UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-22148

PowerShares Actively Managed Exchange-Traded Fund Trust

(Exact name of registrant as specified in charter)

3500 Lacey Road

Downers Grove, IL 60515

(Address of principal executive offices) (Zip code)

Andrew Schlossberg

President

3500 Lacey Road

Downers Grove, IL 60515

(Name and address of agent for service)

Registrant’s telephone number, including area code: 800-983-0903

Date of fiscal year end: October 31

Date of reporting period: October 31, 2015

Item 1. Reports to Stockholders.

The Registrant’s annual report transmitted to shareholders pursuant to Rule 30e-1 under the Investment Company Act of 1940 is as follows:

| October 31, 2015 |

2015 Annual Report to Shareholders

| PSR | PowerShares Active U.S. Real Estate Fund | |

| CHNA | PowerShares China A-Share Portfolio | |

| LALT | PowerShares Multi-Strategy Alternative Portfolio | |

| PHDG | PowerShares S&P 500® Downside Hedged Portfolio | |

| The Market Environment | 3 | |||

| Manager’s Analysis | 4 | |||

| Actively Managed Funds | ||||

| Schedules of Investments | ||||

| 12 | ||||

| 13 | ||||

| 14 | ||||

| 16 | ||||

| Statements of Assets and Liabilities | 22 | |||

| Statements of Operations | 23 | |||

| Statements of Changes in Net Assets | 24 | |||

| Financial Highlights | 26 | |||

| Notes to Financial Statements | 29 | |||

| Report of Independent Registered Public Accounting Firm | 41 | |||

| Fees and Expenses | 42 | |||

| Tax Information | 43 | |||

| Trustees and Officers | 44 | |||

|

|

2 |

|

|

|

3 |

|

| PSR | Manager’s Analysis | |

| PowerShares Active U.S. Real Estate Fund (PSR) |

|

|

4 |

|

PowerShares Active U.S. Real Estate Fund (PSR) (continued)

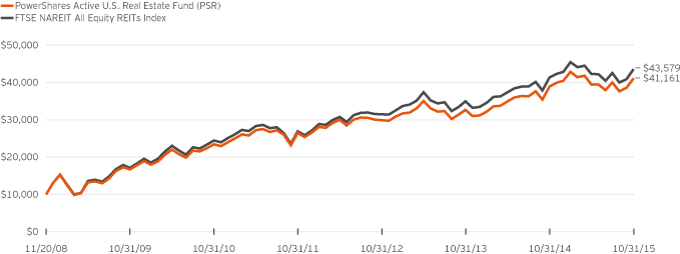

Growth of a $10,000 Investment Since Inception†

Fund Performance History as of October 31, 2015

| 1 Year | 3 Years Average Annualized |

3 Years Cumulative |

5 Years Average Annualized |

5 Years Cumulative |

Fund Inception† | |||||||||||||||||||||||||

| Index | Average Annualized |

Cumulative | ||||||||||||||||||||||||||||

| FTSE NAREIT All Equity REITs Index | 5.35 | % | 11.44 | % | 38.39 | % | 12.23 | % | 78.06 | % | 23.61 | % | 335.79 | % | ||||||||||||||||

| Fund | ||||||||||||||||||||||||||||||

| NAV Return | 5.71 | 11.16 | 37.35 | 11.89 | 75.36 | 22.60 | 311.61 | |||||||||||||||||||||||

| Market Price Return | 5.85 | 11.23 | 37.61 | 11.91 | 75.53 | 22.72 | 314.59 | |||||||||||||||||||||||

|

|

5 |

|

| CHNA | Manager’s Analysis | |

| PowerShares China A-Share Portfolio (CHNA) |

|

|

6 |

|

PowerShares China A-Share Portfolio (CHNA) (continued)

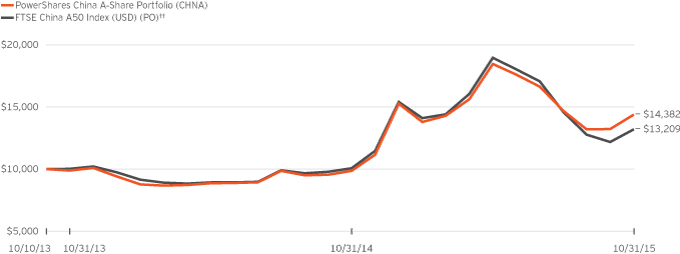

Growth of a $10,000 Investment Since Inception†

Fund Performance History as of October 31, 2015

| 1 Year | Fund Inception† | |||||||||||||

| Index | Average Annualized |

Cumulative | ||||||||||||

| FTSE China A50 Index (USD)(PO)†† | 31.06 | % | 14.49 | % | 32.09 | % | ||||||||

| Fund | ||||||||||||||

| NAV Return | 45.95 | 19.32 | 43.82 | |||||||||||

| Market Price Return | 45.24 | 18.99 | 43.01 | |||||||||||

|

|

7 |

|

| LALT | Manager’s Analysis | |

| PowerShares Multi-Strategy Alternative Portfolio (LALT) |

|

|

8 |

|

PowerShares Multi-Strategy Alternative Portfolio (LALT) (continued)

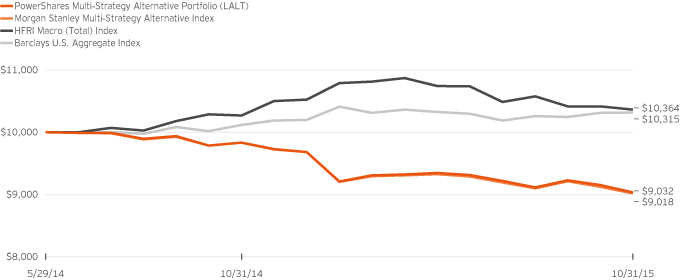

Growth of a $10,000 Investment Since Inception†

Fund Performance History as of October 31, 2015

| 1 Year | Fund Inception† | |||||||||||||

| Index | Average Annualized |

Cumulative | ||||||||||||

| Morgan Stanley Multi-Strategy Alternative Index | (8.28 | )% | (7.01 | )% | (9.82 | )% | ||||||||

| HFRI Macro (Total) Index | 0.92 | 2.55 | 3.64 | |||||||||||

| Barclays U.S. Aggregate Index | 1.96 | 2.20 | 3.15 | |||||||||||

| Fund | ||||||||||||||

| NAV Return | (8.17 | ) | (6.89 | ) | (9.68 | ) | ||||||||

| Market Price Return | (7.94 | ) | (6.92 | ) | (9.71 | ) | ||||||||

|

|

9 |

|

| PHDG | Manager’s Analysis | |

| PowerShares S&P 500® Downside Hedged Portfolio (PHDG) |

|

|

10 |

|

PowerShares S&P 500® Downside Hedged Portfolio (PHDG) (continued)

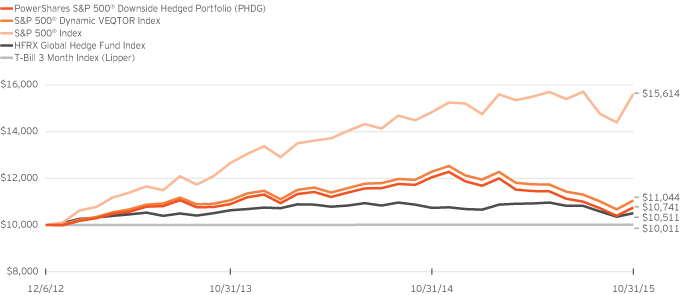

Growth of a $10,000 Investment Since Inception†

Fund Performance History as of October 31, 2015

| 1 Year | Fund Inception† | |||||||||||||

| Index | Average Annualized |

Cumulative | ||||||||||||

| S&P 500® Dynamic VEQTOR Index | (10.09 | )% | 3.48 | % | 10.44 | % | ||||||||

| S&P 500® Index | 5.20 | 16.60 | 56.14 | |||||||||||

| HFRX Global Hedge Fund Index | (2.05 | ) | 1.73 | 5.11 | ||||||||||

| T-Bill 3 Month Index (Lipper) | 0.03 | 0.04 | 0.11 | |||||||||||

| Fund | ||||||||||||||

| NAV Return |

(10.83 | ) | 2.49 | 7.41 | ||||||||||

| Market Price Return | (10.69 | ) | 2.52 | 7.48 | ||||||||||

|

|

11 |

|

Schedule of Investments(a)

PowerShares Active U.S. Real Estate Fund (PSR)

October 31, 2015

See accompanying Notes to Financial Statements which are an integral part of the financial statements.

|

|

12 |

|

Schedule of Investments

PowerShares China A-Share Portfolio (CHNA)

