UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

FORM 10-K

[X]ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2017

OR

[ ]TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from to

Commission File Number: 000-54554

Therapeutic Solutions International, Inc.

(Exact name of registrant as specified in its charter)

Nevada |

| 45-1226465 |

(State or other jurisdiction of incorporation or organization) |

| (I.R.S. Employer Identification No.) |

4093 Oceanside Boulevard, Suite B

(Address of principal executive offices, including zip code)

(Registrant's telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

Securities registered pursuant to Section 12(g) of the Act:

Title of class |

Common Stock, $0.001 par value per share |

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes [ ] No [X]

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act.

Yes [ ] No [X]

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes [ ] No [X]

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes [ ] No [X]

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation SK (§ 229.405) is not contained herein, and will not be contained, to the best of registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. [X]

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of "large accelerated filer," "accelerated filer," and "smaller reporting company" in Rule 12b-2 of the Exchange Act.

Large accelerated filer | [ ] | Accelerated filer | [ ] |

|

|

|

|

Non-accelerated filer | [ ] (Do not check if a smaller reporting company) | Smaller reporting company | [X] |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes [ ] No [X]

The aggregate market value of the voting and non-voting common equity held by non-affiliates was $1,491,152 based on a closing price of $0.006 as of June 30, 2017.

As of April 17, 2018, 832,801,713 shares of the registrant’s common stock, par value of $0.001 per share, were outstanding.

2

INDEX

THERAPEUTIC SOLUTIONS INTERNATIONAL, INC.

|

| PAGE NO |

PART I |

|

|

|

|

|

ITEM 1 | BUSINESS | 5 |

ITEM 1A | RISK FACTORS | 13 |

ITEM 1B | UNRESOLVED STAFF COMMENTS | 18 |

ITEM 2 | PROPERTIES | 18 |

ITEM 3 | LEGAL PROCEEDINGS | 18 |

ITEM 4 | MINE SAFETY DISCLOSURES | 18 |

|

|

|

PART II |

|

|

|

|

|

ITEM 5 | MARKET FOR REGISTRANT'S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES | 19 |

ITEM 6 | SELECTED FINANCIAL DATA | 20 |

ITEM 7 | MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS | 20 |

ITEM 7A | QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK | 22 |

ITEM 8 | FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA | 22 |

ITEM 9 | CHANGES IN AND DISAGREEMENTS WITH ACCOUNTANTS ON ACCOUNTING AND FINANCIAL DISCLOSURE | 22 |

ITEM 9A | CONTROLS AND PROCEDURES | 22 |

ITEM 9B | OTHER INFORMATION | 23 |

|

|

|

PART III |

|

|

|

|

|

ITEM 10 | DIRECTORS, EXECUTIVE OFFICERS AND CORPORATE GOVERNANCE | 23 |

ITEM 11 | EXECUTIVE COMPENSATION | 27 |

ITEM 12 | SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT AND RELATED STOCKHOLDER MATTERS | 28 |

ITEM 13 | CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS, AND DIRECTOR INDEPENDENCE | 28 |

ITEM 14 | PRINCIPAL ACCOUNTANT FEES AND SERVICES | 28 |

|

|

|

PART IV |

|

|

|

|

|

ITEM 15 | EXHIBITS AND FINANCIAL STATEMENT SCHEDULES | 29 |

|

|

|

SIGNATURES |

| 30 |

3

PART I.

This Annual Report on Form 10-K contains forward-looking statements within the meaning of federal securities laws, which are subject to a number of risks and uncertainties. All statements that are not historical facts are forward-looking statements, including statements about our business strategy, uncertainty regarding our future operating results and our profitability, anticipated sources of funds and all plans, objectives, expectations and intentions and any statements regarding future potential revenue, gross margins and our prospects for 2017 and thereafter. These statements may appear in a number of places and can be identified by the use of forward-looking terminology such as "may," "will," "should," "expect," "plan," "anticipate," "believe," "estimate," "predict," "future," "intend," or "certain" or the negative of these terms or other variations or comparable terminology, or by discussions of strategy.

The following factors are among those that may cause actual results to differ materially from our forward-looking statements:

Limited operating history in our new business model;

Limited experience introducing new products;

Our ability to successfully expand our operations and manage our future growth;

Difficulty in managing our growth and expansion;

Dilutive effects of any raising of additional capital;

The deterioration of global economic conditions and the decline of consumer confidence and spending;

Material weaknesses reported in our internal control over financial reporting;

Our ability to protect intellectual property rights and the value of our products;

The potential for product liability claims against us;

Our dependence on third party manufacturers to manufacture our products;

Our common stock is currently classified as a penny stock;

Our stock price may experience future volatility;

The illiquidity of our common stock; and

Substantial sales of shares of our common stock.

Actual results may vary materially from those in such forward-looking statements as a result of various factors, including those identified in "Item 1A. Risk Factors" and elsewhere in this document. No assurance can be given that the risk factors described in this Annual Report on Form 10-K are all of the factors that could cause actual results to vary materially from the forward-looking statements. Forward-looking statements are not guarantees of future performance. They involve risks, uncertainties, and assumptions. The Company's future results and shareholder values may differ materially from those expressed in these forward-looking statements. Readers are cautioned not to put undue reliance on any forward-looking statements. Forward-looking statements also include statements in which words such as “expect,” “anticipate,” “intend,” “plan,” “believe,” “estimate,” “consider,” or similar expressions are used. References in this Annual Report on Form 10-K to the “Company,” “TSOI,” “we,” “our,” and “us” refer to Therapeutic Solutions International, Inc.

4

ITEM 1 BUSINESS.

Corporate History

Therapeutic Solutions International, Inc. (“TSI” or the “Company”) was organized August 6, 2007 under the name Friendly Auto Dealers, Inc., under the laws of the State of Nevada. In the first quarter of 2011 the Company changed its name from Friendly Auto Dealers, Inc. to Therapeutic Solutions International, Inc., and acquired Splint Decisions, Inc., a California corporation.

Currently the Company is focused on immune modulation for the treatment of several specific diseases. Immune modulation refers to the ability to upregulate (make more active) or downregulate (make less active) one’s immune system.

Activating one’s immune system is now an accepted method to cure certain cancers, reduce recovery time from viral or bacterial infections and to prevent illness. Additionally, inhibiting one’s immune system is vital for reducing inflammation, autoimmune disorders and allergic reactions.

TSI is developing a range of immune-modulatory agents to target certain cancers, improve maternal and fetal health, fight periodontal disease, and for daily health.

Nutraceutical Division – TSI has been producing high quality nutraceuticals. Its flagship product, ProJuvenol®, is a proprietary mixture containing pterostilbene – one of the most potent antioxidants known. TSI filed a patent application for ProJuvenol® on 07-08-2015 titled: “Augmentation of Oncology Immunotherapies by Pterostilbene Containing Compositions” and was granted that patent on June 20, 2017.

Emvolio, Inc. (“EMVO”) – is a wholly-owned subsidiary of TSI, incorporated in the State of Delaware on October 03, 2016. EMVO intends to focus on developing products that can be used together to attack cancer at different levels, as well as to be used alone or in combination with existing therapies. Mr. Dixon and Mr. Berg, and Dr. Ichim, of the Company, are also officers and officers and/or directors of EMVO. As of April 16, 2018, formal operations have not commenced.

SandBox Dental Labs, Inc. – is a wholly-owned subsidiary of TSI consisting of a dental laboratory to manufacture and fill prescriptions from dentists who will use our proprietary Sleep Appliance to treat their patients with mild to moderate obstructive sleep apnea. The Company is currently in the process of seeking regulatory approval for its device to treat sleep apnea. As of April 16, 2018, formal operations have not commenced.

