UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

(Mark one)

xQUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the quarterly period ended June 30, 2011

or

¨ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from _______________to ________________

Commission File Number: 333-148928

CHINA ENVIRONMENTAL PROTECTION. INC.

(Exact Name of Registrant as Specified in Its Charter)

| NEVADA | 75-3255056 |

| (State or Other jurisdiction of Incorporation or

Organization) |

(I.R.S. Employer Identification No.) |

C/O Jiangsu Jinyu Environmental Engineering Co., Ltd. West Garden, Gaocheng Town, Yixing City, Jiangsu Province, P.R. China |

214214 |

| (Address of Principal Executive Offices) | (Zip Code) |

86-510-87838598

(Registrant’s Telephone Number, Including Area Code)

N/A

(Former Name, Former Address and Former Fiscal Year, if Changed Since Last Report)

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

Yes x No ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definitions of “large accelerated filer”, “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one)

| Large accelerated filer ¨ | Accelerated filer ¨ |

| Non-accelerated filer ¨ | Smaller reporting company x |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

Yes ¨ No x

Indicated the number of shares outstanding of each of the issuer’s classes of common stock, as of the latest practicable date

17,170,015 shares of common stock are issued and outstanding as of August 15, 2011.

TABLE OF CONTENTS

| Page | ||

| PART I | 3 | |

| Item 1. | Financial Statements. | 3 |

| Item 2. | Management’s Discussion and Analysis of Financial Condition and Results of Operation. | 4 |

| Item 3. | Quantitative and Qualitative Disclosures About Market Risk. | 9 |

| Item 4. | Controls and Procedures. | 10 |

| PART II | 11 | |

| Item 1. | Legal Proceedings. | 11 |

| Item 1A. | Risk Factors. | 11 |

| Item 2. | Unregistered Sales of Equity Securities and Use of Proceeds. | 11 |

| Item 3. | Defaults Upon Senior Securities. | 11 |

| Item 4. | Mine Safety Disclosures. | 11 |

| Item 5. | Other Information. | 11 |

| Item 6. | Exhibits. | 11 |

| SIGNATURES | 13 | |

| 2 |

PART I - FINANCIAL INFORMATION

Item 1. Financial Statements.

CHINA ENVIRONMENTAL PROTECTION, INC. AND SUBSIDIARIES

(FORMERLY T.O.D TASTE ON DEMAND INC)

FINANCIAL REPORT

AT JUNE 30, 2011 AND SEPTEMBER 30, 2010, AND

FOR THE THREE AND NINE MONTHS ENDED JUNE 30, 2011 AND 2010

| 3 |

CHINA ENVIRONMENTAL PROTECTION, INC. AND SUBSIDIARIES

(FORMERLY T.O.D TASTE ON DEMAND INC)

INDEX

| PAGE | ||

| CONSOLIDATED BALANCE SHEETS | F-2 | |

| CONSOLIDATED STATEMENTS OF OPERATIONS | F-3 | |

| CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME | F-4 | |

| CONSOLIDATED STATEMENTS OF CASH FLOWS | F-5 | |

| NOTES TO CONSOLICATED FINANCIAL STATEMENTS | F-6 - F-32 |

| F-1 |

CHINA ENVIRONMENTAL PROTECTION, INC. AND SUBSIDIARIES

(FORMERLY T.O.D TASTE ON DEMAND INC)

CONDENSED CONSOLIDATED BALANCE SHEETS

| June 30, | September 30, | |||||||

| 2011 | 2010 | |||||||

| (unaudited) | ||||||||

| ASSETS | ||||||||

| Current Assets: | ||||||||

| Cash and cash equivalents | $ | 2,274,615 | $ | 1,268,674 | ||||

| Restricted cash | - | 5,844,020 | ||||||

| Accounts receivable, net (Note 4) | 4,704,378 | 815,566 | ||||||

| Others receivables | 87,214 | 93,310 | ||||||

| Inventory (Note 5) | 1,894,893 | 9,045,390 | ||||||

| Advance to suppliers | 12,228 | 1,606,018 | ||||||

| Prepaid expenses | - | 15,424 | ||||||

| Deferred tax assets | - | 98,514 | ||||||

| Total current assets | 8,973,328 | 18,786,916 | ||||||

| Property, Plant and Equipment, net (Note 6) | 1,654,567 | 1,536,358 | ||||||

| Other Assets | ||||||||

| Intangible asset-Land use right, net (Note 7) | 1,131,579 | 1,109,867 | ||||||

| Refundable security deposit | 2,140,228 | 2,501,031 | ||||||

| Total other assets | 3,271,807 | 3,610,898 | ||||||

| Total Assets | $ | 13,899,702 | $ | 23,934,172 | ||||

| LIABILITIES AND SHAREHOLDERS' EQUITY | ||||||||

| Current Liabilities: | ||||||||

| Bank loans (Note 8) | $ | 773,515 | $ | 746,480 | ||||

| Accounts payable | 6,420,047 | 4,223,235 | ||||||

| Salary and welfare payables | 460,118 | 671,797 | ||||||

| Others payable | 977 | 83,056 | ||||||

| Taxes payable (Note 9) | 2,008,285 | 1,768,495 | ||||||

| Advance from customers | 599,856 | 7,449,518 | ||||||

| Due to the CEO | 1,986,172 | 894,714 | ||||||

| Total Current Liabilities | 12,248,970 | 15,837,295 | ||||||

| COMMITMENTS AND CONTINGENCIES (Note 14) | - | - | ||||||

| STOCKHOLDERS' EQUITY | ||||||||

| Preferred stock, $0.01 par value. 10,000,000 shares authorized; Authorized 10,000,000 shares; none issued as of June 30, 2011 and September 30, 2010, respectively | - | - | ||||||

| Common stock, $0.01 par value; authorized 34,639,823 shares; Issued and outstanding- 17,170,015 shares as of June 30, 2011 and September 30, 2010, respectively | 171,700 | 171,700 | ||||||

| Additional paid-in capital | 2,960,904 | 2,960,904 | ||||||

| Retained earnings | (1,694,551 | ) | 4,889,989 | |||||

| Accumulated other comprehensive income (loss) | 212,679 | 74,284 | ||||||

| Total Shareholders' Equity | 1,650,732 | 8,096,877 | ||||||

| TOTAL LIABILITIES AND STOCKHOLDERS' EQUITY | $ | 13,899,702 | $ | 23,934,172 | ||||

The accompanying notes are an integral part of these consolidated financial statements

| F-2 |

CHINA ENVIRONMENTAL PROTECTION, INC. AND SUBSIDIARIES

(FORMERLY T.O.D TASTE ON DEMAND INC)

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

| For the Three Months Ended | For the Nine Months Ended | |||||||||||||||

| June 30, | June 30, | |||||||||||||||

| 2011 | 2010 | 2011 | 2010 | |||||||||||||

| (unaudited) | (unaudited) | (unaudited) | (unaudited) | |||||||||||||

| Revenues | ||||||||||||||||

| Sales of Installation projects | $ | 304,172 | $ | 9,398,525 | $ | 25,154,435 | $ | 26,543,896 | ||||||||

| Sales of equipment | 61,829 | 192,863 | 776,321 | 1,242,042 | ||||||||||||

| Total revenues | 366,001 | 9,591,388 | 25,930,756 | 27,785,938 | ||||||||||||

| Costs of Revenues | ||||||||||||||||

| Cost of installation projects | 245,052 | 6,663,803 | 17,474,738 | 18,407,405 | ||||||||||||

| Cost of equipment | 47,511 | 132,642 | 570,546 | 851,636 | ||||||||||||

| Total costs of revenues | 292,563 | 6,796,445 | 18,045,284 | 19,259,041 | ||||||||||||

| Gross profit | 73,438 | 2,794,943 | 7,885,472 | 8,526,897 | ||||||||||||

| Operating Expense | ||||||||||||||||

| Selling Expenses | ||||||||||||||||

| Payroll and Commission | - | 187 | - | 1,122,516 | ||||||||||||

| Fright out | 14,296 | - | 16,242 | 3,706 | ||||||||||||

| Office expenses | - | 49 | - | 73,637 | ||||||||||||

| Total selling expenses | 14,296 | 236 | 16,242 | 1,199,859 | ||||||||||||

| General and administrative expenses | ||||||||||||||||

| Payroll | 68,202 | 63,195 | 181,498 | 188,821 | ||||||||||||

| Employee benefit and pension | 5,571 | 3,624 | 15,215 | 11,527 | ||||||||||||

| Depreciation and amortization expenses | 21,529 | 22,458 | 64,118 | 65,165 | ||||||||||||

| Professional fees and consultancy fees | 155 | 50,299 | 25,452 | 63,661 | ||||||||||||

| Taxes | 2,000 | 19,012 | 19,682 | 36,824 | ||||||||||||

| Office expenses | 17,410 | 43,945 | 63,718 | 127,977 | ||||||||||||

| Bad debt expenses | 1,092,479 | 1,419,233 | 9,120,585 | 1,487,396 | ||||||||||||