October 31, 2015

See accompanying Notes to Financial Statements which are an integral part of the financial statements.

|

|

13 |

|

Schedule of Investments(a)

PowerShares Multi-Strategy Alternative Portfolio (LALT)

October 31, 2015

See accompanying Notes to Financial Statements which are an integral part of the financial statements.

|

|

14 |

|

PowerShares Multi-Strategy Alternative Portfolio (LALT) (continued)

October 31, 2015

See accompanying Notes to Financial Statements which are an integral part of the financial statements.

|

|

15 |

|

Schedule of Investments(a)

PowerShares S&P 500® Downside Hedged Portfolio (PHDG)

October 31, 2015

See accompanying Notes to Financial Statements which are an integral part of the financial statements.

|

|

16 |

|

PowerShares S&P 500® Downside Hedged Portfolio (PHDG) (continued)

October 31, 2015

See accompanying Notes to Financial Statements which are an integral part of the financial statements.

|

|

17 |

|

PowerShares S&P 500® Downside Hedged Portfolio (PHDG) (continued)

October 31, 2015

See accompanying Notes to Financial Statements which are an integral part of the financial statements.

|

|

18 |

|

PowerShares S&P 500® Downside Hedged Portfolio (PHDG) (continued)

October 31, 2015

See accompanying Notes to Financial Statements which are an integral part of the financial statements.

|

|

19 |

|

PowerShares S&P 500® Downside Hedged Portfolio (PHDG) (continued)

October 31, 2015

See accompanying Notes to Financial Statements which are an integral part of the financial statements.

|

|

20 |

|

(This Page Intentionally Left Blank)

Statements of Assets and Liabilities

October 31, 2015

| PowerShares Active U.S. Real Estate Fund (PSR) |

PowerShares China A-Share Portfolio (CHNA) |

PowerShares Multi-Strategy Alternative Portfolio (LALT) |

PowerShares S&P 500® Downside Hedged Portfolio (PHDG) |

|||||||||||||

| Assets: | ||||||||||||||||

| Unaffiliated investments, at value |

$ | 55,077,492 | $ | — | $ | 8,509,929 | $ | 387,225,653 | ||||||||

| Affiliated investments, at value |

— | 2,592,435 | 6,089,700 | 11,744,163 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total investments, at value |

55,077,492 | 2,592,435 | 14,599,629 | 398,969,816 | ||||||||||||

| Cash |

— | — | 340,228 | — | ||||||||||||

| Cash collateral for futures contracts |

— | 3,620,662 | 1,389,142 | 17,345,317 | ||||||||||||

| Receivables: |

||||||||||||||||

| Dividends |

91,680 | 150 | 11,753 | 443,151 | ||||||||||||

| Investments sold |

— | — | — | 4,797,563 | ||||||||||||

| Unrealized appreciation on forward foreign currency contracts outstanding |

— | — | 44,655 | — | ||||||||||||

| Unrealized appreciation on futures contracts |

— | — | — | 608,249 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total Assets |

55,169,172 | 6,213,247 | 16,385,407 | 422,164,096 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Liabilities: | ||||||||||||||||

| Due to custodian |

64,180 | 704,389 | — | 432 | ||||||||||||

| Payables: |

||||||||||||||||

| Shares repurchased |

— | — | — | 4,978,834 | ||||||||||||

| Investments purchased |

— | — | — | 68,680 | ||||||||||||

| Unrealized depreciation on forward foreign currency contracts outstanding |

— | — | 33,378 | — | ||||||||||||

| Unrealized depreciation on futures contracts |

— | 42,812 | 527,336 | — | ||||||||||||

| Accrued unitary management fees |

35,874 | 2,486 | 12,392 | 135,378 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total Liabilities |

100,054 | 749,687 | 573,106 | 5,183,324 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Net Assets | $ | 55,069,118 | $ | 5,463,560 | $ | 15,812,301 | $ | 416,980,772 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Net Assets Consist of: | ||||||||||||||||

| Shares of beneficial interest |

$ | 51,959,019 | $ | 3,311,609 | $ | 17,078,648 | $ | 494,345,474 | ||||||||

| Undistributed net investment income (loss) |

354,017 | — | (40,756 | ) | 927,472 | |||||||||||

| Undistributed net realized gain (loss) |

60,092 | 2,194,763 | (335,253 | ) | (102,970,391 | ) | ||||||||||

| Net unrealized appreciation (depreciation) |

2,695,990 | (42,812 | ) | (890,338 | ) | 24,678,217 | ||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Net Assets | $ | 55,069,118 | $ | 5,463,560 | $ | 15,812,301 | $ | 416,980,772 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Shares outstanding (unlimited amount authorized, $0.01 par value) |

750,000 | 150,001 | 700,000 | 16,750,000 | ||||||||||||

| Net asset value |

$ | 73.43 | $ | 36.42 | $ | 22.59 | $ | 24.89 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Market price |

$ | 73.49 | $ | 36.31 | $ | 22.60 | $ | 24.92 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Unaffiliated investments, at cost |

$ | 52,381,502 | $ | — | $ | 8,884,208 | $ | 363,129,073 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Affiliated investments, at cost |

$ | — | $ | 2,592,435 | $ | 6,089,700 | $ | 11,770,775 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total investments, at cost |

$ | 52,381,502 | $ | 2,592,435 | $ | 14,973,908 | $ | 374,899,848 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

See accompanying Notes to Financial Statements which are an integral part of the financial statements.

|

|

22 |

|

For the year ended October 31, 2015

| PowerShares Active U.S. Real Estate Fund (PSR) |

PowerShares China A-Share Portfolio (CHNA) |

PowerShares Multi-Strategy Alternative Portfolio (LALT) |

PowerShares S&P 500® Downside Hedged Portfolio (PHDG) |

|||||||||||||

| Investment Income: | ||||||||||||||||

| Unaffiliated dividend income |

$ | 1,436,586 | $ | — | $ | 125,436 | $ | 9,313,518 | ||||||||

| Affiliated dividend income |

6 | (1,568 | ) | 3,206 | 66,213 | |||||||||||

| Foreign withholding tax |

— | — | (999 | ) | (1,121 | ) | ||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total Income |

1,436,592 | (1,568 | ) | 127,643 | 9,378,610 | |||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Expenses: | ||||||||||||||||

| Unitary management fees |

397,081 | 45,372 | 155,519 | 2,309,217 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Less: Waivers |

(30 | ) | (3,893 | ) | (3,084 | ) | (213,625 | ) | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Net Expenses |

397,051 | 41,479 | 152,435 | 2,095,592 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Net Investment Income (Loss) |

1,039,541 | (43,047 | ) | (24,792 | ) | 7,283,018 | ||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Realized and Unrealized Gain (Loss): | ||||||||||||||||

| Net realized gain (loss) from: |

||||||||||||||||

| Investment securities |

1,162,527 | — | (149,764 | ) | (10,477,875 | ) | ||||||||||

| In-kind redemptions |

1,195,999 | — | 370,144 | 3,013,185 | ||||||||||||

| Futures contracts |

— | 2,365,500 | 162,850 | (69,528,145 | ) | |||||||||||

| Foreign currencies |

— | — | (966,266 | ) | — | |||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Net realized gain (loss) |

2,358,526 | 2,365,500 | (583,036 | ) | (76,992,835 | ) | ||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Change in net unrealized appreciation (depreciation) on: |

||||||||||||||||

| Investment securities |

(1,016,843 | ) | — | (473,592 | ) | (4,706,784 | ) | |||||||||

| Futures contracts |

— | (128,950 | ) | (561,256 | ) | 3,403,163 | ||||||||||

| Foreign currencies |

— | — | (3,083 | ) | — | |||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Net change in unrealized appreciation (depreciation) |

(1,016,843 | ) | (128,950 | ) | (1,037,931 | ) | (1,303,621 | ) | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Net realized and unrealized gain (loss) |

1,341,683 | 2,236,550 | (1,620,967 | ) | (78,296,456 | ) | ||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Net increase (decrease) in net assets resulting from operations |

$ | 2,381,224 | $ | 2,193,503 | $ | (1,645,759 | ) | $ | (71,013,438 | ) | ||||||

|

|

|

|

|

|

|

|

|

|||||||||

See accompanying Notes to Financial Statements which are an integral part of the financial statements.

