2010

Analyst Day Iridium Communications Inc.

December 16, 2010

Exhibit 99.1 |

Welcome

& Agenda Steve E. Kunszabo, Exec. Director Investor Relations

December 16, 2010 |

Forward-Looking Statements

3

Safe Harbor Statement

This presentation contains statements about future events and expectations known as

“forward-looking statements” within the meaning of Section 27A of

the Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the Securities

Exchange Act of 1934, as amended (the “Exchange Act”). We have based

these statements on our current expectations and the information currently

available to us. Forward-looking statements in this presentation include

statements regarding the expected duration of the existing constellation;

expected growth in revenue, subscribers, Operational EBITDA and Operational EBITDA

margins; the transition to the Iridium NEXT constellation; features of the

Iridium NEXT system; expected Iridium NEXT project costs and deployment schedule; the ongoing

availability and adequacy of the Iridium NEXT financing; and hosted payload

opportunities. Other forward-looking statements can be identified by

the words "anticipates," "may," "can," "believes," "expects," "projects," "intends," "likely," "will," "to be" and other

expressions that are predictions of or indicate future events, trends or prospects.

These forward-looking statements involve known and unknown risks,

uncertainties and other factors that may cause the actual results, performance or achievements of

Iridium to differ materially from any future results, performance or achievements

expressed or implied by such forward-looking statements. These risks and

uncertainties include, but are not limited to, uncertainties regarding expected Operational EBITDA

and Operational EBITDA margins, growth in subscribers and revenue, overall Iridium NEXT

costs, the company’s ability to continue to borrow under the Iridium NEXT

financing, potential delays in the Iridium NEXT deployment, levels of demand for mobile

satellite services (MSS), and the company’s ability to maintain the health,

capacity and content of its satellite constellation, as well as general industry

and economic conditions, and competitive, legal, governmental and technological factors. Other factors

that could cause actual results to differ materially from those indicated by the

forward-looking statements include those factors listed under the caption

"Risk Factors" in the company's Quarterly Report on Form 10-Q for the quarter ended September 30, 2010,

filed with the Securities and Exchange Commission on November 9, 2010. There is no

assurance that Iridium's expectations will be realized. If one or more of these

risks or uncertainties materialize, or if Iridium's underlying assumptions prove incorrect, actual

results may vary materially from those expected, estimated or projected.

Readers are cautioned not to place undue reliance on these forward-looking

statements, which speak only as of the date hereof. We undertake no obligation to

release publicly any revisions to any forward-looking statements after the date they are made,

whether as a result of new information, future events or otherwise.

|

Non-GAAP Financial Measures

4

Reporting Entity

For comparison purposes, we have presented the operating results of Iridium Holdings

LLC and Iridium Communications Inc. on a combined basis for the year ended

December 31, 2009 along with the Iridium Holdings LLC operating results for 2008. The combined 2009 presentation is

a simple mathematical addition of the pre-acquisition results of operations

of Iridium Holdings LLC for the period from January 1, 2009 to September

29, 2009 and the post-acquisition results of operations of Iridium Communications Inc. for the three months ended December 31,

2009. Please note that this presentation is different from the “combined”

presentation that we include in the ‘Management’s Discussion and

Analysis’ section of our Form 8-K filed on May 10, 2010, which combined the

pre-acquisition results of operations of Iridium Holdings LLC for the period

from January 1, 2009 to September 29, 2009 with the full-year 2009 results of operations of Iridium Communications Inc., both pre-

and post-acquisition. Iridium Communications Inc. had no material operating

activities from the date of formation of GHL Acquisition Corp. until the

acquisition. There are no other adjustments made in the combined presentation. This presentation is intended to facilitate the

evaluation and understanding of the financial performance of the Iridium business on a

year-to-year basis. Management believes this presentation is useful in

providing the users of our financial information with an understanding of our results of operations because there were

no material changes to the operations or customer relationships of Iridium as a result

of the acquisition of Iridium Holdings LLC by GHL Acquisition Corp.

Non-GAAP Financial Measures

In addition to disclosing financial results that are determined in accordance with U.S.

GAAP, we disclose Operational EBITDA, which is a non- GAAP financial measure,

as a supplemental measure to help investors evaluate our fundamental operational performance. Operational EBITDA

represents earnings before interest, income taxes, depreciation and amortization,

Iridium NEXT revenue and expenses (for periods prior to the commencement of

operations of Iridium NEXT), stock-based compensation expenses, transaction expenses associated with the acquisition, the

impact of purchase accounting adjustments, and changes in the fair value of warrants.

We also present Operational EBITDA expressed as a percentage of total revenue,

or Operational EBITDA margin. Operational EBITDA does not represent, and should not be considered, an

alternative to GAAP measurements such as net income, and our calculations thereof may

not be comparable to similarly entitled measures reported by other companies. A

reconciliation of Operational EBITDA to net (loss) income, its comparable GAAP financial measure, is in the

attached appendix. By eliminating interest, income taxes, depreciation and

amortization, Iridium NEXT revenue and expenses (for periods prio to the

deployment of Iridium NEXT only), stock-based compensation expenses, transaction expenses associated with the acquisition, the impac

of purchase accounting adjustments and changes in fair value of the warrants, we

believe the result is a useful measure across time in evaluating our fundamental

core operating performance. Management also uses Operational EBITDA to manage our business, including in

preparing its annual operating budget, financial projections and compensation plans. We

believe that Operational EBITDA is also useful to investors because similar

measures are frequently used by securities analysts, investors and other interested parties in their evaluation of

companies in similar industries. As indicated, Operational EBITDA does not include

interest expense on borrowed money or the payment of income taxes or

depreciation expense on our capital assets, which are necessary elements of our operations. It also excludes expenses in

connection with the development, deployment and financing of Iridium NEXT. Since

Operational EBITDA does not account for these and other expenses, its utility as

a measure of our operating performance has material limitations. Due to these limitations, our management does not

view Operational EBITDA in isolation and also uses other measurements, such as net

income, revenue and operating profit, to measure operating performance. |

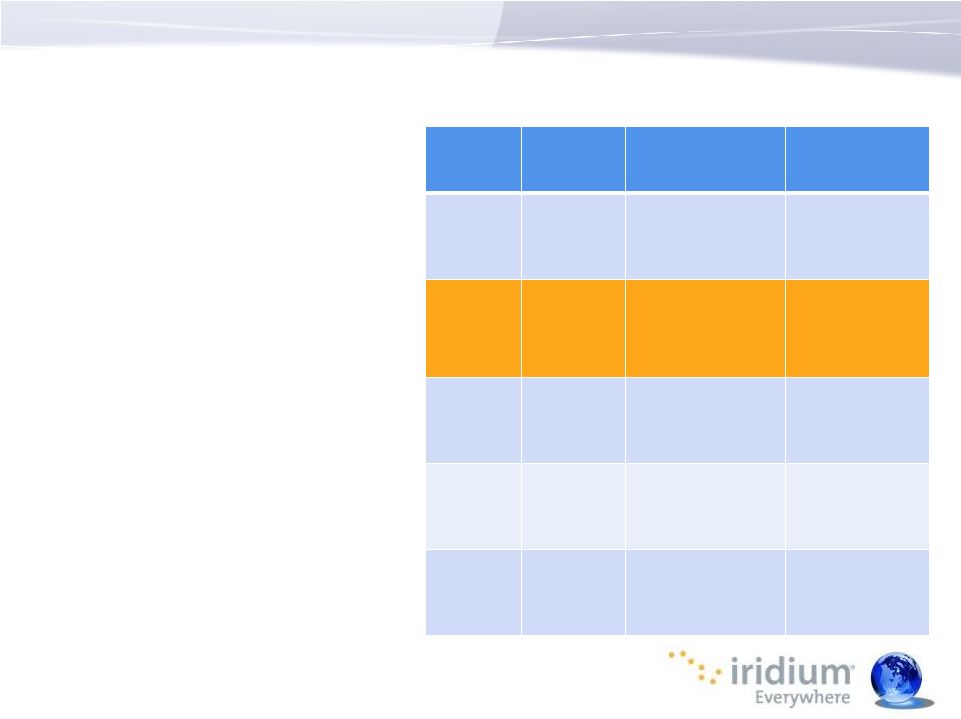

Agenda

Welcome & Agenda

Steve Kunszabo

Exec.

Director, Investor Relations

Corporate Strategy

Matt Desch

Chief Executive Officer

Commercial Business

Don Thoma

EVP, Marketing

Government Business

Gen. John Campbell

EVP, Government Programs

Iridium NEXT

Scott Smith

EVP, Iridium NEXT

Hosted Payloads

Don Thoma

EVP, Marketing

Financial Overview

Tom Fitzpatrick

Chief Financial Officer

5 |

Corporate Strategy Overview

Matthew J. Desch, Chief Executive Officer

December 16, 2010 |

Delivering

Value for Our Shareholders Network leadership

Significant operating

leverage

•

Fast growing target markets in key commercial sectors

and government

•

Favorable competitive dynamics with high barriers to

entry

•

Need for mobility in absence of terrestrial coverage

Attractive and

growing markets

Strong cash flow &

deleveraging

•

100% global coverage and unique mesh architecture

provides sustainable competitive advantage

•

Healthy current constellation supports ongoing growth

•

Fully funded business plan for Iridium NEXT

•

Recurring service revenue business with a robust

product portfolio

•

Maturing, #2 mobile satellite player with track record

of strong results

•

Large, low-cost and growing ecosystem of partners

•

Operating leverage and fixed-cost model expands

margins and grows cash flow

•

Future deleveraging magnifies equity appreciation

7 |

Iridium

Communications Overview Second

largest

provider

of

mobile

voice

and

data

services

via

66

in-

orbit satellites to commercial and government customers

•

Serving 413,000+ customers

across the land-based handset,

maritime, aviation, machine-to-

machine (M2M) and government

markets

•

Anchor U.S. DoD

customer

represents 23% of revenue

(1)