| Travel and entertainment | 48,974 | 17,321 | 85,807 | 58,147 | ||||||||||||

| Total General and Administrative Expenses | 1,256,320 | 1,639,087 | 9,576,075 | 2,039,518 | ||||||||||||

| Total operating expenses | 1,270,616 | 1,639,323 | 9,592,317 | 3,239,377 | ||||||||||||

| Income from operations | (1,197,178 | ) | 1,155,620 | (1,706,845 | ) | 5,287,520 | ||||||||||

| Non-operating income (expenses): | ||||||||||||||||

| Interest income | 49 | 93 | 265 | 193 | ||||||||||||

| Interest expenses | (13,144 | ) | (10,957 | ) | (33,304 | ) | (27,165 | ) | ||||||||

| Gain on bargain purchase | - | 52,016 | ||||||||||||||

| Governmental subsidy | 0 | - | 4,554 | - | ||||||||||||

| Other income (expenses) | 34 | - | 1,123 | - | ||||||||||||

| Total non-operating income (expenses) | (13,061 | ) | (10,864 | ) | (27,362 | ) | 25,044 | |||||||||

| Income before income taxes | (1,210,239 | ) | 1,144,756 | (1,734,207 | ) | 5,312,564 | ||||||||||

| Provision for income taxes | ||||||||||||||||

| Current income tax expense | (13,235 | ) | 305,141 | 224,354 | 1,345,955 | |||||||||||

| Deferred income tax expense (benefit) | 610 | (18,498 | ) | 100,157 | (30,240 | ) | ||||||||||

| Total provision for income taxes | (12,625 | ) | 286,643 | 324,511 | 1,315,715 | |||||||||||

| Net income before extraordinary item | (1,197,614 | ) | 858,113 | (2,058,718 | ) | 3,996,849 | ||||||||||

| Extraordinary item (Note 12) | - | - | (4,525,822 | ) | - | |||||||||||

| Net income (loss) | (1,197,614 | ) | 858,113 | (6,584,540 | ) | 3,996,849 | ||||||||||

| Less: Net income attributable to noncontrolling interest | - | - | - | (222 | ) | |||||||||||

| Net Loss attributable to China Environmental Protection, Inc. | $ | (1,197,614 | ) | $ | 858,113 | $ | (6,584,540 | ) | $ | 3,996,627 | ||||||

| Basic and diluted earnings per share | $ | (0.07 | ) | $ | 0.05 | $ | (0.12 | ) | $ | 0.24 | ||||||

| Weighted average number of shares | 17,170,015 | 16,374,180 | 17,170,015 | 16,581,250 | ||||||||||||

The accompanying notes are an integral part of these consolidated financial statements.

| F-3 |

CHINA ENVIRONMENTAL PROTECTION, INC. AND SUBSIDIARIES

(FORMERLY T.O.D TASTE ON DEMAND INC)

CONSOLIDATED STATEMENT OF COMPRESENTATIVE INCOME

| For the Three Months Ended | For the Nine Months Ended | |||||||||||||||

| June 30, | June 30, | |||||||||||||||

| 2011 | 2010 | 2011 | 2010 | |||||||||||||

| (unaudited) | (unaudited) | (unaudited) | (unaudited) | |||||||||||||

| Net income | $ | (1,197,614 | ) | $ | 858,113 | $ | (6,584,540 | ) | $ | 3,996,849 | ||||||

| Other comprehensive income, net of tax: | ||||||||||||||||

| Effects of foreign currency conversion | 28,638 | 53,357 | 138,395 | 32,969 | ||||||||||||

| Total other comprehensive, not of tax | 28,638 | 53,357 | 138,395 | 32,969 | ||||||||||||

| Comprehensive income | (1,168,976 | ) | 911,470 | (6,446,145 | ) | 4,029,818 | ||||||||||

| Comprehensive income attributable to the noncontrolling interest | - | - | - | 222 | ||||||||||||

| Comprehensive income attributable to the Company | $ | (1,168,976 | ) | $ | 911,470 | $ | (6,446,145 | ) | $ | 4,029,596 | ||||||

The accompanying notes are an integral part of these consolidated financial statements.

| F-4 |

CHINA ENVIRONMENTAL PROTECTION, INC. AND SUBSIDIARIES

(FORMERLY T.O.D TASTE ON DEMAND INC)

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

| For the Nine Months Ended | ||||||||

| June 30, | ||||||||

| 2011 | 2010 | |||||||

| (unaudited) | (unaudited) | |||||||

| CASH FLOWS FROM OPERATING ACTIVITIES: | ||||||||

| Net income | $ | (6,584,540 | ) | $ | 3,996,849 | |||

| Adjustments to reconcile net income to net cash provided by operating activities: | ||||||||

| Depreciation and amortization | 118,472 | 117,303 | ||||||

| Bad debt expense | 9,120,585 | 1,487,396 | ||||||

| Impairment of fixed assets | 16,978 | 7,459 | ||||||

| Gain on bargain purchase | - | (52,016 | ) | |||||

| Deferred tax expense | 100,157 | (30,241 | ) | |||||

| Decrease (increase) in assets: | ||||||||

| Restricted cash | 5,941,479 | (5,916,211 | ) | |||||

| Accounts receivable | (12,907,089 | ) | (1,986,419 | ) | ||||

| Other receivable | 9,297 | (3,017 | ) | |||||

| Advances to suppliers | 1,620,804 | (1,238,627 | ) | |||||

| Inventory | 7,337,075 | (8,046,513 | ) | |||||

| Prepaid expense | 15,681 | 28,425 | ||||||

| Refundable security deposit | 442,869 | (1,175,944 | ) | |||||

| Increase (decrease) in liabilities: | ||||||||

| Accounts payables | 2,005,324 | 2,381,971 | ||||||

| Salaries and welfare payable | (231,559 | ) | 40,057 | |||||

| Other payables | (83,483 | ) | (20,509 | ) | ||||

| Taxes payable | 172,428 | 1,380,536 | ||||||

| Advance from customers | (6,985,207 | ) | 9,384,251 | |||||

| Net cash provided by operating activities | 109,271 | 354,750 | ||||||

| CASH FLOWS FROM INVESTING ACTIVITIES: | ||||||||

| Purchase of property and equipment | (161,724 | ) | (102,062 | ) | ||||

| Purcahse of minority shares by Dragon Path | - | (280,000 | ) | |||||

| Net cash used in investing activities | (161,724 | ) | (382,062 | ) | ||||

| CASH FLOWS FROM FINANCING ACTIVITIES: | ||||||||

| Shareholder capital contribution | - | 295,000 | ||||||

| Proceeds from bank loans | 758,929 | 732,463 | ||||||

| Repayments of bank loans | (758,929 | ) | (292,985 | ) | ||||

| Proceeds from the CEO | 1,039,085 | 1,043,291 | ||||||

| Repayments to the CEO | - | (10,254 | ) | |||||

| Net cash provided by financing activities | 1,039,085 | 1,767,515 | ||||||

| EFFECT OF EXCHANGE RATE CHANGE ON CASH AND CASH EQUIVALENTS | 19,309 | 7,573 | ||||||

| NET CHANGES IN CASH AND CASH EQUIVALENTS | 1,005,941 | 1,747,776 | ||||||

| CASH AND CASH EQUIVALENTS, BEGINNING OF PERIOD | 1,268,674 | 538,767 | ||||||

| CASH AND CASH EQUIVALENTS, END OF PERIOD | $ | 2,274,615 | $ | 2,286,543 | ||||

| SUPPLEMENTAL DISCLOSURE OF CASH FLOW INFORMATION | ||||||||

| Income taxes paid | $ | 1,589 | $ | 7,963 | ||||

| Interest paid | $ | 33,304 | $ | 27,165 | ||||

The accompanying notes are an integral part of these consolidated financial statements.

| F-5 |

CHINA ENVIRONMENTAL PROTECTION, INC. AND SUBSIDIARIES

(FORMERLY T.O.D. TASTE ON DEMAND INC)

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

| Note 1- | BASIS OF PRESENTATION |

The accompanying unaudited consolidated financial statements of China Environmental Protection Inc. (the “Company” or "China Environmental") reflect all material adjustments consisting of only normal recurring adjustments which, in the opinion of management, are necessary for a fair presentation of results for the interim periods. Certain information and footnote disclosures required under accounting principles generally accepted in the United States of America have been condensed or omitted pursuant to the rules and regulations of the Securities and Exchange Commission, although the Company believes that the disclosures are adequate to make the information presented not misleading. These condensed consolidated financial statements should be read in conjunction with the audited consolidated financial statements and notes thereto for the fiscal year ended September 30, 2010.

