kdp-202303310001418135FALSE2023Q1December 31http://fasb.org/us-gaap/2023#OtherLiabilitiesCurrenthttp://fasb.org/us-gaap/2023#OtherLiabilitiesCurrenthttp://fasb.org/us-gaap/2023#OtherLiabilitiesCurrenthttp://fasb.org/us-gaap/2023#OtherLiabilitiesCurrenthttp://fasb.org/us-gaap/2023#OtherLiabilitiesNoncurrenthttp://fasb.org/us-gaap/2023#OtherLiabilitiesNoncurrenthttp://fasb.org/us-gaap/2023#OtherLiabilitiesNoncurrenthttp://fasb.org/us-gaap/2023#OtherLiabilitiesNoncurrenthttp://fasb.org/us-gaap/2023#AccountsPayableCurrent00014181352023-01-012023-03-3100014181352023-04-25xbrli:sharesiso4217:USD00014181352022-01-012022-03-31iso4217:USDxbrli:shares00014181352023-03-3100014181352022-12-3100014181352021-12-3100014181352022-03-310001418135us-gaap:CommonStockMember2022-12-310001418135us-gaap:AdditionalPaidInCapitalMember2022-12-310001418135us-gaap:RetainedEarningsMember2022-12-310001418135us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-12-310001418135us-gaap:RetainedEarningsMember2023-01-012023-03-310001418135us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-01-012023-03-310001418135us-gaap:AdditionalPaidInCapitalMember2023-01-012023-03-310001418135us-gaap:CommonStockMember2023-01-012023-03-310001418135us-gaap:CommonStockMember2023-03-310001418135us-gaap:AdditionalPaidInCapitalMember2023-03-310001418135us-gaap:RetainedEarningsMember2023-03-310001418135us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-03-310001418135us-gaap:CommonStockMember2021-12-310001418135us-gaap:AdditionalPaidInCapitalMember2021-12-310001418135us-gaap:RetainedEarningsMember2021-12-310001418135us-gaap:AccumulatedOtherComprehensiveIncomeMember2021-12-310001418135us-gaap:RetainedEarningsMember2022-01-012022-03-310001418135us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-01-012022-03-310001418135us-gaap:CommonStockMember2022-01-012022-03-310001418135us-gaap:AdditionalPaidInCapitalMember2022-01-012022-03-310001418135us-gaap:CommonStockMember2022-03-310001418135us-gaap:AdditionalPaidInCapitalMember2022-03-310001418135us-gaap:RetainedEarningsMember2022-03-310001418135us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-03-310001418135us-gaap:SeniorNotesMember2023-03-310001418135us-gaap:SeniorNotesMember2022-12-310001418135us-gaap:CommercialPaperMember2023-03-310001418135us-gaap:CommercialPaperMember2022-12-310001418135us-gaap:SeniorNotesMemberkdp:A2023NotesMember2023-03-31xbrli:pure0001418135us-gaap:SeniorNotesMemberkdp:A2023NotesMember2022-12-310001418135kdp:A2024NotesMemberus-gaap:SeniorNotesMember2023-03-310001418135kdp:A2024NotesMemberus-gaap:SeniorNotesMember2022-12-310001418135kdp:A2025MergerNotesMemberus-gaap:SeniorNotesMember2023-03-310001418135kdp:A2025MergerNotesMemberus-gaap:SeniorNotesMember2022-12-310001418135us-gaap:SeniorNotesMemberkdp:A2025NotesMember2023-03-310001418135us-gaap:SeniorNotesMemberkdp:A2025NotesMember2022-12-310001418135kdp:A2026NotesMemberus-gaap:SeniorNotesMember2023-03-310001418135kdp:A2026NotesMemberus-gaap:SeniorNotesMember2022-12-310001418135us-gaap:SeniorNotesMemberkdp:A2027NotesMember2023-03-310001418135us-gaap:SeniorNotesMemberkdp:A2027NotesMember2022-12-310001418135us-gaap:SeniorNotesMemberkdp:A2028MergerNotesMember2023-03-310001418135us-gaap:SeniorNotesMemberkdp:A2028MergerNotesMember2022-12-310001418135kdp:A2029NotesMemberus-gaap:SeniorNotesMember2023-03-310001418135kdp:A2029NotesMemberus-gaap:SeniorNotesMember2022-12-310001418135us-gaap:SeniorNotesMemberkdp:A2030NotesMember2023-03-310001418135us-gaap:SeniorNotesMemberkdp:A2030NotesMember2022-12-310001418135us-gaap:SeniorNotesMemberkdp:A2031NotesMember2023-03-310001418135us-gaap:SeniorNotesMemberkdp:A2031NotesMember2022-12-310001418135us-gaap:SeniorNotesMemberkdp:A2032NotesMember2023-03-310001418135us-gaap:SeniorNotesMemberkdp:A2032NotesMember2022-12-310001418135kdp:A2038MergerNotesMemberus-gaap:SeniorNotesMember2023-03-310001418135kdp:A2038MergerNotesMemberus-gaap:SeniorNotesMember2022-12-310001418135kdp:A2045NotesMemberus-gaap:SeniorNotesMember2023-03-310001418135kdp:A2045NotesMemberus-gaap:SeniorNotesMember2022-12-310001418135kdp:A2046NotesMemberus-gaap:SeniorNotesMember2023-03-310001418135kdp:A2046NotesMemberus-gaap:SeniorNotesMember2022-12-310001418135kdp:A2048MergerNotesMemberus-gaap:SeniorNotesMember2023-03-310001418135kdp:A2048MergerNotesMemberus-gaap:SeniorNotesMember2022-12-310001418135kdp:A2050NotesMemberus-gaap:SeniorNotesMember2023-03-310001418135kdp:A2050NotesMemberus-gaap:SeniorNotesMember2022-12-310001418135kdp:A2051NotesMemberus-gaap:SeniorNotesMember2023-03-310001418135kdp:A2051NotesMemberus-gaap:SeniorNotesMember2022-12-310001418135us-gaap:SeniorNotesMemberkdp:A2052NotesMember2023-03-310001418135us-gaap:SeniorNotesMemberkdp:A2052NotesMember2022-12-310001418135kdp:A2022RevolvingCreditAgreementMember2023-03-310001418135kdp:A2022RevolvingCreditAgreementMember2022-12-310001418135kdp:LetterOfCreditSubfacilityMember2023-03-310001418135us-gaap:CommercialPaperMember2023-01-012023-03-310001418135us-gaap:CommercialPaperMember2022-01-012022-03-310001418135us-gaap:LetterOfCreditMember2023-03-310001418135us-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsNonrecurringMemberus-gaap:SeniorNotesMember2023-03-310001418135us-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsNonrecurringMemberus-gaap:SeniorNotesMember2022-12-310001418135kdp:USRefreshmentBeveragesMember2022-12-310001418135kdp:PackagedBeveragesMember2022-12-310001418135kdp:InternationalMember2022-12-310001418135kdp:USRefreshmentBeveragesMember2023-01-012023-03-310001418135kdp:PackagedBeveragesMember2023-01-012023-03-310001418135kdp:InternationalMember2023-01-012023-03-310001418135kdp:USCoffeeMember2023-03-310001418135kdp:PackagedBeveragesMember2023-03-310001418135kdp:USRefreshmentBeveragesMember2023-03-310001418135kdp:BrandsMember2023-03-310001418135kdp:BrandsMember2022-12-310001418135us-gaap:TradeNamesMember2023-03-310001418135us-gaap:TradeNamesMember2022-12-310001418135us-gaap:ContractualRightsMember2023-03-310001418135us-gaap:ContractualRightsMember2022-12-310001418135us-gaap:DistributionRightsMember2023-03-310001418135us-gaap:DistributionRightsMember2022-12-310001418135kdp:BrandsMember2023-01-012023-03-310001418135us-gaap:DistributionRightsMember2023-01-012023-03-310001418135us-gaap:TechnologyBasedIntangibleAssetsMember2023-03-310001418135us-gaap:TechnologyBasedIntangibleAssetsMember2022-12-310001418135us-gaap:CustomerRelationshipsMember2023-03-310001418135us-gaap:CustomerRelationshipsMember2022-12-310001418135us-gaap:TradeNamesMember2023-03-310001418135us-gaap:TradeNamesMember2022-12-310001418135kdp:BrandsMember2023-03-310001418135kdp:BrandsMember2022-12-310001418135us-gaap:ContractualRightsMember2023-03-310001418135us-gaap:ContractualRightsMember2022-12-310001418135us-gaap:DistributionRightsMember2023-03-310001418135us-gaap:DistributionRightsMember2022-12-310001418135us-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:InterestRateContractMember2023-03-310001418135us-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:InterestRateContractMember2022-12-310001418135us-gaap:NondesignatedMemberus-gaap:InterestRateContractMember2023-03-310001418135us-gaap:NondesignatedMemberus-gaap:InterestRateContractMember2022-12-310001418135us-gaap:NondesignatedMemberkdp:ReceiveFixedPayVariableInterestRateSwapsMember2023-03-310001418135us-gaap:NondesignatedMemberkdp:ReceiveFixedPayVariableInterestRateSwapsMember2022-12-310001418135us-gaap:NondesignatedMemberus-gaap:ForeignExchangeForwardMember2023-03-310001418135us-gaap:NondesignatedMemberus-gaap:ForeignExchangeForwardMember2022-12-310001418135us-gaap:ForeignExchangeForwardMemberus-gaap:DesignatedAsHedgingInstrumentMember2023-03-310001418135us-gaap:ForeignExchangeForwardMemberus-gaap:DesignatedAsHedgingInstrumentMember2022-12-310001418135us-gaap:NondesignatedMemberus-gaap:CommodityContractMember2023-03-310001418135us-gaap:NondesignatedMemberus-gaap:CommodityContractMember2022-12-310001418135us-gaap:FairValueInputsLevel2Memberus-gaap:NondesignatedMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:ForeignExchangeForwardMember2023-03-310001418135us-gaap:FairValueInputsLevel2Memberus-gaap:NondesignatedMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:ForeignExchangeForwardMember2022-12-310001418135us-gaap:FairValueInputsLevel2Memberus-gaap:NondesignatedMemberus-gaap:CommodityContractMemberus-gaap:FairValueMeasurementsRecurringMember2023-03-310001418135us-gaap:FairValueInputsLevel2Memberus-gaap:NondesignatedMemberus-gaap:CommodityContractMemberus-gaap:FairValueMeasurementsRecurringMember2022-12-310001418135us-gaap:FairValueInputsLevel2Memberus-gaap:NondesignatedMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:InterestRateContractMember2023-03-310001418135us-gaap:FairValueInputsLevel2Memberus-gaap:NondesignatedMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:InterestRateContractMember2022-12-310001418135us-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:ForeignExchangeForwardMember2023-03-310001418135us-