UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-01209

Bridges Investment Fund, Inc.

(Exact name of registrant as specified in charter)

8401 West Dodge Road, Suite 256

Omaha, NE 68114

(Address of principal executive offices) (Zip code)

Edson A. Bridges III

8401 West Dodge Road, Suite 256

Omaha, NE 68114

(Name and address of agent for service)

(402) 397-4700

Registrant's telephone number, including area code

Date of fiscal year end: December 31, 2011

Date of reporting period: June 30, 2011

Item 1. Reports to Stockholders.

Semi-Annual

Shareholder Report

2011

8401 West Dodge Road - 256 Durham Plaza - Omaha, Nebraska 68114 - voice: (402) 397-4700 fax: (402) 397-8617 - www.bridgesfund.com

This page has been intentionally left blank.

Contents of Report

|

Page 1

|

Shareholder Letter

|

|

|

Exhibit 1

|

Portfolio Transactions During the Period From January 1, 2011

|

|

|

Pages 2 – 3

|

through June 30, 2011

|

|

|

Exhibit 2

|

Selected Historical Financial Information

|

|

|

Pages 4 – 5

|

||

|

Page 6

|

Expense Example

|

|

|

Page 7

|

Allocation of Portfolio Holdings

|

|

|

Pages 8 – 20

|

Financial Statements

|

|

|

Pages 21 – 24

|

Additional Disclosures

|

IMPORTANT NOTICES

Opinions expressed herein are those of Edson L. Bridges III and are subject to change. They are not guarantees and should not be considered investment advice.

The S&P 500 Index is a broadly based unmanaged composite of 500 stocks which is widely recognized as representative of price changes for the U.S. equity market in general. The Russell 1000 Growth Index is an unmanaged composite of stocks that measures the performance of the stocks of companies with higher price-to-book ratios and higher forecasted growth values from a universe of the 1,000 largest U.S. companies based on total market capitalization.

P/E is a valuation ratio of a company’s current share price compared to its per-share earnings.

Earnings Growth Rate is not a measure of the Fund’s future performance.

You cannot invest directly in a specific index, however, you may invest in a number of open end investment companies organized and operated by other sponsors for the purpose of experiencing the investment results for an index. Fund holdings are subject to change and should not be considered a recommendation to buy or sell any security. Please refer to the Schedule of Investments for complete information on holdings in the Fund.

Mutual fund investing involves risk. Principal loss is possible. Small- and medium-capitalization companies tend to have limited liquidity and greater price volatility than large-capitalization companies. Investments in debt securities typically decrease in value when interest rates rise. This risk is usually greater for longer-term debt securities. Growth stocks typically are more volatile than value stocks; however, value stocks have a lower expected growth rate in earnings and sales.

Earnings per share is calculated by taking the total earnings divided by the number of shares outstanding.

This report has been prepared for the information of the shareholders of Bridges Investment Fund, Inc. and is under no circumstances to be construed as an offering of shares of the Fund. Such offering is made only by Prospectus.

The Bridges Investment Fund is distributed by Quasar Distributors, LLC.

This report must be preceded or accompanied by a prospectus.

Bridges Investment Fund, Inc.

256 DURHAM PLAZA

8401 WEST DODGE ROAD

OMAHA, NEBRASKA 68114 - 3453

TELEPHONE 402 - 397 - 4700

FACSIMILE 402 - 397 - 8617

July 6, 2011

Dear Shareholder:

Bridges Investment Fund had a total return of -1.52% in the second quarter of 2011, which lagged the 0.10% gain in the S&P 500 Index and the 0.76% gain in the Russell 1000 Growth Index over the same period. For the twelve month period ended June 30, 2011, the Fund had a total return of 25.95% versus 30.69% for the S&P 500 and 35.01% for the Russell 1000 Growth Index. For the three year period ended June 30, 2011, the Fund had an average annual total return of 2.88% versus 3.34% for the S&P 500 and 5.01% for the Russell 1000 Growth Index. For the five year period ended June 30, 2011, the Fund had an average annual total return of 2.13% versus 2.94% for the S&P 500 and 5.33% for the Russell 1000 Growth Index. For the ten year period ended June 30, 2011, the Fund had an average annual total return of 1.47% versus 2.72% for the S&P 500 and 2.24% for the Russell 1000 Growth Index. The Fund’s expense ratio is 0.91%.

Performance data quoted represents past performance. Past performance does not guarantee future results. The investment return and the principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the Fund may be lower or higher than the performance stated above. Performance data current to the most recent month end may be obtained by calling 866-934-4700.

Stocks ended the second quarter essentially unchanged despite volatility during the quarter. After reaching a recovery high of 1370 on May 2 (representing a year to date gain of 9% and gain of 105% from the March 9, 2009, lows), the S&P 500 declined to an intra-quarter low of 1268 on June 16. The pullback was driven by renewed concerns of European debt defaults and signs of slowing economic growth in the U.S. Stocks rallied sharply during the last week of June to finish about flat for the quarter, and up about 5% for the first half of 2011.

Despite indications of some economic slowing in the U.S., we believe that Gross Domestic Product should continue to show growth during the second half of 2011 and into 2012. Corporate profits remained strong in the first quarter of 2011, and we expect continued solid profit growth should continue during the second half of this year.

At present, the S&P 500 trades at about 14x estimated 2011 earnings of $96, and roughly 13x estimated 2012 earnings of $104. We believe corporate earnings growth may remain better than aggregate economic data might suggest, as companies continue to maintain tight expense controls and find ways to improve productivity in a slow and challenging economic environment.

Most of our companies showed solid earnings progress during the first quarter of 2011, and we expect that trend should continue during the second half of 2011 and into 2012.

Valuations for the Fund’s portfolio remain attractive in our view. The Fund’s equities currently trade at 14.3x estimated 2011 earnings and 12.4x estimated 2012 earnings, with estimated earnings growth rates that on average are well above the 6-7% projected growth rate for the S&P 500.

The relatively larger market capitalization of many of the Fund’s holdings has been a drag on performance over the past three quarters, as smaller and mid cap stocks have materially outperformed larger companies since the Fed’s QE2 program was implemented in the fall of 2010, which drove investors toward relatively riskier securities. We believe our companies are attractively valued and we expect larger, higher quality companies should perform well both absolutely and relative to smaller companies going forward.

|

Sincerely,

|

|

|

|

|

Edson L. Bridges III, CFA

|

|

|

President and Chief Executive Officer

|

Exhibit 1

BRIDGES INVESTMENT FUND, INC.

PORTFOLIO TRANSACTIONS

DURING THE PERIOD FROM

JANUARY 01, 2011 THROUGH JUNE 30, 2011

(Unaudited)

|

Bought or

|

Held After

|

|||||||||

|

Securities

|

Received

|

Transactions

|

||||||||

|

Common Stock Unless

|

$1,000 Par

|

$1,000 Par

|

||||||||

|

Described Otherwise

|

Value (M)

|

Value (M)

|

||||||||

|

or Shares

|

or Shares

|

|||||||||

|

Aflac, Inc.

|

2,000 | 10,000 | ||||||||

|

Amazon.com, Inc.

|

1,000 | 4,000 | ||||||||

|

Anadarko Petroleum Corporation

|

4,000 | 24,000 | ||||||||

|

Autodesk, Inc.

|

15,000 | 15,000 | ||||||||

|

Bank of America Corporation

|

15,000 | 50,000 | ||||||||

|

Chesapeake Energy Corporation

|

5,000 | 60,000 | ||||||||

|

Chevron Corporation

|

3,000 | 23,000 | ||||||||

|

Chicago Bridge & Iron Company

|

10,000 | 20,000 | ||||||||

|

Cognizant Technology Solutions Corporation

|

7,000 | 7,000 | ||||||||

|

Credicorp Limited

|

1,000 | 8,000 | ||||||||

|

EMC Corporation

|

30,000 | 30,000 | ||||||||

| 1 |

Eaton Corporation

|

17,000 | 17,000 | |||||||

|

General Electric Company

|

10,000 | 55,000 | ||||||||

|

iShares S&P MidCap 400 Index Fund

|

11,000 | 21,000 | ||||||||

|

iShares S&P SmallCap 600 Index Fund

|

12,000 | 22,000 | ||||||||

|

Perrigo Company

|

12,000 | 12,000 | ||||||||

|

Praxair, Inc.

|

8,000 | 8,000 | ||||||||

|

Priceline.com, Incorporated

|

1,500 | 1,500 | ||||||||

|

Schlumberger Limited

|

10,000 | 10,000 | ||||||||

|

Stanley Black & Decker Inc.

|

5,000 | 5,000 | ||||||||

1 5,000 Shares Received in a 2-for-1 Stock Split on February 28, 2011

-2-

Exhibit 1

(Continued)

BRIDGES INVESTMENT FUND, INC.

