features, estimated arrival times, and alerts and messaging for its users. The SafeStop application is compatible with various GPS and routing systems. The application continues to evolve and its functionality has increased, as has its adoption by school districts.

The Company has utilized multiple vehicle maintenance system platforms at specific locations in the past, however we will install one standard vehicle maintenance system for a majority of our locations. We began the installation of this standard maintenance system in approximately one half of the locations in fiscal year 2015, and plan to have all of our locations converted to this vehicle maintenance system by the end of fiscal year 2016. In addition, the Company has engine diagnostic systems in place at our locations, which can be used by technicians to efficiently diagnose vehicle system problems. These systems allow us to utilize our maintenance personnel more efficiently and take advantage of the computerized systems in our vehicles to reduce cost, improve vehicle utilization, and assure compliance to Company and regulatory preventative maintenance programs.

The Company has begun installing time and attendance (“TAA”) systems at the terminal locations as a way of automating the collection of hours worked by employees. The TAA system will also automate the process of summarizing the data for payroll processing and for various compliance reporting requirements.

Competitive Environment

Generally, the school bus transportation industry awards contracts through a public bidding process, which is often based on the concept of lowest responsible bid. Specifically, in selecting a bid, the school district will consider a variety of factors in addition to cost, including reputation of the bidder, its safety record and quality of service. As we operate primarily in rural and suburban markets, we generally compete with smaller regional companies.

First Group and National Express are the national industry consolidators and have acquired many of the largest private school bus transportation providers over the last decade. Their strategy has been to purchase competitors in various markets, with the elimination of local branding in favour of the national brand already established. This strategy has resulted in a high concentration of their business in urban markets. As a result of the high concentration in urban markets, companies operating in these markets generally experience a higher degree of competitive pricing than those operating in rural and suburban markets. The following chart lists the top ten providers of school bus transportation services in the United States:

16

TOP TRANSPORTATION CONTRACTORS OF 2015

| Rank |

Company |

Fleet Size(1) | Headquartered | |||||

| 1 |

First Student Inc. (First Group plc) | 49,000 | Cincinnati, OH | |||||

| 2 |

National Express Group plc | 20,500 | Warrenville, IL | |||||

| 3 |

Student Transportation Inc. | 12,500 | Wall, NJ | |||||

| 4 |

Illinois Central School Bus Company | 3,000 | Joliet, IL | |||||

| 5 |

George Krapf Jr. & Sons Inc. | 2,510 | West Chester, PA | |||||

| 6 |

Cook-Illinois Corp. | 2,150 | Oak Brook, IL | |||||

| 7 |

WE Transport | 1,659 | Plainview, NY | |||||

| 8 |

DATTCO Inc. | 1,350 | New Britain, CT | |||||

| 9 |

Dean Transportation Inc. | 1,297 | Lansing, MI | |||||

| 10 |

North Reading Transportation | 1,290 | Methuen, MA | |||||

| 10 |

Lamers Bus Lines Inc | 1,290 | Green Bay, WI | |||||

| Total Top 10 | 96,546 | |||||||

| 12-50 |

Total of Next 39 Operators | 20,164 | ||||||

| Total Private Industry | 170,000 | (2) | ||||||

Note:

| (1) | Source: School Bus Fleet Magazine |

| (2) | Based on an industry total of 510,000 school buses and a one-third market share of the estimated 4,000 private operators. |

Capital Expenditures

Our capital expenditures can be categorized into two types: (i) maintenance and (ii) growth or earnings enhancing. Over the last several years we have financed our replacement capital expenditures with borrowings on the Company’s credit facility for the outright purchase of vehicles and through operating lease financing arrangements.

The table below sets forth our historical and average maintenance and growth capital expenditures purchased for the past three fiscal years (in millions of dollars), and the value of the maintenance capital expenditures we have leased over the same time period.

| 2015 | 2014 | 2013 | Average | |||||||||||||

| Maintenance Fleet Purchased |

$ | 6.7 | $ | 4.6 | $ | 6.3 | $ | 5.9 | ||||||||

| Growth Fleet Purchased |

$ | 26.8 | $ | 33.2 | $ | 35.5 | $ | 31.9 | ||||||||

| Total Capital Expenditures |

$ | 33.5 | $ | 37.8 | $ | 41.8 | $ | 37.7 | ||||||||

| Maintenance Fleet Leased |

$ | 38.7 | $ | 24.0 | $ | 30.3 | $ | 31.0 | ||||||||

| Growth Fleet Leased |

$ | 30.8 | $ | 27.9 | $ | 0 | $ | 19.6 | ||||||||

In fiscal 2015, growth capital expenditures include $1.0 million in investments in new wells in connection with the oil and gas assets.

Proceeds on sale of equipment totaled $2.1 million in fiscal 2015, $1.1 million in fiscal 2014 and $2.9 million in fiscal 2013. Such proceeds are not included in the capital expenditures set forth above.