Management does not expect existing cash as of December 31, 2017 or as of March 31, 2018 to be sufficient to fund the Company’s operations for at least twelve months from the issuance date of these December 31, 2017 financial statements. These financial statements have been prepared on a going concern basis which assumes the Company will continue to realize its assets and discharge its liabilities in the normal course of business. As of December 31, 2017, the Company has incurred losses totaling $5.3 million since inception, has not yet generated material revenue from operations, and will require additional funds to maintain its operations. These factors raise substantial doubt regarding the Company’s ability to continue as a going concern within one year after the consolidated financial statements are issued. The Company’s ability to continue as a going concern is dependent upon its ability to generate future profitable operations and obtain the necessary financing to meet its obligations and repay its liabilities arising from normal business operations when they become due. The Company intends to finance operating costs over the next twelve months through its existing financial resources and we may also raise additional capital through equity offerings, debt financings, collaborations and/or licensing arrangements. If adequate funds are not available on acceptable terms, we may be required to delay, reduce the scope of, or curtail, our operations. The accompanying consolidated financial statements do not include any adjustments to the recoverability and classification of recorded asset amounts and classification of liabilities that might be necessary should the Company be unable to continue as a going concern.

CURRENT BUSINESS DESCRIPTION

Currently the Company is focused on immune modulation for the treatment of several specific diseases. Immune modulation refers to the ability to upregulate (make more active) or downregulate (make less active) one’s immune system.

Activating one’s immune system is now an accepted method to treat certain cancers, reduce recovery time from viral or bacterial infections and to prevent illness. Additionally, inhibiting one’s immune system is vital for reducing inflammation, autoimmune disorders and allergic reactions.

TSI is developing a range of immune-modulatory agents to target certain cancers, improve maternal and fetal health, fight periodontal disease, and for daily health.

5

Nutraceutical Division – TSI has been producing high quality nutraceuticals. Its flagship product, ProJuvenol®, is a proprietary mixture containing pterostilbene – one of the most potent antioxidants known. TSOI filed a patent application for ProJuvenol® on 07-08-2015 titled: “Augmentation of Oncology Immunotherapies by Pterostilbene Containing Compositions”. On April 28, 2016 the Company announced the filing of a patent application covering the use of ProJuvenol© and its active ingredient pterostilbene for augmentation of stem cell activity.

Emvolio, Inc., (“EMVO”) – is a wholly-owned subsidiary of TSI, incorporated in the State of Delaware on October 3, 2016, where the intellectual property surrounding immune-oncology is housed.

SandBox Dental Labs, Inc. SandBox Dental Labs, Inc., is a wholly-owned subsidiary of TSI consisting of a dental laboratory to manufacture and fill prescriptions from dentists who will use our proprietary Sleep Appliance to treat their patients with mild to moderate obstructive sleep apnea.

Nutraceutical Division (TSOI)

ProJuvenol® is a powerful synergistic blend of complex anti-aging ingredients inspired by nature to help promote cellular rejuvenation and healthy functionality for everyday living, based upon pterostilbene, one of nature’s unique and intelligent antioxidants/anti-inflammatories. ProJuvenol includes a scientifically valid blend of interactive ingredients with anti-aging and cellular protective properties to help support optimal health and provide the benefits of mental alertness and physical well-being.

Pterostilbene (pronounced “tero-STILL-bean”) has created a buzz in the world of nutrition research. Scientists discovered this powerful antioxidant several decades ago and have since found that it rivals its cousin resveratrol’s multi-functional abilities, and may actually exceed its anti-aging and health promoting potential. Found naturally in blueberries, pterostilbene has been shown in emerging experimental studies to exhibit up to 7 times greater bioavailability than resveratrol as well as better metabolic stability. This translates to potentially higher levels of pterostilbene in the blood upon ingestion, and longer lasting effects in the body compared to resveratrol. More simply put, it remains active in your body for a much greater period of time and during this enhanced bio-available period your body has the opportunity to allow it to utilize this powerful antioxidant molecule.

A large body of experimental research has now documented a wide range of potential health effects associated with pterostilbene. In fact, the more researchers study pterostilbene, the greater its human health potential becomes. In addition to being a powerful antioxidant, emerging experimental research suggests this plant compound may also help regulate cell growth, promote fat metabolism, support glucose utilization, influence brain function, and improve the body’s natural detoxification enzymes that are required to help protect cells against potentially damaging compounds from the environment.

Patents:

TSOI filed a patent covering the use of its ProJuvenol® product, as well as various pterostilbene compositions, for use in augmenting efficacy of existing immuno-oncology drugs that are currently on the market. The patent is based on the ability of pterostilbene, one of the major ingredients of ProJuvenol®, to reduce oxidative stress produced by cancer cells, which in turn protects the immune system from cancer mediated immune suppression.

Immuno-Oncology, described by Science Magazine as ‘Breakthrough of the Year’ offers the possibility of not only killing tumor cells in a non-toxic manner, but also establishing immunological memory, which patrols the body and destroys recurrent tumor cells. While great progress has been made in developing drugs that stimulate the immune system to recognize and kill tumors, a major pitfall of current approaches is that tumors produce chemicals and oxidative stress that suppresses the immune system, thus limiting efficacy of immune therapies.

Pterostilbene, which is chemically related to resveratrol, has been published to possess anticancer, antioxidant, and anti-inflammatory activities. Through the filing of the recent patent, the company is exploring whether its lead product, ProJuvenol®, may be useful as a nutraceutical adjuvant to conventional cancer immunotherapies.

The importance of proper nutrition in the context of immunotherapy cannot be overstated. Studies on one of the original cancer immunotherapies, interleukin-2, demonstrated that efficacy was related to anti-oxidant content in the patients at time of therapy. Accordingly, we are seeking through the current work to identify whether our currently marketed product, ProJuvenol®, may be utilized as part of an integrative approach to building up the immune response of cancer patients.

In addition, on April 28, 2016 the Company filed a patent application covering the use of pterostilbene for augmentation of stem cell activity. Diseases such as diabetes, cardiovascular disease, and neurodegenerative diseases are characterized by deficient stem cell activity. The patent covers the stimulation of stem cells that already exist in the patient’s body, as well as stem cells that are administered therapeutically.

6

Studies have shown that patients who have higher levels of endogenous stem cell activity have reduced cardiovascular disease risk and undergo accelerated neurological recovery after stroke as compared to patients with lower numbers of such stem cells.

On October 16, 2017 the Company filed a patent application titled "Synergistic Inhibition of Glioma Using Pterostilbene and Analogues Thereof" which was developed to utilize the ability of the immune system to augment the possibility of increasing overall survival of glioma patients after treatment with conventional therapies. Our data suggests that when pterostilbene is combined with brain cancer therapeutics such as Gefitinib, Sertraline, or Temozolomide, the prognosis is vastly improved.

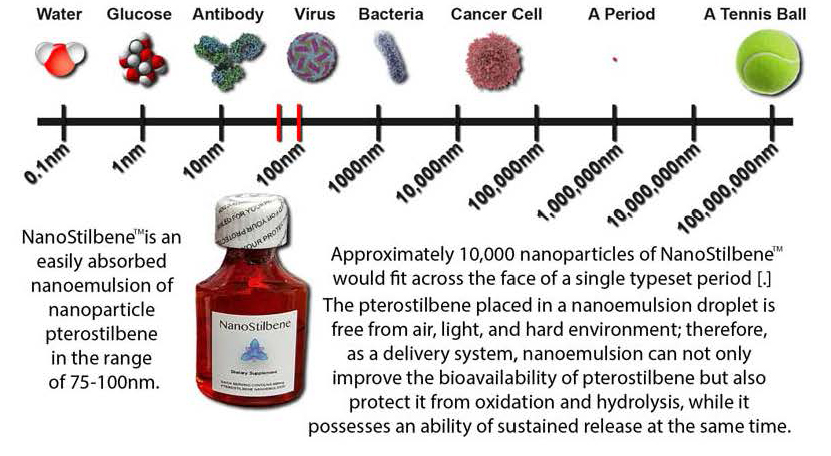

The Company continues their research into the use of pterostilbene the active ingredient in ProJuvenol. To that end we have been able to produce a nanoemulsion of pterostilbene we are tentatively naming “NanoStilbene”.

