WASHINGTON, D.C. 20549

FORM 10-K

FOR THE FISCAL YEAR ENDED December 31 , 2023

OR

FOR THE TRANSITION PERIOD FROM TO

COMMISSION FILE NUMBER 001-33829

| (Exact name of registrant as specified in its charter) | ||||||||||||||

| (State or other jurisdiction of incorporation or organization) | (I.R.S. employer identification number) | ||||||||||

(Address of principal executive offices)

(781 ) 418-7000

(Registrant's telephone number, including area code)

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☒ No ☐

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Exchange Act. Yes ☐ No ☒

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of "large accelerated filer", "accelerated filer", "smaller reporting company", and "emerging growth company" in Rule 12b-2 of the Securities Exchange Act of 1934.

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☒

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant's executive officers during the relevant recovery period pursuant to § 240.10D-1(b). ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Securities Exchange Act of 1934).Yes ☐ No ☒

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading Symbol | Name of each exchange on which registered | ||||||||||||

As of June 30, 2023, the aggregate market value of the registrant's common equity held by non-affiliates of the registrant was approximately $31.3 billion (based on the closing sales price of the registrant's common stock on that date). As of February 20, 2024, there were 1,387,591,010 shares of the registrant's common stock, par value $0.01 per share, outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the registrant's definitive proxy statement to be filed with the Securities and Exchange Commission in connection with the registrant's Annual Meeting of Stockholders are incorporated by reference in Part III.

KEURIG DR PEPPER INC.

FORM 10-K

FOR THE YEAR ENDED DECEMBER 31, 2023

| Page | ||||||||

KEURIG DR PEPPER INC.

FORM 10-K

FOR THE YEAR ENDED DECEMBER 31, 2023

MASTER GLOSSARY

| Term | Definition | |||||||

| 2009 Incentive Plan | Keurig Dr Pepper Inc. Omnibus Incentive Plan of 2009 (formerly known as the Dr Pepper Snapple Group, Inc. Omnibus Stock Incentive Plan of 2009) | |||||||

| 2019 Incentive Plan | Keurig Dr Pepper Inc. Omnibus Incentive Plan of 2019 | |||||||

| 2021 364-Day Credit Agreement | The Company's $1,500 million credit agreement, which was entered into on March 26, 2021 and contains a term-out option | |||||||

| 2022 Revolving Credit Agreement | KDP’s $4 billion revolving credit agreement, which was executed in February 2022 and replaced the 2021 364-Day Credit Agreement and the KDP Revolver | |||||||

| 2022 Strategic Refinancing | A series of transactions in April 2022, whereby KDP issued the 2029 Notes, the 2032 Notes, and the 2052 Notes, and voluntarily prepaid and retired the remaining 2023 Merger Notes and tendered portions of the 2025 Merger Notes, the 2028 Merger Notes, the 2038 Merger Notes, and the 2048 Merger Notes | |||||||

| ABC | The American Bottling Company, a wholly-owned subsidiary of KDP | |||||||

| ABI | Anheuser-Busch InBev SA/NV | |||||||

| Accelerator | Accelerator Active Energy LLC, an equity method investment of KDP and a brand of energy drinks (formerly known as A Shoc) | |||||||

| AOCI | Accumulated other comprehensive income or loss | |||||||

| ASU | Accounting Standards Update | |||||||

| Athletic Brewing | Athletic Brewing Holding Company, LLC, an equity method investment of KDP | |||||||

| Bedford | Bedford Systems, LLC, an equity method investment of KDP and the maker of Drinkworks | |||||||

| Board | The Board of Directors of KDP | |||||||

| BodyArmor | BA Sports Nutrition, LLC | |||||||

| bps | basis points | |||||||

| Central States | The Central States, Southeast and Southwest Areas Pension Fund | |||||||

| CEO | Chief Executive Officer | |||||||

| Chobani | FHU US Holdings LLC, an equity method investment of KDP | |||||||

| CISO | Chief Information Security Officer | |||||||

| Coca-Cola | The Coca-Cola Company | |||||||

| CODM | Chief Operating Decision Maker | |||||||

| CSD | Carbonated soft drink | |||||||

| DIO | Days inventory outstanding | |||||||

| DPO | Days of payables outstanding | |||||||

| DPS | Dr Pepper Snapple Group, Inc. | |||||||

| DPS Merger | The combination of the business operations of Keurig and DPS as of July 9, 2018 | |||||||

| DSD | Direct Store Delivery, KDP’s route-to-market whereby finished beverages are delivered directly to retailers | |||||||

| DSO | Days sales outstanding | |||||||

| EPS | Earnings per share | |||||||

| ESG | Environmental, social, and governance | |||||||

| Exchange Act | Securities Exchange Act of 1934, as amended | |||||||

| FASB | Financial Accounting Standards Board | |||||||

| FX | Foreign exchange | |||||||

| IT | Information technology | |||||||

| IRA | Inflation Reduction Act of 2022 | |||||||

| IRS | Internal Revenue Service | |||||||

| JAB | JAB Holding Company S.a.r.l., and affiliates | |||||||

| JPMorgan | JPMorgan Chase Bank, N.A. | |||||||

| KDP Revolver | The Company's $2,400 million revolving credit facility, which was entered into on February 28, 2018 | |||||||

i

KEURIG DR PEPPER INC.

FORM 10-K

FOR THE YEAR ENDED DECEMBER 31, 2023

| Term | Definition | |||||||

| Keurig | Keurig Green Mountain, Inc., a wholly-owned subsidiary of KDP, and the brand of our brewers | |||||||

| La Colombe | La Colombe Holdings, Inc. | |||||||

| LRB | Liquid refreshment beverages | |||||||

| Nasdaq | The Nasdaq Stock Market LLC | |||||||

| Notes | Collectively, the Company's senior unsecured notes | |||||||

| Nutrabolt | Woodbolt Holdings LLC, d/b/a Nutrabolt, an equity method investment of KDP | |||||||

| PCI Standard | Payment Card Industry Data Security Standard | |||||||

| PepsiCo | PepsiCo, Inc. | |||||||

| Peet's | Peet's Coffee & Tea, Inc. | |||||||

| PET | Polyethylene terephthalate, which is used to make the Company's plastic bottles | |||||||

| PFAS | Per- and polyfluoroalkyl substances | |||||||

| PRMB | Post-retirement medical benefit | |||||||

| Proxy Statement | The definitive proxy statement for the Annual Meeting of Stockholders to be filed with the SEC within 120 days of December 31, 2023, pursuant to Regulation 14A under the Exchange Act | |||||||

| PSU | Performance stock unit | |||||||

| Revive | Revive Brands, a wholly-owned subsidiary of KDP | |||||||

| rPET | Post-consumer recycled PET | |||||||

| RSU | Restricted stock unit | |||||||

| RTD | Ready to drink | |||||||

| RVG | Residual value guarantee | |||||||

| S&P | Standard & Poor’s | |||||||

| SEC | Securities and Exchange Commission | |||||||

| SG&A | Selling, general and administrative | |||||||

| SOFR | Secured Overnight Financing Rate | |||||||

| Tractor | Tractor Beverages, Inc., an equity method investment of KDP | |||||||

| U.S. GAAP | Accounting principles generally accepted in the U.S. | |||||||

| Veyron SPEs | Special purpose entities with a single sponsor, Veyron Global | |||||||

| VIE | Variable interest entity | |||||||

| Vita Coco | The Vita Coco Company, Inc. | |||||||

| Walmart | Walmart Inc. | |||||||

| WD | Warehouse Direct, KDP’s route-to-market whereby finished beverages are shipped to retailer warehouses, and then delivered by the retailer through its own delivery system to its stores | |||||||

| WIP | Work-in-process | |||||||

References throughout this Annual Report on Form 10-K to "we", "our", "KDP" or "the Company" refer to Keurig Dr Pepper Inc. and all wholly-owned subsidiaries included in our audited Consolidated Financial Statements.

