Use these links to rapidly review the document

TABLE OF CONTENTS

As filed with the Securities and Exchange Commission on September 9, 2019

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-3

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

HILLENBRAND, INC.

(Exact name of registrant as specified in its charter)

| Indiana (State or other jurisdiction of incorporation or organization) |

26-1342272 (I.R.S. Employer Identification Number) |

One Batesville Boulevard

Batesville, Indiana 47006

(812) 934-7500

(Address, including zip code, and telephone number, including area code, of registrant's principal executive offices)

Nicholas R. Farrell

Hillenbrand, Inc.

Vice President, General Counsel, Secretary and Chief Compliance Officer

One Batesville Boulevard

Batesville, Indiana 47006

(812) 934-7500

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies of all communications to:

Charles W. Mulaney, Jr.

Michael J. Zeidel

Skadden, Arps, Slate, Meagher & Flom LLP

155 North Wacker Drive

Chicago, Illinois 60606

(312) 407-0700

From time to time after this registration statement becomes effective.

(Approximate date of commencement of proposed sale to the public)

If the only securities being registered on this Form are being offered pursuant to dividend or interest reinvestment plans, please check the following box. o

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, other than securities offered only in connection with dividend or interest reinvestment plans, check the following box. ý

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration number of the earlier effective registration statement for the same offering. o

If this Form is a registration statement pursuant to General Instruction I.D. or a post-effective amendment thereto that shall become effective upon filing with the Commission pursuant to Rule 462(e) under the Securities Act, check the following box. ý

If this Form is a post-effective amendment to a registration statement filed pursuant to General Instruction I.D. filed to register additional securities or additional classes of securities pursuant to Rule 413(b) under the Securities Act, check the following box. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of "large accelerated filer," "accelerated filer," "smaller reporting company" and "emerging growth company" in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer ý | Accelerated filer o | Non-accelerated filer o |

Smaller reporting company o Emerging growth company o |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of Securities Act.

CALCULATION OF REGISTRATION FEE

|

||||||||

| Title of each class of securities to be registered(1) |

Amount to be registered(2) |

Proposed maximum offering price(2) |

Proposed maximum aggregate offering price(1) |

Amount of registration fee(3) |

||||

|---|---|---|---|---|---|---|---|---|

Debt Securities |

— | — | — | — | ||||

Common Stock |

— | — | — | — | ||||

Preferred Stock |

— | — | — | — | ||||

Warrants |

— | — | — | — | ||||

Guarantees of the Debt Securities(4) |

— | — | — | — | ||||

|

||||||||

- (1)

- Securities

registered hereunder may be sold separately, together or as units with other securities registered hereunder.

- (2)

- An

indeterminate aggregate initial offering price, principal amount or number of the securities of each identified class is being registered as may from time to time

be issued at indeterminate prices or upon conversion, exchange or exercise of securities registered hereunder to the extent any such securities are, by their terms, convertible into, or exchangeable

or exercisable for, such securities, including such shares of common stock or preferred stock as may be issued pursuant to anti-dilution adjustments determined at the time of offering. Separate

consideration may or may not be received for securities that are issuable on exercise, conversion or exchange of other securities.

- (3)

- In

accordance with Rule 456(b) and Rule 457(r), the Registrant is deferring payment of the entire registration fee.

- (4)

- Guarantees of the debt securities may be issued by subsidiaries of Hillenbrand Inc. that are listed on the following page under the caption "Table of Additional Registrants." Pursuant to Rule 457(n), no separate registration fee is payable in respect of the registration of the guarantees.

TABLE OF ADDITIONAL REGISTRANTS

Exact Name of Additional Registrants

|

Address and Telephone Number | Jurisdiction of Incorporation |

I.R.S. Employer Identification Number |

|||

|---|---|---|---|---|---|---|

| Batesville Casket Company, Inc. | One Batesville Blvd., Batesville, IN 47006, Phone: 812-934-7500 | Indiana | 35-2057447 | |||

Batesville Manufacturing, Inc. |

One Batesville Blvd., Batesville, IN 47006, Phone: 812-934-7500 |

Indiana |

35-2057332 |

|||

Batesville Services, Inc. |

One Batesville Blvd., Batesville, IN 47006, Phone: 812-934-7500 |

Indiana |

35-0166166 |

|||

K-Tron Investment Co. |

One Batesville Blvd., Batesville, IN 47006, Phone: 812-934-7500 |

Delaware |

51-0330743 |

|||

TerraSource Global Corporation |

100 N. Broadway, Suite 1600, St. Louis, MO 63102, Phone: 855-483-7721 |

Delaware |

23-2433746 |

|||

Process Equipment Group, Inc. |

590 Woodbury Glassboro Road, Sewell, NJ 08080, Phone: 856-589-0500 |

New Jersey |

22-1759452 |

|||

Rotex Global, LLC |

1230 Knowlton Street, Cincinnati, OH 45223, Phone: 513-541-1236 |

Delaware |

20-8587160 |

|||

Coperion Corporation |

590 Woodbury Glassboro Road, Sewell, NJ 08080, Phone: 201-327-6300 |

Delaware |

36-2737051 |

|||

Red Valve Company, Inc. |

750 Holiday Drive, Suite 400, Pittsburgh PA 15220, Phone: 412-279-0044 |

Pennsylvania |

25-1005395 |

|||

Coperion K-Tron Pitman, Inc. |

590 Woodbury Glassboro Road, Sewell, NJ 08080, Phone: 856-589-0500 |

Delaware |

86-0349379 |

PROSPECTUS

![]()

HILLENBRAND, INC.

Debt Securities

Guarantees of Debt Securities

Common Stock

Preferred Stock

Warrants

From time to time, we may offer debt securities, guarantees for debt securities, common stock, preferred stock or warrants.

We will provide the specific terms of any offering and the offered securities in supplements to this prospectus. These securities may be offered separately or together in any combination and as separate series. Any prospectus supplement may also add, update or change information contained in this prospectus. You should read this prospectus and any applicable prospectus supplement carefully before you invest in our securities.

We may sell the securities to or through underwriters, and also to other purchasers or through agents, whether or not owned on the date hereof. The names of the underwriters will be stated in the prospectus supplements and other offering material. We may also sell securities directly to investors.

This prospectus may not be used to sell securities unless accompanied by a prospectus supplement which will describe the method and terms of the related offering.

Our common stock is listed on the New York Stock Exchange under the symbol "HI." Each prospectus supplement will indicate if the securities offered thereby will be listed on any securities exchange.

Investing in our securities involves certain risks. See "Risk Factors" beginning on page 6 of this prospectus and Part I, Item 1A, "Risk Factors" beginning on page 10 of our Annual Report on Form 10-K for the fiscal year ended September 30, 2018, filed with the SEC on November 13, 2018, which is incorporated by reference herein, as well as the other information included and incorporated by reference herein, to read about factors you should consider before deciding to invest in our securities.

Neither the Securities and Exchange Commission nor any state or other securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The date of this prospectus is September 9, 2019.

In this prospectus, except as otherwise noted, the words "we," "our," "ours" and "us" refer to Hillenbrand, Inc. and all of its subsidiaries.