|

|

23 |

|

Statements of Changes in Net Assets

For the years ended October 31, 2015 and 2014

| PowerShares Active U.S. Real Estate Fund (PSR) |

PowerShares China A-Share Portfolio (CHNA) |

|||||||||||||||

| 2015 | 2014 | 2015 | 2014 | |||||||||||||

| Operations: | ||||||||||||||||

| Net investment income (loss) |

$ | 1,039,541 | $ | 515,868 | $ | (43,047 | ) | $ | (10,058 | ) | ||||||

| Net realized gain (loss) |

2,358,526 | 3,072,100 | 2,365,500 | (53,874 | ) | |||||||||||

| Net change in unrealized appreciation (depreciation) |

(1,016,843 | ) | 2,825,687 | (128,950 | ) | 54,037 | ||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Net increase (decrease) in net assets resulting from operations |

2,381,224 | 6,413,655 | 2,193,503 | (9,895 | ) | |||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Distributions to Shareholders from: | ||||||||||||||||

| Net investment income |

(860,284 | ) | (504,520 | ) | — | — | ||||||||||

| Net realized gains |

— | — | — | — | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total distributions to shareholders |

(860,284 | ) | (504,520 | ) | — | — | ||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Shareholder Transactions: | ||||||||||||||||

| Proceeds from shares sold |

25,408,584 | 45,857,016 | 17,894,727 | — | ||||||||||||

| Value of shares repurchased |

(14,256,223 | ) | (42,550,001 | ) | (17,120,361 | ) | — | |||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Net increase (decrease) in net assets resulting from shares transactions |

11,152,361 | 3,307,015 | 774,366 | — | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Increase (Decrease) in Net Assets |

12,673,301 | 9,216,150 | 2,967,869 | (9,895 | ) | |||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Net Assets: | ||||||||||||||||

| Beginning of year |

42,395,817 | 33,179,667 | 2,495,691 | 2,505,586 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| End of year |

$ | 55,069,118 | $ | 42,395,817 | $ | 5,463,560 | $ | 2,495,691 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Undistributed net investment income (loss) at end of year |

$ | 354,017 | $ | 174,760 | $ | — | $ | (7,914 | ) | |||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Changes in Shares Outstanding: | ||||||||||||||||

| Shares sold |

350,000 | 700,000 | 500,000 | — | ||||||||||||

| Shares repurchased |

(200,000 | ) | (650,000 | ) | (450,000 | ) | — | |||||||||

| Shares outstanding, beginning of year |

600,000 | 550,000 | 100,001 | 100,001 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Shares outstanding, end of year |

750,000 | 600,000 | 150,001 | 100,001 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| (a) | For the period May 27, 2014 (commencement of investment operations) through October 31, 2014. |

See accompanying Notes to Financial Statements which are an integral part of the financial statements.

|

|

24 |

|

| PowerShares Multi-Strategy Alternative Portfolio (LALT) |

PowerShares S&P

500® Downside Hedged Portfolio (PHDG) |

|||||||||||||

| 2015 | 2014(a) | 2015 | 2014 | |||||||||||

| $ | (24,792 | ) | $ | 6,275 | $ | 7,283,018 | $ | 2,900,291 | ||||||

| (583,036 | ) | (468,997 | ) | (76,992,835 | ) | 7,937,299 | ||||||||

| (1,037,931 | ) | 147,593 | (1,303,621 | ) | 19,094,957 | |||||||||

|

|

|

|

|

|

|

|

|

|||||||

| (1,645,759 | ) | (315,129 | ) | (71,013,438 | ) | 29,932,547 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||

| — | — | (7,133,672 | ) | (2,996,245 | ) | |||||||||

| — | — | (27,026,571 | ) | — | ||||||||||

|

|

|

|

|

|

|

|

|

|||||||

| — | — | (34,160,243 | ) | (2,996,245 | ) | |||||||||

|

|

|

|

|

|

|

|

|

|||||||

| 7,198,920 | 22,455,058 | 290,676,953 | 462,383,150 | |||||||||||

| (11,880,789 | ) | — | (297,987,820 | ) | (49,436,306 | ) | ||||||||

|

|

|

|

|

|

|

|

|

|||||||

| (4,681,869 | ) | 22,455,058 | (7,310,867 | ) | 412,946,844 | |||||||||

|

|

|

|

|

|

|

|

|

|||||||

| (6,327,628 | ) | 22,139,929 | (112,484,548 | ) | 439,883,146 | |||||||||

|

|

|

|

|

|

|

|

|

|||||||

| 22,139,929 | — | 529,465,320 | 89,582,174 | |||||||||||

|

|

|

|

|

|

|

|

|

|||||||

| $ | 15,812,301 | $ | 22,139,929 | $ | 416,980,772 | $ | 529,465,320 | |||||||

|

|

|

|

|

|

|

|

|

|||||||

| $ | (40,756 | ) | $ | (14,360 | ) | $ | 927,472 | $ | 782,566 | |||||

|

|

|

|

|

|

|

|

|

|||||||

| 300,000 | 900,000 | 10,350,000 | 16,450,000 | |||||||||||

| (500,000 | ) | — | (11,550,000 | ) | (1,800,001 | ) | ||||||||

| 900,000 | — | 17,950,000 | 3,300,001 | |||||||||||

|

|

|

|

|

|

|

|

|

|||||||

| 700,000 | 900,000 | 16,750,000 | 17,950,000 | |||||||||||

|

|

|

|

|

|

|

|

|

|||||||

|

|

25 |

|

PowerShares Active U.S. Real Estate Fund (PSR)

| Year Ended October 31, | ||||||||||||||||||||

| 2015 | 2014 | 2013 | 2012 | 2011 | ||||||||||||||||

| Per Share Operating Performance: | ||||||||||||||||||||

| Net asset value at beginning of year |

$ | 70.66 | $ | 60.33 | $ | 55.99 | $ | 50.32 | $ | 45.42 | ||||||||||

| Net investment income(a) |

1.51 | 0.92 | 0.93 | 0.77 | 0.54 | |||||||||||||||

| Net realized and unrealized gain on investments |

2.51 | 10.33 | 4.20 | 5.82 | 5.15 | |||||||||||||||

| Total from investment operations |

4.02 | 11.25 | 5.13 | 6.59 | 5.69 | |||||||||||||||

| Distributions to shareholders from: |

||||||||||||||||||||

| Net investment income |

(1.25 | ) | (0.92 | ) | (0.79 | ) | (0.84 | ) | (0.79 | ) | ||||||||||

| Net realized gains |

— | — | — | (0.08 | ) | — | ||||||||||||||

| Total distributions |

(1.25 | ) | (0.92 | ) | (0.79 | ) | (0.92 | ) | (0.79 | ) | ||||||||||

| Net asset value at end of year |

$ | 73.43 | $ | 70.66 | $ | 60.33 | $ | 55.99 | $ | 50.32 | ||||||||||

| Market price at end of year(b) |

$ | 73.49 | $ | 70.63 | $ | 60.35 | $ | 55.94 | $ | 50.36 | ||||||||||

| Net Asset Value Total Return(c) | 5.72 | % | 18.95 | % | 9.23 | % | 13.22 | % | 12.77 | % | ||||||||||

| Market Price Total Return(c) | 5.85 | % | 18.86 | % | 9.37 | % | 13.03 | % | 12.86 | % | ||||||||||

| Ratios/Supplemental Data: | ||||||||||||||||||||

| Net assets at end of year (000’s omitted) |

$ | 55,069 | $ | 42,396 | $ | 33,180 | $ | 22,394 | $ | 17,612 | ||||||||||

| Ratio to average net assets of: |

||||||||||||||||||||

| Expenses, after Waivers |

0.80 | % | 0.80 | % | 0.80 | % | 0.80 | % | 0.80 | % | ||||||||||

| Expenses, prior to Waivers |

0.80 | % | 0.80 | % | 0.80 | % | 0.80 | % | 0.80 | % | ||||||||||

| Net investment income |

2.09 | % | 1.46 | % | 1.56 | % | 1.42 | % | 1.10 | % | ||||||||||

| Portfolio turnover rate(d) |

199 | % | 169 | % | 131 | % | 33 | % | 37 | % | ||||||||||

| (a) | Based on average shares outstanding. |

| (b) | The mean between the last bid and ask price. |

| (c) | Net asset value total return is calculated assuming an initial investment made at the net asset value at the beginning of the period, reinvestment of all dividends and distributions at net asset value during the period, and the redemption on the last day of the period. Net asset value total return includes adjustments in accordance with accounting principles generally accepted in the United States of America and as such, the net asset value for financial reporting purposes and the returns based upon those net asset values may differ from the net asset value and returns for shareholder transactions. Market price total return is calculated assuming an initial investment made at the market price at the beginning of the period, reinvestment of all dividends and distributions at market price during the period, and sale at the market price on the last day of the period. Total investment returns calculated for a period of less than one year are not annualized. |

| (d) | Portfolio turnover rate is not annualized for periods less than one year, if applicable, and does not include securities received or delivered from processing creations or redemptions. |