•

LTM revenue of $336 million and

Operational EBITDA (OEBITDA) of

$147 million

•

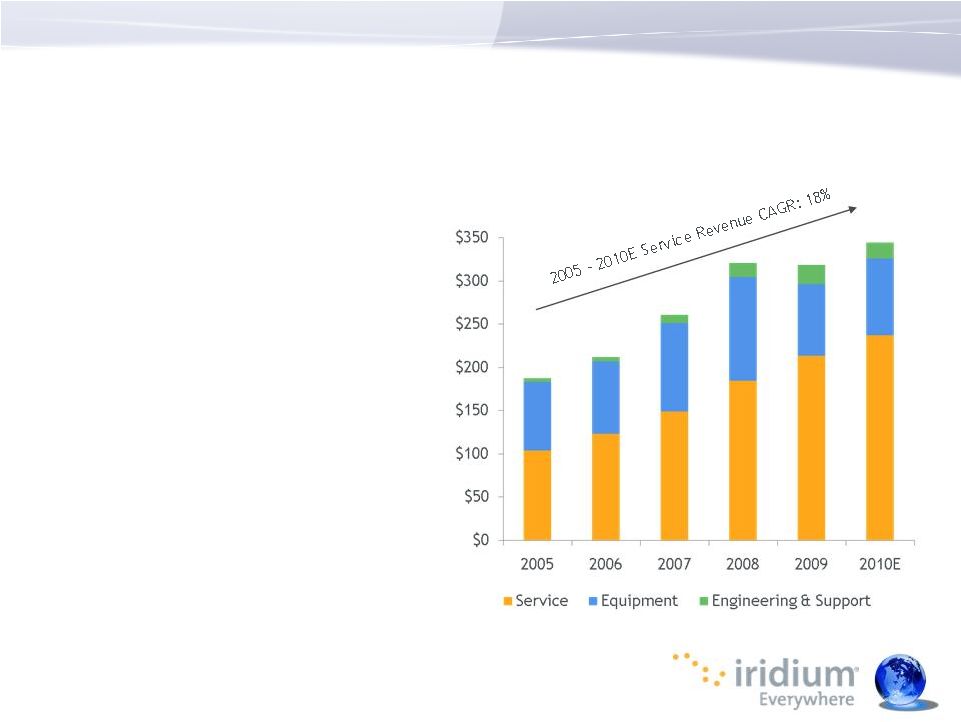

2005-2010E service revenue and

OEBITDA CAGRs

of 18% and 26%

(1)

8

For the LTM period ended 9/30/10. Includes direct and indirect

DoD revenue and revenue from certain other governmental entities through

the DoD gateway. |

A

Transformative Period in Our History •

GHL Acquisition Corp. acquired Iridium Holdings LLC in September

2009 and

changed name to Iridium Communications Inc.

•

Relisted on the NASDAQ Stock Market, paid off historic debt and provided

considerable initial liquidity

•

Raised $1.8 billion of export credit financing in October 2010 with attractive

borrowing costs and good terms over a long period of time

•

A track record of consistent execution --

delivering strong results with

growth through the recent recession

•

Strong management team with decades of experience in satellite and

telecom

services

and

a

history

of

delivering

what

we

promise

We now have tremendous flexibility to execute our business plan

9 |

Attractive and Growing MSS Market

MSS

Provider

2009

Revenue

(2)

Network

Architecture

Core Markets

Inmarsat

$695M

(3)

GEO with no polar

coverage, bent

pipe architecture

Maritime & Land

Broadband,

Aviation

Iridium

$319M

LEO with 100%

coverage and

crosslinks

Handheld Voice,

Maritime

Broadband,

M2M, Aviation

Thuraya

$127M

Regional GEO with

no polar or western

hemisphere

coverage

Regional

Handheld Voice

& Land

Broadband

Globalstar

$64M

LEO with satellite

failures; bent pipe

architecture

One-Way

Personal Locator

Beacons & M2M

Orbcomm

$28M

LEO with no polar

coverage, bent

pipe architecture

M2M

•

MSS market generated $1.3

billion in 2009 revenue

(1)

•

MSS industry revenue CAGR of

10% expected between 2010

and 2015

(1)

•

Differentiated network

technology creates sustainable

competitive advantages

•

Revenue quality and diversity

from serving multiple core

markets

•

Superior functionality and

device innovations

10

(1)

Northern Sky Research (2010) for MSS L-Band market

(2)

Based on publicly reported 2009 revenue except for Thuraya. Thuraya is an

estimate of 2009 revenue from TMF Associates. (3)

Inmarsat Global (MSS) results |

Maritime

Aviation

Government

Land/Mobile

Machine-to-Machine

Fastest Growing

Value Provider

•

Large addressable

market and limited

competition

•

Growth in data services

•

High average revenue

per user and customer

retention

Value Provider for

General Aviation;

Commercial

Opportunity

•

Large and expanding

addressable market

•

Growth in data services

•

Sustainable competitive

advantage from network

coverage

Mission-Critical

Partner

•

A trusted, reliable and

secure partner for the

government ecosystem

•

Ongoing strength in

traditional voice and

Netted Iridium

•

Growth in data services

•

Serve non-U.S.

government agencies

Foundation for

Success as Market

Leader

•

Premium product and

service

•

Competitive cost

structure

•

True mobility and global

coverage

•

Maintain strong position

despite emerging

competitive threats

Fastest Growing

Premium Provider

•

Large and expanding

addressable market

•

Increasingly important

contributor to overall

growth

•

Millions of potential

devices with unlimited

applications

•

Complementary

to

terrestrial wireless

Favorable Competitive Dynamics & Positioning

11 |

Licensing

New Markets

Expanding

Distribution

Network

Provide New,

Lower Cost

Products

Hosted

Payloads

Iridium’s Growth Pillars

Established and proven business model provides

foundation for new growth opportunities |

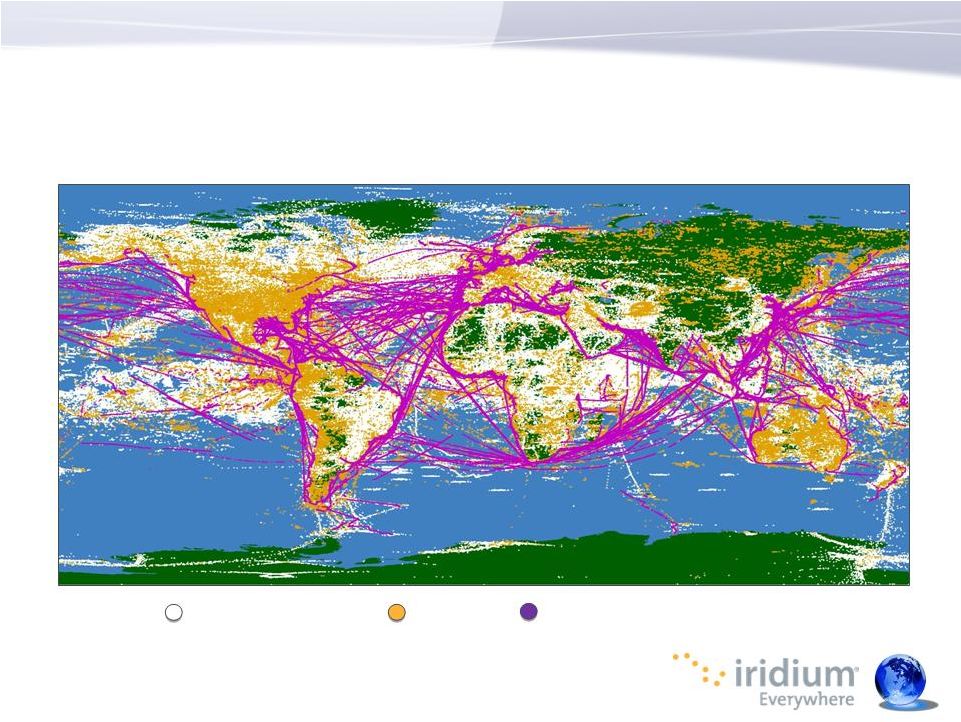

M2M

(SBD) Data Transmission Voice Call

High-Speed Data Traffic

Note: One week plot of M2M/SBD session, voice call and high-speed

data origination points for the week of 11/7/10 to 11/13/10 (commercial traffic

only) Diverse network traffic with significant growth opportunities

Network Leadership Fuels Global Usage

13 |

Revenue

Quality & Significant Operating Leverage Growing cash flow driven by recurring

service revenue and largely fixed-cost business model

•

Fast-growing enterprise and

government subscriber base

•

Predictable and expanding

service revenue

•

Incremental sales at a high

gross margin contribute to

growing profitability

•

High-quality, recurring service

revenue is cornerstone of

expanding margins

14

($ in millions)

55

%

$0

$50

$100

$150

$200

$250

$300

$350

2005

2006

2007

2008

2009

2010E

69

%

Engineering & Support

Service

Equipment

OEBITDA |

Iridium

NEXT Positions Us for the Future Fully funded approximately $3 billion plan that

supports our success for many years

•

Compatibility with existing

network and devices

•

Seamless network transition and

customer continuity

•

66 new operational satellites,

6 in-orbit spares and 9 ground

spares

•

Scheduled early 2015 first

launch, completion by 2017

•

Ongoing relationship with Boeing

for operations --

10-year track

record, lower operational costs

15

Note: Fully funded approximately $3 billion business plans assumes borrowings

under the $1.8 billion Coface financing agreement, projected

Operational EBITDA and hosted payload net contributions |

YTD 2010

Financial Performance Strong financial results highlighted by record service

revenue and OEBITDA in the third quarter of 2010

Revenue

$260M

7%

OEBITDA

$117M 13%

OEBITDA Margin

44%

YTD10

YOY Growth

Service Revenue $133M 11%

Subscribers

371,000

21%

YTD10

YOY Growth

Service Revenue $43M

8%

Subscribers

42,000 27%

YTD10

YOY Growth

Revenue

$69M

5%

Gross

Margin

44%

(1)