PORTFOLIO TRANSACTIONS

DURING THE PERIOD FROM

JANUARY 01, 2011 THROUGH JUNE 30, 2011

(Unaudited)

|

Sold or

|

Held After

|

|||||||||

|

Securities

|

Exchanged

|

Transactions

|

||||||||

|

Common Stock Unless

|

$1,000 Par

|

$1,000 Par

|

||||||||

|

Described Otherwise

|

Value (M)

|

Value (M)

|

||||||||

|

or Shares

|

or Shares

|

|||||||||

|

Abbott Laboratories

|

20,000 | — | ||||||||

|

Allergan, Inc.

|

2,000 | 15,000 | ||||||||

|

Altria Group, Inc.

|

30,000 | 25,000 | ||||||||

|

American Capital Ltd.

|

40,000 | — | ||||||||

|

Best Buy Co., Inc.

|

25,000 | 25,000 | ||||||||

|

Capital One Financial Corporation

|

5,000 | 45,000 | ||||||||

| 2 |

Cardinal Health, Inc.

|

250,000 | — | |||||||

|

6.75% due 2/15/2011

|

||||||||||

|

Cisco Systems, Inc.

|

20,000 | 30,000 | ||||||||

|

CME Group Inc.

|

500 | 2,500 | ||||||||

|

Credicorp Limited

|

1,000 | 7,000 | ||||||||

|

Dolby Laboratories Inc.

|

11,000 | — | ||||||||

|

Express Scripts, Inc.

|

8,000 | 42,000 | ||||||||

|

Hewlett-Packard Company

|

20,000 | — | ||||||||

|

Mastercard, Inc.

|

1,000 | 12,000 | ||||||||

|

McDonald’s Corporation

|

2,000 | 15,000 | ||||||||

|

Microsoft Corporation

|

25,000 | — | ||||||||

|

PepsiCo, Inc.

|

10,000 | 15,000 | ||||||||

|

Procter & Gamble Company (The)

|

10,000 | — | ||||||||

|

Research In Motion Limited

|

10,000 | — | ||||||||

|

Roper Industries, Inc.

|

3,000 | 15,000 | ||||||||

|

Stryker Corporation

|

13,500 | — | ||||||||

|

Transocean Ltd.

|

10,000 | — | ||||||||

|

Visa Inc.

|

3,000 | 17,000 | ||||||||

|

Waters Corporation

|

1,000 | 9,000 | ||||||||

2 Matured at Par on 2/15/2011

-3-

Exhibit 2

BRIDGES INVESTMENT FUND, INC.

SELECTED HISTORICAL FINANCIAL INFORMATION

(Unaudited)

– – – – – – – – – – – Year End Statistics – – – – – – – – – – –

|

Valuation

|

Net

|

Shares

|

Net Asset

|

Dividend/

|

Capital

|

||||||||||||||||||

|

Date

|

Assets

|

Outstanding

|

Value/Share

|

Share

|

Gains/Share

|

||||||||||||||||||

| 07-01-63 | $ | 109,000 | 10,900 | $ | 10.00 | $ | — | $ | — | ||||||||||||||

| 12-31-63 | 159,187 | 15,510 | 10.13 | .07 | — | ||||||||||||||||||

| 12-31-64 | 369,149 | 33,643 | 10.97 | .28 | — | ||||||||||||||||||

| 12-31-65 | 621,241 | 51,607 | 12.04 | .285 | . | 028 | |||||||||||||||||

| 12-31-66 | 651,282 | 59,365 | 10.97 | .295 | — | ||||||||||||||||||

| 12-31-67 | 850,119 | 64,427 | 13.20 | .295 | — | ||||||||||||||||||

| 12-31-68 | 1,103,734 | 74,502 | 14.81 | .315 | — | ||||||||||||||||||

| 12-31-69 | 1,085,186 | 84,807 | 12.80 | .36 | — | ||||||||||||||||||

| 12-31-70 | 1,054,162 | 90,941 | 11.59 | .37 | — | ||||||||||||||||||

| 12-31-71 | 1,236,601 | 93,285 | 13.26 | .37 | — | ||||||||||||||||||

| 12-31-72 | 1,272,570 | 93,673 | 13.59 | .35 | . | 08 | |||||||||||||||||

| 12-31-73 | 1,025,521 | 100,282 | 10.23 | .34 | . | 07 | |||||||||||||||||

| 12-31-74 | 757,545 | 106,909 | 7.09 | .35 | — | ||||||||||||||||||

| 12-31-75 | 1,056,439 | 111,619 | 9.46 | .35 | — | ||||||||||||||||||

| 12-31-76 | 1,402,661 | 124,264 | 11.29 | .38 | — | ||||||||||||||||||

| 12-31-77 | 1,505,147 | 145,252 | 10.36 | .428 | . | 862 | |||||||||||||||||

| 12-31-78 | 1,574,097 | 153,728 | 10.24 | .481 | . | 049 | |||||||||||||||||

| 12-31-79 | 1,872,059 | 165,806 | 11.29 | .474 | . | 051 | |||||||||||||||||

| 12-31-80 | 2,416,997 | 177,025 | 13.65 | .55 | . | 0525 | |||||||||||||||||

| 12-31-81 | 2,315,441 | 185,009 | 12.52 | .63 | . | 0868 | |||||||||||||||||

| 12-31-82 | 2,593,411 | 195,469 | 13.27 | .78 | . | 19123 | |||||||||||||||||

| 12-31-83 | 3,345,988 | 229,238 | 14.60 | .85 | . | 25 | |||||||||||||||||

| 12-31-84 | 3,727,899 | 278,241 | 13.40 | .80 | . | 50 | |||||||||||||||||

| 12-31-85 | 4,962,325 | 318,589 | 15.58 | .70 | . | 68 | |||||||||||||||||

| 12-31-86 | 6,701,786 | 407,265 | 16.46 | .688 | . | 86227 | |||||||||||||||||

| 12-31-87 | 7,876,275 | 525,238 | 15.00 | .656 | 1. | 03960 | |||||||||||||||||

| 12-31-88 | 8,592,807 | 610,504 | 14.07 | .85 | 1. | 10967 | |||||||||||||||||

| 12-31-89 | 10,895,182 | 682,321 | 15.97 | .67 | . | 53769 | |||||||||||||||||

| 12-31-90 | 11,283,448 | 744,734 | 15.15 | .67 | . | 40297 | |||||||||||||||||

| 12-31-91 | 14,374,679 | 831,027 | 17.30 | .66 | . | 29292 | |||||||||||||||||

| 12-31-92 | 17,006,789 | 971,502 | 17.51 | .635 | . | 15944 | |||||||||||||||||

| 12-31-93 | 17,990,556 | 1,010,692 | 17.80 | .6225 | . | 17075 | |||||||||||||||||

| 12-31-94 | 18,096,297 | 1,058,427 | 17.10 | .59 | . | 17874 | |||||||||||||||||

| 12-31-95 | 24,052,746 | 1,116,620 | 21.54 | .575 | . | 19289 | |||||||||||||||||

| 12-31-96 | 29,249,488 | 1,190,831 | 24.56 | .55 | . | 25730 | |||||||||||||||||

| 12-31-97 | 36,647,535 | 1,262,818 | 29.02 | .5075 | . | 30571 | |||||||||||||||||

| 12-31-98 | 48,433,113 | 1,413,731 | 34.26 | .44 | 2. | 11648 | |||||||||||||||||

| 12-31-99 | 69,735,684 | 1,508,154 | 46.24 | .30 | . | 91088 | |||||||||||||||||

| 12-31-00 | 71,411,520 | 1,850,301 | 38.59 | .40 | . | 80880716 | |||||||||||||||||

| 12-31-01 | 60,244,912 | 1,940,494 | 31.05 | .26 | — | ||||||||||||||||||

| 12-31-02 | 45,854,541 | 1,989,769 | 23.05 | .20 | — | ||||||||||||||||||

| 12-31-03 | 62,586,435 | 2,016,560 | 31.04 | .24 | — | ||||||||||||||||||

| 12-31-04 | 74,281,648 | 2,230,038 | 33.31 | .305 | — | ||||||||||||||||||

| 12-31-05 | 80,715,484 | 2,305,765 | 35.01 | .2798 | — | ||||||||||||||||||

| 12-31-06 | 82,754,479 | 2,336,366 | 35.42 | .2695 | — | ||||||||||||||||||

| 12-31-07 | 77,416,617 | 2,258,380 | 34.28 | .2364 | 2. | 5735 | |||||||||||||||||

| 12-31-08 | 49,448,417 | 2,257,410 | 21.91 | .2603 | — | ||||||||||||||||||

| 12-31-09 | 67,435,343 | 2,303,377 | 29.28 | .17 | — | ||||||||||||||||||

| 12-31-10 | 75,014,486 | 2,307,301 | 32.51 | .126 | — | ||||||||||||||||||

-4-

Exhibit 2

(Continued)

BRIDGES INVESTMENT FUND, INC.