PowerShares China A-Share Portfolio (CHNA)

| Year Ended October 31, | For the Period October 8, 2013(a) Through October 31, 2013 |

|||||||||||

| 2015 | 2014 | |||||||||||

| Per Share Operating Performance: | ||||||||||||

| Net asset value at beginning of period |

$ | 24.96 | $ | 25.06 | $ | 25.40 | ||||||

| Net investment income(b) |

(0.18 | ) | (0.10 | ) | 0.00 | (c) | ||||||

| Net realized and unrealized gain (loss) on investments |

11.64 | 0.00 | (c) | (0.34 | ) | |||||||

| Total from investment operations |

11.46 | (0.10 | ) | (0.34 | ) | |||||||

| Net asset value at end of period |

$ | 36.42 | $ | 24.96 | $ | 25.06 | ||||||

| Market price at end of period(d) |

$ | 36.31 | $ | 25.00 | $ | 25.18 | ||||||

| Net Asset Value Total Return(e) | 45.91 | % | (0.40 | )% | (1.34 | )%(f) | ||||||

| Market Price Total Return(e) | 45.24 | % | (0.72 | )% | (0.87 | )%(f) | ||||||

| Ratios/Supplemental Data: | ||||||||||||

| Net assets at end of period (000’s omitted) |

$ | 5,464 | $ | 2,496 | $ | 2,506 | ||||||

| Ratio to average net assets of: |

||||||||||||

| Expenses, after Waivers |

0.46 | %(g) | 0.43 | %(g) | 0.45 | %(h) | ||||||

| Expenses, prior to Waivers |

0.50 | %(g) | 0.50 | %(g) | 0.50 | %(h) | ||||||

| Net investment income (loss), after Waivers |

(0.47 | )% | (0.43 | )% | (0.13 | )%(h) | ||||||

| (a) | Commencement of investment operations. |

| (b) | Based on average shares outstanding. |

| (c) | Amount represents less than $0.005. |

| (d) | The mean between the last bid and ask price. |

| (e) | Net asset value total return is calculated assuming an initial investment made at the net asset value at the beginning of the period, reinvestment of all dividends and distributions at net asset value during the period, and the redemption on the last day of the period. Net asset value total return includes adjustments in accordance with accounting principles generally accepted in the United States of America and as such, the net asset value for financial reporting purposes and the returns based upon those net asset values may differ from the net asset value and returns for shareholder transactions. Market price total return is calculated assuming an initial investment made at the market price at the beginning of the period, reinvestment of all dividends and distributions at market price during the period, and sale at the market price on the last day of the period. Total investment returns calculated for a period of less than one year are not annualized. |

| (f) | The net asset value total return from Fund Inception (October 10, 2013, the first day of trading on the exchange) to October 31, 2013 was (1.07)%. The market price total return from Fund Inception to October 31, 2013 was (0.83)%. |

| (g) | In addition to the fees and expenses which the Fund bears directly, the Fund indirectly bears a pro rata share of the fees and expenses of the investment companies in which the Fund invests. Estimated investment companies’ expenses are not expenses that are incurred directly by the Fund. They are expenses that are incurred directly by the investment companies and are deducted from the value of the investment companies the Fund invests in. The effect of the estimated investment companies’ expenses that the Fund bears indirectly is included in the Fund’s total return. |

| (h) | Annualized. |

See accompanying Notes to Financial Statements which are an integral part of the financial statements.

|

|

26 |

|

Financial Highlights (continued)

PowerShares Multi-Strategy Alternative Portfolio (LALT)

| Year Ended October 31, 2015 |

For the Period May 27, 2014(a) Through October 31, 2014 |

|||||||

| Per Share Operating Performance: | ||||||||

| Net asset value at beginning of period |

$ | 24.60 | $ | 25.00 | ||||

| Net investment income(b) |

(0.04 | ) | 0.01 | |||||

| Net realized and unrealized gain (loss) on investments |

(1.97 | ) | (0.41 | ) | ||||

| Total from investment operations |

(2.01 | ) | (0.40 | ) | ||||

| Net asset value at end of period |

$ | 22.59 | $ | 24.60 | ||||

| Market price at end of period(c) |

$ | 22.60 | $ | 24.55 | ||||

| Net Asset Value Total Return(d) | (8.17 | )% | (1.60 | )%(e) | ||||

| Market Price Total Return(d) | (7.94 | )% | (1.80 | )%(e) | ||||

| Ratios/Supplemental Data: | ||||||||

| Net assets at end of period (000’s omitted) |

$ | 15,812 | $ | 22,140 | ||||

| Ratio to average net assets of: |

||||||||

| Expenses, after Waivers |

0.93 | %(f) | 0.90 | %(f)(g) | ||||

| Expenses, prior to Waivers |

0.95 | %(f) | 0.95 | %(f)(g) | ||||

| Net investment income (loss), after Waivers |

(0.15 | )% | 0.08 | %(g) | ||||

| Portfolio turnover rate(h) |

154 | % | 63 | % | ||||

| (a) | Commencement of investment operations. |

| (b) | Based on average shares outstanding. |

| (c) | The mean between the last bid and ask price. |

| (d) | Net asset value total return is calculated assuming an initial investment made at the net asset value at the beginning of the period, reinvestment of all dividends and distributions at net asset value during the period, and the redemption on the last day of the period. Net asset value total return includes adjustments in accordance with accounting principles generally accepted in the United States of America and as such, the net asset value for financial reporting purposes and the returns based upon those net asset values may differ from the net asset value and returns for shareholder transactions. Market price total return is calculated assuming an initial investment made at the market price at the beginning of the period, reinvestment of all dividends and distributions at market price during the period, and sale at the market price on the last day of the period. Total investment returns calculated for a period of less than one year are not annualized. |

| (e) | The net asset value total return from Fund Inception (May 29, 2014, the first day of trading on the exchange) to October 31, 2014 was (1.64)%. The market price total return from Fund Inception to October 31, 2014 was (1.92)%. |

| (f) | In addition to the fees and expenses which the Fund bears directly, the Fund indirectly bears a pro rata share of the fees and expenses of the investment companies in which the Fund invests. Estimated investment companies’ expenses are not expenses that are incurred directly by the Fund. They are expenses that are incurred directly by the investment companies and are deducted from the value of the investment companies the Fund invests in. The effect of the estimated investment companies’ expenses that the Fund bears indirectly is included in the Fund’s total return. |

| (g) | Annualized. |

| (h) | Portfolio turnover rate is not annualized for periods less than one year, if applicable, and does not include securities received or delivered from processing creations or redemptions. |

See accompanying Notes to Financial Statements which are an integral part of the financial statements.

|

|

27 |

|

Financial Highlights (continued)

PowerShares S&P 500® Downside Hedged Portfolio (PHDG)

| Year Ended October 31, | For the

Period December 4, 2012(a) Through October 31, 2013 |

|||||||||||

| 2015 | 2014 | |||||||||||

| Per Share Operating Performance: | ||||||||||||

| Net asset value at beginning of period |

$ | 29.50 | $ | 27.15 | $ | 25.00 | ||||||

| Net investment income(b) |

0.33 | 0.33 | 0.33 | |||||||||

| Net realized and unrealized gain (loss) on investments |

(3.39 | ) | 2.49 | 2.04 | ||||||||

| Total from investment operations |

(3.06 | ) | 2.82 | 2.37 | ||||||||

| Distributions to shareholders from: |

||||||||||||

| Net investment income |

(0.32 | ) | (0.47 | ) | (0.22 | ) | ||||||

| Net realized gains |

(1.23 | ) | — | — | ||||||||

| Total distributions |

(1.55 | ) | (0.47 | ) | (0.22 | ) | ||||||

| Net asset value at end of period |

$ | 24.89 | $ | 29.50 | $ | 27.15 | ||||||

| Market price at end of period(c) |

$ | 24.92 | $ | 29.49 | $ | 27.23 | ||||||

| Net Asset Value Total Return(d) | (10.83 | )% | 10.50 | % | 9.51 | %(e) | ||||||