YTD10

YOY Growth

(1)

Equipment gross margin excludes purchase accounting adjustments of $10.9 million

16

Iridium Communications

Service -

Commercial

Service -

Government

Equipment |

Comparative Valuation Considerations

12/06/10 Share Price

$9.29

$10.67

Outstanding Shares

(1)

74

489

Market Capitalization

$687

$5,218

Total Gross Debt

(2)

$158

$1,353

Less: Cash & Equivalents

(2)

$111

$185

Net Debt

$47

$1,168

Enterprise Value

$734

$6,386

Divided

by:

2011E

OEBITDA/EBITDA

(3)

$185

$714

EV/EBITDA Multiple

3.9x

8.9x

Faster

revenue

growth rates

More room

for margin

expansion

17

(1)

Includes outstanding shares and the value of outstanding warrants using the treasury

stock method (2)

Balance sheet data as of 10/31/2010 for Iridium including $135 million draw under

Coface financing agreement; balance sheet data as of 9/30/10 for

Inmarsat based on company financial statements (3)

Represents midpoint of 2011 Operational OEBITDA outlook for Iridium; RBC

Capital Markets EBITDA estimate for Inmarsat Note: In millions except per

share data; Inmarsat share price data converted to U.S. Dollars |

Why Will

Iridium Continue to Win? Network leadership

Significant operating

leverage

Favorable competitive dynamics

in evolving markets…

Attractive and

growing markets

Strong cash flow &

deleveraging

…with a healthy current constellation and

fully funded plan for Iridium NEXT…

…and a track record of execution –-

recurring

service revenue business with strong

OEBITDA growth…

Delivers equity appreciation

18 |

Commercial Business Overview

Don Thoma, EVP Marketing

December 16, 2010 |

Superior

Network Attractive Market Opportunity

#1 or #2 Position in Each of

Our Core Markets

Diverse and Growing Product Set

Accelerated by Licensing Technology

Expanding Distribution Network

New Geographic Markets

Commercial Service/Market Growth Is Driven by...

20 |

Long-Term Track Record

Focus on recurring service revenue growth and profitable equipment

contribution

•

2005-2010E commercial

service revenue CAGR of 24%

•

2005-2010E government

service revenue CAGR of 6%

21

($ in millions)

$0

$50

$100

$150

$200

$250

$300

2005

2006

2007

2008

2009

2010E

Commercial Service

Government Service |

Significant Network Advantage

•

Global coverage and consistency --

pole to pole

•

True mobility –-

communications

on the move

•

Very reliable & resilient

•

Inherently secure –-

valued by

government customers

22 |

(1)

Northern Sky Research (2010) for MSS L-Band market

•

Attractive

MSS

market

generating

$1.3

billion

in

2009

revenue

(1)

•

MSS industry revenue expected to grow at a CAGR of

10%

between

2010

and

2015

(1)

Total 2009 Revenue: $1.3 billion

Total MSS Market Share 2009

Other 3%

Globalstar

7%

Thuraya

–

10%

Iridium –

26%

Inmarsat

-

52%

Orbcomm

2%

Total MSS Market Share 2001

Inmarsat

-

79%

Iridium –

9%

Globalstar

1%

Thuraya

–

7%

Other4%

Strong Position in Growing Market

23

Total 2001 Revenue: $0.6 billion |

Mission

Critical Communications for Customers Position

Key

Competitors

Market

Growth

Growth

Strategy

Iridium

Advantage

Land

M2M

Maritime

Aviation

Government

(1)

Northern Sky Research (2010) for MSS L-Band market

24 |

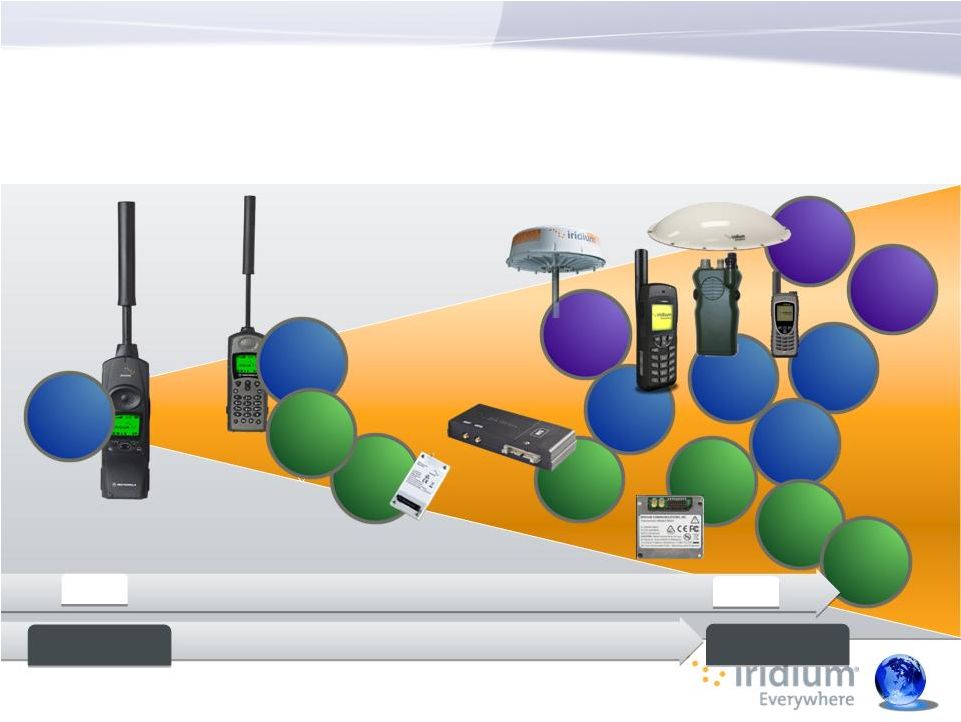

43% of

cumulative service revenue growth from new products during the last three

years Iridium

OpenPort

High

Functionality

Handset

Low Cost

Handset

Original

Motorola

Voice

Handset

Iridium

9505A

M2M

9601

Voice

& Data

Modem

iGPS

M2M

Chipset

M2M

9602

Iridium

9522B

Iridium

9555

U.S. DOD

Tactical Radio

(Netted)

Pre-NEXT

Devices

Iridium

Aero

OpenPort

Accelerating Growth Through Service Innovations

25

0

Partners

>

240

Partners

2001

2010 |

•

Enabling valuable partner solutions by licensing core technology

--

Iridium Connected

•

Accelerating recurring revenue streams

•

Accessing new markets with a wide array of applications

Technology

Licensing

Strategy

–

Iridium

Connected

26 |

•

Wholesale distribution model

lowers costs and risks

•

Growing channel of hundreds

of distribution partners

•

Partners provide “outsourced

R&D”

to develop specialty

products for customer

segments

•

>240 applications targeting

key vertical markets

Expanding Distribution Network Ensures Market Reach

27

End Customers

EVERYWHERE

Global

Distributors

Value Added

Specialized

Solutions

Service

Providers

(SPs)

VARs

VAMs

Iridium

VADs |

New

Geographic Opportunities •

Distribution presence in over 100 countries

•

Potential distribution presence in certain countries offering large growth

opportunity: Russia, China, India --

population of 2.7 billion

(1)

Major Opportunities

Licenses recently received

Pursuing Access to Large New Markets

28

(1)

CIA World Factbook (2010) |

Growth in

Core Markets 29

LAND

AVIATION

MARITIME

M2M

GOVERNMENT |

(1)

Northern Sky Research (2010) for MSS L-Band market; CAGR through 2015

30

Iridium is the Market Leader

•

Premium product and service

•

Unmatched performance

advantage over competition

•

True mobility, global coverage,

reliability

•

Low cost manufacturer of handsets

Evolving Market

•

Need for connectivity by remote

enterprise, emergency responder, and

government customers

•

Re-emerging competition

•

2011 market and market growth

similar to 2006/2007 time period

•

2009 market

(1)

•

650K installed base; 5-year CAGR 6%

•

Revenue of $350 million; 5-year

CAGR 2%-3%

Land/Mobile Market –

The Market Leader |

Expanding product portfolio

sustains leadership

•

Introduce premium phone for the

high-end segment

•

Enhance value through new

location-based and data services

•

Defend price sensitive segment

with less feature-rich phone

•

Create new segments with

commercial netted services

•

Devices will continue to make

meaningful margin contribution

Multiple Growth Paths

Performance (Capability, Coverage)

Globalstar

Thuraya

Inmarsat

Iridium

Value

Phone

Premium

Phone &

Services

LAND

Portfolio Strategy Drives Service Revenue

31 |

Premium

Service Provider •

Significant network advantage

•

Coverage

•

Latency

•

Throughput

•

Cost competitive hardware

•

Strong and diverse reseller base

Large, Expanding Market

•

Fastest growing segment piggybacking

on terrestrial wireless data market --

“The Internet of Things”

•

Diverse value-added solutions for

enterprise customers

•

2009 market

•

2.5 million devices; 5-year

CAGR 18%

(1)

•

Revenue of $700 million; 5-year

CAGR 14%

(2)