The results of operations for the three and nine months ended June 30, 2011 are not necessarily indicative of the results to be expected for the entire year or for any other period.

| Note 2- | ORGANIZATION |

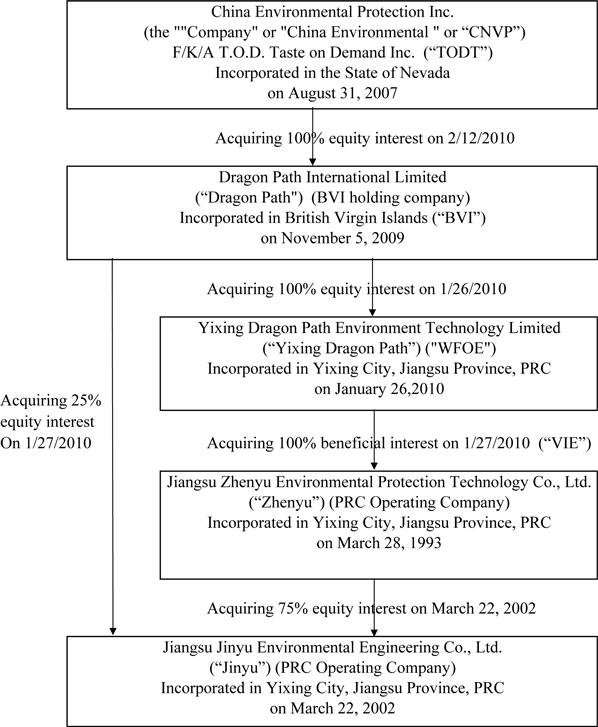

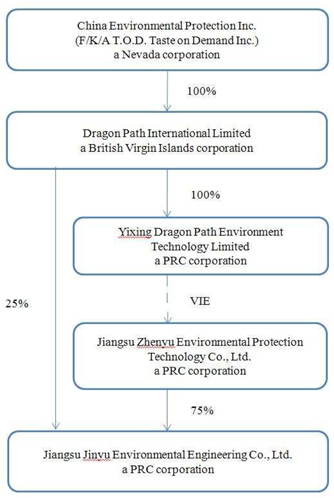

China Environmental Protection Inc. (the “Company” or "China Environmental" or "CNVP"), formerly known as T.O.D. Taste On Demand Inc., was incorporated on August 31, 2007 in the state of Nevada. On February 12, 2010, the Company entered into a share exchange agreement and acquired all of the outstanding capital stock of Dragon Path International Limited, a British Virgin Islands corporation (“Dragon Path”), through China Environmental Protection Inc., a Nevada corporation (the “Merger Sub”) wholly owned by the Company. Dragon Path is a holding company which owns 100% of the registered capital of Yixing Dragon Path Environment Technology Limited (“Yixing Dragon Path”), a limited liability company organized under the laws of the People’s Republic of China (“China” or “PRC”). Dragon Path's operations are conducted in China through Yixing Dragon Path, and through contractual arrangements with Yixing Dragon Path’s consolidated affiliated entity, Jiangsu Zhenyu Environmental Protection Technology Co. Ltd. (“Zhenyu”). Zhenyu is engaged in design, manufacture, and installation of waste water treatment equipment for environmental protection purposes in China.

In connection with the acquisition, the Merger Sub issued 100 shares of the common stock of the Merger Sub which constituted no more than 10% ownership interest in the Merger Sub in exchange for all the shares of the capital stock of Dragon Path (the “Share Exchange” or “Merger”). The 100 shares of the common stock of the Merger Sub were converted into approximately 16,150,000 shares of the common stock of the Company so that upon completion of the Merger, the stockholder of Dragon Path and his assignees own approximately 95% of the common stock of the Company. Upon completion of the Merger, there were 17,000,017 shares of the Company’s common stock issued and outstanding.

| F-6 |

CHINA ENVIRONMENTAL PROTECTION, INC. AND SUBSIDIARIES

(FORMERLY T.O.D. TASTE ON DEMAND INC)

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

| Note 2- | ORGANIZATION (continued) |

For the accounting purposes, this acquisition was accounted for as a reverse merger since the shareholder of Dragon Path and his assignees own a majority of the outstanding shares of the Company’s common stock immediately following the share exchange and there was a change of control. Dragon Path was deemed to be the acquirer in the reverse merger. Consequently, the assets and liabilities and the historical operations that were reflected in the consolidated financial statements for periods prior to the Merger were those of Dragon Path and its subsidiaries and were recorded at the historical cost basis. After completion of the share exchange, the Company‘s consolidated financial statements included the assets and liabilities of both China Environmental and Dragon Path, the historical operations of Dragon Path and the operations of the Company and its subsidiaries from the closing date of the share exchange.

On February 12, 2010, the Company’s name was changed from “T.O.D. Taste on Demand, Inc.” to the Merger Sub’s name “China Environmental Protection Inc.” to better reflect the Company’s business.

Dragon Path was organized under the laws of the British Virgin Island on November 5, 2009. The Articles of Incorporation authorized Dragon Path to issue 50,000 shares of common stock with a par value of $1.00 per share. Upon formation of Dragon Path, 10,000 shares of common stock was issued for $10,000 on November 18, 2009. Dragon Path established and owns 100% of the equity interest of Yixing Dragon Path, a wholly foreign-owned entity ("WFOE") incorporated under the laws of China on January 26, 2010 in Yixing City, Jiangsu Province, China, as a limited liability company with a registered capital of $100,000, of which, $20,000 was contributed on August 24, 2010, and the balance of $80,000 was contributed in January 2012.

Dragon Path does not conduct any substantive operations of its own. Instead, through its wholly-owned subsidiary, Yixing Dragon Path, it had entered into certain exclusive contractual agreements with Zhenyu on January 27, 2010. Pursuant to these agreements, Yixing Dragon is obligated to absorb a majority of the risk of loss from Zhenyu’s activities and entitled it to receive a majority of its expected residual returns. In addition, Zhenyu’s shareholders have pledged their equity interest in Zhenyu to Yixing Dragon, irrevocably granted Yixing Dragon an exclusive option to purchase, to the extent permitted under PRC Law, all or part of the equity interests in Zhenyu and agreed to entrust all the rights to exercise their voting power to the persons appointed by Zhenyu. Through these contractual arrangements, Dragon Path and Yixing Dragon Path hold all the variable interests of Zhenyu. Therefore, Dragon Path is the primary beneficiary of Zhenyu.

Based on these contractual arrangements, the management believes that Zhenyu and its 75% owned subsidiary, Jiangsu Jinyu Environmental Engineering Co,. Ltd. (“Jinyu”) should be considered as a Variable Interest Entity (“VIE”) under the provisions of Accounting Standards Codification (“ASC”) 510 “Consolidation of Variable Interest Entities. Accordingly, Yixing Dragon Path consolidates Zhenyu and its subsidiary’s results, assets and liabilities.

| F-7 |

CHINA ENVIRONMENTAL PROTECTION, INC. AND SUBSIDIARIES

(FORMERLY T.O.D. TASTE ON DEMAND INC)

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

| Note 2- | ORGANIZATION (continued) |

Zhenyu was incorporated under the laws of China on March 28, 1993 in Yixing City, Jiangsu Province, China, as a limited liability company with a registered capital of RMB 1,880,000 (equivalent to approximately $227,135 on the contribution date) which was increased to RMB 16,880,000 (equivalent to approximately $2,140,116 on the contribution date) on May 17, 2000. The registered capital has been fully contributed by the owners.

Jinyu was incorporated under the laws of China on March 22, 2002, as a limited liability company with a registered capital of $1,200,000 which has been fully contributed by the owners, in the Yixing City, Jiangsu Province, China. Jinyu is engaged in design, manufacture, and installation of waste water treatment equipment for environmental protection purposes in China.

On January 28, 2010, Dragon Path acquired the 25% equity interest of Jinyu from its minority shareholder for $280,000. As a result of this transfer of ownership, Dragon Path now owns 100% interest of the Jinyu, consisting of the newly acquired 25% direct ownership and 75% indirect ownership through Zhenyu.

Zhenyu and Jinyu are the two of these affiliated companies that are engaged in business operations. China Environmental, Dragon Path, and Yixing Dragon Path are holding companies, whose business is to hold an equity ownership interest or a beneficial interest in Zhenyu and Jinyu. All these affiliated companies are hereafter referred to as the "Company". Currently, the Company is engaged in the business of design, manufacture, and installation of waste water treatment equipment for environmental protection purposes in China. The Company's structure is summarized in the following chart.

| F-8 |

CHINA ENVIRONMENTAL PROTECTION, INC. AND SUBSIDIARIES

(FORMERLY T.O.D. TASTE ON DEMAND INC)

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

| Note 2- | ORGANIZATION (continued) |

Company Structure Flow Chart

| F-9 |

CHINA ENVIRONMENTAL PROTECTION, INC. AND SUBSIDIARIES

(FORMERLY T.O.D. TASTE ON DEMAND INC)

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

| Note 3- | SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES |

Principles of consolidation

The accompanying consolidated financial statements are prepared in accordance with generally accepted accounting principles in the United States of America ("US GAAP"). This basis of accounting differs from that used in the statutory accounts of the Company, which are prepared in accordance with the "Accounting Principles of China " ("PRC GAAP"). Certain accounting principles, which are stipulated by US GAAP, are not applicable in the PRC GAAP. The difference between PRC GAAP accounts of the Company and its US GAAP consolidated financial statements is immaterial.