17

Maintenance Capital Expenditures

Maintenance capital expenditures include those required to maintain and upgrade existing infrastructure, including the replacement of school buses and vans.

Over the last three years we have deployed replacement fleet and incurred non-vehicle capital expenditures with a gross value of $45.4 million, $28.6 million and $36.6 million for the 2015, 2014 and 2013 fiscal years, respectively, as set forth in the table above. We have utilized operating lease financing for a portion of the replacement fleet. These leases have six year terms with fixed rates of interest and residual values in the 20% to 30% range. Utilizing operating lease financing for a portion of the replacement fleet provides an alternative source of financing at attractive rates for the Company, while also allowing us to maintain borrowing availability under the credit agreement for financing future additional growth opportunities. We intend to review leasing alternatives on an annual basis, based on the economics of the lease financing. While the current lease of vehicles has been an attractive alternative to purchasing due to the low cost of financing, it effectively accelerates expense recognition as lease payments are expensed over the six year lease term to a residual value in the 25% to 30% range, as compared to purchased vehicles, which would be depreciated over a period of nine years to 11 years.

Growth Capital Expenditures

Growth capital expenditures are those related to new bids and/or new revenue routes, the purchase of new equipment and the expansion of existing infrastructure (i.e., expansion of existing building facilities and/or addition of new facilities and other capital improvements). Growth capital expenditures are intended to increase productivity and cash flows, enhance margins and/or increase capacity.

Over the last three years we have purchased fleet and incurred associated non-vehicle capital expenditures related to growth opportunities (excluding acquisitions) of $57.7 million, $61.1 million and $35.5 million for the 2015, 2014 and 2013 fiscal years, respectively. These growth expenditures were financed though borrowings on our credit agreement and through operating lease financing arrangements.

Currency Hedging Policy

The Company managed its exposure to currency fluctuations through foreign currency exchange contracts (“Forward Contracts”) primarily to mitigate the exchange rate risk on the common share dividends. In May 2015, the Company announced that the Board of Directors had approved a change in the currency of the monthly dividend to U.S dollars, effective July 1, 2015. Effective with the announcement, the Company liquidated all of the Forwards Contracts that were outstanding, which had a notional value of $17.5 million. This liquidation resulted in a realized loss of $0.4 million which is recorded in foreign currency (gain) loss in the consolidated statement of operations (see “The Issuer—Dividend Policy” and “The Issuer – Description of Common Shares and Share Capital of the Issuer – The Debentures”).

In June 2015, the Company liquidated the foreign exchange forward contract it had in place to cover the principal amount of the Cdn $6.75% Convertible Debentures that matured on June 30, 2015. This liquidation resulted in a realized gain of $0.1 million which is recorded in foreign currency (gain) loss in the consolidated statement of operations.

The Company uses cash flows from its Canadian operations to partially mitigate the exchange rate risk on the Convertible Debentures interest payments.

The Company prepares its financial statements in U.S. dollars. In connection with the Company’s Canadian operations, approximately 21.7% of the Company’s consolidated income before taxes are incurred in Canadian dollars. The results of the Canadian operations are translated into U.S. dollars for financial statement reporting purposes.

18

Changes in the Canadian dollar / U.S. dollar currency exchange rate from period to period will impact the translated U.S. dollar equivalent results of the Canadian operations. The Company recorded a gain of $0.1 million on the translation of its monthly dividends into U.S. dollars (which included the liquidation of the monthly currency contracts used to hedge the dividends). Both of these transactions are recorded in foreign currency gain in the consolidated statements of operations.

The Company was not required to deposit any collateral with regards to the Forward Contracts. We review our hedging policy on an ongoing basis.

Employees

As at June 30, 2015, we had approximately 13,750 employees, most of whom are employed on a part-time basis. Of these employees, approximately 12,500 are drivers and monitors, approximately 1,100 are employed in operations, maintenance and safety training and approximately 150 are employed in administration. Approximately 22% of the workforce is represented by labour unions. Management believes that the workforce is relatively stable and considers our employee relations to be excellent.

Facilities

We operate a total of 145 terminal locations, seventeen of which are owned. The typical school bus terminal consists of parking spaces for buses, additional space for driver parking, several maintenance bays, a small office and dispatch area and a driver training and rest area. The leased properties range in lease length from month-to-month to 10 years and contain various renewal options. We generally tie our lease terms to the length of the primary local revenue contract, with our leases currently set to expire at various times through 2023. Twenty-eight of the terminals are located on school district properties under the terms of our contracts with those customers. In addition, we lease twenty-eight parking-only sites and nine office locations. Rental expenses were $13.8 million for the twelve months ended June 30, 2015.