The following discussion should be read in conjunction with our audited Consolidated Financial Statements and the related Notes thereto included elsewhere in this Annual Report on Form 10-K. This discussion contains forward-looking statements that are based on management's current expectations, estimates, and projections about our business and operations. Our actual results may differ materially from those currently anticipated and expressed in such forward-looking statements as a result of various factors, including the factors described under "Risk Factors" within Item 1A and elsewhere in this Annual Report on Form 10-K, and subsequent filings with the SEC.

ii

PART I

ITEM 1. BUSINESS

OUR COMPANY

Keurig Dr Pepper Inc. is a leading beverage company in North America that manufactures, markets, distributes and sells hot and cold beverages and single serve brewing systems. KDP has a broad portfolio of iconic beverage brands, including Dr Pepper, Canada Dry, Green Mountain Coffee Roasters, Snapple, Mott's, The Original Donut Shop, Clamato, and Core Hydration, as well as the Keurig brewing system. We have some of the most recognized beverage brands in North America, with significant consumer awareness levels and long histories that evoke strong emotional connections with consumers. We offer more than 125 owned, licensed, and partner brands, available nearly everywhere people shop and consume beverages through our sales and distribution network.

KDP was created on July 9, 2018, through the combination of the business operations of Keurig, a leading producer of innovative single serve brewing systems and specialty coffee in the U.S. and Canada, and DPS, a company built over time through a series of strategic acquisitions that brought together iconic beverage brands in North America. Today, we trade on Nasdaq under the symbol KDP, and we are a member of the Nasdaq 100 Index.

OUR STRENGTHS AND STRATEGY

Our scalable business model provides a platform for future growth, focused on:

Strong, balanced portfolio of leading, consumer-preferred brands with proven ability to expand via innovation, renovation and partnerships. We own a diverse portfolio of well-known beverage brands. Many of our brands enjoy high levels of consumer awareness, preference, and loyalty rooted in their rich heritage. This portfolio provides our customers with a wide variety of products to meet consumers' needs and provides us with a platform for growth and profitability.

We drive growth in our business through investments in innovation, renovation, and marketing to support our portfolio of owned brands and partnerships with other leading beverage brands. We have a robust innovation program, which is designed to meet consumers' changing flavor and beverage preferences and to grow our share of beverage occasions. We have cultivated relationships with leading beverage brands to create long-term partnerships that enable us and our partners to benefit equitably in future value creation, and where appropriate, we bring these partner brands into our owned portfolio through acquisitions. We continually evaluate making investments in companies that fill in whitespace in our portfolio.

Flexible and scalable route-to-market network, with unique e-commerce expertise. We have strategically-located distribution capabilities, which enable us to better align our operations with our customers and our sales channels, to ensure our products are available to meet consumer demand, to reduce transportation costs, and to have greater control over the timing and coordination of new product launches. We actively manage transportation of our products using our fleet (owned and leased) of approximately 6,900 vehicles in the U.S. and 2,000 in Mexico, as well as third party logistics providers.

With our Keurig.com website, we have a leading direct-to-consumer e-commerce platform which provides us insights and expertise in the e-commerce channel. We have been able to translate those insights and experiences to our cold business as the number of fulfillment options that are better suited economically for beverages has evolved, leading to growth in the e-commerce channel.

High-performing team driving better, faster decisions, enabled by technology. We believe that our team and the culture we have created are a competitive advantage. When we approach our customers, we do so as a modern beverage company, strengthened through our use of data and technology.

Bold ESG commitments and collaborations making positive impacts. We have worked diligently to embed conscious and responsible business practices into the foundation of our company. Our holistic ESG strategy is positioned to drive tangible and scalable solutions in service of doing more and better for our people, our environment and our communities.

Highly efficient business model, driving significant cash flow and investments. Our highly efficient business model, both from a cost and a cash perspective, gives us optionality to invest internally and pursue investments, partnerships, acquisitions, or other opportunities to continue to drive growth and create value.

1

OUR PRODUCTS AND OPERATING STRUCTURE

We are a leading integrated brand owner, manufacturer, and distributor of beverages in the U.S., Canada, Mexico and the Caribbean. We have a portfolio of brands with the ability to satisfy every consumer need, anytime and anywhere – hot or cold, at home or on-the-go, at work, or at play.

Operating and Reportable Segments

As of December 31, 2023, our operating structure consists of three operating and reportable segments: U.S. Refreshment Beverages, U.S. Coffee, and International. Segment financial data, including financial information about foreign and domestic operations, is included in Note 7 of the Notes to our Consolidated Financial Statements.

U.S. Refreshment Beverages

Our U.S. Refreshment Beverages segment is a brand owner, manufacturer, and distributor of liquid refreshment beverages, or LRBs, in the U.S. In this segment, we manufacture and distribute beverage concentrates, syrups, and finished beverages of our brands to third-party bottlers, distributors, retailers, and, ultimately, the end consumer.

We manufacture beverage concentrates and syrups, which we then sell throughout the U.S. to third party bottlers or use them in our own manufacturing systems. Beverage concentrates, which are highly concentrated proprietary flavors, are combined with carbonation, water, sweeteners, and other ingredients, packaged in aluminum cans, PET bottles, and glass bottles, and sold as a packaged beverage to retailers and, ultimately, the end consumer. Beverage concentrates are also manufactured into syrup, which is shipped to fountain customers, such as fast food restaurants, who mix the syrup with water and carbonation to create a finished beverage at the point of sale to consumers. Dr Pepper represents most of our fountain channel volume.

We manufacture and distribute finished beverages of our own beverage brands. Additionally, in order to maximize the size and scale of our manufacturing and distribution operations, we also distribute finished beverages for our partner brands and manufacture finished beverages for other third parties, including partners and private labels. We partner with other brands seeking effective route-to-market capabilities, including national selling and distribution scale. These brands can also give us exposure in certain markets to fast growing segments of the beverage industry in a capital-efficient manner. We sell finished beverages through our DSD and our WD systems, both of which include sales to all major retail channels.

Key brands in this segment include Dr Pepper, Canada Dry, Mott’s, Snapple, A&W, 7UP, Sunkist soda, Squirt, Hawaiian Punch, Core Hydration, Bai, C4 Energy, Clamato, Evian, Yoo-Hoo, Big Red, and Vita Coco.

U.S. Coffee

Our U.S. Coffee segment is primarily a brand owner, manufacturer, and distributor of innovative single serve brewers, specialty coffee (including hot and iced varieties), and RTD coffee in the U.S. Our Keurig single serve brewers are aimed at changing the way consumers prepare and enjoy coffee and other beverages both at home and away from home in places such as offices, hotels, restaurants, cafeterias, and convenience stores. We create value by developing and selling our Keurig single serve brewers and by expanding Keurig brewer household adoption, which enables sales of specialty coffee and a variety of other specialty beverages in K-Cup pods (including hot and iced teas, hot cocoa, and other beverages) for use with Keurig brewers. We also compete in the broader coffee category through traditional whole bean and ground coffee in other package types, including bags, fractional packages, and cans, as well as RTD coffee beverages. We, together with our partners, are able to bring consumers high-quality coffee and other beverage experiences from the brands they love, all through the one-touch simplicity and convenience of Keurig brewers. We manufacture approximately 80% of the pods in the single serve format in the U.S. on a dollar share basis.