M2M

32

M2M Market –

Fastest Growing, Premium Provider

(1) Frost & Sullivan World Satellite M2M Market (2010), CAGR through 2015

(2) Includes FSS units (Qualcomm, Inmarsat C, VSAT SCADA)

|

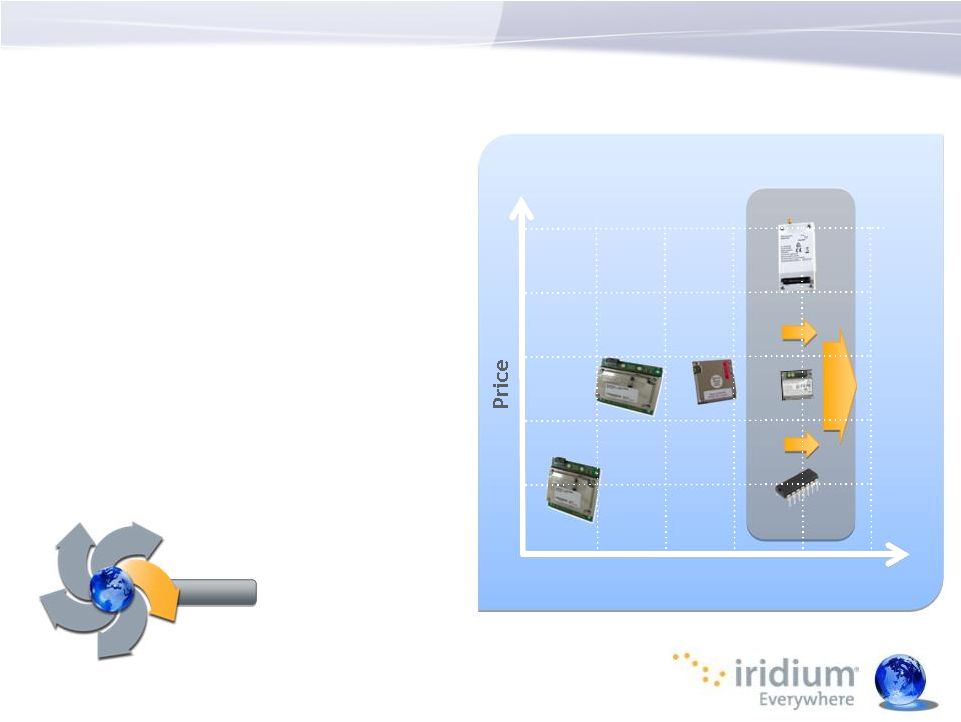

Accelerate Customer Growth

•

Introduce smaller, lower-cost

modems --

decrease cost of access

•

License technology to increase

breadth and depth of applications

•

Partners developing new, unique

applications across a variety of

markets

•

Enable consumer-oriented

applications --

personal locator

beacons

Growth Opportunities

Performance (Capability, Coverage)

Orbcomm

9602

Inmarsat

Enhanced

Services

Chipset

Globalstar

Iridium

9601

M2M

M2M Device Strategy Fuels Growth

33 |

Maritime

Market – The Value Provider

MARITIME

(1)

Northern Sky Research (2010) for MSS L-Band market; CAGR through 2015

34

Fastest Growing, #2 Player

•

Historic growth in voice and

low-speed data

•

Attractive value proposition to

price sensitive market

•

IP data plus 3 phone lines

•

Addresses ship’s business and crew

morale in single package

•

Attractive recurring service revenue

of $450-500 per month

Growth Driven by Data

•

Internet connectivity, regulatory

mandates, crew communications

•

<25% of 220,000 ship addressable

market have adopted high speed data

(1)

•

Common for merchant ships to employ

multiple devices on each ship

•

2009 Market

(1)

•

Addressable market: merchant ships (55K),

large fishing vessels (40K), yachts (125K)

•

261K installed terminals; 5-year CAGR 12%

•

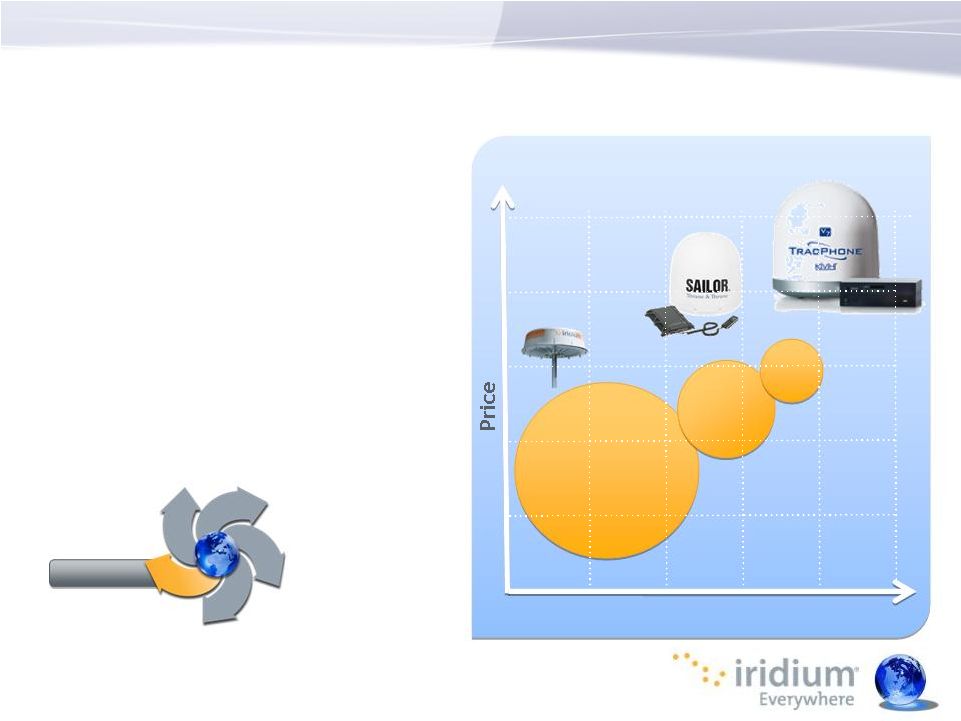

Revenue of $509 million; 5-year CAGR 11% |

Iridium

OpenPort •

Expanding data services into

larger, underserved markets

•

Crew calling drives revenue

•

Enables backup solution for VSAT

Data Growth Opportunity

Data Capability

Circle size = size

of

terminal market

< 128 kbps

< 512

kbps

Inmarsat

FB 500

Maritime

VSAT

MARITIME

< 1 Mbps

Iridium

Driving Growth in Maritime High-Speed Data

35 |

AVIATION

Aviation Market –

The Value Provider

(1)

Northern Sky Research (2010) for MSS L-Band market; CAGR through 2015

36

Connectivity Driving Demand

•

Leading provider to general aviation

and helicopter fleets

•

Competitive advantage in size, weight

and cost over competition

•

Flight safety voice and data for airlines

•

Oceanic and polar coverage

The #1 Value Provider

•

<20% of addressable market have satcom

•

Need for cost-effective tracking and

cockpit communications (voice and data)

•

Passenger broadband gaining momentum

•

2009 Market

(1)

•

Addressable market: 150,000

commercial airliners, business jets,

general aviation and government

•

32K devices; 5-year CAGR 12.5%

•

Revenue of $130 million; 5-year

CAGR 13% |

Data

Throughput < 1 Mbps

~$500,000

Swift

Broadband

Growth in Cockpit and Cabin

•

Attractive value proposition drives

growth in air transport safety

communications

•

Iridium Aero OpenPort

--

enables

cost-effective access to fast

growing broadband market

•

Blackberry on airplanes

•

UAV market underserved, demand

for bandwidth and coverage

Supports New Growth

< 128 kbps

~$50,000

< 512 kbps

~$250,000

Iridium

VSAT

AVIATION

Expanding the Aviation Market

37 |

The

Iridium Ecosystem - A Powerful Growth Engine

38 |

•

Attractive position in growing markets

•

Competitive landscape is known --

we have unique advantages and new

entrants are unlikely

•

Solid product portfolio with many new products fueling growth and leading

the transition to Iridium NEXT

•

Scalable distribution network that leverages R&D, expertise and reach of

partners

A Growth Business

39 |

Commercial Business Q&A Panel

Matt Desch

Chief Executive Officer

Don Thoma

EVP Marketing |

Morning

Break and Product Marketing Table |

42

Government Business Overview

Lt. Gen. John H. Campbell, USAF (Ret.)

EVP Government Programs

December 16, 2010 |

Evolution

of the U.S. Government Relationship A ten-year track record of growth from a

niche supplier of phones to an integral element in the communications

infrastructure •

A unique value proposition

(global, secure) that is not

easily duplicated

•

Expanding service portfolio

•

Significant USG investment in

devices and dedicated

gateway

•

Robust partner channel

•

Future growth supported by

Iridium NEXT and hosted

payloads

($ in millions)

43 |

•

Serves all DoD

branches, other

USG agencies and foreign

governments

•

Five-year

(1)

contract signed in

2008

•

Simple fixed-fee voice and

tiered data pricing structure

•

Significant R&D funding source

•

Growing Non-DoD

government

revenue through commercial

gateway

U.S. Government Services Market Overview

Remains a large and important customer that complements growth

in our commercial markets

44

(1)

As is customary for government contracts, Iridium’s DoD contact is structured as a

five-year contract with one base year and for one-year options to

extend. Iridium’s contract is currently in the second year of optional extension,

making this the third overall year of the DoD contract. Two one-year option

periods remain. |

Netted:

Distributed

Tactical

Communications System that leverages

our constellation to provide beyond line-

of-sight push-to-talk tactical radio

Data:

Circuit-switched

and

low-latency

M2M

services deployed for asset/personnel

tracking, unattended sensors and

specialized applications

DoD

Gateway:

Ties it all

together in a secure package

Handset:

Only secure, encrypted

commercial SATCOM handset for

government users

U.S. Government Product Portfolio

45

2010E Subscribers

& Y-O-Y Growth

Netted

3600%

M2M

138%

Paging

4%

Handset

4% |

46

Netted Iridium: Expeditionary Communications

DoD’s

investment in Netted Iridium is indicative of long-term

commitment as key element of its communications architecture

•

Newest and fastest growing

USG service --

greater than

5,300 fielded in 2010

•

Funded operational priority by

DoD

with significant R&D

through 2011

•

Bridge to new products in

commercial market drives

additional growth

•

Ability to embed solutions in a

growing number of devices

Basic Radio

Command/Control

Radio

Regional Nets Provide

Push-to-Talk Communications |

Strength

of Government Relationship •

U.S. government investment in product and application pipeline to meet

operational needs

•

Robust network of partners, close customer relationships, targeted

competitive strategy and partner R&D

•

Leverage U.S. government and partner investments

Highly scalable, low-cost approach to product development and

distribution minimizes our investment

USER NEED

VALIDATED

REQUIREMENT

DEVELOPMENT

FUNDED PROGRAM

PRODUCTION/DEPLO

YMENT

OPERATIONS

SUSTAINMENT

USG –

Funded Development, Competition, Acquisition

Partner Funded IR&D

Minimal Iridium Cost

47 |

Blue

Force Tracking Over-the-Horizon A/C Comms.