Pterostilbene, being extracted from many plants, has significant biological activities in preventing cancer, diabetes, and cardiovascular diseases so as to have great potential applications in pharmaceutical fields. |

|

NanoStilbene is prepared by low-energy emulsification which allows for better solubility, stability, and the release performance of pterostilbene nanoparticles. The pterostilbene placed in a nanoemulsion droplet is free from air, light, and hard environment; therefore, as a delivery system, nanoemulsion can not only improve the bioavailability of pterostilbene but also protect it from oxidation and hydrolysis, while it possesses an ability of sustained release at the same time.

A typical dose would be 5-10 milliliters yielding between 150 – 300 milligrams per dose. In addition to the benefits of the nanoparticle pterostilbene we chose to use medium chain triglycerides (MCT), derived from coconut oil, as one of our oil mediums in preparing the nanoemulsion. MCTs are not stored as fat, but rather convert quickly into Adenosine triphosphate (ATP), which provides energy for the body and brain at the cellular level.

MCT’s are also shown to increase metabolic thermo-genesis, improve stamina, endurance, athletic performance, and energy levels, as well as exhibiting potent anti-microbial properties – providing immune system benefits and helping in balancing candida in the gut.

NanoStilbene will soon be available in 150ml & 300ml bottles at a concentration of 30mg per ml with a recommended daily dose of 150mg.

Pterostilbene, (trans-3,5-dimethoxy-4-hydroxystilbene) is a stilbene compound that is structurally similar to other popular stilbenes such as resveratrol or piceatannol; it is named after its first discovered source (the pterocarpus genus) but is also a component of blueberries and grape products. It is a phytoalexin (compound produced by plants as a defense against parasites and insects) similar to resveratrol albeit more potent.

7

Pterostilbene has been found to be significantly more stable in vivo than resveratrol, its half-life in vivo is approximately 104 minutes versus resveratrol, for 13 minutes. Further, studies indicate that the body better absorbs pterostilbene than resveratrol, and pterostilbene is more biologically active than resveratrol, and is more efficacious than resveratrol in inhibiting certain biological activities including pro-inflammatory enzymes (providing anti-inflammatory benefits), and cell membranes producing lipid peroxidation (providing anti-oxidant support).

Each of the benefits below are specifically a growing concern within our targeted demographics, the availability of a natural product to the existing medical protocols provides a logical and affordable alternative, without many of the adverse side effects of traditional medicines.

Reduced insulin sensitivity

Reduction in VLDL and LDL (bad) cholesterol levels

Increasing HDL (good) cholesterol levels

Positive vascular smooth muscle cells

Anti-inflammatory benefits

Anti-oxidant benefits

Cognitive function improvement

Skin protection from Ultra Violet light exposure

NanoTechnology

Therapeutic uses of nanotechnology typically involve the delivery of small-molecule drugs, peptides, proteins, and nucleic acids. Nanoparticles have advanced pharmacological effects compared with the therapeutic entities they contain. Active intracellular delivery and improved pharmacokinetics and pharmacodynamics of drug nanoparticles depend on various factors, including their size and surface properties.

Nanoparticle therapeutics is an emerging treatment modality in cancer and other inflammatory disorders. The National Cancer Institute has recognized nanotechnology as an emerging field with the potential to revolutionize modern medicine for detection, treatment, and prevention of cancer.

To perfect and scale up this product we need to accomplish several important steps.

1.)Pharmacokinetics of blood serum concentration across a prescribed period of time.

2.)This involves the study of the bodily absorption, distribution, metabolism, and excretion of drugs and the characteristic interactions of a drug and the body in terms of its absorption, distribution, metabolism, and excretion.

3.)Small pilot study to be performed under the direction of Dr. Santosh Kesari at John Wayne Cancer Institute in Santa Monica CA. by conducting a clinical trial assessing the effects of pterostilbene in modulating immune response and inflammatory parameters in a group of advanced solid tumor cancer patients.

4.)Translate our PIC process to our GMP manufacturer.

The data in Granted U.S. Patent No.: 9,682,047 strongly suggest that pterostilbene administration may be an inexpensive and safe method of augmenting efficacy of numerous immunotherapeutic drugs. Although cancer immunotherapy has revolutionized the prognosis of many patients, the majority of patients still possess poor or suboptimal responses to this approach.

We are optimistic that if the proposed trial demonstrates positive results, this will serve as a foundation for initiating combination clinical trials aimed at turning non-responders to responders using pterostilbene.

8

| ProJuvenol® - Is a powerful synergistic blend of complex anti-aging ingredients inspired by nature to help promote cellular rejuvenation and healthy functionality for everyday living. Based upon one of nature’s unique and intelligent anti- oxidants/anti-inflammatories. |

| NanoStilbene is an easily absorbed nanoemulsion of nanoparticle pterostilbene in the range of 75-100nm at a concentration of 30 milligrams per milliliter. The pterostilbene placed in a nanoemulsion droplet is free from air, light, and hard environment; therefore, as a delivery system, nanoemulsion can not only improve the bioavailability of pterostilbene but also protect it from oxidation and hydrolysis, while it possesses an ability of sustained release at the same time. |

Dental

SandBox Dental Labs, Inc.

SandBox Dental Labs, Inc., is a wholly-owned subsidiary of TSI consisting of a dental laboratory to manufacture and fill prescriptions from dentists who will use our proprietary Sleep Appliance named Morpheus™ to treat their patients with mild to moderate obstructive sleep apnea.

The SandBox Dental Sleep Appliance, named Morpheus™, has been tested in a randomized controlled cross over trial against CPAP and a placebo, and it is also one of the most technologically advanced and patient friendly MAS’s (mandibular advancement splints) on the market.

The Company has submitted to FDA a new 510(k) application on June 20, 2017. On June 27, 2017, the Company was notified that our Submission for premarket notification was received and has been given Submission Number: K171918. Currently K171918 is in a clinical hold until we are able to conduct cytotoxicity and biocompatibility testing of the plastic and acrylic materials used in the construction of the appliance.

The full clinical trial information is not contained in this document, but the headline success rate of Morpheus was 80.3% in fully apneic patients. The potential exists for the device to be even more successful in non-apneic snorers (Barnes et al. (2004). Efficacy of Positive Airway Pressure and Oral Appliance in Mild to Moderate Obstructive Sleep Apnoea.).

The appliance combines a high clinical success rate with key features that make it more comfortable and flexible for the patient. Unlike some MAS devices, our appliance is fully patient adjustable negating the need for further clinical visits for simple titration. Should the patient need to modify the degree of mandibular advancement they can simply adjust with the key provided.

Education, Training & Marketing

Our goal is to make every effort to educate our physicians and dentists so that evidenced based decision making leads to a patient centric system. Oral appliance therapy will only increase in its value in sleep medicine, if the education of our physicians and patients as well as dentists leads to increased awareness, a patient centric decision becomes more likely.

The Company intends to provide Continuing Education and Training as part of our overall marketing. We are staffed and prepared to offer the high quality courses that are indeed evidenced based and taught with our Dental Advisor and key opinion leader, Dr. Barry Glassman, other carefully chosen and trained dental instructors, and an appropriate physician team as well.

There is no field in medicine that has experienced growth and the dynamic changes more than sleep medicine. Those changes are seen as “traumatic” by traditionalists who do not recognize the problems of the existing model of sleep medicine and how that model actually prevents effective diagnosis and treatment. In an attempt to maintain “status quo” sleep medicine tends to react defensively.