2

We manufacture and sell 100% of the K-Cup pods of certain brands, including Green Mountain Coffee Roasters, The Original Donut Shop, and McCafé, to retailers, away from home channel participants, and end-use consumers. We also manufacture K-Cup pods for our partner brands, who in turn sell them to retailers and consumers. Our partner brands include Starbucks, Dunkin', Folgers, Peet's, Newman’s Own Organics, Caribou Coffee, and Community Coffee, among others. We also participate in private label manufacturing arrangements. Generally, we are able to sell these brands to our away from home channel participants and directly to consumers through our website at www.keurig.com. We also have agreements for manufacturing, distributing, and selling K-Cup pods for tea under brands such as Celestial Seasonings and Bigelow. We also produce and sell K-Cup pods for cocoa, including through a licensing agreement for the Swiss Miss brand, and hot apple cider, including under our own brand, Mott's.

Our U.S. Coffee segment manufactures K-Cup pods using freshly roasted and ground coffee as well as tea, cocoa, and other products. We offer high-quality, responsibly sourced coffee, including certified single-origin, organic, flavored, limited edition, and proprietary blends. We carefully select our coffee beans and roast them to optimize their taste and flavor differences. We engineer and design most of our single serve brewers and utilize third-party contract manufacturers located in various countries in Asia for brewer appliance manufacturing. We distribute our brewers using third-party distributors, retail partners and directly to consumers through our website at www.keurig.com.

International

Our International segment includes:

•Sales in Canada, Mexico, and other international markets from the manufacture and distribution of branded concentrates, syrup, and finished beverages, including sales of the Company's own brands and third-party brands, to third-party bottlers, distributors, and retailers. Key beverage brands include Peñafiel, Clamato, Squirt, Canada Dry, Dr Pepper, Mott’s, and Crush.

•Sales in Canada from the manufacture and distribution of finished goods relating to the Company's single serve brewers, K-Cup pods, and other coffee products to partners and retailers. Key K-Cup pod brands include Van Houtte, Tim Hortons, and McCafé, as well as other partner and private label brands.

Product Innovation and New Partnerships

We are focused on a robust innovation pipeline within our portfolio of products to build household penetration of our business. We regularly launch new brewers with new features and benefits, technological advances, sustainable attributes, and changes in aesthetics to provide a variety of options to suit individual consumer preferences. We also continuously innovate and renovate our portfolio of K-Cup pods and beverages to provide an expansive array of flavors.

During 2023, we launched our Keurig K-Iced family of brewers, featuring an innovative brew over ice process that allows consumers to brew both hot and iced beverages with a single coffeemaker. In addition, we expanded our ICED K-Cup pod offerings to include a variety of options that can be brewed over ice and are compatible with all Keurig models. We launched a limited edition “Start Me Up” iced coffee kit in collaboration with The Rolling Stones, which featured a custom-designed K-Iced brewer and a customized coffee blend.

We launched Dr Pepper Strawberries & Cream and Dr Pepper Strawberries & Cream Zero Sugar. We also expanded our Core Hydration enhanced water portfolio with Core Hydration+, a nutrient enhanced water with real fruit extracts and essences, in Vibrance (grapefruit), Immunity (lemon), and Calm (cucumber). In Mexico, we elevated our mineral water portfolio with Peñafiel Soft, which has no calories or sugar. Finally, we joined forces with Blue Bell Creameries to create Dr Pepper Float ice cream, which provides us a royalty from these sales.

We entered into a new partnership with Philz Coffee to provide two unique coffee blends in K-Cup pod format. We invested in, and simultaneously entered into a long-term strategic partnership with, La Colombe, which enables us to sell and distribute La Colombe shelf-stable varieties of RTD coffee and to license, manufacture, and distribute La Colombe branded K-Cup pods, both of which began in the fourth quarter of 2023. We also entered into a long-term agreement with Grupo PiSA to sell, distribute and merchandise Electrolit, a premium hydration beverage, across the U.S, beginning in early 2024.

3

CUSTOMERS

We primarily serve the following types of customers:

Retailers

Retailers include supermarkets, hypermarkets, mass merchandisers, club stores, e-commerce retailers, office superstores, vending machines, fountains, grocery and drug stores, convenience stores, and other small outlets. Retailers purchase finished beverages, K-Cup pods, appliances, and accessories directly from us. Our portfolio of strong brands, operational scale and experience in the beverage industry has enabled us to maintain strong relationships with major retailers throughout the U.S., Canada, and Mexico. Our largest retailer, Walmart, represented approximately 17% of our consolidated net sales in 2023. Net sales to Walmart are included in all reportable segments.

Bottlers and Distributors

In the U.S. and Canada, we generally grant manufacturing and distribution licenses for our carbonated soft drinks to bottlers for specific geographic areas that are exclusive and long-term, and they have historically been perpetual in many cases. These bottlers may be affiliated with Coca-Cola or with PepsiCo, or they may be independent. These agreements prohibit bottlers and distributors from selling the licensed products outside their exclusive territory and from selling any imitative products in that territory. Generally, we may terminate bottling and distribution agreements only for cause, change in control, or breach of agreements, and the bottler or distributor may terminate without cause upon giving certain specified notice and complying with other applicable conditions. These bottlers and distributor agreements may also contain provisions for fountain distribution rights, which are not exclusive for a territory, but generally do restrict bottlers from carrying imitative product in the territory.

Certain other brands, such as Snapple, Bai, and Core, are licensed for distribution in various territories to bottlers and a number of smaller distributors such as beer wholesalers, wine and spirit distributors, independent distributors, and retail brokers.

Partners

We have differentiated ourselves and the Keurig brand through our ability to create and sustain partnerships with other leading coffee, tea, and beverage brand companies through multi-year licensing and manufacturing agreements that best suit each brand's interests and strengths. Typically, we manufacture K-Cup pods on behalf of our partners, who in turn sell them to retailers.

Away from Home Channel Participants

We distribute brewers, accessories, and K-Cup pods (owned, licensed, and partner brands) to away from home channel participants, which include office coffee distributors and hotel chains.

End-use Consumers

We have a robust e-commerce platform at www.keurig.com where end-use consumers can purchase brewers, accessories, K-Cup pods, and other coffee products, such as bagged traditional coffee and cold brew.

COMPETITORS

The beverage industry is highly competitive and continues to evolve in response to changing consumer preferences. Competition is generally based on brand recognition, taste, quality, price, availability, selection and convenience, as well as factors related to corporate responsibility and sustainability. We compete with multinational corporations with significant financial resources. In our bottling and manufacturing operations, we also compete with a number of smaller bottlers and distributors and a variety of smaller, regional, and private label manufacturers.

Our primary competitors include Coca-Cola, PepsiCo, Starbucks Corporation, The J.M. Smucker Company, The Kraft Heinz Company, and Nestlé S.A. Although these companies offer competing brands in categories we participate in, many are also our partners or customers, as they purchase beverage concentrates or K-Cup pods directly from us.

4

MATERIAL RESOURCES

Raw Materials

The principal raw materials we use in our business, which we commonly refer to as ingredients and materials, represent approximately 55% of our cost of sales and include green coffee, water, aluminum cans and ends, PET bottles and caps, including both virgin and rPET, CO2, sweeteners, paper products, K-Cup pod packaging materials, fruit, glass bottles and enclosures, cocoa, teas, juices, and other ingredients. We also use post-consumer recycled materials in the manufacturing of our single serve brewers.

The availability, quality, and costs of many of these materials have fluctuated, and may continue to fluctuate, over time. Additionally, under many of our supply arrangements for these raw materials, the price we pay fluctuates along with certain changes in indirect commodity costs, such as aluminum in the case of cans and ends, natural gas in the case of glass bottles, resin in the case of K-Cup pods, PET bottles and caps, corn in the case of sweeteners, and pulp in the case of paperboard packaging.

When appropriate, we mitigate the exposure to volatility in the prices of certain commodities used in our production process and transportation to our customers through the use of various commodity derivative contracts or supplier pricing agreements. The intent of the contracts and agreements is to provide a certain level of predictability in our operating margins and our overall cost structure, while remaining in what we believe to be a competitive cost position.