Medical Support

Logistics Support

Secure Voice & Data

Push-to-Talk

Personal Comms.

Personnel Tracking

48

Solutions & Partners |

49

The Future

Unique value proposition not likely to be challenged

•

Increasingly viewed as a mission-critical partner for DoD expeditionary

communications infrastructure

•

Embedded applications are “sticky”

•

New and innovative products like Netted Iridium provide enhanced

capabilities

•

Increasing demand for bandwidth and an expanding service portfolio

|

50

Network Leadership & Iridium NEXT

S. Scott Smith, EVP Iridium NEXT

December 16, 2010 |

Iridium’s Long Term Competitive Advantage

Our satellite network provides a superior and differentiated

experience for our customers

•

A unique LEO constellation sets it

apart from MEO and GEO systems --

shorter distance to satellites results

in a better customer experience

•

Cross-linked and overlapping “mesh”

architecture delivers superior

availability, efficiency, flexibility

and reliability

•

Near-polar orbit constellation truly

means “Iridium Everywhere”

51 |

52

End-of Life Source

Status

Applicability to

Iridium

Expendables (e.g.

propellants)

Fuel load in operational

satellites expected to last until

Iridium NEXT deployment

Unlikely

Wear-Out Mechanisms

Modeling indicates that

component wear-out will not

jeopardize constellation until

at least 2017

Eventually (but not in

the near-term)

Radiation

Recent testing indicates that

total dose radiation on key

parts should not be an issue

Unlikely

Orbital Debris

New operational regimen

deployed with U.S. Air Force to

monitor all significant debris

near current constellation

Unlikely

Current Constellation Health

Our current constellation is viable and healthy for years to come

and is supported by in-orbit spares

Note: Significant due diligence performed in conjunction with Coface financing

agreement regarding health of current constellation

|

53

What Is Iridium NEXT?

•

Fully replaces the current

constellation and updates the

ground system with new features

and capabilities

•

Retains 66 satellite LEO

architecture supported by 6 in-

orbit spares and 9 ground spares

•

Scheduled deployment between

early 2015 and 2017 via 8 Falcon 9

launches (9 SVs/launch)

•

Significant advantages including

expanded capacity, higher data

speeds and ability to host payloads

•

Deployment approach designed to

provide service continuity |

Planned

Evolution to Iridium NEXT Constellation 54

•

Customer products evolution –-

building on a strong track record of new and

enhanced products since 2001

•

Customer services evolution --

new and advanced data services not included

in the current constellation design

•

Ground system evolution including significant upgrades to commercial

gateway and satellite network operations center (SNOC)

•

Incremental one-for-one replacement of current constellation satellites

with Iridium NEXT satellites

A continuous and deliberate evolution from the current

constellation to Iridium NEXT |

Iridium

NEXT Service Phased Deployment Approach •

Iridium NEXT satellites provide superior processing power compared to the

current constellation –-

9x improvement in throughput and 125x

improvement in memory capacity

•

Many new service offerings can be provided due to enhanced processing

capabilities including:

•

Higher quality voice

•

Expanded capacity and operational flexibility for M2M

•

High-Speed (up to 128 kbps to mobile class equipment) and

Broadband (up to 1.5 Mbps to Iridium OpenPort class terminals)

•

Broadcast (undirected regional services at up to 64 kbps)

•

Ka-Band (>8 Mbps to fixed/transportable terminals)

55

Expanded and enhanced product portfolio supports ongoing growth

|

A World

Class Development Team •

Iridium NEXT team

•

25 seasoned aerospace and telecommunications engineers and managers

•

Hundreds of years of collective experience with significant expertise

directly applicable to building the current constellation

•

Thales Alenia Space France (Prime contractor for Iridium NEXT)

•

Global leader in satellite communications and constellation development

•

40% of suppliers are based in North America

•

Boeing

•

Onboard communications payload software development, constellation

flight operations, satellite control system development

•

Developer and operator of current constellation software

56 |

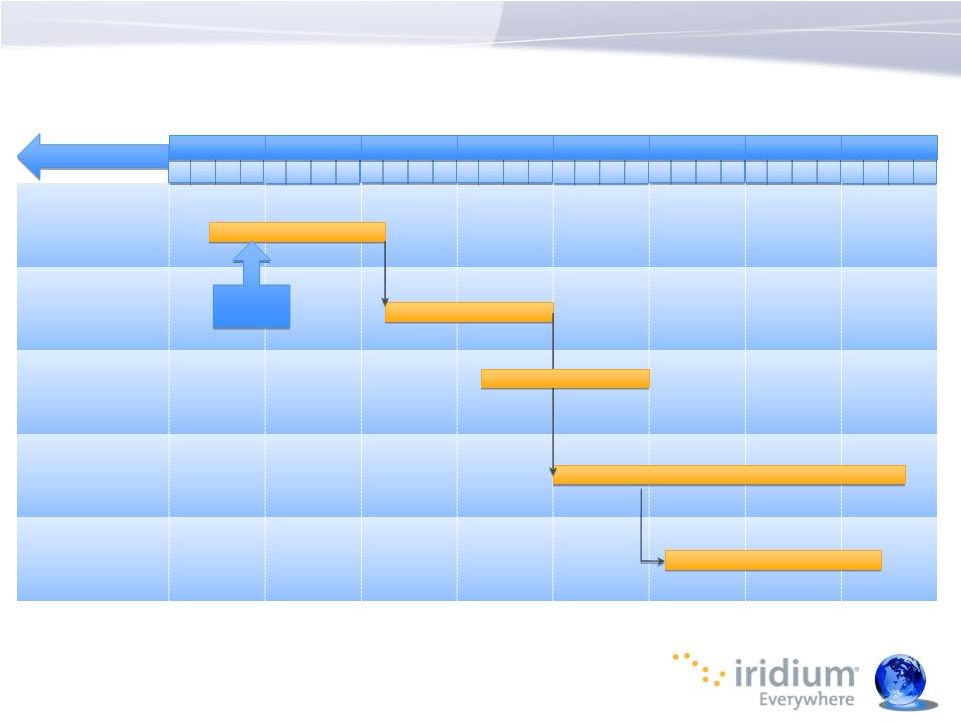

57

Iridium NEXT Development Schedule

81 SVs

(Total)