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:ForeignExchangeForwardMember2022-12-310001418135us-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:InterestRateContractMember2023-03-310001418135us-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:InterestRateContractMember2022-12-310001418135us-gaap:NondesignatedMemberus-gaap:InterestExpenseMemberus-gaap:InterestRateContractMember2023-01-012023-03-310001418135us-gaap:NondesignatedMemberus-gaap:InterestExpenseMemberus-gaap:InterestRateContractMember2022-01-012022-03-310001418135us-gaap:NondesignatedMemberus-gaap:ForeignExchangeForwardMemberus-gaap:CostOfSalesMember2023-01-012023-03-310001418135us-gaap:NondesignatedMemberus-gaap:ForeignExchangeForwardMemberus-gaap:CostOfSalesMember2022-01-012022-03-310001418135us-gaap:NondesignatedMemberus-gaap:OtherNonoperatingIncomeExpenseMemberus-gaap:ForeignExchangeForwardMember2023-01-012023-03-310001418135us-gaap:NondesignatedMemberus-gaap:OtherNonoperatingIncomeExpenseMemberus-gaap:ForeignExchangeForwardMember2022-01-012022-03-310001418135us-gaap:NondesignatedMemberus-gaap:CommodityContractMemberus-gaap:CostOfSalesMember2023-01-012023-03-310001418135us-gaap:NondesignatedMemberus-gaap:CommodityContractMemberus-gaap:CostOfSalesMember2022-01-012022-03-310001418135us-gaap:NondesignatedMemberus-gaap:SellingGeneralAndAdministrativeExpensesMemberus-gaap:CommodityContractMember2023-01-012023-03-310001418135us-gaap:NondesignatedMemberus-gaap:SellingGeneralAndAdministrativeExpensesMemberus-gaap:CommodityContractMember2022-01-012022-03-310001418135us-gaap:InterestRateContractMember2023-01-012023-03-310001418135us-gaap:InterestRateContractMember2022-01-012022-03-310001418135us-gaap:ForeignExchangeForwardMember2023-01-012023-03-310001418135us-gaap:ForeignExchangeForwardMember2022-01-012022-03-310001418135srt:MinimumMember2023-03-310001418135srt:MaximumMember2023-03-310001418135kdp:VeyronSPEMarch312023SLBTransactionMember2023-01-012023-03-310001418135kdp:VeyronSPEMarch312023SLBTransactionMember2023-03-310001418135kdp:USRefreshmentBeveragesMember2022-01-012022-03-310001418135kdp:USCoffeeMember2023-01-012023-03-310001418135kdp:USCoffeeMember2022-01-012022-03-310001418135kdp:InternationalMember2022-01-012022-03-310001418135us-gaap:OperatingSegmentsMemberkdp:USRefreshmentBeveragesMember2023-01-012023-03-310001418135us-gaap:OperatingSegmentsMemberkdp:USRefreshmentBeveragesMember2022-01-012022-03-310001418135kdp:USCoffeeMemberus-gaap:OperatingSegmentsMember2023-01-012023-03-310001418135kdp:USCoffeeMemberus-gaap:OperatingSegmentsMember2022-01-012022-03-310001418135kdp:InternationalMemberus-gaap:OperatingSegmentsMember2023-01-012023-03-310001418135kdp:InternationalMemberus-gaap:OperatingSegmentsMember2022-01-012022-03-310001418135us-gaap:CorporateNonSegmentMember2023-01-012023-03-310001418135us-gaap:CorporateNonSegmentMember2022-01-012022-03-310001418135kdp:USCoffeeMember2022-12-310001418135kdp:InternationalMember2023-03-310001418135us-gaap:OperatingSegmentsMember2023-03-310001418135us-gaap:OperatingSegmentsMember2022-12-310001418135us-gaap:CorporateNonSegmentMember2023-03-310001418135us-gaap:CorporateNonSegmentMember2022-12-310001418135kdp:USRefreshmentBeveragesMemberkdp:LRBMember2023-01-012023-03-310001418135kdp:USCoffeeMemberkdp:LRBMember2023-01-012023-03-310001418135kdp:InternationalMemberkdp:LRBMember2023-01-012023-03-310001418135kdp:LRBMember2023-01-012023-03-310001418135kdp:KCupPodsMemberkdp:USRefreshmentBeveragesMember2023-01-012023-03-310001418135kdp:USCoffeeMemberkdp:KCupPodsMember2023-01-012023-03-310001418135kdp:KCupPodsMemberkdp:InternationalMember2023-01-012023-03-310001418135kdp:KCupPodsMember2023-01-012023-03-310001418135kdp:AppliancesMemberkdp:USRefreshmentBeveragesMember2023-01-012023-03-310001418135kdp:USCoffeeMemberkdp:AppliancesMember2023-01-012023-03-310001418135kdp:AppliancesMemberkdp:InternationalMember2023-01-012023-03-310001418135kdp:AppliancesMember2023-01-012023-03-310001418135kdp:OtherNetSalesMemberkdp:USRefreshmentBeveragesMember2023-01-012023-03-310001418135kdp:USCoffeeMemberkdp:OtherNetSalesMember2023-01-012023-03-310001418135kdp:InternationalMemberkdp:OtherNetSalesMember2023-01-012023-03-310001418135kdp:OtherNetSalesMember2023-01-012023-03-310001418135kdp:USRefreshmentBeveragesMemberkdp:LRBMember2022-01-012022-03-310001418135kdp:USCoffeeMemberkdp:LRBMember2022-01-012022-03-310001418135kdp:InternationalMemberkdp:LRBMember2022-01-012022-03-310001418135kdp:LRBMember2022-01-012022-03-310001418135kdp:KCupPodsMemberkdp:USRefreshmentBeveragesMember2022-01-012022-03-310001418135kdp:USCoffeeMemberkdp:KCupPodsMember2022-01-012022-03-310001418135kdp:KCupPodsMemberkdp:InternationalMember2022-01-012022-03-310001418135kdp:KCupPodsMember2022-01-012022-03-310001418135kdp:AppliancesMemberkdp:USRefreshmentBeveragesMember2022-01-012022-03-310001418135kdp:USCoffeeMemberkdp:AppliancesMember2022-01-012022-03-310001418135kdp:AppliancesMemberkdp:InternationalMember2022-01-012022-03-310001418135kdp:AppliancesMember2022-01-012022-03-310001418135kdp:OtherNetSalesMemberkdp:USRefreshmentBeveragesMember2022-01-012022-03-310001418135kdp:USCoffeeMemberkdp:OtherNetSalesMember2022-01-012022-03-310001418135kdp:InternationalMemberkdp:OtherNetSalesMember2022-01-012022-03-310001418135kdp:OtherNetSalesMember2022-01-012022-03-310001418135srt:CumulativeEffectPeriodOfAdoptionAdjustmentMember2022-01-012022-03-310001418135us-gaap:RestrictedStockUnitsRSUMember2022-12-310001418135us-gaap:RestrictedStockUnitsRSUMember2022-01-012022-09-300001418135us-gaap:RestrictedStockUnitsRSUMember2023-01-012023-03-310001418135us-gaap:RestrictedStockUnitsRSUMember2023-03-310001418135kdp:NutraboltMember2023-03-310001418135kdp:NutraboltMember2022-12-310001418135kdp:TractorMember2023-03-310001418135kdp:TractorMember2022-12-310001418135kdp:AthleticBrewingMember2023-03-310001418135kdp:AthleticBrewingMember2022-12-310001418135kdp:DylaLLCMember2023-03-310001418135kdp:DylaLLCMember2022-12-310001418135kdp:ForceHoldingLLCMember2023-03-310001418135kdp:ForceHoldingLLCMember2022-12-310001418135kdp:BeveragestartupcompaniesMember2023-03-310001418135kdp:BeveragestartupcompaniesMember2022-12-310001418135kdp:OtherEquityMethodInvestmentsMember2023-03-310001418135kdp:OtherEquityMethodInvestmentsMember2022-12-310001418135us-gaap:AccumulatedTranslationAdjustmentMember2022-12-310001418135us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2022-12-310001418135us-gaap:AccumulatedGainLossNetCashFlowHedgeParentMember2022-12-310001418135us-gaap:AccumulatedTranslationAdjustmentMember2023-01-012023-03-310001418135us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2023-01-012023-03-310001418135us-gaap:AccumulatedGainLossNetCashFlowHedgeParentMember2023-01-012023-03-310001418135us-gaap:AccumulatedTranslationAdjustmentMember2023-03-310001418135us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2023-03-310001418135us-gaap:AccumulatedGainLossNetCashFlowHedgeParentMember2023-03-310001418135us-gaap:AccumulatedTranslationAdjustmentMember2021-12-310001418135us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2021-12-310001418135us-gaap:AccumulatedGainLossNetCashFlowHedgeParentMember2021-12-310001418135us-gaap:AccumulatedTranslationAdjustmentMember2022-01-012022-03-310001418135us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2022-01-012022-03-310001418135us-gaap:AccumulatedGainLossNetCashFlowHedgeParentMember2022-01-012022-03-310001418135us-gaap:AccumulatedTranslationAdjustmentMember2022-03-310001418135us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2022-03-310001418135us-gaap:AccumulatedGainLossNetCashFlowHedgeParentMember2022-03-310001418135us-gaap:AccumulatedGainLossNetCashFlowHedgeParentMemberus-gaap:InterestRateContractMember2023-01-012023-03-310001418135us-gaap:AccumulatedGainLossNetCashFlowHedgeParentMemberus-gaap:InterestRateContractMember2022-01-012022-03-310001418135us-gaap:AccumulatedGainLossNetCashFlowHedgeParentMemberus-gaap:ForeignExchangeForwardMember2023-01-012023-03-310001418135us-gaap:AccumulatedGainLossNetCashFlowHedgeParentMemberus-gaap:ForeignExchangeForwardMember2022-01-012022-03-310001418135us-gaap:AccumulatedGainLossCashFlowHedgeIncludingNoncontrollingInterestMember2023-01-012023-03-310001418135us-gaap:AccumulatedGainLossCashFlowHedgeIncludingNoncontrollingInterestMember2022-01-012022-03-310001418135kdp:AntitrustLitigationMember2020-07-012020-07-310001418135kdp:LeasingArrangementsMemberus-gaap:VariableInterestEntityNotPrimaryBeneficiaryMember2023-03-310001418135kdp:LeasingArrangementsMemberus-gaap:VariableInterestEntityNotPrimaryBeneficiaryMember2022-12-310001418135us-gaap:VariableInterestEntityNotPrimaryBeneficiaryMember2023-03-310001418135us-gaap:VariableInterestEntityNotPrimaryBeneficiaryMember2022-12-310001418135kdp:LicensingArrangementsMemberus-gaap:VariableInterestEntityNotPrimaryBeneficiaryMember2023-03-310001418135kdp:NutraboltMember2023-03-310001418135us-gaap:EmployeeSeveranceMember2022-12-310001418135us-gaap:EmployeeSeveranceMember2023-03-31