9

There are many instances of resolution of severe Obstructive Sleep Apnea (OSA) with oral appliance therapy, and at the same time, one can point to instances of failure of oral appliance therapy to treat mild OSA. Clearly the number of outliers using AHI alone is significant. In addition, recent work of Cistuli, Sullivan, Anandam and others make it clear that oral appliance therapy can be as effective as CPAP in prevention of severe cardiovascular accidents in patients with severe OSA. There is no question, then, that Oral Appliance Therapy (OAT) has a real role in treatment, and that programs that do not have OAT as an alternative may not an effective treatment for patients.

Market Competition

According to a new research study from Global Market Insights, Inc., the Sleep Apnea Devices Market size is poised to exceed USD 8.7 billion by 2023.

The ‘Morpheus’ is an “in-patent” laboratory-manufactured device molded specifically to patient impressions. As a soft, slim-line two-piece device it allows full lateral movement while retaining high levels of patient comfort and custom made accuracy. By allowing a degree of movement during the night the device remains in the mouth unlike some devices that may dislocate. TSOI has exclusivity in the USA until patent expires in 2033. |

|

The ‘Thornton Adjustable Positioner’, or TAP, is an "out-of-patent" mandibular (lower jaw) advancement device specifically engineered for keeping your airway open during sleep. Currently the #1 prescribed appliance in the USA.

|

|

The ‘SomnoDent’ oral appliance is a premium, custom-fitted dental sleep appliance developed for the treatment of snoring and obstructive sleep apnea. Currently the #2 prescribed appliance in the USA with sales of 5000 new appliances monthly.

|

|

Operational Workflow and Support

The Company has plans to eventually build-out our own physical dental lab but for a period of time we will engage contract manufacturing to produce our appliances until sufficient capital is available to construct our own laboratory.

Contract Manufacturing with S4S Dental UK

The Company has exclusivity in the USA in a licensing agreement with S4S Dental Laboratory of Sheffield England (s4sdental.com). TSOI has had a relationship with S4S Dental for many years and they are more than capable of meeting our needs as we grow our market.

|

|

10

Workflow:

SandBox will receive dental impressions and prescription from dentist.

SandBox lab techs will produce dental models from impressions that will be scanned 3-Dimensionally and transmitted to manufacturer.

Appliance will then be fabricated to the specifications of prescribing dentist.

Finished appliance will be returned to SandBox and subsequently delivered to prescribing dentist.

All of this will be accomplished within the general two-week turnaround time of most labs.

Technical and Clinical Support:

Tier 1 technical support will be provided through support line and electronic communications.

Tier 2 clinical support (doctor to doctor) will be provided by Dr. Glassman for a period of time with the addition of future assistants as we grow.

The Officers and Directors of the Company are also officers and Directors of SandBox. As of April 16, 2018, formal operations have not commenced. Expenses to date have been funded by TSI.

Immune-Oncology

Emvolio, Inc.

Emvolio, Inc., (EMVO) is a wholly-owned subsidiary of TSI where the intellectual property surrounding immune-oncology is housed. The Company intends to develop products that can be used together to attack cancer at different levels, as well as to be used alone or in combination with existing therapies.

The Officers and Directors of the Company are also officers and Directors of EMVO. As of April 16, 2018, TSI has licensed certain patents to Emvolio, but formal commercial operations have not commenced. Expenses to date have been funded by TSI.

On April 10, 2017, TSI licensed to EMVO a patent titled “Targeting the Tumor Microenvironment through Nutraceutical Based Immunoadjuvants” known clinically as “StemVacs”.

On May 01, 2017, TSI licensed to EMVO a patent titled “Targeting the Tumor Microenvironment through Nutraceutical Based Immunoadjuvants” known clinically as “Cancer Metabolic Detox”.

On May 17, 2017, TSI licensed to EMVO a patent titled “Activated Leukocyte Extract for Repair of Innate Immunity in Cancer Patients” known clinically as “innaMune”.

On June 01, 2017, TSI licensed to EMVO a patent titled “Augmentation of Anti-Tumor Immunity by Mifepristone and Analogues Thereof” known clinically as “LymphoBoost”.

On June 12, 2017, TSI licensed to EMVO a patent titled “Methods of Re-Activating Dormant Memory Cells with Anticancer Activity” known clinically as “MemoryMune”.

StemVacs: StemVacs is a subcutaneously administered vaccine comprised of immune stimulatory peptides resembling cancer stem cell specific proteins.

On April 12, 2017, the Company announced the submission of an Investigational New Drug Application with the US FDA for use of its StemVacs cancer immunotherapeutic in patients with solid tumors. The trial seeks to establish safety and immune response of the cancer, targeting a new personalized dendritic cell vaccine.

This is a single center, open label, non-randomized phase I trial to test the safety and potential efficacy of StemVacs in advanced cancer patients. We plan to treat a total of 15 patients that are ineligible for current treatments or have failed standard therapy using a total of 2 intravenously administered ascending doses of irradiated StemVacs. Doses will be 10, 25, and 50 million cells per injection. Injections will be performed on days 0 and 14 and responses will be evaluated at 1, 3, 6 and 12 months based on RECIST criteria (Response Evaluation Criteria In Solid Tumors (RECIST) is a set of published rules that define when tumors in cancer patients improve ("respond"), stay the same ("stabilize"), or worsen ("progress") during treatment.).

11

Additionally immune response changes will be assessed at baseline, 3, 6 and 12 months. The study will last 1 year. As of April 16, 2018, enrollment has not commenced.

Thomas Ichim, Ph.D., will be the person responsible for monitoring the conduct and progress of the clinical investigation as well as responsibility to review and evaluate information relevant to the safety of StemVacs.

Santosh Kesari, M.D., Ph.D., will be the Principal Investigator and the trial will be conducted at the John Wayne Cancer Institute with the cellular product being generated, tested, and filled by the John Wayne Cancer Institute Cell Processing Facility with cells previously generated from autologous patients.

The Primary Objective is safety and feasibility of StemVacs administration at 12 months as assessed by lack of adverse medical events. The Secondary Objective is efficacy as judged by tumor response, time to progression, and immunological monitoring.

Patients will be divided into 3 groups of 5 and administered: a) Group 1: 10 million cells; b) Group 2; 25 million and c) Group 3; 50 million cells of StemVacs intravenously administered. Each injection will be in a volume of 20 ml. StemVacs administration will be performed on days 0 and 14. Between dose escalation there will be a minimum 1 month break to assess adverse events by the data safety monitoring board.

Stimulation of immunity by Dendritic Cells (DC) has been demonstrated to function via antigen specific and non-specific manner. The current study will test the hypothesis that administration of peripheral blood DC matured by Transfer Factor (TF) will possess a favorable toxicity criteria and induce immune modulation in patients with advanced solid tumors.

Given the known suppression of DC activity by tumor cells, one hypothesis of the clinical trial will be that exogenously generated and matured DC will allow for an antigen non-specific immune modulation in the T cell and Natural Killer (NK) cell compartment. The findings of this study will support the use of StemVacs as an antigen-nonspecific immune modulatory treatment that will be utilized as a monotherapy or as combination with antigen specific modalities such as peptide or protein based vaccines.

In addition to StemVacs, the following four products will also be licensed exclusively to EMVO by TSOI who owns the intellectual property.