You should rely only on the information contained in or incorporated by reference into this prospectus or any related prospectus supplement. We and the underwriters have not authorized anyone to provide you with different or additional information. If anyone provides you with different or additional information, you should not rely on it. The information in this prospectus, any related prospectus supplement and the documents incorporated by reference herein and therein is accurate only as of their respective dates, even though this prospectus may be delivered or securities may be sold under this prospectus on a later date. Our business, financial condition, results of operations, cash flows and prospects may have changed since those dates.

This prospectus is part of an automatic shelf registration statement on Form S-3 that we filed with the Securities and Exchange Commission, or the SEC, as a "well-known seasoned issuer" as defined in Rule 405 of the Securities Act of 1933, as amended, or the Securities Act. Under this shelf registration process, we may sell, from time to time, an indeterminate amount of any combination of debt securities, common stock, preferred stock or warrants, as described in this prospectus, in one or more offerings. As allowed by the SEC rules, this prospectus does not contain all of the information included in the registration statement. For further information, we refer you to the registration statement, including its exhibits. Statements contained in this prospectus about the provisions or contents of any agreement or other document are not necessarily complete. If the SEC's rules or regulations require that an agreement or document be filed as an exhibit to the registration statement, please see that agreement or document for a complete description of these matters.

This prospectus provides you with a general description of the securities that we may offer. Each time that securities are sold, a prospectus supplement containing specific information about the terms of that offering, including the securities offered, will be provided. The prospectus supplement will contain more specific information about the offering. The prospectus supplement also may add, update or change information contained in this prospectus. If there is any inconsistency between the information in this prospectus and the information in any such prospectus supplement, you should rely on the information in such prospectus supplement. Please carefully read both this prospectus and any prospectus supplement together with the additional information described below under the section entitled "Incorporation of Certain Documents by Reference."

We may sell these securities on a continuous or delayed basis directly, through underwriters, dealers or agents as designated from time to time, or through a combination of these methods. We and our agents reserve the sole right to accept and to reject in whole or in part any proposed purchase of the securities. The names of any such underwriters, dealers or agents involved in the sale of any such securities, and any applicable fee, commission or discount arrangements with them, will be described in the applicable prospectus supplement for such securities.

You should not assume that the information contained in this prospectus or any prospectus supplement is accurate on any date other than the date on the front cover of such documents or that any information we have incorporated by reference is correct on any date subsequent to the date of the document incorporated by reference, even though this prospectus or any prospectus supplement is delivered or securities are sold on a later date. Neither the delivery of this prospectus or any applicable prospectus supplement nor any distribution of securities pursuant to such documents shall, under any circumstances, create any implication that there has been no change in the information set forth in this prospectus or any applicable prospectus supplement or in our affairs since the date of this prospectus or any applicable prospectus supplement.

Our principal offices are located at One Batesville Boulevard, Batesville, Indiana 47006 and our telephone number is (812) 934-7500.

1

WHERE YOU CAN FIND MORE INFORMATION

We are subject to the reporting requirements of the Securities Exchange Act of 1934, as amended (the "Exchange Act"), and its rules and regulations. The Exchange Act requires us to file reports, proxy statements and other information with the SEC. Copies of these reports, proxy statements and other information can be read and copied at: SEC Public Reference Room, 100 F Street N.E., Washington, D.C. 20549. The SEC maintains a web site that contains reports, proxy statements and other information regarding issuers that file electronically with the SEC. These materials may be obtained electronically by accessing the SEC's website at http://www.sec.gov.

This prospectus and any prospectus supplement, which form a part of the registration statement, do not contain all the information that is included in the registration statement. You will find additional information about us in the registration statement. Any statements made in this prospectus or any prospectus supplement concerning the provisions of legal documents are not necessarily complete and you should read the documents that are filed as exhibits to the registration statement or otherwise filed with the SEC and incorporated by reference herein or therein for a more complete understanding of the document or matter.

We make available, free of charge on our website, our Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K, proxy statements and amendments to these reports filed or furnished pursuant to Section 13(a), 14 or 15(d) of the Exchange Act, as soon as reasonably practicable after we electronically file these documents with, or furnish them to, the SEC. These documents are posted on our website at www.Hillenbrand.com. The information contained on our website (other than the SEC filings expressly referred to below) is not incorporated by reference herein and does not form a part of this prospectus.

2

INCORPORATION OF CERTAIN DOCUMENTS BY REFERENCE

The SEC allows us to incorporate into this prospectus information we file with the SEC in other documents. The information incorporated by reference is considered to be part of this prospectus and information we later file with the SEC will automatically update and supersede this information. The documents listed below, previously filed with the SEC, are incorporated by reference herein:

- •

- Annual Report on

Form 10-K for the fiscal year ended September 30, 2018, filed with the SEC on November 13, 2018;

- •

- Quarterly Report on Form 10-Q

for the quarterly period ended December 31, 2018, filed with the SEC on January 29, 2019;

- •

- Quarterly Report on Form 10-Q

for the quarterly period ended March 31, 2019, filed with the SEC on May 1, 2019;

- •

- Quarterly Report on

Form 10-Q for the quarterly period ended June 30, 2019, filed with the SEC on July 31, 2019;

- •

- Portions of the Definitive Proxy

Statement on Schedule 14A, filed with the SEC on January 2, 2019, that are incorporated by reference into Part III of our Annual Report on Form 10-K for the

fiscal year ended September 30, 2018, filed with the SEC on November 13, 2018;

- •

- Current Reports on Form 8-K filed with the SEC on

December 10, 2018,

February 15, 2019,

July 12, 2019,

July 16, 2019,

August 22, 2019,

September 4, 2019 and

September 9, 2019;

- •

- The description of our common stock contained in our Registration Statement on

Form 10-12B, filed with the SEC on November 5, 2007, including any

amendment or report filed for the purpose of updating such description;

- •

- The audited consolidated

balance sheets of Milacron Holdings Corp. ("Milacron") as of December 31, 2018 and 2017, and the related consolidated statements of operations, comprehensive income (loss), shareholders'

equity, and cash flows for the years ended December 31, 2018, 2017 and 2016, and the notes related thereto contained in Item 8 of Exhibit 99.1 to Milacron's Current Report on

Form 8-K filed on September 6, 2019; and

- •

- The unaudited condensed consolidated balance sheets of Milacron as of June 30, 2019 and December 31, 2018, and the related unaudited condensed consolidated statements of operations, comprehensive income (loss), shareholders' equity, and cash flows for the six months ended June 30, 2019 and 2018, and the notes related thereto contained in Milacron's Quarterly Report on Form 10-Q for the fiscal quarter ended June 30, 2019.

Whenever after the date of this prospectus, and before the termination of the offering of the securities made under this prospectus, we file reports or documents under Sections 13(a), 13(c), 14 or 15(d) of the Securities Exchange Act of 1934, as amended, or the Exchange Act, those reports and documents will be deemed to be incorporated by reference into this prospectus from the time they are filed. Notwithstanding the above, information that is "furnished" to the SEC (including information furnished under Item 2.02 or 7.01 of Form 8-K and corresponding information furnished under Item 9.01 or included as an exhibit) shall not be incorporated by reference or deemed to be incorporated by reference into this prospectus or the related registration statement, unless specifically stated otherwise.

We will provide, without charge, to each person, including any beneficial owner, to whom a copy of this prospectus is delivered, upon written or oral request of such person, a copy of any or all of the documents incorporated by reference into this prospectus, other than exhibits to such documents unless such exhibits are specifically incorporated by reference into such documents. Requests may be made by telephone at (812) 934-7500, or by sending a written request to Hillenbrand, Inc., One Batesville Boulevard, Batesville, Indiana 47006, Attention: Secretary.