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-Q

☒ QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

FOR THE QUARTERLY PERIOD ENDED March 31, 2023

OR

☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

FOR THE TRANSITION PERIOD FROM TO

Commission file number 001-33829

Keurig Dr Pepper Inc.

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | |

| Delaware | 98-0517725 |

| (State or other jurisdiction of incorporation or organization) | (I.R.S. employer identification number) |

53 South Avenue

Burlington, Massachusetts

01803

(Address of principal executive offices)

(781) 418-7000

(Registrant's telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol | | Name of each exchange on which registered |

| Common stock | | KDP | | The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of "large accelerated filer", "accelerated filer", "smaller reporting company", and "emerging growth company" in Rule 12b-2 of the Securities Exchange Act of 1934.

Large Accelerated Filer ☒ Accelerated Filer ☐ Non-Accelerated Filer ☐ Smaller Reporting Company ☐ Emerging Growth Company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Securities Exchange Act of 1934). Yes ☐ No ☒

As of April 25, 2023, there were 1,403,776,408 shares of the registrant's common stock, par value $0.01 per share, outstanding.

KEURIG DR PEPPER INC.

FORM 10-Q

TABLE OF CONTENTS

| | | | | | | | | | | | | | |

| | | | | Page |

| | |

| | | | |

| | | | |

| | | |

| | | | |

| | | | |

| | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | Item 3. | Quantitative and Qualitative Disclosures About Market Risk | |

| | | | |

| | | | |

| | |

| | | | |

| | | |

| | | |

| | | | |

KEURIG DR PEPPER INC.

MASTER GLOSSARY

| | | | | | | | |

| Term | | Definition |

| | |

| | |

| | |

| 2021 364-Day Credit Agreement | | The Company's $1,500 million credit agreement, which was entered into on March 26, 2021 and was terminated on February 23, 2022 |

| 2022 Revolving Credit Agreement | | KDP’s $4 billion revolving credit agreement, which was executed in February 2022 and replaced the 2021 364-Day Credit Agreement and the KDP Revolver |

| | |

| | |

| | |

| Annual Report | | Annual Report on Form 10-K for the year ended December 31, 2022 |

| AOCI | | Accumulated other comprehensive income or loss |

| | |

| Athletic Brewing | | Athletic Brewing Holding Company, LLC, an equity method investment of KDP |

| Bedford | | Bedford Systems, LLC, an equity method investment of KDP and the maker of Drinkworks |

| Board | | The Board of Directors of KDP |

| BodyArmor | | BA Sports Nutrition, LLC, a former equity method investment of KDP |

| bps | | basis points |

| CSD | | Carbonated soft drink |

| DIO | | Days inventory outstanding |

| DPO | | Days of payables outstanding |

| DPS | | Dr Pepper Snapple Group, Inc. |

| DPS Merger | | The combination of the business operations of Keurig and DPS that was consummated on July 9, 2018 through a reverse merger transaction, whereby a wholly-owned special purpose merger subsidiary of DPS merged with and into the direct parent of Keurig |

| DSD | | Direct Store Delivery, KDP’s route-to-market whereby finished beverages are delivered directly to retailers |

| DSO | | Days sales outstanding |

| EPS | | Earnings per share |

| Exchange Act | | Securities Exchange Act of 1934, as amended |

| | |

| | |

| FX | | Foreign exchange |

| | |

| | |

| IRi | | Information Resources, Inc. |

| | |

| KDP | | Keurig Dr Pepper Inc. |

| | |

| KDP Revolver | | The Company's $2,400 million revolving credit facility, which was entered into on February 28, 2018 and terminated on February 23, 2022. |

| Keurig | | Keurig Green Mountain, Inc., a wholly-owned subsidiary of KDP, and the brand of our brewers |

| LIBOR | | London Interbank Offered Rate |

| LRB | | Liquid refreshment beverages |

| NCB | | Non-carbonated beverage |

| Notes | | Collectively, the Company's senior unsecured notes |

| Nutrabolt | | Woodbolt Holdings LLC, d/b/a Nutrabolt, an equity method investment of KDP |

| | |

| | |

| RSU | | Restricted share unit |

| | |

| RVG | | Residual value guarantee |

| Tractor | | Tractor Beverages, Inc., an equity method investment of KDP |

| SEC | | Securities and Exchange Commission |

| SG&A | | Selling, general and administrative |

| SOFR | | Secured Overnight Financing Rate |

| U.S. GAAP | | Accounting principles generally accepted in the U.S. |

| Veyron SPEs | | Special purpose entities with the same sponsor, Veyron Global |

| VIE | | Variable interest entity |

| Vita Coco | | The Vita Coco Company, Inc. |

| WD | | Warehouse Direct, KDP’s route-to-market whereby finished beverages are shipped to retailer warehouses, and then delivered by the retailer through its own delivery system to its stores |

PART I - FINANCIAL INFORMATION

ITEM 1.Financial Statements (Unaudited)

KEURIG DR PEPPER INC.

CONDENSED CONSOLIDATED STATEMENTS OF INCOME

(UNAUDITED)

| | | | | | | | | | | | | | | |

| | | | First Quarter |

| (in millions, except per share data) | | | | | 2023 | | 2022 |

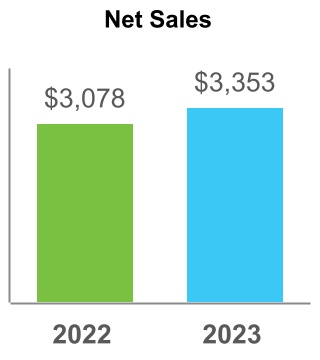

| Net sales | | | | | $ | 3,353 | | | $ | 3,078 | |

| Cost of sales | | | | | 1,609 | | | 1,428 | |

| Gross profit | | | | | 1,744 | | | 1,650 | |

| Selling, general and administrative expenses | | | | | 1,165 | | | 1,018 | |

| | | | | | | |

| Gain on litigation settlement | | | | | — | | | (299) | |

| Other operating income, net | | | | | (5) | | | (35) | |

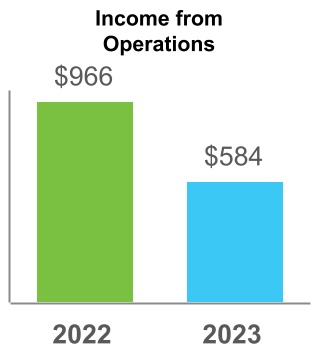

| Income from operations | | | | | 584 | | | 966 | |

| Interest expense | | | | | 23 | | | 188 | |

| Loss on early extinguishment of debt | | | | | — | | | 48 | |

| Gain on sale of equity method investment | | | | | — | | | (50) | |

| Impairment of investments and note receivable | | | | | — | | | 6 | |

| Other (income) expense, net | | | | | (20) | | | 9 | |

| Income before provision for income taxes | | | | | 581 | | | 765 | |

| Provision for income taxes | | | | | 114 | | | 180 | |

| Net income including non-controlling interest | | | | | 467 | | | 585 | |

| Less: Net loss attributable to non-controlling interest | | | | | — | | | — | |

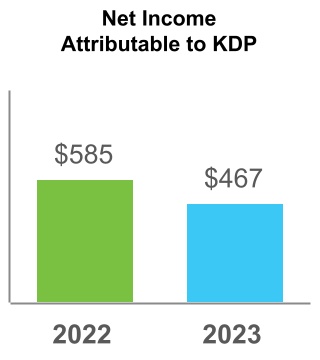

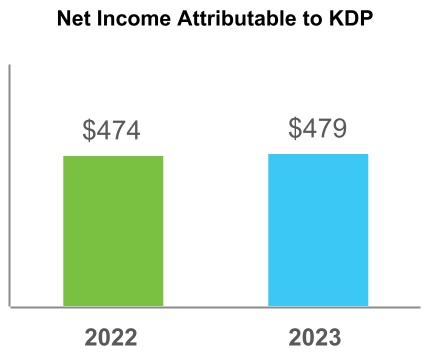

| Net income attributable to KDP | | | | | $ | 467 | | | $ | 585 | |

| | | | | | | |

| Earnings per common share: | | | | | | | |

| Basic | | | | | $ | 0.33 | | | $ | 0.41 | |

| Diluted | | | | | 0.33 | | | 0.41 | |

| Weighted average common shares outstanding: | | | | | | | |

| Basic | | | | | 1,406.2 | | | 1,418.2 | |

| Diluted | | | | | 1,417.0 | | | 1,429.7 | |

The accompanying notes are an integral part of these unaudited condensed consolidated financial statements.

KEURIG DR PEPPER INC.