Green Coffee

We develop and pursue direct relationships with farms, estates, cooperatives, cooperative groups, and exporters in order to purchase green coffee and to support our broader traceability and sustainable supply chain initiatives. We also purchase green coffee through outside brokers.

Energy and Transportation Costs

In addition to ingredients and packaging costs, we are significantly impacted by changes in fuel costs, which can also fluctuate substantially, due to the large truck fleet we operate in our distribution operations (reflected within SG&A expenses) and the energy costs consumed in the production process (reflected within cost of sales).

We are also significantly impacted by changes in other transportation costs, such as ocean freight and tariffs. Transportation costs associated with the transportation and import of certain raw materials and finished goods to our manufacturing and distribution facilities are reflected within cost of sales.

Intellectual Property

Trademarks and Patents

We possess a variety of intellectual property rights that are important to our business. We rely on a combination of trademarks, copyrights, patents, and trade secrets to safeguard our proprietary rights, including our brands, our technologies, and ingredient and production formulas for our products.

We own numerous trademarks in our portfolio within the U.S., Canada, Mexico, and other countries. Depending upon the jurisdiction, trademarks are valid as long as they are in use and/or their registrations are properly maintained.

In many countries outside the U.S., Canada and Mexico, the manufacturing and distribution rights to many of our CSD brands, including our Dr Pepper trademark and formula, are owned by third parties, including, in certain cases, competitors such as Coca-Cola.

We hold U.S. and international patents related to Keurig brewers and K-Cup pod technology. Of these, a majority are utility patents and the remainder are design patents. We view these patents as valuable assets but we do not view any single patent as critical to our success. We also have pending patent applications associated with Keurig brewers and K-Cup pod technology. We take steps that we believe are appropriate to protect such innovation.

5

Licensing Arrangements

We license various trade names from our partners in order to manufacture K-Cup pods. Although these licenses vary in length and other terms, they generally are long-term, cover the entire U.S. and/or Canada, and may include royalty payments, upfront payments, or some combination of the two, to the partner in order to use their trade names to manufacture and/or distribute the K-Cup pods.

We license various trademarks from third parties, which generally allow us to manufacture and distribute certain products or brands throughout the U.S. and/or Canada and Mexico. For example, we license trademarks for Sunkist soda, Rose's, and Margaritaville from third parties. Although these licenses vary in length and other terms, they generally are long-term, cover the entire U.S. and/or Canada and Mexico and generally include a royalty payment to the licensor.

For beverages in emerging and fast growing categories where we may not currently have a brand presence, we license various trademarks from third party partners, which generally allow us to sell and distribute certain products or brands throughout the U.S., Canada, or Mexico. These partners view us as a distributor with strong route-to-market resources to grow their brands. Although these licenses vary in length and other terms, they generally are long-term and require a payment from the partner if the licensing agreement is terminated. In some instances, we make investments in these companies, which may include a path to acquire the company. As of December 31, 2023, our portfolio of partner brands included, but was not limited to, C4 energy drinks, evian water, Vita Coco coconut water, Polar Beverages seltzer water, Accelerator energy drinks, La Colombe shelf-stable RTD coffee, and Peet's RTD coffee.

SEASONALITY

The beverage market is subject to some seasonal variations. Our cold beverage sales are generally higher during the warmer months, while hot beverage sales are generally higher during the cooler months. Overall beverage sales can also be influenced by the timing of holidays and weather fluctuations. Sales of brewers and related accessories are generally higher during the second half of the year due to the holiday shopping season.

HUMAN CAPITAL RESOURCES

Our Employees

We have approximately 28,100 employees, primarily located in North America. In the U.S., we have approximately 21,700 employees, of which approximately 5,000 employees are covered by union collective bargaining agreements. In Mexico, we have approximately 4,800 employees, of which approximately 3,600 are covered by union collective bargaining agreements. In Canada, we have approximately 1,400 employees, with approximately 500 covered by union collective bargaining agreements. We also have approximately 200 employees in Europe and Asia.

Our collective bargaining agreements generally address working conditions, as well as wage rates and benefits, and expire over varying terms over the next several years. We generally believe that these agreements can be renegotiated on terms satisfactory to us as they expire and that we have good relationships with our employees and any representative organizations for our unionized employees.

Our compensation programs are designed to ensure that we attract and retain the right talent. We generally review and consider median market pay levels when assessing total compensation, but pay decisions are based on a more comprehensive set of considerations such as company performance, individual performance, experience, and internal equity. We continually monitor key talent metrics including employee engagement and employee turnover.

Our employee benefits programs strive to deliver competitive benefits that are effective in attracting and retaining talent, that create a culture of well-being and inclusiveness, and that meet the diverse needs of our employees. Our total package of benefits is designed to support the physical, mental, and financial health of our employees, and we currently provide access to medical, dental, vision, life insurance, retirement benefits,and disability benefits, as well as assistance with major life activities such as adoption, childbirth, and eldercare, among other benefits.

6

Our Culture

Together with our employees, we created a set of core values that are a unifying force for our team and are the cornerstone of KDP's culture. These core values are:

•Team First. Win together. Be the kind of person you want on your team.

•Deliver Big. Achieve our commitments. Then push beyond the expected.

•Think Bold. Challenge the usual. Dare to try something new.

•Be Fearless and Fair. Tell the truth with courage. Listen and act with respect.

Additionally, we have adopted a corporate code of conduct that applies to all of our employees, officers and our Board, which lays the foundation for ethical behavior for our team. Our code of conduct is available on our website at http://www.keurigdrpepper.com.

Employee Health and Safety

KDP uses a wide variety of strategies and programs to support the health and safety of our employees. From training on risks from non-routine tasks, such as unexpected maintenance on equipment, to installing automated systems to prevent trailers from shifting during loading and unloading, our Environmental Health & Safety team considers all aspects of what our employees may encounter and works to minimize risk. Key to these efforts are data and preventive actions. KDP measures Lost Time Incident Rate, a reliable indication of Total Recordable Injuries Rate severity, and uses a risk reduction process that thoroughly analyzes injuries and near misses.

Diversity and Inclusion

Innovative ideas come from a diverse workforce, and KDP is committed to both. Just as each of our brands brings its own personality to our product portfolio, each KDP employee brings their own unique set of experiences, perspectives, and background to our business. KDP is embracing those differences to drive rapid change, inspire innovation, and better connect with our customers and consumers. To focus our efforts on diversity and inclusion at KDP, we have established executive-level governance, including participation by our CEO, as well as a Diversity and Inclusion leadership team, comprised of committed leaders from across KDP to help set priorities and lead two-way dialogue throughout the organization, including in our Employee Resource Groups.

In 2020, we set representation goals for management at or above the Director level, known as Director+. As of December 31, 2023, our global workforce was approximately 21% female, while our global Director+ workforce was approximately 32%, as compared to our baseline of 26% in 2020. Approximately 48% of our U.S. workforce was comprised of people of color, with our U.S. Director+ workforce comprised of approximately 19% of people of color, as compared to our baseline of 17% in 2020.

GOVERNMENTAL REGULATIONS ON OUR BUSINESS

In the normal course of our business, we are subject to a variety of federal, state, and local laws and regulations in the countries in which we do business. Regulations in the U.S., as well as jurisdictions including Canada, Mexico, and the European Union, apply to many aspects of our business, including our products and their ingredients, manufacturing, safety, labeling, transportation, packaging, advertising, and sale. For example, our products and their manufacturing, labeling, marketing and sale in the U.S. are subject to various aspects of the Federal Food, Drug, and Cosmetic Act, the Federal Trade Commission Act, the Robinson-Patman Act, the Clayton Act, the Sherman Act, the Lanham Act, state consumer protection laws, and state warning and labeling laws, such as the state of California’s Safe Drinking Water and Toxic Enforcement Act of 1986.