Cancer Metabolic DeTox: This is an orally administered agent that is derived from various herbs termed apigenin. The unique property of apigenin is that it inhibits a cancer associated metabolic pathway that degrades the amino acid tryptophan. Specifically, apigenin inhibits the enzyme indolamine 2,3 deoxygenase (IDO), which is responsible for breaking down tryptophan in the vicinity of the tumor and generating by-products such as kynurenine. It is known that immune activation is dependent on tryptophan being present in the tumor environment. The depletion of tryptophan and generation of kynurenine by tumor cells and tumor associated cells is a major cause of immune suppression in cancer. By administering Cancer Metabolic DeTox, the innate arm of the immune system has a chance to regenerate. This positions the patient for better outcome after administration of specific immune stimulating vaccines.

MemoryMune: This is a product derived from a two-step culture process of donor blood cells. The product MemoryMune reawakens dormant immune memory cells. It is known that many cancer patients possess memory T cells that enter the tumor, however, once inside the tumor these cells are inactivated. MemoryMune contains a unique combination of growth factors specific for immune system cells called “cytokines”.

LymphoBoost: LymphoBoost is a proprietary formulation of Misoprostol, a drug approved for another indication, which we have shown to be capable of stimulating lymphocytes, particularly NK cells and T cells, both critical in maintaining anti-tumor immunity.

innaMune: This is a biological product derived from tissue culture of blood cells derived from healthy donors. It is a combination of cytokines that maintain activity of innate immune system cells, as well as having ability to shift M2 macrophages to M1.

The overarching approach to cancer at EMVO is as follows:

1.)Treat innate immune suppression: Administration of oral apigenin/pterostilbene (Cancer DeTox Product) to decrease immune suppressive toxic molecules made by tumor and tumor microenvironment.

2.)Treat adaptive immune suppression: Administration of MemoryMune to activate dormant memory cells recognizing the tumor. Administration of LymphoBoost to repair deficient IL-12 production.

3.)Stimulation of immune response to cancer stem cells (StemVacs).

4.)Consolidation and maintenance of immunity: Cycles of StemVacs, supported by innaMune and LymphoBoost

12

GOVERNMENT REGULATION

The Company’s business is subject to varying degrees of regulation by a number of government authorities in the United States, including the United States Food and Drug Administration (FDA), the Federal Trade Commission (FTC), and the Consumer Product Safety Commission. The Company will be subject to additional agencies and regulations if it enters the manufacturing business. Various agencies of the state and localities in which we operate and in which our products are sold also regulate our business, such as the California Department of Health Services, Food and Drug Branch. The areas of our business that these and other authorities regulate include, among others:

product claims and advertising;

product labels;

product ingredients; and

how we package, distribute, import, export, sell and store our products.

The FDA, in particular, regulates the formulation, manufacturing, packaging, storage, labeling, promotion, distribution and sale of vitamins and other nutritional supplements in the United States, while the FTC regulates marketing and advertising claims. The FDA issued a final rule called “Statements Made for Dietary Supplements Concerning the Effect of the Product on the Structure or Function of the Body,” which includes regulations requiring companies, their suppliers and manufacturers to meet Good Manufacturing Practices in the preparation, packaging, storage and shipment of their products. Management is committed to meeting or exceeding the standards set by the FDA.

The FDA has also issued regulations governing the labeling and marketing of dietary and nutritional supplement products. They include:

the identification of dietary or nutritional supplements and their nutrition and ingredient labeling;

requirements related to the wording used for claims about nutrients, health claims, and statements of nutritional support;

labeling requirements for dietary or nutritional supplements for which “high potency” and “antioxidant” claims are made;

notification procedures for statements on dietary and nutritional supplements; and

pre-market notification procedures for new dietary ingredients in nutritional supplements.

The Dietary Supplement Health and Education Act of 1994 (DSHEA) revised the existing provisions of the Federal Food, Drug and Cosmetic Act concerning the composition and labeling of dietary supplements and defined dietary supplements to include vitamins, minerals, herbs, amino acids and other dietary substances used to supplement diets. DSHEA generally provides a regulatory framework to help ensure safe, quality dietary supplements and the dissemination of accurate information about such products. The FDA is generally prohibited from regulating active ingredients in dietary supplements as drugs unless product claims, such as claims that a product may heal, mitigate, cure or prevent an illness, disease or malady, trigger drug status.

The Company is also subject to a variety of other regulations in the United States, including those relating to taxes, labor and employment, import and export, and intellectual property.

EMPLOYEES

As of December 31, 2017, we had three full-time employees, all non-union. We believe that our relations with our employees are good.

COMPETITION

The bio-technology, bio-pharma, and nutraceutical industries are subject to rapid technological change. Competition from domestic and foreign companies, large pharmaceutical companies and other interested businesses is intense and expected to increase. A number of companies with significantly greater resources are pursuing the development of pharmaceuticals, biologics, and nutraceuticals in our targeted areas.

ITEM 1A RISK FACTORS

As a smaller reporting company we are not required to provide a statement of risk factors. However, we believe this information may be valuable to our shareholders for this filing. We reserve the right to not provide risk factors in our future filings. Our primary risk factors and other considerations include:

This Annual Report on Form 10-K contains forward-looking statements concerning our future programs, expenses, revenue, liquidity and cash needs as well as our plans and strategies. These forward-looking statements are based on current expectations and we assume no obligation to update this information, except as required by applicable laws and regulations. Numerous factors could cause actual results to differ significantly from the results described in these forward-looking statements, including the following risk factors.

13

Internal Control

Our management has concluded that our internal control over financial reporting is not effective. Material weaknesses in our internal control over financial reporting could cause our financial reporting to be unreliable and could lead to misinformation being disseminated to the public.

Our management concluded that as of December 31, 2017 our internal control over financial reporting was not effective, and that material weaknesses existed in the following areas as of December 31, 2017:

(1)we do not employ full time in-house personnel with the technical knowledge to identify and address some of the reporting issues surrounding certain complex or non-routine transactions. With respect to material, complex and non-routine transactions, management has and will continue to seek guidance from third-party experts and/or consultants to gain a thorough understanding of these transactions;

(2)we have inadequate segregation of duties consistent with the control objectives including but not limited to the disbursement process, transaction or account changes, and the performance of account reconciliations and approval ;

(3)we have ineffective controls over the period end financial disclosure and reporting process caused by reliance on third-party experts and/or consultants and insufficient accounting staff;

Based on our current plan, we believe we will need additional capital to support our operations.

Based on our current business plan, we believe that our cash and cash equivalents at December 31, 2017 will not be sufficient to meet our anticipated cash requirements during the twelve-month period subsequent to the issuance of the financial statements included in this Annual Report on Form 10-K. Our current commercialization of products and clinical trial strategy will undergo continual prioritization and in the future we may adjust our commercialization efforts to preserve our existing cash. We need to raise additional capital to fund our operations. We may raise additional capital through equity offerings, debt financings, collaborations and/or licensing arrangements. Additional funds may not be available when we need them on terms that are acceptable to us, or at all. If adequate funds are not available, we may be required to delay, reduce the scope of, or curtail, our operations. To the extent that we raise additional funds by issuing equity securities, our shareholders will experience dilution, and debt financing or other preferred equity instruments, if available, may involve restrictive covenants.

There is substantial doubt about our ability to continue as a going concern.

Our recurring losses from operations raise substantial doubt about our ability to continue as a going concern, and as a result, our independent registered public accounting firm included an explanatory paragraph in its report on our financial statements as of and for the year ended December 31, 2017 with respect to this uncertainty. This going concern uncertainty, and any future going concern uncertainty, could materially limit our ability to raise additional capital. We have incurred significant losses since our inception, and it is possible we will never achieve future profitability. The Company is currently developing its new NanoStilbene product for commercialization. In addition, we are currently seeking regulatory clearance for our subsidiary SandBox’s product to treat obstructive sleep apnea in the United States. As a result, we continue to incur significant general and administrative expenses related to our operations. As a result, we have incurred substantial net losses to date. Our net losses for the years ended December 31, 2017 and 2016 were $0.996 million and $1.062 million, respectively. As of December 31, 2017, we had an accumulated deficit of $5.3 million. Meaningful revenues will likely not be available until, and unless, the Company can successfully launch our current TSI product line and our SandBox subsidiary’s product is cleared by the FDA and successfully commercialized. The perception that we may not be able to continue as a going concern may cause potential partners or investors to choose not to deal with us due to concerns about our ability to meet our contractual and financial obligations.