CONDENSED CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME

(UNAUDITED)

| | | | | | | | | | | | | | | |

| | | | First Quarter |

| (in millions) | | | | | 2023 | | 2022 |

| Net income including non-controlling interest | | | | | $ | 467 | | | $ | 585 | |

| Other comprehensive (loss) income | | | | | | | |

| Foreign currency translation adjustments | | | | | 108 | | | 99 | |

Net change in pension and post-retirement liability, net of tax of $0 and $0, respectively | | | | | — | | | — | |

Net change in cash flow hedges, net of tax of $21 and $(48), respectively | | | | | (82) | | | 142 | |

| Total other comprehensive income | | | | | 26 | | | 241 | |

| Comprehensive income including non-controlling interest | | | | | 493 | | | 826 | |

| Less: Comprehensive income attributable to non-controlling interest | | | | | — | | | — | |

| Comprehensive income attributable to KDP | | | | | $ | 493 | | | $ | 826 | |

The accompanying notes are an integral part of these unaudited condensed consolidated financial statements.

KEURIG DR PEPPER INC.

CONDENSED CONSOLIDATED BALANCE SHEETS

(UNAUDITED) | | | | | | | | | | | | | | |

| | | March 31, | | December 31, |

| (in millions, except share and per share data) | | 2023 | | 2022 |

| Assets |

| Current assets: | | | | |

| Cash and cash equivalents | | $ | 204 | | | $ | 535 | |

| | | | |

| Trade accounts receivable, net | | 1,451 | | | 1,484 | |

| Inventories | | 1,391 | | | 1,314 | |

| Prepaid expenses and other current assets | | 540 | | | 471 | |

| Total current assets | | 3,586 | | | 3,804 | |

| Property, plant and equipment, net | | 2,480 | | | 2,491 | |

| Investments in unconsolidated affiliates | | 1,009 | | | 1,000 | |

| Goodwill | | 20,117 | | | 20,072 | |

| Other intangible assets, net | | 23,273 | | | 23,183 | |

| Other non-current assets | | 1,160 | | | 1,252 | |

| Deferred tax assets | | 35 | | | 35 | |

| Total assets | | $ | 51,660 | | | $ | 51,837 | |

| Liabilities and Stockholders' Equity |

| Current liabilities: | | | | |

| Accounts payable | | $ | 4,947 | | | $ | 5,206 | |

| Accrued expenses | | 1,046 | | | 1,153 | |

| Structured payables | | 137 | | | 137 | |

| Short-term borrowings and current portion of long-term obligations | | 2,310 | | | 895 | |

| Other current liabilities | | 687 | | | 685 | |

| Total current liabilities | | 9,127 | | | 8,076 | |

| Long-term obligations | | 9,929 | | | 11,072 | |

| Deferred tax liabilities | | 5,739 | | | 5,739 | |

| Other non-current liabilities | | 1,763 | | | 1,825 | |

| Total liabilities | | 26,558 | | | 26,712 | |

| Commitments and contingencies | | | | |

| Stockholders' equity: | | | | |

Preferred stock, $0.01 par value, 15,000,000 shares authorized, no shares issued | | — | | | — | |

Common stock, $0.01 par value, 2,000,000,000 shares authorized, 1,403,720,858 and 1,408,394,293 shares issued and outstanding as of March 31, 2023 and December 31, 2022, respectively | | 14 | | | 14 | |

| Additional paid-in capital | | 21,210 | | | 21,444 | |

| Retained earnings | | 3,724 | | | 3,539 | |

| Accumulated other comprehensive income | | 155 | | | 129 | |

| Total stockholders' equity | | 25,103 | | | 25,126 | |

| Non-controlling interest | | (1) | | | (1) | |

| Total equity | | 25,102 | | | 25,125 | |

| Total liabilities and equity | | $ | 51,660 | | | $ | 51,837 | |

The accompanying notes are an integral part of these unaudited condensed consolidated financial statements.

KEURIG DR PEPPER INC.

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(UNAUDITED) | | | | | | | | | | | |

| | First Quarter |

| (in millions) | 2023 | | 2022 |

| Operating activities: | | | |

| Net income attributable to KDP | $ | 467 | | | $ | 585 | |

| Adjustments to reconcile net income to net cash provided by operating activities: | | | |

| Depreciation expense | 107 | | | 106 | |

| Amortization of intangibles | 34 | | | 34 | |

| Other amortization expense | 45 | | | 42 | |

| Provision for sales returns | 10 | | | 12 | |

| Deferred income taxes | — | | | 8 | |

| Employee stock-based compensation expense | 29 | | | (15) | |

| Loss on early extinguishment of debt | — | | | 48 | |

| | | |

| Gain on sale of equity method investment | — | | | (50) | |

| Gain on disposal of property, plant and equipment | (5) | | | (38) | |

| Unrealized gain on foreign currency | (2) | | | (11) | |

| Unrealized gain on derivatives | (95) | | | — | |

| | | |

| Equity in (earnings) loss of unconsolidated affiliates | (9) | | | 3 | |

| | | |

| Impairment on investments and note receivable of unconsolidated affiliate | — | | | 6 | |

| Other, net | (4) | | | 13 | |

| Changes in assets and liabilities: | | | |

| Trade accounts receivable | 28 | | | (73) | |

| Inventories | (74) | | | (147) | |

| Income taxes receivable and payables, net | 60 | | | 135 | |

| Other current and non-current assets | (151) | | | (284) | |

| Accounts payable and accrued expenses | (391) | | | 151 | |

| Other current and non-current liabilities | 22 | | | 138 | |

| Net change in operating assets and liabilities | (506) | | | (80) | |

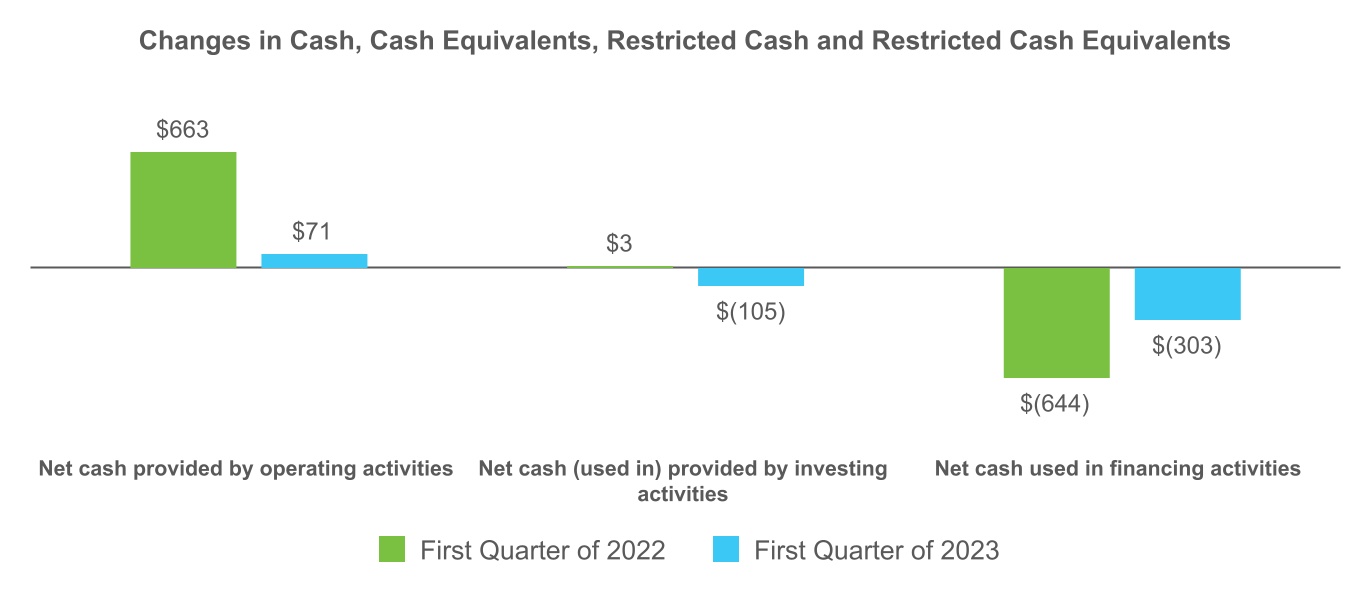

| Net cash provided by operating activities | 71 | | | 663 | |

| Investing activities: | | | |

| | | |

| | | |

| Proceeds from sale of investment in unconsolidated affiliates | — | | | 50 | |

| Purchases of property, plant and equipment | (62) | | | (109) | |

| Proceeds from sales of property, plant and equipment | 7 | | | 78 | |

| Purchases of intangibles | (51) | | | (10) | |

| Issuance of related party note receivable | — | | | (6) | |

| Investments in unconsolidated affiliates | — | | | (3) | |

| | | |

| Other, net | 1 | | | 3 | |

| Net cash (used in) provided by investing activities | $ | (105) | | | $ | 3 | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

The accompanying notes are an integral part of these unaudited condensed consolidated financial statements.

KEURIG DR PEPPER INC.

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(UNAUDITED, CONTINUED)

| | | | | | | | | | | |

| | First Quarter |

| (in millions) | 2023 | | 2022 |

| Financing activities: | | | |

| | | |

Repayments of Notes | $ | — | | | $ | (201) | |

| Proceeds from issuance of commercial paper | 3,523 | | | — | |

| Repayments of commercial paper | (3,258) | | | (149) | |

| | | |

| | | |

| | | |

| | | |

| | | |

| Proceeds from structured payables | 34 | | | 38 | |

| Repayments of structured payables | (32) | | | (37) | |

| Cash dividends paid | (281) | | | (265) | |

| Repurchases of common stock | (231) | | | — | |

| | | |

| Tax withholdings related to net share settlements | (31) | | | (5) | |

| Payments on finance leases | (24) | | | (20) | |

| Other, net | (3) | | | (5) | |

| Net cash used in financing activities | (303) | | | (644) | |

| Cash, cash equivalents, and restricted cash and cash equivalents: | | | |

| Net change from operating, investing and financing activities | (337) | | | 22 | |

| Effect of exchange rate changes | 6 | | | 4 | |

| Beginning balance | 535 | | | 568 | |

| Ending balance | $ | 204 | | | $ | 594 | |

| | | |

| Supplemental cash flow disclosures of non-cash investing activities: | | | |

| Capital expenditures included in accounts payable and accrued expenses | $ | 222 | | | $ | 139 | |

| Transaction costs included in accounts payable and accrued expenses | 8 | | | — | |

| | | |

| | | |

| Supplemental cash flow disclosures of non-cash financing activities: | | | |

| Dividends declared but not yet paid | 282 | | | 266 | |

| | | |

| Supplemental cash flow disclosures: | | | |

| Cash paid for interest | 39 | | | 27 | |

| Cash paid for income taxes | 49 | | | 37 | |

The accompanying notes are an integral part of these unaudited condensed consolidated financial statements.