SELECTED HISTORICAL FINANCIAL INFORMATION

(Unaudited)

– – – – – – – – – – – Current Six Months Compared to Same Six Months in Prior Year – – – – – – – – – – –

|

Valuation

|

Net

|

Shares

|

Net Asset

|

Dividend/

|

Capital

|

||||||||||||||||||

|

Date

|

Assets

|

Outstanding

|

Value/Share

|

Share

|

Gains/Share

|

||||||||||||||||||

| 06-30-10 | $ | 61,747,862 | 2,299,232 | $ | 26.86 | $ | .05 | $ | — | ||||||||||||||

| 06-30-11 | 77,853,396 | 2,310,574 | 33.69 | .06 | — | ||||||||||||||||||

-5-

BRIDGES INVESTMENT FUND, INC.

EXPENSE EXAMPLE

JUNE 30, 2011

(Unaudited)

As a shareholder of The Bridges Investment Fund, Inc., you incur ongoing costs, including management fees; services fees; and other Fund expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare costs with the ongoing costs of investing in other mutual funds.

The Example is based on an investment of $1,000 invested at the beginning of the period and held the entire period (January 1, 2011 – June 30, 2011).

ACTUAL EXPENSES

The first line of the table below provides information about actual account values and actual expenses. Although the Fund charges no sales load or transactions fees, you will be assessed fees for outgoing wire transfers, returned checks or stop payment orders at prevailing rates charged by U.S. Bancorp Fund Services, LLC, the Fund’s transfer agent. If you request a redemption be made by wire transfer, currently a $15.00 fee is charged by the Fund’s transfer agent. To the extent that the Fund invests in shares of other investment companies as part of its investment strategy, you will indirectly bear your proportionate share of any fees and expenses charged by the underlying funds in which a Fund invests in addition to the expenses of the Fund. Actual expenses of the underlying funds are expected to vary among the various underlying funds. These expenses are not included in the example below. The example includes, but is not limited to, management fees, shareholder servicing fees, fund accounting, custody and transfer agent fees. However, the example below does not include portfolio trading commissions and related expenses, interest expense or dividends on short positions taken by the Fund and other extraordinary expenses as determined under generally accepted accounting principles. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

HYPOTHETICAL EXAMPLE FOR COMPARISON PURPOSES

The second line of the table below provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratios and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads), redemption fees, or exchange fees. Therefore, the second line of the table is useful in comparing ongoing costs only, and will not help you determine the relative costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

|

Expenses Paid

|

|||

|

Beginning

|

Ending

|

During Period*

|

|

|

Account Value

|

Account Value

|

January 1, 2011 –

|

|

|

January 1, 2011

|

June 30, 2011

|

June 30, 2011

|

|

|

Actual

|

$1,000.00

|

$1,038.10

|

$4.42

|

|

Hypothetical (5% return before expenses)

|

1,000.00

|

1,020.46

|

4.38

|

|

*

|

Expenses are equal to the Fund’s annualized expense ratio of 0.87%, multiplied by the average account value over the period, multiplied by 181/365 to reflect the one-half year period.

|

-6-

BRIDGES INVESTMENT FUND, INC.

ALLOCATION OF PORTFOLIO HOLDINGS

JUNE 30, 2011

(Unaudited)

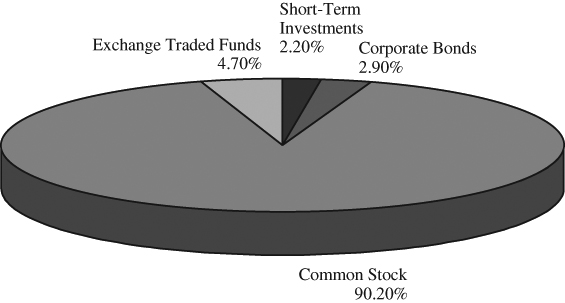

COMPONENTS OF PORTFOLIO HOLDINGS

|

Common Stock

|

$ | 70,373,375 | |||

|

Corporate Bonds

|

2,266,496 | ||||

|

Exchange Traded Funds

|

3,664,740 | ||||

|

Short-Term Investments

|

1,716,948 | ||||

|

Total

|

$ | 78,021,559 |

-7-

BRIDGES INVESTMENT FUND, INC.

SCHEDULE OF INVESTMENTS

JUNE 30, 2011

(Unaudited)

|

Title of Security

|

Shares

|

Cost

|

Value

|

|||||||||

|

COMMON STOCKS – 90.39%

|

||||||||||||

|

Amusement, Gambling, and Recreation Industries – 0.50%

|

||||||||||||

|

The Walt Disney Co.

|

10,000 | $ | 336,300 | $ | 390,400 | |||||||

|

Beverage and Tobacco Product Manufacturing – 3.92%

|

||||||||||||

|

Altria Group, Inc.

|

25,000 | $ | 478,400 | $ | 660,250 | |||||||

|

PepsiCo, Inc.

|

15,000 | 657,954 | 1,056,450 | |||||||||

|

Philip Morris International, Inc.

|

20,000 | 685,363 | 1,335,400 | |||||||||

| $ | 1,821,717 | $ | 3,052,100 | |||||||||

|

Chemical Manufacturing – 5.80%

|

||||||||||||

|

Allergan, Inc.

|

15,000 | $ | 593,458 | $ | 1,248,750 | |||||||

|

Perrigo Co.

|

12,000 | 891,115 | 1,054,440 | |||||||||

|

Praxair, Inc.

|

8,000 | 758,391 | 867,120 | |||||||||

|

Teva Pharmaceutical Industries, Ltd. – ADR

|

28,000 | 911,242 | 1,350,160 | |||||||||

| $ | 3,154,206 | $ | 4,520,470 | |||||||||

|

Computer and Electronic Product Manufacturing – 10.87%

|

||||||||||||

|

Apple, Inc. (a)

|

12,000 | $ | 1,380,553 | $ | 4,028,040 | |||||||

|

Cisco Systems, Inc.

|

30,000 | 735,598 | 468,300 | |||||||||

|

EMC Corp. (a)

|

30,000 | 776,088 | 826,500 | |||||||||

|

QUALCOMM, Inc.

|

40,000 | 1,541,688 | 2,271,600 | |||||||||

|

Waters Corp. (a)

|

9,000 | 472,047 | 861,660 | |||||||||

| $ | 4,905,974 | $ | 8,456,100 | |||||||||

|

Couriers and Messengers – 2.16%

|

||||||||||||

|

FedEx Corp.

|

10,000 | $ | 688,396 | $ | 948,500 | |||||||

|

United Parcel Service, Inc.

|

10,000 | 671,348 | 729,300 | |||||||||

| $ | 1,359,744 | $ | 1,677,800 | |||||||||

|

Credit Intermediation and Related Activities – 10.04%

|

||||||||||||

|

Bank Of America Corporation

|

50,000 | $ | 780,750 | $ | 548,000 | |||||||

|

Capital One Financial Corp.

|

45,000 | 1,362,267 | 2,325,150 | |||||||||

|

Credicorp Ltd.

|

7,000 | 647,997 | 602,700 | |||||||||

|

JPMorgan Chase & Co.

|

30,000 | 1,320,491 | 1,228,200 | |||||||||

|

Visa, Inc.

|

17,000 | 1,256,513 | 1,432,420 | |||||||||

|

Wells Fargo & Co.

|

60,000 | 1,444,347 | 1,683,600 | |||||||||

| $ | 6,812,365 | $ | 7,820,070 | |||||||||

|

Data Processing, Hosting and Related Services – 1.10%

|

||||||||||||

|

Rackspace Hosting, Inc. (a)

|

20,000 | $ | 478,448 | $ | 854,800 | |||||||

|

Electrical Equipment, Appliance, and Component Manufacturing – 1.08%

|

||||||||||||

|

Emerson Electric Co.

|

15,000 | $ | 820,875 | $ | 843,750 | |||||||

|

Electronics and Appliance Stores – 1.01%

|

||||||||||||

|

Best Buy Co., Inc.

|

25,000 | $ | 829,496 | $ | 785,250 | |||||||

See accompanying Notes to the Financial Statements.

ADRAmerican Depository Receipt

(a) Non Income Producing.

-8-

BRIDGES INVESTMENT FUND, INC.