Various countries, states, provinces, and other authorities have enacted eco-taxes, extended producer responsibility laws, deposit or reuse/refill mandates, fees on certain products or packaging, restrictions or bans on the use of certain types of packaging, including single-use plastics, and regulations on PFAS, and other chemicals of concern. Certain cities and municipalities within the U.S. have also passed various taxes on the distribution of sugar-sweetened and diet beverages, which are at different stages of enactment. We expect that legislation or regulations like those described above will continue to be proposed in the future at local, state and federal levels, both in the U.S. and elsewhere.

7

CORPORATE RESPONSIBILITY

We are committed to acting responsibly, and our ambition is to ensure our beverages make a positive impact with every drink. Drink Well. Do Good. is our corporate responsibility platform. Under this platform, we focus on our greatest opportunities for impact in our supply chain, the environment, our people and communities, and on the health and well-being of our consumers. We are committed to transparency and disclosure of corporate responsibility strategies, programs, progress, and governance. Our Corporate Responsibility Report, which is issued annually, is available on our website at www.keurigdrpepper.com.

Environment

Circular Economy

Sustainable packaging is a top priority for us, and we continue to innovate for circular solutions across our portfolio. We aim to reduce the use of unnecessary materials and offer packaging that is compatible with recycling, reuse, and composting systems. We also aim to use more post-consumer recycled content across our packaging portfolio.

Improving packaging solutions for product quality, consumer use, recoverability, and reuse requires collaboration of all parties along the value chain. Using our strength in forming partnerships, we collaborate closely with a number of stakeholders, including industry groups, non-governmental organizations, and coalitions, to move our commitments beyond independent ambitions to collective action.

Climate Change

KDP is working to address climate change and build the resilience of our business and supply chain. Our approach includes a corporate policy, governance structures and transparency. Our climate goals provide a path for us to reduce our share of greenhouse gas emissions from our 2018 baseline through continuation of existing efforts, like improving energy efficiency in our operations, and the development of new focus areas, such as packaging improvements and value chain engagement. We report non-financial data annually on our climate efforts to CDP Climate.

Water Stewardship

Water is a precious natural resource that is essential to our business. As water is the primary ingredient in most of our beverages, we have a particular responsibility to be good stewards of water use in our operations, our communities and throughout our supply chain. Our water stewardship goals are focused on safeguarding water resources and building healthy communities resilient to climate change.

We conduct periodic water risk assessments of our operations and supply chain. To refine our understanding of challenges for our high water-risk sites, we assess each site in the context of the surrounding watershed, the local water issues and other local entities’ interest and perspective on those issues. We last conducted a water risk assessment of our operations and supply chain in 2021. We have public goals and programs to both increase operational efficiency and to replenish water through conservation and restoration projects with conservation organizations in communities where we operate that have high water risk based on our periodic assessments. We report non-financial data annually on our water stewardship efforts to CDP Water.

Supply Chain

KDP cross-functional teams collaborate to source materials and inputs that meet our established quality requirements and sustainability goals. We identify key suppliers, farmers and business partners to encourage sustainable practices across our supply chain. We are committed to responsibly sourcing coffee, cocoa, and other priority crops, relying on third-party certification or verification programs to foster social, environmental and economic protections. We aim to responsibly source manufactured products by prioritizing and engaging key suppliers to implement and maintain effective social and environmental management systems in their own operations. We continue to focus on supporting regenerative agriculture and conservation in our supply chains, as well as advancing inclusion and improving livelihoods for the people in KDP’s upstream supply chain.

8

Health and Well-Being

We are committed to providing a balanced portfolio of beverage options and the resources consumers need to make informed choices. Over the past few years, we have expanded our product offerings that deliver nutritional and functional benefits, as well as reducing sugar and calories. We have transformed our portfolio over the past decade, offering a low- or no-calorie option for virtually every full-calorie brand in our portfolio, and we have also added smaller portion-size offerings. Our KDP Product Facts website, found at www.kdpproductfacts.com, contains important nutrition, certification, and allergen information to empower consumers to make informed decisions and find products that meet their needs. To advance our transparency and rigor around our marketing practices and standards, we published a new Responsible Marketing Policy for the U.S. in 2023. Employees and media agencies with primary responsibility for adhering to the Responsible Marketing Policy are required to complete mandatory training on our marketing standards.

OTHER INFORMATION

Our website address is www.keurigdrpepper.com. Information on our website is not incorporated by reference in this document. We make available, free of charge through this website, our annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K and amendments to those reports filed or furnished pursuant to the Exchange Act, as soon as reasonably practicable after such material is electronically filed with, or furnished to, the SEC.

MARKET AND INDUSTRY DATA

The market and industry data in this Annual Report on Form 10-K is from Circana, an independent industry source, and is based on retail dollar sales and sales volumes in 2023. Although we believe that this independent source is reliable, we have not verified the accuracy or completeness of this data or any assumptions underlying such data. Circana is a market information provider, primarily serving consumer packaged goods manufacturers and retailers. We use Circana data as our primary management tool to track market performance because it has broad and deep data coverage, is based on consumer transactions at retailers, and is reported to us weekly. Circana data provides measurement and analysis of marketplace trends such as market share, retail pricing, promotional activity, and distribution across various channels, retailers, and geographies. Measured categories provided to us by Circana include K-Cup pods, carbonated soft drinks, RTD teas and coffee, single serve and multi-serve juice and juice drinks, sports drinks, energy drinks, still waters, carbonated waters, and non-alcoholic mixers. Circana also provides data on other food items such as apple sauce. Circana data we present in this report is compiled from scanner transactions in key retail channels, including grocery stores, mass merchandisers (including Walmart), club stores (excluding Costco), drug chains, convenience stores, and gas stations. However, this data does not include the fountain or vending channels, or small independent retail outlets, which together represent a meaningful portion of the U.S. beverage market. This data does not include certain customers and e-commerce sales which represents a significant portion of our Coffee Systems segment. Our market share data for our brewers is also based on information provided by Circana. The data presented is based upon Circana’s Consumer Tracking Service for Coffeemakers in the U.S. and represents the twelve month period ended December 31, 2023.

9

ITEM 1A. RISK FACTORS

RISKS RELATED TO OUR OPERATIONS

Disruption of our manufacturing and distribution operations or supply chain, including increased commodity, raw material, packaging, energy, transportation, and other input costs may adversely affect our financial condition or results of operations.

We have experienced, and could continue to experience, disruptions in our supply chain and our manufacturing and distribution operations, which could have a material adverse effect on our business. Some raw materials and supplies used in the production of our products, including packaging materials, are available from a limited number of suppliers or from a sole supplier or are in short supply when seasonal demand is at its peak. Certain raw materials and supplies used directly or indirectly in the production of our products are sourced from countries experiencing civil unrest, political instability, or unfavorable economic conditions. Adverse weather conditions may affect the supply of agricultural commodities from which key ingredients for our products are derived. We may not be able to maintain favorable arrangements and relationships with suppliers, and our contingency plans may not be effective to mitigate disruptions that may arise from shortages or discontinuation of any raw materials and other supplies that we use in the manufacture and distribution of our products. In order to ensure a continuous supply of high-quality raw materials, some of our inventory purchase obligations include long-term purchase commitments for certain strategic raw materials; the timing of these may not always coincide with the period in which we need the supplies to fulfill customer demand. Any sustained or significant disruption to the manufacturing or sourcing of raw materials could increase our costs and interrupt product supply, which could adversely impact our business.