3

CAUTIONARY STATEMENT CONCERNING FORWARD-LOOKING STATEMENTS

Throughout this prospectus and any applicable prospectus supplement, we make a number of "forward-looking statements" within the meaning of the Private Securities Litigation Reform Act of 1995. For a discussion of factors that could cause actual results to differ from those contained in forward-looking statements, see the section entitled "Risk Factors" in this prospectus and any applicable prospectus supplement and any sections entitled "Business," "Management's Discussion and Analysis of Financial Condition and Results of Operations" and "Risk Factors" contained in documents incorporated by reference into this prospectus or any applicable prospectus supplement. As the words imply, these are statements about future plans, objectives, beliefs, and expectations that might or might not happen in the future, as contrasted with historical information. Forward-looking statements are based on assumptions that we believe are reasonable, but by their very nature are subject to a wide range of risks. If our assumptions prove inaccurate or unknown risks and uncertainties materialize, actual results could vary materially from Hillenbrand's expectations and projections. Words that could indicate we are making forward-looking statements include:

| intend | believe | plan | expect | may | goal | would | ||||||

| become | pursue | estimate | will | forecast | continue | could | ||||||

| target | encourage | promise | improve | progress | potential | should |

This is not an exhaustive list, but is intended to give you an idea of how we try to identify forward-looking statements. The absence of any of these words, however, does not mean that the statement is not forward-looking.

Here is the key point: Forward-looking statements are not guarantees of future performance, and our actual results could differ materially from those set forth in any forward-looking statements.

Any number of factors, many of which are beyond our control, could cause our performance to differ significantly from what is described in the forward-looking statements. This includes the impact of the Tax Act on the Company's financial position, results of operations, and cash flows. We assume no obligation to update or revise any forward-looking statements.

4

We are a global diversified industrial company with multiple leading brands that serve a wide variety of industries around the world. Our portfolio is composed of two business segments: the Process Equipment Group and Batesville®. The Process Equipment Group businesses design, develop, manufacture, and service highly engineered industrial equipment around the world. Batesville is a recognized leader in the death care industry in North America. Hillenbrand was incorporated on November 1, 2007, in the state of Indiana and began trading on the New York Stock Exchange under the symbol "HI" on April 1, 2008. "Hillenbrand," "the Company," "we," "us," "our," and similar words refer to Hillenbrand, Inc. and its subsidiaries unless context otherwise requires.

Although Hillenbrand has been a public company for a little more than ten years, the businesses owned by Hillenbrand have been in operation for many decades.

We are an Indiana corporation and the address of our principal executive offices is One Batesville Boulevard, Batesville, Indiana 47006. Our telephone number is (812) 934-7500, and our website is www.Hillenbrand.com. Any references in this prospectus to our website are inactive textual references only, and the information contained on or that can be accessed through our website (except for the SEC filings expressly incorporated by reference herein) is not incorporated in, and is not a part of, this prospectus, and any such information should not be relied upon in connection with any investment decision to purchase any securities.

5

Investing in our securities involves risks. Before you decide whether to purchase any of our securities, you should carefully review the risk factors contained in our filings under the Exchange Act (including those in our Annual Report on Form 10-K for the fiscal year ended September 30, 2018 and in our subsequent quarterly reports on Form 10-Q), each of which are incorporated by reference into this prospectus, the information contained under the heading "Cautionary Statement Concerning Forward-Looking Statements" in this prospectus or under any similar heading in any applicable prospectus supplement or in any document incorporated herein or therein by reference. The risks and uncertainties described in our SEC filings are not the only risks we face. Additional risks not currently known or considered immaterial by us at this time and thus not listed could also result in adverse effects on our business. Additional risks and uncertainties not presently known to us, or that we currently see as immaterial, may also harm our business. If any such risks and uncertainties actually occur, our business, financial condition, results of operations, cash flows and prospects could be materially and adversely affected, the market price of our securities could decline and you could lose all or part of your investment. See "Incorporation of Certain Documents by Reference" and "Cautionary Statement Regarding Forward-Looking Statements."

6

We intend to use the net proceeds from the sales of the securities offered by us as set forth in the applicable prospectus supplement.

7

This prospectus contains summary descriptions of the debt securities, guarantees of debt securities, common stock, preferred stock and warrants that we may offer and sell from time to time. These summary descriptions are not meant to be complete descriptions of each security. The particular terms of any security will be described in the applicable prospectus supplement.

8

DESCRIPTION OF DEBT SECURITIES AND GUARANTEES

References to "Hillenbrand," "us," "we" or "our" in this section mean Hillenbrand, Inc., and do not include the consolidated subsidiaries of Hillenbrand, Inc. In this section, references to "holders" mean those who own debt securities registered in their own names, on the books that we or the applicable trustee maintain for this purpose, and not those who own beneficial interests in debt securities registered in street name or in debt securities issued in book-entry form through one or more depositaries.

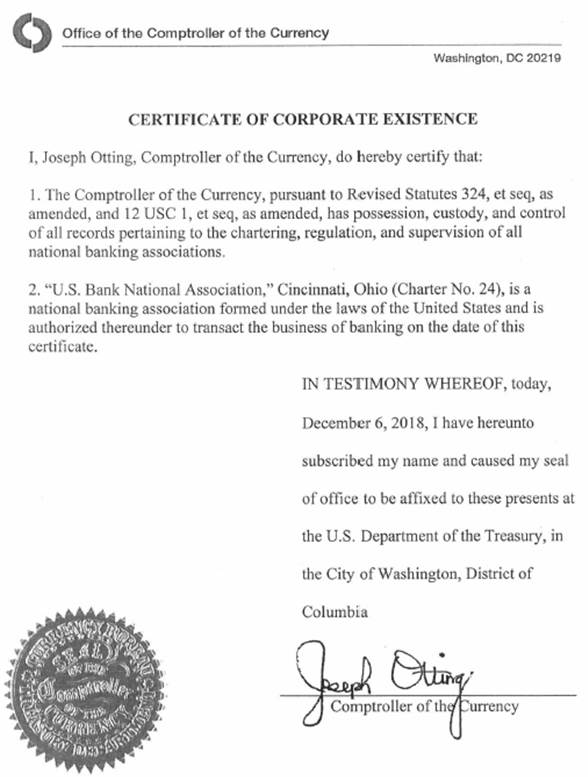

We may offer secured or unsecured debt securities, which may be convertible. Our debt securities and any related guarantees will be issued under an indenture, dated July 9, 2010, between us and U.S. Bank National Association, as trustee. The debt securities will be structurally subordinated to all existing and future liabilities, including trade payables, of our subsidiaries that do not guarantee the debt securities, and the claims of creditors of those subsidiaries, including trade creditors, will have priority as to the assets and cash flows of those subsidiaries.

We have summarized certain general features of the debt securities from the indenture. A copy of the indenture is attached as an exhibit to the registration statement of which this prospectus forms a part. The following description of the terms of the debt securities and the guarantees sets forth certain general terms and provisions. The particular terms of the debt securities and guarantees offered by any prospectus supplement (including which indenture such securities will be governed by) and the extent, if any, to which such general provisions may apply to the debt securities and guarantees will be described in the related prospectus supplement. Accordingly, for a description of the terms of a particular issue of debt securities, reference must be made to both the related prospectus supplement and to the following description.

General

The aggregate principal amount of debt securities that may be issued under the indenture is unlimited. The debt securities may be issued in one or more series as may be authorized from time to time.

Reference is made to the applicable prospectus supplement for the following terms of the debt securities (if applicable):

- •

- the title and aggregate principal amount of the debt securities;

- •

- whether the debt securities will be senior, subordinated or junior subordinated;

- •

- whether the debt securities will be secured or unsecured;

- •

- the specific indenture under which the debt securities will be issued;

- •

- whether the debt securities are convertible or exchangeable into other securities;

- •

- the percentage or percentages of principal amount at which such debt securities will be issued;

- •

- the interest rate(s) or the method for determining the interest rate(s);

- •

- the dates on which interest will accrue or the method for determining dates on which interest will accrue and dates on which interest will be

payable;

- •

- the maturity date;

- •

- redemption or early repayment provisions;

- •

- authorized denominations;

- •

- form;

9

- •

- amount of discount or premium, if any, with which such debt securities will be issued;

- •

- whether such debt securities will be issued in whole or in part in the form of one or more global securities;

- •

- the identity of the depositary for global securities;

- •

- whether a temporary security is to be issued with respect to such series and whether any interest payable prior to the issuance of definitive

securities of the series will be credited to the account of the persons entitled thereto;

- •

- the terms upon which beneficial interests in a temporary global security may be exchanged in whole or in part for beneficial interests in a

definitive global security or for individual definitive securities;

- •

- any covenants applicable to the particular debt securities being issued;

- •

- any defaults and events of default applicable to the particular debt securities being issued;

- •

- the guarantors of each series, if any, and the extent of the guarantees (including provisions relating to seniority, subordination, security

and release of the guarantees), if any;

- •

- any restriction or condition on the transferability of the debt securities;

- •

- the currency, currencies or currency units in which the purchase price for, the principal of and any premium and any interest on, such debt

securities will be payable;

- •

- the time period within which, the manner in which and the terms and conditions upon which the purchaser of the debt securities can select the

payment currency;

- •

- the securities exchange(s) on which the securities will be listed, if any;

- •

- whether any underwriter(s) will act as market maker(s) for the securities;

- •

- the extent to which a secondary market for the securities is expected to develop;

- •

- our obligation or right to redeem, purchase or repay debt securities under a sinking fund, amortization or analogous provision;

- •

- provisions relating to covenant defeasance and legal defeasance;

- •

- provisions relating to satisfaction and discharge of the indenture;

- •

- provisions relating to the modification of the indenture both with and without the consent of holders of debt securities issued under the

indenture; and

- •

- additional terms not inconsistent with the provisions of the indenture.

One or more series of debt securities may be sold at a substantial discount below their stated principal amount, bearing no interest or interest at a rate which at the time of issuance is below market rates. One or more series of debt securities may be variable rate debt securities that may be exchanged for fixed rate debt securities.

United States federal income tax consequences and special considerations, if any, applicable to any such series will be described in the applicable prospectus supplement.

Debt securities may be issued where the amount of principal and/or interest payable is determined by reference to one or more currency exchange rates, commodity prices, equity indices or other factors. Holders of such securities may receive a principal amount or a payment of interest that is greater than or less than the amount of principal or interest otherwise payable on such dates, depending upon the value of the applicable currencies, commodities, equity indices or other factors. Information as to the

10

methods for determining the amount of principal or interest, if any, payable on any date, the currencies, commodities, equity indices or other factors to which the amount payable on such date is linked and certain additional United States federal income tax considerations will be set forth in the applicable prospectus supplement.

The term "debt securities" includes debt securities denominated in U.S. dollars or, if specified in the applicable prospectus supplement, in any other freely transferable currency or units based on or relating to foreign currencies.

We expect most debt securities to be issued in fully registered form without coupons and in denominations of $2,000 and integral multiples of $1,000 in excess thereof. Subject to the limitations provided in the applicable indenture and in the applicable prospectus supplement, debt securities that are issued in registered form may be transferred or exchanged at the office of the applicable trustee maintained in the Borough of Manhattan, The City of New York or the principal corporate trust office of the applicable trustee, without the payment of any service charge, other than any tax or other governmental charge payable in connection therewith.

Guarantees

Any debt securities may be guaranteed by one or more of our direct or indirect subsidiaries. Each prospectus supplement will describe any guarantees for the benefit of the series of debt securities to which it relates, including required financial information of the subsidiary guarantors, as applicable.

Global Securities

The debt securities of a series may be issued in whole or in part in the form of one or more global securities that will be deposited with, or on behalf of, a depositary (the "depositary") identified in the applicable prospectus supplement. Global securities will be issued in registered form and in either temporary or definitive form. Unless and until it is exchanged in whole or in part for the individual debt securities, a global security may not be transferred except as a whole by the depositary for such global security to a nominee of such depositary or by a nominee of such depositary to such depositary or another nominee of such depositary or by such depositary or any such nominee to a successor of such depositary or a nominee of such successor. The specific terms of the depositary arrangement with respect to any debt securities of a series and the rights of and limitations upon owners of beneficial interests in a global security will be described in the applicable prospectus supplement.

Governing Law

The indenture, the debt securities and the guarantees shall be construed in accordance with and governed by the laws of the State of New York, without giving effect to the principles thereof relating to conflicts of law.

11

The following is a description of certain material terms of our restated and amended articles of incorporation (as amended, our "Articles of Incorporation"), our amended and restated code of by-laws (our "By-Laws", and together with our Articles of Incorporation, our "organizational documents") and certain provisions of Indiana law. The following summary does not purport to be complete and is qualified in its entirety by reference to our Articles of Incorporation and By-Laws, copies of which are filed as exhibits incorporated by reference to the registration statement of which this prospectus forms a part, and the relevant provisions of Indiana law.

General

Our authorized capital structure consists of:

- •

- 199,000,000 shares of common stock, without par value, and

- •

- 1,000,000 shares of preferred stock

As of July 25, 2019, there were 62,667,094 shares of common stock and no shares of preferred stock issued and outstanding.

Common Stock

Voting

The holders of our common stock are entitled to one vote for each share held of record on each matter submitted to a vote of shareholders, including the election of directors, and do not have any right to cumulate votes in the election of directors.

Dividends

Subject to the rights and preferences of the holders of any series of preferred stock which may at the time be outstanding, holders of our common stock are entitled to share equally such dividends as our board of directors may declare out of funds legally available.

Liquidation Rights

The holders of our common stock are entitled to receive our net assets upon dissolution except as may otherwise be provided in an amendment to our Articles of Incorporation setting out the terms for a series of preferred stock.

Other matters

Holders of our common stock have no conversion, preemptive or other subscription rights and there are no redemption rights or sinking fund provisions with respect to the common stock.

Our common stock is traded on the New York Stock Exchange under the symbol "HI."

The transfer agent and registrar for our common stock is Computershare Trust Company, N.A.