| Market Price Total Return(d) | (10.69 | )% | 10.14 | % | 9.83 | %(e) | ||||||

| Ratios/Supplemental Data: | ||||||||||||

| Net assets at end of period (000’s omitted) |

$ | 416,981 | $ | 529,465 | $ | 89,582 | ||||||

| Ratio to average net assets of: |

||||||||||||

| Expenses, after Waivers |

0.35 | %(f) | 0.36 | %(f) | 0.38 | %(g) | ||||||

| Expenses, prior to Waivers |

0.39 | %(f) | 0.39 | %(f) | 0.39 | %(g) | ||||||

| Net investment income, after Waivers |

1.23 | % | 1.16 | % | 1.37 | %(g) | ||||||

| Portfolio turnover rate(h) |

478 | % | 58 | % | 99 | % | ||||||

| (a) | Commencement of investment operations. |

| (b) | Based on average shares outstanding. |

| (c) | The mean between the last bid and ask price. |

| (d) | Net asset value total return is calculated assuming an initial investment made at the net asset value at the beginning of the period, reinvestment of all dividends and distributions at net asset value during the period, and the redemption on the last day of the period. Net asset value total return includes adjustments in accordance with accounting principles generally accepted in the United States of America and as such, the net asset value for financial reporting purposes and the returns based upon those net asset values may differ from the net asset value and returns for shareholder transactions. Market price total return is calculated assuming an initial investment made at the market price at the beginning of the period, reinvestment of all dividends and distributions at market price during the period, and sale at the market price on the last day of the period. Total investment returns calculated for a period of less than one year are not annualized. |

| (e) | The net asset value total return from Fund Inception (December 6, 2012, the first day of trading on the exchange) to October 31, 2013 was 8.99%. The market price total return from Fund Inception to October 31, 2013 was 9.26%. |

| (f) | In addition to the fees and expenses which the Fund bears directly, the Fund indirectly bears a pro rata share of the fees and expenses of the investment companies in which the Fund invests. Estimated investment companies’ expenses are not expenses that are incurred directly by the Fund. They are expenses that are incurred directly by the investment companies and are deducted from the value of the investment companies the Fund invests in. The effect of the estimated investment companies’ expenses that the Fund bears indirectly is included in the Fund’s total return. |

| (g) | Annualized. |

| (h) | Portfolio turnover rate is not annualized for periods less than one year, if applicable, and does not include securities received or delivered from processing creations or redemptions. |

See accompanying Notes to Financial Statements which are an integral part of the financial statements.

|

|

28 |

|

PowerShares Actively Managed Exchange-Traded Fund Trust

October 31, 2015

Note 1. Organization

PowerShares Actively Managed Exchange-Traded Fund Trust (the “Trust”) was organized as a Delaware statutory trust on November 6, 2007 and is authorized to have multiple series of portfolios. The Trust is an open-end management investment company registered under the Investment Company Act of 1940, as amended (the “1940 Act”). As of October 31, 2015, the Trust offered four portfolios:

| Full Name |

Short Name | |

| PowerShares Active U.S. Real Estate Fund (PSR) | “Active U.S. Real Estate Fund” | |

| PowerShares China A-Share Portfolio (CHNA) | “China A-Share Portfolio” | |

| PowerShares Multi-Strategy Alternative Portfolio (LALT) | “Multi-Strategy Alternative Portfolio” | |

| PowerShares S&P 500® Downside Hedged Portfolio (PHDG) | “S&P 500® Downside Hedged Portfolio” |

Each portfolio (each, a “Fund”, and collectively, the “Funds”) represents a separate series of the Trust. The shares of the Funds are referred to herein as “Shares” or “Fund’s Shares.” Each Fund’s Shares are listed and traded on NYSE Arca, Inc., except for Shares of Multi-Strategy Alternative Portfolio, which are listed and traded on The NASDAQ Stock Market LLC.

The market price of each Share may differ to some degree from the Fund’s net asset value (“NAV”). Unlike conventional mutual funds, each Fund issues and redeems Shares on a continuous basis, at NAV, only in a large specified number of Shares, each called a “Creation Unit.” Creation Units for Active U.S. Real Estate Fund are issued and redeemed principally in exchange for the deposit or delivery of a basket of securities (“Deposit Securities”). Creation Units for China A-Share Portfolio and Multi-Strategy Alternative Portfolio are issued and redeemed principally in exchange for the deposit or delivery of cash. Creation Units for S&P 500® Downside Hedged Portfolio are issued and redeemed partially in exchange for the deposit or delivery of cash and partially in exchange for Deposit Securities. Except when aggregated in Creation Units by Authorized Participants, the Shares are not individually redeemable securities of the Funds.

The investment objective for Active U.S. Real Estate Fund is high total return through growth of capital and current income. The investment objective for China A-Share Portfolio is to provide long-term capital appreciation. The investment objective for Multi-Strategy Alternative Portfolio is to seek a positive total return that has a low correlation to the broader securities markets. The investment objective for S&P 500® Downside Hedged Portfolio is to achieve positive total returns in rising or falling markets that are not directly correlated to broad equity or fixed income market returns.

Note 2. Significant Accounting Policies

The preparation of the financial statements in accordance with accounting principles generally accepted in the United States of America (“GAAP”) requires management to make estimates and assumptions that affect the reported amounts and disclosures in the financial statements, including estimates and assumptions related to taxation. Actual results could differ from these estimates. In addition, the Funds monitor for material events or transactions that may occur or become known after the period-end date and before the date the financial statements are released to print. The following is a summary of the significant accounting policies followed by the Funds in preparation of the financial statements.

A. Security Valuation

Securities, including restricted securities, are valued according to the following policies:

Securities, including restricted securities in a fund that are held as investments (the “Underlying Fund”) of a Fund, are valued in accordance with the Underlying Fund’s valuation policy. The policies of Underlying Funds affiliated with the Funds as a result of having the same investment adviser are set forth below.

A security listed or traded on an exchange (except convertible securities) is valued at its last sales price or official closing price as of the close of the customary trading session on the exchange where the security is principally traded, or lacking any sales or official closing price on a particular day, the security may be valued at the closing bid price on that day. Securities traded in the over-the-counter market are valued based on prices furnished by independent pricing services or market makers. When such securities are valued by an independent pricing service they may be considered fair valued. Futures contracts are valued at the final settlement price set by an exchange on which they are principally traded. Listed options are valued at the mean between the last bid and asked prices from the exchange on which they are principally traded. Options not listed on an exchange are valued by an independent source at the mean between the last bid and asked prices. For purposes of determining NAV per Share, futures and option contracts generally are valued 15 minutes after the close of the customary trading session of the New York Stock Exchange (“NYSE”).

Investments in open-end and closed-end registered investment companies that do not trade on an exchange are valued at the end of day NAV per share. Investments in open-end and closed-end registered investment companies that trade on an exchange are valued at the last sales price or official closing price as of the close of the customary trading session on the exchange where the security is principally traded.

|

|

29 |

|

Debt obligations (including convertible securities) and unlisted equities are fair valued using an evaluated quote provided by an independent pricing service. Evaluated quotes provided by the pricing service may be determined without exclusive reliance on quoted prices, and may reflect appropriate factors such as institution-size trading in similar groups of securities, developments related to specific securities, dividend rate (for unlisted equities), yield (for debt obligations), quality, type of issue, coupon rate (for debt obligations), maturity (for debt obligations), individual trading characteristics and other market data. Securities with a demand feature exercisable within one to seven days are valued at par. Debt obligations are subject to interest rate and credit risks. In addition, all debt obligations involve some risk of default with respect to interest and/or principal payments.

Foreign securities’ (including foreign exchange contracts’) prices are converted into U.S. dollar amounts using the applicable exchange rates as of the close of the London world markets. If market quotations are available and reliable for foreign exchange-traded equity securities, the securities will be valued at the market quotations. Because trading hours for certain foreign securities end before the close of the NYSE, closing market quotations may become unreliable. If between the time trading ends on a particular security and the close of the customary trading session on the NYSE, events occur that Invesco PowerShares Capital Management LLC (the “Adviser”) determines are significant and make the closing price unreliable, the Fund may fair value the security. If the event is likely to have affected the closing price of the security, the security will be valued at fair value in good faith using procedures approved by the Board of Trustees. Adjustments to closing prices to reflect fair value may also be based on a screening process of an independent pricing service to indicate the degree of certainty, based on historical data, that the closing price in the principal market where a foreign security trades is not the current value as of the close of the NYSE. Foreign securities’ prices meeting the approved degree of certainty that the price is not reflective of current value will be priced at the indication of fair value from the independent pricing service. Multiple factors may be considered by the independent pricing service in determining adjustments to reflect fair value and may include information relating to sector indices, American Depositary Receipts and domestic and foreign index futures. Foreign securities may have additional risks including exchange rate changes, potential for sharply devalued currencies and high inflation, political and economic upheaval, the relative lack of issuer information, relatively low market liquidity and the potential lack of strict financial and accounting controls and standards.

Securities for which market prices are not provided by any of the above methods may be valued based upon quotes furnished by independent sources. The last bid price may be used to value equity securities. The mean between the last bid and asked prices is used to value debt obligations, including corporate loans.