The raw materials and other supplies, including agricultural commodities (such as coffee, apples, and corn), fuel and packaging materials, transportation, and other supply chain inputs that we use for the manufacturing, production, and distribution of our products are subject to price volatility and fluctuations in availability caused by many factors, which include changes in supply and demand; supplier capacity constraints; inflation; weather conditions (including the effects of climate change); wildfires and other natural disasters; disease or pests; agricultural uncertainty; cost increases in farm inputs; health epidemics, pandemics, or other contagious outbreaks; labor shortages, strikes, or work stoppages; changes in or the enactment of new laws and regulations; governmental actions or controls (including import/export restrictions, such as new or increased tariffs, sanctions, quotas, or trade barriers); port congestion or delays; transport capacity constraints; cybersecurity incidents or other disruptions; political uncertainties; acts of terrorism; governmental instability; speculation in global trading of commodities, such as coffee; or fluctuations in foreign currency exchange rates. We have been affected by a number of these factors, led by inflationary pressures on input and other costs, which may continue.

Many of our raw materials and supplies are purchased in the open market, and the prices we pay for such items are subject to fluctuation. Under many of our supply arrangements, the price we pay for raw materials fluctuates along with certain changes in underlying commodities costs. This could lead to higher and more variable inventory levels or higher raw material costs for us. In our coffee business, the quality of the coffee we seek tends to trade on a negotiated basis at a premium above the “C” price of coffee. This premium depends upon the supply and demand at the time of purchase, and the amount of the premium can vary significantly. Volatility in coffee prices can impact our ability to enter into fixed-price purchase commitments, and we frequently enter into “price-to-be-fixed” supply contracts in which the quality, quantity, delivery period, and other negotiated terms are agreed upon, but the date, and therefore price, at which the base coffee commodity price component will be fixed has not yet been established.

When input prices increase unexpectedly or significantly, we may be unwilling or unable to increase our product prices or unable to effectively hedge against price increases to offset these increased costs without suffering reduced volume, revenue, margins, and operating results. To the extent that price increases are not sufficient to offset higher costs adequately or in a timely manner, or if they result in significant decreases in sales volume, our financial condition or results of operations may be adversely affected. In addition, price decreases in commodities that we have effectively hedged could also increase our cost of goods sold for mark-to-market changes in the derivative instruments.

10

We operate in intensely competitive categories, and our potential inability to compete effectively could adversely impact our business.

The beverage industry is highly competitive and continues to evolve in response to changing consumer preferences. We compete with multinational corporations that can rapidly respond to competitive pressures and changes in consumer preferences by introducing new products, changing their route to market, reducing prices, or increasing promotional activities. We also compete with various smaller or regional companies and private label manufacturers, which may be more innovative, better able to bring new products to market, and better able to quickly serve niche markets. Additionally, we compete for contract manufacturing with other bottlers and manufacturers.

A significant portion of our business is attributable to sales of K-Cup pods for use with Keurig brewing systems. Continued acceptance of Keurig brewers to further increase household penetration is a significant factor in our growth plans. Any substantial or sustained decline in the sale of Keurig brewers could materially and adversely affect our business. Keurig brewers compete against all sellers and types of coffeemakers, as well as cafes and coffee shops. Our competitive position may be weakened if we do not succeed in differentiating Keurig brewers from our competitors’ products.

Our sales of beverages, Keurig brewers, K-Cup pods, and other products may be negatively affected by numerous factors including our inability to maintain or increase prices, our inability to effectively promote our products, new entrants into the market, the decision of wholesalers, retailers, or consumers to purchase competitors' products instead of ours, increased marketing costs, and higher in-store placement and slotting fees driven by our competitors' willingness to spend aggressively. In addition, the rapid growth of e-commerce may create additional consumer price deflation by, among other things, facilitating comparison shopping, and could potentially threaten the value of some of our legacy route-to-market strategies and thus negatively affect revenues. If we are unable to effectively compete, our business and our financial results would be negatively affected.

We may not effectively respond to changing consumer preferences and shopping behavior, which could impact our financial results.

Consumers’ preferences continually evolve due to a variety of factors, including changing demographics of the population, social trends, changes in consumer lifestyles and consumption patterns, concerns or perceptions regarding the health effects or environmental impact of our products or packaging, concerns regarding the location of origin or source of ingredients and products, changes in consumers' spending habits, negative publicity, economic downturn, or other factors. If we do not effectively anticipate and respond to changing trends and consumer beverage preferences, including through innovation and renovation, our sales and growth could suffer.

Addressing changes in consumer preferences may require successful development, introduction, and marketing of new products and line extensions. There are inherent risks associated with new product or packaging innovation, including uncertainties about trade and consumer acceptance or potential impacts on our existing product offerings. Successful innovation may depend on our ability to obtain, protect, and maintain necessary intellectual property rights and to avoid infringing upon the intellectual property rights of others. Failure to innovate successfully could compromise our competitive position and impact our product sales, financial condition, and operating results.

Consumers are increasingly focused on sustainability, with particular attention to the recyclability or reuse of product packaging, reducing consumption of single-use plastics and non-recyclable materials and the environmental impact of manufacturing operations. If we do not meet consumer demands by continuing to provide sustainable packaging options and focusing on sustainability throughout our manufacturing operations, our sales could suffer.

Consumer shopping behavior is also rapidly evolving. Changes in mobility, travel, and leisure activity patterns, the acceleration of e-commerce and other methods of purchasing products, inflation and economic uncertainty, and pandemics, epidemics or other disease outbreaks, among others, have impacted and could continue to impact consumer shopping behavior and demand for our products. If we are unable to meet the consumer where and when they desire their products or if we are unable to respond to changes in distribution channels, our financial results could be adversely impacted.

11

Concerns about the safety, quality, or health effects of our products could negatively affect our business.

The success of our business depends in part on our ability to maintain consumer confidence in the safety and quality of all of our products, including beverage products, their ingredients, their packaging, and our brewers. A failure or perceived failure to meet our quality, health, or safety standards, particularly as we expand our product offerings through innovation, partnerships or acquisitions into new beverage categories, including product contamination or tampering, undeclared allergens or allegations of mislabeling, whether actual or perceived, could occur in our operations or those of our bottlers, manufacturers, distributors or suppliers. This could result in time-consuming and expensive production interruptions, recalls, market withdrawals, product liability claims, and negative publicity. It could also result in the destruction of product inventory, lost sales due to the unavailability of product for a period of time, fines from applicable regulatory agencies, and higher-than-anticipated rates of warranty returns and other returns of goods. Moreover, negative publicity may result from false, unfounded, or nominal liability claims or limited recalls.

In addition, adverse public opinion, third-party studies, or other allegations, whether or not valid, regarding the perceived or potential negative health effects of ingredients in our beverage products, such as concerns about the caloric intake associated with soft drinks or the use of artificial sweeteners in our beverages, or chemicals of concern or other substances in our ingredients or materials, may contribute to actual or threatened legal action against us, negative consumer perception of our products, additional government regulation, or new or increased taxes on our products, any of which could result in decreased demand for our products or reformulations of existing products to remove such ingredients or substances, which may be costly and reduce their appeal.

Any or all of these events may lead to a loss of consumer confidence and trust, could damage the reputation of our brands and may cause consumers to choose other products and could negatively affect our business and financial performance.

Damage to our reputation or brand image can adversely affect our business.

Our ability to maintain our reputation and the brand image of our products is important to our success. Our corporate image and reputation has in the past been, and could in the future be, adversely impacted by a variety of factors, including: any failure by us or our business partners to achieve goals or maintain high standards relating to ethical, business and environmental, social and governance practices, including with respect to human rights, child labor laws, diversity, equity and inclusion, workplace conditions, employee health and safety, the nutrition profile of our products, packaging, water use and impact on the environment; any failure to address health or other concerns about our products, products we distribute or particular ingredients in our products, including concerns regarding whether certain of our products contribute to obesity or an increase in public health costs; our research and development efforts; any product quality or safety issues, including the recall of any of our products; any failure to comply with laws and regulations; consumer perception of our advertising campaigns, sponsorship arrangements, marketing programs, use of social media and our response to political and social issues or catastrophic events; or any failure to effectively respond to negative or inaccurate comments about us on social media or otherwise regarding any of the foregoing. Damage to our reputation or brand image could decrease demand for our products, thereby adversely affecting our business.