Preferred Stock

We are authorized to issue up to 1,000,000 shares of preferred stock in one or more series. Our Articles of Incorporation authorize our board of directors to fix the rights, preferences, privileges and restrictions granted to or imposed upon the preferred stock, including voting rights, dividend rights, conversion rights, terms of redemption, liquidation preference, sinking fund terms, subscription rights

12

and the number of shares constituting any series or the designation of a series. All shares of preferred stock of the same series must be identical with each other in all respects.

When we issue preferred stock, we will provide specific information about the particular class or series being offered in a prospectus supplement. This information will include some or all of the following:

- •

- the serial designation and the number of shares in that series;

- •

- the dividend rate or rates, whether dividends shall be cumulative and, if so, from what date, the payment date or dates for dividends, and any

participating or other special rights with respect to dividends;

- •

- any voting powers of the shares;

- •

- whether the shares will be redeemable and, if so, the price or prices at which, and the terms and conditions on which the shares may be

redeemed;

- •

- the amount or amounts payable upon the shares in the event of voluntary or involuntary liquidation, dissolution or winding up of us prior to

any payment or distribution of our assets to any class or classes of our stock ranking junior to the preferred stock;

- •

- whether the shares will be entitled to the benefit of a sinking or retirement fund and, if so entitled, the amount of the fund and the manner

of its application, including the price or prices at which the shares may be redeemed or purchased through the application of the fund;

- •

- whether the shares will be convertible into, or exchangeable for, shares of any other class or of any other series of the same or any other

class of our stock or the stock of another issuer, and if so convertible or exchangeable, the conversion price or prices, or the rates of exchange, and any adjustments to the conversion price or rates

of exchange at which the conversion or exchange may be made, and any other terms and conditions of the conversion or exchange; and

- •

- any other preferences, privileges and powers, and relative, participating, optional, or other special rights, and qualifications, limitations or restrictions, as our board of directors may deem advisable and as shall not be inconsistent with the provisions of our Articles of Incorporation.

Depending on the rights prescribed for a series of preferred stock, the issuance of preferred stock could have an adverse effect on the voting power of the holders of common stock and could adversely affect holders of common stock by delaying or preventing a change in control of us, making removal of our present management more difficult or imposing restrictions upon the payment of dividends and other distributions to the holders of common stock.

The preferred stock, when issued, will be fully paid and non-assessable. Unless the applicable prospectus supplement provides otherwise, the preferred stock will have no preemptive rights to subscribe for any additional securities which may be issued by us in the future. The transfer agent and registrar for the preferred stock will be specified in the applicable prospectus supplement.

Certain Anti-Takeover Matters

Certain provisions of our organizational documents, as well as certain provisions of the Indiana Business Corporation Law (the "IBCL"), may have the effect of encouraging persons considering

13

unsolicited tender offers or other unilateral takeover proposals to negotiate with our board of directors rather than pursue non-negotiated takeover attempts. These provisions include:

Classified Board of Directors

Our Articles of Incorporation and By-Laws provide for our board of directors to be composed of not fewer than seven directors and to be divided into three classes of directors, as nearly equal in number as possible, serving staggered terms. Our By-Laws also provide that our board of directors shall not consist of more than thirteen directors. Approximately one-third of our board will be elected each year. Under our Articles of Incorporation, our directors can be removed only for cause and only upon the affirmative vote of the holders of at least two-thirds of the voting power of all shares of our capital stock entitled to vote generally in the election of directors, voting together as a single class. The provisions for our classified board and certain other board of director matters may be amended, altered or repealed only upon the affirmative vote of the holders of at least two-thirds of the voting power of all shares of our capital stock entitled to vote generally in the election of directors, voting together as a single class.

Under Chapter 23 of the IBCL, a corporation with a class of voting shares registered with the SEC under Section 12 of the Exchange Act must have a classified board unless the corporation adopted a by-law expressly electing not to be governed by this provision by the later of July 31, 2009 or 30 days after the corporation's voting shares are registered under Section 12 of the Exchange Act. We adopted a by-law electing not to be subject to this mandatory requirement on July 15, 2009.

The provision for a classified board in our Articles of Incorporation could prevent a party that acquires control of a majority of the outstanding voting stock from obtaining control of our board until the second annual shareholders' meeting following the date the acquiror obtains the controlling stock interest. The classified board provision could have the effect of discouraging a potential acquiror from making a tender offer for our shares or otherwise attempting to obtain control of us and could increase the likelihood that our incumbent directors will retain their positions.

We believe that a classified board helps to assure the continuity and stability of our board and our business strategies and policies as determined by our board, because a majority of the directors at any given time will have prior experience on our board. The classified board provision also helps to ensure that our board, if confronted with an unsolicited proposal from a third party that has acquired a block of our voting stock, will have sufficient time to review the proposal and appropriate alternatives and to seek the best available result for all shareholders.

After the initial term of each class, our directors will serve three-year terms. At each annual meeting of shareholders, a class of directors will be elected for a three-year term to succeed the directors of the same class whose terms are then expiring.

Our Articles of Incorporation further provide that vacancies or newly created directorships in our board may only be filled by the vote of a majority of the directors then in office, and any director so chosen will hold office until the next annual meeting of shareholders.

At any annual or special meeting of directors, our By-Laws require the presence of a majority of the duly elected and qualified members then occupying office as a quorum. Our Articles of Incorporation provide for a quorum of one-third of such members unless the By-Laws otherwise specify (which they do).

Removal of Directors Only for Cause; Filling Vacancies

Our organizational documents provide that, subject to the right of holders of any series of preferred stock to elect directors, any director may be removed from office, but only for cause and only by the affirmative vote of the holders of at least 2/3 of the combined voting power of all of the shares

14

of our capital stock entitled to vote generally in the election of directors. Our organizational documents also provide that, subject to the right of holders of any series of preferred stock to elect directors, any newly created directorships resulting from an increase in the number of directors and any vacancy on the board shall be filled by the affirmative vote of a majority of the remaining directors then in office. Any director elected in accordance with the preceding sentence will hold office for a term expiring at the next annual meeting of shareholders and until such director's successor is duly elected and qualified. No decrease in the number of directors constituting the board of directors shall shorten the term of any incumbent director.

The director removal and vacancy provisions restrict the ability of a third party to remove incumbent directors and simultaneously gain control of the board of directors by filling the vacancies created by removal with its own nominees.

Shareholder Proposals

At any meeting of shareholders, only business that is properly brought before the meeting will be conducted. To be properly brought before a meeting of shareholders, business must be specified in the notice of the meeting, brought before the meeting by or at the direction of our board of directors, our chairman of the board or our chief executive officer or properly brought before the meeting by a shareholder.

For business to be properly brought before any meeting of shareholders by a shareholder, the shareholder must have given timely notice thereof in writing to our secretary at our principal place of business. To be timely, a shareholder's notice must be delivered to or mailed and received by our secretary not later than 100 days prior to the anniversary of the date of the immediately preceding annual meeting which was specified in the initial formal notice of such meeting (but if the date of the forthcoming annual meeting is more than 30 days after such anniversary date, such written notice will also be timely if received by our secretary by the later of 100 days prior to the forthcoming meeting date and the close of business 10 days following the date on which we first make public disclosure of the meeting date).