KEURIG DR PEPPER INC.

CONDENSED CONSOLIDATED STATEMENTS OF CHANGES IN STOCKHOLDERS' EQUITY

(UNAUDITED)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Common Stock Issued | | Additional

Paid-In Capital | | Retained Earnings | | Accumulated Other Comprehensive Income | | Total Stockholders' Equity | | Non-controlling Interest | | Total

Equity |

| (in millions, except per share data) | Shares | | Amount | | | | | | |

| Balance as of January 1, 2023 | 1,408.4 | | | $ | 14 | | | $ | 21,444 | | | $ | 3,539 | | | $ | 129 | | | $ | 25,126 | | | $ | (1) | | | $ | 25,125 | |

| Net income | — | | | — | | | — | | | 467 | | | — | | | 467 | | | — | | | 467 | |

| Other comprehensive income | — | | | — | | | — | | | — | | | 26 | | | 26 | | | — | | | 26 | |

Dividends declared, $0.20 per share | — | | | — | | | — | | | (282) | | | — | | | (282) | | | — | | | (282) | |

| | | | | | | | | | | | | | | |

| Repurchases of common stock | (6.6) | | | — | | | (232) | | | — | | | — | | | (232) | | | — | | | (232) | |

| Shares issued under employee stock-based compensation plans and other | 1.9 | | | — | | | — | | | — | | | — | | | — | | | — | | | — | |

| Tax withholdings related to net share settlements | — | | | — | | | (31) | | | — | | | — | | | (31) | | | — | | | (31) | |

| Stock-based compensation and stock options exercised | — | | | — | | | 29 | | | — | | | — | | | 29 | | | — | | | 29 | |

Balance as of March 31, 2023 | 1,403.7 | | | $ | 14 | | | $ | 21,210 | | | $ | 3,724 | | | $ | 155 | | | $ | 25,103 | | | $ | (1) | | | $ | 25,102 | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Common Stock Issued | | Additional

Paid-In Capital | | Retained Earnings | | Accumulated Other Comprehensive Income (Loss) | | Total Stockholders' Equity | | Non-controlling Interest | | Total Equity |

| (in millions, except per share data) | Shares | | Amount | | | | | | |

Balance as of January 1, 2022 | 1,418.1 | | | $ | 14 | | | $ | 21,785 | | | $ | 3,199 | | | $ | (26) | | | $ | 24,972 | | | $ | — | | | $ | 24,972 | |

| | | | | | | | | | | | | | | |

| Net income | — | | | — | | | — | | | 585 | | | — | | | 585 | | | — | | | 585 | |

| Other comprehensive loss | — | | | — | | | — | | | — | | | 241 | | | 241 | | | | | 241 | |

Dividends declared, $0.1875 per share | — | | | — | | | — | | | (266) | | | — | | | (266) | | | — | | | (266) | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| Shares issued under employee stock-based compensation plans and other | 0.4 | | | — | | | — | | | — | | | — | | | — | | | — | | | — | |

| Tax withholdings related to net share settlements | — | | | — | | | (5) | | | — | | | — | | | (5) | | | — | | | (5) | |

| Stock-based compensation and stock options exercised | — | | | — | | | (16) | | | — | | | — | | | (16) | | | — | | | (16) | |

Balance as of March 31, 2022 | 1,418.5 | | | $ | 14 | | | $ | 21,764 | | | $ | 3,518 | | | $ | 215 | | | $ | 25,511 | | | $ | — | | | $ | 25,511 | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

The accompanying notes are an integral part of these unaudited condensed consolidated financial statements.

KEURIG DR PEPPER INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(UNAUDITED)

1. General

ORGANIZATION

References in this Quarterly Report on Form 10-Q to "KDP" or "the Company" refer to Keurig Dr Pepper Inc. and all entities included in the unaudited condensed consolidated financial statements. Definitions of terms used in this Quarterly Report on Form 10-Q are included within the Master Glossary.

This Quarterly Report on Form 10-Q refers to some of KDP's owned or licensed trademarks, trade names and service marks, which are referred to as the Company's brands. All of the product names included herein are either KDP registered trademarks or those of the Company's licensors.

BASIS OF PRESENTATION

The accompanying unaudited condensed consolidated financial statements have been prepared in accordance with U.S. GAAP for interim financial information and in accordance with the instructions to Form 10-Q and Article 10 of Regulation S-X. Accordingly, they do not include all of the information and footnotes required by U.S. GAAP for complete consolidated financial statements. In the opinion of management, all adjustments, consisting principally of normal recurring adjustments, considered necessary for a fair presentation have been included. These unaudited condensed consolidated financial statements should be read in conjunction with KDP's consolidated financial statements and accompanying notes included in the Company's Annual Report.

References to the "first quarter" indicate the Company's quarterly periods ended March 31, 2023 and 2022.

USE OF ESTIMATES

The process of preparing KDP's unaudited condensed consolidated financial statements in conformity with U.S. GAAP requires the use of estimates and judgments that affect reported amounts. These estimates and judgments are based on historical experience, future expectations and other factors and assumptions the Company believes to be reasonable under the circumstances. These estimates and judgments are reviewed on an ongoing basis and are revised when necessary. Changes in estimates are recorded in the period of change. Actual amounts may differ from these estimates.

REPORTABLE SEGMENTS

As of January 1, 2023, the Company revised its segment structure to align with changes in how the Company’s Chief Operating Decision Maker manages the business, assesses performance and allocates resources. This change had no impact on the Company’s consolidated results of operations or financial position. Prior period segment results have been recast to reflect the Company’s new reportable segments. Refer to Note 6 for additional information on the Company’s reportable segments and Note 7 for the Company’s disaggregated revenue portfolio for each reportable segment. The change in segment structure also resulted in a change to the Company’s reporting units. Refer to Note 3 for additional information on the Company’s reporting units.

RECENTLY ADOPTED ACCOUNTING STANDARDS

As of January 1, 2023, the Company adopted ASU 2022-04, Liabilities — Supplier Finance Programs (Subtopic 405-50): Disclosure of Supplier Finance Program Obligations. The objective of ASU 2022-04 is to require entities to disclose information about the use of supplier finance programs in connection with the purchase of goods and services. While the adoption of ASU 2022-04 did not have a material impact on the Company’s unaudited condensed consolidated financial statements, it did impact the nature of the disclosures. The previous disclosure was specific to the amount of KDP’s outstanding payment obligations that were voluntarily elected by the supplier and sold to financial institutions as informed by the third party administrators. ASU 2022-04 instead requires disclosure of the amount of KDP’s outstanding obligations loaded into the supplier finance programs by the Company at each reporting period regardless of whether the outstanding obligation has been elected by the supplier to be sold to financial institutions. Refer to Note 13 for additional information on the Company’s obligations to participating suppliers.

KEURIG DR PEPPER INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(UNAUDITED, CONTINUED)

2. Long-term Obligations and Borrowing Arrangements

The following table summarizes the Company's long-term obligations:

| | | | | | | | | | | |

| (in millions) | March 31, 2023 | | December 31, 2022 |

Notes | $ | 11,575 | | | $ | 11,568 | |

| Less: current portion of long-term obligations | (1,646) | | | (496) | |

| Long-term obligations | $ | 9,929 | | | $ | 11,072 | |

The following table summarizes the Company's short-term borrowings and current portion of long-term obligations:

| | | | | | | | | | | |

| (in millions) | March 31, 2023 | | December 31, 2022 |

| Commercial paper notes | $ | 664 | | | $ | 399 | |

| Current portion of long-term obligations | 1,646 | | | 496 | |

| Short-term borrowings and current portion of long-term obligations | $ | 2,310 | | | $ | 895 | |

SENIOR UNSECURED NOTES

The Company's Notes consisted of the following:

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| (in millions, except %) | | | | | | | | |