SCHEDULE OF INVESTMENTS

(Continued)

JUNE 30, 2011

(Unaudited)

|

Title of Security

|

Shares

|

Cost

|

Value

|

|||||||||

|

COMMON STOCKS (Continued)

|

||||||||||||

|

Food Services and Drinking Places – 1.62%

|

||||||||||||

|

McDonald’s Corp.

|

15,000 | $ | 974,095 | $ | 1,264,800 | |||||||

|

General Merchandise Stores – 1.21%

|

||||||||||||

|

Target Corp.

|

20,000 | $ | 614,615 | $ | 938,200 | |||||||

|

Health and Personal Care Stores – 2.91%

|

||||||||||||

|

Express Scripts, Inc. (a)

|

42,000 | $ | 850,874 | $ | 2,267,160 | |||||||

|

Heavy and Civil Engineering Construction – 2.25%

|

||||||||||||

|

Chicago Bridge & Iron Co. – ADR

|

20,000 | $ | 667,122 | $ | 778,000 | |||||||

|

Fluor Corp.

|

15,000 | 579,555 | 969,900 | |||||||||

| $ | 1,246,677 | $ | 1,747,900 | |||||||||

|

Insurance Carriers and Related Activities – 2.59%

|

||||||||||||

|

Aflac, Inc.

|

10,000 | $ | 569,975 | $ | 466,800 | |||||||

|

Berkshire Hathaway, Inc. (a)

|

20,000 | 678,649 | 1,547,800 | |||||||||

| $ | 1,248,624 | $ | 2,014,600 | |||||||||

|

Leather and Allied Product Manufacturing – 0.58%

|

||||||||||||

|

NIKE, Inc.

|

5,000 | $ | 424,432 | $ | 449,900 | |||||||

|

Machinery Manufacturing – 6.13%

|

||||||||||||

|

Caterpillar, Inc.

|

20,000 | $ | 1,131,201 | $ | 2,129,200 | |||||||

|

General Electric Co.

|

55,000 | 697,938 | 1,037,300 | |||||||||

|

Roper Industries, Inc.

|

15,000 | 714,293 | 1,249,500 | |||||||||

|

Stanley Black & Decker, Inc.

|

5,000 | 360,606 | 360,250 | |||||||||

| $ | 2,904,038 | $ | 4,776,250 | |||||||||

|

Management of Companies and Enterprises – 1.11%

|

||||||||||||

|

The Goldman Sachs Group, Inc.

|

6,500 | $ | 908,626 | $ | 865,085 | |||||||

|

Mining (except Oil and Gas) – 1.82%

|

||||||||||||

|

BHP Billiton Ltd. – ADR

|

15,000 | $ | 1,122,662 | $ | 1,419,450 | |||||||

|

Nonstore Retailers – 1.05%

|

||||||||||||

|

Amazon.com, Inc. (a)

|

4,000 | $ | 583,033 | $ | 817,960 | |||||||

|

Oil and Gas Extraction – 7.83%

|

||||||||||||

|

Anadarko Petroleum Corp.

|

24,000 | $ | 1,598,009 | $ | 1,842,240 | |||||||

|

Apache Corp.

|

20,000 | 1,502,797 | 2,467,800 | |||||||||

|

Chesapeake Energy Corp.

|

60,000 | 1,649,240 | 1,781,400 | |||||||||

| $ | 4,750,046 | $ | 6,091,440 | |||||||||

|

Other Information Services – 3.25%

|

||||||||||||

|

Google, Inc. (a)

|

5,000 | $ | 2,233,768 | $ | 2,531,900 | |||||||

|

Petroleum and Coal Products Manufacturing – 3.04%

|

||||||||||||

|

Chevron Corp.

|

23,000 | $ | 1,061,445 | $ | 2,365,320 | |||||||

See accompanying Notes to the Financial Statements.

ADRAmerican Depository Receipt

(a) Non Income Producing.

-9-

BRIDGES INVESTMENT FUND, INC.

SCHEDULE OF INVESTMENTS

(Continued)

JUNE 30, 2011

(Unaudited)

|

Title of Security

|

Shares

|

Cost

|

Value

|

|||||||||

|

COMMON STOCKS (Continued)

|

||||||||||||

|

Professional, Scientific, and Technical Services – 7.45%

|

||||||||||||

|

Celgene Corp. (a)

|

15,000 | $ | 839,322 | $ | 904,800 | |||||||

|

Cognizant Technology Solutions Class A (a)

|

7,000 | 526,265 | 513,380 | |||||||||

|

Mastercard, Inc.

|

12,000 | 2,060,959 | 3,616,080 | |||||||||

|

priceline.com, Inc. (a)

|

1,500 | 648,071 | 767,895 | |||||||||

| $ | 4,074,617 | $ | 5,802,155 | |||||||||

|

Publishing Industries (except Internet) – 0.74%

|

||||||||||||

|

Autodesk, Inc. (a)

|

15,000 | $ | 602,959 | $ | 579,000 | |||||||

|

Rail Transportation – 3.35%

|

||||||||||||

|

Union Pacific Corp.

|

25,000 | $ | 1,460,063 | $ | 2,610,000 | |||||||

|

Securities, Commodity Contracts, and Other Financial

|

||||||||||||

|

Investments and Related Activities – 2.10%

|

||||||||||||

|

CME Group, Inc.

|

2,500 | $ | 705,185 | $ | 728,975 | |||||||

|

T. Rowe Price Group, Inc.

|

15,000 | 725,747 | 905,100 | |||||||||

| $ | 1,430,932 | $ | 1,634,075 | |||||||||

|

Support Activities for Mining – 1.11%

|

||||||||||||

|

Schlumberger Ltd.

|

10,000 | $ | 882,188 | $ | 864,000 | |||||||

|

Telecommunications – 1.44%

|

||||||||||||

|

DIRECTV (a)

|

22,000 | $ | 780,297 | $ | 1,118,040 | |||||||

|

Transportation Equipment Manufacturing – 1.12%

|

||||||||||||

|

Eaton Corp.

|

17,000 | $ | 923,522 | $ | 874,650 | |||||||

|

Water Transportation – 1.21%

|

||||||||||||

|

Carnival Corp.

|

25,000 | $ | 951,168 | $ | 940,750 | |||||||

|

TOTAL COMMON STOCKS (Cost $50,547,806)

|

$ | 50,547,806 | $ | 70,373,375 | ||||||||

|

Principal

|

||||||||||||

|

Amount

|

Cost

|

Value

|

||||||||||

|

CORPORATE BONDS – 2.91%

|

||||||||||||

|

Beverage and Tobacco Product Manufacturing – 0.34%

|

||||||||||||

|

Reynolds American, Inc.

|

||||||||||||

|

7.250%, 06/01/2012

|

$ | 250,000 | $ | 251,379 | $ | 264,074 | ||||||

|

Broadcasting (except Internet) – 0.30%

|

||||||||||||

|

Comcast Corp.

|

||||||||||||

|

6.500%, 01/15/2017

|

$ | 200,000 | $ | 199,592 | $ | 233,102 | ||||||

|

Building Material and Garden Equipment and Supplies Dealers – 0.29%

|

||||||||||||

|

Home Depot, Inc.

|

||||||||||||

|

5.400%, 03/01/2016

|

$ | 200,000 | $ | 185,919 | $ | 223,483 | ||||||

See accompanying Notes to the Financial Statements.

(a)Non Income Producing.

-10-

BRIDGES INVESTMENT FUND, INC.

SCHEDULE OF INVESTMENTS

(Concluded)

JUNE 30, 2011

(Unaudited)

|

Principal

|

||||||||||||

|

Title of Security

|

Amount

|

Cost

|

Value

|

|||||||||

|

CORPORATE BONDS (Continued)

|

||||||||||||

|

Credit Intermediation and Related Activities – 0.34%

|

||||||||||||

|

MBNA Corporation

|

||||||||||||

|

7.500%, 03/15/2012

|

$ | 250,000 | $ | 251,725 | $ | 261,735 | ||||||

|

Funds, Trusts, and Other Financial Vehicles – 0.39%

|

||||||||||||

|

Spectra Energy Capital, LLC

|

||||||||||||

|

8.000%, 10/01/2019

|

$ | 250,000 | $ | 267,579 | $ | 305,816 | ||||||

|

General Merchandise Stores – 0.49%

|

||||||||||||

|

JC Penney Corp., Inc.

|

||||||||||||

|

7.400%, 04/01/2037

|

$ | 400,000 | $ | 400,942 | $ | 389,999 | ||||||

|

Machinery Manufacturing – 0.39%

|

||||||||||||

|

Applied Materials, Inc.

|

||||||||||||

|

7.125%, 10/15/2017

|

$ | 250,000 | $ | 253,479 | $ | 301,627 | ||||||

|

Oil and Gas Extraction – 0.37%

|

||||||||||||

|

Anadarko Petroleum Corp.

|

||||||||||||

|

7.625%, 03/15/2014

|

$ | 250,000 | $ | 242,768 | $ | 286,660 | ||||||

|

TOTAL CORPORATE BONDS (Cost $2,053,383)

|

$ | 2,053,383 | $ | 2,266,496 | ||||||||

|

Shares

|

Cost

|

Value

|

||||||||||

|

EXCHANGE TRADED FUNDS – 4.71%

|

||||||||||||

|

Funds, Trusts, and Other Financial Vehicles – 4.71%

|

||||||||||||

|

iShares S&P MidCap 400 Index Fund

|

21,000 | $ | 1,909,405 | $ | 2,051,700 | |||||||

|

iShares S&P SmallCap 600 Index Fund

|

22,000 | 1,514,738 | 1,613,040 | |||||||||

|

TOTAL EXCHANGE TRADED FUNDS (Cost $3,424,143)

|

$ | 3,424,143 | $ | 3,664,740 | ||||||||

|

SHORT-TERM INVESTMENT – 2.21%

|

||||||||||||

|

Mutual Fund – 2.21%

|

||||||||||||

|

SEI Daily Income Trust Treasury Fund, 0.010%

|

1,716,948 | $ | 1,716,948 | $ | 1,716,948 | |||||||

|

TOTAL SHORT-TERM INVESTMENT (Cost $1,716,948)

|

$ | 1,716,948 | $ | 1,716,948 | ||||||||

|

TOTAL INVESTMENTS (Cost $57,742, 280) – 100.22%

|

$ | 78,021,559 | ||||||||||

|

LIABILITIES IN EXCESS OF OTHER ASSETS – (0.22)%

|

(168,163 | ) | ||||||||||

|

TOTAL NET ASSETS – 100.00%

|

$ | 77,853,396 | ||||||||||

See accompanying Notes to the Financial Statements.

-11-

BRIDGES INVESTMENT FUND, INC.

STATEMENT OF ASSETS AND LIABILITIES

JUNE 30, 2011

(Unaudited)

|

ASSETS:

|

||||

|

Investments in securities, at fair value (cost: $57,742,280)

|

$ | 78,021,559 | ||

|

Cash

|

1,000 | |||

|

Receivables

|

||||

|

Dividends and interest

|

97,062 | |||

|

Fund shares issued

|

66 | |||

|

Prepaid Expenses

|

3,811 | |||

|

TOTAL ASSETS

|

$ | 78,123,498 | ||

|

LIABILITIES:

|

||||

|

Payables

|

||||

|

Advisory fees

|

$ | 96,078 | ||

|

Distribution to shareholders

|

8,404 | |||

|

Fund shares redeemed

|

89,949 | |||

|

Payable to directors

|

11,674 | |||

|

Accrued expenses

|

63,997 | |||

|

TOTAL LIABILITIES:

|

$ | 270,102 | ||

|

TOTAL NET ASSETS

|

$ | 77,853,396 | ||

|

NET ASSETS CONSIST OF:

|

||||

|

Capital stock

|

$ | 57,603,474 | ||

|

Accumulated undistributed net investment income

|

19,103 | |||

|

Accumulated undistributed net realized loss on investments

|

(48,460 | ) | ||

|

Unrealized appreciation on investments

|

20,279,279 | |||

|

TOTAL NET ASSETS

|

$ | 77,853,396 | ||

|

SHARES OUTSTANDING (UNLIMITED SHARES OF NO PAR VALUE AUTHORIZED)

|

2,310,574 | |||

|

NET ASSET VALUE, OFFERING AND REDEMPTION PRICE PER SHARE

|

$ | 33.69 | ||

See accompanying Notes to the Financial Statements.

-12-

BRIDGES INVESTMENT FUND, INC.

STATEMENT OF OPERATIONS

FOR THE SIX MONTHS ENDED JUNE 30, 2011

(Unaudited)

|

INVESTMENT INCOME:

|

||||

|

Dividend income (net of foreign tax withheld of $986)

|

$ | 417,764 | ||

|

Interest income

|

74,985 | |||

|

Total investment income

|

$ | 492,749 | ||

|

EXPENSES:

|

||||

|

Advisory fees

|

$ | 192,451 | ||

|

Administration fees

|

43,391 | |||

|

Dividend disbursing and transfer agent fees

|

23,897 | |||

|

Fund accounting fees

|

20,759 | |||

|

Professional Services

|

20,404 | |||

|

Independent director’s expenses and fees

|

11,674 | |||

|

Other

|

9,673 | |||

|

Printing and supplies

|

7,877 | |||

|

Custody fees

|

6,155 | |||

|

Total expenses

|

$ | 336,281 | ||

|

NET INVESTMENT INCOME

|

$ | 156,468 | ||

|

NET REALIZED AND UNREALIZED GAIN / (LOSS) ON INVESTMENTS

|

||||

|

Net realized gain on investments

|

1,480,555 | |||

|

Net change in unrealized appreciation on investments

|

1,234,301 | |||

|

NET REALIZED AND UNREALIZED GAIN ON INVESTMENTS

|

2,714,856 | |||

|

NET INCREASE IN NET ASSETS RESULTING FROM OPERATIONS

|

$ | 2,871,324 | ||

See accompanying Notes to the Financial Statements.

-13-

BRIDGES INVESTMENT FUND, INC.

STATEMENTS OF CHANGES IN NET ASSETS

FOR THE SIX MONTHS ENDED JUNE 30, 2011 AND 2010

(Unaudited)

|

2011

|

2010

|

|||||||

|

OPERATIONS:

|

||||||||

|

Net investment income

|

$ | 156,468 | $ | 119,016 | ||||

|

Net realized gain/(loss) on investments

|

1,480,555 | (138,216 | ) | |||||

|

Net increase/(decrease) in unrealized appreciation on investments

|

1,234,301 | (5,429,534 | ) | |||||

|

Net increase/(decrease) in net assets resulting from operations

|

$ | 2,871,324 | $ | (5,448,734 | ) | |||

|

Net equalization of debits/credits:

|

250 | (41 | ) | |||||

|

Distributions to shareholders:

|

||||||||

|

From net investment income

|

(138,565 | ) | (115,162 | ) | ||||

|

Total distributions

|

$ | (138,565 | ) | $ | (115,162 | ) | ||

|

Capital Share Transactions:

|

||||||||

|

Net increase in net assets from capital share transactions

|

105,901 | (123,544 | ) | |||||

|

Total increase in net assets

|

$ | 2,838,910 | $ | (5,687,481 | ) | |||

|

NET ASSETS:

|

||||||||

|

Beginning of the period

|

$ | 75,014,486 | $ | 67,435,343 | ||||

|

End of the period (including undistributed net investment

|

||||||||

|

income of $19,103 and $4,570, respectively)

|

$ | 77,853,396 | $ | 61,747,862 | ||||

See accompanying Notes to the Financial Statements.

-14-

BRIDGES INVESTMENT FUND, INC.

FINANCIAL HIGHLIGHTS

|

For a Fund share outstanding throughout the period

|

||||||||||||||||||||||||

|

For the Six

|

||||||||||||||||||||||||

|

Months Ended

|

||||||||||||||||||||||||

|

June 30, 2011

|

Years Ended December 31,

|

|||||||||||||||||||||||

|

(Unaudited)

|

2010

|

2009

|

2008

|

2007

|

2006

|

|||||||||||||||||||

|

Net asset value, beginning of period

|

$ | 32.51 | $ | 29.28 | $ | 21.91 | $ | 34.28 | $ | 35.42 | $ | 35.01 | ||||||||||||

|

Income (loss) from investment operations:

|

||||||||||||||||||||||||

|

Net investment income1

|

0.08 | 0.14 | 0.17 | 0.25 | 0.23 | 0.27 | ||||||||||||||||||

|

Net realized and unrealized gain/(loss) on investments

|

1.16 | 3.22 | 7.37 | (12.36 | ) | 1.44 | 0.41 | |||||||||||||||||

|

Total from investment operations

|

1.24 | 3.36 | 7.54 | (12.11 | ) | 1.67 | 0.68 | |||||||||||||||||

|

Less dividends and distributions:

|

||||||||||||||||||||||||

|

Dividends from net investment income

|

(0.06 | ) | (0.13 | ) | (0.17 | ) | (0.25 | ) | (0.24 | ) | (0.27 | ) | ||||||||||||

|

Distributions from net realized gains

|

— | — | — | — | (2.57 | ) | — | |||||||||||||||||

|

Distributions from tax return of capital

|

— | — | — | (0.01 | ) | — | — | |||||||||||||||||

|

Total dividends and distributions

|

(0.06 | ) | (0.13 | ) | (0.17 | ) | (0.26 | ) | (2.81 | ) | (0.27 | ) | ||||||||||||

|

Net asset value, end of period

|

$ | 33.69 | $ | 32.51 | $ | 29.28 | $ | 21.91 | $ | 34.28 | $ | 35.42 | ||||||||||||

|

Total return

|

3.81 | %2 | 11.50 | % | 34.61 | % | (35.47 | %) | 4.72 | % | 1.96 | % | ||||||||||||

|

Supplemental data and ratios:

|

||||||||||||||||||||||||

|

Net assets, end of period (in thousands)

|

$ | 77,853 | $ | 75,014 | $ | 67,435 | $ | 49,448 | $ | 77,417 | $ | 82,754 | ||||||||||||

|

Ratio of net expenses to average net assets:

|

0.87 | %3 | 0.90 | % | 1.02 | % | 0.77 | % | 0.80 | % | 0.84 | % | ||||||||||||

|

Ratio of net investment income to average net assets:

|

0.41 | %3 | 0.42 | % | 0.63 | % | 0.86 | % | 0.64 | % | 0.78 | % | ||||||||||||

|

Portfolio turnover rate

|

13.3 | % | 26.3 | % | 18.2 | % | 23.4 | % | 39.0 | % | 19.0 | % | ||||||||||||

See accompanying Notes to the Financial Statements.

|

1

|

Net investment income per share is calculated using the ending balances prior to consideration or adjustment for permanent book-to-tax differences.

|

|

2

|

Not annualized.

|

|

3

|

Annualized.

|

-15-

BRIDGES INVESTMENT FUND, INC.