72 SVs

Launched

Constellation

Deployment

Vehicle

Integration &

Testing

Segment

Development

Detailed

Design

Requirements

Flowdown

& Prelim Design

2010

2011

2012

2013

2014

2015

2016

2017

We are

here |

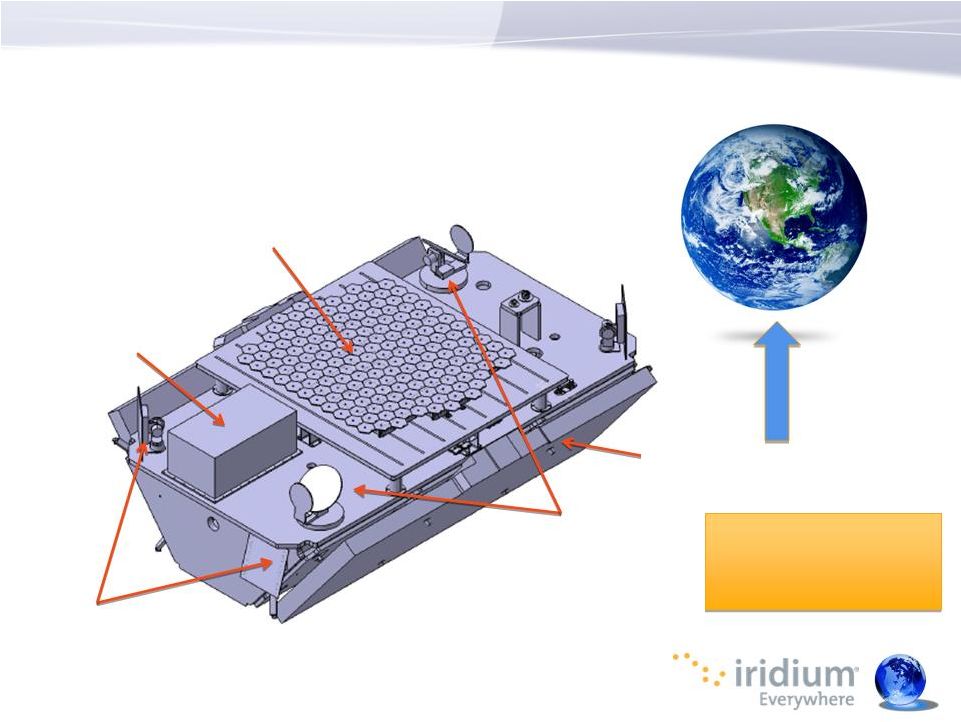

Earth-facing side

of satellite

Hosted Payload

Cross link antennas

K-band

Feeder link antennas

Ka-band

Main Mission Antenna

L-band

Stowed Solar Array

•

Mass –

850 kg

•

Dimensions –

3m x 2.4m x 1.5m

58

Spacecraft Overview (Stowed Configuration) |

•

Superior network architecture provides a sustainable competitive

advantage

•

A healthy current constellation supports ongoing growth and takes us to

the Iridium NEXT era

•

Fully funded and on schedule development plan for Iridium NEXT --

outstanding new services and backwards compatibility with existing

customer devices

•

Iridium NEXT provides meaningful, additional opportunities to support

ongoing growth

59

A Lasting Value Proposition For Our Customers |

Hosted

Payloads Overview Don Thoma, EVP Marketing

December 16, 2010 |

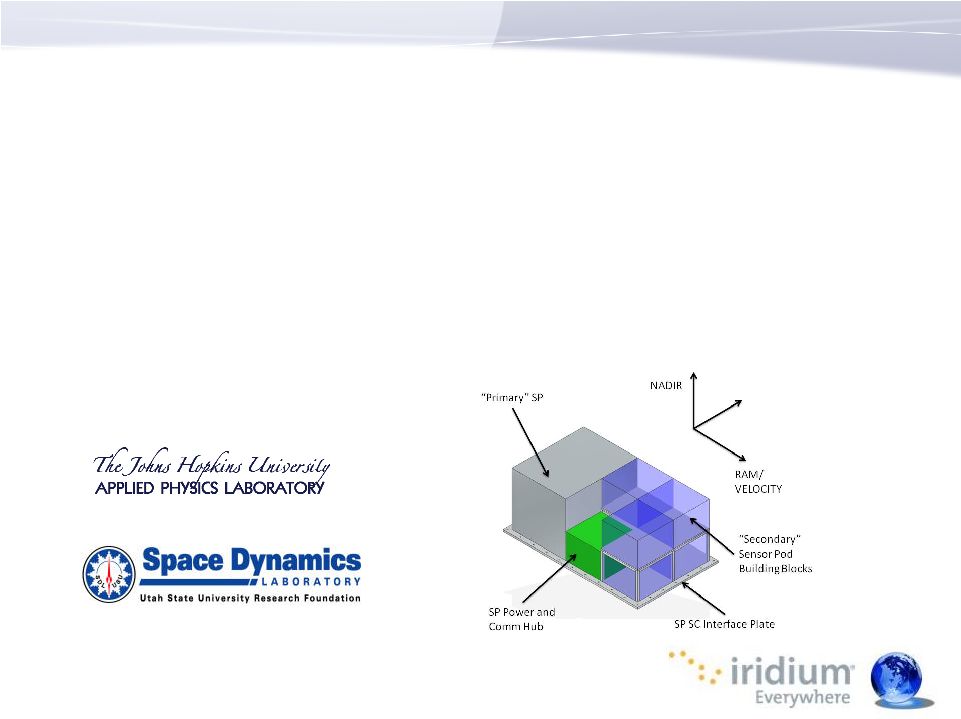

Iridium

NEXT Hosted Payload Specifications

Weight

50 kg

Payload

Dimensions

30 x 40 x 70 cm

Payload Power

50 W average (200 W

peak)

Payload Data Rate

<1 Mbps, Orbit

average ~100Kbps

•

New business opportunity to host third-party payloads on Iridium NEXT

•

Payload customer shares infrastructure of the Iridium NEXT satellite and

global networked communications architecture

•

Significant interest from government and industry for cost-effective space

missions

•

Creates new revenue and cash flow stream post-2017

Hosted

Payload

61

Iridium NEXT Hosted Payloads |

•

Unprecedented coverage --

66

interconnected satellites see entire

globe

•

Low latency --

Real-time relay of data

to and from payloads

•

User control --

Two-way secure

communications with payload

•

Cost-effective --

Access to space at a

fraction of the cost of a dedicated

mission

•

Exclusive

--

No other opportunity like

this is likely to be available for decades

•

Consistent with 2010 President’s

National Space Policy --

Commercial

capabilities, cost-effective access

62

A Unique Value Proposition on Iridium NEXT |

Hosted

Payload Opportunity Mission

Overview

US Government Mission

•

Communications mission

US Government Mission

•

Full 66 satellite mission using 20% of capacity

SensorPOD

–

Scientific Sensor

Hosting Platform/NSF

•

Fractional 5 Kg science missions (similar to cubesats)

•

Science community looking at combination of sensors on 66 satellites

•

Other customers assessing missions (NASA, USAF STP, ESA)