| Issuance | | Maturity Date | | Rate | | March 31, 2023 | | December 31, 2022 |

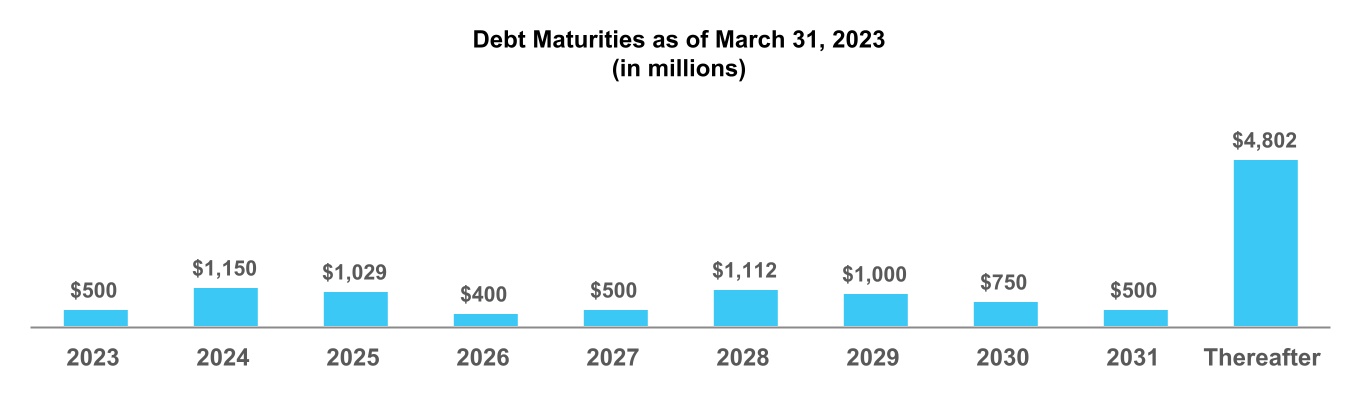

| 2023 Notes | | December 15, 2023 | | 3.130% | | $ | 500 | | | $ | 500 | |

| 2024 Notes | | March 15, 2024 | | 0.750% | | 1,150 | | | 1,150 | |

| 2025 Merger Notes | | May 25, 2025 | | 4.417% | | 529 | | | 529 | |

| 2025 Notes | | November 15, 2025 | | 3.400% | | 500 | | | 500 | |

| 2026 Notes | | September 15, 2026 | | 2.550% | | 400 | | | 400 | |

| 2027 Notes | | June 15, 2027 | | 3.430% | | 500 | | | 500 | |

| 2028 Merger Notes | | May 25, 2028 | | 4.597% | | 1,112 | | | 1,112 | |

| 2029 Notes | | April 15, 2029 | | 3.950% | | 1,000 | | | 1,000 | |

| 2030 Notes | | May 1, 2030 | | 3.200% | | 750 | | | 750 | |

| 2031 Notes | | March 15, 2031 | | 2.250% | | 500 | | | 500 | |

| 2032 Notes | | April 15, 2032 | | 4.050% | | 850 | | | 850 | |

| 2038 Merger Notes | | May 25, 2038 | | 4.985% | | 211 | | | 211 | |

| 2045 Notes | | November 15, 2045 | | 4.500% | | 550 | | | 550 | |

| 2046 Notes | | December 15, 2046 | | 4.420% | | 400 | | | 400 | |

| 2048 Merger Notes | | May 25, 2048 | | 5.085% | | 391 | | | 391 | |

| 2050 Notes | | May 1, 2050 | | 3.800% | | 750 | | | 750 | |

| 2051 Notes | | March 15, 2051 | | 3.350% | | 500 | | | 500 | |

| 2052 Notes | | April 15, 2052 | | 4.500% | | 1,150 | | | 1,150 | |

| Principal amount | | | | | | 11,743 | | | 11,743 | |

Adjustment from principal amount to carrying amount(1) | | (168) | | | (175) | |

| Carrying amount | | | | | | $ | 11,575 | | | $ | 11,568 | |

(1)The carrying amount includes unamortized discounts, debt issuance costs and fair value adjustments related to the DPS Merger.

KEURIG DR PEPPER INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(UNAUDITED, CONTINUED)

VARIABLE-RATE BORROWING ARRANGEMENTS

Revolving Credit Agreement

The following table summarizes information about the 2022 Revolving Credit Agreement:

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| (in millions) | | | | March 31, 2023 | | December 31, 2022 |

| Issuance | | Maturity Date | | Capacity | | Carrying Value | | Carrying Value |

2022 Revolving Credit Agreement(1) | | February 23, 2027 | | $ | 4,000 | | | $ | — | | | $ | — | |

| | | | | | | | |

| | | | | | | | |

(1)The 2022 Revolving Credit Agreement has $200 million letters of credit available, none of which were utilized as of March 31, 2023.

As of March 31, 2023, KDP was in compliance with its minimum interest coverage ratio relating to the 2022 Revolving Credit Agreement.

Commercial Paper Program

The following table provides information about the Company's weighted average borrowings under its commercial paper program:

| | | | | | | | | | | | | | | | | |

| | | First Quarter |

| (in millions, except %) | | | | | 2023 | | 2022 |

| Weighted average commercial paper borrowings | | | | | $ | 506 | | | $ | 45 | |

| Weighted average borrowing rates | | | | | 4.86 | % | | 0.30 | % |

Letter of Credit Facility

In addition to the portion of the 2022 Revolving Credit Agreement reserved for issuance of letters of credit, KDP has an incremental letter of credit facility. Under this facility, $150 million is available for the issuance of letters of credit, $68 million of which was utilized as of March 31, 2023 and $82 million of which remains available for use.

FAIR VALUE DISCLOSURES

The fair value of KDP's commercial paper approximates the carrying value and are considered Level 2 within the fair value hierarchy.

The fair values of KDP's Notes are based on current market rates available to KDP and are considered Level 2 within the fair value hierarchy. The difference between the fair value and the carrying value represents the theoretical net premium or discount that would be paid or received to retire all the Notes and related unamortized costs to be incurred at such date. The fair value of KDP's Notes was $10,777 million and $10,495 million as of March 31, 2023 and December 31, 2022, respectively.

KEURIG DR PEPPER INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(UNAUDITED, CONTINUED)

3. Goodwill and Other Intangible Assets

GOODWILL

Changes in the carrying amount of goodwill by reportable segment are as follows:

| | | | | | | | | | | | | | | | | | | | | | | | | |

| (in millions) | U.S. Refreshment Beverages | | U.S. Coffee | | International | | | | Total |

| Balance as of January 1, 2023 | $ | 8,714 | | | $ | 8,622 | | | $ | 2,736 | | | | | $ | 20,072 | |

| Foreign currency translation | — | | | — | | | 45 | | | | | 45 | |

| | | | | | | | | |

| Balance as of March 31, 2023 | $ | 8,714 | | | $ | 8,622 | | | $ | 2,781 | | | | | $ | 20,117 | |

INTANGIBLE ASSETS OTHER THAN GOODWILL

The net carrying amounts of intangible assets other than goodwill with indefinite lives are as follows:

| | | | | | | | | | | | | | |

| (in millions) | | March 31, 2023 | | December 31, 2022 |

Brands(1) | | $ | 19,363 | | | $ | 19,291 | |

| Trade names | | 2,480 | | | 2,480 | |

| Contractual arrangements | | 122 | | | 122 | |

Distribution rights(2) | | 151 | | | 100 | |

| Total | | $ | 22,116 | | | $ | 21,993 | |

(1)The change in brands with indefinite lives was primarily driven by foreign currency translation of $72 million during the first quarter of 2023.

(2)The Company acquired certain distribution rights from Nutrabolt during the first quarter of 2023 for approximately $51 million.

The net carrying amounts of intangible assets other than goodwill with definite lives are as follows:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| March 31, 2023 | | December 31, 2022 |

| (in millions) | Gross Amount | | Accumulated Amortization | | Net Amount | | Gross Amount | | Accumulated Amortization | | Net Amount |

| Acquired technology | $ | 1,146 | | | $ | (494) | | | $ | 652 | | | $ | 1,146 | | | $ | (475) | | | $ | 671 | |

| Customer relationships | 638 | | | (212) | | | 426 | | | 638 | | | (204) | | | 434 | |

| Trade names | 127 | | | (104) | | | 23 | | | 127 | | | (101) | | | 26 | |

| Brands | 51 | | | (20) | | | 31 | | | 51 | | | (19) | | | 32 | |

| Contractual arrangements | 24 | | | (10) | | | 14 | | | 24 | | | (10) | | | 14 | |

| Distribution rights | 29 | | | (18) | | | 11 | | | 29 | | | (16) | | | 13 | |

| | | | | | | | | | | |

| Total | $ | 2,015 | | | $ | (858) | | | $ | 1,157 | | | $ | 2,015 | | | $ | (825) | | | $ | 1,190 | |

Amortization expense for intangible assets with definite lives was as follows:

| | | | | | | | | | | | | | | |

| | | | First Quarter |

| (in millions) | | | | | 2023 | | 2022 |

| Amortization expense | | | | | $ | 34 | | | $ | 34 | |

Amortization expense of these intangible assets over the remainder of 2023 and the next five years is expected to be as follows:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Remainder of 2023 | | For the Years Ending December 31, |

| (in millions) | | 2024 | | 2025 | | 2026 | | 2027 | | 2028 |

| Expected amortization expense | $ | 101 | | | $ | 127 | | | $ | 115 | | | $ | 111 | | | $ | 95 | | | $ | 87 | |

KEURIG DR PEPPER INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(UNAUDITED, CONTINUED)

IMPAIRMENT TESTING

KDP conducts impairment tests on goodwill and all indefinite lived intangible assets annually, or more frequently if circumstances indicate that the carrying amount of an asset may not be recoverable. Changes to the Company’s operating segments effective January 1, 2023, as described in Note 6, resulted in a change to the Company’s reporting units. The Company’s reporting units are as follows:

| | | | | | | | |

| Reportable Segments | | Reporting Units |

| U.S. Refreshment Beverages | | U.S. Beverage Concentrates |

| | U.S. WD |

| | DSD |

| U.S. Coffee | | U.S. Coffee |

| International | | Canada Beverage Concentrates |

| | Canada WD |

| | Canada Coffee |

| | Latin America Beverages |

Management performed a step 0 analysis as of the effective date of the goodwill for the impacted reporting units. The Company also performed an analysis as of March 31, 2023 to ensure that there were no additional triggering events which occurred during the quarter. As a result of these analyses, management did not identify any indications that the carrying amount of any goodwill or any intangible asset may not be recoverable.

4. Derivatives

KDP is exposed to market risks arising from adverse changes in interest rates, commodity prices, and FX rates. KDP manages these risks through a variety of strategies, including the use of interest rate contracts, FX forward contracts, commodity forward, future, swap and option contracts and supplier pricing agreements. KDP does not hold or issue derivative financial instruments for trading or speculative purposes.

KDP formally designates and accounts for certain foreign exchange forward contracts and interest rate contracts that meet established accounting criteria under U.S. GAAP as cash flow hedges. For such contracts, the effective portion of the gain or loss on the derivative instruments is recorded, net of applicable taxes, in AOCI. When net income is affected by the variability of the underlying transaction, the applicable offsetting amount of the gain or loss from the derivative instrument deferred in AOCI is reclassified to net income. Cash flows from derivative instruments designated in a qualifying hedging relationship are classified in the same category as the cash flows from the hedged items. If a cash flow hedge were to cease to qualify for hedge accounting, or were terminated, the derivatives would continue to be carried on the balance sheet at fair value until settled, and hedge accounting would be discontinued prospectively. If the underlying hedged transaction ceases to exist, any associated amounts reported in AOCI would be reclassified to earnings at that time.

For derivatives that are not designated or for which the designated hedging relationship is discontinued, the gain or loss on the instrument is recognized in earnings in the period of change.

The Company has exposure to credit losses from derivative instruments in an asset position in the event of nonperformance by the counterparties to the agreements. Historically, the Company has not experienced material credit losses as a result of counterparty nonperformance. The Company selects and periodically reviews counterparties based on credit ratings, limits its exposure to a single counterparty under defined guidelines and monitors the market position of the programs upon execution of a hedging transaction and at least on a quarterly basis.