SandBox Dental Labs, Inc.

We are subject to FDA regulations which have tended to become more stringent over time. Regulatory changes could result in restrictions on our ability to carry on or expand our operations, higher than anticipated costs or lower than anticipated sales. Before we can market or sell our proprietary Sleep Appliance named Morpheus™ in the U.S., we must obtain clearance under Section 510(k) from the FDA.

Emvolio, Inc.

The Company is currently on a clinical hold until we can provide additional animal toxicology studies to the FDA. Meaningful revenues will likely not be available until, and unless, the Company can successfully gain approval from the FDA to clinically test our cancer vaccine in humans. The perception that we may not be able to continue as a going concern may cause potential partners or investors to choose not to deal with us due to concerns about our ability to meet our contractual and financial obligations.

14

We may not be able to effectively manage our potential growth and the execution of our business plan.

Our potential growth and the execution of our business plan together are likely to place significant strain on our managerial, operational and financial resources. To effectively manage our potential growth and execute our business plan, we will need to, among other things:

retain additional personnel across several departments in the Company;

develop strong customer loyalty for new products in a crowded competitive marketplace;

continue to establish and continue to increase awareness of our brands;

price our products and services at points which will allow us to maximize sales while at the same time maximizing gross profit margins;

establish, maintain, expand and manage multiple relationships with various vendors, strategic partners, licensees and other third parties, including suppliers of the products we sell on our website and elsewhere, warehousing distributors, shipping companies and others;

rapidly respond to competitive developments, particularly when new high-demand products become available;

build an operations structure to support our business and provide efficient and effective customer service and support;

expand our IT infrastructure to respond to increasing customer traffic to our website, demand for content from site users and to manage growing e-commerce transactions;

establish and maintain effective financial and management controls, reporting systems and procedures;

control our expenses;

provide competitive employee salaries and benefit packages; and,

avoid lawsuits and other adverse claims.

There can be no assurance that we will be able to accomplish any or all of the above goals. If we prove unable to effectively execute our business plan or manage our growth, it is likely to have a material adverse effect on our business, financial condition, including liquidity and profitability, and our results of operations.

If our proposed product sales model does not successfully operate at a profit our growth strategy may be impeded.

To effectively expand and meet our growth objectives our products sales model must be executed upon in a profitable manner. Profitability is dependent upon a variety of factors, some beyond our control, including, but not limited to the amount of traffic we can consistently attract to our brand, to retail sales in “brick and mortar” retailers, to our website, and our ability to stock or otherwise make available products that our customers purchase, our ability to stock or otherwise make available the best new products as they enter the market, our ability to provide consistent and superior customer service, the general economic conditions, particularly in the U.S., that could impact the amount of money customers spend collectively on the products we sell, and/or that could reduce the amount of money our average customer spends, and/or could reduce the number or frequency of repeat orders for products, and/or could result in customers finding products in other venues if they can find those products for a lower price. Other factors that could impact our ability to execute on our business model in a profitable manner include, but are not limited to, competition in our markets, recruiting, training and retaining qualified personnel and management, maintenance of required local, state and federal governmental approvals and permits, costs associated with principal component products and supplies, delivery shortages or interruptions, consumer trends, our ability to finance operations externally, changes in supply or prices of the products we sell and disruptions or business failures among our product suppliers, distributors, warehouses or shippers. Any failure to operate in a profitable manner could hurt our ability to meet our growth objectives by attracting licensees, and our business, financial condition, including liquidity and profitability, and our results of operations would be negatively affected.

We face significant competition for our products.

The markets in which we operate are intensely competitive, continually evolving and, in some cases, subject to rapid change. Our competitors include:

traditional and well established companies with recognized and well patronized brands in the nutritional supplements and health products industry segment;

entrenched nutritional supplements and health products companies with well known customer on-line services and portals and other high-traffic web sites that provide sales access to healthcare and nutritional supplements and related products; and

companies that focus on providing on-line and/or off-line healthcare related content, including some that promote competitor brands.

15

Many of our competitors have greater financial, technical, product development, marketing and other resources than we do. These companies may be better known than we are and have more customers than we do. We cannot provide assurance that we will be able to compete successfully against these companies or any alliances they have formed or may form. If we are unable to compete with one or more of our competitors, our growth strategy may be impeded, which could negatively affect our business, financial condition, including liquidity and profitability, and our results of operations.

Government regulation could adversely affect our business.

Our products and their associated component ingredients are subject to existing and potential government regulation. Our failure, or the failure of our business partners or third party providers, to accurately anticipate the application of laws and regulations affecting our products and the manner in which we deliver them, or any failure to comply, could create liability for us, result in adverse publicity, or negatively affect our business. In addition, new laws and regulations, or new interpretations of existing laws and regulations, may be adopted with respect to consumer protection and other issues, including pricing, products liability, copyrights and patents, distribution and characteristics and quality of products and services. We cannot predict whether these laws or regulations will change or how such changes will affect our business. Any of this government regulation could impact our growth strategy, which could negatively affect our business, financial condition, including liquidity and profitability, and our results of operations.

Third parties may claim that we are infringing their intellectual property, and we could suffer significant litigation or licensing expense or be prevented from providing certain services, and which may otherwise harm our business.

We could be subject to claims that we are misappropriating or infringing intellectual property, trade secrets or other proprietary rights of others. These claims, even if not meritorious, could be expensive to defend and divert management’s attention from our operations. If we become liable to third parties for infringing these rights, we could be required to pay substantial damage awards and to develop non-infringing products, obtain a license or cease selling the products that use or contain the infringing intellectual property. We may be unable to develop non-infringing products or obtain a license on commercially reasonable terms, or at all. Any claims against our company for infringement could impede our growth strategy, which could negatively affect our business, financial condition, including liquidity and profitability, and our results of operations.

We may be subject to claims brought against us as a result of product associated content we provide.

Consumers are reasonably expected to access health-related information regarding our products through our on-line web site. If our content, or content we obtain from third parties, contains inaccuracies, it is possible that consumers or others may sue us for various causes of action. Although our planned web site contains terms and conditions, including disclaimers of liability, that are intended to reduce or eliminate our liability, the law governing the validity and enforceability of on-line agreements with consumers that provide the terms and conditions for use of our public or private portals are unenforceable. A finding by a court that these agreements are invalid and that we are subject to liability could harm our business and require costly changes to our business. We have planned editorial procedures in place to provide quality control of the information that we publish or provide. However, we cannot assure you that our editorial and other quality control procedures will be sufficient to ensure that there are no errors or omissions in particular content. Even if potential claims do not result in liability to us, the fact that we would need to investigate and defend against these claims could be expensive and time consuming and could divert management’s attention away from our operations. In addition, our business is in part based on establishing a reputation amongst consumers that our portals as trustworthy and dependable sources of healthcare information. Allegations of impropriety or inaccuracy, even if unfounded, could therefore harm our reputation and business, which could negatively affect our business, financial condition, including liquidity and profitability, and our results of operations.

Changes in commodity and other operating costs or supply chain and business disruptions could adversely affect our results of operations.

Changes in product costs are a part of our business; any increase in the prices that suppliers charge for their products could adversely affect our operating results. We remain susceptible to increases in prices as a result of factors beyond our control, such as general economic conditions, seasonal fluctuations, weather conditions, demand, safety concerns, product recalls, labor disputes and government regulations. We rely on third-party distribution companies to deliver ingredients to our manufacturers and ultimately our products to customers. Interruption of distribution services due to financial distress or other issues could adversely affect our operations.