NOTES TO FINANCIAL STATEMENTS

JUNE 30, 2011

(Unaudited)

(1) SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

Bridges Investment Fund, Inc. (the “Fund”) is registered under the Investment Company Act of 1940 as a diversified, open-end management investment company. The primary investment objective of the Fund is long-term capital appreciation. In pursuit of that objective, the Fund invests primarily in common stocks. The following is a summary of significant accounting policies consistently followed by the Fund in the preparation of its financial statements. The policies are in conformity with accounting principles generally accepted in the United States of America.

A. Investments –

Security transactions are recorded on trade date. Dividend income is recognized on the ex-divided date, and interest income is recognized on an accrual basis. Discount and premium on fixed income securities is accreted or amortized into interest income using the effective interest method.

The net realized gain (loss) from the sales of securities is determined for income tax and accounting purposes on the basis of the cost of specific securities.

Securities owned are reflected in the accompanying statement of assets and liabilities and the schedule of investments at fair value based on quoted market prices. Bonds and other fixed-income securities (other than the short-term securities) are valued using the bid price provided by an independent pricing service. Other securities traded on a national securities exchange are valued at the last reported sale price at the close of regular trading on each day the exchange is open for trading. Securities listed on the NASDAQ National Market System for which market quotations are readily available are valued using the NASDAQ Official Closing Price (“NOCP”). If no sales were reported on that day, quoted market price represents the closing bid price.

Securities for which prices are not readily available were valued by the Fund’s valuation committee (the “Valuation Committee”) at a fair value determined in good faith under procedures established by and under the general supervision of the Fund’s Board of Directors.

The Valuation Committee concluded that a price determined under the Fund’s valuation procedures was not readily available if, among other things, the Valuation Committee believed that the value of the security might have been materially affected by an intervening significant event. A significant event may be related to a single issuer, to an entire market sector, or to the entire market. These events may include, among other things: issuer–specific events including rating agency action, earnings announcements and corporate actions, significant fluctuations in domestic or foreign markets, natural disasters, armed conflicts, and government actions. In the event that the market quotations are not readily available, the fair value of such securities will be determined in good faith, taking into consideration: (i) fundamental analytical data relating to the investment; (ii) the nature and duration of restrictions on disposition of the securities; and (iii) an evaluation of the forces which influence the market in which these securities are purchased and sold. The members of the Valuation Committee shall continuously monitor for significant events that might necessitate the use of fair value procedures.

U.S. Government securities with less than 60 days remaining to maturity when acquired by the Fund are valued on an amortized cost basis. U.S. Government securities with more than 60 days remaining to maturity are valued at the current market value as provided by an independent pricing service on the day of valuation until the 60th day prior to maturity, and are then valued at amortized cost based upon the value on such date unless the Board determines during such 60-day period that this amortized cost basis does not represent fair value. Short-term investments are stated at cost, which, when combined with accrued interest approximates market value.

B. Federal Income Taxes –

It is the Fund’s policy to comply with the requirements of the Internal Revenue Code applicable to Regulated Investment Companies (“RICs”) to distribute all of its taxable income to shareholders. Therefore, no Federal income tax provision is required. Under applicable foreign tax law, a withholding tax may be imposed on interest, dividends, and capital gains earned on foreign securities.

The character of distributions made during the year from net investment income or net realized gains may differ from its ultimate characterization for federal income tax purposes. In addition, due to the timing of dividend distributions, the fiscal year in which amounts are distributed may differ from the year that the income or realized gains or losses were recorded by the Fund.

-16-

The Fund has not recorded any liability for material unrecognized tax benefits as of December 31, 2010. It is the Fund’s policy to recognize accrued interest and penalties related to uncertain benefits in income taxes as appropriate. Tax years that remain open to examination by major jurisdiction include tax years ended December 31, 2007 through December 31, 2010.

On December 22, 2010, The RIC Modernization Act of 2010 (the “Modernization Act”) was signed by The President. The Modernization Act is the first major piece of legislation affecting RICs since 1986 and it modernizes several of the federal income and excise tax provisions related to RICs. Some highlights of the enacted provisions are as follows:

New capital losses may now be carried forward indefinitely, and retain the character of the original loss. Under pre-enactment law, capital losses could be carried forward for eight years, and carried forward as short-term capital losses, irrespective of the character of the original loss.

The Modernization Act contains simplification provisions, which are aimed at preventing disqualification of a RIC for “inadvertent” failures of the asset diversification and/or qualifying income tests. Additionally, the Modernization Act exempts RICs from the preferential dividend rule, and repealed the 60-day designation requirement for certain types of pay-through income and gains.

Finally, the Modernization Act contains several provisions aimed at preserving the character of distributions made by a fiscal year RIC during the portion of its taxable year ending after October 31 or December 31, reducing the circumstances under which a RIC might be required to file amended Forms 1099 to restate previously reported distributions.

Except for the simplification provisions related to RIC qualification, the Modernization Act is effective for taxable years beginning after December 22, 2010. The provisions related to RIC qualification are effective for taxable years for which the extended due date of the tax return is after December 22, 2010.

C. Distribution To Shareholders –

The Fund pays dividends to shareholders on a quarterly basis on of the ex-dividend date. Distribution of net realized gains, if any, are made on an annual basis to shareholders on the ex-dividend date.

D. Equalization –

The Fund uses the accounting practice of equalization by which a portion of the proceeds from sales and costs of redemption of capital shares, equivalent on a per share basis to the amount of undistributed net investment income on the date of the transactions, is credited or charged to undistributed income. As a result, undistributed net investment income per share is unaffected by sales or redemption of capital shares.

E. Use of Estimates –

The preparation of financial statements in conformity with accounting principles generally accepted in the United States of America requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of increases and decreases in net assets from operations during the reporting period. Actual results could differ from those estimates.

In preparing these financial statements, the Fund has evaluated events and transactions for potential recognition or disclosure through the date the financial statements were issued.

F. Fair Value Measurements –

The Fund has adopted the Financial Accounting Standards Board (“FASB”) guidance on fair value measurements. Fair value is defined as the price that each Fund would receive upon selling an investment in a timely transaction to an independent buyer in the principal or most advantageous market of the investment. A three-tier hierarchy is used to maximize the use of observable market data “inputs” and minimize the use of unobservable “inputs” and to establish classification of fair value measurements for disclosure purposes. Inputs refer broadly to the assumptions that market participants would use in pricing the asset or liability, including assumptions about risk. Inputs may be observable or unobservable. Observable inputs are inputs that reflect the assumptions market participants would use in pricing the asset or liability developed based on market data obtained from sources independent of the reporting entity. Unobservable inputs are inputs that reflect the reporting entity’s own assumptions about the assumptions market participants would use in pricing the asset or liability developed based on the best information available in the circumstances. The three-tier hierarchy of inputs is summarized in the three broad Levels listed below:

|

Level 1 –

|

Unadjusted quoted prices in active markets for identical investments

|

|

|

Level 2 –

|

Observable inputs other than quoted prices included in level 1 that are observable for the asset or liability, either directly or indirectly. These inputs may include quoted prices for the identical instrument on an inactive market, prices for similar instruments, interest rates, prepayment speeds, credit risk, yield curves, default rates and similar data.

|

-17-

|

Level 3 –

|

Unobservable inputs for the asset or liability, to the extent relevant observable inputs are not available; representing the Fund’s own assumptions about the assumptions a market participant would use in valuing the asset or liability, and would be based on the best information available.

|

The FASB also issued guidance on how to determine the fair value of assets and liabilities when the volume and level of activity for the asset/liability have significantly decreased as well as guidance on identifying circumstances that indicate a transaction is not orderly. The valuation techniques used by the Fund to measure fair value for the six months ended June 30, 2011 maximized the use of observable inputs and minimized the use of unobservable inputs. During the six months ended June 30, 2011, no securities held by the fund were deemed as Level 3 and no securities were transferred into or out of Level 1 or 2.

In May 2011, the FASB issued ASU No. 2011-04 “Amendments to Achieve Common Fair Value Measurement and Disclosure Requirements” in GAAP and the International Financial Reporting Standards (“IFRSs”). ASU No. 2011-04 amends FASB ASC Topic 820, Fair Value Measurements and Disclosures, to establish common requirements for measuring fair value and for disclosing information about fair value measurements in accordance with GAAP and IFRSs. ASU No. 2011-04 is effective for fiscal years beginning after December 15, 2011 and for interim periods within those fiscal years. Management is currently evaluating the impact these amendments may have on the Fund’s financial statements.