KEURIG DR PEPPER INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(UNAUDITED, CONTINUED)

INTEREST RATES

Economic Hedges

KDP is exposed to interest rate risk related to its borrowing arrangements and obligations. The Company enters into interest rate contracts to provide predictability in the Company's overall cost structure and to manage the balance of fixed-rate and variable-rate debt. KDP primarily enters into receive-fixed, pay-variable and receive-variable, pay-fixed swaps and swaption contracts. A natural hedging relationship exists in which changes in the fair value of the instruments act as an economic offset to changes in the fair value of the underlying items. Changes in the fair value of these instruments are recorded in earnings throughout the term of the derivative instrument and are generally reported in interest expense in the unaudited Condensed Consolidated Statements of Income. As of March 31, 2023, economic interest rate derivative instruments have maturities ranging from February 2033 to December 2036.

Cash Flow Hedges

In order to hedge the variability in cash flows from interest rate changes associated with the Company’s planned future issuances of long-term debt, during the first quarter of 2021, the Company entered into forward starting swaps and designated them as cash flow hedges. During the first quarter of 2023, KDP terminated the remaining forward starting swaps which were designated as cash flow hedges. As the forecasted debt transaction associated with the terminated forward starting swaps was no longer considered probable, the realized gains associated with the termination were recorded in interest expense during the first quarter of 2023.

FOREIGN EXCHANGE

KDP is exposed to foreign exchange risk in its international subsidiaries or with certain counterparties in foreign jurisdictions, which may transact in currencies that are different from the functional currencies of KDP’s legal entities. Additionally, the balance sheets of each of the Company’s Canadian and Mexican businesses are subject to exposure from movements in exchange rates.

Economic Hedges

KDP holds FX forward contracts to economically manage the balance sheet exposures resulting from changes in the FX exchange rates described above. The intent of these FX contracts is to minimize the impact of FX risk associated with balance sheet positions not in local currency. In these cases, a hedging relationship exists in which changes in the fair value of the instruments act as an economic offset to changes in the fair value of the underlying items. Changes in the fair value of these instruments are recorded in earnings throughout the term of the derivative instrument and are reported in the same caption of the unaudited Condensed Consolidated Statements of Income as the associated risk. As of March 31, 2023, these FX contracts have maturities ranging from April 2023 to September 2024.

Cash Flow Hedges

KDP designates certain FX forward contracts as cash flow hedges in order to manage the exposures resulting from changes in the FX rates described above. These designated FX forward contracts relate to either forecasted inventory purchases in U.S. dollars of the Canadian and Mexican businesses or forecasted capital expenditures of certain equipment in euros for KDP’s U.S. manufacturing facilities. The intent of these FX contracts is to provide predictability in the Company's overall cost structure. As of March 31, 2023, these FX contracts have maturities ranging from April 2023 to October 2024.

COMMODITIES

Economic Hedges

KDP centrally manages the exposure to volatility in the prices of certain commodities used in its production process and transportation through various derivative contracts. The Company generally holds some combination of future, swap and option contracts that economically hedge certain of its risks. In these cases, a hedging relationship exists in which changes in the fair value of the instruments act as an economic offset to changes in the fair value of the underlying items or as an offset to certain costs of production. Changes in the fair value of these instruments are recorded in earnings throughout the term of the derivative instrument and are reported in the same line item of the unaudited Condensed Consolidated Statements of Income as the hedged transaction. Unrealized gains and losses are recognized as a component of unallocated corporate costs until the Company's reportable segments are affected by the completion of the underlying transaction, at which time the gain or loss is reflected as a component of the respective segment's income from operations. As of March 31, 2023, these commodity contracts have maturities ranging from April 2023 to June 2024.

KEURIG DR PEPPER INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(UNAUDITED, CONTINUED)

NOTIONAL AMOUNTS OF DERIVATIVE INSTRUMENTS

The following table presents the notional amounts of KDP's outstanding derivative instruments by type:

| | | | | | | | | | | |

| (in millions) | March 31, 2023 | | December 31, 2022 |

| Interest rate contracts | | | |

| Forward starting swaps, designated as cash flow hedges | $ | — | | | $ | 500 | |

| Forward starting swaps, not designated as hedging instruments | 1,500 | | | 1,000 | |

| | | |

| Receive-fixed, pay-variable interest rate swaps, not designated as hedging instruments | 700 | | | 1,900 | |

| | | |

| FX contracts | | | |

| Forward contracts, not designated as hedging instruments | 589 | | | 490 | |

| Forward contracts, designated as cash flow hedges | 472 | | | 511 | |

Commodity contracts, not designated as hedging instruments(1) | 529 | | | 754 | |

(1)Notional value for commodity contracts is calculated as the expected volume times strike price per unit on a gross basis.

FAIR VALUE OF DERIVATIVE INSTRUMENTS

The fair values of commodity contracts, interest rate contracts and FX forward contracts are determined based on inputs that are readily available in public markets or can be derived from information available in publicly quoted markets. The fair value of commodity contracts are valued using the market approach based on observable market transactions, primarily underlying commodities futures or physical index prices, at the reporting date. Interest rate contracts are valued using models based primarily on readily observable market parameters, such as LIBOR or SOFR forward rates, for all substantial terms of the Company's contracts and credit risk of the counterparties. The fair value of FX forward contracts are valued using quoted forward FX prices at the reporting date. Therefore, the Company has categorized these contracts as Level 2.

Not Designated as Hedging Instruments

The following table summarizes the location of the fair value of the Company's derivative instruments which are not designated as hedging instruments within the unaudited Condensed Consolidated Balance Sheets. All such instruments are considered level 2 within the fair value hierarchy.

| | | | | | | | | | | | | | | | | |

| (in millions) | Balance Sheet Location | | March 31, 2023 | | December 31, 2022 |

| Assets: | | | | | |

| | | | | |

| FX contracts | Prepaid expenses and other current assets | | $ | 5 | | | $ | 8 | |

| Commodity contracts | Prepaid expenses and other current assets | | 7 | | | 6 | |

| Interest rate contracts | Other non-current assets | | 36 | | | 49 | |

| FX contracts | Other non-current assets | | 1 | | | 1 | |

| Commodity contracts | Other non-current assets | | 1 | | | 1 | |

| | | | | |

| Liabilities: | | | | | |

| Interest rate contracts | Other current liabilities | | $ | 22 | | | $ | 58 | |

| FX contracts | Other current liabilities | | 1 | | | — | |

| Commodity contracts | Other current liabilities | | 46 | | | 51 | |

| Interest rate contracts | Other non-current liabilities | | 123 | | | 194 | |

| | | | | |

| Commodity contracts | Other non-current liabilities | | 3 | | | 1 | |

KEURIG DR PEPPER INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(UNAUDITED, CONTINUED)

Designated as Hedging Instruments

The following table summarizes the location of the fair value of the Company's derivative instruments which are designated as hedging instruments within the unaudited Condensed Consolidated Balance Sheets. All such instruments are designated level 2 within the fair value hierarchy.

| | | | | | | | | | | | | | | | | |

| (in millions) | Balance Sheet Location | | March 31, 2023 | | December 31, 2022 |

| Assets: | | | | | |

| FX contracts | Prepaid expenses and other current assets | | $ | 17 | | | $ | 21 | |

| FX contracts | Other non-current assets | | 1 | | | 1 | |

| | | | | |

| Interest rate contracts | Other non-current assets | | — | | | 88 | |

| | | | | |

| Liabilities: | | | | | |

| FX contracts | Other current liabilities | | $ | 11 | | | $ | 3 | |

| | | | | |

| | | | | |

| | | | | |

IMPACT OF DERIVATIVE INSTRUMENTS NOT DESIGNATED AS HEDGING INSTRUMENTS

The following table presents the amount of (gains) losses, net, recognized in the unaudited Condensed Consolidated Statements of Income related to derivative instruments not designated as hedging instruments under U.S. GAAP during the periods presented. Amounts include both realized and unrealized gains and losses.

| | | | | | | | | | | | | | | | | | | | | |

| | | | | | First Quarter |

| (in millions) | Income Statement Location | | | | | | 2023 | | 2022 |

| Interest rate contracts | Interest expense | | | | | | $ | (96) | | | $ | 67 | |

| | | | | | | | | |

| FX contracts | Cost of sales | | | | | | 1 | | | 5 | |

| FX contracts | Other (income) expense, net | | | | | | — | | | 8 | |

| Commodity contracts | Cost of sales | | | | | | (15) | | | (97) | |

| Commodity contracts | SG&A expenses | | | | | | 14 | | | (37) | |

| | | | | | | | | |

IMPACT OF CASH FLOW HEDGES

The following table presents the amount of (gains) losses, net, reclassified from AOCI into the unaudited Condensed Consolidated Statements of Income related to derivative instruments designated as cash flow hedging instruments during the periods presented:

| | | | | | | | | | | | | | | | | | | | | |

| | | | | First Quarter |

| (in millions) | Income Statement Location | | | | | | 2023 | | 2022 |

Interest rate contracts(1) | Interest expense | | | | | | $ | (68) | | | $ | — | |

| FX contracts | Cost of sales | | | | | | (1) | | | 3 | |

(1)Amounts recognized during the first quarter of 2023 include the realized gains associated with the termination of forward starting swaps designated as cash flow hedges of approximately $66 million.

KDP expects to reclassify approximately $8 million and $9 million of pre-tax net gains from AOCI into net income during the next twelve months related to interest rate contracts and FX contracts, respectively.

KEURIG DR PEPPER INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(UNAUDITED, CONTINUED)

5. Leases

The following table presents the components of lease cost:

| | | | | | | | | | | | | | | |

| | | | First Quarter |

| (in millions) | | | | | 2023 | | 2022 |

| Operating lease cost | | | | | $ | 39 | | | $ | 32 | |

| Finance lease cost | | | | | | | |

| Amortization of right-of-use assets | | | | | 22 | | | 18 | |

| Interest on lease liabilities | | | | | 6 | | | 6 | |

Variable lease cost(1) | | | | | 10 | | | 9 | |

| | | | | | | |

| | | | | | | |

| Total lease cost | | | | | $ | 77 | | | $ | 65 | |

| | | | | | | |

| | | | | | | |

(1)Variable lease cost primarily consists of common area maintenance costs, property taxes, and adjustments for inflation.