Global Air Traffic

Monitoring Mission

•

Commercially-financed program to sell aircraft tracking services to the FAA and

others for air traffic control

•

Extension of existing FAA terrestrial ADS-B system for CONUS

•

Coverage of ocean routes, remote areas and developing nations

Weather Monitoring

Mission –

NOAA

•

6

sensor

mission

for

operational

weather

sensor

for

atmospheric

data

•

Continuation of NOAA COSMIC program

Space Debris Monitoring

•

6

sensor

mission

for

monitoring

space

objects

and

debris

•

Input to USG space surveillance network

Other missions

•

Various US Government missions

•

Magnetosphere monitoring

•

Ka band communications capability

Tracking a growing pipeline of 15-20 potential missions

63 |

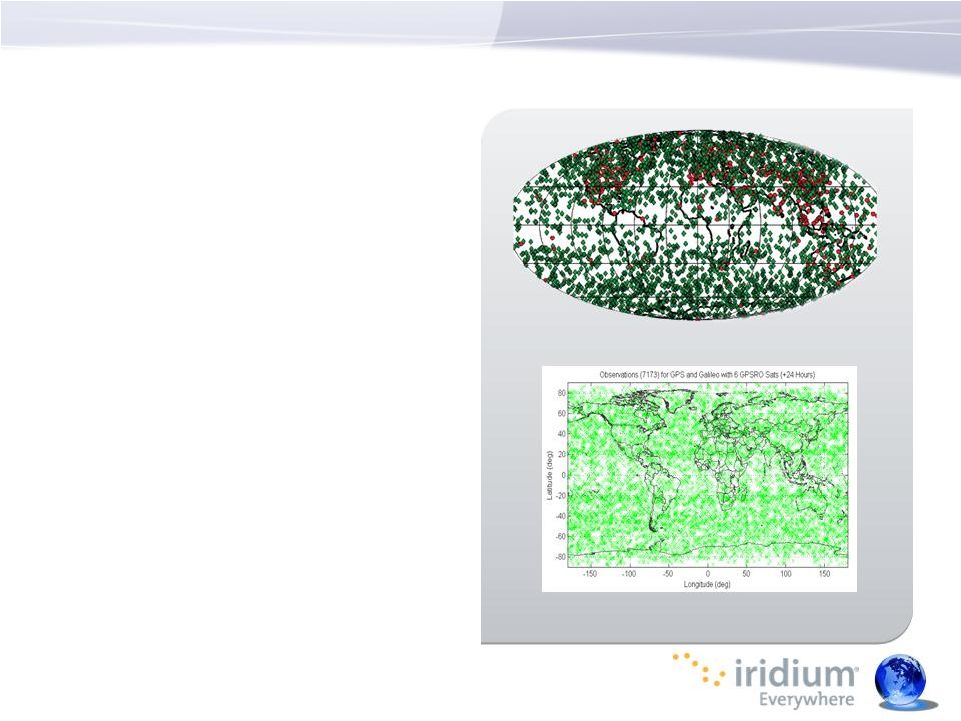

•

NOAA requirement for long-term

atmospheric data by measuring

GPS signals

•

No cost-effective plan for

obtaining data after 2014

•

Sensors on Iridium NEXT

constellation provide high quality

measurements at 50% of the cost

•

NOAA plans procurement for

2012 program start

Data Set on Iridium NEXT

Current Data Capability

64

Weather Data Monitoring |

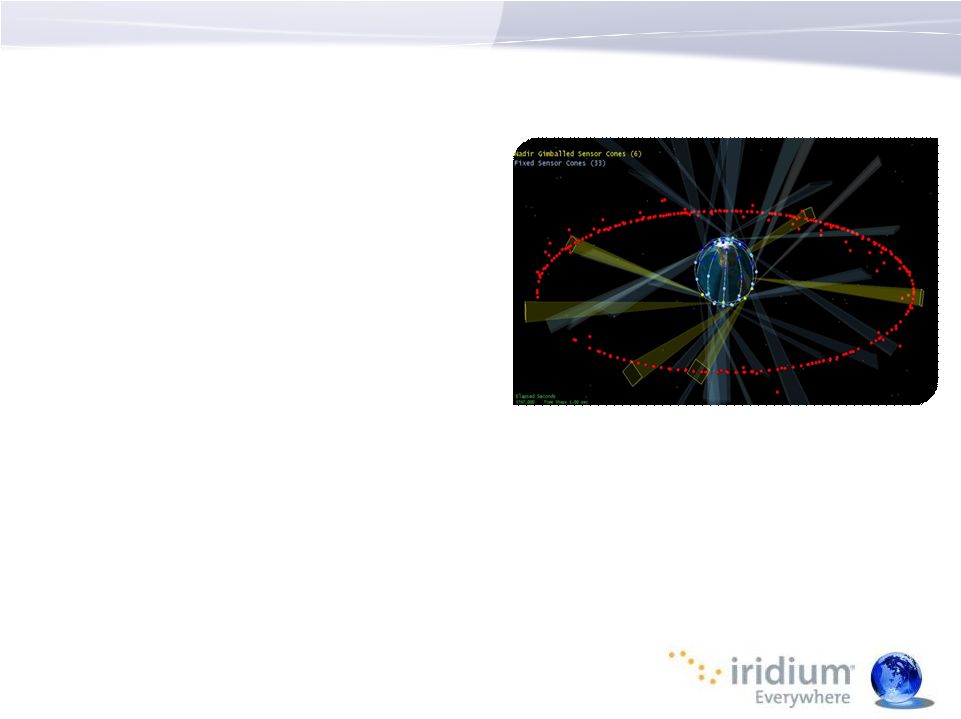

•

DoD

and commercial satellite

operators need improved debris

information to protect satellite

fleets

•

Iridium NEXT provides excellent

platform for detecting orbital

debris

•

Iridium NEXT capability

complements planned DoD

system

•

Provides early warning

•

Enhances survivability and

resiliency

•

Leverages commercial

investment in a global

communications network

65

Space Debris Monitoring |

•

FAA investing in future air traffic control infrastructure to improve

efficiencies in air traffic routes

•

Spaced-based tracking extends the terrestrial infrastructure

•

Possible commercial joint venture to finance development in 2011

•

Sell services to FAA, foreign governments, airlines and others

•

Potential significant revenue opportunity post-2017

66

Global Aircraft Monitoring From Space |

•

Capability to host small research payloads that have no cost-effective

access to space

•

Marketing and support relationship with leading research labs

•

Potential for larger funded project by National Science Foundation

•

Incremental revenue from unused hosted payload space

67

SensorPOD –

Access for Scientific Missions |

•

Many programs developed during last 3 years and the pipeline is growing

•

Activity accelerating since announcement of satellite contract and Coface

financing agreement

•

High probability programs have expertise of seasoned government system

integrators working with customer

•

U.S. Government payload opportunities require budget authorizations --

allocating funds for 2012 program starts

•

Most likely outcome --

host a combination of payloads for different

customers on the same satellite, possibly all 66

•

Expecting $200 million to $300 million net cash contribution from hosted

payloads through launch --

recurring service revenue for 2017 and beyond

•

Hosted payload contract announcements likely in 2011 and 2012 as

business

develops

68

Meaningful New Business Opportunity |

Government Business, Iridium NEXT and

Hosted Payloads Q&A Panel

Gen. John Campbell

EVP Government Programs

Scott Smith

EVP Iridium NEXT

Don Thoma

EVP Marketing |

70

Financial Overview

Thomas J. Fitzpatrick, EVP & Chief Financial Officer

December 16, 2010 |

Increasing Shareholder Returns

71

•

An established track record of rapidly growing recurring service

revenue

•

Significant operating leverage and largely fixed-cost business model create

OEBITDA margin expansion and OEBITDA growth that outpaces revenue

•

Organic growth opportunities in each business --

strong competitive

position in key market segments with an expanding service portfolio

•

Rational plan for Iridium NEXT construction and launch --

attractive

financing, long-term repayment period and manageable leverage targets

•

Greatly reduced capital expenditures after 2016

•

Rapid, highly predictable deleveraging expected after 2015 magnifies

equity appreciation |

Revenue

Quality 72

An established track record of increasing recurring service revenue

•

Predictable and expanding

service revenue

•

Commercial service revenue is

an important growth engine --

50% of total revenue in 3Q10

•

Voice leadership and growing

contributions from M2M data

services

•

M2M represented 10% of total

service revenue and 26% of

total subscribers in 3Q10

($ in millions)

55%

69% |

Significant Operating Leverage

73

Growing cash flow driven by recurring service revenue and largely

fixed-cost business model

•

Incremental sales at a high

gross margin contribute to

growing profitability

•

High-quality, recurring service

revenue is cornerstone of

expanding margins

•

Wholesale distribution

channels lower costs and risks,

while expanding market reach

and product development

opportunities

(1)

OEBITDA margin is calculated by dividing Operational EBITDA by adjusted revenue.

Adjusted revenue excludes purchase accounting adjustments and Iridium NEXT

revenue. ($ in millions) |

Iridium

vs. Peers 3Q10 OEBITDA Margins 74

Considerable room for OEBITDA margin expansion as service

revenue continues to grow

(1)

OEBITDA margin is calculated by dividing Operational EBITDA by adjusted revenue.

Adjusted revenue excludes purchase accounting adjustments and Iridium NEXT

revenue. (2)

Source: Company SEC filings and financial statements. Peer comparisons are

EBITDA. |

Organic

Growth Drivers 75

2005-2010E CAGR

Market/Business

Revenue

Subscribers

Future Prospects

Commercial

Service

24%

28%

Strong demand across vertical

markets; integral to business

infrastructure of customers;

M2M data services opportunity

Government

Service

6%

10%

Develop new services for DoD

(i.e. Netted Iridium); mission

critical communications; M2M

data services opportunity

Equipment

3%

N/A

Continued profitability;

decreased importance

Good organic growth opportunities across all of our markets

|

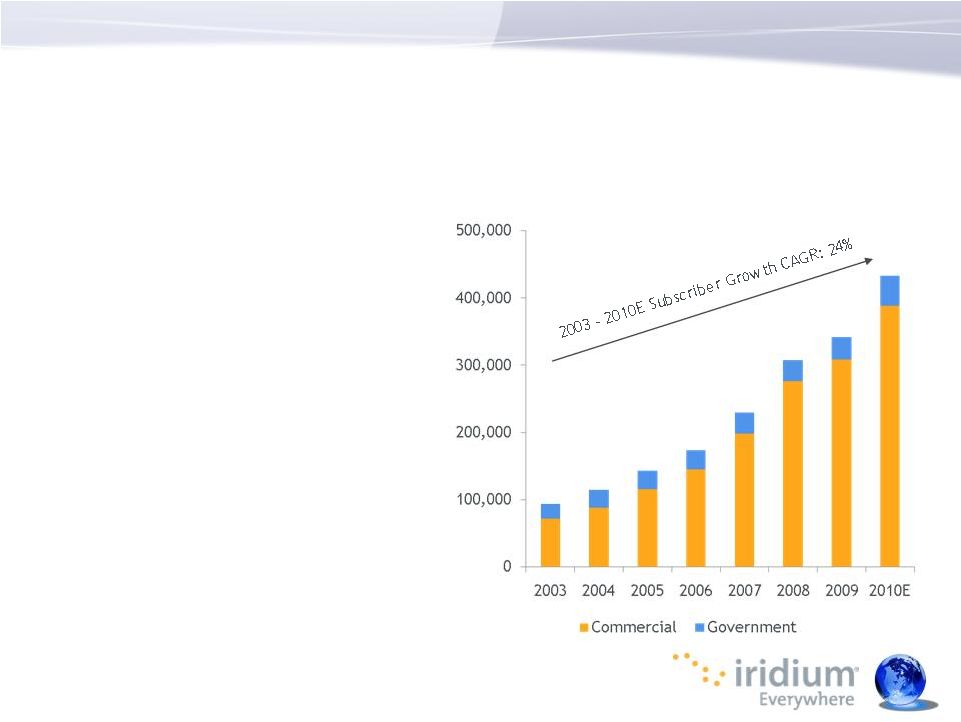

2011

Subscriber Growth Outlook 76

Total subscriber growth of approximately 20% for the full-year 2011

•

Eight consecutive years of

robust subscriber growth |

2011

Service Revenue Outlook 77

Robust service revenue growth of 10% to 13% for the full-year 2011

•

Sustain leadership in voice

market

•

Commercial M2M data services

opportunity --

robust

subscriber growth; new

applications

•

Strong contributions from

Iridium OpenPort

in maritime

business

•

Government service growth –-

Netted Iridium and M2M data

services opportunity

($ in millions)

11%

Growth

10%-13%

Growth |

2011

Equipment Revenue Outlook 78

Equipment revenue decline of 15% to 30% for full-year

2011 (more than offset by service revenue

growth) •

Equipment revenue

meaningfully declines as a

percentage of total revenue in

2011 –-

slower pace of decline

through 2015

•

Equipment margins remain

healthy due to reduced costs

–-

expected to be roughly 40%

•

M2M product substitution for

lower-priced devices

•

Handset volumes and pricing

down due to competition at

the low end of the market

($ in millions)