The following is a summary of the inputs used as of June 30, 2011 in valuing the Fund’s investments carried at market value:

|

Level 1

|

Level 2

|

Level 3

|

Total

|

||||||||||||||

|

Equity

|

|||||||||||||||||

|

Manufacturing

|

$ | 25,381,680 | $ | — | $ | — | $ | 25,381,680 | |||||||||

|

Finance and Insurance

|

11,468,745 | — | — | 11,468,745 | |||||||||||||

|

Mining

|

8,374,890 | — | — | 8,374,890 | |||||||||||||

|

Retail Trade

|

4,808,570 | — | — | 4,808,570 | |||||||||||||

|

Information

|

5,083,740 | — | — | 5,083,740 | |||||||||||||

|

Transportation and Warehousing

|

5,228,550 | — | — | 5,228,550 | |||||||||||||

|

Professional, Scientific

|

|||||||||||||||||

|

and Technical Services

|

5,759,015 | — | — | 5,759,015 | |||||||||||||

|

Accommodation and Food Services

|

1,264,800 | — | — | 1,264,800 | |||||||||||||

|

Management of Companies

|

865,085 | — | — | 865,085 | |||||||||||||

|

Construction

|

1,747,900 | — | — | 1,747,900 | |||||||||||||

|

Arts and Entertainment

|

|||||||||||||||||

|

and Recreation

|

390,400 | — | — | 390,400 | |||||||||||||

|

Total Equity

|

70,373,375 | — | — | 70,373,375 | |||||||||||||

|

Exchange Traded Funds

|

|||||||||||||||||

|

Finance and Insurance

|

3,664,740 | — | — | 3,664,740 | |||||||||||||

|

Fixed Income

|

|||||||||||||||||

|

Corporate Bonds

|

— | 2,266,496 | — | 2,266,496 | |||||||||||||

|

Total Fixed Income

|

— | 2,266,496 | — | 2,266,496 | |||||||||||||

|

Short-Term Investments

|

1,716,948 | — | — | 1,716,948 | |||||||||||||

|

Total Investments in Securities

|

$ | 75,755,063 | $ | 2,266,496 | $ | — | $ | 78,021,559 | |||||||||

G. Derivative Instruments and Hedging Activities –

The Fund has adopted FASB guidance regarding disclosure about derivatives and hedging activities and how they affect the Fund’s Statement of Assets and Liabilities and Statement of Operations. The Fund did not enter into any derivative transactions during the six months ended June 30, 2011.

(2) INVESTMENT ADVISORY CONTRACT AND OTHER TRANSACTIONS WITH AFFILIATES

Under an Investment Advisory Contract, Bridges Investment Management, Inc. (the “Investment Adviser”) furnishes investment advisory services for the Fund. In return, the Fund has agreed to pay the Investment Adviser a management fee computed on a quarterly basis at the rate of 1/8 of 1% of the average month-end net asset value of the Fund during the quarter, equivalent to 1/2 of 1% per annum. Certain officers and directors of the Fund are also officers and directors of the Investment Adviser. These officers do not receive any compensation from the Fund other than that which is received indirectly through the Investment Adviser. For the six months ended June 30, 2011, the Fund incurred $192,451 in advisory fees.

-18-

The contract between the Fund and the Investment Adviser provides that total expenses of the Fund in any year, exclusive of taxes, but including fees paid to the Investment Adviser, shall not exceed, in total, a maximum of 1 and 1/2% of the average month end net asset value of the Fund for the year. Amounts, if any, expended in excess of this limitation are reimbursed by the Investment Adviser as specifically identified in the Investment Advisory Contract. There were no amounts reimbursed during the six months ended June 30, 2011.

The Fund has entered into a Board-approved contract with the Investment Adviser in which the Investment Adviser acts as primary administrator to the Fund at an annual rate of $42,000. U.S. Bancorp Fund Services, LLC acts as sub-administrator to the Fund, and for its services, receives an annual fee at the rate of 0.05% for the first $50 million of the Fund’s average net assets, 0.04% on the next $50 million of average net assets, and 0.03% on the balance, subject to an annual minimum of $32,500. These administrative expenses are shown as Administration Fees on the Statement of Operations.

Quasar Distributors, LLC (the “Distributor”), a registered broker-dealer, acts as the Fund’s principal underwriter in a continuous public offering of the Fund’s shares. The Distributor is an affiliate of U.S. Bancorp Fund Services, LLC.

(3) SECURITY TRANSACTIONS

The cost of long-term investment purchases during the six months ended June 30, were:

|

2011

|

2010

|

||||||||

|

Non U.S. government securities

|

$ | 10,236,602 | $ | 9,263,714 | |||||

Net proceeds from sales of long-term investments during the six months ended June 30, were:

|

2011

|

2010

|

||||||||

|

Non U.S. government securities

|

$ | 10,833,230 | $ | 9,946,650 | |||||

There were no long-term U.S. government transactions for the six months ended June 30, 2011 and 2010.

(4) NET ASSET VALUE

The net asset value per share represents the effective price for all subscription and redemptions.

(5) CAPITAL STOCK

Shares of capital stock issued and redeemed during the six months ended June 30, were as follows:

|

2011

|

2010

|

||||||||

|

Shares sold

|

41,145 | 72,441 | |||||||

|

Shares issued to shareholders in reinvestment of net investment income

|

3,584 | 3,554 | |||||||

| 44,729 | 75,995 | ||||||||

|

Shares redeemed

|

(41,457 | ) | (80,140 | ) | |||||

|

Net increase

|

3,272 | (4,145 | ) | ||||||

Value of capital stock issued and redeemed during the years ended December 31, were as follows:

|

2010

|

2009

|

||||||||

|

Shares sold

|

$ | 1,382,125 | $ | 2,150,147 | |||||

|

Shares issued to shareholders in reinvestment of net investment income

|

121,713 | 100,869 | |||||||

| $ | 1,503,838 | $ | 2,251,016 | ||||||

|

Shares redeemed

|

(1,397,937 | ) | (2,374,560 | ) | |||||

|

Net increase

|

$ | 105,901 | $ | (123,544 | ) | ||||

(6) DISTRIBUTIONS TO SHAREHOLDERS

On March 31, 2011 and June 30, 2011, cash distributions were declared from net investment income accrued through March 31, 2011 and June 30, 2011, respectively. These distributions were calculated as $0.030 and $0.030 per share. The dividends were paid on March 31, 2011 and June 30, 2011, to shareholders of record on March 30, 2011 and June 29, 2011.

-19-

(7) FEDERAL INCOME TAX INFORMATION

The tax character of distributions during the years ended December 31, 2010 and 2009 were as follows:

|

Ordinary

|

Long-Term

|

||||||||

|

Income

|

Capital Gain

|

||||||||

|

12/31/10

|

$ | 290,649 | $ | — | |||||

|

12/31/09

|

385,351 | — | |||||||

The character of distributions made during the year from net investment income or net realized gains may differ from their ultimate characterization for federal income tax purposes. These differences reflect the dissimilar character of certain income items and net realized gains and losses for financial statement and tax purposes. Any permanent differences will result in reclassification among certain capital accounts in the financial statements. For the year ended December 31, 2010 the undistributed net investment income increased by $63, accumulated net realized gain increased by $1, and paid-in-capital decreased by $64.

As of December 31, 2010, the components of the tax basis cost of investments and net unrealized appreciation were as follows:

|

Federal tax cost of investments

|

$ | 56,054,775 | |||

|

Unrealized appreciation

|

$ | 21,263,249 | |||

|

Unrealized depreciation

|

$ | (2,249,536 | ) | ||

|

Net unrealized appreciation

|

$ | 19,013,713 |

As of December 31, 2010, the components of distributable earnings on a tax basis were as follows:

|

Net unrealized appreciation

|

$ | 19,013,713 | |||

|

Undistributed ordinary income

|

$ | 950 | |||

|

Undistributed long term gains

|

$ | — | |||

|

Distributable earnings

|

$ | 950 | |||

|

Other accumulated loss

|

$ | (1,497,750 | ) | ||

|

Total accumulated capital earnings

|

$ | 17,516,913 |

At December 31, 2010, the Fund did not defer any post-October losses.

The Fund had $159,887 in capital loss carry over which expires on December 31, 2016 and $1,337,863 which expires on December 31, 2017.

The Fund utilized $157,107 of prior capital loss carry overs during the year ended December 31, 2010.

-20-

ADDITIONAL DISCLOSURES

(Unaudited)

Shareholder Notification of Federal Tax Status

The Bridges Investment Fund designated 100% of dividends declared during the fiscal year ended December 31, 2010 as dividends qualifying for the dividends received deduction available to corporate shareholders.

The Bridges Investment Fund designated 100% of dividends declared from the net investment income during the fiscal year ended December 31, 2010 as qualified income under the Jobs and Growth Tax Relief Reconciliation Act of 2003.

Availability of Quarterly Portfolio Holdings Schedules

The Fund files its complete schedule of portfolio holdings with the SEC for the First and Third Quarters of each fiscal year on Form N-Q, which is available on the SEC’s website at http://www.sec.gov or can be reviewed and copied at the SEC’s Public Reference Room in Washington, D.C. (information on the operation of the Public Reference Room may be obtained by calling 1-800-SEC-0330.) These reports can also be obtained from the Fund by sending an e-mail to fund@bridgesinv.com or calling 1-800-939-8401.