The consolidated financial statements include the accounts of the Company, Dragon Path, Yixing Dragon Path, Zhenyu, and Jinyu. All inter-company transactions have been eliminated upon consolidation.

Use of estimates

The preparation of financial statements in conformity with U.S. GAAP requires management to make estimates and assumptions that affect the amounts reported in the financial statements and accompanying notes, and disclosure of contingent liabilities at the date of the condensed consolidated financial statements. Estimates are used for, but not limited to, the selection of the useful lives of property and equipment, provision necessary for contingent liabilities, taxes and other similar charges. Management believes that the estimates utilized in preparing its condensed consolidated financial statements are reasonable and prudent. Actual results could differ from these estimates.

Subsequent Events

As required by FASB ASC 855 “Subsequent Events”, the Company evaluated subsequent events through the date of issuance of these financial statements. We are not aware of any significant events that occurred subsequent to the balance sheet date but prior to the filing of this report that would have a material impact on our consolidated financial statements, except the matters disclosed in Note 15 “Subsequent Event”.

Cash and cash equivalents

The Company considers all highly liquid investments with original maturities of three months or less when purchased to be cash equivalents. The Company maintains its cash and cash equivalents with various financial institutions in the PRC which do not provide insurance for the amounts on deposit. The Company has not experienced any losses in such accounts and the management believes it is not exposed to significant risks on its cash and cash equivalents in the bank accounts.

| F-10 |

CHINA ENVIRONMENTAL PROTECTION, INC. AND SUBSIDIARIES

(FORMERLY T.O.D. TASTE ON DEMAND INC)

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

| Note 3- | SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (continued) |

Restricted Cash

Restricted cash is cash set aside to provide a guarantee for execution of contracts and is subject to withdrawal restrictions. Prior to the start of the sales of equipment or installation of waste water treatment facility projects, the Company is required to maintain certain deposits, as restricted cash, with the PRC financial institutions to provide a guarantee to the Company’s industrial or municipal clients in relation to the execution of the sales of equipment contracts or the installation contracts of waste water treatment facility projects. These deposits are non-interest bearing and normally equivalent to 5% to 10% of the contract price or the amount specifically descripted in the contracts, and are subject to withdrawal restrictions up to the completion of the sales of equipment contracts, or one year after completion of the installation projects, or for a period specifically descripted in the contacts. We record the restricted cash as current assets or non-current assets based on the term when the cash was set aside. The Company has not experienced any losses in withdrawal of the restricted cash and the management believes that no allowance is considered necessary.

Accounts receivable

Accounts receivables consist of trade receivables resulting from sales of products during the normal course of business. The Company carries accounts receivable at the invoiced amount without bearing interest, less an allowance for doubtful accounts. Allowances for doubtful accounts are recorded as a general and administrative expense. The Company evaluates the adequacy of the allowance for doubtful accounts at least quarterly and computes the allowance for doubtful accounts based on the history of actual write-offs. The Company also performs a subjective review of specific large accounts to determine if an additional reserve is necessary. The formula for calculating the allowance closely parallels the Company’s history of actual write-offs and account adjustments based upon contractual terms. In circumstances in which we receive payment for accounts receivable which have previously been written off, we reverse the allowance and bad debt expenses.

Others Receivable

Others receivable principally includes advance to employees who are working on projects on behalf of the Company. After the work is finished, they will submit expense reports with supporting documents to the accounting department. Upon being properly approved, the expenses are debited into the relevant accounts and the advances are credited out. Cash flows from these activities are classified as cash flows from operating activities.

| F-11 |

CHINA ENVIRONMENTAL PROTECTION, INC. AND SUBSIDIARIES

(FORMERLY T.O.D. TASTE ON DEMAND INC)

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

| Note 3- | SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (continued) |

Inventory

Inventory is stated at the lower of cost or market using a weighted average method. Inventory consists of raw materials, work in process and finished goods. Raw materials consist of steel, polyresen, silicone and filtering components used in manufacturing of water treatment equipment. Cost of finished goods included direct costs of raw materials as well as direct labor used in production and an allocated portion of manufacturing overheads.

The management compares the cost of inventory with its market value and an allowance is made for estimated obsolescence or for writing down the inventory to its market value, if lower than cost.

Advance to suppliers

Advance to suppliers represent the payments made and recorded in advance for goods and services received. The Company makes advances to suppliers for the purchase of certain materials and equipment components. Advances to suppliers are short-term in nature and are reviewed regularly to determine whether their carrying value has become impaired. The Company considers the assets to be impaired if the collectability of the services or the goods become doubtful, or the fair value of the services or the goods ordered become lower than the purchase price.

Revenue recognition

The Company recognizes revenues in accordance with FASB ASC 605-10 “Revenue Recognition”. The Company sells waste water treatment equipment or facilities to various industrial or municipal clients through sales orders or equipment-bundled installation contracts. All of the Company’s sales and installation contracts are generally short-term in nature, range from three to six months. The Company recognizes sales based on the completed contract method. The Company recognizes revenue when the following fundamental criteria are met: (i) persuasive evidence of an arrangement exists, (ii) delivery has occurred or services have been rendered and accepted, (iii) the price to the customer is fixed or determinable and (iv) collection of the resulting receivable is reasonably assured. Revenue is not recognized until title and risk of loss is transferred to the customer, which generally occurs upon delivery of goods, and objective evidence exists that customer acceptance provisions have been met. Deposits or advance payments from customers prior to satisfying the Company’s revenue recognition criteria are recorded as advance from customers.

Product warranty

The Company provides product warranty to its customers that all equipment manufactured by the Company will be free from defects in materials and workmanship under normal use for a period of one to two years from the date of shipment and installation. The Company's costs and expenses in connection with such warranties has been immaterial and the management believes that no product warranty reserve is considered necessary.

| F-12 |

CHINA ENVIRONMENTAL PROTECTION, INC. AND SUBSIDIARIES

(FORMERLY T.O.D. TASTE ON DEMAND INC)

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

| Note 3- | SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (continued) |

Property, plant and equipment

Property and equipment are recorded at cost less accumulated depreciation and any impairment losses. The cost of an asset is comprised of its purchase price and any directly attributable costs of bringing the asset to its working condition and location for its intended use. Expenditure incurred after the assets have been put into operation, such as repairs and maintenance and overhaul costs, is normally charged to expense in the year in which it is incurred.

In situations where it can be clearly demonstrated that the expenditure has resulted in an increase in the future economic benefits expected to be obtained from the use of the asset beyond its originally assessed standard of performances, the expenditure is capitalized as an additional cost of the asset.

Depreciation is computed using the straight-line method over the estimated useful lives of the assets, less any estimated residual value. Estimated useful lives of the assets are as follows:

| Plants and Buildings | 20 years |

| Machinery and office equipment | 10 years |

| Vehicles | 5 years |

Any gain or loss on disposal or retirement of a property or equipment is recognized in the profit and loss account and is the difference between the net sales proceeds and the carrying amount of the relevant asset. When property and equipment are retired or otherwise disposed of, the asset and accumulated depreciation are removed from the accounts and the resulting profit or loss is reflected in operations.

Intangible asset-Land Use Right

Intangible asset includes a land use right only. All land in the People’s Republic of China is government owned and cannot be sold to any individual or company. However, the government grants the user a “land use right” (the right to use the land). The land use right for a piece of land, approximately 2.62 acre (10,622 square meters), located in Gaocheng County, Yixing City, Jiangsu Provice, was originally acquired by Zhenyu for RMB 7,965,000 (then equivalent to $1,063,020) from the relevant PRC land authority in April 2007. Zhenyu has the right to use the land for 50 years on which the office premises, production facilities, and warehouse of Zhenyu are located and the land use right is amortized on a straight-line basis over a period of 50 years.

| F-13 |

CHINA ENVIRONMENTAL PROTECTION, INC. AND SUBSIDIARIES

(FORMERLY T.O.D. TASTE ON DEMAND INC)

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

| Note 3- | SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (continued) |

Impairment of long-lived assets

Long-lived assets, which include property, plant and equipment, - and finite-lived intangible assets, are reviewed for impairment whenever events or changes in circumstances indicate that the carrying amount of an asset may not be recoverable.

Recoverability of long-lived assets to be held and used is measured by a comparison of the carrying amount of an asset to the estimated undiscounted future cash flows expected to be generated by the assets. If the carrying amount of an asset exceeds its estimated undiscounted future cash flows, an impairment charge is recognized by the amount by which the carrying amount of the asset exceeds the fair value of the assets. Fair value is generally determined using the asset’s expected future discounted cash flows or market value, if readily determinable.

Refundable security deposit

Refundable security deposit represents the security deposits withheld by the Company’s customers to warrant against potential defects for the sales of equipment or installation of water treatment projects. Refundable security deposit normally accounts for 5% to 10% of the total contract price and generally to be refunded within one to two years after the completion of the sales or the installation, depending on the various terms included in different equipment sales contracts or waste water treatment installation project contracts.