Securities for which market quotations are not readily available or became unreliable are valued at fair value as determined in good faith following procedures approved by the Board of Trustees. Issuer-specific events, market trends, bid/asked quotes of brokers and information providers and other market data may be reviewed in the course of making a good faith determination of a security’s fair value.

Each Fund may invest in securities that are subject to interest rate risk, meaning the risk that the prices will generally fall as interest rates rise and, conversely, the prices will generally rise as interest rates fall. Specific securities differ in their sensitivity to changes in interest rates depending on their individual characteristics. Changes in interest rates may result in increased market volatility, which may affect the value and/or liquidity of certain Fund investments.

Valuations change in response to many factors, including the historical and prospective earnings of the issuer, the value of the issuer’s assets, general economic conditions, interest rates, investor perceptions and market liquidity. Because of the inherent uncertainties of valuation, the values reflected in the financial statements may materially differ from the value received upon actual sale of those investments.

B. Other Risks

Equity Risk. Equity risk is the risk that the value of the securities that each Fund holds will fall due to general market and economic conditions, perceptions regarding the industries in which the issuers of securities that a Fund holds participate or factors relating to specific companies in which the Fund invests. For example, an adverse event, such as an unfavorable earnings report, may depress the value of securities a Fund holds; the price of securities may be particularly sensitive to general movements in the stock market; or a drop in the stock market may depress the price of most or all of the securities a Fund holds. In addition, securities of an issuer in the Fund’s portfolio may decline in price if the issuer fails to make anticipated dividend payments because, among other reasons, the issuer of the security experiences a decline in its financial condition.

China Investment Risk. For China A-Share Portfolio, there are significant legal requirements that must be resolved before the Fund can invest directly in A-Shares. Currently, the Fund invests in futures contracts. Investing in futures based on the performance of Chinese companies included in the FTSE China A50 Index involves several risks: The economy of China differs, sometimes unfavorably, from the U.S. economy in such respects as structure, general development, government involvement, wealth distribution, rate of inflation, growth rate, allocation of resources and capital reinvestment, among others; the central government has historically exercised substantial control over virtually every sector of the Chinese economy through administrative regulation and/or state ownership; and actions of the Chinese central and local government authorities continue to have a substantial effect on economic conditions in China. In addition, from time to time the Chinese government has taken actions that influence the prices at which certain goods may be sold,

|

|

30 |

|

encouraged companies to invest or concentrate in particular industries, induced mergers between companies in certain industries and induced private companies to publicly offer their securities to increase or continue the rate of economic growth, control the rate of inflation or otherwise regulated economic expansion. The regulatory oversight of Chinese companies differs from that in the United States and may not otherwise deter or uncover fraudulent actions by the issuers.

REIT Risk. For Active U.S. Real Estate Fund, although the Fund will not invest in real estate directly, the REITs in which the Fund invests are subject to risks inherent in the direct ownership of real estate. These risks include, but are not limited to, a possible lack of mortgage funds and associated interest rate risks, overbuilding, property vacancies, increases in property taxes and operating expenses, changes in zoning laws, losses due to environmental damages and changes in neighborhood values and appeal to purchasers.

Non-Diversified Fund Risk. Because each Fund is non-diversified and can invest a greater portion of its assets in securities of individual issuers than diversified funds, changes in the market value of a single investment could cause greater fluctuations in Share price than would occur in a diversified fund. This may increase each Fund’s volatility and cause the performance of a relatively small number of issuers to have a greater impact on each Fund’s performance.

Management Risk. The Funds are subject to management risk because they are actively managed portfolios. In managing a Fund’s portfolio securities, the Adviser or a sub-adviser (as applicable and as set forth below), applies investment techniques and risk analyses in making investment decisions, but there can be no guarantee that these will produce the desired results.

Cash Transaction Risk. Unlike most exchange-traded funds (“ETFs”), China A-Share Portfolio and Multi-Strategy Alternative Portfolio currently effect creations and redemptions principally for cash and S&P 500® Downside Hedged Portfolio currently effects creations and redemptions partially for cash and partially in-kind, rather than primarily in-kind, because of the nature of each of these Funds’ investments. As such, investments in each Fund’s Shares may be less tax efficient than investments in shares of conventional ETFs that utilize an entirely in-kind redemption process.

VIX Index Risk. For Multi-Strategy Alternative Portfolio and S&P 500® Downside Hedged Portfolio, the Chicago Board Options Exchange (“CBOE”) can make methodological changes to the calculation of the Chicago Board Options Exchange Volatility Index (“VIX Index”) that could affect the value of the futures contracts on the VIX Index. There can be no assurance that the CBOE will not change the VIX Index calculation methodology in a way that may affect the value of your investment. Additionally, the CBOE may alter, discontinue or suspend calculation or dissemination of the VIX Index and/or the exercise settlement value. Any of these actions could adversely affect the value of each Fund’s Shares.

Tax Risk. China A-Share Portfolio may invest in stock index futures contracts that provide exposure to the China A-Shares market. Multi-Strategy Alternative Portfolio may purchase and sell interest rate futures, including Eurodollar interest rate futures or Euro Euribor interest rate futures, and VIX Index futures contracts. S&P 500® Downside Hedged Portfolio will gain most of its exposure to the futures markets by entering into VIX Index futures (and, to a lesser extent, S&P 500® Index futures (“S&P 500 Futures”)). To qualify as a regulated investment company (“RIC”) under Subchapter M of the Internal Revenue Code of 1986, as amended (the “Internal Revenue Code”), the Funds must meet a qualifying income test each taxable year. The S&P 500® Downside Hedged Portfolio has received a private letter ruling from the Internal Revenue Service (“IRS”) that income it derives from VIX Index futures contracts will constitute qualifying income for purposes of that test. China A-Share Portfolio and Multi-Strategy Alternative Portfolio each received an opinion of its counsel (which is not binding on the IRS or courts) stating that such income should be qualifying for purposes of that test. Failure to comply with the qualifying income test in any taxable year would have significant negative tax consequences to shareholders of the Funds. If the IRS were to determine that the income that the Funds derive from futures did not constitute qualifying income, the Funds likely would be required to reduce their exposure to such investments in order to maintain qualification as a RIC, which may result in difficulty in implementing their investment strategies.

Risk of Investing in Investment Companies. Because Multi-Strategy Alternative Portfolio may invest in other investment companies generally, and China A-Share Portfolio and S&P 500® Downside Hedged Portfolio may invest in other ETFs specifically, each Fund’s investment performance may depend on the investment performance of the funds in which it invests. An investment in an investment company is subject to the risks associated with that investment company. Each Fund will pay indirectly a proportional share of the fees and expenses of the investment companies in which it invests (including costs and fees of the investment companies), while continuing to pay its own management fee to the Adviser. As a result, shareholders will absorb duplicate levels of fees with respect to a Fund’s investments in other investment companies.

Commodity Pool Risk. China A-Share Portfolio, Multi-Strategy Alternative Portfolio and S&P 500® Downside Hedged Portfolio invest in futures contracts, which cause each to be deemed to be a commodity pool, thereby subjecting each Fund to regulation under the Commodity Exchange Act and rules of the Commodity Futures Trading Commission (“CFTC”). The Adviser is registered as a Commodity Pool Operator (“CPO”) and as a commodity trading advisor (“CTA”), and the Funds will be operated in accordance with CFTC rules. Registration as a CPO or CTA subjects the Adviser to additional laws, regulations and enforcement policies, all of which could increase compliance costs and may affect the operations and financial performance of these Funds. Registration as a commodity pool may have negative effects on the ability of each of these Funds to engage in their respective planned investment program.

|

|

31 |

|

C. Federal Income Taxes

Each Fund intends to comply with the provisions of the Internal Revenue Code of 1986, as amended (the “Internal Revenue Code”), applicable to regulated investment companies and to distribute substantially all of the Fund’s taxable earnings to its shareholders. As such, the Funds will not be subject to federal income taxes on otherwise taxable income (including net realized gains) that is distributed to the shareholders. Therefore, no provision for federal income taxes is recorded in the financial statements.

Each Fund recognizes the tax benefits of uncertain tax positions only when the position is more likely than not to be sustained. Management has analyzed each Fund’s uncertain tax positions and concluded that no liability for unrecognized tax benefits should be recorded related to uncertain tax positions. Management is not aware of any tax positions for which it is reasonably possible that the total amounts of unrecognized tax benefits will change materially in the next 12 months.

Income and capital gain distributions are determined in accordance with federal income tax regulations, which may differ from GAAP. These differences are primarily due to differing book and tax treatments for in-kind transactions, losses deferred due to wash sales, and passive foreign investment company adjustments, if any.