12

If we do not successfully manage our acquisitions of and investments in new businesses or brands, our operating results may adversely be affected.

From time to time, we acquire or invest in businesses or brands, form joint ventures, and enter into licensing and distribution agreements. In evaluating such endeavors, we are required to make difficult judgments regarding the value of business strategies, opportunities, technologies and other assets, and the risks and cost of potential liabilities. Furthermore, we may incur unforeseen liabilities and obligations in connection with any such transactions, including in connection with the integration or management of the businesses or brands, and may encounter unexpected difficulties and costs in integrating them into our operating, governance and internal control structures. In the past we have been, and in the future we may be, unable to realize the expected benefits of acquisitions, investments or licensing or distribution agreements; it may also take longer than expected to realize the expected benefits. We may also experience delays in extending our respective internal control over financial reporting to new acquisitions or investments, which may increase the risk of misstatements in our financial records and in our consolidated financial statements. In addition, our quality management protocols, which are designed to ensure product quality and safety, may not be sufficiently robust to fully manage the expanded range of product offerings introduced through new investments, licensing or distribution agreements, which may increase our costs or subject us to negative publicity. Any acquisitions, investments or ventures may also disrupt ongoing business activity or result in the diversion of management attention and resources from other initiatives and operations. Our ability to manage and improve the performance of acquired businesses or brands and our other investments and ventures will impact our financial performance. We may not achieve the strategic and financial objectives for such transactions. If we are unable to achieve such objectives, our consolidated results could be negatively affected.

Failure to realize benefits or successfully manage the potential negative consequences of our productivity initiatives can adversely affect our financial performance.

We pursue strategic initiatives that are transformative in nature and are expected to generate significant cost savings, or productivity, over time. These strategic initiatives have included investments in new technologies and optimization of certain processes and of our manufacturing footprint. Some of our productivity initiatives may result in unintended consequences, such as business disruptions, distraction of management and employees, reduced morale and productivity, inability to obtain expected savings to reinvest into the business, an inability to attract or retain employees, negative publicity and disruption of the internal control structures of the affected business operations. If we are unable to successfully implement our productivity initiatives as planned or do not achieve expected savings as a result of these initiatives, we may not realize all or any of the anticipated benefits, resulting in adverse effects on our financial performance.

Our facilities and operations may require substantial investment and upgrading, including investments in new technologies and digital transformation, and such investments may not achieve the intended financial benefits.

We continue to incur significant costs to maintain or upgrade various technologies, facilities, and equipment or restructure our operations, including closing existing facilities or opening new ones. We invest in new and emerging technologies, including the use of automation, connected data, robotics, and artificial intelligence throughout our operations, including in our manufacturing and distribution facilities and our sales organization.

If the cost of our investments is higher than anticipated, the investments and upgrades are not sufficient to meet our near-term future business needs, our business does not develop as anticipated to appropriately utilize new or upgraded facilities, or third parties fail to complete the construction or renovation of facilities or production equipment in a timely manner or in accordance with our specifications, we may be delayed in realizing the intended benefits or our costs and financial performance could be negatively affected.

We have ongoing programs to invest and upgrade our manufacturing, distribution and other facilities, including expansive investments in manufacturing facilities in Spartanburg, South Carolina and Allentown, Pennsylvania. These investments require us to rely on third parties for the construction and renovation of our facilities and manufacturing of our production equipment. We have experienced delays related to the production equipment contained within our manufacturing facilities, including delays in receiving the equipment or in operating the equipment according to specifications outlined by the manufacturer, which have led to increased costs, and we may continue to experience such delays and cost increases.

13

Increases in our cost of employee benefits in the future could reduce our profitability.

Our profitability is substantially affected by costs for employee health care, pension and other retirement programs and other benefits. In recent years, these costs have increased significantly due to factors such as increases in health care costs, declines in investment returns on pension assets, and changes in discount rates used to calculate pension and related liabilities. These factors will continue to put pressure on our business and financial performance. There can be no assurance that we will succeed in limiting future cost increases, and continued upward cost pressure could have a material adverse effect on our business and financial performance.

We depend on key information systems, and our use of information technology exposes us to business disruptions that could adversely affect us.

Our information systems contain proprietary and other confidential information related to our business. These systems and services are vulnerable to interruptions or other failures resulting from, among other things, natural disasters, terrorist attacks, software, equipment or telecommunications failures, processing errors, computer viruses, other security issues or supplier defaults. Security, backup and disaster recovery measures may not be adequate or implemented properly to avoid such disruptions or failures. Any disruption or failure of these systems or services could cause substantial errors, processing inefficiencies, security breaches, inability to use the systems or process transactions, loss of customers or other business disruptions, all of which could negatively affect our business and financial performance. Our users’ data and customer information may be improperly accessed, used or disclosed if we fail to adopt or adhere to adequate information security practices, or fail to comply with their respective online policies, or in the event of a breach of our networks, which could subject us to legal action, reputational harm, or otherwise negatively impact our business and financial performance.

Substantial disruption at our manufacturing and distribution facilities could occur.

A disruption at our manufacturing and distribution facilities could have a material adverse effect on our business, as could a disruption at the facilities of our bottlers, contract manufacturers or distributors. Disruptions could occur for many reasons, including fire, natural disasters, weather, water scarcity, manufacturing problems, disease, widespread illness, strikes, labor shortages, transportation or supply interruption, contractual dispute, government regulation, cybersecurity attacks or terrorism. Moreover, if demand increases beyond our production capabilities, we would need to expand our capabilities internally or acquire additional capacity. Alternative facilities with sufficient capacity or capabilities may not be available, may cost substantially more than existing facilities or may take a significant time to start production, each of which could negatively affect our business and financial performance.

Our intellectual property rights could be infringed or we could infringe the intellectual property rights of others, and adverse events regarding licensed intellectual property could harm our business.

We possess intellectual property that is important to our business. This intellectual property includes ingredient formulas, trademarks, copyrights, patents, business processes and other trade secrets. We cannot be certain that the legal steps taken to protect our rights will be sufficient or that others will not infringe or misappropriate our rights. If we fail to adequately protect our intellectual property rights, or if changes in laws diminish or remove the current legal protections available to them, the competitiveness of our products may be eroded and our business could suffer. We and third parties, including competitors, could come into conflict over intellectual property rights, resulting in disruptive and expensive litigation. If we are unable to protect our intellectual property rights, our brands, products and business could be harmed.

We also license various trademarks from third parties and license our trademarks to third parties. In some countries, third parties own certain trademarks and related intellectual property that we own in other countries. For example, the Dr Pepper trademark and formula is owned by Coca-Cola in some countries outside North America. Adverse events affecting those third parties or their products could also negatively impact our brands.

14

Failure to attract, retain, develop and motivate a highly skilled and diverse workforce, or failure to effectively manage changes in our workforce such as labor shortages, employee turnover and increases in wages, could significantly impact our operations.

The labor market has experienced and may continue to experience labor shortages, inflation in labor costs and increased employee turnover, which has impacted and may continue to impact our ability to attract and retain a highly skilled and diverse workforce. Competition in the labor market for qualified employees has increased alongside current and prospective employees’ changing expectations for compensation, benefits, and flexible work models. Unplanned turnover or failure to develop and implement succession plans for senior management and other key personnel, including our CEO, could deplete our institutional knowledge base and erode our competitiveness. Failure to attract, retain, develop, and motivate a highly skilled and diverse workforce, including employees with specialized capabilities, or to maintain a culture that fosters inclusivity and diversity, including by increasing representation of underrepresented communities, can damage our business results and our reputation.