The Company's costs and expenses in connection with the product warranties covered by refundable security deposit have been immaterial and the management believes that no warranty accrual is considered necessary. If a refundable security deposits or portion of the refundable security deposit has not been received upon its maturity, we reclassify the balance to the accounts receivable, and an allowance will be recorded if the collectability becomes doubtful based on the management's review, just as we do for trade accounts receivable.

| F-14 |

CHINA ENVIRONMENTAL PROTECTION, INC. AND SUBSIDIARIES

(FORMERLY T.O.D. TASTE ON DEMAND INC)

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

| Note 3- | SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (continued) |

Fair value of measurements

The Company follows the provisions of Accounting Standards Codification (“ASC”) 820, Fair Value Measurements and Disclosures. It clarifies the definition of fair value, prescribes methods for measuring fair value, and establishes a fair value hierarchy to classify the inputs used in measuring fair value as follows:

Level 1-Inputs are unadjusted quoted prices in active markets for identical assets or liabilities available at the measurement date.

Level 2-Inputs are unadjusted quoted prices for similar assets and liabilities in active markets, quoted prices for identical or similar assets and liabilities in markets that are not active, inputs other then quoted prices that are observable, and inputs derived from or corroborated by observable market data.

Level 3-Inputs are unobservable inputs which reflect the reporting entity’s own assumptions on what assumptions the market participants would use in pricing the asset or liability based on the best available information.

An asset or liability’s level within the fair value hierarchy is based on the lowest level of any input that is significant to the fair value measurement. Availability of observable inputs can vary and is affected by a variety of factors. The Company uses judgment in determining fair value of assets and liabilities and Level 3 assets and liabilities involve greater judgment than Level 1 and Level 2 assets or liabilities.

The carrying amounts reported in the balance sheets for cash and cash equivalents, restricted cash, accounts receivable, other current assets, short-term loans, accounts payable, taxes payable, advance from customers, other payables, and accrued expenses, approximate their fair market value based on the short-term maturity of these instruments. The Company did not identify any assets or liabilities that are required to be measured at fair value on a recurring basis on the consolidated balance sheets in accordance with ASC 820.

Advertising Costs

The Company expenses advertising costs as incurred or the first time the advertising takes place, whichever is earlier, in accordance with the FASB ASC 720-35, “Advertising Costs". The advertising costs were immarterial for the nine months ended June 30, 2011 and 2010, respectively.

Research and Development Costs

Research and development costs relating to the development of new products and processes, including significant improvements and refinements to existing products, are expensed when incurred in accordance with the FASB ASC 730, "Research and Development". Research and development costs were immaterial for the nine months ended June 30, 2011 and 2010, respectively.

| F-15 |

CHINA ENVIRONMENTAL PROTECTION, INC. AND SUBSIDIARIES

(FORMERLY T.O.D. TASTE ON DEMAND INC)

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

| Note 3- | SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (continued) |

China Contribution Plan

Full time employees of the PRC entities participate in a government mandated multi-employer defined contribution plan pursuant to which certain pension benefits, medical care, unemployment insurance, employee housing fund and other welfare benefits are provided to employees. Chinese labor regulations require the Company to pay to the local labor bureau a monthly contribution at a stated contribution rate based on the monthly basic compensation of qualified employees. The relevant local labor bureau is responsible for meeting all retirement benefit obligations; the Company has no further commitments beyond its monthly contribution. The total provisions for such contribution was $13,259 and $9,905 for the nine months ended June 30, 2011 and 2010, respectively.

The Company made the provisions based on the number of qualified employees and the rate and base regulated by the government. However, the Company did not make full monthly contribution to these funds. In the event that any current or former employee files a complaint with the PRC government, the Company may be subject to administrative fines. The Company has not experienced any such fines. The Management believes that these fines would be immaterial and no accrual for such fines has been made in this regard.

Due to the CEO

Due to the CEO is the temporally short-term loans from our chief executive office, director, and majority shareholder, Mr. Li Boping to finance the Company’s operation due to lack of cash resources. These loans are unsecured, non-interest bearing and have no fixed terms of repayment, therefore, deemed payable on demand. Cash flows from these activities are classified as cash flows from financing activates.

| F-16 |

CHINA ENVIRONMENTAL PROTECTION, INC. AND SUBSIDIARIES

(FORMERLY T.O.D. TASTE ON DEMAND INC)

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

| Note 3- | SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (continued) |

Foreign currency translation

The Company and Dragon Path maintain its accounting records in the United States Dollars (US$), whereas Yixing Dragon Path, Zhenyu, and Jinyu maintain their accounting records in the currency of Renminbi (“RMB”), the currency of the PRC. For financial reporting purpose, RMB has been translated into USD$ as the reporting currency in accordance with FASB ASC 830, “Foreign Currency Matters”. The financial information is translated into U.S. dollars at period-end exchange rates as to assets and liabilities and average exchange rates as to revenue and expenses. Capital accounts are translated at their historical exchange rates when the capital transactions occurred. The effects of foreign currency translation adjustments are included as a component of accumulated other comprehensive income in stockholders’ equity.

The exchange rates used for foreign currency translation were as follows (USD$1 = RMB):

| Period Covered | Balance Sheet Date | Average Rates | ||||||

| Nine Months ended March 31, 2011 | 6.46400 | 6.58823 | ||||||

| Nine Months ended March 31, 2010 | 6.78140 | 6.82630 | ||||||

| Year ended September 30, 2010 | 6.69810 | 6.82135 | ||||||

| Year ended September 30, 2009 | 6.82630 | 6.83400 | ||||||

The RMB is not freely convertible into foreign currency and all foreign exchange transactions must take place through authorized institutions. No representation is made that the RMB amounts could have been, or could be, converted into US dollars at the rates used in translation.

Statement of Cash Flows

In accordance with ASC 230 "Statement of Cash Flows", cash flows from the Company's operations are calculated based upon the local currencies. As a result, amounts related to assets and liabilities reported on the statements of cash flows will not necessarily agree with changes in the corresponding balances on the balance sheets.

Value-added tax

Sales revenue represents the invoiced value of goods, net of a value-added tax (“VAT”). All of the Company’s products that are produced and sold in the PRC are subject to a Chinese value-added tax at a rate of 17% of the gross sales price. This VAT may be offset by VAT paid by the Company on purchase of raw materials and other materials included in the cost of producing their finished product. The Company recorded VAT payable and VAT receivable net of payments in the financial statements. The VAT tax return is filed offsetting the payables against the receivables.

| F-17 |

CHINA ENVIRONMENTAL PROTECTION, INC. AND SUBSIDIARIES

(FORMERLY T.O.D. TASTE ON DEMAND INC)

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

| Note 3- | SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (continued) |

Sales Tax

The Company derives revenue from waste water treatment facility installation projects, which is subject to the sales tax in the PRC. The sales tax is generally approximately 5% of the gross sales price and is included into the costs of revenue.

Sales Tax Affixation

Sales tax affixation is in connection with the sales tax and the VAT payment. Sales tax affixation is approximately 9% of the sales tax, or approximately 9% of the VAT payment. Sales tax affixation was paid whenever the sales tax or the VAT was paid. The Company presents the sales tax affixation in the costs of revenue.

Income taxes

The Company accounts for income taxes in accordance with ASC 740 “Income Taxes”. Deferred tax assets and liabilities are recognized for the expected future tax consequences of events that have been included in the financial statements or income tax returns. Deferred tax assets and liabilities are determined based on the difference between the financial statement and tax basis of assets and liabilities using enacted rates expected to apply to taxable income in the years in which those differences are expected to be recovered or settled. The effect on deferred tax assets and liabilities of a change in tax rates is recognized in income in the period that includes the enactment date.

The Company adopted a new FASB guidance, which clarifies the accounting for uncertainty in income taxes recognized in an enterprise’s financial statements. The new FASB guidance prescribes a recognition threshold and measurement attribute for the financial statement recognition and measurement of a tax position taken or expected to be taken in a tax return. The new FASB guidance also provides guidance on de-recognition of tax benefits, classification on the balance sheet, interest and penalties, accounting in interim periods, disclosure, and transition. In accordance with the new FASB guidance, the Company performed a self-assessment and concluded that there were no significant uncertain tax positions requiring recognition in its consolidated financial statements.

The Company accounts for income taxes in interim periods in accordance with FASB ASC 740-270, "Interim Reporting". The Company has determined an estimated annual effective tax rate. The rate will be revised, if necessary, as of the end of each successive interim period during the Company's fiscal year to its best current estimate. The estimated annual effective tax rate is applied to the year-to-date ordinary income (or loss) at the end of the interim period.

| F-18 |

CHINA ENVIRONMENTAL PROTECTION, INC. AND SUBSIDIARIES

(FORMERLY T.O.D. TASTE ON DEMAND INC)

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

| Note 3- | SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (continued) |

Segment Reporting

FASB ASC 820, “Segments Reporting”, establishes standards for reporting information about operating segments on a basis consistent with the Company’s internal organization structure as well as information about geographical areas, business segments and major customers in financial statements. The Company currently operates in two principal business segments, sales of waste water treatment equipment and equipment-bundled installation of waste water treatment facility.