A shareholder's notice must set forth, as to each matter the shareholder proposes to bring before the meeting:

- •

- a brief description of the business desired to be brought before the meeting;

- •

- the name and address of the shareholder proposing such business;

- •

- the class and number of shares that are owned beneficially by the shareholder proposing such business;

- •

- any interest of the shareholder in such business;

- •

- a description of any agreement, arrangement or understanding (including, without limitation, any derivative or short positions, profit

interests, options, hedging transactions, and borrowed or loaned shares) that has been entered into as of the date of the shareholder's notice by, or on behalf of, the Shareholder or any of its

affiliates or associates, the effect or intent of which is to mitigate loss to, manage risk or benefit of share price changes for, or increase or decrease the voting power of the shareholder or any of

its affiliates or associates with respect to common stock; and

- •

- an undertaking by the shareholder to notify the corporation in writing of any change in the information called for the preceding three bullets as of the record date for such meeting, by notice received by the secretary of the corporation not later than the 10th day following such record date, and thereafter by notice so given and received within two business days of any

15

change in such information, and, in any event, as of the close of business of the day preceding the meeting date.

Shareholder Nomination of Candidates for Elections to Our Board

Our By-Laws provide that nominations of persons for election to our board of directors may be made at any meeting of shareholders by or at the direction of the board of directors or by any shareholder entitled to vote for the election of members of the board of directors at the meeting. For nominations to be made by a shareholder, the shareholder must have given timely notice thereof in writing to our secretary at our principal place of business and any nominee must satisfy the qualifications established by the board of directors from time to time as contained in the proxy statement for our immediately preceding annual meeting or posted on our website. To be timely, a shareholder's nomination must be delivered to or mailed and received by the secretary not later than (i) in the case of the annual meeting, 100 days prior to the anniversary of the date of the immediately preceding annual meeting which was specified in the initial formal notice of such meeting (but if the date of the forthcoming annual meeting is more than 30 days after such anniversary date, such written notice will also be timely if received by the secretary by the later of 100 days prior to the forthcoming meeting date and the close of business 10 days following the date on which we first make public disclosure of the meeting date) and (ii) in the case of a special meeting, the close of business on the tenth day following the date on which we first make public disclosure of the meeting date.

The notice given by a shareholder must set forth:

- •

- the name and address of the shareholder who intends to make the nomination and of the person or persons to be nominated;

- •

- a representation that the shareholder is a holder of record, setting forth the shares so held, and intends to appear in person or by proxy as a

holder of record at the meeting to nominate the person or persons specified in the notice;

- •

- a description of any agreement, arrangement or understanding (including, without limitation, any derivative or short positions, profit

interests, options, hedging transactions, and borrowed or loaned shares) that has been entered into as of the date of the shareholder's notice by, or on behalf of, the shareholder or any of its

affiliates or associates, the effect or intent of which is to mitigate loss to, manage risk or benefit of share price changes for, or increase or decrease the voting power of the shareholder or any of

its affiliates or associates with respect to common stock;

- •

- a description of all arrangements or understandings between such shareholder and each nominee proposed by the shareholder and any other person

or persons (identifying such person or persons) pursuant to which the nomination or nominations are to be made by the shareholders;

- •

- such other information regarding each nominee proposed by such shareholder as would be required to be included in a proxy statement filed

pursuant to the proxy rules of the SEC;

- •

- the consent in writing of each nominee to serve as a director if so elected;

- •

- a description of the qualifications of such nominee to serve as a director; and

- •

- an undertaking by the shareholder to notify the corporation in writing of any change in the information called for by the second, third and fourth bullets above as of the record date for such meeting, by notice received by the secretary of the corporation not later than the 10th day following such record date, and thereafter by notice so given and received within two business days of any change in such information, and, in any event, as of the close of business of the day preceding the meeting date.

16

Shareholder Action; Special Meetings of Shareholders

Our Articles of Incorporation provide that shareholder action required or permitted to be taken at any meeting of the shareholders may be taken without a meeting if a written consent setting forth the action so taken is signed by all the holders of our issued and outstanding capital stock entitled to vote thereon. Our By-Laws provide that special meetings of the shareholders can only be called by our board of directors, our president or shareholders holding not less than one-fourth of the outstanding shares of our common stock.

Restrictions on Certain Related Party Business Combination Transactions

Under our Articles of Incorporation, any contract or other transaction between us and (i) any of our directors or (ii) any legal entity (A) in which any of our directors has a material financial interest or is a general partner or (B) of which any of our directors is a director, officer or trustee of such other legal entity (collectively, a "Conflict Transaction") is only valid if (1) the material facts of such Conflict Transaction and our director's interest in such were disclosed to or known by our board of directors, any of our committees with authority to act on the Conflict Transaction, or our shareholders entitled to vote on such Conflict Transaction and (2) the Conflict Transaction was properly authorized, approved or ratified by, as applicable:

- •

- Our board of directors or authorized committee, if it receives the affirmative vote of a majority of the directors who have no interest in the

Conflict Transaction; provided, however, that the vote not be of a single director; and

- •

- Our shareholders, if it receives the vote of a majority of the shares entitled to be counted, in which shares owned or voted under the contract of any director who or legal entity that has an interest in the Conflict Transaction may be counted.

Amendment of Articles and Bylaws

Except as otherwise expressly provided in our Articles of Incorporation, any proposal to amend, alter, change or repeal any provision of our Articles of Incorporation, except as may be provided in the terms of any preferred stock, requires approval by our board of directors and our shareholders. In general, such a proposal would be approved by our shareholders if the votes cast favoring the proposal exceed the votes cast opposing the proposal at a meeting at which a quorum is present.

Our By-Laws may be amended, altered or repealed only by our board of directors by affirmative vote of a majority of the directors who would constitute a full board at the time of such action. On August 21, 2019, our board of directors approved an amendment and restatement of the Articles of Incorporation to also permit our shareholders to amend the By-Laws. The amendment and restatement is subject to shareholder approval and, if approved, will provide that our shareholders may amend the By-Laws by the affirmative vote, at a meeting, of at least a majority of the votes entitled to be cast by the holders of the outstanding shares of all classes of our stock entitled to vote generally in the election of directors, considered as a single voting group. Our board of directors has directed that the amendment and restatement be submitted for approval by our shareholders at the 2020 annual meeting of shareholders.

Indiana Business Corporations Law

As an Indiana corporation, we are governed by the IBCL. Under specified circumstances, the following provisions of the IBCL may delay, prevent or make more difficult unsolicited acquisitions or changes of control of us. These provisions also may have the effect of preventing changes in our management. It is possible that these provisions could make it more difficult to accomplish transactions which shareholders may otherwise deem to be in their best interest.

17

Control share acquisitions. Although Chapter 42 of the IBCL contains certain restrictions on control share acquisitions, our By-Laws provide that Chapter 42 of the IBCL shall not apply to control share acquisitions of shares of our capital stock.

Certain business combinations. Chapter 43 of the IBCL restricts the ability of a "resident domestic corporation" to engage in any combinations with an "interested shareholder" for five years after the date the interested shareholder became such, unless the combination or the purchase of shares by the interested shareholder on the interested shareholder's date of acquiring shares is approved by the board of directors of the resident domestic corporation before that date. If the combination was not previously approved, the interested shareholder may effect a combination after the five-year period only if that shareholder receives approval from a majority of the disinterested shares or the offer meets specified fair price criteria. For purposes of the above provisions, "resident domestic corporation" means an Indiana corporation that has 100 or more shareholders. "Interested shareholder" means any person, other than the resident domestic corporation or its subsidiaries, who is (i) the beneficial owner, directly or indirectly, of 10% or more of the voting power of the outstanding voting shares of the resident domestic corporation or (ii) an affiliate or associate of the resident domestic corporation, which at any time within the five-year period immediately before the date in question, was the beneficial owner, directly or indirectly, of 10% or more of the voting power of the then outstanding shares of the resident domestic corporation. Although under certain circumstances a corporation may opt out of Chapter 43 of the IBCL, our Articles of Incorporation do not exclude us from the restrictions imposed by Chapter 43 of the IBCL.