Environmental

Our facilities and operations are subject to extensive and constantly evolving federal, state, provincial and local environmental and occupational health and safety laws and regulations, including requirements relating to air emissions, storage and handling of chemicals and hazardous substances, vehicle fuelling and maintenance, wastewater and storm water discharge, ownership and operation of Underground Storage Tanks (“USTs”) and cleanup of contaminated soil and groundwater. We have taken into account the requirements of such environmental laws in the improvement, expansion and start-up of our facilities. We typically conduct Phase I environmental assessments of most terminals prior to occupying them, and upon entering into a lease of any terminal, we typically obtain an indemnity from the landlord in regard to any pre-existing environmental liabilities, contamination or compliance obligations that relate to the period prior to our occupancy. USTs are located and operated at fifteen of our properties. Under applicable environmental laws, we could be potentially responsible for cleanup of contamination at owned or leased facilities caused by our operation or, potentially, by the past operations of others. Although we do not expect significant environmental liabilities or compliance or cleanup obligations, there can be no assurance that such liabilities and/or obligations will not increase in the future or have a material adverse effect on operations at such facilities.

19

Regulatory Environment

We are subject to a wide variety of federal, state, provincial and municipal laws in the U.S. and Canada concerning vehicle standards, equipment maintenance, the qualification, training and testing of employees and the qualification and maintenance of operating facilities.

In the U.S., our vehicles are subject to federal motor vehicle safety standards established by the National Highway Traffic Safety Administration (“NHTSA”), a division of the U.S. Department of Transportation pursuant to the National Traffic and Motor Vehicle Safety Act (1966). Specific standards are promulgated by the NHTSA with regard to school buses pursuant to the School Bus Safety Amendments passed in 1974. Our vehicles are also subject to the laws and regulations of each state in which we operate, which are often more stringent than applicable federal requirements.

The Commercial Motor Vehicle Safety Act of 1986 requires drivers of commercial vehicles, including school buses, to obtain a Commercial Drivers License. Many states have additional licensing requirements for subclasses of drivers such as school bus drivers. Under regulations enacted at the state and/or local levels, our school bus drivers are required to complete certain minimum basic training and follow-up refresher classes annually. Pursuant to regulations promulgated by the U.S. Department of Transportation under the Drug Free Workplace Act of 1988, U.S. drivers are required to undergo pre-employment drug and alcohol testing and we are required to conduct random testing for drug and/or alcohol abuse. Similar drug and alcohol abuse testing is also required under various state laws. As well, we conduct criminal background checks on all of our drivers. The Surface Transportation Board governs interstate movements of school buses and the Federal Highway Administration regulates the licensing of all school bus carriers conducting interstate commerce. Certain states require contractors to obtain operating permits to carry on intra-state business.

In Canada, our operations in Ontario are subject to provincial motor vehicle safety, licensing and driver operation standards established by the Ontario Ministry of Transportation under the Highway Traffic Act and the Provincial Offences Act. Ontario law also requires bus companies which provide charter trips to obtain a Public Vehicle Operating Licence from the Ontario Highway Transport Board, under the Public Vehicles Act. Our Ontario operations are also subject to workplace safety laws including the Workplace Safety and Insurance Act and the Occupational Health and Safety Act.

Oil and Gas Portfolio

In connection with the acquisition of Canadex on January 18, 2008, the Company acquired an energy portfolio which includes non-operating interests in oil and gas properties which are jointly owned with others. Earnings of the acquired energy portfolio are included in the Company’s results of operations from the acquisition date. The Company uses the full-cost method of accounting to determine the capitalized cost, whereby all direct expenditures related to the acquisition, exploration and development of oil and gas properties are capitalized. Capitalized costs include the cost of land acquired or leased, intangible drilling costs such as those for equipment, casing and attachments and completion costs as well as re-completion costs on both productive and non-productive wells. These costs, net of salvage values, are accumulated in a single cost center and are depleted and amortized using the units-of production method. Natural gas reserves and production are converted, at a ratio of six thousand cubic feet of natural gas to one barrel of oil, for depletion and depreciation purposes. The Company has not capitalized any of its own administrative or interest costs and accounts for these costs as expenses during the year. The oil and gas portfolio is a non-core operation that represents approximately 0.5% of the Company’s overall revenues. While the oil and gas portfolio represents only 0.5% of the Company’s overall revenues, the cash generated by the oil and gas portfolio provides the Company with an economic hedge against market price exposure of fuel used in the school bus transportation operations.

20

THE ISSUER

Description of Common Shares and Share Capital of the Issuer

Share Capital of STI

The authorized share capital of STI consists of an unlimited number of common and preferred shares. As at June 30, 2015, no preferred shares and 96,141,516 Common Shares were issued and outstanding. See “The Issuer – Description of Common Shares”.

Holders of Common Shares of STI are entitled to receive dividends as and when declared by the board of directors and are entitled to one vote per Common Share on all matters to be voted on at all meetings of shareholders. Upon the voluntary or involuntary liquidation, dissolution or winding-up of STI, the holders of Common Shares are entitled to share rateably in the remaining assets available for distribution, after payment of liabilities. The Common Shares are not redeemable or convertible.

The Debentures