Comprehensive income

FASB ASC 220, “Comprehensive Income”, establishes standards for reporting and display of comprehensive income, its components and accumulated balances. Comprehensive income as defined includes all changes in equity during a period from non-owner sources. Accumulated comprehensive income, as presented in the accompanying consolidated statements of changes in owners' equity consists of changes in unrealized gains and losses on foreign currency translation. This comprehensive income is not included in the computation of income tax expense or benefit.

Earnings per share

The Company computes earnings per share (“EPS”) in accordance with the ASC 260, “Earnings per share” which requires companies with complex capital structures to present basic and diluted EPS. Basic EPS is measured as net income divided by the weighted average common shares outstanding for the period. Diluted EPS is similar to basic EPS but presents the dilutive effect on a per share basis of potential common shares (e.g., convertible securities, options and warrants) as if they had been converted at the beginning of the periods presented, or issuance date, if later. Potential common shares that have an anti-dilutive effect (i.e., those that increase income per share or decrease loss per share) are excluded from the calculation of diluted EPS. There are no potentially dilutive securities outstanding (options and warrants) for the nine months ended June 30, 2011 and 2010, respectively.

| F-19 |

CHINA ENVIRONMENTAL PROTECTION, INC. AND SUBSIDIARIES

(FORMERLY T.O.D. TASTE ON DEMAND INC)

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

| Note 3- | SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (continued) |

Concentration of credit risk

Financial instruments that potentially subject the Company to concentration of credit risk consist primarily of accounts receivables and other receivables. The Company does not require collateral or other security to support these receivables. The Company conducts periodic reviews of its clients' financial condition and customer payment practices to minimize collection risk on accounts receivables.

Amendment to the articles of incorporation

Effective on February 12, 2010, The Company filed with the Nevada Secretary of State a Certificate of Amendment to its Articles of Incorporation. The amendment effected

| (1) | a reverse stock split of the Company's common stock in the ratio of 1:4.61896118. The number of common stocks issued and outstanding immediately after the reverse stock split was 850,017. All share and per share information included in these consolidated financial statements have been adjusted to reflect this reverse stock split. |

| (2) | an increase of the par value of the preferred stock and the common stock from $0.001 per share to $0.01 per share. |

| (3) | a decrease of the number of the authorized common stock from 160,000,000 to 34,639,823. |

Recent accounting pronouncements

In June 2011, the Financial Accounting Standards Board (FASB) issued amended disclosure requirements for the presentation of comprehensive income. The amended guidance eliminates the option to present components of other comprehensive income (OCI) as part of the statement of changes in equity. Under the amended guidance, all changes in OCI are to be presented either in a single continuous statement of comprehensive income or in two separate but consecutive financial statements. The changes are effective January 1, 2012. Early application is permitted. The Management does not expect the adoption of this new guidance will have a material effect on the Company’s financial position, results of operations, and cash flows.

In May 2011, the FASB issued amended standards to achieve a consistent definition of fair value and common requirements for measurement of and disclosure about fair value between U.S. GAAP and International Financial Reporting Standards. For assets and liabilities categorized as Level 3 and recognized at fair value, these amended standards require disclosure of quantitative information about unobservable inputs, a description of the valuation processes used by the entity, and a qualitative discussion about the sensitivity of the measurements. In addition, these amended standards require that we disclose the level in the fair value hierarchy for financial instruments disclosed at fair value but not recorded at fair value. These new standards are effective for us beginning in the first quarter of 2012; early adoption of these standards is prohibited. The Management does not expect the adoption of this new guidance will have a material effect on the Company’s financial position, results of operations, and cash flows.

| F-20 |

CHINA ENVIRONMENTAL PROTECTION, INC. AND SUBSIDIARIES

(FORMERLY T.O.D. TASTE ON DEMAND INC)

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

| Note 4- | ACCOUNTS RECEIVABLE |

Accounts receivable consists of the following:

| June 30, | September 30, | |||||||

| 2011 | 2010 | |||||||

| (unaudited) | ||||||||

| Accounts receivable | $ | 16,799,806 | $ | 3,760,751 | ||||

| Less: Allowance for doubtful accounts | (12,065,770 | ) | (2,945,185 | ) | ||||

| Accounts receivable, net | $ | 4,734,036 | $ | 815,566 | ||||

Bad debt expense charged to operations was $9,120,585 and $1,487,396 for the nine months ended June 30, 2011 and 2010, respectively.

| Note 5- | INVENTORY |

The inventory consists of the following

| June 30, | September 30, | |||||||

| 2011 | 2010 | |||||||

| (unaudited) | ||||||||

| Finished goods | $ | 1,335,164 | $ | 2,576,575 | ||||

| Work-in-process | 264,642 | 2,300,589 | ||||||

| Raw materials | 295,087 | 4,168,226 | ||||||

| Total | $ | 1,894,893 | $ | 9,045,390 | ||||

No allowance for obsolete inventories was charged to operations for the nine months ended June 30, 2011 and 2010.

| Note 6- | PROPERTY, PLANT AND EQUIPMENT |

The detail of property, plant and equipment is as follows:

| June 30, | September 30, | |||||||

| 2011 | 2010 | |||||||

| (unaudited) | ||||||||

| Building and warehouses | $ | 1,739,775 | $ | 1,678,971 | ||||

| Machinery and equipment | 272,463 | 262,940 | ||||||

| Office equipment and furniture | 85,562 | 78,336 | ||||||

| Motor vehicles | 309,081 | 143,442 | ||||||

| Sub total | 2,406,881 | 2,163,689 | ||||||

| Less: accumulated depreciation | (752,314 | ) | (627,331 | ) | ||||

| Total property, plant and equipment, net | $ | 1,654,567 | $ | 1,536,358 | ||||

Depreciation expense charged to operations was $100,337 and $99,801 for the nine months ended June 30, 2011 and 2010, respectively. Depreciation expense with respect to production equipment that was charged to cost of sales was $47,376 and $45,404 for the nine months ended June 30, 2011 and 2010. The remainder, depreciation expense attributable to equipment used in administration, was $52,961 and $54,397 for the nine months ended June 30, 2011 and 2010, respectively, and was included in general and administration expenses.

| F-21 |

CHINA ENVIRONMENTAL PROTECTION, INC. AND SUBSIDIARIES

(FORMERLY T.O.D. TASTE ON DEMAND INC)

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

| Note 7- | INTANGIBLE ASSET-LAND USE RIGHT |

The following is a summary of land use right, less amortization:

| June 30, | September 30, | |||||||

| 2011 | 2010 | |||||||

| (unaudited) | ||||||||

| Land use right | $ | 1,232,209 | $ | 1,189,143 | ||||

| Less: Amortization | (100,630 | ) | (79,276 | ) | ||||

| Land use right, net | $ | 1,131,579 | $ | 1,109,867 | ||||

Amortization expense charged to operations was $18,135 and $17,502 for the nine months ended June 30, 2011 and 2010, respectively. Amortization expense with respect to the area where the production facility is located was charged to cost of revenues was $6,978 and $6,734 for the nine months ended June 30, 2011 and 2010, respectively. The remainder, amortization expense attributable to the area where the administration facility is located , was $11,157 and $10,768 for the nine months ended June 30, 2011 and 2010, respectively, and was included in general and administration expenses.

| Note 8- | SHORT-TERM BANK LOAN |

Short-term bank loans represent amounts due to a local bank and are due on the dates indicated below. These loans generally can be renewed with the bank. Short-term bank loans consisted of the following:

| June 30, | September 30, | ||||||||

| 2011 | 2010 | ||||||||

| (unaudited) | |||||||||

| a) | Loan payable to China Construction Bank 1 year term from 12/3/2009 to 12/2/2010 a fixed interest rate of 0.487% per month | $ | - | $ | 746,480 | ||||

| b) | Loan payable to China Construction Bank 1 year term from 12/6/2010 to 12/5/2011 a fixed interest rate of 0.487% per month | 773,515 | - | ||||||

| Total | $ | 773,515 | $ | 746,480 | |||||

| a) | The loan payable to China Construction Bank is one year term from December 3, 2009, to December 2, 2010 with a fixed interest rate of 0.4867% per month. The Company pledged a land use right in an amount of approximately $0.28 million as well as a building in an amount of approximately $0.52 million as collateral for the loan. This loan was paid back in December 2010. |

| b) | The loan payable to China Construction Bank is one year term from December 6, 2010, to December 5, 2011 with a fixed interest rate of 0.4867% per month. The Company pledged a land use right in an amount of approximately $0.28 million as well as a building in an amount of approximately $0.52 million as collateral for the loan. |

Interest expense for the above short term loans totaled $33,304 and $27,165 for the nine months ended June 30, 2011 and 2010, respectively. We remitted interest payment upon receiving the bank's monthly notice. The interest amount in the bank's notice may be different from the amount calculated based on the interest rate descripted in the loan agreements.

| F-22 |

CHINA ENVIRONMENTAL PROTECTION, INC. AND SUBSIDIARIES

(FORMERLY T.O.D. TASTE ON DEMAND INC)

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

| Note 9- | TAXES PAYABLE |

The taxes payable consists of the following:

| June 30, | September 30, | |||||||

| 2011 | 2010 | |||||||

| (unaudited) | ||||||||

| Income tax payable | $ | 1,993,300 | $ | 1,725,048 | ||||

| VAT payable | 1,901 | 32,438 | ||||||

| Sales taxes and sales taxes affixation payable | 1,675 | - | ||||||

| Other taxes payable | 11,409 | 11,009 | ||||||

| Total taxes payable | $ | 2,008,285 | $ | 1,768,495 | ||||

| Note 10- | SEGMENT REPORTING |

The Company currently operates in two principal business segments, sales of waste water treatment equipment and equipment-bundled installation of waste water treatment facility, which are determined based upon differences in products and services. The Company does not allocate any operating expenses or assets to its two business segments as management does not use this information to measure the performance of the operating segments. Certain costs of revenues are shared between business segments. Also, no measures of assets by segment are reported and used by the chief operating decision maker. Hence, the Company has not made disclosure of total assets by reportable segments.