The following table presents supplemental cash flow and other information about the Company's leases:

| | | | | | | | | | | |

| First Quarter |

| (in millions) | 2023 | | 2022 |

| Cash paid for amounts included in the measurement of lease liabilities: | | | |

| Operating cash flows from operating leases | $ | 36 | | | $ | 29 | |

| Operating cash flows from finance leases | 6 | | | 6 | |

| Financing cash flows from finance leases | 24 | | | 20 | |

| Right-of-use assets obtained in exchange for lease obligations: | | | |

| Operating leases | 38 | | | 168 | |

| Finance leases | 17 | | | 23 | |

The following table presents information about the Company's weighted average discount rate and remaining lease term:

| | | | | | | | | | | |

| March 31, 2023 | | December 31, 2022 |

| Weighted average discount rate | | | |

| Operating leases | 5.1 | % | | 5.0 | % |

| Finance leases | 3.7 | % | | 3.7 | % |

| Weighted average remaining lease term | | | |

| Operating leases | 10 years | | 11 years |

| Finance leases | 9 years | | 9 years |

Future minimum lease payments for non-cancellable leases that have commenced and are reflected on the unaudited Condensed Consolidated Balance Sheets as of March 31, 2023 were as follows:

| | | | | | | | | | | |

| (in millions) | Operating Leases | | Finance Leases |

| Remainder of 2023 | $ | 98 | | | $ | 90 | |

| 2024 | 141 | | | 116 | |

| 2025 | 133 | | | 111 | |

| 2026 | 121 | | | 148 | |

| 2027 | 100 | | | 61 | |

| 2028 | 78 | | | 47 | |

| Thereafter | 519 | | | 264 | |

| Total future minimum lease payments | 1,190 | | | 837 | |

| Less: imputed interest | (275) | | | (131) | |

| Present value of minimum lease payments | $ | 915 | | | $ | 706 | |

KEURIG DR PEPPER INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(UNAUDITED, CONTINUED)

SIGNIFICANT LEASES THAT HAVE NOT YET COMMENCED

As of March 31, 2023, the Company has entered into leases that have not yet commenced with estimated aggregated future lease payments of approximately $208 million. These leases are expected to commence between the fourth quarter of 2023 and 2025, with initial lease terms ranging from 4 years to 10 years.

ASSET SALE-LEASEBACK TRANSACTION

The Company entered into a sale-leaseback transaction with the Veyron SPEs during the first quarter of 2023. The following table presents details of the transaction. The gain on the sale-leaseback is recorded in Other operating income, net, and the leaseback is accounted for as an operating lease.

| | | | | | | | | | | | | | | | | | | | |

| (in millions) | | Sale Proceeds | | Carrying Value | | Gain on Sale |

March 31, 2023(1) | | $ | 7 | | | $ | 1 | | | $ | 6 | |

(1)The sale-leaseback transaction included one distribution property.

The initial term of the leaseback is approximately 15 years, with two 10-year renewal options. The renewal options are not reasonably assured as (i) the Company's position that the dynamic environment in which it operates precludes the Company's ability to be reasonably certain of exercising the renewal options in the distant future and (ii) the options are contingent on the Company remaining investment grade and no change-in-control as of the end of the lease term. The leaseback has a RVG. Refer to Note 15 for additional information about the RVG associated with the asset sale-leaseback transaction.

6. Segments

Effective January 1, 2023, the Company revised its segment structure to align with changes in how the Company’s Chief Operating Decision Maker manages the business, assesses performance and allocates resources. The Company's reportable segments consist of the following:

•The U.S. Refreshment Beverages segment reflects sales in the U.S. from the manufacture and distribution of branded concentrates, syrup and finished beverages, including the sales of the Company's own brands and third-party brands, to third-party bottlers, distributors and retailers.

•The U.S. Coffee segment reflects sales in the U.S. from the manufacture and distribution of finished goods relating to the Company's K-Cup pods, single-serve brewers and accessories, and other coffee products to partners, retailers and directly to consumers through the Company’s Keurig.com website.

•The International segment reflects sales in international markets, including the following:

◦Sales in Canada, Mexico, the Caribbean and other international markets from the manufacture and distribution of branded concentrates, syrup and finished beverages, including sales of the Company's own brands and third-party brands, to third-party bottlers, distributors and retailers.

◦Sales in Canada from the manufacture and distribution of finished goods relating to the Company’s single-serve brewers, K-Cup pods and other coffee products.

Segment results are based on management reports. Net sales and income from operations are the significant financial measures used to assess the operating performance of the Company's reportable segments. Intersegment sales are recorded at cost and are eliminated in the unaudited Condensed Consolidated Statements of Income. “Unallocated corporate costs” are excluded from the Company's measurement of segment performance and include unrealized commodity derivative gains and losses, and certain general corporate expenses.

KEURIG DR PEPPER INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(UNAUDITED, CONTINUED)

Information about the Company's operations by reportable segment is as follows:

| | | | | | | | | | | | | | | |

| | | | First Quarter |

| (in millions) | | | | | 2023 | | 2022 |

| Segment Results – Net sales | | | | | | | |

| U.S. Refreshment Beverages | | | | | $ | 2,007 | | | $ | 1,781 | |

| U.S. Coffee | | | | | 931 | | | 943 | |

| International | | | | | 415 | | | 354 | |

| Net sales | | | | | $ | 3,353 | | | $ | 3,078 | |

| | | | | | | |

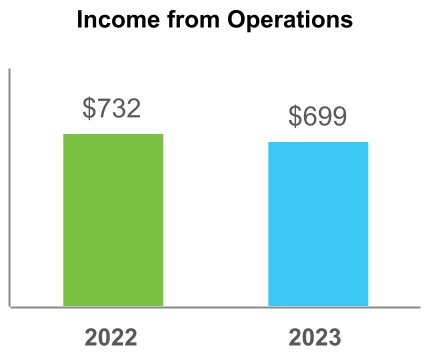

| Segment Results – Income from operations | | | | | | | |

| U.S. Refreshment Beverages | | | | | $ | 490 | | | $ | 704 | |

| U.S. Coffee | | | | | 232 | | | 255 | |

| International | | | | | 80 | | | 64 | |

| Unallocated corporate costs | | | | | (218) | | | (57) | |

| Income from operations | | | | | $ | 584 | | | $ | 966 | |

| | | | | | | | | | | |

| (in millions) | March 31, 2023 | | December 31, 2022 |

| Identifiable operating assets | | | |

| U.S. Refreshment Beverages | $ | 28,991 | | | $ | 28,987 | |

| U.S. Coffee | 14,155 | | | 14,220 | |

| International | 6,903 | | | 6,873 | |

| Segment total | 50,049 | | | 50,080 | |

| Unallocated corporate assets | 602 | | | 757 | |

| Total identifiable operating assets | 50,651 | | | 50,837 | |

| Investments in unconsolidated affiliates | 1,009 | | | 1,000 | |

| Total assets | $ | 51,660 | | | $ | 51,837 | |

KEURIG DR PEPPER INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(UNAUDITED, CONTINUED)

7. Revenue Recognition

KDP recognizes revenue when obligations under the terms of a contract with the customer are satisfied. Branded product sales, which include LRB, K-Cup pods and appliances, occur once control is transferred upon delivery to the customer. Revenue is measured as the amount of consideration that KDP expects to receive in exchange for transferring goods. The amount of consideration KDP receives and revenue KDP recognizes varies with changes in customer incentives that KDP offers to its customers and their customers. Sales taxes and other similar taxes are excluded from revenue. Costs associated with shipping and handling activities, such as merchandising, are included in SG&A expenses as revenue is recognized.

The following table disaggregates KDP's revenue by product portfolio and by reportable segment:

| | | | | | | | | | | | | | | | | | | | | | | |

| (in millions) | U.S. Refreshment Beverages | | U.S. Coffee | | International | | Total |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| For the first quarter of 2023: | | | | | | | |

LRB | $ | 1,970 | | | $ | — | | | $ | 253 | | | $ | 2,223 | |

| K-Cup pods | — | | | 771 | | | 117 | | | 888 | |

| Appliances | — | | | 125 | | | 12 | | | 137 | |

| Other | 37 | | | 35 | | | 33 | | | 105 | |

| Net sales | $ | 2,007 | | | $ | 931 | | | $ | 415 | | | $ | 3,353 | |

| | | | | | | |

| For the first quarter of 2022: | | | | | | | |

LRB | $ | 1,753 | | | $ | — | | | $ | 203 | | | $ | 1,956 | |

| K-Cup pods | — | | | 749 | | | 106 | | | 855 | |

| Appliances | — | | | 161 | | | 17 | | | 178 | |

| Other | 28 | | | 33 | | | 28 | | | 89 | |

| Net sales | $ | 1,781 | | | $ | 943 | | | $ | 354 | | | $ | 3,078 | |

LRB represents net sales of owned and partner brands within our portfolio and includes CSDs, NCBs, and contract manufacturing of KDP branded products for our bottlers and distributors. K-Cup pods represents net sales from owned brands, partner brands, and private label owners. Net sales for partner brands and private label owners are contractual and long-term in nature.

8. Earnings Per Share

The following table presents the Company's basic and diluted EPS and shares outstanding. Anti-dilutive stock-based awards excluded from the calculations of diluted EPS were immaterial during the periods presented.

| | | | | | | | | | | | | | | |

| | | | First Quarter |

| (in millions, except per share data) | | | | | 2023 | | 2022 |

| Net income attributable to KDP | | | | | $ | 467 | | | $ | 585 | |

| | | | | | | |

| Weighted average common shares outstanding | | | | | 1,406.2 | | | 1,418.2 | |

| Dilutive effect of stock-based awards | | | | | 10.8 | | | 11.5 | |

| Weighted average common shares outstanding and common stock equivalents | | | | | 1,417.0 | | | 1,429.7 | |

| | | | | | | |

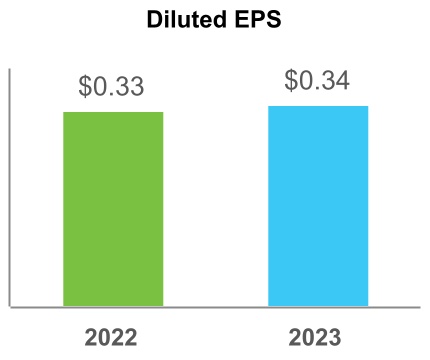

| Basic EPS | | | | | $ | 0.33 | | | $ | 0.41 | |