The Funds file U.S. federal tax returns and tax returns in certain other jurisdictions. Generally, a Fund is subject to examinations by such taxing authorities for up to three years after the filing of the return for the tax period.

D. Investment Transactions and Investment Income

Investment transactions are accounted for on a trade date basis. Realized gains and losses from the sale or disposition of securities are computed on the specific identified cost basis. Interest income is recorded on the accrual basis. Dividend income (net of withholding tax, if any) is recorded on the ex-dividend date. Realized gains, dividends and interest received by a Fund may give rise to withholding and other taxes imposed by foreign countries. Tax conventions between certain countries and the United States may reduce or eliminate such taxes.

Corporate actions (including cash dividends) are recorded net of non-reclaimable foreign tax withholdings on the ex-date.

Brokerage commissions and mark ups are considered transaction costs and are recorded as an increase to the cost basis of securities purchased and/or a reduction of proceeds on a sale of securities. Such transaction costs are included in the determination of net realized and unrealized gain (loss) from investment securities reported in the Statements of Operations and the Statements of Changes in Net Assets and the net realized and unrealized gains (losses) on securities per share in the Financial Highlights. Transaction costs are included in the calculation of each Fund’s net asset value and, accordingly, they reduce each Fund’s total returns. These transaction costs are not considered operating expenses and are not reflected in net investment income reported in the Statements of Operations and the Statements of Changes in Net Assets, or the net investment income per share and the ratios of expenses and net investment income reported in the Financial Highlights, nor are they limited by any expense limitation arrangements between each Fund and the Adviser.

E. Country Determination

For the purposes of making investment selection decisions and presentation in the Schedule of Investments, the Adviser may determine the country in which an issuer is located and/or credit risk exposure based on various factors. These factors include the laws of the country under which the issuer is organized, where the issuer maintains a principal office, the country in which the issuer derives 50% or more of its total revenues and the country that has the primary market for the issuer’s securities, as well as other criteria. Among the other criteria that may be evaluated for making this determination are the country in which the issuer maintains 50% or more of its assets, the type of security, financial guarantees and enhancements, the nature of the collateral and the sponsor organization. Country of issuer and/or credit risk exposure has been determined to be the United States of America, unless otherwise noted.

F. Expenses

Each Fund has agreed to pay an annual unitary management fee to the Adviser. Out of the unitary management fee, the Adviser has agreed to pay for substantially all expenses of the Funds, including payments to the Sub-Advisers (as defined below) for Active U.S. Real Estate Fund and Multi-Strategy Alternative Portfolio, and for each Fund, the cost of transfer agency, custody, fund administration, legal, audit and other services, except for advisory fees, distribution fees, if any, brokerage expenses, taxes, interest, litigation expenses and other extraordinary expenses (including acquired fund fees and expenses, if any).

Expenses of the Trust that are excluded from a Fund’s unitary management fee and are directly identifiable to a specific Fund are applied to that Fund. Expenses of the Trust that are excluded from each Fund’s unitary management fee and that are not readily identifiable to a specific Fund are allocated in such a manner as deemed equitable, taking into consideration the nature and type of expense and the relative net assets of each Fund.

To the extent a Fund invests in other investment companies, the expenses shown in the accompanying financial statements reflect the expenses of the Fund and do not include any expenses of the investment companies in which it invests. The effects of such investment companies’ expenses are included in the realized and unrealized gain or loss on the investments in the investment companies.

G. Dividends and Distributions to Shareholders

Active U.S. Real Estate Fund and S&P 500® Downside Hedged Portfolio declare and pay dividends from net investment income, if any, to their shareholders quarterly and record such dividends on ex-dividend date. China A-Share Portfolio and Multi-Strategy Alternative Portfolio declare and pay dividends from net investment income, if any, to their shareholders annually and record such dividends on ex-dividend date. Generally, each Fund distributes net realized taxable capital gains, if any, annually in cash and records them on ex-dividend date. Such

|

|

32 |

|

distributions on a tax basis are determined in conformity with federal income tax regulations which may differ from GAAP. Distributions in excess of tax basis earnings and profits, if any, are reported in such Fund’s financial statements as a tax return of capital at fiscal year-end.

H. Foreign Currency Translations

Foreign currency is valued at the close of the NYSE based on quotations posted by banks and major currency dealers. Portfolio securities and other assets and liabilities denominated in foreign currencies are translated into U.S. dollar amounts at date of valuation. Purchases and sales of portfolio securities (net of foreign taxes withheld on disposition) and income items denominated in foreign currencies are translated into U.S. dollar amounts on the respective dates of such transactions. The Funds do not separately account for the portion of the results of operations resulting from changes in foreign exchange rates on investments and the fluctuations arising from changes in market prices of securities held. The combined results of changes in foreign exchange rates and the fluctuation of market prices on investments (net of estimated foreign tax withholding) are included with the net realized and unrealized gain or loss from investments in the Statements of Operations. Reported net realized foreign currency gains or losses arise from (1) sales of foreign currencies, (2) currency gains or losses realized between the trade and settlement dates on securities transactions, and (3) the difference between the amounts of dividends, interest, and foreign withholding taxes recorded on each Fund’s books and the U.S. dollar equivalent of the amounts actually received or paid. Net unrealized foreign currency gains and losses arise from changes in the fair values of assets and liabilities, other than investments in securities at fiscal period-end, resulting from changes in exchange rates.

The Funds may invest in foreign securities, which may be subject to foreign taxes on income, gains on investments or currency repatriation, a portion of which may be recoverable. Foreign taxes, if any, are recorded based on the tax regulations and rates that exist in the foreign markets in which each Fund invests.

I. Forward Foreign Currency Contracts

Multi-Strategy Alternative Portfolio engages in foreign currency transactions either on a spot (i.e. for prompt delivery and settlement) basis at the rate prevailing in the currency exchange market at the time or through forward foreign currency contracts to manage or minimize currency or exchange rate risk.

The Fund also enters into forward foreign currency contracts for the purchase or sale of a security denominated in a foreign currency in order to “lock in” the U.S. dollar price of that security, or the Fund also enters into forward foreign currency contracts that do not provide for physical settlement of the two currencies, but instead are settled by a single cash payment calculated as the difference between the agreed upon exchange rate and the spot rate at settlement based upon an agreed upon notional amount (non-deliverable forwards). The Fund sets aside liquid assets in an amount equal to daily mark-to-market obligation for forward foreign currency contracts.

A forward foreign currency contract is an obligation between two parties (“Counterparties”) to purchase or sell a specific currency for an agreed-upon price at a future date. The use of forward foreign currency contracts does not eliminate fluctuations in the price of the underlying securities the Fund owns or intends to acquire but establishes a rate of exchange in advance. Fluctuations in the value of these contracts are measured by the difference in the contract date and reporting date exchange rates and are recorded as unrealized appreciation (depreciation) until the contracts are closed. When the contracts are closed, realized gains (losses) are recorded. Realized and unrealized gains (losses) on the contracts are included in the Statements of Operations. The primary risks associated with forward foreign currency contracts include failure of the Counterparty to meet the terms of the contract and the value of the foreign currency changing unfavorably. These risks may be in excess of the amounts reflected in the Statements of Assets and Liabilities.

J. Futures Contracts

China A-Share Portfolio, Multi-Strategy Alternative Portfolio and S&P 500® Downside Hedged Portfolio entered into futures contracts to simulate full investment in securities or manage exposure to equity and market price movements and/or currency risks and provide exposure to markets and indexes. China A-Share Portfolio entered into FTSE China A50 Index futures contracts to simulate full investment in the China A-Shares securities. Multi-Strategy Alternative Portfolio entered into currency futures and interest rate futures including Eurodollar interest rate futures or Euro Euribor interest rate futures, and VIX Index futures contracts. S&P 500® Downside Hedged Portfolio entered into U.S. listed futures contracts on the VIX Index and on S&P 500 Futures to simulate full investment in the S&P 500® Dynamic VEQTOR Index, to facilitate trading or to reduce transaction costs.

A futures contract is an agreement between Counterparties to purchase or sell a specified underlying security or index for a specified price at a future date. China A-Share Portfolio will only enter into futures contracts that are traded on the Singapore Exchange; Multi-Strategy Alternative Portfolio and S&P 500® Downside Hedged Portfolio will only enter into futures contracts that are traded on a U.S. exchange and that are standardized as to maturity date and underlying financial instrument. Initial margin deposits required upon entering into futures contracts are satisfied by the segregation of specific securities or cash as collateral at the futures commission merchant broker. During the period the futures contracts are open, changes in the value of the contracts are recognized as unrealized gains or losses by recalculating the value of the contracts on a daily basis. Subsequent or variation margin payments are received or made depending upon whether unrealized gains or losses are incurred. These amounts are reflected as a receivable or payable on the Statements of Assets and Liabilities. When the contracts are closed or expire, each Fund recognizes a realized gain or loss equal to the difference between the proceeds from, or cost of, the closing transaction and the Fund’s basis in the contract. The net realized gain (loss) and the change in unrealized gain (loss) on futures contracts held during the period is included on the Statements of Operations.