The summarized information by business segment follows:

| For the Six Months Ended | ||||||||

| March 31, | ||||||||

| 2011 | 2010 | |||||||

| (unaudited) | (unaudited) | |||||||

| REVENUE | ||||||||

| Sales of Installation projects | $ | 25,154,435 | $ | 26,543,896 | ||||

| Sales of equipment | 776,321 | 1,242,042 | ||||||

| Total revenue | $ | 25,930,756 | $ | 27,785,938 | ||||

| COST OF SALES | ||||||||

| Cost of installation projects | $ | 17,474,738 | $ | 18,407,405 | ||||

| Cost of equipment | 570,546 | 851,636 | ||||||

| Total costs of revenue | $ | 18,038,465 | $ | 19,259,041 | ||||

| GROSS PROFITS | ||||||||

| Sales of Installation projects | $ | 7,679,697 | $ | 8,136,491 | ||||

| Sales of equipment | 205,775 | 390,406 | ||||||

| Total gross profit | $ | 7,885,472 | $ | 8,526,897 | ||||

| June 30, | September 30, | |||||||

| 2011 | 2010 | |||||||

| (unaudited) | ||||||||

| TOTAL ASSETS OF THE COMPANY | $ | 13,899,702 | $ | 23,934,172 | ||||

| F-23 |

CHINA ENVIRONMENTAL PROTECTION, INC. AND SUBSIDIARIES

(FORMERLY T.O.D. TASTE ON DEMAND INC)

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

| Note 11- | CORPORATE INCOME TAXES |

Dragon Path is registered in the BVI. Under the current laws of the BVI, the Company is not subject to tax on income or capital gains. Additionally, upon payments of dividends by the Company to its shareholders, no BVI withholding tax will be imposed. Dragon Path had no income during the period.

PRC Income Tax

The Company's PRC subsidiaries, Yixing Dragon Path, Zhenyu, and Jinyu are governed by the Income Tax Law of the People’s Republic of China concerning private-run enterprises, which are generally subject to income tax at statutory rate on income reported in the statutory financial statements after appropriate tax adjustments. The PRC companies are subject to effective income tax rate of 25% beginning from January 1, 2008.

The following table reconciles the U.S. statutory rates to the Company’s effective tax rate:

| For the Nine Months Ended | ||||||||

| June 30, | ||||||||

| 2011 | 2010 | |||||||

| U.S. Statutory income tax rate | 35.00 | % | 35.00 | % | ||||

| Foreign income not recognized in the U.S. | -35.00 | % | -35.00 | % | ||||

| China Statutory income tax rate | 25.00 | % | 25.00 | % | ||||

| Net operating loss carry-forward | -25.00 | % | 0.00 | % | ||||

| Effective tax rate | 0.00 | % | 25.00 | % | ||||

The Company and its majority owned subsidiary, Yixing Dragon, Zhenyu, and Jinyu suffered operating losses in the prior years' operations. For the Chinese income tax purpose, these operating losses can be carried forward in in a 5-year period and be available to reduce future years' taxable income. The Management believes that the realization of the deferred tax asset arising from the operating losses of Jinyu is the best interest to the Company's business operations to offset future taxable income. Since there is no certainty that Yixing Dragon will generate taxable income in the future, the Management established a 100% valuation allowance for the operation losses carried forward by Yixing Dragon Path and no deferred tax assets have been recorded as a result of these losses. Beginning from October 2010, since there is no certainty that Zhenyu will generate taxable income in the future, the Management established a 100% valuation allowance for the operation losses carried forward by Zhenyu and no deferred tax assets have been recorded as a result of these losses.

Deferred income tax reflects the net effects of temporary difference between the carrying amounts of assets and liabilities for financial statements purposes and the amounts used for income tax purposes, and operating loss carry-forward.

| F-24 |

CHINA ENVIRONMENTAL PROTECTION, INC. AND SUBSIDIARIES

(FORMERLY T.O.D. TASTE ON DEMAND INC)

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

| Note 11- | CORPORATE INCOME TAXES (continued) |

The components of deferred tax assets consist of the following:

| Name of the companies | Zhenyu | Jinyu | Total | |||||||||||||

| Net deferred tax assets @ September 30, 2009 | $ | - | $ | 39,465 | $ | 39,465 | ||||||||||

| Income (loss) before income tax | ||||||||||||||||

| Zhenyu | $ | 5,383,819 | ||||||||||||||

| Jinyu | (120,963 | ) | ||||||||||||||

| Total | $ | 5,262,856 | ||||||||||||||

| Deferred tax benefit (expense) utilized | - | 30,240 | 30,240 | |||||||||||||

| Other comprehensive income, net of tax: | ||||||||||||||||

| effects of foreign currency conversion | - | 462 | 462 | |||||||||||||

| Deferred tax assets @ June 30, 2010 (unaudited) | $ | - | $ | 70,167 | $ | 70,167 | ||||||||||

| Deferred tax assets @ September 30, 2010 | $ | - | $ | 98,514 | $ | 98,514 | ||||||||||

| Income (loss) before income tax | ||||||||||||||||

| Zhenyu | $ | (3,004,674 | ) | |||||||||||||

| Jinyu | 1,298,041 | |||||||||||||||

| Total | $ | (1,706,633 | ) | |||||||||||||

| Deferred tax benefit (expense) utilized | - | (100,157 | ) | (100,157 | ) | |||||||||||

| Other comprehensive income, net of tax: | ||||||||||||||||

| effects of foreign currency conversion | 1,643 | 1,643 | ||||||||||||||

| Deferred tax assets @ June 30, 2011 (unaudited) | $ | - | $ | - | $ | - | ||||||||||

Income taxes consist of the following:

| For the Nine Months Ended June 30, | ||||||||||||

| 2010 | ||||||||||||

| (unaudited) | ||||||||||||

| Name of the companies | Zhenyu | Jinyu | Total | |||||||||

| Income (loss) before income tax provision | $ | 5,383,819 | $ | (120,963 | ) | $ | 5,262,856 | |||||

| Current income tax expense | 1,345,955 | - | 1,345,955 | |||||||||

| Deferred income tax expense (benefit) | - | (30,240 | ) | (30,240 | ) | |||||||

| Total provision for income taxes | $ | 6,729,774 | $ | (151,203 | ) | $ | 1,315,715 | |||||

| For the Nine Months Ended June 30, | ||||||||||||

| 2011 | ||||||||||||

| (unaudited) | ||||||||||||

| Name of the companies | Zhenyu | Jinyu | Total | |||||||||

| Income (loss) before income tax provision | $ | (3,004,674 | ) | $ | 1,298,041 | $ | (1,706,633 | ) | ||||

| Current income tax expense | - | 224,354 | 224,354 | |||||||||

| Deferred income tax expense (benefit) | - | 100,157 | 100,157 | |||||||||

| Total provision for income taxes | $ | - | $ | 324,511 | $ | 324,511 | ||||||

| F-25 |

CHINA ENVIRONMENTAL PROTECTION, INC. AND SUBSIDIARIES

(FORMERLY T.O.D. TASTE ON DEMAND INC)

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

| Note 11- | CORPORATE INCOME TAXES (continued) |

Accounting for Uncertainty in Income Taxes

The tax authority of the PRC Government conducts periodic and ad hoc tax filing reviews on business enterprises operating in the PRC after those enterprises complete their relevant tax filings. Therefore, the Company’s tax filings results are subject to change. It is therefore uncertain as to whether the PRC tax authority may take different views about the Company’s tax filings, which may lead to additional tax liabilities.

The Company adopted the provisions of Accounting for Uncertainty in Income Taxes on January 1, 2007. The provisions clarify the accounting for uncertainty in income taxes recognized in an enterprise’s financial statements in accordance with the standard “Accounting for Income Taxes,” and prescribes a recognition threshold and measurement process for financial statement recognition and measurement of a tax position taken or expected to be taken in a tax return. The provisions of Accounting for Uncertainty in Income Taxes also provides guidance on derecognition, classification, interest and penalties, accounting in interim periods, disclosure and transition.

Based on the Company’s evaluation, the Company has concluded that there are no significant uncertain tax positions requiring recognition in its financial statements.

The Company may from time to time be assessed interest or penalties by local tax jurisdictions. In the event it receives an assessment for interest and/or penalties, it will be classified in the financial statements as tax expense.

| Note 12- | EXTRAORDINARY ITEM |

In October 2010, one of our subsidiaries, Zhenyu, executed an agreement with Jiangsu Guangyang Dongli Environmental Protection Equipment Co., Ltd. ("Jiangsu Guangyang"), pursuant to which both parties will jointly work on an installation of a waste water treatment plant, located in Yingjiang City, Yunnan Province, the PRC. The sales price of this project is RMB 600,000,000 (then equivalent to approximately $89,995,230) and the municipal client will not make any payment until the project is 30% completed. While Zhenyu owns 15% interest in the project, Jiangsu Guangyang owns 75% interest in the project and is in charge of the installation of the project. In according to the agreement, Zhenyu made payment of RMB 30,000,000 (equivalent to approximately $4,525,822) to Jiangsu Guangyang in October 2010.

In March 2011, an earthquake occurred in Yingjiang County and the earth quake triggered landslides. Our ongoing installation project was buried. Since the installation project was not insured, no insurance compensation can be claimed. Jiangsu Guangyang and Zhenyu are in discussion with the municipal client for a compensation and the Management believes that the compensation, if any, will be minimal.

Since Zhenyu usually works on installation projects alone and earthquake has not occurred in the location, we treat the loss as an extraordinary item. Also, because there is not taxable income in the current period and it is uncertain that Zhenyu will generate taxable income in the future, no income tax benefit has been recorded as a result of this loss.

| F-26 |

CHINA ENVIRONMENTAL PROTECTION, INC. AND SUBSIDIARIES

(FORMERLY T.O.D. TASTE ON DEMAND INC)

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

| Note 13- | CONCENTRATION OF RISKS |

Two major customers accounted for approximately 81.79% of our revenue in the nine months ended June 30, 2011, with each customer individually accounting for 43.34% and 38.45%, respectively. Seven major customers accounted for approximately 85.98% of our revenue in the nine months ended June 30, 2010, with each customer individually accounting for 11.18%, 11.38%, 11.54%, 13.15%, 13.81%,14.32, and 10.60%, respectively.

Three major vendors provided approximately 86.37% of the Company’s purchases for the nine months ended June 30, 2011, with each vendor individually accounting for 41.62%, 30.41%, and 14.34%, respectively. No vendor provided 10% or more of the Company’s purchases for the nine months ended June 30, 2010.

| Note 14- | COMMITMENTS AND CONTINGENCIES |

Operating Lease

Our subsidiary, Jinyu leased a land use right for a piece of land, approximately 0.52 acre (2,100 square meters), located in Gaocheng County, Yixing City, Jiangsu Province, for a three-year period from March 22, 2011 to March 21, 2014, from the local government. The annual rent is RMB 50,000 (then equivalent to $7,140) and payable quarterly. The lease can not be automately renewed. The parties will negotiate a new lease if both parries desire to do so when the lease expires. Jinyu's office premises, production facilities, and warehouse are located in this piece of land. The rental expense was $6,830 and $6,592 for the nine months ended March 31, 2011 and 2010, respectively. The future lease payments for the lease are as following at June 30, 2011.

| The Year Ending September 30, | Future Lease Payment | |||

| 2011 | $ | 1,934 | ||

| 2012 | 7,735 | |||

| 2013 | 7,735 | |||

| 2014 | 3,868 | |||

| $ | 21,272 | |||

The Company’s assets are located in PRC and revenues are derived from operations in PRC.

The Company’s operations in the PRC are subject to specific considerations and significant risks not typically associated with companies in the North America and Western Europe. These include risks associated with, among others, the political, economic and legal environments and foreign currency exchange. The Company’s results may be adversely affected by changes in governmental policies with respect to laws and regulations, anti-inflationary measures, currency conversion and remittance abroad, and rates and methods of taxation, among other things.

The Company’s sales, purchases and expenses transactions are denominated in RMB and all of the Company’s assets and liabilities are also denominated in RMB. The RMB is not freely convertible into foreign currencies under the current law. In China, foreign exchange transactions are required by law to be transacted only by authorized financial institutions at exchange rates set by the People’s Bank of China, the central bank of China. Remittances in currencies other than RMB may require certain supporting documentation in order to affect the remittance.

| F-27 |

CHINA ENVIRONMENTAL PROTECTION, INC. AND SUBSIDIARIES

(FORMERLY T.O.D. TASTE ON DEMAND INC)

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

| Note 14- | COMMITMENTS AND CONTINGENCIES (continued) |

Lack of Insurance

The Company does not carry any business interruption insurance, products liability insurance or any other insurance policy except for a limited property insurance policy. As a result, the Company may incur uninsured losses, increasing the possibility that the investors would lose their entire investment in the Company.

The Company could be exposed to liabilities or other claims for which the Company would have no insurance protection. The Company does not currently maintain any business interruption insurance, products liability insurance, or any other comprehensive insurance policy except for property insurance policies with limited coverage. As a result, the Company may incur uninsured liabilities and losses as a result of the conduct of its business. There can be no guarantee that the Company will be able to obtain additional insurance coverage in the future, and even if it can obtain additional coverage, the Company may not carry sufficient insurance coverage to satisfy potential claims. If an uninsured loss should occur, any purchasers of the Company’s common stock could lose their entire investment.

Because the Company does not carry products liability insurance, a failure of any of the products marketed by the Company may subject the Company to the risk of product liability claims and litigation arising from injuries allegedly caused by the improper functioning or design of its products. The Company cannot assure that it will have enough funds to defend or pay for liabilities arising out of a products liability claim. To the extent the Company incurs any product liability or other litigation losses, its expenses could materially increase substantially. There can be no assurance that the Company will have sufficient funds to pay for such expenses, which could end its operations and the investors would lose their entire investment.

Control by Principal shareholders

The directors, executive officers, their affiliates, and related parties own, directly or indirectly, beneficially and in the aggregate, the majority of the voting power of the outstanding capital of the Company. Accordingly, directors, executive officers and their affiliates, if they voted their shares uniformly, would have the ability to control the approval of most corporate actions, including approving significant expenses, increasing the authorized capital and the dissolution, merger or sale of the Company's assets.

Contingent Liability from Prior Operation

Prior to the reverse merger with Dragon Path International Limited on February 12, 2010, the Company was a development stage company and was engaged in the business of developing a device that will allow drinkers of bottled water to choose a few flavors as they pour the water from the bottle in the glass. Management believes that there are no valid outstanding liabilities from prior operations. If a creditor were to come forward and claim a liability, the Company has committed to contest such claim to the fullest extent of the law. No amount has been accrued in the financial statements for this contingent liability.

| F-28 |

CHINA ENVIRONMENTAL PROTECTION, INC. AND SUBSIDIARIES

(FORMERLY T.O.D. TASTE ON DEMAND INC)

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

| Note 15- | CONDENSED PARENT COMPANY FINANCIAL INFORMATION |

Basis of Presentation

The condensed parent company financial statements have been prepared in accordance with Rule 12-04, Schedule I of Regulation S-X, as the restricted net assets of the subsidiaries of CHINA ENVIRONMENTAL PROTECTION, INC. exceed 25% of the consolidated net assets of CHINA ENVIRONMENTAL PROTECTION, INC. The ability of the Company’s Chinese operating subsidiaries to pay dividends may be restricted due to the foreign exchange control policies and availability of cash balances of the Chinese operating subsidiaries. Because substantially all of the Company’s operations are conducted in China and a substantial majority of its revenues are generated in China, a majority of the Company’s revenue being earned and currency received are denominated in Renminbi (RMB). RMB is subject to the exchange control regulation in China, and, as a result, the Company may be unable to distribute any dividends outside of China due to PRC exchange control regulations that restrict its ability to convert RMB into US Dollars.

The condensed parent company financial statements have been prepared using the same accounting principles and policies described in the notes to the consolidated financial statements, with the only exception being that the parent company accounts for its subsidiaries using the equity method. Refer to the consolidated financial statements and notes presented above for additional information and disclosures with respect to these financial statements.

CHINA ENVIRONMENTAL PROTECTION, INC.

CONDENSED PARENT COMPANY BALANCE SHEETS

(Dollars in Thousands)

| June 30, | September 30, | |||||||

| 2011 | 2010 | |||||||

| (unaudited) | ||||||||

| ASSETS | ||||||||

| Investment in subsidiaries, at equity in net assets | 1,651 | 8,097 | ||||||