Directors' duties and liability. Under Chapter 35 of the IBCL, directors are required to discharge their duties:

- •

- in good faith;

- •

- with the care an ordinarily prudent person in a like position would exercise under similar circumstances; and

- •

- in a manner the directors reasonably believe to be in the best interests of the corporation.

However, the IBCL also provides that a director is not liable for any action taken as a director, or any failure to act, regardless of the nature of the alleged breach of duty, including alleged breaches of the duty of care, the duty of loyalty and the duty of good faith, unless the director has breached or failed to perform the duties of the director's office in accordance with the foregoing standard and such action or failure to act constitutes willful misconduct or recklessness. The exculpation from liability under the IBCL does not affect the liability of directors for violations of the federal securities laws.

Consideration of effects on other constituents. Chapter 35 of the IBCL also provides that a board of directors, in discharging its duties, may consider, in its discretion, both the long-term and short-term best interests of the corporation, taking into account, and weighing as the directors deem appropriate, the effects of an action on the corporation's shareholders, employees, suppliers and customers and the communities in which offices or other facilities of the corporation are located and any other factors the directors consider pertinent. Directors are not required to consider the effects of a proposed corporate action on any particular corporate constituent group or interest as a dominant or controlling factor. If a determination is made with the approval of a majority of the disinterested directors of the board, that determination is conclusively presumed to be valid unless it can be demonstrated that the determination was not made in good faith after reasonable investigation. Chapter 35 specifically provides that specified judicial decisions in Delaware and other jurisdictions, which might be looked upon for guidance in interpreting Indiana law, including decisions that propose a higher or different degree of scrutiny in response to a proposed acquisition of the corporation, are inconsistent with the proper application of the business judgment rule under that section.

18

We may issue warrants to purchase debt securities, preferred stock or common stock. Such warrants may be issued independently or together with any such underlying warrant securities and may be attached to or separate from such underlying warrant securities. Each series of warrants will be issued under a separate warrant agreement to be entered into between us and a warrant agent. The warrant agent will act solely as our agent in connection with the warrants of such series and will not assume any obligation or relationship of agency for or with holders or beneficial owners of warrants.

The applicable prospectus supplement will describe the specific terms of any warrants offered thereby. This information will include some or all of the following:

- •

- the title or designation of such warrants;

- •

- the aggregate number of such warrants;

- •

- the price or prices at which such warrants will be issued;

- •

- the currency or currencies, including composite currencies or currency units, in which the exercise price of such warrants may be payable;

- •

- the designation, aggregate principal amount and terms of the underlying warrant securities purchasable upon exercise of such warrants, and the

procedures and conditions relating to the exercise of the warrant securities;

- •

- the price at which the underlying warrant securities purchasable upon exercise of such warrants may be purchased;

- •

- the date on which the right to exercise such warrants shall commence and the date on which such right shall expire;

- •

- whether such warrants will be issued in registered form or bearer form;

- •

- if applicable, the minimum or maximum amount of such warrants which may be exercised at any one time;

- •

- if applicable, the designation and terms of the underlying warrant securities with which such warrants are issued and the number of such

warrants issued with each such underlying warrant security;

- •

- if applicable, the currency or currencies, including composite currencies or currency units, in which any principal, premium, if any, or

interest on the underlying warrant securities purchasable upon exercise of such warrant will be payable;

- •

- if applicable, the date on and after which such warrants and the related underlying warrant securities will be separately transferable;

- •

- information with respect to book-entry procedures, if any;

- •

- if necessary, a discussion of certain federal income tax considerations; and

- •

- any other terms of such warrants, including terms, procedures and limitations relating to the exchange and exercise of such warrants.

19

We may sell the securities offered by this prospectus from time to time in one or more transactions, including without limitation:

- •

- directly to one or more purchasers;

- •

- through agents;

- •

- to or through underwriters, brokers or dealers;

- •

- through a combination of any of these methods.

A distribution of the securities offered by this prospectus may also be effected through the issuance of derivative securities, including without limitation, warrants, subscriptions, exchangeable securities, forward delivery contracts and the writing of options.

In addition, the manner in which we may sell some or all of the securities covered by this prospectus includes, without limitation, through:

- •

- a block trade in which a broker-dealer will attempt to sell as agent, but may position or resell a portion of the block, as principal, in order

to facilitate the transaction;

- •

- purchases by a broker-dealer, as principal, and resale by the broker-dealer for its account;

- •

- ordinary brokerage transactions and transactions in which a broker solicits purchasers; or

- •

- privately negotiated transactions.

We may also enter into hedging transactions. For example, we may:

- •

- enter into transactions with a broker-dealer or affiliate thereof in connection with which such broker-dealer or affiliate will engage in short

sales of the common stock pursuant to this prospectus, in which case such broker-dealer or affiliate may use shares of common stock received from us to close out its short positions;

- •

- sell securities short and redeliver such shares to close out our short positions;

- •

- enter into option or other types of transactions that require us to deliver common stock to a broker-dealer or an affiliate thereof, who will

then resell or transfer the common stock under this prospectus; or

- •

- loan or pledge the common stock to a broker-dealer or an affiliate thereof, who may sell the loaned shares or, in an event of default in the case of a pledge, sell the pledged shares pursuant to this prospectus.

In addition, we may enter into derivative or hedging transactions with third parties, or sell securities not covered by this prospectus to third parties in privately negotiated transactions. In connection with such a transaction, the third parties may sell securities covered by and pursuant to this prospectus and an applicable prospectus supplement or pricing supplement, as the case may be. If so, the third party may use securities borrowed from us or others to settle such sales and may use securities received from us to close out any related short positions. We may also loan or pledge securities covered by this prospectus and an applicable prospectus supplement to third parties, who may sell the loaned securities or, in an event of default in the case of a pledge, sell the pledged securities pursuant to this prospectus and the applicable prospectus supplement or pricing supplement, as the case may be.

20

A prospectus supplement with respect to each offering of securities will state the terms of the offering of the securities, including:

- •

- the name or names of any underwriters or agents and the amounts of securities underwritten or purchased by each of them, if any;

- •

- the public offering price or purchase price of the securities and the net proceeds to be received by us from the sale;

- •

- any delayed delivery arrangements;

- •

- any underwriting discounts or agency fees and other items constituting underwriters' or agents' compensation;

- •

- any discounts or concessions allowed or reallowed or paid to dealers; and

- •

- any securities exchange or markets on which the securities may be listed.

The offer and sale of the securities described in this prospectus by us, the underwriters or the third parties described above may be effected from time to time in one or more transactions, including privately negotiated transactions, either:

- •

- at a fixed price or prices, which may be changed;

- •

- at market prices prevailing at the time of sale;

- •

- at prices related to the prevailing market prices; or

- •

- at negotiated prices.

General

Any public offering price and any discounts, commissions, concessions or other items constituting compensation allowed or reallowed or paid to underwriters, dealers, agents or remarketing firms may be changed from time to time. Underwriters, dealers, agents and remarketing firms that participate in the distribution of the offered securities may be "underwriters" as defined in the Securities Act. Any discounts or commissions they receive from us and any profits they receive on the resale of the offered securities may be treated as underwriting discounts and commissions under the Securities Act. We will identify any underwriters, agents or dealers and describe their commissions, fees or discounts in the applicable prospectus supplement or pricing supplement, as the case may be.

Underwriters and Agents

If underwriters are used in a sale, they will acquire the offered securities for their own account. The underwriters may resell the offered securities in one or more transactions, including negotiated transactions. These sales may be made at a fixed public offering price or prices, which may be changed, at market prices prevailing at the time of the sale, at prices related to such prevailing market price or at negotiated prices. We may offer the securities to the public through an underwriting syndicate or through a single underwriter. The underwriters in any particular offering will be mentioned in the applicable prospectus supplement or pricing supplement, as the case may be.

Unless otherwise specified in connection with any particular offering of securities, the obligations of the underwriters to purchase the offered securities will be subject to certain conditions contained in an underwriting agreement that we will enter into with the underwriters at the time of the sale to them. The underwriters will be obligated to purchase all of the securities of the series offered if any of the securities are purchased, unless otherwise specified in connection with any particular offering of securities. Any initial offering price and any discounts or concessions allowed, reallowed or paid to dealers may be changed from time to time.

21

We may designate agents to sell the offered securities. Unless otherwise specified in connection with any particular offering of securities, the agents will agree to use their best efforts to solicit purchases for the period of their appointment. We may also sell the offered securities to one or more remarketing firms, acting as principals for their own accounts or as agents for us. These firms will remarket the offered securities upon purchasing them in accordance with a redemption or repayment pursuant to the terms of the offered securities. A prospectus supplement or pricing supplement, as the case may be will identify any remarketing firm and will describe the terms of its agreement, if any, with us and its compensation.

In connection with offerings made through underwriters or agents, we may enter into agreements with such underwriters or agents pursuant to which we receive our outstanding securities in consideration for the securities being offered to the public for cash. In connection with these arrangements, the underwriters or agents may also sell securities covered by this prospectus to hedge their positions in these outstanding securities, including in short sale transactions. If so, the underwriters or agents may use the securities received from us under these arrangements to close out any related open borrowings of securities.

Dealers

We may sell the offered securities to dealers as principals. We may negotiate and pay dealers' commissions, discounts or concessions for their services. The dealer may then resell such securities to the public either at varying prices to be determined by the dealer or at a fixed offering price agreed to with us at the time of resale. Dealers engaged by us may allow other dealers to participate in resales.

Direct Sales

We may choose to sell the offered securities directly. In this case, no underwriters or agents would be involved.

Institutional Purchasers

We may authorize agents, dealers or underwriters to solicit certain institutional investors to purchase offered securities on a delayed delivery basis pursuant to delayed delivery contracts providing for payment and delivery on a specified future date. The applicable prospectus supplement or pricing supplement, as the case may be will provide the details of any such arrangement, including the offering price and commissions payable on the solicitations.

We will enter into such delayed contracts only with institutional purchasers that we approve. These institutions may include commercial and savings banks, insurance companies, pension funds, investment companies and educational and charitable institutions.

Indemnification; Other Relationships

We may have agreements with agents, underwriters, dealers and remarketing firms to indemnify them against certain civil liabilities, including liabilities under the Securities Act. Agents, underwriters, dealers and remarketing firms, and their affiliates, may engage in transactions with, or perform services for, us in the ordinary course of business. This includes commercial banking and investment banking transactions.

Market-Making, Stabilization and Other Transactions

There is currently no market for any of the offered securities, other than the common stock which is listed on the New York Stock Exchange. If the offered securities are traded after their initial issuance, they may trade at a discount from their initial offering price, depending upon prevailing

22

interest rates, the market for similar securities and other factors. While it is possible that an underwriter could inform us that it intends to make a market in the offered securities, such underwriter would not be obligated to do so, and any such market-making could be discontinued at any time without notice. Therefore, no assurance can be given as to whether an active trading market will develop for the offered securities. We have no current plans for listing of the debt securities, preferred stock or warrants on any securities exchange or on the National Association of Securities Dealers, Inc. automated quotation system; any such listing with respect to any particular debt securities, preferred stock or warrants will be described in the applicable prospectus supplement or pricing supplement, as the case may be.

In connection with any offering of common stock, the underwriters may purchase and sell shares of common stock in the open market. These transactions may include short sales, syndicate covering transactions and stabilizing transactions. Short sales involve syndicate sales of common stock in excess of the number of shares to be purchased by the underwriters in the offering, which creates a syndicate short position. "Covered" short sales are sales of shares made in an amount up to the number of shares represented by the underwriters' over-allotment option. In determining the source of shares to close out the covered syndicate short position, the underwriters will consider, among other things, the price of shares available for purchase in the open market as compared to the price at which they may purchase shares through the over-allotment option. Transactions to close out the covered syndicate short involve either purchases of the common stock in the open market after the distribution has been completed or the exercise of the over-allotment option. The underwriters may also make "naked" short sales of shares in excess of the over-allotment option. The underwriters must close out any naked short position by purchasing shares of common stock in the open market. A naked short position is more likely to be created if the underwriters are concerned that there may be downward pressure on the price of the shares in the open market after pricing that could adversely affect investors who purchase in the offering. Stabilizing transactions consist of bids for or purchases of shares in the open market while the offering is in progress for the purpose of pegging, fixing or maintaining the price of the securities.

In connection with any offering, the underwriters may also engage in penalty bids. Penalty bids permit the underwriters to reclaim a selling concession from a syndicate member when the securities originally sold by the syndicate member are purchased in a syndicate covering transaction to cover syndicate short positions. Stabilizing transactions, syndicate covering transactions and penalty bids may cause the price of the securities to be higher than it would be in the absence of the transactions. The underwriters may, if they commence these transactions, discontinue them at any time.

Fees and Commissions

In compliance with the guidelines of the Financial Industry Regulatory Authority ("FINRA"), the aggregate maximum discount, commission or agency fees or other items constituting underwriting compensation to be received by any FINRA member or independent broker-dealer will not exceed 8% of any offering pursuant to this prospectus and any applicable prospectus supplement or pricing supplement, as the case may be; however, it is anticipated that the maximum commission or discount to be received in any particular offering of securities will be significantly less than this amount.

23

Unless otherwise specified in a prospectus supplement accompanying this prospectus, Skadden, Arps, Slate, Meagher & Flom LLP, Chicago, Illinois and Ice Miller LLP, Indianapolis, Indiana will provide opinions regarding the authorization and validity of the securities. Additional legal matters may be passed on for us, or any underwriters, dealers or agents, by counsel which we will name in the applicable prospectus supplement.

24

The financial statements and management's assessment of the effectiveness of internal control over financial reporting (which is included in Management's Report on Internal Control over Financial Reporting) incorporated in this prospectus supplement by reference to our Annual Report on Form 10-K for the year ended September 30, 2018 have been so incorporated in reliance on the report of PricewaterhouseCoopers LLP, an independent registered public accounting firm, given on the authority of said firm as experts in auditing and accounting.