Proxy Voting Policies and Procedures and Proxy Voting Record

A description of the policies and/procedures that the Fund uses to determine how to vote proxies relating to portfolio securities, and a report on how the Fund voted such proxies during the 12-month period ended June 30, 2010 can be obtained by request and without charge from the Fund by sending an e-mail to fund@bridgesinv.com or calling 1-800-939-8401, or from the SEC’s website at http://www.sec.gov.

Disclosure Regarding Fund Trustees and Officers

**Disinterested Persons

Also Known As Independent Directors**

|

Name, Age,

|

||

|

Position with

|

||

|

Fund and Term

|

||

|

of Office

|

Principal Occupation(s) and Directorships*

|

|

|

Nathan Phillips

|

Mr. Dodge is the Executive Vice President of N.P. Dodge Company. He has worked at N.P. Dodge Company

|

|

|

Dodge III(1) Age: 47

|

since October, 1993. Mr. Dodge is also a principal officer and director of a number of subsidiary and affiliated

|

|

|

companies in the property management, insurance, and real estate syndication fields. Mr. Dodge became a

|

||

|

Director

|

Director of Lauritzen Corp. in 2008 and of First State Bank of Loomis in 2003.

|

|

|

(2010 – present)

|

||

|

John J. Koraleski

|

Mr. Koraleski was elected Chairman on April 13, 2005. Mr. Koraleski is Executive Vice President-Marketing &

|

|

|

Age: 60

|

Sales of the Union Pacific Railroad Company headquartered in Omaha, Nebraska. Mr. Koraleski was employed

|

|

|

by Union Pacific in June, 1972, where he has served in various capacities. He was promoted to his present

|

||

|

Chairman

|

position in March, 1999. As the Executive Vice President-Marketing & Sales, Mr. Koraleski is responsible for

|

|

|

(2005 – present)

|

all sales, marketing, and commercial activities for the railroad and its Union Pacific Distribution Services

|

|

|

subsidiary. He is a member of the Railroad’s Operating Committee. Prior to his current officer position with

|

||

|

Director

|

the Railroad, Mr. Koraleski was the Railroad’s Chief Financial Officer, Controller of Union Pacific Corporation.

|

|

|

(1995 – present)

|

In those positions, he was responsible for the Railroad’s Information Technologies and Real Estate Departments. Mr. Koraleski has been designated as the Lead Independent Director of the Fund.

|

|

|

Adam M. Koslosky

|

Mr. Koslosky is the President and Chief Executive Officer of Magnolia Metal Corporation. Magnolia Metal

|

|

|

Age: 54

|

Corporation is a bronze bearing manufacturer located in Omaha, Nebraska. Mr. Koslosky commenced his

|

|

|

career with Magnolia Metal Corporation in 1978. Mr. Koslosky also is a general partner of Mack Investments,

|

||

|

Director

|

Ltd., a privately held investment company located in Omaha, Nebraska. He has been a Director of Nebraska

|

|

|

(2007 – present)

|

Methodist Hospital Foundation since 1993. Mr. Koslosky has been determined to be an “audit committee financial expert” within the meaning of the Sarbanes Oxley Act of 2002 and the regulations related thereto by the Fund’s Board of Directors. Mr. Koslosky serves as the Chairman of the Fund’s Audit Committee.

|

-21-

|

Name, Age,

|

||

|

Position with

|

||

|

Fund and Term

|

||

|

of Office

|

Principal Occupation(s) and Directorships*

|

|

|

Michael C. Meyer

|

Mr. Meyer is currently the Vice President of Asset Management of Tenaska, Inc. Tenaska is a privately held

|

|

|

Age: 52

|

energy company that develops, constructs, owns and operates large-scale non-utility power plants. Tenaska also

|

|

|

markets natural gas, electricity and biofuels products and provides associated energy risk management services;

|

||

|

Director

|

provides management and operation services to private equity partnerships; and engages in natural gas

|

|

|

(2008 – present)

|

exploration production and associated transportation systems. Prior to his current position, Mr. Meyer was Vice President, International Asset Management with responsibility for managing Tenaska’s international business and has been employed at Tenaska since 1995. In his 30-plus years of financial and operations management experience in the banking and energy industries, Mr. Meyer has held positions with the United States Treasury Department’s Office of the Comptroller of the Currency, the Farm Credit System and the First National Bank of Omaha.

|

|

|

Gary L. Petersen

|

Mr. Petersen is the retired President of Petersen Manufacturing Co. Inc. of DeWitt, Nebraska. Mr. Petersen

|

|

|

Age: 68

|

commenced employment with the company in February, 1966. He became President in May, 1979, and retired

|

|

|

in June, 1986. Petersen Manufacturing Co. Inc. produced a broad line of hand tools for national and worldwide

|

||

|

Director

|

distribution under the brand names Vise-Grip, Unibit, Prosnip, and Punch Puller. Mr. Petersen serves as

|

|

|

(1987 – present)

|

Chairman of the Fund’s Administration and Nominating Committee.

|

|

|

Robert Slezak

|

Mr. Slezak is currently an independent management consultant and has been since November 1999. Prior to

|

|

|

Age: 53

|

that, Mr. Slezak served as Vice President, Chief Financial Officer and Treasurer of the Ameritrade Holding

|

|

|

Corporation from January 1989 to November 1999 and as a director from October 1996 to September 2002.

|

||

|

Director

|

Mr. Slezak currently serves as a member of the board of directors of United Western Bancorp, Inc. and Xanadoo

|

|

|

(2008 – present)

|

Company, a provider of wireless communication services.

|

*Except as otherwise indicated, each individual has held the position shown or other positions in the same company for the last five years.

The address for all Fund Directors is 256 Durham Plaza, 8401 West Dodge Road, Omaha, Nebraska 68114.

Interested Person Directors and Officers

The following Directors and Officers are interested persons of the Fund. The determination of an interested person is based on the definition in Section 2(a)(19) of the Investment Company Act of 1940 and Securities and Exchange Commission Release (Release No. IC-24083, dated October 14, 1999), providing additional guidance to investment companies about the types of professional and business relationships that may be considered to be material for purposes of Section 2(a)(19).

|

Name, Age,

|

||

|

Position with

|

||

|

Fund and Term

|

||

|

of Office

|

Principal Occupation(s) and Directorships*

|

|

|

Edson L.

|

Mr. Bridges has been a full-time member of the professional staff of Bridges Investment Counsel, Inc. since

|

|

|

Bridges III, CFA

|

August 1983. Mr. Bridges has been responsible for securities research and the investment management for an

|

|

|

Age: 53

|

expanding base of discretionary management accounts, including the Fund, for more than ten years. Mr.

|

|

|

Bridges was elected President of Bridges Investment Fund, Inc. on April 11, 1997, and he assumed the position

|

||

|

President

|

of Portfolio Manager at the close of business on that date. Mr. Bridges became Chief Executive Officer of the

|

|

|

(1997 – present)

|

Fund on April 13, 2004. Mr. Bridges has been Executive Vice President of Bridges Investment Counsel, Inc.

|

|

|

since February, 1993, and he is a Director of that firm. Mr. Bridges is an officer and a Director of Bridges

|

||

|

Chief Executive

|

Investor Services, Inc. and Provident Trust Company. Since December 2000, Mr. Bridges has been President,

|

|

|

Officer

|

Chief Executive Officer, and Director of Bridges Investment Management, Inc. Mr. Bridges became a Director

|

|

|

(2004 – present)

|

of Stratus Fund, Inc., an open-end, regulated investment company located in Lincoln, Nebraska, in October,

|

|

|

1990 and is Chairman of the Audit Committee of the Stratus Fund.

|

||

|

Director

|

||

|

(1991 – present)

|

-22-

|

Name, Age,

|

||

|

Position with

|

||

|

Fund and Term

|

||

|

of Office

|

Principal Occupation(s) and Directorships*

|

|

|

Robert W.

|

Mr. Bridges is a Director and Senior Equity Analyst at Sterling Capital Management LLC. Sterling Capital

|

|

|

Bridges, CFA

|

Management LLC, located in Charlotte, North Carolina, is an investment management company founded in

|

|

|

Age: 45

|

1970. Mr. Bridges commenced his career with Sterling Capital Management, LLC in 1996 and served in a

|

|

|

variety of capacities including client service, systems integration, and compliance before assuming his current

|

||

|

Director

|

position in 2000. Mr. Bridges has been a Director of Bridges Investment Counsel, Inc. since December 2006.

|

|

|

(2007 – present)

|

Prior to joining Sterling, Mr. Bridges served in accounting, research analysis and several other roles for Bridges Investment Counsel, Inc. for six years. Mr. Bridges earned his B.S. in Business from Wake Forest University, and became a CFA charter holder in 2003.

|

|

|

Additional Officers of the Fund

|

||

|

Name, Age,

|

||

|

Position with

|

||

|

Fund and Term

|

||

|

of Office

|

Principal Occupation(s) and Directorships*

|

|

|

Edson L.

|