The primary risks associated with futures contracts are market risk, leverage risk and the absence of a liquid secondary market. If a Fund were unable to liquidate a futures contract and/or enter into an offsetting closing transaction, the Fund would continue to be subject to market risk with respect to the value of the contracts and may be required to continue to maintain the margin deposits on the

|

|

33 |

|

futures contracts until the position expired or matured. As futures contracts approach expiration, they may be replaced by similar contracts that have a later expiration. This process is referred to as “rolling.” If the market for these contracts is in “contango,” meaning that the prices of futures contracts in the nearer months are lower than the price of contracts in the distant months, the sale of the near-term month contract would be at a lower price than the longer-term contract, resulting in a cost to “roll” the futures contract. The actual realization of a potential roll cost will depend on the difference in price of the near and distant contracts. The contracts included in the VIX Index historically have traded in “contango” markets, resulting in a roll cost, which could adversely affect the value of Shares of the S&P 500® Downside Hedged Portfolio. Futures have minimal Counterparty risk since the exchange’s clearinghouse, as Counterparty to all exchange-traded futures contracts, guarantees the futures against default. Risks may exceed amounts recognized in the Statements of Assets and Liabilities.

Note 3. Investment Advisory Agreement and Other Agreements

The Trust has entered into an Investment Advisory Agreement with the Adviser on behalf of each Fund, pursuant to which the Adviser has overall responsibility for the selection and ongoing monitoring of the Funds’ investments, managing the Funds’ business affairs, providing certain clerical, bookkeeping and other administrative services, and for Active U.S. Real Estate Fund and Multi-Strategy Alternative Portfolio, oversight of Invesco Advisers, Inc., Invesco Asset Management Deutschland GmbH, Invesco Asset Management Limited, Invesco Asset Management (Japan) Limited, Invesco Hong Kong Limited, Invesco Senior Secured Management, Inc. and Invesco Canada Ltd. (collectively, the “Affiliated Sub-Advisers”).

As compensation for its services, each Fund has agreed to pay the Adviser an annual unitary management fee. Out of the unitary management fee, the Adviser has agreed to pay for substantially all expenses of the Funds, including for Active U.S. Real Estate Fund and Multi-Strategy Alternative Portfolio, payments to the Sub-Advisers, and for each Fund, the cost of transfer agency, custody, fund administration, legal, audit and other services, except for advisory fees, distribution fees, if any, brokerage expenses, taxes, interest, litigation expenses and other extraordinary expenses (including acquired fund fees and expenses, if any). The unitary management fee is paid by each Fund to the Adviser at the following annual rates:

| % of Average Daily Net Assets |

||||

| Active U.S. Real Estate Fund | 0.80 | % | ||

| China A-Share Portfolio | 0.50 | % | ||

| Multi-Strategy Alternative Portfolio | 0.95 | % | ||

| S&P 500® Downside Hedged Portfolio | 0.39 | % | ||

The Adviser has entered into an Investment Sub-Advisory Agreement with the Sub-Advisers for each of Active U.S. Real Estate Fund and Multi-Strategy Alternative Portfolio. The sub-advisory fee for these Funds is paid by the Adviser to the Sub-Advisers at 40% of the Adviser’s compensation of the sub-advised assets of each Fund.

Further, through August 31, 2017, the Adviser has contractually agreed to waive a portion of each Fund’s management fee in an amount equal to 100% of the net advisory fees an affiliate of the Adviser receives that are attributable to certain of the Funds’ investments in money market funds managed by that affiliate. The Adviser cannot discontinue this waiver prior to its expiration.

For the fiscal year ended October 31, 2015, the Adviser waived fees for each Fund in the following amounts:

| Active U.S. Real Estate Fund | $ | 30 | ||

| China A-Share Portfolio | 3,893 | |||

| Multi-Strategy Alternative Portfolio | 3,084 | |||

| S&P 500® Downside Hedged Portfolio | 213,625 |

The Trust has entered into a Distribution Agreement with Invesco Distributors, Inc. (the “Distributor”), which serves as the distributor of Creation Units for each Fund. The Distributor does not maintain a secondary market in the Shares. The Funds are not charged any fees pursuant to the Distribution Agreement. The Distributor is an affiliate of the Adviser.

The Trust has entered into service agreements whereby The Bank of New York Mellon, a wholly-owned subsidiary of The Bank of New York Mellon Corporation, serves as the administrator, custodian, fund accountant and transfer agent for each Fund.

Note 4. Investments in Affiliates

The Adviser is a wholly-owned subsidiary of Invesco Ltd. and therefore, Invesco Ltd. is considered to be affiliated with the Funds. The table below shows S&P 500® Downside Hedged Portfolio’s transactions in, and earnings from, its investment in affiliates for the fiscal year ended October 31, 2015.

S&P 500® Downside Hedged Portfolio

| Value October 31, 2014 |

Purchases at Cost |

Proceeds from Sales |

Change in Unrealized Appreciation/ (Depreciation) |

Realized Gain |

Value October 31, 2015 |

Dividend Income |

||||||||||||||||||||||

| Invesco Ltd. | $ | 372,243 | $ | 1,462 | $ | (15,266 | ) | $ | (67,920 | ) | $ | 2,538 | $ | 293,057 | $ | 9,468 | ||||||||||||

|

|

34 |

|

Note 5. Additional Valuation Information

GAAP defines fair value as the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date, under current market conditions. GAAP establishes a hierarchy that prioritizes the inputs to valuation methods, giving the highest priority to readily available unadjusted quoted prices in an active market for identical assets (Level 1) and the lowest priority to significant unobservable inputs (Level 3), generally when market prices are not readily available or are unreliable. Based on the valuation inputs, the securities or other investments are tiered into one of three levels. Changes in valuation methods may result in transfers in or out of an investment’s assigned level:

| Level 1 — | Prices are determined using quoted prices in an active market for identical assets. |

| Level 2 — | Prices are determined using other significant observable inputs. Observable inputs are inputs that other market participants may use in pricing a security. These may include quoted prices for similar securities, interest rates, prepayment speeds, credit risk, yield curves, loss severities, default rates, discount rates, volatilities and others. |

| Level 3 — | Prices are determined using significant unobservable inputs. In situations where quoted prices or observable inputs are unavailable (for example, when there is little or no market activity for an investment at the end of the period), unobservable inputs may be used. Unobservable inputs reflect a Fund’s own assumptions about the factors market participants would use in determining fair value of the securities or instruments and would be based on the best available information. |

Except for the Fund listed below, as of October 31, 2015, all of the securities in each Fund were valued based on Level 1 inputs (see the Schedules of Investments for security categories). The appreciation (depreciation) on futures contracts held in China-A Share Portfolio and S&P 500® Downside Hedged Portfolio were based on Level 1 inputs. The level assigned to the securities valuations may not be an indication of the risk or liquidity associated with investing in those securities. Because of the inherent uncertainties of valuation, the values reflected in the financial statements may materially differ from the value received upon actual sale of those investments.

| Investments in Securities | ||||||||||||||||

| Level 1 | Level 2 | Level 3 | Total | |||||||||||||

| Multi-Strategy Alternative Portfolio | ||||||||||||||||

| Equity Securities |

$ | 14,599,629 | $ | — | $ | — | $ | 14,599,629 | ||||||||

| Forward Foreign Currency Contracts(a) |

— | 11,277 | — | 11,277 | ||||||||||||

| Futures(a) |

(527,336 | ) | — | — | (527,336 | ) | ||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total Investments |

$ | 14,072,293 | $ | 11,277 | $ | — | $ | 14,083,570 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| (a) | Unrealized appreciation (depreciation). |

Note 6. Derivative Investments

China A-Share Portfolio, Multi-Strategy Alternative Portfolio and S&P 500® Downside Hedged Portfolio have implemented required disclosures about derivative investments and hedging activities in accordance with GAAP. These disclosures are intended to improve financial reporting about the effects of derivative investments and hedging activities by enabling investors to better understand an entity’s financial position and financial performance. The enhanced disclosure has no impact on the results of operations reported in the financial statements.

Value of Derivative Investments at Fiscal Year-End