16

We face substantial competition in attracting and retaining qualified senior management and key personnel and may be unable to develop and grow our business if we cannot attract and retain such senior management and key personnel.

As an early stage company, our ability to develop and grow our business, to a large extent, depends upon our ability to attract, hire and retain highly qualified and knowledgeable senior management and key personnel who possess the skills and experience necessary to satisfy our business needs. Our ability to attract and retain such senior management and key personnel will depend on numerous factors, including our ability to offer salaries, benefits and professional growth opportunities that are comparable with and competitive to those offered by more established companies operating in our marketplace. We may be required to invest significant time and resources in attracting and retaining additional senior management and key personnel as needed. Moreover, many of the companies with which we will compete for any such individuals have greater financial and other resources, affording them the ability to undertake more extensive and aggressive hiring campaigns, than we can. The normal running of our operations may be interrupted, and our financial condition and results of operations negatively affected, as a result of any inability on our part to attract or retain the services of qualified and experienced senior management and key personnel, or should our prospective key personnel refuse to serve, or, once appointed, leave prior to a suitable replacement being found.

Risks Associated With Our Restricted Securities

Because there is currently a limited public trading market for our common stock, investor may not be able to resell stock.

Our stock is now traded in OTC Markets under the stock symbol TSOI, which results in a very illiquid and limited market for our common stock.

There is currently no liquid trading market for our common stock and we cannot ensure that one will ever develop or be sustained.

The trading market for our common stock is currently not liquid. We cannot predict how liquid the market for our common stock might become. Our common stock is quoted in OTC Markets under the symbol TSOI.

Our common stock may be deemed a “penny stock”, which would make it more difficult for investors to sell their shares.

Our common stock is subject to the “penny stock” rules adopted under the Exchange Act. The penny stock rules apply to companies whose common stock is not listed on the NASDAQ Stock Market or other national securities exchange and trades at less than $4.00 per share, other than companies that have had average revenue of at least $6,000,000 for the last three years or that have tangible net worth of at least $5,000,000 ($2,000,000 if the company has been operating for three or more years). These rules require, among other things, that brokers who trade penny stock to persons other than “established customers” complete certain documentation, make suitability inquiries of investors and provide investors with certain information concerning trading in the security, including a risk disclosure document and quote information under certain circumstances. Many brokers have decided not to trade penny stocks because of the requirements of the penny stock rules and, as a result, the number of broker-dealers willing to act as market makers in such securities is limited. If we remain subject to the penny stock rules for any significant period, it could have an adverse effect on the market, if any, for our securities and investors may find it more difficult to dispose of our securities.

Offers or availability for sale of a substantial number of shares of our common stock may cause the price of our common stock to decline.

If our stockholders have the right to sell substantial amounts of common stock in the public market, e.g. upon the expiration of any statutory holding period under Rule 144, it could create a circumstance commonly referred to as an “overhang” and in anticipation of which the market price of our common stock could fall. The existence of an overhang, whether or not sales have occurred or are occurring, also could make our ability to raise additional financing through the sale of equity or equity-related securities in the future, at a time and price that we deem reasonable or appropriate, more difficult.

The elimination of monetary liability against our directors and officers under the Company’s Articles of Incorporation and Nevada law, and the existence of indemnification rights to our directors, officers and employees, may result in substantial expenditures by the Company.

Article 6 of our Articles of Incorporation exculpates our directors and officers from certain monetary liabilities. Article 7 of our Articles of Incorporation provides that we shall indemnify all directors (and all persons serving at our request as a director or officer of another corporation) to the fullest extent permitted by Nevada law.

Further pursuant to Article 7, the expenses of the indemnified person incurred in defending a civil suit or proceeding must be paid by us as incurred and in advance of the final disposition of the action, suit, or proceeding under receipt of an undertaking by or on behalf of the indemnified person to repay the amount if it is ultimately determined by a court of competent jurisdiction that he or she is not entitled to be indemnified by us.

17

The foregoing indemnification obligations could result in us incurring substantial expenditures, which we may be unable to recoup. These provisions and resultant costs may also discourage us from bringing a lawsuit against directors and officers for breaches of their fiduciary duties even though such actions, if successful, might otherwise benefit us and our stockholders.

Public company compliance may make it more difficult to attract and retain officers and directors.

The Sarbanes-Oxley Act and related rules implemented by the SEC have required changes in corporate governance practices of public companies. As a public entity, these rules and regulations increase compliance costs and make certain activities more time consuming and costly. As a public entity, these rules and regulations also make it more difficult and expensive for us to obtain director and officer liability insurance and we may be required to accept reduced policy limits and coverage. As a result, it may be more difficult for us to attract and retain qualified persons to serve as directors or as executive officers.

We do not plan to pay any cash or stock dividends in the foreseeable future.

The payment of dividends upon our capital stock is solely within the discretion of our future board of directors and is dependent upon our financial condition, results of operations, capital requirements, restrictions contained in our future financing instruments and any other factors our board of directors may deem relevant. We have never declared or paid any cash or stock dividends on our capital stock and we currently anticipate that we will retain earnings, if any, to finance the development and expansion of our business and, as such, do not intend on paying any cash or stock dividends in the foreseeable future.

ITEM 1B UNRESOLVED STAFF COMMENTS

As a Smaller Reporting Company, we are not required to furnish information under this Item 1B.

ITEM 2 PROPERTIES.

We do not own any real-estate property or manufacturing equipment. Our business is conducted in approximately 1,300 square feet of rented offices and warehouse space located at 4093 Oceanside Blvd., Suite B, Oceanside, CA 92056.

ITEM 3 LEGAL PROCEEDINGS.

From time to time, claims are made against us in the ordinary course of business, which could result in litigation. Claims and associated litigation are subject to inherent uncertainties and unfavorable outcomes could occur, such as monetary damages, fines, penalties or injunctions prohibiting us from selling one or more products or engaging in other activities. The occurrence of an unfavorable outcome in any specific period could have a material adverse effect on our results of operations for that period or future periods.

However, as of the date of this report, management believes the outcome of currently identified potential claims and lawsuits will not have a material adverse effect on our financial condition or results of operations.

ITEM 4 MINE SAFETY DISCLOSURES.

18

ITEM 5 MARKET FOR REGISTRANT'S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES.

Our stock is now traded in OTC Markets under the stock symbol TSOI, which results in a very illiquid and limited market for our common stock. As of the date of Annual Report on Form 10-K there are approximately 171 stockholders of record of our common stock.

The following table sets forth the quarterly high and low closing sales prices for our common stock from January 1, 2016 through December 31, 2017.

Quarter Ended | High | Low |

December 31, 2017 | $0.009 | $0.004 |

September 30, 2017 | $0.02 | $0.005 |

June 30, 2017 | $0.018 | $0.004 |

March 31, 2017 | $0.013 | $0.002 |

December 31, 2016 | $0.007 | $0.002 |

September 30, 2016 | $0.01 | $0.004 |

June 30, 2016 | $0.012 | $0.003 |

March 31, 2016 | $0.007 | $0.002 |

Dividends

We did not declare or pay dividends during 2016 to 2017.

Issuances of Unregistered Securities

On January 4, 2016, we issued 2,500,000 shares of common stock, valued at $0.0025 per share, for consulting services.

On January 22, 2016, we issued 2,500,000 shares of common stock, valued at $0.0035 per share, for consulting services.

On February 1, 2016, we issued 2,500,000 shares of common stock, valued at $0.003 per share, for consulting services.

On February 5, 2016, we issued 8,000,000 shares of common stock, valued at $0.0025 per share, for an investment in the Company’s Private Placement.