We may not be able to renew collective bargaining agreements on satisfactory terms, or we could experience union activity, including new unionization, labor disputes or work stoppages.

Many of our employees that are involved in the manufacturing or distribution of our products are covered by collective bargaining agreements. Additional employees have sought and may continue to seek to be covered by collective bargaining agreements, which may be facilitated by changing labor laws and regulations. These agreements typically expire every three to four years at various dates. We may not be able to renew our existing collective bargaining agreements on satisfactory terms or at all. This could result in labor disputes, strikes, or work stoppages, which could impair our ability to manufacture and distribute our products and result in a substantial loss of sales. The terms of existing, renewed or expanded agreements could also significantly increase our costs or negatively affect our ability to increase operational efficiency.

RISKS RELATED TO OUR FINANCIAL PERFORMANCE

We negotiate with our suppliers to optimize our terms and conditions, including payment terms, and reductions in our payment terms with our suppliers could adversely affect our liquidity.

As part of ongoing efforts to decrease our cash conversion cycle and manage our working capital, we negotiate with our suppliers to optimize our terms and conditions, which includes the consideration of payment terms. As part of this process, we strive to seek extended payment terms in commercial negotiations with potential suppliers. Excluding our suppliers who require cash at date of purchase or sale, our current payment terms with our suppliers generally range from 10 to 360 days.

The length of our payment terms has been reduced in recent periods and will continue to be reduced, including as a result of a supplier being replaced, renegotiation of a supplier’s contract during the procurement process, through efforts to increase the overall pool of potential suppliers for selection, or in order to receive favorable pricing or other terms during commercial negotiations. Reductions in our payment terms have negatively affected, and could continue to negatively affect, our liquidity and our ability to maintain our cash conversion cycle to maximize our working capital. Reduced payment terms have contributed to, and could continue to contribute to, our need to utilize various financing arrangements for short-term liquidity.

15

We cannot guarantee that our share repurchase program will be fully consummated or that our share repurchase program will enhance long-term stockholder value.

In October 2021, our Board authorized the Company to repurchase up to $4 billion of our outstanding common stock over a four-year period, beginning on January 1, 2022, potentially enabling us to return value to shareholders. Our repurchase program does not obligate us to repurchase any specific dollar amount or to acquire any specific number of shares. Under the terms of our share repurchase program, shares may be repurchased from time to time in open market transactions at prevailing market prices, in privately negotiated transactions, or by other means (including through the use of trading plans intended to qualify under Rule 10b5-1 under the Exchange Act) in accordance with federal securities laws. We may fund our share repurchases through a combination of cash flow from operations, borrowings, a combination of the two, or other sources of liquidity. The actual manner, timing, amount, value and counterparties of any repurchases under the program will be determined in our discretion and will depend on a number of factors, including the market price of our common stock, trading volume, other capital management objectives and opportunities, applicable legal requirements, applicable tax effects, and general market and economic conditions.

We cannot guarantee that we will repurchase shares (or the terms or amount of any such repurchase) or conduct future share repurchase programs, and we cannot guarantee that any such programs will result in long-term increases to shareholder value. The existence of our stock repurchase program could also cause the price of our common stock to be higher than it would be in the absence of such a program and could potentially reduce the market liquidity for our common stock. Additionally, significant changes in laws or regulations may reduce our ability or inclination to take advantage of our share repurchase program.

Determinations in the future that a significant impairment of the value of our goodwill and other indefinite-lived intangible assets has occurred could have a material adverse effect on our financial performance.

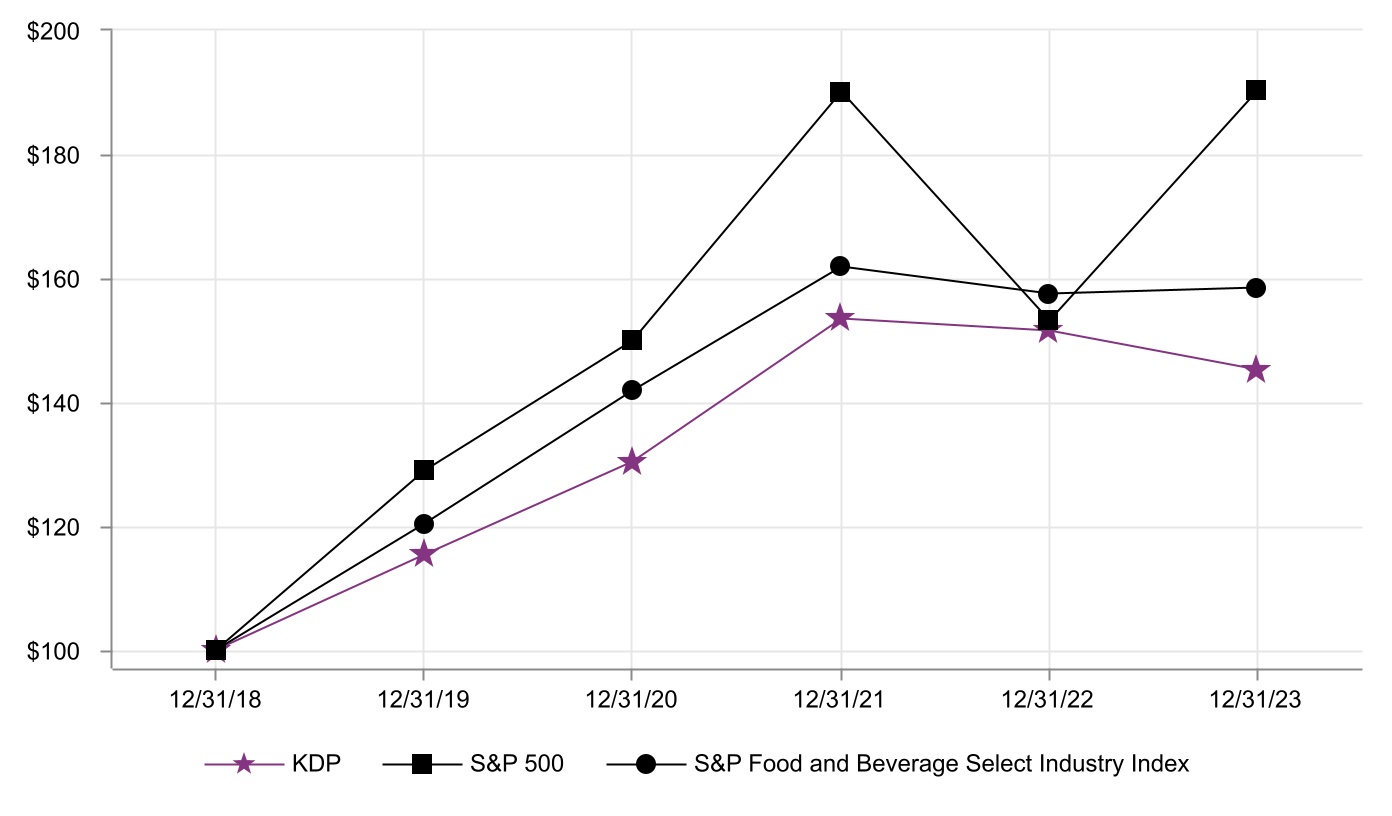

As of December 31, 2023, we had $52,130 million of total assets, of which $20,202 million were goodwill and $23,287 million were other intangible assets. Intangible assets include both definite and indefinite-lived intangible assets in connection with brands, trade names, acquired technology, customer relationships, and contractual arrangements. We conduct impairment tests on goodwill and all indefinite-lived intangible assets annually, as of October 1, or more frequently if circumstances indicate that all or a portion of the carrying amount of an asset may not be recoverable. In addition, definite-lived intangible assets and property, plant and equipment are evaluated for impairment or accelerated depreciation as circumstances indicate.