15%-30% decline |

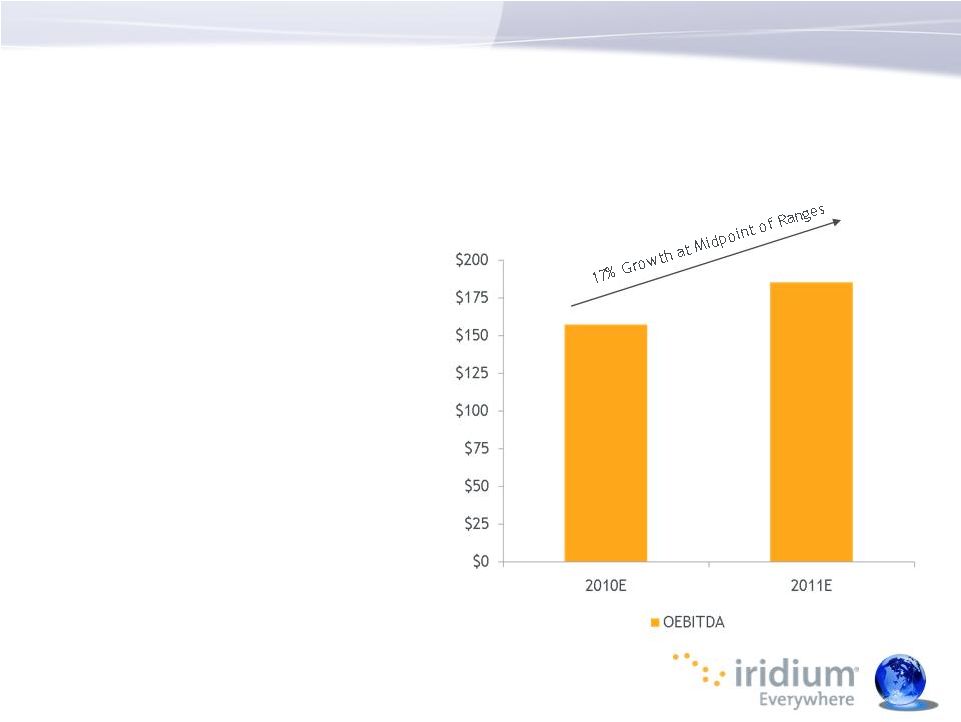

2011

OEBITDA Outlook 79

Operational EBITDA between $180 million and $190 million for the

full-year 2011

•

Double-digit growth in service

revenue

•

Continued OEBITDA margin

expansion enhanced by

reduction in cost of services

related to Boeing contract

amendment

•

Building on a strong year in

2010 --

internally generated

cash flows and debt financing

continue to support Iridium

NEXT

($ in millions) |

Long-Range Revenue Outlook

80

Average service revenue growth of 9% to 13% between 2011 and

2015; expect solid total revenue growth

•

Fast-growing enterprise and

government subscriber base –-

strong demand across vertical

markets and government

•

Broadening adoption of M2M

data services with new

applications

•

Strong contributions from

Iridium OpenPort

in maritime

business

•

Predictable and expanding

service revenue

($ in millions) |

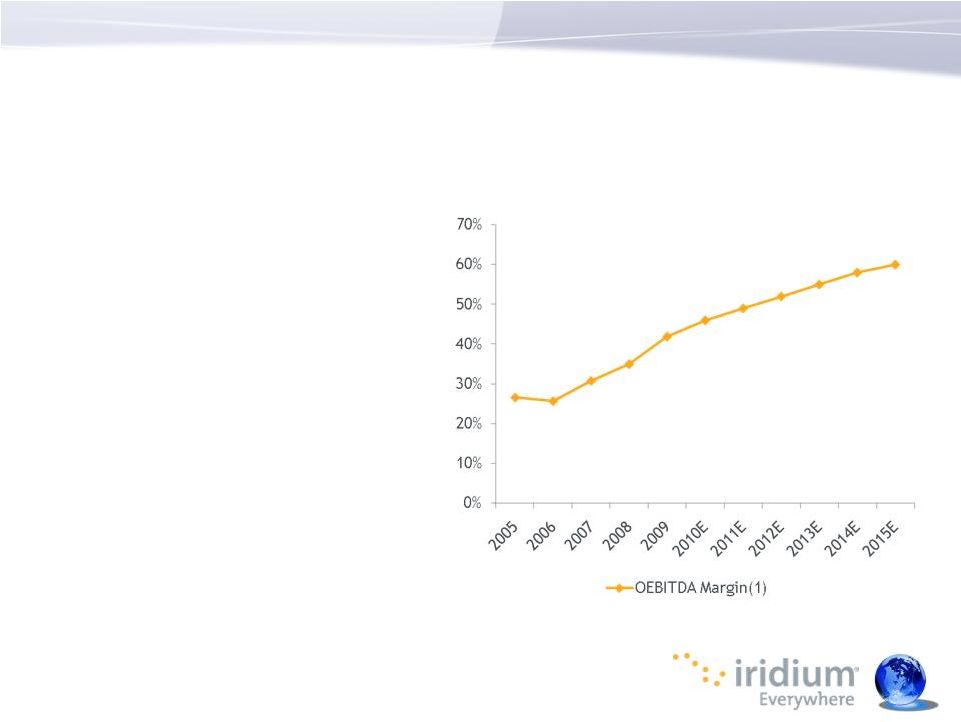

Long-Range OEBITDA Outlook

81

OEBITDA margins expected to expand to approximately 60% by 2015

•

Recurring service revenue is

cornerstone of expanding

margins

•

Operating leverage and largely

fixed-cost model expands

margins and grows cash flow

(1)

OEBITDA margin is calculated by dividing Operational EBITDA by adjusted revenue.

Adjusted revenue excludes purchase accounting adjustments and Iridium NEXT

revenue. |

$1.8

Billion Coface Financing Agreement •

Draw funds from 2010 to 2015

•

Repay funds from 2017

(1)

to 2024

•

$1.5 billion fixed tranche at 4.96%

•

$0.3 billion floating tranche at LIBOR +1.95% (2.4% currently)

82

Attractive borrowing costs and good terms over a long period of time

(1)

Assumes substantial completion of Iridium NEXT by 2017 |

•

Iridium NEXT capex

through

2011 of approximately $600

million --

Coface

draw of $400

million in capex

with financed

interest of $40 million

•

Expect Net Debt/OEBITDA of

approximately 2x in 2011; 3x in

2012; 4x-5x in 2015 and

deleveraging beginning in 2016

•

Customary financial covenants

with cushions above bank case

--

we’re off to a good start

Capital Structure and Capex

Snapshot

83

Manageable debt and leverage targets

(1)

Assumes substantial completion of Iridium NEXT by 2017

($ in millions) |

Iridium

NEXT Funding 84

A fully funded plan for the approximately $3 billion construction of

Iridium NEXT with cushion provided by potential warrant proceeds

(1)

OEBITDA margin is calculated by dividing Operational EBITDA by adjusted revenue.

Adjusted revenue excludes purchase accounting adjustments and Iridium NEXT

revenue. Not Considered in Fully

Funded Plan

•

$7.00 warrant proceeds of

$95 million

•

$11.50 warrant proceeds of

$166 million

Sources of

Funding

•

Agreement with lenders on financial

plan resulting in $1.8 billion Coface

financing agreement

•

OEBITDA --

26% CAGR from 2005 to

2010E; expect 17% growth in 2011 at

midpoint of guidance ranges;

continued solid growth thereafter

•

Hosted payloads net contribution of

$200 million to $300 million |

Putting

Cost of Iridium NEXT in Perspective •

Approximately $3 billion expected total cost for constellation

•

Capital expenditures occur from 2010 to 2017 as OEBITDA grows

•

Assumes constellation provides commercially acceptable service through

2030

85

Significant cash flow potential during constellation life supports the

investment

(1)

The Operational EBITDA CAGRs are for illustrative purposes only and are not

intended to be and should not be relied upon as management outlook or

projections (2)

Cumulative Operational EBITDA based on midpoint of 2010 Operational EBITDA outlook

previously provided by management and assuming Operational EBITDA

grows at 10% and 15% per year, respectively |

Iridium’s Target Profile in 2015

86

A strong recurring revenue business with healthy cash flows that

drive rapid deleveraging after 2015

Approximately $400 million

(1)

Approximately 60%

Greatly reduced after 2016

No cash taxes from 2016 to 2020

Approximately 4x –

5x

0.5 -

1 turn annual deleveraging

Service revenue base

OEBITDA margins

Capex

Taxes

Net Debt/OEBITDA

Strong cash flow

(1)

Represents midpoint of 2011 and long-range service revenue outlook for

Iridium |

Rapid

Deleveraging Magnifies Equity Appreciation 87

Rapid, highly predictable

deleveraging expected after 2015

driven by greatly reduced

capex

and 5-year tax shield

OEBITDA growth

Equity Appreciation |

Comparative Valuation Considerations

12/06/10 Share Price

$9.29

$10.67

Outstanding Shares

(1)

74

489

Market Capitalization

$687

$5,218

Total Gross Debt

(2)

$158

$1,353

Less: Cash & Equivalents

(2)

$111

$185

Net Debt

$47

$1,168

Enterprise Value

$734

$6,386

Divided by: 2011E OEBITDA/EBITDA

(3)

$185

$714

EV/EBITDA Multiple

3.9x

8.9x

Faster

revenue

growth rates

More room

for margin

expansion

88

(1)

Includes outstanding shares and the value of outstanding warrants using the treasury

stock method (2)

Balance sheet data as of 10/31/2010 for Iridium including $135 million draw under

Coface financing agreement; balance sheet data as of 9/30/10 for

Inmarsat based on company financial statements (3)

Represents midpoint of 2011 Operational OEBITDA outlook for Iridium; RBC

Capital Markets EBITDA estimate for Inmarsat Note: In millions except per

share data; Inmarsat share price data converted to U.S. Dollars |

Why Will

Iridium Continue to Win? Network leadership

Significant operating

leverage

Favorable competitive dynamics

in evolving markets…

Attractive and

growing markets

Strong cash flow &

deleveraging

…with a healthy current constellation and

fully funded plan for Iridium NEXT…

…and a track record of execution –-

recurring

service revenue business with strong

OEBITDA growth…

Delivers equity appreciation

89 |

Closing

Remarks/Final Q&A Panel Matt Desch

Chief Executive Officer

Tom Fitzpatrick

Chief Financial Officer |

Lunch

and Product Marketing Table |

Appendix |

Non-GAAP Financial Measures

93

$ in Thousands

For the Year Ended December 31,

2005

2006

2007

2008

2009

YTD Sept

2010

LTM

Net income

$ 39,595

$ 31,814

$ 43,773

$ 53,879

$ 48,535

$ 12,569

$ 7,820

Interest expense

2,580

15,179

21,771

21,094

13,180

23

374

Interest income

(302)

(1,291)

(2,192)

(1,345)

(585)

(438)

(736)

Income taxes

-

-

-

-

(705)

10,259

9,554

Depreciation and amortization

7,722

8,541

11,380

12,535

32,363

67,617

89,130

EBITDA

49,595

54,243

74,732

86,163

92,788

90,030

106,142

Iridium NEXT expenses, net

-

-

1,777

14,113

13,268

11,436

15,545

Stock-based compensation

251

284

2,901

2,868

5,841

3,847

4,283

Transaction expenses

-

-

-

7,959

12,478

-

-

Purchase accounting adjustments

-

-

-

-

9,554

11,560

21,114

Operational EBITDA

$ 49,846

$ 54,527

$ 79,410

$ 111,103

$ 133,929

$ 116,873

$ 147,084

For the Year Ended December 31,

2005

2006

2007

2008

2009

YTD Sept

2010

LTM

Reported revenue

$ 187,700

$ 212,412

$ 260,901

$ 320,944

$ 318,940

$ 260,243

$ 336,232

NEXT revenue

-

-

(3,471)

(3,262)

(1,082)

(58)

(129)

Purchase accounting adjustments

-

-

-

-

1,675

2,949

4,624

Adjusted revenue

$ 187,700

$ 212,412

$ 257,430

$ 317,682

$ 319,533

$ 263,134

$ 340,727

LTM = Last 12 Months |

94

2010 Analyst Day

Iridium Communications Inc.

December 16, 2010 |