On February 22, 2016, we issued 5,451,000 shares of common stock, valued at $0.003 per share, in regard to a License Agreement (Form 8-K filed on February 25, 2016).

On February 26, 2016, we issued 1,000,000 shares of common stock, valued at $0.0025 per share, for an investment in the Company’s Private Placement.

On March 7, 2016, we issued 10,000,000 shares of common stock, valued at $0.0004 per share, for consulting services.

On March 21, 2016, we issued 100,800,000 shares of common stock, valued at $0.0025 per share, for an investment in the Company’s Private Placement.

On May 2, 2016, we issued 1,000,000 shares of common stock, valued at $0.0025 per share, for an investment in the Company’s Private Placement and 1,000,000 shares of common stock, valued at $0.0025 per share, for consulting services.

On May 26, 2016, we issued 2,500,000 shares of common stock, valued at $0.0066 per share, for consulting services.

On May 26, 2016, we issued 2,000,000 shares of common stock, valued at $0.0025 per share, for an investment in the Company’s Private Placement.

On May 31, 2016, we issued 2,500,000 shares of common stock, valued at $0.0066 per share, for legal services.

On September 16, 2016, we issued 12,500,000 shares of common stock, valued at $0.004 per share, for an investment in the Company’s Private Placement.

19

On October 18, 2016, we issued 40,000,000 shares valued at $0.0045 to the officers and directors of the Company for services, and 5,000,000 shares valued at $.0045 for consulting services.

On January 17, 2017, we issued 12,500,000 shares of common stock, valued at $0.004 per share, for an investment in the Company’s Private Placement to a related party.

On March 2, 2017, we issued 12,500,000 shares of common stock, valued at $0.004 per share, for an investment in the Company’s Private Placement to a related party.

On April 3, 2017, we issued 1,000,000 shares of common stock, valued at $0.0067 per share for consulting services.

On April 20, 2017, we issued a six month convertible note in the amount of $100,000 with an annual interest rate of 10% to a related party.

On April 28, 2017, we issued 10,000,000 shares of common stock, valued at $0.008 per share, for legal services and 1,000,000 shares of common stock, valued at $0.004 per share, for an investment in the Company’s Private Placement.

On July 6, 2017, we issued 2,000,000 shares of common stock, valued at $0.0083 per share for consulting services.

On July 24, 2017, we issued a six month convertible note in the amount of $28,000 with an annual interest rate of 10%.

On August 21, 2017, we issued 6,250,000 shares of common stock, valued at $0.004 per share, for an investment in the Company’s Private Placement and 1,000,000 shares of common stock, valued at $0.0053 per share, for consulting services.

On August 28, 2017, we issued 2,000,000 shares of common stock, valued at $0.0063 per share, for consulting services.

On September 7, 2017, we issued a six month convertible note in the amount of $28,000 with an annual interest rate of 10%.

On September 20, 2017, we issued 3,000,000 shares of common stock, valued at $0.004 per share, for an investment in the Company’s Private Placement to a related party.

On October 2, 2017, we issued 2,500,000 shares of common stock, valued at $0.0095 per share for consulting services.

On October 20, 2017, we issued 12,500,000 shares of common stock, valued at $0.004 per share, for an investment in the Company’s Private Placement to a related party.

ITEM 6 SELECTED FINANCIAL DATA.

Not required for a “smaller reporting company”.

ITEM 7 MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS.

The following discussion and analysis should be read in conjunction with the consolidated Financial Statements and Notes thereto appearing elsewhere in this Annual Report.

Overview

Currently the Company is focused on immune modulation for the treatment of several specific diseases. Immune modulation refers to the ability to upregulate (make more active) or downregulate (make less active) one’s immune system.

Activating one’s immune system is now an accepted method to cure certain cancers, reduce recovery time from viral or bacterial infections and to prevent illness. Additionally, inhibiting one’s immune system is vital for reducing inflammation, autoimmune disorders and allergic reactions.

Nutraceutical Division – TSI has been producing high quality nutraceuticals. Its flagship product, ProJuvenol®, is a proprietary mixture containing pterostilbene – one of the most potent antioxidants known. TSI filed a patent application for ProJuvenol® on 07-08-2015 titled: “Augmentation of Oncology Immunotherapies by Pterostilbene Containing Compositions”.

20

We had a net loss of approximately $0.996 million in 2017 compared to a net loss of approximately $1.06 million in 2016.

Net sales decreased $2,158, from $5,009 to $2,851, for the years ended December 31, 2016 and 2017, respectively. This decrease was mainly lack of marketing resources to promote the Company’s nutraceutical line of products.

Cost of goods sold decreased $783, from $1,606 to $823, for the years ended December 31, 2017 and 2016, respectively. This decrease was mainly due to lower net sales of the Company’s new nutraceutical line of products in 2017 vs 2016

Operating expenses for the years ended December 31, 2017 and December 31, 2016 were approximately $0.886 million and $1.046 million, respectively, a decrease of $0.158 million. This decrease was mainly due a combination of decreased general and administrative expenses, increased salaries, wages and related costs, a decrease in consulting fees, and an increase in legal and accounting fees.

General and administrative expenses decreased approximately $14 thousand, from $121 thousand to $107 thousand, for the years ended December 31, 2016 and 2017, respectively. This decrease was mainly due to a decrease in bad debt expenses during the year.

Salaries, wages and related expenses increased approximately $48 thousand, from $355 thousand to $403 thousand, for the years ended December 31, 2016 and 2017, respectively. This increase was mainly due to an increase in officers’ salaries.

Selling expenses increased approximately $1.8 thousand, from $1.5 thousand to $3.3 thousand, for the years ended December 31, 2016 and 2017, respectively. This increase was mainly due to increased selling and marketing expenses related to the Company’s nutraceutical line of products.

Consulting fees decreased approximately $286 thousand from $356 thousand to $70 thousand for the years ended December 31, 2016 and 2017, respectively, due to a decrease in overall consulting services during 2017.

Legal and professional fees increased approximately $77 thousand, from $201 thousand to $278 thousand for the years ended December 31, 2016 and 2017, respectively, due to an increase in overall accounting, patent and general counsel services.

Research and Development costs increased approximately $14 thousand, from $11 thousand to $25 thousand, for the years ended December 31, 2016 and 2017, respectively. This increase was mainly due to research and development expenses related to the Company’s nutraceutical line of products.

Loss on derivative liability increased approximately $84 thousand from $0 to $84 thousand for the years ended December 31, 2016 and 2017, respectively. This increase was due to a derivative liability loss from certain convertible notes in 2017 compared to 2016. This loss was partially offset by a $26 thousand change in the fair value of derivative liability during the year ended December 31, 2017, compared to a $0 change during the year ended December 31, 2016.

Net interest expense increased approximately $33 thousand from $20 thousand to $53 thousand for the years ended December 31, 2016 and 2017, respectively. This increase was mainly due to increased debt balances.

Liquidity and Capital Resources

We have experienced recurring losses over the past years which have resulted in accumulated deficits of approximately $5.3 million and a working capital deficit of approximately $1.3 million at December 31, 2017. These conditions raise significant doubt about the Company’s ability to continue as a going concern. The Company’s ability to continue as a going concern is contingent upon its ability to secure additional financing, increase sales of its products and attain profitable operations. It is the intent of management to continue to raise additional capital. However, there can be no assurance that the Company will be able to secure such additional funds or obtain such on terms satisfactory to the Company, if at all.

There is no guarantee we will receive the required financing to complete our business strategies, and it is uncertain whether future financing will be available to us on acceptable terms. If financing is not available on satisfactory terms, we may be unable to continue, develop or expand our operations.

Off-Balance Sheet Arrangements.

We currently do not have any off-balance sheet arrangements.

21

ITEM 7A QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK.

Not required for a “smaller reporting company”.

ITEM 8 FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA.